The U.S. economy (as measured by gross domestic product – GDP) grew at a moderate rate during the fiscal year. The annualized “real” rate of GDP growth (factoring out inflation) ranged from 3.3% to 4.3%. Energy costs and short-term interest rates soared, but “core” inflation (excluding food and energy prices) remained relatively stable.

Energy costs jumped 35% in the Consumer Price Index (CPI) for the year ended September 30, 2005 (reported in October 2005) as crude oil futures flirted with $70 a barrel. But the one-year percentage change in core CPI fell back to the same 2% level as a year earlier. Attempting to keep inflation under control, the Federal Reserve, in eight quarter-point increments, raised its overnight interest rate target two full percentage points to 3.75% by October 2005 from 1.75% in October 2004.

Overcoming rising fuel and interest costs, corporate earnings for the Standard & Poor’s 500 Index (through the third quarter of 2005) extended their string of double-digit growth to 12 straight quarters. The S&P 500, a key benchmark for larger-capitalization companies, returned 8.72% in the fiscal year. That performance trailed its smaller-cap counterparts, the S&P MidCap 400 and SmallCap 600 indices, which gained 17.65% and 15.27%, respectively.

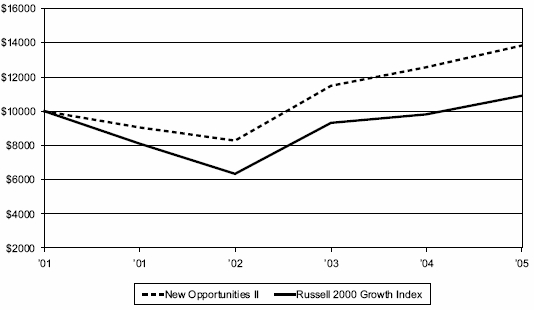

As a group, small-cap value stocks outpaced small-cap growth issues, as the Russell 2000 Value Index gained 13.04%, 213 bps more than the 10.91% return of the Russell 2000 Growth.

Solid security selection in the materials sector, especially in the metals and mining industry, contributed significantly to New Opportunities II’s fiscal-year return. Titanium Metals Corp., a maker of titanium parts used in aircraft and the portfolio’s largest average individual weighting during the year, exemplified the type of investment the New Opportunities II team targets.

Benefiting from surging demand as aircraft makers sought more lightweight materials, in part to combat rising jet fuel costs, Titanium Metals exhibited both solid earnings acceleration and strong relative price strength – two key attributes for portfolio inclusion. The company’s share price increased almost five-fold in the 12-month period, composing about a third of the portfolio’s total return.

In the consumer discretionary sector, sound stock picks among specialty retailers and an avoidance of struggling media companies and multi-line retailers boosted relative performance for New Opportunities II. As a whole, the sector ranked second only to materials in positive absolute contributions to the portfolio.

Stock selection in industrials also generated positive results. The portfolio bought a stake in Administaff, a provider of human resources staffing to small and medium-sized businesses, and that company’s shares surged along with its earnings.

TRIPPING ON TECHNOLOGY

The information technology sector stripped more than any other from New Opportunities II’s return. The portfolio’s underweight position couldn’t overcome weak stock selection in software, semiconductors and information technology services. Six of the portfolio’s 10 leading individual relative detractors came from the IT sector. However, the portfolio did enjoy substantial contributions from Itron, a maker of electronic meter and data collection equipment for the utility industry.

The portfolio’s biggest decliner, Able Laboratories, lost 90% of its value in a two-month period in mid-2005. The generic drug maker abruptly suspended all manufacturing and shipping operations as regulatory questions arose about its laboratory and production procedures. Shortly after the second quarter of 2005 ended, the company lost its second chief executive in two months and has since decided to auction all its assets. New Opportunities II shed the stock, but not before incurring some of its damage.

An overweight in financials – in large part reflecting a decision to avoid bigger weights in IT and health care – also hurt the portfolio’s performance as rising short-term interest rates and a flattening yield curve challenged commercial banks, thrifts and other lenders.

INVESTMENT PHILOSOPHY

We remain committed to pursuing an investment approach of identifying small companies that appear to have accelerating earnings and revenue growth. We believe this approach provides the optimum potential for long-term investment rewards.

| Top Five Industries as of October 31, 2005 |

| as a % of Net Assets |

| | | 10/31/05 | | 4/30/05 |

| Health Care Equipment & Supplies | | 10.9 | % | | 5.6 | % |

| Capital Markets | | 8.7 | % | | 0.8 | % |

| Commercial Banks | | 6.2 | % | | 3.5 | % |

| Commercial Services & Supplies | | 5.5 | % | | 2.0 | % |

| Semiconductors & Semiconductor Equipment | | 5.1 | % | | 1.2 | % |

| |

| Types of Investments in Portfolio |

| as a % of Net Assets |

| | | 10/31/05 | | 4/30/05 |

| Common Stocks | | 100.1 | % | | 97.7 | % |

| Temporary Cash Investments | | 1.7 | % | | 1.2 | % |

| Other Assets and Liabilities | | (1.8 | )% | | 1.1 | % |

D-7

EXHIBIT E

FINANCIAL INFORMATION

AC EQUITY GROWTH FUND

Financial Highlights–Annual

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31

| | Investor Class |

| | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of | | | | | | | | | | | | | | | | | | | |

| Period | $ | 22.08 | | | $ | 19.60 | | | $ | 15.19 | | | $ | 19.24 | | | $ | 21.77 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | | | | | | | | | | | | | | | | | |

| (Loss)(1) | | 0.22 | | | | 0.25 | | | | 0.17 | | | | 0.15 | | | | 0.13 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) | | 1.39 | | | | 2.47 | | | | 4.41 | | | | (4.05 | ) | | | (2.53 | ) |

| Total From Investment | | | | | | | | | | | | | | | | | | | |

| Operations | | 1.61 | | | | 2.72 | | | | 4.58 | | | | (3.90 | ) | | | (2.40 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | (0.22 | ) | | | (0.24 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.13 | ) |

| From Net Realized Gains | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | (0.32 | ) | | | (0.24 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.13 | ) |

| Net Asset Value, End of Period | $ | 23.37 | | | $ | 22.08 | | | $ | 19.60 | | | $ | 15.19 | | | $ | 19.24 | |

| TOTAL RETURN(2) | | 7.30 | % | | | 13.98 | % | | | 30.27 | % | | | (20.32 | )% | | | (11.01 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | 0.67 | % | | | 0.68 | % | | | 0.69 | % | | | 0.69 | % | | | 0.68 | % |

| Ratio of Net Investment Income | | | | | | | | | | | | | | | | | | | |

| (Loss) to Average Net Assets | | 0.98 | % | | | 1.24 | % | | | 1.00 | % | | | 0.86 | % | | | 0.64 | % |

| Portfolio Turnover Rate | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | % |

| Net Assets, End of Period | | | | | | | | | | | | | | | | | | | |

| (in thousands) | $ | 1,962,596 | | | $ | 1,547,062 | | | $ | 1,188,103 | | | $ | 979,959 | | | $ | 1,465,026 | |

____________________

| (1) | Computed using average shares outstanding throughout the period. |

| |

| (2) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| | See Notes to Financial Statements. |

