WSFS Financial Exhibit 99.2 Corporation 3Q 2019 Earnings Release Supplement October 21, 2019

Forward Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the markets in which the Company operates and in which its loans are concentrated, including the effects of declines in housing markets, an increase in unemployment levels and slowdowns in economic growth; the Company's level of nonperforming assets and the costs associated with resolving problem loans including litigation and other costs; possible additional loan losses and impairment of the collectability of loans; changes in market interest rates which may increase funding costs and reduce earning asset yields and thus reduce margin; the impact of changes in interest rates and the credit quality and strength of underlying collateral and the effect of such changes on the market value of the Company's investment securities portfolio; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial and industrial loans in our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company's operations including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) the Economic Growth, Regulatory Relief, and Consumer Protection Act (which amended the Dodd-Frank Act), and the rules and regulations issued in accordance therewith and potential expenses associated with complying with such regulations; the Company's ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including its ability to generate liquidity internally or raise capital on favorable terms; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; any impairment of the Company's goodwill or other intangible assets; failure of the financial and operational controls of the Company's Cash Connect® division; conditions in the financial markets that may limit the Company's access to additional funding to meet its liquidity needs; the success of the Company's growth plans, including the successful integration of past and future acquisitions; the Company's ability to fully realize the cost savings and other benefits of its acquisitions, manage risks related to business disruption following those acquisitions, and post-acquisition customer acceptance of the Company's products and services and related Customer disintermediation; negative perceptions or publicity with respect to the Company's trust and wealth management business; adverse judgments or other resolution of pending and future legal proceedings, and cost incurred in defending such proceedings; system failures or cybersecurity incidents or other breaches of the Company's network security; the Company's ability to recruit and retain key employees; the effects of problems encountered by other financial institutions that adversely affect the Company or the banking industry generally; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and man-made disasters including terrorist attacks; possible changes in the speed of loan prepayments by the Company's customers and loan origination or sales volumes; possible changes in the speed of prepayments of mortgage-backed securities due to changes in the interest rate environment, and the related acceleration of premium amortization on prepayments in the event that prepayments accelerate; regulatory limits on the Company's ability to receive dividends from its subsidiaries and pay dividends to its stockholders; any reputation, credit, interest rate, market, operational, legal, liquidity, regulatory and compliance risk resulting from developments related to any of the risks discussed above; and the costs associated with resolving any problem loans, litigation, and other risks and uncertainties, including those discussed in the Company's Form 10-K for the year ended December 31, 2018 and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. 2

Table of Contents Non-GAAP Reconciliation Page 4 Loan and Deposit Growth Page 5 Reconciliation of Conversion-related Reclassifications Page 6 Net Interest Margin Page 7 2019 Core Outlook Page 8 3

