- SNBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Sleep Number (SNBR) DEFA14AAdditional proxy soliciting materials

Filed: 25 Jun 09, 12:00am

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

| [_] | Preliminary Proxy Statement |

| [_] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [_] | Definitive Proxy Statement |

| [_] | Definitive Additional Materials |

| [X] | Soliciting Material Pursuant to § 240.14a-12 |

Select Comfort Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required |

| [_] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| [_] | Fee paid previously with preliminary materials. |

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 25, 2009

SELECT COMFORT CORPORATION

(Exact name of registrant as specified in its charter)

Minnesota

(State or other jurisdiction of incorporation or organization)

|

|

0-25121 | 41-1597886 |

(Commission File No.) | (IRS Employer Identification No.) |

|

9800 59th Avenue North, Minneapolis, Minnesota 55442 |

(Address of principal executive offices) (Zip Code) |

|

(763) 551-7000 |

(Registrant’s telephone number, including area code) |

|

Not applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 7.01. REGULATION FD DISCLOSURE.

Anticipated Change in Chief Executive Officer

As previously announced, on May 22, 2009 Select Comfort Corporation (the “Company”) entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Sterling SC Investor, LLC, a Delaware limited liability company (“Sterling”) and an affiliate of Sterling Capital Partners III, L.P. (“Sterling Partners”), that provides for the sale of 50,000,000 shares of the Company’s common stock to Sterling at a purchase price of $0.70 per share for gross proceeds of $35.0 million (the “Sterling Transaction”).

Sterling’s designees to the Company’s Board of Directors have informed us that they intend to seek the appointment of Patrick A. Hopf as Chief Executive Officer of the Company, replacing William R. McLaughlin, following the closing of the Sterling Transaction. This proposed action was discussed with the Company’s directors who will be continuing as directors after the Sterling Transaction. The appointment of Mr. Hopf as Chief Executive Officer will require the approval of the Company’s Board of Directors, and the Sterling designees intend to pursue that approval after the closing of the Sterling Transaction.

Mr. Hopf previously served as a member of the Company’s Board of Directors from December 1991 to May 2006, and served as Chairman of the Company’s Board of Directors from August 1993 to April 1996 and again from April 1999 to May 2004. Mr. Hopf also served as the Company’s interim chief executive officer from July 1999 to March 2000.

PowerPoint Presentation

Furnished as Exhibit 99.1 to this report is a PowerPoint presentation that representatives of the Company plan to use for discussions with certain of the Company’s large institutional shareholders in informational meetings regarding the Company and the Sterling Transaction.

Any information contained in the PowerPoint presentation should be read in the context of and with due regard to the more detailed information provided in other documents the Company files with or furnishes to the Securities and Exchange Commission, including, but not limited to, the Company’s proxy statement and other documents regarding the Sterling Transaction, Annual Report on Form 10-K for the year ended January 3, 2009, and Quarterly Report on Form 10-Q for the quarter ended April 4, 2009.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements about Select Comfort within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These factors include, but are not limited to, (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the securities purchase agreement; (2) the outcome of any legal proceedings that may be instituted against Select Comfort and others following announcement of the proposed transaction; (3) the failure to obtain approval of Select Comfort’s shareholders as required to consummate the proposed transaction; (4) the inability to complete the proposed transaction due to the failure to satisfy any of the conditions to closing of the proposed transaction; (5) the risk that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the proposed transaction; and (6) other risks, including, among others, the impact of the Company’s defaults under its credit agreements; costs and uncertainties related to the outcome of pending litigation; the Company’s ability to sustain increased sales, improve operations and realize cost savings; competitive and general economic conditions; and the risks described in the Company’s Annual Report on Form 10-K for the year ended January 3, 2009 under the caption “Risk Factors.” These risks and uncertainties are not exclusive and further information concerning Select Comfort’s business, including factors that potentially could materially affect Select Comfort’s financial results or condition, may emerge from time to time, including factors that Select Comfort may consider immaterial or does not anticipate at this time.

2

When relying on forward-looking statements to make decisions with respect to Select Comfort, investors and others are cautioned to consider these and other risks and uncertainties. Select Comfort can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. Select Comfort undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events or for any other reason.

