A letter from the president

Commitment is not an idle promise or a buzz word at Select Comfort. Commitment is the way we live, what we work for, who we are, what we do.

At Select Comfort, we are committed to our customers, our employees, our shareholders and our community. Every moment of every day, we are committed to innovation, growth and improving people’s lives.

As an employee of Select Comfort, I am committed to delivering a better night’s sleep to millions of Americans. As president and chief executive of this great and developing company, I am committed to delivering growing shareholder value, unmatched customer satisfaction and career-best experiences for our 2,000 employees.

In 2003, we demonstrated these commitments in very meaningful ways.

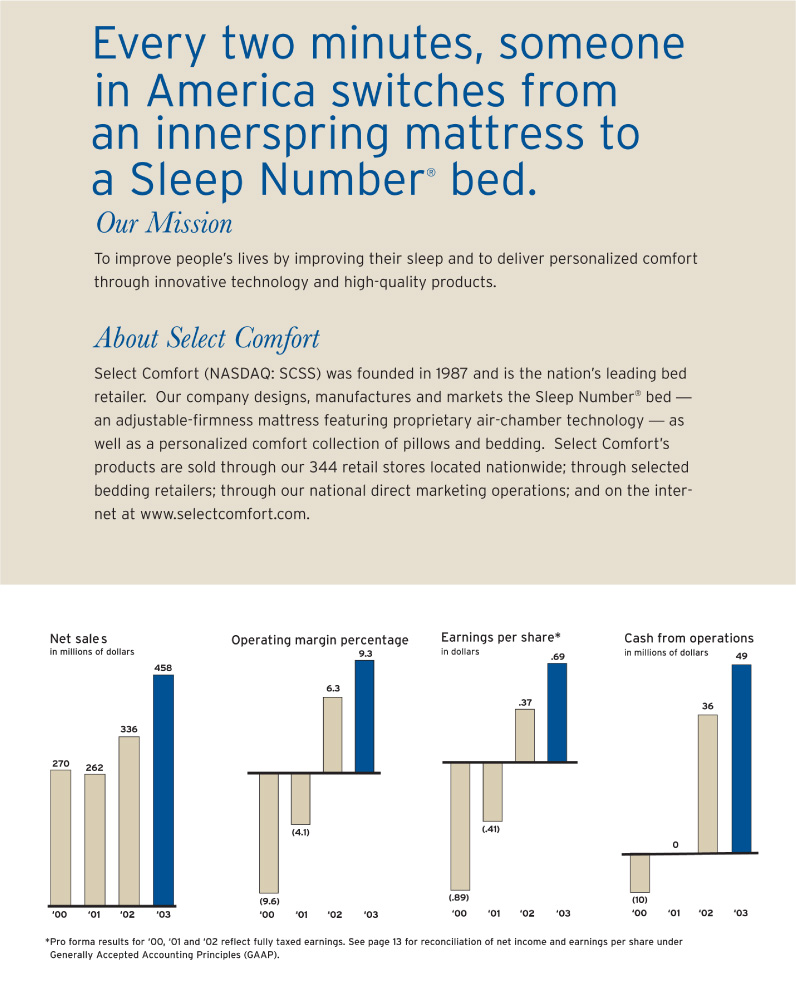

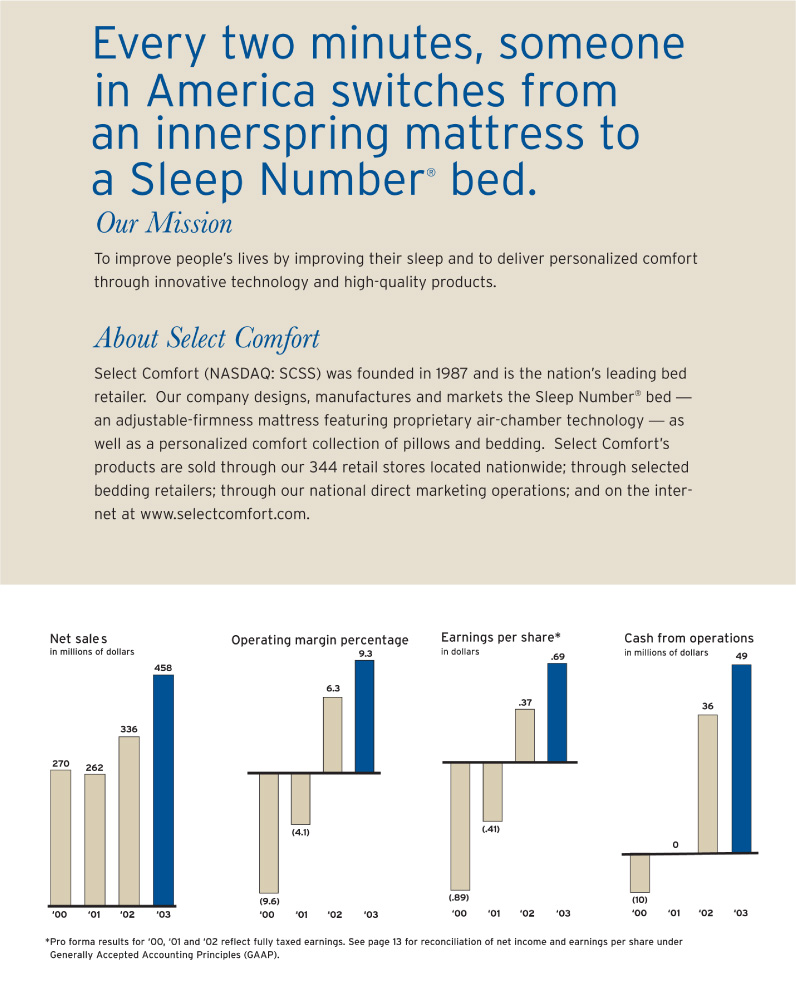

First, we delivered record sales of $458 million and net income of $27 million. Our cash from operations was a record $49 million — a 36 percent increase over 2002. Lapping a 2002 revenue gain of 28 percent, our total sales were up 37 percent and our 2003 same-store sales were up 31 percent — far outpacing bedding industry trends for the second consecutive year.

Equally important to what we achieved financially was who we became as an organization in 2003. We committed to become a stronger, more agile organization in terms of people, systems and culture, and to recruit and retain some of the best minds and workers in America. During the year, we began to strengthen our talent pool in human resources, sales, finance and information technology to ensure a strong infrastructure. We launched a national home delivery program in 118 markets. We achieved a record low in product returns and a record high in

2

customer satisfaction. We continued to expand our successful, award-winning Sleep Number® integrated marketing campaign, doubling unaided awareness of our Sleep Number® brand in 2003. We added more than 250,000 new consumers to the Sleep Number® family during the year, and received many letters of appreciation as a result — bringing our total number of consumer testimonials to over 50,000.

In 2004, we plan to sustain our commitment to our five core strategies that have so effectively propelled our company’s growth over the past three years. First, we plan toincrease awarenessof the Sleep Number® bed by increasing media investment by more than 30 percent to over $80 million, expanding our national and local advertising campaign. Second, we plan toexpand distribution with the opening of 25 to 30 new stores during the year, while continuing to selectively grow distribution at leading furniture retailers. Third, we plan toaccelerate product innovationwith what will be the most exciting year of product introductions in our history. Fourth, we plan to continue tostrengthen and leverage our unique make-to-order business model and systems.Finally, we plan tobuild the strength of our organizationby investing back into our employees and our communities, doubling our charitable commitment to Ronald McDonald House Charities®.

Equally important to what we achieved financially was who we became as an organization in 2003.

While filled with victory, 2003 was not without challenge for Select Comfort. Nothing worth having ever is. We experienced the growing pains of rapidly starting one of the nation’s largest home delivery networks. We quickly responded to minimize the impact of increased costs from an unexpected fuel surcharge. We successfully labored through our company’s largest systems implementation. We watched with hope and trepidation as eight of our valued employees served our country in the Middle East, and we proudly welcomed them back as they began arriving home.

Select Comfort reached soaring heights in 2003. Yet we’re still at the base of a very tall mountain. We have an exceptionally strong foundation from which to climb and become an industry leader and an icon company within the next five years. As an organization, we are young, we are innovative, we are hard working and we will not rest until we have reached the top — with the exception of eight hard-earned and enjoyable hours each night on our Sleep Number® beds.

At Select Comfort, we remain committed to improving people’s lives by improving their sleep. And we remain confident in our ability to sustain long-term, profitable growth. Thank you for joining me on this wonderful journey of improving the way America sleeps — one bed at a time.

Sleep well,

Bill McLaughlin

3

Building awareness and distribution

In 2000, we identified low brand awareness as Select Comfort’s number-one barrier to growth. Today, with the proven and creative Sleep Number® advertising campaign, awareness-building is our number-one tool for rapid and successful market expansion.

Despite Select Comfort’s tremendous growth in sales and profitability in recent years, our national unaided brand awareness with consumers is still only eight percent. Compare this to our unaided brand awareness of 26 percent in Minneapolis — our leading market — and it’s clear that we have tremendous future opportunity to grow our brand franchise nationwide.

And while we gauge the success of our brand in part through awareness growth, the real measure and purpose of our advertising is to drive traffic to our 344 retail stores and our other sales channels.

