Regal Investor Day 2020 March 3, 2020 CREATING A BETTER TOMORROW™… ©2020 Regal Beloit Corporation, Proprietary and Confidential

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 2

INVESTOR DAY CAUTIONARY STATEMENT The following is a cautionary statement made under the Private Securities Litigation Reform Act of 1995: factors that we cannot control; product liability and other litigation, or claims by end users, government With the exception of historical facts, the statements contained in this presentation may be forward-looking agencies or others that our products or our customers’ applications failed to perform as anticipated, statements. Forward-looking statements represent our management’s judgment regarding future events. In particularly in high volume applications or where such failures are alleged to be the cause of property or many cases, you can identify forward-looking statements by terminology such as “may,” “will,” “expect,” casualty claims; our overall debt levels and our ability to repay principal and interest on our outstanding “intend,” “estimate,” “forecast,” “anticipate,” “believe,” “should,” “project” or “plan” or the negative of debt; changes in the method of determining and/or the replacement of LIBOR; unanticipated liabilities of these terms or other similar words. These forward-looking statements are not guarantees of future acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; performance and are subject to risks, uncertainties, assumptions and other factors, some of which are unanticipated costs or expenses we may incur related to product warranty issues; our dependence on key beyond our control, which could cause actual results to differ materially from those expressed or implied by suppliers and the potential effects of supply disruptions; infringement of our intellectual property by third such forward-looking statements, including but not limited to: uncertainties regarding our ability to execute parties, challenges to our intellectual property, and claims of infringement by us of third party technologies; our restructuring plans within expected costs and timing; actions taken by our competitors and our ability to losses from failures, breaches, attacks or disclosures involving our information technology infrastructure and effectively compete in the increasingly competitive global electric motor, drives and controls, power data; cyclical downturns affecting the global market for capital goods; and other risks and uncertainties generation and power transmission industries; our ability to develop new products based on technological including but not limited to those described in “Item 1A-Risk Factors” of the Company’s Annual Report on innovation, such as the Internet of Things, and marketplace acceptance of new and existing products, Form 10-K filed with the U.S. Securities and Exchange Commission on February 26, 2019 and from time to including products related to technology not yet adopted or utilized in certain geographic locations in which time in other filed reports. All subsequent written and oral forward-looking statements attributable to us or we do business; fluctuations in commodity prices and raw material costs; our dependence on significant to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary customers; risks associated with global manufacturing, including risks associated with public health crises; statements. The forward-looking statements included in this presentation are made only as of their issues and costs arising from the integration of acquired companies and businesses and the timing and respective dates, and we undertake no obligation to update these statements to reflect subsequent events impact of purchase accounting adjustments; effects on earnings of any significant impairment of goodwill or or circumstances. intangible assets; prolonged declines in one or more markets we serve, such as heating, ventilation, air conditioning, refrigeration, power generation, oil and gas, unit material handling or water heating; economic changes in global markets where we do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external ©2020 Regal Beloit Corporation 3

INVESTOR DAY NON-GAAP FINANCIAL MEASURES We prepare financial statements in accordance with accounting principles generally accepted percentage of adjusted net income attributable to Regal Beloit Corporation, adjusted income in the United States (“GAAP”). We also periodically disclose certain financial measures in our before taxes, adjusted provision for income taxes, adjusted effective tax rate, net sales from quarterly earnings releases, on investor conference calls, and in investor presentations and ongoing business, adjusted income from operations of ongoing business, ongoing business similar events that may be considered “non-GAAP” financial measures. This additional adjusted operating margin and adjusted diluted earnings per share for ongoing business are information is not meant to be considered in isolation or as a substitute for our results of primarily used to help us evaluate our business and forecast our future results. Accordingly, we operations prepared and presented in accordance with GAAP. believe disclosing and reconciling each of these measures helps investors evaluate our business in the same manner as management. In this presentation, we disclose the following non-GAAP financial measures, and we reconcile these measures in the tables below to the most directly comparable GAAP financial measures: In addition to these non-GAAP measures, we also use the term “organic sales” to refer to GAAP adjusted diluted earnings per share (both historical and projected), adjusted income from sales from existing operations excluding any sales from acquired businesses recorded prior to operations, adjusted operating margin, adjusted net sales, net debt, adjusted EBITDA, adjusted the first anniversary of the acquisition (“net sales from business acquired") and excluding any operating leverage, adjusted net income attributable to Regal Beloit Corporation, free cash sales from business divested/to be exited (“net sales from business divested/to be exited“) flow, free cash flow as a percentage of adjusted net income attributable to Regal Beloit recorded prior to the first anniversary of the exit and excluding the impact of foreign currency Corporation, adjusted income before taxes, adjusted provision for income taxes, adjusted translation. The impact of foreign currency translation is determined by translating the effective tax rate, net sales from ongoing business, adjusted income from operations of respective period’s organic sales using the currency exchange rates that were in effect during ongoing business, ongoing business adjusted operating margin, and adjusted diluted earnings the prior year periods. We use the term “organic sales growth” to refer to the increase in our per share for ongoing business. We believe that these non-GAAP financial measures are useful sales between periods that is attributable to organic sales. For further clarification, we may use measures for providing investors with additional information regarding our results of the term “acquisition growth” to refer to the increase in our sales between periods that is operations and for helping investors understand and compare our operating results across attributable to acquisition sales. accounting periods and compared to our peers. Our management primarily uses adjusted income from operations, adjusted operating income, adjusted operating margin, and adjusted operating leverage to help us manage and evaluate our business and make operating decisions, while adjusted diluted earnings per share, net debt, adjusted EBITDA, adjusted net sales, adjusted net income attributable to Regal Beloit Corporation, free cash flow, free cash flow as a ©2020 Regal Beloit Corporation 4

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 5

STRATEGIC OVERVIEW WHY INVEST IN REGAL o Growth From Energy Efficiency, Electrification and Digital Connectivity o Leading Brands, Installed Base, and Differentiated Technology o Global Manufacturing Footprint Enables Efficiency and Flexibility o 80/20 Driving Margin Enhancement on Our Road to 300 in 3 o Strong Free Cash Flow Combined with Balanced Capital Allocation o Sustainability is Fundamental to Both Our Products and Our Operations ©2020 Regal Beloit Corporation 6

STRATEGIC OVERVIEW REGAL HISTORY Operating Since 1955 and Ready for the Next 65 Years ©2020 Regal Beloit Corporation 7

STRATEGIC OVERVIEW REGAL OVERVIEW % of Sales Products Brands Climate • Fractional HP Motors 30% Solutions • Small Fans and Blowers Commercial • Fractional to 5 HP Motors 28% • Fans and Blowers Systems • Hermetic Motors 5 to 3,000 HP Power • Mounted and Unmounted Bearings • Drives, Gearboxes and Gearing Sets Transmission 24% • High Performance Couplings Solutions • Conveying Products and Components • Motors from 3 to 12,000 HP Industrial • Alternators from 5 to 4,000 Kilowatts 18% Systems • Automatic Transfer Switches & Paralleling Switchgear Incredibly Strong Brands with a Wealth of History ©2020 Regal Beloit Corporation 8

STRATEGIC OVERVIEW INDUSTRY TRENDS DRIVING GROWTH Energy Efficiency Regulations Electrification Connectivity • Sustainability Focus in Both • U.S. DOE Pool Pump 2021 • Emissions Under Scrutiny in • Digital Tools Expected in Residential & Commercial • Euro Eco Design 2022 Response to Climate Change Industrial Space • Continuing Shift from • U.S. SEER +1 2023 • Gas and Diesel Engine • Growing Demand for Constant Torque to Variable Applications Converting to Monitoring, Diagnostics, & Speed Electric Motors Electric Motors Predictive Maintenance Source: Sector Energy Efficiency U.S. DOE Technology Leader Well-Positioned To Capitalize on Global Trends ©2020 Regal Beloit Corporation 9

STRATEGIC OVERVIEW REGAL CORE STRENGTHS Differentiated Technology Global and Flexible Footprint OEM & Distribution Access Distribution 35% Aftermarket 30% OEM 65% OEM 70% 28 62 33 • Strong Brand Recognition, Large Installed Base Engineering Manufacturing Service • Superior OEM and Distribution Access Centers Facilities Centers • Like-for-Like Replacement Drives Recurring Sales Leading with Technology, Global Footprint, and Distribution/OEM Access ©2020 Regal Beloit Corporation 10

STRATEGIC OVERVIEW A LOOK BACK ON 2019… Transformed Organization from Centralized to Decentralized 2019 Launched 80/20 Initiative Executed Simplification Phase II Footprint Consolidations Infused New Leadership Talent Strengthened Return Based Decision Making Foundational Year Setting the Path for Profitable Growth ©2020 Regal Beloit Corporation 11

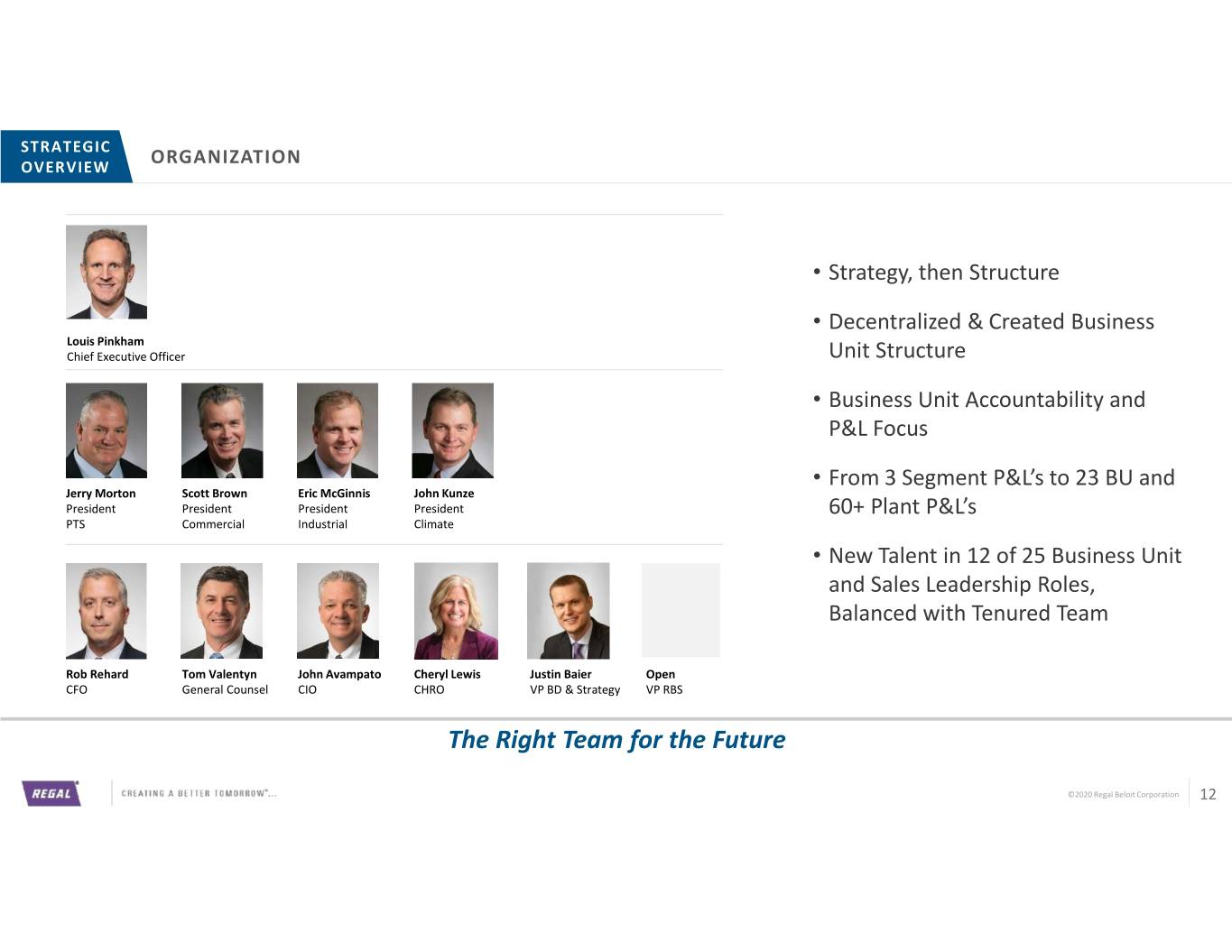

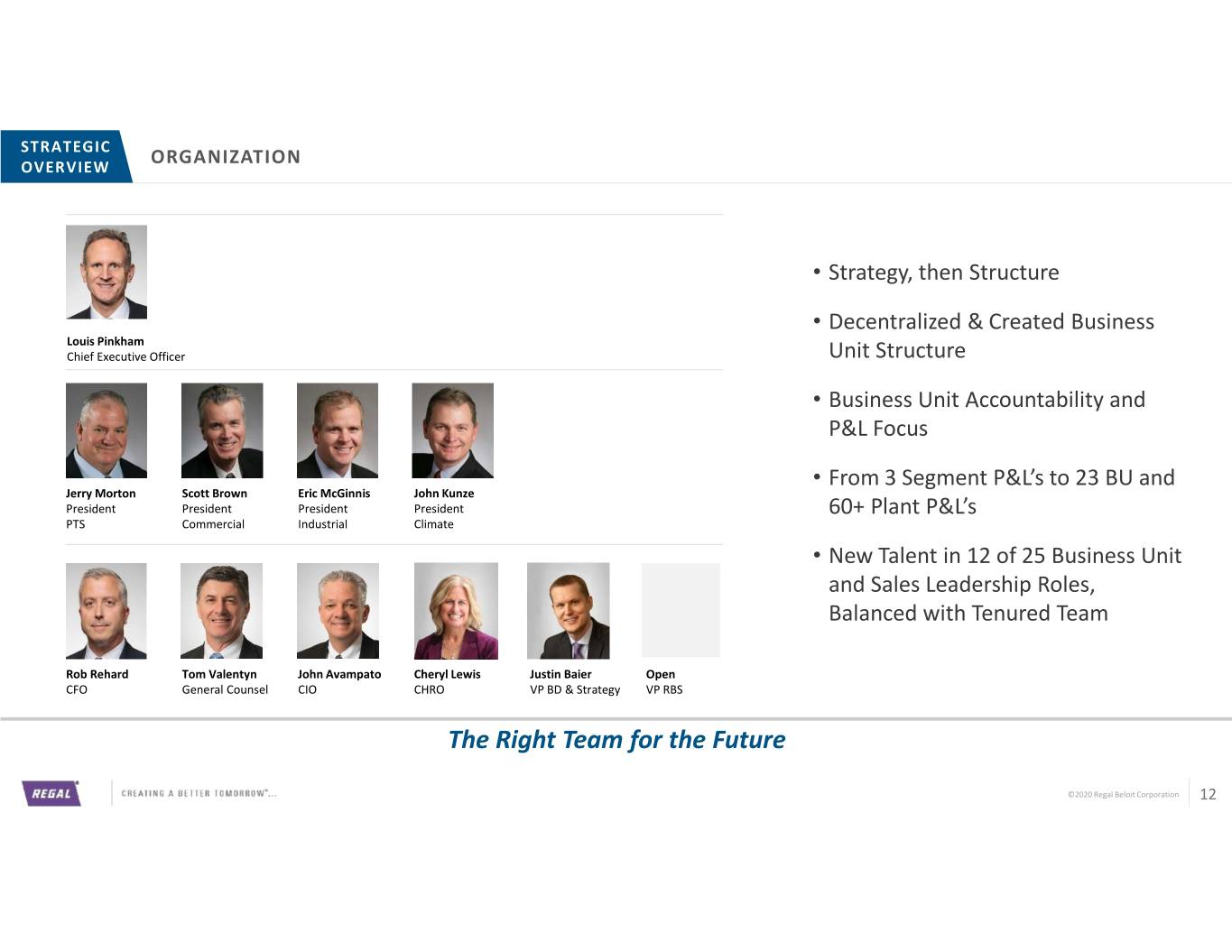

STRATEGIC OVERVIEW ORGANIZATION • Strategy, then Structure • Decentralized & Created Business Louis Pinkham Chief Executive Officer Unit Structure • Business Unit Accountability and P&L Focus • From 3 Segment P&L’s to 23 BU and Jerry Morton Scott Brown Eric McGinnis John Kunze President President President President 60+ Plant P&L’s PTS Commercial Industrial Climate • New Talent in 12 of 25 Business Unit and Sales Leadership Roles, Balanced with Tenured Team Rob Rehard Tom Valentyn John Avampato Cheryl Lewis Justin Baier Open CFO General Counsel CIO CHRO VP BD & Strategy VP RBS The Right Team for the Future ©2020 Regal Beloit Corporation 12

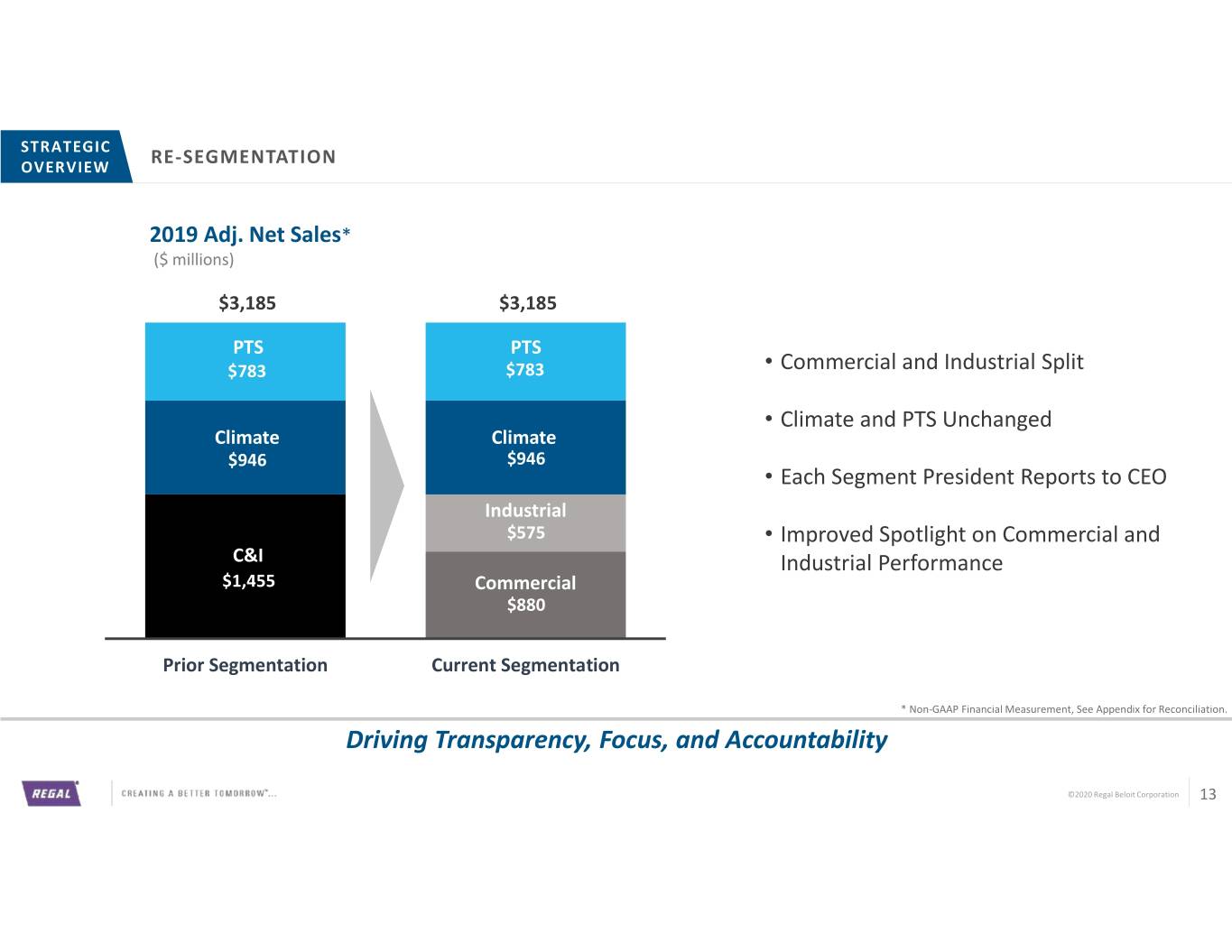

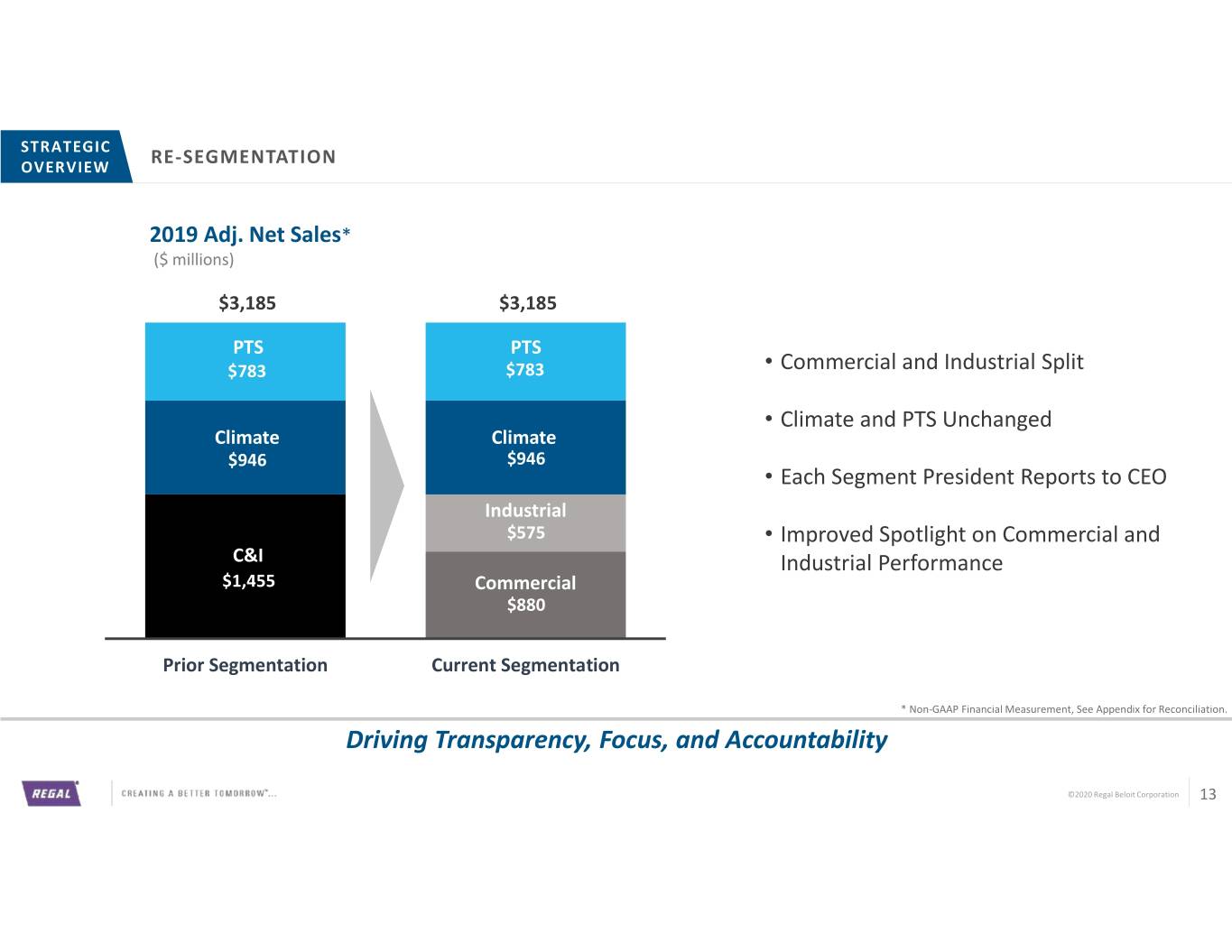

STRATEGIC OVERVIEW RE-SEGMENTATION 2019 Adj. Net Sales* ($ millions) $3,185 $3,185 PTS PTS $783 $783 • Commercial and Industrial Split • Climate and PTS Unchanged Climate Climate $946 $946 • Each Segment President Reports to CEO Industrial $575 • Improved Spotlight on Commercial and C&I Industrial Performance $1,455 Commercial $880 Prior Segmentation Current Segmentation * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Driving Transparency, Focus, and Accountability ©2020 Regal Beloit Corporation 13

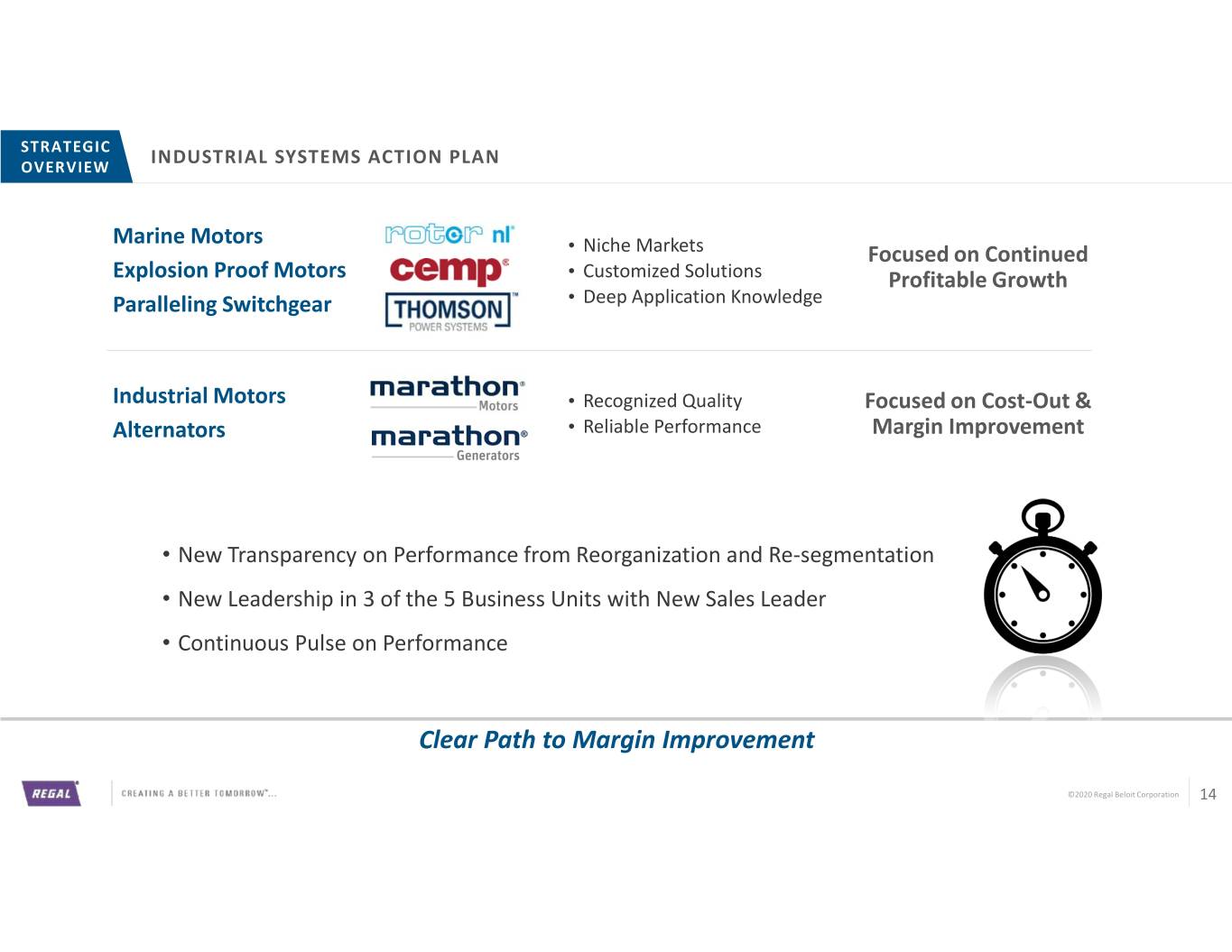

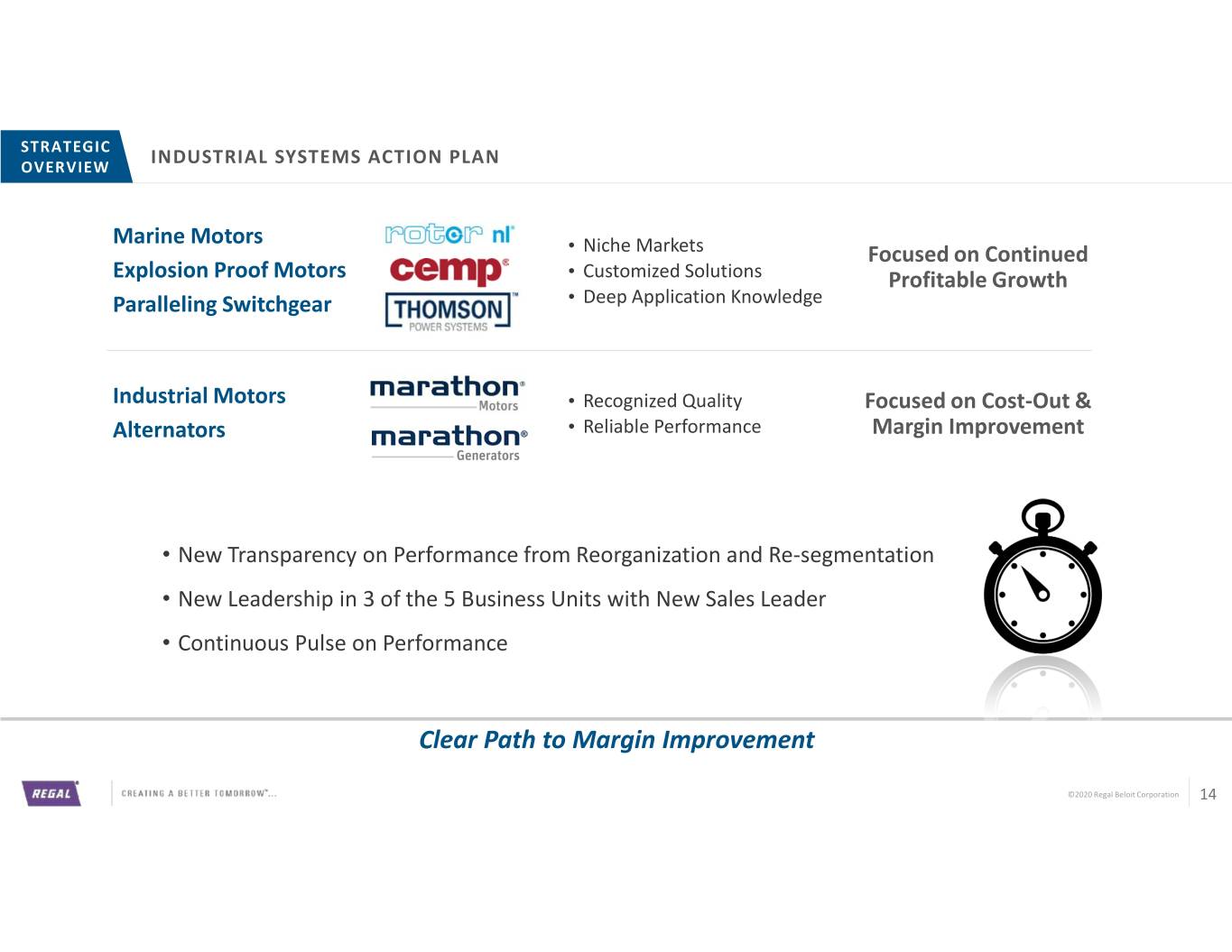

STRATEGIC OVERVIEW INDUSTRIAL SYSTEMS ACTION PLAN Marine Motors • Niche Markets Focused on Continued Explosion Proof Motors • Customized Solutions Profitable Growth Paralleling Switchgear • Deep Application Knowledge Industrial Motors • Recognized Quality Focused on Cost-Out & Alternators • Reliable Performance Margin Improvement • New Transparency on Performance from Reorganization and Re-segmentation • New Leadership in 3 of the 5 Business Units with New Sales Leader • Continuous Pulse on Performance Clear Path to Margin Improvement ©2020 Regal Beloit Corporation 14

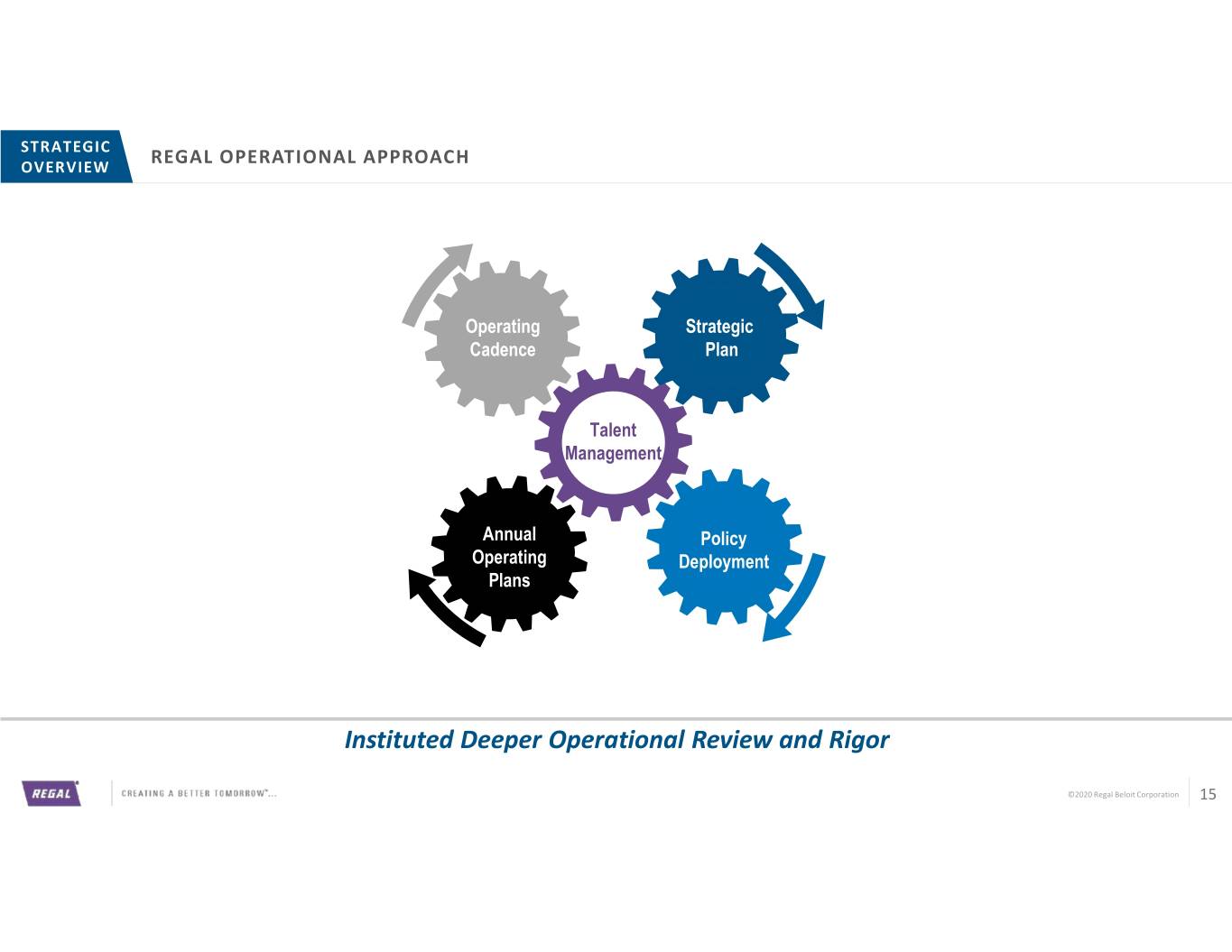

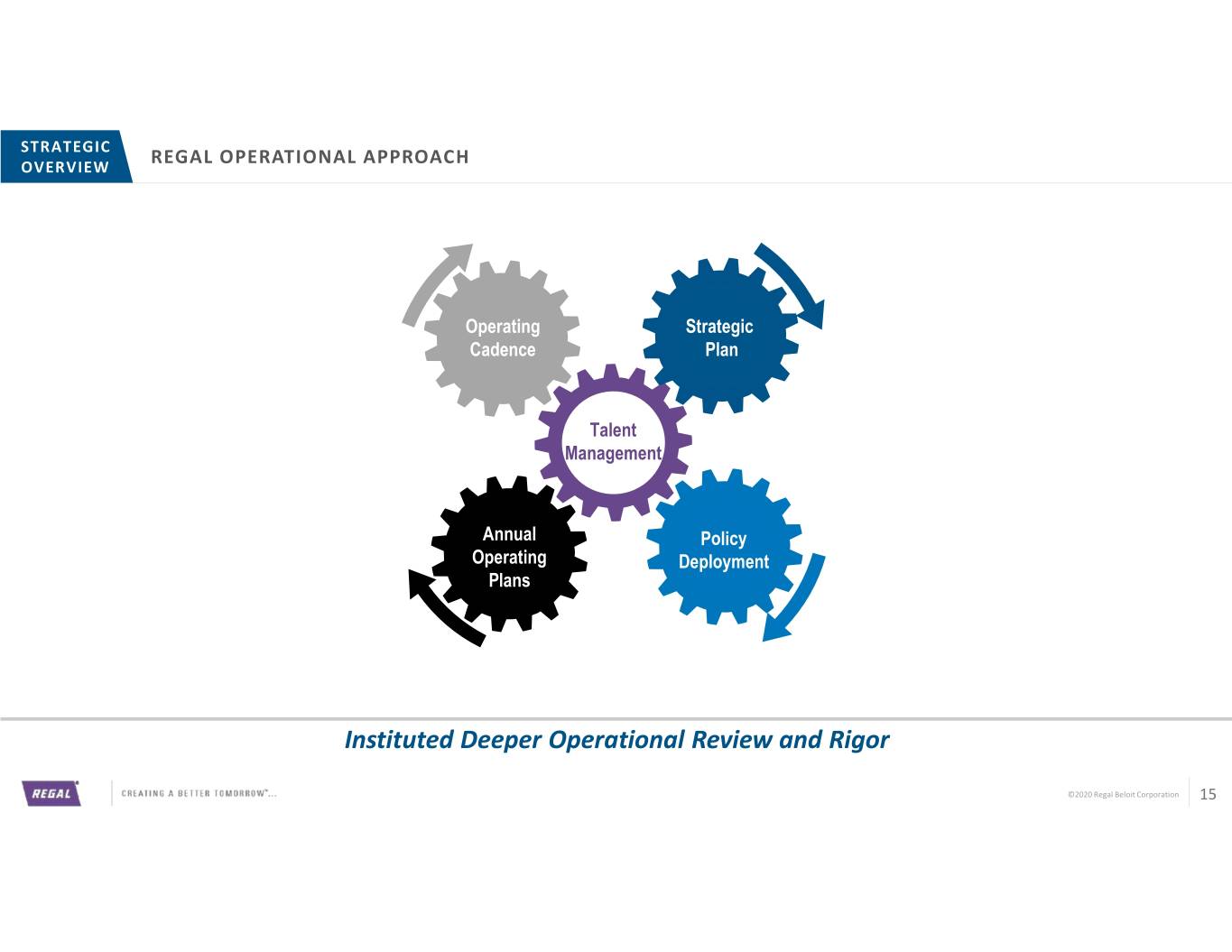

STRATEGIC OVERVIEW REGAL OPERATIONAL APPROACH Operating Strategic Cadence Plan Talent Management Annual Policy Operating Deployment Plans Instituted Deeper Operational Review and Rigor ©2020 Regal Beloit Corporation 15

STRATEGIC OVERVIEW REGAL BUSINESS SYSTEM APPROACH RBS: Driving Value For Customers, Shareholders & Associates Balanced Capital Deployment Strategy and Structure Are Fundamental to How We Operate ©2020 Regal Beloit Corporation 16