Important Additional Information for Investors and Shareholders

This communication is being made in respect of the proposed equity investment transaction involving Select Comfort and Sterling Partners. In connection with the proposed transaction, Select Comfort has filed a preliminary proxy statement with the SEC and Select Comfort plans to file with the SEC a definitive proxy statement and other documents regarding the proposed transaction. The final proxy statement will be mailed to the shareholders of Select Comfort.INVESTORS AND SECURITY HOLDERS OF SELECT COMFORT ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SELECT COMFORT AND THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the proxy statement (when available) and other documents filed with the SEC by Select Comfort at the SEC’s website at www.sec.gov. Free copies of the proxy statement (when available) and other documents filed with the SEC can also be obtained by directing a request to Select Comfort Corporation, 9800 59th Avenue North, Plymouth, Minnesota 55442, Attention: Investor Relations, telephone: (763) 551-7000. In addition, investors and security holders may access copies of the documents filed with the SEC by Select Comfort on Select Comfort’s website at www.selectcomfort.com.

Select Comfort and its directors, executive officers, certain members of management and employees may be soliciting proxies from the shareholders of Select Comfort in respect of the proposed transaction. If and to the extent that any of the Select Comfort participants will receive any additional benefits in connection with the proposed transaction that are unknown as of the date of this filing, the details of those benefits will be described in the definitive proxy statement relating to the transaction. Investors and shareholders can obtain more detailed information regarding the direct and indirect interests of Select Comfort directors and executive officers in the proposed transaction by reading the definitive proxy statement when it becomes available.

The information in this report is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference into any document filed under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

| (d) Exhibits. | |

|

|

|

| 99.1 | Select Comfort Corporation Shareholder PowerPoint Presentation. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

| SELECT COMFORT CORPORATION | ||

| (Registrant) | ||

|

|

|

|

Dated: June 25, 2009 | By: | /s/ Mark A. Kimball |

|

| Title: | Senior Vice President |

|

4

EXHIBIT INDEX

The exhibit listed in this index is being furnished pursuant to Item 9.01 of Form 8-K and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference into any document filed under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

|

|

|

|

| Exhibit No. |

| Description |

|

|

|

|

| 99.1 |

| Select Comfort Corporation Shareholder PowerPoint Presentation. |

Exhibit 99.1

Sterling Partners Investment in Select Comfort

June 2009

General/Forward-Looking Statements

Any information contained in this PowerPoint presentation should be read in the context of and with due regard to the more detailed information provided in other documents the Company files with or furnishes to the Securities and Exchange Commission, including, but not limited to, the Company’s proxy statement and other documents regarding the Sterling Transaction, Annual Report on Form 10-K for the year ended January 3, 2009, and Quarterly Report on Form 10-Q for the quarter ended April 4, 2009.

This PowerPoint presentation, which is included in our Current Report on Form 8-K, contains certain forward-looking statements about Select Comfort within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements. These factors include, but are not limited to, (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the securities purchase agreement; (2) the outcome of any legal proceedings that may be instituted against Select Comfort and others following announcement of the proposed transaction; (3) the failure to obtain approval of Select Comfort’s shareholders as required to consummate the proposed transaction; (4) the inability to complete the proposed transaction due to the failure to satisfy any of the conditions to closing of the proposed transaction; (5) the risk that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the proposed transaction; and (6) other risks, including, among others, the impact of the Company’s defaults under its credit agreements; costs and uncertainties related to the outcome of pending litigation; the Company’s ability to sustain increased sales, improve operations and realize cost savings; competitive and general economic conditions; and the risks described in the Company’s Annual Report on Form 10-K for the year ended January 3, 2009 under the caption “Risk Factors.” These risks and uncertainties are not exclusive and further information concerning Select Comfort’s business, including factors that potentially could materially affect Select Comfort’s financial results or condition, may emerge from time to time, including factors that Select Comfort may consider immaterial or does not anticipate at this time.

When relying on forward-looking statements to make decisions with respect to the Select Comfort, investors and others are cautioned to consider these and other risks and uncertainties. Select Comfort can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. Select Comfort undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events or for any other reason.

