- SNBR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Sleep Number (SNBR) DEF 14ADefinitive proxy

Filed: 12 Apr 05, 12:00am

UNITED STATES | |||

SECURITIES AND EXCHANGE COMMISSION | |||

Washington, D.C. 20549 | |||

| |||

SCHEDULE 14A INFORMATION | |||

| |||

Proxy Statement Pursuant to Section 14(a) of | |||

| |||

Filed by the Registrant ý | |||

| |||

Filed by a Party other than the Registrant o | |||

| |||

Check the appropriate box: | |||

o | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

ý | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material Pursuant to §240.14a-12 | ||

| |||

SELECT COMFORT CORPORATION | |||

(Name of Registrant as Specified In Its Charter) | |||

| |||

Not applicable | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| |||

Payment of Filing Fee (Check the appropriate box): | |||

ý | No fee required. | ||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | |

|

|

| |

| (2) | Aggregate number of securities to which transaction applies: | |

|

|

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

| |

| (4) | Proposed maximum aggregate value of transaction: | |

|

|

| |

| (5) | Total fee paid: | |

|

|

| |

o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | |

|

|

| |

| (2) | Form, Schedule or Registration Statement No.: | |

|

|

| |

| (3) | Filing Party: | |

|

|

| |

| (4) | Date Filed: | |

|

|

| |

|

| Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | |

6105 Trenton Lane North

Minneapolis, Minnesota 55442

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 11, 2005

TO THE SHAREHOLDERS OF SELECT COMFORT CORPORATION:

Select Comfort Corporation will hold its Annual Meeting of Shareholders at 9:00 a.m., Central Daylight Savings Time, on Wednesday, May 11, 2004, at the company’s offices at 6105 Trenton Lane North, Plymouth, Minnesota 55442. The purposes of the meeting are to:

1. Elect four persons to serve as directors for three-year terms;

2. Approve the amendment of the Select Comfort Corporation 1999 Employee Stock Purchase Plan;

3. Approve the appointment of independent auditors; and

4. Act on any other business that may properly come before the meeting.

Only shareholders of record at the close of business on April 4, 2005 will be entitled to notice of, and to vote at, the meeting and any adjournments thereof. It is important that your shares be represented and voted at the meeting. Please vote your shares in accordance with the instructions on the enclosed proxy card in a timely manner to accommodate our meeting scheduled for May 11, 2005.

| By Order of the Board of Directors, | |

|

| |

|

| |

| /s/ Mark A. Kimball |

|

| Mark A. Kimball | |

| Senior Vice President, | |

| General Counsel & Secretary | |

April 12, 2005

Minneapolis, Minnesota

TABLE OF CONTENTS

| Page |

2 | |

3 | |

3 | |

3 | |

3 | |

4 | |

4 | |

|

|

5 | |

|

|

8 | |

8 | |

8 | |

8 | |

9 | |

10 | |

12 | |

20 | |

|

|

21 | |

21 | |

22 | |

24 | |

24 | |

25 | |

|

|

27 | |

27 | |

27 | |

28 | |

30 | |

30 | |

|

|

32 | |

|

|

33 |

i

AMENDMENT OF THE SELECT COMFORT CORPORATION 1999 EMPLOYEE STOCK PURCHASE PLAN | 34 |

34 | |

34 | |

35 | |

37 | |

38 | |

39 | |

|

|

40 | |

40 | |

40 | |

41 | |

|

|

41 | |

41 | |

41 | |

42 | |

42 | |

43 | |

|

|

APPENDIX A – Select Comfort Corporation 1999 Employee Stock Purchase Plan | A-1 |

ii

6105 Trenton Lane North

Minneapolis, Minnesota 55442

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

May 11, 2005

This Proxy Statement is being mailed to our shareholders beginning on or about April 12, 2005 in connection with the solicitation of proxies by the Board of Directors of Select Comfort Corporation for use at the Annual Meeting of Shareholders. The meeting will be held on Wednesday, May 11, 2005, at 9:00 a.m., Central Daylight Savings Time, at the company’s offices at 6105 Trenton Lane North, Plymouth, Minnesota 55442, for the purposes set forth in the Notice of Meeting.

Your vote is important. A proxy card is enclosed for your use. You are solicited on behalf of the Board of Directors, to vote your shares by returning your signed proxy card or, where applicable, voting by telephone or on the internet in accordance with the instructions on your proxy card. If you choose to mail your proxy card utilizing the enclosed envelope, no postage is required if mailed within the United States. If you choose to vote by telephone or on the internet, please do not mail your proxy card.

Proxies will be voted as specified by you. Signed proxies that lack any such specification will be voted in favor of the proposals set forth in the Notice of Meeting and in favor of the election as directors of the four nominees listed in this Proxy Statement.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOR OF THE ELECTION OF THE NOMINEES FOR DIRECTOR NAMED HEREIN AND FOR APPROVAL OF THE OTHER PROPOSALS SET FORTH IN THE NOTICE OF MEETING.

2

Shareholders of record at the close of business on April 4, 2005 will be entitled to vote at the meeting. As of that date, there were 36,084,619 outstanding shares of common stock. Each share is entitled to one vote on each matter to be voted on at the Annual Meeting. Shareholders are not entitled to cumulative voting rights.

Any shareholder giving a proxy may revoke it at any time prior to its use at the Annual Meeting by:

• Giving written notice of such revocation to the Corporate Secretary;

• Filing a duly executed proxy bearing a later date with the Corporate Secretary; or

• Appearing at the Annual Meeting and filing written notice of revocation with the Corporate Secretary prior to use of the proxy.

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting (18,042,310 shares) will constitute a quorum for the transaction of business at the Annual Meeting. In general, shares of common stock represented by a properly signed and returned proxy card or properly voted by telephone or the internet will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining a quorum, without regard to whether the card reflects abstentions (or is left blank) or reflects a “broker non-vote” on a matter. A “broker non-vote” is a proxy submitted by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received, and the broker has no discretionary authority to vote.

Assuming a quorum is represented at the Annual Meeting, either in person or by proxy, each of the matters to be voted upon by shareholders at the meeting requires the affirmative vote of the holders of a majority of the shares present and entitled to vote in person or by proxy at the meeting for approval.

Shares represented by a proxy that includes any broker non-votes on a matter will be treated as shares not entitled to vote on that matter, and thus will not be counted in determining whether that matter has been approved. Shares represented by a proxy voted as “withholding authority” to vote for any nominee for director will be treated as shares present and entitled to vote that were voted against the nominee. Signed proxies that lack any specification will be

3

voted in favor of the election as directors of each of the four nominees for director listed in this Proxy Statement and in favor of each of the other proposals listed in this Proxy Statement.

The cost of soliciting proxies, including the preparation, assembly and mailing of proxies and soliciting material, as well as the cost of forwarding such material to the beneficial owners of our common stock, will be borne by us. Our directors, officers and regular employees may, without compensation other than their regular compensation, solicit proxies by telephone or personal conversation. We may reimburse brokerage firms and others for expenses in forwarding proxy materials to the beneficial owners of our common stock.

Select Comfort is pleased to offer its shareholders the opportunity to receive shareholder communications electronically. By signing up for electronic delivery of documents such as the Annual Report and the Proxy Statement, you can receive shareholder communications as soon as they are available without waiting for them to arrive in the mail, and submit your shareholder votes online. You can also reduce the number of paper documents in your personal files, eliminate duplicate mailings, conserve natural resources, and help reduce our printing and mailing costs. To sign up for electronic delivery, visit www.icsdelivery.com and enter information for all of your Select Comfort shareholdings. Your enrollment will be effective until canceled. If you have questions about electronic delivery, please call Select Comfort Investor Relations at (763) 551-7498.

