Creating a better tomorrow™… Third Quarter 2021 Earnings November 2, 2021 Louis Pinkham, Chief Executive Officer Rob Rehard, Vice President, Chief Financial Officer

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… 3Q 2021 FORWARD LOOKING STATEMENTS 2 This document contains forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect Regal Rexnord’s current estimates, expectations and projections about Regal Rexnord’s future results, performance, prospects and opportunities. Such forward-looking statements may include, among other things, statements about the merger with the PMC Business or the acquisition of Arrowhead, the benefits and synergies of the transactions described in this communication relating to the acquisitions of the PMC Business and Arrowhead (the “Transactions”), future opportunities for Regal Rexnord, and any other statements regarding Regal Rexnord’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition and other expectations and estimates for future periods. Forward-looking statements include statements that are not historical facts and can be identified by forward-looking words such as “anticipate,” “believe,” “confident,” “estimate,” “expect,” “plan,” “may,” “will,” “project,” “forecast,” “would,” “could,” “should,” and similar expressions. These forward-looking statements are based upon information currently available to Regal Rexnord and are subject to a number of risks, uncertainties, and other factors that could cause actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Important factors that could cause actual results to differ materially from the results referred to in the forward-looking statements Regal Rexnord makes in this communication include: risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; the possibility that the conditions to the consummation of the acquisition of Arrowhead will not be satisfied; the failure to consummate or delay in consummating the acquisition of Arrowhead for other reasons; the possibility that Regal Rexnord may be unable to achieve expected synergies and operating efficiencies in connection with the Transactions within the expected time-frames or at all and to successfully integrate the PMC Business and Arrowhead; expected or targeted future financial and operating performance and results; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) being greater than expected following the Transactions; Regal Rexnord’s ability to retain key executives and employees; the continued financial and operational impacts of and uncertainties relating to the COVID-19 pandemic on customers and suppliers and the geographies in which they operate; uncertainties regarding the ability to execute restructuring plans within expected costs and timing; the ability to obtain the anticipated tax treatment of the acquisition of the PMC Business and related transactions; actions taken by competitors and their ability to effectively compete in the increasingly competitive global electric motor, drives and controls, power generation and power transmission industries; the ability to develop new products based on technological innovation, such as the Internet of Things, and marketplace acceptance of new and existing products, including products related to technology not yet adopted or utilized in geographic locations in which Regal Rexnord does business; fluctuations in commodity prices and raw material costs; dependence on significant customers; seasonal impact on sales of products into HVAC systems and other residential applications; risks associated with global manufacturing, including risks associated with public health crises; issues and costs arising from the integration of acquired companies and businesses and the timing and impact of purchase accounting adjustments; Regal Rexnord’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the Transactions; prolonged declines in one or more markets, such as heating, ventilation, air conditioning, refrigeration, power generation, oil and gas, unit material handling or water heating; economic changes in global markets, such as reduced demand for products, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external factors that Regal Rexnord cannot control; product liability and other litigation, or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated, particularly in high volume applications or where such failures are alleged to be the cause of property or casualty claims; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; unanticipated costs or expenses that may be incurred related to product warranty issues; dependence on key suppliers and the potential effects of supply disruptions; infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party technologies; effects on earnings of any significant impairment of goodwill or intangible assets; losses from failures, breaches, attacks or disclosures involving information technology infrastructure and data; cyclical downturns affecting the global market for capital goods; changes in the method of determining London Interbank Offered Rate (“LIBOR”), or the replacement of LIBOR with an alternative reference rate; and other risks and uncertainties including, but not limited, to those described in the section entitled “Risk Factors” in Regal Rexnord’s joint proxy statement/prospectus-information statement on file with the Securities and Exchange Commission, in Regal Rexnord’s Annual Report on Form 10-K on file with the SEC and from time to time in other filed reports including Regal Rexnord’s Quarterly Reports on Form 10-Q. For a more detailed description of the risk factors associated with Regal Rexnord, please refer to Regal Rexnord’s Annual Report on Form 10-K for the fiscal year ended January 2, 2021 on file with the SEC and subsequent SEC filings. Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this communication are made only as of the date of this communication, and Regal Rexnord undertakes no obligation to update any forward-looking information contained in this communication or with respect to the announcements described herein to reflect subsequent events or circumstances.

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… NON-GAAP FINANCIAL MEASURES We prepare financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We also periodically disclose certain financial measures in our quarterly earnings releases, on investor conference calls, and in investor presentations and similar events that may be considered “non-GAAP” financial measures. This additional information is not meant to be considered in isolation or as a substitute for our results of operations prepared and presented in accordance with GAAP. In this presentation, we disclose the following non-GAAP financial measures, and we reconcile these measures in the tables below to the most directly comparable GAAP financial measures: adjusted diluted earnings per share, adjusted income from operations, adjusted operating margin, adjusted net sales, net debt, adjusted EBITDA, adjusted EBITDA margin, adjusted bank EBITDA, adjusted operating leverage, adjusted net income attributable to Regal Rexnord Corporation, free cash flow, free cash flow as a percentage of adjusted net income attributable to Regal Rexnord Corporation, adjusted income before taxes, adjusted provision for income taxes, adjusted effective tax rate, net sales from ongoing business, adjusted income from operations of ongoing business, ongoing business adjusted operating margin and adjusted diluted earnings per share for ongoing business. We believe that these non-GAAP financial measures are useful measures for providing investors with additional information regarding our results of operations and for helping investors understand and compare our operating results across accounting periods and compared to our peers. Our management primarily uses adjusted income from operations, adjusted operating income, adjusted operating margin, and adjusted operating leverage to help us manage and evaluate our business and make operating decisions, while adjusted diluted earnings per share, net debt, adjusted EBITDA, adjusted EBITDA margin, adjusted net sales, adjusted net income attributable to Regal Rexnord Corporation, free cash flow, free cash flow as a percentage of adjusted net income attributable to Regal Rexnord Corporation, adjusted income before taxes, adjusted provision for income taxes, adjusted effective tax rate, net sales from ongoing business, adjusted income from operations of ongoing business, ongoing business adjusted operating margin and adjusted diluted earnings per share for ongoing business are primarily used to help us evaluate our business and forecast our future results. Accordingly, we believe disclosing and reconciling each of these measures helps investors evaluate our business in the same manner as management. In addition to these non-GAAP measures, we use the term “organic sales growth” to refer to the increase in our sales between periods that is attributable to organic sales. “Organic sales” to refers to GAAP sales from existing operations excluding any sales from acquired businesses recorded prior to the first anniversary of the acquisition and excluding any sales from business divested/to be exited recorded prior to the first anniversary of the exit and excluding the impact of foreign currency translation. The impact of foreign currency translation is determined by translating the respective period’s organic sales using the currency exchange rates that were in effect during the prior year periods . 3Q 2021 3

Creating a better tomorrow™… Opening Comments & Overview LOUIS PINKHAM, CEO 3Q 2021 Results, 2021 & 2022 Outlooks ROB REHARD, CFO Arrowhead Systems LOUIS PINKHAM, CEO Questions & Answers Closing Remarks LOUIS PINKHAM, CEO 3Q 2021

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Opening Comments • Margin & Adjusted EPS Records Despite Inflation & Supply Chain Headwinds, Aided by 80/20, Price Discipline, Ongoing Restructuring • Continue to Realize Pockets of Share Gain Across the Business • Closed Transformational Merger with Rexnord PMC • Announcing Acquisition of Arrowhead Systems * Non-GAAP Financial Measurement, See Appendix for Reconciliation . OPENING COMMENTS & OVERVIEW OF RESULTS ($ in millions, except per share data) 3Q 2020 3Q 2021 Adjusted Net Sales* $758.2 $892.7 Adjusted Income from Operations* $97.0 $127.2 Adjusted Operating Margin* 12.8% 14.2% Adjusted Diluted EPS* $1.73 $2.36 Free Cash Flow* $111.0 $108.3 3Q 2021 5

Creating a better tomorrow™… Opening Comments & Overview LOUIS PINKHAM, CEO 3Q 2021 Results, 2021 & 2022 Outlooks ROB REHARD, CFO Arrowhead Systems LOUIS PINKHAM, CEO Questions & Answers Closing Remarks LOUIS PINKHAM, CEO 3Q 2021

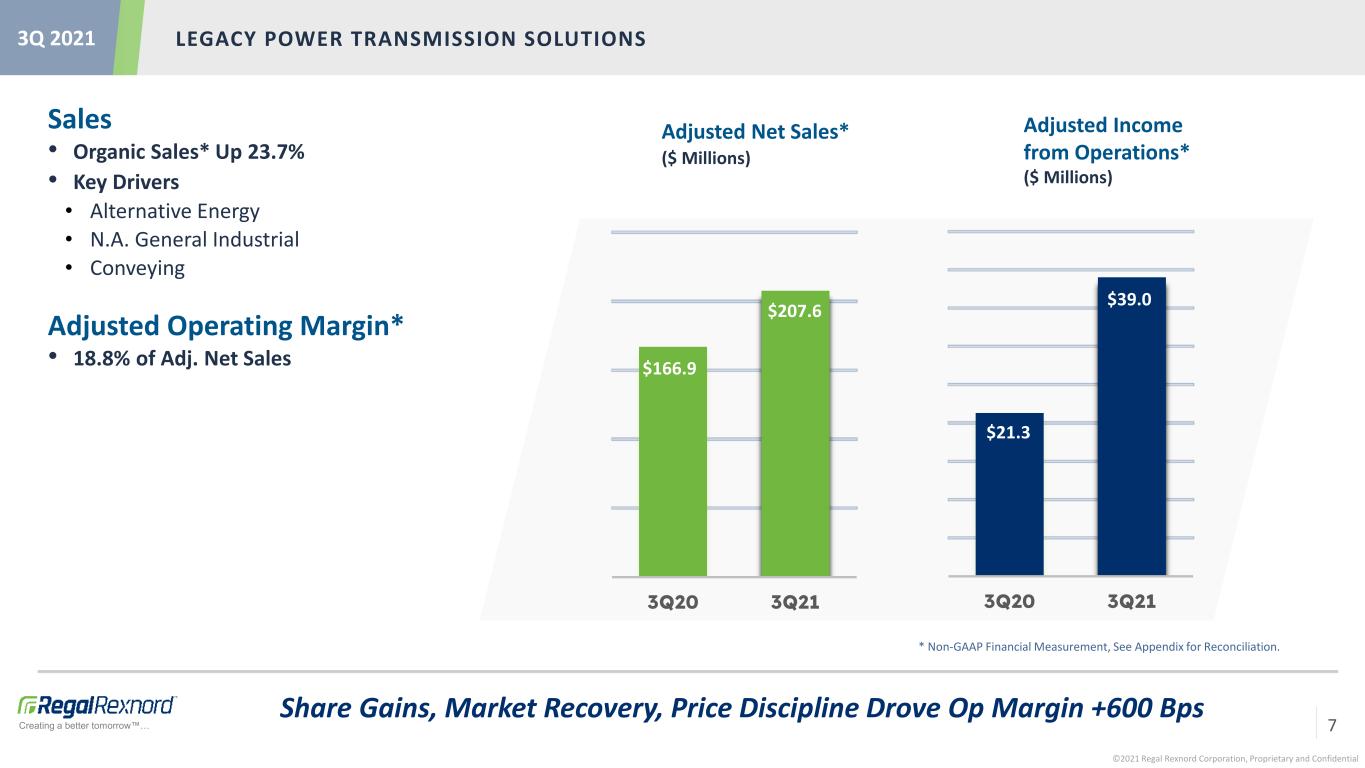

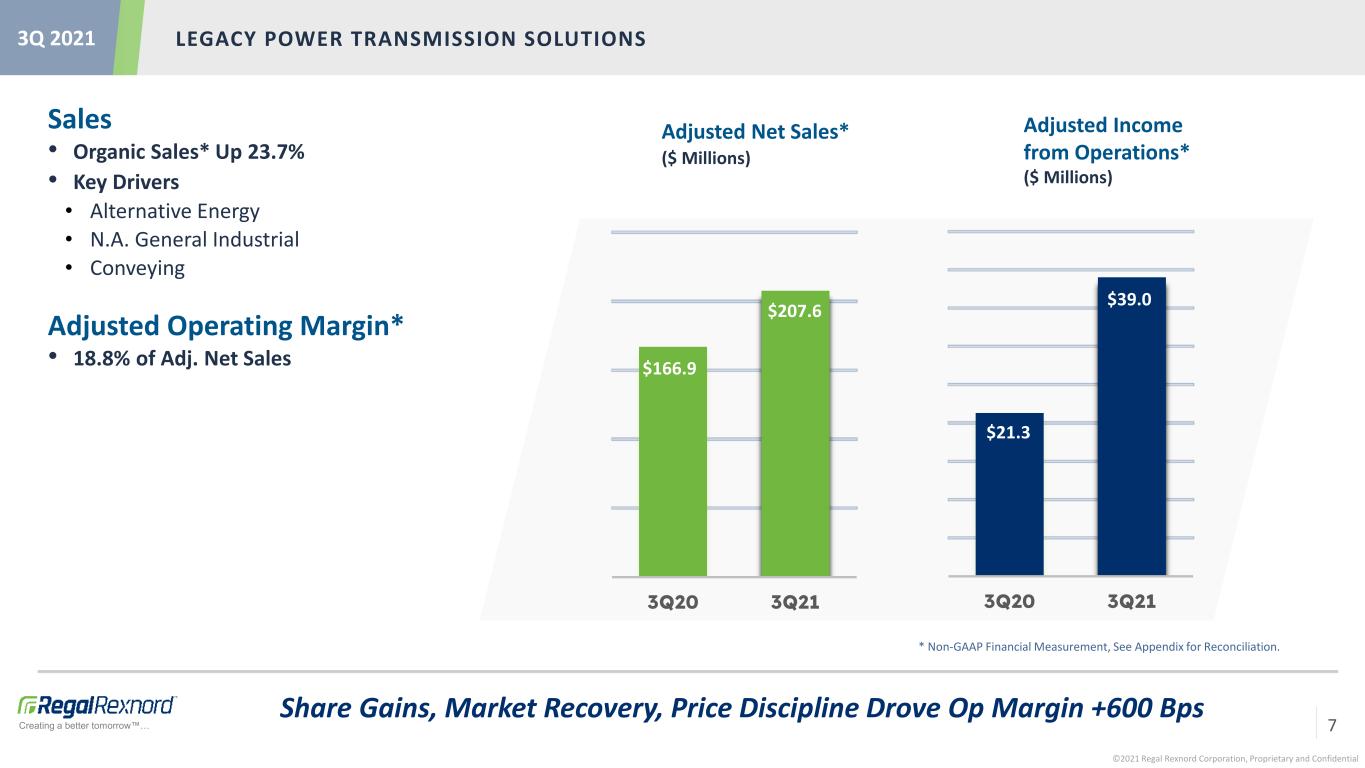

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Adjusted Income from Operations* ($ Millions) LEGACY POWER TRANSMISSION SOLUTIONS Adjusted Net Sales* ($ Millions) * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 3Q 2021 Share Gains, Market Recovery, Price Discipline Drove Op Margin +600 Bps Sales • Organic Sales* Up 23.7% • Key Drivers • Alternative Energy • N.A. General Industrial • Conveying Adjusted Operating Margin* • 18.8% of Adj. Net Sales 3Q20 3Q21 $166.9 $207.6 3Q20 3Q21 $21.3 $39.0 7