2

Important Information for Investors and Stockholders

3

This communication is being made in respect of the proposed equity investment transaction involving Select Comfort and

Sterling Partners. In connection with the proposed transaction, Select Comfort has filed a preliminary proxy statement with

the SEC, and Select Comfort plans to file with the SEC a definitive proxy statement and other documents regarding the

proposed transaction. The final proxy statement will be mailed to the shareholders of Select Comfort. INVESTORS AND

SECURITY HOLDERS OF SELECT COMFORT ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SELECT COMFORT

AND THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the proxy statement (when available) and other documents

filed with the SEC by Select Comfort at the SEC’s website at www.sec.gov. Free copies of the proxy statement (when

available) and other documents filed with the SEC can also be obtained by directing a request to Select Comfort Corporation,

9800 59th Avenue North, Plymouth, Minnesota 55442, Attention: Investor Relations, telephone: (763) 551-7000. In addition,

investors and security holders may access copies of the documents filed with the SEC by Select Comfort on Select Comfort’s

website at www.selectcomfort.com.

Select Comfort and its directors, executive officers, certain members of management and employees may be soliciting

proxies from the shareholders of Select Comfort in respect of the proposed transaction. If and to the extent that any of the

Select Comfort participants will receive any additional benefits in connection with the proposed transaction that are unknown

as of the date of this filing, the details of those benefits will be described in the definitive proxy statement relating to the

transaction. Investors and shareholders can obtain more detailed information regarding the direct and indirect interests of

Select Comfort directors and executive officers in the proposed transaction by reading the definitive proxy statement when it

becomes available.

Agenda

4

Presenter

Transaction summary

Jim Raabe

Rationale for investment

Jim Raabe

Board process focused on shareholder

value

Steve Gulis

Sterling Partners overview

Chris Hoehn-Saric / Mats

Lederhausen

Appendix

Transaction Summary

Sterling Partners has agreed to invest $35 million in cash in exchange for

50 million shares of common stock at $0.70 per share

Sterling to own 52.5% of Company

5 of 9 Board seats

Agreement includes important minority shareholder protections

Subject to shareholder approval and customary closing conditions

Transaction contemplates amended credit agreement that provides for

short term relief and longer-term financial flexibility, allowing management

and the Board to drive value creation by executing a plan free of existing

bank restrictions

Waive all existing defaults

Maximum availability of $70 million

Term extended from Jun 2010 to Dec 2012

Amended operating covenants

5

6

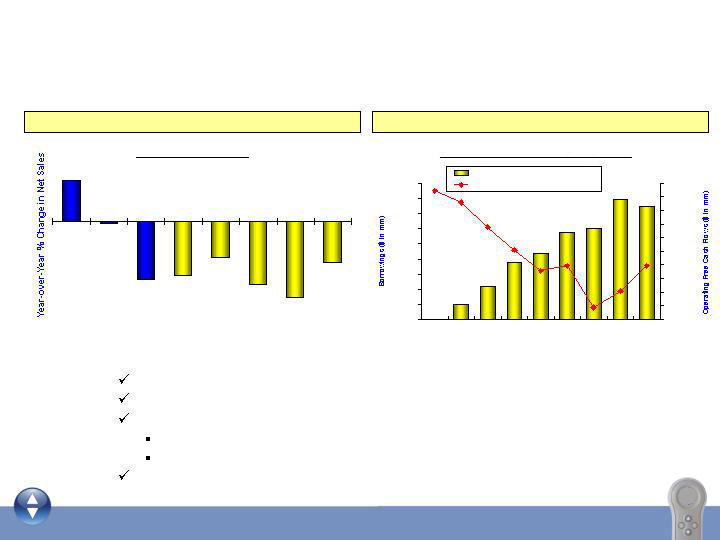

Recent Performance and Very Difficult Liquidity

Situation Necessitated Our Efforts to Raise Capital

Sales Trends Worsened in 2008

Sales Trends Pressured Cash Flows and Debt Levels

Uncertain outlook dictates continuing need for capital

Unemployment rate projected to continue increasing

Consumer confidence remains at recessionary levels

Oil cost currently up 122% from December low, presenting risk

Commodity cost risk

Slower consumer discretionary spend

Interest rates rising . . . could slow housing recovery

Historical Sales Trends

(24%)

(17%)