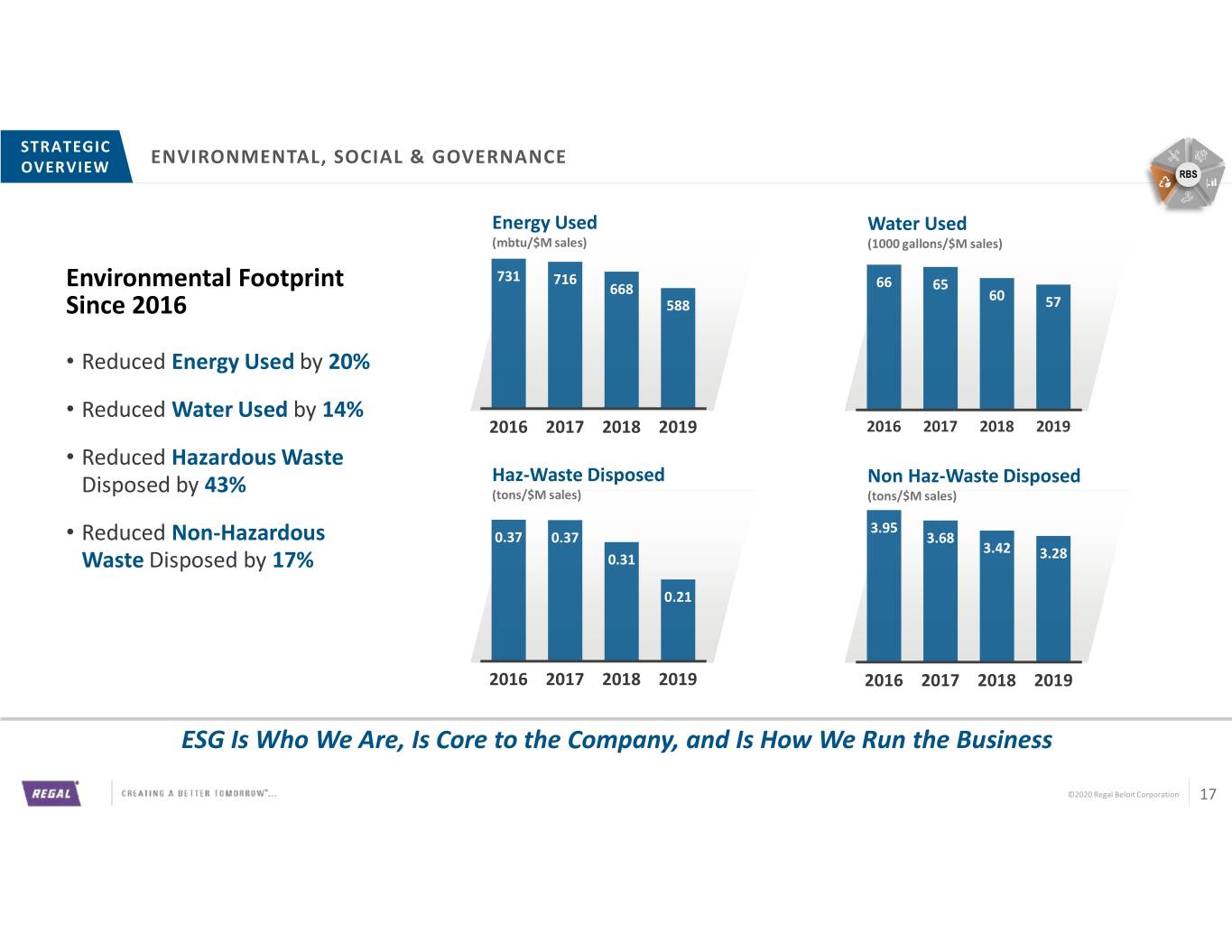

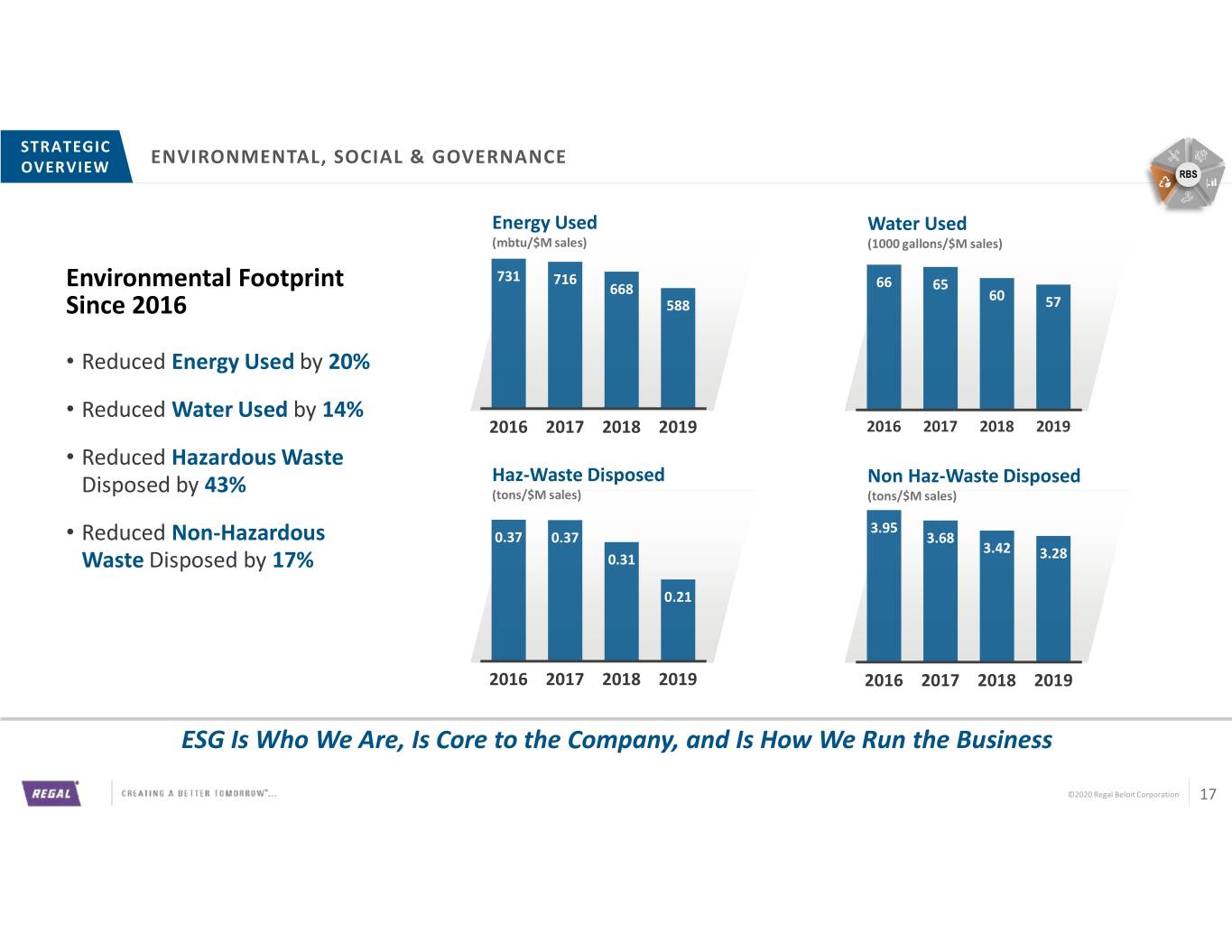

STRATEGIC ENVIRONMENTAL, SOCIAL & GOVERNANCE OVERVIEW RBS Energy Used Water Used (mbtu/$M sales) (1000 gallons/$M sales) 731 Environmental Footprint 716 66 65 668 60 Since 2016 588 57 • Reduced Energy Used by 20% • Reduced Water Used by 14% 2016 2017 2018 2019 2016 2017 2018 2019 • Reduced Hazardous Waste Haz-Waste Disposed Non Haz-Waste Disposed Disposed by 43% (tons/$M sales) (tons/$M sales) 3.95 • Reduced Non-Hazardous 0.37 0.37 3.68 3.42 Waste Disposed by 17% 0.31 3.28 0.21 2016 2017 2018 2019 2016 2017 2018 2019 ESG Is Who We Are, Is Core to the Company, and Is How We Run the Business ©2020 Regal Beloit Corporation 17

STRATEGIC ENVIRONMENTAL, SOCIAL & GOVERNANCE OVERVIEW RBS 15% Lower Energy Eliminates Lubricants and 627K Metric Tons/Year 75% NOX Reduction vs Consumption vs Saves~4 Million Gallons of CO2 Reduction vs Traditional Boilers Nearest Competitor Water/Year for One Bottling Line Traditional Motors Our Products Lead with Sustainability and Energy Efficiency ©2020 Regal Beloit Corporation 18

STRATEGIC ENVIRONMENTAL, SOCIAL & GOVERNANCE OVERVIEW RBS Independent Directors: • 3 Women and 7 Men Independent Chair All Directors Stand for Annual Election ‘Smack Hunger’ in the Community Annual Evaluation of Board and Committees Shareholder Interest: Total Recordable Rate • Majority Voting Standard • Proxy access 1.11 0.92 0.86 Compensation Committee Oversight: 0.73 • Pay-for-Performance Culture • Stock Ownership Requirements 2016 2017 2018 2019 We Seek Diversity on Our Board and a Safe Work Environment for Our Associates ©2020 Regal Beloit Corporation 19

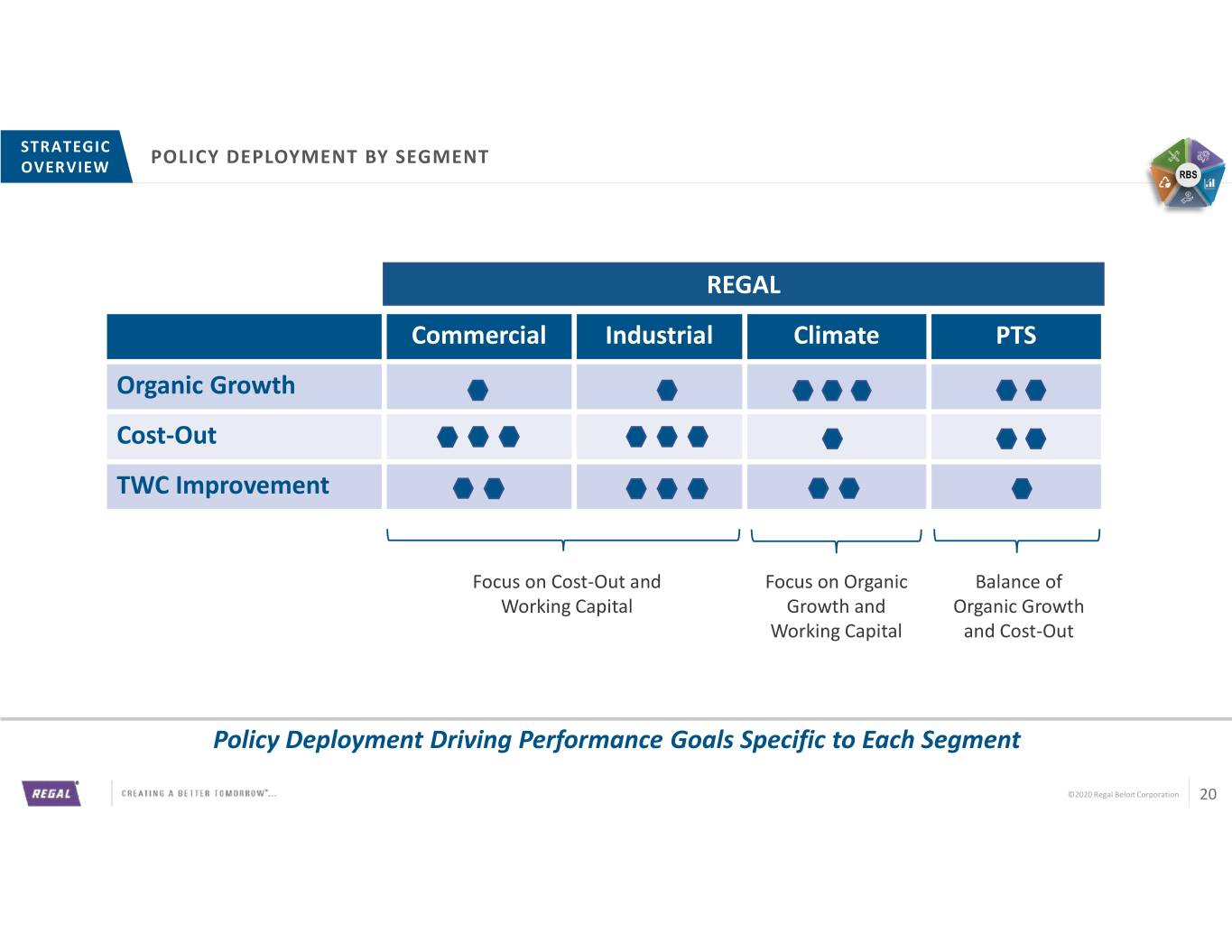

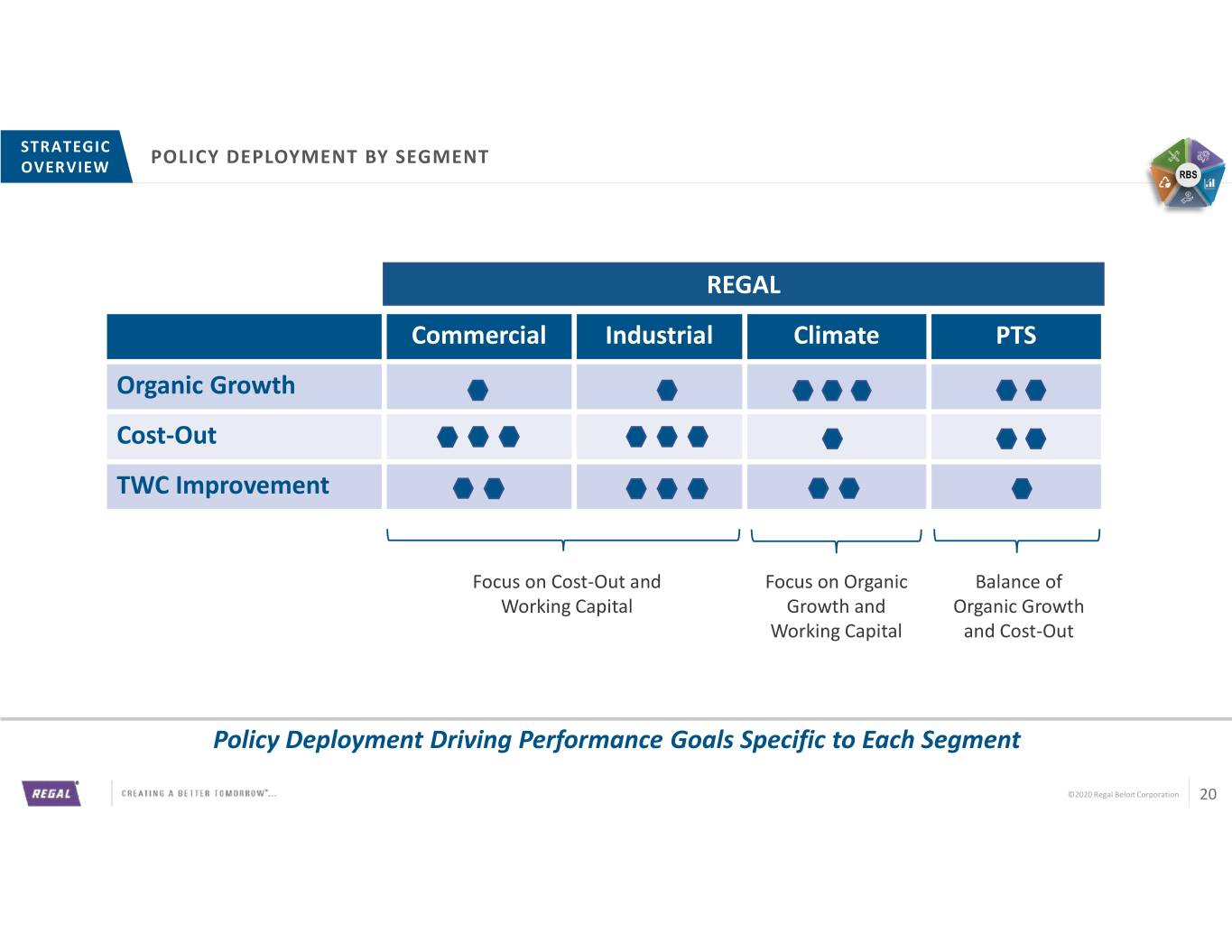

STRATEGIC POLICY DEPLOYMENT BY SEGMENT OVERVIEW RBS REGAL Commercial Industrial Climate PTS Organic Growth Cost-Out TWC Improvement Focus on Cost-Out and Focus on Organic Balance of Working Capital Growth and Organic Growth Working Capital and Cost-Out Policy Deployment Driving Performance Goals Specific to Each Segment ©2020 Regal Beloit Corporation 20

STRATEGIC 80/20 APPROACH OVERVIEW RBS • Focus on “A” Customers and Products • Proportion Attention and Resources on “B” Customers and Products • All Segments Have Opportunity to Better Manage Margin Mix • Positions Businesses for Profitable Growth 80/20 Is How We Think and How We Operate ©2020 Regal Beloit Corporation 21

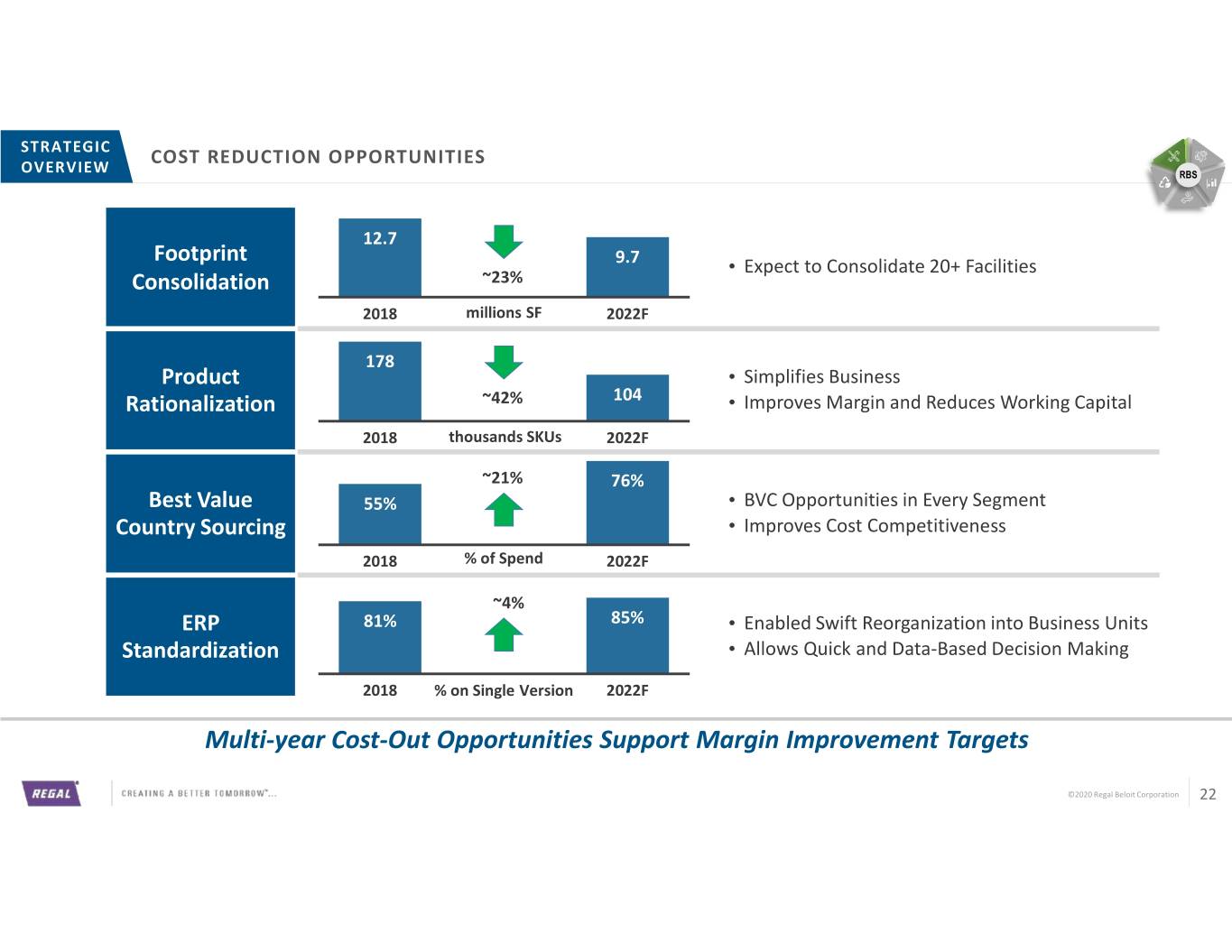

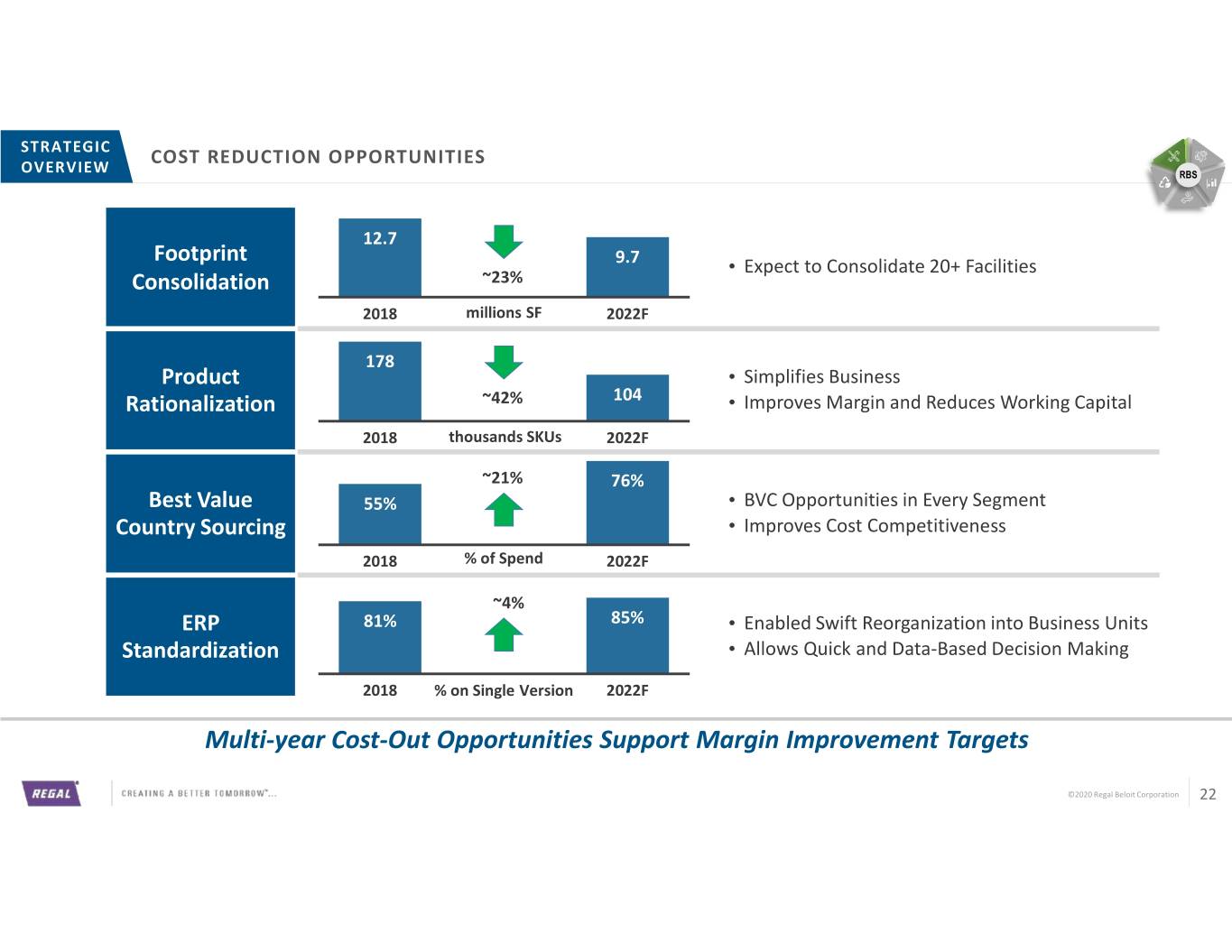

STRATEGIC COST REDUCTION OPPORTUNITIES OVERVIEW RBS 12.7 Footprint 9.7 • Expect to Consolidate 20+ Facilities Consolidation ~23% 2018 millions0.0 SF 2022F 178 Product • Simplifies Business Rationalization ~42% 104 • Improves Margin and Reduces Working Capital 2018 thousands0 SKUs 2022F ~21% 76% Best Value 55% • BVC Opportunities in Every Segment Country Sourcing • Improves Cost Competitiveness 2018 % of0% Spend 2022F ~4% ERP 81% 85% • Enabled Swift Reorganization into Business Units Standardization • Allows Quick and Data-Based Decision Making 2018 % on Single0% Version 2022F Multi-year Cost-Out Opportunities Support Margin Improvement Targets ©2020 Regal Beloit Corporation 22

STRATEGIC TECHNOLOGY DIFFERENTIATION OVERVIEW RBS ECM High Gas Pre-Mix Pool Pump High Efficiency Fan Explosion Proof Marine Duty Paralleling Modsort® Efficiency Motor Blower Motor Motor Switchgear Conveyor • 100 bps Increase in Engineering Spending Over Next 3 Years • Leveraging Over 1,200 Active Registered Patents Differentiated Product Technology with Industry Leading Positions ©2020 Regal Beloit Corporation 23

STRATEGIC GROWTH OPPORTUNITIES OVERVIEW RBS Product Innovation Geographic Expansion Commercial Initiatives Connected Technology • Modsort® Conveyor • Gas Pre-Mix Blowers • “Making it Easy” • Connected Commercial • Supporting ‘Last Mile’ Of in ROW • QR Codes & App Enable Refrigeration Technology Parcel Processing • Leveraging U.S. Position Product Identification, • Reduces Risk of Food • Rapid ROI • 75% NOX Reduction vs Replacement, and Support Spoilage from Outages Traditional Blowers • Monetizing Uptime Compelling Product and Market Opportunities to Grow GDP+ ©2020 Regal Beloit Corporation 24

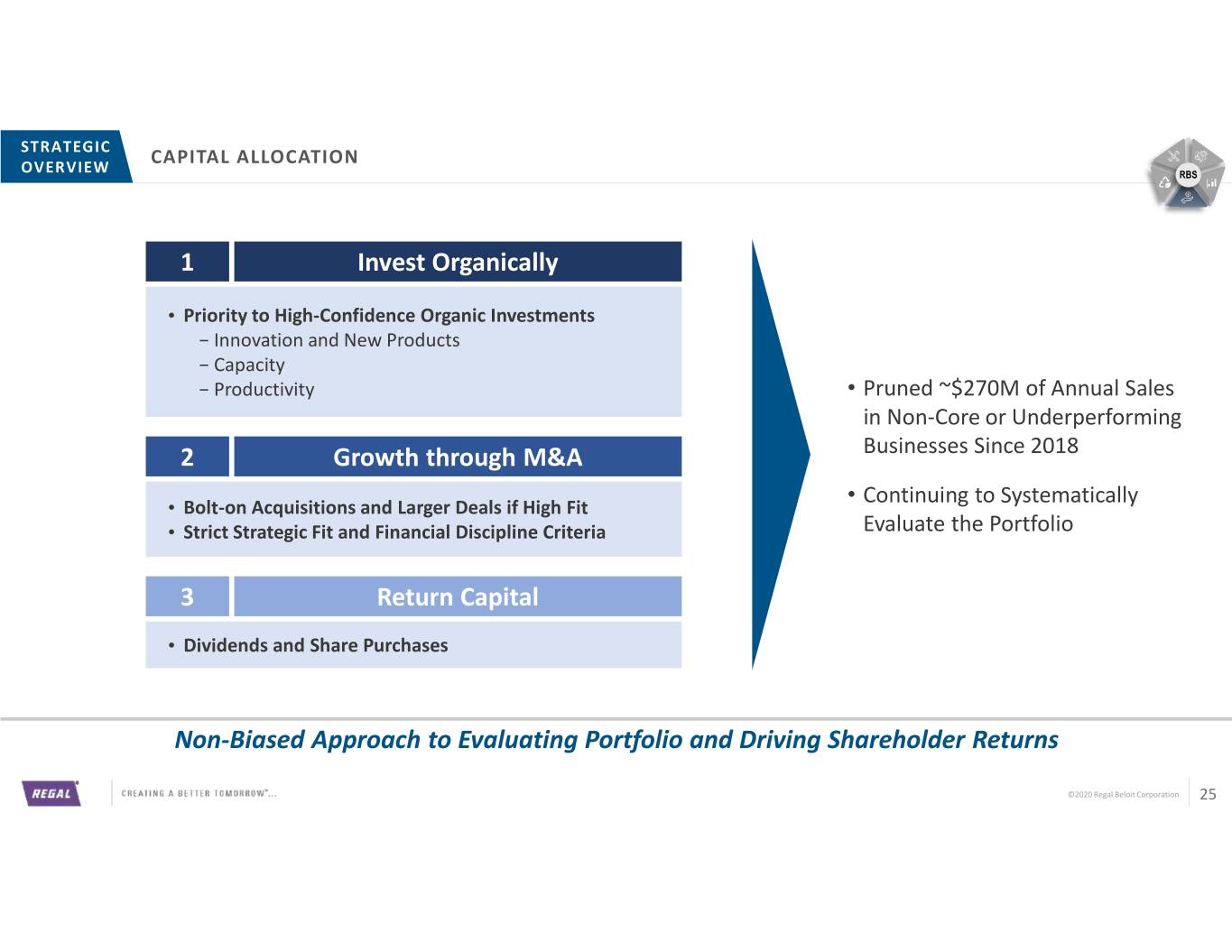

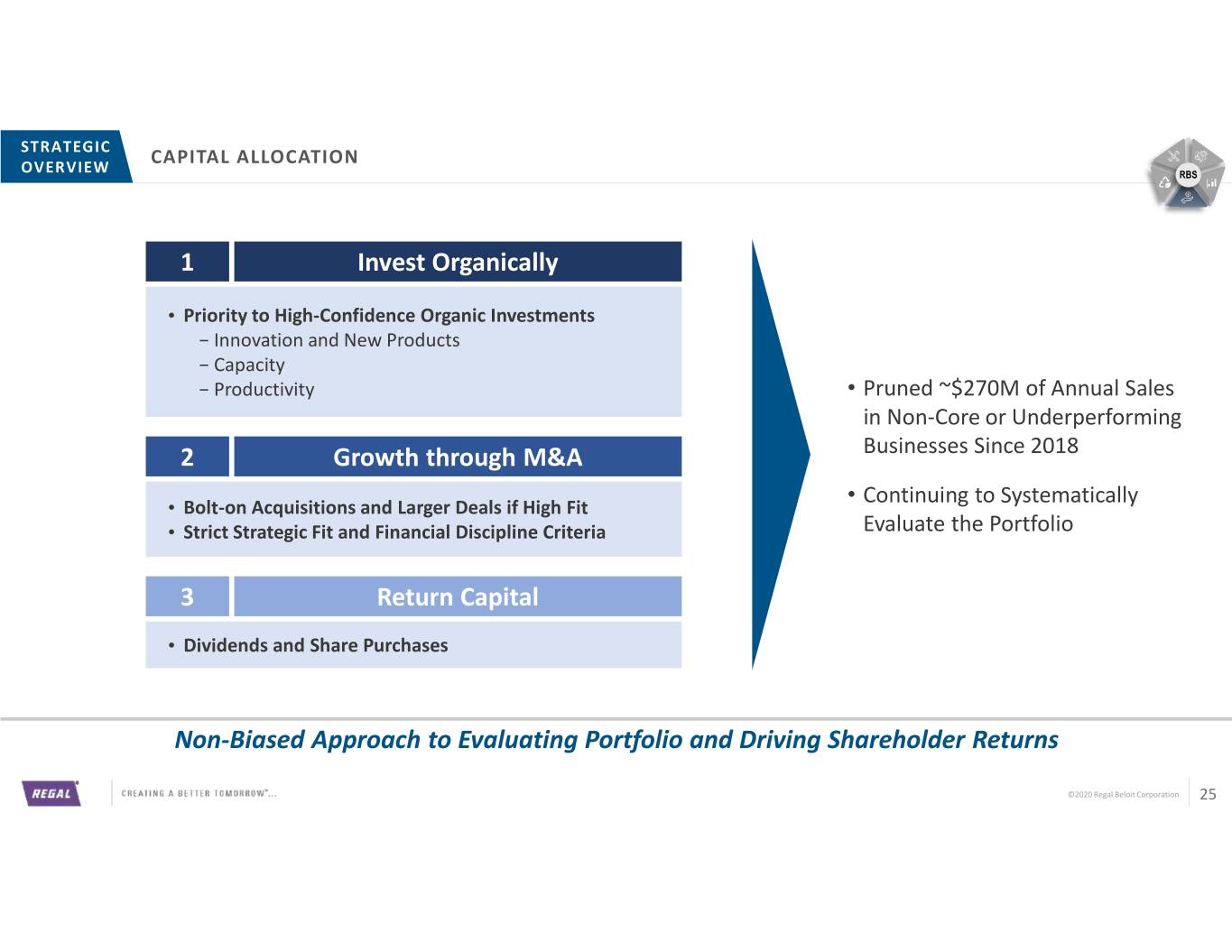

STRATEGIC CAPITAL ALLOCATION OVERVIEW RBS 1 Invest Organically • Priority to High-Confidence Organic Investments − Innovation and New Products − Capacity − Productivity • Pruned ~$270M of Annual Sales in Non-Core or Underperforming 2 Growth through M&A Businesses Since 2018 • Continuing to Systematically • Bolt-on Acquisitions and Larger Deals if High Fit • Strict Strategic Fit and Financial Discipline Criteria Evaluate the Portfolio 3 Return Capital • Dividends and Share Purchases Non-Biased Approach to Evaluating Portfolio and Driving Shareholder Returns ©2020 Regal Beloit Corporation 25

STRATEGIC M&A APPROACH OVERVIEW RBS Bolt-ons for the PTS and Climate Segments Larger Scale M&A with High Synergy Potential MARKET • Stable GDP+ Growth • Limited Risk of Technology Disruption • Deal Runway TARGET • Margin Accretive (GM >35%) • Leading Market Position / Brand • Differentiated Product Offering FIT • Fit with Regal Culture • Leverages Regal’s Core Strengths • Reinforces or Adds Capabilities DEAL • ROIC > WACC by 200 bps by Year 3 • EPS Accretive in Year 1 • Strong Cost Synergies Disciplined Approach to Drive Value Creation through M&A ©2020 Regal Beloit Corporation 26

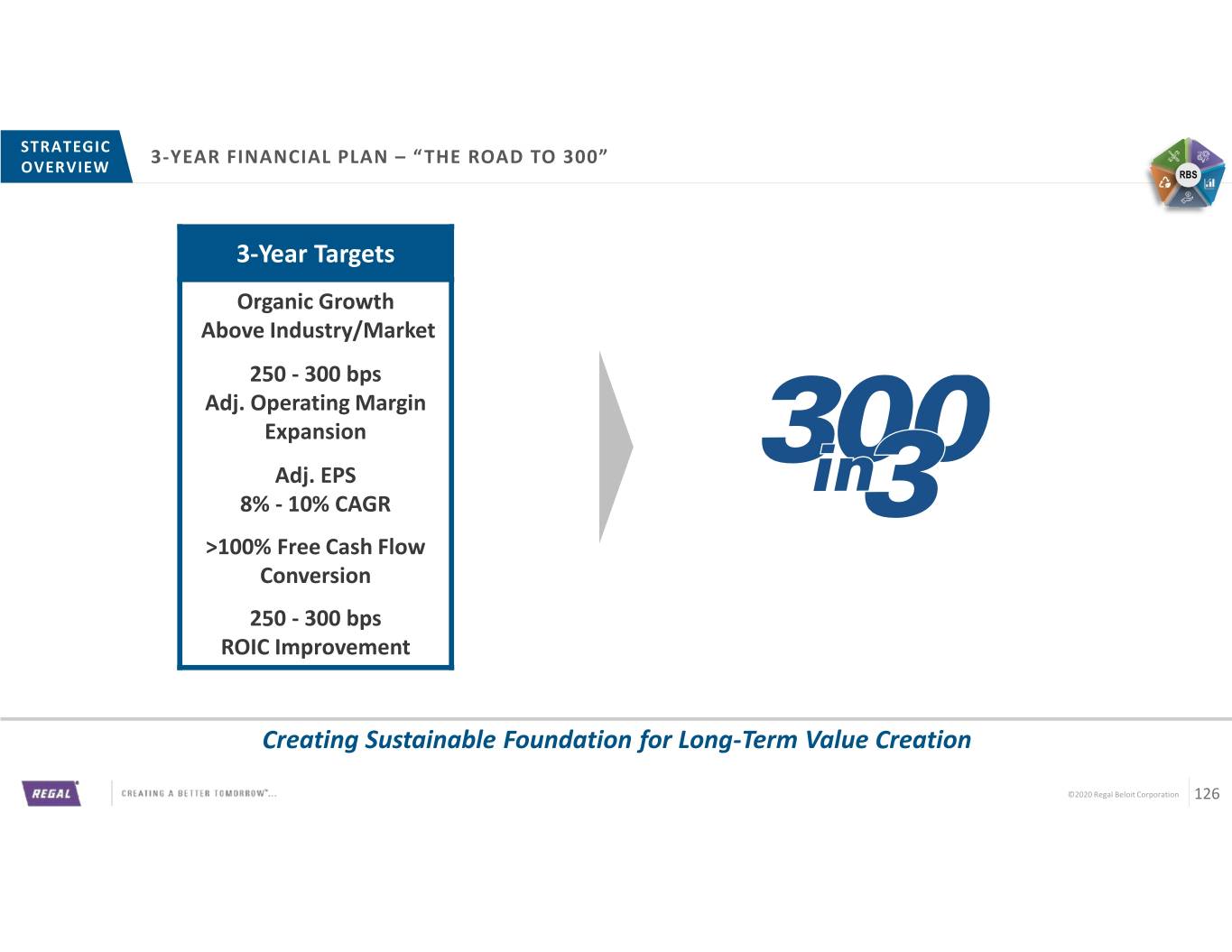

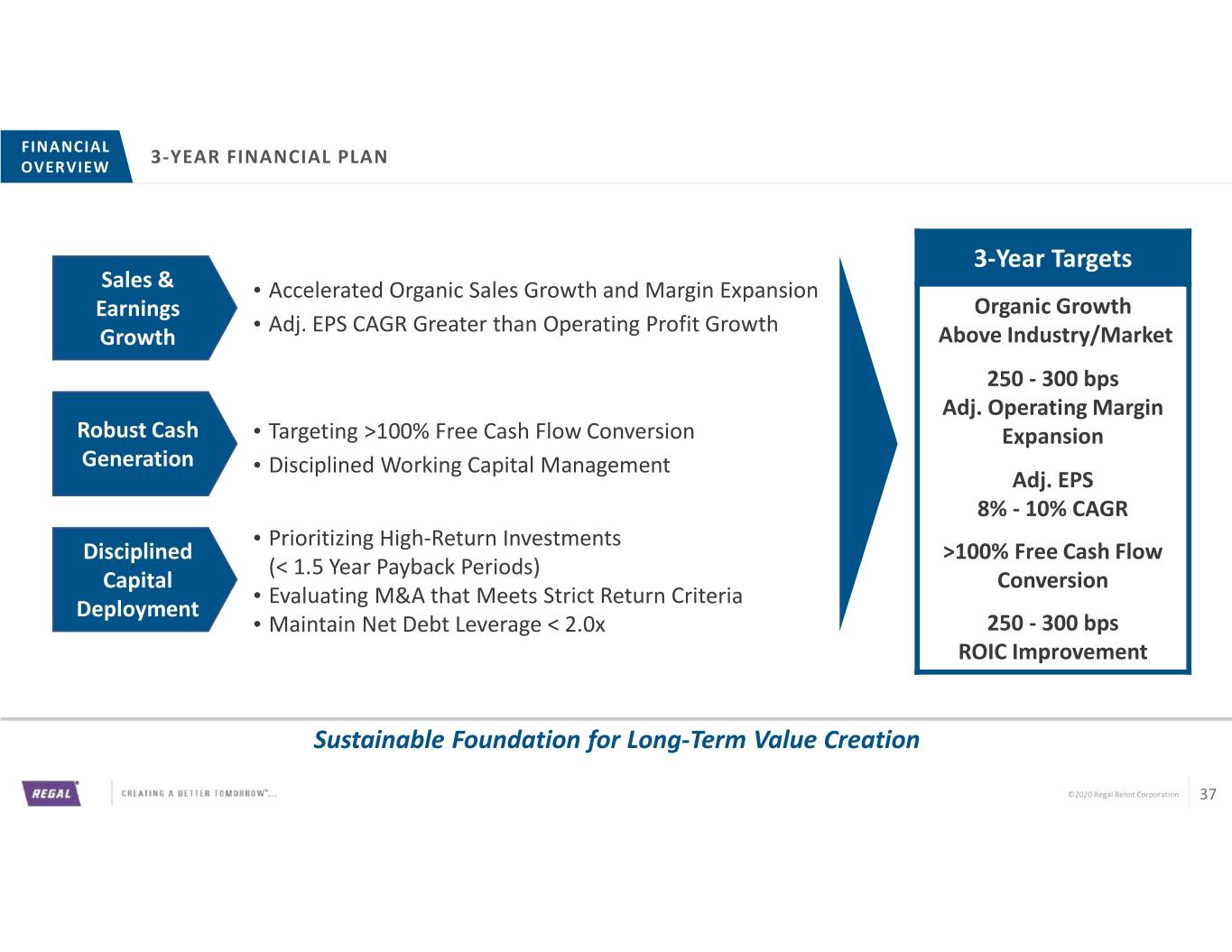

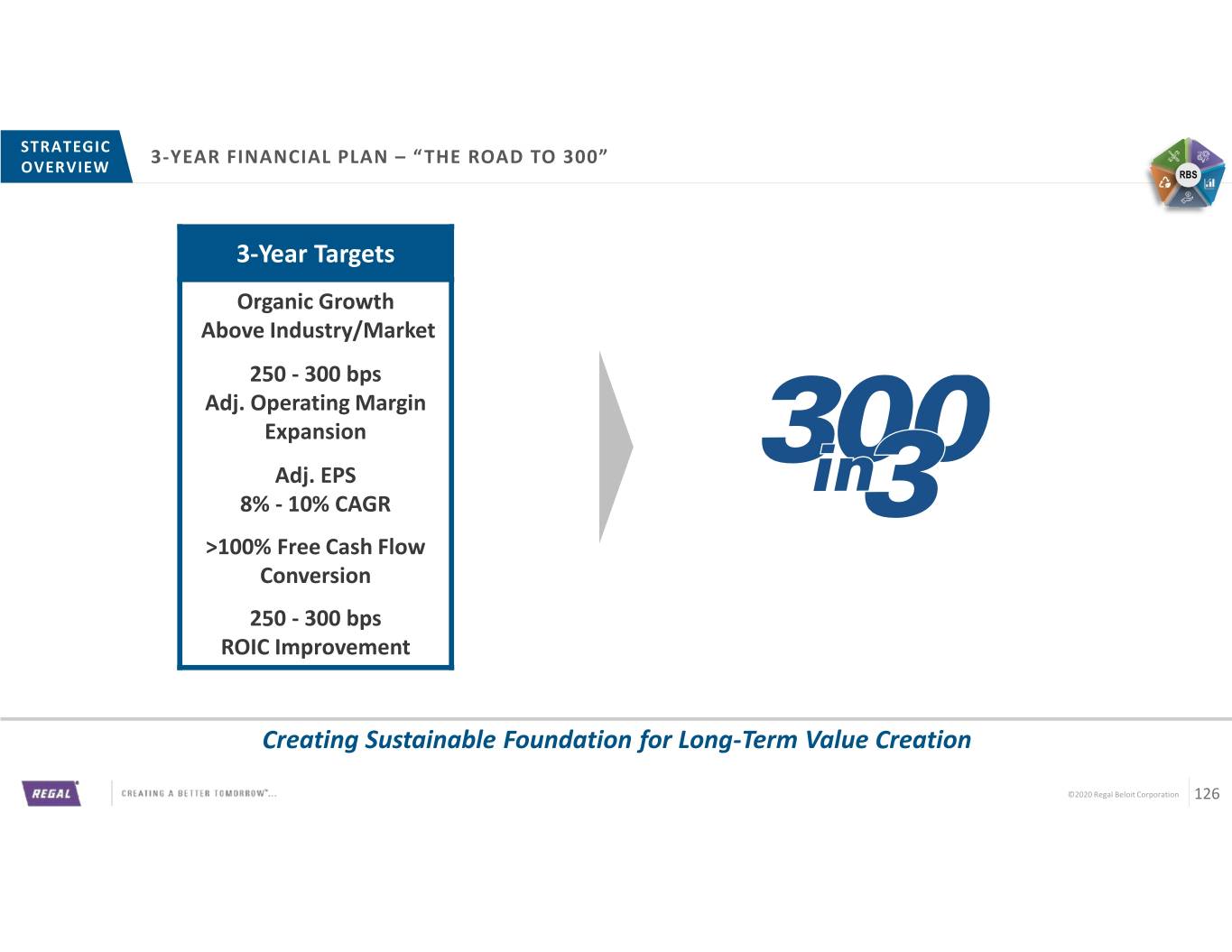

STRATEGIC 3-YEAR FINANCIAL PLAN – “THE ROAD TO 300” OVERVIEW RBS 3-Year Targets Organic Growth Above Industry/Market 250 - 300 bps Adj. Operating Margin Expansion Adj. EPS 8% - 10% CAGR Creating Sustainable Foundation for Long-Term Value Creation ©2020 Regal Beloit Corporation 27

STRATEGIC VISION – WHO IS REGAL IN FIVE YEARS? OVERVIEW RBS o Customer Driven Technology Leader o Products and Solutions Differentiated by Sustainability o World Class Business System o Top Talent Driving Business o 35% Gross Margin o GDP+ Growth Profile o Reduced Cyclicality o Top Quartile TSR A Compelling Future ©2020 Regal Beloit Corporation 28

STRATEGIC OVERVIEW KEY TAKEAWAYS o Growth From Energy Efficiency, Electrification and Digital Connectivity o Leading Brands, Installed Base, and Differentiated Technology o Global Manufacturing Footprint Enables Efficiency and Flexibility o 80/20 Driving Margin Enhancement on Our Road to 300 in 3 o Strong Free Cash Flow Combined with Balanced Capital Allocation o Sustainability is Fundamental to Both Our Products and Our Operations ©2020 Regal Beloit Corporation 29