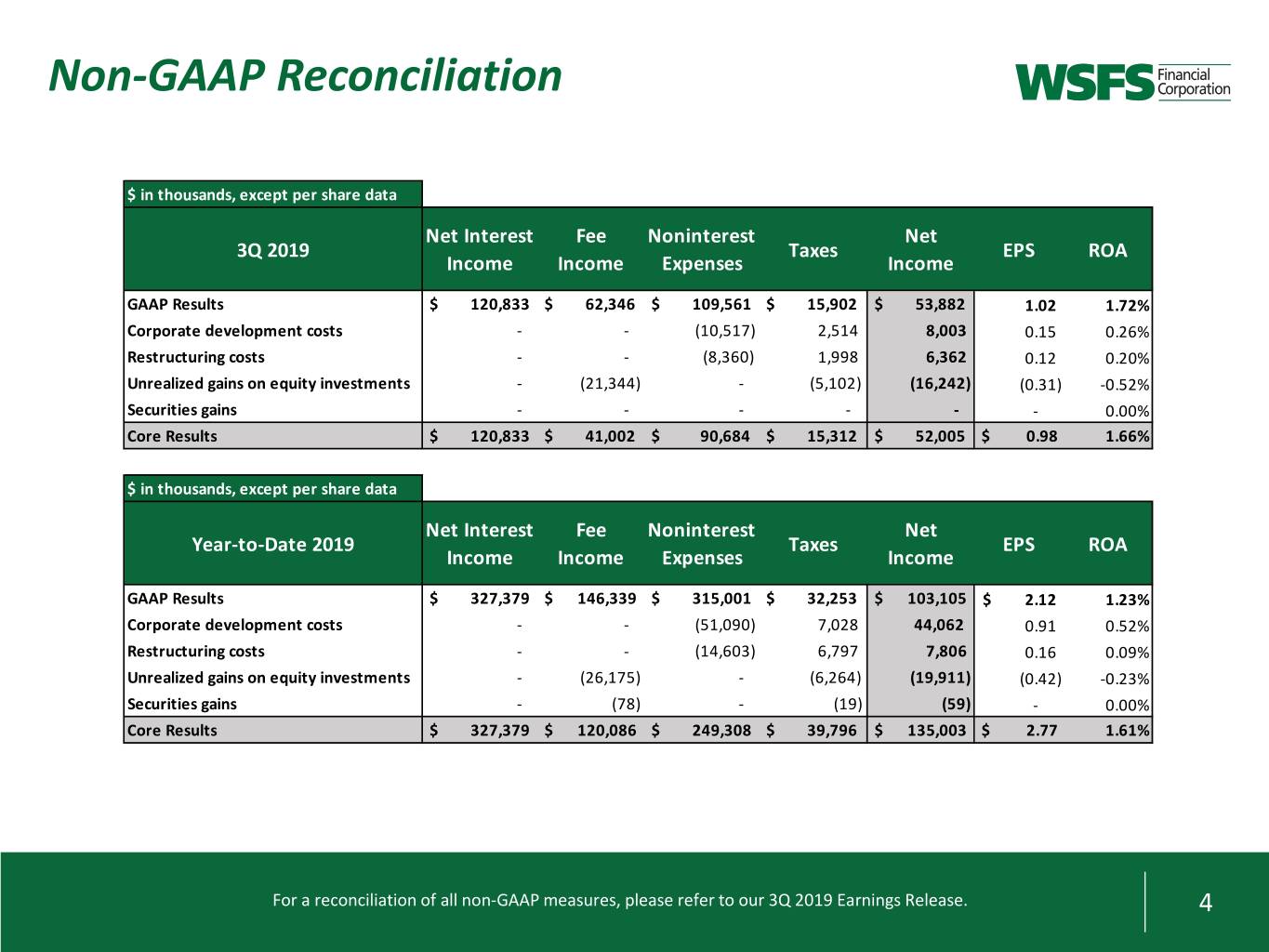

Non-GAAP Reconciliation $ in thousands, except per share data Net Interest Fee Noninterest Net 3Q 2019 Taxes EPS ROA Income Income Expenses Income GAAP Results $ 120,833 $ 62,346 $ 109,561 $ 15,902 $ 53,882 1.02 1.72% Corporate development costs - - (10,517) 2,514 8,003 0.15 0.26% Restructuring costs - - (8,360) 1,998 6,362 0.12 0.20% Unrealized gains on equity investments - (21,344) - (5,102) (16,242) (0.31) -0.52% Securities gains - - - - - - 0.00% Core Results $ 120,833 $ 41,002 $ 90,684 $ 15,312 $ 52,005 $ 0.98 1.66% $ in thousands, except per share data Net Interest Fee Noninterest Net Year-to-Date 2019 Taxes EPS ROA Income Income Expenses Income GAAP Results $ 327,379 $ 146,339 $ 315,001 $ 32,253 $ 103,105 $ 2.12 1.23% Corporate development costs - - (51,090) 7,028 44,062 0.91 0.52% Restructuring costs - - (14,603) 6,797 7,806 0.16 0.09% Unrealized gains on equity investments - (26,175) - (6,264) (19,911) (0.42) -0.23% Securities gains - (78) - (19) (59) - 0.00% Core Results $ 327,379 $ 120,086 $ 249,308 $ 39,796 $ 135,003 $ 2.77 1.61% For a reconciliation of all non-GAAP measures, please refer to our 3Q 2019 Earnings Release. 4

