19

Current Board of Directors

Independent, Experienced and Committed to Shareholder Value

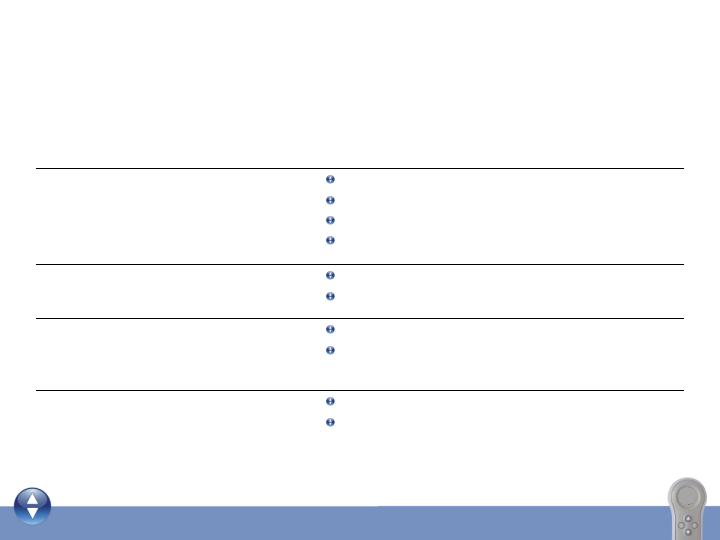

Name

Position

Biography

Ervin R. Shames

Chairman, Independent Director

Former Chief Executive Officer of Borden, Inc. and Stride Rite Corporation. Director of Choice Hotels International, Inc. and Online Resources Corporation.

Thomas J. Albani

Independent Director

Former President and Chief Executive Officer of Electrolux Corporation. Director of Barnes Group Inc.

Christine M. Day

Independent Director

Chief Executive Officer of lululemon athletica inc. Former President of Asia Pacific Group, Starbucks Coffee International.

Stephen L. Gulis, Jr.

Independent Director

Former Executive Vice President and Chief Financial Officer of Wolverine World Wide, Inc. Director of Independent Bank Corporation.

Christopher P. Kirchen

Independent Director

Managing General Partner and co-founder of BEV Capital, a venture capital firm.

David T. Kollat

Independent Director

President of 22 Inc. Former Executive Vice President of Marketing for The Limited and former President of Victoria’s Secret Catalogue. Director of Big Lots, Inc., Limited Brands, Inc. and Wolverine World Wide, Inc.

Brenda J. Lauderback

Independent Director

Former President of the Retail and Wholesale Group for Nine West Group, Inc. Director of Big Lots, Inc., Denny’s Corporation, Irwin Financial Corporation and Wolverine World Wide, Inc.

Michael A. Peel

Independent Director

Vice President of Human Resources and Administration at Yale University. Former Executive Vice President of Human Resources and Administrative Services at General Mills, Inc.

Jean-Michel Valette

Independent Director

Chairman of the Board of Directors, Peet’s Coffee and Tea, Inc. Director of The Boston Beer Company.

William R. McLaughlin

Director, President, Chief Executive

Officer

Previous executive-level positions at PepsiCo Foods International, Inc.

Sterling’s Partnership with Pat Hopf

Sterling plans to propose Pat Hopf, former longtime Chairman of Select, to

become the new CEO of the Company

Pat is an entrepreneur, investor and operator who has been involved with

Select since 1991

In 1991 Pat led the initial investment in Select Comfort as a Partner at St.

Paul Venture Capital

At time of the investment, Pat also assumed the role of interim CEO for 6

months

From 1991 – 2006, Pat was on the Board of Select (serving as Chairman

from 1991-1997 and 1999-2003)