4

STOCK OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows the beneficial ownership of Select Comfort common stock as of March 11, 2005 (unless another date is indicated) by (a) each director and each executive officer named in the Summary Compensation Table under the heading “Executive Compensation and Other Benefits,” (b) all directors and executive officers as a group and (c) each person known by us to be the beneficial owner of more than 5% of Select Comfort common stock.

|

| Shares of Common Stock |

| ||

Name |

| Amount |

| Percent of Class |

|

Thomas J. Albani |

| 148,706 |

|

| * |

Christine M. Day |

| 0 |

|

|

|

Patrick A. Hopf (2) |

| 177,616 |

|

| * |

Mark A. Kimball (3) |

| 327,774 |

|

| * |

Christopher P. Kirchen |

| 289,596 |

|

| * |

David T. Kollat |

| 108,706 |

|

| * |

Brenda J. Lauderback |

| 7,500 |

|

| * |

William R. McLaughlin (4) |

| 1,255,773 |

| 3.4 | % |

Michael A. Peel |

| 20,000 |

|

| * |

James C. Raabe (5) |

| 267,852 |

|

| * |

Noel F. Schenker (6) |

| 136,532 |

|

| * |

Ervin R. Shames |

| 248,611 |

|

| * |

Keith C. Spurgeon (7) |

| 95,233 |

|

| * |

Jean-Michel Valette |

| 131,254 |

|

| * |

All directors and executive officers as a group (17 persons) (8) |

| 3,647,071 |

| 9.5 | % |

Baron Capital Group, Inc. (9) |

| 2,366,825 |

| 6.6 | % |

FMR Corp. (10) |

| 2,768,320 |

| 7.7 | % |

Goldman Sachs Asset Management, L.P. (11) |

| 2,665,148 |

| 7.4 | % |

Neuberger Berman, Inc. (12) |

| 1,850,900 |

| 5.1 | % |

Nominingue Asset Management, LLC (13) |

| 1,823,693 |

| 5.1 | % |

Royce & Associates, LLC (14) |

| 2,813,200 |

| 7.8 | % |

Wasatch Advisors, Inc. (15) |

| 2,430,655 |

| 6.8 | % |

* Less than 1% of the outstanding shares.

(2) Includes 1,216 shares held by Mr. Hopf’s wife and children.

(3) Includes 5,000 shares held under a performance stock grant.

5

(4) Does not include 400,000 shares issuable upon exercise of an outstanding warrant held by BWSJ Corporation, for which Mr. McLaughlin serves as a director and is a shareholder. Mr. McLaughlin disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. Includes 25,000 shares held under a restricted stock grant and 12,500 shares held under a performance stock grant.

(5) Includes 5,000 shares held under a restricted stock grant and 5,000 shares held under a performance stock grant.

(6) Ms. Schenker resigned from the Company effective as of March 17, 2005.

(7) Includes 2,500 shares held under a performance stock grant.

(8) Includes an aggregate of 2,405,808 shares that directors and executive officers as a group have the right to acquire within 60 days through the exercise of stock options or warrants. Also includes an aggregate of 92,000 shares held in the form of restricted stock or performance stock grants.

(9) Baron Capital Group, Inc. (“BCG”), BAMCO, Inc. (“BAMCO”), Baron Capital Management, Inc. (“BCM”) and Ronald Baron reported in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2005 that as of December 31, 2004, BCG, BAMCO, BCM and Ronald Baron beneficially owned an aggregate of 2,366,825 shares. The filing indicated that, of these shares, BCG beneficially owned 2,366,825 shares, and had shared power to vote or direct the voting of 2,143,825 shares and shared power to dispose or direct the disposition of 2,366,825 shares; BAMCO beneficially owned 2,142,925 shares, and had shared power to vote or direct the voting of 1,927,925 shares and shared power to dispose or direct the disposition of 2,142,925 shares; BCM beneficially owned 223,900 shares, and had shared power to vote or direct the voting of 215,900 shares and shared power to dispose or direct the disposition of 223,900 shares; and Ronald Baron beneficially owned 2,366,825 shares, and had shared power to vote or direct the voting of 2,143,825 shares and shared power to dispose or direct the disposition of 2,366,825 shares. BCG and Ronald Baron disclaim beneficial ownership of shares held by their controlled entities (or the investment advisory clients thereof) to the extent shares are held by persons other than BCG and Ronald Baron. BAMCO and BCM disclaim beneficial ownership of shares held by their investment advisory clients to the extent such shares are held by persons other than BAMCO, BCM and their affiliates. The address of BCG, BAMCO, BCM and Ronald Baron is 767 Fifth Avenue, New York, NY 10153.

(10) FMR Corp. reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February 14, 2005 that as of December 31, 2004, Fidelity Management & Research Company, or “Fidelity,” a wholly owned subsidiary of FMR Corp., beneficially owned 2,586,720 shares as a result of acting as investment adviser to various investment funds. Each of FMR Corp. (through its control of Fidelity), Edward C. Johnson III (Chairman of FMR Corp.) and the investment funds has the power to dispose of the shares owned by the investment funds. Neither FMR Corp. nor Mr. Johnson has the sole power to vote or direct the voting of the shares owned directly by the investment funds, which power resides in the investment funds’ respective Boards of Trustees. Fidelity Management Trust Company, a wholly owned subsidiary of FMR Corp., is the beneficial owner of 169,400 shares as a result of its serving as investment manager for certain institutional accounts. Mr. Johnson and FMR Corp. (through its control of Fidelity Management Trust Company) each has sole dispositive power and sole power to vote or to direct the voting of the 169,400 shares owned by the institutional accounts. Mr. Johnson, and various Johnson family members, may be considered, by their stock ownership and the execution of a shareholders’ voting agreement, to form a controlling group with respect to FMR Corp. Fidelity International Limited is the beneficial owner of 12,200 shares and currently operates as an entity independent of FMR Corp. and Fidelity. The address of FMR Corp. is 82 Devonshire Street, Boston, MA 02109.

(11) Goldman Sachs Asset Management, L.P. reported in a Schedule 13G filed with the Securities and Exchange Commission on February 9, 2005 that as of December 31, 2004, it beneficially owned 2,665,148 shares. The filing indicated that, of these shares, Goldman Sachs Asset Management, L.P had sole voting

6

power with respect to 2,407,547 shares and sole dispositive power with respect to 2,665,148 shares. The address of Goldman Sachs Asset Management, L.P. is 32 Old Slip, New York, NY 10005.

(12) Neuberger Berman, Inc. reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February 17, 2005 that as of December 31, 2004, Neuberger Berman, Inc. and Neuberger Berman, LLC beneficially owned 1,850,900 shares. The filing indicated that, of these shares, Neuberger Berman, Inc. and Neuberger Berman, LLC had sole voting power with respect to 16,500 shares, shared voting power with respect to 1,827,000 shares and shared dispositive power with respect to 1,850,900 shares. The filing further indicated that (i) Neuberger Berman, LLC is deemed to be a beneficial owner of certain shares since it has shared power to make decisions whether to retain or dispose, and in some cases the sole power to vote, the securities of many unrelated clients; and (ii) Neuberger Berman, LLC and Neuberger Berman Management Inc. serve as sub-adviser and investment manager, respectively, of Neuberger Berman’s various mutual funds which hold such shares in the ordinary course of their business and not with the purpose nor with the effect of changing or influencing the control of the issuer. The address of Neuberger Berman, Inc. is 605 Third Avenue, New York, NY 10158.

