UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-05447 |

| |

| AMERICAN CENTURY QUANTITATIVE EQUITY FUNDS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 6-30 |

| |

| Date of reporting period: | 06-30-2022 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| | | | | |

| |

| Annual Report |

| |

| June 30, 2022 |

| |

| Disciplined Core Value Fund |

| Investor Class (BIGRX) |

| I Class (AMGIX) |

| A Class (AMADX) |

| C Class (ACGCX) |

| R Class (AICRX) |

| R5 Class (AICGX) |

| | | | | |

| President's Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Approval of Management Agreement | |

| Liquidity Risk Management Program | |

| |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended June 30, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Second-Half Sell-Off Sank Stock Returns

Stock market performance changed dramatically during the 12-month period. In the first half, generally upbeat economic activity and corporate earnings supported solid six-month returns for most broad U.S. and global stock indices. Performance remained positive despite rapidly rising inflation and waning central bank support.

The market climate changed considerably in the period’s second half. Inflation, which was already at multiyear highs, rose to levels last seen in the early 1980s. The massive fiscal and monetary support unleashed during the pandemic was partly to blame. In addition, escalating energy prices, supply chain breakdowns and labor market shortages further aggravated the inflation rate. Russia’s invasion of Ukraine in February also exacerbated global inflationary pressures.

The Federal Reserve responded to surging inflation in March, launching an aggressive rate-hike campaign and ending its asset purchase program. Policymakers indicated taming inflation is their priority, even if the economy slips into recession in the process. Despite a rate-hike total of 1.5 percentage points through June 30, U.S. inflation climbed to a 41-year high of 9.1%.

The combination of accelerating inflation, tighter monetary policy, geopolitical strife and slowing economic growth fueled sharp market volatility and eventually triggered recession fears. U.S. and global stocks erased their first-half gains and plunged for the 12-month period. U.S. stocks generally fared better than non-U.S. stocks, and value stocks outperformed growth stocks. Commodities were a bright spot, rallying amid severe supply/demand imbalances and geopolitical tensions.

Staying Disciplined in Uncertain Times

We expect market volatility to linger as investors navigate a complex environment of high inflation, rising interest rates and economic uncertainty. In addition, Russia’s invasion of Ukraine complicates a tense geopolitical backdrop. We will continue to monitor this evolving situation and what it broadly means for our clients and investment exposure.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | | | |

| Total Returns as of June 30, 2022 |

| | | | Average Annual Returns | |

| Ticker

Symbol | | 1 year | 5 years | 10 years | Since

Inception | | Inception

Date |

| Investor Class | BIGRX | | -9.84% | 8.82% | 10.90% | — | | 12/17/90 |

| Russell 1000 Value Index | — | | -6.82% | 7.16% | 10.49% | — | | — |

| I Class | AMGIX | | -9.67% | 9.04% | 11.12% | — | | 1/28/98 |

| A Class | AMADX | | | | | — | | 12/15/97 |

| No sales charge | | | -10.07% | 8.54% | 10.63% | — | | |

| With sales charge | | | -15.24% | 7.27% | 9.97% | — | | |

| C Class | ACGCX | | -10.76% | 7.73% | 9.80% | — | | 6/28/01 |

| R Class | AICRX | | -10.30% | 8.28% | 10.35% | — | | 8/29/03 |

| R5 Class | AICGX | | -9.64% | 9.04% | — | 8.99% | | 4/10/17 |

Average annual returns since inception are presented when ten years of performance history is not available.