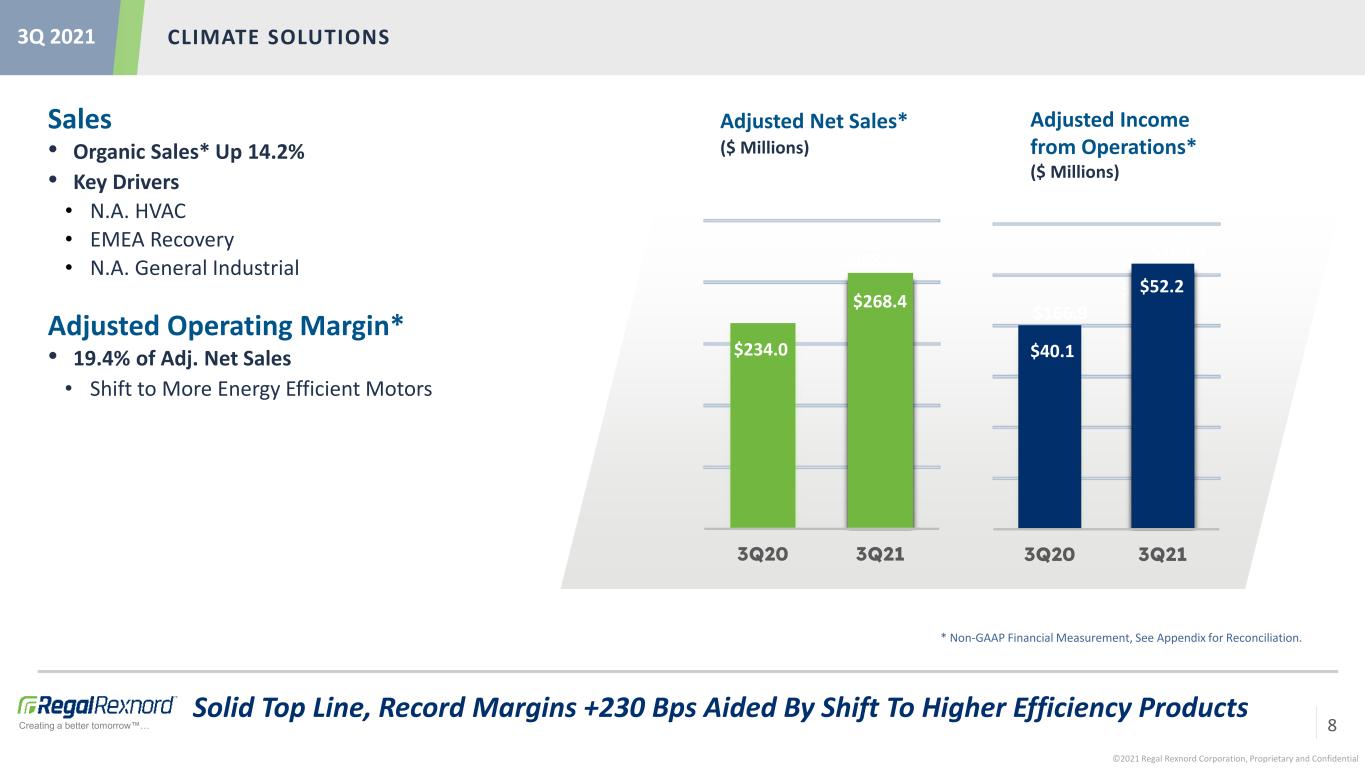

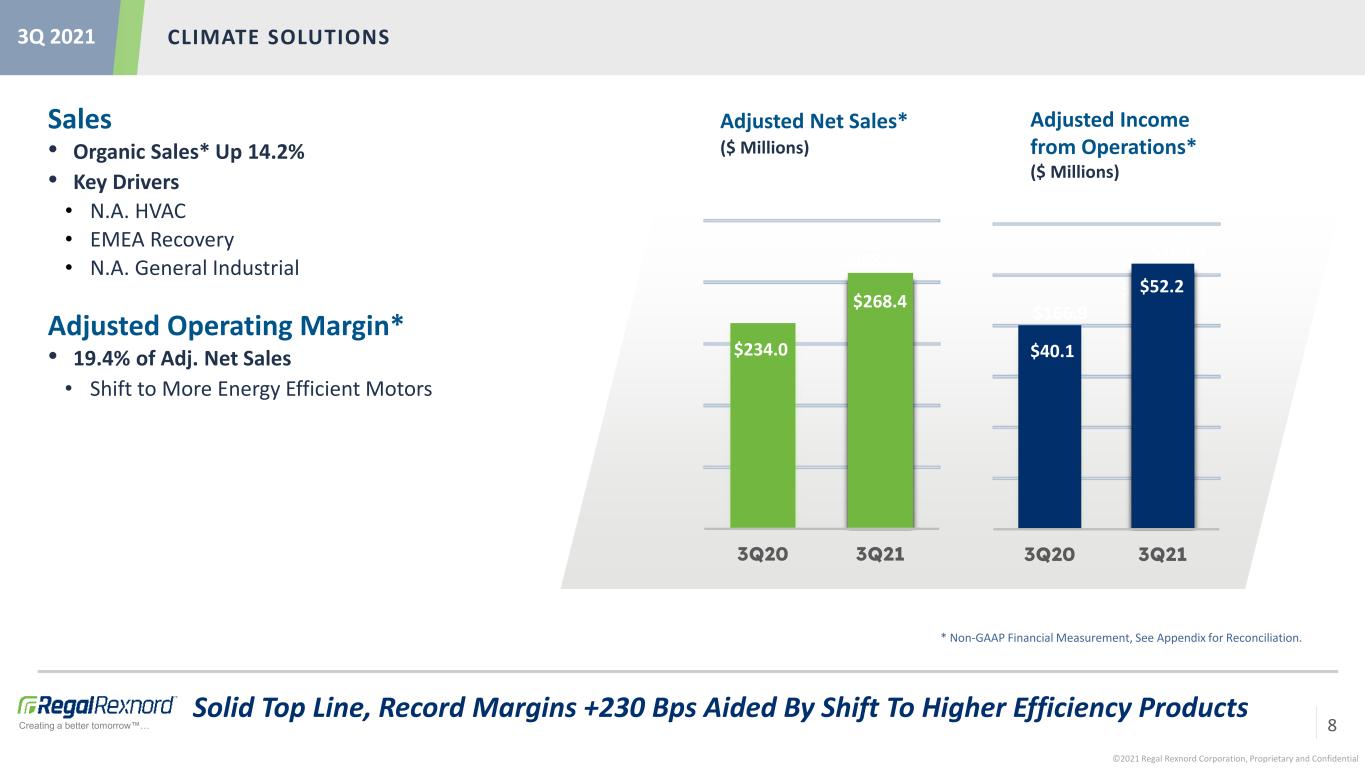

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Adjusted Net Sales* ($ Millions) Adjusted Income from Operations* ($ Millions) Sales • Organic Sales* Up 14.2% • Key Drivers • N.A. HVAC • EMEA Recovery • N.A. General Industrial Adjusted Operating Margin* • 19.4% of Adj. Net Sales • Shift to More Energy Efficient Motors CLIMATE SOLUTIONS * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 3Q 2021 Solid Top Line, Record Margins +230 Bps Aided By Shift To Higher Efficiency Products $52.2 $268.4 $166.9 $166.9 $166.9 3Q20 3Q21 $40.1 $52.2 3Q20 3Q21 $234.0 $268.4 8

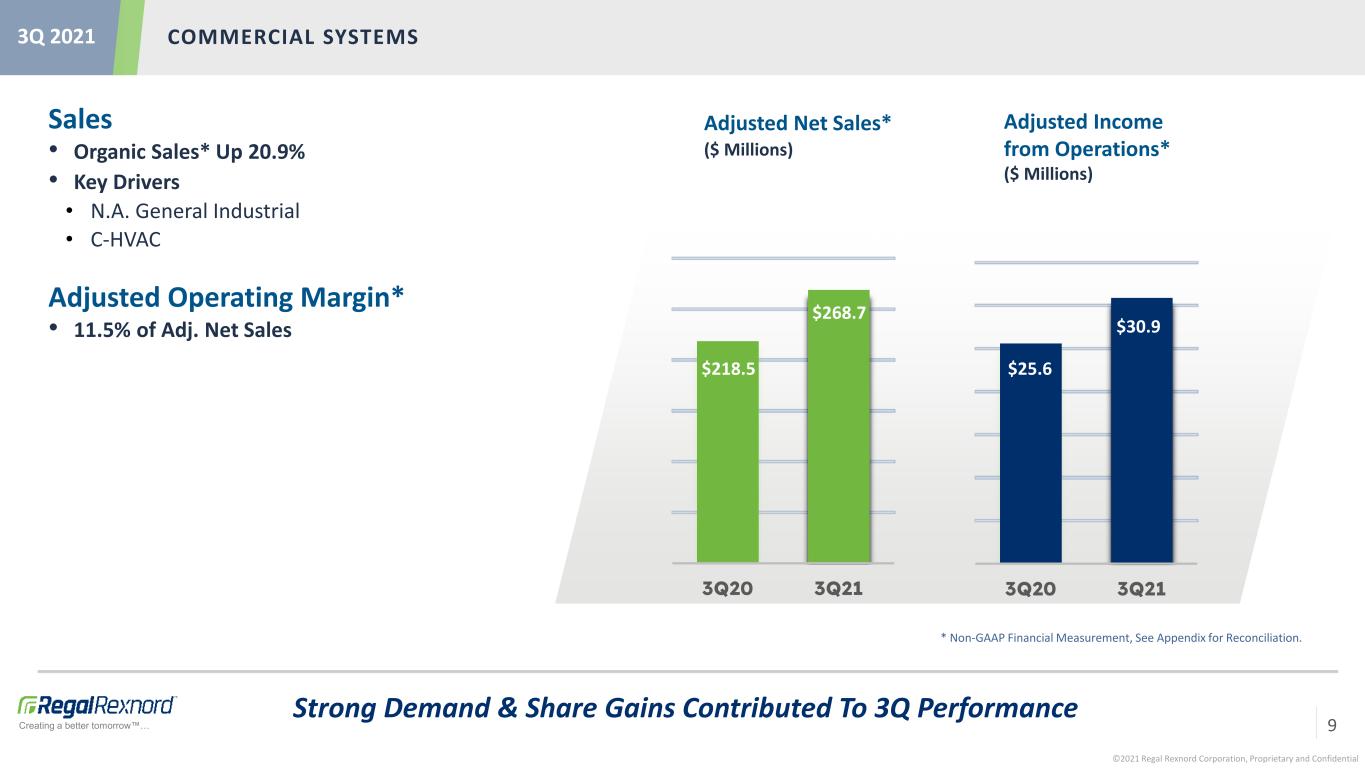

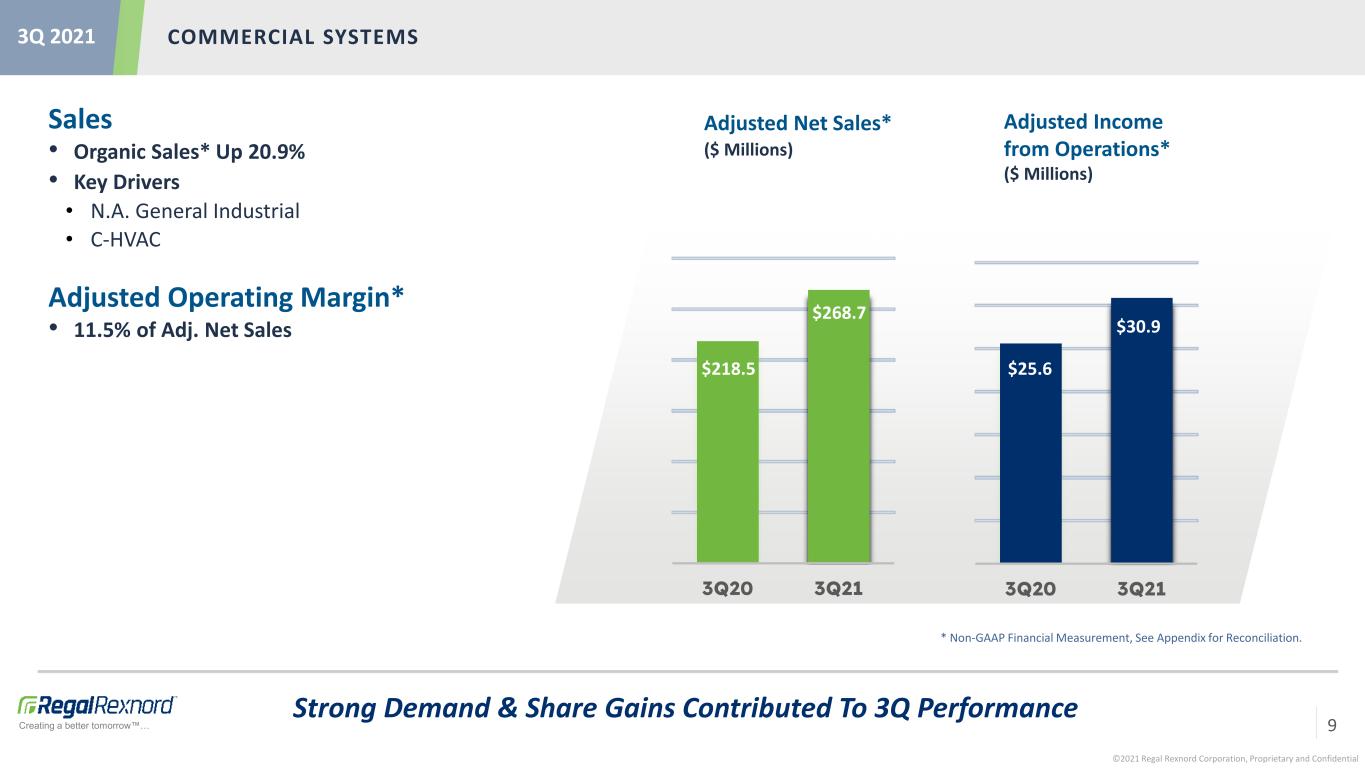

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Adjusted Net Sales* ($ Millions) Adjusted Income from Operations* ($ Millions) Sales • Organic Sales* Up 20.9% • Key Drivers • N.A. General Industrial • C-HVAC Adjusted Operating Margin* • 11.5% of Adj. Net Sales COMMERCIAL SYSTEMS * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 3Q 2021 Strong Demand & Share Gains Contributed To 3Q Performance $268.7 3Q20 3Q21 3Q20 3Q21 $218.5 $268.7 $25.6 $30.9 9

