UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-01)

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

of the Securities Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

GSI Commerce, Inc.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | No fee required. |

| o | Fee computed below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| þ | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | ||

| 2) | Form, Schedule or Registration Statement No.: | ||

| 3) | Filing Party: | ||

| 4) | Date Filed: |

May 11, 2011

Dear Stockholder:

You are cordially invited to attend the special meeting of the stockholders of GSI Commerce, Inc., a Delaware corporation (“GSI”), which will be held at the Crowne Plaza Hotel, 260 Mall Boulevard, King of Prussia, Pennsylvania 19406, on Friday, June 17, 2011, at 9:00 a.m, local time.

On March 27, 2011, we entered into a merger agreement providing for the acquisition of GSI by eBay Inc., a Delaware corporation (“eBay”). If the acquisition is completed, you will be entitled to receive $29.25 per share in cash, without interest and less any applicable withholding taxes, for each share of GSI common stock you own. The total amount expected to be paid in the merger in respect of our outstanding common stock and vested equity awards is approximately $2.2 billion. At the special meeting, you will be asked to adopt the merger agreement, which contemplates the merger of a wholly-owned subsidiary of eBay with and into GSI, as a result of which GSI will become a wholly-owned subsidiary of eBay.

In connection with the merger, our Board of Directors formed a special committee of the Board of Directors composed of independent directors to, among other things, evaluate and make a recommendation to our Board of Directors with respect to the merger. The special committee and our Board of Directors (acting upon the unanimous recommendation of the special committee), with the exception of Michael G. Rubin and Mark S. Menell, both of whom recused themselves from the Board of Directors’ vote on the merger, after careful consideration, have unanimously approved the merger agreement and the merger, and have determined that the merger agreement and the merger are advisable, fair to and in the best interests of the holders of GSI common stock.Therefore, the special committee and our Board of Directors (other than Messrs. Rubin and Menell, who recused themselves) unanimously recommend that you vote “FOR” the adoption of the merger agreement.

In considering the recommendation of the special committee and the Board of Directors, you should be aware that Mr. Rubin, our chairman of the board, president and chief executive officer, has certain interests in the merger that are different from, and in addition to, the interests of our stockholders generally. NRG Commerce, LLC (“NRG”), a Delaware limited liability company wholly-owned by Mr. Rubin, is a party to a stock purchase agreement, dated as of March 27, 2011, with eBay (the “purchase agreement”), pursuant to which eBay has agreed to sell all or a portion of the equity interests of certain subsidiaries of GSI to NRG immediately after the completion of the merger on the terms and subject to the conditions set forth in the purchase agreement (including the condition that the merger has been completed). In addition, NRG will enter into a secured loan agreement with GSI pursuant to which GSI, which will be an affiliate of eBay at the time the agreement is entered into, will lend NRG funds to finance a substantial portion of the purchase price for such divestiture transaction on the terms and subject to the conditions set forth in the loan agreement. The closing of the merger is not subject to, or dependent upon, the closing of the divestiture transaction, and the special committee and the Board of Directors have not made any recommendation with regard to the divestiture transaction. In addition, in considering the recommendation of the special committee and the Board of Directors, you should be aware that the other directors and executive officers of GSI have certain other interests in the merger that are different from, and in addition to, the interests of our stockholders generally. The accompanying proxy statement includes additional information regarding interests of Mr. Rubin and other directors and executive officers of GSI that are different from, and in addition to, the interests of our stockholders generally.

The proxy statement attached to this letter provides you with information about the proposed merger and the special meeting. We encourage you to read the entire proxy statement carefully because it explains the proposed merger, the documents related to the merger and other related matters, including the conditions to the completion of the merger. You may also obtain more information about GSI from documents we have filed with the Securities and Exchange Commission.

Your vote is very important, regardless of the number of shares of GSI common stock you own. The merger cannot be completed unless the merger agreement is adopted by the affirmative vote of holders of at least a majority of the outstanding shares of our common stock entitled to vote. If you fail to vote on the adoption of the merger agreement, the effect will be the same as a vote against the adoption of the merger agreement.

If your shares of GSI common stock are held in street name by your broker, dealer, commercial bank, trust company or other nominee, your broker, dealer, commercial bank, trust company or other nominee will be unable to vote your shares of GSI common stock without instructions from you. You should instruct your bank, brokerage firm or other nominee as to how to vote your shares of GSI common stock, following the procedures provided by your bank, brokerage firm or other nominee.The failure to instruct your broker, dealer, commercial bank, trust company or other nominee to vote your shares of GSI common stock “FOR” the adoption of the merger agreement will have the same effect as voting against the adoption of the merger agreement.

Please do not send your GSI common stock certificates to us at this time. If the merger is completed, you will be sent instructions regarding surrender of your certificates.

Whether or not you expect to attend the special meeting in person, we urge you to submit your proxy as promptly as possible (1) through the Internet, (2) by telephone or (3) by marking, signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided.If you receive more than one proxy card because you own shares that are registered differently, please vote all of your shares shown on all of the proxy cards.

If you are a stockholder of record of GSI, voting by proxy will not prevent you from voting your shares in person if you subsequently choose to attend the special meeting.

We look forward to seeing you at the special meeting.

Sincerely,

Ronald D. Fisher

Lead Director and Member of the Special Committee

Lead Director and Member of the Special Committee

May 11, 2011

This proxy statement is dated May 11, 2011 and is first being mailed to GSI stockholders on or about May 11, 2011.

GSI COMMERCE, INC.

935 First Avenue

King of Prussia, Pennsylvania 19406

Telephone number:(610) 491-7000

935 First Avenue

King of Prussia, Pennsylvania 19406

Telephone number:(610) 491-7000

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 17, 2011

A special meeting of the stockholders of GSI Commerce, Inc., a Delaware corporation (“GSI”), will be held at the Crowne Plaza Hotel, 260 Mall Boulevard, King of Prussia, Pennsylvania 19406, on Friday, June 17, 2011, at 9:00 a.m, local time, for the following purposes:

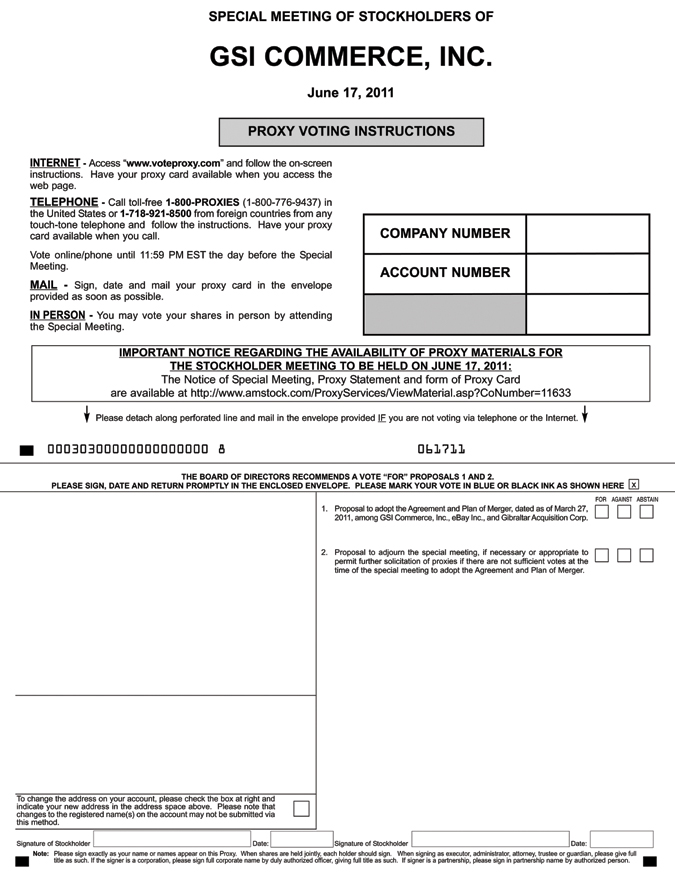

1. To consider and vote upon a proposal to adopt the Agreement and Plan of Merger (the “merger agreement”), dated as of March 27, 2011, among GSI, eBay Inc.(“eBay”), and Gibraltar Acquisition Corp., a wholly-owned subsidiary of eBay (“Merger Sub”), which contemplates the merger of Merger Sub with and into GSI, with GSI continuing as the surviving corporation. Pursuant to the merger agreement, each share of common stock of GSI outstanding immediately prior to the effective time of the merger (other than shares held by eBay, GSI or any of their subsidiaries and by stockholders, if any, who validly perfect their appraisal rights under Delaware law) will be converted into the right to receive $29.25 per share in cash, without interest and less any applicable withholding taxes.

