- SNBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRER14A Filing

Sleep Number (SNBR) PRER14APreliminary revised proxy

Filed: 18 Mar 15, 12:00am

|

|

|

|

|

|

|

|

|

Filed by the Registrant | ☒ | |

Filed by a party other than the Registrant | ☐ | |

Check the appropriate box: | ||

☒ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under Rule 14a-12 | |

|

|

|

|

|

|

| SELECT COMFORT CORPORATION |

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box): | |||

☒ | No fee required. | ||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

| (1) | Title of each class of securities to which transaction applies: |

|

|

| ............................................................. |

|

| (2) | Aggregate number of securities to which transaction applies: |

|

|

| ............................................................. |

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

| ............................................................. |

|

| (4) | Proposed maximum aggregate value of transaction: |

|

|

| ............................................................. |

|

| (5) | Total fee paid: |

|

|

| ............................................................. |

|

|

|

|

☐ | Fee paid previously with preliminary materials. | ||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

| (1) | Amount Previously Paid: |

|

|

| ............................................................ |

|

| (2) | Form, Schedule or Registration Statement No.: |

|

|

| ............................................................ |

|

| (3) | Filing Party: |

|

|

| ............................................................ |

|

| (4) | Date Filed: |

|

|

| ............................................................ |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

Dear Shareholders,

During 2014, we made substantial progress toward our vision of ‘becoming one of the world’s most beloved brands by delivering an unparalleled sleep experience.’ We improved the lives of more than 600,000 customers while delivering record net sales of $1.16 billion for the year, a 20% increase over the prior year, including 12% comparable store sales growth. We also made progress with our business model leverage in the back half of the year, resulting in 16% full-year EPS growth to $1.25.

Consistent with our priorities, we invested $77M of capital to advance our consumer-driven innovation strategy for long-term sustainability. Our return on invested capital was 15%, which was clearly above our peers and our 10% weighted average cost of capital. In addition, we returned $45 million to shareholders in 2014 through share repurchases, and increased our share repurchase authorization to $250 million. Since the beginning of our share repurchase program in April 2012, the company has returned to shareholders $115 million or 124% of free cash flows. Efficient capital deployment remains a top priority.

Consumers responded strongly to our initiatives in 2014. Our strategic, operational and financial advancements resulted in total shareholder return of 27% in fiscal 2014.

Competitive Advantages

Our innovation strategy is predicated on strengthening the three important competitive advantages of our business model. Highlights from 2014 include:

Proprietary Sleep Innovations - All of our new sleep innovations complement our core differentiation, the Sleep Number® bed. These innovations are additive to our revenue and profit as illustrated by the 13% growth in average revenue per mattress unit (ARU) and 8% increase in mattress unit sales.

|

|

|

| • | SleepIQ® technology strengthens the value of the Sleep Number bed’s adjustability. It provides consumers with knowledge of their individual sleep experiences and empowers them to adjust their comfort via their Sleep Number® setting or changes to other aspects of their life to improve their sleep experience. |

| • | Partner Snore™ technology and our FlexTop™ mattress solve important consumer sleep issues. At the touch of a button, it may temporarily relieve common, mild snoring in otherwise healthy adults. |

| • | Our advertising featuring these innovations is driving new customers to our website and stores with improved marketing efficiency and effectiveness. |

Ongoing Customer Relationship -As both the manufacturer and retailer, we develop life-long relationships with our customers. Smart technology and connectivity are deepening this relationship.

|

|

|

| • | SleepIQ technology creates opportunities for daily customer interaction with our brand and we expect this brand interaction to result in increased demand. Our technology also provides meaningful sleep data to inform innovation priorities. |

| • | Repeat and referral continues to be a source of growth at more than 30% of net sales. |

Exclusive Distribution - Our retail distribution strategy is the foundation for sustainable, profitable growth and, therefore, must be agile to keep pace with ever evolving consumer shopping behavior. We ended fiscal 2014 with 463 stores in 47 states, complemented by an increasing digital presence.

|

|

|

| • | We advanced our value-added retail experience by increasing our average revenue per comp store to over $2.3 million. We continued to develop local markets by adding 23 net new locations while also investing in existing stores through repositions and expansions. With these customer experience investments, we expect our store portfolio to ultimately deliver average revenue per location of more than $3 million, while growing the store base 5-7% annually. |

| • | We implemented a new website platform to enable search, traffic and stability. Results included a 44% increase in unique site visitors, a leading indicator of future sales. |

Growth Enablers

With a strong growth trajectory, including steady marketing evolution, new sleep innovations, and retail and digital advancements, we are now prioritizing the transformation of our operating systems and supply chain.

Late in 2015, we will execute an Enterprise Resource Planning (ERP) implementation which involves the majority of our core operating systems. As a vertically integrated business, this is a significant undertaking for which we are actively preparing. These new systems are a necessary strategic growth enabler of our business in both the short- and long-term. We also expect supply chain related efficiencies to deliver margin expansion and improved customer experience over time.

Profit Commitments

The results of our integrated initiatives and strategic investments position us for sustainable, profitable growth. We expect to more than double EPS to $2.75 in the next five years while generating returns on invested capital of at least mid-teens. We will achieve this goal by increasing demand for our sleep innovations, leveraging the business model and deploying capital efficiently.

We will also continue our share repurchases and expect to accelerate our investment opportunistically in 2015 and beyond. We expect share count to be accretive to our EPS.

Management and the Board appreciated the shareholder engagement and communication during the past year. Our shareholder outreach resulted in value-added input and we look forward to ongoing and open dialogue.

Thank you to our Sleep Number team for their passionate dedication to our mission ofimproving lives by individualizing sleep experiences. We are deeply committed to our vision and superior shareholder value, which go hand-in-hand for us.

|

Sleep well, dream big, |

|

|

Shelly Ibach, Sleep Number® setting 40 |

President and Chief Executive Officer |

Forward-Looking Statements

This proxy statement contains certain “forward-looking statements,” as such term is defined in Section 21E of the Securities Exchange Act of 1934, as amended, relating to future events and the financial performance of Select Comfort. Such statements are only predictions and involve risks and uncertainties, resulting in the possibility that the actual events or performance will differ materially from such predictions. As such, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as to management’s plans, assumptions and expectations as of the date hereof. In addition to the considerations and factors referred to in this proxy statement and prior filings and releases, major factors which Select Comfort believes could cause actual events to differ materially include, but are not limited to, current and future general and industry economic trends and consumer confidence; the effectiveness of our marketing messages; the efficiency of our advertising and promotional efforts; our ability to execute our company-controlled distribution strategy; our ability to achieve and maintain acceptable levels of product and service quality, and acceptable product return and warranty claims rates; our ability to continue to improve and expand our product line; consumer acceptance of our products, product quality, innovation and brand image; industry competition, the emergence of additional competitive products, and the adequacy of our intellectual property rights to protect our products and brand from competitive or infringing activities; availability of attractive and cost-effective consumer credit options; pending and unforeseen litigation and the potential for adverse publicity associated with litigation; our “just-in-time” manufacturing processes with minimal levels of inventory, which may leave us vulnerable to shortages in supply; our dependence on significant suppliers and our ability to maintain relationships with key suppliers, including several sole-source suppliers; the vulnerability of key suppliers to recessionary pressures, labor negotiations, liquidity concerns or other factors; rising commodity costs and other inflationary pressures; risks inherent in global sourcing activities; risks of disruption in the operation of either of our two primary manufacturing facilities; increasing government regulations, which have added or will add cost pressures and process changes to ensure compliance; the adequacy of our management information systems to meet the evolving needs of our business and to protect sensitive data from potential cyber threats; the costs, distractions and potential disruptions to our business related to upgrading our management information systems; our ability to attract, retain and motivate qualified management, executive and other key employees, including qualified retail sales professionals and managers; and uncertainties arising from global events, such as terrorist attacks or a pandemic outbreak, or the threat of such events. Additional information concerning these and other risks and uncertainties is contained in the company’s filings with the Securities and Exchange Commission (SEC), including the Annual Report on Form 10-K, and other periodic reports filed with the SEC. The company has no obligation to publicly update or revise any of the forward-looking statements in this proxy statement.