(13) Nominingue Asset Management, LLC reported in a Schedule 13G/A filed with the Securities and Exchange Commission on February 11, 2005 that as of December 31, 2004, it beneficially owned and had sole voting power and sole dispositive power with respect to 1,823,693 shares. The address of Nominingue Asset Management, LLC is 712 Fifth Avenue, New York, NY 10019.

(14) Royce & Associates, LLC reported in a Schedule 13G filed with the Securities and Exchange Commission on February 2, 2005 that as of December 31, 2004, it beneficially owned and had sole voting power and sole dispositive power with respect to 2,813,200 shares. The address of Royce & Associates, LLC is 1414 Avenue of the Americas, New York, NY 10019.

(15) Wasatch Advisors, Inc. reported in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2005 that as of December 31, 2004, it beneficially owned and had sole voting power and sole dispositive power with respect to 2,430,655 shares. The address of Wasatch Advisors, Inc. is 150 Social Hall Avenue, Salt Lake City, UT 84111.

7

(Proposal 1)

Article XIV of our Articles of Incorporation provides that the number of directors must be at least one but not more than 12 and must be divided into three classes as nearly equal in number as possible. The exact number of directors is determined from time to time by the Board of Directors, and currently consists of 10 members. The term of each class is three years and the term of one class expires each year in rotation.

The Board has nominated the following individuals to serve as directors of our company for terms of three years, expiring at the 2008 Annual Meeting of Shareholders, or until their successors are elected and qualified:

• Christopher P. Kirchen

• Brenda J. Lauderback

• Michael A. Peel

• Jean-Michel Valette

Each of the nominees is currently a member of our Board of Directors.

Assuming a quorum is represented at the Annual Meeting, either in person or by proxy, the election of each nominee requires the affirmative vote of a majority of the shares of common stock represented in person or by proxy at the Annual Meeting.

The Board recommends a vote FOR the election of Mr. Kirchen, Ms. Lauderback, Mr. Peel and Mr. Valette. In the absence of other instructions, the proxies will be voted FOR the election of each of these nominees.

If prior to the Annual Meeting the Board should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for such nominee will be voted for such substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for such fewer number of nominees as results from the inability of any such nominee to serve. The Board has no reason to believe that any of the nominees will be unable to serve.

8

Information about Nominees and Other Directors

The following table sets forth certain information, as of March 31, 2005, that has been furnished to us by each director and each person who has been nominated by the Board to serve as a director of our company.

Name of Nominee |

| Age |

| Principal Occupation |

| Director |

|

|

|

|

|

|

|

Nominees for three-year terms expiring in 2008: |

|

| ||||

|

|

|

|

|

|

|

Christopher P. Kirchen (1) |

| 62 |

| Managing General Partner and co-founder of BEV Capital, a venture capital partnership |

| 1991 |

|

|

|

|

|

|

|

Brenda J. Lauderback (2) |

| 54 |

| Former President of the Retail and Wholesale Group for Nine West Group, Inc.; Currently a director of Big Lots, Inc., Irwin Financial Corporation, Louisiana-Pacific Corporation and Wolverine World Wide, Inc. |

| 2004 |

|

|

|

|

|

|

|

Michael A. Peel (3) |

| 55 |

| Senior Vice President, Human Resources and Corporate Services of General Mills, Inc. |

| 2003 |

|

|

|

|

|

|

|

Jean-Michel Valette (1) |

| 44 |

| Chairman (non-executive) of Robert Mondavi Winery; Chairman of the Board of Directors of Peet’s Coffee and Tea, Inc.; Also a director of The Boston Beer Company. |

| 1994 |

|

|

|

|

|

|

|

Directors not standing for election this year whose terms expire in 2006: |

|

| ||||

|

|

|

|

|

|

|

Christine M. Day (3) |

| 43 |

| President, Asia Pacific Group, Starbucks Coffee International |

| 2004 |

|

|

|

|

|

|

|

Patrick A. Hopf (2) |

| 56 |

| Chairman of Better Life Media, Inc. and President of Symmetry Partners; Former President of St. Paul Venture Capital, Inc. |

| 1991 |

|

|

|

|

|

|

|

Ervin R. Shames (2)(3) |

| 64 |

| Former Chief Executive Officer of Borden, Inc.; Currently a Lecturer at the University of Virginia’s Darden Graduate School of Business and a director of Online Resources Corporation and Choice Hotels International, Inc. |

| 1996 |

9

Directors not standing for election this year whose terms expire in 2007: |

|

| ||||

|

|

|

|

|

|

|

Thomas J. Albani (3) |

| 62 |

| Former President and Chief Executive Officer of Electrolux Corporation |

| 1994 |

|

|

|

|

|

|

|

David T. Kollat (1) |

| 66 |

| President of 22 Inc.; Former Executive Vice President of Marketing for The Limited and former President of Victoria’s Secret Catalogue; Currently a director of Big Lots, Inc., The Limited, Inc. and Wolverine World Wide, Inc. |

| 1994 |

|

|

|

|

|

|

|

William R. McLaughlin |

| 48 |

| Chairman and Chief Executive Officer of Select Comfort Corporation |

| 2000 |

(1) Member of the Audit Committee

(2) Member of the Corporate Governance and Nominating Committee

(3) Member of the Management Development and Compensation Committee

Additional Information about Nominees and Other Directors

Christopher P. Kirchen has served as a member of our Board of Directors since December 1991. Mr. Kirchen is currently Managing General Partner of BEV Capital, a venture capital firm that he co-founded in March 1997. From 1986 to December 2002, he was a General Partner of Consumer Venture Partners, a venture capital firm and a former investor in our company. Mr. Kirchen also serves as a director of several privately held companies.

Brenda J. Lauderback was appointed to our Board of Directors in February 2004. Ms. Lauderback served as President of the Retail and Wholesale Group for the Nine West Group, Inc., a designer and marketer of women’s footwear and accessories, from May 1995 until January 1998. Ms. Lauderback also serves as a director of Big Lots, Inc., Irwin Financial Corporation, Louisiana-Pacific Corporation and Wolverine World Wide, Inc.

Michael A. Peel has served as a member of our Board of Directors since February 2003. Mr. Peel has served as Senior Vice President, Human Resources and Corporate Services of General Mills, Inc., a manufacturer and marketer of packaged consumer foods, since 1991. From 1977 to 1991, Mr. Peel served in various capacities for PepsiCo, Inc., including as Senior Vice President, Human Resources for PepsiCo Worldwide Foods from 1987 to 1991.

Jean-Michel Valette has served as a member of our Board of Directors since October 1994. Mr. Valette is an independent adviser to branded consumer companies. In April 2005 Mr. Valette was named the Chairman (non-executive) of Robert Mondavi Winery and from October 2004 to April 2005 he served as President and Managing Director of Robert Mondavi Winery.

10

Since January 2004 he has served as Chairman of the Board of Directors of Peet’s Coffee and Tea, Inc. From August 1998 to May 2000, Mr. Valette served as President and Chief Executive Officer of Franciscan Estates, Inc., a Napa Valley winery. He was a Managing Director of Hambrecht & Quist LLC, an investment banking firm, from October 1994 to August 1998 and served as a Senior Analyst at Hambrecht & Quist LLC from November 1992 to October 1994. Mr. Valette also serves as a director of The Boston Beer Company.

Christine M. Day was appointed to our Board of Directors in November 2004. Since July 2004, Ms. Day has been the President of Asia Pacific Group, Starbucks Coffee International. Prior to that, she served as Senior Vice President, Starbucks Coffee International. From 1987 to 2003, Ms. Day served in various capacities for Starbucks, including Senior Vice President, North American Finance and Administration; Senior Vice President, North American Strategic Business Systems; and Vice President of Sales and Operations for Starbucks foodservice and licensed concepts division. Ms. Day also serves as a director of Starbucks Coffee Japan Ltd.