E-1

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31

| | | Advisor Class |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 22.07 | | | $ | 19.59 | | | $ | 15.17 | | | $ | 19.23 | | | $ | 21.77 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(1) | | | 0.17 | | | | 0.20 | | | | 0.13 | | | | 0.11 | | | | 0.08 | |

| Net Realized and Unrealized Gain | | | | | | | | | | | | | | | | | | | | |

| (Loss) | | | 1.37 | | | | 2.47 | | | | 4.41 | | | | (4.06 | ) | | | (2.54 | ) |

| Total From Investment Operations | | | 1.54 | | | | 2.67 | | | | 4.54 | | | | (3.95 | ) | | | (2.46 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.16 | ) | | | (0.19 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.08 | ) |

| From Net Realized Gains | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (0.26 | ) | | | (0.19 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.08 | ) |

| Net Asset Value, End of Period | | $ | 23.35 | | | $ | 22.07 | | | $ | 19.59 | | | $ | 15.17 | | | $ | 19.23 | |

| TOTAL RETURN(2) | | | 6.99 | % | | | 13.71 | % | | | 30.05 | % | | | (20.60 | )% | | | (11.28 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | 0.92 | % | | | 0.93 | % | | | 0.94 | % | | | 0.94 | % | | | 0.93 | % |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | 0.73 | % | | | 0.99 | % | | | 0.75 | % | | | 0.61 | % | | | 0.39 | % |

| Portfolio Turnover Rate | | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | % |

| Net Assets, End of Period (in thousands) | | $ | 265,812 | | | $ | 160,427 | | | $ | 114,404 | | | $ | 99,615 | | | $ | 132,214 | |

__________________

| (1) | Computed using average shares outstanding throughout the period. |

| |

| (2) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| | See Notes to Financial Statements. |

E-2

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31 (except as noted)

| | | C Class |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001(1) |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 22.03 | | | $ | 19.55 | | | $ | 15.14 | | | $ | 19.23 | | | $ | 20.26 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(2) | | | — | (3) | | | 0.05 | | | | (0.01 | ) | | | (0.02 | ) | | | (0.04 | ) |

| Net Realized and Unrealized Gain (Loss) | | | 1.37 | | | | 2.47 | | | | 4.43 | | | | (4.07 | ) | | | (0.99 | ) |

| Total From Investment Operations | | | 1.37 | | | | 2.52 | | | | 4.42 | | | | (4.09 | ) | | | (1.03 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.02 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | | | | — | |

| From Net Realized Gains | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (0.12 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | | $ | 23.28 | | | $ | 22.03 | | | $ | 19.55 | | | $ | 15.14 | | | $ | 19.23 | |

| TOTAL RETURN(4) | | | 6.23 | % | | | 12.89 | % | | | 29.20 | % | | | (21.23 | )% | | | (5.13 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net | | | | | | | | | | | | | | | | | | | | |

| Assets | | | 1.67 | % | | | 1.68 | % | | | 1.69 | % | | | 1.69 | % | | | 1.68 | %(5) |

| Ratio of Net Investment Income (Loss) to Average | | | | | | | | | | | | | | | | | | | | |

| Net Assets | | | (0.02 | )% | | | 0.24 | % | | | 0.00 | % | | | (0.14 | )% | | | (0.44 | )%(5) |

| Portfolio Turnover Rate | | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | %(6) |

| Net Assets, End of Period (in thousands) | | $ | 4,536 | | | $ | 2,088 | | | $ | 1,076 | | | $ | 268 | | | $ | 139 | |

__________________

| (1) | July 18, 2001 (commencement of sale) through December 31, 2001. |

| |

| (2) | Computed using average shares outstanding throughout the period. |

| |

| (3) | Per-share amount was less than $0.005. |

| |

| (4) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (5) | Annualized. |

| | |

| (6) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended December 31, 2001. |

| | |

| | See Notes to Financial Statements. |

E-3

AC Equity Growth Fund- Financial Highlights – Semiannual

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31 (except as noted)

| | | Investor Class |

| | | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | $ | 23.37 | | | $ | 22.08 | | | $ | 19.60 | | | $ | 15.19 | | | $ | 19.24 | | | $ | 21.77 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss)(2) | | | 0.11 | | | | 0.22 | | | | 0.25 | | | | 0.17 | | | | 0.15 | | | | 0.13 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) | | | 0.57 | | | | 1.39 | | | | 2.47 | | | | 4.41 | | | | (4.05 | ) | | | (2.53 | ) |

| Total From Investment | | | | | | | | | | | | | | | | | | | | | | | | |

| Operations | | | 0.68 | | | | 1.61 | | | | 2.72 | | | | 4.58 | | | | (3.90 | ) | | | (2.40 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| From Net Investment | | | | | | | | | | | | | | | | | | | | | | | | |

| Income | | | (0.09 | ) | | | (0.22 | ) | | | (0.24 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.13 | ) |

| From Net Realized Gains | | | (0.03 | ) | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (0.12 | ) | | | (0.32 | ) | | | (0.24 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.13 | ) |

| Net Asset Value, End of Period | | $ | 23.93 | | | $ | 23.37 | | | $ | 22.08 | | | $ | 19.60 | | | $ | 15.19 | | | $ | 19.24 | |

| TOTAL RETURN(3) | | | 2.95 | % | | | 7.30 | % | | | 13.98 | % | | | 30.27 | % | | | (20.32 | )% | | | (11.01 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | 0.67 | %(4) | | | 0.67 | % | | | 0.68 | % | | | 0.69 | % | | | 0.69 | % | | | 0.68 | % |

| Ratio of Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss) to Average Net Assets | | | 0.87 | %(4) | | | 0.98 | % | | | 1.24 | % | | | 1.00 | % | | | 0.86 | % | | | 0.64 | % |

| Portfolio Turnover Rate | | | 54 | % | | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | % |

| Net Assets, End of Period | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | $ | 2,210,452 | | | $ | 1,962,596 | | | $ | 1,547,062 | | | $ | 1,188,103 | | | $ | 979,959 | | | $ | 1,465,026 | |

____________________

| (1) | Six months ended June 30, 2006 (unaudited). |

| |

| (2) | Computed using average shares outstanding throughout the period. |

| |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (4) | Annualized. |

| |

| | See Notes to Financial Statements. |

E-4

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31 (except as noted)

| | | Advisor Class |

| | | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 23.35 | | | $ | 22.07 | | | $ | 19.59 | | | $ | 15.17 | | | $ | 19.23 | | | $ | 21.77 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss)(2) | | | 0.08 | | | | 0.17 | | | | 0.20 | | | | 0.13 | | | | 0.11 | | | | 0.08 | |

| Net Realized and Unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain (Loss) | | | 0.58 | | | | 1.37 | | | | 2.47 | | | | 4.41 | | | | (4.06 | ) | | | (2.54 | ) |

| Total From Investment | | | | | | | | | | | | | | | | | | | | | | | | |

| Operations | | | 0.66 | | | | 1.54 | | | | 2.67 | | | | 4.54 | | | | (3.95 | ) | | | (2.46 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.07 | ) | | | (0.16 | ) | | | (0.19 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.08 | ) |

| From Net Realized Gains | | | (0.03 | ) | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (0.10 | ) | | | (0.26 | ) | | | (0.19 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.08 | ) |

| Net Asset Value, End of Period | | $ | 23.91 | | | $ | 23.35 | | | $ | 22.07 | | | $ | 19.59 | | | $ | 15.17 | | | $ | 19.23 | |

| TOTAL RETURN(3) | | | 2.83 | % | | | 6.99 | % | | | 13.71 | % | | | 30.05 | % | | | (20.60 | )% | | | (11.28 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | 0.92 | %(4) | | | 0.92 | % | | | 0.93 | % | | | 0.94 | % | | | 0.94 | % | | | 0.93 | % |

| Ratio of Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss) to Average Net Assets | | | 0.62 | %(4) | | | 0.73 | % | | | 0.99 | % | | | 0.75 | % | | | 0.61 | % | | | 0.39 | % |

| Portfolio Turnover Rate | | | 54 | % | | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | % |

| Net Assets, End of Period (in thousands) | | $ | 351,466 | | | $ | 265,812 | | | $ | 160,427 | | | $ | 114,404 | | | $ | 99,615 | | | $ | 132,214 | |