2. To consider and vote upon a proposal to adjourn the special meeting, if necessary or appropriate to permit further solicitation of proxies if there are not sufficient votes at the time of the special meeting to adopt the merger agreement referred to in Proposal 1 set forth above.

3. To transact such other business as may properly come before the special meeting or any adjournments of the special meeting.

For more information about the merger, please review the accompanying proxy statement and the merger agreement attached thereto asAppendix A.

In connection with the merger, our Board of Directors formed a special committee of the Board of Directors composed of independent directors to, among other things, evaluate and make a recommendation to our Board of Directors with respect to the merger. The special committee and our Board of Directors (acting upon the unanimous recommendation of the special committee), with the exception of Michael G. Rubin and Mark S. Menell, both of whom recused themselves from the Board of Directors’ vote on the merger, after careful consideration, have unanimously approved the merger agreement and the merger, and have determined that the merger agreement and the merger are advisable, fair to and in the best interests of the holders of GSI common stock.Therefore, the special committee and our Board of Directors (other than Messrs. Rubin and Menell who recused themselves) unanimously recommend that you vote “FOR” the adoption of the merger agreement.

In considering the recommendation of the special committee and the Board of Directors, you should be aware that Mr. Rubin, our chairman of the board, president and chief executive officer, has certain interests in the merger that are different from, and in addition to, the interests of our stockholders generally. NRG Commerce, LLC (“NRG”), a Delaware limited liability company wholly-owned by Mr. Rubin, is a party to a stock purchase agreement, dated as of March 27, 2011, with eBay (the “purchase agreement”), pursuant to which eBay has agreed to sell all or a portion of the equity interests of certain subsidiaries of GSI to NRG immediately after the completion of the merger on the terms and subject to the conditions set forth in the purchase agreement (including the condition that the merger has been completed). In addition, NRG will enter into a secured loan agreement with GSI pursuant to which GSI, which will be an affiliate of eBay at the time the agreement is entered into, will lend NRG funds to finance a substantial portion of the purchase price for such divestiture transaction on the terms and subject to the conditions set forth in the loan agreement. The closing of the merger is not subject to, or dependent upon, the closing of the divestiture transaction, and the special committee and the Board of Directors have not made any recommendation with regard to the divestiture transaction. In addition, in considering the recommendation of the special committee and the Board of Directors, you should be aware that the other directors and executive officers of GSI have certain other interests in the merger that are different from, and in addition to, the interests of our stockholders generally. The accompanying proxy statement includes additional information regarding interests of Mr. Rubin and

other directors and executive officers of GSI that are different from, and in addition to, the interests of our stockholders generally.

Your vote is very important, regardless of the number of shares of stock that you own. The adoption of the merger agreement requires the affirmative vote of the holders of a majority of the outstanding shares of GSI common stock that are entitled to vote at the special meeting. The proposal to adjourn the special meeting, if necessary or appropriate, to solicit additional proxies requires the affirmative vote of the holders of a majority of the shares of GSI common stock that are present and entitled to vote at the special meeting, whether or not a quorum is present.

Only holders of record of shares of GSI common stock at the close of business on May 9, 2011, the record date for the special meeting, are entitled to notice of the special meeting and to vote at the special meeting and at any adjournment of the special meeting. All stockholders of record are cordially invited to attend the special meeting in person.

Whether or not you expect to attend the special meeting in person, we urge you to submit your proxy as promptly as possible (1) through the Internet, (2) by telephone or (3) by marking, signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided.Prior to the vote, you may revoke your proxy in the manner described in the proxy statement.Your failure to vote will have the same effect as a vote against the adoption of the merger agreement.

Stockholders who do not vote in favor of the adoption of the merger agreement will have the right to seek appraisal of the fair value of their shares of GSI common stock if the merger is completed, but only if they perfect their appraisal rights by complying with all of the required procedures under Delaware law, which are summarized in the accompanying proxy statement.

By Order of the Board of Directors,

Paul D. Cataldo

Secretary

Secretary

May 11, 2011

SUMMARY VOTING INSTRUCTIONS

Ensure that your shares of GSI common stock can be voted at the special meeting by submitting your proxy or contacting your broker, dealer, commercial bank, trust company or other nominee.

If your shares of GSI common stock are registered in the name of a broker, dealer, commercial bank, trust company or other nominee: check the voting instruction card forwarded by your broker, dealer, commercial bank, trust company or other nominee to see which voting options are available or contact your broker, dealer, commercial bank, trust company or other nominee in order to obtain directions as to how to ensure that your shares of GSI common stock are voted at the special meeting.

If your shares of GSI common stock are registered in your name: submit your proxy as soon as possible by telephone, via the Internet or by signing, dating and returning the enclosed proxy card in the enclosed postage-paid envelope, so that your shares of GSI common stock can be voted at the special meeting.

Instructions regarding telephone and Internet voting are included on the proxy card.

The failure to vote will have the same effect as a vote against the proposal to adopt the merger agreement. If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be voted in favor of the proposal to adopt the merger agreement and the proposal to adjourn the special meeting, if necessary or appropriate, to solicit additional proxies.

If you have any questions, require assistance with voting your proxy card,

or need additional copies of proxy material, please call Georgeson Inc.

at the phone numbers listed below.

or need additional copies of proxy material, please call Georgeson Inc.

at the phone numbers listed below.

199 Water Street, 26th Floor

New York, NY 10038

Banks and Brokers Call:(212) 440-9800

All Others Toll Free:(866) 628-6021

New York, NY 10038

Banks and Brokers Call:(212) 440-9800

All Others Toll Free:(866) 628-6021

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 10 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 34 | ||||

| 37 | ||||

| 45 | ||||

| 45 | ||||

| 47 | ||||

| 58 | ||||

| 58 | ||||

| 60 | ||||

| 61 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| Page | ||||

| 77 | ||||

| 77 | ||||

| 77 | ||||

| 78 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| 87 | ||||

| 88 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

ii

SUMMARY

The following summary highlights selected information in this proxy statement regarding substantive matters about the merger, the merger agreement and the special meeting and may not contain all the information that may be important to you. Accordingly, we encourage you to read carefully this entire proxy statement, its appendices and the documents referred to or incorporated by reference in this proxy statement. Each item in this summary includes a page reference directing you to a more complete description of that topic. See “Where Stockholders Can Find More Information.”