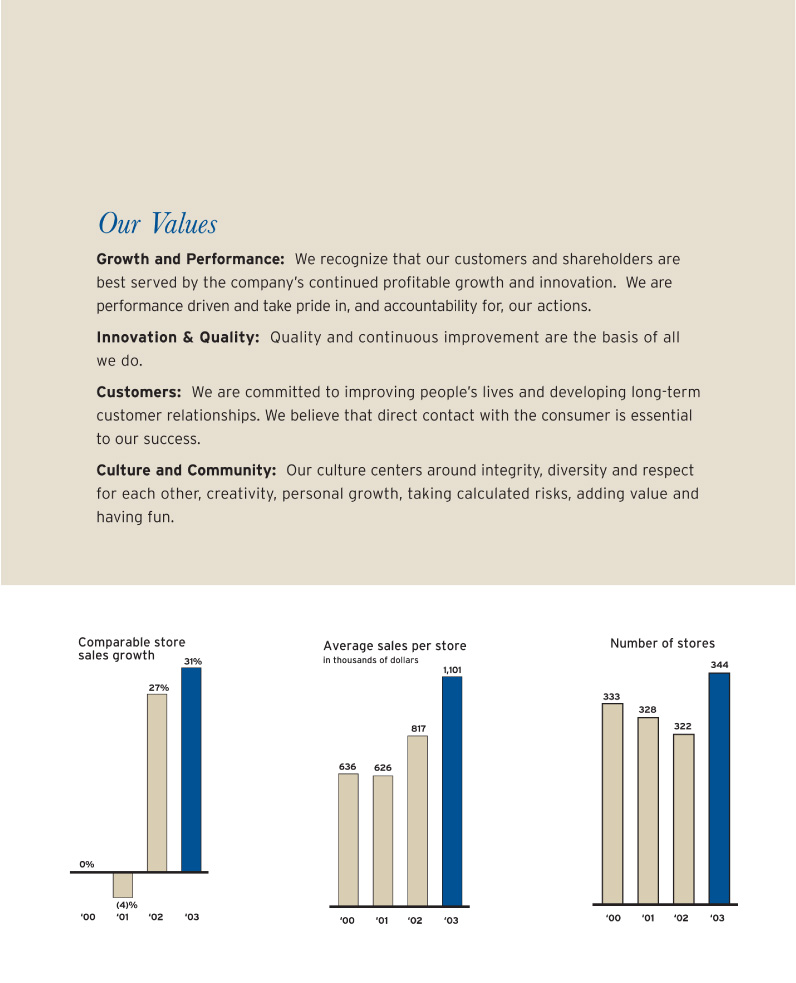

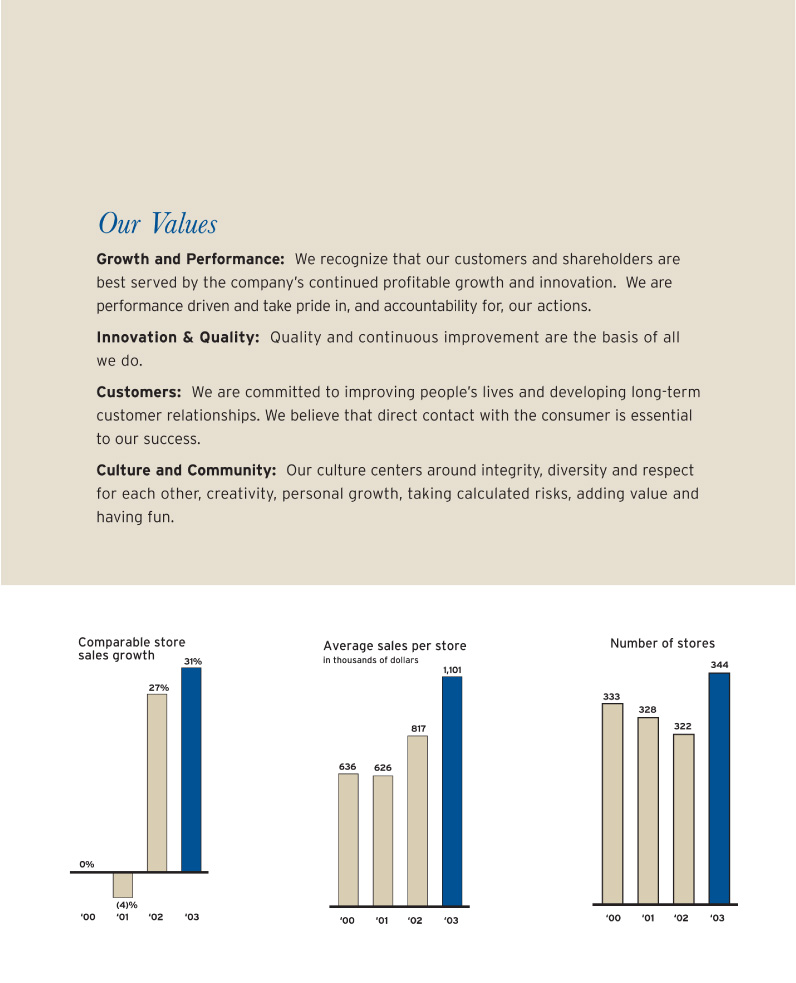

As a relatively small and agile company with a vertically integrated business model, we are fortunate that our marketing and real estate teams can work closely together to expand into new markets and consistently drive more traffic to existing stores. In fact, it is through our existing stores that we see our largest growth opportunity in the near future. Our comparable store sales in 2003 increased by an impressive 31 percent, and we expect same-store growth to continue at a double-digit rate in 2004 and 2005.

Reaching major metro markets

How will we do this? One strategy for building brand awareness and driving retail store traffic is to supplement our national media reach with local advertising in America’s larger metropolitan markets — New York, Los Angeles, Chicago, Boston and other cities where there is currently limited awareness for the Sleep Number® bed and local stores. At the same time, we plan to open 25 to 30 new stores in these metro markets in 2004 to ensure that we have appropriate store density for the population base.

The Sleep Number® local-market advertising campaign is only one component of our integrated, cross-channel marketing program, which also includes more than 135 radio personalities, national print and television advertising featuring actress Lindsay Wagner, direct marketing programs, e-commerce and celebrity testimonials.

Our comparable store sales in 2003 increased by an impressive 31 percent, and we expect same-store growth to continue at a double-digit rate in 2004 and 2005.

As media spending propels sales and profit growth, Select Comfort plans to continue to reinvest in further advertising expansion. In 2001, we spent $30 million on advertising, and we’ve carefully grown this number by $10 to $20 million annually. We plan to increase advertising by more than 30 percent in 2004 to a total of over $80 million.

With this coordinated marketing and real estate strategy in place — coupled with momentum building every day from satisfied customers and word of mouth — Select Comfort is well positioned for growth in 2004 and beyond.

4

Accelerating growth through product development

In 1987, a gifted inventor and former innerspring mattress maker named Bob Walker created the Sleep Number® bed in his garage. With the objective of delivering a better night’s sleep, Mr. Walker applied sleep research to create a superior alternative to metal coils and springs. He discovered that air was the perfect medium for providing maximum comfort, support and durability in a mattress, with the added benefit of offering personalized, dual-adjustable firmness.

This spirit of innovation continues at Select Comfort today. In 2003, we dedicated substantial time and investment intomaking the best bed betterthrough a number of innovations and product improvements founded in the science of sleep and focused on delivering real consumer benefits. A few of the year’s highlights included national rollouts of the company’s Precision Comfort® adjustable foundation, the Sleep Number® Grand King™ and several new bed models for our wholesale line. We also formed a Sleep Advisory Board™ with six of the nation’s leading sleep experts and medical practitioners to advance the study of sleep at Select Comfort.

Clinically proven to improve sleep

In clinical studies, the Sleep Number® bed has been shown to improve sleep quality and to allow a deeper, more restorative sleep. In a study conducted at the Stanford University Medical Sleep Disorders Center, researchers found that 87 percent of those who slept on a Sleep Number® bed experienced a greater percentage of REM sleep with fewer sleep disturbances.

A new level of luxury

In the spring of 2004, Select Comfort plans to introduce its most luxurious bed ever — the Sleep Number® 9000. The 9000 model will feature the latest in design and technology for personalized comfort. The mattress tops out at 16 inches of thickness, and includes a unique two-sided seasonal duvet-style pillowtop.

Select Comfort’s new Firmness Comfort Control System™ 9000 will be the company’s fastest, quietest and most advanced technology to date.

Welcoming guests in comfort

In another industry first, Select Comfort plans to combine the comfort, support and dual adjustability of a Sleep Number® bed with the convenience and beauty of a custom-designed sofa to create the Sleep Number® SofaBed™.

Scheduled for a pilot-market test launch in spring 2004, this distinctive sofa sleeper features an 11-inch-thick queen-size mattress, dual-adjustable Sleep Number® firmness control, an easy-pull folding mechanism and no uncomfortable bar in the back. The sofa surround also offers unmatched seating comfort and beauty, and comes in two styles with 38 choices of fabric or leather.

Despite our most aggressive year of product development ever in 2004, the core benefit of our bed remains — a patented air chamber and Firmness Control System™ that provide unparalleled support, personalized comfort and improved sleep.

6

Leveraging our integrated business model

| | | |

| | Select Comfort has a differentiated, vertically integrated business model that allows us to directly design, manufacture, sell, deliver and service the Sleep Number® bed. |

| |

| | One way we are improving service is by remodeling our store base to make the mattress-buying experience easier and more inviting for consumers, and to reflect the fun of the Sleep Number® brand inside our retail stores. In 2003, we updated nearly 100 of our stores, and plan to continue this strategy in 2004.