____________________

| (1) | Six months ended June 30, 2006 (unaudited). |

| |

| (2) | Computed using average shares outstanding throughout the period. |

| |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (4) | Annualized. |

| |

| | See Notes to Financial Statements. |

E-5

AC Equity Growth Fund – Financial Highlights

For a share outstanding throughout the years ended December 31 (except as noted)

| | | C Class |

| | | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001(2) |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 23.28 | | | $ | 22.03 | | | $ | 19.55 | | | $ | 15.14 | | | $ | 19.23 | | | $ | 20.26 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(3) | | | (0.01 | ) | | | — | (4) | | | 0.05 | | | | (0.01 | ) | | | (0.02 | ) | | | (0.04 | ) |

| Net Realized and Unrealized Gain | | | | | | | | | | | | | | | | | | | | | | | | |

| (Loss) | | | 0.57 | | | | 1.37 | | | | 2.47 | | | | 4.43 | | | | (4.07 | ) | | | (0.99 | ) |

| Total From Investment Operations | | | 0.56 | | | | 1.37 | | | | 2.52 | | | | 4.42 | | | | (4.09 | ) | | | (1.03 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | — | | | | (0.02 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | | | | — | |

| From Net Realized Gains | | | (0.03 | ) | | | (0.10 | ) | | | — | | | | — | | | | — | | | | — | |

| Total Distributions | | | (0.03 | ) | | | (0.12 | ) | | | (0.04 | ) | | | (0.01 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | | $ | 23.81 | | | $ | 23.28 | | | $ | 22.03 | | | $ | 19.55 | | | $ | 15.14 | | | $ | 19.23 | |

| TOTAL RETURN(5) | | | 2.42 | % | | | 6.23 | % | | | 12.89 | % | | | 29.20 | % | | | (21.23 | )% | | | (5.13 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets | | | 1.67 | %(6) | | | 1.67 | % | | | 1.68 | % | | | 1.69 | % | | | 1.69 | % | | | 1.68 | %(6) |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | (0.13 | )%(6) | | | (0.02 | )% | | | 0.24 | % | | | 0.00 | % | | | (0.14 | )% | | | (0.44 | )%(6) |

| Portfolio Turnover Rate | | | 54 | % | | | 106 | % | | | 97 | % | | | 95 | % | | | 100 | % | | | 79 | %(7) |

| Net Assets, End of Period (in thousands) | | $ | 7,235 | | | $ | 4,536 | | | $ | 2,088 | | | $ | 1,076 | | | $ | 268 | | | $ | 139 | |

____________________

| (1) | Six months ended June 30, 2006 (unaudited). |

| |

| (2) | July 18, 2001 (commencement of sale) through December 31, 2001. |

| |

| (3) | Computed using average shares outstanding throughout the period. |

| | |

| (4) | Per-share amount is less than $0.005. |

| | |

| (5) | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (6) | Annualized. |

| |

| (7) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended December 31, 2001. |

| | |

| | See Notes to Financial Statements. |

E-6

AC NEW OPPORTUNITIES II FUND

Financial Highlights – Annual

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | | Investor Class |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001(1) |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 6.29 | | | $ | 5.75 | | | $ | 4.15 | | | $ | 4.52 | | | $ | 5.00 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(2) | | | (0.06 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.01 | ) |

| Net Realized and Unrealized Gain | | | | | | | | | | | | | | | | | | | | |

| (Loss) | | | 0.69 | | | | 0.61 | | | | 1.65 | | | | (0.32 | ) | | | (0.47 | ) |

| Total From Investment Operations | | | 0.63 | | | | 0.54 | | | | 1.60 | | | | (0.37 | ) | | | (0.48 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Realized Gains | | | (0.17 | ) | | | — | | | | — | | | | — | | | | — | |

| Net Asset Value, End of Period | | $ | 6.75 | | | $ | 6.29 | | | $ | 5.75 | | | $ | 4.15 | | | $ | 4.52 | |

| TOTAL RETURN(3) | | | 10.14 | % | | | 9.39 | % | | | 38.55 | % | | | (8.19 | )% | | | (9.60 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average | | | | | | | | | | | | | | | | | | | | |

| Net Assets | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | %(4) |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | | | | | | | | | | |

| Average Net Assets | | | (0.93 | )% | | | (1.09 | )% | | | (1.11 | )% | | | (1.02 | )% | | | (0.81 | )%(4) |

| Portfolio Turnover Rate | | | 269 | % | | | 255 | % | | | 236 | % | | | 182 | % | | | 89 | % |

| Net Assets, End of Period (in thousands) | | $ | 43,157 | | | $ | 38,917 | | | $ | 32,512 | | | $ | 25,479 | | | $ | 18,217 | |

____________________

| (1) | June 1, 2001 (fund inception) through October 31, 2001. |

| |

| (2) | Computed using average shares outstanding throughout the period. |

| |

| (3) | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (4) | Annualized. |

E-7

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | A Class |

| | 2005 | | 2004 | | 2003(1) |

| PER-SHARE DATA | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 6.26 | | | $ | 5.74 | | | $ | 4.15 | |

| Income From Investment Operations | | | | | | | | | | | |

| Net Investment Income (Loss)(2) | | (0.08 | ) | | | (0.08 | ) | | | (0.05 | ) |

| Net Realized and Unrealized Gain (Loss) | | 0.70 | | | | 0.60 | | | | 1.64 | |

| Total From Investment Operations | | 0.62 | | | | 0.52 | | | | 1.59 | |

| Distributions | | | | | | | | | | | |

| From Net Realized Gains | | (0.16 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | $ | 6.72 | | | $ | 6.26 | | | $ | 5.74 | |

| TOTAL RETURN(3) | | 9.91 | % | | | 9.06 | % | | | 38.31 | % |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net Assets | | 1.75 | % | | | 1.75 | % | | | 1.75 | %(4) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | (1.18 | )% | | | (1.34 | )% | | | (1.47 | )%(4) |

| Portfolio Turnover Rate | | 269 | % | | | 255 | % | | | 236 | %(5) |

| Net Assets, End of Period (in thousands) | $ | 47,937 | | | $ | 20,337 | | | $ | 891 | |

____________________

| (1) | | January 31, 2003 (commencement of sale) through October 31, 2003. |

| |

| (2) | | Computed using average shares outstanding throughout the period. |

| |

| (3) | | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (4) | | Annualized. |

| |

| (5) | | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2003. |

| |

| | | See Notes to Financial Statements. |

E-8

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | C Class |

| | 2005 | | 2004 | | 2003(1) |

| PER-SHARE DATA | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 6.20 | | | $ | 5.73 | | | $ | 4.15 | |

| Income From Investment Operations | | | | | | | | | | | |

| Net Investment Income (Loss)(2) | | (0.13 | ) | | | (0.13 | ) | | | (0.07 | ) |

| Net Realized and Unrealized Gain (Loss) | | 0.70 | | | | 0.60 | | | | 1.65 | |

| Total From Investment Operations | | 0.57 | | | | 0.47 | | | | 1.58 | |

| Distributions | | | | | | | | | | | |

| From Net Realized Gains | | (0.11 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | $ | 6.66 | | | $ | 6.20 | | | $ | 5.73 | |

| TOTAL RETURN(3) | | 9.16 | % | | | 8.20 | % | | | 38.07 | % |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net Assets | | 2.50 | % | | | 2.50 | % | | | 2.22 | %(4)(5) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | (1.93 | )% | | | (2.09 | )% | | | (1.97 | )%(4)(5) |

| Portfolio Turnover Rate | | 269 | % | | | 255 | % | | | 236 | %(6) |

| Net Assets, End of Period (in thousands) | $ | 3,414 | | | $ | 1,294 | | | $ | 34 | |