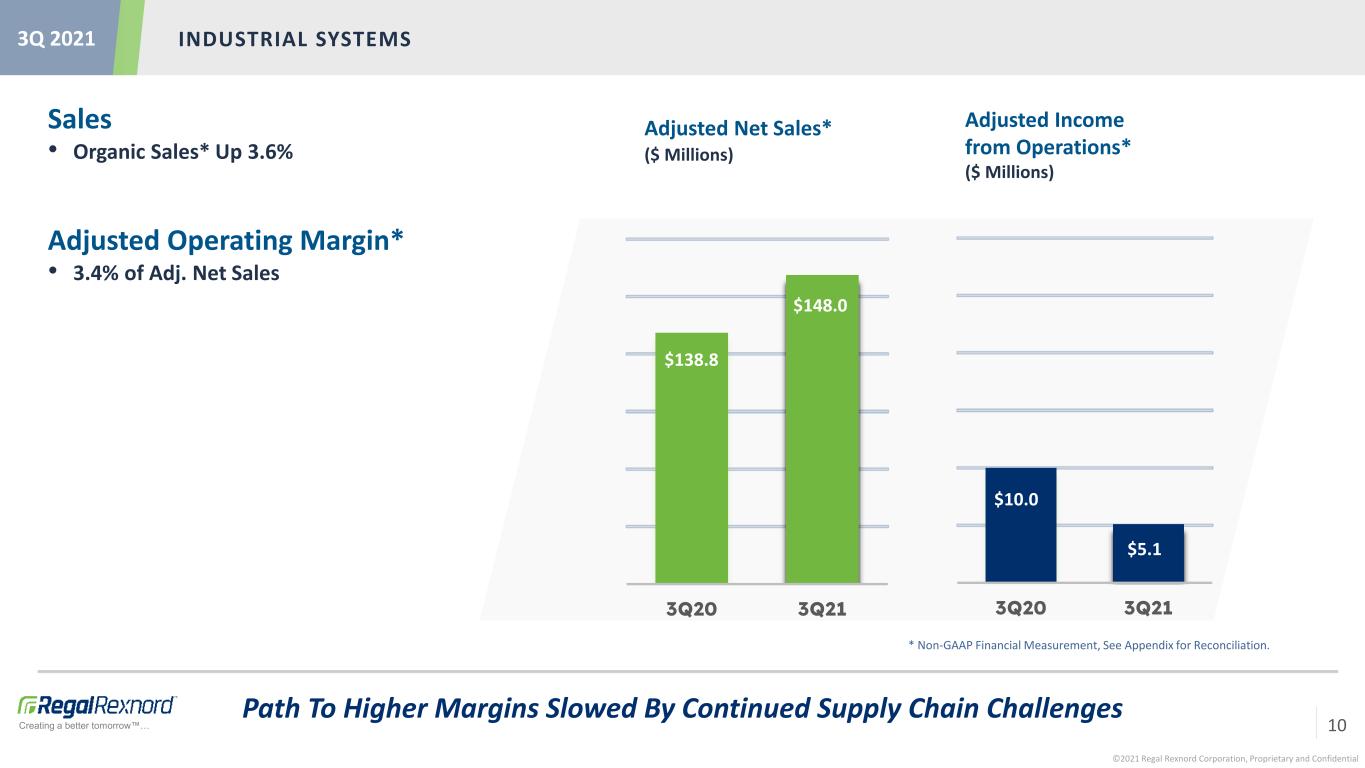

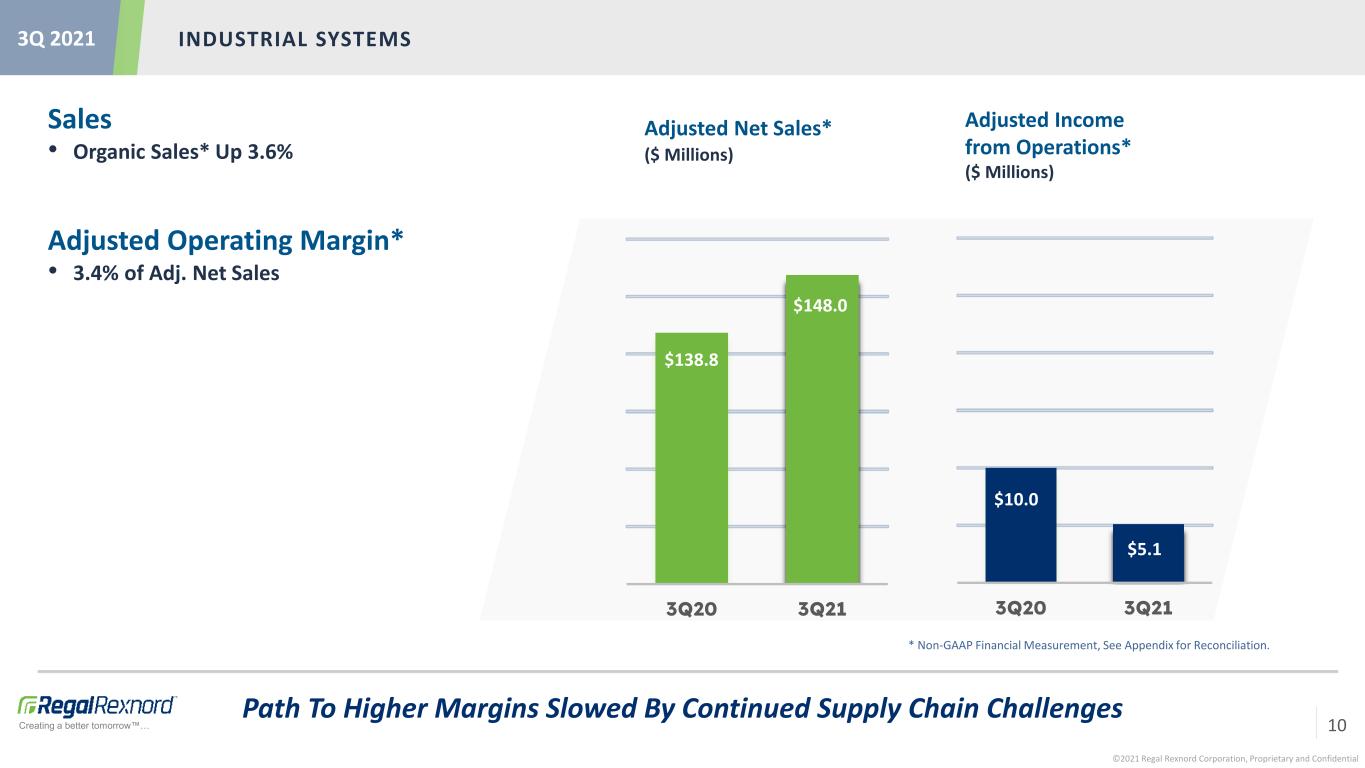

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Adjusted Net Sales* ($ Millions) Adjusted Income from Operations* ($ Millions) Sales • Organic Sales* Up 3.6% Adjusted Operating Margin* • 3.4% of Adj. Net Sales INDUSTRIAL SYSTEMS * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 3Q 2021 Path To Higher Margins Slowed By Continued Supply Chain Challenges 3Q20 3Q21 $5.1 $10.0 3Q20 3Q21 $138.8 $148.0 10

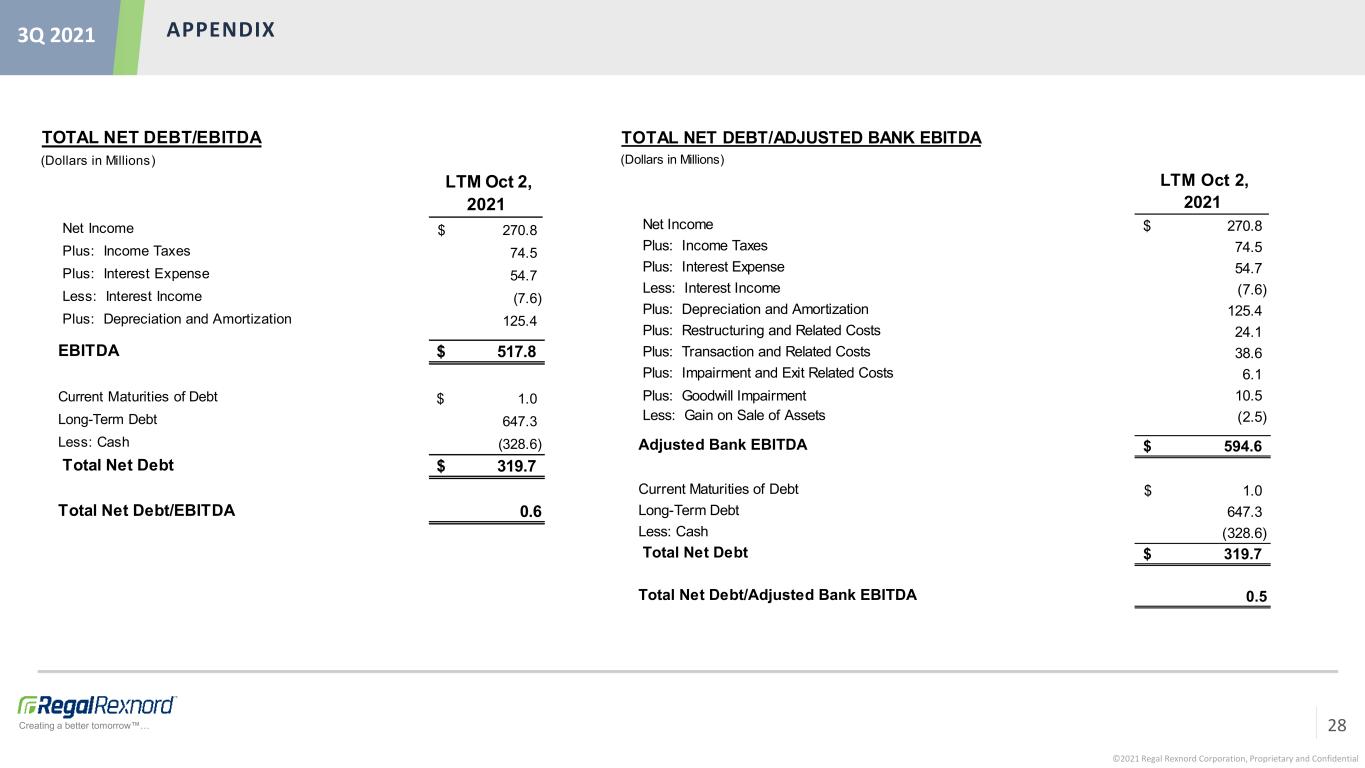

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Capital Expenditures • $13.2 Million in 3Q 2021 • $57.0 Million Expected in FY 2021** Effective Tax Rate (ETR) • 20.2% Adj. ETR* in 3Q 2021 • 21.0% Adj. ETR* Expected in FY 2021** Restructuring & Related Costs • $2.8 Million in 3Q 2021 • $23.0 Million Expected in FY 2021** Low Net Leverage Provides Lots Of Optionality KEY FINANCIAL METRICS & OTHER UPDATES Balance Sheet at October 2, 2021 • Total Debt of $648.3 Million • Net Debt of $319.7 Million • Net Debt/Adj. EBITDA* of 0.5 Free Cash Flow* • $108.3 Million in 3Q 2021 • 3Q Conversion of 133.4% Other Updates • Increased Share Purchase Authorization From $250M to $500M * Non-GAAP Financial Measurement, See Appendix for Reconciliation. 3Q 2021 ** Guidance does not give effect to the Rexnord-PMC Transaction, or any costs or expenses related to the transaction. 11

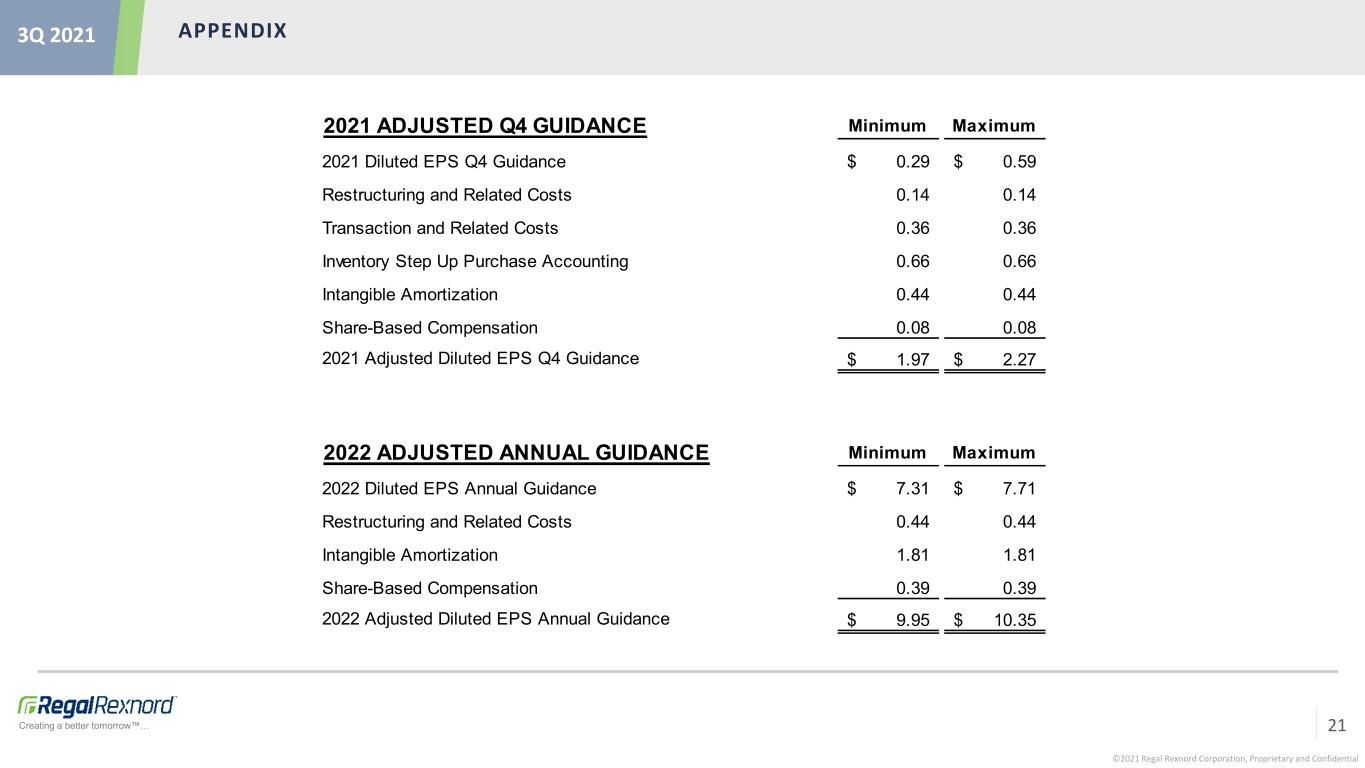

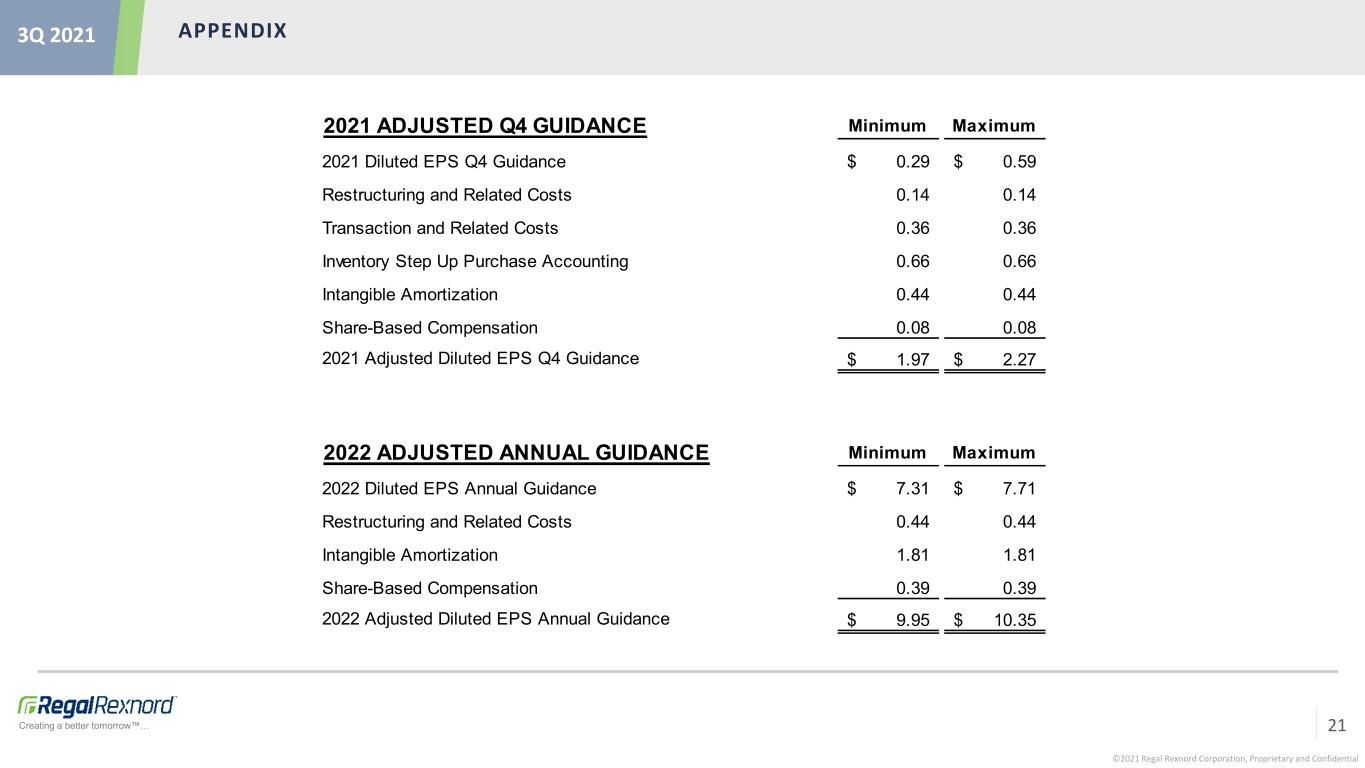

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… Maintaining Prior Outlooks For Regal & PMC, Layering On PMC & Arrowhead Impacts • Incorporating Rexnord PMC and related merger impacts (higher shares, D&A, interest, tax) as of 4Q 2021, and Arrowhead as of January 1, 2022. • Updating calculation of Adjusted EBITDA to add back stock- based compensation and calculation of Adjusted EPS to add back all amortization and stock-based compensation, after tax – both beginning in 4Q 2021. • Expect 4Q 2021 sales to grow at a mid teens rate. • Expect 4Q 2021 Adjusted Diluted Earnings per Share* in a range of $1.97 to $2.27. • New 4Q target consistent with prior outlooks for PMC and for legacy Regal after giving effect to merger with PMC and new approach for calculating adjusted EPS. • Expect 2022 Adjusted Diluted Earnings per Share* in a range of ~$9.95 to $10.35. • Expect Net Debt/Adjusted EBITDA of 1.1x at EOY 2021.** UPDATING 2021 & 2022 OUTLOOKS3Q 2021 * Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures; see Appendix for reconciliations. ** Pro forma for the acquisition of Arrowhead.. Outlook Summary 12

