EXHIBIT 99.2 WSFS Financial Corporation Q1 2019 Earnings Release Supplement Beneficial Combination April 25, 2019

Forward Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the markets in which the Company operates and in which its loans are concentrated, including the effects of declines in housing markets, an increase in unemployment levels and slowdowns in economic growth; the Company's level of nonperforming assets and the costs associated with resolving problem loans including litigation and other costs; possible additional loan losses and impairment of the collectability of loans; changes in market interest rates which may increase funding costs and reduce earning asset yields and thus reduce margin; the impact of changes in interest rates and the credit quality and strength of underlying collateral and the effect of such changes on the market value of the Company's investment securities portfolio; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial and industrial loans in our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company's operations including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) the Economic Growth, Regulatory Relief, and Consumer Protection Act (which amended the Dodd-Frank Act), and the rules and regulations issued in accordance therewith and potential expenses associated with complying with such regulations; the Company's ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including its ability to generate liquidity internally or raise capital on favorable terms; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; any impairment of the Company's goodwill or other intangible assets; failure of the financial and operational controls of the Company's Cash Connect® division; conditions in the financial markets that may limit the Company's access to additional funding to meet its liquidity needs; the success of the Company's growth plans, including the successful integration of past and future acquisitions; including the acquisition of Beneficial Bancorp, Inc. (“Beneficial”); the Company's ability to fully realize the cost savings and other benefits of its acquisitions, manage risks related to business disruption following those acquisitions, and post-acquisition customer acceptance of the Company's products and services and related Customer disintermediation; negative perceptions or publicity with respect to the Company's trust and wealth management business; adverse judgments or other resolution of pending and future legal proceedings, and cost incurred in defending such proceedings; system failure or cybersecurity incidents or other breaches of the Company's network security; the Company's ability to recruit and retain key employees; the effects of problems encountered by other financial institutions that adversely affect the Company or the banking industry generally; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and man-made disasters including terrorist attacks; possible changes in the speed of loan prepayments by the Company's customers and loan origination or sales volumes; possible changes in the speed of prepayments of mortgage-backed securities due to changes in the interest rate environment, and the related acceleration of premium amortization on prepayments in the event that prepayments accelerate; regulatory limits on the Company's ability to receive dividends from its subsidiaries and pay dividends to its stockholders; the effects of any reputation, credit, interest rate, market, operational, legal, liquidity, regulatory and compliance risk resulting from developments related to any of the risks discussed above; and the costs associated with resolving any problem loans, litigation, and other risks and uncertainties, including those discussed in the Company's Form 10-K for the year ended December 31, 2018 and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. 2

Day 1 Transaction Impact • Legal Close: March 1, 2019 • Transaction Value & Consideration: $15.97 per share plus cash out of options; Aggregate of $1.2 billion ($1.5 billion at announcement) • $2.93 in cash and 0.3013 WSFS shares of WSFS common stock • Price / Tangible Book Value: 130.6% (171.7% estimated at announcement) • Core Deposit Premium: 7.2% (15.4% estimated at announcement) • Fair Value of Assets: $5.1 billion • Fair Value of Liabilities: $4.2 billion • Total Loans: $3.5 billion(1) • Core Deposits: $3.0 billion; $85.1 million core deposit intangible • Total Goodwill: $309.0 million (see page 6 for details) (1) Includes an approximate fair value adjustment of ($161.6 million). See slide 5. 3

