General. In 2007, no single property accounted for more than 1.8% of our total assets or 1.4% of gross revenues. The five largest properties, in the aggregate, represented approximately 6.4% of our gross revenues for the year ended December 31, 2007; otherwise, none of the remaining properties accounted for more than 1.1% of our gross revenues during the same period. The weighted average occupancy rate for all of our improved properties as of December 31, 2007 was 94.4% compared to 94.1% as of December 31, 2006.

Substantially all of our properties are owned directly by us (subject in some cases to mortgages), although our interests in some properties are held indirectly through interests in real estate joint ventures or under long-term leases. In our opinion, our properties are well maintained and in good repair, suitable for their intended uses, and adequately covered by insurance.

We participate in 65 real estate joint ventures or partnerships that hold 116 of our properties. Our ownership interest ranges from 7.8% to 99%; we are normally the managing or operating partner and receive a fee for acting in this capacity.

We may use a DownREIT operating partnership structure in the acquisition of some real estate properties. In these transactions, a fair value purchase price is agreed upon between us, as general partner of the DownREIT, and the seller where the seller receives operating partnership units in exchange for some or all of its ownership interest in the property. Each operating partnership unit is the equivalent of one of our common shares of beneficial interest. These units generally allow our partners the right to put their limited partnership units interest to us on or after the first anniversary of the entity’s formation. We may acquire these limited partnership units for either cash or a fixed number of our common shares of beneficial interest at our discretion.

Shopping Centers. At December 31, 2007, we owned or operated under long-term leases, either directly or through our interest in real estate joint ventures or partnerships, a total of 303 developed income-producing properties and 32 properties under various stages of construction and development, which are located in 22 states spanning the USA from coast to coast.

Our shopping centers are primarily neighborhood and community shopping centers that typically range in size from 100,000 to 600,000 square feet of building area, as distinguished from large regional enclosed malls and small strip centers, which generally contain 5,000 to 25,000 square feet. Almost none of the centers have climatized common areas, but are designed to allow retail customers to park their automobiles in close proximity to any retailer in the center. Our centers are customarily constructed of masonry, steel and glass, and all have lighted, paved parking areas, which are typically landscaped with berms, trees and shrubs. They are generally located at major intersections in close proximity to neighborhoods that have existing populations sufficient to support retail activities of the types conducted in our centers.

We have approximately 7,500 separate leases with 5,700 different tenants. Included among our top revenue-producing tenants are: The Kroger Co., T.J.X. Companies, Safeway, Ross Stores, Publix, Home Depot, Office Depot, Blockbuster Video, Barnes & Noble and Gap. The diversity of our tenant base is also evidenced by the fact that our largest tenant accounted for only 2.9% of rental revenues during 2007.

In the ordinary course of business, we have tenants who cease making payments under their leases or who file for bankruptcy protection. We are unable to predict or forecast the timing of store closings or unexpected vacancies. While we believe the effect of this will not have a material impact on our financial position, results of operations, or liquidity due to the significant diversification of our tenant base, the uncertainty in the commercial credit markets could result in a negative impact.

Our shopping center leases have lease terms generally ranging from three to five years for tenant space under 5,000 square feet and from 10 to 25 years for tenant space over 10,000 square feet. Leases with primary lease terms in excess of 10 years, generally for anchor and out-parcels, frequently contain renewal options which allow the tenant to extend the term of the lease for one or more additional periods, with each of these periods generally being of a shorter duration than the primary lease term. The rental rates paid during a renewal period are generally based upon the rental rate for the primary term; sometimes adjusted for inflation, market conditions or an amount of the tenant's sales during the primary term.

Most of our leases provide for the monthly payment in advance of fixed minimum rentals, the tenants' prorata share of ad valorem taxes, insurance (including fire and extended coverage, rent insurance and liability insurance) and common area maintenance for the center (based on estimates of the costs for these items). They also provide for the payment of additional rentals based on a percentage of the tenants' sales. Utilities are generally paid directly by tenants except where common metering exists with respect to a center. In this case we make payments for the utilities, and the tenants on a monthly basis reimburse us. Generally, our leases prohibit the tenant from assigning or subletting its space. They also require the tenant to use its space for the purpose designated in its lease agreement and to operate its business on a continuous basis. Some of the lease agreements with major tenants contain modifications of these basic provisions in view of the financial condition, stability or desirability of those tenants. Where a tenant is granted the right to assign its space, the lease agreement generally provides that the original lessee will remain liable for the payment of the lease obligations under that lease agreement.

During 2007, we invested approximately $458.4 million in the acquisition of operating retail properties. Approximately $417.3 million was invested in 13 shopping centers and $41.1 million was invested in four unconsolidated joint ventures to acquire seven retail properties.

A portfolio of six retail properties was purchased in January and March 2007, including five properties in Tucson, Arizona and one in Scottsdale, Arizona. The centers are leased to a diverse mix of national retailers including Wal-Mart, Safeway, Walgreens, Kohl’s, Home Depot, PetSmart and Circuit City. This acquisition added 801,551 square feet to our portfolio and represented a total investment of $140 million. This purchase transaction includes an earnout provision of approximately $29 million that is contingent upon the subsequent development of space by the property seller. This contingency agreement expires in 2010.

Cherokee Plaza, acquired in January 2007, is a 98,553 square foot grocery-anchored neighborhood center located in the prestigious Buckhead area in Atlanta, Georgia. The 100% occupied property is anchored by a 57,000 square foot Kroger.

Sunrise West Shopping Center, acquired in January 2007, is a 76,321 square foot grocery-anchored neighborhood center located in Sunrise (Miami), Florida. This property is anchored by a 44,000 square foot Publix. Cole Park Plaza, acquired in February 2007, is an 82,258 square foot retail development located in Chapel Hill (Durham), North Carolina next to our existing Chatham Crossing shopping center. Both Sunrise and Cole Park were acquired through an existing unconsolidated joint venture with AEW Capital Management.

Oak Grove Market Center, acquired in June 2007, is a 97,207 square foot grocery-anchored shopping center located in Portland, Oregon. The center is anchored by a 53,000 square foot Safeway.

In July 2007, we acquired a portfolio of five retail power centers, adding 1.4 million square feet to our portfolio under management. Three of the retail power centers in Florida, Georgia and Texas were acquired through a new unconsolidated real estate joint venture with PNC Realty Investors on behalf of its institutional client, AFL-CIO Building Investment Trust (the “BIT”). We own 20% of this joint venture with the BIT owning 80%. The remaining two centers, one in Atlanta, Georgia and the other in Chicago, Illinois, were wholly acquired by us.

Countryside Centre, a 242,123 square foot community center located in the St. Petersburg/Clearwater Area of Florida, was also acquired in July 2007. This center is anchored by Albertson’s, TJ Maxx, Home Goods and Shoe Carnival.

Stella Link Shopping Center is a 28,510 square foot shopping center located in Houston, Texas, which was acquired in August 2007. This retail center is adjacent to one of our operating properties, which is anchored by Sellers Brothers and Burke’s Outlet.

The Shoppes at South Semoran is a 101,535 square foot shopping center located in suburban Orlando, Florida, which was acquired in September 2007. This 100% occupied center is anchored by a 57,000 square foot Winn Dixie.

In September 2007, we acquired a 10% interest in Tully Corners Shopping Center through a tenancy-in-common arrangement. This 115,992 square foot grocery-anchored shopping center, located in San Jose, California, is anchored by Save Mart, Petco and Party City.

In October 2007, we acquired a 10% interest in Paradise Key Shopping Center through a tenancy-in-common arrangement. This 271,777 square foot grocery-anchored shopping center is located in Destin, Florida.

In December 2007, we acquired our partner’s 50% interest in Tropicana Beltway located in Las Vegas, Nevada. The center is anchored by Lowe’s and Wal-Mart.

In 2007, we sold 17 shopping centers totaling 1.8 million square feet of building area, of which nine were located in Texas, three in Louisiana, two each in Colorado and Illinois and one in Georgia. Sales proceeds from these dispositions totaled $243.2 million and generated gains of $80.9 million. Three of these shopping centers were each held in a 50% consolidated real estate joint venture. These real estate joint ventures are consolidated in our financial statements because we exercise financial and operating control.