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 30

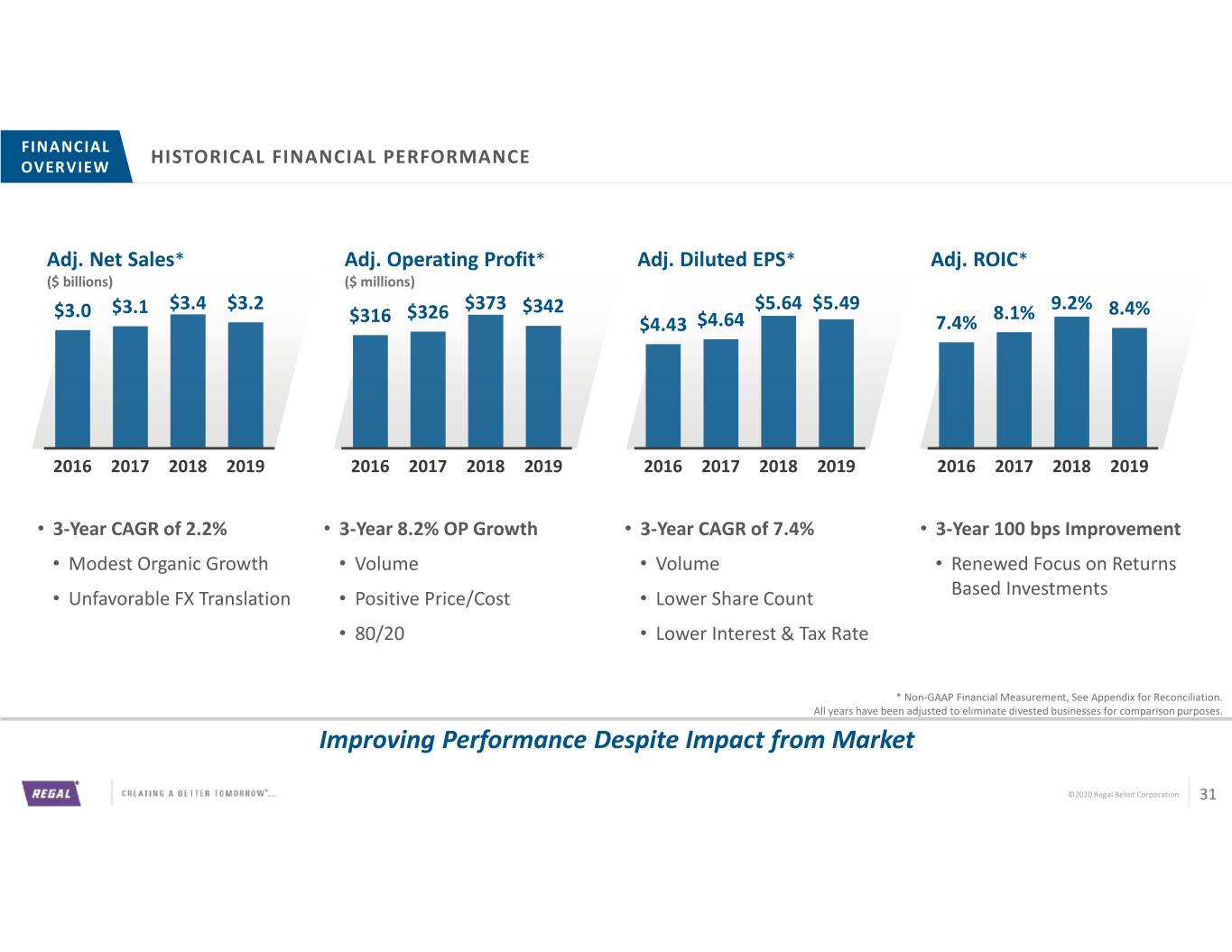

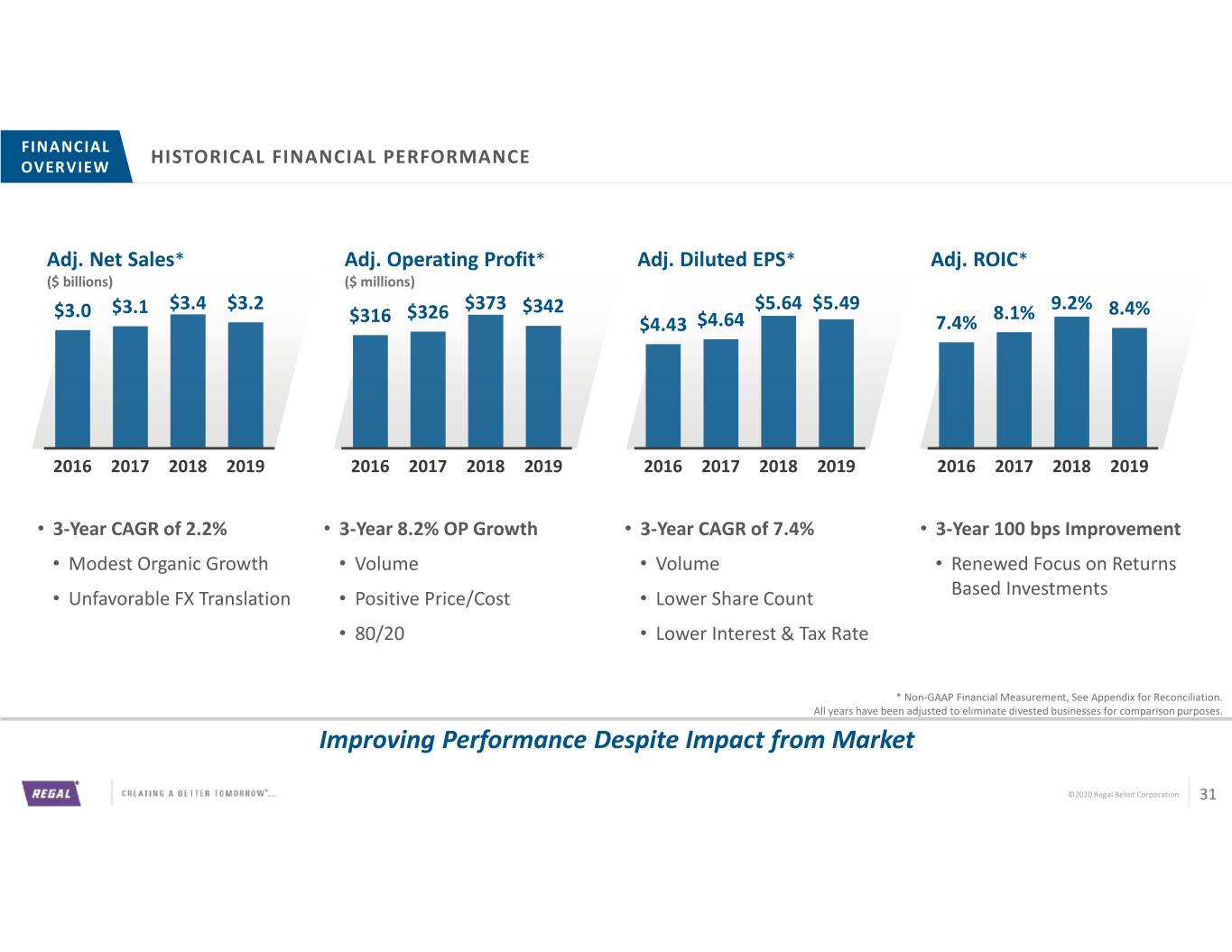

FINANCIAL OVERVIEW HISTORICAL FINANCIAL PERFORMANCE Adj. Net Sales* Adj. Operating Profit* Adj. Diluted EPS* Adj. ROIC* ($ billions) ($ millions) $3.0 $3.1 $3.4 $3.2 $326 $373 $342 $5.64 $5.49 8.1% 9.2% 8.4% $316 $4.43 $4.64 7.4% 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 • 3-Year CAGR of 2.2% • 3-Year 8.2% OP Growth • 3-Year CAGR of 7.4% • 3-Year 100 bps Improvement • Modest Organic Growth • Volume • Volume • Renewed Focus on Returns Based Investments • Unfavorable FX Translation • Positive Price/Cost • Lower Share Count • 80/20 • Lower Interest & Tax Rate * Non-GAAP Financial Measurement, See Appendix for Reconciliation. All years have been adjusted to eliminate divested businesses for comparison purposes. Improving Performance Despite Impact from Market ©2020 Regal Beloit Corporation 31

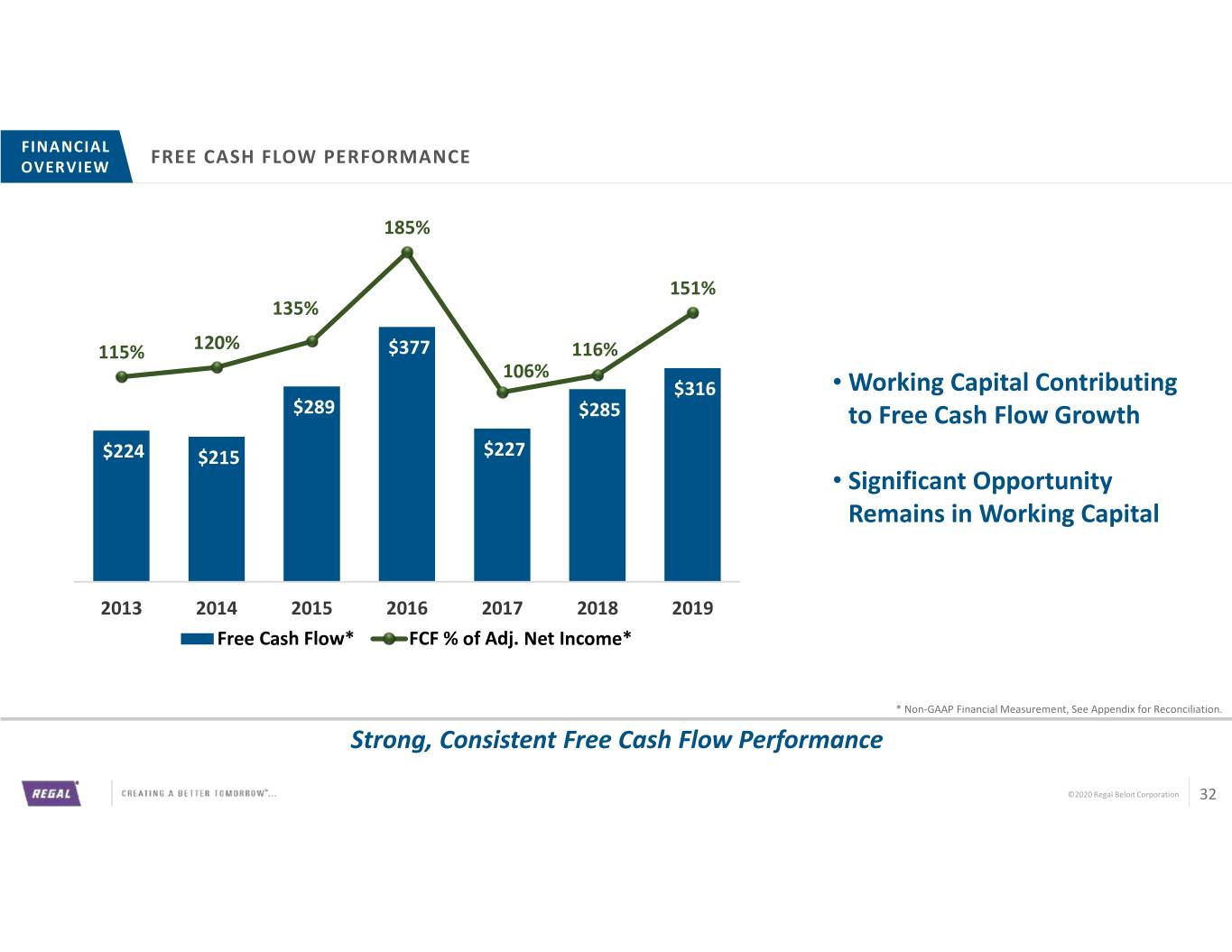

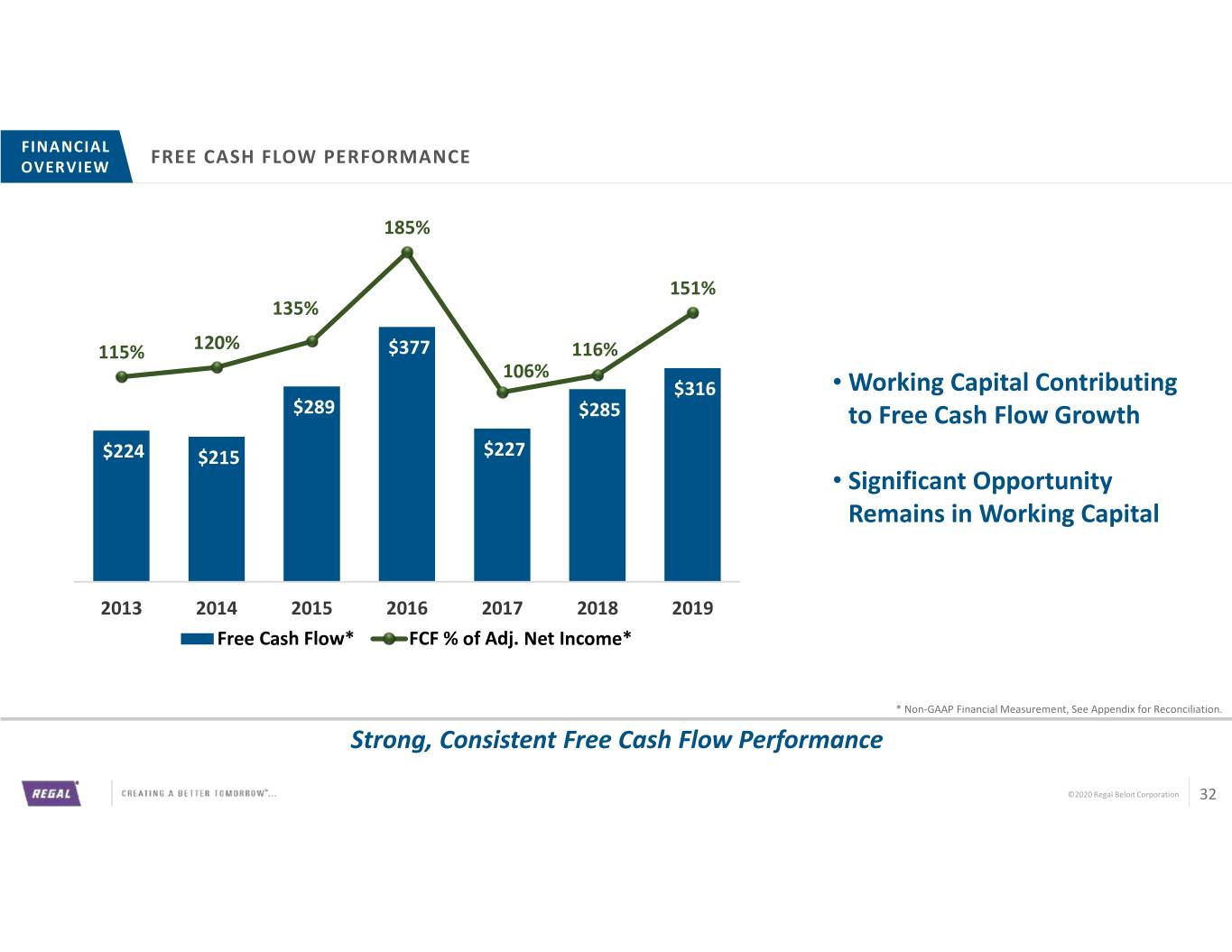

FINANCIAL OVERVIEW FREE CASH FLOW PERFORMANCE 185% $500 175% 151% $400 135% 150% 120% $377 115% 116% 125% $300 106% $316 • Working Capital Contributing $289 $285 100% to Free Cash Flow Growth $200 $224 $215 $227 75% 50% • Significant Opportunity $100 Remains in Working Capital 25% $- 0% 2013 2014 2015 2016 2017 2018 2019 Free Cash Flow* FCF % of Adj. Net Income* * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Strong, Consistent Free Cash Flow Performance ©2020 Regal Beloit Corporation 32

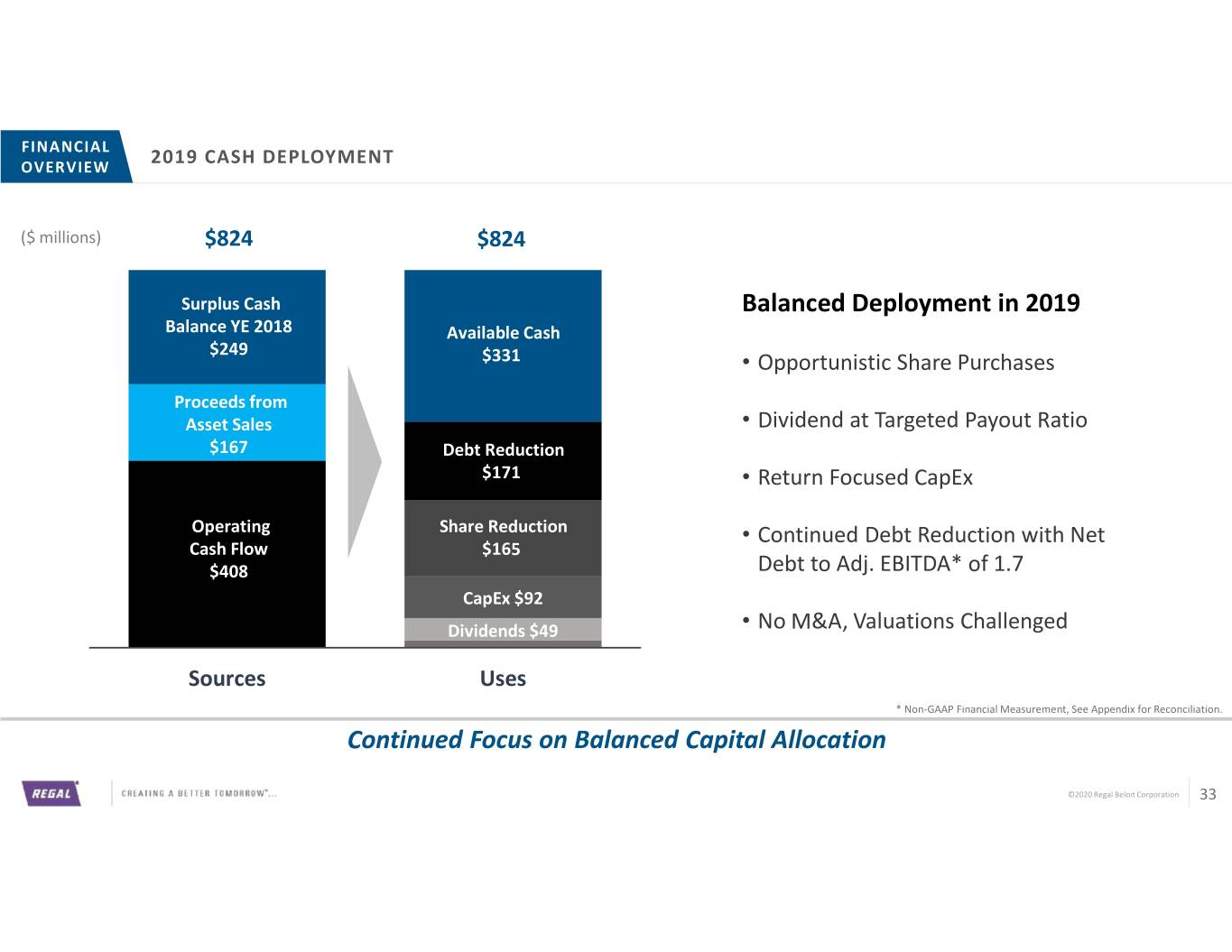

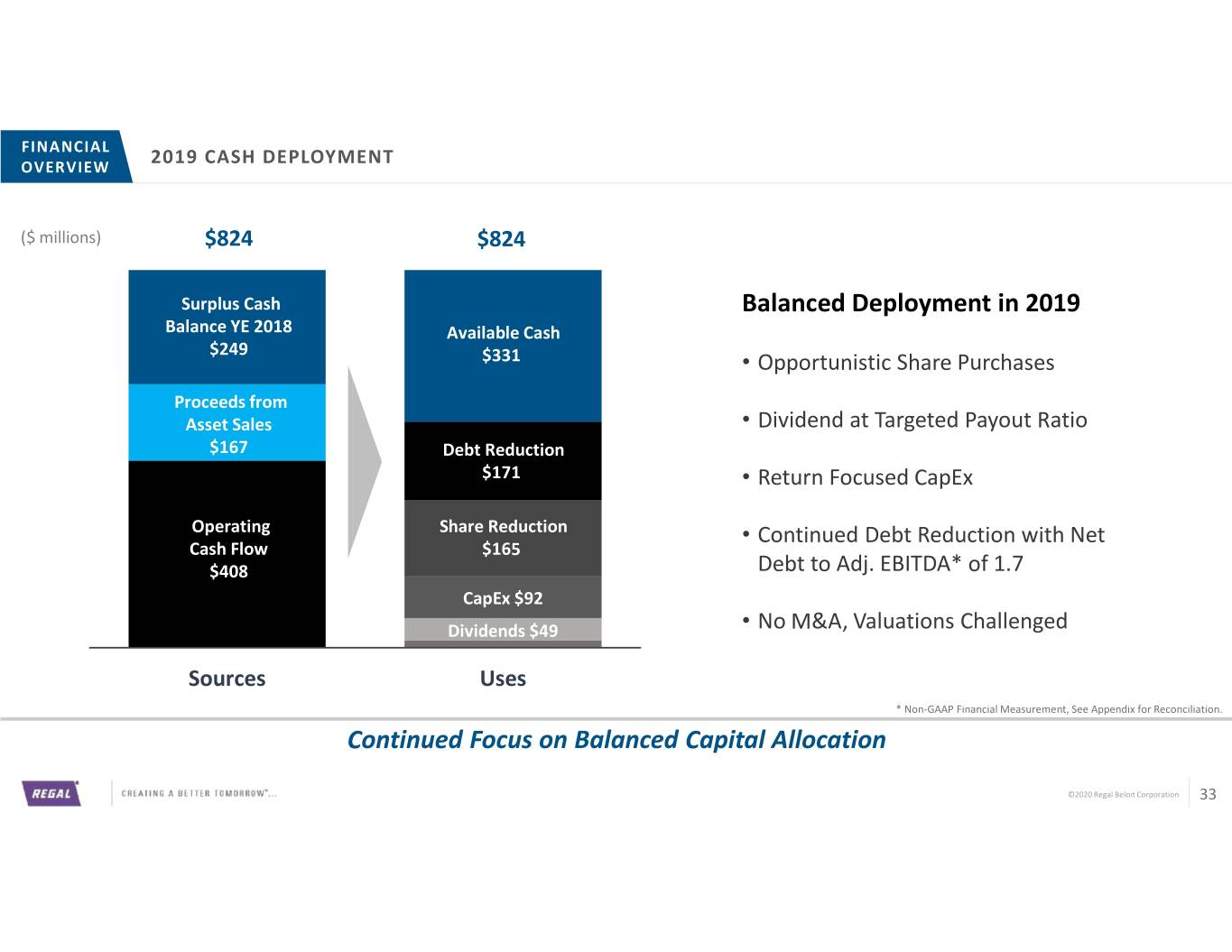

FINANCIAL OVERVIEW 2019 CASH DEPLOYMENT ($ millions) $824 $824 Surplus Cash Balanced Deployment in 2019 Balance YE 2018 Available Cash $249 $331 • Opportunistic Share Purchases Proceeds from Asset Sales • Dividend at Targeted Payout Ratio $167 Debt Reduction $171 • Return Focused CapEx Operating Share Reduction • Continued Debt Reduction with Net Cash Flow $165 $408 Debt to Adj. EBITDA* of 1.7 CapEx $92 Dividends $49 • No M&A, Valuations Challenged Sources Uses * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Continued Focus on Balanced Capital Allocation ©2020 Regal Beloit Corporation 33

FINANCIAL OVERVIEW DIVIDEND HISTORY Dividends Paid Per Share $1.16 $1.08 $1.00 $0.94 $0.90 $0.84 $0.78 $0.74 $0.70 $0.66 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Consistently Increasing Dividend Paid to Shareholders ©2020 Regal Beloit Corporation 34

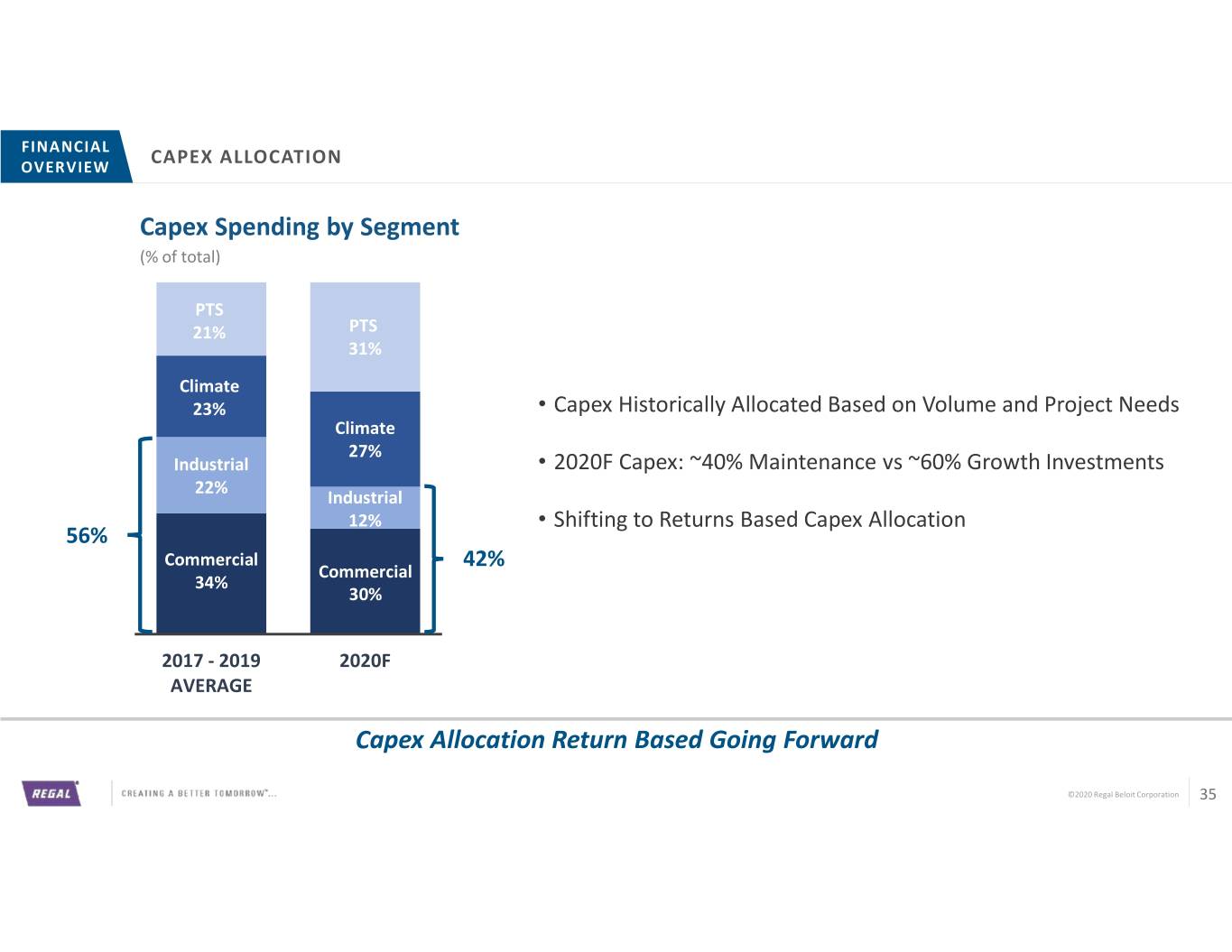

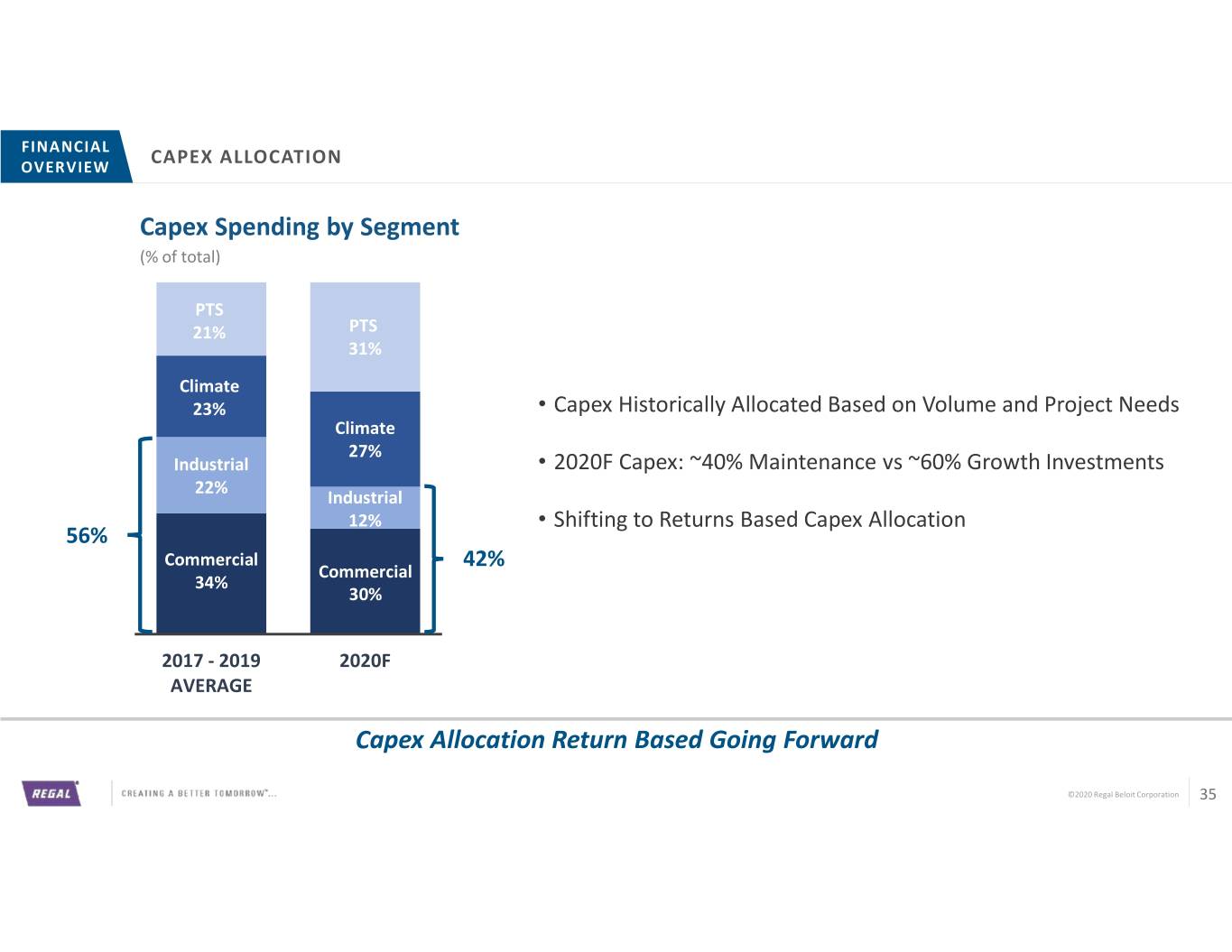

FINANCIAL OVERVIEW CAPEX ALLOCATION Capex Spending by Segment (% of total) PTS 21% PTS 31% Climate 23% • Capex Historically Allocated Based on Volume and Project Needs Climate 27% Industrial • 2020F Capex: ~40% Maintenance vs ~60% Growth Investments 22% Industrial 12% • Shifting to Returns Based Capex Allocation 56% Commercial 42% Commercial 34% 30% 2017 - 2019 2020F AVERAGE Capex Allocation Return Based Going Forward ©2020 Regal Beloit Corporation 35

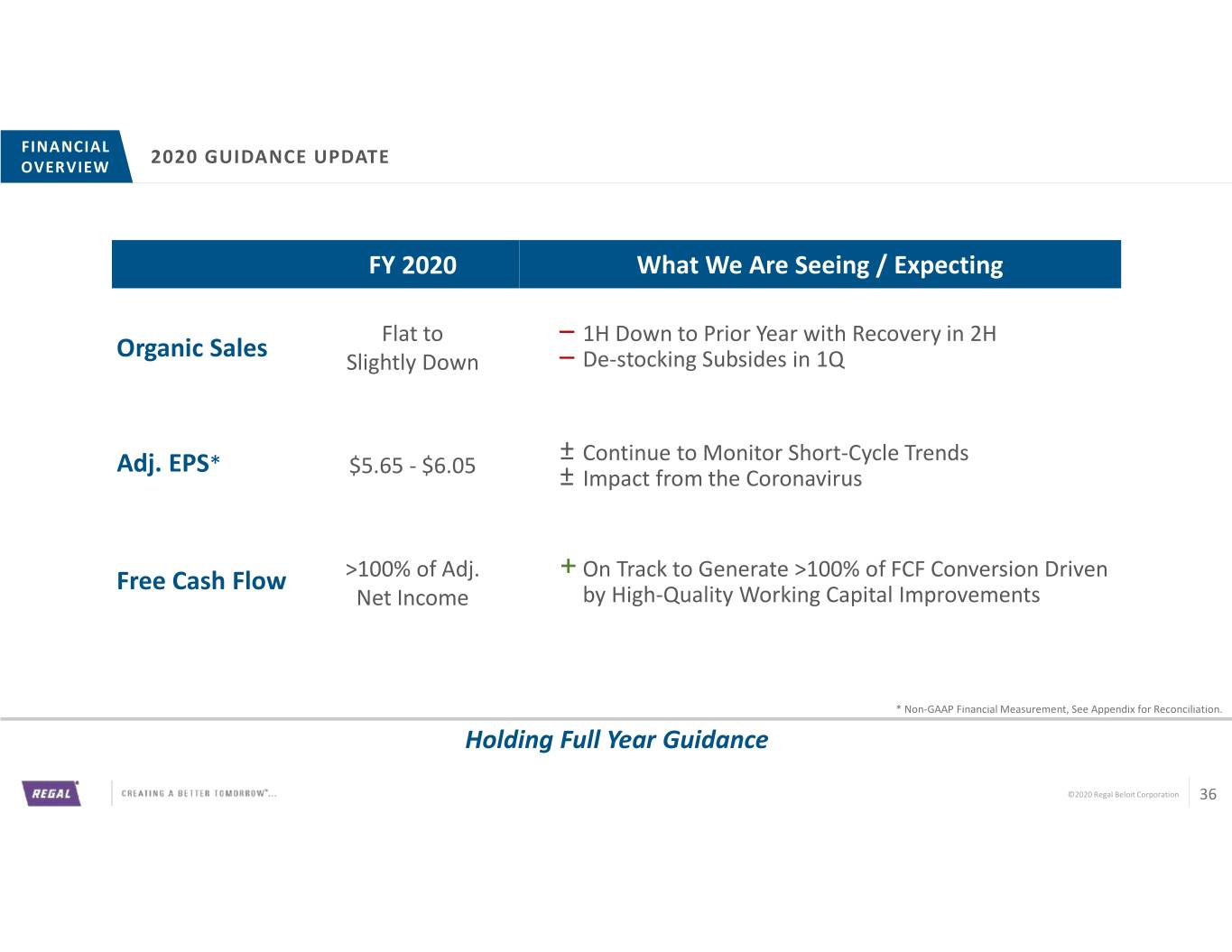

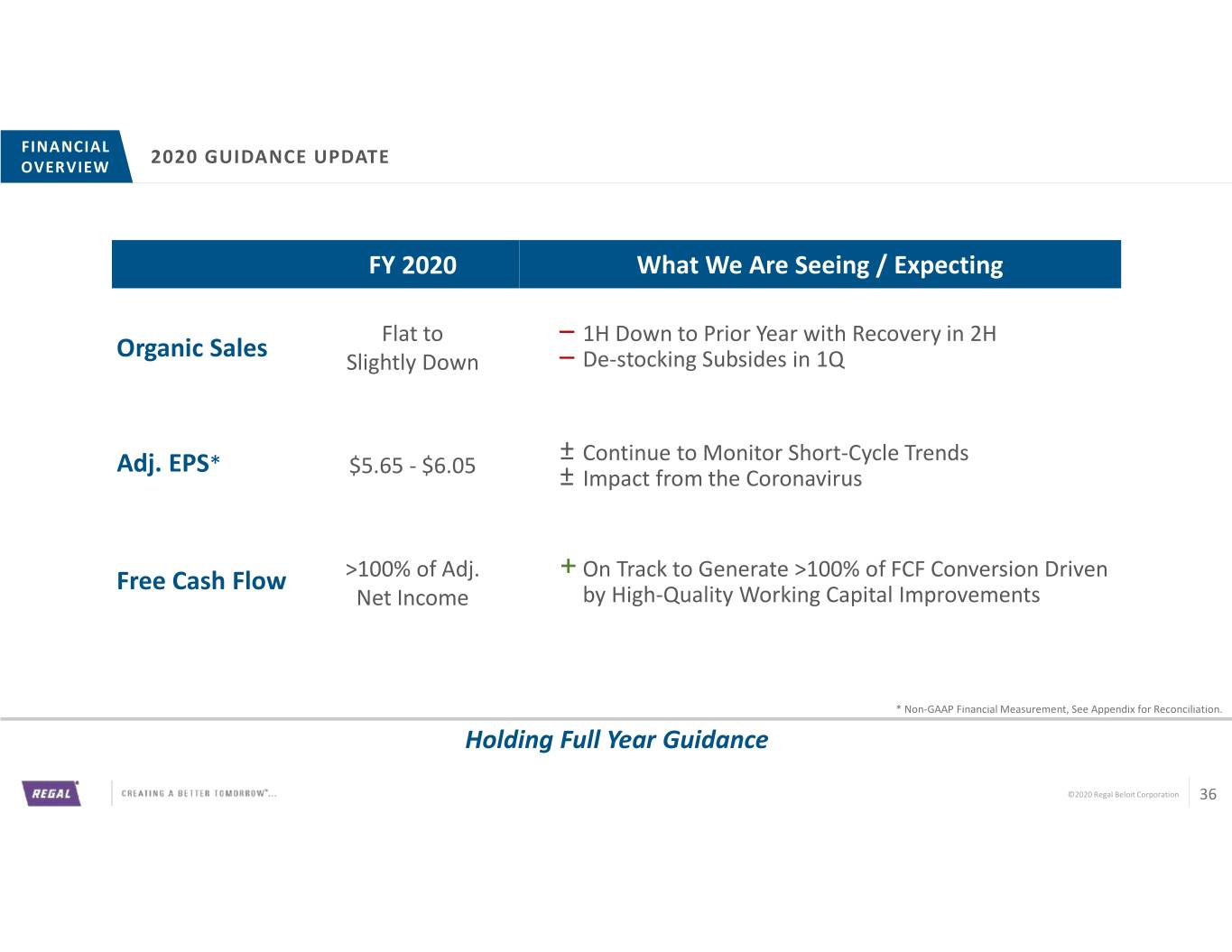

FINANCIAL OVERVIEW 2020 GUIDANCE UPDATE FY 2020 What We Are Seeing / Expecting Flat to – 1H Down to Prior Year with Recovery in 2H Organic Sales Slightly Down – De-stocking Subsides in 1Q ± Continue to Monitor Short-Cycle Trends Adj. EPS* $5.65 - $6.05 ± Impact from the Coronavirus Free Cash Flow >100% of Adj. + On Track to Generate >100% of FCF Conversion Driven Net Income by High-Quality Working Capital Improvements * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Holding Full Year Guidance ©2020 Regal Beloit Corporation 36