C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

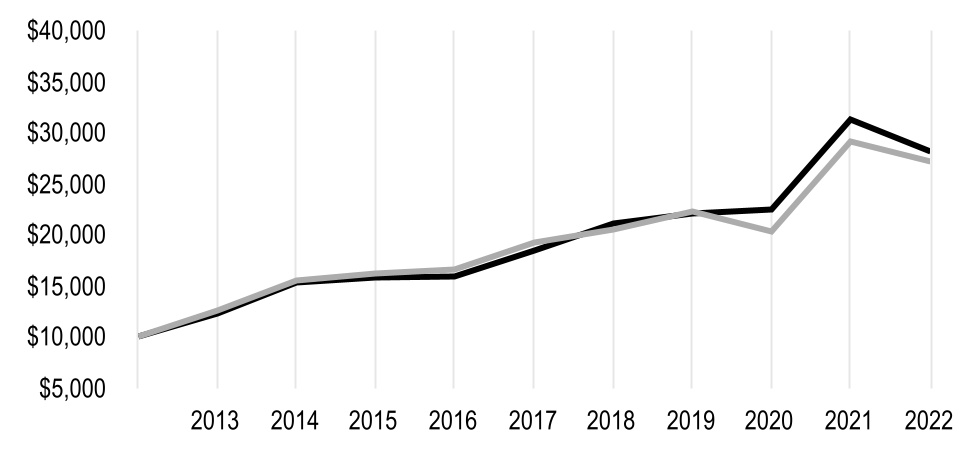

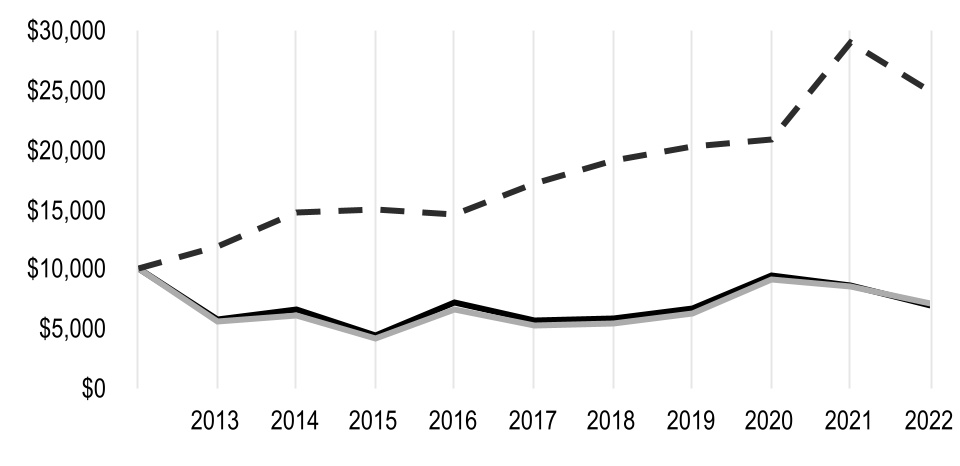

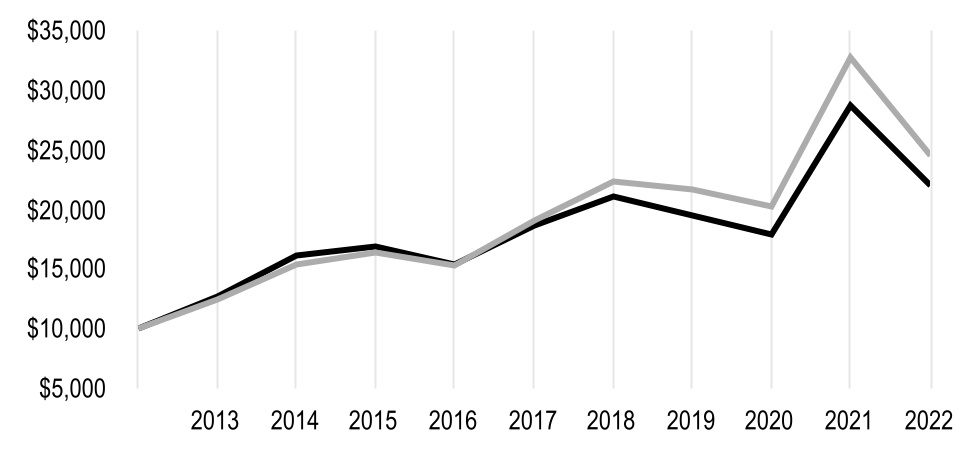

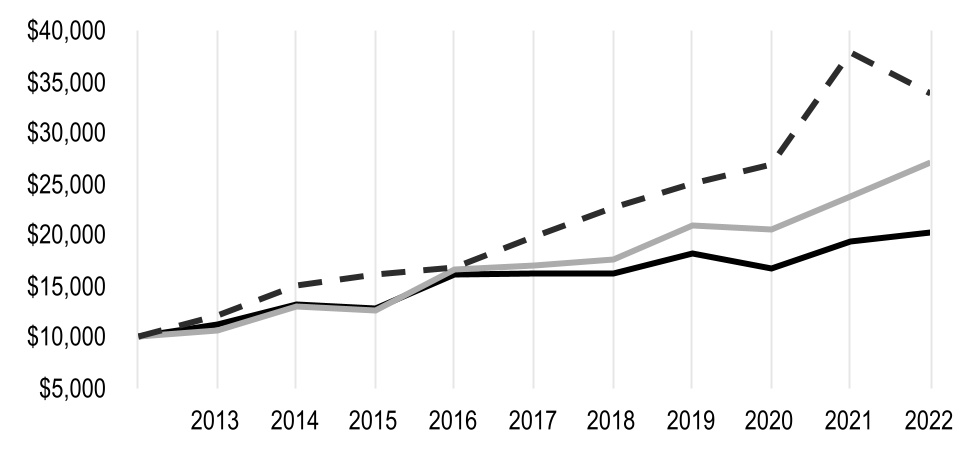

| Growth of $10,000 Over 10 Years |

| $10,000 investment made June 30, 2012 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on June 30, 2022 |

| Investor Class — $28,159 |

|

| Russell 1000 Value Index — $27,139 |

|

| | | | | | | | | | | | | | | | | |

| Total Annual Fund Operating Expenses | |

| Investor Class | I Class | A Class | C Class | R Class | R5 Class |

| 0.66% | 0.46% | 0.91% | 1.66% | 1.16% | 0.46% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Steven Rossi and Yulin Long

Performance Summary

Disciplined Core Value returned -9.84%* for the year ended June 30, 2022, compared with the -6.82% return of its benchmark, the Russell 1000 Value Index.

Disciplined Core Value lost ground during the fiscal year and underperformed its benchmark, the Russell 1000 Value Index. Disciplined Core Value’s stock selection process incorporates factors of valuation, quality, growth and sentiment, while striving to minimize unintended risks along industries and other risk characteristics. The fund’s returns were primarily driven by allocation and security selection decisions in the consumer discretionary sector. Security selection results among industrials and materials holdings also detracted. In contrast, stock selection in the health care and information technology sectors aided relative performance.

Consumer Discretionary Sector Detracted Most from Relative Performance

Positioning in the consumer discretionary sector was a main source of the portfolio’s underperformance. An overweight to the specialty retail industry detracted, as did overweight positions in Williams-Sonoma and Bath & Body Works. Shares of Williams-Sonoma performed quite well in 2021, easily outpacing the benchmark as the company reported better-than-expected revenues and earnings, but rising inflation and interest rates weighed on the shares’ performance in 2022. Shares of Bath & Body Works also easily outperformed in 2021, fueled by strong sales and earnings. But shares declined sharply in 2022 as inflation and rising rates caused valuations to compress. Stock selections in the hotels, restaurants and leisure industry also detracted. Lack of exposure to McDonald’s in particular was a drag on performance. Shares performed well in 2021, sold off early in 2022 but rebounded through the first half of the year as the company posted better-than-expected sales and earnings, driven by its drive-thru business and its digitization efforts. In the multiline retail industry, shares of Target detracted. The company cited problems with surplus inventories, which may require price reductions to eliminate. We exited our position.

Stocks selection in the industrials sector also hampered relative performance. In the aerospace and defense industry, underweight positions in Raytheon Technologies and Northrop Grumman were the primary drivers. Shares of aerospace and defense industry stocks were favored in 2022 as investors opted increasingly for companies that were perceived as likely to hold up well during a possible economic slowdown. Raytheon performed well as the company posted year-over-year improvements in both revenues and earnings. Shares of Northrop Grumman rose despite the company’s year-over-year decline in organic sales. We terminated our position in Northrop Grumman. The fund’s underweight position in The Boeing Co. detracted as well, primarily due to the timing of the fund’s purchase and exit. The company reported lower revenues and higher costs early in 2022 and said it would have to delay deliveries of its new widebody passenger jetliner. We exited our position in the second quarter of 2022. In the air freight and logistics industry, an overweight position in FedEx also detracted as rising transportation and labor costs reduced earnings. An overweight position in MasTec, a building materials company, also hindered returns in the construction and engineering industry. The company posted strong year-over-year results but lowered earnings guidance for full-year 2022. We exited our position.

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

Stocks selection in the materials sector was also an area of weakness. An overweight position in The Chemours Co., a specialty chemical company, hindered returns. Although shares performed well early in 2022, they have experienced volatility due to a slowdown in the automobiles industry and to supply chain concerns, so we sold out of our position. In the containers and packaging industry, International Paper also hurt performance. Shares enjoyed a strong run in 2021 prior to the reporting period but declined over the past 12 months despite improvement in earnings year over year. This position was liquidated.

Health Care Contributed the Most to Relative Performance

The health care sector was the leading contributor, primarily due to strong stock selection. In the health care providers and services industry, an overweight position contributed to results, as did positioning in McKesson, a drug distributor. The company reported strong results due in part to distribution of COVID-19 vaccines and its increased guidance for fiscal 2022. In the biotechnology industry, overweight positions in Moderna and AbbVie were also advantageous. Moderna has performed well due to revenues from its COVID-19 vaccine, while AbbVie’s performance was driven by sales of Skyrizi, Rinvoq and Venclexta, and revenues from its aesthetics and neuroscience business.