In this proxy statement, the terms “we,” “us,” “our,” “GSI” and the “Company” refer to GSI Commerce, Inc. and, where appropriate, its subsidiaries. We refer to eBay Inc. as “eBay”; and Gibraltar Acquisition Corp. as “Merger Sub.” We refer to the United States as “U.S.” When we refer to the “merger agreement” we mean the Agreement and Plan of Merger, dated as of March 27, 2011, among GSI, eBay and Merger Sub. We refer to the proposed merger of Merger Sub with and into GSI as the “merger.”

This proxy statement is first being mailed to stockholders on or about May 11, 2011.

| • | The Parties to the Merger (Page 17) |

GSI Commerce, Inc.

935 First Avenue

King of Prussia, Pennsylvania 19406

Telephone number:(610) 491-7000

935 First Avenue

King of Prussia, Pennsylvania 19406

Telephone number:(610) 491-7000

GSI operates a network of businesses to enable enterprise clients to maximize their opportunities in the digital channel. GSI operates three business segments: Globale-Commerce Services, Global Marketing Services and Consumer Engagement. Each business segment offers products and services that are, or aim to be, market leaders in their respective areas on a stand-alone basis, but that also complement each other, which allows for cross-selling within and between businesses. The combination of these segments provides a unique view into the digital channel and gives GSI insight into customer and transaction lifecycles, as well as multi-channel activities. The Company provides products and services to over 2,000 brands globally, including Toys ‘R’ Us®, the National Football League®, Aeropostale®, Polo Ralph Lauren®, Dick’s Sporting Goods®, Dell® and Estee Lauder®. GSI’s worldwide workforce included approximately 5,300 employees as of January 17, 2011.

Detailed descriptions of GSI’s business and financial results are contained in ourForm 10-K for the fiscal year ended January 1, 2011, which is incorporated by reference into this proxy statement. See “Where Stockholders Can Find More Information” beginning on page 88 of this proxy statement.

eBay Inc.

2145 Hamilton Avenue

San Jose, California 95125

Telephone number:(408) 376-7400

2145 Hamilton Avenue

San Jose, California 95125

Telephone number:(408) 376-7400

eBay connects millions of buyers and sellers globally on a daily basis through eBay, the world’s largest online marketplace, and PayPal, which enables individuals and businesses to securely, easily and quickly send and receive online payments. eBay also reaches millions through specialized marketplaces such as StubHub, the world’s largest ticket marketplace, and eBay classifieds sites, which together have a presence in more than 1,000 cities around the world. eBay Inc. and its subsidiaries employed approximately 17,700 people (including temporary employees), approximately 11,100 of whom are located in the U.S. as of December 31, 2010.

Gibraltar Acquisition Corp., a newly-formed Delaware corporation, was formed by eBay for the sole purpose of entering into the merger agreement and completing the merger contemplated by the merger agreement. Merger Sub is wholly-owned by eBay and has not engaged in any business except in anticipation of the merger.

| • | The Proposed Transaction (Page 21) |

You are being asked to vote to adopt the merger agreement, pursuant to which GSI will be acquired by eBay. The acquisition will be effected by the merger of Merger Sub, a wholly-owned subsidiary of eBay, with and into

1

GSI, with GSI surviving as a wholly-owned subsidiary of eBay. At the effective time of the merger, each issued and outstanding share of our common stock (other than shares held by GSI, eBay, Merger Sub or any of their subsidiaries and shares held by stockholders, if any, who validly perfect their appraisal rights under Delaware law) will be converted into the right to receive $29.25 per share in cash, without interest and less any applicable withholding taxes, which we refer to in this proxy statement as the “merger consideration.” The total amount expected to be paid in the merger in respect of our outstanding common stock and vested equity awards is approximately $2.2 billion.

The parties currently expect to complete the merger as early as the end of the second quarter of 2011, subject to satisfaction of the conditions described under “Terms of the Merger Agreement — Conditions to the Completion of the Merger” beginning on page 73.

A copy of the merger agreement is attached asAppendix A to this proxy statement.You are encouraged to read the merger agreement carefully in its entirety because it is the legal agreement that governs the merger.

| • | Treatment of Restricted Stock, Options and Restricted Stock Unit Awards (Page 65) |

The merger agreement provides that:

| • | to the extent that any outstanding shares of GSI’s common stock are unvested or subject to a repurchase option, risk of forfeiture or other condition as of the effective time of the merger, each such share will be converted into a right to receive $29.25 per share in cash, without interest and less any applicable withholding taxes, at the effective time of the merger, which right will remain unvested and subject to the same repurchase option, risk of forfeiture or other condition previously applicable to the respective shares, and need not be paid until such time as such repurchase option, risk of forfeiture or other condition lapses or otherwise terminates; | |

| • | each outstanding stock option of GSI, to the extent vested immediately prior to the effective time of the merger, including the options that will vest contingent upon consummation of the merger, will be terminated and converted into the right to receive an amount in cash (subject to any applicable withholding taxes) equal to (i) the number of shares of GSI common stock underlying the option multiplied by (ii) the difference between (A) $29.25, and (B) the exercise price per share of such option; and | |

| • | each outstanding stock option to acquire shares of GSI common stock, to the extent unvested immediately prior to the effective time of the merger, will be converted into an option to purchase eBay common stock in an amount equal to (i) the number of shares of GSI common stock underlying such option immediately prior to the effective time of the merger, multiplied by (ii) a “conversion ratio” equal to (A) $29.25 divided by (B) the average of the closing sale prices of a share of eBay common stock as reported on NASDAQ for each of the ten consecutive trading days immediately preceding the closing date of the merger, rounding the resulting number down to the nearest whole number of shares of eBay common stock. The per share exercise price for the eBay common stock issuable upon exercise of each such unvested GSI stock option converted into an option to purchase eBay common stock will be equal to (i) the per share exercise price of the GSI common stock subject to such unvested GSI option, as in effect immediately prior to the effective time of the merger, divided by (ii) the conversion ratio, rounding up to the nearest whole cent. |

The merger agreement provides that:

| • | each restricted stock unit of GSI, to the extent vested immediately prior to the effective time of the merger, will be converted into the right to receive an amount in cash (subject to any applicable withholding taxes) equal to (i) the number of shares of GSI common stock underlying the restricted stock unit multiplied by (ii) $29.25; and | |

| • | each restricted stock unit of GSI, to the extent unvested immediately prior to the effective time of the merger, will be converted into a restricted stock unit representing the right to receive the number of shares of eBay common stock equal to (i) the number of shares of GSI common stock subject to such restricted stock unit immediately prior to the effective time of the merger, multiplied by (ii) the conversion ratio, rounding down the product to the nearest whole number of shares of eBay common stock. |

2

The total amount expected to be paid in respect of restricted stock, vested stock options and restricted stock units of GSI that will vest prior to the effective time is approximately $38.7 million (assuming completion of the merger at the end of the second quarter of 2011).

| • | Recommendation of our Board of Directors and Special Committee (Page 34) |

In connection with the merger, our Board of Directors formed a special committee of the Board of Directors composed of certain independent directors to, among other things, evaluate and make a recommendation to our Board of Directors with respect to the merger. The special committee consisted of the following independent directors: M. Jeffrey Branman, Michael J. Donahue, Ronald D. Fisher, and Jeffrey F. Rayport. The special committee and our Board of Directors (acting upon the unanimous recommendation of the special committee), with the exception of Michael G. Rubin and Mark S. Menell, both of whom recused themselves from the Board of Directors’ vote on the merger, after careful consideration, have unanimously: (i) determined that the merger agreement and the merger, are advisable, fair to and in the best interests of the holders of GSI common stock, (ii) approved and declared advisable the execution, delivery and performance of the merger agreement and the merger, (iii) recommended that our stockholders vote“FOR” adoption of the merger agreement, and (iv) recommended that the our stockholders vote“FOR” the approval of any proposal to adjourn the special meeting, if necessary or appropriate to solicit additional proxies in the event that there are not sufficient votes in favor of adoption of the merger agreement at the time of the special meeting.

