WSFS Financial EXHIBIT 99.1 Corporation Q3 2019 Investor Update November 5, 2019

Forward Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the markets in which the Company operates and in which its loans are concentrated, including the effects of declines in housing markets, an increase in unemployment levels and slowdowns in economic growth; the Company's level of nonperforming assets and the costs associated with resolving problem loans including litigation and other costs; possible additional loan losses and impairment of the collectability of loans; changes in market interest rates which may increase funding costs and reduce earning asset yields and thus reduce margin; the impact of changes in interest rates and the credit quality and strength of underlying collateral and the effect of such changes on the market value of the Company's investment securities portfolio; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial and industrial loans in our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company's operations including the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act) the Economic Growth, Regulatory Relief, and Consumer Protection Act (which amended the Dodd-Frank Act), and the rules and regulations issued in accordance therewith and potential expenses associated with complying with such regulations; the Company's ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including our ability to generate liquidity internally or raise capital on favorable terms; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; any impairment of the Company's goodwill or other intangible assets; failure of the financial and operational controls of the Company's Cash Connect® division; conditions in the financial markets that may limit the Company's access to additional funding to meet its liquidity needs; the success of the Company's growth plans, including the successful integration of past and future acquisitions; the Company's ability to fully realize the cost savings and other benefits of its acquisitions, manage risks related to business disruption following those acquisitions, and post-acquisition customer acceptance of the Company's products and services and related Customer disintermediation; negative perceptions or publicity with respect to the Company's trust and wealth management business; adverse judgments or other resolution of pending and future legal proceedings, and cost incurred in defending such proceedings; system failures or cybersecurity incidents or other breaches of the Company's network security; the Company's ability to recruit and retain key employees; the effects of problems encountered by other financial institutions that adversely affect the Company or the banking industry generally; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and man-made disasters including terrorist attacks; possible changes in the speed of loan prepayments by the Company's customers and loan origination or sales volumes; possible changes in the speed of prepayments of mortgage-backed securities due to changes in the interest rate environment, and the related acceleration of premium amortization on prepayments in the event that prepayments accelerate; regulatory limits on the Company's ability to receive dividends from its subsidiaries and pay dividends to its stockholders; any reputation, credit, interest rate, market, operational, legal, liquidity, regulatory and compliance risk resulting from developments related to any of the risks discussed above; and the costs associated with resolving any problem loans, litigation, and other risks and uncertainties, including those discussed in the Company's Form 10-K for the year ended December 31, 2018 and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. 2