Stock choices in the information technology sector contributed to performance as well. In the IT services industry, avoiding Twilio, a cloud computing company, was advantageous as shares declined throughout the period. The company has experienced high growth but has not been profitable, and stocks like this have been hit by a change in investor sentiment. In the software industry, underweighting Salesforce.com also helped drive returns. Although the company reported year-over-year improvements in sales and earnings and raised its guidance for fiscal 2023, high-growth companies with high valuations have experienced declines in their shares as investors have shifted to more defensive names. We exited this position. A portfolio-only position in Broadcom, a semiconductor company, also added to returns. The company posted robust results year over year, beating expectations, and shares performed well in the first half of the reporting period. Shares came under pressure in 2022, but we exited our position in order to capitalize on the earlier runup.

A Look Ahead

Our disciplined, objective and systematic investment strategy is designed to take advantage of opportunities at the individual company level. We believe this approach is an effective way to capitalize on market inefficiencies that lead to the mispricing of individual stocks. Our strategy is designed to provide investors with well-diversified and risk-managed exposure to broad U.S. equity market exposure with strong current income. As such, we do not see significant deviations in sector weightings versus the Russell 1000 Value Index. Nevertheless, we can point to select sectors and industries where we are finding more or less investment opportunity.

At period-end, health care was the portfolio’s largest absolute and relative weighting as the investment team’s screens identified a significant number of opportunities in the sector. The industrials and consumer discretionary sectors were also areas of notable active exposure. Conversely, the portfolio’s utilities sector underweight reflects more limited opportunities that align with the team’s stock selection model. Likewise, the portfolio maintains relative underweight positions in financials and communication services, reflecting less compelling opportunities, based on our model.

| | | | | |

| JUNE 30, 2022 |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 99.1% |

| Short-Term Investments | 0.8% |

| Other Assets and Liabilities | 0.1% |

| |

| Top Five Industries | % of net assets |

| Health Care Providers and Services | 10.3% |

| Oil, Gas and Consumable Fuels | 8.5% |

| Banks | 8.1% |

| Biotechnology | 6.8% |

| Pharmaceuticals | 5.5% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from January 1, 2022 to June 30, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| Beginning

Account Value

1/1/22 | Ending

Account Value

6/30/22 | Expenses Paid During Period(1) 1/1/22 - 6/30/22 | Annualized Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $848.60 | $3.03 | 0.66% |

| I Class | $1,000 | $849.40 | $2.11 | 0.46% |

| A Class | $1,000 | $847.50 | $4.17 | 0.91% |

| C Class | $1,000 | $844.30 | $7.59 | 1.66% |

| R Class | $1,000 | $846.50 | $5.31 | 1.16% |

| R5 Class | $1,000 | $849.50 | $2.11 | 0.46% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,021.52 | $3.31 | 0.66% |

| I Class | $1,000 | $1,022.51 | $2.31 | 0.46% |

| A Class | $1,000 | $1,020.28 | $4.56 | 0.91% |

| C Class | $1,000 | $1,016.56 | $8.30 | 1.66% |

| R Class | $1,000 | $1,019.04 | $5.81 | 1.16% |

| R5 Class | $1,000 | $1,022.51 | $2.31 | 0.46% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