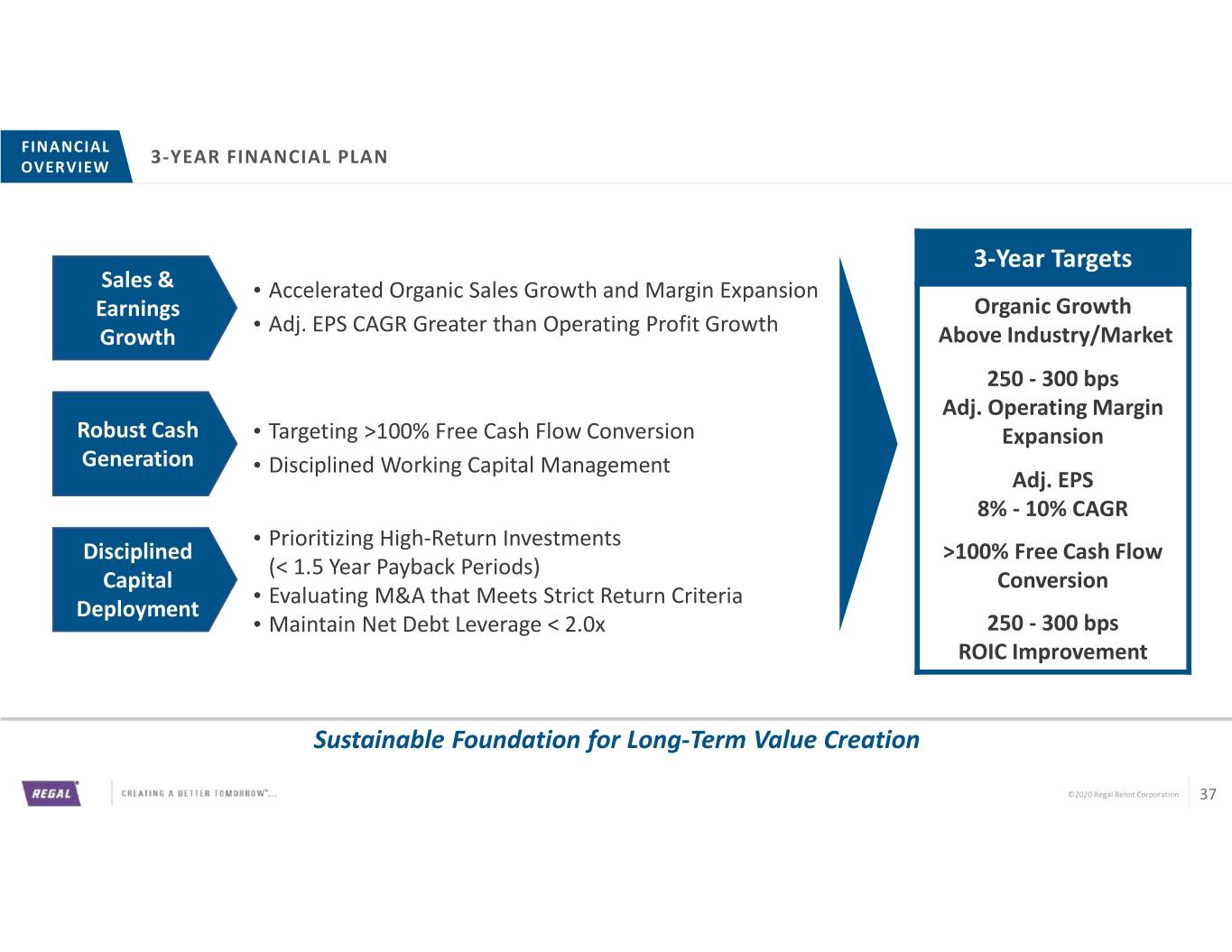

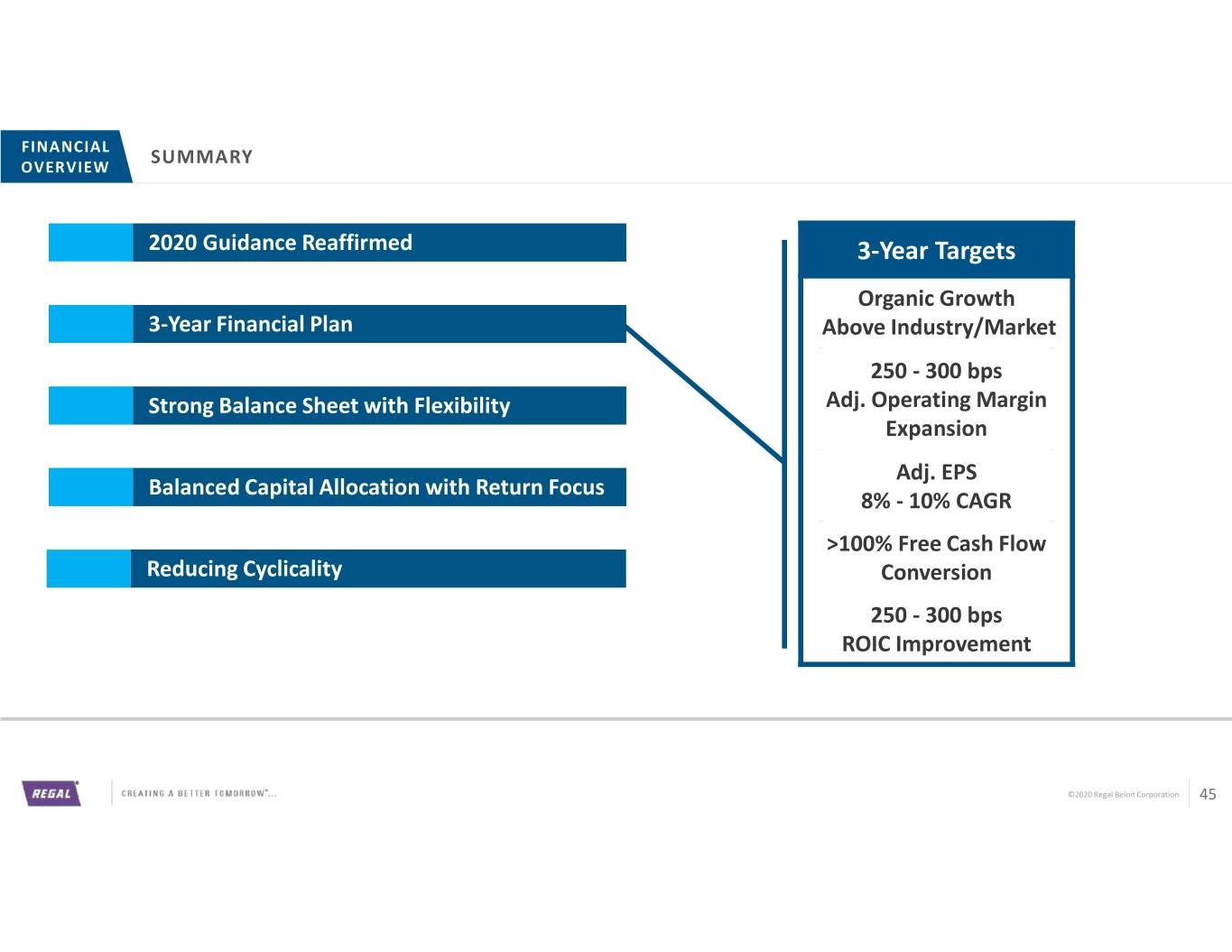

FINANCIAL OVERVIEW 3-YEAR FINANCIAL PLAN 3-Year Targets Sales & • Accelerated Organic Sales Growth and Margin Expansion Earnings Organic Growth • Adj. EPS CAGR Greater than Operating Profit Growth Growth Above Industry/Market 250 - 300 bps Adj. Operating Margin Robust Cash • Targeting >100% Free Cash Flow Conversion Expansion Generation • Disciplined Working Capital Management Adj. EPS 8% - 10% CAGR • Prioritizing High-Return Investments Disciplined >100% Free Cash Flow (< 1.5 Year Payback Periods) Capital Conversion • Evaluating M&A that Meets Strict Return Criteria Deployment • Maintain Net Debt Leverage < 2.0x 250 - 300 bps ROIC Improvement Sustainable Foundation for Long-Term Value Creation ©2020 Regal Beloit Corporation 37

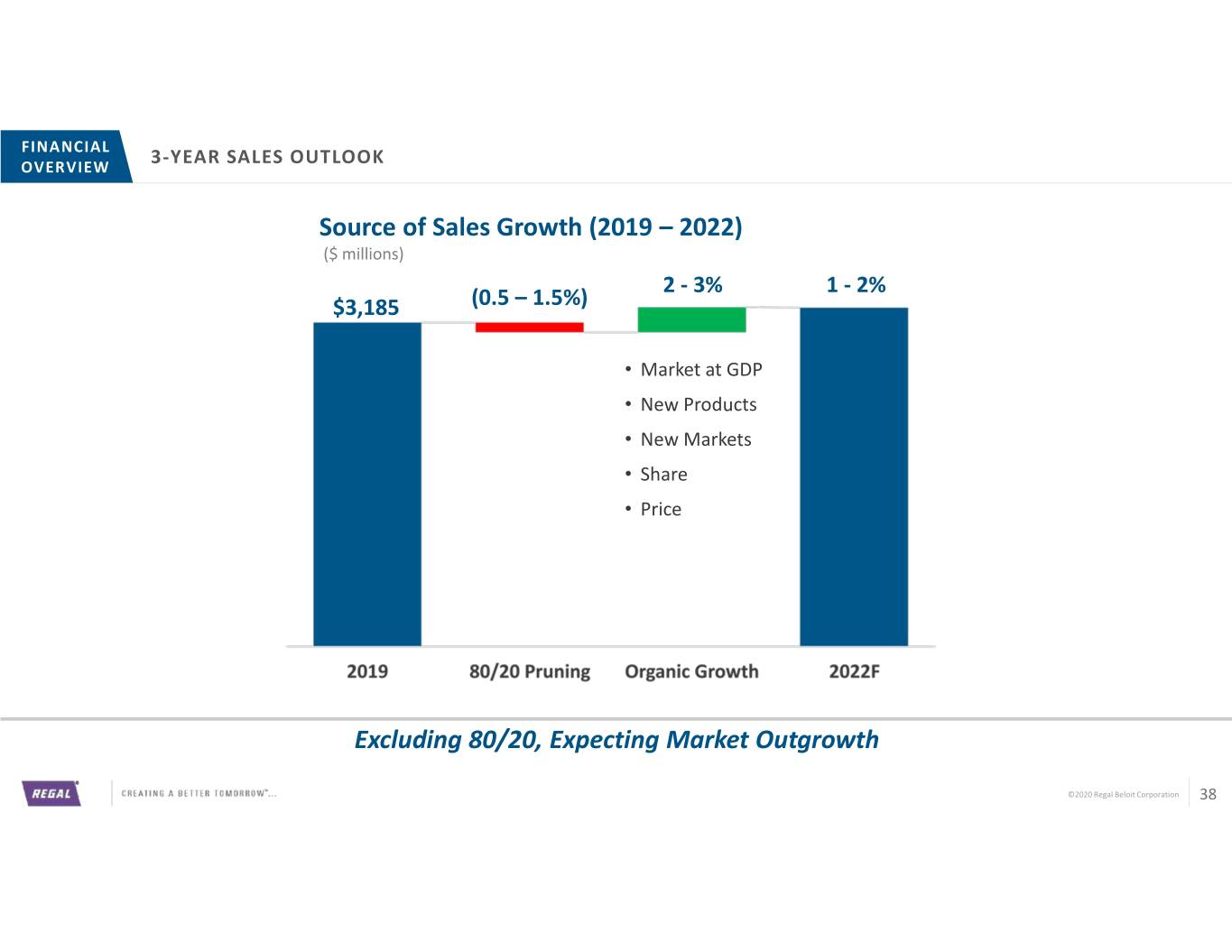

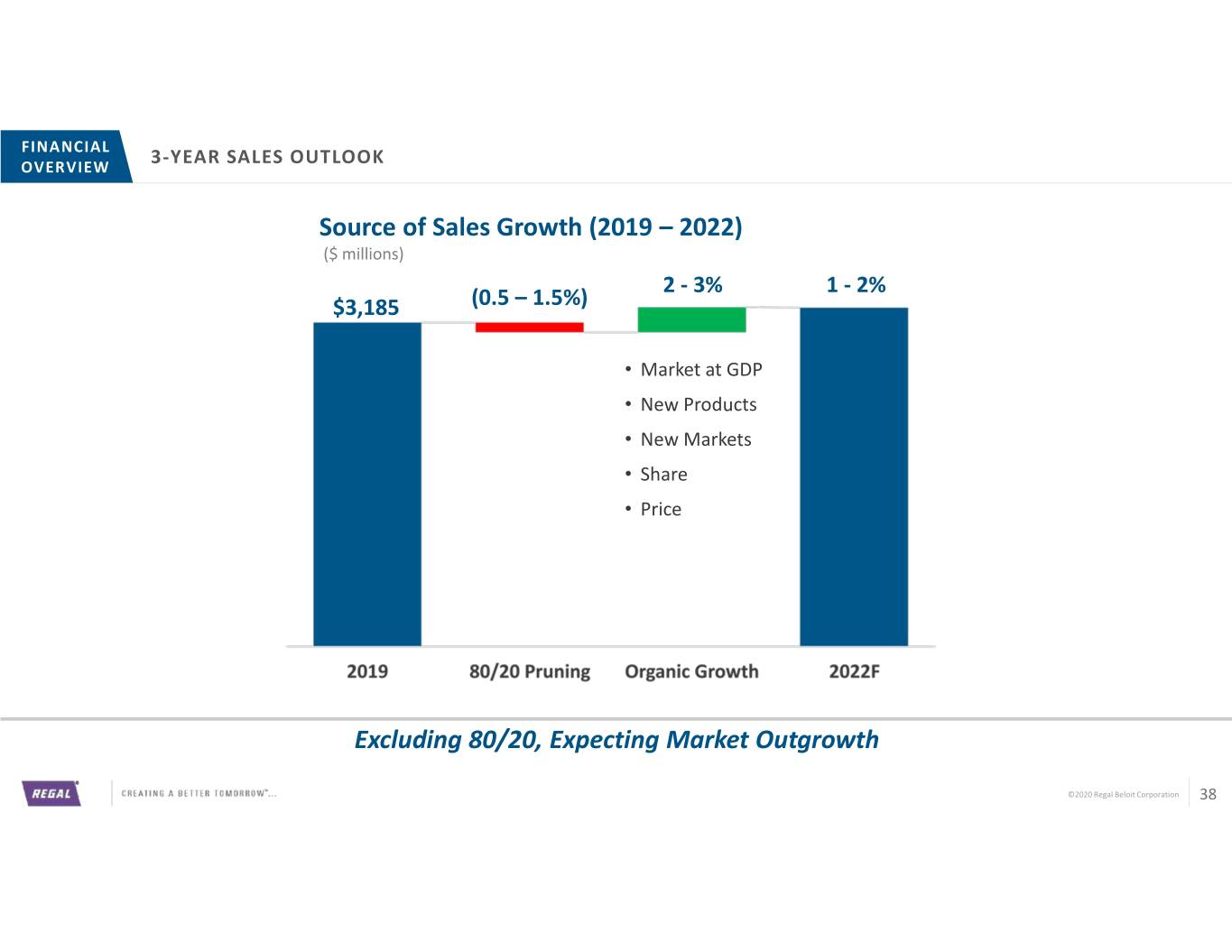

FINANCIAL OVERVIEW 3-YEAR SALES OUTLOOK Source of Sales Growth (2019 – 2022) ($ millions) 2 - 3% 1 - 2% $3,185 (0.5 – 1.5%) • Market at GDP • New Products • New Markets • Share • Price Excluding 80/20, Expecting Market Outgrowth ©2020 Regal Beloit Corporation 38

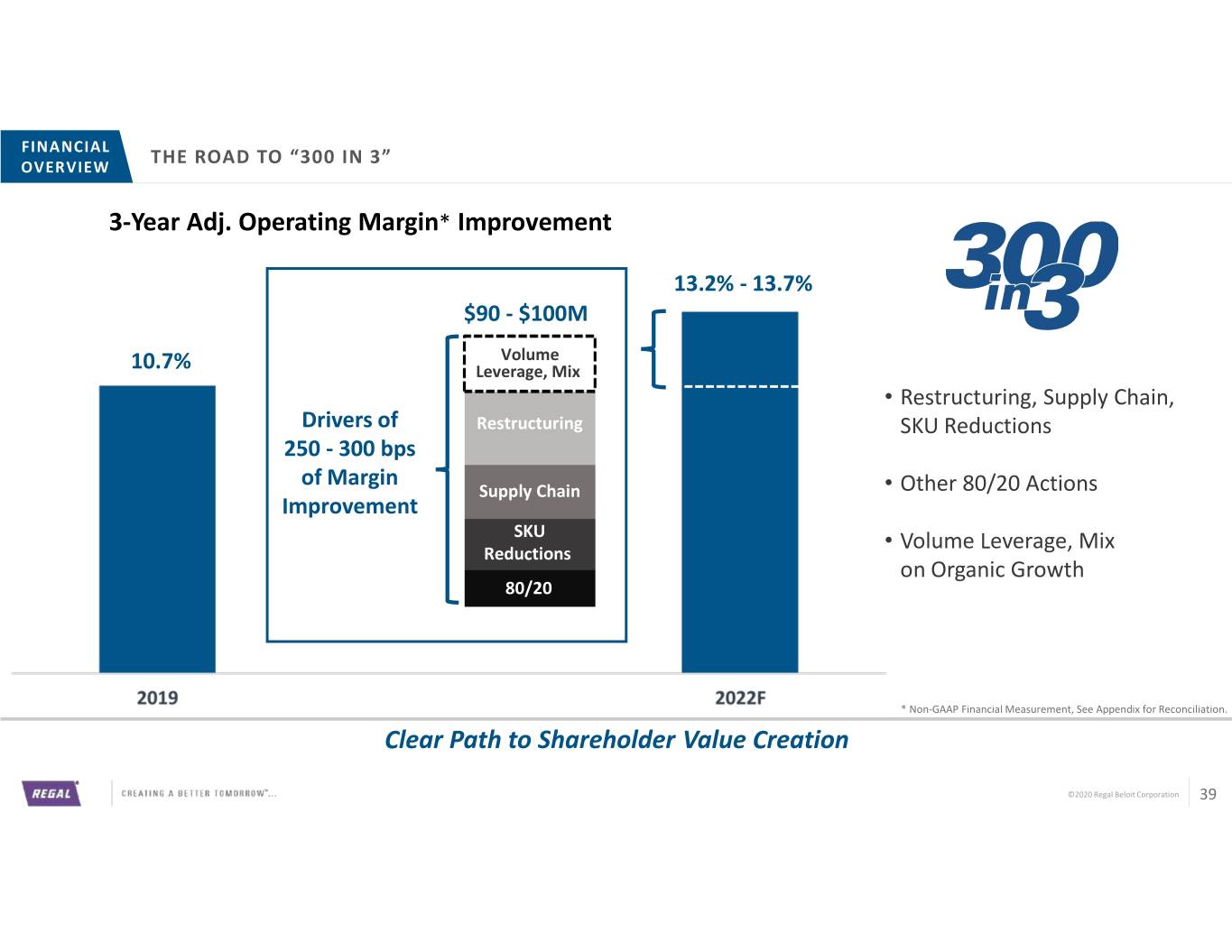

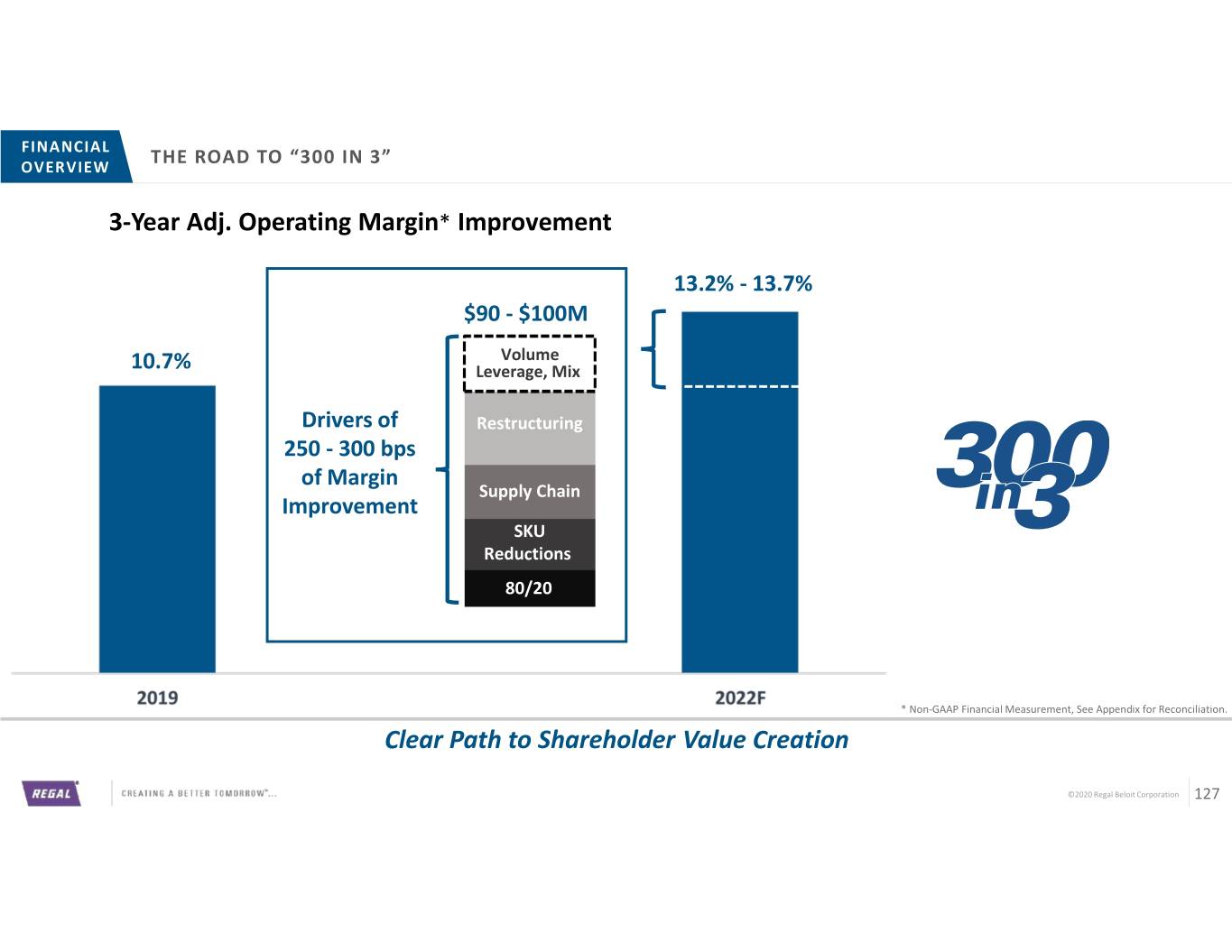

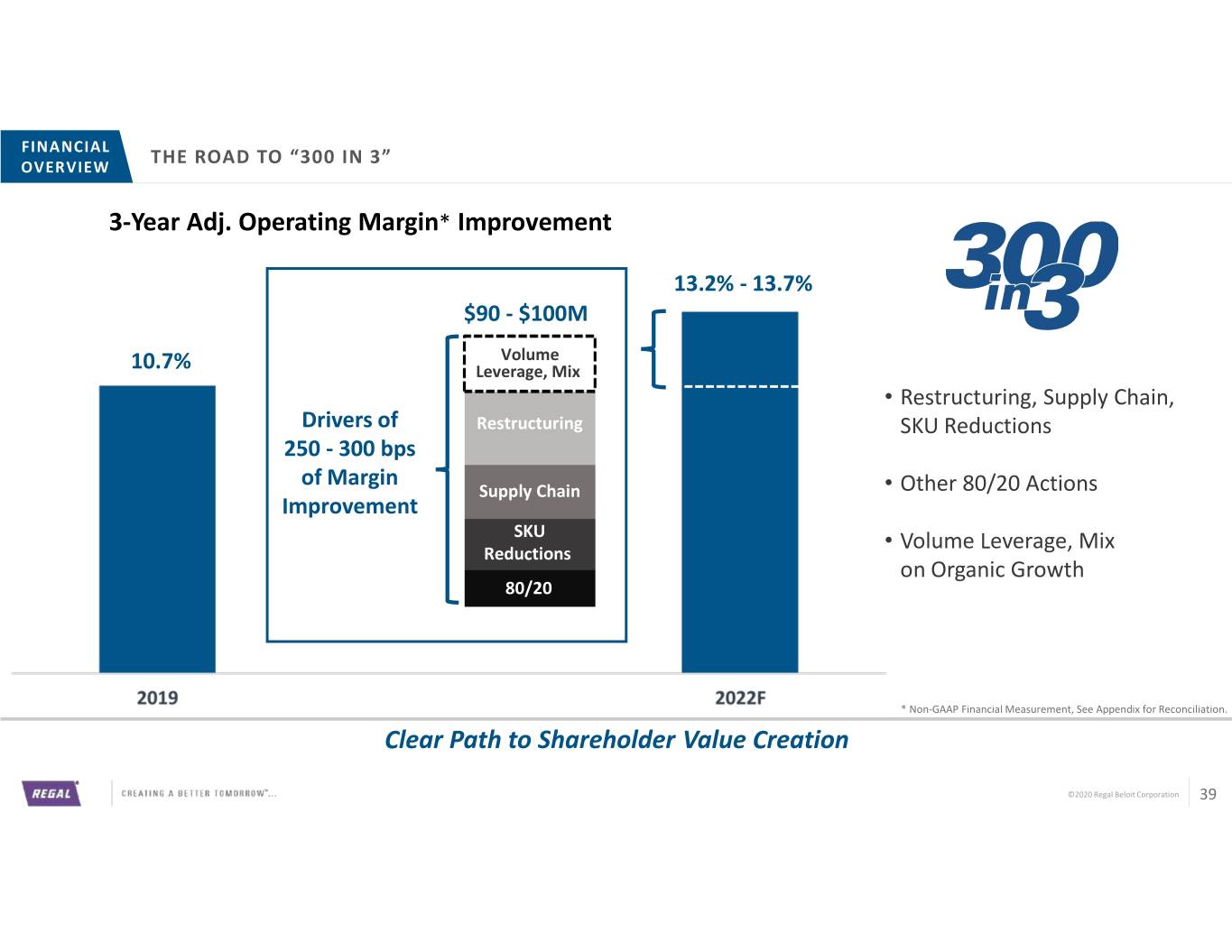

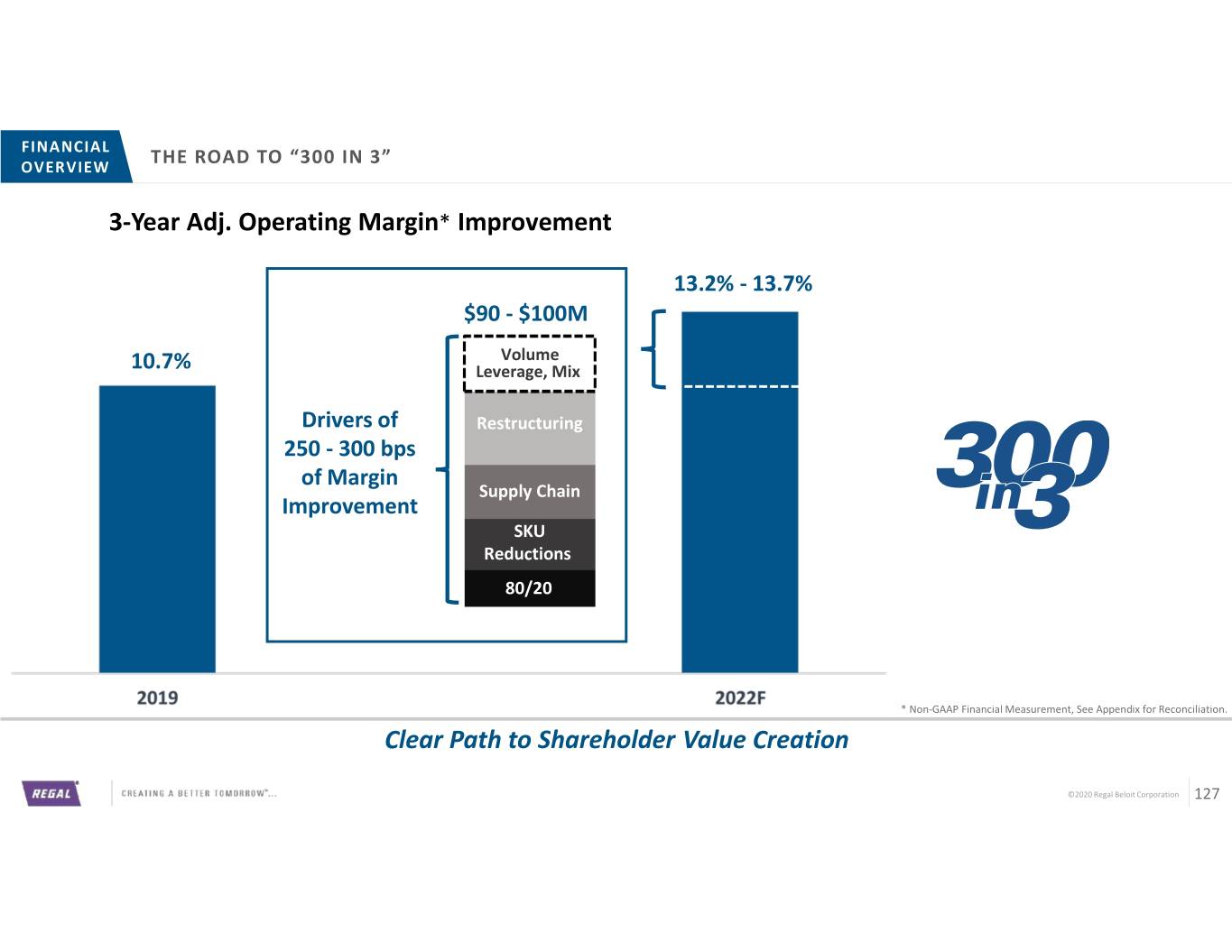

FINANCIAL OVERVIEW THE ROAD TO “300 IN 3” 3-Year Adj. Operating Margin* Improvement 13.2% - 13.7% $90 - $100M Volume 10.7% Leverage, Mix • Restructuring, Supply Chain, Drivers of Restructuring SKU Reductions 250 - 300 bps of Margin Supply Chain • Other 80/20 Actions Improvement SKU • Volume Leverage, Mix Reductions on Organic Growth 80/20 * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Clear Path to Shareholder Value Creation ©2020 Regal Beloit Corporation 39

FINANCIAL OVERVIEW ROIC – WHAT MOVES THE NEEDLE Invested Capital Key ROIC Improvement Drivers: (% of total) • Operating Profit Improvement Trade Working Capital ~25% • Trade Working Capital Optimization Fixed Assets, Leases & Other ~20% • High Return Organic Investments • Footprint Consolidation Goodwill, Other Intangibles, & • Disciplined Financial Approach for M&A Non-current Liabilities Increasing Actionability ~55% Disciplined Approach to ROIC Improvement ©2020 Regal Beloit Corporation 40

FINANCIAL OVERVIEW THROUGH THE CYCLE MARGIN TARGETS BY SEGMENT Targeted Adj. Operating Margin 2019 Adj. Operating Margin* through the Cycle Commercial 9.1% 10 – 13% Industrial 0.1% 8 – 11% Climate 16.9% 17 – 20% PTS 13.0% 15 – 18% * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Expecting Meaningful Operating Margin Growth Across All Segments ©2020 Regal Beloit Corporation 41

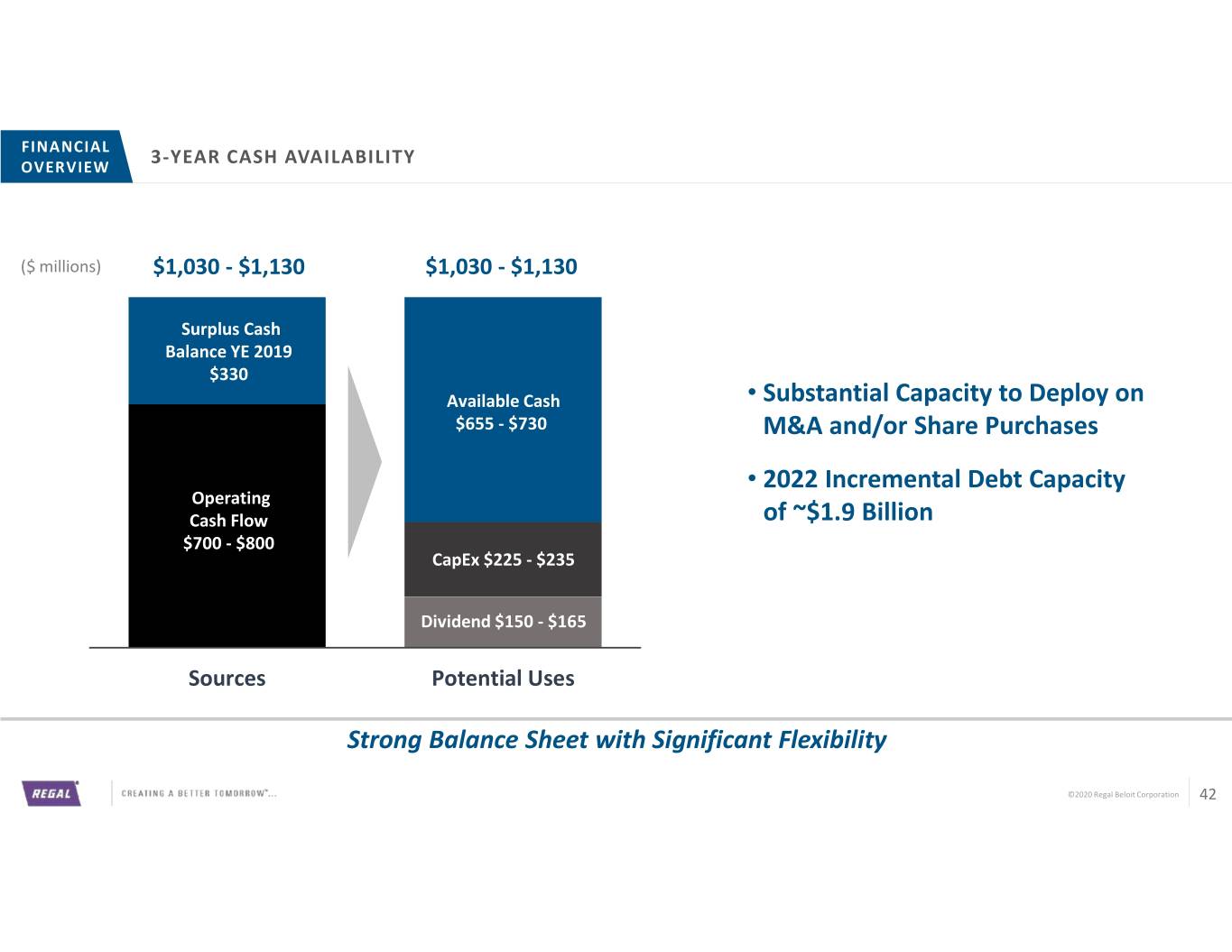

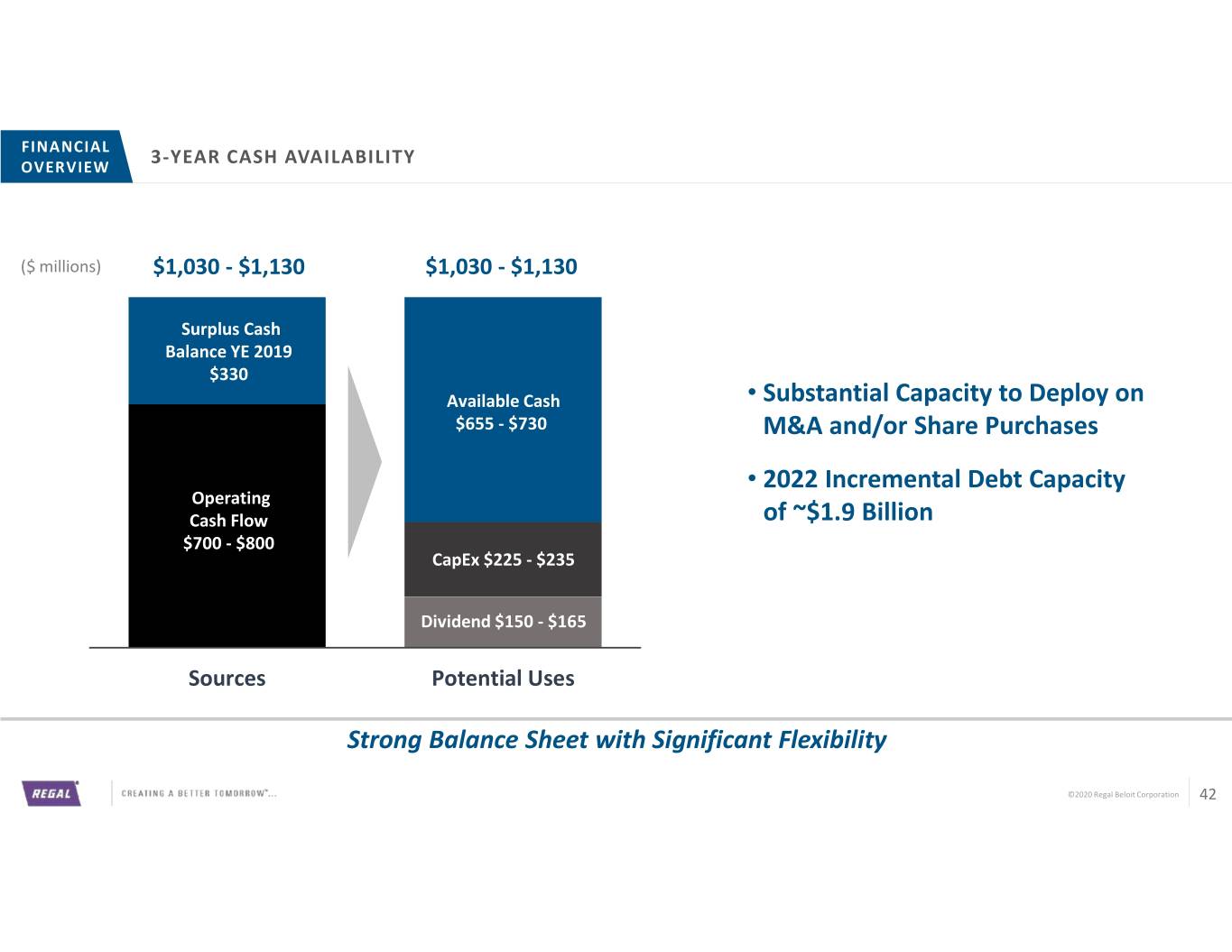

FINANCIAL OVERVIEW 3-YEAR CASH AVAILABILITY ($ millions) $1,030 - $1,130 $1,030 - $1,130 Surplus Cash Balance YE 2019 $330 Available Cash • Substantial Capacity to Deploy on $655 - $730 M&A and/or Share Purchases • 2022 Incremental Debt Capacity Operating Cash Flow of ~$1.9 Billion $700 - $800 CapEx $225 - $235 Dividend $150 - $165 Sources Potential Uses Strong Balance Sheet with Significant Flexibility ©2020 Regal Beloit Corporation 42

FINANCIAL OVERVIEW CAPITAL ALLOCATION Clear M&A Criteria 1 Invest Organically MARKET • Priority to High-Confidence Organic Investments • Stable GDP+ Growth − Innovation and New Products • Limited Risk of Technology Disruption • Deal Runway − Capacity for Growth − Digitization, e-Commerce − Productivity and Automation (Cobots) TARGET • Margin Accretive (GM >35%) • Leading Market Position / Brand 2 Growth through M&A • Differentiated Product Offering • Bolt-on Acquisitions FIT • Potentially Larger Deals if High Fit • Fit with Regal Culture • Leverages Regal’s Core Strengths • Strict Strategic Fit and Financial Discipline Criteria • Reinforces or Adds Capabilities 3 Return Capital DEAL • ROIC > WACC by 200 bps by Year 3 • EPS Accretive in Year 1 • Dividend Target ~20% Payout • Strong Cost Synergies • Share Purchases if No Investment Opportunities Consistent Approach to Capital Allocation Priorities ©2020 Regal Beloit Corporation 43

FINANCIAL OVERVIEW ACTIVELY MANAGING CYCLICALITY Cost Structure Changes RBS • Overhead Elimination/Reduction • Working Capital Optimization • Product/SKU Rationalization Market Diversification RBS • Connected Technology • Monitoring, Diagnostics, Predictive Maintenance • New Products • New Markets RBS Portfolio Management • Reduced Exposure to Highly Cyclical Industries through Divestitures Reducing Cyclicality ©2020 Regal Beloit Corporation 44

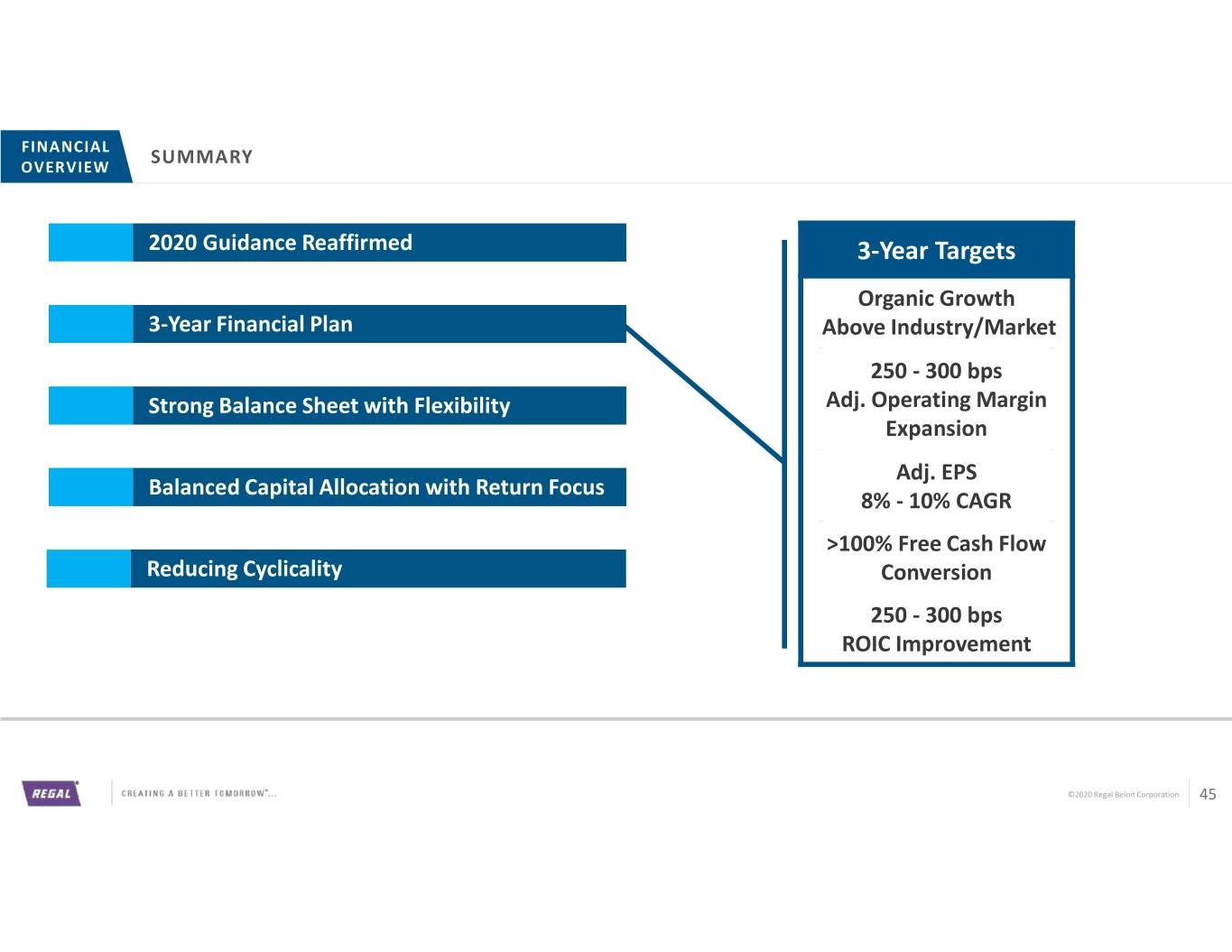

FINANCIAL OVERVIEW SUMMARY 2020 Guidance Reaffirmed 3-Year Targets Organic Growth 3-Year Financial Plan Above Industry/Market 250 - 300 bps Strong Balance Sheet with Flexibility Adj. Operating Margin Expansion Adj. EPS Balanced Capital Allocation with Return Focus 8% - 10% CAGR >100% Free Cash Flow Reducing Cyclicality Conversion 250 - 300 bps ROIC Improvement ©2020 Regal Beloit Corporation 45