In December 2007, a retail center in Highland Ranch, Colorado was sold. This property was held in a 40%-owned unconsolidated real estate joint venture, and our share of the sales proceeds and gain generated was $11.2 million and $2.2 million, respectively.

Industrial Properties. At December 31, 2007, we owned, either directly or through our interest in real estate joint ventures or partnerships, 77 industrial projects and three other operating properties totaling approximately 17.3 million square feet of building area. Our industrial properties consist of bulk warehouse, business distribution and office-service center assets ranging in size from 13,000 to 727,000 square feet. Similar to our shopping centers, these properties are customarily constructed of masonry, steel and glass, and have lighted, concrete parking areas and are well landscaped. The national and regional tenants in our industrial centers include Hitachi Transport Systems, Sears Logistics, Publix, Shell, Rooms to Go, UPS Supply Chain Solutions, Sanderson Industries, Stone Container, General Electric Company, G.E. Polymershapes, Inc., Interline Brands, Inc., Constar International, Inc., Rooftop Systems Inc., Wells Fargo Bank and Iron Mountain. Our properties are located in California, Florida, Georgia, Tennessee, Texas and Virginia. During 2007, we invested approximately $85.8 million in the acquisition of seven industrial properties and one office building, and $21.2 million was invested in an unconsolidated real estate joint venture to acquire seven industrial properties.

Lakeland Business Park, acquired in January 2007, is a 100% leased 168,400 square foot industrial business center located in Lakeland (Tampa), Florida.

In April and May 2007, we acquired a portfolio of 10 high quality industrial buildings located in Richmond, Virginia for a purchase price of $136 million, including $6 million that is contingent upon the lease up of vacant space by the property seller. This contingency agreement expires in 2009. Eight of the buildings were acquired through an existing 20%-owned unconsolidated joint venture with PNC Realty Investors on behalf of its institutional client the BIT. The remaining two buildings were acquired directly by us. This portfolio added 2.4 million square feet under management.

Town & Country Commerce Center, acquired in June 2007, is a 206,000 square foot industrial distribution center located in Houston, Texas. The property is 100% leased to Arizona Tile and Seitel Solution Tech Center.

Riverview Distribution Center, acquired in August 2007, is a 265,200 square foot industrial center located in Atlanta, Georgia. It is anchored by 109,000 square foot CHEP USA.

In October 2007, we acquired Westlake Industrial Centre, a 154,464 square foot industrial building, and Southpark Industrial Centre, a 234,525 square foot industrial center, both of which are located in Atlanta, Georgia.

In 2007, we sold an industrial distribution center totaling 152,000 square feet and an industrial building totaling 90,000 square feet. Both of these properties are located in Texas. Sales proceeds from these dispositions totaled $10.7 million and generated gains of $3.7 million.

Unimproved Land. At December 31, 2007, we owned 19 parcels of unimproved land consisting of approximately 9.9 million square feet of land area located in Arizona, Louisiana, North Carolina and Texas. These properties include approximately 1.6 million square feet of land adjacent to certain of our existing developed properties, which may be used for expansion of these developments, as well as approximately 8.3 million square feet of land, which may be used for new development. Most of these unimproved properties are served by roads and utilities and are suitable for development as shopping centers or industrial projects, and we intend to emphasize the development of these parcels for such purpose.

New Development Properties. At December 31, 2007, we had 32 projects under construction or in preconstruction stages with an estimated final square footage of approximately 9.1 million. These properties are slated to be completed over the next one to five years.

In 2007, under our merchant development program, we sold two vacant industrial buildings in San Diego, California; one shopping center in Phoenix, Arizona, the River Pointe apartments in Conroe, Texas and 17 parcels of land, of which 11 were located in Texas, three in Arizona and one each in Florida, Louisiana and Tennessee. Sales proceeds from these dispositions totaled $103.0 million and generated gains of $16.4 million. At a 50%-owned unconsolidated joint venture, a land parcel was sold in Liberty Lakes, Washington. Our share of the sales proceeds and the gain generated totaled $1.5 million and $.6 million, respectively.

We are involved in various matters of litigation arising in the normal course of business. While we are unable to predict with certainty the amounts involved, our management and counsel believe that when such litigation is resolved, our resulting liability, if any, will not have a material adverse effect on our consolidated financial statements.

None.

PART II

Our common shares of beneficial interest are listed and traded on the New York Stock Exchange under the symbol "WRI." The number of holders of record of our common shares of beneficial interest as of January 31, 2008 was 3,305. The closing high and low sale prices per common share as reported on the New York Stock Exchange, and dividends per share paid for the fiscal quarters indicated were as follows:

| | | High | | | Low | | | Dividends | |

| | | | | | | | | | |

| 2007: | | | | | | | | | |

| Fourth | | $ | 44.82 | | | $ | 31.44 | | | $ | .495 | |

| Third | | | 42.15 | | | | 36.34 | | | | .495 | |

| Second | | | 49.00 | | | | 40.84 | | | | .495 | |

| First | | | 52.16 | | | | 46.06 | | | | .495 | |

| | | | | | | | | | | | | |

| 2006: | | | | | | | | | | | | |

| Fourth | | $ | 47.83 | | | $ | 42.72 | | | $ | .465 | |

| Third | | | 43.26 | | | | 38.19 | | | | .465 | |

| Second | | | 40.56 | | | | 37.10 | | | | .465 | |

| First | | | 41.76 | | | | 38.66 | | | | .465 | |

The following table summarizes the equity compensation plans under which our common shares of beneficial interest may be issued as of December 31, 2007:

| | | Number of shares to | | Weighted average | | |

| | | be issued upon exercise | | exercise price of | | Number of shares |

| | | of outstanding options, | | outstanding options, | | remaining available |

| Plan category | | warrants and rights | | warrants and rights | | for future issuance |

| | | | | | | |

| Equity compensation plans approved by shareholders | | 2,840,290 | | $ 32.66 | | 2,626,360 |

| | | | | | | |

| Equity compensation plans not approved by shareholders | | ― | | ― | | ― |

| | | | | | | |

| Total | | 2,840,290 | | $ 32.66 | | 2,626,360 |

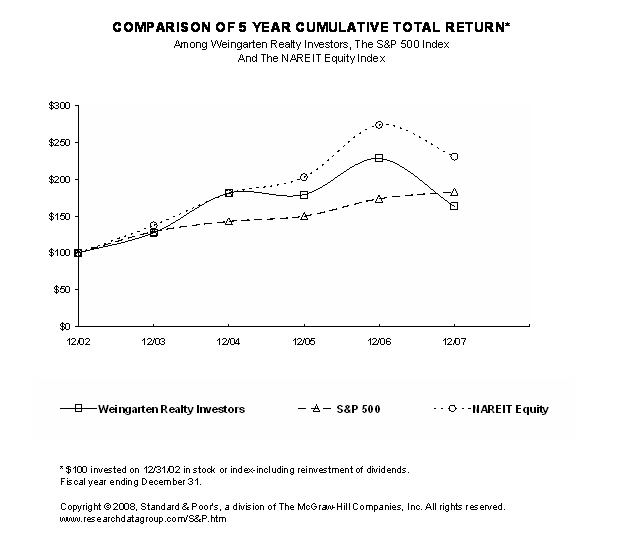

Performance Graph

The graph below provides an indicator of cumulative total shareholder returns for us as compared with the S&P 500 Stock Index and the NAREIT All Equity Index, weighted by market value at each measurement point. The graph assumes that $100 was invested on December 31, 2002 in our common shares of beneficial interest and that all dividends were reinvested by the shareholder.

Comparison of Five Year Cumulative Return

| | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2007 | |

| | | | | | | | | | | | | | | | |

| Weingarten | | | 127.19 | | | | 181.08 | | | | 178.82 | | | | 227.97 | | | | 163.05 | |

| S&P 500 Index | | | 128.68 | | | | 142.69 | | | | 149.70 | | | | 173.34 | | | | 182.87 | |

| The NAREIT All Equity Index | | | 137.13 | | | | 180.44 | | | | 202.38 | | | | 273.34 | | | | 230.45 | |

There can be no assurance that our share performance will continue into the future with the same or similar trends depicted in the graph above. We will not make or endorse any predications as to future share performance.