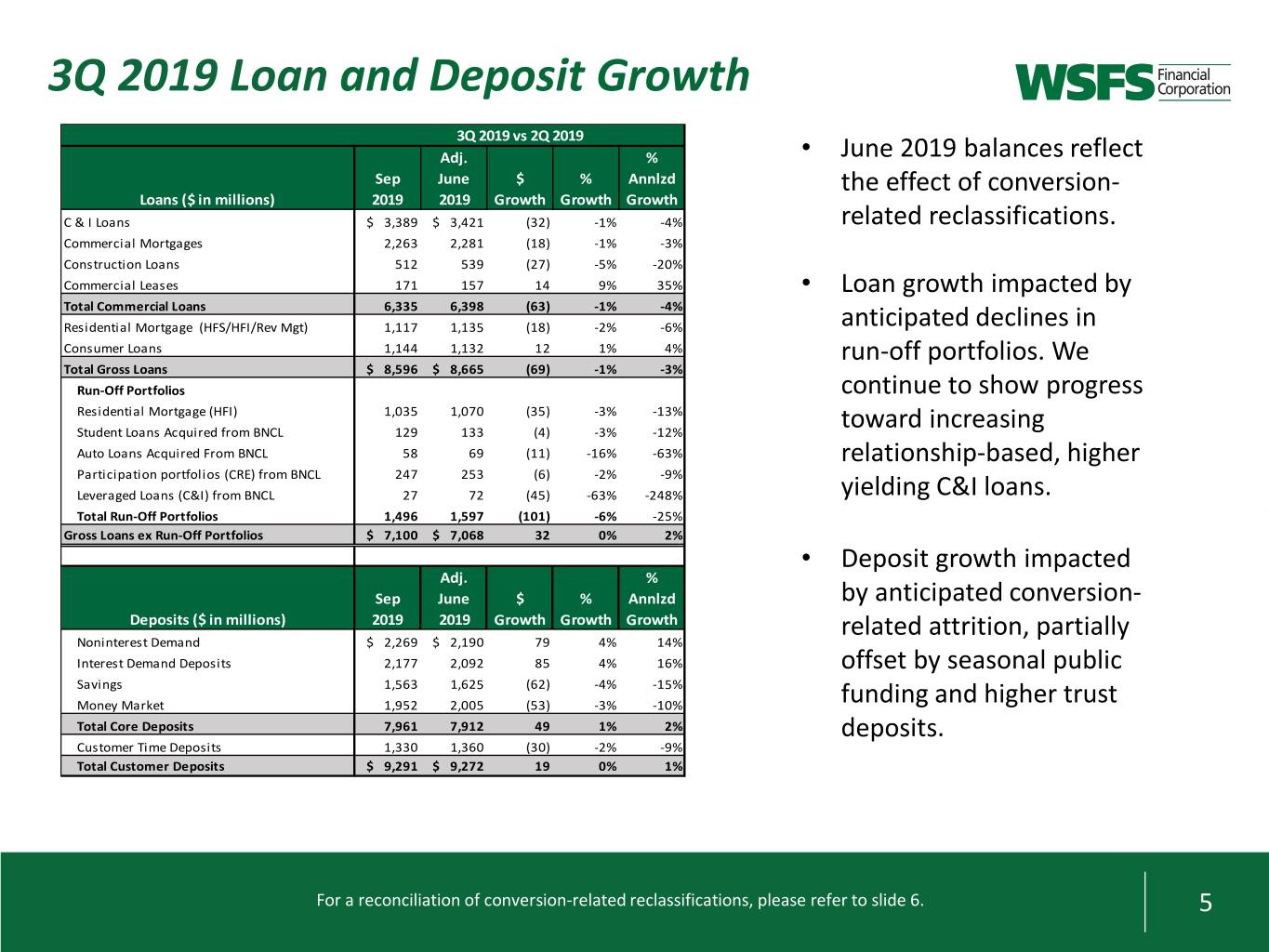

3Q 2019 Loan and Deposit Growth 3Q 2019 vs 2Q 2019 Adj. % • June 2019 balances reflect Sep June $ % Annlzd the effect of conversion- Loans ($ in millions) 2019 2019 Growth Growth Growth C & I Loans $ 3,389 $ 3,421 (32) -1% -4% related reclassifications. Commercial Mortgages 2,263 2,281 (18) -1% -3% Construction Loans 512 539 (27) -5% -20% Commercial Leases 171 157 14 9% 35% • Loan growth impacted by Total Commercial Loans 6,335 6,398 (63) -1% -4% Residential Mortgage (HFS/HFI/Rev Mgt) 1,117 1,135 (18) -2% -6% anticipated declines in Consumer Loans 1,144 1,132 12 1% 4% run-off portfolios. We Total Gross Loans $ 8,596 $ 8,665 (69) -1% -3% Run-Off Portfolios continue to show progress Residential Mortgage (HFI) 1,035 1,070 (35) -3% -13% Student Loans Acquired from BNCL 129 133 (4) -3% -12% toward increasing Auto Loans Acquired From BNCL 58 69 (11) -16% -63% relationship-based, higher Participation portfolios (CRE) from BNCL 247 253 (6) -2% -9% Leveraged Loans (C&I) from BNCL 27 72 (45) -63% -248% yielding C&I loans. Total Run-Off Portfolios 1,496 1,597 (101) -6% -25% Gross Loans ex Run-Off Portfolios $ 7,100 $ 7,068 32 0% 2% • Deposit growth impacted Adj. % Sep June $ % Annlzd by anticipated conversion- Deposits ($ in millions) 2019 2019 Growth Growth Growth related attrition, partially Noninterest Demand $ 2,269 $ 2,190 79 4% 14% Interest Demand Deposits 2,177 2,092 85 4% 16% offset by seasonal public Savings 1,563 1,625 (62) -4% -15% Money Market 1,952 2,005 (53) -3% -10% funding and higher trust Total Core Deposits 7,961 7,912 49 1% 2% deposits. Customer Time Deposits 1,330 1,360 (30) -2% -9% Total Customer Deposits $ 9,291 $ 9,272 19 0% 1% For a reconciliation of conversion-related reclassifications, please refer to slide 6. 5