____________________

| (1) | | January 31, 2003 (commencement of sale) through October 31, 2003. |

| |

| (2) | | Computed using average shares outstanding throughout the period. |

| |

| (3) | | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (4) | | Annualized. |

| |

| (5) | | During a portion of the period ended October 31, 2003, the distributor agreed to voluntarily waive the distribution and service fees. Had fees not been waived the annualized ratio of operating expenses to average net assets and the annualized ratio of net investment loss to average net assets would have been 2.50% and (2.25)%, respectively. |

| |

| (6) | | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2003. |

| |

| | | See Notes to Financial Statements. |

E-9

AC New Opportunities II Fund Financial Highlights – Semiannual

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | Investor Class |

| | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001(2) |

| PER-SHARE DATA | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 6.75 | | | $ | 6.29 | | | $ | 5.75 | | | $ | 4.15 | | | $ | 4.52 | | | $ | 5.00 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(3) | | (0.04 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.01 | ) |

| Net Realized and Unrealized Gain (Loss) | | 1.60 | | | | 0.69 | | | | 0.61 | | | | 1.65 | | | | (0.32 | ) | | | (0.47 | ) |

| Total From Investment Operations | | 1.56 | | | | 0.63 | | | | 0.54 | | | | 1.60 | | | | (0.37 | ) | | | (0.48 | ) |

| Distributions | | | | | | | | | | | | | | | | | | | | | | | |

| From Net Realized Gains | | (0.22 | ) | | | (0.17 | ) | | | — | | | | — | | | | — | | | | — | |

| Net Asset Value, End of Period | $ | 8.09 | | | $ | 6.75 | | | $ | 6.29 | | | $ | 5.75 | | | $ | 4.15 | | | $ | 4.52 | |

| TOTAL RETURN(4) | | 23.55 | % | | | 10.14 | % | | | 9.39 | % | | | 38.55 | % | | | (8.19 | )% | | | (9.60 | )% |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net Assets | | 1.50 | %(5) | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | %(5) |

| Ratio of Net Investment Income (Loss) to Average Net | | | | | | | | | | | | | | | | | | | | | | | |

| Assets | | (1.21 | )%(5) | | | (0.93 | )% | | | (1.09 | )% | | | (1.11 | )% | | | (1.02 | )% | | | (0.81 | )%(5) |

| Portfolio Turnover Rate | | 120 | % | | | 269 | % | | | 255 | % | | | 236 | % | | | 182 | % | | | 89 | % |

| Net Assets, End of Period (in thousands) | $ | 51,169 | | | $ | 43,157 | | | $ | 38,917 | | | $ | 32,512 | | | $ | 25,479 | | | $ | 18,217 | |

____________________

| (1) | | Six months ended April 30, 2006 (unaudited). |

| |

| (2) | | June 1, 2001 (fund inception) through October 31, 2001. |

| |

| (3) | | Computed using average shares outstanding throughout the period. |

| |

| (4) | | Total return assumes reinvestment of net investment income and capital gains distributions, if any. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (5) | | Annualized. |

| |

| | | See Notes to Financial Statements. |

E-10

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | A Class |

| | 2006(1) | | 2005 | | 2004 | | 2003(2) |

| PER-SHARE DATA | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 6.72 | | | $ | 6.26 | | | $ | 5.74 | | | $ | 4.15 | |

| Income From Investment Operations | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(3) | | (0.05 | ) | | | (0.08 | ) | | | (0.08 | ) | | | (0.05 | ) |

| Net Realized and Unrealized Gain (Loss) | | 1.60 | | | | 0.70 | | | | 0.60 | | | | 1.64 | |

| Total From Investment Operations | | 1.55 | | | | 0.62 | | | | 0.52 | | | | 1.59 | |

| Distributions | | | | | | | | | | | | | | | |

| From Net Realized Gains | | (0.21 | ) | | | (0.16 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | $ | 8.06 | | | $ | 6.72 | | | $ | 6.26 | | | $ | 5.74 | |

| TOTAL RETURN(4) | | 23.42 | % | | | 9.91 | % | | | 9.06 | % | | | 38.31 | % |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net Assets | | 1.75 | %(5) | | | 1.75 | % | | | 1.75 | % | | | 1.75 | %(5) |

| Ratio of Net Investment Income (Loss) to Average Net | | | | | | | | | | | | | | | |

| Assets | | (1.46 | )%(5) | | | (1.18 | )% | | | (1.34 | )% | | | (1.47 | )%(5) |

| Portfolio Turnover Rate | | 120 | % | | | 269 | % | | | 255 | % | | | 236 | %(6) |

| Net Assets, End of Period (in thousands) | $ | 60,590 | | | $ | 47,937 | | | $ | 20,337 | | | $ | 891 | |

____________________

| (1) | | Six months ended April 30, 2006 (unaudited). |

| |

| (2) | | January 31, 2003 (commencement of sale) through October 31, 2003. |

| |

| (3) | | Computed using average shares outstanding throughout the period. |

| |

| (4) | | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (5) | | Annualized. |

| |

| (6) | | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2003. |

| |

| | | See Notes to Financial Statements. |

E-11

AC New Opportunities II Fund – Financial Highlights

For a share outstanding throughout the years ended October 31 (except as noted)

| | C Class |

| | 2006(1) | | 2005 | | 2004 | | 2003(2) |

| PER-SHARE DATA | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 6.66 | | | $ | 6.20 | | | $ | 5.73 | | | $ | 4.15 | |

| Income From Investment Operations | | | | | | | | | | | | | | | |

| Net Investment Income (Loss)(3) | | (0.08 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.07 | ) |

| Net Realized and Unrealized Gain (Loss) | | 1.60 | | | | 0.70 | | | | 0.60 | | | | 1.65 | |

| Total From Investment Operations | | 1.52 | | | | 0.57 | | | | 0.47 | | | | 1.58 | |

| Distributions | | | | | | | | | | | | | | | |

| From Net Realized Gains | | (0.15 | ) | | | (0.11 | ) | | | — | | | | — | |

| Net Asset Value, End of Period | $ | 8.03 | | | $ | 6.66 | | | $ | 6.20 | | | $ | 5.73 | |

| TOTAL RETURN(4) | | 22.90 | % | | | 9.16 | % | | | 8.20 | % | | | 38.07 | % |

| |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | |

| Ratio of Operating Expenses to Average Net Assets | | 2.50 | %(5) | | | 2.50 | % | | | 2.50 | % | | | 2.22 | %(5)(6) |

| Ratio of Net Investment Income (Loss) to Average Net | | | | | | | | | | | | | | | |

| Assets | | (2.21 | )%(5) | | | (1.93 | )% | | | (2.09 | )% | | | (1.97 | )%(5)(6) |

| Portfolio Turnover Rate | | 120 | % | | | 269 | % | | | 255 | % | | | 236 | %(7) |

| Net Assets, End of Period (in thousands) | $ | 4,084 | | | $ | 3,414 | | | $ | 1,294 | | | $ | 34 | |

____________________

| (1) | | Six months ended April 30, 2006 (unaudited). |

| |

| (2) | | January 31, 2003 (commencement of sale) through October 31, 2003. |

| |

| (3) | | Computed using average shares outstanding throughout the period. |

| |

| (4) | | Total return assumes reinvestment of net investment income and capital gains distributions, if any, and does not reflect applicable sales charges. Total returns for periods less than one year are not annualized. The total return of the classes may not precisely reflect the class expense differences because of the impact of calculating the net asset values to two decimal places. If net asset values were calculated to three decimal places, the total return differences would more closely reflect the class expense differences. The calculation of net asset values to two decimal places is made in accordance with SEC guidelines and does not result in any gain or loss of value between one class and another. |

| |

| (5) | | Annualized. |

| |

| (6) | | During a portion of the period ended October 31, 2003, the distributor agreed to voluntarily waive the distribution and service fees. Had fees not been waived the annualized ratio of operating expenses to average net assets and the annualized ratio of net investment income (loss) to average net assets would have been 2.50% and (2.25)%, respectively. |

| |

| (7) | | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended October 31, 2003. |

| |

| | | See Notes to Financial Statements. |

E-12

STATEMENT OF ADDITIONAL INFORMATION

NOVEMBER 13, 2006

ACQUISITION OF THE ASSETS OF

KOPP TOTAL QUALITY MANAGEMENT FUND,

A SERIES OF KOPP FUNDS, INC.