Unlike other mattress makers or bed retailers, Select Comfort has direct contact with our nearly three million Sleep Number® bed owners from purchase through make-to-order manufacturing through delivery of the Sleep Number® bed right into their homes. This unique involvement in every aspect of the business process not only allows for more satisfied bed owners, but also provides us valuable consumer insight for continued innovation and scalable, profitable growth. Adding to this advantage are our enviable inventory levels which, due to our just-in-time manufacturing process, equal approximately $13 million on $450 million in annual sales. |

| |

| | Select Comfort takes pride in offering a consumer experience like no other in the bedding industry. Through our multiple sales channels and touchpoints — at our 344 retail stores in 46 states, through our 800-number call center, on our website, on QVC, or through one of our selected retail partners — Select Comfort offers consumers uniquely convenient access to our products. Very simply, we make it easy for consumers to find their personal Sleep Number® and to discover a better way to sleep. |

| |

| | As part of our commitment to improving service to customers, in 2003 we expanded our home delivery, assembly and mattress removal programs to all of our retail markets nationwide. During the year, the company delivered over 100,000 beds through our new delivery service. |

8

Each year, thousands of families stay at a Ronald McDonald House while their children receive medical treatment at nearby hospitals. These family members frequently experience stress and anxiety that can disrupt sleep schedules, cause insomnia and provoke a greater occurrence of daytime sleepiness. It is during these stressful times that restorative sleep is needed most for recovery and healing.

Ronald McDonald House was created through the leadership of Fred Hill, a former professional football player, and his wife Fran, who grew tired of sleeping on hospital furniture while their young daughter received leukemia treatments. Each House is run by a local nonprofit organization comprised of members of the medical community, business and civic leaders, parents, volunteers and McDonald’s owners/operators.

Since 1974, the program has helped more than three million family members.

Improving lives through better sleep

At Select Comfort, our employees are our most valuable and irreplaceable asset. We strive to recruit and retain the very best people — people who are smart, hardworking, honest and committed to excellence and long-term careers.

In 2003, Select Comfort grew to over 2,000 employees nationwide and we improved our hiring and selection process with an innovative program called “Hiring by Numbers.” In support of our growth, we continue to search for the nation’s best and brightest to ensure we can sustain our growth momentum in the future.

Retaining talented people is equally as important as recruiting them. Recognizing this, Select Comfort expanded our bonus program in 2003 to include all non-commissioned employees nationwide — allowing every employee to commit to, and share in, the benefits of the company’s success. We also expanded our sales incentive program and we continued our practice of celebrating customer satisfaction, team success and company performance.

Last year, we kicked off a comprehensive leadership development training program for our front-line managers. In 2004, we plan to implement succession planning and improved career planning to reinforce our goal of making Select Comfort a great place to build a long-term career.

Working together toward a common commitment

Watching a child struggle with a serious illness can be difficult, exhausting and heartbreaking. Through our support of Ronald McDonald House Charities®, Select Comfort is working to help the families of sick children get a better night’s sleep so they have the energy needed during the day to be strong and supportive.

In 2001, Select Comfort became the “Official Bed Provider” for Ronald McDonald House® . Through our shared mission of improving lives through better sleep, Select Comfort and Ronald McDonald House Charities® have successfully worked together to provide a better sleep environment for thousands of families nationwide. To date, Select Comfort has donated more than 1,500 Sleep Number® beds to the 150 Ronald McDonald Houses in the United States, and we’re on our way to filling the more than 4,000 bedrooms.

In 2004, Select Comfort employees will travel to Ronald McDonald Houses nationwide to deliver over 1,000 donated Sleep Number® beds. We are proud of the significant and sustaining commitment of our employees to the communities in which they work and live.

Many of our employees and their families also have chosen to further support their local Ronald McDonald House by donating their own time and hard-earned money. Select Comfort employees support the charity through fundraisers, a payroll deduction program and through volunteer programs, logging more than 1,200 hours to date.

10

Selected Consolidated Financial Data

(in thousands, except per share and selected operating data, unless otherwise indicated)

The data presented below have been derived from our Consolidated Financial Statements and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and Notes thereto included in this Annual Report:

| | | | | | | | | | | | | | | | | | | | | |

| | | 2003(1)

| | 2002

| | 2001

| | 2000

| | 1999

|

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Net sales | | $ | 458,489 | | | $ | 335,795 | | | $ | 261,687 | | | $ | 270,077 | | | $ | 273,767 | |

| Gross profit | | | 287,326 | | | | 209,999 | | | | 154,477 | | | | 154,476 | | | | 163,847 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Sales and marketing | | | 206,129 | | | | 155,890 | | | | 138,417 | | | | 149,283 | | | | 147,929 | |

| General and administrative | | | 38,423 | | | | 32,854 | | | | 25,296 | | | | 29,211 | | | | 29,213 | |

| Store closings and asset impairments | | | 71 | | | | 233 | | | | 1,366 | | | | 1,952 | | | | 1,498 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Operating income (loss) | | | 42,703 | | | | 21,022 | | | | (10,602 | ) | | | (25,970 | ) | | | (14,793 | ) |

| Net income (loss) | | $ | 27,172 | | | $ | 37,122 | | | $ | (12,066 | ) | | $ | (37,214 | ) | | $ | (8,204 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Pro forma net income (loss) (2) | | $ | 27,172 | | | $ | 12,239 | | | $ | (7,481 | ) | | $ | (15,877 | ) | | $ | (8,204 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.83 | | | $ | 1.51 | | | $ | (0.66 | ) | | $ | (2.09 | ) | | $ | (0.45 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Diluted | | $ | 0.69 | | | $ | 1.09 | | | $ | (0.66 | ) | | $ | (2.09 | ) | | $ | (0.45 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Pro forma (2) | | $ | 0.69 | | | $ | 0.37 | | | $ | (0.41 | ) | | $ | (0.89 | ) | | $ | (0.45 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Shares used in calculation of net income (loss) per share (2): | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 32,856 | | | | 24,549 | | | | 18,157 | | | | 17,848 | | | | 18,300 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Diluted and pro forma (2) | | | 39,277 | | | | 34,532 | | | | 18,157 | | | | 17,848 | | | | 18,300 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents and marketable securities | | $ | 75,118 | | | $ | 40,824 | | | $ | 16,375 | | | $ | 5,448 | | | $ | 27,570 | |

| Working capital | | | 53,972 | | | | 26,765 | | | | (3,739 | ) | | | (12,431 | ) | | | 14,470 | |

| Total assets | | | 150,702 | | | | 108,331 | | | | 67,436 | | | | 64,672 | | | | 95,363 | |

| Long-term debt, less current maturities | | | — | | | | 2,991 | | | | 17,109 | | | | 2,322 | | | | 36 | |

| Total shareholders’ equity | | | 92,762 | | | | 54,515 | | | | 6,772 | | | | 16,600 | | | | 52,872 | |

Selected Operating Data: | | | | | | | | | | | | | | | | | | | | |

| Stores open at period-end (3) | | | 344 | | | | 322 | | | | 328 | | | | 333 | | | | 341 | |

| Stores opened during period | | | 27 | | | | 15 | | | | 11 | | | | 19 | | | | 79 | |

| Stores closed during period | | | 5 | | | | 21 | | | | 16 | | | | 27 | | | | 2 | |

| Average net sales per store (000’s) (4) | | $ | 1,101 | | | $ | 817 | | | $ | 626 | | | $ | 636 | | | $ | 644 | |

| Percentage of stores with more than $1.0 million in net sales (4) | | | 49 | % | | | 24 | % | | | 10 | % | | | 12 | % | | | 13 | % |

| Comparable store sales increase (decrease) (5) | | | 31 | % | | | 27 | % | | | (4) | % | | | — | | | | 5 | % |

| Average square footage per store open during period (4) | | | 990 | | | | 972 | | | | 941 | | | | 913 | | | | 893 | |

| Net sales per square foot (4) | | $ | 1,113 | | | $ | 841 | | | $ | 666 | | | $ | 697 | | | $ | 721 | |

| Average store age (in months at period end) | | | 70 | | | | 61 | | | | 51 | | | | 41 | | | | 31 | |

| Operating free cash flow (6) | | $ | 30,839 | | | $ | 28,342 | | | $ | (4,445 | ) | | $ | (22,370 | ) | | $ | (6,006 | ) |