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

9800 59th Avenue North

Plymouth, Minnesota 55442

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

[●], 2015

TO THE SHAREHOLDERS OF SELECT COMFORT CORPORATION:

Select Comfort Corporation will hold its Annual Meeting of Shareholders at8:30 a.m. Central Time on[●],[●], 2015, at theMillennium Minneapolis Hotel located at 1313 Nicollet Mall, Minneapolis, Minnesota 55403. The purposes of the meeting are to:

|

|

|

| 1. | Elect three persons to serve as directors for three-year terms; |

|

|

|

| 2. | Re-approve the material terms of the performance goals included in the company’s Amended and Restated 2010 Omnibus Incentive Plan; |

|

|

|

| 3. | Cast an advisory vote on executive compensation; |

|

|

|

| 4. | Cast an advisory vote on the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the 2015 fiscal year ending January 2, 2016; and |

|

|

|

| 5. | If a quorum is not present or represented at the meeting, approve any motion proposed by the Chairman of the Board of Select Comfort to adjourn the meeting until a quorum shall be present or represented. |

Shareholders of record at the close of business on[●], 2015 will be entitled to vote at the meeting and any adjournments thereof.

Please note that Blue Clay Capital Partners CO III LP (together with its affiliates and related parties, “Blue Clay”) has filed a preliminary proxy statement indicating that Blue Clay intends to nominate two nominees for election to the Board of Directors at the Annual Meeting. You may receive solicitation materials from Blue Clay, including a proxy statement and proxy card. We are not responsible for the accuracy of any information provided by or relating to Blue Clay or its nominees contained in solicitation materials filed or disseminated by or on behalf of Blue Clay or any other statements Blue Clay may make.

AFTER DUE CONSIDERATION, THE BOARD OF DIRECTORS DOES NOT ENDORSE ANY BLUE CLAY NOMINEES AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES PROPOSED BY OUR BOARD OF DIRECTORS. OUR BOARD OF DIRECTORS STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY BLUE CLAY. IF YOU PREVIOUSLY SUBMITTED A PROXY CARD SENT TO YOU BY BLUE CLAY, YOU CAN REVOKE THAT PROXY AND VOTE FOR OUR BOARD OF DIRECTORS’ NOMINEES AND ON THE OTHER MATTERS TO BE VOTED ON AT THE ANNUAL MEETING BY USING THE ENCLOSEDWHITE PROXY CARD. ONLY THE LATEST VALIDLY EXECUTED PROXY THAT YOU SUBMIT WILL BE COUNTED.

Your vote is important. Please be sure to vote your shares in favor of the Board of Directors’ recommendations in time for our [●], 2015 meeting date.

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement of the matters to be considered at the meeting. A copy of the Annual Report for the year ended January 3, 2015 also accompanies this Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS’ MEETING TO BE HELD ON[●]: The Proxy Statement and Annual Report for the year ended January 3, 2015 and related materials are available atwww.sleepnumber.com/investor-relations.

|

|

| By Order of the Board of Directors, |

|

|

|

|

| Mark A. Kimball |

[●], 2015

Plymouth, Minnesota

Page

|

|

|

| 1 | |

|

|

|

| 10 | |

|

|

|

| 13 | |

|

|

|

| 31 | |

|

|

|

| 63 | |

|

|

|

| 83 | |

|

|

|

| 84 | |

|

|

|

PROPOSAL 4 −RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 86 |

|

|

|

| 87 | |

|

|

|

| 88 |

As used in this Proxy Statement, the terms “we,” “us,” “our,” the “company” and “Select Comfort” mean Select Comfort Corporation and its subsidiaries and the term “common stock” means our common stock, par value $0.01 per share.

i

9800 59th Avenue North

Plymouth, Minnesota 55442

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

[●], 2015

FREQUENTLY ASKED QUESTIONS ABOUT THE MEETING AND VOTING

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Select Comfort Corporation for use at the 2015 Annual Meeting of Shareholders.

When and where is the Annual Meeting and who may attend?

The Annual Meeting will be held at 8:30 a.m. Central Time on [●], [●], 2015, at the Millennium Minneapolis Hotel located at 1313 Nicollet Mall, Minneapolis, Minnesota 55403. Shareholders who are entitled to vote may attend the meeting.

Who is entitled to vote?

Shareholders of record at the close of business on [●], 2015 (the “Record Date”) are entitled to vote at the meeting. As of the Record Date, there were [●]shares of common stock outstanding. Each share is entitled to one vote on each matter to be voted on at the Annual Meeting. Shareholders are not entitled to cumulative voting rights.

If I am eligible to vote and want to attend the Annual Meeting, what do I need to bring?

Shareholders of Record. If you are a Shareholder of Record and plan to attend the meeting, please bring the notice of the meeting and photo identification. Shareholders of Record who do not present the notice of the meeting will be admitted only upon verification of ownership at the meeting.

Beneficial Owners. If you are a Beneficial Owner and plan to attend the meeting, you must present proof of ownership of the company’s common stock as of the Record Date, such as a brokerage account statement, and photo identification. If you are a Beneficial Owner and wish to vote at the meeting, you must also bring a legal proxy from your bank, broker or other holder of record.

1

What is the difference between “Shareholders of Record” and “Beneficial Owners”?

If your shares are registered in your name in the records maintained by our stock transfer agent, you are a “Shareholder of Record.” If you are a Shareholder of Record, notice of the meeting was sent directly to you.

If your shares are held in the name of your bank, broker or other holder of record, your shares are held in “street name” and you are considered the “Beneficial Owner.” Notice of the meeting has been forwarded to you by your bank, broker or other holder of record, who is considered, with respect to those shares, the Shareholder of Record. As the Beneficial Owner, you have the right to direct your bank, broker or other holder of record how to vote your shares by using the voting instructions you received.

If you are a Beneficial Owner and you do not give instructions to the organization holding your shares, then that organization cannot vote your shares and the shares held by that organization will not be considered as present and will not be entitled to vote on any matter to be considered at the Annual Meeting.

What does it mean if I receive more than one proxy card or Shareholder Notice?

If you received a paper copy of the proxy statement and you choose to vote by mail, sign and return eachWHITE proxy card. If you choose to vote by Internet or telephone, vote once for eachWHITE proxy card you receive to ensure that all of your shares are voted. If you have received more than one Shareholder Notice, it generally means you hold shares registered in more than one account - vote once for each Shareholder Notice that you receive.

If Blue Clay proceeds with its nominations, you will likely also receive a proxy card notice from Blue Clay. You may receive multiple mailings from Blue Clay, and you will likely receive multiple mailings from Select Comfort prior to the date of the Annual Meeting, so that our shareholders have our latest proxy information and materials to vote. We anticipate that we will send you a newWHITE proxy card with each mailing, regardless of whether you have previously voted. Only the latest validly executed proxy you submit will be counted. If you wish to vote as recommended by Select Comfort’s Board, you should submit only theWHITE proxy cards. Please see “What should I do if I receive a proxy card from Blue Clay?” below for more information.

The Board strongly urges you not to sign or return any proxy card sent to you by Blue Clay. If you have already submitted a proxy card that you have received from Blue Clay, you may revoke such proxy and vote for the Board’s nominees by following the instructions under “May I revoke a proxy and change my vote?”.