JUNE 30, 2022

| | | | | | | | |

| Shares | Value |

| COMMON STOCKS — 99.1% |

|

|

| Aerospace and Defense — 2.6% | | |

| Huntington Ingalls Industries, Inc. | 112,001 | | $ | 24,396,058 | |

| Lockheed Martin Corp. | 30,283 | | 13,020,478 | |

| Raytheon Technologies Corp. | 282,754 | | 27,175,487 | |

| | 64,592,023 | |

| Air Freight and Logistics — 0.8% | | |

| FedEx Corp. | 86,942 | | 19,710,621 | |

| Auto Components — 0.4% | | |

| BorgWarner, Inc. | 279,152 | | 9,315,302 | |

| Automobiles — 0.6% | | |

| Honda Motor Co. Ltd. | 665,900 | | 16,055,568 | |

| Banks — 8.1% | | |

| Canadian Imperial Bank of Commerce | 339,820 | | 16,502,601 | |

| Comerica, Inc. | 219,568 | | 16,111,900 | |

| JPMorgan Chase & Co. | 141,905 | | 15,979,922 | |

| KeyCorp | 1,754,117 | | 30,223,436 | |

| Popular, Inc. | 308,509 | | 23,733,597 | |

| Royal Bank of Canada | 287,612 | | 27,849,565 | |

| Synovus Financial Corp. | 647,807 | | 23,353,442 | |

| Wells Fargo & Co. | 184,325 | | 7,220,010 | |

| Western Alliance Bancorp | 239,758 | | 16,926,915 | |

| Zions Bancorp NA | 430,200 | | 21,897,180 | |

| | 199,798,568 | |

| Beverages — 0.6% | | |

| Coca-Cola Co. | 226,359 | | 14,240,245 | |

| Biotechnology — 6.8% | | |

| AbbVie, Inc. | 190,852 | | 29,230,892 | |

| Amgen, Inc. | 92,103 | | 22,408,660 | |

Biogen, Inc.(1) | 59,741 | | 12,183,580 | |

Exelixis, Inc.(1) | 892,575 | | 18,583,411 | |

| Gilead Sciences, Inc. | 531,925 | | 32,878,284 | |

Moderna, Inc.(1) | 51,418 | | 7,345,061 | |

Regeneron Pharmaceuticals, Inc.(1) | 48,168 | | 28,473,550 | |

United Therapeutics Corp.(1) | 63,537 | | 14,971,859 | |

| | 166,075,297 | |

| Building Products — 0.8% | | |

| Owens Corning | 257,474 | | 19,132,893 | |

| Capital Markets — 1.5% | | |

| Affiliated Managers Group, Inc. | 154,803 | | 18,050,030 | |

| SEI Investments Co. | 120,216 | | 6,494,068 | |

| T. Rowe Price Group, Inc. | 105,744 | | 12,013,576 | |

| | 36,557,674 | |

| Chemicals — 3.0% | | |

| CF Industries Holdings, Inc. | 235,200 | | 20,163,696 | |

| Eastman Chemical Co. | 70,482 | | 6,327,169 | |

| LyondellBasell Industries NV, Class A | 322,279 | | 28,186,522 | |

| Olin Corp. | 399,519 | | 18,489,739 | |

| | 73,167,126 | |

| | | | | | | | |

| Shares | Value |

| Commercial Services and Supplies — 0.2% | | |

| ABM Industries, Inc. | 139,738 | | $ | 6,067,424 | |

| Communications Equipment — 0.8% | | |

| Nokia Oyj, ADR | 2,571,810 | | 11,856,044 | |

| Telefonaktiebolaget LM Ericsson, ADR | 974,383 | | 7,210,434 | |

| | 19,066,478 | |

| Containers and Packaging — 0.6% | | |

| WestRock Co. | 366,888 | | 14,616,818 | |

| Distributors — 0.4% | | |

| LKQ Corp. | 182,701 | | 8,968,792 | |

| Diversified Consumer Services — 0.4% | | |

| H&R Block, Inc. | 274,506 | | 9,695,552 | |

| Diversified Financial Services — 1.0% | | |

Berkshire Hathaway, Inc., Class B(1) | 89,744 | | 24,501,907 | |

| Diversified Telecommunication Services — 1.2% | | |

| Lumen Technologies, Inc. | 2,661,580 | | 29,037,838 | |

| Electric Utilities — 0.9% | | |

| NRG Energy, Inc. | 561,895 | | 21,447,532 | |

| Electrical Equipment — 0.2% | | |

| Encore Wire Corp. | 41,035 | | 4,264,357 | |

| Entertainment — 2.3% | | |

| Electronic Arts, Inc. | 244,163 | | 29,702,429 | |

| Nintendo Co. Ltd. | 64,000 | | 27,523,605 | |

| | 57,226,034 | |

| Equity Real Estate Investment Trusts (REITs) — 1.2% | | |

| Weyerhaeuser Co. | 923,744 | | 30,594,401 | |

| Food and Staples Retailing — 4.6% | | |

| Albertsons Cos., Inc., Class A | 950,238 | | 25,390,359 | |

| Costco Wholesale Corp. | 36,582 | | 17,533,021 | |

| Kroger Co. | 1,000,085 | | 47,334,023 | |

| Walmart, Inc. | 180,319 | | 21,923,184 | |

| | 112,180,587 | |

| Food Products — 5.2% | | |

| Archer-Daniels-Midland Co. | 822,687 | | 63,840,511 | |

| Tyson Foods, Inc., Class A | 730,137 | | 62,835,590 | |

| | 126,676,101 | |

| Health Care Equipment and Supplies — 1.3% | | |

Hologic, Inc.(1) | 470,454 | | 32,602,462 | |

| Health Care Providers and Services — 10.3% | | |

Centene Corp.(1) | 487,578 | | 41,253,975 | |

| CVS Health Corp. | 728,514 | | 67,504,107 | |

| Elevance Health, Inc. | 61,403 | | 29,631,860 | |

Henry Schein, Inc.(1) | 204,409 | | 15,686,347 | |

| Laboratory Corp. of America Holdings | 21,315 | | 4,995,383 | |

| McKesson Corp. | 191,586 | | 62,497,269 | |

| Quest Diagnostics, Inc. | 46,885 | | 6,234,767 | |

| UnitedHealth Group, Inc. | 47,818 | | 24,560,759 | |

| | 252,364,467 | |

| Hotels, Restaurants and Leisure — 0.3% | | |

| Boyd Gaming Corp. | 143,298 | | 7,129,076 | |

| Independent Power and Renewable Electricity Producers — 0.4% | |

| Vistra Corp. | 436,347 | | 9,970,529 | |

| | | | | | | | |

| Shares | Value |

| Insurance — 4.3% | | |

| Allstate Corp. | 145,912 | | $ | 18,491,428 | |

| Everest Re Group Ltd. | 205,339 | | 57,552,415 | |

| Progressive Corp. | 246,885 | | 28,705,319 | |

| | 104,749,162 | |

| Interactive Media and Services — 0.2% | | |

Alphabet, Inc., Class A(1) | 1,822 | | 3,970,612 | |

| IT Services — 4.5% | | |

| Amdocs Ltd. | 357,244 | | 29,761,998 | |

| Cognizant Technology Solutions Corp., Class A | 395,857 | | 26,716,389 | |

DXC Technology Co.(1) | 399,087 | | 12,096,327 | |

| International Business Machines Corp. | 290,218 | | 40,975,879 | |

| | 109,550,593 | |

| Life Sciences Tools and Services — 0.6% | | |

| PerkinElmer, Inc. | 107,610 | | 15,304,294 | |

| Machinery — 2.8% | | |

| AGCO Corp. | 159,608 | | 15,753,310 | |

| CNH Industrial NV | 1,293,533 | | 14,992,047 | |

| Oshkosh Corp. | 306,913 | | 25,209,834 | |

| Snap-on, Inc. | 64,980 | | 12,803,009 | |

| | 68,758,200 | |

| Metals and Mining — 0.3% | | |

| Nucor Corp. | 80,300 | | 8,384,123 | |

| Multi-Utilities — 0.2% | | |

| Brookfield Infrastructure Partners LP | 103,586 | | 3,959,057 | |

| Multiline Retail — 0.4% | | |

| Kohl's Corp. | 299,500 | | 10,689,155 | |

| Oil, Gas and Consumable Fuels — 8.5% | | |

| APA Corp. | 161,238 | | 5,627,206 | |

| Cheniere Energy, Inc. | 35,049 | | 4,662,569 | |

| Chevron Corp. | 77,240 | | 11,182,807 | |

| Devon Energy Corp. | 260,876 | | 14,376,876 | |

| Diamondback Energy, Inc. | 89,805 | | 10,879,876 | |

| Equinor ASA, ADR | 1,245,194 | | 43,282,943 | |

| Exxon Mobil Corp. | 584,914 | | 50,092,035 | |

| Oasis Petroleum, Inc. | 64,407 | | 7,835,112 | |

| Ovintiv, Inc. | 175,928 | | 7,774,258 | |

| PDC Energy, Inc. | 77,294 | | 4,762,083 | |

| Phillips 66 | 209,542 | | 17,180,349 | |

| Shell PLC, ADR | 467,921 | | 24,467,589 | |

| SM Energy Co. | 186,534 | | 6,377,598 | |

| | 208,501,301 | |

| Paper and Forest Products — 0.7% | | |

| Louisiana-Pacific Corp. | 217,055 | | 11,375,853 | |

| Sylvamo Corp. | 161,480 | | 5,277,166 | |

| | 16,653,019 | |

| Pharmaceuticals — 5.5% | | |

| Bristol-Myers Squibb Co. | 419,028 | | 32,265,156 | |

| Johnson & Johnson | 202,932 | | 36,022,459 | |

| Merck & Co., Inc. | 375,417 | | 34,226,768 | |

| Organon & Co. | 425,199 | | 14,350,466 | |

| Takeda Pharmaceutical Co. Ltd. | 288,700 | | 8,109,101 | |

| | | | | | | | |

| Shares | Value |

| Viatris, Inc. | 1,023,967 | | $ | 10,720,935 | |

| | 135,694,885 | |

| Professional Services — 4.6% | | |