In considering the recommendation of the special committee and the Board of Directors, you should be aware that Mr. Rubin, our chairman of the board, president and chief executive officer, has certain interests in the merger that are different from, and in addition to, the interests of our stockholders generally. NRG Commerce, LLC (“NRG”), a Delaware limited liability company wholly-owned by Mr. Rubin, is a party to a stock purchase agreement, dated as of March 27, 2011, with eBay (the “purchase agreement”), pursuant to which eBay has agreed to sell all or a portion of the equity interests of certain subsidiaries of GSI to NRG immediately after the completion of the merger on the terms and subject to the conditions set forth in the purchase agreement (including the condition that the merger has been completed). In addition, NRG will enter into a secured loan agreement with GSI pursuant to which GSI, which will be an affiliate of eBay at the time the agreement is entered into, will lend NRG funds to finance a substantial portion of the purchase price for such divestiture transaction on the terms and subject to the conditions set forth in the loan agreement. The closing of the merger is not subject to, or dependent upon, the closing of the divestiture transaction, and the special committee and the Board of Directors have not made any recommendation with regard to the divestiture transaction. In addition, in considering the recommendation of the special committee and the Board of Directors, you should be aware that the other directors and executive officers of GSI have certain other interests in the merger that are different from, and in addition to, the interests of our stockholders generally. The accompanying proxy statement includes additional information regarding interests of Mr. Rubin and other directors and executive officers of GSI that are different from, and in addition to, the interests of our stockholders generally.

For a discussion of the material factors considered by the special committee and our Board of Directors in reaching their conclusions, see “The Merger — Reasons for the Merger; Recommendation of Our Board of Directors and Special Committee” beginning on page 34.

| • | Opinion of Morgan Stanley (Page 37) |

In connection with the merger, our Board of Directors received an opinion from Morgan Stanley & Co. Incorporated, or Morgan Stanley, as independent financial advisor to the Company selected by the special committee, that, as of the date of such opinion, and based upon and subject to the various assumptions, considerations, qualifications and limitations set forth in the opinion, the consideration to be received by holders of shares of GSI common stock (other than holders of certain excluded shares) pursuant to the merger agreement was fair from a financial point of view to such holders. The full text of the written opinion of Morgan Stanley, dated March 27, 2011, is attached to this proxy statement asAppendix B.We encourage you to read this opinion carefully and in its entirety for a description of the assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken.Morgan Stanley’s opinion is directed to our Board of Directors and addresses only the fairness from a financial point of view of the consideration to be received by the holders of GSI common stock (other than holders of certain excluded shares) pursuant to the merger

3

agreement, does not address any other aspect of the merger and does not constitute a recommendation to any stockholder as to how to vote or act with respect to the merger.

Other details of GSI’s arrangement with Morgan Stanley are described under “The Merger — Opinion of Morgan Stanley” beginning on page 37.

| • | No Financing Condition (Page 45) |

The merger agreement does not contain any financing-related closing condition. GSI and eBay estimate that the total amount of funds necessary to pay the merger consideration is approximately $2.2 billion, and eBay has represented in the merger agreement that it will have sufficient cash available to pay the aggregate merger consideration at the effective time of the merger.

| • | Interests of Our Directors and Executive Officers in the Merger (Page 47) |

As of the close of business on May 9, 2011, the record date for the special meeting, our current directors and executive officers, as well as a former director, Mark S. Menell, beneficially owned and are entitled to vote, in the aggregate, 4,553,748 shares of our common stock, representing approximately 6.26% of our outstanding shares. eBay entered into a Voting and Support Agreement, dated as of March 27, 2011, with Michael Rubin (the “Rubin Support Agreement”) and Voting and Support Agreements, dated as of March 27, 2011, with each of the other directors and certain officers of GSI (the “D&O Support Agreements” and together with the Rubin Support Agreement, the “Support Agreements”). Under the terms of Support Agreements, the directors and officers party to the Support Agreements agreed to vote all of their shares of our common stock“FOR”the adoption of the merger agreement. Additional details of the voting interests of our directors and executive officers are described under “Security Ownership of Management and Certain Beneficial Owners” beginning on page 84.

In considering the unanimous recommendation of our Board of Directors (other than Messrs Rubin and Menell, who recused themselves), you should be aware that our directors and executive officers have interests in the merger that are different from, and in addition to, your interests as a stockholder and that may present actual or potential conflicts of interest. Our Board of Directors was aware of these interests and considered that these interests may be different from, and in addition to, the interests of our stockholders generally in approving the merger agreement and the merger, and in determining to recommend that our stockholders vote for adoption of the merger agreement. These interests include, among others:

| • | accelerated vesting of equity awards in certain specified instances; | |

| • | the entry by certain of our executive officers into transaction incentive agreements; and | |

| • | continued indemnification and liability insurance for our directors and officers following completion of the merger. |

In addition, NRG is a party to the purchase agreement with eBay, pursuant to which eBay has agreed to sell all or a portion of the equity interests of certain subsidiaries of GSI to NRG immediately after the completion of the merger on the terms and subject to the conditions set forth in the purchase agreement (including the condition that the merger has been completed). In addition, NRG will enter into a secured loan agreement with GSI, pursuant to which GSI, which will be an affiliate of eBay at the time the agreement is entered into, will lend NRG funds to finance a substantial portion of the purchase price for such divestiture transaction on the terms and subject to the conditions set forth in the loan agreement. The closing of the merger is not subject to, or dependent upon, the closing of the divestiture transaction, and neither the special committee nor the Board of Directors has made any recommendation with regard to the divestiture transaction. In addition, concurrently with the negotiations of the divestiture transaction, Mr. Rubin had preliminary discussions with Mr. Menell concerning the potential employment of Mr. Menell by NRG and, subsequent to GSI’s announcement of the entry into the merger agreement, Mr. Menell resigned from the Board of Directors in order to accept a position with NRG.

For a discussion of these and other interests of our directors and executive officers, see “The Merger — Interests of GSI’s Directors and Executive Officers in the Merger” beginning on page 47.

4

| • | Solicitations (Page 70) |

The merger agreement provides that until 11:59 p.m. California time on May 6, 2011 (the “go-shop” period), GSI and its representatives are permitted to:

| • | solicit, initiate, encourage, assist, induce or facilitate the submission, announcement or making of acquisition proposals or inquiries with respect to an acquisition proposal or take any action that could reasonably be expected to have such effect; | |

| • | furnish and provide access to information to any entity in connection with or in response to a proposal or inquiry relating to an alternative transaction so long as such entity has entered into a confidentiality agreement with the Company that is at least as favorable to the Company as the confidentiality agreement between the Company and eBay and that does not prohibit the Company from making certain disclosures to eBay (an “acceptable confidentiality agreement”); and | |

| • | engage in discussions or negotiations with any entity with respect to a proposal or inquiry relating to an alternative transaction. |

The merger agreement provides that within 48 hours after the expiration of the “go-shop” period, the Company must deliver to eBay written notice setting forth the identity of each excluded party (as defined below) as well as any entity that, to the Company’s knowledge, has, or is expected to have, a material equity interest in each excluded party or is expected to participate in the transaction proposed by each excluded party. The Company must also deliver to eBay within 48 hours after the expiration of the “go-shop” period the material terms and conditions (including the per share price) of each excluded party’s acquisition proposal as well as copies of all proposed definitive documents received by the Company from any excluded party relating to any acquisition proposal.