Creating a better tomorrow™… Opening Comments & Overview LOUIS PINKHAM, CEO 3Q 2021 Results, 2021 & 2022 Outlooks ROB REHARD, CFO Arrowhead Systems LOUIS PINKHAM, CEO Questions & Answers Closing Remarks LOUIS PINKHAM, CEO 3Q 2021

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… 40% 38% 22% ARROWHEAD SYSTEMS COMPANY SNAPSHOT Conveying-Related Offering Rises From 19% To 26% Of MCS Segment 2022 Sales $99M Sales 33% GM % 18% Adj. EBITDA % 18% ‘18-’21 sales CAGR 2021F Key Metrics1 Sales by Segment2 Sales by End-Market2 1. 2021 forecast. 2. Reflects 2020 actuals. Palletizing/ de-palletizing Conveyance Aftermarket/ services 57% 15% 15% 13% Aluminum beverage can Consumer staples Other beverage Food Bulk palletizersMat top conveyors Representative Products Sanitary/ washdown 3Q 2021 14

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… 15 ARROWHEAD SYSTEMS STRATEGIC RATIONALE 1 2 3 4 Strong growth outlook – Compelling historic growth (18% CAGR 2018-2021) with long-term forward-looking forecast of mid-single digits plus, driven by high-growth end markets (e.g. aluminum beverage can manufacturing and filling) Attractive product portfolio – Leading portfolio of highly engineered palletizers/ de-palletizers and conveyance systems, supported by a best-in-class aftermarket and services team Complementary products – Regal Rexnord has a leading portfolio of conveyance components and modules. Arrowhead’s system and solution focus is highly complementary and helps accelerate Regal Rexnord’s focus on value- added solutions for our customers such as our ModSort Systems offering Compelling financial metrics – $297M deal price, projecting ROIC to exceed 10%, accretive to adjusted EPS in Year 1, Synergies of $8M by year 3, growing to $12M with additional cross-marketing synergies. Expected to close in Q4 2021 5 Platform for future growth – Highly fragmented industry with opportunities for further acquisitions 3Q 2021 Strong Strategic Rationale Balanced Between Growth & Margin Opportunities

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… A GREAT FIT: ARROWHEAD’S SYSTEMS AND SERVICES & REGAL REXNORD’S COMPONENTS & MODULES 16Complementary Offerings Expected To Deliver Increased Value To Customers Palletizing / Depalletizing SystemsComponent Offerings Gearing Motors Gearmotors Guides Bearings Chain Belts Combining complementary portfolios will enable Regal Rexnord to better meet our conveying customers’ needs for end-to-end solutions (components, pre-engineered modules, engineered systems, and services)Module Offerings ModSort Transfer & Diverter Station Conveyance Sub-Systems Aftermarket / Services Bulk palletizers Case palletizers Sanitary/ washdown Mat top conveyors Vertical case conveyors Upgrade Kits & Parts Installation & Service Project Management 3Q 2021

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… 17 Combining the ModSort offering, Regal Rexnord’s high-growth transfer & divert module… ModSort Product Line Overview • Innovative module in the conveyor system that can divert products in any direction • Serving high-growth end markets including ecommerce and warehousing • Sales on track to double in 2021 with margins accretive to MCS segment average Synergy between Arrowhead and ModSort • Arrowhead brings controls and fabrication & assembly expertise for system solutions • Regal Rexnord brings an extensive integrator network focused on ecommerce and other markets where Arrowhead has limited presence today SYNERGY IN ACTION: ACCELERATING GROWTH OF THE MODSORT OFFERING Combination Creates Significant Opportunities For Above Market Growth …with Arrowhead’s proven system capabilities, we expect to further accelerate the platform’s growth 3Q 2021

Creating a better tomorrow™… 3Q 2021 Opening Comments & Overview LOUIS PINKHAM, CEO 3Q 2021 Results, 2021 & 2022 Outlooks ROB REHARD, CFO Arrowhead Systems LOUIS PINKHAM, CEO Questions & Answers Closing Remarks LOUIS PINKHAM, CEO

Creating a better tomorrow™… 3Q 2021 Opening Comments & Overview LOUIS PINKHAM, CEO 3Q 2021 Results, 2021 & 2022 Outlooks ROB REHARD, CFO Arrowhead Systems LOUIS PINKHAM, CEO Questions & Answers Closing Remarks LOUIS PINKHAM, CEO

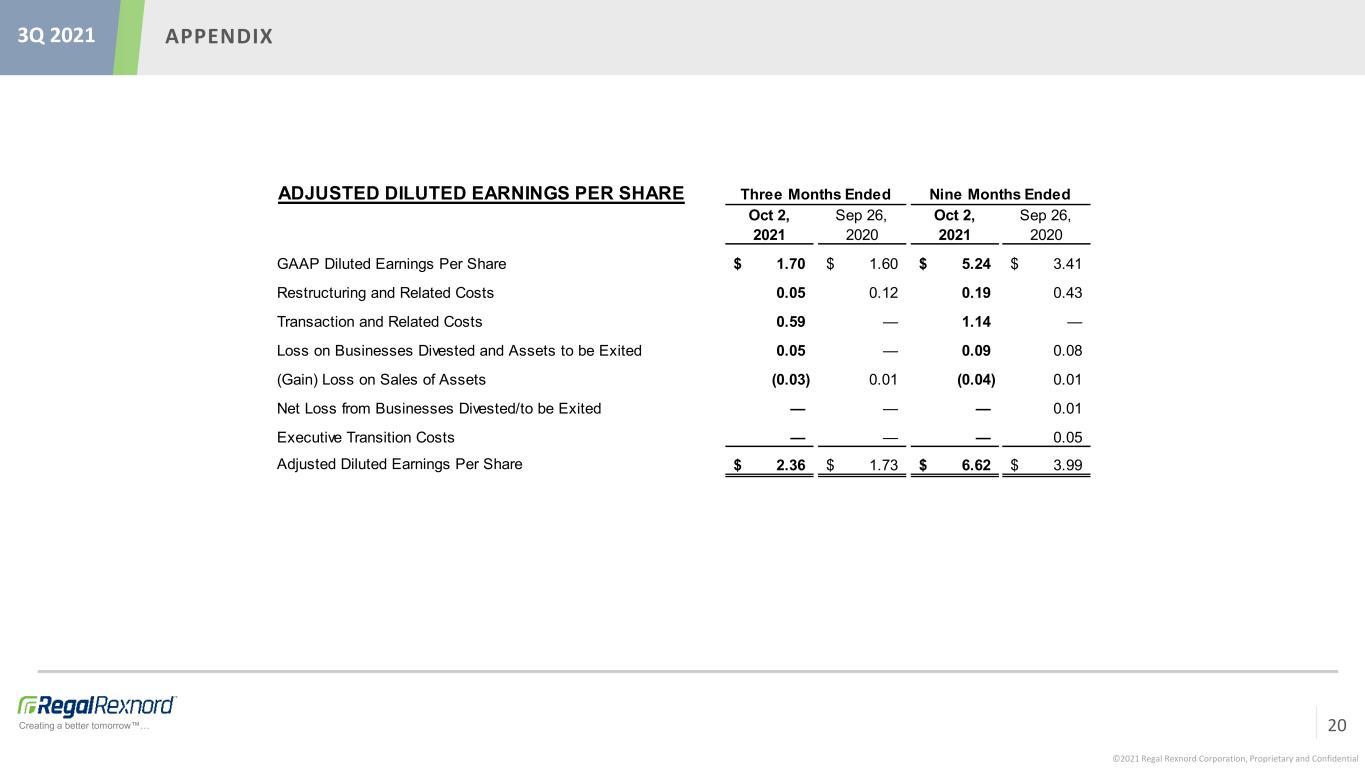

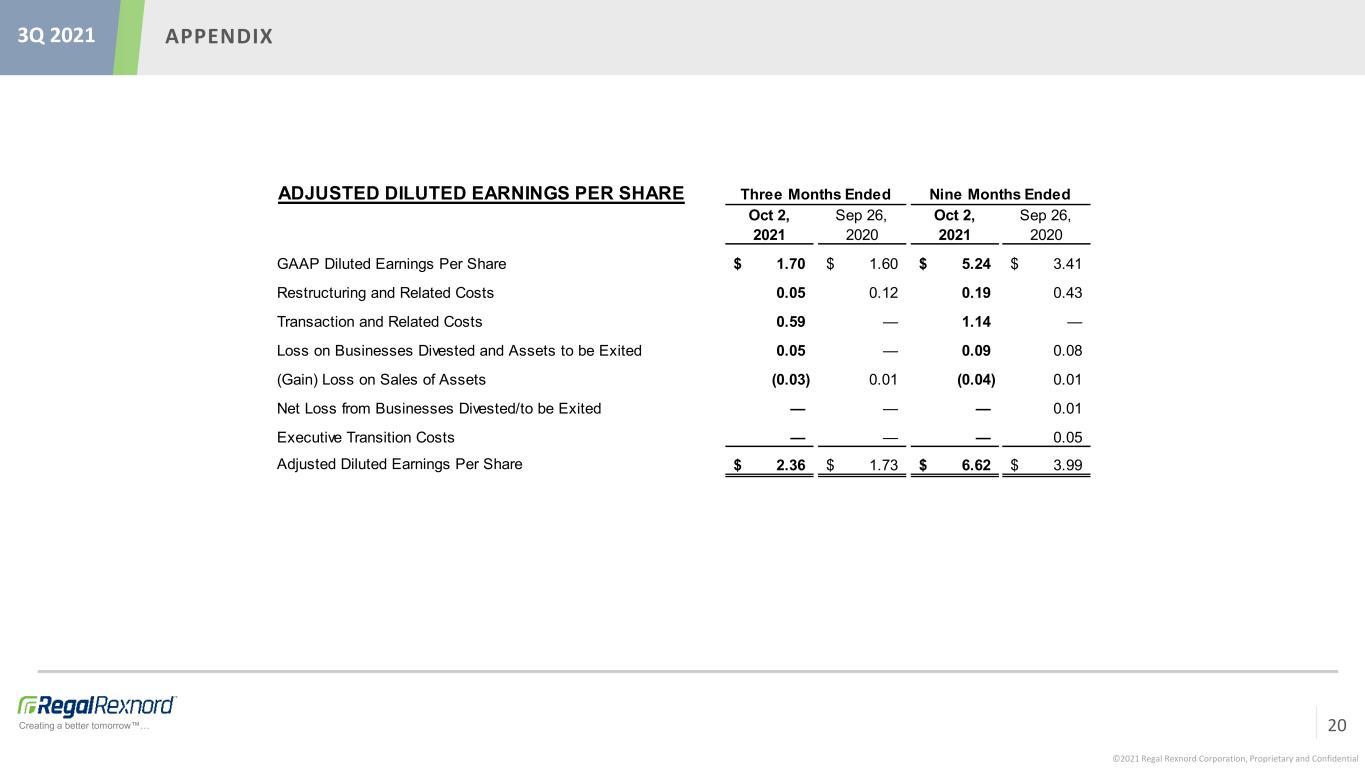

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 ADJUSTED DILUTED EARNINGS PER SHARE Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 GAAP Diluted Earnings Per Share 1.70$ 1.60$ 5.24$ 3.41$ Restructuring and Related Costs 0.05 0.12 0.19 0.43 Transaction and Related Costs 0.59 — 1.14 — Loss on Businesses Divested and Assets to be Exited 0.05 — 0.09 0.08 (Gain) Loss on Sales of Assets (0.03) 0.01 (0.04) 0.01 Net Loss from Businesses Divested/to be Exited — — — 0.01 Executive Transition Costs — — — 0.05 Adjusted Diluted Earnings Per Share 2.36$ 1.73$ 6.62$ 3.99$ Three Months Ended Nine Months Ended 20

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 21 2021 ADJUSTED Q4 GUIDANCE Minimum Maximum 2021 Diluted EPS Q4 Guidance 0.29$ 0.59$ Restructuring and Related Costs 0.14 0.14 Transaction and Related Costs 0.36 0.36 Inventory Step Up Purchase Accounting 0.66 0.66 Intangible Amortization 0.44 0.44 Share-Based Compensation 0.08 0.08 2021 Adjusted Diluted EPS Q4 Guidance 1.97$ 2.27$ 2022 ADJUSTED ANNUAL GUIDANCE Minimum Maximum 2022 Diluted EPS Annual Guidance 7.31$ 7.71$ Restructuring and Related Costs 0.44 0.44 Intangible Amortization 1.81 1.81 Share-Based Compensation 0.39 0.39 2022 Adjusted Diluted EPS Annual Guidance 9.95$ 10.35$

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 GAAP Income from Operations 30.4$ 24.6$ 6.4$ 7.3$ 52.1$ 39.2$ 18.5$ 18.9$ 107.4$ 90.0$ Restructuring and Related Costs 0.3 0.8 0.8 2.4 0.1 0.7 1.6 2.4 2.8 6.3 Transaction and Related Costs - - - - - - 16.1 - 16.1 - Loss on Businesses Divested and Assets to be Exited - - - - - - 2.8 - 2.8 - (Gain) Loss on Sale of Assets 0.2 0.2 (2.1) 0.3 - 0.2 - - (1.9) 0.7 Adjusted Income from Operations 30.9$ 25.6$ 5.1$ 10.0$ 52.2$ 40.1$ 39.0$ 21.3$ 127.2$ 97.0$ GAAP Operating Margin % 11.3 % 11.3 % 4.3 % 5.3 % 19.4 % 16.8 % 8.9 % 11.3 % 12.0 % 11.9 % Adjusted Operating Margin % 11.5 % 11.7 % 3.4 % 7.2 % 19.4 % 17.1 % 18.8 % 12.8 % 14.2 % 12.8 % ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 GAAP Income from Operations 83.3$ 42.9$ 13.2$ 10.4$ 141.9$ 88.7$ 75.1$ 63.9$ 313.5$ 205.9$ Restructuring and Related Costs 4.6 4.9 1.6 5.3 0.7 3.1 3.2 9.5 10.1 22.8 Transaction and Related Costs - - - - - - 37.9 - 37.9 - Loss on Businesses Divested and Assets to be Exited 1.8 2.7 - 0.2 0.5 1.3 2.8 - 5.1 4.2 (Gain) Loss on Sale of Assets 0.2 0.2 (2.2) 0.3 - 0.2 (0.5) (0.1) (2.5) 0.6 Operating Loss from Businesses Divested/to be Exited - - - - - 0.4 - - - 0.4 Executive Transition Costs - 0.5 - 0.4 - 0.5 - 0.4 - 1.8 Adjusted Income from Operations 89.9$ 51.2$ 12.6$ 16.6$ 143.1$ 94.2$ 118.5$ 73.7$ 364.1$ 235.7$ GAAP Operating Margin % 10.7 % 7.2 % 3.1 % 2.7 % 18.6 % 14.3 % 12.0 % 12.3 % 12.1 % 9.7 % Adjusted Operating Margin % 11.6 % 8.6 % 2.9 % 4.3 % 18.7 % 15.1 % 19.0 % 14.1 % 14.0 % 11.1 % Total Regal Nine Months Ended Commercial Systems Climate Solutions Power Transmission Solutions Total RegalIndustrial Systems Three Months Ended Commercial Systems Climate Solutions Power Transmission SolutionsIndustrial Systems 22