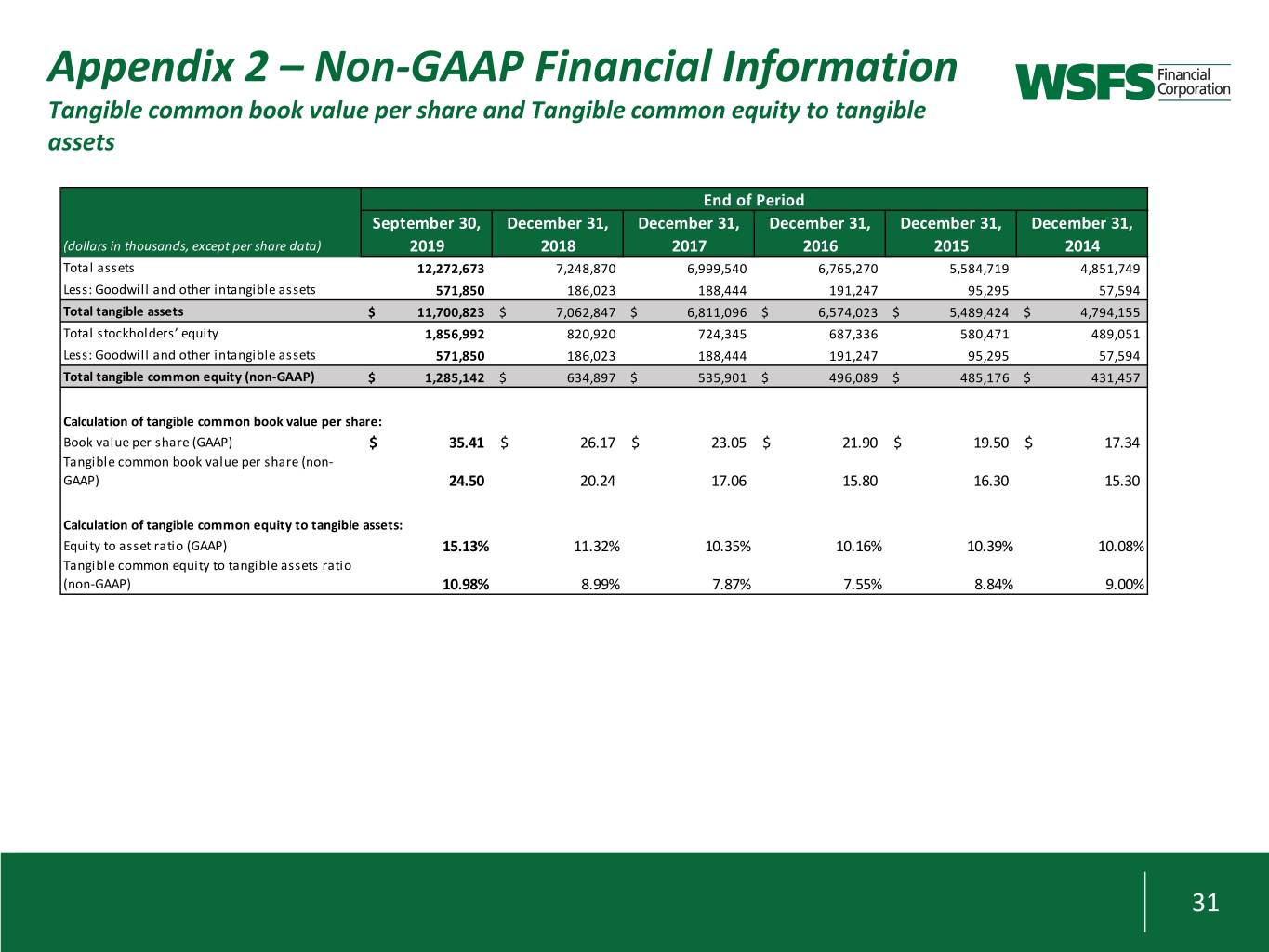

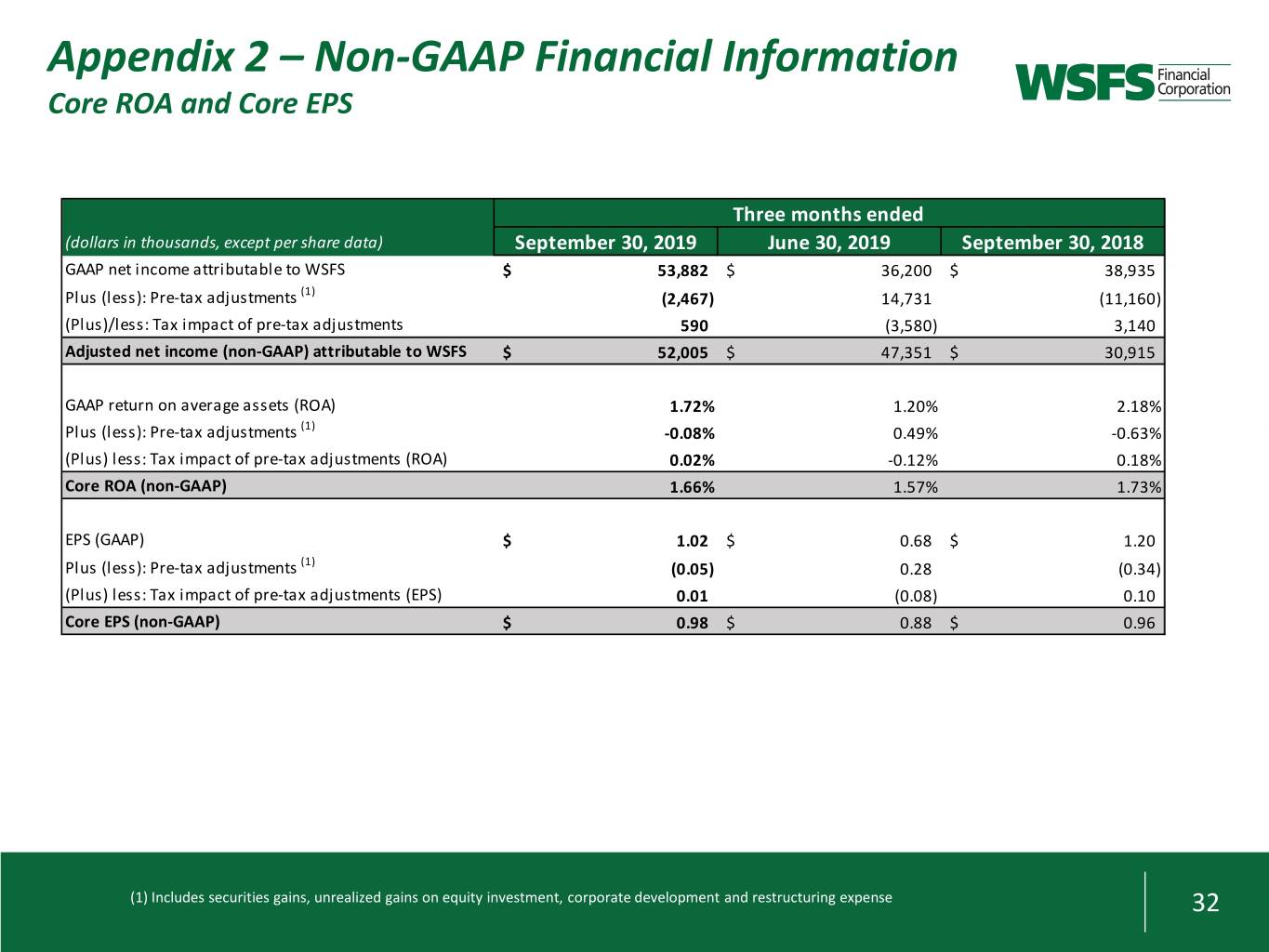

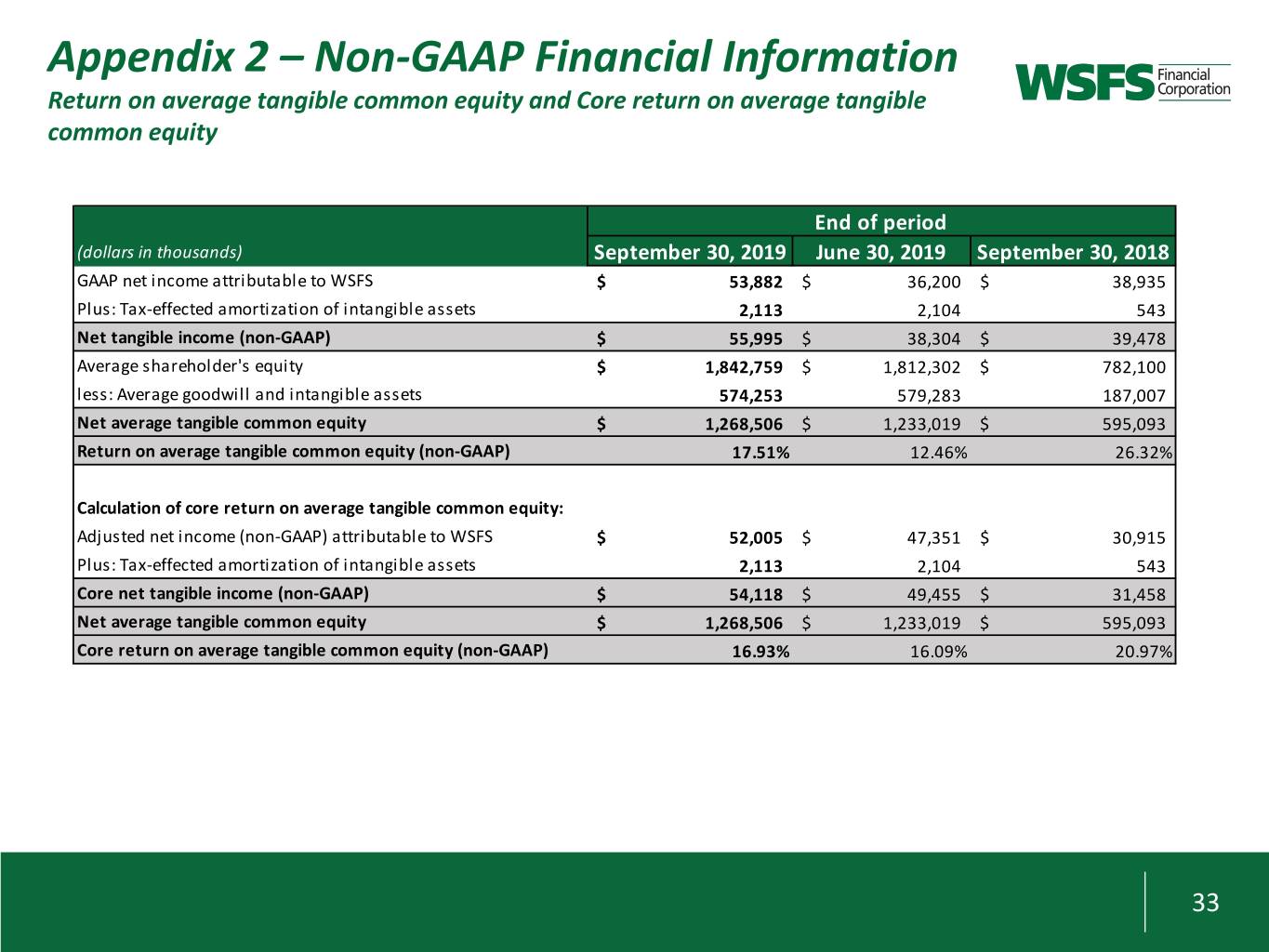

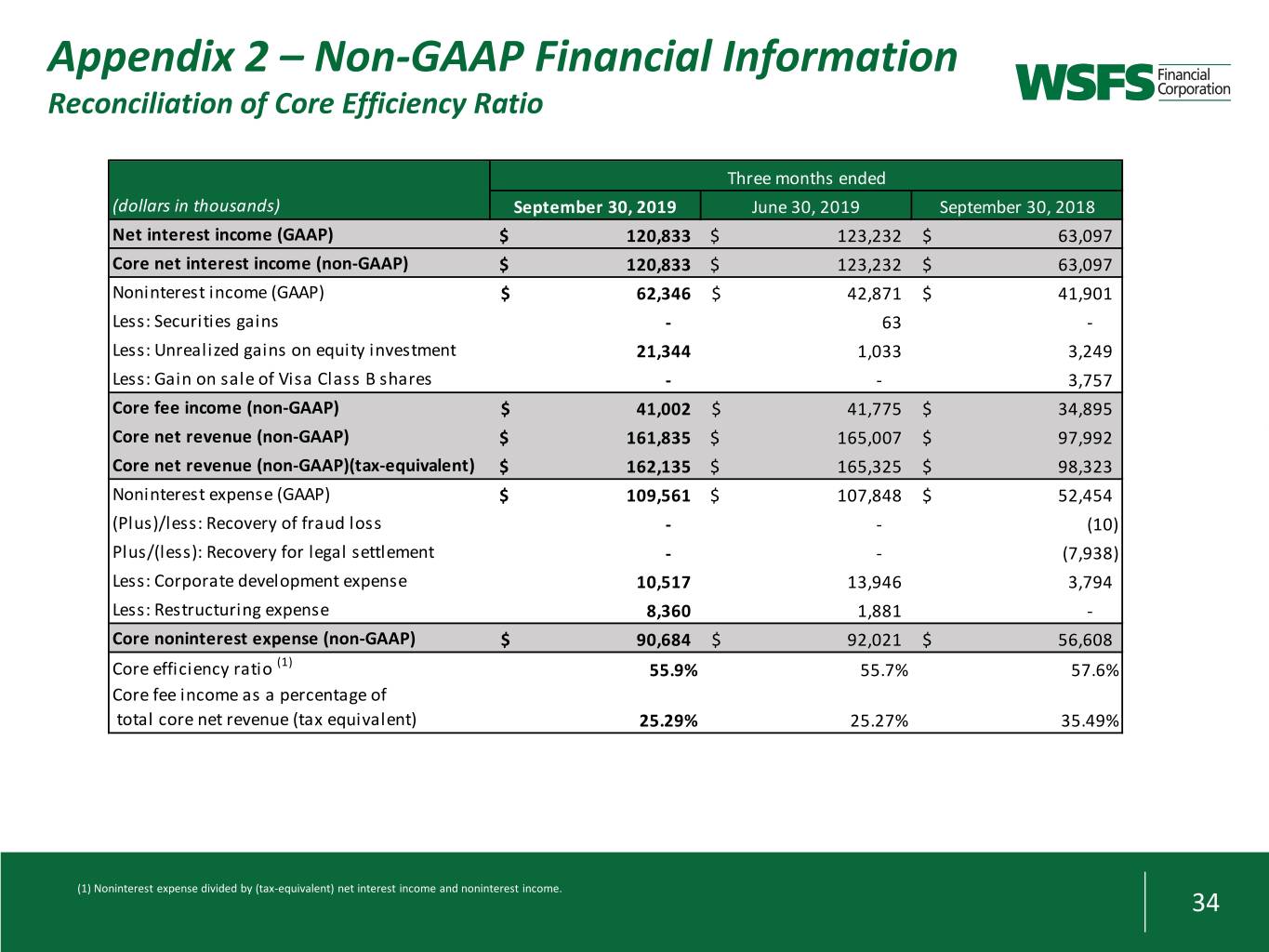

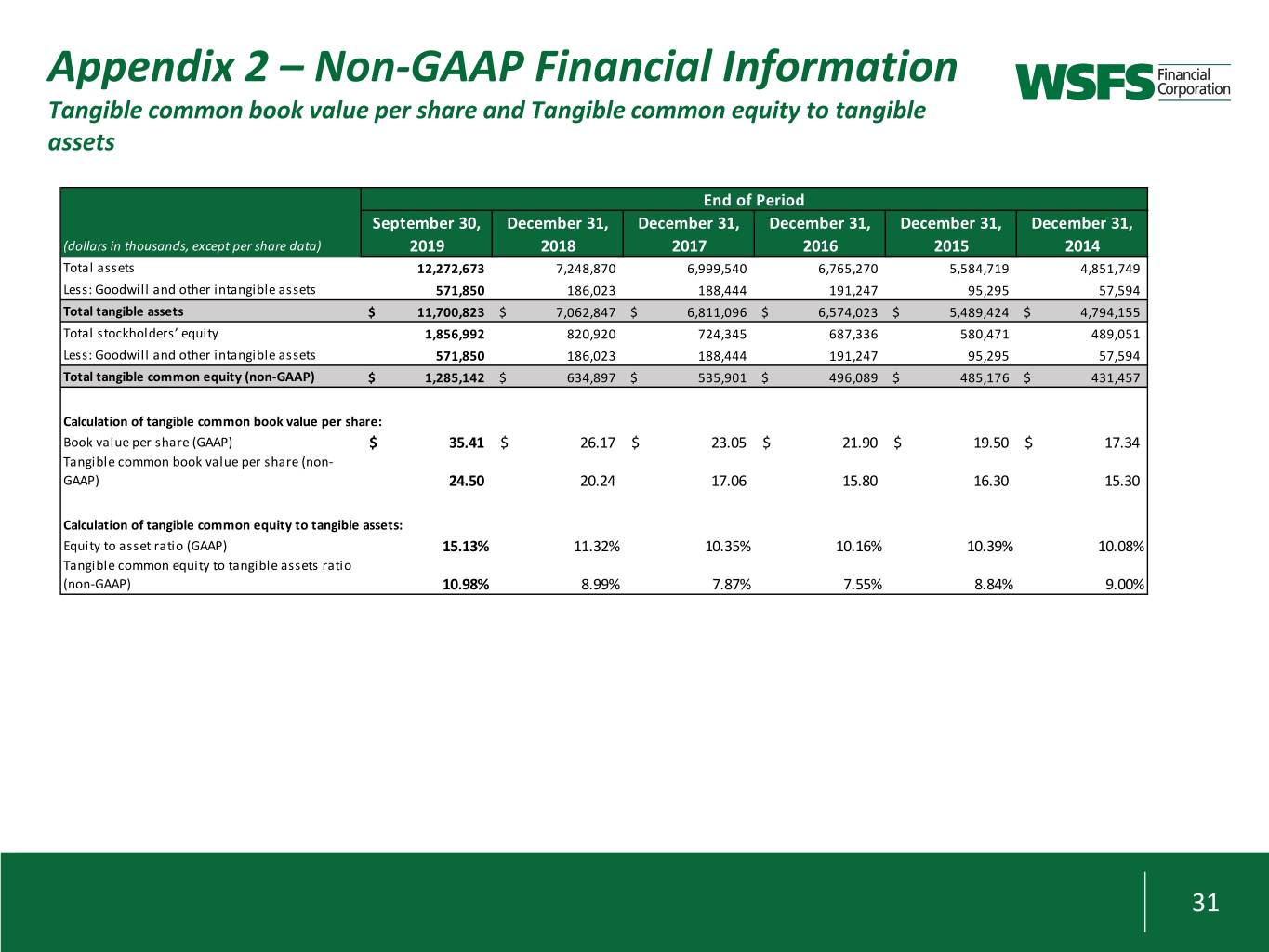

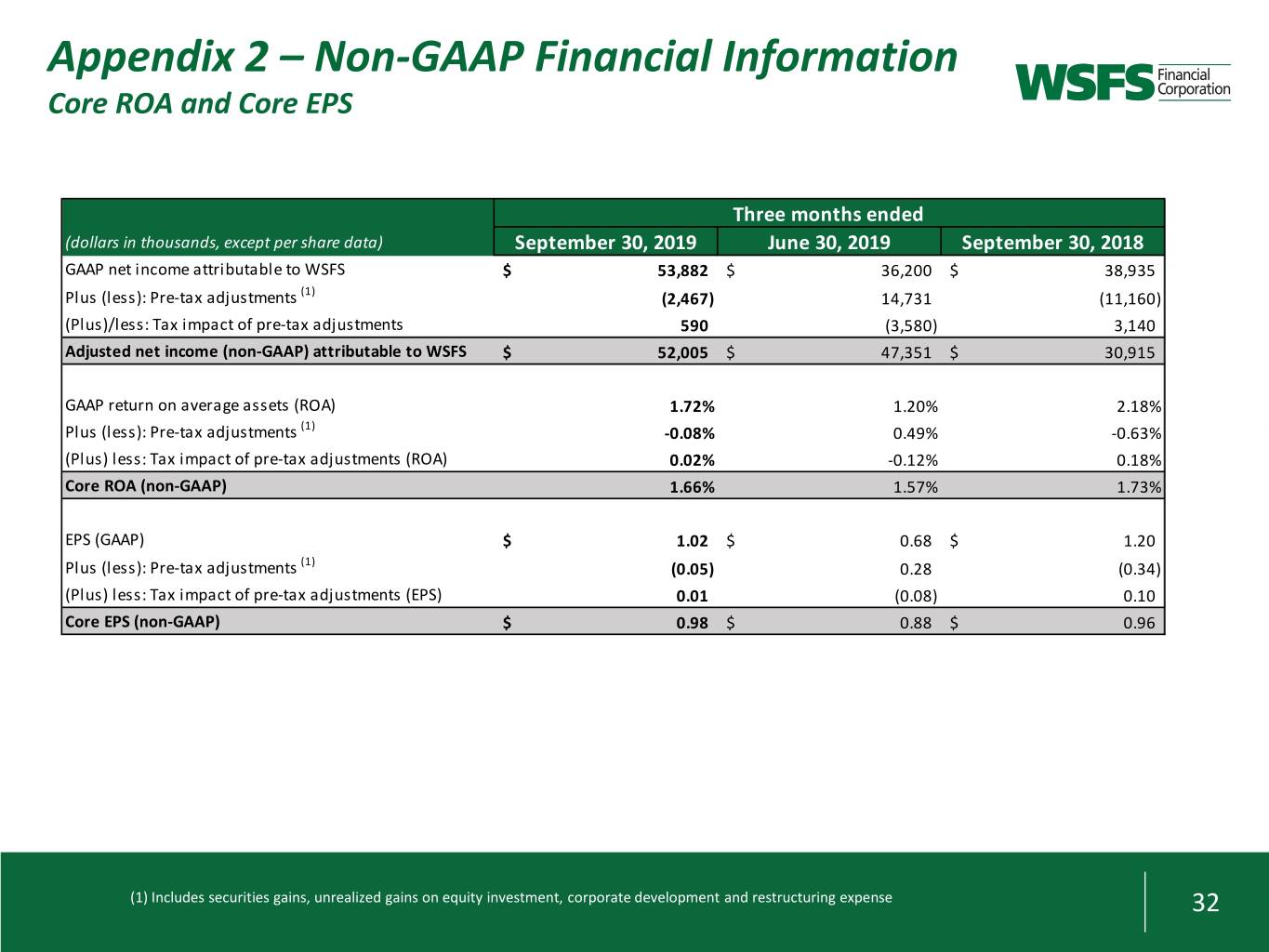

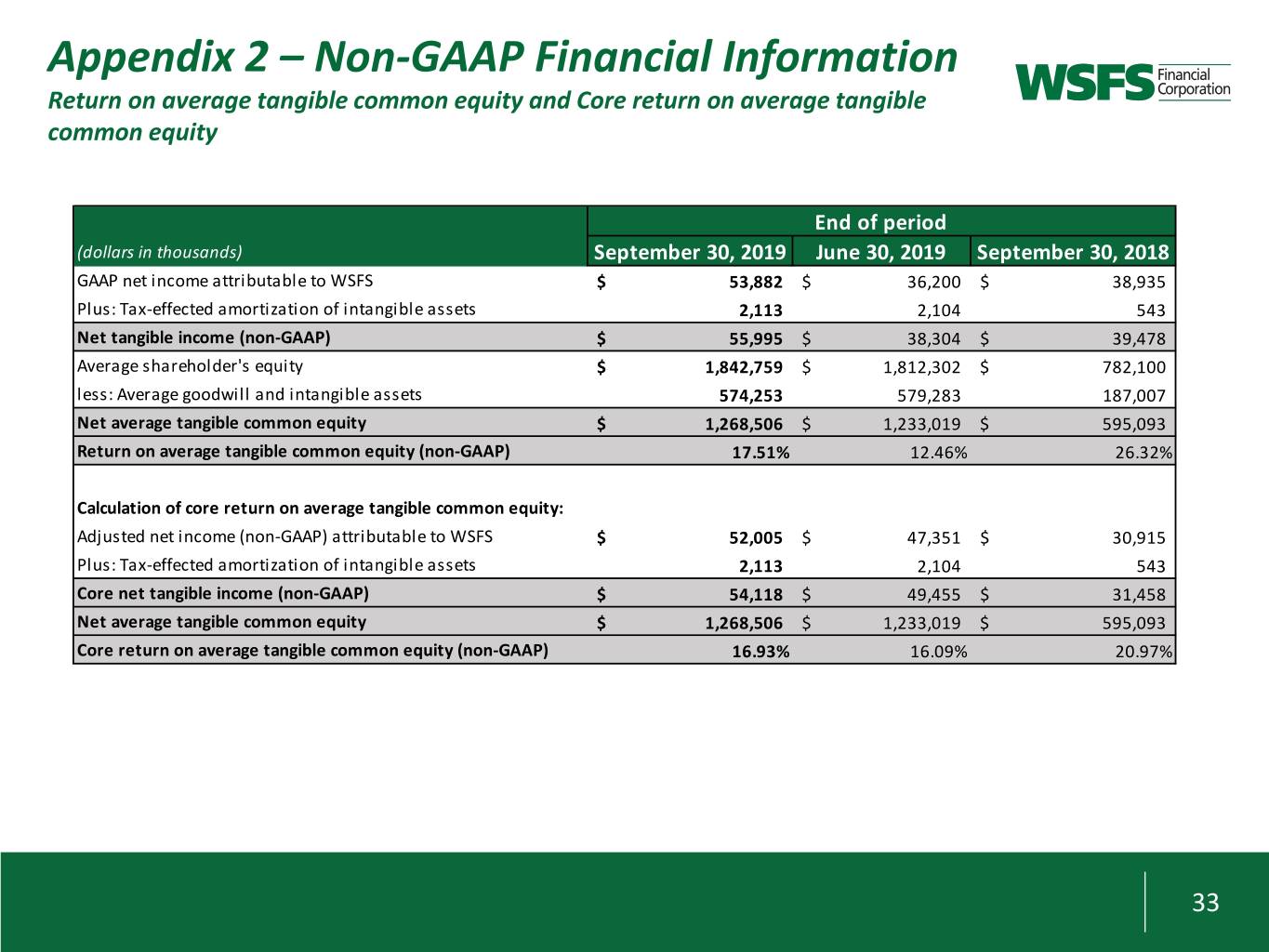

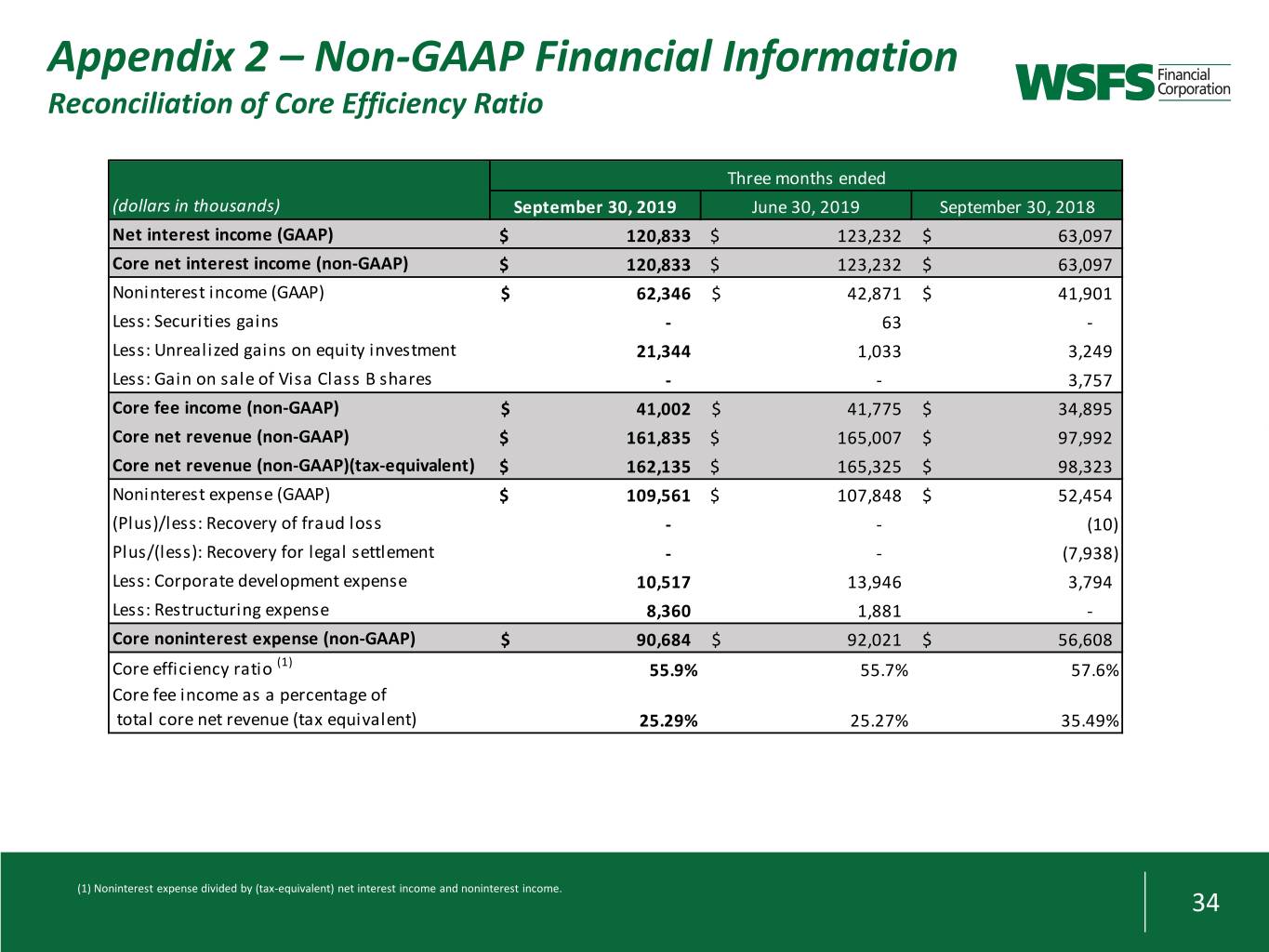

Non-GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see Appendix 2. The following are the non-GAAP measures used in this presentation: • Adjusted net income (non-GAAP) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains, realized and unrealized gains on equity investments, recovery of/provision for fraud loss, recovery of/provision for legal settlement, and corporate development and restructuring costs • Core noninterest income, also called core fee income, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of securities gains (losses) and realized and unrealized gains on equity investments • Core earnings per share (“EPS”) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) by (ii) weighted average shares of common stock outstanding for the applicable period • Core net revenue is a non-GAAP measure that