In July 2007, our Board of Trust Managers authorized a common share repurchase program as part of our ongoing investment strategy. Under the terms of the program, we may purchase up to a maximum value of $300 million of our common shares of beneficial interest during the next two years. Share repurchases may be made in the open market or in privately negotiated transactions at the discretion of management and as market conditions warrant. We anticipate funding the repurchase of shares primarily through the proceeds received from our property disposition program, as well as from general corporate funds.

Repurchases of our common shares of beneficial interest for the quarter ended December 31, 2007 are as follows:

| | | (a) | | | (b) | | | (c) | | | (d) | |

| | | Total | | | Average | | | Total Number of | | | Maximum Dollar | |

| | | Number | | | Price | | | Shares Purchased | | | Value of Shares that | |

| | | of Shares | | | Paid per | | | as Part of Publicly | | | May Yet be Purchased | |

| Period | | Purchased | | | Share | | | Announced Program | | | Under the Program | |

| November 1, 2007 to November 30, 2007 | | | 1,370,073 | | | $ | 36.47 | | | | 1,370,073 | | | $ | 196,715,648 | |

| | | | | | | | | | | | | | | | | |

The following table sets forth our selected consolidated financial data and should be read in conjunction with "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," the Consolidated Financial Statements and accompanying Notes in "Item 8. Financial Statements and Supplementary Data" and the financial schedules included elsewhere in this Form 10-K.

| | | (Amounts in thousands, except per share amounts) | |

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Revenues (primarily real estate rentals) | | $ | 599,054 | | | $ | 538,194 | | | $ | 487,856 | | | $ | 441,144 | | | $ | 361,757 | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 131,708 | | | | 121,471 | | | | 110,956 | | | | 98,727 | | | | 78,139 | |

| Other | | | 201,798 | | | | 174,471 | | | | 146,778 | | | | 137,674 | | | | 110,360 | |

| Total | | | 333,506 | | | | 295,942 | | | | 257,734 | | | | 236,401 | | | | 188,499 | |

| Operating Income | | | 265,548 | | | | 242,252 | | | | 230,122 | | | | 204,743 | | | | 173,258 | |

| Interest Expense | | | (148,829 | ) | | | (145,374 | ) | | | (129,160 | ) | | | (116,142 | ) | | | (90,214 | ) |

| Interest and Other Income | | | 8,486 | | | | 9,044 | | | | 2,860 | | | | 1,389 | | | | 1,562 | |

| Loss on Redemption of Preferred Shares | | | | | | | | | | | | | | | (3,566 | ) | | | (2,739 | ) |

Equity in Earnings of Real Estate Joint Ventures and Partnerships, net | | | 19,853 | | | | 14,655 | | | | 6,610 | | | | 5,384 | | | | 4,681 | |

| Income Allocated to Minority Interests | | | (10,237 | ) | | | (6,414 | ) | | | (6,060 | ) | | | (4,928 | ) | | | (2,723 | ) |

| Gain on Land and Merchant Development Sales | | | 16,385 | | | | 7,166 | | | | 804 | | | | | | | | | |

| Gain on Sale of Properties | | | 4,086 | | | | 22,493 | | | | 22,306 | | | | 1,562 | | | | 667 | |

| Provision for Income Taxes | | | (4,073 | ) | | | (1,366 | ) | | | | | | | | | | | | |

| Income from Continuing Operations | | | 151,219 | | | | 142,456 | | | | 127,482 | | | | 88,442 | | | | 84,492 | |

| Income from Discontinued Operations (1) | | | 86,798 | | | | 162,554 | | | | 92,171 | | | | 52,939 | | | | 31,788 | |

| Net Income | | $ | 238,017 | | | $ | 305,010 | | | $ | 219,653 | | | $ | 141,381 | | | $ | 116,280 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Income Available to Common Shareholders | | $ | 212,642 | | | $ | 294,909 | | | $ | 209,552 | | | $ | 133,911 | | | $ | 97,880 | |

| Per Share Data - Basic: | | | | | | | | | | | | | | | | | | | | |

| Income from Continuing Operations | | $ | 1.47 | | | $ | 1.51 | | | $ | 1.32 | | | $ | 0.94 | | | $ | 0.84 | |

| Net Income | | $ | 2.49 | | | $ | 3.36 | | | $ | 2.35 | | | $ | 1.55 | | | $ | 1.24 | |

| Weighted Average Number of Shares | | | 85,504 | | | | 87,719 | | | | 89,224 | | | | 86,171 | | | | 78,800 | |

| Per Share Data - Diluted: | | | | | | | | | | | | | | | | | | | | |

| Income from Continuing Operations | | $ | 1.46 | | | $ | 1.50 | | | $ | 1.32 | | | $ | 0.94 | | | $ | 0.84 | |

| Net Income | | $ | 2.44 | | | $ | 3.27 | | | $ | 2.31 | | | $ | 1.54 | | | $ | 1.24 | |

| Weighted Average Number of Shares | | | 88,893 | | | | 91,779 | | | | 93,166 | | | | 89,511 | | | | 81,574 | |

| | | | | | | | | | | | | | | | | | | | | |

| Property (at cost) | | $ | 4,972,344 | | | $ | 4,445,888 | | | $ | 4,033,579 | | | $ | 3,751,607 | | | $ | 3,200,091 | |

| Total Assets | | $ | 4,993,343 | | | $ | 4,373,887 | | | $ | 3,737,741 | | | $ | 3,470,318 | | | $ | 2,923,094 | |

| Debt | | $ | 3,165,059 | | | $ | 2,941,039 | | | $ | 2,348,504 | | | $ | 2,138,842 | | | $ | 1,835,126 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Data: | | | | | | | | | | | | | | | | | | | | |

| Cash Flows from Operating Activities | | $ | 223,309 | | | $ | 242,592 | | | $ | 200,525 | | | $ | 203,886 | | | $ | 162,316 | |

| Cash Flows from Investing Activities | | $ | (480,630 | ) | | $ | (314,686 | ) | | $ | (105,459 | ) | | $ | (349,654 | ) | | $ | (331,503 | ) |

| Cash Flows from Financing Activities | | $ | 252,095 | | | $ | 100,407 | | | $ | (97,791 | ) | | $ | 170,928 | | | $ | 168,623 | |

| Cash Dividends per Common Share | | $ | 1.98 | | | $ | 1.86 | | | $ | 1.76 | | | $ | 1.66 | | | $ | 1.56 | |

| | | | | | | | | | | | | | | | | | | | | |

| Funds from Operations: (2) | | | | | | | | | | | | | | | | | | | | |

| Net Income Available to Common Shareholders | | $ | 212,642 | | | $ | 294,909 | | | $ | 209,552 | | | $ | 133,911 | | | $ | 97,880 | |

| Depreciation and Amortization | | | 141,150 | | | | 131,792 | | | | 125,742 | | | | 114,342 | | | | 90,367 | |

| Gain on Sale of Properties | | | (86,076 | ) | | | (172,056 | ) | | | (87,561 | ) | | | (26,316 | ) | | | (7,273 | ) |

| Total | | $ | 267,716 | | | $ | 254,645 | | | $ | 247,733 | | | $ | 221,937 | | | $ | 180,974 | |

| (1) | SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" requires the operating results and gain (loss) on the sale of operating properties to be reported as discontinued operations for all periods presented. |

| (2) | The National Association of Real Estate Investment Trusts defines funds from operations (“FFO”) as net income (loss) available to common shareholders computed in accordance with generally accepted accounting principles, excluding gains or losses from sales of operating real estate assets and extraordinary items, plus depreciation and amortization of operating properties, including our share of unconsolidated real estate joint ventures and partnerships. We calculate FFO in a manner consistent with the NAREIT definition. Management uses FFO as a supplemental measure to conduct and evaluate our business because there are certain limitations associated with using GAAP net income by itself as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, management believes that the presentation of operating results for real estate companies that uses historical cost accounting is insufficient by itself. There can be no assurance that FFO presented by us is comparable to similarly titled measures of other REITs. FFO should not be considered as an alternative to net income or other measurements under GAAP as an indicator of our operating performance or to cash flows from operating, investing or financing activities as a measure of liquidity. FFO does not reflect working capital changes, cash expenditures for capital improvements or principal payments on indebtedness. |

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto and the comparative summary of selected financial data appearing elsewhere in this report. Historical results and trends which might appear should not be taken as indicative of future operations. Our results of operations and financial condition, as reflected in the accompanying consolidated financial statements and related footnotes, are subject to management's evaluation and interpretation of business conditions, retailer performance, changing capital market conditions and other factors which could affect the ongoing viability of our tenants.