CACI International, Inc., Class A(1) | 156,486 | | 44,094,625 | |

FTI Consulting, Inc.(1) | 57,621 | | 10,420,758 | |

| Jacobs Engineering Group, Inc. | 130,006 | | 16,527,663 | |

| KBR, Inc. | 187,548 | | 9,075,448 | |

| Leidos Holdings, Inc. | 256,468 | | 25,828,892 | |

| Science Applications International Corp. | 81,980 | | 7,632,338 | |

| | 113,579,724 | |

| Real Estate Management and Development — 1.6% | | |

CBRE Group, Inc., Class A(1) | 99,742 | | 7,342,009 | |

Jones Lang LaSalle, Inc.(1) | 184,267 | | 32,220,927 | |

| | 39,562,936 | |

| Road and Rail — 0.9% | | |

| Knight-Swift Transportation Holdings, Inc. | 229,571 | | 10,626,842 | |

| Ryder System, Inc. | 68,304 | | 4,853,682 | |

| Schneider National, Inc., Class B | 290,910 | | 6,510,566 | |

| | 21,991,090 | |

| Semiconductors and Semiconductor Equipment — 1.1% | | |

| ASE Technology Holding Co. Ltd., ADR | 937,969 | | 4,849,300 | |

| Intel Corp. | 574,377 | | 21,487,443 | |

| | 26,336,743 | |

| Software — 1.3% | | |

Dropbox, Inc., Class A(1) | 242,519 | | 5,090,474 | |

Fortinet, Inc.(1) | 163,760 | | 9,265,541 | |

| Microsoft Corp. | 48,751 | | 12,520,719 | |

| Oracle Corp. (New York) | 59,039 | | 4,125,055 | |

| | 31,001,789 | |

| Specialty Retail — 3.7% | | |

AutoNation, Inc.(1) | 234,714 | | 26,231,637 | |

| Bath & Body Works, Inc. | 205,662 | | 5,536,421 | |

| Dick's Sporting Goods, Inc. | 147,987 | | 11,153,780 | |

| Lithia Motors, Inc. | 47,300 | | 12,998,513 | |

| Penske Automotive Group, Inc. | 207,817 | | 21,756,362 | |

| Williams-Sonoma, Inc. | 117,158 | | 12,998,680 | |

| | 90,675,393 | |

| Technology Hardware, Storage and Peripherals — 0.8% | | |

| Dell Technologies, Inc., Class C | 186,663 | | 8,625,697 | |

| Hewlett Packard Enterprise Co. | 488,992 | | 6,484,034 | |

Western Digital Corp.(1) | 117,144 | | 5,251,566 | |

| | 20,361,297 | |

| Wireless Telecommunication Services — 0.6% | | |

| Vodafone Group PLC, ADR | 1,023,530 | | 15,946,597 | |

TOTAL COMMON STOCKS (Cost $2,432,261,417) | | 2,430,725,642 | |

| SHORT-TERM INVESTMENTS — 0.8% |

|

|

| Repurchase Agreements — 0.8% | | |

| BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 0.125% - 4.25%, 5/15/23 - 11/15/43, valued at $2,860,790), in a joint trading account at 1.43%, dated 6/30/22, due 7/1/22 (Delivery value $2,793,816) | | 2,793,705 | |

| | | | | | | | |

| Shares | Value |

| Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 1.25%, 3/31/28, valued at $17,132,979), at 1.44%, dated 6/30/22, due 7/1/22 (Delivery value $16,797,672) | | $ | 16,797,000 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $19,590,705) | | 19,590,705 | |

TOTAL INVESTMENT SECURITIES — 99.9% (Cost $2,451,852,122) | | 2,450,316,347 | |

| OTHER ASSETS AND LIABILITIES — 0.1% | | 1,521,484 | |

| TOTAL NET ASSETS — 100.0% | | $ | 2,451,837,831 | |

| | | | | | | | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| ADR | - | American Depositary Receipt |

(1)Non-income producing.

See Notes to Financial Statements.

| | |

| Statement of Assets and Liabilities |

| | | | | |

| JUNE 30, 2022 | |

| Assets | |

| Investment securities, at value (cost of $2,451,852,122) | $ | 2,450,316,347 | |

| Foreign currency holdings, at value (cost of $162,567) | 163,676 | |

| Receivable for investments sold | 3,125,409 | |

| Receivable for capital shares sold | 759,080 | |

| Dividends and interest receivable | 3,384,533 | |

| 2,457,749,045 | |

| |

| Liabilities | |

| Disbursements in excess of demand deposit cash | 161,656 | |

| Payable for investments purchased | 3,193,861 | |

| Payable for capital shares redeemed | 1,215,960 | |

| Accrued management fees | 1,288,864 | |

| Distribution and service fees payable | 50,873 | |

| 5,911,214 | |

| |

| Net Assets | $ | 2,451,837,831 | |

| |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 2,517,369,827 | |

| Distributable earnings | (65,531,996) | |

| $ | 2,451,837,831 | |

| | | | | | | | | | | |

| Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value | $1,739,617,127 | 57,756,979 | $30.12 |

| I Class, $0.01 Par Value | $466,889,688 | 15,464,323 | $30.19 |

| A Class, $0.01 Par Value | $171,904,713 | 5,722,079 | $30.04* |

| C Class, $0.01 Par Value | $8,455,122 | 282,450 | $29.93 |

| R Class, $0.01 Par Value | $15,264,568 | 507,131 | $30.10 |

| R5 Class, $0.01 Par Value | $49,706,613 | 1,645,596 | $30.21 |

*Maximum offering price $31.87 (net asset value divided by 0.9425).

See Notes to Financial Statements.

| | | | | |

| YEAR ENDED JUNE 30, 2022 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $465,577) | $ | 56,681,525 | |

| Interest | 61,298 | |

| 56,742,823 | |

| |

| Expenses: | |

| Management fees | 17,464,461 | |

| Distribution and service fees: | |

| A Class | 474,834 | |

| C Class | 118,638 | |

| R Class | 91,700 | |

| Directors' fees and expenses | 181,677 | |

| Other expenses | 14,244 | |

| 18,345,554 | |

| |

| Net investment income (loss) | 38,397,269 | |

| |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 32,887,763 | |

| Futures contract transactions | 2,306,859 | |

| Foreign currency translation transactions | (124,224) | |

| 35,070,398 | |

| |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (336,450,905) | |

| Futures contracts | (1,062,948) | |

| Translation of assets and liabilities in foreign currencies | (1,200) | |

| (337,515,053) | |

| |

| Net realized and unrealized gain (loss) | (302,444,655) | |

| |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (264,047,386) | |

See Notes to Financial Statements.

| | |

| Statement of Changes in Net Assets |

| | | | | | | | |

| YEARS ENDED JUNE 30, 2022 AND JUNE 30, 2021 |

| Increase (Decrease) in Net Assets | June 30, 2022 | June 30, 2021 |

| Operations | | |

| Net investment income (loss) | $ | 38,397,269 | | $ | 35,780,967 | |

| Net realized gain (loss) | 35,070,398 | | 858,762,414 | |

| Change in net unrealized appreciation (depreciation) | (337,515,053) | | (95,588,565) | |

| Net increase (decrease) in net assets resulting from operations | (264,047,386) | | 798,954,816 | |

| | |

| Distributions to Shareholders | | |

| From earnings: | | |

| Investor Class | (475,933,439) | | (254,331,165) | |

| I Class | (138,393,623) | | (54,034,778) | |

| A Class | (47,316,315) | | (20,486,205) | |

| C Class | (2,761,020) | | (1,325,433) | |

| R Class | (4,304,355) | | (1,999,924) | |

| R5 Class | (12,366,658) | | (3,500,888) | |

| Decrease in net assets from distributions | (681,075,410) | | (335,678,393) | |

| | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | 485,745,933 | | 418,638,776 | |

| | |

| Net increase (decrease) in net assets | (459,376,863) | | 881,915,199 | |

| | |

| Net Assets | | |

| Beginning of period | 2,911,214,694 | | 2,029,299,495 | |

| End of period | $ | 2,451,837,831 | | $ | 2,911,214,694 | |

See Notes to Financial Statements.

| | |

| Notes to Financial Statements |

JUNE 30, 2022

1. Organization

American Century Quantitative Equity Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Disciplined Core Value Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek long-term capital growth by investing in common stocks. Income is a secondary objective.