What are shareholders being asked tovote on?

|

|

|

| There are four items to be voted on at the meeting: | |

|

| |

| • | The election of three persons to serve as directors for three-year terms; |

|

|

|

| • | Re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan; |

|

|

|

| • | An advisory vote on executive compensation; and |

2

|

|

|

| • | An advisory vote on the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 2, 2016. |

In addition, if a quorum is not present or represented at the meeting, the shareholders may be asked to approve a motion to adjourn the meeting until a quorum shall be present or represented.

What are my voting choices?

|

|

|

| For proposal 1, the election of directors, you may: | |

|

| |

| • | Vote in favor of all nominees; |

|

|

|

| • | Vote in favor of specific nominees and withhold a favorable vote for specific nominees; or |

|

|

|

| • | Withhold authority to vote for all nominees. |

|

|

|

| For each of proposal 2 (re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan), proposal 3 (the advisory vote on executive compensation), proposal 4 (the advisory vote on ratification of the selection of independent auditors) and proposal 5 (adjournment of the meeting if a quorum is not present), you may: | |

|

| |

| • | Vote in favor of the proposal; |

|

|

|

| • | Vote against the proposal; or |

|

|

|

| • | Abstain from voting on the proposal. |

Have other candidates been nominated for election as directors at the Annual Meeting in opposition to the Board’s nominees?

Blue Clay, a shareholder of the company, has filed a preliminary proxy statement indicating that it intends to nominate two nominees for election to the Board of Directors at the Annual Meeting, in opposition to the nominees recommended by our Board. The Board of Directors does not endorse any Blue Clay nominees and unanimously recommends that you voteFOR the election of each of the nominees proposed by the Board of Select Comfort by using theWHITEproxy card accompanying this proxy statement. The Board strongly urges you not to sign or return any proxy card sent to you by Blue Clay.

3

How does the Board recommend that I vote?

|

|

|

| Select Comfort’s Board unanimously recommends that you vote your shares: | |

|

| |

| • | “For” the election of each of the nominees for director nominated herein by the Board of Select Comfort; |

|

|

|

| • | “For” the re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan; |

|

|

|

| • | “For” the advisory vote on executive compensation; |

|

|

|

| • | “For” the advisory vote on the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending January 2, 2016; and |

|

|

|

| • | “For”any motion to adjourn the meeting proposed by the Chairman of the Board of Select Comfort if a quorum is not present or represented at the meeting. |

The Board strongly urges you not to sign or return any proxy card sent to you by Blue Clay. If you have already submitted a proxy card that you have received from Blue Clay, you may revoke such proxy and vote for the Board’s nominees by following the instructions under “May I revoke a proxy and change my vote?”.

How are votes counted?

If you are a Shareholder of Record and grant a proxy by telephone or Internet without voting instructions, or sign and submit yourWHITEproxy card without voting instructions, your shares will be voted “FOR” each director nominee, “FOR” proposal 2 (re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan), “FOR” proposal 3 (the advisory vote on executive compensation), “FOR” proposal 4 (the advisory vote on ratification of the selection of independent auditors) and “FOR” proposal 5 (adjournment of the meeting if a quorum is not present).

Proxies marked “Withhold” on proposal 1 (election of directors), or “Abstain” on proposal 2 (re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan), proposal 3 (the advisory vote on executive compensation), proposal 4 (the advisory vote on ratification of the selection of independent auditors) or proposal 5 (adjournment of the meeting if a quorum is not present), will be counted in determining the total number of shares entitled to vote on such proposals and will have the effect of a vote “Against” a director or a proposal.

If you are a Beneficial Owner and hold your shares in “street name,” such as through a bank, broker or other nominee, you generally cannot vote your shares directly and must instead instruct the broker how to vote your shares using the voting instruction form provided by the broker. When a beneficial owner of shares held by a bank, broker or other nominee fails to

4

provide the record holder with voting instructions and such organization lacks the discretionary voting power to vote those shares with respect to a particular proposal, a “broker non-vote” (defined below) occurs.

What is a Broker Non-Vote?

In an uncontested election, a broker is entitled to vote shares held for a Beneficial Owner on “routine” matters without instructions from the Beneficial Owner of those shares. However, if a Beneficial Owner does not provide timely instructions, the broker will not have the authority to vote on any “non-routine” proposals at the Annual Meeting.

Given that we anticipate this will be a contested election, the rules of the New York Stock Exchange governing brokers’ discretionary authority – which apply to brokers’ authority with respect to companies listed on the NASDAQ – do not permit brokers licensed by the NYSE to exercise discretionary authority regarding any proposals to be voted on at the Annual Meeting, whether “routine” or not.As a result, we do not expect there to be any broker non-votes at the Annual Meeting.

Please instruct your broker how to vote your shares using the voting instruction form provided by your broker by returning the completed WHITE proxy card or voting instruction form to your broker or following the instructions provided by your broker for voting your shares over the Internet or telephonically.

What is the voterequired to approve each proposal?

With respect to the election of directors, our Articles of Incorporation (our “Charter”) provide that in a contested election, the director nominees receiving the highest number of “FOR” votes will be elected at the Annual Meeting. We expect the 2015 Annual Meeting to be a contested election because the number of nominees for election, taking into account the Blue Clay nominees, will exceed the number of directors to be elected.

However, in the event Blue Clay withdraws its nominees on or prior to the day preceding the date the company first mails the notice for the Annual Meeting to the company’s shareholders, the election of directors will not be contested. In an uncontested election, our Charter provides for majority voting in elections of directors. In such case, the number of votes “FOR” each director must constitute a majority of the voting power of the shares of common stock represented and entitled to vote in person or by proxy at the Annual Meeting.

Assuming that a quorum is present to vote on each of the proposals, proposals 2, 3 and 4 before the shareholders will require the affirmative vote of holders of a majority of the shares represented and entitled to vote in person or by proxy on such action. If a quorum is not present or represented at the meeting, any motion to adjourn the meeting until a quorum shall be present or represented will require the affirmative vote of a majority of the shares represented and entitled to vote at the meeting.

5

Please note that each of proposals 3 and 4 are “advisory” votes, meaning that the shareholder votes on these items are for purposes of enabling shareholders to express their point of view or preference on these proposals, but are not binding on the company or its board of directors and do not require the company or its board of directors to take any particular action in response to the shareholder vote. The Board intends to consider fully the votes of our shareholders in the context of any future action with respect to these proposals.

What constitutes a “quorum,” or how many shares are required to be present to conduct business at the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote (i.e., at least [●] shares) will constitute a quorum for the transaction of business at the Annual Meeting. In general, shares of common stock represented by a properly signed and returned proxy card or properly voted by telephone or via the Internet will be counted as shares represented and entitled to vote at the Annual Meeting for purposes of determining a quorum, without regard to whether the card reflects abstentions is left blank, or reflects a broker non-vote on a matter.

How do I vote my shares without attending the meeting?

If you are a Shareholder of Record, you may vote by granting a proxy. If you are a Beneficial Owner of shares held in street name, such as through a bank, broker or other holder of record, you may vote by submitting voting instructions to your bank, broker or other holder of record. In most circumstances, you may vote:

|

|

|

| • | By Internet or Telephone — If you have Internet or telephone access, you may submit your proxy by following the voting instructions on the proxy card or Notice no later than 11:59 p.m., Eastern Daylight Time, on[●], 2015. If you vote by Internet or telephone, you donot need to return your proxy card. |

|

|

|

| • | By Mail — If you received a paper copy of the proxy statement, you may vote by mail by signing, dating and mailing your proxy card in the envelope provided. You should sign your name exactly as it appears on the proxy card. If you are signing for jointly held shares, all joint owners should sign. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. |

Beneficial Owners should be aware that given that we expect this to be a contested election, brokers are not permitted to exercise discretionary authority regarding any proposals to be voted on at the Annual Meeting, whether “routine” or not. As a result, brokers are not permitted to vote shares on proposal 1 (election of directors), proposal 2 (re-approval of the material terms of the performance goals included in the company’s 2010 Omnibus Incentive Plan), proposal 3 (the advisory vote on executive compensation), proposal 4 (ratification of auditors) or proposal 5 (adjournment of the meeting if a quorum is not present), without instructions from the Beneficial Owner. Therefore, Beneficial Owners are advised that if they do not provide timely instructions to their bank, broker or other holder of record, their shares will not be voted in connection with proposals 1, 2, 3, 4 and 5.