is determined by adding core net interest income plus core noninterest income • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude corporate development and restructuring costs, recovery of/provision for fraud loss, and recovery of/provision for legal settlement • Core efficiency ratio is a non-GAAP measure that is determined by dividing core noninterest expense by the sum of core interest income and core noninterest income • Core fee income to total revenue is a non-GAAP measure that divides (i) core non interest income by (ii) (tax equivalent) core net interest income and core noninterest income • Core return on average assets (“ROA”) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) by (ii) average assets for the applicable period • Tangible common equity (“TCE”) is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other intangible assets. Return on average tangible common equity (“ROTCE”) is a non-GAAP measure and is defined as net income allocable to common stockholders excluding tax-effected amortization of intangible assets divided by tangible common equity • Core return on average tangible common equity (“ROTCE”) is a non-GAAP measure and is defined as adjusted net income allocable to common stockholders excluding tax-effected amortization of intangible assets divided by tangible common equity • Tangible common book value per share is a non-GAAP measure that is equal to common equity less goodwill and intangible assets, divided by total shares outstanding 3

Table of Contents 3Q 2019 Results Page 5 Net Interest Margin Page 8 Outlook Page 9 The WSFS Franchise Page 12 Selected Financial Information Page 17 Appendix 1 – Management Team Page 29 Appendix 2 – Non-GAAP Financial Information Page 31 Appendix 3 – Reconciliation of Conversion-related Reclassifications Page 35 4

3Q 2019 Reported Financial Results 3Q 2019 Reported Results: • EPS $1.02 • NIM 4.38% • ROA 1.72 % • Fee Income / Total Revenue 34.0% • ROTCE (1) 17.51% • Efficiency Ratio 59.7% • Net revenue (which includes net interest income and noninterest income) was $183.2 million for 3Q 2019, an increase of $78.2 million, or 74%, from 3Q 2018. • Net interest income was $120.8 million, an increase of $57.7 million, or 92%, from 3Q 2018 and net interest margin for 3Q 2019 was 4.38%, a 27 bps increase compared to 3Q 2018. • Fee income (noninterest income) was $62.3 million, an increase of $20.4 million, or 49%, from 3Q 2018, which included $21.3 million (pre-tax), or approximately $0.31 per share (after-tax), of unrealized gains on our investment in VISA Class B shares compared with $7.0 million, or approximately $0.17 per share, in realized and unrealized gains related to Visa Class B shares in 3Q 2018. • Noninterest expenses were $109.6 million in 3Q 2019, an increase of $57.1 million, or 109%, from 3Q 2018, which included $18.9 million (pre-tax), or approximately $0.27 per share, of net corporate development and restructuring costs related to our acquisition of Beneficial Bancorp, Inc. (Beneficial), compared to $3.8 million, or approximately $0.11 per share, in 3Q 2018. • In 3Q 2019, we repurchased 959,300 shares of common stock at an average price of $42.33 per share as part of our share buyback program approved by the Board in 4Q 2018. 1,906,338 shares, or approximately 4% of outstanding shares, remaining to repurchase under this authorization. (1) This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix 2 for a reconciliation to GAAP financial information. 5