(31%)

(26%)

(15%)

(22%)

17%

(1%)

FY06

FY07

FY08

Q108

Q208

Q308

Q408

Q109

Historical Cash Flows & Debt Levels

$22

$74

$79

$60

$58

$43

$38

$0

$10

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Q107

Q207

Q307

Q407

Q108

Q208

Q308

Q408

Q109

$(50)

$(40)

$(30)

$(20)

$(10)

$-

$10

$20

$30

$40

$50

Borrowings

Operating Free Cash Flow (ttm)

SCSS Rationale for Sterling Partners’ Investment

A cash infusion into the business is necessary:

Meets the Company’s liquidity needs to operate the business

Avoids creditor risk with banks and suppliers. Current situation with lenders is

very difficult:

11 waiver amendments since Feb 2008

Helps alleviate issues around going concern opinion issued by auditor

Shifts focus from short-term liquidity to long-term profitable growth

Amend credit agreement for longer-term financial flexibility

Ideal partnership fit with Sterling:

Operationally focused and growth oriented private equity firm

Provides business knowledge and important resources

Shared vision for growing the Company and creating value for shareholders

7

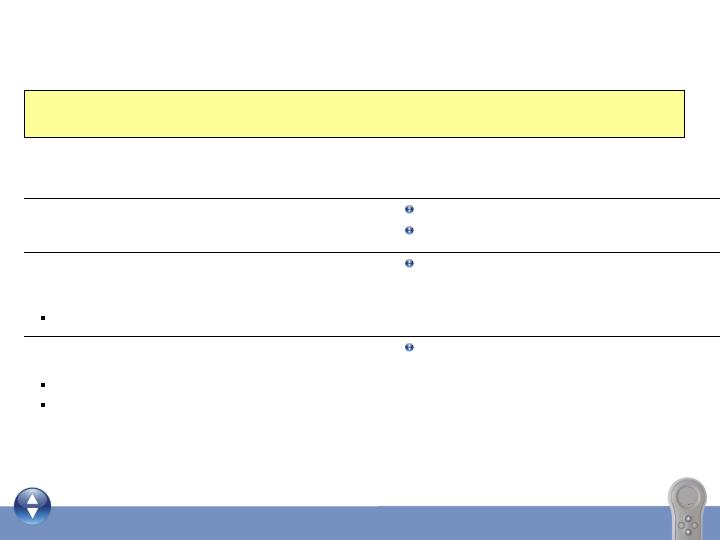

The definitive purchase agreement signed with Sterling Partners meets the SCSS Board of Directors’ key objectives

Significant Challenges Under Existing Credit Agreement

8

Sterling transaction results in a long term credit agreement with workable operating

covenants and an extended term, providing longer-term financial flexibility

Existing Credit Agreement Challenges

Solution with Sterling Transaction

Credit availability insufficient to weather sustained

economic downturn

Maximum availability of $70 million

New cash necessary for working capital

Current agreement expires in June 2010, and current cash

forecast dictates need for continued credit into 2011 or

longer

Uncertain ability to extend/replace

Term extended from June 2010 to Dec 2012

Since 4Q07, SCSS has required modifications or waivers

of covenants to remain in compliance

11 waiver amendments granted since Feb 2008

Banks could exercise remedies as secured creditors,

potentially forcing us to seek protection under

applicable bankruptcy laws

Improved operating covenants

Board Process Focused on Shareholder Value

Nine of ten current directors are independent (see Appendix)

Piper Jaffray retained in Sep 2008 to assist Board in evaluation and pursuit of strategic and financial alternatives.

Over 8-month period:

174 potential investors and/or acquirers were contacted

91 parties agreed to securities trading restrictions and were told the name of the Company

28 parties signed non-disclosure agreements

5 parties submitted non-binding indications of interest

Board conducted weekly calls and additional Finance Committee deliberations with Piper, other outside advisors,

and management to monitor the Company’s financial condition and evaluate strategic alternatives and potential transactions (see proxy for

more detail)

Sterling Partners transaction was selected, as it offered pricing, credit and other terms that the Board believes were

superior to other proposals

Board obtained fairness opinion on the consideration offered by Sterling Partners