The fund offers the Investor Class, I Class, A Class, C Class, R Class and R5 Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value (NAV) per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Open-end management investment companies are valued at the reported NAV per share. Repurchase agreements are valued at cost, which approximates fair value. Exchange-traded futures contracts are valued at the settlement price as provided by the appropriate exchange.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s NAV per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. The fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. ACIM monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that ACIM will pay all expenses of managing and operating the fund, except brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), extraordinary expenses, and expenses incurred in connection with the provision of shareholder services and distribution services under a plan adopted pursuant to Rule 12b-1 under the 1940 Act. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. The fee consists of (1) an Investment Category Fee based on the daily net assets of the fund and certain other accounts managed by the investment advisor that are in the same broad investment category as the fund and (2) a Complex Fee based on the assets of all funds in the American Century Investments family of funds that have the same investment advisor and distributor as the fund. For purposes of determining the Investment Category Fee and Complex Fee, the assets of funds managed by the investment advisor that invest exclusively in the shares of other funds (funds of funds) are not included.

The Investment Category Fee range, the Complex Fee range and the effective annual management fee for each class for the period ended June 30, 2022 are as follows:

| | | | | | | | | | | |

| Investment Category Fee Range | Complex Fee Range | Effective Annual Management Fee |

| Investor Class | 0.3380% to 0.5200% | 0.2500% to 0.3100% | 0.64% |

| I Class | 0.0500% to 0.1100% | 0.44% |

| A Class | 0.2500% to 0.3100% | 0.64% |

| C Class | 0.2500% to 0.3100% | 0.64% |

| R Class | 0.2500% to 0.3100% | 0.64% |

| R5 Class | 0.0500% to 0.1100% | 0.44% |

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended June 30, 2022 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $12,851,595 and $5,027,919, respectively. The effect of interfund transactions on the Statement of Operations was $(543,915) in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the period ended June 30, 2022 were $6,634,703,561 and $6,694,048,566, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | | | | | | | | | | | | |

| Year ended

June 30, 2022 | Year ended

June 30, 2021 |

| Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 700,000,000 | | | 700,000,000 | | |

| Sold | 4,669,254 | | $ | 177,517,658 | | 5,708,618 | | $ | 230,950,608 | |

| Issued in reinvestment of distributions | 13,120,782 | | 455,216,474 | | 6,583,099 | | 242,539,451 | |

| Redeemed | (8,107,702) | | (306,438,060) | | (8,354,506) | | (340,087,595) | |

| 9,682,334 | | 326,296,072 | | 3,937,211 | | 133,402,464 | |

| I Class/Shares Authorized | 210,000,000 | | | 140,000,000 | | |

| Sold | 4,843,587 | | 188,303,380 | | 7,751,329 | | 318,793,094 | |

| Issued in reinvestment of distributions | 3,822,669 | | 132,978,335 | | 1,415,321 | | 52,333,909 | |

| Redeemed | (6,700,140) | | (252,251,987) | | (3,222,185) | | (129,132,207) | |

| 1,966,116 | | 69,029,728 | | 5,944,465 | | 241,994,796 | |

| A Class/Shares Authorized | 50,000,000 | | | 50,000,000 | | |

| Sold | 1,593,304 | | 64,416,812 | | 953,219 | | 38,326,670 | |

| Issued in reinvestment of distributions | 1,191,186 | | 41,206,941 | | 481,393 | | 17,682,254 | |

| Redeemed | (1,251,911) | | (46,543,599) | | (874,730) | | (34,463,198) | |

| 1,532,579 | | 59,080,154 | | 559,882 | | 21,545,726 | |

| C Class/Shares Authorized | 20,000,000 | | | 20,000,000 | | |

| Sold | 63,050 | | 2,365,086 | | 171,319 | | 6,899,197 | |

| Issued in reinvestment of distributions | 72,480 | | 2,499,126 | | 33,007 | | 1,205,196 | |

| Redeemed | (155,116) | | (5,643,676) | | (110,192) | | (4,350,721) | |

| (19,586) | | (779,464) | | 94,134 | | 3,753,672 | |

| R Class/Shares Authorized | 20,000,000 | | | 20,000,000 | | |

| Sold | 149,780 | | 5,779,473 | | 186,216 | | 7,613,452 | |

| Issued in reinvestment of distributions | 118,390 | | 4,104,295 | | 50,623 | | 1,860,231 | |

| Redeemed | (183,609) | | (6,791,311) | | (209,542) | | (8,432,505) | |

| 84,561 | | 3,092,457 | | 27,297 | | 1,041,178 | |

| R5 Class/Shares Authorized | 40,000,000 | | | 40,000,000 | | |

| Sold | 668,304 | | 26,897,892 | | 481,786 | | 19,037,581 | |

| Issued in reinvestment of distributions | 341,060 | | 11,862,144 | | 91,088 | | 3,369,664 | |

| Redeemed | (252,932) | | (9,733,050) | | (138,196) | | (5,506,305) | |

| 756,432 | | 29,026,986 | | 434,678 | | 16,900,940 | |

| Net increase (decrease) | 14,002,436 | | $ | 485,745,933 | | 10,997,667 | | $ | 418,638,776 | |

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

•Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments.

•Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars.

•Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions).

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| | | | | | | | | | | |

| Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | $ | 2,334,685,202 | | $ | 96,040,440 | | — | |

| Short-Term Investments | — | | 19,590,705 | | — | |

| $ | 2,334,685,202 | | $ | 115,631,145 | | — | |

7. Derivative Instruments

Equity Price Risk — The fund is subject to equity price risk in the normal course of pursuing its investment objectives. A fund may enter into futures contracts based on an equity index in order to manage its exposure to changes in market conditions. A fund may purchase futures contracts to gain exposure to increases in market value or sell futures contracts to protect against a decline in market value. Upon entering into a futures contract, a fund is required to deposit either cash or securities in an amount equal to a certain percentage of the contract value (initial margin). Subsequent payments (variation margin) are made or received daily, in cash, by a fund. The variation margin is equal to the daily change in the contract value and is recorded as unrealized gains and losses. A fund recognizes a realized gain or loss when the contract is closed or expires. Net realized and unrealized gains or losses occurring during the holding period of futures contracts are a component of net realized gain (loss) on futures contract transactions and change in net unrealized appreciation (depreciation) on futures contracts, respectively. One of the risks of entering into futures contracts is the possibility that the change in value of the contract may not correlate with the changes in value of the underlying securities. The fund's average notional exposure to equity price risk derivative instruments held during the period was $1,933,988 futures contracts purchased.