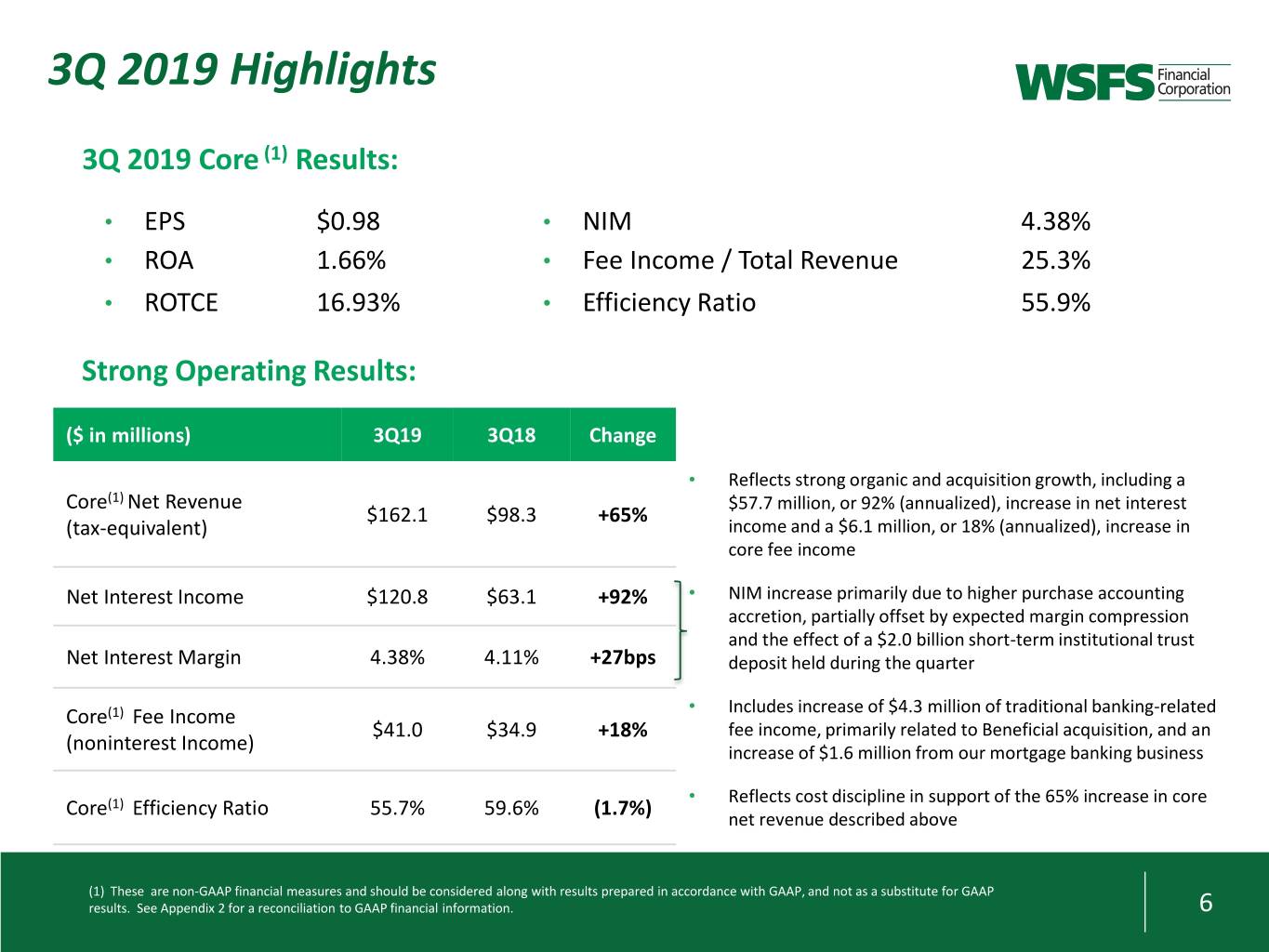

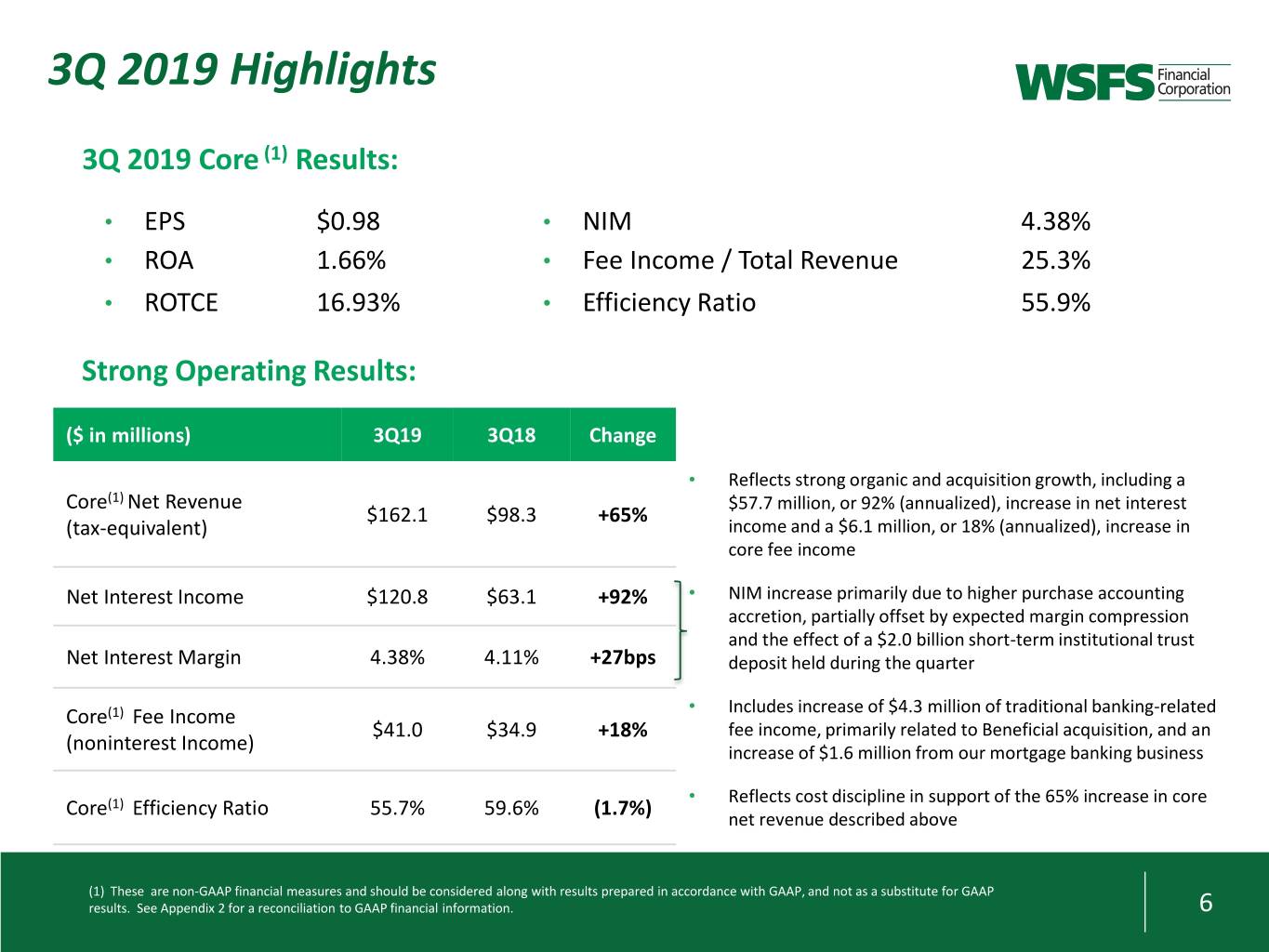

3Q 2019 Highlights 3Q 2019 Core (1) Results: • EPS $0.98 • NIM 4.38% • ROA 1.66% • Fee Income / Total Revenue 25.3% • ROTCE 16.93% • Efficiency Ratio 55.9% Strong Operating Results: ($ in millions) 3Q19 3Q18 Change • Reflects strong organic and acquisition growth, including a Core(1) Net Revenue $57.7 million, or 92% (annualized), increase in net interest $162.1 $98.3 +65% (tax-equivalent) income and a $6.1 million, or 18% (annualized), increase in core fee income Net Interest Income $120.8 $63.1 +92% • NIM increase primarily due to higher purchase accounting accretion, partially offset by expected margin compression and the effect of a $2.0 billion short-term institutional trust Net Interest Margin 4.38% 4.11% +27bps deposit held during the quarter Core(1) Fee Income • Includes increase of $4.3 million of traditional banking-related $41.0 $34.9 +18% fee income, primarily related to Beneficial acquisition, and an (noninterest Income) increase of $1.6 million from our mortgage banking business • Reflects cost discipline in support of the 65% increase in core Core(1) Efficiency Ratio 55.7% 59.6% (1.7%) net revenue described above (1) These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix 2 for a reconciliation to GAAP financial information. 6