6

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares in time for our[●], 2015 meeting date.

How do I vote my shares in person at the meeting?

If you are a Shareholder of Record and prefer to vote your shares at the meeting, bring the accompanying proxy card (if you received a paper copy of the proxy statement) and photo identification. If you are a Beneficial Owner holding shares in “street name,” such as through a bank, brokerage account, trust or other nominee, you may vote the shares only if you obtain a signed proxy from the record holder (i.e., the bank, broker, trust or other nominee who is the record holder of the shares) giving you the right to vote the shares.

Even if you plan to attend the meeting, we encourage you to vote your shares in advance by Internet, telephone or mail so that your vote will be counted in the event you are unable to attend.

What should I do if I receive a proxy card from Blue Clay?

Blue Clay has filed a preliminary proxy statement indicating that it intends to nominate two nominees for election to the Board of Directors at the Annual Meeting, in opposition to the nominees recommended by our Board. If Blue Clay proceeds with its nominations, you may receive proxy solicitation materials from Blue Clay, including an opposition proxy statement and a proxy card. The company is not responsible for the accuracy of any information contained in any proxy solicitation materials used by Blue Clay or any other statements that Blue Clay may make.

After due consideration, our Board of Directors does not endorse any Blue Clay nominee and unanimously recommends that you disregard any proxy card or solicitation materials that may be sent to you by Blue Clay. Voting to WITHHOLD with respect to any Blue Clay nominee on its proxy card is NOT the same as voting for the nominees of Select Comfort’s Board of Directors, because a vote to WITHHOLD with respect to any Blue Clay nominee on its proxy card will revoke any proxy you previously submitted, including any proxy that you previously submitted voting for the Board’s nominees.

May I revoke a proxy and change my vote?

Yes. Any shareholder giving a proxy may revoke it at any time prior to its use at the Annual Meeting by:

|

|

|

| • | Delivering written notice of revocation to the Corporate Secretary before 6:00 p.m., Eastern Daylight Time, on[●], 2015; |

|

|

|

| • | Submitting to the Corporate Secretary before 6:00 p.m., Eastern Daylight Time, on[●], 2015, a properly signed proxy card bearing a later date than the prior proxy card; |

|

|

|

| • | Voting again by Internet or telephone before 11:59 p.m., Eastern Daylight Time, on[●], 2015; or |

7

|

|

|

| • | Appearing at the Annual Meeting as a shareholder of record or with a legal proxy (for shares held in street name) and filing written notice of revocation with the Corporate Secretary. |

If you have previously signed a proxy card sent to you by Blue Clay, you have every right to change your vote.Submitting a proxy card sent to you by Blue Clay will revoke votes you have previously made via ourWHITE proxy card. You may change your vote by marking, signing, dating and returning the enclosedWHITE proxy card in the accompanying post-paid envelope, or by voting by telephone or via the Internet by following the instructions on yourWHITE proxy card. Only the latest validly executed proxy that you submit will be counted.

Attendance at the Annual Meeting will not, by itself, revoke your proxy. For shares you hold in street name, such as through a brokerage account, bank, trust or other nominee, you would need to obtain a legal proxy from your broker or nominee and bring it to the meeting in order to revoke a prior proxy and to vote those shares at the Annual Meeting. Prior to the meeting, you may revoke your proxy by contacting your broker or nominee and following their instructions for revoking your proxy.

Can I receive future proxy materials electronically?

Yes. If you are a Shareholder of Record and you have received a paper copy of the proxy materials, you may elect to receive future proxy statements and annual reports online as described in the next paragraph. If you elect this feature, you will receive an email message notifying you when the materials are available, along with a web address for viewing the materials. If you received this proxy statement electronically, you do not need to do anything to continue receiving proxy materials electronically in the future.

Whether you are a Shareholder of Record or a Beneficial Owner holding shares through a bank or broker, you can enroll for future electronic delivery of proxy statements and annual reports by following these steps:

|

|

|

| • | Go to our website atwww.sleepnumber.com; |

|

|

|

| • | In theInvestor Relations section, click onElectronic Fulfillment; |

|

|

|

| • | Click on the check-marked box next to the statement“Shareholders can register for electronic delivery of proxy-related materials.”; and |

|

|

|

| • | Follow the prompts to submit your request to receive proxy materials electronically. |

Generally, banks and brokers offering this choice require that shareholders vote through the Internet in order to enroll. Beneficial Owners whose bank or broker is not included in this website are encouraged to contact their bank or broker and ask about the availability of electronic delivery. As is customary with Internet usage, the user must pay all access fees and telephone charges. You may view this year’s proxy materials atwww.proxyvote.com.

8

What are the costs and benefits of electronic delivery of Annual Meeting materials?

There is no cost to you for electronic delivery of annual meeting materials. You may incur the usual expenses associated with Internet access as charged by your Internet service provider. Electronic delivery ensures quicker delivery, allows you to view or print the materials at your computer and makes it convenient to vote your shares online. Electronic delivery also conserves natural resources and saves the company printing, postage and processing costs.

Who bears the proxy solicitation costs?

The proxies being solicited hereby are being solicited by the Board of Directors of the company. The cost of preparing and mailing the notice of Annual Meeting, this proxy statement and the accompanying proxy and the cost of solicitation of proxies on behalf of the Board of Directors will be borne by the company. The company may solicit proxies by mail, internet (including by email, Twitter, the use of our investor relations website and other online channels of communication), telephone, facsimile and other electronic channels of communication, town hall meetings, personal interviews, press releases, and press interviews. Our directors, officers and regular employees may, without compensation other than their regular compensation and the reimbursement of expenses, solicit proxies by telephone or personal conversation.Annex A sets forth information relating to certain of our directors, officers and employees who are considered “participants” in this proxy solicitation under the rules of the Securities and Exchange Commission, by reason of their position or because they may be soliciting proxies on our behalf. In addition, we may reimburse brokerage firms and others for their reasonable and documented expenses incurred in connection with forwarding proxy materials to the Beneficial Owners of our common stock.

We have retained the services of Georgeson, Inc. (“Georgeson”), a professional proxy solicitation firm, to aid in the solicitation of proxies. This proxy solicitation firm estimates that approximately [●] of its employees will assist in this proxy solicitation, which they may conduct by personal interview, mail, telephone, facsimile, email, other electronic channels of communication, or otherwise. We expect that we will pay Georgeson its customary fees, estimated not to exceed approximately $[●] in the aggregate, plus reasonable out-of-pocket expenses incurred in the process of soliciting proxies. Our aggregate expenses, including those of Georgeson, related to the solicitation in excess of those normally spent for an annual meeting as a result of the potential proxy contest and excluding salaries and wages of our officers and regular employees, are expected to be approximately $[●], of which approximately $[●] has been spent to date. We have agreed to indemnify Georgeson against certain liabilities relating to or arising out of their engagement.