Patrick A. Hopf served as Chairman of the Board of Directors from April 1999 to May 2004 and has served as a member of our Board of Directors since December 1991. Mr. Hopf also served as Chairman of our Board of Directors from August 1993 to April 1996. Since September 2003, Mr. Hopf has served as Chairman of Better Life Media, Inc., a privately held media company. Since April 2002, Mr. Hopf has been the President of Symmetry Partners, a venture capital firm. From August 1988 to February 2002, he was President of St. Paul Venture Capital, Inc., a venture capital firm, and from February 2002 to December 2002, he was Executive Vice President of St. Paul Venture Capital, Inc. From August 1988 to January 1999, Mr. Hopf served as Vice President of St. Paul Fire and Marine Insurance Company. Mr. Hopf also serves as a director of several privately held companies.

Ervin R. Shames has served as a member of our Board of Directors since April 1996. From April 1996 to April 1999, Mr. Shames served as Chairman of our Board of Directors. In May 2004, Mr. Shames also assumed the role of Lead Director under our Corporate Governance Principles. Since January 1995, Mr. Shames has served as an independent management consultant to consumer goods and services companies, advising on management and marketing strategy. Since 1996, he has been a Lecturer at the University of Virginia’s Darden Graduate School of Business. From December 1993 to January 1995, he served as the Chief Executive Officer of Borden, Inc. and was President and Chief Operating Officer of Borden, Inc. from July 1993 until December 1993. From June 1990 to June 1992, he was the Chief Executive Officer of Stride Rite Corporation and from June 1992 to July 1993 he was Stride Rite’s Chairman and Chief Executive Officer. From 1967 to 1989, Mr. Shames was employed by General Foods/Altria Companies in varying capacities including the presidencies of General Foods International, General Foods USA and Kraft USA. Mr. Shames serves as a director of Online Resources Corporation, Choice Hotels International, Inc. and several privately held companies

Thomas J. Albani has served as a member of our Board of Directors since February 1994. Mr. Albani served as President and Chief Executive Officer of Electrolux Corporation, a manufacturer of premium floor care machines, from June 1991 to May 1998. From September 1984 to April 1989, he was employed by Allegheny International Inc., a home appliance

11

manufacturing company, in a number of positions, most recently as Executive Vice President and Chief Operating Officer.

David T. Kollat has served as a member of our Board of Directors since February 1994. Dr. Kollat has served as President and Chairman of 22 Inc., a research and consulting company for retailers and consumer goods manufacturers, since 1987. From 1976 until 1987, he served in various capacities for The Limited, a women’s apparel retailer, including Executive Vice President of Marketing and President of Victoria’s Secret Catalogue. Dr. Kollat also serves as a director of Big Lots, Inc., The Limited, Inc. and Wolverine World Wide, Inc.

William R. McLaughlin joined our company in March 2000 as President and Chief Executive Officer and as a member of our Board of Directors. In May 2004, Mr. McLaughlin was also named Chairman of our Board of Directors. From December 1988 to March 2000, Mr. McLaughlin served as an executive of PepsiCo Foods International, Inc., a snack food company and subsidiary of PepsiCo, Inc., in various capacities, including from September 1996 to March 2000 as President of Frito-Lay Europe, Middle East and Africa, and from June 1993 to June 1996 as President of Grupo Gamesa, S.A. de C.V., a cookie and flour company based in Mexico.

Information about the Board of Directors and its Committees

The Board of Directors has determined that each of the following directors is an “independent director” as defined by applicable rules of the National Association of Securities Dealers (“NASD”):

Thomas J. Albani

Christine M. Day

Patrick A. Hopf

Christopher P. Kirchen

David T. Kollat

Brenda J. Lauderback

Michael A. Peel

Ervin R. Shames

Jean-Michel Valette

The Board maintains three standing committees, including an Audit Committee, a Management Development and Compensation Committee and a Corporate Governance and Nominating Committee. The charter for each of these committees is included in the investor relations section of the company’s Web site at selectcomfort.com. Further information regarding each of these committees is included below.

The Board has determined that each member of the three Board committees meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission (“SEC”) and the Internal Revenue Service. The Board of Directors has further determined that two members of the Audit Committee, Jean-Michel Valette

12

and David T. Kollat, meet the definition of “audit committee financial expert” as set forth in Item 401(h) of Regulation S-K promulgated by the SEC.

The Board of Directors met in person four times during fiscal 2004. The Audit Committee met in person or by telephone conference 10 times during fiscal 2004 and took action by written consent on one occasion during fiscal 2004. The Management Development and Compensation Committee met in person or by telephone conference six times and took action by written consent on four occasions during fiscal 2004. The Corporate Governance and Nominating Committee met in person or by telephone conference six times during fiscal 2004. All of the directors attended 75% or more of the meetings of the Board and all committees on which they served during fiscal 2004.

Audit Committee. The Audit Committee is comprised entirely of independent directors, currently including Jean-Michel Valette (Chair), Christopher P. Kirchen and David T. Kollat. The Audit Committee provides assistance to the Board in satisfying its fiduciary responsibilities relating to accounting, auditing, operating and reporting practices of our company. The Audit Committee is responsible for providing independent, objective oversight with respect to our company’s accounting and financial reporting functions, internal and external audit functions, and systems of internal controls regarding financial matters and legal, ethical and regulatory compliance. The responsibilities and functions of the Audit Committee are further described in the Audit Committee Report on page 32 of this Proxy Statement.

Management Development and Compensation Committee. The Management Development and Compensation Committee is comprised entirely of independent directors, currently including Michael A. Peel (Chair), Thomas J. Albani, Christine M. Day and Ervin R. Shames. The principal function of the Management Development and Compensation Committee is to discharge the responsibilities of the Board relating to compensation of the company’s executive officers. The responsibilities and functions of the Management Development and Compensation Committee are further described in the Compensation Committee Report on Executive Compensation beginning on page 27 of this Proxy Statement.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee is comprised entirely of independent directors, currently including Ervin R. Shames (Chair), Patrick A. Hopf and Brenda J. Lauderback. The primary functions of the Corporate Governance and Nominating Committee are to:

• Develop and recommend to the Board corporate governance principles to govern the Board, its committees, and our executive officers and employees in the conduct of the business and affairs of our company;

• Identify and recommend to the Board individuals qualified to become members of the Board and its committees; and

• Develop and oversee the annual Board and Board committee evaluation process.

13

14

Shareholder Communications with the Board

Shareholders may communicate with the Board of Directors, its Committees or any individual member of the Board of Directors by sending a written communication to our Corporate Secretary at 6105 Trenton Lane North, Minneapolis, MN 55442. The Corporate Secretary will promptly forward any communication so received to the Board, any Committee of the Board or any individual Board member specifically addressed in the communication. In addition, if any shareholder or other person has a concern regarding any accounting, internal control or auditing matter, the matter may be brought to the attention of the Audit Committee, confidentially and anonymously, by calling 1-800-835-5870, inserting the I.D. Code of AUDIT (28348) and following the prompts from the recorded message. The company reserves the right to revise this policy in the event that the process is abused, becomes unworkable or otherwise does not efficiently serve the purposes of the policy.

Policy Regarding Director Attendance at Annual Meeting

Our policy is to require attendance of all of our directors at our annual meeting of shareholders, except for absences due to causes beyond the reasonable control of the director. Nine of the 10 directors then serving on our Board of Directors were in attendance at our 2004 annual meeting of shareholders.