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 ADJUSTED NET SALES (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Net Sales 268.7$ 218.5$ 148.0$ 138.8$ 268.4$ 234.0$ 207.6$ 166.9$ 892.7$ 758.2$ Adjusted Net Sales 268.7$ 218.5$ 148.0$ 138.8$ 268.4$ 234.0$ 207.6$ 166.9$ 892.7$ 758.2$ ADJUSTED NET SALES (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Net Sales 775.0$ 593.8$ 429.6$ 389.0$ 764.8$ 622.3$ 624.3$ 521.4$ 2,593.7$ 2,126.5$ Adjusted Net Sales 775.0$ 593.8$ 429.6$ 389.0$ 764.8$ 622.3$ 624.3$ 521.4$ 2,593.7$ 2,126.5$ Nine Months Ended Commercial Systems Climate Solutions Power Transmission Solutions Total RegalIndustrial Systems Total Regal Three Months Ended Commercial Systems Climate Solutions Power Transmission SolutionsIndustrial Systems 23

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 ADJUSTED EFFECTIVE TAX RATE (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Income before Taxes 88.9$ 83.4$ 276.5$ 181.8$ Provision for Income Taxes 17.8 17.1 57.2 39.5 Effective Tax Rate 20.0% 20.5% 20.7% 21.7% Income before Taxes 88.9$ 83.4$ 276.5$ 181.8$ Loss on Businesses Divested and Assets to be Exited 2.8 - 5.1 4.2 Adjusted Income before Taxes 91.7$ 83.4$ 281.6$ 186.0$ Provision for Income Taxes 17.8$ 17.1$ 57.2$ 39.5$ Tax Effect from Loss on Businesses Divested and Assets to be Exited 0.7 - 1.2 0.9 Non-deductible Portion of Executive Transition Costs - - - (0.5) Adjusted Provision for Income Taxes 18.5$ 17.1$ 58.4$ 39.9$ Adjusted Effective Tax Rate 20.2% 20.5% 20.7% 21.5% Three Months Ended Nine Months Ended 24

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 25 FREE CASH FLOW (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Net Cash Provided by Operating Activities 121.5$ 120.3$ 258.1$ 309.9$ Additions to Property Plant and Equipment (13.2) (9.3) (37.5) (29.7) Free Cash Flow 108.3$ 111.0$ 220.6$ 280.2$ GAAP Net Income Attributable to Regal Rexnord Corporation 69.5$ 65.0$ 214.7$ 138.9$ Loss on Businesses Divested and Impairments 2.8 - 5.1 4.2 Early Debt Termination Charge 12.7 - 12.7 - Tax Effect from Loss on Businesses Divested, Impairments and Early Debt Termination Charge (3.8) - (4.3) (0.9) Adjusted Net Income Attributable to Regal Rexnord Corporation 81.2$ 65.0$ 228.2$ 142.2$ Free Cash Flow as a Percentage of Adjusted Net Income Attributable to Regal Rexnord Corporation 133.4 % 170.8 % 96.7 % 197.0 % 1 The Net Income Attributable to Regal Rexnord Corporation is adjusted for goodwill and asset impairments related to the business to be exited and is used in the Free Cash Flow Calculation. Three Months Ended Nine Months Ended

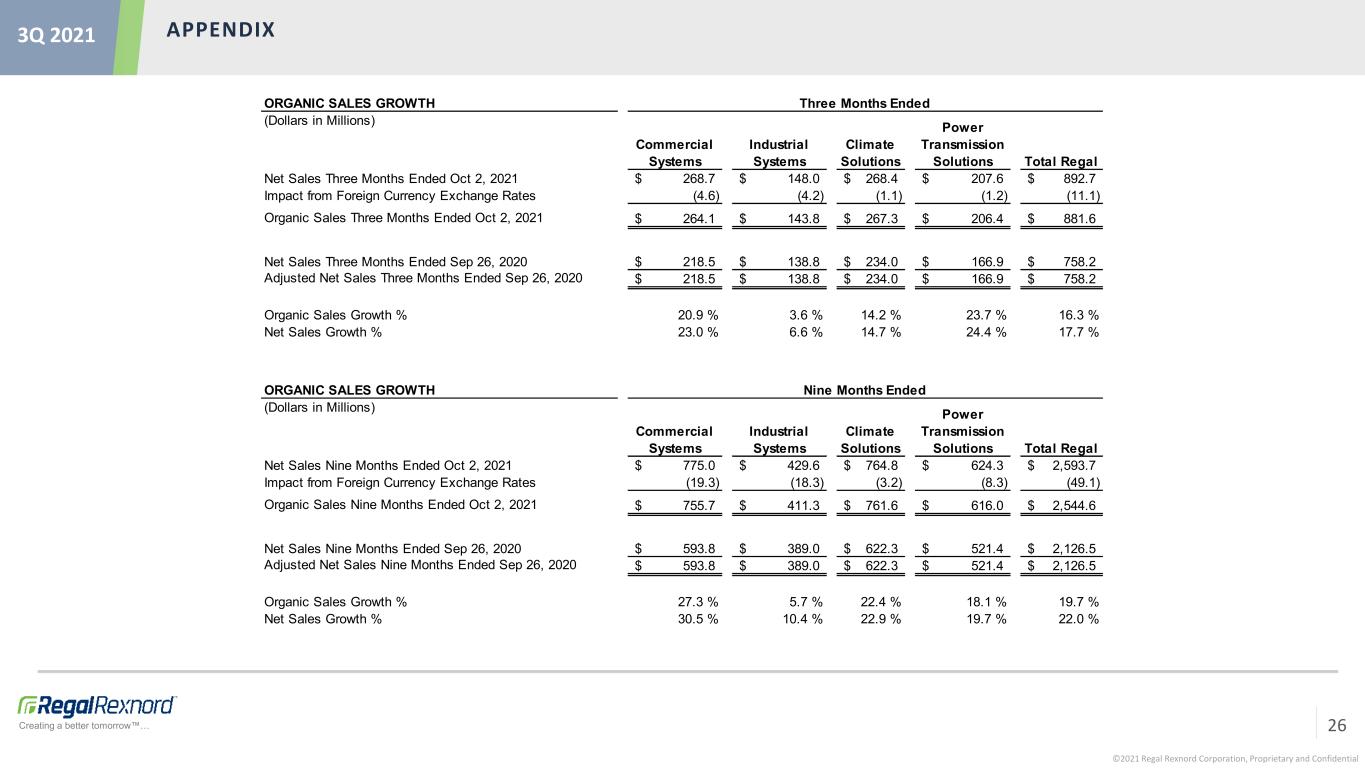

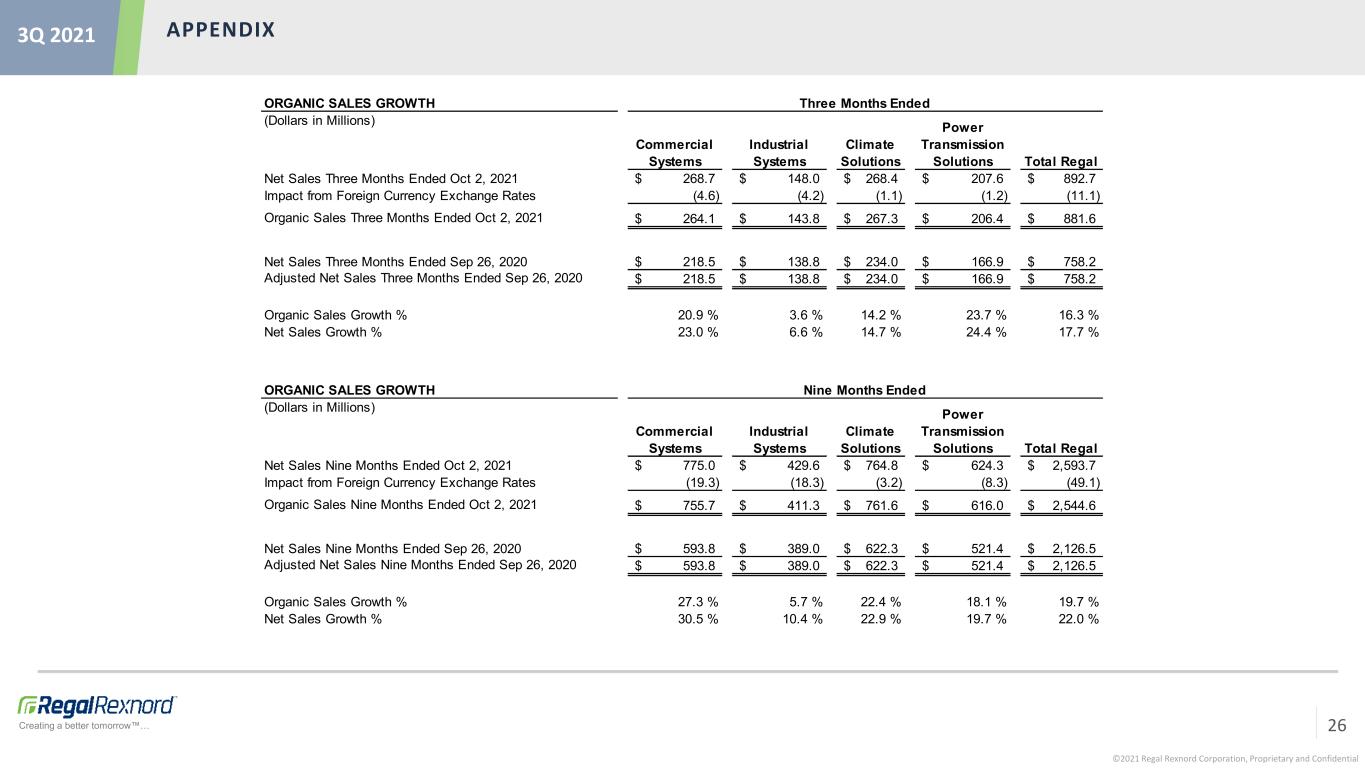

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 ORGANIC SALES GROWTH (Dollars in Millions) Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal Net Sales Three Months Ended Oct 2, 2021 268.7$ 148.0$ 268.4$ 207.6$ 892.7$ Impact from Foreign Currency Exchange Rates (4.6) (4.2) (1.1) (1.2) (11.1) Organic Sales Three Months Ended Oct 2, 2021 264.1$ 143.8$ 267.3$ 206.4$ 881.6$ Net Sales Three Months Ended Sep 26, 2020 218.5$ 138.8$ 234.0$ 166.9$ 758.2$ Adjusted Net Sales Three Months Ended Sep 26, 2020 218.5$ 138.8$ 234.0$ 166.9$ 758.2$ Organic Sales Growth % 20.9 % 3.6 % 14.2 % 23.7 % 16.3 % Net Sales Growth % 23.0 % 6.6 % 14.7 % 24.4 % 17.7 % ORGANIC SALES GROWTH (Dollars in Millions) Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal Net Sales Nine Months Ended Oct 2, 2021 775.0$ 429.6$ 764.8$ 624.3$ 2,593.7$ Impact from Foreign Currency Exchange Rates (19.3) (18.3) (3.2) (8.3) (49.1) Organic Sales Nine Months Ended Oct 2, 2021 755.7$ 411.3$ 761.6$ 616.0$ 2,544.6$ Net Sales Nine Months Ended Sep 26, 2020 593.8$ 389.0$ 622.3$ 521.4$ 2,126.5$ Adjusted Net Sales Nine Months Ended Sep 26, 2020 593.8$ 389.0$ 622.3$ 521.4$ 2,126.5$ Organic Sales Growth % 27.3 % 5.7 % 22.4 % 18.1 % 19.7 % Net Sales Growth % 30.5 % 10.4 % 22.9 % 19.7 % 22.0 % Three Months Ended Nine Months Ended 26

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 (Dollars in Millions) LTM Oct 2, 2021 Net Income 270.8$ Plus: Income Taxes 74.5 Plus: Interest Expense 54.7 Less: Interest Income (7.6) Plus: Depreciation and Amortization 125.4 EBITDA 517.8$ Current Maturities of Debt 1.0$ Long-Term Debt 647.3 Total Gross Debt 648.3$ Total Gross Debt/EBITDA 1.3 TOTAL GROSS DEBT/EBITDA 27 (Dollars in Millions) LTM Oct 2, 2021 Net Income 270.8$ Plus: Income Taxes 74.5 Plus: Interest Expense 54.7 Less: Interest Income (7.6) Plus: Depreciation and Amortization 125.4 Plus: Restructuring and Related Costs 24.1 Plus: Transaction and Related Costs 38.6 Plus: Impairment and Exit Related Costs 6.1 Plus: Goodwill Impairment 10.5 Less: Gain on Sale of Assets (2.5) Adjusted Bank EBITDA 594.6$ Current Maturities of Debt 1.0$ Long-Term Debt 647.3 Total Gross Debt 648.3$ Total Gross Debt/Adjusted Bank EBITDA 1.1 TOTAL GROSS DEBT/ADJUSTED BANK EBITDA

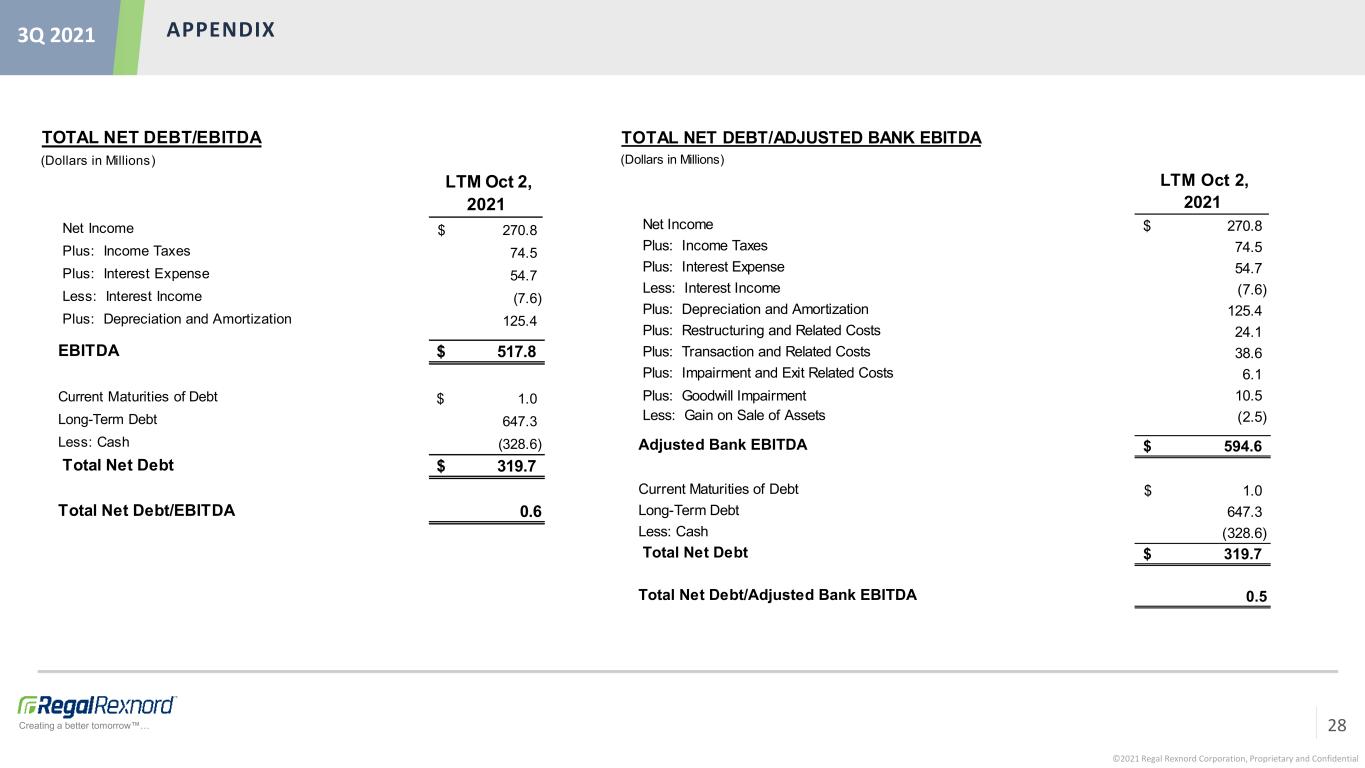

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 (Dollars in Millions) LTM Oct 2, 2021 Net Income 270.8$ Plus: Income Taxes 74.5 Plus: Interest Expense 54.7 Less: Interest Income (7.6) Plus: Depreciation and Amortization 125.4 EBITDA 517.8$ Current Maturities of Debt 1.0$ Long-Term Debt 647.3 Less: Cash (328.6) Total Net Debt 319.7$ Total Net Debt/EBITDA 0.6 TOTAL NET DEBT/EBITDA 28 (Dollars in Millions) LTM Oct 2, 2021 Net Income 270.8$ Plus: Income Taxes 74.5 Plus: Interest Expense 54.7 Less: Interest Income (7.6) Plus: Depreciation and Amortization 125.4 Plus: Restructuring and Related Costs 24.1 Plus: Transaction and Related Costs 38.6 Plus: Impairment and Exit Related Costs 6.1 Plus: Goodwill Impairment 10.5 Less: Gain on Sale of Assets (2.5) Adjusted Bank EBITDA 594.6$ Current Maturities of Debt 1.0$ Long-Term Debt 647.3 Less: Cash (328.6) Total Net Debt 319.7$ Total Net Debt/Adjusted Bank EBITDA 0.5 TOTAL NET DEBT/ADJUSTED BANK EBITDA