12

| (1) | | Fiscal year 2003 had 53 weeks. All other fiscal years presented had 52 weeks. |

| |

| (2) | | Pro forma net income (loss) per share reflects the effects on net income (loss) from specific non-recurring items and from the recognition of an income tax benefit (provision) for years where a regular tax provision, at a rate of 38%, was not recorded. Generally accepted accounting principles (GAAP) did not allow us to reduce net income for income tax expense in 2002 or to provide an income tax benefit in 2001 or 2000. Because we have recorded income tax expense in 2003 and we expect to continue recording income tax in future periods, we believe pro forma net income (loss) and pro forma net income (loss) per share provide a more meaningful comparison than GAAP net income (loss) and GAAP net income (loss) per share for 2002, 2001 and 2000. |

| |

| | | In addition, we excluded the effect of the extraordinary after-tax, non-cash charges associated with early repayment of our $5.0 million 12% senior secured debt in December 2002. A reconciliation of net income (loss) and net income (loss) per diluted share (as determined in accordance with GAAP) to pro forma net income (loss) and pro forma net income (loss) per diluted share is as follows: |

| | | | | | | | | | | | | |

| | | 2002

| | 2001

| | 2000

|

| GAAP net income (loss) | | $ | 37,122 | | | $ | (12,066 | ) | | $ | (37,214 | ) |

| Effect of: | | | | | | | | | | | | |

| Income tax (provision) benefit at 38% of income (loss) before tax | | | (7,501 | ) | | | 4,585 | | | | 9,736 | |

| Charges from early repayment of debt | | | 614 | | | | — | | | | — | |

| (Restoration) write-off of deferred tax asset | | | (17,996 | ) | | | — | | | | 11,601 | |

| | | |

| | | |

| | | |

| |

| Pro forma net income (loss) | | $ | 12,239 | | | $ | (7,481 | ) | | $ | (15,877 | ) |

| | | |

| | | |

| | | |

| |

| |

|

| | | 2002

| | 2001

| | 2000

|

| GAAP net income (loss) per diluted share | | $ | 1.09 | | | $ | (0.66 | ) | | $ | (2.09 | ) |

| Effect of: | | | | | | | | | | | | |

| Income tax (provision) benefit at 38% of income (loss) before tax | | | (0.22 | ) | | | 0.25 | | | | 0.55 | |

| Charges from early repayment of debt | | | 0.02 | | | | — | | | | — | |

| (Restoration) write-off of deferred tax asset | | | (0.52 | ) | | | — | | | | 0.65 | |

| | | |

| | | |

| | | |

| |

| Pro forma net income (loss) per diluted share | | $ | 0.37 | | | $ | (0.41 | ) | | $ | (0.89 | ) |

| | | |

| | | |

| | | |

| |

| (3) | | Includes stores operated in leased departments within other retail stores (13, 13, 22, 25 and 45 at the end of 2003, 2002, 2001, 2000 and 1999, respectively). |

| (4) | | For stores open during the entire period indicated. |

| (5) | | Stores enter the comparable store calculation in the 13th full month of operation. Stores that have been remodeled or relocated within the same shopping center remain in the comparable store base. The number of comparable stores used to calculate such data was 316, 307, 317, 314 and 262 for 2003, 2002, 2001, 2000 and 1999, respectively. Our 2003 comparable store sales increase reflects an adjustment for an additional week of sales in 2003. Without adjusting for the additional week, comparable store sales increase would have been 34% for 2003. |

| (6) | | Operating free cash flow (OFCF) is a key financial measure but should not be construed as an alternative to operating income or net cash provided by (used in) operating activities (as determined in accordance with GAAP). We believe that OFCF is a useful supplement to cash flow data in understanding cash flows generated from operations after reductions for capital expenditures. A reconciliation of net cash provided by (used in) operating activities to operating free cash flow for each of the fiscal years indicated is as follows: |

| | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

| Net cash provided by (used in) operating activities | | $ | 49,203 | | | $ | 36,144 | | | $ | 414 | | | $ | (10,286 | ) | | $ | 7,657 | |

| Purchases of property and equipment | | | (18,364 | ) | | | (7,802 | ) | | | (4,859 | ) | | | (12,084 | ) | | | (13,663 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Operating free cash flow (OFCF) | | $ | 30,839 | | | $ | 28,342 | | | $ | (4,445 | ) | | $ | (22,370 | ) | | $ | (6,006 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

FORWARD-LOOKING STATEMENTS

The discussion in this Annual Report contains certain forward-looking statements that relate to future plans, events, financial results or performance. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “predict,” “intend,” “potential,” “continue” or the negative of these or similar terms. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, among others, such factors as general and industry economic trends, uncertainties arising from global events, consumer confidence, effectiveness of our advertising and promotional efforts, our ability to secure suitable retail locations, our ability to attract and retain qualified sales professionals and other key employees, consumer acceptance of our products and product innovation, our ability to continue to expand and improve our product line, industry competition, warranty expenses, California wage and hour litigation, our dependence on significant suppliers, and the vulnerability of any suppliers to recessionary pressures, labor negotiations, liquidity concerns or other factors, increasing government regulations, including possible new flammability standards for the bedding industry. Additional information concerning these and other risks and uncertainties is contained in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K.

OVERVIEW

Select Comfort is the leading developer, manufacturer and marketer of premium-quality, adjustable-firmness beds. The air-chamber technology of our proprietary Sleep Number® bed allows adjustable firmness on each side of the mattress and provides a sleep surface that is clinically proven to provide better sleep quality and greater relief of back pain compared to traditional mattress products. In addition we market and sell accessories and other sleep related products which focus on providing personalized comfort to complement the Sleep Number® bed and provide a better night’s sleep to the consumer.

We generate revenue by selling our products through four complementary distribution channels. Three of these channels — retail, direct marketing and e-commerce — are company-controlled and sell directly to consumers. Our wholesale channel sells to leading home furnishings retailers, specialty bedding retailers and the QVC shopping channel. Fiscal year 2003 had 53 weeks. Fiscal years 2002 and 2001 had 52 weeks.

The proportion of our total net sales, by dollar volume, from each of our channels during the last three years is summarized as follows:

| | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

| Retail | | | 78.5 | % | | | 76.8 | % | | | 77.6 | % |

| Direct marketing | | | 13.0 | % | | | 14.2 | % | | | 15.3 | % |

| E-commerce | | | 4.3 | % | | | 4.3 | % | | | 3.4 | % |

| Wholesale | | | 4.2 | % | | | 4.7 | % | | | 3.7 | % |

| | | |

| | | |

| | | |

| |

| Total | | | 100 | % | | | 100 | % | | | 100 | % |

| | | |

| | | |

| | | |

| |

The growth rates for each distribution channel are as follows:

| | | | | | | | | | | | | |

| | | 2003* | | 2002 | | 2001 |

| | | Channel inc (dec)

| | Channel inc (dec)

| | Channel inc (dec)

|

| Retail: | | | | | | | | | | | | |

| Comp. store sales | | | 31 | % | | | 27 | % | | | (4 | )% |

| New/closed stores, net | | | 7 | % | | | 1 | % | | | — | |

| Retail total* | | | 40 | % | | | 27 | % | | | (4 | )% |

| Direct marketing | | | 25 | % | | | 20 | % | | | (18 | )% |

| E-commerce | | | 37 | % | | | 59 | % | | | 1 | % |

| Wholesale | | | 23 | % | | | 61 | % | | | 1,517 | % |

| * | | There were 53 weeks in fiscal 2003 and 52 weeks in fiscal 2002 and 2001. Increases, with the exception of comparable store sales increases, reflect the absolute increase in sales, including the additional week in 2003. Retail total is not additive in 2003 due to the 53rd week’s sales included in the total but not in the comparable store sales nor in 2002 due to rounding. The additional week in 2003 contributed approximately 2% to sales growth company-wide. |

The number of company-operated retail locations during the last three years is summarized as follows:

| | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

| Beginning of year | | | 322 | | | | 328 | | | | 333 | |

| Opened | | | 27 | | | | 15 | | | | 11 | |

| Closed | | | (5 | ) | | | (21 | ) | | | (16 | ) |

| | | |

| | | |

| | | |

| |

| End of year | | | 344 | | | | 322 | | | | 328 | |

| | | |

| | | |

| | | |

| |

We anticipate opening 25 to 30 new retail stores and expect to close approximately 5 stores in 2004. Company-operated stores included leased departments within 13, 13 and 22 Bed, Bath & Beyond stores in 2003, 2002 and 2001, respectively.

Our growth plans are centered on increasing the awareness of our products and stores through expansion of media, increasing distribution — primarily through new retail store openings, and expanding and improving our product lines. Our primary market consists of consumers in the U.S. domestic market. We believe that opportunities exist longer term for sales internationally and to commercial markets.

Increases in sales, along with controlling costs, have provided significant improvement to operating income and operating margin over the past several years. The majority of operating margin improvement has been generated through leverage in selling expenses (increased sales through the existing store base) and leverage of our existing infrastructure (general and administrative expenses). We expect any future improvements in operating margin to be derived from similar sources. Our target is to sustain sales growth rates of 15% to 25% and sustain earnings growth rates of approximately 30%.

14

RESULTS OF OPERATIONS

The following table sets forth, for the periods indicated, our results of operations expressed as dollars and percentages of net sales. Figures are in millions except percentages and per share amounts.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

| | | | | | | % of | | | | | | % of | | | | | | % of |

| | | $

| | Net Sales

| | $

| | Net Sales

| | $

| | Net Sales

|

| Net sales | | $ | 458.5 | | | | 100.0 | % | | $ | 335.8 | | | | 100.0 | % | | $ | 261.7 | | | | 100.0 | % |

| Cost of sales | | | 171.2 | | | | 37.3 | | | | 125.8 | | | | 37.5 | | | | 107.2 | | | | 41.0 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Gross profit | | | 287.3 | | | | 62.7 | | | | 210.0 | | | | 62.5 | | | | 154.5 | | | | 59.0 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales and marketing | | | 206.1 | | | | 45.0 | | | | 155.9 | | | | 46.4 | | | | 138.4 | | | | 52.9 | |

| General and administrative | | | 38.4 | | | | 8.4 | | | | 32.9 | | | | 9.8 | | | | 25.3 | | | | 9.7 | |

| Store closings and asset impairments | | | 0.1 | | | | 0.0 | | | | 0.2 | | | | 0.1 | | | | 1.4 | | | | 0.5 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Total operating expenses | | | 244.6 | | | | 53.4 | | | | 189.0 | | | | 56.3 | | | | 165.1 | | | | 63.1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Operating income (loss) | | | 42.7 | | | | 9.3 | | | | 21.0 | | | | 6.3 | | | | (10.6 | ) | | | (4.0 | ) |