Executive Overview

Weingarten Realty Investors is a real estate investment trust (“REIT”) organized under the Texas Real Estate Investment Trust Act. We, and our predecessor entity, began the ownership and development of shopping centers and other commercial real estate in 1948. Our primary business is leasing space to tenants in the shopping and industrial centers we own or lease. We also manage centers for joint ventures in which we are partners or for other outside owners for which we charge fees.

We operate a portfolio of rental properties which includes neighborhood and community shopping centers and industrial properties of approximately 72.8 million square feet. We have a diversified tenant base with our largest tenant comprising only 2.9% of total rental revenues during 2007.

We focus on increasing funds from operations (“FFO”) and growing dividend payments to our common shareholders. We do this through hands-on leasing, management and selected redevelopment of the existing portfolio of properties, through disciplined growth from selective acquisitions and new developments, and through the disposition of assets that no longer meet our ownership criteria. We do this while remaining committed to maintaining a conservative balance sheet, a well-staggered debt maturity schedule and strong credit agency ratings.

We continue to maintain a strong, conservative capital structure, which provides ready access to a variety of attractive capital sources. We carefully balance obtaining low cost financing with minimizing exposure to interest rate movements and matching long-term liabilities with the long-term assets acquired or developed. The turmoil in the current capital markets has adversely affected both the pricing and the availability of certain financial instruments. However, based on our business plan for the upcoming year, we believe that asset dispositions, joint venture relationships and existing capital resources such as our revolving credit facilities will provide adequate capital to execute our business plan.

At December 31, 2007, we owned or operated under long-term leases, either directly or through our interest in real estate joint ventures or partnerships, a total of 383 developed income-producing properties and 32 properties under various stages of construction and development. The total number of centers includes 335 neighborhood and community shopping centers, 77 industrial projects and three other operating properties located in 23 states spanning the country from coast to coast.

We also owned interests in 19 parcels of unimproved land held for future development that totaled approximately 9.9 million square feet.

We had approximately 7,500 leases with 5,700 different tenants at December 31, 2007.

Leases for our properties range from less than a year for smaller spaces to over 25 years for larger tenants. Rental revenues generally include minimum lease payments, which often increase over the lease term, reimbursements of property operating expenses, including ad valorem taxes, and additional rent payments based on a percentage of the tenants' sales. The majority of our anchor tenants are supermarkets, value-oriented apparel/discount stores and other retailers or service providers who generally sell basic necessity-type goods and services. We believe stability of our anchor tenants, combined with convenient locations, attractive and well-maintained properties, high quality retailers and a strong tenant mix, should ensure the long-term success of our merchants and the viability of our portfolio.

In assessing the performance of our properties, management carefully tracks the occupancy of the portfolio. Occupancy for the total portfolio was 94.4% at December 31, 2007 compared to 94.1% at December 31, 2006. Historically, occupancy for the total portfolio has never fallen below 90.0%. We expect our existing portfolio occupancy to continue at this level due to our tenant diversification and a strong tenant anchor base in 2008. Another important indicator of performance is the spread in rental rates on a same-space basis as we complete new leases and renew existing leases. We completed 1,261 new leases or renewals during 2007 totaling 7.0 million square feet, increasing rental rates an average of 10.3% on a cash basis.

In the first quarter of 2006, we articulated a new long-term growth strategy with a planned three-year implementation. The key elements of this strategy are as follows:

| | · | A much greater focus on new development, including merchant development, with $300 million in annual new development completions beginning in 2009. |

| | · | Increased use of joint ventures for acquisitions including the recapitalization (or partial sale) of existing assets, which provide the opportunity to further increase returns on investment through the generation of fee income from leasing and management services we will provide to the venture. |

| | · | Further recycling capital through the active disposition of non-core properties and reinvesting the proceeds into properties with barriers to entry within high growth metropolitan markets. This, combined with our continuous focus on our assets, produces a higher quality portfolio with higher occupancy rates and much stronger internal revenue growth. |

During 2007 and 2006, we made excellent progress in the execution of this long-term growth strategy as described in the following sections on new development, acquisitions and joint ventures and dispositions.

New Development

At December 31, 2007, we had 32 properties in various stages of development, including our merchant development program, which is up from 26 properties under development a year ago. We have invested $341.0 million to-date on these projects and, at completion we estimate our total investment to be $628.7 million. These properties are slated to open over the next one to five years with a projected return on investment of approximately 9% when completed.

In addition to these projects, we have a development pipeline with eight development sites under contract, which will represent a projected investment of approximately $178 million. Due to current economic factors, obtaining new projects over the next year may prove challenging as potential retail anchors are delaying their expansion plans due to the softening of the economy. We will continue to seek opportunities and monitor this market closely.

Merchant development is a new program in which we develop a project with the objective of selling all or part of it, instead of retaining it in our portfolio on a long-term basis. Also, disposition of land parcels and non-operating properties are included in this program. We generated gains of approximately $16.4 million from this program during 2007. We expect to generate similar gains in 2008 and throughout future years.

Acquisitions and Joint Ventures

During 2007, we acquired 20 shopping centers, 14 industrial properties, our partner’s 50% interest in a retail center and one other operating property for a purchase price of approximately $565 million. Included in that total were seven retail properties and seven industrial properties purchased as part of unconsolidated real estate joint ventures. It is possible that, consistent with our strategy, some of the other acquired properties will also be contributed to future joint ventures.

Acquisitions are a key component of our strategy. However, the turmoil in the credit markets has significantly reduced transactions in the marketplace and, therefore, created uncertainty with respect to pricing. Partnering with institutional investors through joint ventures enables us to acquire high quality assets in our target markets while also meeting our financial return objectives. We benefit from access to lower-cost capital, as well as leveraging our expertise to provide fee-based services such as the acquisition, leasing and management of properties, to the joint ventures.

Joint venture fee income for 2007 was approximately $8.2 million or an increase of $5.7 million over 2006. This is a direct result of our strategy initiative to develop new joint venture relationships. We expect continued strong growth in joint venture income during the upcoming year.

Dispositions

During 2007, we sold 17 shopping centers, one industrial distribution center and one industrial building for $253.9 million. Also, one shopping center in an unconsolidated joint venture was sold, of which our share of the sales proceeds totaled $11.2 million. Although lenders for prospective acquirers have tightened their underwriting criteria, we expect to continue to dispose of non-core properties during the coming year as opportunities present themselves. Dispositions are part of an ongoing portfolio management process where we prune our portfolio of properties that do not meet our geographic or growth targets and provide capital to recycle into properties that have barrier-to-entry locations within high growth metropolitan markets. Over time, we expect this to produce a portfolio with higher occupancy rates and much stronger internal revenue growth.

Summary of Critical Accounting Policies

Our discussion and analysis of financial condition and results of operations is based on our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities and contingencies as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We evaluate our assumptions and estimates on an ongoing basis. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our more significant judgments and estimates used in the preparation of our consolidated financial statements.

Revenue Recognition

Rental revenue is generally recognized on a straight-line basis over the life of the lease, which begins the date the leasehold improvements are substantially complete, if owned by us, or the date the tenant takes control of the space, if the leasehold improvements are owned by the tenant. Revenue from tenant reimbursements of taxes, maintenance expenses and insurance is recognized in the period the related expense is recognized. Revenue based on a percentage of tenants' sales is recognized only after the tenant exceeds their sales breakpoint. In addition, in circumstances where we would provide a tenant improvement allowance for improvements that are owned by the tenant, we would recognize the allowance as a reduction of rental revenue on a straight-line basis over the term of the lease. Other revenue is income from contractual agreements with third parties, tenants or partially owned real estate joint ventures or partnerships, which is recognized as the related services are performed under the respective agreements.