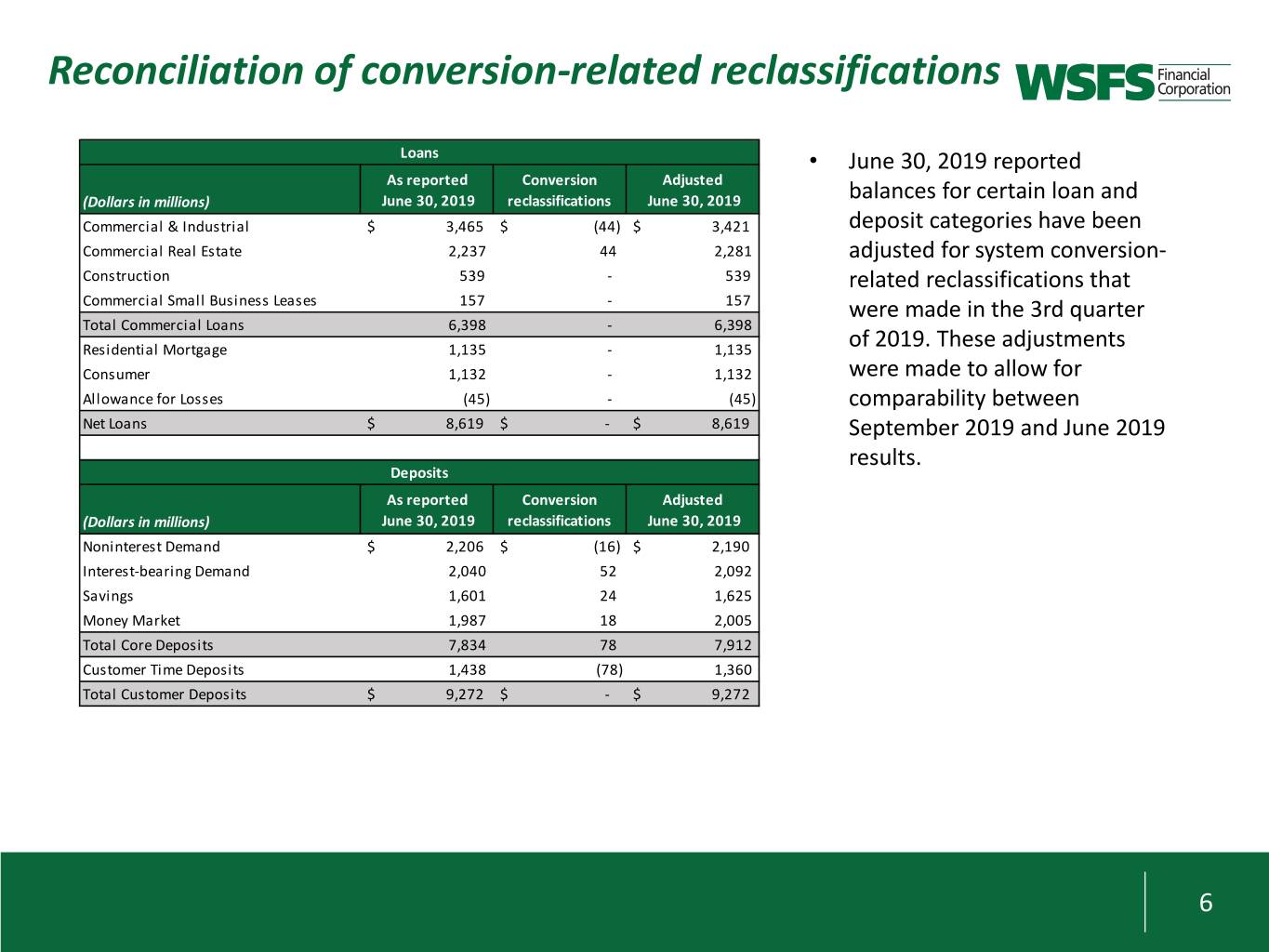

Reconciliation of conversion-related reclassifications Loans • June 30, 2019 reported As reported Conversion Adjusted (Dollars in millions) June 30, 2019 reclassifications June 30, 2019 balances for certain loan and Commercial & Industrial $ 3,465 $ (44) $ 3,421 deposit categories have been Commercial Real Estate 2,237 44 2,281 adjusted for system conversion- Construction 539 - 539 related reclassifications that Commercial Small Business Leases 157 - 157 were made in the 3rd quarter Total Commercial Loans 6,398 - 6,398 Residential Mortgage 1,135 - 1,135 of 2019. These adjustments Consumer 1,132 - 1,132 were made to allow for Allowance for Losses (45) - (45) comparability between Net Loans $ 8,619 $ - $ 8,619 September 2019 and June 2019 results. Deposits As reported Conversion Adjusted (Dollars in millions) June 30, 2019 reclassifications June 30, 2019 Noninterest Demand $ 2,206 $ (16) $ 2,190 Interest-bearing Demand 2,040 52 2,092 Savings 1,601 24 1,625 Money Market 1,987 18 2,005 Total Core Deposits 7,834 78 7,912 Customer Time Deposits 1,438 (78) 1,360 Total Customer Deposits $ 9,272 $ - $ 9,272 6