| Other income (expense), net | | | 0.4 | | | | 0.1 | | | | (1.3 | ) | | | (0.4 | ) | | | (1.5 | ) | | | (0.6 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Income (loss) before income taxes and extraordinary loss | | | 43.1 | | | | 9.4 | | | | 19.7 | | | | 5.9 | | | | (12.1 | ) | | | (4.6 | ) |

| Income tax (expense) benefit | | | (16.0 | ) | | | (3.5 | ) | | | 17.8 | | | | 5.3 | | | | 0.0 | | | | 0.0 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Income (loss) before extraordinary loss | | | 27.2 | | | | 5.9 | | | | 37.5 | | | | 11.2 | | | | (12.1 | ) | | | (4.6 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Extraordinary loss, net of tax | | | 0.0 | | | | 0.0 | | | | (0.4 | ) | | | (0.1 | ) | | | 0.0 | | | | 0.0 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Net income (loss) | | $ | 27.2 | | | | 5.9 | % | | $ | 37.1 | | | | 11.1 | % | | $ | (12.1 | ) | | | (4.6 | )% |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Pro forma net income (loss) | | $ | 27.2 | | | | 5.9 | % | | $ | 12.2 | | | | 3.6 | % | | $ | (7.5 | ) | | | (2.9 | )% |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | | | | | | | | | | | |

| | | 2003

| | 2002

| | 2001

|

| Net income (loss) per share: | | | | | | | | | | | | |

| Basic | | $ 0.83 | | | | $ 1.51 | | | $ (0.66) | |

| Diluted | | 0.69 | | | | 1.09 | | | (0.66) | |

| Pro forma | | 0.69 | | | | 0.37 | | | (0.41) | |

| Weighted-average number of common shares: | | | | | | | | | | | | |

| Basic | | 32.9 | | | | 24.5 | | | 18.2 | |

| Diluted and pro forma | | 39.3 | | | | 34.5 | | | 18.2 | |

Pro forma net income (loss) per share reflects the effects on net income (loss) from specific non-recurring items and from the recognition of an income tax benefit (provision) for years where a regular tax provision, at a rate of 38%, was not recorded. Generally accepted accounting principles (GAAP) did not allow us to reduce net income for income tax expense in 2002 or to provide an income tax benefit in 2001 or 2000. Because we have recorded income tax expense in 2003 and we expect to continue recording income tax in future periods, we believe pro forma net income (loss) and pro forma net income (loss) per share provide a more meaningful comparison than GAAP net income (loss) and GAAP net income (loss) per share for 2002 and 2001.

In addition, we excluded the effect of the extraordinary after-tax, non-cash charges associated with early repayment of our $5.0 million 12% senior secured debt in December 2002. A reconciliation of net income (loss) and net income (loss) per diluted share (as determined in accordance with GAAP) to pro forma net income (loss) and pro forma net income (loss) per diluted share is as follows:

| | | | | | | | | | | | | | | | | |

| | | Net Income (loss)

| | Earnings (loss) per share

|

| | | 2002

| | 2001

| | 2002

| | 2001

|

| GAAP net income (loss) | | $ | 37,122 | | | $ | (12,066 | ) | | $ | 1.09 | | | $ | (0.66 | ) |

| Effect of: | | | | | | | | | | | | | | | | |

| Income tax (provision) benefit at 38% of income (loss) before tax | | | (7,501 | ) | | | 4,585 | | | | (0.22 | ) | | | 0.25 | |

| Charges from early repayment of debt | | | 614 | | | | — | | | | 0.02 | | | | — | |

| (Restoration) write-off of deferred tax asset | | | (17,996 | ) | | | — | | | | (0.52 | ) | | | — | |

| | | |

| | | |

| | | |

| | | |

| |

| Pro forma net income (loss) | | $ | 12,239 | | | $ | (7,481 | ) | | $ | 0.37 | | | $ | (0.41 | ) |

| | | |

| | | |

| | | |

| | | |

| |

15

Net sales

We record revenue at the time product is shipped to our customer, except when beds are delivered and set up by our home delivery employees, in which case revenue is recorded at the time the bed is delivered and set up in the home. We reduce sales at the time revenue is recognized for estimated returns. This estimate is based on historical return rates, which are reasonably consistent from period to period. If actual returns vary from expected rates, revenue in future periods is adjusted, which could have a material adverse effect on future results of operations. Historically we have not experienced material adjustments to the financial statements due to changes to these estimates.

Cost of sales

Cost of sales includes costs associated with purchasing materials, manufacturing costs and costs to deliver our products to our customers. Cost of sales also includes estimated costs to service warranty claims of customers. This estimate is based on historical claim rates during the warranty period. Because this estimate covers an extended period of time, a revision of estimated claim rates could result in a significant adjustment of estimated future costs of fulfilling warranty commitments. An increase in estimated claim rates could have a material adverse effect on future results of operations. Historically we have not experienced material adjustments to the financial statements due to changes to these estimates.

Gross profit

Our gross profit margin is dependent on a number of factors and may fluctuate from quarter to quarter. These factors include the mix of products sold, the level at which we offer promotional discounts to purchase our products, the cost of materials and manufacturing and the mix of sales between wholesale and company-controlled distribution channels. Sales of products manufactured by third parties, such as accessories and our adjustable foundation, generate lower gross margins. Similarly, sales directly to consumers through company-controlled channels generally generate higher gross margins than sales through our wholesale channels because we capture both the manufacturer’s and retailer’s margin.

Sales and marketing expenses

Sales and marketing expenses include advertising and media production, other marketing and selling materials such as brochures, videos, customer mailings and in-store signage, sales compensation, store occupancy costs, costs of consumer financing and customer service. We expense all store opening and advertising costs as incurred, except for production costs and advance payments, which are deferred and expensed from the time the advertisement is first run.

Advertising expense was $59.5 million in 2003, $39.5 million in 2002 and $29.5 million in 2001. Future advertising expenditures will depend on the effectiveness and efficiency of the advertising in creating awareness of our products and brand name, generating consumer inquiries and driving consumer traffic to our points of sale. We anticipate that full year advertising expenditures in 2004 will exceed $80 million.

General and administrative expenses

General and administrative expenses include costs associated with management of functional areas, including information technology, human resources, finance, sales and marketing administration, investor relations, risk management and research and development. Costs include salaries, bonus and benefits, travel, information systems hardware, software and maintenance, office facilities, insurance and other overhead.

Store closings and asset impairments

Store closing and asset impairment expenses include charges recorded for store related or other capital assets that have been written off when a store is underperforming and generating negative cash flows. We evaluate our long-lived assets, including leaseholds and fixtures in existing stores and stores expected to be remodeled, based on expected cash flows through the remainder of the lease term after considering the potential impact of planned operational improvements and marketing programs. Expected cash flows may not be realized, which could cause long-lived assets to become impaired in future periods and could have a material adverse effect on future results of operations. Store assets are written off when we believe these costs will not be recovered through future operations.

Quarterly and annual results

Quarterly and annual operating results may fluctuate significantly as a result of a variety of factors, including increases or decreases in comparable store sales, the timing, amount and effectiveness of advertising expenditures, any changes in sales return rates or warranty experience, the timing of new store openings and related expenses, net sales contributed by new stores, competitive factors, any disruptions in supplies or third-party service providers and general economic conditions, consumer confidence, mattress industry and mall seasonality, timing of consumer holiday promotions, and timing of QVC shows. Furthermore, a substantial portion of net sales is often realized in the last month of a quarter, due in part to our promotional schedule and commission structure. As a result, we may be unable to adjust spending in a timely manner, and our business, financial condition and operating results may be significantly harmed. Our historical results of operations may not be indicative of the results that may be achieved for any future period.

16

COMPARISON OF 2003 AND 2002

Net sales

Net sales in 2003 increased 37% to $458.5 million from $335.8 million in 2002 due to a 19% increase in mattress unit sales and higher average selling prices. The additional week in fiscal 2003 contributed approximately 2% to sales growth company-wide. Fiscal 2004 will have one less week than 2003. The average selling price per bed set in our company-controlled channels for 2003 was $1,686, an increase of approximately 15% from 2002. The higher average selling prices resulted primarily from improvements in product mix and lower return rates. We expect the growth rate of average selling price to slow in 2004.

The increase in net sales by sales channel was attributable to (i) a $102.1 million increase in sales from our retail stores, including an increase in comparable store sales of $77.7 million, an estimated $7.4 million of additional sales due to a 53rd week in 2003 and an increase of $17.0 million from new stores opened in 2003, net of stores closed in 2003, (ii) an $11.8 million increase in direct marketing sales, (iii) a $5.3 million increase in sales from our e-commerce channel and (iv) a $3.5 million increase in sales from our wholesale channel.

Gross profit

Gross profit margin increased to 62.7% in 2003 from 62.5% in 2002 primarily due to improved product sales mix, partially offset by increased product delivery costs.

Sales and marketing expenses

Sales and marketing expenses in 2003 increased 32% to $206.1 million from $155.9 million in 2002, but decreased as a percentage of net sales to 45.0% in 2003 from 46.4% in 2002. The $50.2 million increase was primarily due to additional media investments, sales-based incentive compensation, and increased occupancy and financing costs. The decrease as a percentage of net sales was comprised of a 1.2 percentage point (ppt) increase in media investments offset by a 1.2 ppt decrease in occupancy costs, a 0.5 ppt decrease in sales compensation costs, 0.5 ppt decrease in field management and support costs and 0.4 ppt decrease in other marketing costs. With additional sales growth, we expect sales and marketing expenses as a percentage of net sales to decline in 2004 as we achieve greater leverage from our base sales compensation and occupancy costs while reinvesting some of these leverage benefits into higher levels of media investments and training.