Real Estate Joint Ventures and Partnerships

To determine the method of accounting for partially owned real estate joint ventures and partnerships, we first apply the guidelines set forth in Financial Accounting Standards Board (“FASB”) Interpretation No. 46R, "Consolidation of Variable Interest Entities." Based upon our analysis, we have determined that we have no interests in variable interest entities.

Partially owned real estate joint ventures and partnerships over which we exercise financial and operating control are consolidated in our financial statements. In determining if we exercise financial and operating control, we consider factors such as ownership interest, authority to make decisions, kick-out rights and substantive participating rights. Partially owned real estate joint ventures and partnerships where we have the ability to exercise significant influence, but do not exercise financial and operating control, are accounted for using the equity method.

Our investments in partially owned real estate joint ventures and partnerships are reviewed for impairment, periodically, if events or circumstances change indicating that the carrying amount of our investments may not be recoverable. The ultimate realization of our investments in partially owned real estate joint ventures and partnerships is dependent on a number of factors, including the performance of each investment and market conditions. We will record an impairment charge if we determine that a decline in the value of an investment is other than temporary.

Property

Real estate assets are stated at cost less accumulated depreciation, which, in the opinion of management, is not in excess of the individual property's estimated undiscounted future cash flows, including estimated proceeds from disposition. Depreciation is computed using the straight-line method, generally over estimated useful lives of 18-40 years for buildings and 10-20 years for parking lot surfacing and equipment. Major replacements where the betterment extends the useful life of the asset are capitalized, and the replaced asset and corresponding accumulated depreciation are removed from the accounts. All other maintenance and repair items are charged to expense as incurred. If we do not allocate these costs appropriately or incorrectly estimate the useful lives of our real estate, depreciation expense may be misstated.

Acquisitions of properties are accounted for utilizing the purchase method and, accordingly, the results of operations of an acquired property are included in our results of operations from the date of acquisition. We have used estimates of future cash flows and other valuation techniques to allocate the purchase price of acquired property among land, buildings on an "as if vacant" basis, tenant improvements and other identifiable intangibles. Current economic and operational property conditions, known trends and changes expected in current market conditions are considered in the estimates of future cash flows used for purchase price allocation purposes. Other identifiable intangible assets and liabilities include the effect of out-of-market leases, the value of having leases in place (“as is” versus “as if vacant” and absorption costs), out-of-market assumed mortgages and tenant relationships. Depreciation and amortization is computed using the straight-line method, generally over estimated useful lives of 40 years for buildings and one to 25 years for other identifiable intangible assets. The impact of these estimates could result in significant differences related to the purchased assets, liabilities and resulting depreciation or amortization. Initial valuations are subject to change until such information is finalized, no later than 12 months from the acquisition date. The impact of incorrect estimates in connection with acquisition asset values and related estimated useful lives could be material to our consolidated financial statements.

Property also includes costs incurred in the development of new operating properties and properties in our merchant development program. Merchant development is a new program in which we develop a project with the objective of selling all or part of it, instead of retaining it in our portfolio on a long-term basis. Also, disposition of land parcels and non-operating properties are included in this program. These properties are carried at cost and no depreciation is recorded on these assets until the commencement of rental revenue or no later than one year from the completion of major construction. These costs include pre-acquisition costs directly identifiable with the specific project, development and construction costs, interest and real estate taxes. Indirect development costs, including salaries and benefits, travel and other related costs that are directly attributable to the development of the property, are also capitalized. The capitalization of such costs ceases at the earlier of one year from the completion of major construction or when the property, or any completed portion, becomes available for occupancy.

Property also includes costs for tenant improvements paid by us, including reimbursements to tenants for improvements that are owned by us and will remain our property after the lease expires.

Our properties are reviewed for impairment if events or changes in circumstances indicate that the carrying amount of the property, including any identifiable intangible assets, may not be recoverable. In such an event, a comparison is made of the current and projected operating cash flows of each such property into the foreseeable future on an undiscounted basis to the carrying amount of such property. Our overall future plans for a property and our views on current market and economic conditions may have a significant impact on the resulting estimated future cash flows of a property that are analyzed for these purposes. The property carrying amount is adjusted, if necessary, to the estimated fair value to reflect an impairment in the value of the asset.

Interest Capitalization

Interest is capitalized on land under development and buildings under construction based on rates applicable to borrowings outstanding during the period and the weighted average balance of qualified assets under development/construction during the period. Differences in methodologies to calculate applicable interest rates and the cost of qualified assets can yield significant differences in the amounts capitalized and, as a result, the amount of depreciation recognized.

Deferred Charges

Debt and lease costs are amortized primarily on a straight-line basis, which approximates the effective interest method, over the terms of the debt and over the lives of leases, respectively. Lease costs represent the initial direct costs incurred in origination, negotiation and processing of a lease agreement. Such costs include outside broker commissions and other independent third party costs, as well as salaries and benefits, travel and other internal costs directly related to completing the leases. Costs related to supervision, administration, unsuccessful origination efforts and other activities not directly related to completed lease agreements are charged to expense as incurred. Differences in methodologies to calculate and defer these costs can yield differences in the amounts deferred and, accordingly, the amount of amortization recognized.

Sales of Real Estate

Sales of real estate include the sale of shopping center pads, property adjacent to shopping centers, shopping center properties, merchant development properties, investments in real estate joint ventures and partnerships and partial sales to real estate joint ventures and partnerships in which we participate.

We recognize profit on sales of real estate, including merchant development sales, in accordance with FASB’s Statement of Financial Accounting Standards (“SFAS”) No. 66 (“SFAS 66”), “Accounting for Sales of Real Estate.” Profits are not recognized until (a) a sale is consummated; (b) the buyer’s initial and continuing investments are adequate to demonstrate a commitment to pay; (c) the seller’s receivable is not subject to future subordination; and (d) we have transferred to the buyer the usual risks and rewards of ownership in the transaction, and we do not have a substantial continuing involvement with the property.

We recognize gains on the sale of real estate to joint ventures and partnerships in which we participate to the extent we receive cash from the joint venture or partnership, if it meets the sales criteria in accordance with SFAS 66 and we do not have a commitment to support the operations of the real estate joint venture or partnership to an extent greater than our proportionate interest in the real estate joint venture or partnership..

Accrued Rent and Accounts Receivable

Receivable balances outstanding include base rents, tenant reimbursements and receivables attributable to the straight-lining of rental commitments. An allowance for the uncollectible portion of accrued rents and accounts receivable is determined based upon an analysis of balances outstanding, historical bad debt levels, tenant credit worthiness and current economic trends. Additionally, estimates of the expected recovery of pre-petition and post-petition claims with respect to tenants in bankruptcy are considered in assessing the collectibility of the related receivables. As these factors change, the allowance is subject to revision and may impact the results of operations.

Income Taxes

We have elected to be treated as a REIT under the Internal Revenue Code of 1986, as amended. As a REIT, we generally will not be subject to corporate level federal income tax on taxable income we distribute to our shareholders. To be taxed as a REIT, we must meet a number of requirements including defined percentage tests concerning the amount of our assets and revenues that come from, or are attributable to, real estate operations. As long as we distribute at least 90% of the taxable income of the REIT to our shareholders as dividends, we will not be taxed on the portion of our income we distribute as dividends unless we have ineligible transactions.

The Tax Relief Extension Act of 1999 gave REITs the ability to conduct activities which a REIT was previously precluded from doing as long as such activities are performed in entities which have elected to be treated as taxable REIT subsidiaries under the IRS code. These activities include buying or developing properties with the express purpose of selling them. We conduct certain of these activities in taxable REIT subsidiaries that we have created. We calculate and record income taxes in our consolidated financial statements based on the activities in those entities. We also record deferred taxes for the temporary tax differences that have resulted from those activities as required under SFAS No. 109, “Accounting for Income Taxes.” We use estimates in preparing our deferred tax amounts and if revised, these estimates could impact our results of operations.