Transaction Metrics Original Model ($000’s except per share figures) Updated Estimate Aggregate Per Share Per Share • Pro forma TBV per share is 10% WSFS Standalone TBV (2/28/19)(1) $19.97 $653,777 20.84 higher than originally modeled Plus: Equity Consideration 949,968 Less: Total Intangibles Created 394,479 • Immediate TBV accretion of 1.2%, compared to 4.3% dilution Less: One-time costs (remaining)(2) 85,327 estimated at announcement Pro Forma TBV (3/1/2019) $1,123,939 $21.08 $19.12 TBV Accretion (Dilution) 1.2% (4.3%) Original Model Updated Estimate Pro Forma Pro Forma Impact Impact 2020 EPS Accretion 4.2% 4.2% 2021 EPS Accretion 8.0% 8.0% TBV Accretion (Dilution) 1.2% (4.3%) TBV Earnback (Years)(3) Immediate 3.7 (1) TBV is a non-GAAP financial measure and should be considered along with results presented with GAAP and is not a substitute for GAAP results. See reconciliation to GAAP information at the end of this presentation (2) Total modeled one-time costs less costs incurred through 2/28/19 4 (3) Calculated using the crossover method

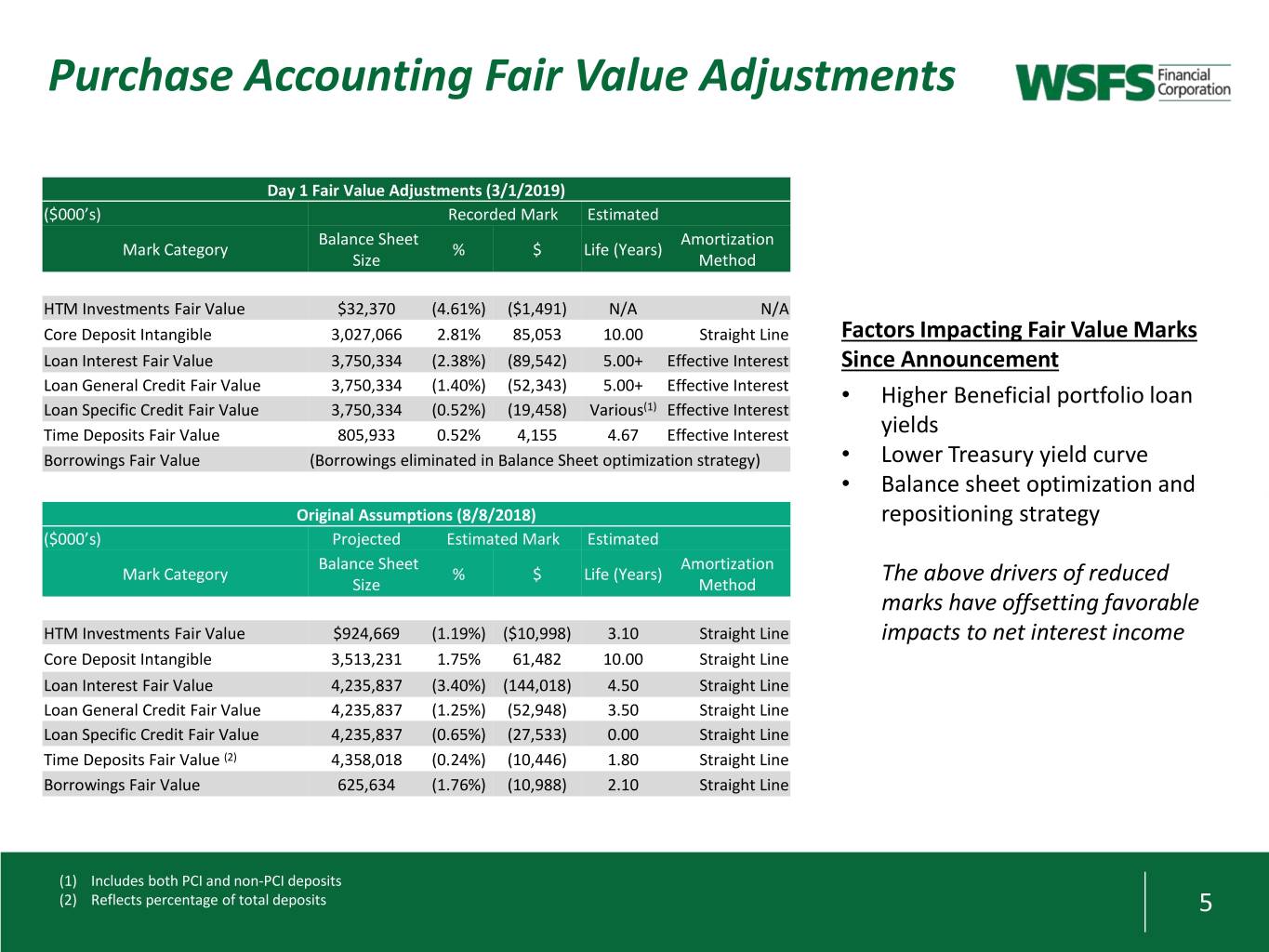

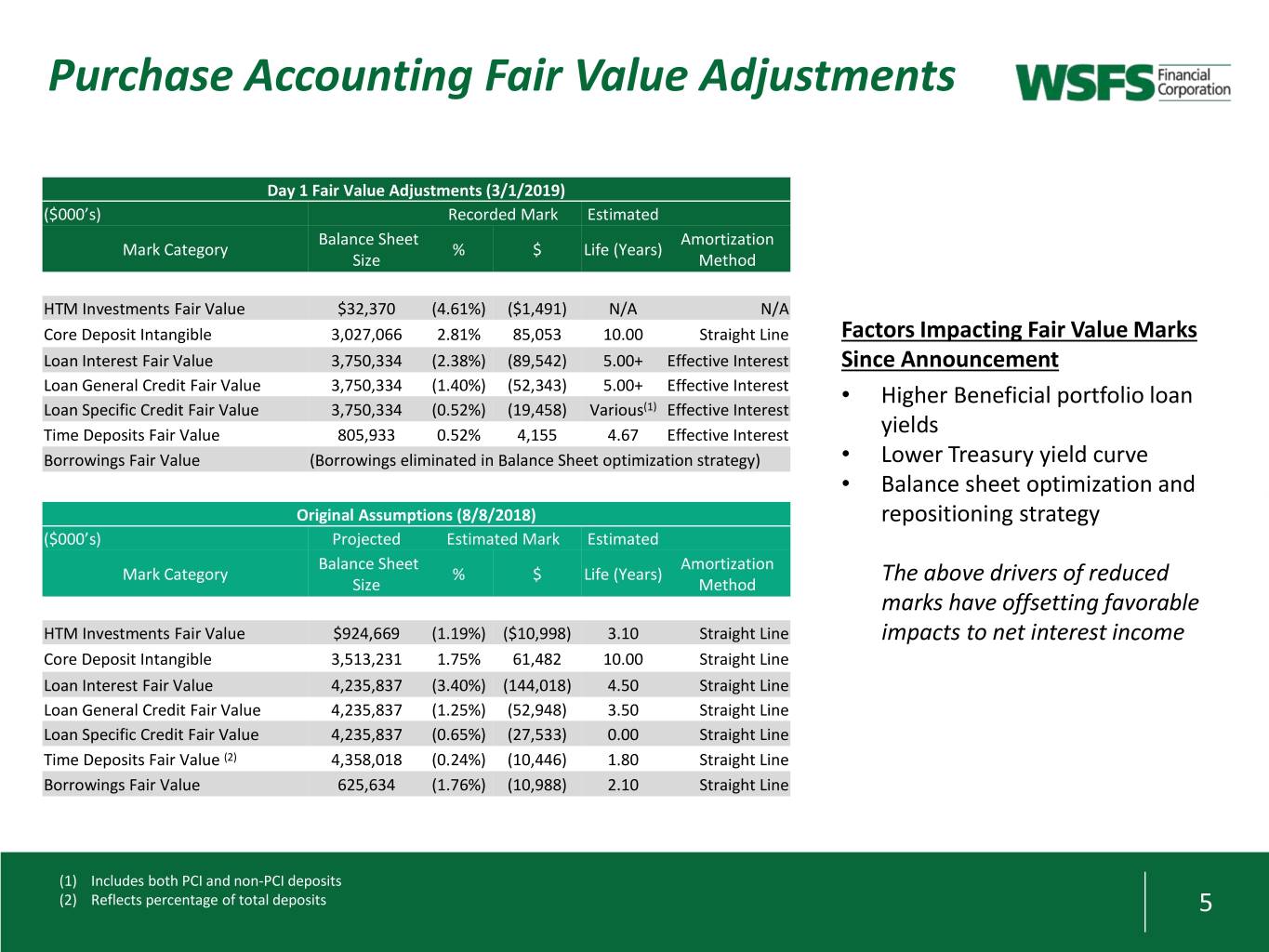

Purchase Accounting Fair Value Adjustments Day 1 Fair Value Adjustments (3/1/2019) ($000’s) Recorded Mark Estimated Balance Sheet Amortization Mark Category % $ Life (Years) Size Method HTM Investments Fair Value $32,370 (4.61%) ($1,491) N/A N/A Core Deposit Intangible 3,027,066 2.81% 85,053 10.00 Straight Line Factors Impacting Fair Value Marks Loan Interest Fair Value 3,750,334 (2.38%) (89,542) 5.00+ Effective Interest Since Announcement Loan General Credit Fair Value 3,750,334 (1.40%) (52,343) 5.00+ Effective Interest • Higher Beneficial portfolio loan Loan Specific Credit Fair Value 3,750,334 (0.52%) (19,458) Various(1) Effective Interest Time Deposits Fair Value 805,933 0.52% 4,155 4.67 Effective Interest yields Borrowings Fair Value (Borrowings eliminated in Balance Sheet optimization strategy) • Lower Treasury yield curve • Balance sheet optimization and Original Assumptions (8/8/2018) repositioning strategy ($000’s) Projected Estimated Mark Estimated Balance Sheet Amortization Mark Category % $ Life (Years) Size Method The above drivers of reduced marks have offsetting favorable HTM Investments Fair Value $924,669 (1.19%) ($10,998) 3.10 Straight Line impacts to net interest income Core Deposit Intangible 3,513,231 1.75% 61,482 10.00 Straight Line Loan Interest Fair Value 4,235,837 (3.40%) (144,018) 4.50 Straight Line Loan General Credit Fair Value 4,235,837 (1.25%) (52,948) 3.50 Straight Line Loan Specific Credit Fair Value 4,235,837 (0.65%) (27,533) 0.00 Straight Line Time Deposits Fair Value (2) 4,358,018 (0.24%) (10,446) 1.80 Straight Line Borrowings Fair Value 625,634 (1.76%) (10,988) 2.10 Straight Line (1) Includes both PCI and non-PCI deposits (2) Reflects percentage of total deposits 5