15

Corporate Governance Principles

Our Board of Directors has adopted Corporate Governance Principles that were originally developed and recommended by the Corporate Governance and Nominating Committee. These Corporate Governance Principles are available in the investor relations section of the company’s Web site at selectcomfort.com. Among these Corporate Governance Principles are the following:

Independence. A substantial majority of the members of the Board should be independent, non-employee directors. It is the responsibility of the Board to establish the standards for independence. At a minimum, however, the Board will conform with the independence requirements applicable to Nasdaq National Market issuers. Currently, nine of our 10 directors are independent. All Committees of the Board shall be composed entirely of independent directors.

Chairman and CEO Positions. At the present time, the Board believes that it is in the best interests of the Company and its stakeholders for the positions of Chairman and CEO to be combined and held by William R. McLaughlin, who has served as the President and CEO of the Company since March of 2000. The Board retains the right to review this determination and to either continue to maintain these positions as combined positions or to separate the positions, as the Board determines to be in the best interests of the company at the time. During any period in which the positions of Chairman and CEO are combined, the Board will appoint a Lead Director from among the independent members of the Board, who will have the responsibilities described below.

Lead Director – Role and Responsibilities. In addition to the regular duties and responsibilities applicable to all Board members, the Lead Director is responsible to:

• Provide guidance to the Chair regarding the Board meeting schedule, seeking to ensure that independent directors can perform their duties responsibly and efficiently while not interfering with the flow of company operations;

• Provide guidance to the Chair regarding the agendas for Board and Committee meetings;

• In consultation with the Corporate Governance and Nominating Committee, advise the Chair regarding the composition of the various Board Committees, as well as the selection of Committee chairs;

• Advise the Chair as to the quality, quantity and timeliness of the flow of information from company management that is necessary for the independent directors to effectively and responsibly perform their duties; although company management is responsible for the preparation of materials for the Board, the Lead Director may specifically request the inclusion of certain material;

16

• Coordinate, develop the agenda for and moderate the executive sessions of the Board’s independent directors; and

• Act as principal liaison between the independent directors and the Chair on sensitive issues.

Classified Board Structure. Our Articles of Incorporation provide for a classified Board serving staggered terms of three years each. The Board will periodically review its classified Board structure in the context of other provisions and measures applicable to unsolicited takeover proposals with the objective of positioning the Board and the company to maximize the long-term value of the company for all shareholders.

Term Limits. To ensure an appropriate balance between new perspectives and experienced directors, it will be customary for non-employee directors to serve no more than 15 years. In exceptional cases, a director who has served 15 years may possess skills or experiences that are highly difficult to replace. In such cases, the term limits may be waived by a two-thirds vote of the Board. This waiver is required each time the director stands for re-election and, at such time, the Board will make a determination as to whether the director should be categorized as an independent director. No non-employee director shall stand for re-election after he or she reaches the age of 72.

Change in Responsibilities. The Board does not believe that Directors who retire or who have a change in their principal employment or affiliation after joining the Board should necessarily leave the Board. There should, however, be an opportunity for the Board, through the Corporate Governance and Nominating Committee, to review the qualifications of the director for continued Board membership. Any Director who undergoes a material change in principal employment or affiliation is required to promptly notify the Chair of the Corporate Governance and Nominating Committee of the change.

Other Board or Audit Committee Service. The Board recognizes that service on other boards can in some circumstances limit the time that Directors may have to devote to fulfilling their responsibilities to the company. It is the Board’s guideline that no Director serve on more than a total of six (6) public company boards, and that no member of the company’s Audit Committee shall serve on more than a total of three (3) public company audit committees. If any Director exceeds or proposes to exceed these guidelines, the Director is required to promptly notify the Chair of the Corporate Governance and Nominating Committee and the Committee will review the facts and circumstances and determine whether such service would interfere with the Director’s ability to devote sufficient time to fulfilling the Director’s responsibilities to the company.

CEO Service on Other Boards. The CEO shall not serve on more than two (2) public company boards other than the Board of Directors of the company.

Board and Committee Evaluations. The Board believes that the company’s governance and the Board’s effectiveness can be continually improved through evaluation of both the Board as a whole and its committees. The Corporate Governance and Nominating Committee is responsible

17

for annually evaluating effectiveness in these areas and reviewing the results and recommendations for improvement with the full Board.

Board Executive Sessions. Executive sessions or meetings of independent directors without management present will be held at least twice each year. At least one session will be to review the performance criteria applicable to the CEO and other senior managers, the performance of the CEO against such criteria, and the compensation of the CEO and other senior managers. Additional executive sessions or meetings of outside directors may be held from time to time as required. The Board’s practice has been to meet in executive session for a portion of each regularly scheduled meeting of the Board. Any member of the Board may request at any time an executive session without the presence of management.

Paid Consulting Arrangements. The Board believes that the company should not enter into paid consulting arrangements with independent directors.

Board Compensation. Board compensation should encourage alignment with shareholders’ interests and should be at a level equitable to comparable companies. The Management Development and Compensation Committee is responsible for periodic assessments to assure these standards are being met.

Share Ownership Guidelines for Executive Officers and Directors. The Board has established the stock ownership guidelines described below for executive officers and directors. For purposes of these guidelines, stock ownership includes the fair market value of (1) all shares of common stock owned outright without restrictions on transfer and (2) vested stock options after taxes at an estimated effective tax rate of 40%. The fair market value of stock options shall mean the then-current market price less the exercise price.

Executive Officer Ownership Guidelines. Within three years of joining the company, the Chief Executive Officer is expected to achieve and maintain stock ownership equal to six (6) times the CEO’s base salary and each of the other executive officers is expected to achieve and maintain stock ownership equal to three (3) times the executive officer’s base salary.

Conflicts of Interest. Directors are expected to avoid any action, position or interest that conflicts with an interest of the company, or that gives the appearance of a conflict. If any

18

member of the Board becomes aware of any such conflicting or potentially conflicting interest involving any member of the Board, the director should immediately bring such information to the attention of the Chairman of the Board, the Chief Executive Officer and the General Counsel of the company.

Performance Goals and Evaluation. The Management Development and Compensation Committee is responsible for establishing the procedures for setting annual and long-term performance goals for the Chief Executive Officer and for the evaluation by the full Board of his or her performance against such goals. The Committee meets at least annually with the Chief Executive Officer to receive his or her recommendations concerning such goals. Both the annual goals and the annual performance evaluation of the Chief Executive Officer are reviewed and discussed by the outside directors at a meeting or executive session of that group. The Committee is also responsible for setting annual and long-term performance goals and compensation for the direct reports to the CEO. These decisions are approved by the outside directors at a meeting or executive session of that group.

Compensation Philosophy. The Board supports and, through the Management Development and Compensation Committee, oversees employee compensation programs that are closely linked to business performance and emphasize equity ownership.

Senior Management Depth and Development. The CEO reports to the Board, at least annually, on senior management depth and development, including a discussion of assessments, leadership development plans and other relevant factors.

Provisions Applicable to Unsolicited Takeover Attempts or Proposals. The Board will periodically review (not less often than every three years) the company’s Articles of Incorporation and Bylaws and various provisions that are designed to maximize shareholder value in the event of an unsolicited takeover attempt or proposal. Such review includes consideration of matters such as the company’s state of incorporation, whether the company should opt in or out of applicable control share acquisition or business combination statutes, and provisions such as the company’s classified Board structure. The objective of this review is to maintain a proper balance of provisions that will not deter bona fide proposals from coming before the Board, and that will position the Board and the company to maximize the long-term value of the company for all shareholders.