Results of Operations

Comparison of the Year Ended December 31, 2007 to the Year Ended December 31, 2006

Revenues

Total revenues were $599.1 million for the year ended 2007 versus $538.2 million for the year ended 2006, an increase of $60.9 million or 11.3%. This increase resulted primarily from an increase in rental revenues of $54.4 million and other income of $6.5 million.

Property acquisitions and new development activity contributed $56.6 million of the rental income increase with $5.3 million resulting from 1,261 renewals and new leases, comprising 7.0 million square feet at an average rental rate increase of 10.3%. Offsetting these rental income increases was a decrease of $7.5 million, which resulted from the sale of an 80% interest in five industrial centers in the third quarter of 2006.

Occupancy (leased space) of the portfolio as compared to the prior year was as follows:

| | | December 31, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

| Shopping Centers | | | 95.1 | % | | | 95.0 | % |

| Industrial | | | 92.0 | % | | | 91.2 | % |

| Total | | | 94.4 | % | | | 94.1 | % |

Other income increased by $6.5 million from the prior year. This increase resulted primarily from the increase in joint venture fee income of $5.7 million and miscellaneous tenant revenue of $.8 million.

Expenses

Total expenses for 2007 were $333.5 million versus $295.9 million in 2006, an increase of $37.6 million or 12.7%.

The increases in 2007 for depreciation and amortization expense ($10.2 million), operating expenses ($18.3 million), ad valorem taxes ($5.9 million) and general and administrative expenses ($3.2 million) were primarily a result of the properties acquired and developed during the year, an increase in property insurance expenses as a result of the hurricanes experienced in 2005, and increases associated with additional headcount needed to achieve growth in the portfolio. Overall, direct operating costs and expenses (operating and ad valorem tax expense) of operating our properties as a percentage of rental revenues were 29.8% in 2007 and 28.4% in 2006.

Interest Expense

Interest expense totaled $148.8 million for 2007, up $3.5 million or 2.4% from 2006. The components of interest expense were as follows (in thousands):

| | | Year Ended December 31, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

| Gross interest expense | | $ | 180,612 | | | $ | 160,454 | |

| Over-market mortgage adjustment of acquired properties | | | (6,758 | ) | | | (7,464 | ) |

| Capitalized interest | | | (25,025 | ) | | | (7,616 | ) |

| | | | | | | | | |

| Total | | $ | 148,829 | | | $ | 145,374 | |

Gross interest expense totaled $180.6 million in 2007, up $20.2 million or 12.6% from 2006. The increase in gross interest expense was due to an increase in the average debt outstanding from $2.5 billion in 2006 to $3.0 billion in 2007 at a weighted average interest rate of 5.9% in 2007 and 6.0% for 2006. Capitalized interest increased $17.4 million due to an increase in new development activity, and the over-market mortgage adjustment decreased by $.7 million.

Equity in Earnings of Real Estate Joint Ventures and Partnerships, net

Our equity in earnings of real estate joint ventures and partnerships was $19.9 million in 2007 versus $14.7 million in 2006, an increase of $5.2 million or 35.4%. This increase was attributable primarily to our incremental income from our investments in newly formed joint ventures for the acquisition and development of retail and industrial properties.

Income Allocated to Minority Interests

Income allocated to minority interests was $10.2 million in 2007 versus $6.4 million in 2006, an increase of $3.8 million or 59.4%. This increase resulted primarily from the gain on sale of three shopping centers that were each held in a 50%-owned consolidated entity. .

Gain on Sale of Properties

The decrease in gain on sale of properties of $18.4 million resulted primarily from the sale of an 80% interest in five industrial properties in the San Diego, Memphis and Atlanta markets in 2006.

Gain on Land and Merchant Development Sales

Gain on land and merchant development sales totaled $16.4 million in 2007. We sold two vacant industrial buildings in San Diego, California; one shopping center in Phoenix, Arizona, the River Pointe apartments in Conroe, Texas and 17 parcels of land, of which 11 are located in Texas, three in Arizona and one each in Florida, Louisiana and Tennessee. The activity in 2006 of $7.1 million resulted from the disposition of the Timber Springs shopping center in Orlando, Florida and the sale of three parcels of land in Arizona (1) and Texas (2).

Provision for Income Taxes

The increase is attributable to an increase of $1.9 million in the Texas margin tax, which was enacted in the second quarter of 2006 and an increase of $.8 million at our taxable REIT subsidiary.

Income from Discontinued Operations

Income from discontinued operations was $86.8 million in 2007 versus $162.6 million in 2006, a decrease of $75.8 million or 46.6%. This decrease was due primarily to the decrease in gain on sale of 17 properties in 2007 as compared to the gain on sale of 23 properties in 2006. Also, the income from discontinued operations for 2006 includes the operating results of the properties disposed of in 2007.

Results of Operations

Comparison of the Year Ended December 31, 2006 to the Year Ended December 31, 2005

Revenues

Total revenues increased by $50.3 million or 10.3% in 2006 ($538.2 million in 2006 versus $487.9 million in 2005). This increase resulted primarily from the increase in rental revenues of $49.8 million or 10.3%.

Property acquisitions and new development activity contributed $35.6 million of the rental income increase. The remaining increase of $14.2 million resulted from 1,264 renewals and new leases, comprising 6.1 million square feet at an average rental rate increase of 7.5%.

Occupancy (leased space) of the portfolio as compared to the prior year was as follows:

| | | December 31, | |

| | | 2006 | | | 2005 | |

| | | | | | | |

| Shopping Centers | | | 95.0 | % | | | 94.6 | % |

| Industrial | | | 91.2 | % | | | 93.1 | % |

| Total | | | 94.1 | % | | | 94.2 | % |

Expenses

Total expenses increased by $38.2 million or 14.8% in 2006 ($295.9 million in 2006 versus $257.7 million in 2005).

The increases in 2006 for depreciation and amortization expense ($10.5 million), operating expenses ($14.8 million) and ad valorem taxes ($6.5 million) and general and administrative expense ($6.4 million) were primarily a result of the properties acquired and developed during the year, an increase in property insurance expenses as a result of the hurricanes experienced in 2005 and increases associated with headcount increases to support the growth of the portfolio. Overall, direct operating costs and expenses (operating and ad valorem tax expense) of operating our properties as a percentage of rental revenues were 28.4% in 2006 and 26.9% in 2005.

Interest Expense

Interest expense totaled $145.4 million for 2006, up $16.2 million or 12.6% from 2005. The components of interest expense were as follows (in thousands):

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | |

| | | | | | | |

| Gross interest expense | | $ | 160,454 | | | $ | 138,845 | |

| Over-market mortgage adjustment of acquired properties | | | (7,464 | ) | | | (7,056 | ) |

| Capitalized interest | | | (7,616 | ) | | | (2,629 | ) |

| | | | | | | | | |

| Total | | $ | 145,374 | | | $ | 129,160 | |

Gross interest expense totaled $160.5 million in 2006, up $21.6 million or 15.6% from 2005. The increase in gross interest expense was due to an increase in the average debt outstanding from $2.2 billion in 2005 to $2.5 billion in 2006 at a weighted average interest rate of 6.0% in 2006 and 6.1% for 2005. Capitalized interest increased $5.0 million due to an increase in new development activity, and the over-market mortgage adjustment increased by $.4 million.

Interest and Other Income

Interest and other income was $9.0 million in 2006 versus $2.9 million in 2005, an increase of $6.1 million or 210.3%. This increase was attributable to interest earned from a qualified escrow account for the purposes of completing like-kind exchanges, construction loans associated with our new development activities, excess proceeds from our $575 million Convertible Debt Offering and assets held in a grantor trust related to our deferred compensation plan.

Equity in Earnings of Real Estate Joint Ventures and Partnerships, net

Equity in earnings of real estate joint ventures and partnerships increased by $8.1 million or 122.7% in 2006 ($14.7 million in 2006 versus $6.6 million in 2005). This increase was attributable primarily to our share of the gains generated from the disposition of two shopping centers in Texas totaling $4.0 million, a gain of $1.1 million associated with land and merchant development activities in Texas and Washington and incremental income from our investments in newly formed joint ventures in 2005 and 2006 for the acquisition and development of retail and industrial properties.

