Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

SNBR similar filings

- 7 Aug 06 Select Comfort Corporation to Present at the Canaccord Adams 26TH Annual Summer Seminar Conference

- 27 Jul 06 Entry into a Material Definitive Agreement

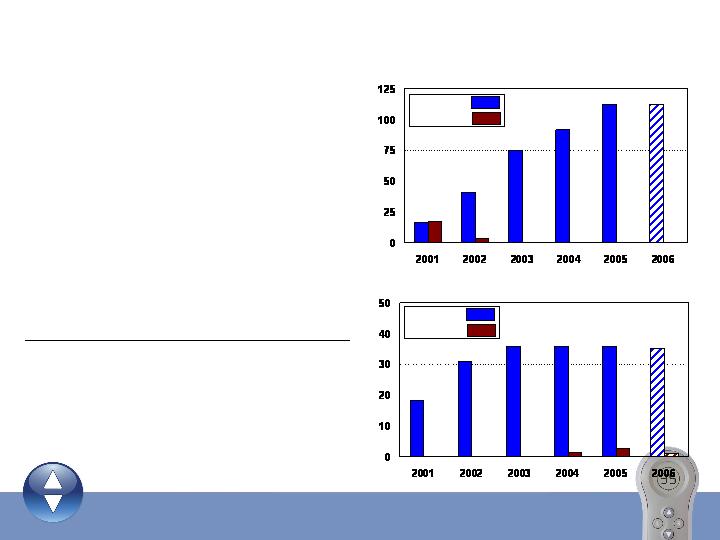

- 25 Jul 06 Results of Operations and Financial Condition

- 21 Jun 06 Statements used in this presentation that relate to future plans, events, financial results or performance are

- 14 Jun 06 Entry into a Material Definitive Agreement

- 14 Jun 06 Second Quarter 2006 Business Update

- 12 Jun 06 Regulation FD Disclosure

Filing view

External links