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 29 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Apr 3, 2021 Mar 28, 2020 Apr 3, 2021 Mar 28, 2020 Apr 3, 2021 Mar 28, 2020 Apr 3, 2021 Mar 28, 2020 Apr 3, 2021 Mar 28, 2020 GAAP Income from Operations 27.5$ 12.1$ 3.7$ (0.1)$ 43.3$ 29.5$ 22.6$ 28.5$ 97.1$ 70.0$ Restructuring and Related Costs 0.2 1.8 0.5 0.9 0.3 1.1 0.7 1.8 1.7 5.6 Transaction and Related Costs - - - - - - 14.7 - 14.7 - Loss on Businesses Divested and Assets to be Exited - 0.7 - 0.2 - 0.5 - - - 1.4 (Gain) Loss on Sale of Assets - - (0.1) - - - (0.3) - (0.4) - Operating Loss from Businesses Divested/to be Exited - - - - - 0.4 - - - 0.4 Executive Transition Costs - 0.5 - 0.4 - 0.5 - 0.4 - 1.8 Adjusted Income from Operations 27.7$ 15.1$ 4.1$ 1.4$ 43.6$ 32.0$ 37.7$ 30.7$ 113.1$ 79.2$ Depreciation 6.1$ 5.9$ 5.5$ 5.2$ 3.5$ 3.5$ 5.6$ 5.8$ 20.7$ 20.4$ Amortization 1.7 2.4 0.4 0.7 1.0 1.2 8.0 7.9 11.1 12.2 Other Income (Expense), Net 0.3 0.3 0.2 0.2 0.4 0.3 0.3 0.3 1.2 1.1 Adjusted Bank EBITDA 35.8$ 23.7$ 10.2$ 7.5$ 48.5$ 37.0$ 51.6$ 44.7$ 146.1$ 112.9$ Stock Based Compensation 0.9 0.8 0.6 0.5 1.0 0.7 0.8 0.7 3.3 2.7 Adjusted EBITDA 36.7$ 24.5$ 10.8$ 8.0$ 49.5$ 37.7$ 52.4$ 45.4$ 149.4$ 115.6$ Adjusted EBITDA Margin % 15.5% 12.3% 7.9% 6.2% 20.7% 17.9% 26.0% 23.3% 18.4% 15.7% Three Months Ended Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal

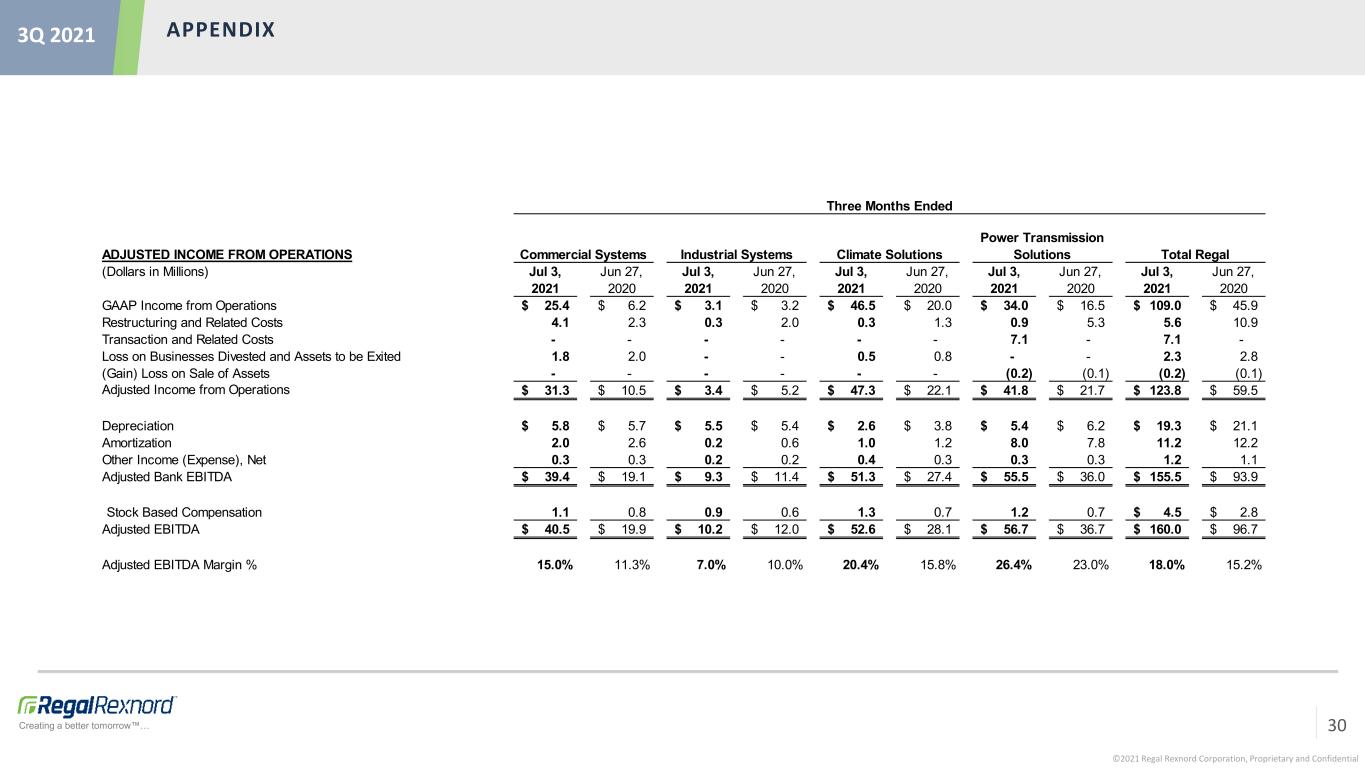

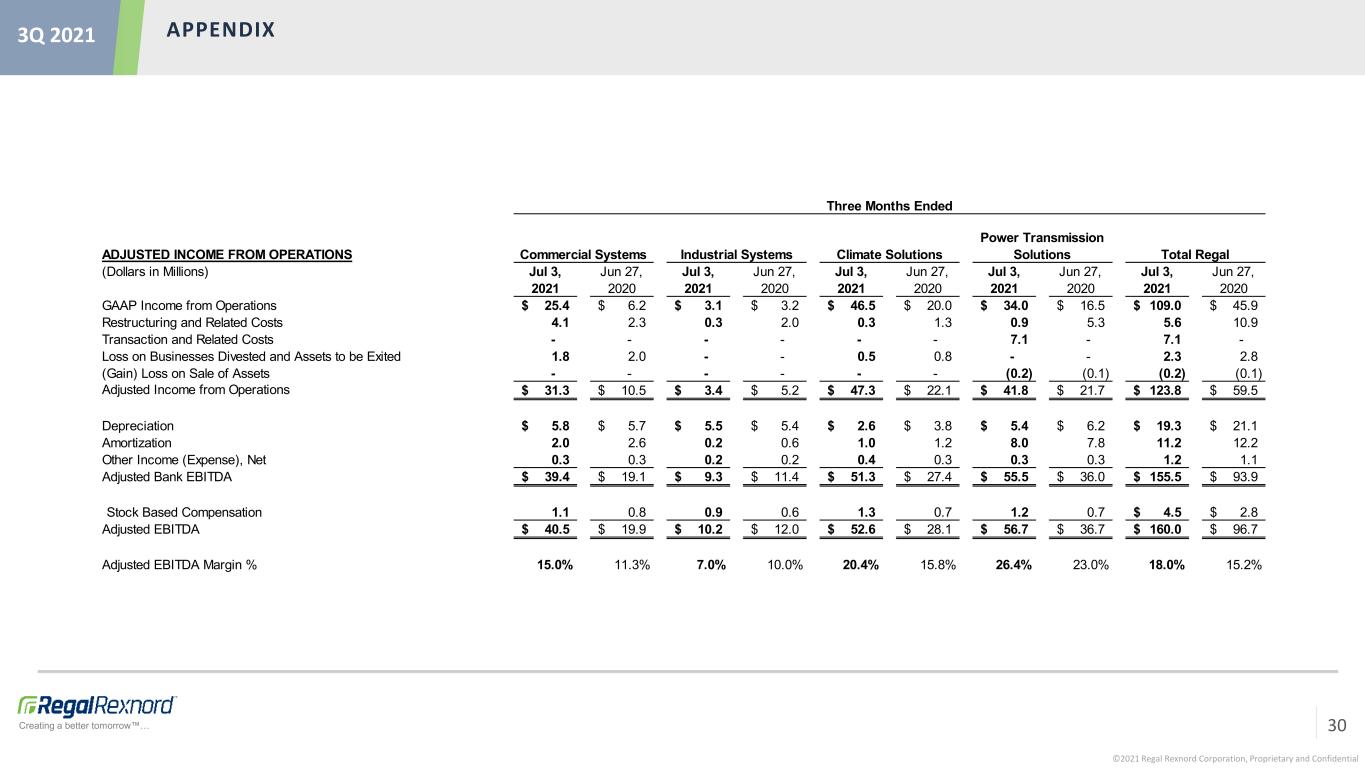

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 30 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 GAAP Income from Operations 25.4$ 6.2$ 3.1$ 3.2$ 46.5$ 20.0$ 34.0$ 16.5$ 109.0$ 45.9$ Restructuring and Related Costs 4.1 2.3 0.3 2.0 0.3 1.3 0.9 5.3 5.6 10.9 Transaction and Related Costs - - - - - - 7.1 - 7.1 - Loss on Businesses Divested and Assets to be Exited 1.8 2.0 - - 0.5 0.8 - - 2.3 2.8 (Gain) Loss on Sale of Assets - - - - - - (0.2) (0.1) (0.2) (0.1) Adjusted Income from Operations 31.3$ 10.5$ 3.4$ 5.2$ 47.3$ 22.1$ 41.8$ 21.7$ 123.8$ 59.5$ Depreciation 5.8$ 5.7$ 5.5$ 5.4$ 2.6$ 3.8$ 5.4$ 6.2$ 19.3$ 21.1$ Amortization 2.0 2.6 0.2 0.6 1.0 1.2 8.0 7.8 11.2 12.2 Other Income (Expense), Net 0.3 0.3 0.2 0.2 0.4 0.3 0.3 0.3 1.2 1.1 Adjusted Bank EBITDA 39.4$ 19.1$ 9.3$ 11.4$ 51.3$ 27.4$ 55.5$ 36.0$ 155.5$ 93.9$ Stock Based Compensation 1.1 0.8 0.9 0.6 1.3 0.7 1.2 0.7 4.5$ 2.8$ Adjusted EBITDA 40.5$ 19.9$ 10.2$ 12.0$ 52.6$ 28.1$ 56.7$ 36.7$ 160.0$ 96.7$ Adjusted EBITDA Margin % 15.0% 11.3% 7.0% 10.0% 20.4% 15.8% 26.4% 23.0% 18.0% 15.2% Three Months Ended Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal

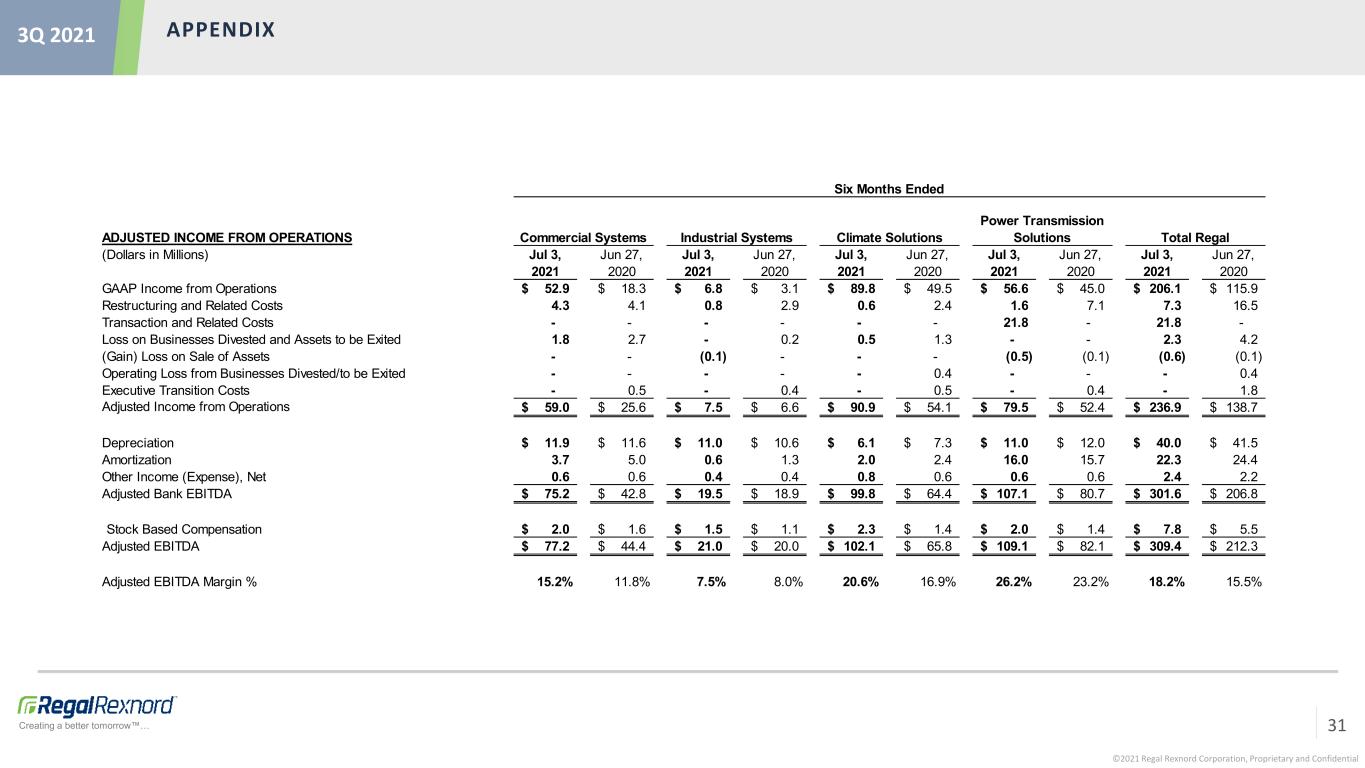

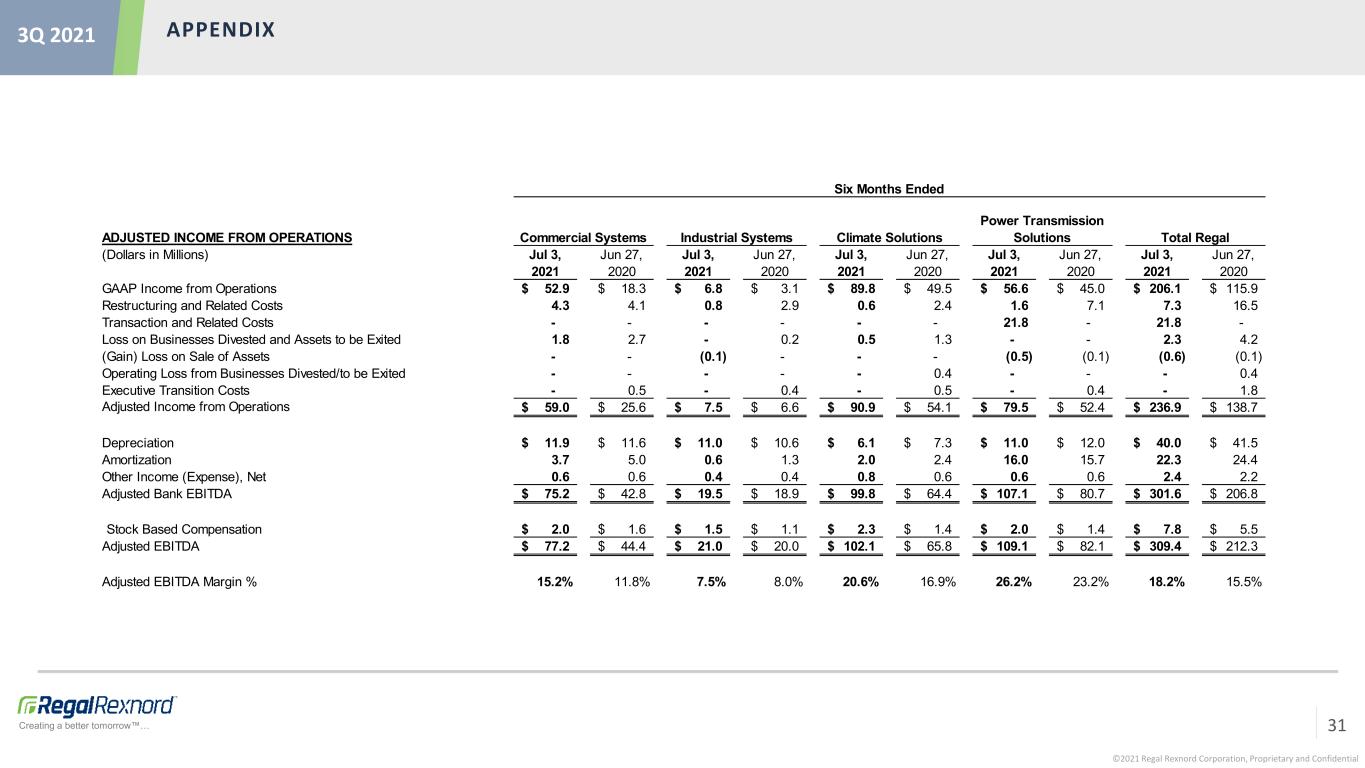

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 31 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 Jul 3, 2021 Jun 27, 2020 GAAP Income from Operations 52.9$ 18.3$ 6.8$ 3.1$ 89.8$ 49.5$ 56.6$ 45.0$ 206.1$ 115.9$ Restructuring and Related Costs 4.3 4.1 0.8 2.9 0.6 2.4 1.6 7.1 7.3 16.5 Transaction and Related Costs - - - - - - 21.8 - 21.8 - Loss on Businesses Divested and Assets to be Exited 1.8 2.7 - 0.2 0.5 1.3 - - 2.3 4.2 (Gain) Loss on Sale of Assets - - (0.1) - - - (0.5) (0.1) (0.6) (0.1) Operating Loss from Businesses Divested/to be Exited - - - - - 0.4 - - - 0.4 Executive Transition Costs - 0.5 - 0.4 - 0.5 - 0.4 - 1.8 Adjusted Income from Operations 59.0$ 25.6$ 7.5$ 6.6$ 90.9$ 54.1$ 79.5$ 52.4$ 236.9$ 138.7$ Depreciation 11.9$ 11.6$ 11.0$ 10.6$ 6.1$ 7.3$ 11.0$ 12.0$ 40.0$ 41.5$ Amortization 3.7 5.0 0.6 1.3 2.0 2.4 16.0 15.7 22.3 24.4 Other Income (Expense), Net 0.6 0.6 0.4 0.4 0.8 0.6 0.6 0.6 2.4 2.2 Adjusted Bank EBITDA 75.2$ 42.8$ 19.5$ 18.9$ 99.8$ 64.4$ 107.1$ 80.7$ 301.6$ 206.8$ Stock Based Compensation 2.0$ 1.6$ 1.5$ 1.1$ 2.3$ 1.4$ 2.0$ 1.4$ 7.8$ 5.5$ Adjusted EBITDA 77.2$ 44.4$ 21.0$ 20.0$ 102.1$ 65.8$ 109.1$ 82.1$ 309.4$ 212.3$ Adjusted EBITDA Margin % 15.2% 11.8% 7.5% 8.0% 20.6% 16.9% 26.2% 23.2% 18.2% 15.5% Six Months Ended Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal

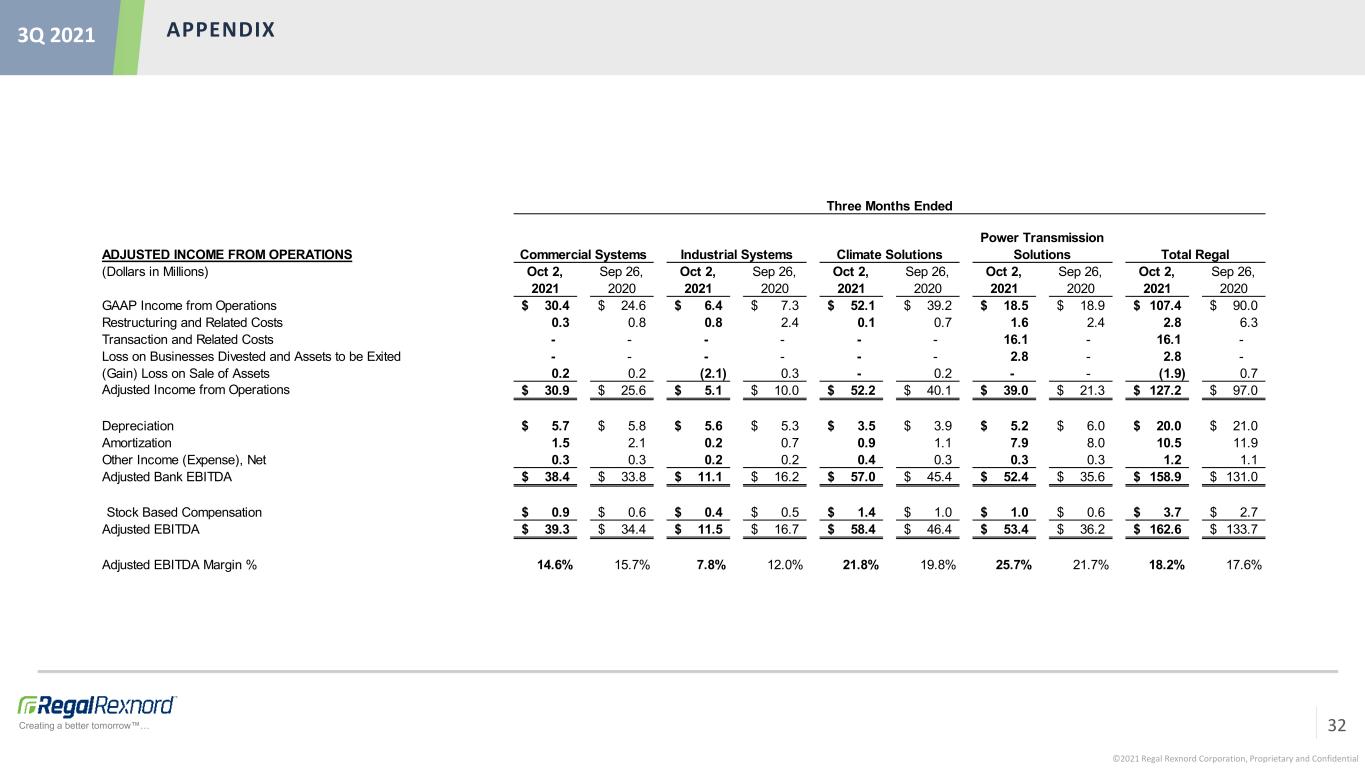

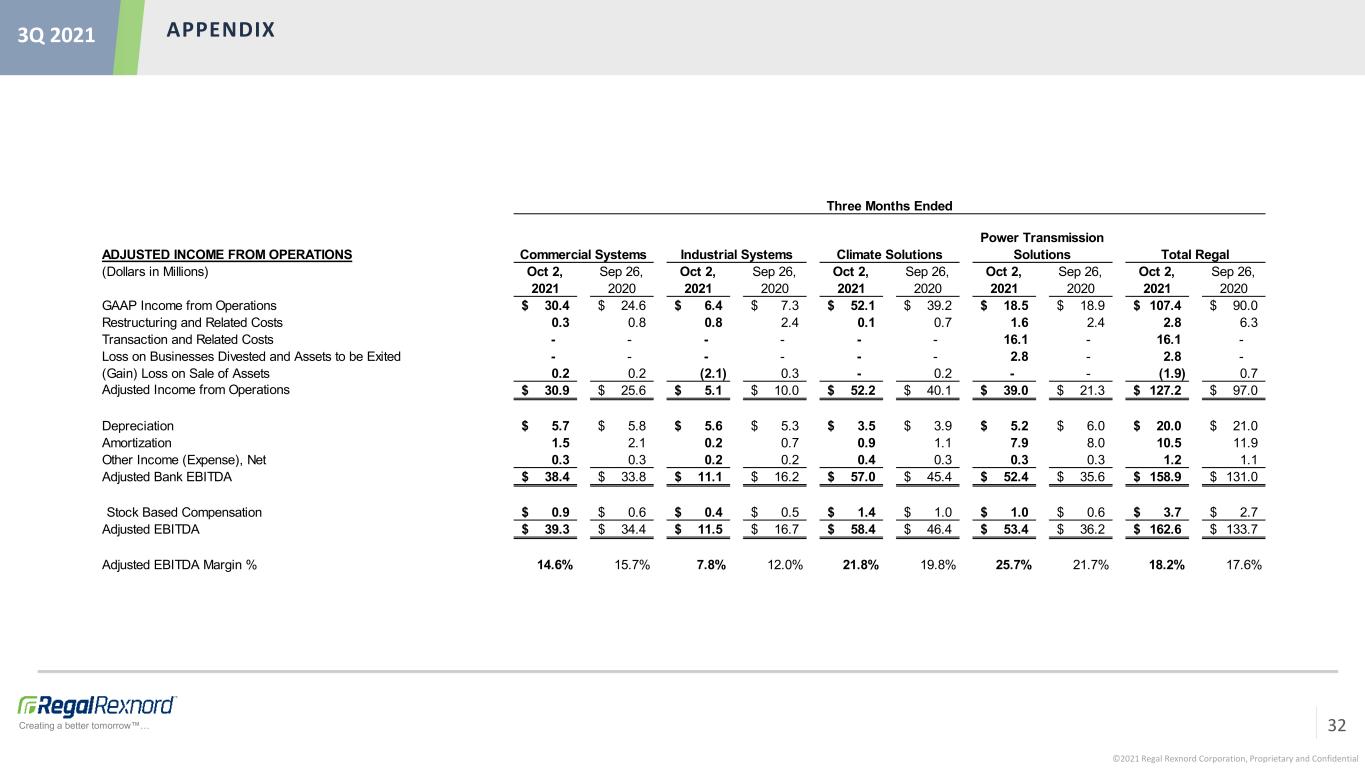

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 32 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 GAAP Income from Operations 30.4$ 24.6$ 6.4$ 7.3$ 52.1$ 39.2$ 18.5$ 18.9$ 107.4$ 90.0$ Restructuring and Related Costs 0.3 0.8 0.8 2.4 0.1 0.7 1.6 2.4 2.8 6.3 Transaction and Related Costs - - - - - - 16.1 - 16.1 - Loss on Businesses Divested and Assets to be Exited - - - - - - 2.8 - 2.8 - (Gain) Loss on Sale of Assets 0.2 0.2 (2.1) 0.3 - 0.2 - - (1.9) 0.7 Adjusted Income from Operations 30.9$ 25.6$ 5.1$ 10.0$ 52.2$ 40.1$ 39.0$ 21.3$ 127.2$ 97.0$ Depreciation 5.7$ 5.8$ 5.6$ 5.3$ 3.5$ 3.9$ 5.2$ 6.0$ 20.0$ 21.0$ Amortization 1.5 2.1 0.2 0.7 0.9 1.1 7.9 8.0 10.5 11.9 Other Income (Expense), Net 0.3 0.3 0.2 0.2 0.4 0.3 0.3 0.3 1.2 1.1 Adjusted Bank EBITDA 38.4$ 33.8$ 11.1$ 16.2$ 57.0$ 45.4$ 52.4$ 35.6$ 158.9$ 131.0$ Stock Based Compensation 0.9$ 0.6$ 0.4$ 0.5$ 1.4$ 1.0$ 1.0$ 0.6$ 3.7$ 2.7$ Adjusted EBITDA 39.3$ 34.4$ 11.5$ 16.7$ 58.4$ 46.4$ 53.4$ 36.2$ 162.6$ 133.7$ Adjusted EBITDA Margin % 14.6% 15.7% 7.8% 12.0% 21.8% 19.8% 25.7% 21.7% 18.2% 17.6% Three Months Ended Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 33 ADJUSTED INCOME FROM OPERATIONS (Dollars in Millions) Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 Oct 2, 2021 Sep 26, 2020 GAAP Income from Operations 83.3$ 42.9$ 13.2$ 10.4$ 141.9$ 88.7$ 75.1$ 63.9$ 313.5$ 205.9$ Restructuring and Related Costs 4.6 4.9 1.6 5.3 0.7 3.1 3.2 9.5 10.1 22.8 Transaction and Related Costs - - - - - - 37.9 - 37.9 - Loss on Businesses Divested and Assets to be Exited 1.8 2.7 - 0.2 0.5 1.3 2.8 - 5.1 4.2 (Gain) Loss on Sale of Assets 0.2 0.2 (2.2) 0.3 - 0.2 (0.5) (0.1) (2.5) 0.6 Operating Loss from Businesses Divested/to be Exited - - - - - 0.4 - - - 0.4 Executive Transition Costs - 0.5 - 0.4 - 0.5 - 0.4 - 1.8 Adjusted Income from Operations 89.9$ 51.2$ 12.6$ 16.6$ 143.1$ 94.2$ 118.5$ 73.7$ 364.1$ 235.7$ Depreciation 17.6$ 17.4$ 16.6$ 15.9$ 9.6$ 11.2$ 16.2$ 18.0$ 60.0$ 62.5$ Amortization 5.2 7.1 0.8 2.0 2.9 3.5 23.9 23.7 32.8 36.3 Other Income (Expense), Net 0.9 0.9 0.6 0.6 1.2 0.9 0.9 0.9 3.6 3.3 Adjusted Bank EBITDA 113.6$ 76.6$ 30.6$ 35.1$ 156.8$ 109.8$ 159.5$ 116.3$ 460.5$ 337.8$ Stock Based Compensation 2.9$ 2.2$ 1.9$ 1.6$ 3.7$ 2.4$ 3.0$ 2.0$ 11.5$ 8.2$ Adjusted EBITDA 116.5$ 78.8$ 32.5$ 36.7$ 160.5$ 112.2$ 162.5$ 118.3$ 472.0$ 346.0$ Adjusted EBITDA Margin % 15.0% 13.3% 7.6% 9.4% 21.0% 18.0% 26.0% 22.7% 18.2% 16.3% Nine Months Ended Commercial Systems Industrial Systems Climate Solutions Power Transmission Solutions Total Regal