Gain on Sale of Properties

The gain of $22.5 million and $22.3 million in 2006 and 2005, respectively, resulted primarily from the sale of an 80% interest in five industrial properties in the San Diego, Memphis and Atlanta markets and two retail centers in Louisiana, respectively, in which we retained a continuing 20% operating interest.

Gain on Land and Merchant Development Sales

Gain on land and merchant development sales of $7.1 million in 2006 resulted from the gain from the sale of the Timber Springs shopping center in Orlando, Florida and the sale of three parcels of land in Arizona (1) and Texas (2). The activity in 2005 resulted from the sale of a parcel of land in Orlando, Florida.

Provision for Income Taxes

The amount reported in 2006 includes the tax expense in our taxable REIT subsidiary and the deferred tax impact attributable to the Texas margin tax enacted in the second quarter of 2006.

Income from Discontinued Operations

Income from discontinued operations increased by $70.4 million ($162.6 million in 2006 versus $92.2 million in 2005). This increase was due to the disposition of 23 properties totaling 3.5 million square feet that provided sales proceeds of $308.2 million and generated gains of $145.5 million. The 2005 caption includes the operating results of properties disposed in 2007 and 2006 plus the disposition of 16 properties and a vacant building totaling 1.3 million square feet in 2005. The 2005 dispositions provided sales proceeds of $133.8 million and generated gains of $65.5 million.

Effects of Inflation

We have structured our leases in such a way as to remain largely unaffected should significant inflation occur. Most of the leases contain percentage rent provisions whereby we receive increased rentals based on the tenants' gross sales. Many leases provide for increasing minimum rentals during the terms of the leases through escalation provisions. In addition, many of our leases are for terms of less than 10 years, which allow us to adjust rental rates to changing market conditions when the leases expire. Most of our leases also require the tenants to pay their proportionate share of operating expenses and ad valorem taxes. As a result of these lease provisions, increases due to inflation, as well as ad valorem tax rate increases, generally do not have a significant adverse effect upon our operating results as they are absorbed by our tenants.

Capital Resources and Liquidity

Our primary liquidity needs are payment of our common and preferred dividends, maintaining and operating our existing properties, payment of our debt service costs and funding planned growth. We anticipate that cash flows from operating activities will continue to provide adequate capital for all common and preferred dividend payments and debt service costs, as well as the capital necessary to maintain and operate our existing properties. We do not anticipate that the current turmoil in the capital markets will have a significant effect on our ability to obtain capital or to execute our business plan. We believe that asset dispositions, real estate joint venture relationships and existing capital resources such as our revolving credit facilities will provide adequate capital. Our most restrictive debt covenants limit the amount of additional leverage we can add, however, we believe the sources of capital described above are adequate to execute our current business plan and remain in compliance with our debt covenants.

Primary sources of capital for funding our acquisitions and new development programs are our revolving credit facilities, cash generated from sales of properties, transactions with venture partners, cash flow generated by our operating properties and proceeds from capital issuances as needed. Amounts outstanding under the revolving credit agreement are retired as needed with proceeds from the issuance of long-term debt, common and preferred equity, cash generated from dispositions of properties and cash flow generated by our operating properties. As of December 31, 2007, the balance outstanding under our $575 million revolving credit facility was $255.0 million, and no amounts were outstanding under our $30 million credit facility, which we use for cash management purposes.

Our capital structure also includes non-recourse secured debt that we assume in conjunction with our acquisitions program. We also have non-recourse debt secured by acquired or developed properties held in several of our real estate joint ventures and partnerships. We hedge the future cash flows of certain debt transactions, as well as changes in the fair value of our debt instruments, principally through interest rate swaps with major financial institutions. We generally have the right to sell or otherwise dispose of our assets except in certain cases where we are required to obtain a third party consent, such as assets held in entities in which we have less than 100% ownership.

Investing Activities:

Acquisitions

Retail Properties.

A portfolio of six retail properties was purchased in January and March 2007, including five properties in Tucson, Arizona and one in Scottsdale, Arizona. The centers are leased to a diverse mix of national retailers including Wal-Mart, Safeway, Walgreens, Kohl’s, Home Depot, PetSmart and Circuit City. This acquisition added 801,551 square feet to our portfolio and represented a total investment of $140 million. This purchase transaction includes an earnout provision of approximately $29 million that is contingent upon the subsequent development of space by the property seller. This contingency agreement expires in 2010.

Cherokee Plaza, acquired in January 2007, is a 98,553 square foot grocery-anchored neighborhood center located in the prestigious Buckhead area in Atlanta, Georgia. The 100% occupied property is anchored by a 57,000 square foot Kroger.

Sunrise West Shopping Center, acquired in January 2007, is a 76,321 square foot grocery-anchored neighborhood center located in Sunrise (Miami), Florida. This property is anchored by a 44,000 square foot Publix. Cole Park Plaza, acquired in February 2007, is an 82,258 square foot retail development located in Chapel Hill (Durham), North Carolina next to our existing Chatham Crossing shopping center. Both Sunrise and Cole Park were acquired through an existing unconsolidated joint venture with AEW Capital Management.

Oak Grove Market Center, acquired in June 2007, is a 97,207 square foot grocery-anchored shopping center located in Portland, Oregon. The center is anchored by a 53,000 square foot Safeway.

In July 2007, we acquired a portfolio of five retail power centers, adding 1.4 million square feet to our portfolio under management. Three of the retail power centers in Florida, Georgia and Texas were acquired through a new unconsolidated real estate joint venture with PNC Realty Investors on behalf of its institutional client, AFL-CIO Building Investment Trust (the “BIT”). We own 20% of this joint venture with the BIT owning 80%. The remaining two centers, one in Atlanta, Georgia and the other in Chicago, Illinois, were wholly acquired by us.

Countryside Centre, a 242,123 square foot community center located in the St. Petersburg/Clearwater Area of Florida, was also acquired in July 2007. This center is anchored by Albertson’s, TJ Maxx, Home Goods and Shoe Carnival.

Stella Link Shopping Center is a 28,510 square foot shopping center located in Houston, Texas, which was acquired in August 2007. This retail center is adjacent to one of our operating properties, which is anchored by Sellers Brothers and Burke’s Outlet.

The Shoppes at South Semoran is a 101,535 square foot shopping center located in suburban Orlando, Florida, which was acquired in September 2007. This 100% occupied center is anchored by a 57,000 square foot Winn Dixie.

In September 2007, we acquired a 10% interest in Tully Corners Shopping Center through a tenancy-in-common arrangement. This 115,992 square foot grocery-anchored shopping center, located in San Jose, California, is anchored by Save Mart, Petco and Party City.

In October 2007, we acquired a 10% interest in Paradise Key Shopping Center through a tenancy-in-common arrangement. This 271,777 square foot grocery-anchored shopping center is located in Destin, Florida.

In December 2007, we acquired our partner’s 50% interest in Tropicana Beltway located in Las Vegas, Nevada. The center is anchored by Lowe’s and Wal-Mart.

Industrial Properties.

Lakeland Business Park, acquired in January 2007, is a 100% leased 168,400 square foot industrial business center located in Lakeland (Tampa), Florida.

In April and May 2007, we acquired a portfolio of 10 high quality industrial buildings located in Richmond, Virginia for a purchase price of $136 million, including $6 million that is contingent upon the lease up of vacant space by the property seller. This contingency agreement expires in 2009. Eight of the buildings were acquired through an existing 20%-owned unconsolidated joint venture with PNC Realty Investors on behalf of its institutional client the BIT. The remaining two buildings were acquired directly by us. This portfolio added 2.4 million square feet under management.

Town & Country Commerce Center, acquired in June 2007, is a 206,000 square foot industrial distribution center located in Houston, Texas. The property is 100% leased to Arizona Tile and Seitel Solution Tech Center.

Riverview Distribution Center, acquired in August 2007, is a 265,200 square foot industrial center located in Atlanta, Georgia. It is anchored by 109,000 square foot CHEP USA.