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 46

PTS AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 47

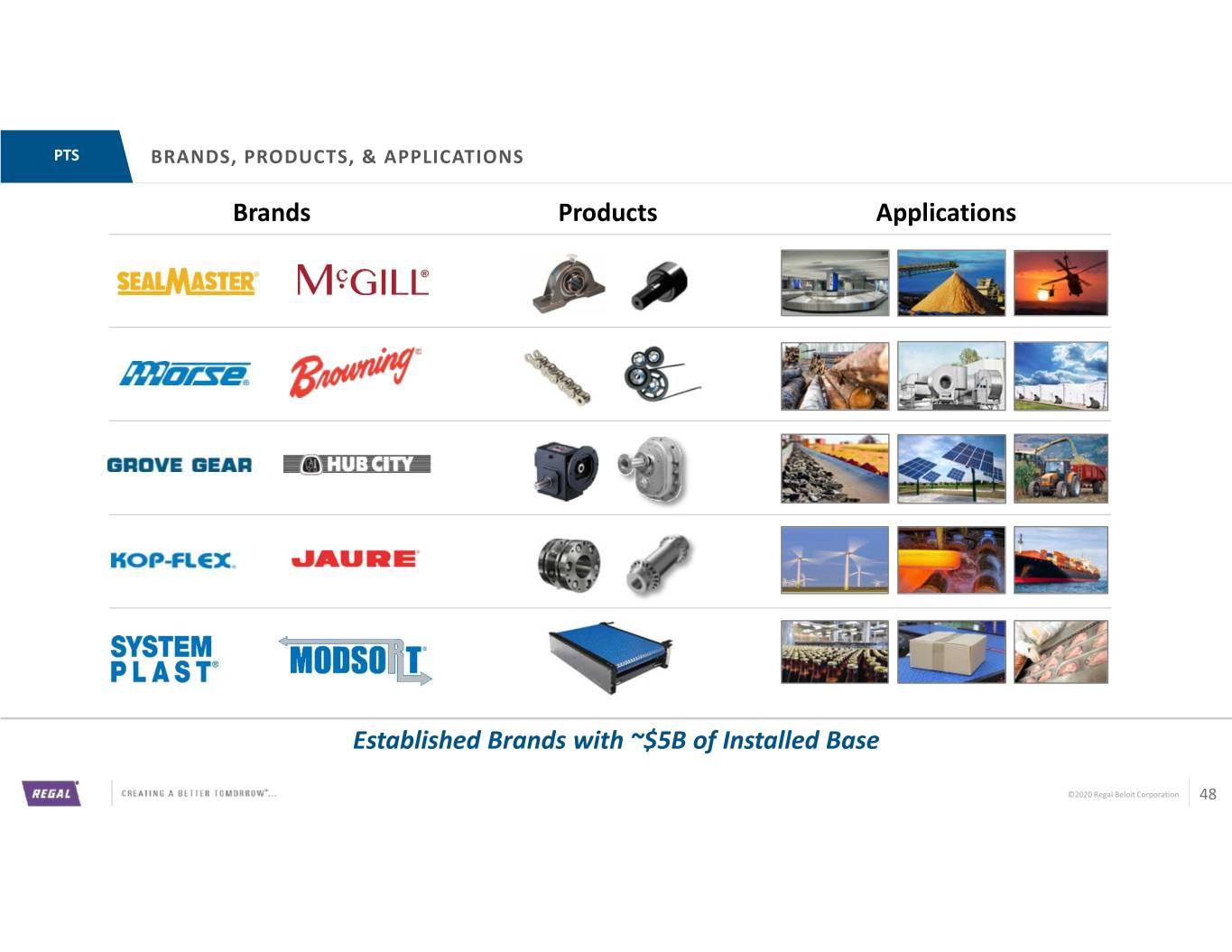

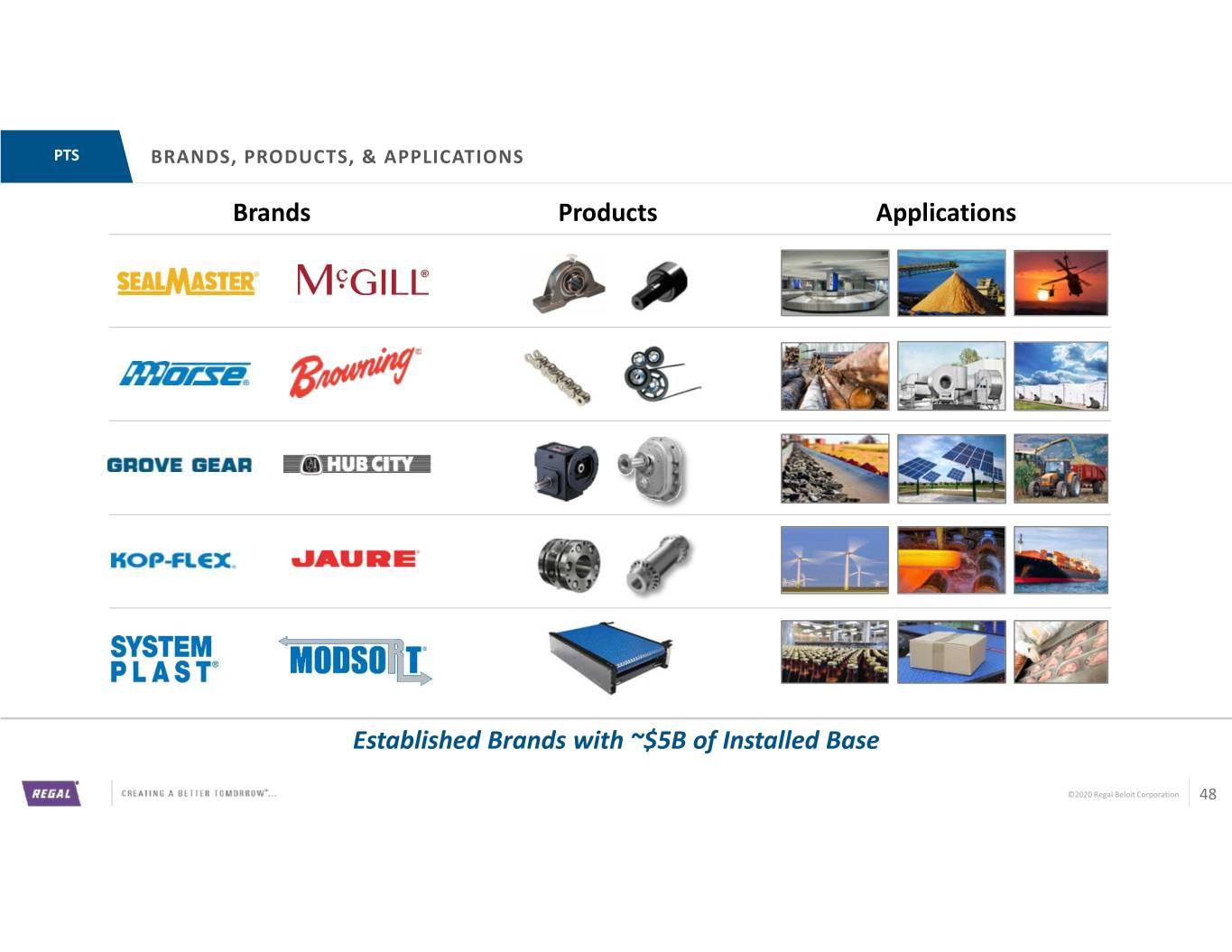

PTS BRANDS, PRODUCTS, & APPLICATIONS Brands Products Applications Established Brands with ~$5B of Installed Base ©2020 Regal Beloit Corporation 48

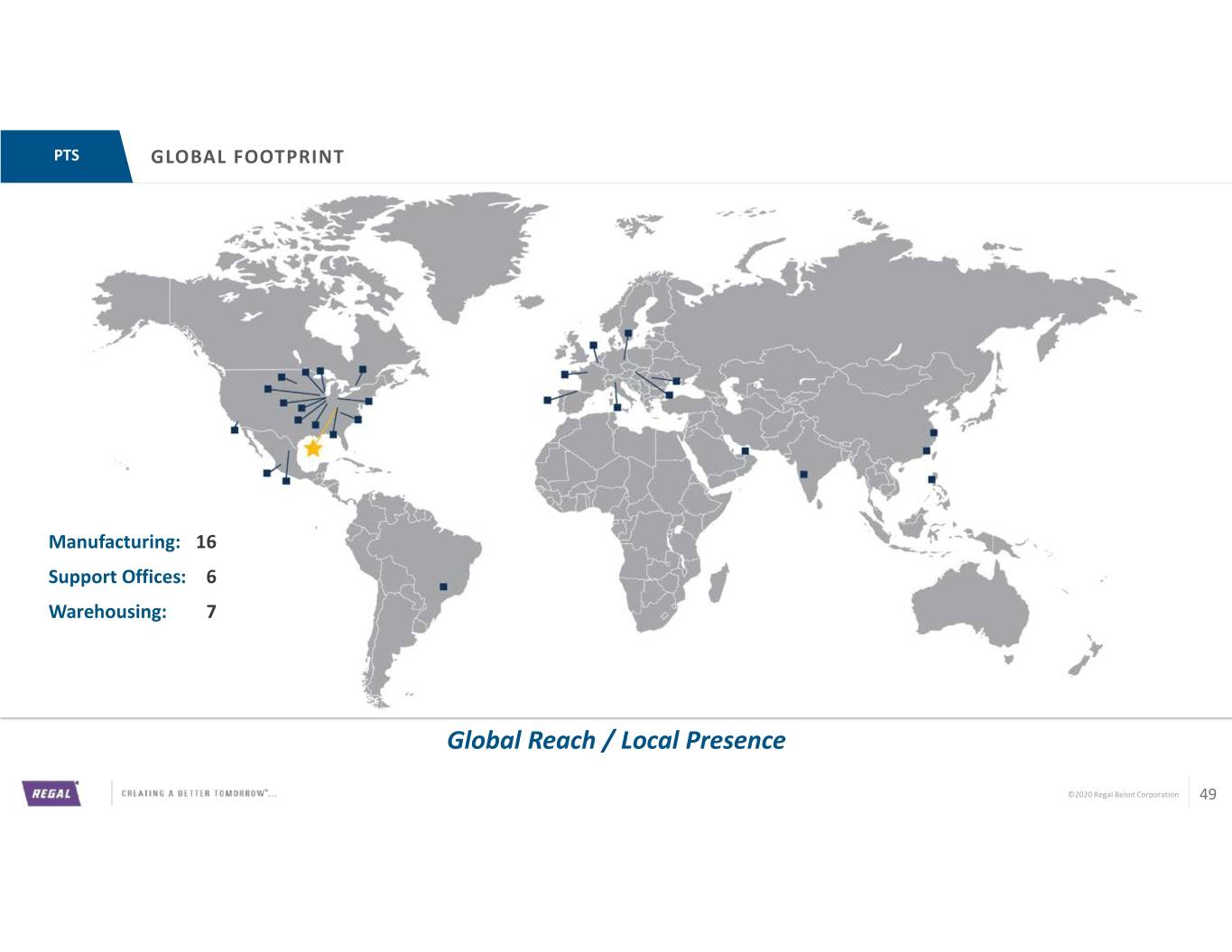

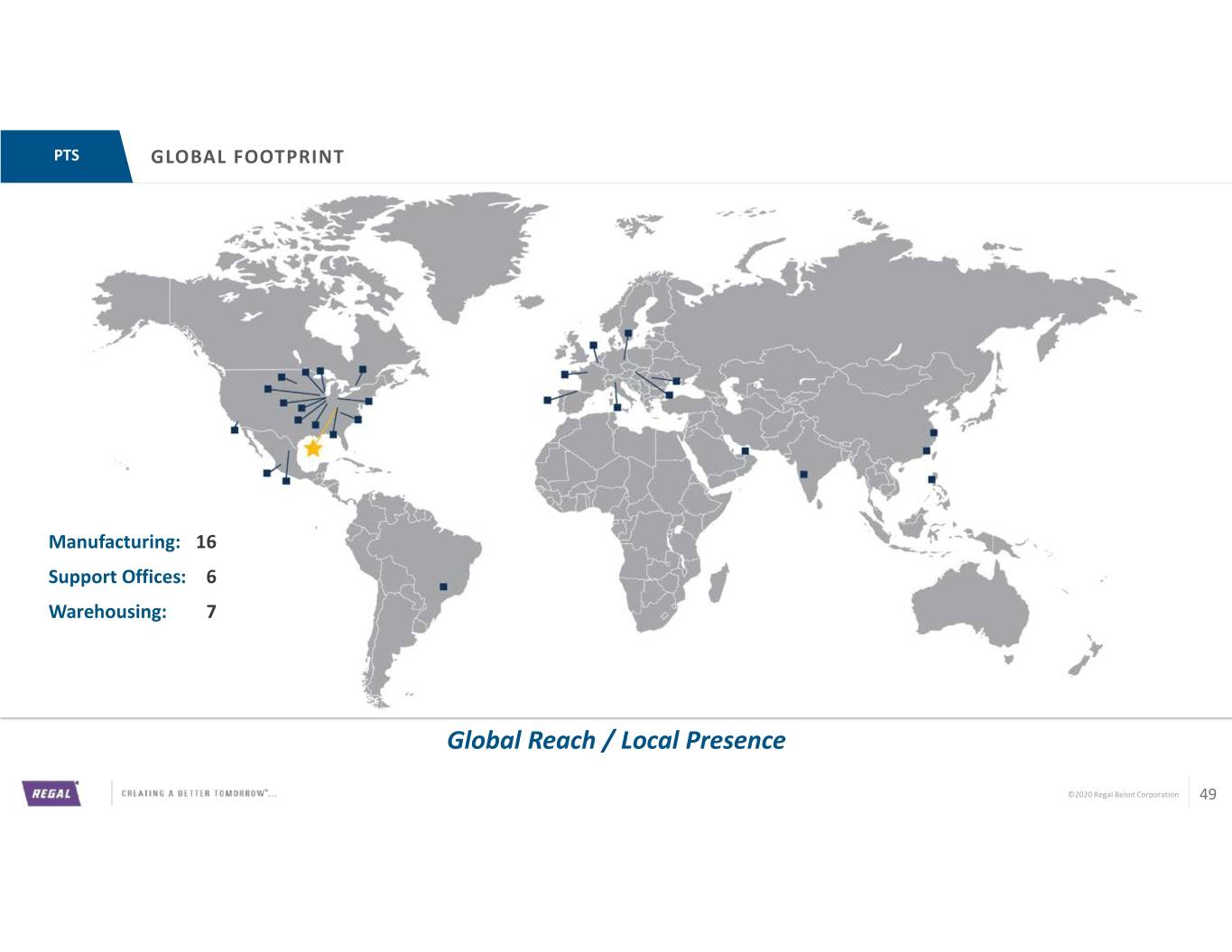

PTS GLOBAL FOOTPRINT Manufacturing: 16 Support Offices: 6 Warehousing: 7 Global Reach / Local Presence ©2020 Regal Beloit Corporation 49

PTS AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 50

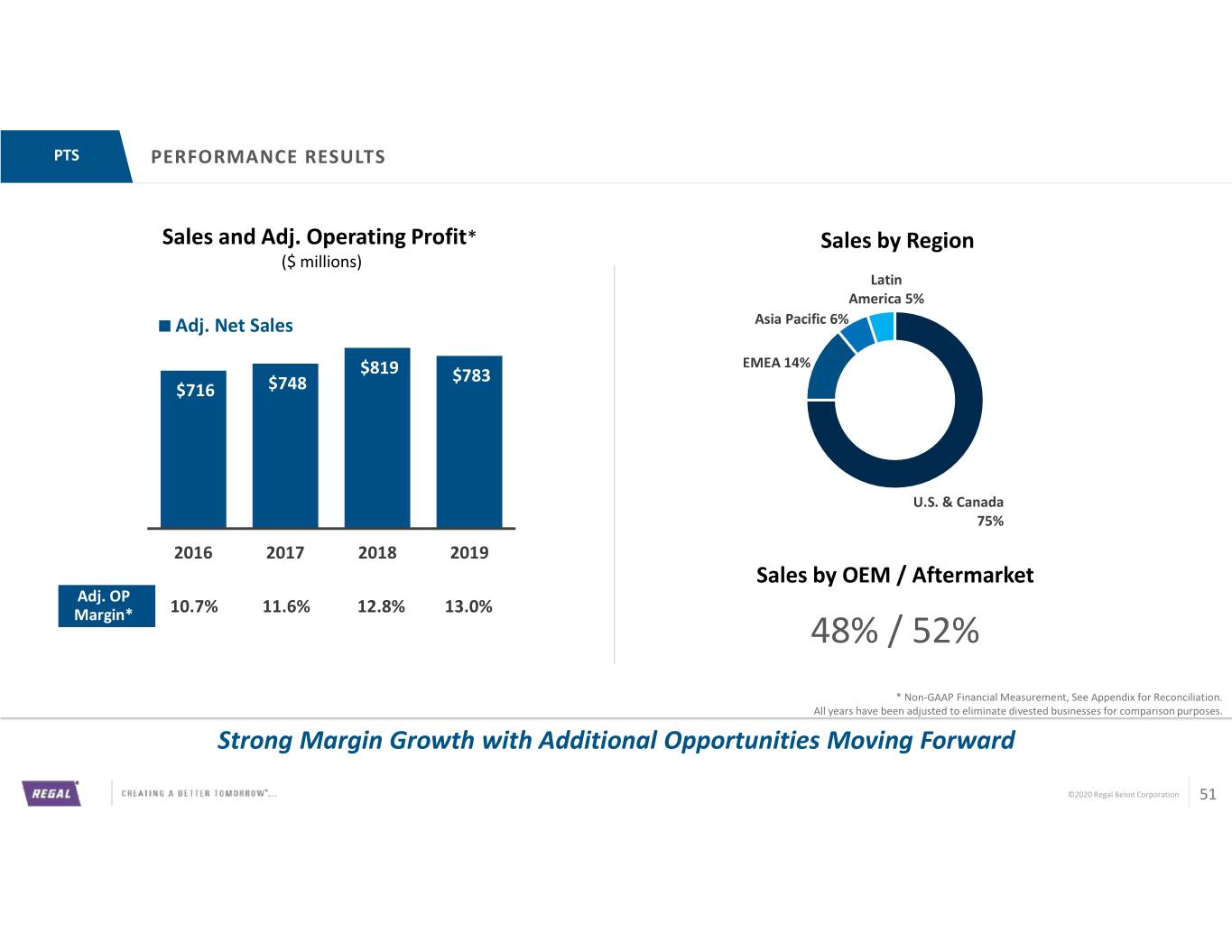

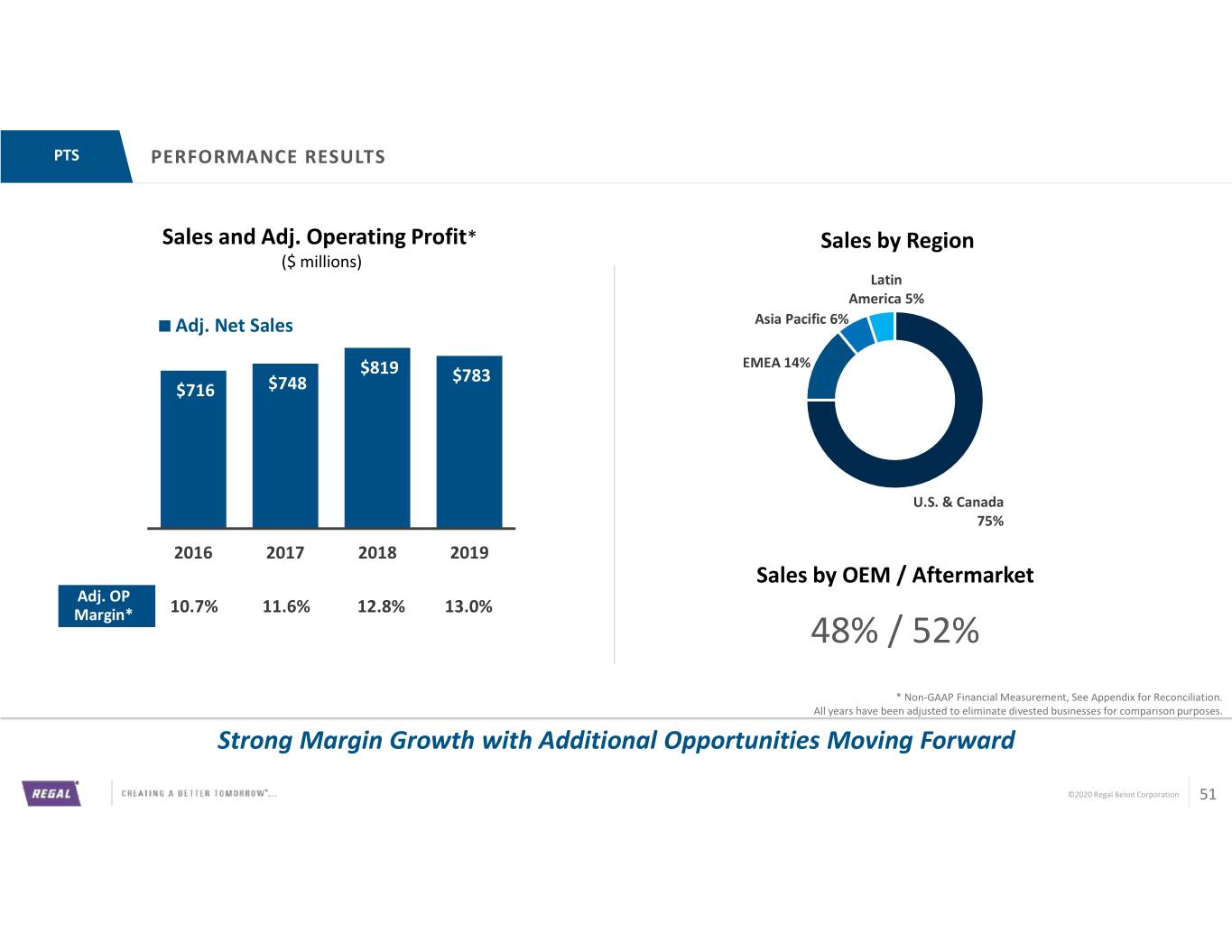

PTS PERFORMANCE RESULTS Sales and Adj. Operating Profit* Sales by Region ($ millions) Latin America 5% Adj. Net Sales Asia Pacific 6% EMEA 14% $819 $783 $716 $748 U.S. & Canada 75% 2016 2017 2018 2019 Sales by OEM / Aftermarket Adj. OP 10.7% 11.6% 12.8% 13.0% Margin* 48% / 52% * Non-GAAP Financial Measurement, See Appendix for Reconciliation. All years have been adjusted to eliminate divested businesses for comparison purposes. Strong Margin Growth with Additional Opportunities Moving Forward ©2020 Regal Beloit Corporation 51

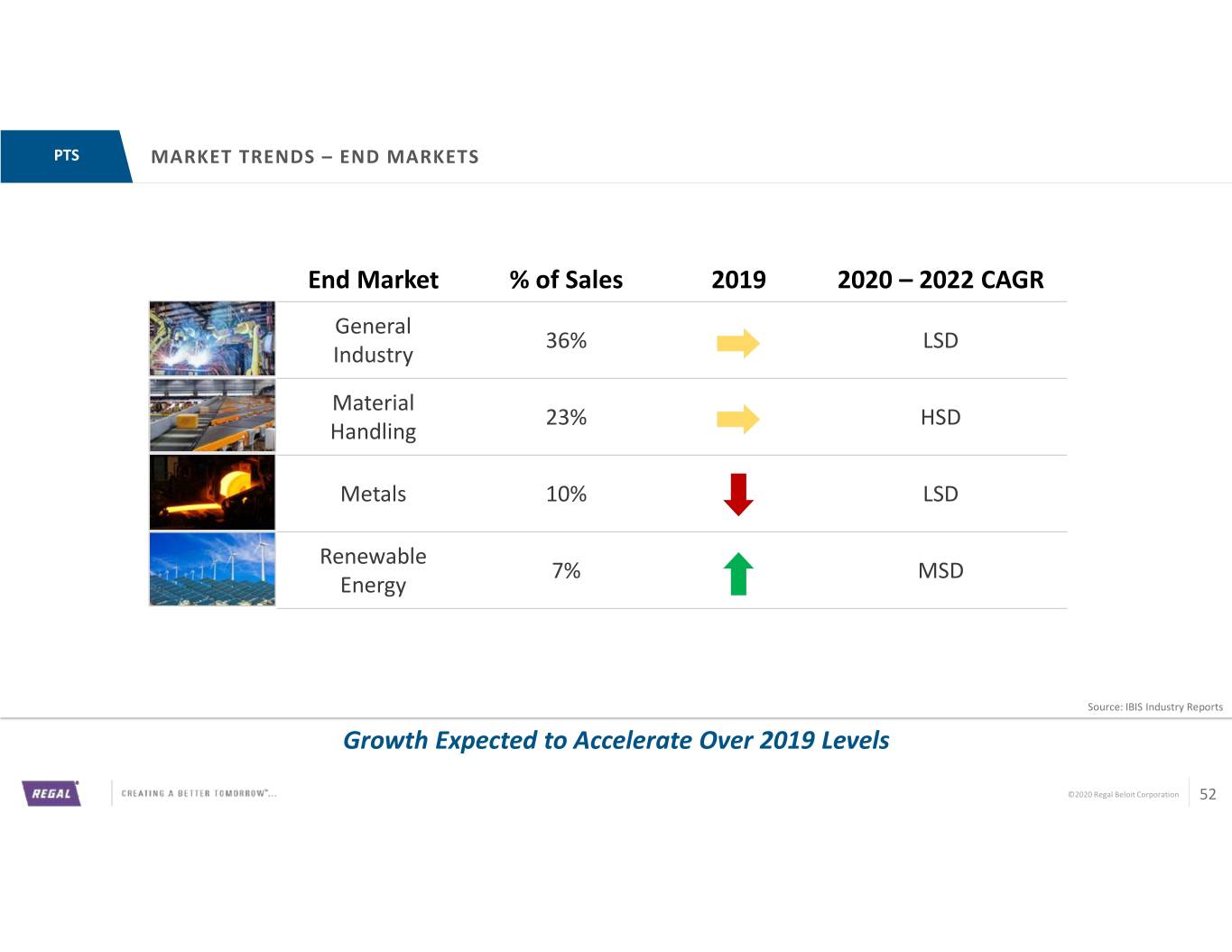

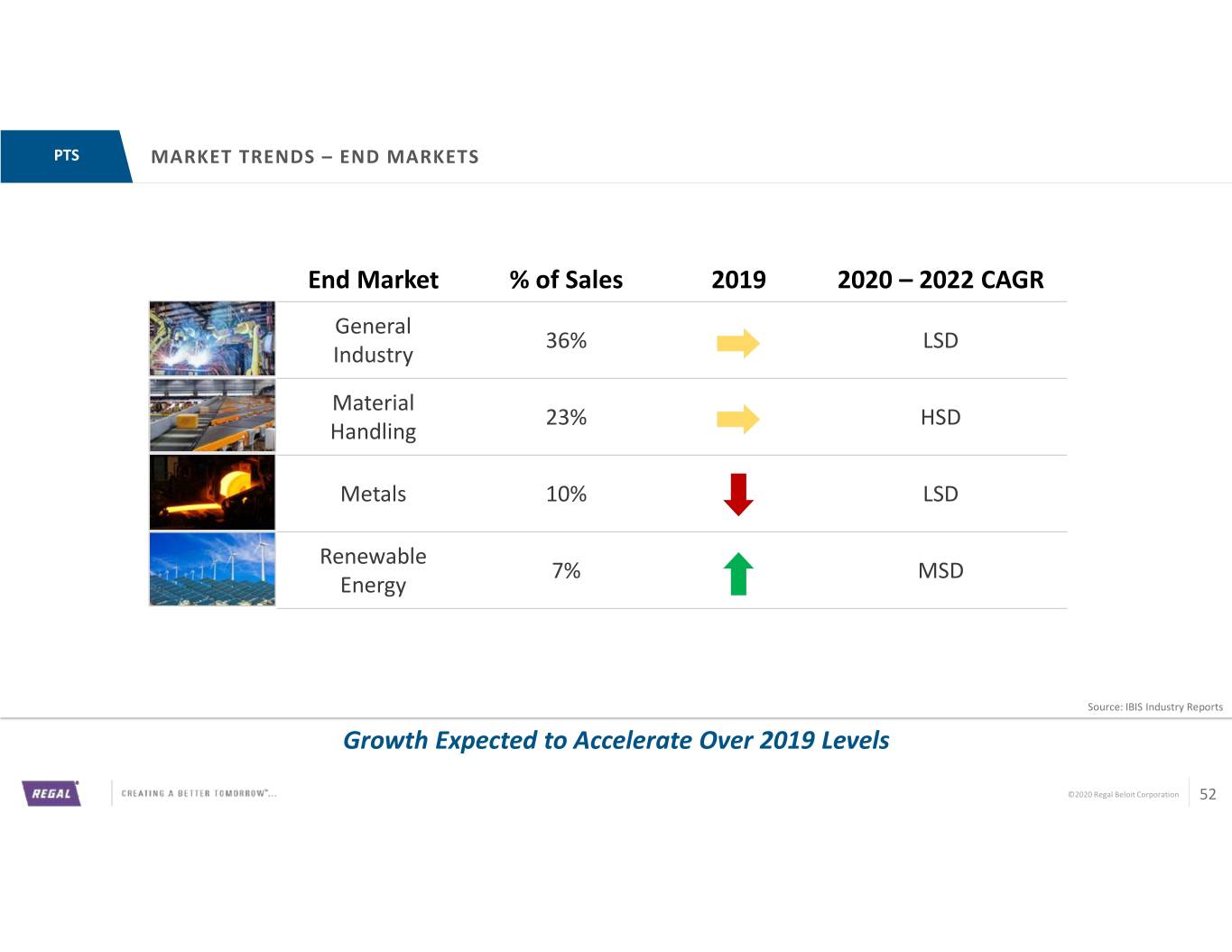

PTS MARKET TRENDS – END MARKETS End Market % of Sales 2019 2020 – 2022 CAGR General 36% LSD Industry Material 23% HSD Handling Metals 10% LSD Renewable 7% MSD Energy Source: IBIS Industry Reports Growth Expected to Accelerate Over 2019 Levels ©2020 Regal Beloit Corporation 52

PTS AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 53

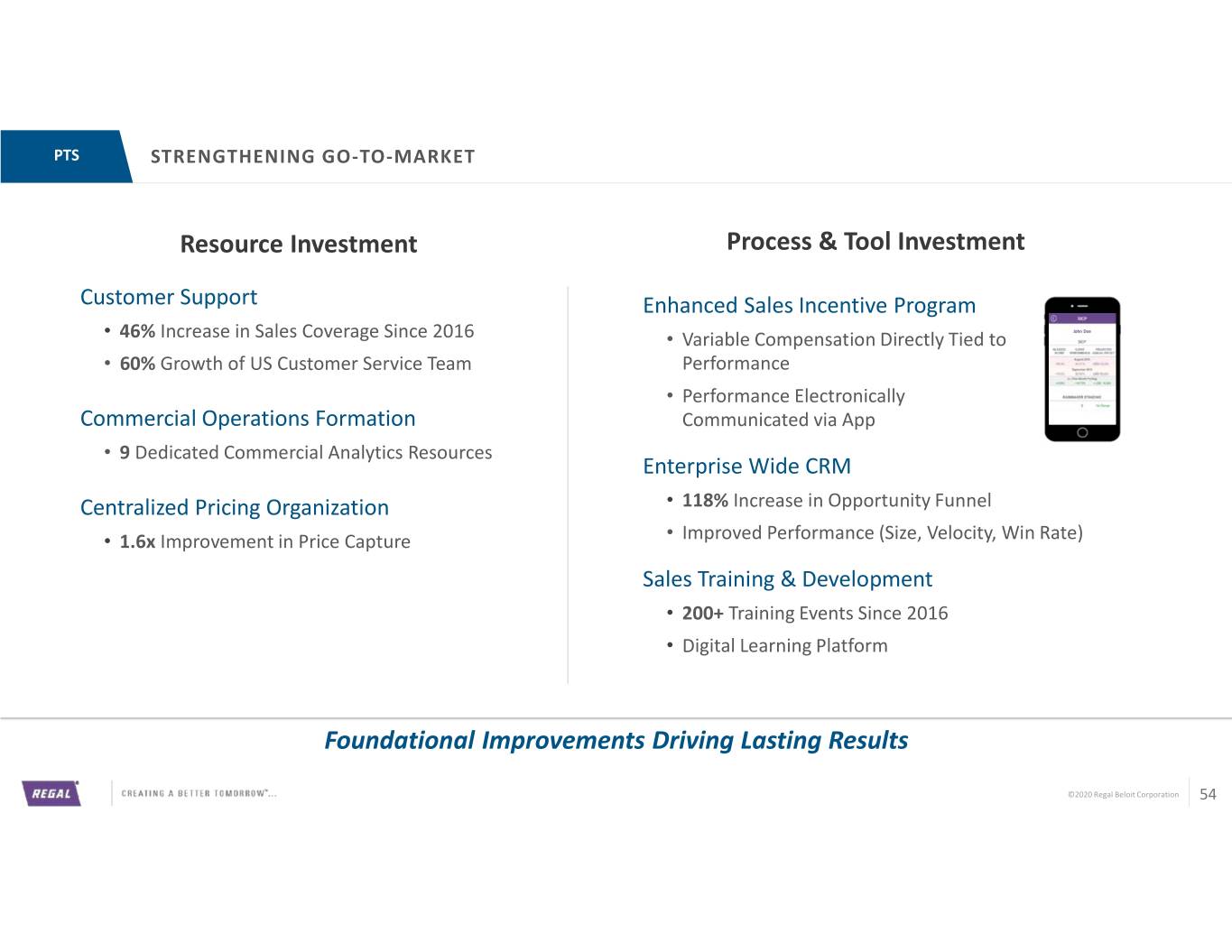

PTS STRENGTHENING GO-TO-MARKET Resource Investment Process & Tool Investment Customer Support Enhanced Sales Incentive Program • 46% Increase in Sales Coverage Since 2016 • Variable Compensation Directly Tied to John Doe • 60% Growth of US Customer Service Team Performance • Performance Electronically Commercial Operations Formation Communicated via App • 9 Dedicated Commercial Analytics Resources Enterprise Wide CRM Centralized Pricing Organization • 118% Increase in Opportunity Funnel • 1.6x Improvement in Price Capture • Improved Performance (Size, Velocity, Win Rate) Sales Training & Development • 200+ Training Events Since 2016 • Digital Learning Platform Foundational Improvements Driving Lasting Results ©2020 Regal Beloit Corporation 54

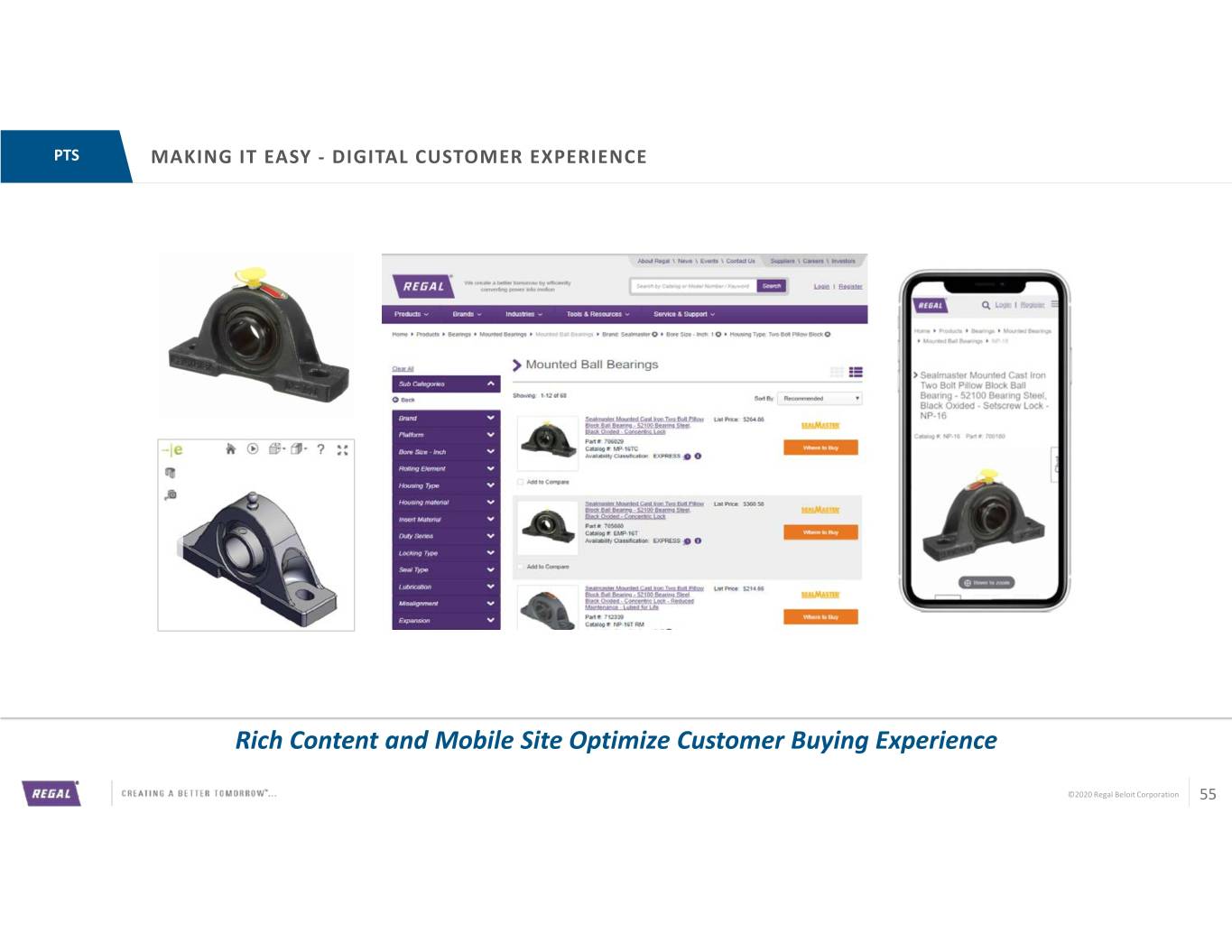

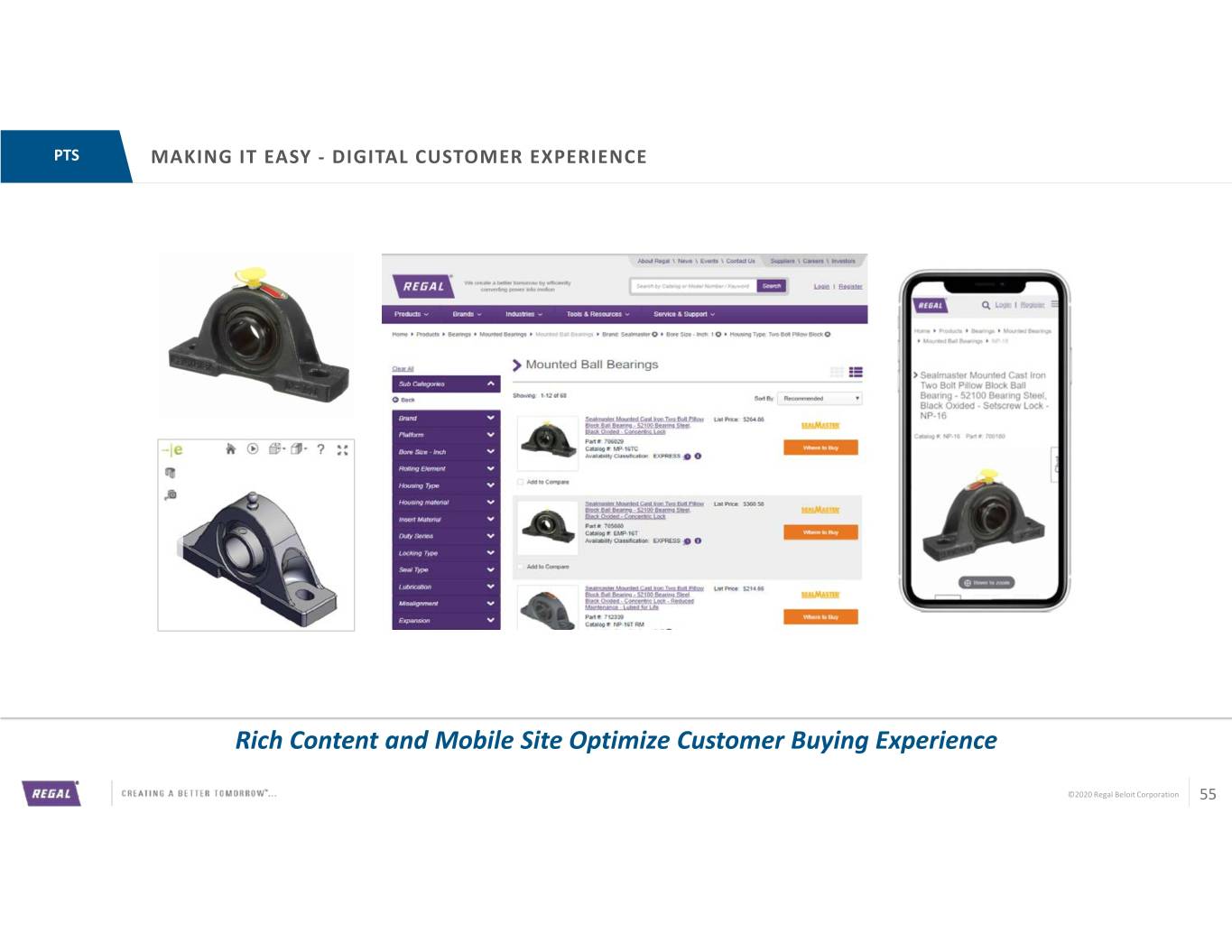

PTS MAKING IT EASY - DIGITAL CUSTOMER EXPERIENCE Rich Content and Mobile Site Optimize Customer Buying Experience ©2020 Regal Beloit Corporation 55