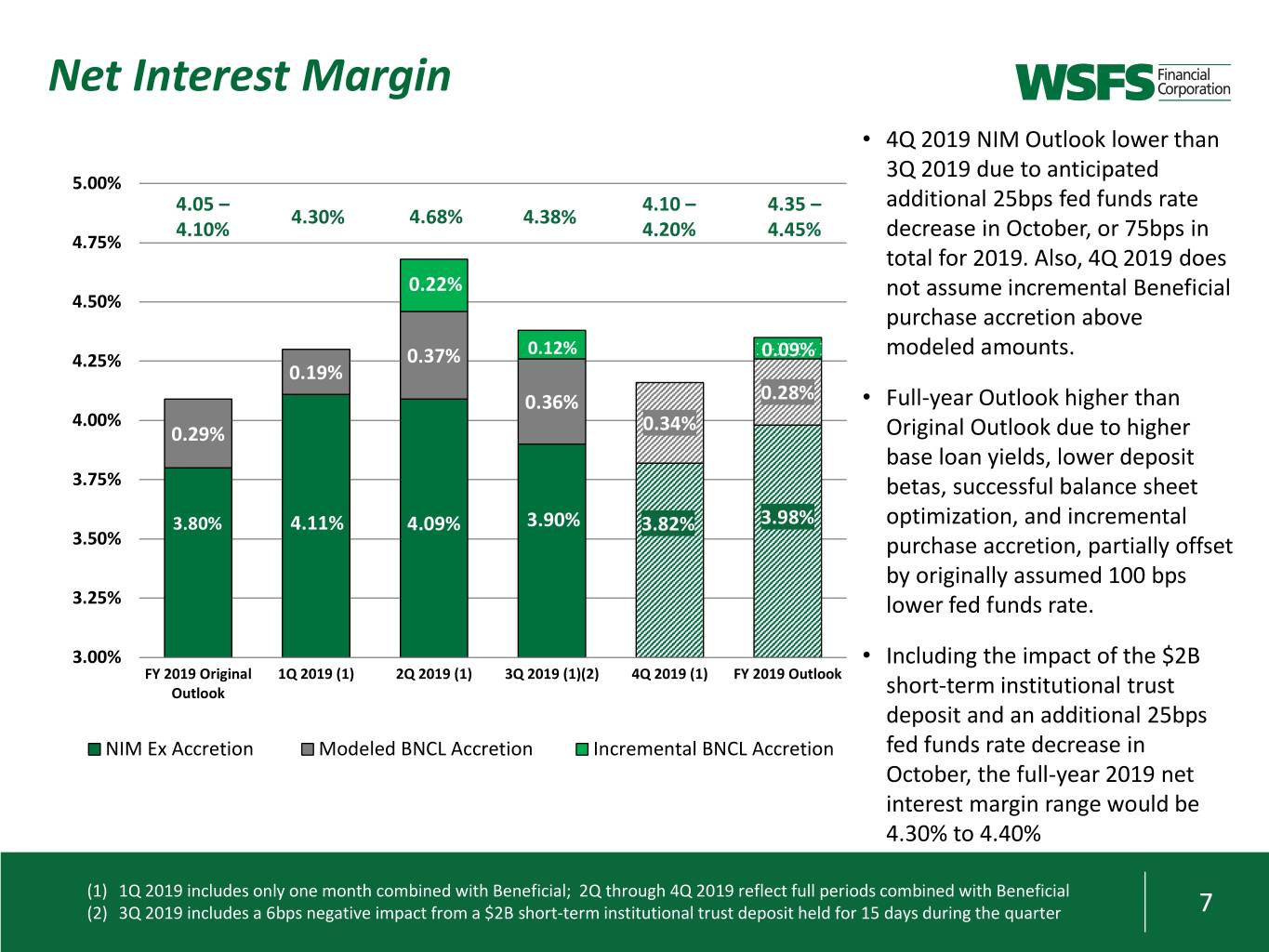

Net Interest Margin • 4Q 2019 NIM Outlook lower than 3Q 2019 due to anticipated 5.00% 4.05 – 4.10 – 4.35 – additional 25bps fed funds rate 4.30% 4.68% 4.38% 4.10% 4.20% 4.45% decrease in October, or 75bps in 4.75% total for 2019. Also, 4Q 2019 does 0.00% 0.22% not assume incremental Beneficial 4.50% purchase accretion above 0.12% 0.15% 0.09% modeled amounts. 4.25% 0.37% 0.19% 0.36% 0.28% • Full-year Outlook higher than 4.00% 0.34% 0.29% Original Outlook due to higher base loan yields, lower deposit 3.75% betas, successful balance sheet 3.80% 4.11% 4.09% 3.90% 3.82% 3.98% optimization, and incremental 3.50% purchase accretion, partially offset by originally assumed 100 bps 3.25% lower fed funds rate. 3.00% • Including the impact of the $2B FY 2019 Original 1Q 2019 (1) 2Q 2019 (1) 3Q 2019 (1)(2) 4Q 2019 (1) FY 2019 Outlook Outlook short-term institutional trust deposit and an additional 25bps NIM Ex Accretion Modeled BNCL Accretion Incremental BNCL Accretion fed funds rate decrease in October, the full-year 2019 net interest margin range would be 4.30% to 4.40% (1) 1Q 2019 includes only one month combined with Beneficial; 2Q through 4Q 2019 reflect full periods combined with Beneficial (2) 3Q 2019 includes a 6bps negative impact from a $2B short-term institutional trust deposit held for 15 days during the quarter 7