At period end, the fund did not have any derivative instruments disclosed on the Statement of Assets and Liabilities. For the year ended June 30, 2022, the effect of equity price risk derivative instruments on the Statement of Operations was $2,306,859 in net realized gain (loss) on futures contract transactions and $(1,062,948) in change in net unrealized appreciation (depreciation) on futures contracts.

8. Risk Factors

The value of the fund’s shares will go up and down, sometimes rapidly or unpredictably, based on the performance of the securities owned by the fund and other factors generally affecting the securities market. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, war, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

9. Federal Tax Information

The tax character of distributions paid during the years ended June 30, 2022 and June 30, 2021 were as follows:

| | | | | | | | |

| 2022 | 2021 |

| Distributions Paid From | | |

| Ordinary income | $ | 384,667,461 | | $ | 34,853,046 | |

| Long-term capital gains | $ | 296,407,949 | | $ | 300,825,347 | |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| | | | | |

| Federal tax cost of investments | $ | 2,453,143,792 | |

| Gross tax appreciation of investments | $ | 176,992,916 | |

| Gross tax depreciation of investments | (179,820,361) | |

| Net tax appreciation (depreciation) of investments | (2,827,445) | |

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | (1,200) | |

| Net tax appreciation (depreciation) | $ | (2,828,645) | |

| Undistributed ordinary income | — | |

| Post-October capital loss deferral | $ | (62,703,351) | |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

Loss deferrals represent certain qualified losses that the fund has elected to treat as having been incurred in the following fiscal year for federal income tax purposes.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | |

| 2022 | $43.20 | 0.50 | (3.51) | (3.01) | (0.50) | (9.57) | (10.07) | $30.12 | (9.84)% | 0.65% | 1.31% | 234% | $1,739,617 | |

| 2021 | $35.99 | 0.58 | 12.52 | 13.10 | (0.58) | (5.31) | (5.89) | $43.20 | 39.42% | 0.66% | 1.44% | 240% | $2,076,714 | |

| 2020 | $36.82 | 0.76 | (0.07) | 0.69 | (0.77) | (0.75) | (1.52) | $35.99 | 1.70% | 0.67% | 2.08% | 100% | $1,588,537 | |

| 2019 | $39.61 | 0.78 | 0.63 | 1.41 | (0.73) | (3.47) | (4.20) | $36.82 | 4.43% | 0.67% | 2.07% | 72% | $1,707,536 | |

| 2018 | $37.90 | 0.93 | 4.40 | 5.33 | (0.88) | (2.74) | (3.62) | $39.61 | 14.32% | 0.66% | 2.33% | 77% | $1,751,738 | |

| I Class | | | | | | | | | | | |

| 2022 | $43.28 | 0.58 | (3.53) | (2.95) | (0.57) | (9.57) | (10.14) | $30.19 | (9.67)% | 0.45% | 1.51% | 234% | $466,890 | |

| 2021 | $36.05 | 0.65 | 12.55 | 13.20 | (0.66) | (5.31) | (5.97) | $43.28 | 39.70% | 0.46% | 1.64% | 240% | $584,160 | |

| 2020 | $36.88 | 0.83 | (0.07) | 0.76 | (0.84) | (0.75) | (1.59) | $36.05 | 1.90% | 0.47% | 2.28% | 100% | $272,307 | |

| 2019 | $39.66 | 0.85 | 0.65 | 1.50 | (0.81) | (3.47) | (4.28) | $36.88 | 4.65% | 0.47% | 2.27% | 72% | $306,583 | |

| 2018 | $37.94 | 0.99 | 4.43 | 5.42 | (0.96) | (2.74) | (3.70) | $39.66 | 14.55% | 0.46% | 2.53% | 77% | $274,687 | |

| A Class | | | | | | | | | | | | | |

| 2022 | $43.11 | 0.40 | (3.50) | (3.10) | (0.40) | (9.57) | (9.97) | $30.04 | (10.07)% | 0.90% | 1.06% | 234% | $171,905 | |

| 2021 | $35.93 | 0.48 | 12.49 | 12.97 | (0.48) | (5.31) | (5.79) | $43.11 | 39.04% | 0.91% | 1.19% | 240% | $180,616 | |

| 2020 | $36.76 | 0.67 | (0.07) | 0.60 | (0.68) | (0.75) | (1.43) | $35.93 | 1.46% | 0.92% | 1.83% | 100% | $130,398 | |

| 2019 | $39.55 | 0.69 | 0.63 | 1.32 | (0.64) | (3.47) | (4.11) | $36.76 | 4.18% | 0.92% | 1.82% | 72% | $152,312 | |

| 2018 | $37.85 | 0.83 | 4.39 | 5.22 | (0.78) | (2.74) | (3.52) | $39.55 | 14.03% | 0.91% | 2.08% | 77% | $155,233 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended June 30 (except as noted) |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| Net Asset

Value,

Beginning

of Period | Net Investment Income (Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| C Class | | | | | | | | | | | | | |

| 2022 | $43.00 | 0.10 | (3.48) | (3.38) | (0.12) | (9.57) | (9.69) | $29.93 | (10.76)% | 1.65% | 0.31% | 234% | $8,455 | |

| 2021 | $35.84 | 0.17 | 12.48 | 12.65 | (0.18) | (5.31) | (5.49) | $43.00 | 38.05% | 1.66% | 0.44% | 240% | $12,987 | |

| 2020 | $36.68 | 0.39 | (0.08) | 0.31 | (0.40) | (0.75) | (1.15) | $35.84 | 0.68% | 1.67% | 1.08% | 100% | $7,452 | |

| 2019 | $39.48 | 0.41 | 0.63 | 1.04 | (0.37) | (3.47) | (3.84) | $36.68 | 3.40% | 1.67% | 1.07% | 72% | $9,107 | |

| 2018 | $37.79 | 0.53 | 4.39 | 4.92 | (0.49) | (2.74) | (3.23) | $39.48 | 13.18% | 1.66% | 1.33% | 77% | $8,557 | |

| R Class | | | | | | | | | | | | | |

| 2022 | $43.18 | 0.31 | (3.51) | (3.20) | (0.31) | (9.57) | (9.88) | $30.10 | (10.30)% | 1.15% | 0.81% | 234% | $15,265 | |

| 2021 | $35.97 | 0.38 | 12.51 | 12.89 | (0.37) | (5.31) | (5.68) | $43.18 | 38.73% | 1.16% | 0.94% | 240% | $18,245 | |

| 2020 | $36.81 | 0.58 | (0.09) | 0.49 | (0.58) | (0.75) | (1.33) | $35.97 | 1.18% | 1.17% | 1.58% | 100% | $14,218 | |

| 2019 | $39.59 | 0.60 | 0.64 | 1.24 | (0.55) | (3.47) | (4.02) | $36.81 | 3.95% | 1.17% | 1.57% | 72% | $24,676 | |

| 2018 | $37.89 | 0.73 | 4.40 | 5.13 | (0.69) | (2.74) | (3.43) | $39.59 | 13.73% | 1.16% | 1.83% | 77% | $25,298 | |