Board members were actively involved in negotiations with Sterling

Proposed Sterling transaction has terms designed to protect current shareholders

Sale of common stock with no special preferences or rights, other than Board designations

Minority shareholder protection

Standstill obligations of Sterling

Market competitive break-up fees

No competing proposals from other investors have been received since the announcement of the proposed Sterling

transaction

9

SCSS Board of Directors conducted an extensive review of alternatives to address the Company’s liquidity crisis, and negotiated an agreement with Sterling Partners that is aimed at enhancing shareholder value

Sterling Partners Offers Shareholders Best Opportunity

to Realize Value

Alternative

Why Rejected

Renegotiation with lenders (without

incremental investment)

Did not provide incremental liquidity

Dilution from associated warrants

Very limited operational flexibility

Inability to extend credit agreement term

Other PIPE investors

Dilution higher than Sterling transaction

Unacceptable terms to bank syndicate

Rights offering

Uncertain success of closing w/ adequate proceeds

Uncertain ability to extend credit agreement on

favorable terms

Bankruptcy filing

Elimination of current shareholder value

Impact on relationships with suppliers

10

Sterling Partners Overview

Sterling has a 26 year history of producing outstanding returns for investors

Nearly $4 billion capital under management

Growth oriented investor

Limited use of leverage

Large team and deep resources

Entrepreneurial culture with team of industry veterans, seasoned operator-

investors

Organizational structure designed to optimize team and firm experience

Operationally focused strategy

Long-term investment horizon

Success in growing consumer-facing/marketing driven businesses

Experienced and engaged leadership

Founders together for 25 years

12 senior team members average 17 years at Sterling

Please note: Sterling Partners is not affiliated with Sterling Capital Management (a current SCSS investor)

11

Sterling brings a long track record and a proven model of success

Sterling’s Large, Experienced Team

Approximately 40 members with diverse industry and operating experience

Sterling senior level operating experience will be actively involved in working

with Select management to help drive growth:

Chris Hoehn-Saric (Board Nominee) – retail, direct marketing, consumer, CEO and

operating experience; Sylvan, Laureate, Co-Founder Sterling Partners

Eric Becker (Board Nominee) – entrepreneurial, direct marketing and operating

experience; Co-Founder Sterling Partners

Mats Lederhausen, Executive in Residence (Chairman Designee) –

entrepreneurial, consumer and executive experience; Head of McDonald’s global

strategy, McDonald’s ventures, Former Chairman of Chipotle

Steven Scheyer, Executive in Residence – entrepreneurial retail and consumer

products expertise; Newell Rubbermaid, President Wal-Mart Division

Steve Chang (Board Nominee), Principal – 20+ years of management and

operations consulting; McKinsey

12

Sterling’s Rationale for the Investment

Sterling has known the Company for over 15 years

Sterling believes Select Comfort has a nationally recognized brand and a

differentiated product line with a loyal and passionate consumer base

Opportunity to partner with Pat Hopf, original seed investor in Select

Comfort, and former long time Chairman and interim CEO of the

Company. Sterling plans to propose Pat Hopf to become the new CEO of

the Company

Mats, Pat and the Sterling team will work together to capitalize on the

opportunity to grow sales, improve marketing and strengthen brand

positioning

13

Sterling Vision for Select Comfort

Revitalize brand and marketing approach

Analyze consumer needs, store sales drivers and store footprint

Emphasize a sales focused culture

Improve overall customer service and product experience

Enhance organizational effectiveness

Invest in innovation and product development

14

Summary

SCSS is in a distressed financial position

The SCSS Board of Directors conducted an exhaustive process regarding

strategic and financial alternatives

Sterling Partners is the best option for the Company as it brings financial and operational resources to the business

Sterling offers all shareholders the opportunity to achieve long term value

15

16

Appendix

Road Map to Completion

Event

Expected Timeline

Board approval of transaction

Completed May 19

Execute definitive agreement

Completed May 22

File preliminary proxy

Completed June 1

SEC review

In process

File definitive proxy

July, pending SEC review

Q209 earnings release

July

Special meeting & shareholder vote

August/September

Finalize amended credit agreement

August

Close Sterling Partners transaction

August/September

17

Stock Price Trends Since September 2008

18

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

Sep-08

Oct-08

Nov-08

Dec-08

Jan-09

Feb-09

Mar-09

Apr-09

May-09

Closing Price

60 Day Moving Average

Sterling Deal

19

Current Board of Directors

Independent, Experienced and Committed to Shareholder Value

Name

Position

Biography

Ervin R. Shames

Chairman, Independent Director

Former Chief Executive Officer of Borden, Inc. and Stride Rite Corporation. Director of Choice Hotels International, Inc. and Online Resources Corporation.