Shareholder Approval of Equity-Based Compensation Plans. Shareholder approval will be sought for all equity-based compensation plans.

Code of Conduct

We have developed and circulated to all of our employees a Code of Business Conduct addressing legal and ethical issues that may be encountered by our employees in the conduct of our business. Among other things, the Code of Business Conduct requires that our employees comply with applicable laws, engage in ethical and safe conduct in our work environment, avoid conflicts of interests, conduct our business with integrity and high ethical standards, and

19

safeguard our company’s assets. A copy of the Code of Conduct is included in the investor relations section of our Web site at selectcomfort.com.

Employees are required to report any conduct that they believe in good faith violates our Code of Business Conduct. The Code of Business Conduct also sets forth procedures under which employees or others may report through our management team and, ultimately, directly to our Audit Committee (confidentially and anonymously, if so desired) any questions or concerns regarding accounting, internal accounting controls or auditing matters.

All of our employees are required to certify annually their commitment to abide by our Code of Business Conduct. We also provide training in key areas covered by the Code of Business Conduct to help our employees to comply with their obligations.

Annual Retainer. All of our non-employee directors receive an annual cash retainer of $25,000, each committee chair receives additional compensation of $5,000 per year and each member of the Audit Committee receives additional compensation of $5,000 per year.

Stock Options. Each non-employee director is eligible to receive, as of the date that the director first begins to serve on the Board, an initial grant of options to purchase 7,500 shares of our common stock. These initial options become exercisable one year after the date of grant, so long as the director remains a director of our company. In addition, each of our non-employee directors is eligible for an annual grant, coincident with the annual meeting of shareholders, of options to purchase 7,500 shares of our common stock. These annual options become exercisable one year after the date of grant, so long as the director remains a director of our company. All options granted to directors have an exercise price equal to the fair market value of our common stock on the date of grant and remain exercisable for a period of up to 10 years, subject to continuous service on our Board of Directors.

Reimbursement of Expenses. All of our directors are reimbursed for travel expenses for attending meetings of our Board or any Board committee.

No Director Compensation for Employee Directors. Any director who is also an employee of our company does not receive additional compensation for service as a director.

20

EXECUTIVE COMPENSATION AND OTHER BENEFITS

Summary of Cash and Certain Other Compensation

The following table provides summary information concerning cash and non-cash compensation paid to or earned by the Chief Executive Officer and the four most highly compensated executive officers other than the Chief Executive Officer serving as executive officers at the end of 2004 (the “Named Executive Officers”).

Summary Compensation Table

|

|

|

|

|

| Long-Term Compensation |

|

|

| ||||||||

|

|

|

| Annual Compensation |

| Restricted |

| Securities |

| All Other |

| ||||||

Name and Principal Position |

| Year |

| Salary($) |

| Bonus($) |

| Awards ($) |

| Options(#) |

| ($)(1) |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

William R. McLaughlin |

| 2004 |

| $ | 600,000 |

| $ | 182,135 | (2) | $ | 621,500 | (3) | 75,000 |

| $ | 13,200 |

|

President and Chief Executive Officer |

| 2003 |

| 500,000 |

| 718,738 |

| — |

| 50,000 |

| 6,000 |

| ||||

|

| 2002 |

| 500,000 |

| 937,500 |

| — |

| 250,000 |

| 1,462 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Noel F. Schenker (4) |

| 2004 |

| 273,000 |

| 61,336 | (2) | — |

| 20,000 |

| 10,350 |

| ||||

Senior Vice President, Marketing and |

| 2003 |

| 260,000 |

| 273,084 |

| 223,750 | (5) | 30,000 |

| 8,485 |

| ||||

New Business Development |

| 2002 |

| 250,000 |

| 281,250 |

| — |

| 50,000 |

| 2,924 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Keith C. Spurgeon (6) |

| 2004 |

| 268,000 |

| 60,229 | (2) | — |

| 20,000 |

| 8,760 |

| ||||

Senior Vice President, Sales |

| 2003 |

| 256,250 |

| 269,504 |

| — |

| 30,000 |

| 8,475 |

| ||||

|

| 2002 |

| 206,731 |

| 237,981 |

| — |

| 100,000 |

| 165,930 | (7) | ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

James C. Raabe |

| 2004 |

| 220,000 |

| 49,025 | (2) | 124,300 | (8) | 20,000 |

| 8,200 |

| ||||

Senior Vice President and Chief |

| 2003 |

| 186,250 |

| 195,714 |

| — |

| 25,000 |

| 6,925 |

| ||||

Financial Officer |

| 2002 |

| 180,000 |

| 201,958 |

| — |

| 50,000 |

| 3,038 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Mark A. Kimball |

| 2004 |

| 215,000 |

| 48,326 | (2) | — |

| 20,000 |

| 8,200 |

| ||||

Senior Vice President, Legal, General |

| 2003 |

| 206,000 |

| 216,558 |

| — |

| 22,500 |

| 6,000 |

| ||||

Counsel and Secretary |

| 2002 |

| 200,000 |

| 225,000 |

| — |

| 50,000 |

| 2,423 |

| ||||

(1) Except as noted, the amounts disclosed for each individual represent our contributions to the accounts of the named individuals in our 401(k) defined contribution plan and/or fees paid for tax or financial services.

(2) Represents bonuses earned in 2004, the payment of which occurred in February 2005.

(3) The aggregate value of restricted stock holdings was $621,500 based on 25,000 shares.

(4) Ms. Schenker resigned from the company effective as of March 17, 2005.

(5) The aggregate value of restricted stock holdings was $223,750 based on 25,000 shares.

(6) Mr. Spurgeon joined Select Comfort on February 25, 2002.

(7) Includes reimbursement of Mr. Spurgeon’s relocation expenses totaling $163,218.

(8) The aggregate value of restricted stock holdings was $124,300 based on 5,000 shares.

21

The following table summarizes option grants during the fiscal year ended January 1, 2005 to the Named Executive Officers.

Option Grants in Last Fiscal Year

|

| Individual Grants (1) |

|

|

|

|

| |||||||||

|

| Number of |

| Percent of |

| Exercise |

| Expiration |

| Potential Realizable Value |

| |||||

Name |

| Granted (#) |

| Year |

| ($/Sh) |

| Date |

| 5% |

| 10% |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

William R. McLaughlin |

| 75,000 | (3) | 12.7 | % | $ | 24.86 |

| 02/12/14 |

| $ | 1,172,574 |

| $ | 2,971,533 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Noel F. Schenker |

| 20,000 | (3) | 3.4 | % | 24.86 |

| 02/12/14 |

| 312,686 |

| 792,409 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Keith C. Spurgeon |

| 20,000 | (3) | 3.4 | % | 24.86 |

| 02/12/14 |

| 312,686 |

| 792,409 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

James C. Raabe |

| 20,000 | (3) | 3.4 | % | 24.86 |

| 02/12/14 |

| 312,686 |

| 792,409 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Mark A. Kimball |

| 20,000 | (3) | 3.4 | % | 24.86 |

| 02/12/14 |

| 312,686 |

| 792,409 |

| |||

(1) All of the options granted to the Named Executive Officers were granted under our 1997 Stock Incentive Plan.

(2) In accordance with the rules of the Securities and Exchange Commission, the amounts shown on this table represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date and do not reflect our estimates or projections of future common stock prices. The gains shown are net of the option price, but do not include deductions for taxes or other expenses associated with the exercise. Actual gains, if any, on stock option exercises will depend upon the future performance of the common stock, the executive’s continued employment with our company or our subsidiaries and the date on which the options are exercised. The amounts represented in this table might not necessarily be achieved.