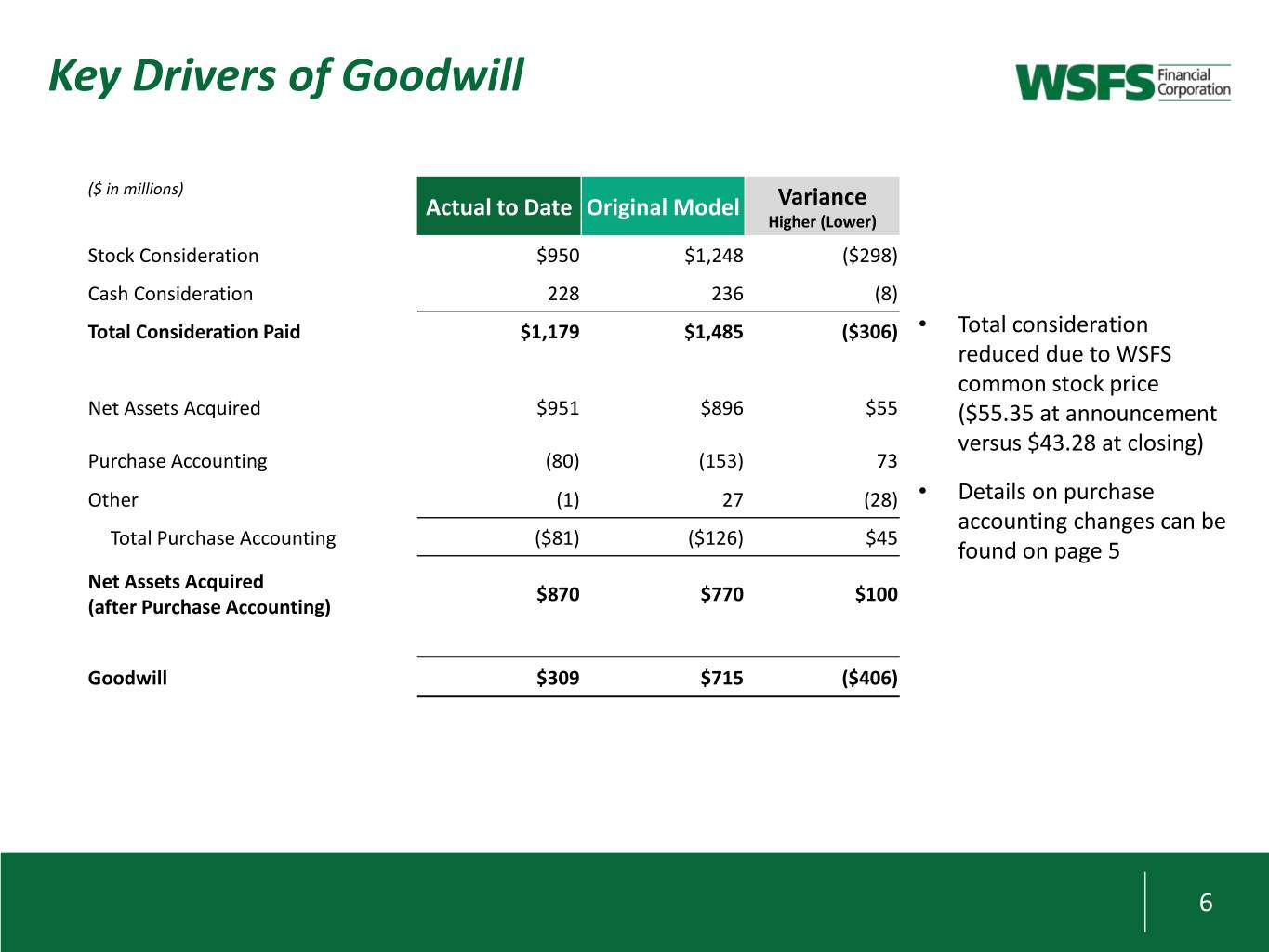

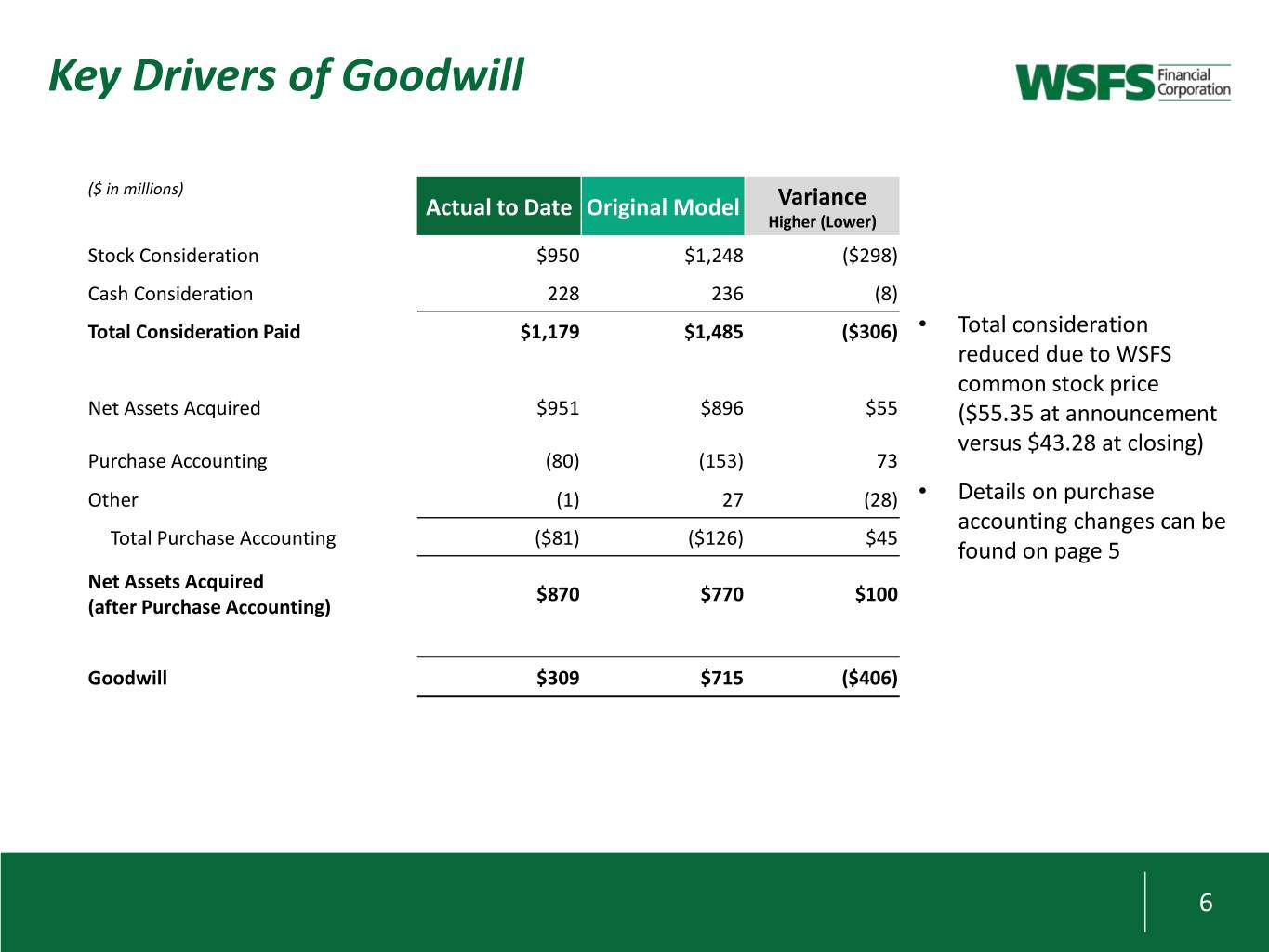

Key Drivers of Goodwill ($ in millions) Actual to Date Original Model Variance Higher (Lower) Stock Consideration $950 $1,248 ($298) Cash Consideration 228 236 (8) Total Consideration Paid $1,179 $1,485 ($306) • Total consideration reduced due to WSFS common stock price Net Assets Acquired $951 $896 $55 ($55.35 at announcement versus $43.28 at closing) Purchase Accounting (80) (153) 73 Other (1) 27 (28) • Details on purchase accounting changes can be Total Purchase Accounting ($81) ($126) $45 found on page 5 Net Assets Acquired $870 $770 $100 (after Purchase Accounting) Goodwill $309 $715 ($406) 6

Non-GAAP Reconciliation Calculation of WSFS tangible book value: (Dollars in thousands) February 28, 2019 Shareholders' equity $ 837,984 Less: Goodwill and intangible assets 184,207 Tangible book value $ 653,777 The Company uses non-GAAP (Generally Accepted Accounting Principles) financial information in its analysis of the Company’s performance. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non- GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. 7

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-792-6009 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 8