In October 2007, we acquired Westlake Industrial Centre, a 154,464 square foot industrial building, and Southpark Industrial Centre, a 234,525 square foot industrial center, both of which are located in Atlanta, Georgia.

The cash requirements for these acquisitions were initially financed under our revolving credit facilities, using available cash generated from dispositions of properties or using cash flow generated by our operating properties.

Dispositions

Retail Properties.

In 2007, we sold 17 shopping centers totaling 1.8 million square feet of building area, of which nine were located in Texas, three in Louisiana, two each in Colorado and Illinois and one in Georgia. Sales proceeds from these dispositions totaled $243.2 million and generated gains of $80.9 million. Three of these shopping centers were each held in a 50% consolidated real estate joint venture. These real estate joint ventures are consolidated in our financial statements because we exercise financial and operating control.

In December 2007, a retail center in Highland Ranch, Colorado was sold. This property was held in a 40%-owned unconsolidated joint venture, and our share of the sales proceeds and the gain generated was $11.2 million and $2.2 million, respectively.

Industrial Properties.

In 2007, we sold an industrial distribution center totaling 152,000 square feet and an industrial building totaling 90,000 square feet. Both of these properties are located in Texas. Sales proceeds from these dispositions totaled $10.7 million and generated gains of $3.7 million.

New Development and Capital Expenditures

At December 31, 2007, we had 32 projects under construction or in preconstruction stages with an estimated final square footage of approximately 9.1 million. These properties are slated to be completed over the next one to five years.

In 2007, under our merchant development program, we sold two vacant industrial buildings in San Diego, California; one shopping center in Phoenix, Arizona, the River Pointe apartments in Conroe, Texas and 17 parcels of land, of which 11 are located in Texas, three in Arizona and one each in Florida, Louisiana and Tennessee. Sales proceeds from these dispositions totaled $103.0 million and generated gains of $16.4 million. At a 50%-owned unconsolidated joint venture, a land parcel was sold in Liberty Lakes, Washington. Our share of the sales proceeds and the gain generated totaled $1.5 million and $.6 million, respectively.

Our new development projects are financed initially under our revolving credit facilities, using available cash generated from dispositions of properties or using cash flow generated by our operating properties.

Capital expenditures for additions to the existing portfolio, acquisitions, new development and our share of investments in unconsolidated real estate joint ventures and partnerships totaled $1.1 billion in both 2007 and 2006 and $455.1 million in 2005. We expect to invest approximately $127.0 million in 2008, $100.5 million in 2009, $53.3 million in 2010, $7.8 million in 2011 and $1.4 million in 2012 to complete construction of 32 properties under various stages of development. We also expect to invest $8.3 million to acquire projects in 2008 and $1.8 in 2009.

Financing Activities:

Debt

Total debt outstanding increased to $3.2 billion at December 31, 2007 from $2.9 billion at December 31, 2006. Total debt at December 31, 2007 included $2.8 billion of which interest rates are fixed and $321.7 million, including the effect of $50 million of interest rate swaps, that bears interest at variable rates. Additionally, debt totaling $1.1 billion was secured by operating properties while the remaining $2.1 billion was unsecured.

In November 2007, we increased our revolving credit facility from $400 million to $575 million and amended certain covenants of this facility. This unsecured revolving credit facility held by a syndicate of banks expires in February 2010 and provides a one-year extension option available at our request. Borrowing rates under this facility float at a margin over LIBOR, plus a facility fee. The borrowing margin and facility fee, which are currently 42.5 and 15.0 basis points, respectively, are priced off a grid that is tied to our senior unsecured credit rating. This facility includes a competitive bid feature where we are allowed to request bids for borrowings up to $287.5 million from the syndicate banks. As of February 15, 2008, there was $380.0 million outstanding under this facility. We also maintain a $30 million unsecured and uncommitted overnight facility that is used for cash management purposes, and as of February 15, 2008, there was no outstanding balance under this facility. The available balance under our revolving credit agreement was $184.6 million at February 15, 2008, which is reduced by amounts outstanding for letters of credit and our overnight facility. We are in full compliance with the covenants of our unsecured revolving credit facilities as of December 31, 2007.

In January 2008, we elected to repay at par a fixed rate 8.33% mortgage totaling $121.8 million that was secured by 19 supermarket-anchored shopping centers in California originally acquired in April 2001.

In August 2006, we issued $575 million of 3.95% convertible senior unsecured notes due 2026. The net proceeds from the sale of the debentures, after repurchasing 4.3 million of our common shares of beneficial interest, were used for general business purposes and to reduce amounts outstanding under our revolving credit facility. The debentures are convertible under certain circumstances for our common shares of beneficial interest at an initial conversion rate of 20.3770 common shares of beneficial interest per $1,000 of principal amount of debentures (an initial conversion price of $49.075). Upon the conversion of debentures, we will deliver cash for the principal return, as defined, and cash or common shares of beneficial interest, at our option, for the excess of the conversion value, as defined, over the principal return. The debentures are redeemable for cash at our option beginning in 2011 for the principal amount plus accrued and unpaid interest. Holders of the debentures have the right to require us to repurchase their debentures for cash equal to the principal of the debentures plus accrued and unpaid interest in 2011, 2016 and 2021 and in the event of a change in control.

In December 2006, we issued $75 million of 10-year unsecured fixed rate medium term notes at 6.1% including the effect of an interest rate swap that had hedged the transaction. Proceeds from this issuance were used to repay balances under our revolving credit facilities, to cash settle a forward hedge and for general business purposes.

In May 2006, we entered into a forward-starting interest rate swap with a notional amount of $74.0 million. In December 2006, we terminated this interest rate swap in conjunction with the issuance of the $75.0 million of medium term notes. The termination fee of $4.1 million is being amortized over the life of the medium term note.

At December 31, 2007, we had two interest rate swap contracts designated as fair value hedges with an aggregate notional amount of $50.0 million that convert fixed rate interest payments at rates of 4.2% to variable interest payments. Also, at December 31, 2007, we had two forward-starting interest rate swap contracts with an aggregate notional amount of $118.6 million. These contracts have been designated as cash flow hedges and mitigate the risk of increasing interest rates on forecasted long-term debt issuances over a maximum period of two years. We could be exposed to losses in the event of nonperformance by the counter-parties; however, management believes the likelihood of such nonperformance is remote.

In July, November and December 2007, swaps of $10 million, $5 million and $10 million, respectively, matured in conjunction with the maturity of the associated medium term notes. These hedge contracts were designated as a fair value hedges.

In conjunction with acquisitions completed during 2007, we assumed $99.4 million of non-recourse debt secured by the related properties. A capital lease obligation totaling $12.9 million was assumed and subsequently settled in 2007. As of December 31, 2006, the balance of non-recourse secured debt that was assumed in conjunction with 2006 acquisitions was $140.7 million.

In conjunction with the disposition of properties completed during 2007, we incurred a net loss of $.4 million on the early extinguishment of three loans totaling $22.2 million.

Equity

Common and preferred dividends increased to $194.5 million in 2007, compared to $173.0 million in 2006. The dividend rate for our common shares of beneficial interest increased for each quarter of 2007 to $.495 compared to $.465 for the same period of 2006. Our dividend payout ratio on common equity for 2007, 2006 and 2005 approximated 63.2%, 64.0% and 63.4%, respectively, based on basic funds from operations for the respective periods.

In July 2007, our Board of Trust Managers authorized a common share repurchase program as part of our ongoing investment strategy. Under the terms of the program, we may purchase up to a maximum value of $300 million of our common shares of beneficial interest during the next two years. Share repurchases may be made in the open market or in privately negotiated transactions at the discretion of management and as market conditions warrant. We anticipate funding the repurchase of shares primarily through the proceeds received from our property disposition program, as well as from general corporate funds.

During 2007, we have repurchased and cancelled 1.4 million common shares of beneficial interest at an average share price of $37.75. At December 31, 2007, a total of 1.4 million common shares of beneficial interest were outstanding that were purchased at an average share price of $36.47. These shares were subsequently retired on January 11, 2008.