7701 France Avenue South, Suite 500

Edina, Minnesota 55435

Telephone No: 1-888-533-KOPP

BY AND IN EXCHANGE FOR SHARES OF

AMERICAN CENTURY EQUITY GROWTH FUND,

A SERIES OF AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC.

4500 Main Street

Kansas City, MO 64111-7709

Telephone No: 1-877-345-8836

This Statement of Additional Information dated November 13, 2006, is not a

prospectus. A Proxy Statement/Prospectus dated November 13, 2006, related to the

above-referenced matter may be obtained, by writing or calling Kopp at the

address and telephone number shown above. This Statement of Additional

Information should be read in conjunction with such Proxy Statement/Prospectus.

TABLE OF CONTENTS

1. Statement of Additional Information of American Century Equity Growth Fund,

a series of American Century Quantitative Equity Funds, Inc., dated May 1,

2006, as supplemented on August 1, 2006.

2. Statement of Additional Information of Kopp Total Quality Management Fund,

a series of Kopp Funds, Inc., dated January 30, 2006, as supplemented on

September 13, 2006.

3. Audited Financial Statements of American Century Equity Growth Fund, a

series of American Century Quantitative Equity Funds, Inc., dated December

31, 2005.

4. Audited Financial Statements of Kopp Total Quality Management Fund, a

series of Kopp Funds, Inc., dated September 30, 2005.

5. Unaudited Financial Statements of American Century Equity Growth Fund, a

series of American Century Quantitative Equity Funds, Inc., dated June 30,

2006.

6. Unaudited Financial Statements of Kopp Total Quality Management Fund, a

series of Kopp Funds, Inc., dated March 31, 2006.

Pursuant to Item 14(a) of Form N-14, the pro forma financial statements required

by Rule 11-01 of Regulation S-X are not prepared for the reorganization of Kopp

Total Quality Management Fund into American Century Equity Growth Fund because

the net asset value of Kopp Total Quality Management Fund does not exceed ten

percent of American Century Equity Growth Fund net asset value, measured as of

October 20, 2006.

INFORMATION INCORPORATED BY REFERENCE

1. The Statement of Additional Information of American Century Equity Growth

Fund, a series of American Century Quantitative Equity Funds, Inc. ("AC

Equity Growth Fund") dated May 1, 2006, as supplemented on August 1, 2006,

is incorporated by reference to the AC Equity Growth Fund's Post-Effective

Amendment No. 44 to its Registration Statement on Form N-1A (File No.

811-5447), which was filed with the Securities and Exchange Commission on

April 28, 2006. A copy may be obtained from American Century at

1-877-345-8836.

2. The Statement of Additional Information of the Kopp Total Quality

Management Fund, a series of Kopp Funds, Inc. ("Kopp TQM Fund") dated

January 30, 2006, as supplemented September 13, 2006, is incorporated by

reference to the Kopp TQM Fund's Post-Effective Amendment No. 15 to its

Registration Statement on Form N-1A (File No. 811-8267), which was filed

with the Securities and Exchange Commission on January 27, 2006. A copy may

be obtained from the Kopp TQM Fund at 1-888-533-KOPP.

3. The audited financial statements of AC Equity Growth Fund dated December

31, 2005, are incorporated by reference to the Annual Report to

shareholders of AC Equity Growth Fund, which was filed with the Securities

and Exchange Commission pursuant to Section 30(b) of the Investment Company

Act of 1940, as amended, on March 1, 2006.

4. The audited financial statements of Kopp TQM Fund dated September 30, 2005,

are incorporated by reference to the Annual Report to shareholders of Kopp

TQM Fund, which was filed with the Securities and Exchange Commission

pursuant to Section 30(b) of the Investment Company Act of 1940, as

amended, on December 8, 2005.

5. The unaudited financial statements of AC Equity Growth Fund dated June 30,

2006, are incorporated by reference to the Semi-Annual Report to

shareholders of AC Equity Growth Fund, which was filed with the Securities

and Exchange Commission pursuant to Section 30(b) of the Investment Company

Act of 1940, as amended, on August 29, 2006.

6. The unaudited financial statements of Kopp TQM Fund dated March 31, 2006,

are incorporated by reference to the Semi-Annual Report to shareholders of

Kopp TQM Fund, which was filed with the Securities and Exchange Commission

pursuant to Section 30(b) of the Investment Company Act of 1940, as

amended, on June 6, 2006.

AMERICAN CENTURY EQUITY GROWTH FUND,

A SERIES OF AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC.

INVESTMENT ADVISOR

American Century Investment Management, Inc.

4500 Main Street

Kansas City, Missouri 64111

DISTRIBUTOR

American Century Investment Services, Inc.

4500 Main Street

Kansas City, Missouri 64111

TRANSFER AGENT

American Century Services, LLC

4500 Main Street

Kansas City, Missouri 64111

KOPP TOTAL QUALITY MANAGEMENT FUND,

A SERIES OF KOPP FUNDS, INC.

INVESTMENT ADVISOR

KOPP INVESTMENT ADVISORS, LLC

7701 France Avenue South, Suite 500

Edina, Minnesota 55435

DISTRIBUTOR

CENTENNIAL LAKES CAPITAL, LLC

7701 France Avenue South, Suite 500

Edina, Minnesota 55435

TRANSFER AGENT AND ADMINISTRATOR

U.S. BANCORP FUND SERVICES, LLC

For overnight deliveries, use: For regular mail deliveries, use:

Kopp Funds, Inc. Kopp Funds, Inc.

c/o U.S. Bancorp Fund Services, LLC c/o U.S. Bancorp Fund Services, LLC

615 East Michigan Street P.O. Box 701

Third Floor

Milwaukee, Wisconsin 53201-0701

Milwaukee, Wisconsin 53202-5207

AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC.

PART C OTHER INFORMATION

Item 15. Indemnification

The Registrant is a Maryland corporation. Under Maryland General

Corporation Law, a corporation is permitted to indemnify its officers,

directors, employees and agents to the extent provided in applicable statutes.

Article Ninth of Registrant's Articles of Incorporation requires the

indemnification of the Registrant's directors and officers to the full extent

permitted by Maryland General Corporation Law, the Investment Company Act of

1940 and all other applicable laws.

The Registrant has purchased an insurance policy insuring its officers and

directors against certain liabilities which such officers and directors may

incur while acting in such capacities and providing reimbursement to the

Registrant for sums which it may be permitted or required to pay to its officers

and directors by way of indemnification against such liabilities, subject in

either case to clauses respecting deductibility and participation.

Item 16. Exhibits

(1) (a) Articles of Incorporation of American Century Quantitative Equity

Funds, Inc., dated February 26, 2004 (filed electronically as Exhibit a to

Post-Effective Amendment No. 34 to the Registration Statement of the Registrant

on March 1, 2004, File No. 33-19589, and incorporated herein by reference).

(b) Articles Supplementary of American Century Quantitative Equity

Funds, Inc., dated April 22, 2004 (filed electronically as Exhibit a2 to

Post-Effective Amendment No. 35 to the Registration Statement of the Registrant

on April 29, 2004, File No. 33-19589, and incorporated herein by reference).

(c) Articles Supplementary of American Century Quantitative Equity

Funds, Inc., dated May 4, 2004 (filed electronically as Exhibit a3 to

Post-Effective Amendment No. 38 to the Registration Statement of the Registrant

on February 17, 2005, File No. 33-19589, and incorporated herein by reference).

(d) Articles Supplementary of American Century Quantitative Equity

Funds, Inc., dated August 29, 2005 (filed electronically as Exhibit a4 to

Post-Effective Amendment No. 41 to the Registration Statement of the Registrant

on September 29, 2005, File No. 33-19589, and incorporated herein by reference).