General and administrative expenses

General and administrative (G&A) expenses increased 17% to $38.4 million or 8.4% of net sales in 2003 from $32.9 million or 9.8% of net sales in 2002. The dollar increase in general and administrative expenses was comprised primarily of $3.5 million from increased compensation expenses related to additional headcount, $1.0 million from increased incentive compensation expense resulting from improved company performance and $0.4 million from increased investments in research and development activities. We expect G&A growth rates to continue to be lower than the rate of sales growth due to leveraging the fixed component of G&A expenses across a higher sales base.

Store closing and asset impairment expenses

Store closing and asset impairment expenses in 2003 were $0.1 million compared to $0.2 million in 2002. In 2003 and 2002, the entire amount represented impairments related to store closures.

Other income (expense), net

Other income (expense) changed by $1.7 million to income of $0.4 million in 2003 compared to an expense of $1.3 million in 2002. The improvement is primarily due to reduced interest expense following the elimination of $16 million of debt in 2002 and increased interest income reflecting higher balances of invested cash in 2003.

Income tax expense (benefit)

Income tax expense (benefit) changed $33.8 million to an income tax expense of $16.0 million in 2003 compared to $17.8 million in income tax benefit in 2002. The increase in income tax expense was due to recording income tax expense at a rate of 37% in 2003. The $17.8 million income tax benefit for 2002 was the result of recording a non-recurring, non-operating, non-cash addition to earnings due to the expected realization of tax benefits from net operating loss carryforwards and other deferred tax assets. We expect to record income tax expense at a rate of 38.5% in 2004.

COMPARISON OF 2002 AND 2001

Net sales

Net sales in 2002 increased 28% to $335.8 million from $261.7 million in 2001 due to a 15% increase in mattress unit sales and higher average selling prices resulting primarily from improvements in product mix and lower return rates. The increase in net sales by sales channel was attributable to (i) a $54.9 million increase in sales from company-controlled retail stores, including an increase in comparable store sales of $52.9 million, (ii) a $7.9 million increase in direct marketing sales, (iii) a $5.9 million increase in sales from our wholesale channel and (iv) a $5.4 million increase in sales from our e-commerce channel.

Gross profit

Gross profit margin increased to 62.5% in 2002 from 59.0% in 2001 primarily due to improved product sales mix, savings in processing returned product, reduced product delivery costs, reduced warranty claim rates resulting from improved product quality and greater manufacturing leverage.

Sales and marketing expenses

Sales and marketing expenses in 2002 increased 13% to $155.9 million from $138.4 million in 2001, but decreased as a percentage of net sales to 46.4% in 2002 from 52.9% in 2001. The $17.5 million increase was primarily due to additional media investments, sales-based compensation and retail occupancy costs. The decrease as a percentage of net sales was attributable to greater leverage in fixed selling expenses and lower cost promotional offerings.

17

General and administrative expenses

General and administrative (G&A) expenses increased 30% to $32.9 million in 2002 from $25.3 million in 2001. Of the increase, $5.9 million was due to additional incentive compensation costs resulting from our improved performance, with the remaining increase primarily resulting from an increased investment in information technology.

Store closing and asset impairment expenses

Store closing and asset impairment expenses in 2002 were $0.2 million compared to $1.4 million in 2001. In 2002, the entire amount represented impairments related to store closures. In 2001, the expenses included $1.0 million related to store closures and $0.4 million related primarily to the write-off of unusable fixtures for the merchandising of our sleeper sofa products.

Other income (expense), net

Other expense decreased $0.2 million to approximately $1.3 million in 2002 from $1.5 million in 2001. The decrease was primarily due to an increase in interest income from our improved cash position, partially offset by increased interest expense associated with our senior secured debt. This debt was repaid in December 2002.

Income tax (benefit) expense

Income tax benefit was $17.8 million in 2002 as compared to zero in 2001. The $17.8 million income tax benefit for 2002 was the result of recording a non-recurring, non-operating, non-cash addition to earnings due to the expected realization of tax benefits from net operating loss carryforwards and other deferred tax assets.

LIQUIDITY AND CAPITAL RESOURCES

As of January 3, 2004, we had cash and marketable securities of $75.1 million with $74.0 million classified as a current asset. As of December 28, 2002, cash and marketable securities totaled $40.8 million with $39.3 million classified as current. Net working capital totaled $54.0 million at the end of 2003 compared to $26.8 million at the end of 2002. The $34.3 million improvement in cash balances was the result of generating $30.8 million of operating free cash flow ($49.2 million of cash provided by operating activities, reduced by $18.4 million of capital expenditures) and $3.5 million of cash provided by financing activities. Cash from financing activities was primarily comprised of cash received from option and warrant exercises and shares purchased by employees as part of an employee share purchase program, offset by purchases of stock made by us as part of our ongoing common stock repurchase program. We expect to continue to generate positive cash flows from operations in the future, while not anticipating any significant additional working capital requirements due to our advantaged business model which requires low levels of inventory and other working capital assets.

We generated cash from operations of $49.2 million in 2003, and $36.1 million in 2002. The $13.1 million year-to-year improvement in cash from operations resulted primarily from improved operating income in 2003 partially offset by increases in income taxes due, as we utilized substantially all net operating loss carryforwards (“NOLs”) in 2003.

Capital expenditures amounted to $18.4 million in 2003, compared to $7.8 million in 2002. In both periods our capital expenditures related primarily to new and remodeled retail stores and investments in information technology. The majority of the year-over-year increase in capital expenditures relates to investments in retail stores. In 2003 we opened 27 retail stores and we remodeled approximately 100 stores while in 2002 we opened 15 stores. We anticipate total capital expenditures of approximately $25 million in 2004 with the majority of the increase planned for investments in our retail stores. We anticipate opening 25 to 30 new stores while upgrading the marquee and design of approximately 150 stores. We will fund the investment in new and upgraded stores with capital generated from operations. We expect our new stores to be cash flow positive within the first twelve months of operation and, as a result, do not anticipate a negative effect on net cash provided by operations. We do not anticipate investing capital to expand our manufacturing capacity, as our plants have capacity available to accommodate nearly the doubling of our business.

Net cash provided by financing activities totaled $3.5 million in 2003, an increase of $7.3 million compared to cash used in financing activities during 2002. The $7.3 million increase in cash from financing activities was comprised of $5.0 million of cash used to repay early our senior secured term debt in 2002 and an increase of $4.1 million received for exercises of options and warrants and for employee purchases of common stock. These improvements to cash were offset by $1.8 million in purchases of common stock by us under our Board-authorized common stock repurchase program. The Board of Directors has authorized the repurchase of company shares from time-to-time, subject to market conditions and at prevailing market prices, through open-market purchases. The total authorized for repurchase as of January 3, 2004 was $14 million. Repurchased shares will be retired and may be reissued in the future for general corporate or other purposes. We may terminate or limit the stock repurchase at any time. During 2003 we repurchased 200,1 00 shares for $1.8 million at an average cost of $9.17 per share.

Management believes that cash generated from operations will be a sufficient source of liquidity for the short and long term and should provide adequate capital for capital expenditures and common stock repurchases, if any. In addition, our advantaged business model, which can operate with minimal working capital, does not require significant additional capital to fund operations. Historically, our primary source of capital had been from external sources, most recently from the completion of our $11.0 million convertible debt offering in June of 2001 and our $5.0 million senior secured term debt financing completed in September of 2001. The $11.0 million convertible debt was converted to equity in the second quarter of 2002 and the $5.0 million senior debt was prepaid in December of 2002 with cash generated from operations. Our remaining debt, $3.1 million of subordinated convertible debt, was converted to shares of common stock in 2003. Additionally, we obtained a $15 million bank revolving line of credit to provide additional cash flexibility in the case of unexpected significant external or internal developments. The line of credit is a three-year senior secured revolving facility. The interest rate on borrowings is calculated using LIBOR plus 1.5% to 2.25% with the incremental rate dependent on our leverage ratio, as defined by the lender. We are subject to certain financial covenants under the agreement, principally consisting of minimum liquidity requirements, working capital and leverage ratios. We have remained in full compliance with the financial covenants from the date the agreement was originated. We currently have no borrowings outstanding under this credit agreement.

18

The table below represents the scheduled maturities of our long-term contractual obligations as of January 3, 2004 (in thousands):

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Payments Due by Period

|

| | | | | | | <1 | | 1–3 | | 3–5 | | >5 |

| | | Total

| | Years

| | Years

| | Years

| | Years

|

| Operating leases | | $ | 83,973 | | | | 17,612 | | | | 31,979 | | | | 23,103 | | | | 11,279 | |

| Inventory purchase commitments | | | 129,580 | | | | 62,500 | | | | 67,080 | | | | — | | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Total | | $ | 213,553 | | | | 80,112 | | | | 99,059 | | | | 23,103 | | | | 11,279 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Predicting future events is inherently an imprecise activity and as such requires the use of judgment. Actual results may vary from estimates in amounts that may be material to the financial statements. The accounting policies discussed below are considered critical because they involve a degree of estimation and changes to certain judgments and assumptions inherent in these policies could materially affect the financial statements.

Our critical accounting policies relate to revenue recognition, accrued sales returns, accrued warranty costs and impairment of long-lived assets and long-lived assets to be disposed of by us.

In certain instances, accounting principles generally accepted in the United States of America allow for the selection of alternative accounting methods. Our significant accounting policy that involves the selection of an alternative method is accounting for stock options.