The merger agreement also provides that after 11:59 p.m. California time on May 6, 2011, the Company and its representatives are required to immediately cease the activities permitted during the “go-shop” period summarized above and described in more detail under “— “Go-Shop Period” on page 70, except as may relate to excluded parties. Pursuant to the merger agreement, following the expiration of the “go-shop” period, the Company and its representatives must not (except as may be required with respect to an excluded party): (i) solicit, initiate, encourage, assist, induce or facilitate the submission, announcement or making of any acquisition proposals or inquires with respect to an acquisition proposal or take any action that could reasonably be expected to have such effect; (ii) furnish or provide access to information to any entity in connection with or in response to a proposal or inquiry relating to an alternative transaction, and (iii) engage in discussions or negotiations with any entity with respect to a proposal or inquiry relating to an alternative transaction.

Notwithstanding the restrictions described above, the merger agreement provides that at any time before the adoption of the merger agreement by the Company’s stockholders, the Company may provide information to and engage in discussions with third parties from whom the Company has received an acquisition proposal that was not solicited in violation of the merger agreement, so long as the Board of Directors, acting upon the recommendation of the special committee and after consultation with its financial advisor and outside legal counsel, reasonably determines in good faith that such proposal constitutes or is reasonably likely to constitute a superior offer when compared with eBay’s offer to acquire the Company. Such third parties must execute an acceptable confidentiality agreement with the Company prior to receiving any confidential information from the Company or its representatives, and the Company must also provide eBay with access to any non-public information furnished to any third party or any excluded party prior to furnishing such information to such third party or excluded party.

In addition, pursuant to the merger agreement, after 11:59 p.m. California time on May 6, 2011, the Company must promptly, and in no event later than 24 hours following the occurrence of any of the following:

| • | provide written notice to eBay of any proposals, inquiries or requests for non-public information in connection with a potential alternative acquisition, as well as the material terms and conditions thereof, excluding the identity of the entity making such proposal, inquiry or request; | |

| • | provide eBay with redacted copies of all proposed definitive documents received by the Company or any of its representatives from any entity or its representatives relating to any acquisition proposal; and |

5

| • | keep eBay fully informed with respect to the status of any proposals or inquiries related to an alternative acquisition and any modification or proposed modification thereto, and promptly (and in no event later than 24 hours after obtaining knowledge thereof) notify eBay of any material change or development with respect to any such proposal. |

At any time before the adoption of the merger agreement by our stockholders, subject to complying with the applicable terms of the merger agreement, our Board of Directors may withdraw or modify its recommendation with respect to the adoption of the merger agreement if, after the receipt by the Company of an acquisition proposal or due to a change in circumstances, our Board of Directors determines that such withdrawal or modification is required by the Board of Directors’ fiduciary obligations to our stockholders.

For purposes of the merger agreement, an “excluded party” is any entity from which the Company receives a written acquisition proposal during the “go-shop” period that remains pending upon the expiration of the “go-shop” period, so long as the Board of Directors, acting upon the recommendation of the special committee of the Board of Directors and after consultation with its financial advisor and outside legal counsel, reasonably determines in good faith that such entity’s acquisition proposal constitutes or is reasonably likely to constitute a superior offer when compared with eBay’s agreement to acquire the Company. Excluded parties shall cease being an excluded party for purposes of the merger agreement upon the earliest of: (i) 11:59 p.m. California time on May 31, 2011, the date 25 days after the expiration of the “go-shop” period; or (ii) the withdrawal, termination or expiration of such acquisition proposal; or (iii) the time as of which such acquisition proposal no longer constitutes, or is not reasonably likely to result in, a superior offer; or (iv) in the case of a financial buyer, any change of greater than 20% of the actual or proposed equity ownership of such excluded party.

No party submitted a written acquisition proposal to the Company prior to the expiration of the “go-shop” period. As a result, no party can qualify as an excluded party under the merger agreement.

| • | Conditions to the Completion of the Merger (Page 73) |

Our obligations and the obligations of eBay and Merger Sub to consummate the merger are subject to the satisfaction at or before the effective time of the merger of the following principal conditions, among others:

| • | adoption of the merger agreement by our stockholders; | |

| • | absence of legal prohibitions on completion of the merger; and | |

| • | expiration or termination of any applicable waiting periods under theHart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and any applicable foreign antitrust or competition law or regulation and any other foreign legal requirement, and obtaining any other required governmental approvals. |

On April 18, 2011, the Federal Trade Commission notified the parties that early termination of the waiting period under the HSR Act had been granted.

The obligations of eBay and Merger Sub to consummate the merger are subject to the satisfaction at or before the effective time of the merger of the following principal conditions, among others:

| • | accuracy of the representations and warranties made by us in the merger agreement, subject to customary materiality qualifiers; | |

| • | our compliance in all material respects with obligations and preclosing covenants contained in the merger agreement, subject to customary materiality qualifiers; and | |

| • | no material adverse effect on us shall have occurred, and no event shall have occurred or circumstance shall exist that, in combination with any other events or circumstances, could reasonably be expected to have or result in a material adverse effect on us. |

6

Our obligations to consummate the merger are subject to the satisfaction at or before the effective time of the merger of the following principal conditions, among others:

| • | accuracy of the representations and warranties made by eBay and Merger Sub in the merger agreement, subject to customary materiality qualifiers; and | |

| • | eBay’s and Merger Sub’s compliance in all material respects with obligations and preclosing covenants contained in the merger agreement, subject to customary materiality qualifiers. |

| • | Merger Agreement Termination Provisions; Termination Fees (Page 75) |

The merger agreement may be terminated at any time before the effective time of the merger, whether before or after adoption of the merger agreement by our stockholders:

| • | by mutual written consent of eBay and the Company; | |

| • | by either eBay or the Company if: |

| • | the merger has not been consummated by December 31, 2011 or our stockholders fail to adopt the merger agreement, except that neither eBay nor the Company may terminate the merger agreement for either of these reasons if either circumstance is attributable to a failure on the part of such party to perform any covenant or obligation required by the merger agreement; or | |

| • | there is a permanent legal prohibition to completing the merger; |

| • | by eBay, at any time before the adoption of the merger agreement by our stockholders, if: |

| • | a Triggering Event (as defined below) occurs; or | |

| • | (i) any of the Company’s representations and warranties are inaccurate as of the date of the merger agreement or a subsequent date (other than any such representation and warranty made as of a specific earlier date) or (ii) the Company breaches any of its covenants or obligations, in each case such that a condition to closing would not be satisfied as of the effective time of the merger and, with respect to those inaccuracies and breaches that are curable prior to December 31, 2011, the Company fails to cure such inaccuracies and breaches upon 30 days notice, unless eBay is in material breach of the merger agreement in which case eBay may not terminate the merger agreement for the reasons stated in this subsection; |

| • | by the Company, at any time before the adoption of the merger agreement by our stockholders: |

| • | in certain circumstances related to superior offers with respect to acquisition proposals, such circumstances including, among other things, that our Board of Directors authorizes the Company to enter into an agreement concerning a superior offer and the Company (i) gives eBay written notice of its intention to terminate the merger agreement and provides eBay with four days to make an offer at least as favorable to the stockholders of the Company (during which time we have undertaken to make our representatives reasonably available for further negotiations), and eBay does not make such an offer, and (ii) pays the applicable termination fee; or | |

| • | if (i) any of eBay’s representations and warranties are inaccurate as of the date of the merger agreement or (ii) eBay breaches any of its covenants or obligations, in each case such that a condition to closing would not be satisfied as of the effective time of the merger and, with respect to those inaccuracies and breaches that are curable prior to December 31, 2011, eBay fails to cure such inaccuracies and breaches upon 30 days notice, unless the Company is in material breach of the merger agreement in which case the Company may not terminate the merger agreement for the reasons stated in this subsection. |