9

STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows the beneficial ownership of Select Comfort common stock as of February 28, 2015 (unless another date is indicated) by (a) each director, each nominee for director recommended by our Board and each executive officer named in the Summary Compensation Table on page 51 of this Proxy Statement, (b) all directors and executive officers as a group and (c) each person known by us to be the Beneficial Owner of more than 5% of Select Comfort common stock.

| Title of Class | Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership(2) | Percent of Class |

| Common Stock | Daniel I. Alegre | 5,700 | * |

| Common Stock | Kevin K. Brown(3) | 13,271 | * |

| Common Stock | David R. Callen | 7,150 | * |

| Common Stock | Patricia A. Dirks | 8,344 | * |

| Common Stock | Stephen L. Gulis, Jr.(4) | 122,603 | * |

| Common Stock | Michael J. Harrison(4) | 28,170 | * |

| Common Stock | Shelly R. Ibach(5) | 275,370 | * |

| Common Stock | David T. Kollat | 185,374 | * |

| Common Stock | Brenda J. Lauderback(4) | 75,545 | * |

| Common Stock | Kathleen L. Nedorostek(4) | 24,988 | * |

| Common Stock | Michael A. Peel(4) | 104,459 | * |

| Common Stock | Kathryn V. Roedel(6) | 180,564 | * |

| Common Stock | Wendy L. Schoppert(7) | 1,000 | * |

| Common Stock | Jean-Michel Valette | 274,221 | * |

| Common Stock | All directors and executive officers as a group (19 persons)(8) | 1,731,269 | 3.2% |

| Common Stock | BlackRock, Inc.(9) 55 East 52nd Street New York, New York 10022 | 4,607,701 | 8.6% |

| Common Stock | Disciplined Growth Investors, Inc.(10) 150 South Fifth Street, Suite 2100 Minneapolis, Minnesota 55402 | 3,676,155 | 6.8% |

| Common Stock | The Vanguard Group, Inc.(11) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | 3,451,173 | 6.4% |

| Common Stock | FMR LLC(12) 245 Summer Street Boston, Massachusetts 02210 | 2,781,800 | 5.2% |

______________________

* Less than 1% of the outstanding shares.

| (1) | The business address for each of the directors and officers of the company is c/o Select Comfort Corporation, 9800 59th Avenue North, Plymouth, Minnesota 55442. |

| (2) | The shares shown include the following shares that directors and executive officers have the right to acquire within 60 days through the exercise of stock options: Mr. Alegre (3,620 shares); Mr. Brown (2,077 shares); Mr. Callen (2,465 shares); Ms. Dirks (2,200 shares); Mr. Gulis (64,745 shares); Mr. Harrison (7,089 shares); Ms. Ibach (164,387 shares); Dr. Kollat (64,745 shares); Ms. Lauderback (51,995 shares); Ms. Nedorostek (9,495 shares); Mr. Peel (40,983 shares); Ms. Roedel (115,967 shares); and Mr. Valette (64,745 shares). The shares shown also include the following shares that executive officers have the right to acquire within 60 days through the vesting of restricted stock units: Mr. Callen (4,685 shares) and Ms. Dirks (6,030 shares). |

10

| (3) | Includes 8,133 shares held under restricted stock grants that have not vested. |

| (4) | The Amended and Restated 2010 Omnibus Plan (the Plan) permits non-employee directors to receive director fees in the form of common stock in lieu of cash, and to defer receipt of such shares. In addition, the Plan permits non-employee directors to defer receipt of shares of the company’s common stock under an Incentive Award granted under the Plan (referred to as Restricted Stock Units or RSUs). The directors are entitled to the deferred shares and fully-vested RSUs upon separation of service from the company. Mr. Gulis’s amount includes 49,746 shares that were deferred in lieu of director fees and 5,612 RSUs that were deferred. Mr. Harrison’s amount includes 7,033 shares that were deferred in lieu of director fees and 2,080 RSUs that were deferred. Ms. Lauderback’s amount includes 5,612 RSUs that were deferred. Ms. Nedorostek’s amount includes 9,881 shares that were deferred in lieu of director fees. Mr. Peel’s amount includes 2,080 RSUs that were deferred. |

| (5) | Includes 55,504 shares held under restricted or performance stock grants that have not vested. |

| (6) | Includes 25,047 shares held under performance stock grants that have not vested. |

| (7) | Ms. Schoppert resigned from the Company on February 21, 2014. |

| (8) | Includes an aggregate of 796,902 shares that directors and executive officers as a group have the right to acquire within 60 days through the exercise of stock options. Includes an aggregate of 152,531 shares held under restricted or performance stock grants that have not vested and 10,715 shares that officers as a group have the right to acquire within 60 days through the vesting of RSUs. Also includes 66,660 shares that were deferred by non-employee directors in lieu of director fees and 15,384 RSUs that were deferred by non-employee directors. |

| (9) | BlackRock, Inc. reported in a Schedule 13G/A filed with the Securities and Exchange Commission on January 22, 2015 that as of December 31, 2014 it beneficially owned 4,607,701 shares of Common Stock of Select Comfort Corporation, had sole power to vote or to direct the vote on 4,481,731 shares and sole dispositive power with respect to 4,607,701 shares. |

| (10) | Disciplined Growth Investors, Inc. reported in a Schedule 13F filed with the Securities and Exchange Commission on February 9, 2015 that as of December 31, 2014 it beneficially owned 3,676,155 shares of Common Stock of Select Comfort Corporation, had sole dispositive power with respect to 3,676,155 shares, sole voting power with respect to 2,967,995 shares and no voting power with respect to 708,160 shares. |

| (11) | The Vanguard Group, Inc. reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February 11, 2015 that as of December 31, 2014 it beneficially owned 3,451,173 shares of Common Stock of Select Comfort Corporation, had sole power to vote or to direct the vote on 76,288 shares, shared dispositive power with respect to 70,988 shares and sole dispositive power on 3,380,185 shares. |

| (12) | FMR LLC reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February 13, 2015 that as of December 31, 2014 it beneficially owned 2,781,800 shares of Common Stock of Select Comfort Corporation, had sole power to vote or to direct the vote on 36,600 shares and sole dispositive power with respect to 2,781,800 shares. |

11

BACKGROUND OF THE BLUE CLAY SOLICITATION

On December 4, 2014, the company received from Blue Clay a letter stating its intention to nominate two individuals, Adam J. Wright and Brian A. Spaly, for election to the company’s Board at the Annual Meeting.

On January 12, 2015, the company’s Chairman and certain members of the company’s management team met with Adam J. Wright and Gary Kohler, respectively the Managing Partner and Chief Investment Officer of Blue Clay, to discuss Blue Clay’s perspectives on the company and the company’s Board of Directors. The company informed Blue Clay that it would consider the Blue Clay nominees as part of its normal governance process.

On February 6, 2015, as part of its governance process for evaluating director nominee candidates, members of the company’s Corporate Governance and Nominating Committee and the company’s Chief Executive Officer conducted in-person interviews with the two nominees put forward by Blue Clay.

On February 19, 2015, the company’s Corporate Governance and Nominating Committee met to consider the background and experience of the Blue Clay nominees in light of the company’s criteria for the nomination of directors to the Board.

On February 26, 2015, the Board met to discuss and consider the Blue Clay nominees, their background and experience, the company’s criteria for the nomination of directors to the Board, their potential service on the company’s Board of Directors and the unanimous recommendation of the Corporate Governance and Nominating Committee.

On March 4, 2015, the company’s Chairman and the company’s Chief Executive Officer informed Blue Clay that after due consideration the Board had unanimously determined that the Blue Clay nominees would not be included in the company’s slate of nominees at the Annual Meeting.

On March 6, 2015, the company filed its preliminary proxy statement with the SEC nominating Daniel I. Alegre, Stephen L. Gulis, Jr. and Brenda J. Lauderback for election to the company’s Board.

On March 12, 2015, Blue Clay filed a preliminary proxy statement with the SEC nominating two individuals for election to the company’s Board, in opposition to the company’s nominees.