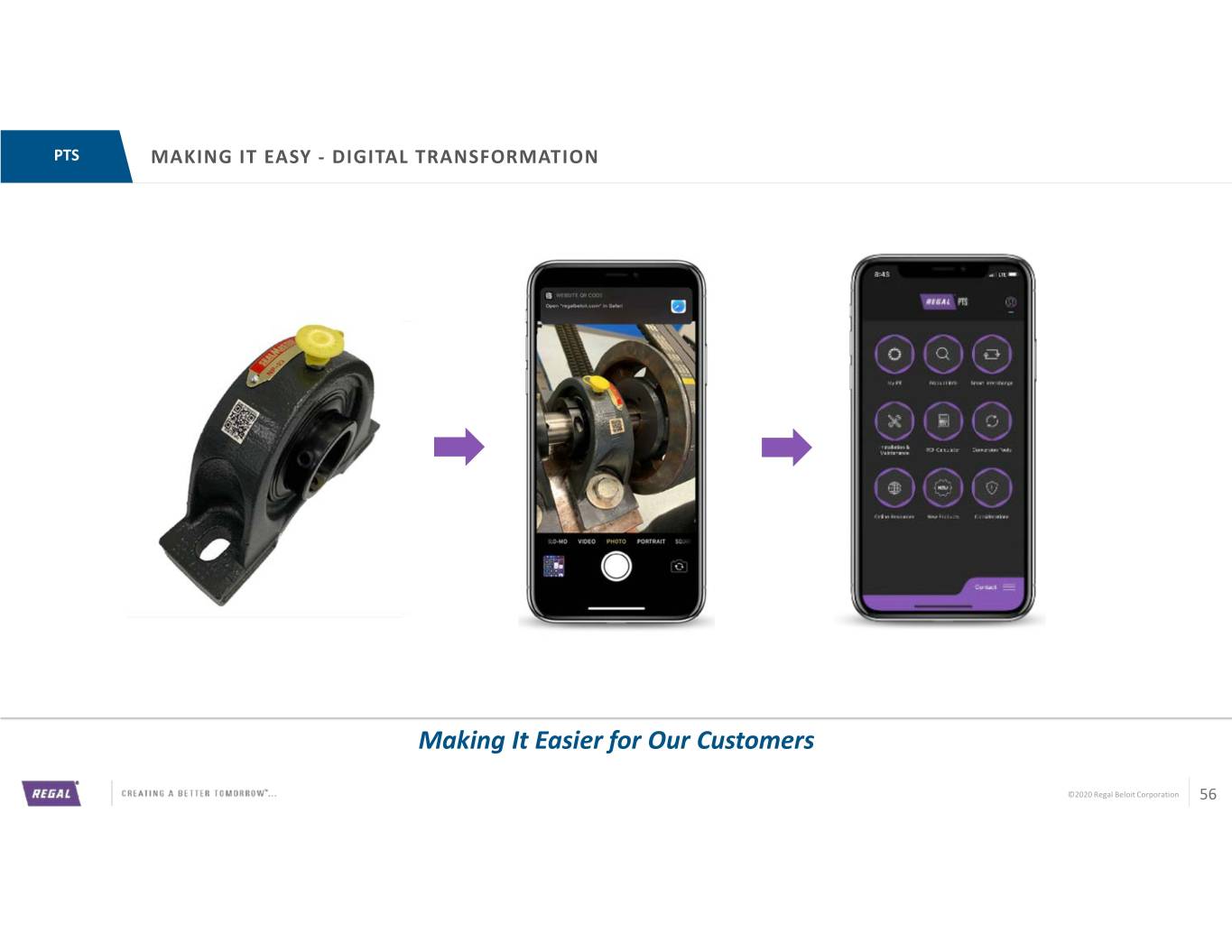

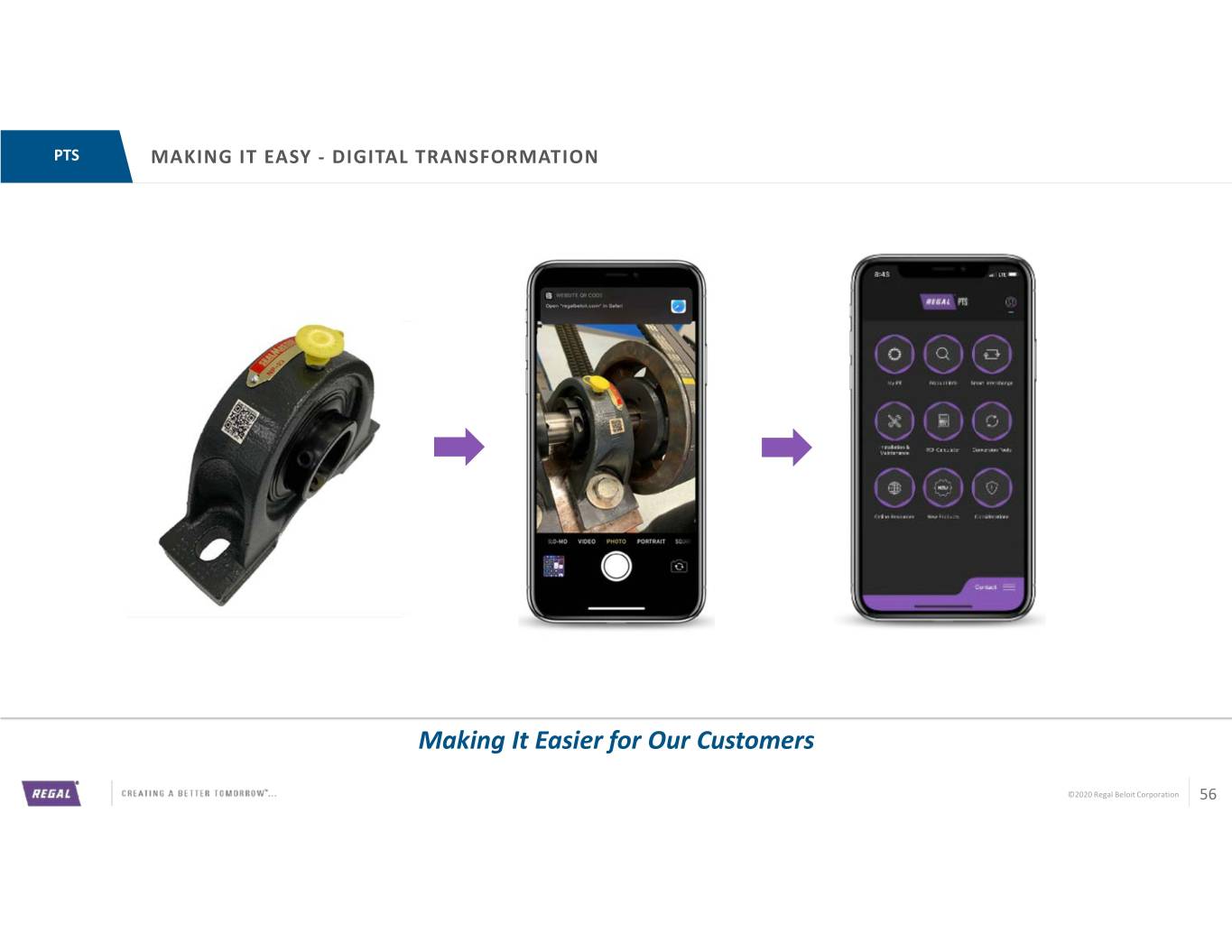

PTS MAKING IT EASY - DIGITAL TRANSFORMATION Making It Easier for Our Customers ©2020 Regal Beloit Corporation 56

PTS PRODUCT INNOVATION - MODSORT® TECHNOLOGY VALUE PROPOSITION Modsort® Module Sortation Solutions • Modular Design For Flexible Integration And Ease Of Maintenance • Rapid ROI: Increased Speed, Improved Accuracy, Reduced Cost Of Labor • IP Backed Technology Supporting ‘Last Mile’ Of Parcel Processing See ModSort in Action: https://www.youtube.com/watch?v=AIxn-DO2Zeg Game Changing Technology ©2020 Regal Beloit Corporation 57

PTS PRODUCT INNOVATION - GEARMOTOR AND CUSTOM GEARING SOLUTIONS Custom Gearing Gearmotor Solutions Fast Customization Differentiating PTS with Customers ©2020 Regal Beloit Corporation 58

PTS CONNECTED TECHNOLOGY – EMBEDDED SENSORS WITH PURPOSE Coupling Wear Measurement Sensi-Torq™ for Gear Drives Real Time Torque Monitoring Solving Customer Challenges through Connected Solutions ©2020 Regal Beloit Corporation 59

PTS AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 60

PTS 80/20 – FOOTPRINT AND PRODUCT RATIONALIZATION Segment Footprint # of Segment Product SKUs 33% 2018 2020 2022 84,000 68,000 47,000 Square Footage Square 2018 2022 Facilities 29 18 Substantial Opportunity Exists To Simplify Business Through 80/20 ©2020 Regal Beloit Corporation 61

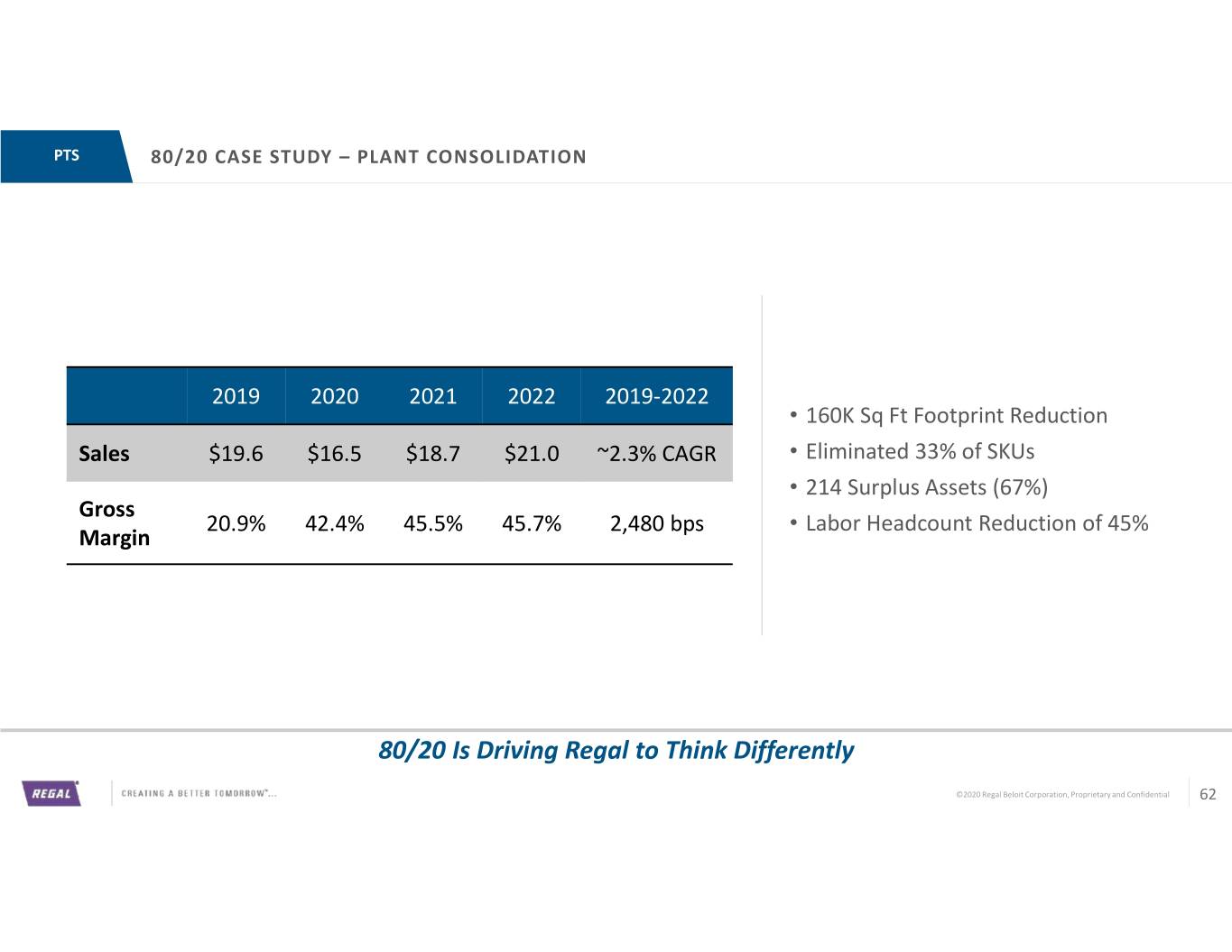

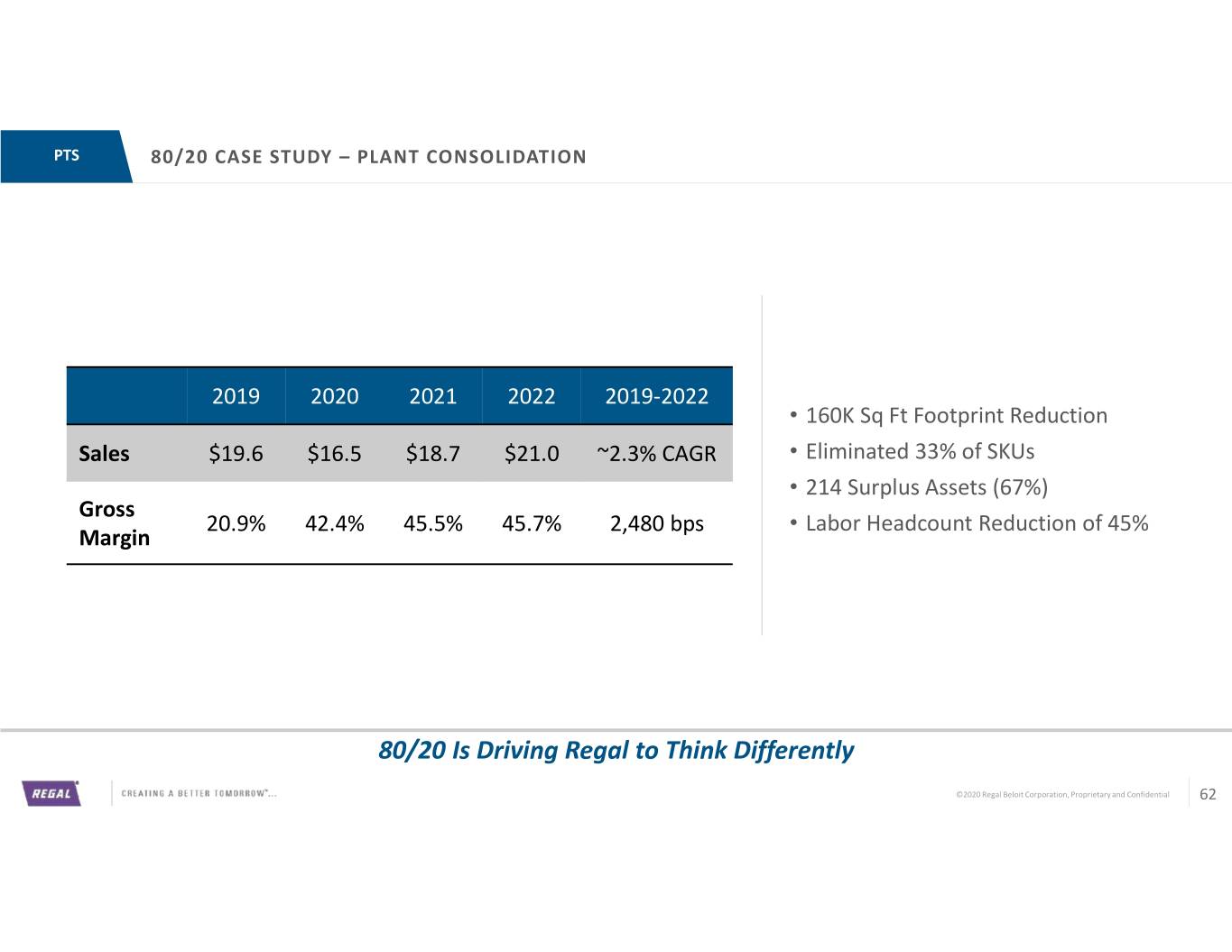

PTS 80/20 CASE STUDY – PLANT CONSOLIDATION 2019 2020 2021 2022 2019-2022 • 160K Sq Ft Footprint Reduction Sales $19.6 $16.5 $18.7 $21.0 ~2.3% CAGR • Eliminated 33% of SKUs • 214 Surplus Assets (67%) Gross 20.9% 42.4% 45.5% 45.7% 2,480 bps • Labor Headcount Reduction of 45% Margin 80/20 Is Driving Regal to Think Differently ©2020 Regal Beloit Corporation, Proprietary and Confidential 62

PTS 80/20 – OPERATIONAL IMPROVEMENTS 80/20 Simplification Enabling Targeted Automation ©2020 Regal Beloit Corporation, Proprietary and Confidential 63

PTS AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 64

PTS WHY WE WILL WIN Positioned for Growth in Fragmented Markets Market leader in Digital Commerce Solutions ModSort® Conveying Technology is a Game Changer Focused Customized Gearmotor Solutions to Solve Customer Challenges Well Positioned to Grow with an Array of Connected Solutions 80/20 Will Simplify and Improve our Performance ©2020 Regal Beloit Corporation 65

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 66

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 67

COMMERCIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 68

COMMERCIAL BRANDS, PRODUCTS, & APPLICATIONS Brands Products Applications Strong Brands, Attractive Segments, Leading Positions ©2020 Regal Beloit Corporation 69

COMMERCIAL GLOBAL FOOTPRINT Manufacturing: 17 Support Offices: 6 Warehousing: 3 Ability To Leverage Global Technology & Manufacturing Capabilities ©2020 Regal Beloit Corporation 70

COMMERCIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 71

COMMERCIAL PERFORMANCE RESULTS Sales and Adj. Operating Profit* Sales by Region ($ millions) Europe 12% Adj. Net Sales Asia $935 $880 Pacific 15% North America 73% 2018 2019 Sales by OEM / Aftermarket Adj. OP Margin* 9.9% 9.1% 76% / 24% * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 2016 and 2017 Results Not Shown Due to Re-Segmentation at the End of 2019 Despite Difficult Markets in 2019, De-levered at 14.3%* ©2020 Regal Beloit Corporation 72

COMMERCIAL MARKET TRENDS – END MARKETS End Market % of Sales 2019 2020 – 2022 CAGR General Industry 42% LSD CHVAC 34% LSD Water – Leisure & 24% LSD Non-Leisure Source: NEMA Industry Reports and Management Estimates Global GDP Markets With Regulation Tailwinds ©2020 Regal Beloit Corporation 73

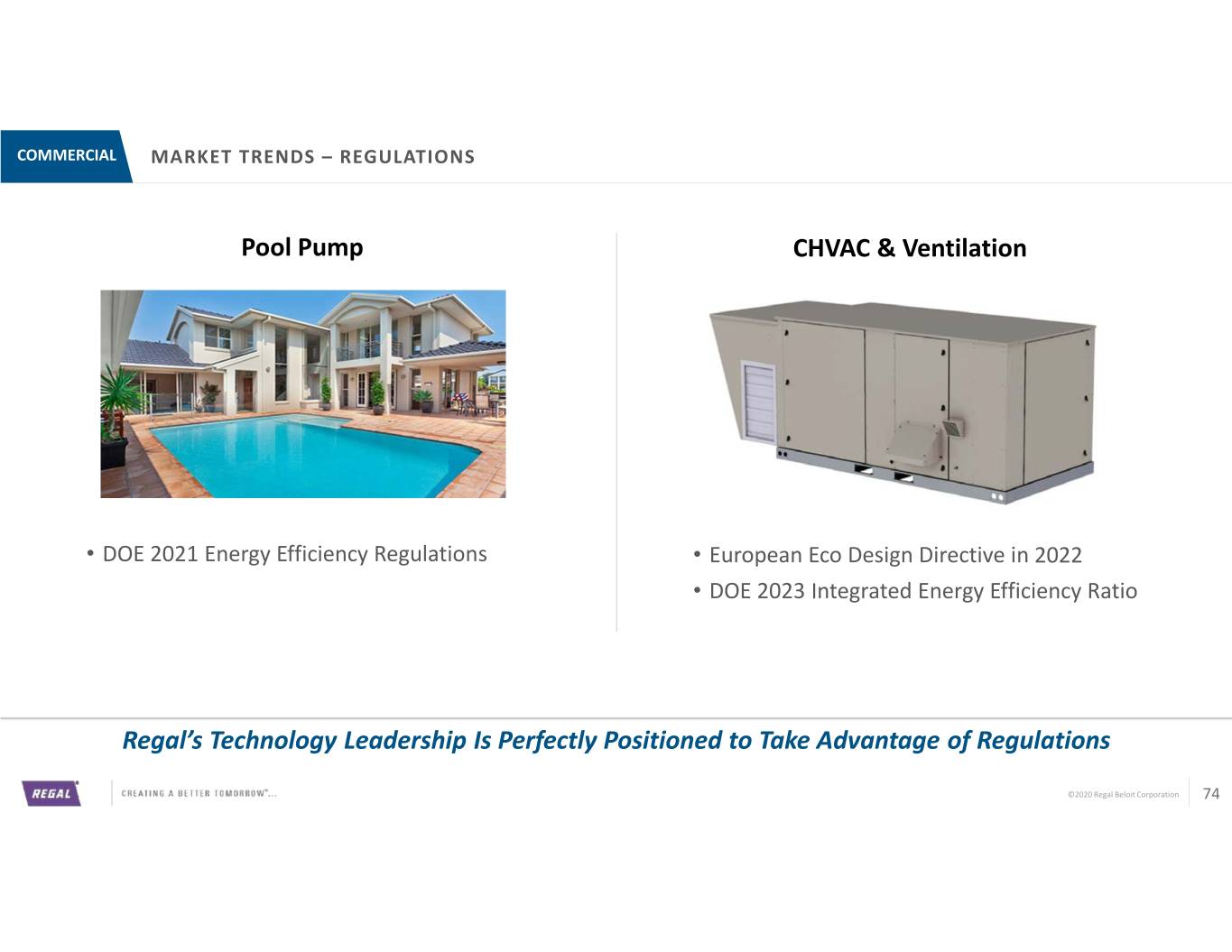

COMMERCIAL MARKET TRENDS – REGULATIONS Pool Pump CHVAC & Ventilation • DOE 2021 Energy Efficiency Regulations • European Eco Design Directive in 2022 • DOE 2023 Integrated Energy Efficiency Ratio Regal’s Technology Leadership Is Perfectly Positioned to Take Advantage of Regulations ©2020 Regal Beloit Corporation 74

COMMERCIAL MARKET TRENDS – INNOVATION Power Density Efficiency Electronics Packaging Smaller Intelligence Form Factors Cost Application Control Our Technology and Application Knowledge Best Positioned to Benefit from these Trends ©2020 Regal Beloit Corporation 75

COMMERCIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 76

COMMERCIAL PRODUCT INNOVATION – POOL PUMP MOTOR • Next Generation Pool Pump Motor • Meets New 2021 Regulations • Targets Underserved Segments • Value Creation for OEMs, Contractors, & Homeowners Regal’s Technology Leads in the Attractive Pool Pump Market ©2020 Regal Beloit Corporation 77

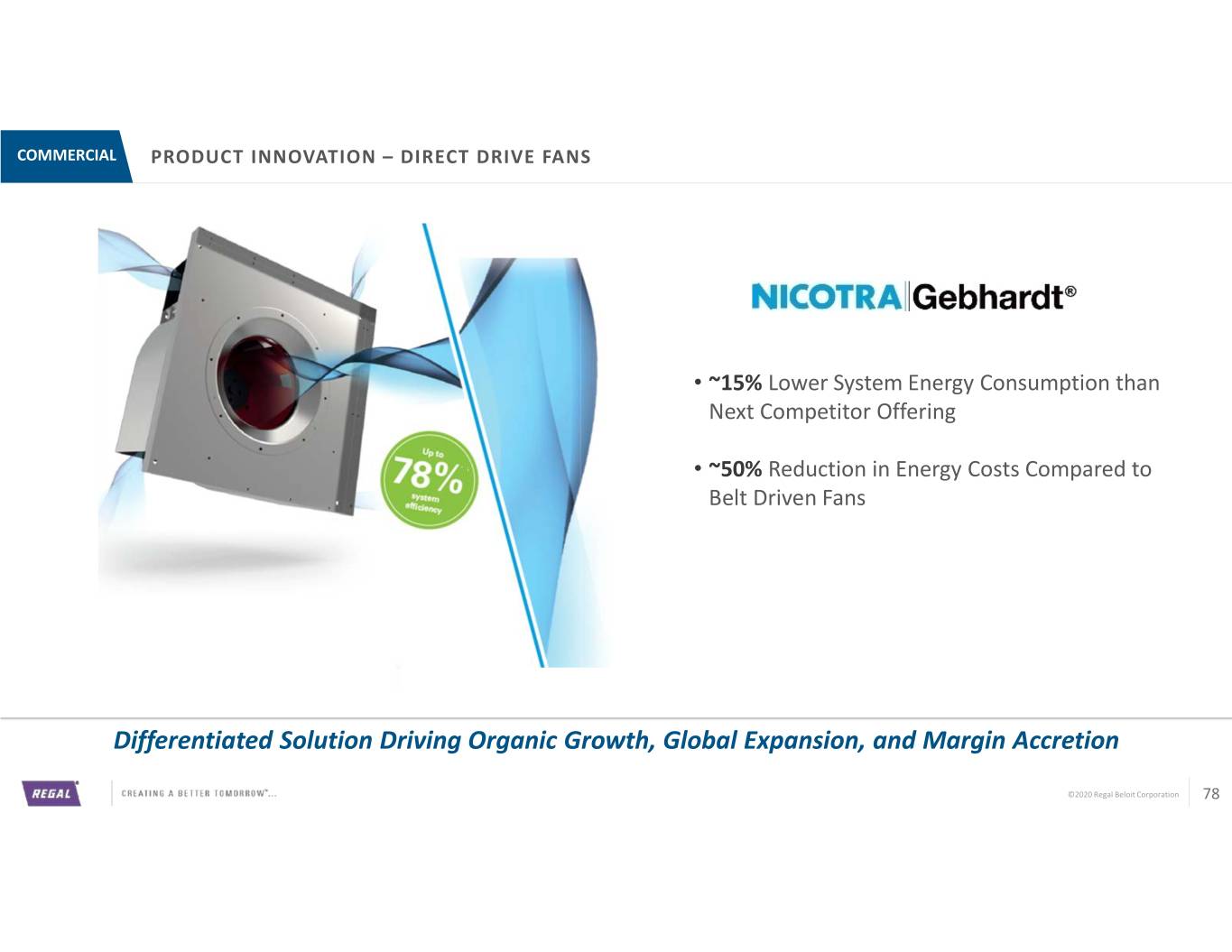

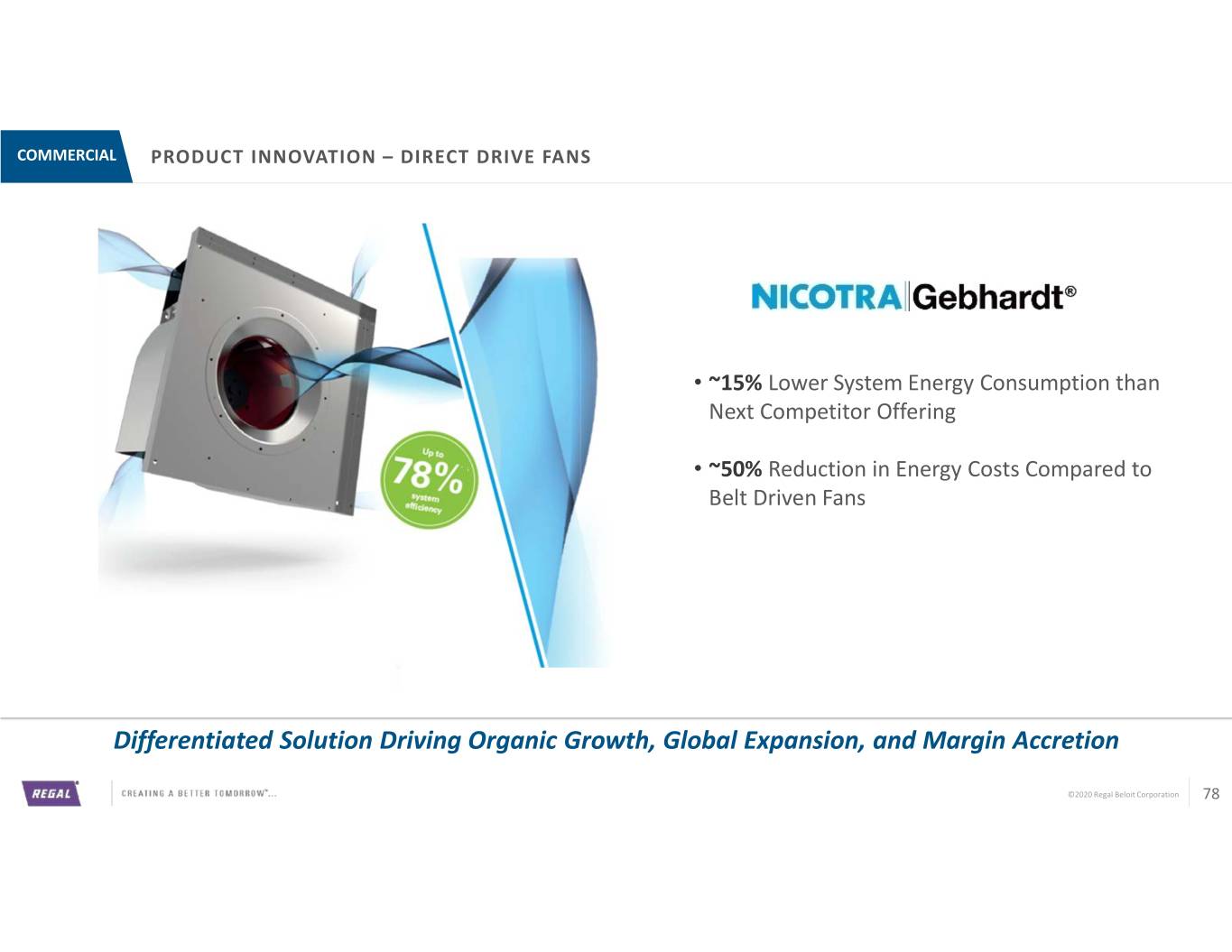

COMMERCIAL PRODUCT INNOVATION – DIRECT DRIVE FANS • ~15% Lower System Energy Consumption than Next Competitor Offering • ~50% Reduction in Energy Costs Compared to Belt Driven Fans Differentiated Solution Driving Organic Growth, Global Expansion, and Margin Accretion ©2020 Regal Beloit Corporation 78

COMMERCIAL PRODUCT INNOVATION – MOTOR FORM FACTORS • New OEM Platforms Must Improve Space & System Efficiency To Meet Commercial HVAC Regulations • Regal Provides All Form Factor Technologies OEMs Need Leveraging Technology to Expand into a New ~$250M Market for Regal ©2020 Regal Beloit Corporation 79

COMMERCIAL PRODUCT INNOVATION – HIGH SPEED MOTORS • Emerging Market for Higher Speed Blowers, Vacuum Pumps, and Air Compressors For Energy Efficiency • Water Treatment, Chemical Processing, Plant Service Air • Customers Attracted to Regal’s Proven Hermetic Motor High Speed Capabilities Expanding into a New $200M Market with Proven Differentiated Technology ©2020 Regal Beloit Corporation 80

COMMERCIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 81

COMMERCIAL 80/20 – FOOTPRINT AND PRODUCT RATIONALIZATION Segment Footprint # of Segment Product SKUs 26% 2018 2020 2022 30,000 28,000 18,000 Square Footage Square 2018 2022 Facilities 17 13 ~26% Footprint Reduction and ~40% SKU Simplification ©2020 Regal Beloit Corporation 82

COMMERCIAL 80/20 CASE STUDY – PRODUCT RATIONALIZATION North America Motor Operations Findings Deploying 80/20 • Service Challenges • Mid 90’s OTD to Highly Valued • 20% Customers ~96% Sales Customers, 10 Point Improvement • 20% Product SKUs ~89% Sales • Labor Productivity +5% per year • Inconsistent Pricing • Pruned $6M Accounts…More to Come • Complexity Growing Every Day • 10%+ Price on “B” Products 80/20 Transforming Our Commercial Motors Business ©2020 Regal Beloit Corporation 83

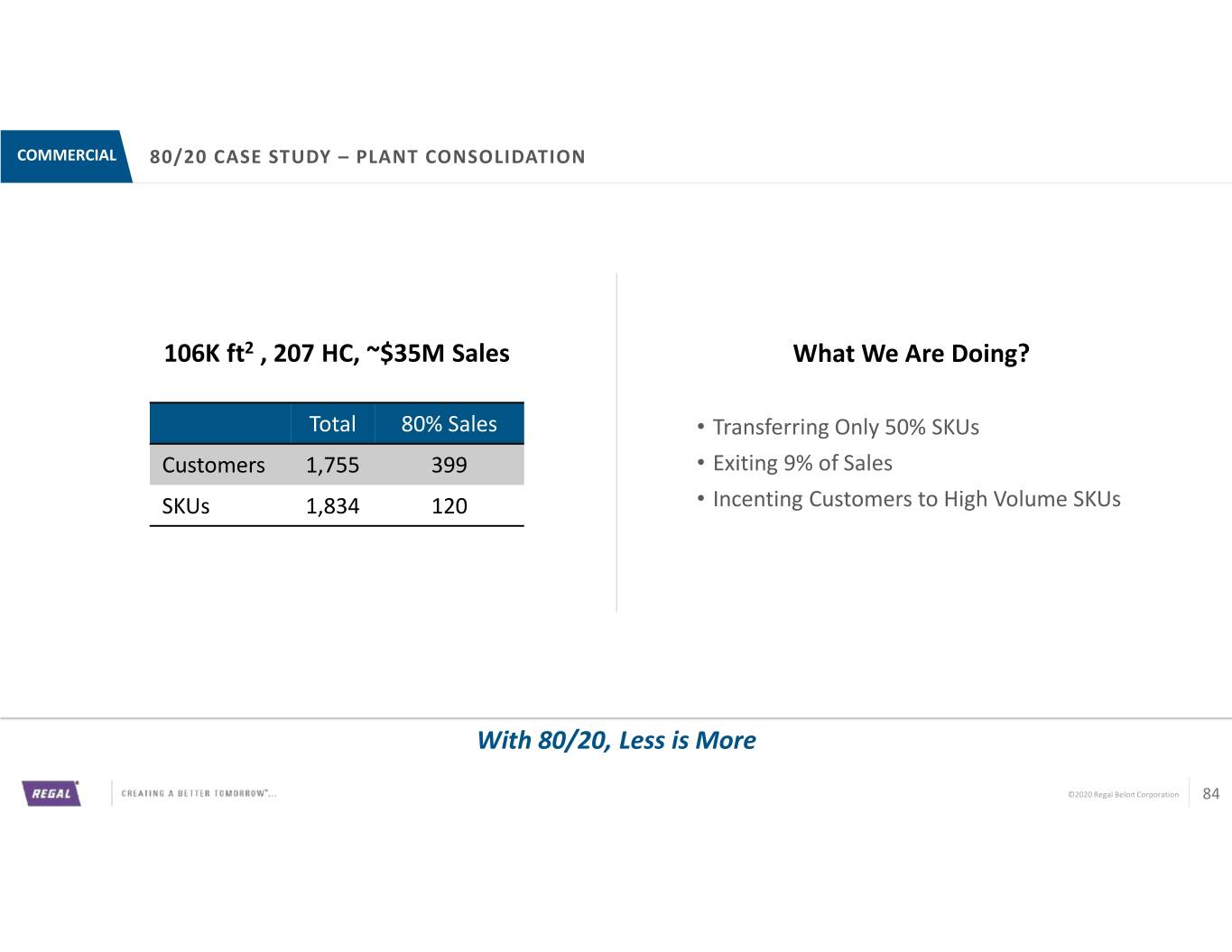

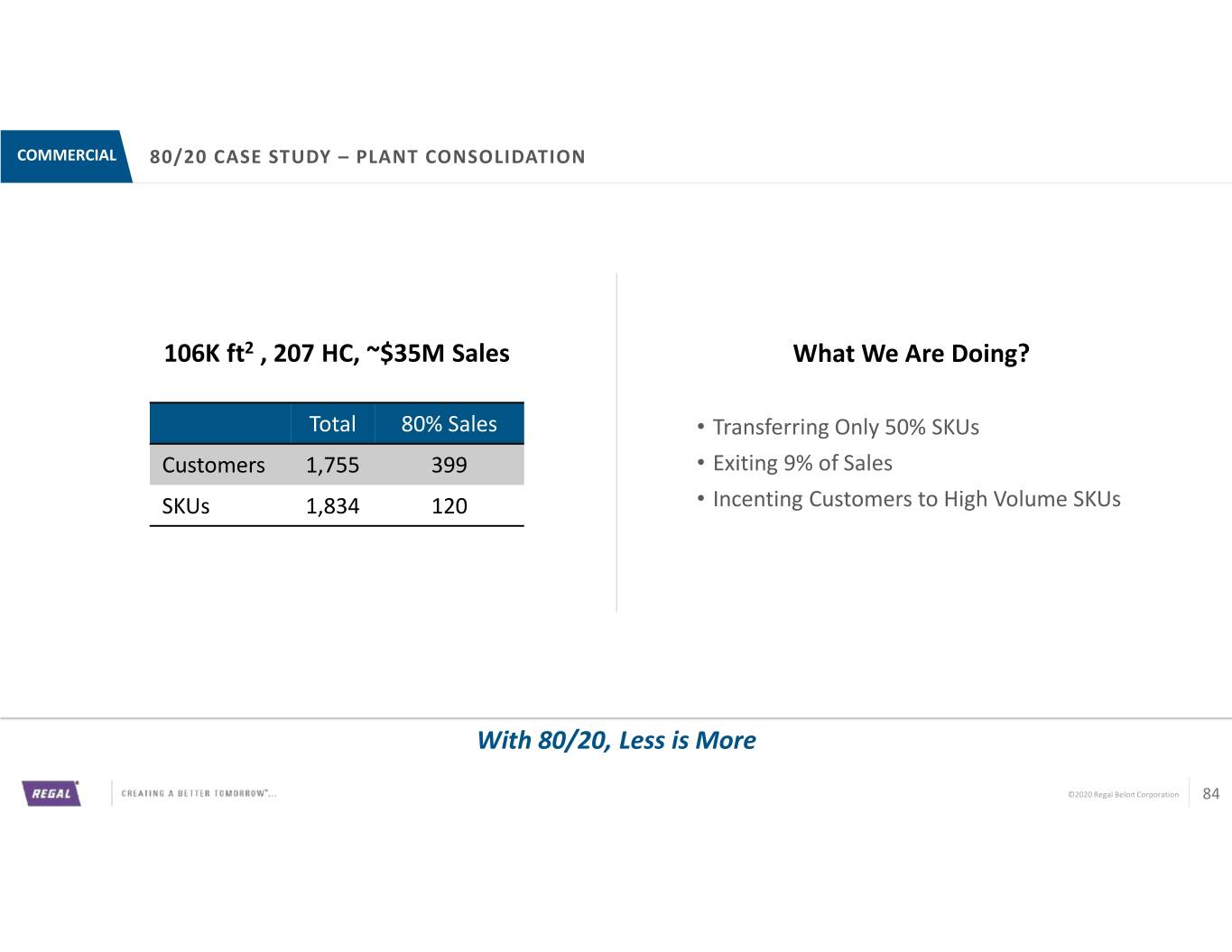

COMMERCIAL 80/20 CASE STUDY – PLANT CONSOLIDATION 106K ft2 , 207 HC, ~$35M Sales What We Are Doing? Total 80% Sales • Transferring Only 50% SKUs Customers 1,755 399 • Exiting 9% of Sales SKUs 1,834 120 • Incenting Customers to High Volume SKUs With 80/20, Less is More ©2020 Regal Beloit Corporation 84

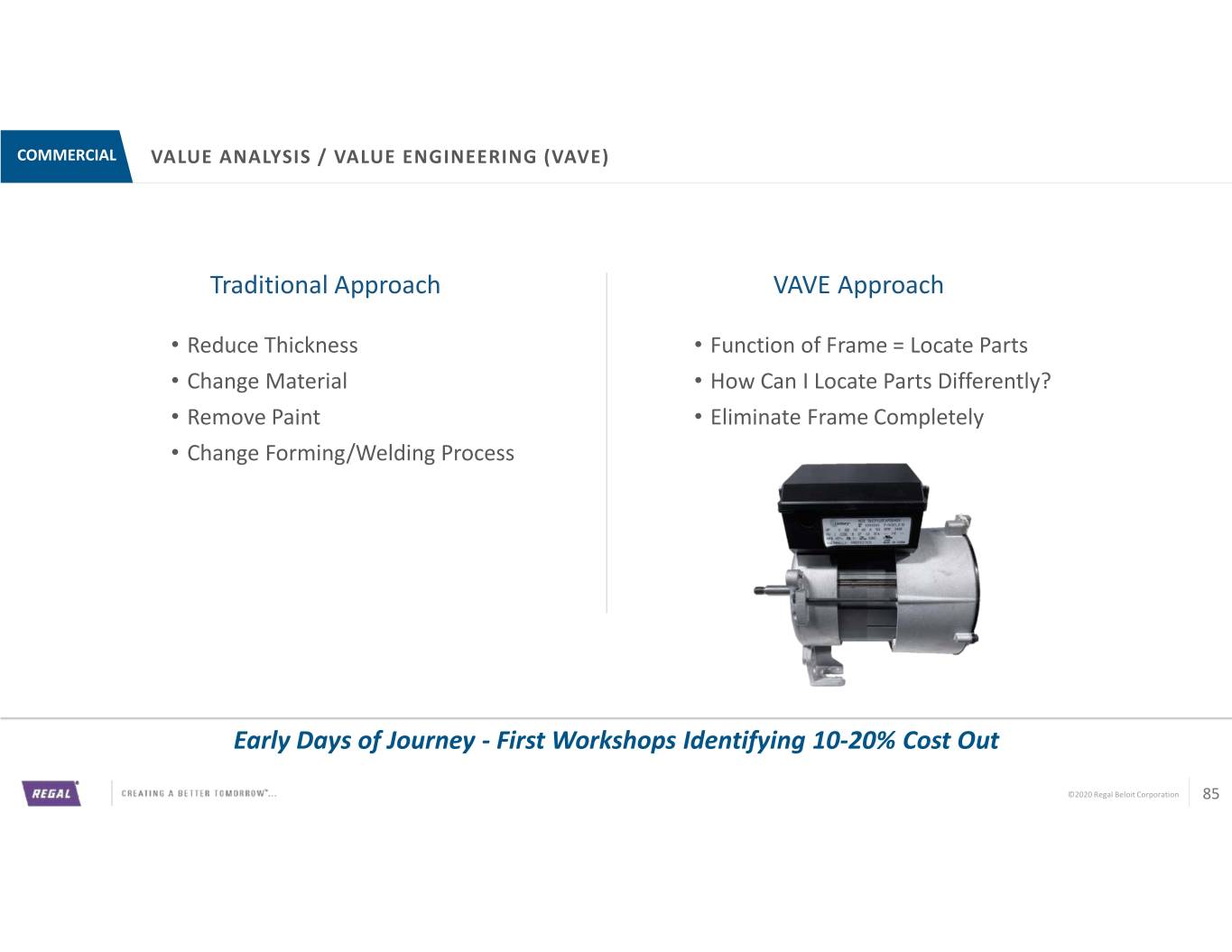

COMMERCIAL VALUE ANALYSIS / VALUE ENGINEERING (VAVE) Traditional Approach VAVE Approach • Reduce Thickness • Function of Frame = Locate Parts • Change Material • How Can I Locate Parts Differently? • Remove Paint • Eliminate Frame Completely • Change Forming/Welding Process Early Days of Journey - First Workshops Identifying 10-20% Cost Out ©2020 Regal Beloit Corporation 85

COMMERCIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 86

COMMERCIAL WHY WE WILL WIN Technology Leadership Foundation with Positive Macro and Regulatory Trends Well Positioned with Technology and Connected Solutions in Pool Pump Sustainability Solutions for Expanding into New Global Markets 80/20 Structural Margin Improvements Transforming the Business ©2020 Regal Beloit Corporation 87

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 88

INDUSTRIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 89

INDUSTRIAL BRANDS, PRODUCTS, & APPLICATIONS Brands % of Sales Products Applications • Industrial Pumps 61% • Industrial Motors • Industrial Fans 21% • Alternators • Generator Set • Paralleling Switchgear 7% • Data Center • Automated Transfer Switches 6% • Marine Duty Motors • Tension Winches 5% • Explosion Proof Motors • Oil Pumping Source: NEMA Industry Reports and Management Estimates Diverse Products, Applications and End Markets ©2020 Regal Beloit Corporation 90