Stock-based compensation

Two alternative methods exist for accounting for stock options: the intrinsic value method and the fair value method. We use the intrinsic value method of accounting for stock options, and accordingly, no compensation expense has been recognized in the financial statements for options granted to employees, or for the discount feature of our employee stock purchase plan.

Revenue recognition

We record revenue at the time product is shipped to our customer, except when beds are delivered and set up by our home delivery employees, in which case revenue is recorded at the time the bed is delivered and set up in the home.

Accrued sales returns

We reduce sales at the time revenue is recognized for estimated returns. This estimate is based on historical return rates, which are reasonably consistent from period to period. If actual returns vary from expected rates, revenue in future periods is adjusted, which could have a material adverse effect on future results of operations. We have not historically experienced material adjustments to these estimates due to unanticipated return rates.

Accrued warranty costs

The estimated costs to service warranty claims of customers is included in cost of sales. This estimate is based on historical claim rates during the warranty period. Because this estimate covers an extended period of time, a revision of estimated claim rates could result in a significant adjustment of estimated future costs of fulfilling warranty commitments. An increase in estimated claim rates could have a material adverse effect on future results of operations. We have not historically experienced material adjustments to these estimates due to unanticipated warranty claims.

Store closing and asset impairment expenses

We evaluate our long-lived assets, including leaseholds and fixtures in existing stores, based on expected cash flows through the remainder of the lease term after considering the potential impact of planned operational improvements and marketing programs. Expected cash flows may not be realized, which could cause long-lived assets to become impaired in future periods and could have a material adverse effect on future results of operations. Store assets are written off when we believe these costs will not be recovered through future operations.

19

Consolidated Balance Sheets

January 3, 2004 and December 28, 2002

(in thousands, except share and per share amounts)

| | | | | | | | | |

| | | 2003

| | 2002

|

Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 24,725 | | | $ | 27,176 | |

| Marketable securities — current (note 2) | | | 49,322 | | | | 12,146 | |

| Accounts receivable, net of allowance for doubtful accounts of $619 and $340, respectively | | | 6,823 | | | | 3,270 | |

| Inventories (note 3) | | | 12,381 | | | | 8,980 | |

| Prepaid expenses | | | 5,244 | | | | 5,467 | |

| Deferred tax assets (note 8) | | | 6,039 | | | | 12,955 | |

| | | |

| | | |

| |

| Total current assets | | | 104,534 | | | | 69,994 | |

| | | |

| | | |

| |

| Marketable securities — non-current (note 2) | | | 1,071 | | | | 1,502 | |

| Property and equipment, net (note 4) | | | 36,134 | | | | 28,977 | |

| Deferred tax assets (note 8) | | | 5,620 | | | | 4,352 | |

| Other assets | | | 3,343 | | | | 3,506 | |

| | | |

| | | |

| |

| Total assets | | $ | 150,702 | | | $ | 108,331 | |

| | | |

| | | |

| |

Liabilities and Shareholders’ Equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Current maturities of long-term debt (note 6) | | $ | — | | | $ | 11 | |

| Accounts payable | | | 14,773 | | | | 16,508 | |

| Accruals: | | | | | | | | |

| Sales returns | | | 3,469 | | | | 3,181 | |

| Compensation and benefits | | | 16,579 | | | | 13,666 | |

| Taxes and withholding | | | 3,661 | | | | 2,779 | |

| Consumer prepayments | | | 5,970 | | | | 1,964 | |

| Other | | | 6,110 | | | | 5,120 | |

| | | |

| | | |

| |

| Total current liabilities | | | 50,562 | | | | 43,229 | |

| Long-term debt, less current maturities (note 6) | | | — | | | | 2,991 | |

| Warranty costs | | | 2,557 | | | | 3,626 | |

| Other liabilities | | | 4,821 | | | | 3,970 | |

| | | |

| | | |

| |

| Total liabilities | | | 57,940 | | | | 53,816 | |

| | | |

| | | |

| |

| Shareholders’ equity (notes 6, 7 and 10): | | | | | | | | |

| Undesignated preferred stock; 5,000,000 shares authorized, no shares issued and outstanding | | | — | | | | — | |

| Common stock, $0.01 par value; 95,000,000 shares authorized, 35,769,606 and 30,727,101 shares issued and outstanding, respectively | | | 358 | | | | 307 | |

| Additional paid-in capital | | | 104,085 | | | | 92,184 | |

| Unearned compensation | | | (877 | ) | | | — | |

| Accumulated deficit | | | (10,804 | ) | | | (37,976 | ) |

| | | |

| | | |

| |

| Total shareholders’ equity | | | 92,762 | | | | 54,515 | |

| | | |

| | | |

| |

| Commitments and contingencies (notes 5 and 11): | | | | | | | | |

| Total liabilities and shareholders’ equity | | $ | 150,702 | | | $ | 108,331 | |

| | | |

| | | |

| |

See accompanying notes to consolidated financial statements.

20

Consolidated Statements of Operations

Years Ended January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except per share amounts)

| | | | | | | | | | | | | |

| | | 2003*

| | 2002

| | 2001

|

| Net sales | | $ | 458,489 | | | $ | 335,795 | | | $ | 261,687 | |

| Cost of sales | | | 171,163 | | | | 125,796 | | | | 107,210 | |

| | | |

| | | |

| | | |

| |

| Gross profit | | | 287,326 | | | | 209,999 | | | | 154,477 | |

| | | |

| | | |

| | | |

| |

| Operating expenses: | | | | | | | | | | | | |

| Sales and marketing (note 1) | | | 206,129 | | | | 155,890 | | | | 138,417 | |

| General and administrative | | | 38,423 | | | | 32,854 | | | | 25,296 | |

| Store closings and asset impairments (note 4) | | | 71 | | | | 233 | | | | 1,366 | |

| | | |

| | | |

| | | |

| |

| Total operating expenses | | | 244,623 | | | | 188,977 | | | | 165,079 | |

| | | |

| | | |

| | | |

| |

| Operating income (loss) | | | 42,703 | | | | 21,022 | | | | (10,602 | ) |

| | | |

| | | |

| | | |

| |

| Other income (expense): | | | | | | | | | | | | |

| Interest income | | | 612 | | | | 571 | | | | 237 | |

| Interest expense (note 6) | | | (170 | ) | | | (1,655 | ) | | | (1,362 | ) |

| Other, net | | | — | | | | (198 | ) | | | (339 | ) |

| | | |

| | | |

| | | |

| |

| Other income (expense), net | | | 442 | | | | (1,282 | ) | | | (1,464 | ) |

| | | |

| | | |

| | | |

| |

| Income (loss) before income taxes and extraordinary loss | | | 43,145 | | | | 19,740 | | | | (12,066 | ) |

| Income tax (expense) benefit (note 8) | | | (15,973 | ) | | | 17,762 | | | | — | |

| | | |

| | | |

| | | |

| |

| Income (loss) before extraordinary loss | | | 27,172 | | | | 37,502 | | | | (12,066 | ) |

| Extraordinary loss from early extinguishment of debt, net of tax of $234 (note 6) | | | — | | | | (380 | ) | | | — | |

| | | |

| | | |

| | | |

| |

| Net income (loss) | | $ | 27,172 | | | $ | 37,122 | | | $ | (12,066 | ) |

| | | |

| | | |

| | | |

| |

| Basic net income (loss) per share (note 9): | | | | | | | | | | | | |

| Income (loss) before extraordinary loss | | $ | 0.83 | | | $ | 1.53 | | | $ | (0.66 | ) |

| Extraordinary loss from early extinguishment of debt | | | — | | | | (0.02 | ) | | | — | |

| | | |

| | | |

| | | |

| |

| Net income (loss) per share — basic | | $ | 0.83 | | | $ | 1.51 | | | $ | (0.66 | ) |

| | | |

| | | |

| | | |

| |

| Weighted average common shares — basic | | | 32,856 | | | | 24,549 | | | | 18,157 | |

| | | |

| | | |

| | | |

| |

| Diluted net income (loss) per share (note 9): | | | | | | | | | | | | |

| Income (loss) before extraordinary loss | | $ | 0.69 | | | $ | 1.10 | | | $ | (0.66 | ) |

| Extraordinary loss from early extinguishment of debt | | | — | | | | (0.01 | ) | | | — | |

| | | |

| | | |

| | | |

| |

| Net income (loss) per share — diluted | | $ | 0.69 | | | $ | 1.09 | | | $ | (0.66 | ) |

| | | |

| | | |

| | | |

| |

| Weighted average common shares — diluted | | | 39,277 | | | | 34,532 | | | | 18,157 | |

| | | |

| | | |

| | | |

| |

*Fiscal year 2003 had 53 weeks. All other fiscal years presented had 52 weeks.

See accompanying notes to consolidated financial statements.