12

13

14

Name and Age of Nominee and/or Director | Principal Occupation, Business Experience And Directorships of Public Companies | Director Since | ||

| Nominees for election this year to three-year terms expiring in 2018: | ||||

Daniel I. Alegre Age 46 | Occupation: President of Global Partner Business Solutions for Google, Inc. since November 2012; Held various roles at Google since 2004, including President of Asia Pacific and Japan, overseeing all regional operations, and Vice President of Latin American and Asia Pacific Business Development. Previously, Mr. Alegre was Vice President at Bertelsmann, responsible for business development of its ecommerce division. | 2013 | ||

Qualifications: Mr. Alegre provides the Board with valuable insight into mobile and technology platforms, digital brand building and advertising, and e-commerce deployment and strategy, as well as extensive leadership in global operations and expansion, partner management and business development in technology and mass media industries. | ||||

Stephen L. Gulis, Jr Age 57 | Occupation: Retired Executive Vice President and President of Global Operations for Wolverine World Wide, Inc. (WWW), a global marketer of branded footwear, apparel and accessories, a position he held from October 2007 until July 2008; Executive Vice President, CFO and Treasurer of WWW from April 1996 until October 2007. | 2005 | ||

Qualifications: Mr. Gulis provides the Board with extensive experience as a senior executive of a publicly traded consumer products company, including as a chief financial officer and treasurer with responsibility for capital stewardship and cash management, significant M&A activity and broad oversight of financial reporting and controls. Mr. | ||||

15

| Gulis also brings expertise in risk management, implementation of enterprise technology platforms, global operations, human resources and product sourcing and quality directives. | ||||

Other Public Company Boards: Current: Independent Bank Corporation Prior: Meritage Hospitality | ||||

Brenda J. Lauderback Age 64 | Occupation: Former President of the Retail and Wholesale Group for the Nine West Group, Inc., a designer and marketer of women’s footwear and accessories, from May 1995 until January 1998; Previous roles include President of Wholesale and Manufacturing for US Shoe Corporation and more than 18 years in senior merchandising roles at the Department Store Division of Target Corporation. | 2004 | ||

Qualifications: Ms. Lauderback brings to our Board extensive leadership in merchandising, marketing, product development and design and manufacturing at prominent national wholesale and retail companies. Her breadth of experience as a director on several other publicly traded company boards also provides our Board with significant insight into leading practices in executive compensation and corporate governance. | ||||

Other Public Company Boards: Current: Big Lots, Inc., Denny’s Corporation and Wolverine World Wide, Inc. Prior: Louisiana-Pacific Corporation, Irwin Financial Corporation, Jostens Corporation | ||||

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE | ||||

| Directors not standing for election this year whose terms expire in 2016: | ||||

Michael J. Harrison Age 54 | Occupation: Interim CEO, since March 2014, of OOFOS, LLC, a leader in the emerging global category of recovery footwear for athletes; Independent business and management consultant since November 2012; Previously Chief Brand Officer for Timberland, a leading brand of outdoor footwear, apparel and gear from July 2009 through November 2012; Prior to 2009, Mr. Harrison held various senior leadership roles at Timberland and Procter & Gamble, including positions with significant responsibility for international marketing, global operations and business development. | 2011 | ||

Qualifications: Mr. Harrison brings 30 years of business acumen to our Board from his senior executive experience in marketing, product design and development, retailing and international management with leading consumer brands. | ||||

Other Company Boards: Current: OOFOS, LLC, Totes/Isotoner Corporation | ||||

Shelly R. Ibach Age 55 | Occupation: President and Chief Executive Officer of Select Comfort Corporation since June 2012; Executive Vice President and Chief Operating Officer from June 2011 to June 2012; Executive Vice President, Sales & Merchandising from October 2008 to June 2011. Previously held various executive merchandising positions at Macy’s and Marshall Field’s Department Stores for more than 25 years. | 2012 | ||

Qualifications: Ms. Ibach brings experience and perspective as Select Comfort’s President and CEO as well as intimate knowledge of our strategy, operations, real estate and competitive environment gained during eight years in executive management with the company. Ms. Ibach also brings more than two decades of retail experience with P&L oversight, brand and product development and customer-focused leadership experience with prominent national retailers. | ||||

David T. Kollat Age 76 | Occupation: President and Chairman of 22 Inc., a research and consulting company for retailers and consumer goods manufacturers, since 1987. Formerly Executive Vice President of L Brands and President and CEO of Victoria’s Secret Direct for 11 years. | 1994 | ||

Qualifications: Dr. Kollat brings more than 40 years of valuable consumer insight, development of marketing and corporate strategies and management expertise from his consulting, leadership and board experience with branded consumer goods manufacturers and retailers. His extensive experience on boards of public and private companies also gives him significant knowledge of corporate governance practices. | ||||

Other Public Company Boards: Current: L Brands, Inc., Wolverine World Wide, Inc. Prior: Big Lots, Inc. |

17

| Directors not standing for election this year whose terms expire in 2017: | ||||

Kathleen L. Nedorostek Age 62 | Occupation: Global CEO of Nine West Group, a division of Nine West Holdings, a leading global designer, marketer and wholesaler of brands in apparel, footwear and accessories from April 2014 to September 2014. Group President, Global Footwear and Accessories at The Jones Group from October 2012 until April 2014. President of the North American Wholesale and Global Licensing divisions of Coach Inc. from 2003 to 2012. | 2011 | ||

Qualifications: Ms. Nedorostek provides our Board with significant experience leading high-end, multi-national branded consumer products companies with both manufacturing and retail operations. Her experience includes strategic planning for global businesses, P&L oversight, organizational strategy and change management, product design, global licensing and distribution, brand marketing and real estate. | ||||

Michael A. Peel Age 65 | Occupation: Elected an Officer of Yale University in October 2008 and currently Vice President for Human Resources and Administration. Previously a 17-year member of the senior management team at General Mills, a manufacturer and marketer of consumer food products, including Executive Vice President of Human Resources and Global Business Services; Also 14 years at PepsiCo, including Chief Human Resources Officer for PepsiCo Worldwide Foods and Pepsi-Cola Bottling Group. | 2003 | ||

Qualifications: Mr. Peel’s experience at large, consumer-oriented, publicly traded companies and large institutions provides our Board with senior level perspective on organizational management, talent development, succession planning and executive compensation. | ||||

Other Public Company Boards: Current: Pier 1 Imports, Inc. | ||||

Jean-Michel Valette Age 54 | Occupation: Chairman of our Board since May 2010; Independent adviser to branded consumer companies; Currently serves as Lead Director of The Boston Beer Company; Served as Chairman of the Board of Directors of Peet’s Coffee and Tea, Inc. from January 2004 to October 2012; Also served as non-executive Chairman of the Robert | 1994 | ||

18

| Mondavi Winery from April 2005 to October 2006 and was its Managing Director from October 2004 to April 2005; Head of Branded Consumer Equity Research and Branded Consumer Venture Capital Investments at Hambrecht & Quist LLC, an investment banking firm, during the 1990s. | ||||

Qualifications: Mr. Valette provides our Board with significant, relevant leadership and proven track record of shareholder value creation with multiple successful branded consumer growth companies as well as valuable perspective in guiding the company on strategy, financial performance and corporate governance practices. | ||||