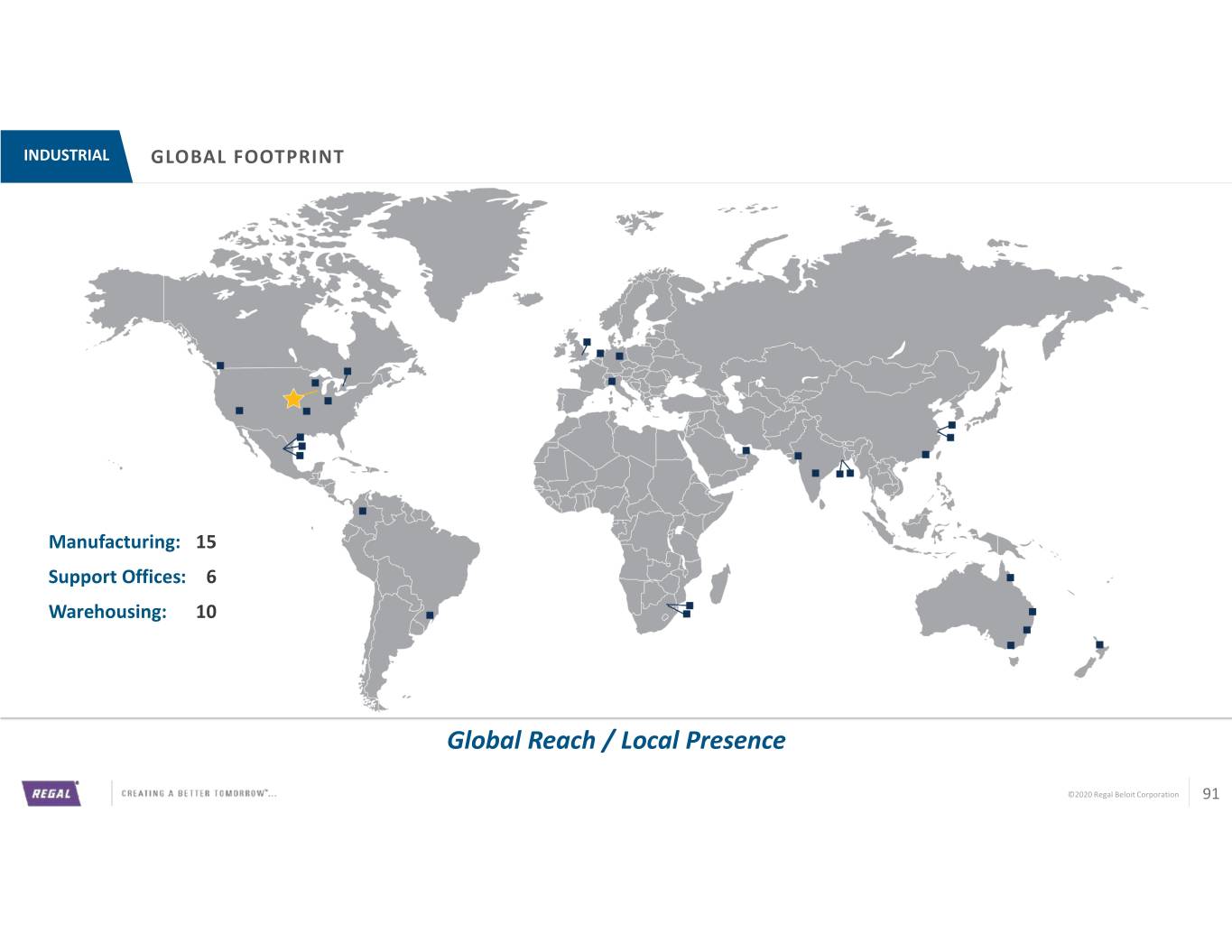

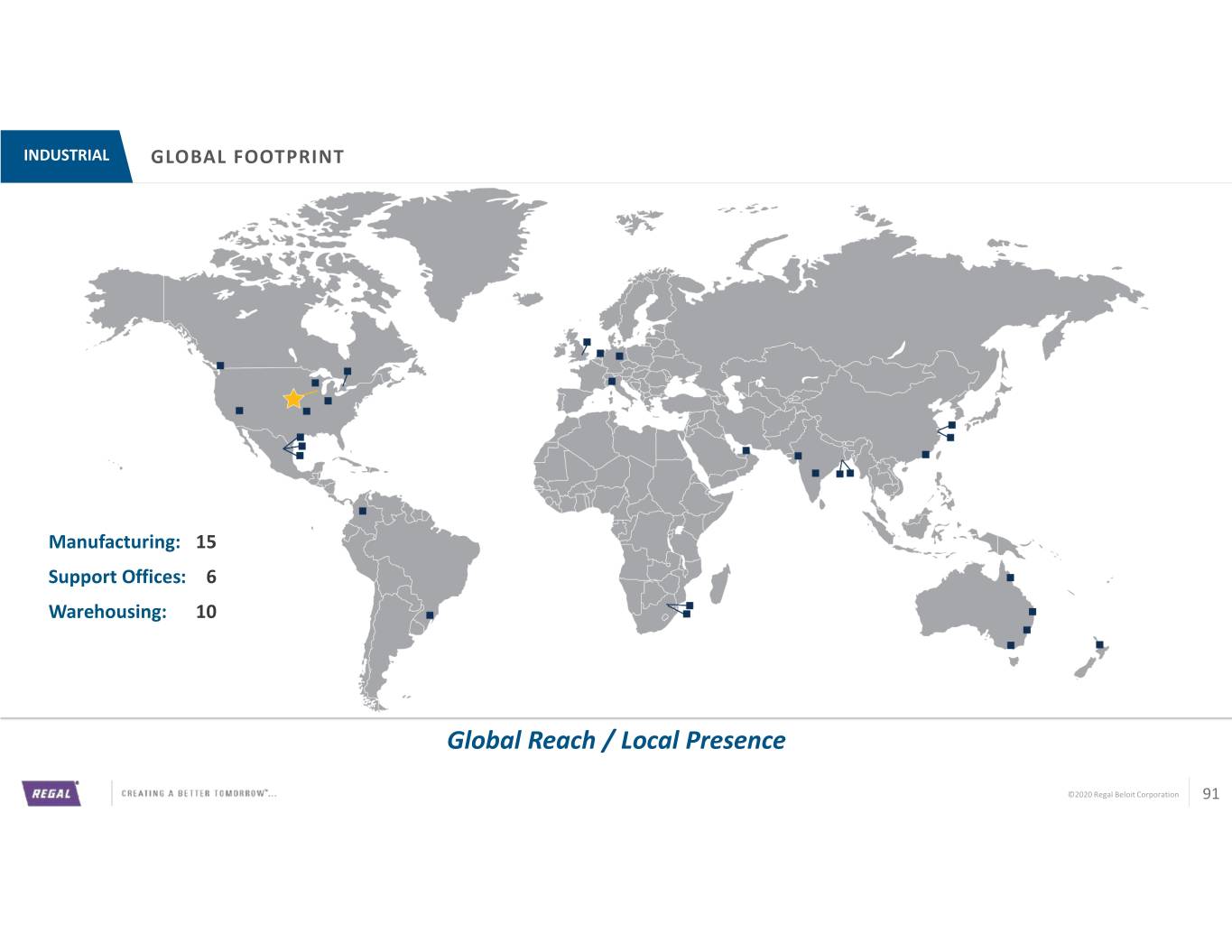

INDUSTRIAL GLOBAL FOOTPRINT Manufacturing: 15 Support Offices: 6 Warehousing: 10 Global Reach / Local Presence ©2020 Regal Beloit Corporation 91

INDUSTRIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 92

INDUSTRIAL PERFORMANCE RESULTS Sales and Adj. Operating Profit* Sales by Region ($ millions) Europe 9% Adj. Net Sales $665 Asia 31% $575 Americas 60% Sales by OEM / Aftermarket 2018 2019 Adj. OP 77% / 23% Margin* 4.3% 0.1% * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 2016 and 2017 Results Not Shown Due to Re-Segmentation at the End of 2019 Challenging 2019, Positioned to Rebound in 2020 ©2020 Regal Beloit Corporation 93

INDUSTRIAL MARKET TRENDS – END MARKETS End Market % of Sales 2019 2020 – 2022 CAGR Distribution 32% LSD Power Gen 26% LSD CHVAC 6% LSD Oil & Gas 6% LSD Data Centers 4% MSD Marine 4% LSD Source: NEMA and Frost & Sullivan Industry Reports Trade Conflict with China Impacting Market Growth; Future Growth at Market ©2020 Regal Beloit Corporation 94

INDUSTRIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 95

INDUSTRIAL PRODUCT INNOVATION – CRITICAL POWER APPLICATION FOR HIGH TECH MANUFACTURING Hybrid Power Distribution Unit • Customized to Customer Need • Plug-and-Play Compact Design • Ease of Installation Customization and Speed to Market ©2020 Regal Beloit Corporation 96

INDUSTRIAL GEOGRAPHIC MARKET EXPANSION – BRAND LEVERAGE • Cemp and Rotor Following Existing European OEM Customers to Asia • Leveraging Regal Infrastructure for Assembly and Customer Support • ~$130M Market Opportunity Expanding the Reach of Our Strong European Brands ©2020 Regal Beloit Corporation 97

INDUSTRIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 98

INDUSTRIAL COST COMPETITIVE SOLUTION – TERRAMAX® CONVERSION NA Motor BVC as a % of Spend 73% • Common Platform for NEMA and IEC Motors 54% • Reduces Complexity and SKUs • Leverages Best Value Country (BVC) Supply Base • Reduces Motor Platforms fromPiloting 14 to 4 today with: 23% 12% 2019 2020 2021 2022 Platform Consolidation Drives 10% to 25% Cost Savings and Market Competitiveness ©2020 Regal Beloit Corporation 99

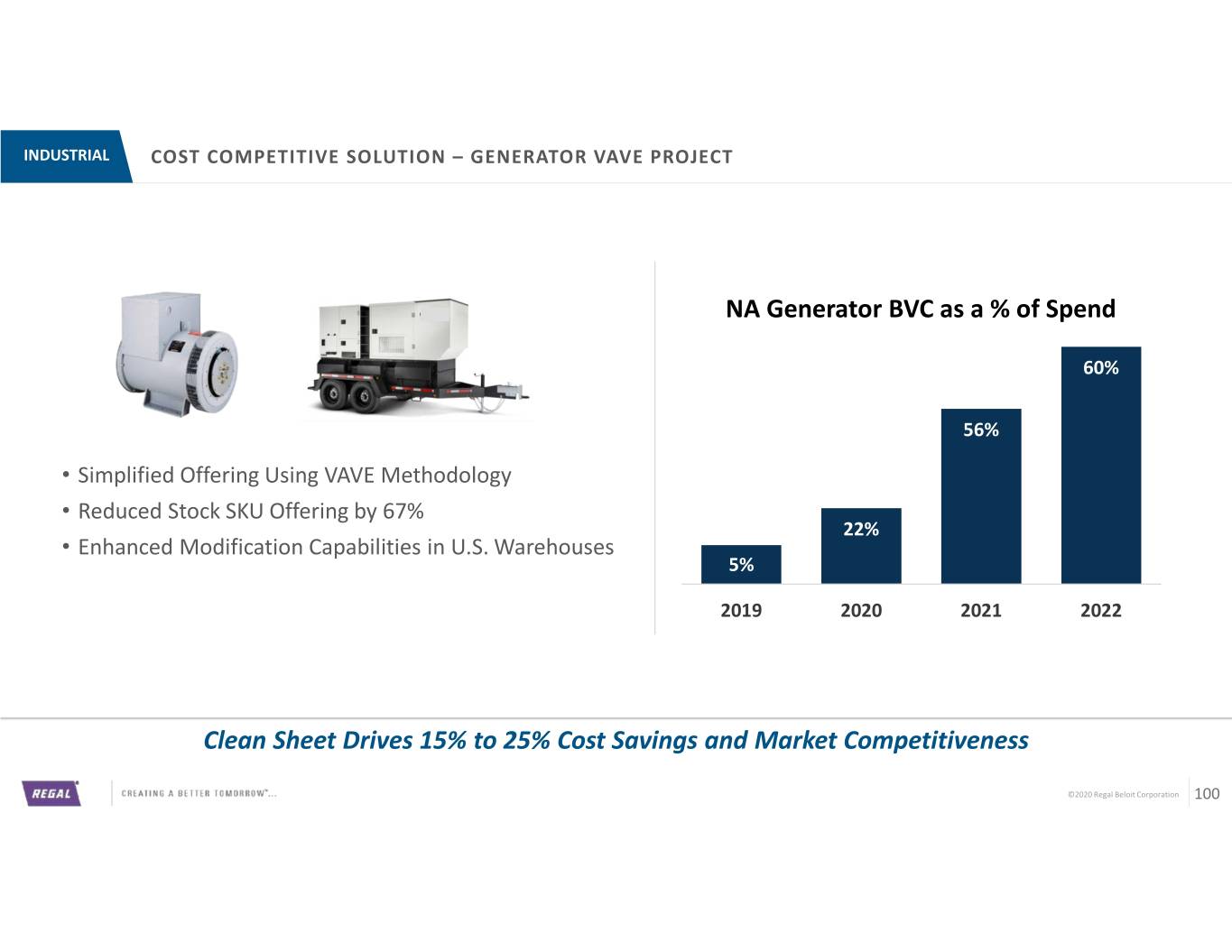

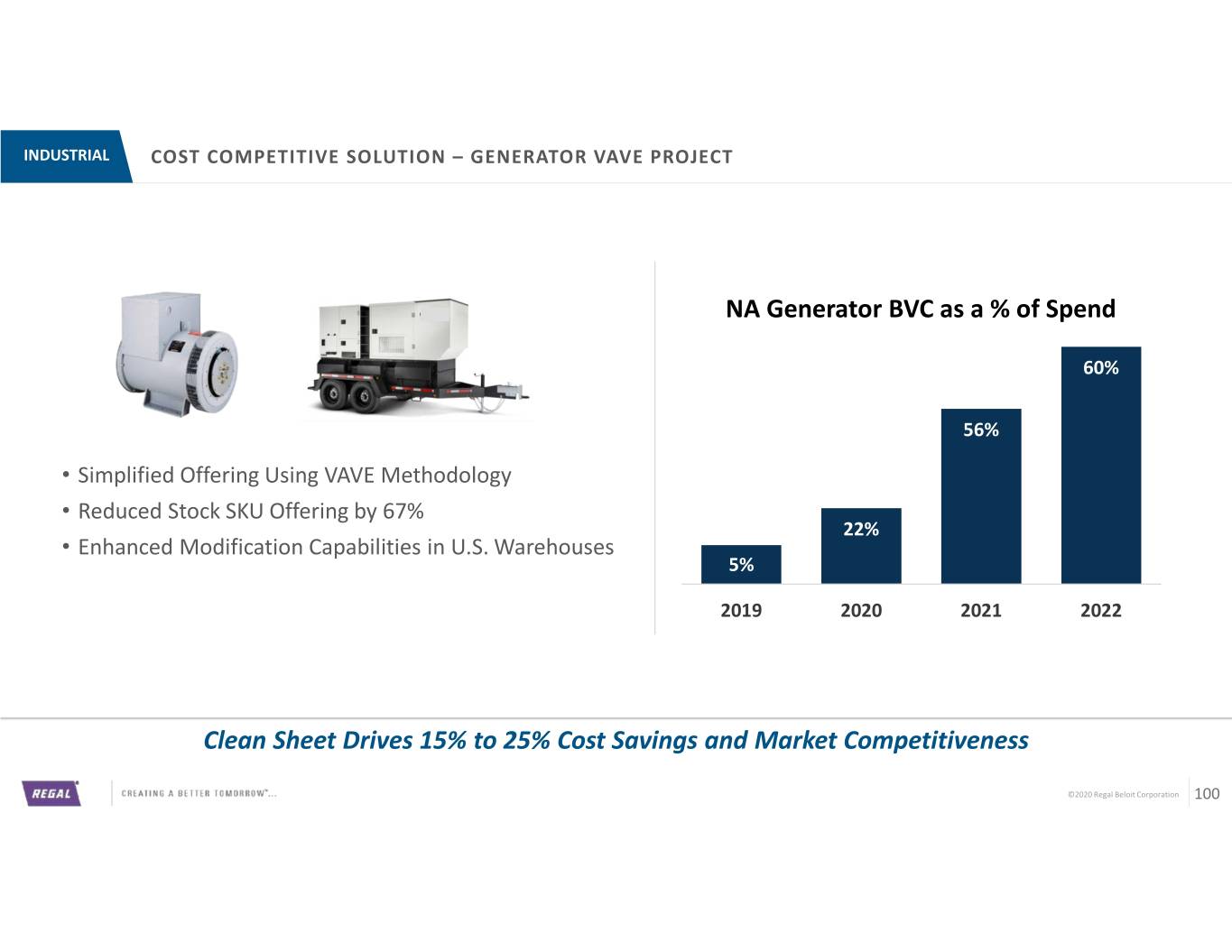

INDUSTRIAL COST COMPETITIVE SOLUTION – GENERATOR VAVE PROJECT NA Generator BVC as a % of Spend 60% 56% • Simplified Offering Using VAVE Methodology • Reduced Stock SKU Offering by 67% 22% • Enhanced Modification Capabilities in U.S. Warehouses 5% 2019 2020 2021 2022 Clean Sheet Drives 15% to 25% Cost Savings and Market Competitiveness ©2020 Regal Beloit Corporation 100

INDUSTRIAL 80/20 – FOOTPRINT AND PRODUCT RATIONALIZATION Segment Footprint # of Segment Product SKUs 20% 2018 2020 2022 56,000 44,000 34,000 Square Footage Square 2018 2022 Manufacturing 15 12 Warehousing 10 5 Transforming Our Business through 80/20 ©2020 Regal Beloit Corporation 101

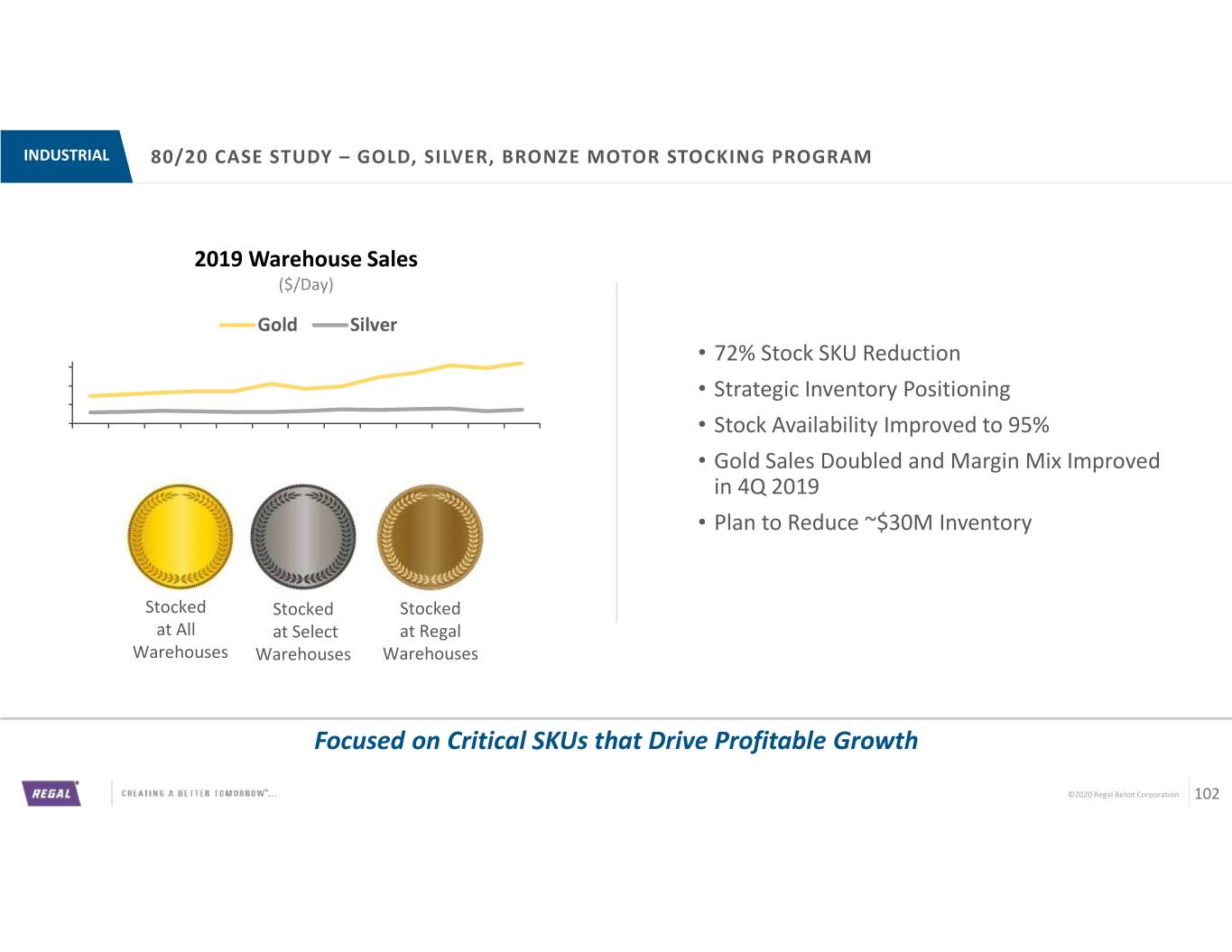

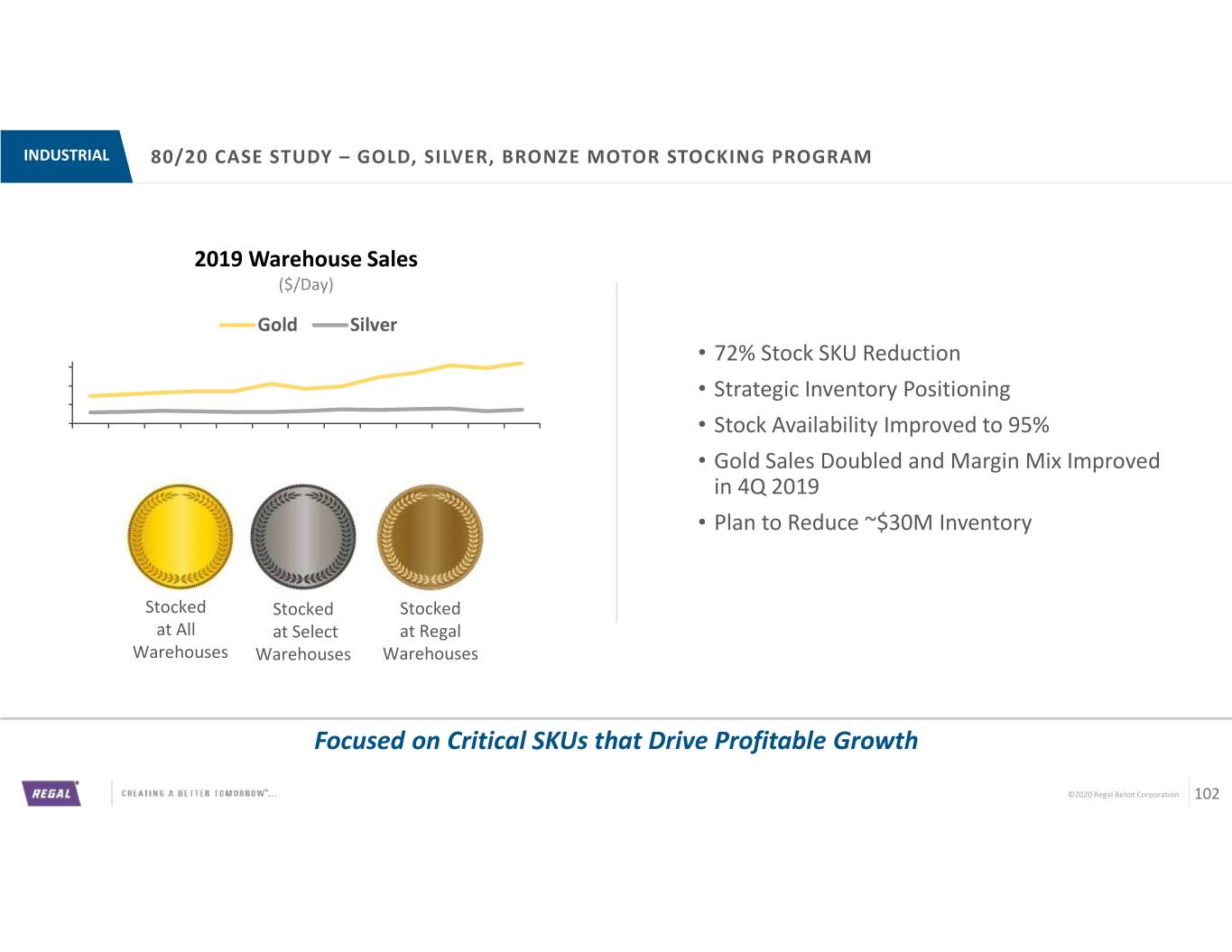

INDUSTRIAL 80/20 CASE STUDY – GOLD, SILVER, BRONZE MOTOR STOCKING PROGRAM 2019 Warehouse Sales ($/Day) Gold Silver • 72% Stock SKU Reduction • Strategic Inventory Positioning • Stock Availability Improved to 95% • Gold Sales Doubled and Margin Mix Improved in 4Q 2019 • Plan to Reduce ~$30M Inventory Stocked Stocked Stocked at All at Select at Regal Warehouses Warehouses Warehouses Focused on Critical SKUs that Drive Profitable Growth ©2020 Regal Beloit Corporation 102

INDUSTRIAL AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 103

INDUSTRIAL WHY WE WILL WIN Top Priority is Cost Competitiveness & Margin Improvement New Mexico Manufacturing Facility to Service the Americas Strong Niche Brands Will Grow Profitably Launching New Cost Competitive Motor & Generator Products 80/20 Will Simplify Everything We Do ©2020 Regal Beloit Corporation 104

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 105

CLIMATE AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 106

CLIMATE BRANDS, PRODUCTS, & APPLICATIONS Brands Products Applications Strong Brands, Innovation Leader, Rich Application Experience ©2020 Regal Beloit Corporation 107

CLIMATE GLOBAL FOOTPRINT Manufacturing: 14 Support Offices: 6 Warehousing: 6 Global Footprint a Clear Competitive Advantage ©2020 Regal Beloit Corporation 108

CLIMATE AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 109

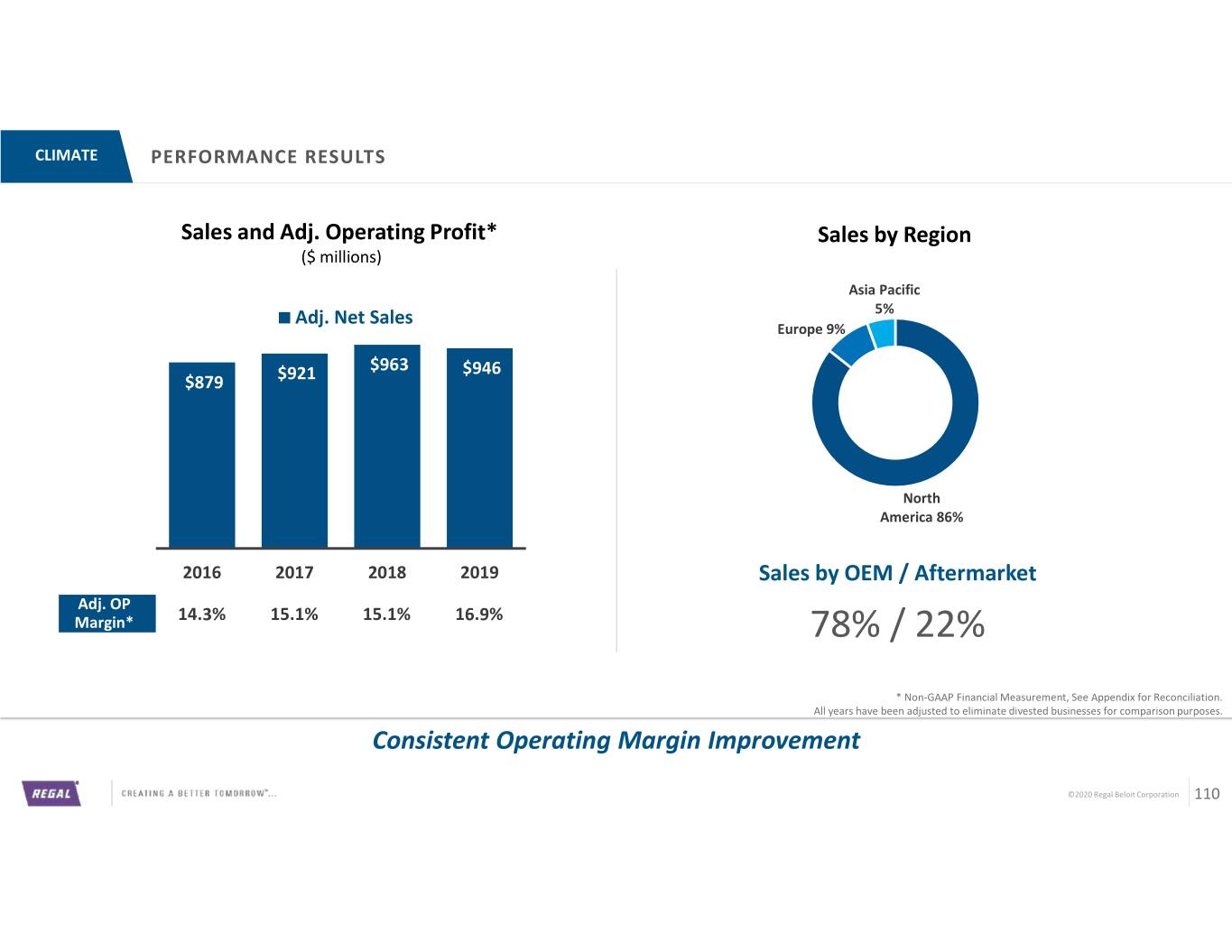

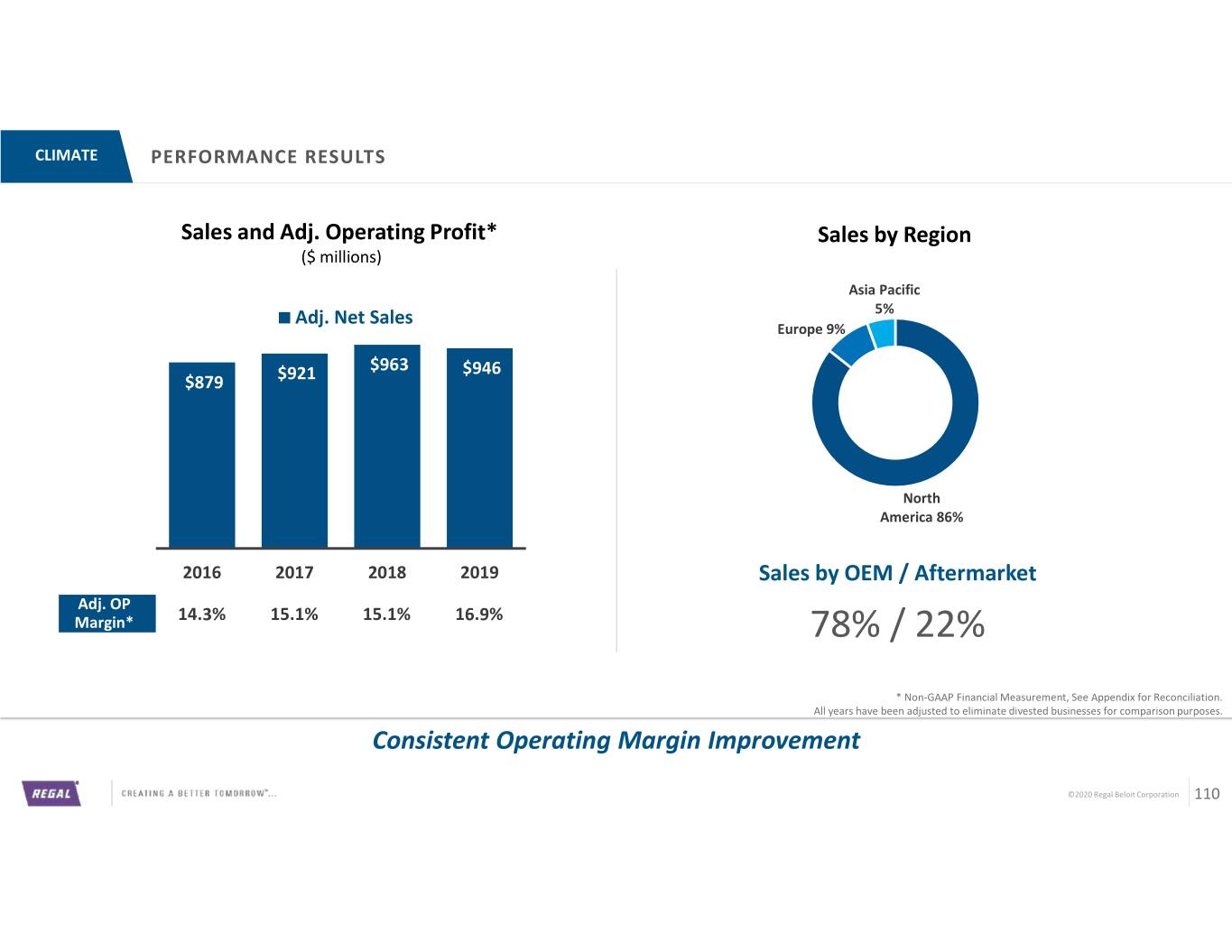

CLIMATE PERFORMANCE RESULTS Sales and Adj. Operating Profit* Sales by Region ($ millions) Asia Pacific Adj. Net Sales 5% Europe 9% $963 $946 $879 $921 North America 86% 2016 2017 2018 2019 Sales by OEM / Aftermarket Adj. OP Margin* 14.3% 15.1% 15.1% 16.9% 78% / 22% * Non-GAAP Financial Measurement, See Appendix for Reconciliation. All years have been adjusted to eliminate divested businesses for comparison purposes. Consistent Operating Margin Improvement ©2020 Regal Beloit Corporation 110

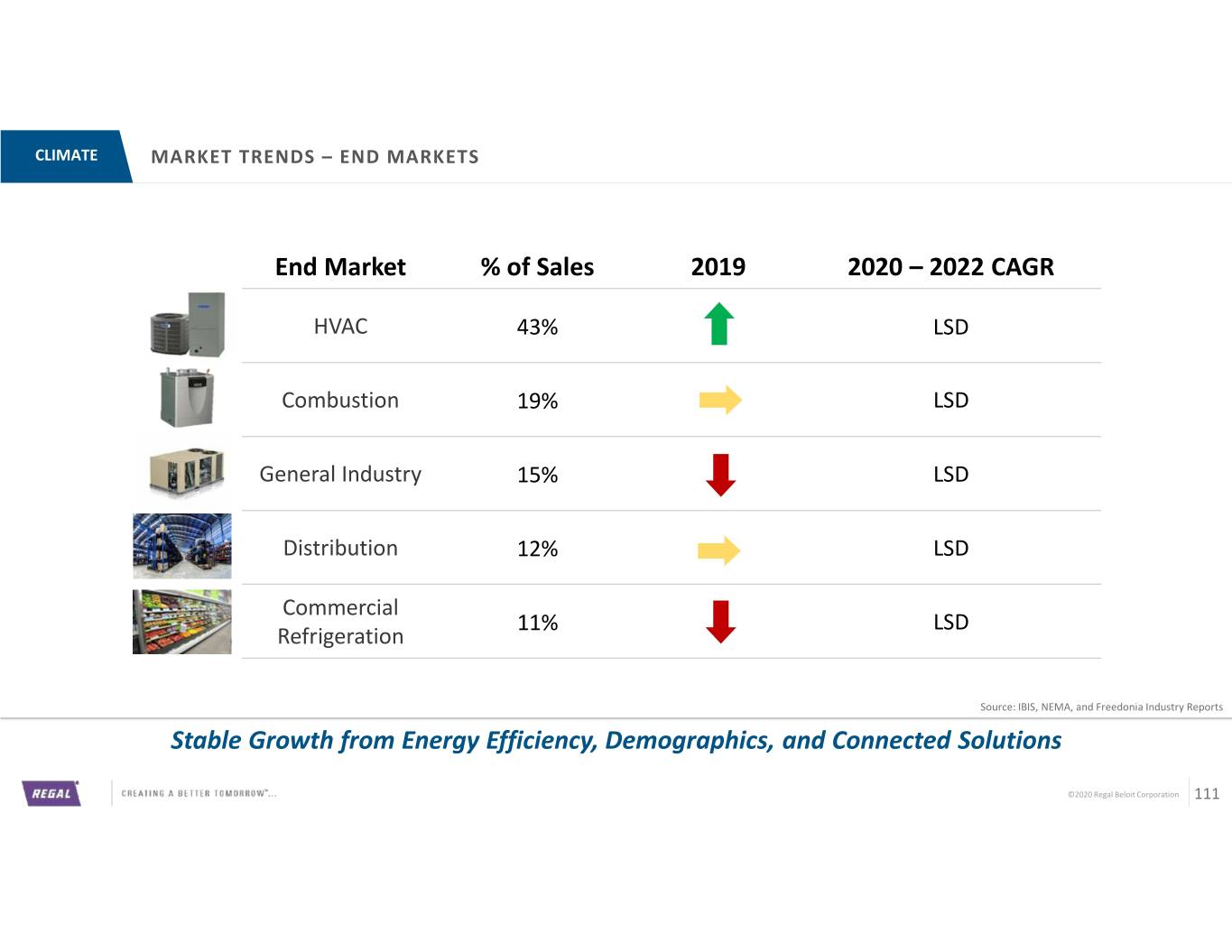

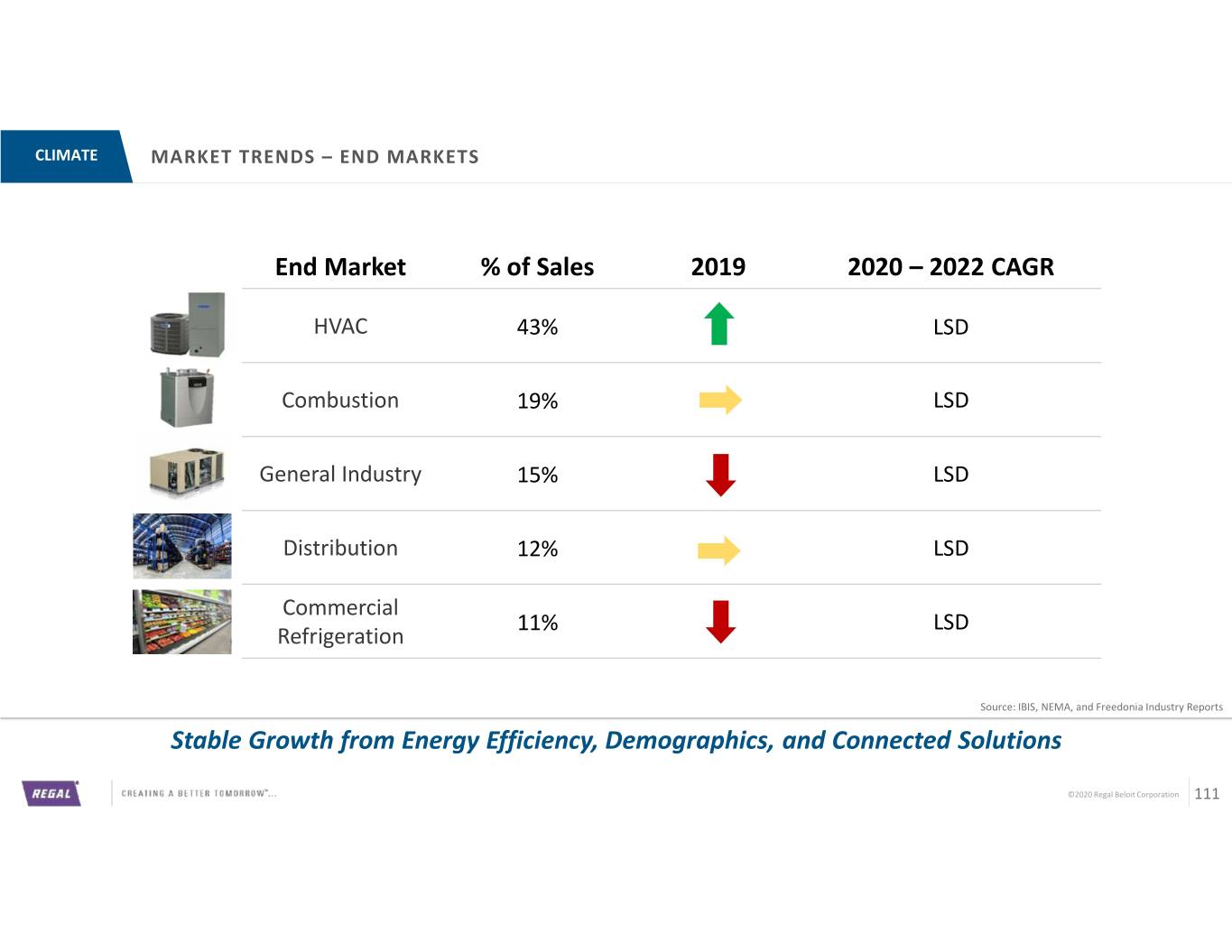

CLIMATE MARKET TRENDS – END MARKETS End Market % of Sales 2019 2020 – 2022 CAGR HVAC 43% LSD Combustion 19% LSD General Industry 15% LSD Distribution 12% LSD Commercial 11% LSD Refrigeration Source: IBIS, NEMA, and Freedonia Industry Reports Stable Growth from Energy Efficiency, Demographics, and Connected Solutions ©2020 Regal Beloit Corporation 111

CLIMATE MARKET TRENDS – NORTH AMERICAN HVAC SHIPMENTS AHRI Reported Unit Shipments 14 Years Since Peak 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Gas Furnace A/C Heat Pump Replacement Cycle in Later Stages While Housing Starts Remain Strong ©2020 Regal Beloit Corporation 112

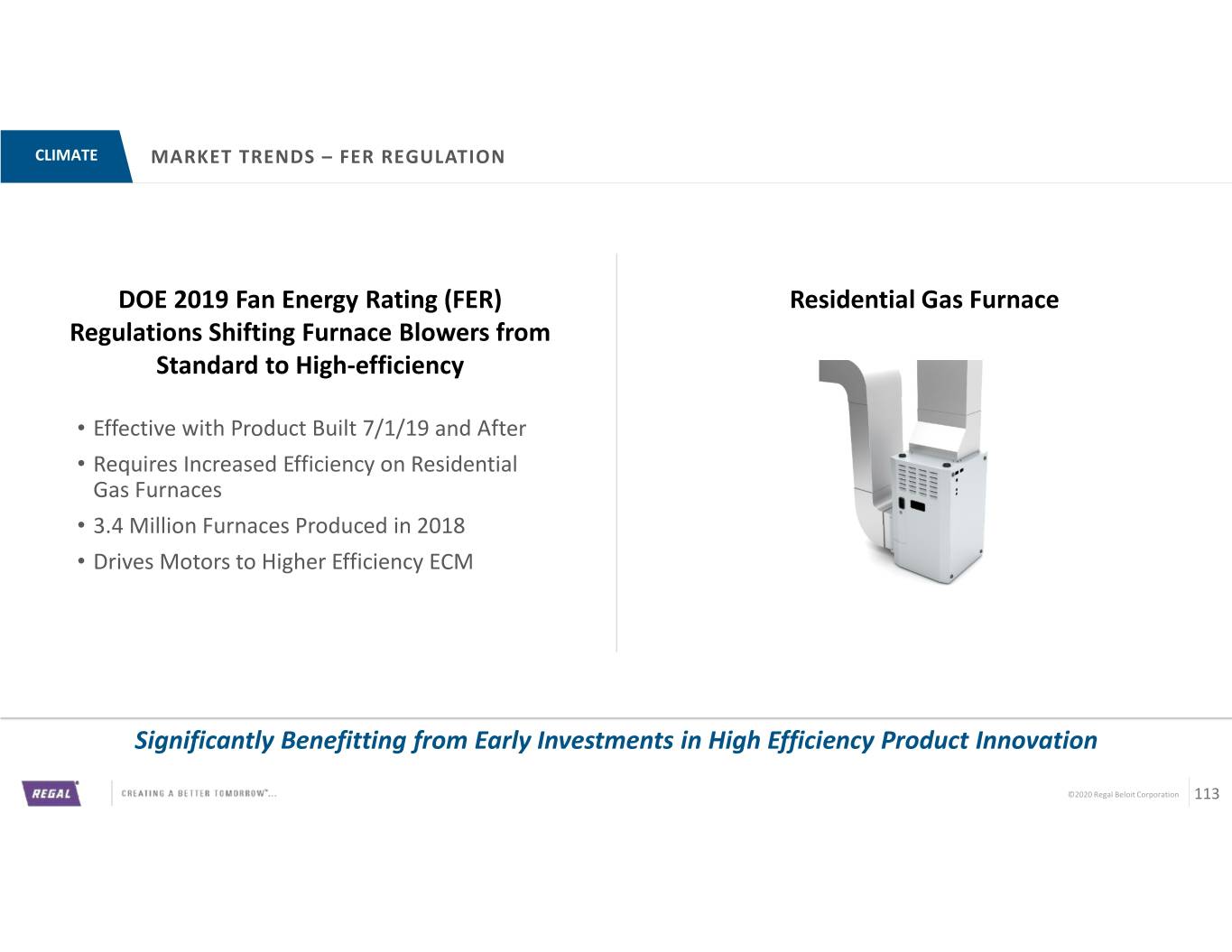

CLIMATE MARKET TRENDS – FER REGULATION DOE 2019 Fan Energy Rating (FER) Residential Gas Furnace Regulations Shifting Furnace Blowers from Standard to High-efficiency • Effective with Product Built 7/1/19 and After • Requires Increased Efficiency on Residential Gas Furnaces • 3.4 Million Furnaces Produced in 2018 • Drives Motors to Higher Efficiency ECM Significantly Benefitting from Early Investments in High Efficiency Product Innovation ©2020 Regal Beloit Corporation 113