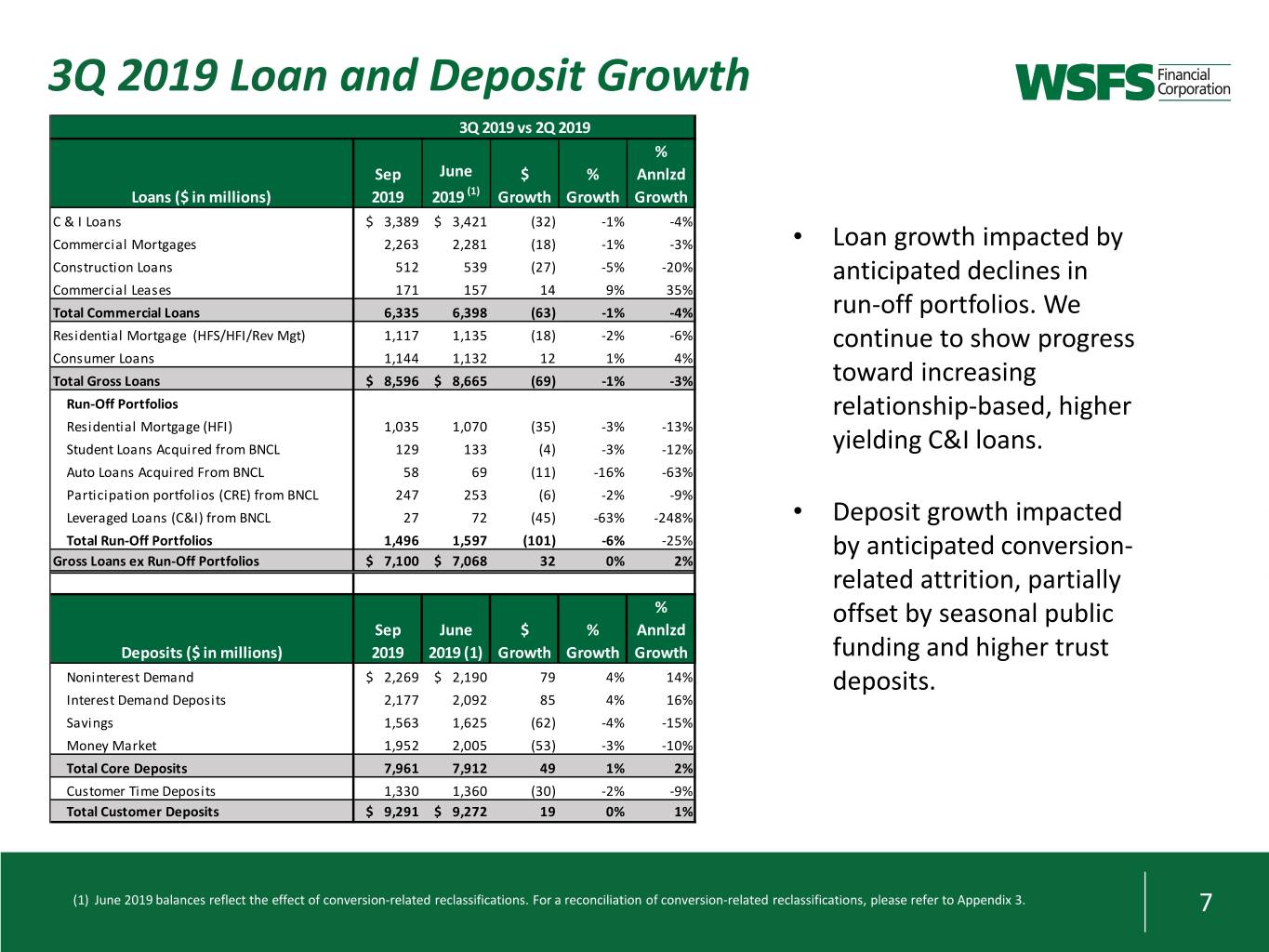

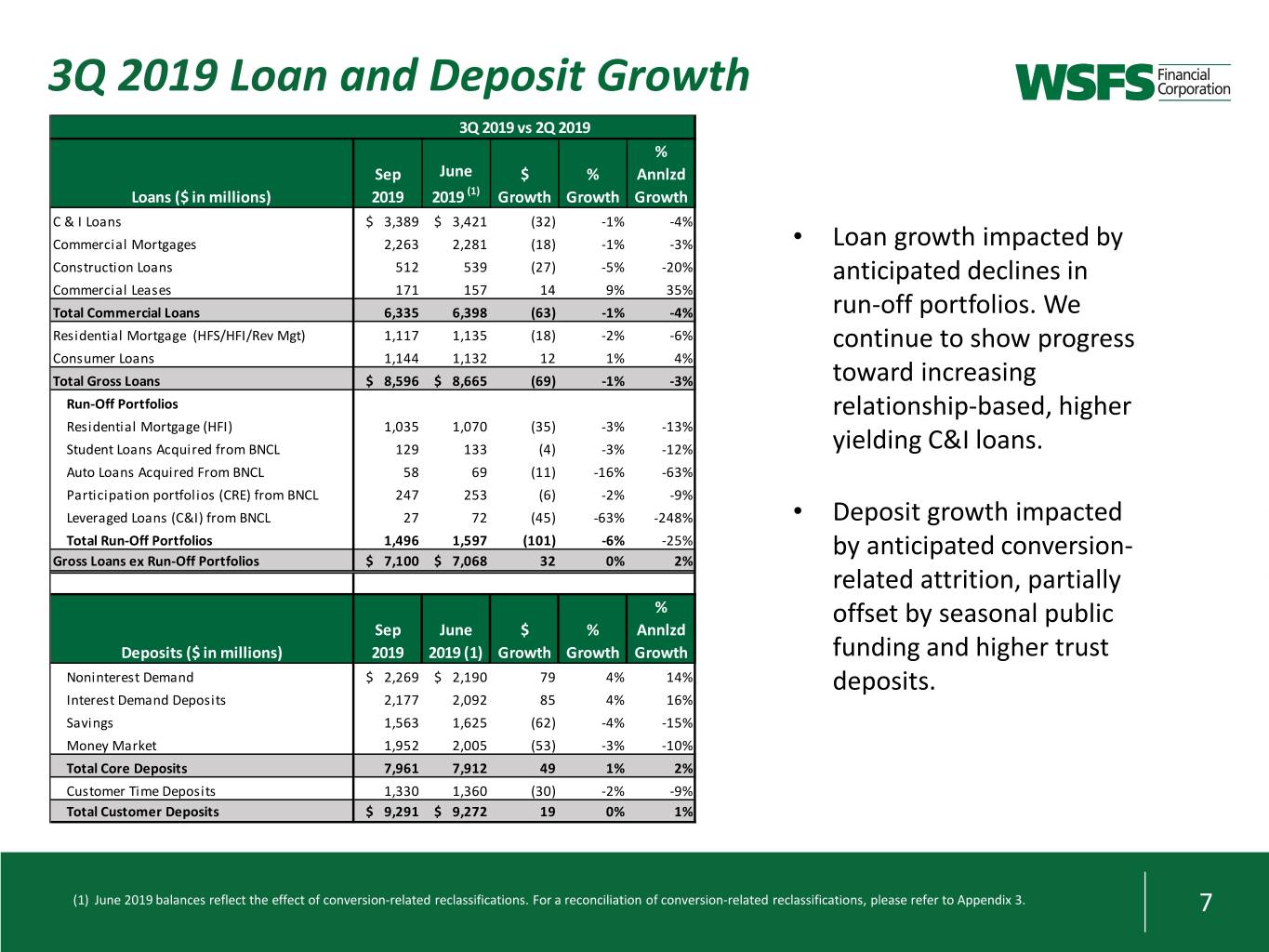

3Q 2019 Loan and Deposit Growth 3Q 2019 vs 2Q 2019 % Sep June $ % Annlzd Loans ($ in millions) 2019 2019 (1) Growth Growth Growth C & I Loans $ 3,389 $ 3,421 (32) -1% -4% Commercial Mortgages 2,263 2,281 (18) -1% -3% • Loan growth impacted by Construction Loans 512 539 (27) -5% -20% anticipated declines in Commercial Leases 171 157 14 9% 35% Total Commercial Loans 6,335 6,398 (63) -1% -4% run-off portfolios. We Residential Mortgage (HFS/HFI/Rev Mgt) 1,117 1,135 (18) -2% -6% continue to show progress Consumer Loans 1,144 1,132 12 1% 4% Total Gross Loans $ 8,596 $ 8,665 (69) -1% -3% toward increasing Run-Off Portfolios relationship-based, higher Residential Mortgage (HFI) 1,035 1,070 (35) -3% -13% Student Loans Acquired from BNCL 129 133 (4) -3% -12% yielding C&I loans. Auto Loans Acquired From BNCL 58 69 (11) -16% -63% Participation portfolios (CRE) from BNCL 247 253 (6) -2% -9% Leveraged Loans (C&I) from BNCL 27 72 (45) -63% -248% • Deposit growth impacted Total Run-Off Portfolios 1,496 1,597 (101) -6% -25% by anticipated conversion- Gross Loans ex Run-Off Portfolios $ 7,100 $ 7,068 32 0% 2% related attrition, partially % offset by seasonal public Sep June $ % Annlzd Deposits ($ in millions) 2019 2019 (1) Growth Growth Growth funding and higher trust Noninterest Demand $ 2,269 $ 2,190 79 4% 14% deposits. Interest Demand Deposits 2,177 2,092 85 4% 16% Savings 1,563 1,625 (62) -4% -15% Money Market 1,952 2,005 (53) -3% -10% Total Core Deposits 7,961 7,912 49 1% 2% Customer Time Deposits 1,330 1,360 (30) -2% -9% Total Customer Deposits $ 9,291 $ 9,272 19 0% 1% (1) June 2019 balances reflect the effect of conversion-related reclassifications. For a reconciliation of conversion-related reclassifications, please refer to Appendix 3. 7