Other Public Company Boards: Current: Lead Director of The Boston Beer Company Prior: Peet’s Coffee and Tea, Inc., Golden State Vintners |

| NUMBER OF | |

| TENURE ON BOARD | DIRECTORS/ NOMINEES |

| Less than 5 years | 4 |

| 5 to 10 years | 2 |

| More than 10 years | 3 |

| Daniel I. Alegre | Stephen L. Gulis, Jr. | Michael J. Harrison | |

| David T. Kollat | Brenda J. Lauderback | Kathleen L. Nedorostek | |

| Michael A. Peel | Jean-Michel Valette |

19

Director | Audit Committee | Management Development and Compensation Committee | Corporate Governance and Nominating Committee | |||

| Jean-Michel Valette | X | |||||

| Daniel I. Alegre | X | |||||

| Stephen L. Gulis, Jr. | Chair | X | ||||

| Michael J. Harrison | X | X | ||||

| David T. Kollat | X | X | ||||

| Brenda J. Lauderback | X | Chair | ||||

| Kathleen L. Nedorostek | X | |||||

| Michael A. Peel | Chair | X |

Director | Audit Committee | Management Development and Compensation Committee | Corporate Governance and Nominating Committee | |||

| Jean-Michel Valette | X | |||||

| Daniel I. Alegre | X | |||||

| Stephen L. Gulis, Jr. | Chair | X | ||||

| Michael J. Harrison | X | X | ||||

| David T. Kollat | X | |||||

| Brenda J. Lauderback | X | Chair | ||||

| Kathleen L. Nedorostek | X | X | ||||

| Michael A. Peel | X | Chair |

20

| • | Changes, if any, to base salaries; |

| • | Establishing the annual cash incentive program, including the target cash incentive levels, the performance measures and goals, and the threshold, target and maximum payout amounts; and |

21

| • | Establishing the long-term equity incentive program, including the mix of stock options and performance share awards, the performance measures and goals applicable to the performance shares, the threshold, target and maximum payout amounts applicable to the performance shares, any special recognition or retention awards, and the grant levels for each of the executive officers. |

22

23

| • | A proven record of accomplishment and sound judgment in areas relevant to our business; |

| • | The ability to bring insights to the discussion and challenge and stimulate management; |

| • | Understanding of, and ability to commit sufficient time to, Board responsibilities and duties; and |

24

25

26

27

| • | Executive Officer Ownership Guidelines. Within five years of assuming the position, the Chief Executive Officer is expected to achieve and maintain stock ownership equal to five times the Chief Executive Officer’s base salary and each of the other executive officers is expected to achieve and maintain stock ownership equal to three times the executive officer’s base salary. |

| • | Board Ownership Guidelines. Within five years of joining the company’s Board of Directors, each director is expected to achieve and maintain stock ownership equal to five times the director’s annual cash retainer. |

28

| • | Restrictions on Sale Pending Achievement of Ownership Objectives. Any director or executive officer who has not achieved the foregoing ownership objective by the required time period will not be permitted to sell any shares except to the extent required to pay the exercise price, transaction costs and taxes applicable to the exercise of stock options or the vesting of restricted shares. Exceptions to these restrictions on sale of shares may be granted by the Board in its sole discretion for good cause shown by any director or executive officer. |

29

30

| NAME | PRINCIPAL POSITION |

| Shelly R. Ibach | President & Chief Executive Officer (CEO) |

| David R. Callen | Senior Vice President & Chief Financial Officer (CFO) |

| Kathryn V. Roedel | Executive Vice President & Chief Services and Fulfillment Officer |

| Kevin K. Brown | Senior Vice President & Chief Marketing Officer (CMO) |

| Patricia A. Dirks | Senior Vice President & Chief Human Capital Officer |

| Wendy L. Schoppert | Former Executive Vice President and Chief Financial Officer (CFO) |

31

| • | Executive Summary | |

| • | Compensation Governance | |

| • | Compensation Framework and Actions | |

| • | Executive Compensation Tables |

| • | Linking annual incentive awards to the achievement of key financial, strategic and operational goals which closely correlate with shareholder value creation; | |

| • | Providing opportunities for company executives to earn meaningful performance-based equity incentive awards, in addition to their base salary and variable cash incentive; | |

| • | Establishing performance goals with consideration for recent peer group growth and earnings results, with the objective of requiring performance above the median in order for incentives to be earned at a level that would increase compensation above median; and | |

| • | Evaluating the effectiveness of compensation programs in motivating superior competitive performance when compared with both industry peers and other prestigious specialty retailers. |

32

| • | Base Salaries: The Committee aligned the base salary for the CEO, Shelly Ibach, between the bottom quartile and the median, and aligned the base salaries of the other NEOs with the median of the market. |

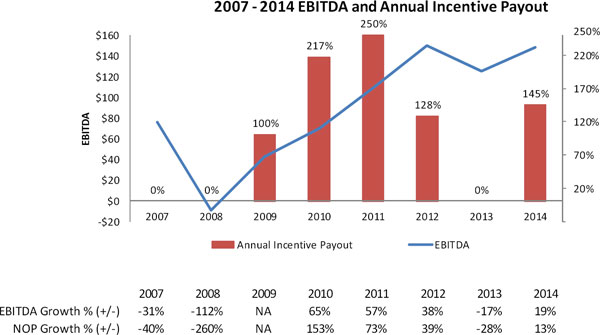

| • | Annual Cash Incentive: Based on EBITDA performance of $148 million, which was 8 percent above plan and 19 percent above 2013, the annual cash incentive payout earned for all NEOs was 145 percent of target. |

| • | Actual Total Cash Compensation: Reflecting base salary and annual cash incentive actions, total cash compensation for NEOs was between the median and the top quartile of the market. |

| • | Long-term Equity-based Incentive: The Committee further aligned executive compensation with shareholder interests by modifying the mix of long-term incentive grant value by increasing performance-vested share values from 50 percent to 75 percent and reducing stock option value from 50 percent to 25 percent of total grant value for annual awards. The 2014 performance-vested shares awarded will be earned based on achievement of goals for both net sales and NOP growth through fiscal 2016. Annual long-term incentive grant values did not increase for Shelly Ibach and Kathryn Roedel. Annual long-term incentive grant values for the three NEOs hired in 2014 were aligned with our overall structure and close to the market median. |

33

● | 2011 grants tied to free cash flow and market share growth through 2013 were earned at 85 percent of target. Net sales CAGR from 2011-2013 was 17 percent. |

● | 2012 grants tied to market share growth through 2014 are projected to be earned at 52 percent of target. Net sales CAGR from 2012-2014 was 16 percent. |

● | Performance-Based Compensation. We believe that linking pay to performance is critical, and as a result, we favor variable compensation that is tied to company performance and relative to our peers. We target total direct compensation near the market median, with the |

34

| opportunity to earn total direct compensation above the market median when company and/or individual performance exceeds performance objectives. |

● | Reward Company and Individual Achievement. In determining annual cash and equity incentive awards, emphasis is placed on achievement of specific company performance objectives. However, we may also recognize and reward superior individual performance, primarily through merit increases in base salaries and long-term equity awards. |

● | Emphasize Stock Ownership. We believe that employee stock ownership is critical in aligning the interests of employees with those of our shareholders. The company has established specific stock ownership guidelines for executive officers as well as for members of the Board of Directors. The company also provides opportunities for broader employee stock ownership through our long-term incentive plans and our 401(k) savings plan. |

| COMPENSATION | ||

| PRACTICE | SELECT COMFORT POLICY | |

| Pay for Performance | YES | A significant percentage of the total direct compensation package is performance-based. |

| Robust stock ownership guidelines | YES | We have stock ownership guidelines for executive officers and Board members. Within five years of joining the company or Board, executive officers & Directors are expected to achieve and maintain stock ownership of: ● 5x base salary for the CEO ● 3x base salary for non-CEO executive officers, and ● 5x annual cash retainer for Board members We do not include unearned performance-vested awards as ownership. |

| Annual Shareholder “Say on Pay” | YES | We value our shareholders’ input on our executive compensation programs. Our Board of Directors seeks an annual non-binding advisory vote from shareholders to approve the executive compensation disclosed in our CD&A, tabular disclosures and related narrative of this proxy statement. |

| Annual compensation risk assessment | YES | A risk assessment of our compensation programs is performed on an annual basis. |

| Clawback policy | YES | Our policy allows recovery of incentive cash and earned equity compensation in the event of inaccurate financial statements or other actions that would constitute “cause” or “adverse action”. In addition, certain participants are subject to automatic forfeiture in connection with material noncompliance, as a result of misconduct, resulting in an accounting restatement. |