CLIMATE MARKET TRENDS – SEER 14/15 AIR CONDITIONER REGULATION DOE 2023 Energy Efficiency Regulation Air Conditioner, Heat Pump, Air Handler +1 SEER Jump • Compliance Start Date January 1, 2023 • +1 SEER Jump (National: 14 SEER, SW/SE: 15 SEER) • Drives Increase in Compressor and Blower Modulation Over 8 Million Units Require Higher Efficiency Motors / Blowers ©2020 Regal Beloit Corporation 114

CLIMATE AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 115

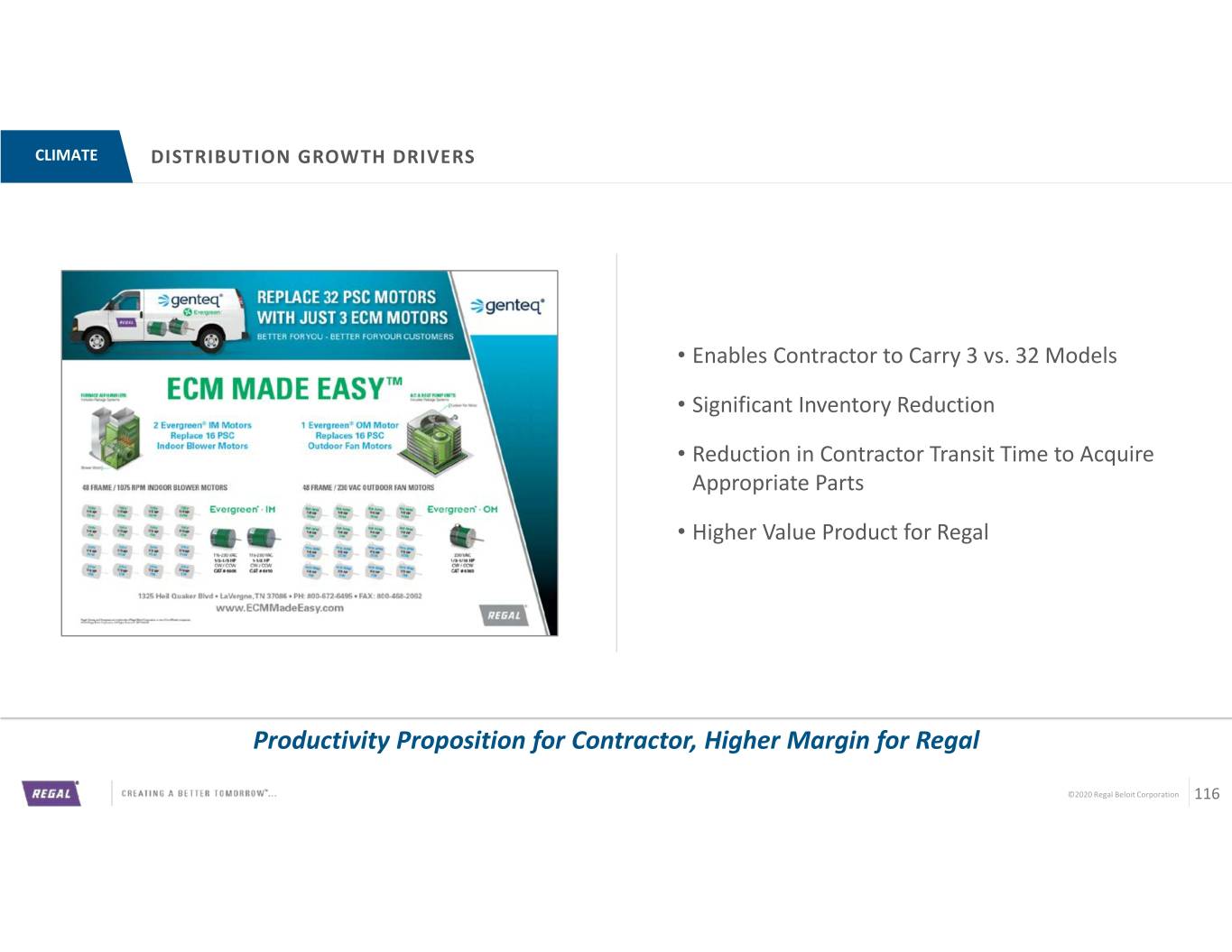

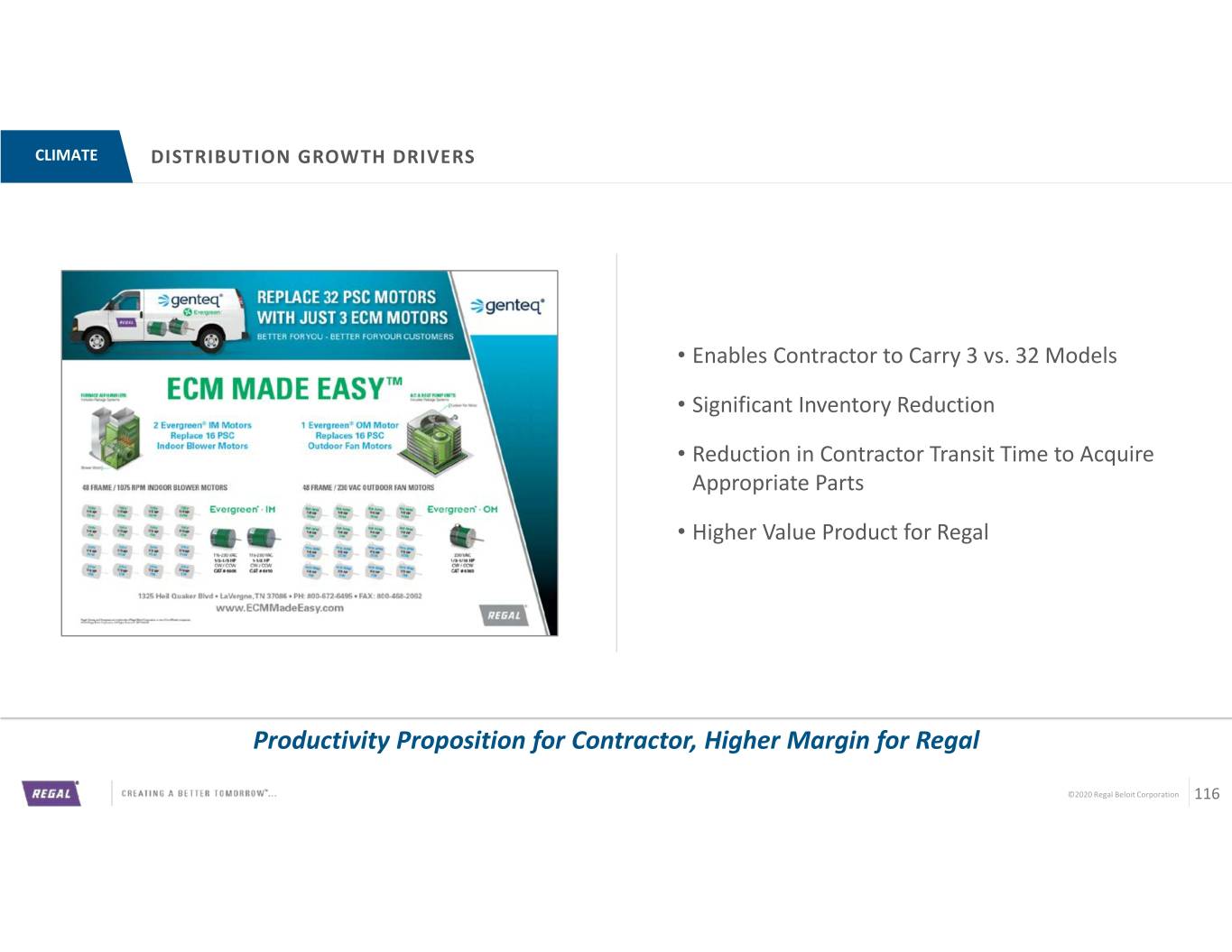

CLIMATE DISTRIBUTION GROWTH DRIVERS • Enables Contractor to Carry 3 vs. 32 Models • Significant Inventory Reduction • Reduction in Contractor Transit Time to Acquire Appropriate Parts • Higher Value Product for Regal Productivity Proposition for Contractor, Higher Margin for Regal ©2020 Regal Beloit Corporation 116

CLIMATE GEOGRAPHIC EXPANSION – GAS PRE-MIX BLOWERS • Leveraging U.S. Position in ROW • Sustainability • 15 - 25% Reduction In Gas Usage vs Traditional Blowers • 75% NOX Reduction vs Traditional Blowers • Competitive Differentiation • 5-6” Lower Overall Height • 16 lbs. Less Weight • Capable of Continuous Operation in 60° C Ambient • 5 - 10% Higher Performance Expanding Proven and Sustainable Products to New Regions ©2020 Regal Beloit Corporation 117

CLIMATE CONNECTED TECHNOLOGY – NEW SERVICE MODEL • Connected Commercial Refrigeration Technology • Reduces Risk of Food Spoilage from Outages • Monetizing Uptime Value Proposition REDUCING WASTE, SAVING ENERGY Solving a Customer Problem Leading to a Recurring Revenue Service Model ©2020 Regal Beloit Corporation 118

CLIMATE AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 119

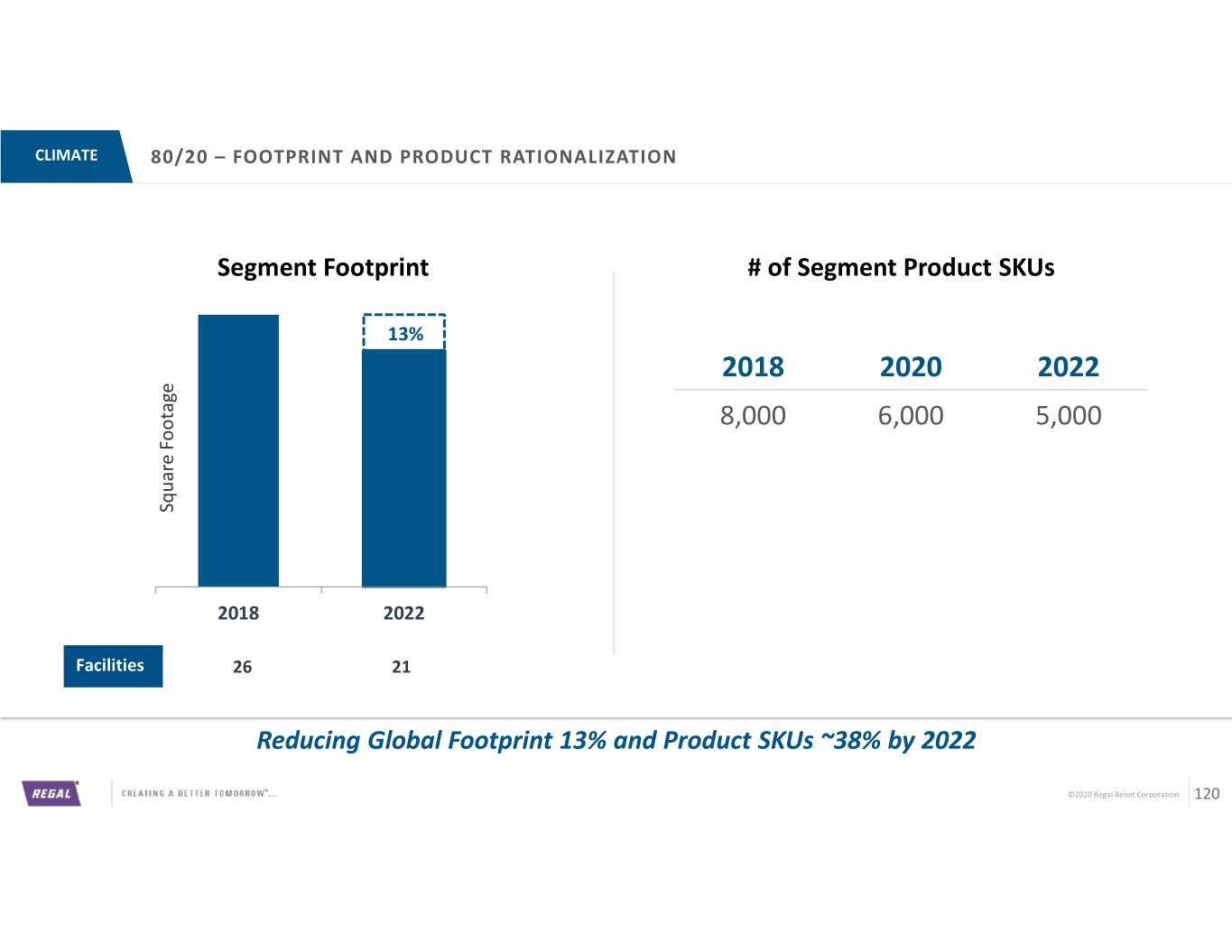

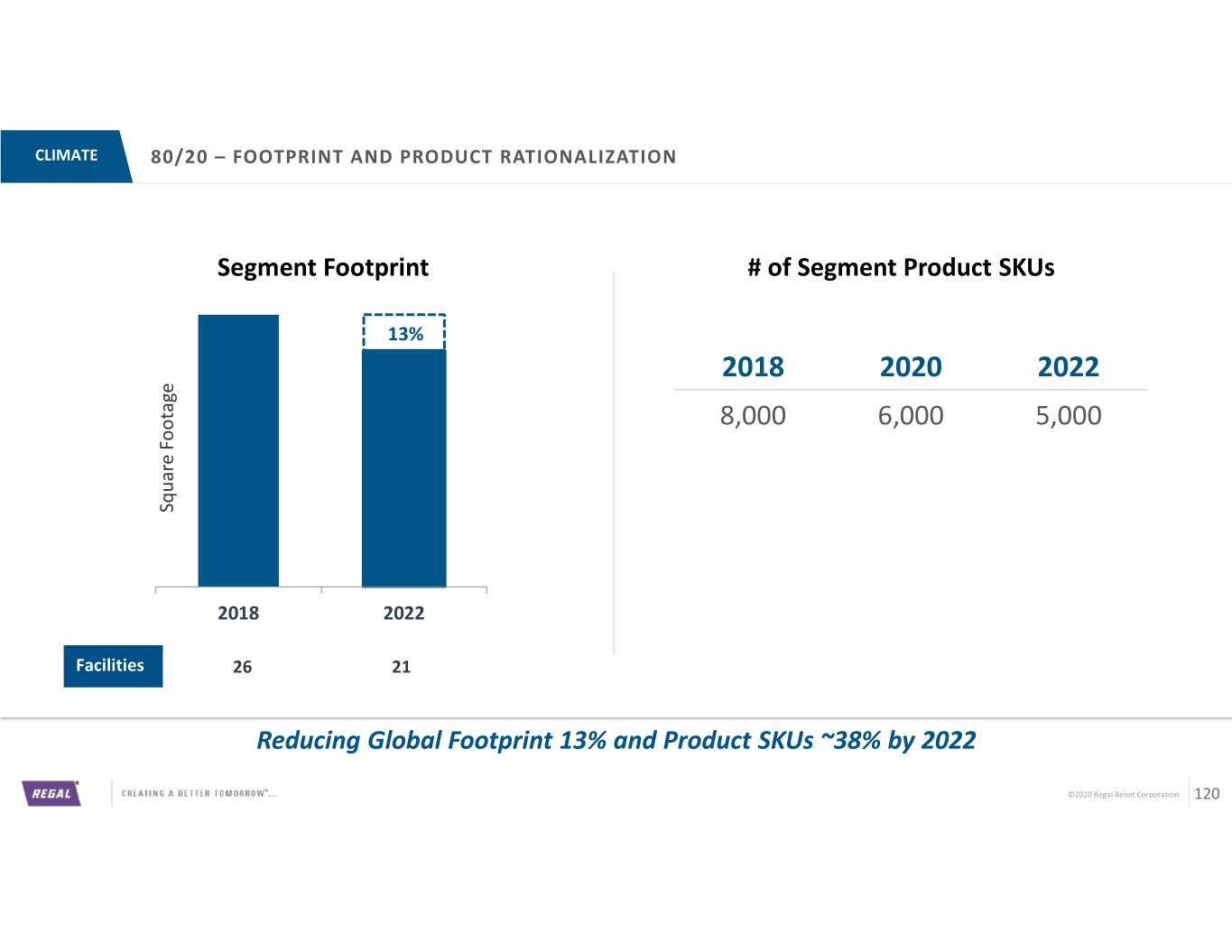

CLIMATE 80/20 – FOOTPRINT AND PRODUCT RATIONALIZATION Segment Footprint # of Segment Product SKUs 13% 2018 2020 2022 8,000 6,000 5,000 Square Footage Square 2018 2022 Mohamad Facilities 26 21 Reducing Global Footprint 13% and Product SKUs ~38% by 2022 ©2020 Regal Beloit Corporation 120

CLIMATE CASE STUDY – AUTOMATION Before… After… 4.- 3.- 2.- 4.- 3.- 2.- Automatic Automatic Projection Notch Notch Projection Notch Notch Press # 1 Press # 2 Press # 3 # 2 Press # 3 # 2 (Notch 1,2,3 & (Notch 1,2,3 & Projections) Projections) Automation Driving Higher Levels of Productivity and Improving Quality ©2020 Regal Beloit Corporation 121

CLIMATE 80/20 CASE STUDY – STRATEGIC ALIGNMENT Revenue Profile Resource Allocation 315 Customers 73 Customers 315 Customers Sales Associates 11 Outside 1 Inside Customer Service 6 1 Associates 73 Engineering Customers Associates 6 0 Aligning Resources to Create Differentiated Customer Experience ©2020 Regal Beloit Corporation 122

CLIMATE AGENDA • Brands, Products, & Applications • Performance Results & Market Trends • Growth Initiatives • 80/20 Actions • Summary ©2020 Regal Beloit Corporation 123

CLIMATE WHY WE WILL WIN Strong Brands, Rich Application Experience Track Record of Strong Operating Margin Growth Energy Efficiency Regulations Providing Tailwinds Connectivity Opportunities for Growth 80/20 Is Transforming Our Business ©2020 Regal Beloit Corporation 124

INVESTOR DAY AGENDA 8:30 – 8:35 Welcome & Introductions Rob Cherry, VP IR 8:35 – 9:10 Strategic Overview Louis Pinkham, CEO 9:10 – 9:35 Financial Overview Rob Rehard, CFO 9:35 – 10:05 Power Transmission Solutions Jerry Morton, President 10:05 – 10:20 Break 10:20 – 10:50 Commercial Systems Scott Brown, President 10:50 – 11:15 Industrial Systems Eric McGinnis, President 11:15 – 11:45 Climate Solutions John Kunze, President 11:45 – 12:00 Summary and Q&A ©2020 Regal Beloit Corporation 125

STRATEGIC 3-YEAR FINANCIAL PLAN – “THE ROAD TO 300” OVERVIEW RBS 3-Year Targets Organic Growth Above Industry/Market 250 - 300 bps Adj. Operating Margin Expansion Adj. EPS 8% - 10% CAGR >100% Free Cash Flow Conversion 250 - 300 bps ROIC Improvement Creating Sustainable Foundation for Long-Term Value Creation ©2020 Regal Beloit Corporation 126

FINANCIAL OVERVIEW THE ROAD TO “300 IN 3” 3-Year Adj. Operating Margin* Improvement 13.2% - 13.7% $90 - $100M Volume 10.7% Leverage, Mix Drivers of Restructuring 250 - 300 bps of Margin Supply Chain Improvement SKU Reductions 80/20 * Non-GAAP Financial Measurement, See Appendix for Reconciliation. Clear Path to Shareholder Value Creation ©2020 Regal Beloit Corporation 127

INVESTOR SUMMARY DAY o Growth From Energy Efficiency, Electrification and Digital Connectivity o Leading Brands, Installed Base, and Differentiated Technology o Global Manufacturing Footprint Enables Efficiency and Flexibility o 80/20 Driving Margin Enhancement on Our Road to 300 in 3 o Strong Free Cash Flow Combined with Balanced Capital Allocation o Sustainability is Fundamental to Both Our Products and Our Operations ©2020 Regal Beloit Corporation 128

Question & Answer Session CREATING A BETTER TOMORROW™… ©2020 Regal Beloit Corporation, Proprietary and Confidential

Appendix CREATING A BETTER TOMORROW™… ©2020 Regal Beloit Corporation, Proprietary and Confidential

INVESTOR DAY APPENDIX ADJUSTED DILUTED EARNINGS PER SHARE Three Months Ended Twelve Months Ended Dec 28, Dec 29, Dec 28, Dec 29, 2019 2018 2019 2018 GAAP Diluted Earnings Per Share $ 0.89 $ 1.28 $ 5.66 $ 5.26 Restructuring and Related Costs 0.33 0.04 0.57 0.13 Purchase Accounting and Transaction Costs — — — 0.09 (Gain) Loss on Businesses Divested and Assets to be Exited 0.01 — (0.69) 0.61 Net (Income) Loss from Businesses Divested/to be Exited 0.01 (0.11) (0.07) (0.40) Executive Transition Costs 0.07 0.07 0.08 0.07 Gain on Sale of Assets (0.06) (0.04) (0.06) (0.04) Impact of the New US Tax Legislation — 0.07 — (0.08) Adjusted Diluted Earnings Per Share $ 1.25 $ 1.31 $ 5.49 $ 5.64 2020 ADJUSTED ANNUAL GUIDANCE Minimum Maximum 2020 Diluted EPS Annual Guidance $ 5.35 $ 5.75 Restructuring and Related Costs 0.28 0.28 Gain on Businesses Divested and Assets to be Exited (0.01) (0.01) Executive Transition Costs 0.03 0.03 2020 Adjusted Diluted EPS Annual Guidance $ 5.65 $ 6.05 ©2020 Regal Beloit Corporation 131

INVESTOR APPENDIX DAY Twelve Months Ended Commercial Power Transmission ADJUSTED NET SALES Systems Industrial Systems Climate Solutions Solutions Total Regal (Dollars in Millions) Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 Net Sales $ 905.3 $ 1,110.9 $ 575.4 $ 671.1 $ 968.5 $ 1,024.8 $ 788.8 $ 838.8 $ 3,238.0 $ 3,645.6 Nets Sales from Businesses Divested/to be Exited (25.0) (175.5) - (6.3) (22.2) (61.7) (5.6) (19.9) (52.8) (263.4) Adjusted Net Sales $ 880.3 $ 935.4 $ 575.4 $ 664.8 $ 946.3 $ 963.1 $ 783.2 $ 818.9 $ 3,185.2 $ 3,382.2 Twelve Months Ended Power Commercial Transmission ADJUSTED INCOME FROM OPERATIONS Systems Industrial Systems Climate Solutions Solutions Total Regal (Dollars in Millions) Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, Dec 28, Dec 29, 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 GAAP Income (Loss) from Operations $ 103.1 $ 102.2 $ (9.3) $ 24.8 $ 163.9 $ 115.6 $ 93.4 $ 104.4 $ 351.1 $ 347.0 Restructuring and Related Costs 11.8 2.9 8.4 2.7 4.2 1.8 6.9 0.3 31.3 7.7 Purchase Accounting and Transaction Costs 0.1 5.4 - - - - - - 0.1 5.4 (Gain) Loss on Businesses Divested and Assets to be Exited (32.6) - 1.0 - (4.7) 34.9 1.6 - (34.7) 34.9 Gain on Sale of Assets - (1.5) - - (3.8) (0.7) - - (3.8) (2.2) Operating (Income) Loss from Businesses Divested/to be Exited (3.3) (17.1) - 0.5 (0.5) (6.8) (0.3) (0.5) (4.1) (23.9) Executive Transition Costs 0.6 1.1 0.5 0.7 0.6 1.1 0.5 0.9 2.2 3.8 Adjusted Income from Operations $ 79.7 $ 93.0 $ 0.6 $ 28.7 $ 159.7 $ 145.9 $ 102.1 $ 105.1 $ 342.1 $ 372.7 GAAP Operating Margin % 11.4 % 9.2 % (1.6)% 3.7 % 16.9 % 11.3 % 11.8 % 12.4 % 10.8 % 9.5 % Adjusted Operating Margin % 9.1 % 9.9 % 0.1 % 4.3 % 16.9 % 15.1 % 13.0 % 12.8 % 10.7 % 11.0 % ©2020 Regal Beloit Corporation 132

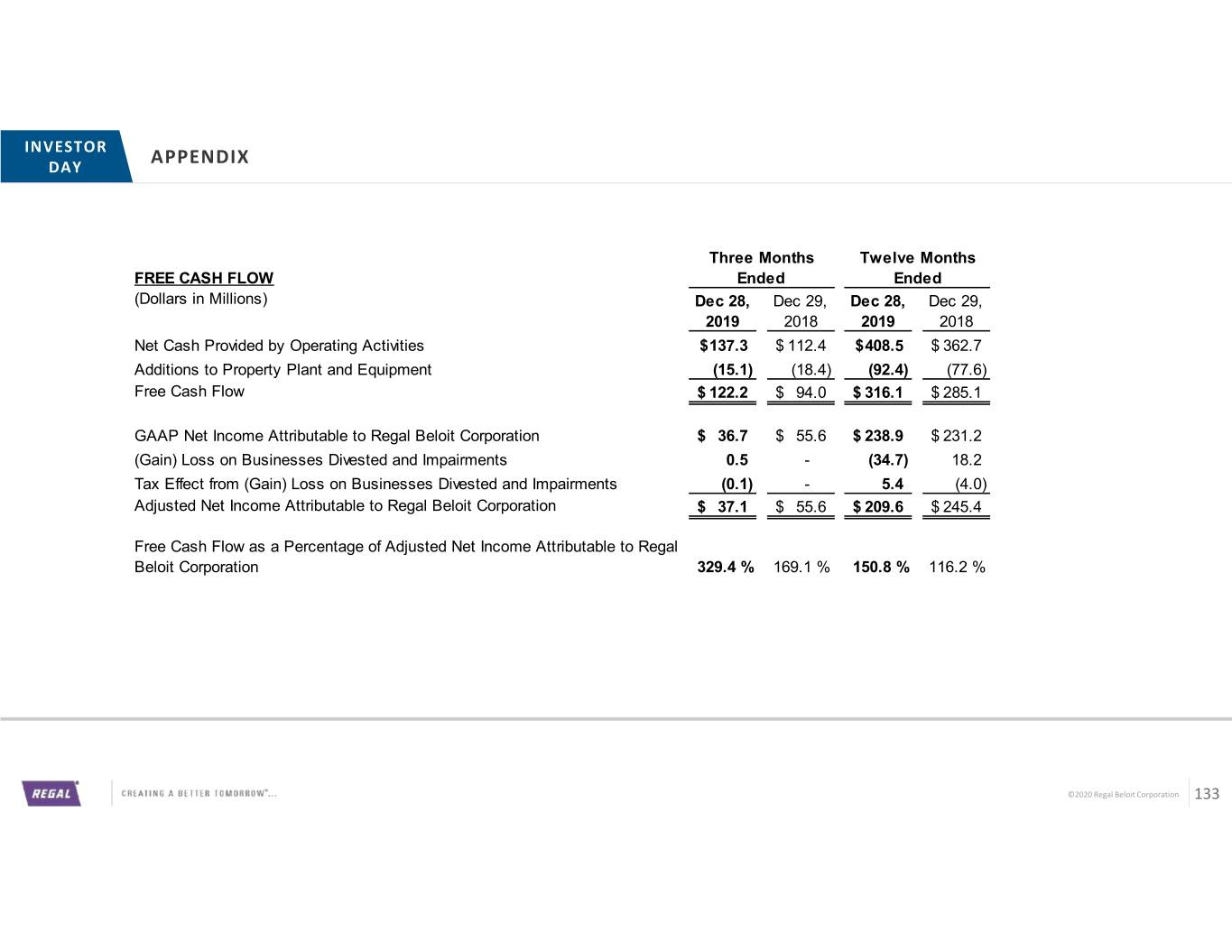

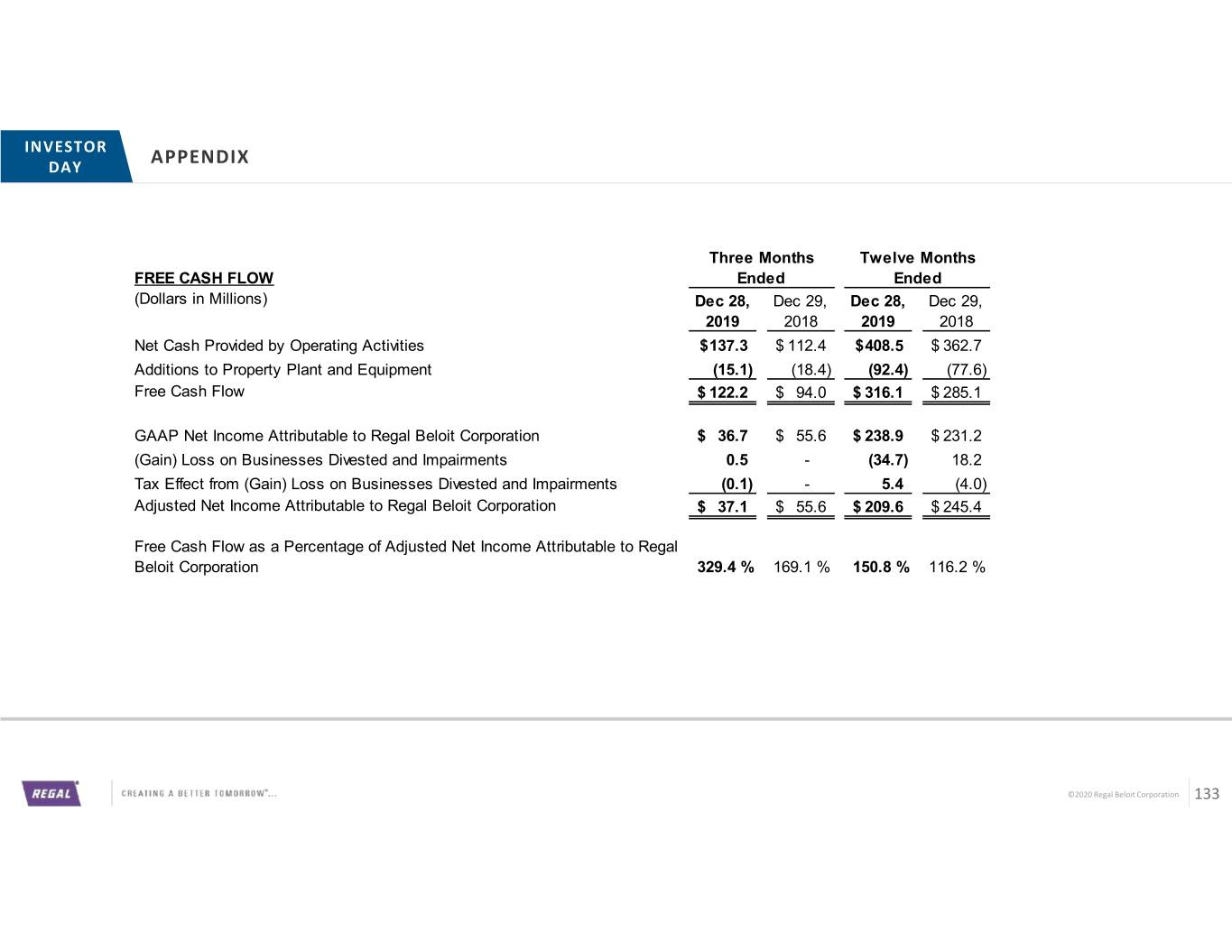

INVESTOR DAY APPENDIX Three Months Twelve Months FREE CASH FLOW Ended Ended (Dollars in Millions) Dec 28, Dec 29, Dec 28, Dec 29, 2019 2018 2019 2018 Net Cash Provided by Operating Activities $ 137.3 $ 112.4 $ 408.5 $ 362.7 Additions to Property Plant and Equipment (15.1) (18.4) (92.4) (77.6) Free Cash Flow $ 122.2 $ 94.0 $ 316.1 $ 285.1 GAAP Net Income Attributable to Regal Beloit Corporation $ 36.7 $ 55.6 $ 238.9 $ 231.2 (Gain) Loss on Businesses Divested and Impairments 0.5 - (34.7) 18.2 Tax Effect from (Gain) Loss on Businesses Divested and Impairments (0.1) - 5.4 (4.0) Adjusted Net Income Attributable to Regal Beloit Corporation $ 37.1 $ 55.6 $ 209.6 $ 245.4 Free Cash Flow as a Percentage of Adjusted Net Income Attributable to Regal Beloit Corporation 329.4 % 169.1 % 150.8 % 116.2 % ©2020 Regal Beloit Corporation 133

INVESTOR DAY APPENDIX TOTAL NET DEBT/EBITDA TOTAL NET DEBT/ADJUSTED EBITDA (Dollars in Millions) (Dollars in Millions) LTM Dec 28, LTM Dec 28, 2019 2019 Net Income $ 242.6 Net Income $ 242.6 Plus: Taxes 61.2 Plus: Taxes 61.2 Plus: Interest Expense 53.0 Plus: Interest Expense 53.0 Less: Interest Income (5.6) Less: Interest Income (5.6) Plus: Depreciation and Amortization 134.5 Plus: Depreciation and Amortization 134.5 Plus: Restructuring and Related Costs 31.3 Plus: Purchase Accounting & Transaction Costs Adjusted EBITDA $ 485.7 0.1 Plus: Impairment and Exit Related Costs 10.0 Plus: Executive Transition Costs 2.2 Current Maturities of Debt $ 0.6 Less: Operating Income from Businesses Divested/to be Exited (4.1) Long-Term Debt 1,136.9 Less: Gain on Sale of Assets (3.8) Less: Cash (331.4) Less: Gain on Divestiture of Business (44.7) Total Net Debt $ 806.1 Adjusted EBITDA $ 476.7 Total Net Debt/Adjusted EBITDA 1.7 Current Maturities of Debt $ 0.6 Long-Term Debt 1,136.9 Less: Cash (331.4) Total Net Debt $ 806.1 Total Net Debt/Adjusted EBITDA 1.7 ©2020 Regal Beloit Corporation 134

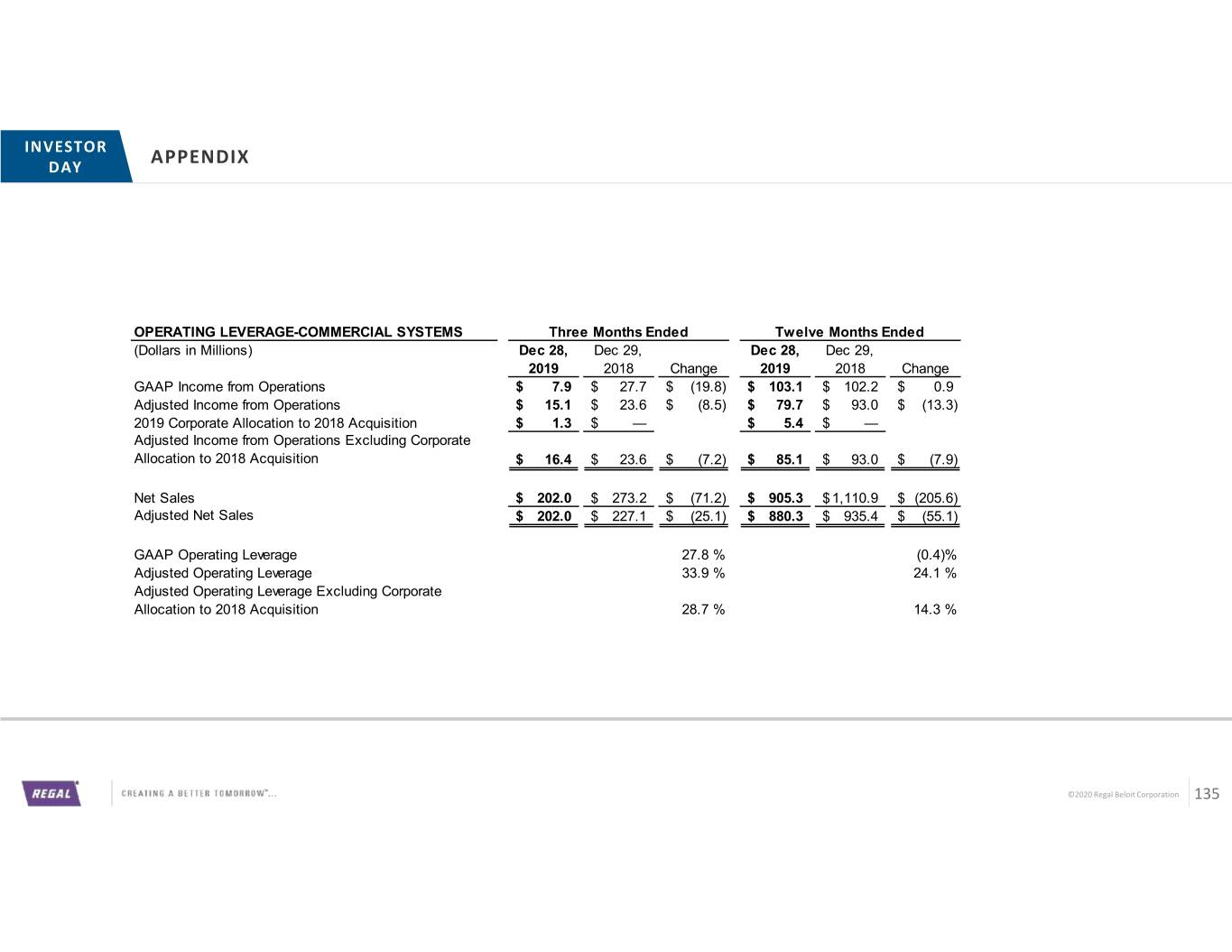

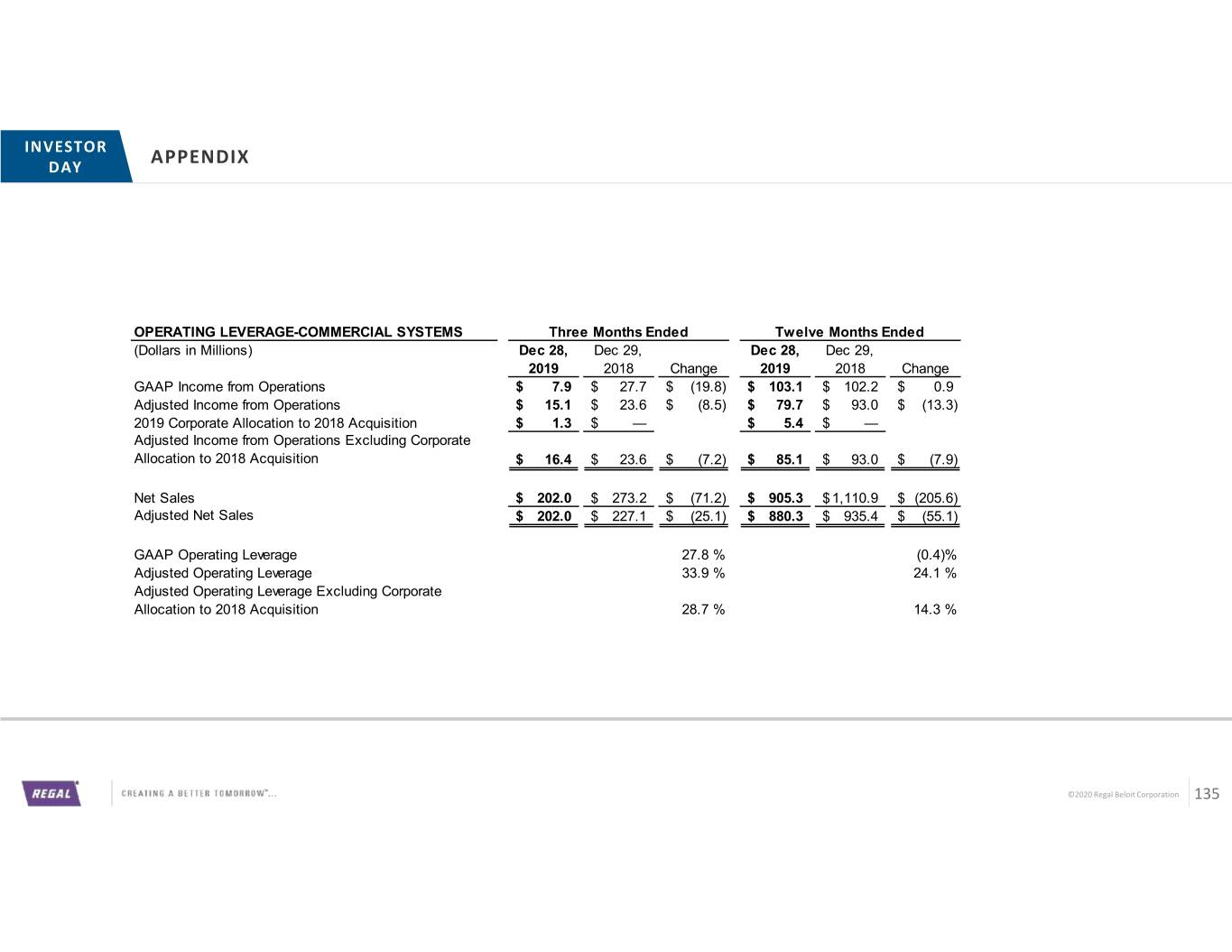

INVESTOR DAY APPENDIX OPERATING LEVERAGE-COMMERCIAL SYSTEMS Three Months Ended Twelve Months Ended (Dollars in Millions) Dec 28, Dec 29, Dec 28, Dec 29, 2019 2018 Change 2019 2018 Change GAAP Income from Operations $ 7.9 $ 27.7 $ (19.8) $ 103.1 $ 102.2 $ 0.9 Adjusted Income from Operations $ 15.1 $ 23.6 $ (8.5) $ 79.7 $ 93.0 $ (13.3) 2019 Corporate Allocation to 2018 Acquisition $ 1.3 $ — $ 5.4 $ — Adjusted Income from Operations Excluding Corporate Allocation to 2018 Acquisition $ 16.4 $ 23.6 $ (7.2) $ 85.1 $ 93.0 $ (7.9) Net Sales $ 202.0 $ 273.2 $ (71.2) $ 905.3 $ 1,110.9 $ (205.6) Adjusted Net Sales $ 202.0 $ 227.1 $ (25.1) $ 880.3 $ 935.4 $ (55.1) GAAP Operating Leverage 27.8 % (0.4)% Adjusted Operating Leverage 33.9 % 24.1 % Adjusted Operating Leverage Excluding Corporate Allocation to 2018 Acquisition 28.7 % 14.3 % ©2020 Regal Beloit Corporation 135