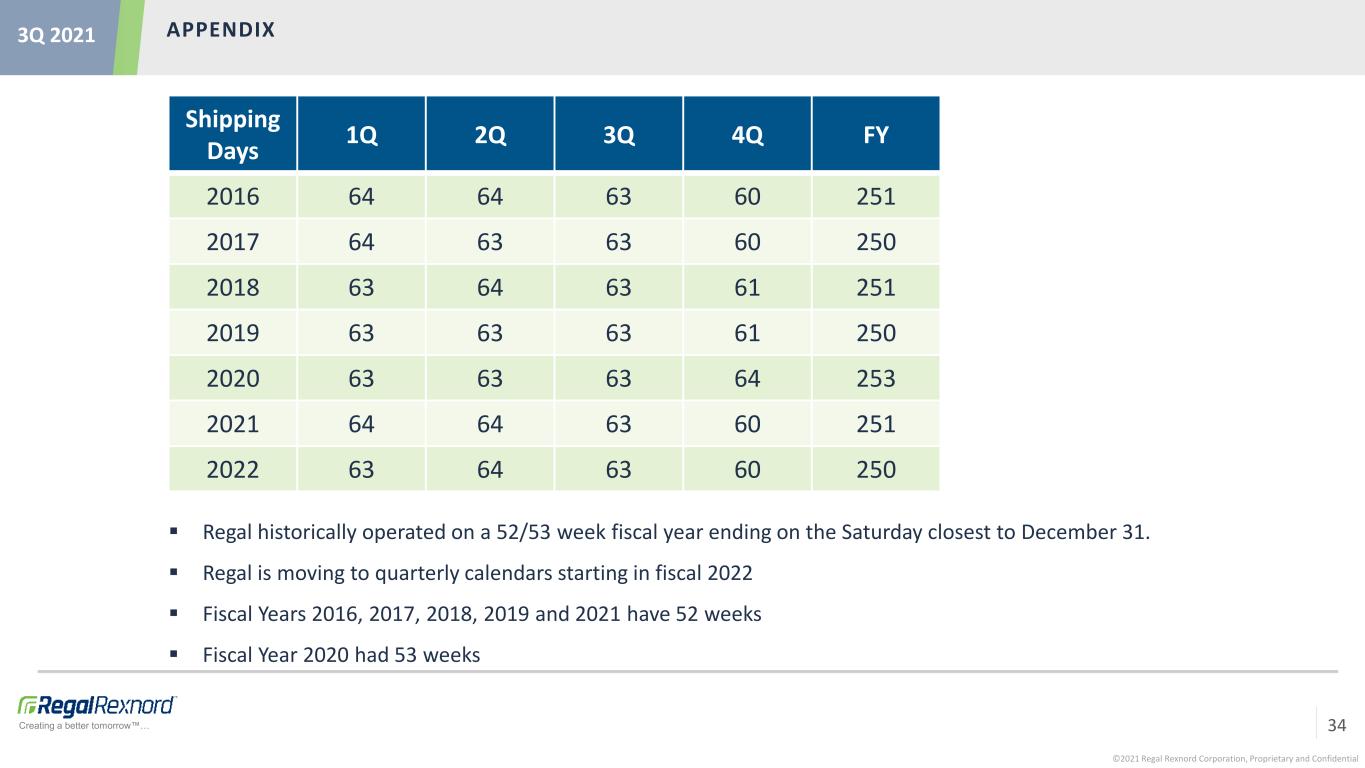

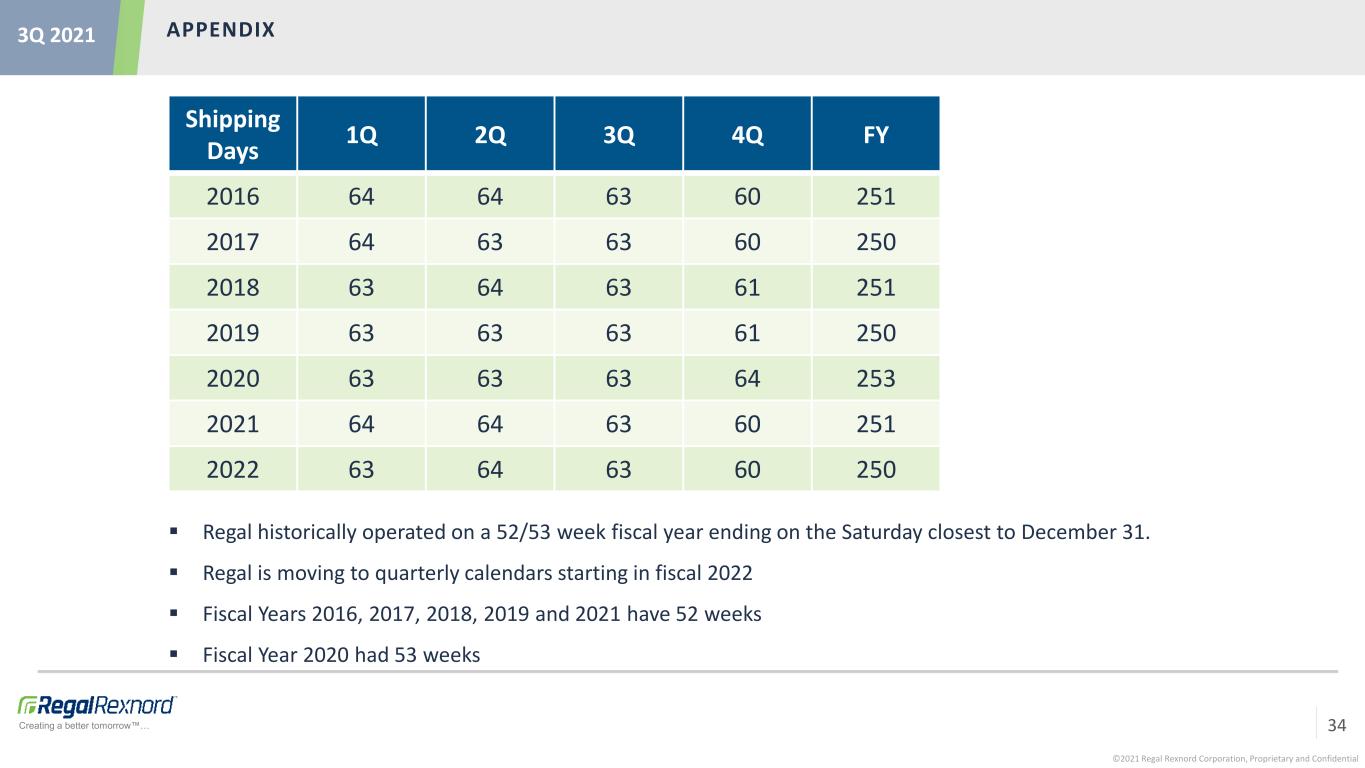

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… APPENDIX3Q 2021 34 Shipping Days 1Q 2Q 3Q 4Q FY 2016 64 64 63 60 251 2017 64 63 63 60 250 2018 63 64 63 61 251 2019 63 63 63 61 250 2020 63 63 63 64 253 2021 64 64 63 60 251 2022 63 64 63 60 250 Regal historically operated on a 52/53 week fiscal year ending on the Saturday closest to December 31. Regal is moving to quarterly calendars starting in fiscal 2022 Fiscal Years 2016, 2017, 2018, 2019 and 2021 have 52 weeks Fiscal Year 2020 had 53 weeks

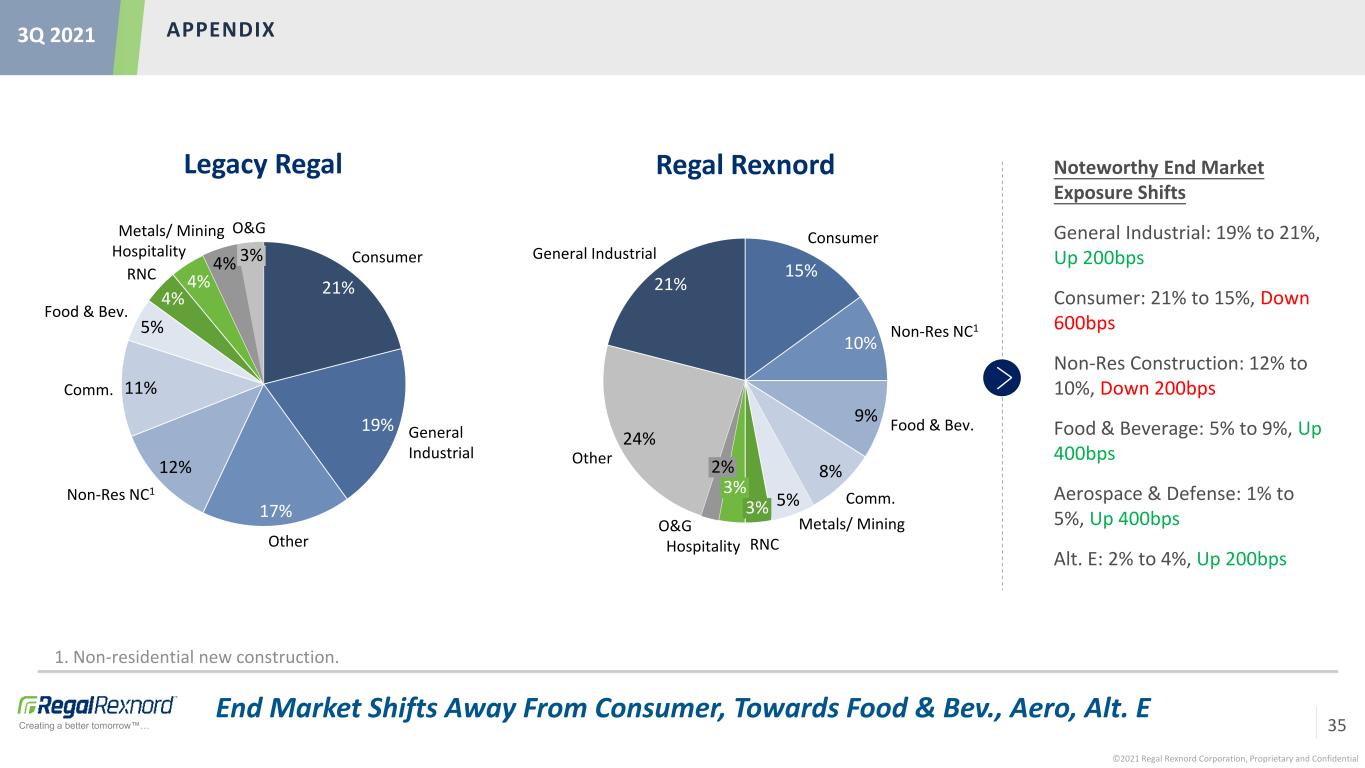

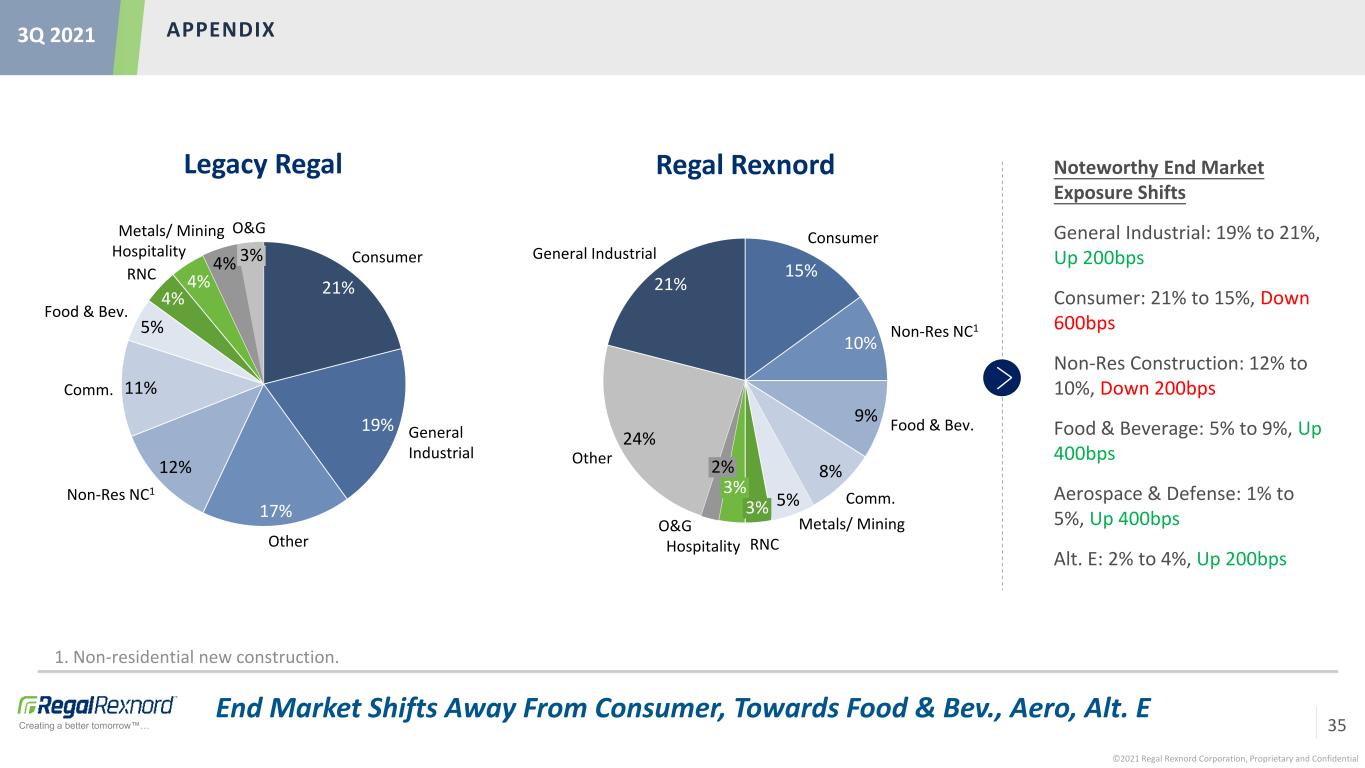

©2021 Regal Rexnord Corporation, Proprietary and Confidential Creating a better tomorrow™… End Market Shifts Away From Consumer, Towards Food & Bev., Aero, Alt. E APPENDIX Legacy Regal Noteworthy End Market Exposure Shifts General Industrial: 19% to 21%, Up 200bps Consumer: 21% to 15%, Down 600bps Non-Res Construction: 12% to 10%, Down 200bps Food & Beverage: 5% to 9%, Up 400bps Aerospace & Defense: 1% to 5%, Up 400bps Alt. E: 2% to 4%, Up 200bps Regal Rexnord 21% 19% 17% 12% 11% 5% 4% 4% 4% Comm. Other Consumer Metals/ Mining Food & Bev. General Industrial RNC 3% Non-Res NC1 Hospitality O&G 24% 21% 15% 10% 9% 8% 5% RNC 3% Food & Bev. Other General Industrial Consumer Non-Res NC1 Comm. Metals/ Mining 3% Hospitality 2% O&G 1. Non-residential new construction. 3Q 2021 35