(3) These options become exercisable in as nearly equal as possible annual installments on each of the first three anniversaries of the date of grant, so long as the executive remains employed by our company or one of our subsidiaries at that date. To the extent not already exercisable, these options become immediately exercisable in full upon certain changes in control of our company and remain exercisable for the remainder of their term.

22

The following table summarizes option exercises during the fiscal year ended January 1, 2005 and the number of securities underlying unexercised options and the value of unexercised in-the-money options at January 1, 2005:

Aggregated Option Exercises In

Last Fiscal Year and Fiscal Year-End Option Values

|

| Shares |

| Value |

| Number of Securities |

| Value of Unexercised |

| |||||||

Name |

| Exercise (#) |

| ($)(1) |

| Exercisable |

| Unexercisable |

| Exercisable |

| Unexercisable |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

William R. McLaughlin |

| 96,995 |

| $ | 2,238,137 |

| 923,228 |

| 265,277 |

| $ | 13,051,649 |

| $ | 2,206,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Noel F. Schenker |

| 84,921 |

| 2,001,565 |

| 81,278 |

| 41,389 |

| 1,216,214 |

| 198,927 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Keith C. Spurgeon |

| — |

| — |

| 70,833 |

| 44,167 |

| 989,837 |

| 239,513 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

James C. Raabe |

| 17,000 |

| 365,730 |

| 192,445 |

| 38,055 |

| 2,510,068 |

| 169,287 |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Mark A. Kimball |

| 28,000 |

| 592,406 |

| 275,665 |

| 36,389 |

| 2,794,578 |

| 154,477 |

| |||

(1) Value based on the difference between the fair market value of one share of common stock on the date of exercise and the exercise price of the option.

(2) Value based on the difference between the fair market value of one share of common stock at December 31, 2004 ($17.94) and the exercise price of the options ranging from $1.00 to $24.86 per share. Options are in-the-money if the market price of the shares exceeds the option exercise price.

23

Equity Compensation Plan Information

The following table summarizes information about our equity compensation plans as of January 1, 2005.

Plan Category |

| Number of shares to |

| Weighted-average |

| Number of shares |

| |

|

|

|

|

|

|

|

| |

Equity compensation plans approved by security holders (1) |

| 5,898,577 |

| $ | 7.31 |

| 2,890,500 |

|

|

|

|

|

|

|

|

| |

Equity compensation plans not approved by security holders |

| None |

| Not applicable |

| None |

| |

|

|

|

|

|

|

|

|

|

Total |

| 5,898,577 |

| $ | 7.31 |

| 2,890,500 |

|

(1) Includes the Select Comfort Corporation 1990 Omnibus Stock Option Plan, the Select Comfort Corporation 1997 Stock Incentive Plan and the Select Comfort Corporation 2004 Stock Incentive Plan.

William R. McLaughlin. We have entered into a letter agreement with William R. McLaughlin pursuant to which he serves as President and Chief Executive Officer. Mr. McLaughlin receives a base salary and is entitled to participate in our incentive compensation plans. Upon involuntary termination of Mr. McLaughlin’s employment by the Board or constructive dismissal, Mr. McLaughlin is entitled to one year’s salary as severance. Upon an involuntary termination or constructive dismissal of Mr. McLaughlin’s employment following a change in control of our company, Mr. McLaughlin would be entitled to two years’ salary as severance compensation and his stock options would become fully vested.

Noel F. Schenker. We entered into a letter agreement with Noel F. Schenker pursuant to which she served as Senior Vice President, Marketing and New Business Development until her resignation from the company effective as of March 17, 2005.

Keith C. Spurgeon. We have entered into a letter agreement with Keith C. Spurgeon pursuant to which he serves as Senior Vice President of Sales. Mr. Spurgeon’s receives a base salary and is entitled to participate in our incentive compensation plans. Upon the involuntary termination of Mr. Spurgeon’s employment following a change in control, a termination without cause or a constructive dismissal, Mr. Spurgeon is entitled to one year’s salary as severance.

24

Mark A. Kimball. We have entered into a letter agreement with Mark A. Kimball pursuant to which he serves as Senior Vice President, General Counsel and Secretary. Mr. Kimball receives a base salary and is entitled to participate in our incentive compensation plans. Upon termination of Mr. Kimball’s employment without cause, Mr. Kimball is entitled to one year’s salary as severance compensation.

Change in Control Arrangements

Under our company’s 1990 Omnibus Stock Option Plan (the “1990 Plan”), 1997 Stock Incentive Plan (the “1997 Plan”) and 2004 Stock Incentive Plan (the “2004 Plan”), if a “change in control” of our company occurs, then, unless the Compensation Committee decides otherwise either at the time of grant of an incentive award or at any time thereafter, all outstanding options will become immediately exercisable in full and will remain exercisable for the remainder of their terms, regardless of whether the participant to whom such options have been granted remains in the employ or service of our company or any subsidiary.

In addition, under the 1997 Plan and the 2004 Plan, if a “change in control” of our company occurs, then, unless the Compensation Committee decides otherwise either at the time of grant of an incentive award or at any time thereafter:

• All outstanding stock appreciation rights will become immediately exercisable in full and will remain exercisable for the remainder of their terms, regardless of whether the participant to whom such stock appreciation rights have been granted remains in the employ or service of our company or any subsidiary;

• All outstanding restricted stock awards will become immediately fully vested and non-forfeitable; and

• All outstanding performance units, stock bonuses and performance stock awards will vest and/or continue to vest in the manner determined by the Compensation Committee and set forth in the agreement evidencing such performance units or stock bonuses.

There are presently no outstanding stock appreciation rights, performance units or stock bonuses.

In addition, the Compensation Committee may pay cash for all or a portion of the outstanding options. The amount of cash the participants would receive will equal (a) the fair market value of such shares immediately prior to the change in control minus (b) the exercise price per share and any required tax withholding. The acceleration of the exercisability of options under the 1990 and 1997 Plans may be limited, however, if the acceleration would be subject to an excise tax imposed upon “excess parachute payments.”

Under the 1990 Plan, the 1997 Plan and the 2004 Plan, a “change in control” will include any of the following:

• The sale, lease, exchange or other transfer of all or substantially all of the assets of our company to a corporation not controlled by our company;

25

• The approval by our shareholders of a plan or proposal for the liquidation or dissolution of our company;

• Any change in control that is required by the Securities and Exchange Commission to be reported;

• Any person who was not a shareholder of our company on the effective date of the Plan becomes the beneficial owner of 50% or more of the voting power of our company’s outstanding common stock; or

• The “continuity” directors (directors as of the effective date of the Plan and their future nominees) ceasing to constitute a majority of the Board of Directors.

Notwithstanding anything in the foregoing to the contrary, solely for purposes of options granted under the 1990 Plan or the 1997 Plan prior to July 27, 1999, no change in control will be deemed to have occurred by virtue of any transaction which was approved by the affirmative vote of at least a majority of the “continuity” directors, as defined above. For options granted on or after July 27, 1999, each of the transactions constituting a change in control as defined above will constitute a change in control for purposes of the plans regardless of whether the transaction was approved by the continuity directors.

26

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Responsibilities of the Compensation Committee

The Management Development and Compensation Committee of the Board of Directors (the “Committee”) is comprised entirely of independent, non-employee directors. The primary purpose of the Committee is to discharge the responsibilities of our Board relating to the compensation and development of our executive officers. The responsibilities of the Committee include:

• Establishing corporate goals and objectives with respect to compensation for our Chief Executive Officer and other executive officers;

• Reviewing and approving salaries and other compensation applicable to our Chief Executive Officer and other executive officers;

• Administering our incentive compensation plans applicable to executive officers;

• Administering our long-term incentive and stock purchase plans applicable to all employees; and

• Reviewing our management development progress, organizational structure, succession for key leadership positions and overall talent depth to support the company’s future growth.