21

Consolidated Statements of Shareholders’ Equity

Years Ended January 3, 2004, December 28, 2002 and December 29, 2001

(in thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | | | | Additional | | |

| | |

| | Paid-in | | Unearned | | Accumulated | | |

| | | Shares

| | Amount

| | Capital

| | Compensation

| | Deficit

| | Total

|

| Balance at December 30, 2000 | | | 17,962,689 | | | $ | 180 | | | $ | 79,452 | | | $ | — | | | $ | (63,032 | ) | | $ | 16,600 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Exercise of common stock options (note 7) | | | 694 | | | | — | | | | 1 | | | | — | | | | — | | | | 1 | |

| Issuance of common stock warrants | | | — | | | | — | | | | 1,868 | | | | — | | | | — | | | | 1,868 | |

| Employee stock purchases (note 10) | | | 338,924 | | | | 3 | | | | 366 | | | | — | | | | — | | | | 369 | |

| Net loss | | | — | | | | — | | | | — | | | | — | | | | (12,066 | ) | | | (12,066 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Balance at December 29, 2001 | | | 18,302,307 | | | | 183 | | | | 81,687 | | | | — | | | | (75,098 | ) | | | 6,772 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Exercise of common stock options (note 7) | | | 166,238 | | | | 2 | | | | 279 | | | | — | | | | — | | | | 281 | |

| Exercise of common stock warrants | | | 1,046,344 | | | | 10 | | | | (10 | ) | | | — | | | | — | | | | — | |

| Conversion of convertible debt | | | 11,000,000 | | | | 110 | | | | 9,382 | | | | — | | | | — | | | | 9,492 | |

| Employee stock purchases (note 10) | | | 212,212 | | | | 2 | | | | 846 | | | | — | | | | — | | | | 848 | |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 37,122 | | | | 37,122 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Balance at December 28, 2002 | | | 30,727,101 | | | | 307 | | | | 92,184 | | | | — | | | | (37,976 | ) | | | 54,515 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Exercise of common stock options (note 7) | | | 1,007,841 | | | | 10 | | | | 7,411 | | | | — | | | | — | | | | 7,421 | |

| Exercise of common stock warrants | | | 3,232,205 | | | | 32 | | | | 405 | | | | — | | | | — | | | | 437 | |

| Repurchase of common stock | | | (200,100 | ) | | | (2 | ) | | | (1,832 | ) | | | — | | | | — | | | | (1,834 | ) |

| Conversion of convertible debt (note 6) | | | 727,272 | | | | 7 | | | | 2,834 | | | | — | | | | — | | | | 2,841 | |

| Issuance of restricted stock (note 7) | | | 102,000 | | | | 2 | | | | 950 | | | | (877 | ) | | | — | | | | 75 | |

| Employee stock purchases and 401(k) match (note 10) | | | 173,287 | | | | 2 | | | | 2,133 | | | | — | | | | — | | | | 2,135 | |

| Net income | | | — | | | | — | | | | — | | | | — | | | | 27,172 | | | | 27,172 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| Balance at January 3, 2004 | | | 35,769,606 | | | $ | 358 | | | $ | 104,085 | | | $ | (877 | ) | | $ | (10,804 | ) | | $ | 92,762 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

See accompanying notes to consolidated financial statements.

22

Consolidated Statements of Cash Flows

| | | | | | | | | | | | | |

| Years Ended January 3, 2004, December 28, 2002 and December 29, 2001 | | | | | | |

| (in thousands) | | | | | | |

| | | | | | | |

| Cash flows from operating activities: | | 2003* | | 2002 | | 2001 |

| | | |

| | | |

| | | |

| |

| Net income (loss) | | $ | 27,172 | | | $ | 37,122 | | | $ | (12,066 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | | | | | | |

| Depreciation and amortization | | | 11,145 | | | | 9,194 | | | | 9,570 | |

| Amortization of debt discount and deferred finance fees | | | 130 | | | | 1,279 | | | | 512 | |

| Non-cash compensation | | | 75 | | | | — | | | | — | |

| Loss on disposal of assets and impaired assets | | | 96 | | | | 548 | | | | 1,687 | |

| Deferred tax expense (benefit) | | | 5,648 | | | | (17,307 | ) | | | — | |

| Change in operating assets and liabilities: | | | | | | | | | | | | |

| Accounts receivable | | | (3,553 | ) | | | (647 | ) | | | 70 | |

| Inventories | | | (3,401 | ) | | | (894 | ) | | | 2,926 | |

| Prepaid expenses | | | 223 | | | | (1,879 | ) | | | 2,023 | |

| Other assets | | | 129 | | | | 1,441 | | | | (2,244 | ) |

| Accounts payable | | | (1,735 | ) | | | 1,292 | | | | (2,055 | ) |

| Accrued compensation and benefits | | | 2,913 | | | | 6,487 | | | | 1,154 | |

| Accrued taxes and withholding | | | 5,295 | | | | (253 | ) | | | (143 | ) |

| Customer Payments | | | 4,006 | | | | 701 | | | | 6 | |

| Other accruals and liabilities | | | 1,060 | | | | (940 | ) | | | (1,026 | ) |

| | | |

| | | |

| | | |

| |

| Net cash provided by operating activities | | | 49,203 | | | | 36,144 | | | | 414 | |

| | | |

| | | |

| | | |

| |

| Cash flows from investing activities: | | | | | | | | | | | | |

| Purchases of property and equipment | | | (18,364 | ) | | | (7,802 | ) | | | (4,859 | ) |

| Investments in marketable securities | | | (55,717 | ) | | | (24,780 | ) | | | — | |

| Proceeds from maturity of marketable securities | | | 18,972 | | | | 11,132 | | | | 3,950 | |

| | | |

| | | |

| | | |

| |

| Net cash used in investing activities | | | (55,109 | ) | | | (21,450 | ) | | | (909 | ) |

| | | |

| | | |

| | | |

| |

| Cash flows from financing activities: | | | | | | | | | | | | |

| Principal payments on long-term debt | | | (11 | ) | | | (5,022 | ) | | | (38 | ) |

| Repurchase of common stock | | | (1,834 | ) | | | — | | | | — | |

| Proceeds from issuance of shares from option and warrant exercises | | | 3,445 | | | | 280 | | | | 1 | |

| Proceeds from issuance of ESPP shares and other equity transactions | | | 1,855 | | | | 849 | | | | 369 | |

| Net proceeds from long-term debt | | | — | | | | — | | | | 15,040 | |

| | | |

| | | |

| | | |

| |

| Net cash provided by (used in) financing activities | | | 3,455 | | | | (3,893 | ) | | | 15,372 | |

| | | |

| | | |

| | | |

| |

| (Decrease) increase in cash and cash equivalents | | | (2,451 | ) | | | 10,801 | | | | 14,877 | |

| Cash and cash equivalents, at beginning of year | | | 27,176 | | | | 16,375 | | | | 1,498 | |

| | | |

| | | |

| | | |

| |

| Cash and cash equivalents, at end of year | | $ | 24,725 | | | $ | 27,176 | | | $ | 16,375 | |

| | | |

| | | |

| | | |

| |

Supplemental Disclosure of Cash Flow Information | | | | | | | | | | | | |

| Cash paid during the year for: | | | | | | | | | | | | |

| Interest | | $ | 39 | | | $ | 1,494 | | | $ | 182 | |

| Income taxes | | | 5,917 | | | | 495 | | | | 188 | |

| Non-cash impact of conversion of debt to equity | | | 3,121 | | | | 9,492 | | | | — | |

| Tax benefit from disqualifying option dispositions | | | 4,413 | | | | — | | | | — | |

*Fiscal year 2003 had 53 weeks. All other fiscal years presented had 52 weeks.

See accompanying notes to consolidated financial statements.

23

Notes to Consolidated Financial Statements

(1) BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Select Comfort Corporation and its wholly-owned subsidiaries (the Company) develops, manufactures and markets premium quality, adjustable-firmness beds.

Financial Statement Presentation

Certain prior-year amounts have been reclassified to conform to the current-year presentation. The Company’s fiscal year ends on the Saturday closest to December 31. Fiscal years and their respective fiscal year ends are as follows: fiscal year 2003 ended January 3, 2004; fiscal year 2002 ended December 28, 2002 and fiscal year 2001 ended December 29, 2001. Fiscal year 2003 had 53 weeks. Fiscal years 2002 and 2001 each had 52 weeks.

Principles of Consolidation

The consolidated financial statements include the accounts of Select Comfort Corporation and its subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Cash and Cash Equivalents

Cash and cash equivalents include highly liquid investments with original maturities of three months or less.

Marketable Securities

Investments with an original maturity of greater than 90 days are classified as marketable securities. Marketable securities include highly liquid investment grade debt instruments issued by the U.S. government and related agencies, municipalities and corporations and commercial paper issued by companies with investment grade ratings. The Company’s investments have an original maturity of up to 18 months. Marketable securities with a remaining maturity of greater than one year are classified as long-term.

Inventories

Inventories include material, labor and overhead and are stated at the lower of cost or market. Cost is determined by the first-in, first-out method.

Property and Equipment

Property and equipment, carried at cost, are depreciated using the straight-line method over the estimated useful lives of the assets, which range from three to seven years. Leasehold improvements are depreciated over the shorter of the life of the lease, 5 years or the period through the date a store remodel is expected to be completed.

Other Assets

Other assets include security deposits, patents, trademarks, and goodwill. Patents and trademarks are amortized using the straight-line method over periods ranging from 10 to 17 years. Goodwill is not amortized.

Fair Value of Financial Instruments

The carrying value of cash and cash equivalents and accounts receivable approximate fair value because of the short-term maturity of those instruments.

Research and Development Costs

Costs incurred in connection with research and development are charged to expense as incurred. Research and development expense was $1,295,000, $936,000 and $1,086,000 in 2003, 2002 and 2001, respectively.

Pre-opening Costs

Costs associated with the opening of new stores are expensed as incurred.

Advertising Costs

The Company incurs advertising costs associated with print and broadcast advertisements. Such costs are charged to expense the first time the advertisement airs. Advertising expense was $59,547,000, $39,477,000 and $29,451,000 in 2003, 2002 and 2001, respectively.

Income Taxes