(e) Articles Supplementary of American Century Quantitative Equity

Funds, Inc., dated March 15, 2006 (filed electronically as Exhibit a5 to

Post-Effective Amendment No. 44 to the Registration Statement of the Registrant

on April 28, 2006, File No. 33-19589, and incorporated herein by reference).

(f) Articles Supplementary of American Century Quantitative Equity

Funds, Inc., dated August 25, 2006 (filed electronically as Exhibit a6 to

Post-Effective Amendment No. 45 to the Registration Statement of the Registrant

on September 1, 2006, File No. 33-19589, and incorporated herein by reference).

(2) Amended and Restated Bylaws, dated August 26, 2004 (filed

electronically as Exhibit b to Post-Effective Amendment No. 38 to the

Registration Statement of the Registrant on February 17, 2005, File No.

33-19589, and incorporated herein by reference).

(3) Not applicable.

(4) Form of Agreement and Plan of Reorganization with Kopp Funds, Inc.

(filed electronically as Exhibit 4 to the Registration Statement on Form N-14 of

the Registrant on October 2, 2006, File No. 33-19589, and incorporated herein by

reference).

(5) Registrant hereby incorporates by reference, as though set forth fully

herein, the Fifth and Seventh declarations of the Registrant's Articles of

Incorporation, incorporated herein by reference as Exhibit 1 hereto, and

Sections 3 through 11 of the Registrant's Bylaws, incorporated herein by

reference as Exhibit 2 hereto.

(6) (a) Management Agreement with American Century Investment Management,

Inc., dated August 1, 2006 (filed electronically as Exhibit d1 to Post-Effective

Amendment No. 45 to the Registration Statement of the Registrant on September 1,

2006, File No. 33-19589, and incorporated herein by reference).

(b) Management Agreement with American Century Investment Management,

Inc., dated April 28, 2006 (filed electronically as Exhibit d2 to Post-Effective

Amendment No. 44 to the Registration Statement of the Registrant on April 28,

2006, File No. 33-19589, and incorporated herein by reference).

(7) (a) Amended and Restated Distribution Agreement with American Century

Investment Services, Inc., dated September 29, 2005 (filed electronically as

Exhibit e to Post-Effective Amendment No. 41 to the Registration Statement of

the Registrant on September 29, 2005, File No. 33-19589, and incorporated herein

by reference).

(b) Form of Dealer/Agency Agreement (filed electronically as Exhibit

e2 to Pre-Effective Amendment No. 1 to the Registration Statement of American

Century Growth Funds, Inc. on May 30, 2006, File No. 333-132114, and

incorporated herein by reference).

(8) Not applicable.

(9) (a) Master Agreement with Commerce Bank, N. A., dated January 22, 1997

(filed electronically as Exhibit b8e to Post-Effective Amendment No. 76 to the

Registration Statement of American Century Mutual Funds, Inc. on February 28,

1997, File No. 2-14213, and incorporated herein by reference).

(b) Global Custody Agreement with The Chase Manhattan Bank, dated

August 9, 1996 (filed electronically as Exhibit b8 to Post-Effective Amendment

No. 31 to the Registration Statement of American Century Government Income Trust

on February 7, 1997, File No. 2-99222, and incorporated herein by reference).

(c) Amendment to the Global Custody Agreement with The Chase Manhattan

Bank, dated December 9, 2000 (filed electronically as Exhibit g2 to

Pre-Effective Amendment No. 2 to the Registration Statement of American Century

Variable Portfolios II, Inc. on January 9, 2001, File No. 333-46922, and

incorporated herein by reference).

(d) Amendment No. 2 to the Global Custody Agreement between American

Century Investments and the JPMorgan Chase Bank, dated as of May 1, 2004 (filed

electronically as Exhibit g4 to Post-Effective Amendment No. 35 to the

Registration Statement of the Registrant on April 29, 2004, File No. 33-19589,

and incorporated herein by reference).

(e) Chase Manhattan Bank Custody Fee Schedule, dated October 19, 2000

(filed electronically as Exhibit g5 to Post-Effective Amendment No. 35 to the

Registration Statement of the Registrant on April 29, 2004, File No. 33-19589,

and incorporated herein by reference).

(f) Amendment No. 3 to the Global Custody Agreement between American

Century Investments and the JPMorgan Chase Bank, dated as of May 31, 2006 (filed

electronically as Exhibit g6 to Pre-Effective Amendment No. 1 to the

Registration Statement of American Century Growth Funds, Inc. on May 30, 2006,

File No. 333-132114, and incorporated herein by reference).

(g) Special Custody and Pledge Agreement with Goldman, Sachs & Co. and

State Street Bank and Trust Company, dated September 29, 2005 (filed

electronically as Exhibit g6 to Post-Effective Amendment No. 41 to the

Registration Statement of the Registrant on September 29, 2005, File No.

33-19589, and incorporated herein by reference).

(h) Custodian and Investment Accounting Agreement with State Street

Bank and Trust Company, dated May 27, 2005 (filed electronically as Exhibit g6

to Post-Effective Amendment No. 27 to the Registration Statement of American

Century Investment Trust on May 27, 2005, File No. 33-65170, and incorporated

herein by reference).

(i) Amendment No. 1 to Custodian and Investment Accounting Agreement

with State Street Bank and Trust Company, effective September 30, 2005 (filed

electronically as Exhibit g8 to Post-Effective Amendment No. 41 to the

Registration Statement of the Registrant on September 29, 2005, File No.

33-19589, and incorporated herein by reference).

(j) Amendment No. 2 to Custodian and Investment Accounting Agreement

with State Street Bank and Trust Company, effective March 31, 2006 (filed

electronically as Exhibit g9 to Post-Effective Amendment No. 32 to the

Registration Statement of American Century Investment Trust on March 31, 2006,

File No. 33-65170, and incorporated herein by reference).

(k) Registered Investment Company Custody Agreement with Goldman,

Sachs & Co., dated February 6, 2006 (filed electronically as Exhibit g10 to

Post-Effective Amendment No. 44 to the Registration Statement of the Registrant

on April 28, 2006, File No. 33-19589, and incorporated herein by reference).

(l) Amendment to Futures and Options Account Agreement and Registered

Investment Company Custody Agreement with Goldman, Sachs & Co., effective May

12, 2006 (filed electronically as Exhibit g11 to Post-Effective Amendment No. 44

to the Registration Statement of the Registrant on April 28, 2006, File No.

33-19589, and incorporated herein by reference).

(10) (a) Master Distribution and Individual Shareholder Services Plan (C

Class), dated September 16, 2000 (filed electronically as Exhibit m3 to

Post-Effective Amendment No. 35 to the Registration Statement of American

Century Target Maturities Trust on April 17, 2001, File No. 2-94608, and

incorporated herein by reference).

(b) Amendment No. 1 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated August 1, 2001 (filed electronically

as Exhibit m5 to Post-Effective Amendment No. 44 to the Registration Statement

of American Century Government Income Trust on July 31, 2001, File No. 2-99222,

and incorporated herein by reference).

(c) Amendment No. 2 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated December 3, 2001 (filed

electronically as Exhibit m7 to Post-Effective Amendment No. 16 to the

Registration Statement of American Century Investment Trust on November 30,

2001, File No. 33-65170, and incorporated herein by reference).

(d) Amendment No. 3 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated July 1, 2002 (filed electronically as

Exhibit m9 to Post-Effective Amendment No. 17 to the Registration Statement of

American Century Investment Trust on June 28, 2002, File No. 33-65170, and

incorporated herein by reference).

(e) Amendment No. 4 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated September 3, 2002 (filed

electronically as Exhibit m5 to Post-Effective Amendment No. 35 to the

Registration Statement of American Century Municipal Trust on September 30,

2002, File No. 2-91229, and incorporated herein by reference).

(f) Amendment No. 5 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated January 2, 2004, (filed

electronically as Exhibit m6 to Post-Effective Amendment No. 42 to the

Registration Statement of American Century Municipal Trust on February 26, 2004,

File No. 2-91229, and incorporated herein by reference).