The decisions of the Committee and our compensation programs are based on the following principles:

• As a performance-driven growth company, we favor variable compensation tied to results and achievement over fixed compensation.

• As a growth company, we need to attract, retain and motivate executives and key employees with the capability to enable us to achieve significantly greater scale. We therefore benchmark our compensation against companies with revenue levels of the same size and larger.

• We seek to reward achievement of aggressive performance objectives that are aligned with the interests of our shareholders. Our incentive compensation programs are designed to provide significant earnings potential as aggressive performance targets are met or surpassed.

• We target base compensation at the 50th percentile with the opportunity to earn total compensation above the market median when business performance exceeds the company’s aggressive plan targets.

27

• Significant differentiation can occur in long-term equity awards as we seek to recognize performance and potential. Individual differentiation in compensation based on performance is also achieved by the size of merit increases granted.

In discharging its responsibilities, the Committee considers factors such as our company’s performance, both in isolation and in comparison to other companies; the individual performance of our executive officers; historical compensation levels; the overall competitive environment for executive talent; and the level of compensation necessary to attract and retain the talent necessary to achieve our objectives. The Committee places primary emphasis on our company’s performance (rather than individual performance) as measured against goals approved by the Committee. In analyzing these factors, the Committee from time to time reviews competitive compensation data gathered in comparative surveys or collected by independent consultants.

Executive Compensation Program Elements

Our executive compensation program is comprised of base salary, annual cash incentive compensation, and long-term equity-based incentive compensation.

Base Salary. The Committee’s determinations regarding the base salary of our executive officers, including the compensation of our Chief Executive Officer, are based on a number of factors, including: the level of skill and responsibility required to fulfill each executive’s responsibilities; each executive’s experience and qualifications; each executive’s performance and the impact of such performance on our results; and competitive compensation data. Base salaries are reviewed annually, and the Committee seeks to set executive officer base salaries at approximately the 50th percentile of base salaries at the companies with which we compete for executives.

Annual Incentive Compensation. We provide annual cash incentive compensation for executive officers and other employees under our Executive and Key Employee Incentive Plan. This plan is designed to provide a direct financial incentive to our executive officers and other employees for achievement of specific performance goals of our company. Consistent with the requirements of this plan, at the beginning of each fiscal year, the Committee determines:

• The employees by grade level that are eligible to participate in the plan for the year;

• The quarterly and/or annual performance goal or goals for the year (from among sales growth and volume, net operating profit, cash flow, earnings per share, return on capital, and/or return on assets);

• For each eligible employee, (A) the target bonus level as a percentage of base compensation, (B) the portion of the target bonus level that is based on achievement of objective company performance goals, and (C) the portion of the target bonus level, if any, that is based on achievement of objective individual performance goals; and

28

• The range of actual bonus payment levels, expressed as percentages of the target bonus levels, to be paid based on various levels of achievement of the performance goal or goals for the year.

For each of the fiscal years 2002 through 2004, the Committee established company-wide net operating profit as the exclusive performance goal for determining annual incentive compensation for executive officers and no portion of the target bonus level has been based on individual performance targets. For 2005, the Committee has maintained company-wide net operating profit as the primary performance goal and has added company-wide unit sales growth as a secondary performance goal.

The target bonus level for the CEO has been set at 75% of base salary for each year since 2002. The target bonus level for Senior Vice Presidents has been set at 55% of base salary for each year since 2003. The actual bonus payment may range from 0% to 250% of the target bonus level, depending on the level of achievement versus the performance goals. For 2004, the company achieved a net operating profit level resulting in payments at 41% of the target bonus levels described above.

Long-Term Incentive Compensation. We make long-term incentive compensation available to our executive officers, as well as to many other of our employees, in the form of stock options, restricted stock awards and performance stock awards. Through the grant of these equity incentives, we seek to align the long-term interests of our executives and other employees with the long-term interests of our shareholders by creating a strong and direct linkage between compensation and shareholder return. We further seek to enable executives and other key employees to achieve significant ownership in our company, thereby improving our ability to retain executives and other key employees. Executive officers and other employees are eligible for equity-based grants upon joining the company and thereafter on an annual basis. The total size of our annual equity-based incentive awards is reviewed against benchmark data. Individual awards are based on levels of responsibility and potential impact on our results, individual performance and benchmark data.

In the past, stock option grants have been the primary form of equity-based incentives granted to our executives and other key employees. In 2003 and 2004, we began to grant restricted stock awards to certain executives and other key employees for retention and recognition purposes and to further align the interests of these employees with those of our shareholders. In 2005, we began to grant performance stock awards to executive officers, vice presidents and director-level employees, with the mix of annual awards for these employees targeted at 75% in the form of stock options and 25% in the form of performance stock awards. Key employees below the director level will receive equity compensation grants exclusively in the form of restricted stock.

All stock option grants have an exercise price equal to 100% of the fair market value of the common stock on the date of grant. In the past, stock option grants have typically become exercisable over a period of three years from the date of grant. Beginning in 2005, new stock option grants will become exercisable over a period of four years in equal annual increments. Stock options typically remain exercisable for a period of 10 years from the date of grant, so long as the individual continues to be employed by us.

29

Restricted stock awards represent full share grants that become fully vested and owned by the employee free of restrictions only at the end of four years from the date of grant.

The performance stock awards are essentially similar to restricted stock awards, with the number of shares that may ultimately vest to the employee determined on the basis of the company’s performance against net operating profit targets in the year of grant. The number of shares may be increased by up to 50% for above-plan performance and may be decreased by 50% or greater for below-plan performance. In addition, in the discretion of the Committee, a performance stock award may be reduced to zero shares in the event of below-plan performance. As with restricted stock awards, the performance stock awards become fully vested in the employee only at the end of four years from the date of grant.

Further information regarding equity-based incentive awards is included in the tables on pages 22 and 23 of this Proxy Statement.

Chief Executive Officer Compensation and Performance

The compensation for William R. McLaughlin, our President and Chief Executive Officer, consists of an annual base salary, annual cash incentive compensation and long-term equity-based incentive compensation. The Committee determines the level for each of these compensation elements using methods consistent with those used for the company’s other senior executives, including the assessment of Mr. McLaughlin’s performance and review of competitive benchmark data. The Committee evaluates Mr. McLaughlin’s performance by soliciting input from all members of the Board as well as other members of the senior management team. The Board also assesses Mr. McLaughlin’s performance against objectives in a variety of areas, including growth, profitability, product innovation, advancement of strategic initiatives, organizational development and investor relations.

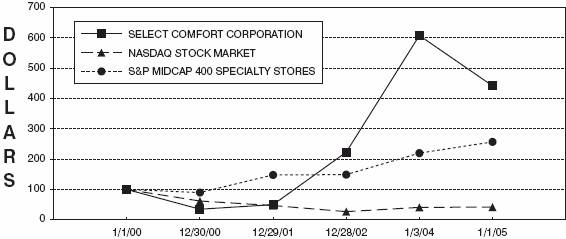

For 2005, the Committee approved an increase in Mr. McLaughlin’s base salary to $625,000, maintained his target bonus level at 75% of base salary and granted to Mr. McLaughlin 75,000 stock options and 12,500 shares under a performance stock award. The Committee believes that these compensation elements are commensurate with Mr. McLaughlin’s performance for the most recent fiscal year and well-aligned with competitive benchmarks.