35

| Independent compensation consultant | YES | The Management Development and Compensation Committee retains an independent compensation consultant to advise on the executive compensation program and practices. |

| Double-Trigger Vesting | YES | An executive officer’s unvested equity awards will vest upon a change in control only if the executive also experiences a qualifying termination of employment or significant diminution in role |

| Hedging of Company stock | NO | Executive officers and members of the Board of Directors may not directly or indirectly engage in transactions intended to hedge or offset the market value of Select Comfort common stock owned by them. |

| Pledging of Company stock | NO | Executive officers and members of the Board of Directors may not directly or indirectly pledge Select Comfort common stock as collateral for any obligation. |

| Tax gross-ups | NO | We do not provide tax gross-ups on any benefits or perquisites, other than for relocation benefits that are applied consistently for all employees. |

| Repricing of stock options | NO | Our equity incentive plan does not permit repricing of stock options without shareholder approval or the granting of stock options with an exercise price below fair market value. |

| Employment contracts | NO | None of our current named executive officers has an employment contract that provides for continued employment for any period of time. |

| ● | Review and approve the company’s compensation philosophy | |

| ● | Establish executive compensation structure and programs designed to motivate and reward superior company performance |

36

| ● | Lead the Board of Directors’ annual process to evaluate the performance of the Chief Executive Officer | |

| ● | Determine the composition and value of compensation for the Chief Executive Officer and other executive officers including base salaries, annual cash incentive awards, equity-based awards, benefits, and perquisites | |

| ● | Establish, administer, amend and terminate executive compensation and major employee benefit programs | |

| ● | Assess management development progress and talent depth, organizational strategy, and succession planning for key leadership positions in the context of the company’s strategic, operational and financial growth objectives | |

| ● | Establish structure and amount of non-employee director compensation |

| ● | any other services it provides to the company; | |

| ● | fees paid by the company as a percentage of the consulting firm’s total revenue; | |

| ● | policies and procedures adopted by the consulting firm to prevent conflicts of interest; | |

| ● | any business or personal relationships between the individual compensation advisors and a member of the Committee; | |

| ● | any company stock owned by the individual compensation advisors; and | |

| ● | any business or personal relationships between Select Comfort’s executive officers and the individual compensation advisors or consulting firm. |

37

| ● | Provides on-going assessment of each of the principal elements of the company’s executive compensation program; | |

| ● | Advises the Committee on the design of both the annual cash incentive plan and the long-term equity incentive program; | |

| ● | Works with the Committee and representatives of senior management to assess and refine the company’s peer group for ongoing comparative analysis purposes; | |

| ● | Provides the Committee with updates related to regulatory and legislative matters; | |

| ● | Reviews market data, trends and analyses from general industry and proxy peer group surveys to inform executive compensation levels and design; and | |

| ● | Provides advice and guidance to the Committee on pay actions for executives. |

38

● | Chico’s FAS Inc., |

● | lululemon athletica, inc. |

● | Polaris Industries Inc., and |

● | Williams-Sonoma, Inc. |

● Ann Inc. | ● La-Z-Boy Inc. |

| ● Columbia Sportswear Co. | ● Lumber Liquidators Holdings Inc. |

| ● Deckers Outdoor Corp. | ● Mattress Firm Holding Corp. |

| ● Ethan Allen Interiors Inc. | ● Pier 1 Imports Inc. |

| ● Express Inc. | ● Restoration Hardware Holdings Inc. |

| ● Haverty Furniture Companies Inc. | ● Steven Madden Ltd. |

| ● Jos. A. Bank Clothiers Inc. | ● Tempur Sealy International Inc. |

| ● Kirkland’s Inc. | ● Vitamin Shoppe Inc. |

● | Compilation of a comprehensive inventory of the company’s compensation policies, practices and programs; |

● | Identification of potential areas of risk by members of a cross-functional team, comprised of internal company representatives from Legal, Human Capital and Risk Management; |

● | Review of compensation programs in light of risks identified; |

39

● | Review of plans and controls in place to mitigate potential risks; |

● | Review of the assessment process and cross-functional team’s conclusions by the Committee’s independent compensation consultant, Cook & Co.; and |

● | Review of the assessment process and conclusions by the Committee with members of the senior management team and Cook & Co. representatives. |

● | Base salary; |

● | Annual cash incentive compensation; |

● | Long-term equity-based incentive compensation; |

● | Severance compensation upon termination of employment under certain circumstances; |

● | Non-qualified deferred compensation plan; |

● | Broad-based benefit plans available to other employees generally; and |

● | Limited perquisites. |

40

● | the scope and complexity of each officer’s responsibilities; |

● | each executive officer’s qualifications, skills and experience; |

● | internal pay equity among senior executives; and |

● | individual job performance, including both impact on current financial results and contributions to building longer-term competitive advantage and shareholder value. |

| Name | Title | Salary | |||

| 2013 | 2014 | % | |||

| Increase | |||||

| Shelly R. Ibach | President and CEO | $680 | $700 | 2.9% | |

| David R. Callen | SVP and CFO | $375 | |||

| Kathryn V. Roedel | EVP, Chief Services and Fulfillment Officer | $373 | $388 | 4.0% | |

| Kevin K. Brown | SVP, Chief Marketing Officer | $385 | |||

| Patricia A. Dirks | SVP, Chief Human Capital Officer | $350 | |||

| Wendy L. Schoppert | Former EVP and CFO | $373 | |||

41

● | Performance Goals. The Committee determines both the type and the specific targets of the performance goals for each fiscal year. Since 2001, the Committee has selected an annual profit metric as the primary company performance measure based on its belief that this single goal provides a balanced focus on both net sales growth and improved profitability. The profit target is determined by the Committee with consideration for performance after deduction of all annual cash incentive payments. For 2014, the Committee changed the profit metric from net operating profit (NOP) to EBITDA (earnings before interest, taxes, depreciation & amortization) for the following reasons: |

| § | Belief that EBITDA is a useful indicator of the company’s financial performance and ability to generate cash from operating activities. |

| § | To align the company’s annual incentive program with operating performance and cash generation. |

| § | To diversify the portfolio of metrics used to evaluate performance, given that NEOs are already accountable for NOP growth in the long-term incentive plan (consistent with guidance from shareholder advisory groups such as ISS and Glass Lewis). |

● | Target and Actual Incentive Levels. For 2014, Shelly Ibach’s target incentive level remained at 100 percent of base salary, and target incentive levels were also maintained at 60 percent for Executive Vice Presidents and 55 percent for Senior Vice Presidents. These target incentive levels are reviewed annually in comparison with the peer group and general industry market data identified above. The table below provides detail for the 2014 target incentive and target total cash compensation levels for NEOs, as well as consideration for actual cash compensation with a 145 percent of target payout for 2014 performance. Both outcomes are consistent with our compensation payout philosophy, which is to pay close to the median of the market for target performance, and above the median of the market for above target performance. With the 145 percent of target payout for 2014, cash compensation (base and annual incentive) was between the median and the top quartile. |

42

| Target Annual | |||||

| Name | Title | Incentive | 2014 | 2014 Actual | |

% of Salary | Target | Total Cash | |||

| $ | Total | (w/ 145% | |||

| Cash | payout) | ||||

| Shelly R. Ibach | President and CEO | 100% | $700 | $1,400 | $1,715 |

| David R. Callen | SVP and CFO | 55% | $206 | $581 | $674 |

| Kathryn V. Roedel | EVP, Chief Services and Fulfillment Officer | 60% | $233 | $621 | $726 |

| Kevin K. Brown | SVP, Chief Marketing Officer | 55% | $212 | $597 | $692 |

| Patricia A. Dirks | SVP, Chief Human Capital Officer | 55% | $193 | $543 | $629 |

| Wendy L. Schoppert | Former EVP and CFO | 60% | |||