Thomas J. Albani

Independent Director

Former President and Chief Executive Officer of Electrolux Corporation. Director of Barnes Group Inc.

Christine M. Day

Independent Director

Chief Executive Officer of lululemon athletica inc. Former President of Asia Pacific Group, Starbucks Coffee International.

Stephen L. Gulis, Jr.

Independent Director

Former Executive Vice President and Chief Financial Officer of Wolverine World Wide, Inc. Director of Independent Bank Corporation.

Christopher P. Kirchen

Independent Director

Managing General Partner and co-founder of BEV Capital, a venture capital firm.

David T. Kollat

Independent Director

President of 22 Inc. Former Executive Vice President of Marketing for The Limited and former President of Victoria’s Secret Catalogue. Director of Big Lots, Inc., Limited Brands, Inc. and Wolverine World Wide, Inc.

Brenda J. Lauderback

Independent Director

Former President of the Retail and Wholesale Group for Nine West Group, Inc. Director of Big Lots, Inc., Denny’s Corporation, Irwin Financial Corporation and Wolverine World Wide, Inc.

Michael A. Peel

Independent Director

Vice President of Human Resources and Administration at Yale University. Former Executive Vice President of Human Resources and Administrative Services at General Mills, Inc.

Jean-Michel Valette

Independent Director

Chairman of the Board of Directors, Peet’s Coffee and Tea, Inc. Director of The Boston Beer Company.

William R. McLaughlin

Director, President, Chief Executive

Officer

Previous executive-level positions at PepsiCo Foods International, Inc.

Sterling’s Partnership with Pat Hopf

Sterling plans to propose Pat Hopf, former longtime Chairman of Select, to

become the new CEO of the Company

Pat is an entrepreneur, investor and operator who has been involved with

Select since 1991

In 1991 Pat led the initial investment in Select Comfort as a Partner at St.

Paul Venture Capital

At time of the investment, Pat also assumed the role of interim CEO for 6

months

From 1991 – 2006, Pat was on the Board of Select (serving as Chairman

from 1991-1997 and 1999-2003)

Pat was interim CEO again from June ’99 – March ’00

Over Pat’s 15 years with Select, he has been an integral part of the

Company’s success

Pat is a passionate believer in the Company and its products

Sterling and Pat will work together to help create long term value for

shareholders

20

Improvement to Capital Structure

21

Sterling transaction significantly improves cash position to provide sufficient growth

capital and economic hedge. Credit terms would also be extended from 2010 to 2012,

to provide additional flexibility required by the Company.

(in thousands except per share amounts)

April 4, 2009

Historical

Pro Forma

Cash, cash equivalents and $23 million of restricted cash (restriction released April 2009)

26,164

$

44,408

$

Debt:

Short-term debt:

Borrowings under revolving credit facility

74,300

$

24,500

$

Bank term loan

-

100

Capital lease obligations

292

292

Long-term debt:

Bank term loan

-

39,900

Capital lease obligations

479

479

Total indebtedness

75,071

65,271

Shareholders' deficit:

Undesignated preferred stock; 5,000 shares authorized, no shares issued and

outstanding

-

-

Common stock, $0.01 par value; 142,500 and 245,000 shares authorized, respectively;

452

952

45,240 and 95,240 shares issued and outstanding, respectively

Additional paid-in capital

5,527

34,471

Accumulated deficit

(49,192)

(54,248)

Total shareholders' deficit

(43,213)

$

(18,825)

$

Total capitalization

31,858

$

46,446

$

Reflects (i) sale of 50 million shares of common stock for $35 million after deduction of estimated transaction fees and expenses ($5.6 million); and (ii) conversion of $40 million outstanding under our revolving credit facility into a term loan and adjusting the commitment amount to $30 million.