(g) Amendment No. 6 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated May 1, 2004 (filed electronically as

Exhibit m13 to Post-Effective Amendment No. 35 to the Registration Statement of

the Registrant on April 29, 2004, File No. 33-19589, and incorporated herein by

reference).

(h) Amendment No. 7 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated May 1, 2005 (filed electronically as

Exhibit m15 to Post-Effective Amendment No. 38 to the Registration Statement of

the Registrant on May 13, 2005, File No. 33-19589, and incorporated herein by

reference).

(i) Amendment No. 8 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated September 29, 2005 (filed

electronically as Exhibit m17 to Post-Effective Amendment No. 41 to the

Registration Statement of the Registrant on September 29, 2005, File No.

33-19589, and incorporated herein by reference).

(j) Amendment No. 9 to the Master Distribution and Individual

Shareholder Services Plan (C Class), dated March 30, 2006 (filed electronically

as Exhibit m10 to Post-Effective Amendment No. 50 to the Registration Statement

of American Century Municipal Trust on March 31, 2006, File No. 2-14213, and

incorporated herein by reference).

(k) Master Distribution and Individual Shareholder Services Plan (A

Class), dated September 3, 2002 (filed electronically as Exhibit m6 to

Post-Effective Amendment No. 34 to the Registration Statement of American

Century California Tax-Free and Municipal Funds on October 1, 2002, File No.

2-82734, and incorporated herein by reference).

(l) Amendment No. 1 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated February 27, 2004 (filed

electronically as Exhibit m18 to Post-Effective Amendment No. 104 to the

Registration Statement of American Century Mutual Funds, Inc. on February 26,

2004, File No. 2-14213, and incorporated herein by reference).

(m) Amendment No. 2 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated September 30, 2004 (filed

electronically as Exhibit m22 to Post-Effective Amendment No. 106 to the

Registration Statement of American Century Mutual Funds, Inc. on November 29,

2004, File No. 2-14213, and incorporated herein by reference).

(n) Amendment No. 3 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated November 17, 2004 (filed

electronically as Exhibit m23 to Post-Effective Amendment No. 106 to the

Registration Statement of American Century Mutual Funds, Inc. on November 29,

2004, File No. 2-14213, and incorporated herein by reference).

(o) Amendment No. 4 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated May 1, 2005 (filed electronically as

Exhibit m13 to Post-Effective Amendment No. 44 to the Registration Statement of

American Century Municipal Trust. on May 13, 2005, File No. 2-91229, and

incorporated herein by reference).

(p) Amendment No. 5 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated September 29, 2005 (filed

electronically as Exhibit m25 to Post-Effective Amendment No. 38 to the

Registration Statement of American Century World Mutual Funds, Inc. on November

30, 2005, File No. 33-39242, and incorporated herein by reference).

(q) Amendment No. 6 to the Master Distribution and Individual

Shareholder Services Plan (A Class), dated March 30, 2006 (filed electronically

as Exhibit m27 to Post-Effective Amendment No. 23 to the Registration Statement

of American Century Strategic Asset Allocations, Inc. on March 30, 2006, File

No. 33-79482, and incorporated herein by reference).

(r) Master Distribution and Individual Shareholder Services Plan (B

Class), dated September 3, 2002 (filed electronically as Exhibit m7 to

Post-Effective Amendment No. 34 to the Registration Statement of American

Century California Tax-Free and Municipal Funds on October 1, 2002, File No.

2-82734, and incorporated herein by reference).

(s) Amendment No. 1 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated February 27, 2004 (filed

electronically as Exhibit m20 to Post-Effective Amendment No. 104 to the

Registration Statement of American Century Mutual Funds, Inc. on February 26,

2004, File No. 2-14213, and incorporated herein by reference).

(t) Amendment No. 2 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated September 30, 2004 (filed

electronically as Exhibit m26 to Post-Effective No. 106 to the Registration

Statement of American Century Mutual Funds, Inc. on November 29, 2004, File No.

2-14213, and incorporated herein by reference).

(u) Amendment No. 3 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated November 17, 2004 (filed

electronically as Exhibit m27 to Post-Effective Amendment No. 106 to the

Registration Statement of American Century Mutual Funds, Inc. on November 29,

2004, File No. 2-14213, and incorporated herein by reference).

(v) Amendment No. 4 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated May 1, 2005 (filed electronically as

Exhibit m18 to Post-Effective Amendment No. 44 to the Registration Statement of

Municipal Trust on May 13, 2005, File No. 2-91229, and incorporated herein by

reference).

(w) Amendment No. 5 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated September 29, 2005 (filed

electronically as Exhibit m31 to Post-Effective Amendment No. 38 to the

Registration Statement of American Century World Mutual Funds, Inc. on November

30, 2005, File No. 33-39242, and incorporated herein by reference).

(x) Amendment No. 6 to the Master Distribution and Individual

Shareholder Services Plan (B Class), dated March 30, 2006 (filed electronically

as Exhibit m34 to Post-Effective Amendment No. 23 to the Registration Statement

of American Century Strategic Asset Allocations, Inc. on March 30, 2006, File

No. 33-79482, and incorporated herein by reference).

(y) Master Distribution and Shareholder Services Plan (Advisor Class),

dated August 1, 1997, (filed electronically as Exhibit m18 to Post-Effective

Amendment No. 32 to the Registration Statement of American Century Target

Maturities Trust on January 31, 2000, File No. 2-94608, and incorporated herein

by reference).

(z) Amendment to Master Distribution and Shareholder Services Plan

(Advisor Class), dated June 29, 1998 (filed electronically as Exhibit m2 to

Post-Effective Amendment No. 32 to the Registration Statement of American

Century Target Maturities Trust on January 31, 2000, File No. 2-94608, and

incorporated herein by reference).

(aa) Amendment No. 1 to Master Distribution and Shareholder Services

Plan (Advisor Class), dated August 1, 2001 (filed electronically as Exhibit m3

to Post-Effective Amendment No. 44 to the Registration Statement of American

Century Government Income Trust on July 31, 2001, File No. 2-99222, and

incorporated herein by reference).

(bb) Amendment No. 2 to Master Distribution and Shareholder Services

Plan (Advisor Class), dated December 3, 2001 (filed electronically as Exhibit m4

to Post-Effective Amendment No. 16 to the Registration Statement of the American

Century Investment Trust on November 30, 2001, File No. 33-65170, and

incorporated herein by reference).

(cc) Amendment No. 3 to Master Distribution and Shareholder Services

Plan (Advisor Class), dated July 1, 2002 (filed electronically as Exhibit m5 to

Post-Effective Amendment No. 38 to the Registration Statement of American

Century Target Maturities Trust on January 31, 2005, File No. 2-94608, and

incorporated herein by reference).

(dd) Amendment No. 4 to Master Distribution and Shareholder Services

Plan (Advisor Class), dated May 1, 2004 (filed electronically as Exhibit m6 to

Post-Effective Amendment No. 35 to the Registration Statement of the Registrant

on April 29, 2004, File No. 33-19589, and incorporated herein by reference).

(ee) Amendment No. 5 to Master Distribution and Shareholder Services

Plan (Advisor Class), dated July 29, 2005 (filed electronically as Exhibit m7 to

Post-Effective Amendment No. 51 to the Registration Statement of American

Century Government Income Trust on July 28, 2005, File No. 2-99222, and

incorporated herein by reference).

(ff) Amendment No. 6 to the Master Distribution and Shareholder

Services Plan (Advisor Class), dated September 29, 2005 (filed electronically as

Exhibit m8 to Post-Effective Amendment No. 41 to the Registration Statement of

the Registrant on September 29, 2005, File No. 33-19589, and incorporated herein

by reference).