Pat was interim CEO again from June ’99 – March ’00

Over Pat’s 15 years with Select, he has been an integral part of the

Company’s success

Pat is a passionate believer in the Company and its products

Sterling and Pat will work together to help create long term value for

shareholders

20

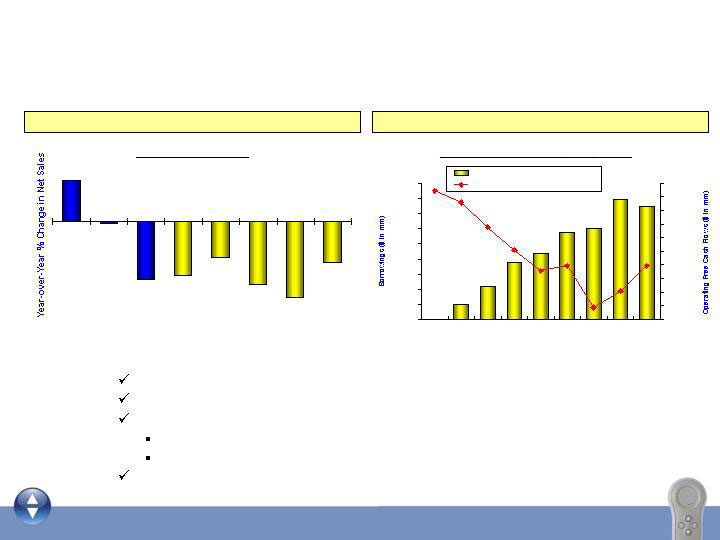

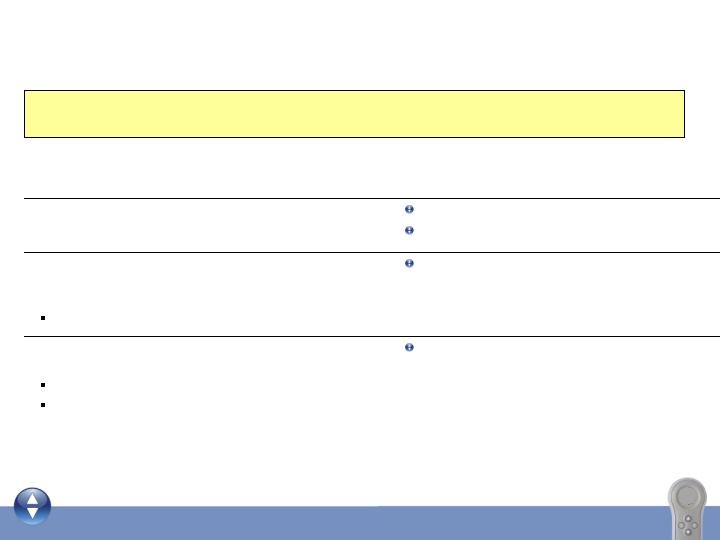

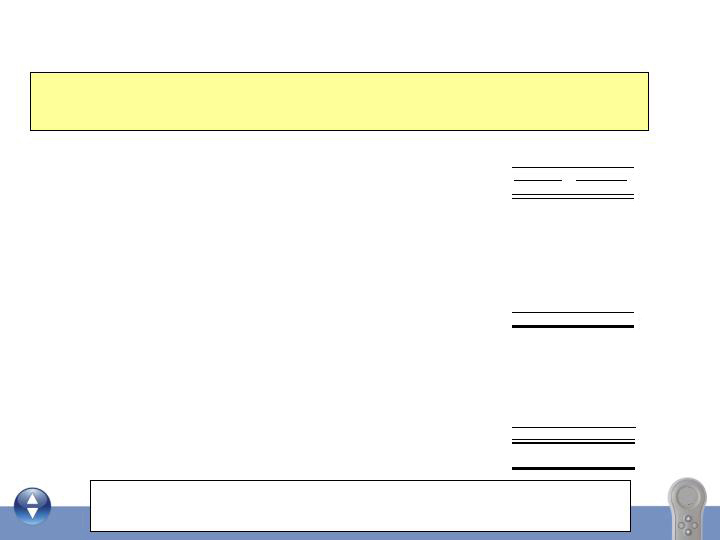

Improvement to Capital Structure

21

Sterling transaction significantly improves cash position to provide sufficient growth

capital and economic hedge. Credit terms would also be extended from 2010 to 2012,

to provide additional flexibility required by the Company.

(in thousands except per share amounts)

April 4, 2009

Historical

Pro Forma

Cash, cash equivalents and $23 million of restricted cash (restriction released April 2009)

26,164

$

44,408

$

Debt:

Short-term debt:

Borrowings under revolving credit facility

74,300

$

24,500

$

Bank term loan

-

100

Capital lease obligations

292

292

Long-term debt:

Bank term loan

-

39,900

Capital lease obligations

479

479

Total indebtedness

75,071

65,271

Shareholders' deficit:

Undesignated preferred stock; 5,000 shares authorized, no shares issued and

outstanding

-

-

Common stock, $0.01 par value; 142,500 and 245,000 shares authorized, respectively;

452

952

45,240 and 95,240 shares issued and outstanding, respectively

Additional paid-in capital

5,527

34,471

Accumulated deficit

(49,192)

(54,248)

Total shareholders' deficit

(43,213)

$

(18,825)

$

Total capitalization

31,858

$

46,446

$

Reflects (i) sale of 50 million shares of common stock for $35 million after deduction of estimated transaction fees and expenses ($5.6 million); and (ii) conversion of $40 million outstanding under our revolving credit facility into a term loan and adjusting the commitment amount to $30 million.