For purposes of the merger agreement, a “Triggering Event” is deemed to have occurred if:

| • | our Board of Directors or any committee thereof withdraws or modifies (in a manner adverse to eBay) its recommendation in favor of the merger or takes, authorizes or publicly proposes specified actions related to acquisition proposals or transactions with respect to the Company; |

7

| • | our Board of Directors fails to reaffirm, unanimously and publicly, its recommendation in favor of the merger within five business days after eBay reasonably requests, in writing, such reaffirmation; | |

| • | a tender or exchange offer relating to shares of Company common stock is commenced and the Company fails to issue to its security holders a statement to the effect that the Company recommends rejection of such tender or exchange offer and reaffirming the Board of Directors’ recommendation in favor of the merger within ten business days after the commencement of such tender or exchange offer; or | |

| • | the Company or its subsidiaries or any director or executive officer of the Company shall have breached in any material respect or taken any action materially inconsistent with certain provisions of the merger agreement relating to the “go-shop” period or acquisition proposals. |

Under certain circumstances resulting in the termination of the merger agreement, we will be required to pay a termination fee of $74 million to eBay.

| • | U.S. Tax Considerations for GSI’s Stockholders (Page 58) |

Generally, the merger will be taxable to our stockholders who are U.S. persons for U.S. federal income tax purposes. A holder of GSI common stock receiving cash in the merger that is a U.S. person generally will recognize gain or loss for U.S. federal income tax purposes in an amount equal to the difference between the amount of cash received and the holder’s adjusted tax basis in our common stock surrendered. You should consult your own tax advisor for a full understanding of how the merger will affect your particular tax consequences.

| • | Dissenters’ Rights of Appraisal (Page 61) |

Under Delaware law, if you take certain specific actionsand/or refrain from taking other certain specific actions, you are entitled to appraisal rights in connection with the merger. You will have the right, under and assuming full compliance with Delaware law, to have the fair value of your shares of GSI common stock determined by the Court of Chancery of the State of Delaware (the “Delaware Court”) and to receive such fair value, together with interest, if any, as determined by the court, in lieu of the consideration you would otherwise be entitled to pursuant to the merger agreement. This right to appraisal is subject to a number of restrictions and technical requirements. Generally, in order to exercise your appraisal rights you must:

| • | send a timely written demand to us at the address set forth on page 62 of this proxy statement for appraisal in compliance with Delaware law, which demand must be delivered to us before the stockholder vote to adopt the merger agreement set forth in this proxy statement; | |

| • | not vote in favor of the adoption of the merger agreement; and | |

| • | continuously hold your shares of GSI common stock, from the date you make the demand for appraisal through the closing of the merger. |

Merely voting against the merger agreement will not protect your rights to an appraisal, which requires all the steps provided under Delaware law. Requirements under Delaware law for exercising appraisal rights are described in further detail beginning on page 61. The relevant section of Delaware law regarding appraisal rights, Section 262 of the Delaware General Corporation Law, regarding appraisal rights is reproduced and attached asAppendix Cto this proxy statement.

If you vote for the adoption of the merger agreement, you will be deemed to have waived your rights to seek appraisal of your shares of GSI common stock under Delaware law. This proxy statement constitutes our notice to our stockholders of the availability of appraisal rights in connection with the merger in compliance with the requirements of Section 262 of the Delaware General Corporation Law.

| • | Litigation Related to the Merger (Page 60) |

Following the announcement of the proposed merger, several putative stockholder class action complaints challenging the transaction (one of which also purports to be brought derivatively on behalf of GSI) were filed in the Delaware Court and the Court of Common Pleas for Montgomery County, Pennsylvania (the “Pennsylvania Court”)

8

against various combinations of eBay, Merger Sub, NRG, us, the individual members of our board of directors, and certain of ournon-director officers. Additional similar lawsuits may be filed in the future.

The complaints generally allege, among other things, that the members of our board of directors breached their fiduciary duties owed to our public stockholders by entering into the merger agreement, approving the proposed merger, and failing to take steps to maximize our value to our public stockholders; that Mr. Rubin breached his fiduciary duties owed to our public stockholders by engaging in a transaction pursuant to which eBay agreed to sell certain subsidiaries of GSI to NRG after the completion of the merger; and that various combinations of eBay, Merger Sub, NRG, and us aided and abetted such breaches of fiduciary duties. In addition, the complaints allege that the transactions improperly favor eBay and Mr. Rubin and unjustly enrich certain of the defendants; and that certain provisions of the merger agreement unduly restrict our ability to negotiate with other potential bidders. In one of these actions, the plaintiff also purports to bring derivative claims on behalf of GSI, alleging that the individual members of the board of directors and certainnon-director officers are wasting corporate assets, unjustly enriching themselves, and breaching their fiduciary duties, and that eBay and Merger Sub are aiding and abetting such breaches of fiduciary duties. The complaints generally seek, among other things, declaratory and injunctive relief concerning the alleged fiduciary breaches, injunctive relief prohibiting the defendants from consummating the proposed merger, other forms of equitable relief and, with respect to the complaints filed in Delaware Court, damages.

Beginning on April 5, 2011, various plaintiffs in these lawsuits filed motions with the Delaware Court to consolidate the suits, to expedite the proceedings, to appoint lead plaintiff and lead counsel, and for preliminary injunction. On April 27, 2011, the Delaware Court held a hearing on these motions. On April 29, 2011, the Delaware Court issued a letter opinion consolidating the Delaware cases, appointing lead plaintiff and lead counsel, and directing the parties to submit an order setting forth a schedule and effectuating the letter opinion. By order dated May 4, 2011, the Delaware Court scheduled a hearing on the plaintiffs’ motion to preliminarily enjoin the proposed merger for June 10, 2011.

On April 21, 2011, the plaintiff filed their claim with the Pennsylvania Court as well as a motion for expedited proceedings and preliminary injunction. The claim and the motion are currently pending before the Pennsylvania Court. On May 4, all defendants filed or joined in a petition to dismiss or stay the Pennsylvania action in light of the Delaware action; all defendants also opposed plaintiff’s motion for expedited proceedings. On May 5, 2011, a hearing was held on plaintiff’s motion for expedited proceedings. The court has not yet ruled on either the petition to dismiss or stay or the motion for expedited proceedings and has permitted additional briefing on the petition to dismiss or stay. The briefing is scheduled to be completed by May 13, 2011.

One of the conditions to the closing of the merger is that no restraining order, injunction or ruling by a court or other governmental entity shall be in effect that prevents the consummation of the merger or that makes the consummation of the merger illegal. As such, if the plaintiffs in any of the actions discussed above are successful in obtaining an injunction prohibiting the defendants from completing the merger on theagreed-upon terms, then such injunction may prevent the merger from becoming effective, or from becoming effective within the expected timeframe.

While these cases are in their early stages, GSI, eBay and the other defendants to these suits believe that the claims asserted therein are without merit and intend to contest the lawsuits vigorously.