(gg) Master Distribution and Individual Shareholder Services Plan (R

Class), dated August 29, 2003 (filed electronically as Exhibit m16 to

Post-Effective Amendment No. 17 to the Registration Statement of American

Century Strategic Asset Allocations, Inc. on August 28, 2003, File No. 33-79482,

and incorporated herein by reference).

(hh) Amendment No. 1 to the Master Distribution and Individual

Shareholder Services Plan (R Class), dated May 1, 2004 (filed electronically as

Exhibit m13 to Post-Effective Amendment No. 35 to the Registration Statement of

the Registrant on April 29, 2004, File No. 33-19589, and incorporated herein by

reference).

(ii) Amendment No. 2 to the Master Distribution and Individual

Shareholder Services Plan (R Class), dated February 24, 2005 (filed

electronically as Exhibit m30 to Post-Effective Amendment No. 22 to the

Registration Statement of American Century Strategic Asset Allocations, Inc. on

March 30, 2005, File No. 33-79482, and incorporated herein by reference).

(jj) Amendment No. 3 to the Master Distribution and Individual

Shareholder Services Plan (R Class), dated July 29, 2005 (filed electronically

as Exhibit m33 to Post-Effective Amendment No. 111 to the Registration Statement

of American Century Mutual Funds, Inc. on July 28, 2005, File No. 2-14213, and

incorporated herein by reference).

(kk) Amendment No. 4 to the Master Distribution and Individual

Shareholder Services Plan (R Class), dated September 29, 2005 (filed

electronically as Exhibit m22 to Post-Effective Amendment No. 41 to the

Registration Statement of the Registrant on September 29, 2005, File No.

33-19589, and incorporated herein by reference).

(ll) Amendment No. 5 to the Master Distribution and Individual

Shareholder Services Plan (R Class), dated March 30, 2006 (filed electronically

as Exhibit m40 to Post-Effective Amendment No. 23 to the Registration Statement

of American Century Strategic Asset Allocations, Inc. on March 30, 2006, File

No. 33-79482, and incorporated herein by reference).

(mm) Amended and Restated Multiple Class Plan, dated September 3, 2002

(filed electronically as Exhibit n to Post-Effective Amendment No. 35 to the

Registration Statement of American Century California Tax-Free and Municipal

Funds on December 17, 2002, File No. 2-82734, and incorporated herein by

reference).

(nn) Amendment No. 1 to the Amended and Restated Multiple Class Plan,

dated December 31, 2002 (filed electronically as Exhibit n2 to Post-Effective

Amendment No. 39 to the Registration Statement of American Century Municipal

Trust on December 23, 2002, File No. 2-91229, and incorporated herein by

reference).

(oo) Amendment No. 2 to the Amended and Restated Multiple Class Plan,

dated August 29, 2003 (filed electronically as Exhibit n3 to Post-Effective

Amendment No. 17 to the Registration Statement of American Century Strategic

Asset Allocations, Inc. on August 28, 2003, File No. 33-79482, and incorporated

herein by reference).

(pp) Amendment No. 3 to the Amended and Restated Multiple Class Plan,

dated February 27, 2004 (filed electronically as Exhibit n4 to Post-Effective

Amendment No. 104 to the Registration Statement of American Century Mutual

Funds, Inc. on February 26, 2004, File No. 2-14213, and incorporated herein by

reference).

(qq) Amendment No. 4 to the Amended and Restated Multiple Class Plan,

dated May 1, 2004 (filed electronically as Exhibit n5 to Post-Effective

Amendment No. 35 to the Registration Statement of the Registrant on April 29,

2004, File No. 33-19589, and incorporated herein by reference).

(rr) Amendment No. 5 to the Amended and Restated Multiple Class Plan,

dated August 1, 2004 (filed electronically as Exhibit n6 to Post-Effective

Amendment No. 24 to the Registration Statement of American Century Investment

Trust on August 1, 2004, File No. 33-65170, and incorporated herein by

reference).

(ss) Amendment No. 6 to the Amended and Restated Multiple Class Plan,

dated as of September 30, 2004 (filed electronically as Exhibit n7 to

Post-Effective Amendment No. 20 to the Registration Statement of American

Century Strategic Asset Allocations, Inc. on September 29, 2004, File No.

33-79482, and incorporated herein by reference).

(tt) Amendment No. 7 to the Amended and Restated Multiple Class Plan,

dated November 17, 2004 (filed electronically as Exhibit n8 to Post-Effective

Amendment No. 106 to the Registration Statement of American Century Mutual

Funds, Inc. on November 29, 2004, File No. 2-14213, and incorporated herein by

reference).

(uu) Amendment No. 8 to the Amended and Restated Multiple Class Plan,

dated February 24, 2005 (filed electronically as Exhibit n9 to Post-Effective

Amendment No. 22 to the Registration Statement of American Century Strategic

Asset Allocations, Inc. on March 30, 2005, File No. 33-79482, and incorporated

herein by reference).

(vv) Amendment No. 9 to the Amended and Restated Multiple Class Plan,

dated July 29, 2005 (filed electronically as Exhibit n10 to Post-Effective

Amendment No. 111 to the Registration Statement of American Century Mutual

Funds, Inc. on July 28, 2005, File No. 2-14213, and incorporated herein by

reference).

(ww) Amendment No. 10 to the Amended and Restated Multiple Class Plan,

dated September 29, 2005 (filed electronically as Exhibit n11 to Post-Effective

Amendment No. 41 to the Registration Statement of the Registrant on September

29, 2005, File No. 33-19589, and incorporated herein by reference).

(xx) Amendment No. 11 to the Amended and Restated Multiple Class Plan,

dated March 30, 2006 (filed electronically as Exhibit n12 to Post-Effective

Amendment No. 23 to the Registration Statement of American Century Strategic

Asset Allocations, Inc. on March 30, 2006, File No. 33-79482, and incorporated

herein by reference).

(11) Opinion and Consent of Counsel, dated October 2, 2006 (filed

electronically as Exhibit 11 to the Registration Statement on Form N-14 of the

Registrant on October 2, 2006, File No. 33-19589, and incorporated herein by

reference).

(12) Form of Opinion and Consent of Counsel as to the tax matters and

consequences to shareholders (filed electronically as Exhibit 12 to the

Registration Statement on Form N-14 of the Registrant on October 2, 2006, File

No. 33-19589, and incorporated herein by reference).

(13) (a) Transfer Agency Agreement with American Century Services

Corporation, dated August 1, 1997 (filed electronically as Exhibit 9 to

Post-Effective Amendment No. 33 to the Registration Statement of American

Century Government Income Trust on July 31, 1997, File No. 2-99222, and

incorporated herein by reference).

(b) Amendment No. 1 to the Transfer Agency Agreement American Century

Services Corporation, dated June 29, 1998 (filed electronically as Exhibit 9b to

Post-Effective Amendment No. 23 to the Registration Statement of American

Century Quantitative Equity Funds on June 29, 1998, File No. 33-19589, and

incorporated herein by reference).

(c) Amendment No. 2 to the Transfer Agency Agreement with American

Century Services Corporation, dated November 20, 2000 (filed electronically as

Exhibit h4 to Post-Effective Amendment No. 30 to the Registration Statement of

American Century California Tax-Free and Municipal Funds on December 29, 2000,

File No. 2-82734, and incorporated herein by reference).

(d) Amendment No. 3 to the Transfer Agency Agreement with American

Century Services Corporation, dated August 1, 2001 (filed electronically as

Exhibit h5 to Post-Effective Amendment No. 44 to the Registration Statement of

American Century Government Income Trust on July 31, 2001, File No. 2-99222, and

incorporated herein by reference).

(e) Amendment No. 4 to the Transfer Agency Agreement with American

Century Services Corporation, dated December 3, 2001 (filed electronically as

Exhibit h6 to Post-Effective Amendment No. 16 to the Registration Statement of

American Century Investment Trust on November 30, 2001, File No. 33-65170, and