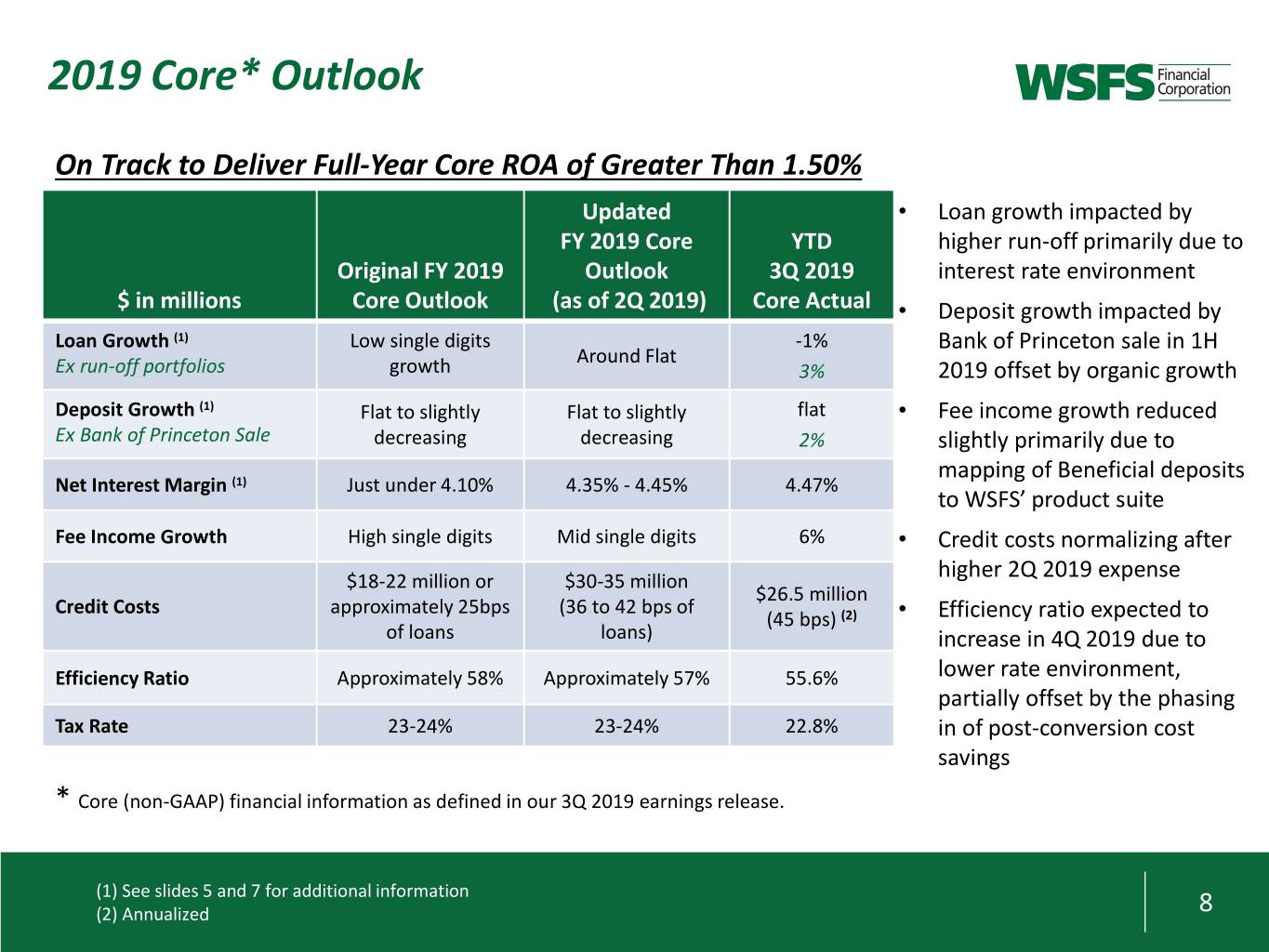

2019 Core* Outlook On Track to Deliver Full-Year Core ROA of Greater Than 1.50% Updated • Loan growth impacted by FY 2019 Core YTD higher run-off primarily due to Original FY 2019 Outlook 3Q 2019 interest rate environment $ in millions Core Outlook (as of 2Q 2019) Core Actual • Deposit growth impacted by Loan Growth (1) Low single digits -1% Bank of Princeton sale in 1H Around Flat Ex run-off portfolios growth 3% 2019 offset by organic growth Deposit Growth (1) Flat to slightly Flat to slightly flat • Fee income growth reduced Ex Bank of Princeton Sale decreasing decreasing 2% slightly primarily due to mapping of Beneficial deposits Net Interest Margin (1) Just under 4.10% 4.35% - 4.45% 4.47% to WSFS’ product suite Fee Income Growth High single digits Mid single digits 6% • Credit costs normalizing after $18-22 million or $30-35 million higher 2Q 2019 expense $26.5 million Credit Costs approximately 25bps (36 to 42 bps of (45 bps) (2) • Efficiency ratio expected to of loans loans) increase in 4Q 2019 due to Efficiency Ratio Approximately 58% Approximately 57% 55.6% lower rate environment, partially offset by the phasing Tax Rate 23-24% 23-24% 22.8% in of post-conversion cost savings * Core (non-GAAP) financial information as defined in our 3Q 2019 earnings release. (1) See slides 5 and 7 for additional information (2) Annualized 8

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-792-6009 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 9