| R5 Class | | | | | | | | | | | | | |

| 2022 | $43.29 | 0.58 | (3.52) | (2.94) | (0.57) | (9.57) | (10.14) | $30.21 | (9.64)% | 0.45% | 1.51% | 234% | $49,707 | |

| 2021 | $36.06 | 0.63 | 12.57 | 13.20 | (0.66) | (5.31) | (5.97) | $43.29 | 39.68% | 0.46% | 1.64% | 240% | $38,493 | |

| 2020 | $36.89 | 0.83 | (0.07) | 0.76 | (0.84) | (0.75) | (1.59) | $36.06 | 1.90% | 0.47% | 2.28% | 100% | $16,388 | |

| 2019 | $39.66 | 0.88 | 0.63 | 1.51 | (0.81) | (3.47) | (4.28) | $36.89 | 4.68% | 0.47% | 2.27% | 72% | $13,615 | |

| 2018 | $37.95 | 0.91 | 4.50 | 5.41 | (0.96) | (2.74) | (3.70) | $39.66 | 14.52% | 0.46% | 2.53% | 77% | $4,241 | |

| | |

| Notes to Financial Highlights |

(1)Computed using average shares outstanding throughout the period.

(2)Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized.

See Notes to Financial Statements.

| | |

| Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Directors of American Century Quantitative Equity Funds, Inc.:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Disciplined Core Value Fund (the “Fund”), one of the funds constituting the American Century Quantitative Equity Funds, Inc., as of June 30, 2022, the related statement of operations, statement of changes in net assets, and financial highlights for the year then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of Disciplined Core Value Fund of the American Century Quantitative Equity Funds, Inc., as of June 30, 2022, and the results of its operations, the changes in its net assets, and the financial highlights for the year then ended in conformity with accounting principles generally accepted in the United States of America. The statement of changes in net assets for the year ended June 30, 2021, and the financial highlights for each of the four years in the period ended June 30, 2021, were audited by other auditors, whose report, dated August 17, 2021, expressed an unqualified opinion on such statement of changes in net assets and financial highlights.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of June 30, 2022, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Kansas City, Missouri

August 16, 2022

We have served as the auditor of one or more American Century investment companies since 1997.

The Board of Directors

The individuals listed below serve as directors of the funds. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors). Independent directors shall retire on December 31 of the year in which they reach their 76th birthday.

Jonathan S. Thomas is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor). The other directors (more than three-fourths of the total number) are independent. They are not employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS), and they do not have any other affiliations, positions or relationships that would cause them to be considered “interested persons” under the Investment Company Act. The directors serve in this capacity for eight (in the case of Jonathan S. Thomas, 16; and Jeremy I. Bulow, 9) registered investment companies in the American Century Investments family of funds.

The following table presents additional information about the directors. The mailing address for each director other than Jonathan S. Thomas is 3945 Freedom Circle, Suite #800, Santa Clara, California 95054. The mailing address for Jonathan S. Thomas is 4500 Main Street, Kansas City, Missouri 64111.

| | | | | | | | | | | | | | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years |

| Independent Directors | | |

Tanya S. Beder

(1955) | Director and Board Chair | Since 2011 (Board Chair since 2022) | Chairman and CEO, SBCC Group Inc. (independent advisory services) (2006 to present) | 34 | Kirby Corporation; Nabors Industries Ltd.; CYS Investments, Inc. (2012-2017) |

Jeremy I. Bulow

(1954) | Director | Since 2011 | Professor of Economics, Stanford University, Graduate School of Business (1979 to present) | 75 | None |

Jennifer Cabalquinto

(1968) | Director | Since 2021 | Chief Financial Officer, 2K (interactive entertainment) (2021 to present); Special Advisor, GSW Sports, LLC (2020 to 2021); Chief Financial Officer, GSW Sports, LLC (2013 to 2020) | 34 | Sabio Holdings Inc. |

| | | | | | | | | | | | | | | | | |

Name

(Year of Birth) | Position(s) Held with Funds | Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of American Century Portfolios Overseen by Director | Other Directorships Held During Past 5 Years |

| Independent Directors | | |

Anne Casscells

(1958) | Director | Since 2016 | Co-Chief Executive Officer and Chief Investment Officer, Aetos Alternatives Management (investment advisory firm) (2001 to present); Lecturer in Accounting, Stanford University, Graduate School of Business (2009 to 2017) | 34 | None |

Jonathan D. Levin

(1972) | Director | Since 2016 | Philip H. Knight Professor and Dean, Graduate School of Business, Stanford University (2016 to present); Professor, Stanford University, (2000 to present) | 34 | None |

Peter F. Pervere

(1947) | Director | Since 2007 | Retired | 34 | None |

John B. Shoven

(1947) | Director | Since 2002 | Charles R. Schwab Professor of Economics, Stanford University (1973 to present, emeritus since 2019) | 34 | Cadence Design Systems; Exponent; Financial Engines |

| Interested Director | | |

Jonathan S. Thomas

(1963) | Director | Since 2007 | President and Chief Executive Officer, ACC (2007 to present). Also serves as Chief Executive Officer, ACS; Director, ACC and other ACC subsidiaries | 139 | None |

The Statement of Additional Information has additional information about the fund's directors and is available without charge, upon request, by calling 1-800-345-2021.

Officers

The following table presents certain information about the executive officers of the funds. Each officer serves as an officer for 16 (in the case of Robert J. Leach, 15) investment companies in the American Century family of funds. No officer is compensated for his or her service as an officer of the funds. The listed officers are interested persons of the funds and are appointed or re-appointed on an annual basis. The mailing address for each officer listed below is 4500 Main Street, Kansas City, Missouri 64111.

| | | | | | | | |

Name

(Year of Birth) | Offices with the Funds | Principal Occupation(s) During the Past Five Years |

Patrick Bannigan

(1965) | President since 2019 | Executive Vice President and Director, ACC (2012 to present); Chief Financial Officer, Chief Accounting Officer and Treasurer, ACC (2015 to present). Also serves as President, ACS; Vice President, ACIM; Chief Financial Officer, Chief Accounting Officer and/or Director, ACIM, ACS and other ACC subsidiaries |

R. Wes Campbell

(1974) | Chief Financial Officer and Treasurer since 2018 | Vice President, ACS (2020 to present); Investment Operations and Investment Accounting, ACS (2000 to present) |

Amy D. Shelton

(1964) | Chief Compliance Officer and Vice President since 2014 | Chief Compliance Officer, American Century funds, (2014 to present); Chief Compliance Officer, ACIM (2014 to present); Chief Compliance Officer, ACIS (2009 to present). Also serves as Vice President, ACIS |

John Pak

(1968) | General Counsel and

Senior Vice President since 2021 | General Counsel and Senior Vice President, ACC (2021 to present). Also serves as General Counsel and Senior Vice President, ACIM, ACS and ACIS. Chief Legal Officer of Investment and Wealth Management, The Bank of New York Mellon (2014 to 2021) |

C. Jean Wade