9

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE MERGER

The following questions and answers are intended to briefly address some commonly asked questions regarding procedural matters relating to the merger, the merger agreement and the special meeting. These questions and answers may not address all questions that may be important to you as a holder of GSI common stock. Please refer to the “Summary” and the more detailed information contained elsewhere in this proxy statement, the appendices to this proxy statement and the documents referred to or incorporated by reference in this proxy statement, which you should read carefully. See “Where Stockholders Can Find More Information” beginning on page 88.

| Q: | Why am I receiving these materials? | |

| A: | eBay and GSI have agreed to a merger, pursuant to which GSI will become a wholly-owned subsidiary of eBay and will no longer be a publicly held corporation. A copy of the merger agreement is attached to this proxy statement asAppendix A. GSI’s stockholders must vote to adopt the merger agreement before the merger can be completed, and GSI is holding a special meeting of its stockholders to enable them to vote on the adoption of the merger agreement. | |

| You are receiving this proxy statement because you own shares of GSI’s common stock. This proxy statement contains important information about the proposed transaction and the special meeting, and you should read it carefully. The enclosed proxy statement allows you to vote your shares of GSI’s common stock without attending the special meeting in person. | ||

| Q: | What will I receive in the merger? | |

| A: | If the merger is completed, you will receive $29.25 per share in cash, without interest and less any applicable withholding taxes, for each share of GSI common stock that you own. For example, if you own 100 shares of GSI common stock, you will receive $2,925 in cash in exchange for your shares of GSI common stock, without interest and less any applicable withholding taxes. You will not be entitled to receive shares in the surviving corporation. | |

| Q: | How does the per share merger consideration compare to the market price of GSI common stock prior to announcement of the merger? | |

| A: | The per share merger consideration represents a premium of approximately 51% over the closing price of GSI common stock on March 25, 2011, the last trading day prior to the public announcement of the merger agreement, and a premium of approximately 47% over GSI’s average closing share price over the 30 trading days prior to the announcement of the merger. | |

| Q: | When and where is the special meeting? | |

| A: | The special meeting of our stockholders will be held at the Crowne Plaza Hotel, 260 Mall Boulevard, King of Prussia, Pennsylvania 19406, on Friday, June 17, 2011, at 9:00 a.m, local time. | |

| Q: | What am I being asked to vote on? | |

| A: | You are being asked to consider and vote on the following proposals: | |

| • the adoption of the merger agreement; | ||

| • the adjournment of the special meeting, if necessary or appropriate to solicit additional proxies if there are insufficient votes at the time of the special meeting to adopt the merger agreement; and | ||

| • on such other business as may properly come before the special meeting or any adjournment thereof. | ||

| Q: | How does the Company’s Board of Directors recommend that I vote on the proposals? | |

| A: | Our Board of Directors unanimously (other than Messrs Rubin and Menell, who recused themselves) recommends that you vote: | |

• “FOR” the proposal to adopt the merger agreement; and | ||

• “FOR” adjournment of the special meeting, if necessary or appropriate to solicit additional proxies if there are insufficient votes at the time of the special meeting to adopt the merger agreement. |

10

| You should read “The Merger — Reasons for the Merger; Recommendation of Our Board of Directors and Special Committee” beginning on page 34 for a discussion of the factors that our Board of Directors and special committee considered in deciding to recommend the adoption of the merger agreement. See also “The Merger — Interests of GSI’s Directors and Executive Officers in the Merger” beginning on page 47. | ||

| Q: | Who is entitled to vote? | |

| A: | All holders of GSI common stock, as of the close of business on May 9, 2011, the record date for this solicitation, are entitled to receive notice of, attend and vote at, the special meeting. On the record date, 72,771,448 shares of GSI common stock, held by approximately 1,751 stockholders of record, were outstanding and entitled to vote. You may vote all shares you owned as of the record date. You are entitled to one vote per share. | |

| Q: | What vote of stockholders is required to adopt the merger agreement? | |

| A: | For us to complete the merger, stockholders as of the close of business on the record date for the special meeting holding a majority of the outstanding shares of GSI common stock entitled to vote at the special meeting, must vote“FOR” the adoption of the merger agreement. | |

| Q: | What vote of stockholders is required to adjourn the special meeting, if necessary or appropriate to solicit additional proxies at the special meeting? | |

| A: | The proposal to adjourn the special meeting, if necessary or appropriate to solicit additional proxies, requires the approval of holders of a majority of our common stock present, in person or by proxy, at the special meeting and entitled to vote on the matter, whether or not a quorum is present. | |

| Q: | What does it mean if I get more than one proxy card? | |

| A: | If you have shares of GSI common stock that are registered differently or are in more than one account, you will receive more than one proxy card. Please follow the directions for voting on each of the proxy cards you receive to ensure that all of your shares are voted. | |

| Q: | How do I vote without attending the special meeting? | |

| A: | If you are a registered stockholder (that is, if you hold one or more stock certificates for your GSI common stock), you may submit your proxy and vote your shares by returning the enclosed proxy card, marked, signed and dated, in the postage-paid envelope provided, or by telephone or through the Internet by following the instructions included with the enclosed proxy card. | |

| If you hold your shares through a broker, dealer, commercial bank, trust company or other nominee, which we refer to in this proxy statement as holding shares in “street name,” you should follow the separate voting instructions provided by the broker, dealer, commercial bank, trust company or other nominee with the proxy statement. If you do not instruct your broker, dealer, commercial bank, trust company or other nominee regarding the voting of your shares, your shares will not be voted and the effect will be the same as a vote“AGAINST” the adoption of the merger agreement. | ||

| Q: | How do I vote in person at the special meeting? | |

| A: | If you are a stockholder of record of the Company, which we refer to in this proxy statement as a “registered stockholder,” you may attend the special meeting and vote your shares in person at the special meeting by giving us a signed proxy card or ballot before voting is closed. If you want to do that, please bring proof of identification with you. Even if you plan to attend the special meeting, we recommend that you vote your shares in advance as described above, so your vote will be counted even if you later decide not to attend. | |

| If you hold your shares in “street name,” you may vote those shares in person at the special meeting only if you obtain and bring with you a signed proxy from the necessary nominee(s) giving you the right to vote the shares. To do this, you should contact your broker, dealer, commercial bank, trust company or other nominee. |

11

| Q: | Can I change my vote? | |

| A: | You may revoke or change your proxy at any time before the vote is taken at the special meeting, except as otherwise described below. If you have not voted through your broker, dealer, commercial bank, trust company or other nominee because you are the registered stockholder, you may revoke or change your proxy before it is voted by: | |

| • filing a notice of revocation, which is dated as of a later date than your proxy, with the Company’s Secretary; | ||

| • submitting a signed and completed proxy card bearing a later date; | ||

| • submitting a new proxy by telephone or through the Internet at a later time, but not later than 11:59 p.m. (Eastern Time) on June 16, 2011 (or if the special meeting is adjourned, not later than 11:59 p.m. (Eastern Time) on the date before the special meeting date); or | ||

| • voting in person at the special meeting. | ||

| Simply attending the special meeting will not constitute revocation of a proxy. If your shares are held in “street name,” you should follow the instructions of your broker, dealer, commercial bank, trust company or other nominee regarding revocation or change of proxies. If your broker, dealer, commercial bank, trust company or other nominee allows you to submit voting instructions by telephone or through the Internet, you may be able to change your vote by submitting new voting instructions by telephone or through the Internet. | ||

| Q: | If my shares are held in “street name” by my broker, dealer, commercial bank, trust company or other nominee, will my nominee automatically vote my shares for me? | |

| A: | No. Youmustprovide voting instructions to your broker, dealer, commercial bank, trust company or other nominee on how to vote your shares of GSI common stock.If you do not provide your broker, dealer, commercial bank, trust company or other nominee with instructions on how to vote your shares, your shares of GSI common stock will not be voted, which will have the same effect as voting “AGAINST” the proposal to adopt the merger agreement. Please refer to the voting instruction card used by your broker, dealer, commercial bank, trust company or other nominee to see if you may submit voting instructions using the Internet or telephone. | |

| Q: | Is it important for me to vote? | |

| A: | Yes, since we cannot complete the merger without the affirmative vote of the majority of the holders of the shares of GSI common stock that are entitled to vote at the special meeting,your failure to vote will have the same effect as a vote “AGAINST” the adoption of the merger agreement. | |

| Q: | What happens if I return my proxy card but I do not indicate how to vote? | |

| A: | If you properly return your proxy card, but do not include instructions on how to vote, your shares of GSI common stock will be voted“FOR”the adoption of the merger agreement and“FOR”the approval of the special meeting adjournment proposal. Our management does not currently intend to bring any other proposals to the special meeting. If other proposals requiring a vote of stockholders are brought before the special meeting in a proper manner, the persons named in the enclosed proxy card will have the authority to vote the shares represented by duly executed proxies in their discretion. | |

| Q: | What happens if I abstain from voting on a proposal? | |

| A: | If you return your proxy card with instructions to abstain from voting on either proposal, your shares will be counted for determining whether a quorum is present at the special meeting. An abstention with respect to the proposal to adopt the merger agreement has the legal effect of a vote“AGAINST”the proposal to adopt the merger agreement. An abstention with respect to the proposal to adjourn the special meeting, if necessary or appropriate, to permit further solicitation of proxies at the special meeting has the legal effect of a vote “AGAINST” the proposal to adjourn the special meeting. |

12

| Q: | What happens if I do not return a proxy card or otherwise do not vote? | |

| A: | Your failure to return a proxy card or otherwise vote will mean that your shares will not be counted toward determining whether a quorum is present at the special meeting and will have the legal effect of a vote“AGAINST”the proposal to adopt the merger agreement. Such failure will have no legal effect with respect to the vote on the special meeting adjournment proposal. | |

| Q: | What happens if I sell my shares before the special meeting? | |

| A: | The record date of the special meeting is earlier than the special meeting and the date that the merger is expected to be completed. If you transfer your shares of GSI common stock after the record date but before the special meeting, you will retain your right to vote at the special meeting, but will have transferred the right to receive $29.25 per share in cash, without interest and less applicable withholding taxes, to be received by our stockholders in the merger. | |

| Q: | Will a proxy solicitor be used? | |

| A: | Yes. The Company has engaged Georgeson Inc. to assist in the solicitation of proxies for the special meeting and the Company estimates that it will pay them a fee of approximately $15,000, and will reimburse them for reasonable administrative andout-of-pocket expenses incurred in connection with the solicitation. | |

| Q: | If the merger is completed, how will I receive the cash for my shares? | |

| A: | If the merger is completed, you will receive a letter of transmittal with instructions on how to send your stock certificates to the paying agent in connection with the merger. You will receive cash for your shares from the paying agent only after you comply with these instructions. If your shares of GSI common stock are held for you in “street name” by your broker, dealer, commercial bank, trust company or other nominee, you will receive instructions from your broker, dealer, commercial bank, trust company or other nominee as to how to effect the surrender of your “street name” shares and receive cash for such shares. | |

| Q: | Should I send in my stock certificates now? | |

| A: | No. Assuming the merger is completed, you will receive a letter of transmittal shortly thereafter with instructions informing you how to send your share certificates to the paying agent in order to receive the merger consideration, without interest and less applicable withholding taxes. You should use the letter of transmittal to exchange GSI stock certificates for the merger consideration that you are entitled to receive as a result of the merger.Do not send any stock certificates with your proxy. | |

| Q: | When do you expect the merger to be completed? | |

| A: | We currently expect to complete the merger promptly after stockholder approval is obtained. However, in addition to obtaining stockholder approval, all of the conditions to the merger must have been satisfied or waived. In the event all of the conditions to the merger are not satisfied or waived if and when stockholder approval is obtained, completion of the merger may still occur, but would be delayed. | |

| Q: | What is householding and how does it affect me? | |

| A: | The Securities and Exchange Commission permits companies to send a single set of certain disclosure documents to any household at which two or more stockholders reside, unless contrary instructions have been received, but only if the company provides advance notice and follows certain procedures. In such cases, each stockholder continues to receive a separate notice of the special meeting and proxy card. This householding process reduces the volume of duplicative information and reduces printing and mailing expenses. Therefore, only one set of proxy materials is being delivered to multiple security holders sharing an address, unless we have received contrary instructions from you or another person sharing your address. If you receive a single set of proxy materials as a result of householding, and you would like to have separate copies of our proxy materials mailed to you, please submit a request to our proxy solicitor, Georgeson Inc., at the address and telephone number set forth on page 20 of this proxy statement and we will promptly send you the proxy materials. If you currently receive multiple copies of proxy materials at your address and would like to begin the householding |

13

| process, you may request delivery of a single copy by submitting a request to Georgeson Inc. at the address and telephone number set forth on page 20 of this proxy statement. | ||

| Q: | Who can help answer my other questions? | |

| A: | If you have more questions about the merger or the special meeting, or require assistance in submitting your proxy or voting your shares or need additional copies of the proxy statement or the enclosed proxy card, please contact Georgeson Inc., our proxy solicitor, toll free at(866) 628-6021. If your broker, dealer, commercial bank, trust company or other nominee holds your shares, you should also call your broker, dealer, commercial bank, trust company or other nominee for additional information. |

14

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This proxy statement and the documents to which we refer you in this proxy statement contains statements that are not historical facts and that are considered“forward-looking”within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can identify these statements by the fact that they do not relate strictly to historical or current facts. We have based these forward-looking statements on our current expectations about future events. Statements that include words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “continue” or “pursue,” or the negative or other words or expressions of similar meaning, may identify forward-looking statements. These forward-looking statements, include without limitation, those relating to future actions, strategies, future performance and future financial results. Although we believe that the expectations underlying these forward looking statements are reasonable, there are a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward-looking statements should, therefore, be considered in light of various important factors set forth from time to time in our filings with the Securities and Exchange Commission, which we refer to as the “SEC.” In addition to other factors and matters contained or incorporated in this document, these statements are subject to risks, uncertainties and other factors, including, among others:

| • | the current market price of our common stock may reflect a market assumption that the merger will occur, and a failure to complete the merger could result in a decline in the market price of our common stock; | |

| • | the occurrence of any event, change or other circumstances that could give rise to a termination of the merger agreement; | |

| • | under certain circumstances, we may have to pay a termination fee to eBay of $74 million; | |

| • | the inability to complete the merger due to the failure to obtain stockholder approval or the failure to satisfy other conditions to consummation of the merger; | |

| • | the failure of the merger to close for any other reason; | |

| • | our remedies against eBay with respect to certain breaches of the merger agreement may not be adequate to cover our damages; | |

| • | the proposed transactions may disrupt current business plans and operations and there may be potential difficulties in attracting and retaining employees as a result of the announced merger; | |

| • | due to restrictions imposed in the merger agreement, we may be unable to respond effectively to competitive pressures, industry developments and future opportunities; | |

| • | the effect of the announcement of the merger on our business relationships, operating results and business generally; and | |

| • | the costs, fees, expenses and charges we have incurred and may incur related to the merger, whether or not the merger is completed. |

The foregoing sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. A more complete description of the risks applicable to us is provided in our filings with the SEC available at the SEC’s web site athttp://www.sec.gov, including our most recent filings onForms 10-Q and10-K, as amended. Investors are cautioned not to place undue reliance on these forward-looking statements. Stockholders also should understand that it is not possible to predict or identify all risk factors and that neither this list nor the factors identified in our SEC filings should be considered a complete statement of all potential risks and uncertainties. We undertake no obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this proxy statement.

15

CONSIDERATIONS RELATING TO THE PROPOSED MERGER