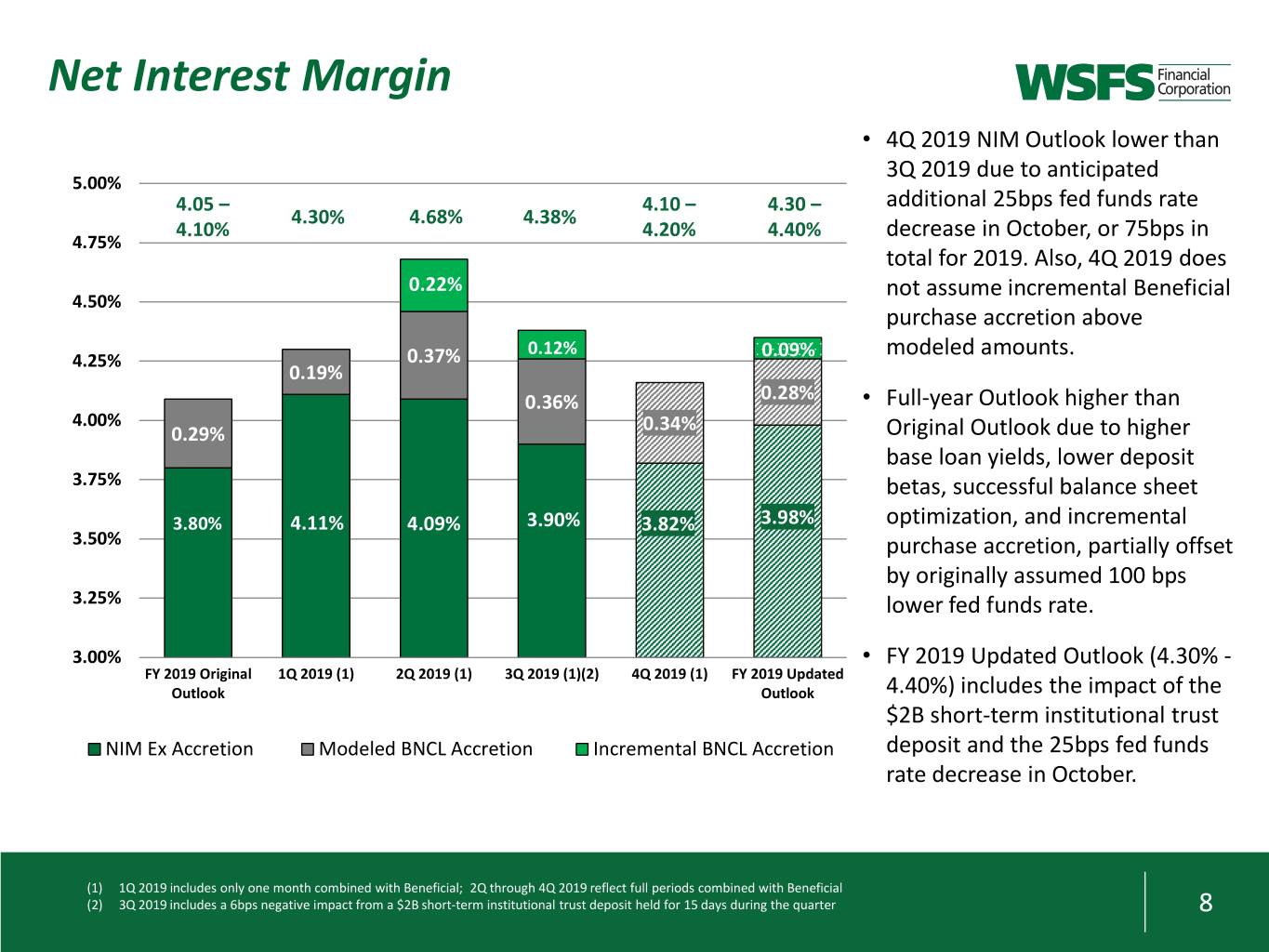

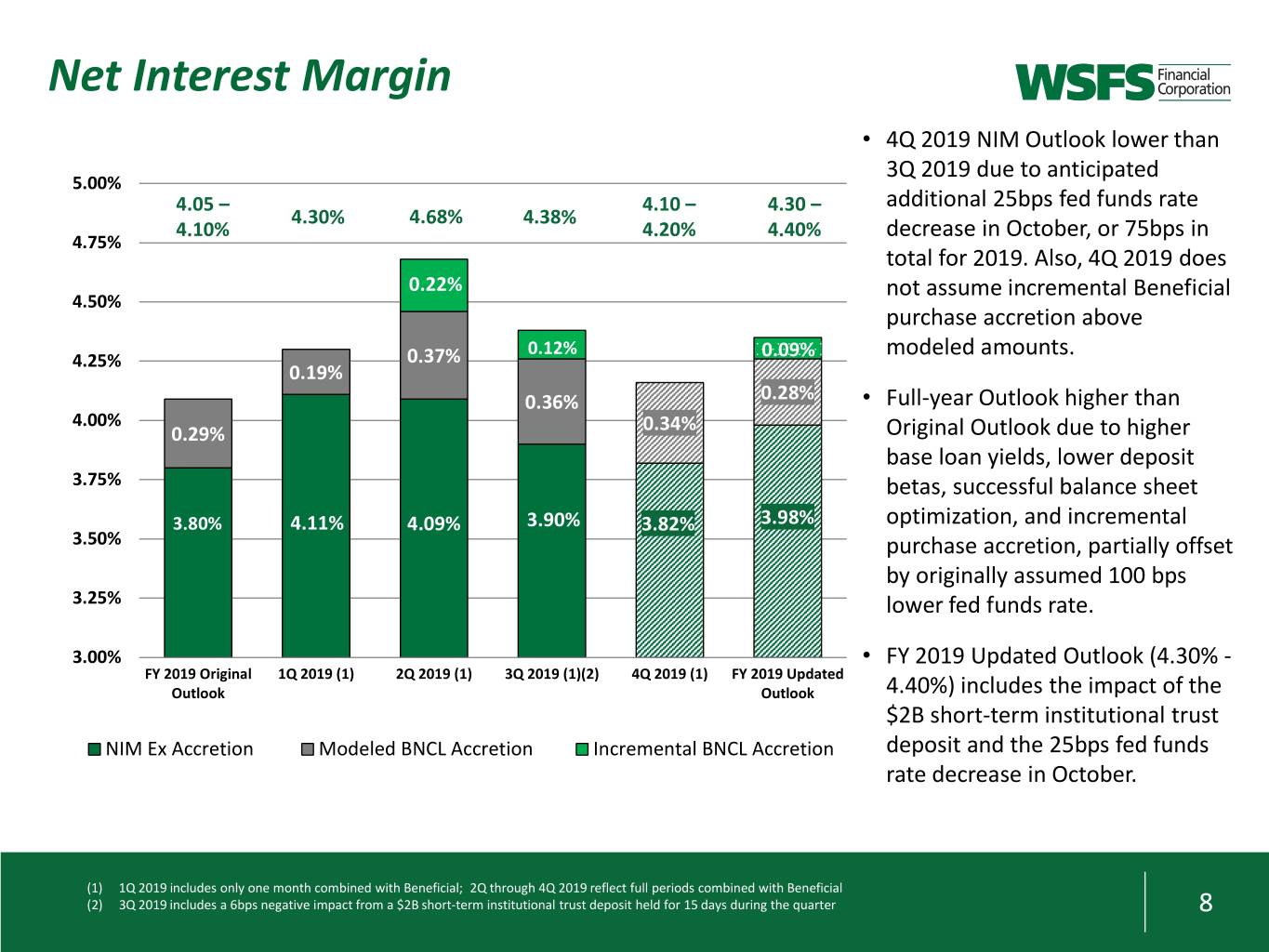

Net Interest Margin • 4Q 2019 NIM Outlook lower than 3Q 2019 due to anticipated 5.00% 4.05 – 4.10 – 4.30 – additional 25bps fed funds rate 4.30% 4.68% 4.38% 4.10% 4.20% 4.40% decrease in October, or 75bps in 4.75% total for 2019. Also, 4Q 2019 does 0.00% 0.22% not assume incremental Beneficial 4.50% purchase accretion above 0.12% 0.15% 0.09% modeled amounts. 4.25% 0.37% 0.19% 0.36% 0.28% • Full-year Outlook higher than 4.00% 0.34% 0.29% Original Outlook due to higher base loan yields, lower deposit 3.75% betas, successful balance sheet 3.80% 4.11% 4.09% 3.90% 3.82% 3.98% optimization, and incremental 3.50% purchase accretion, partially offset by originally assumed 100 bps 3.25% lower fed funds rate. 3.00% • FY 2019 Updated Outlook (4.30% - FY 2019 Original 1Q 2019 (1) 2Q 2019 (1) 3Q 2019 (1)(2) 4Q 2019 (1) FY 2019 Updated Outlook Outlook 4.40%) includes the impact of the $2B short-term institutional trust NIM Ex Accretion Modeled BNCL Accretion Incremental BNCL Accretion deposit and the 25bps fed funds rate decrease in October. (1) 1Q 2019 includes only one month combined with Beneficial; 2Q through 4Q 2019 reflect full periods combined with Beneficial (2) 3Q 2019 includes a 6bps negative impact from a $2B short-term institutional trust deposit held for 15 days during the quarter 8

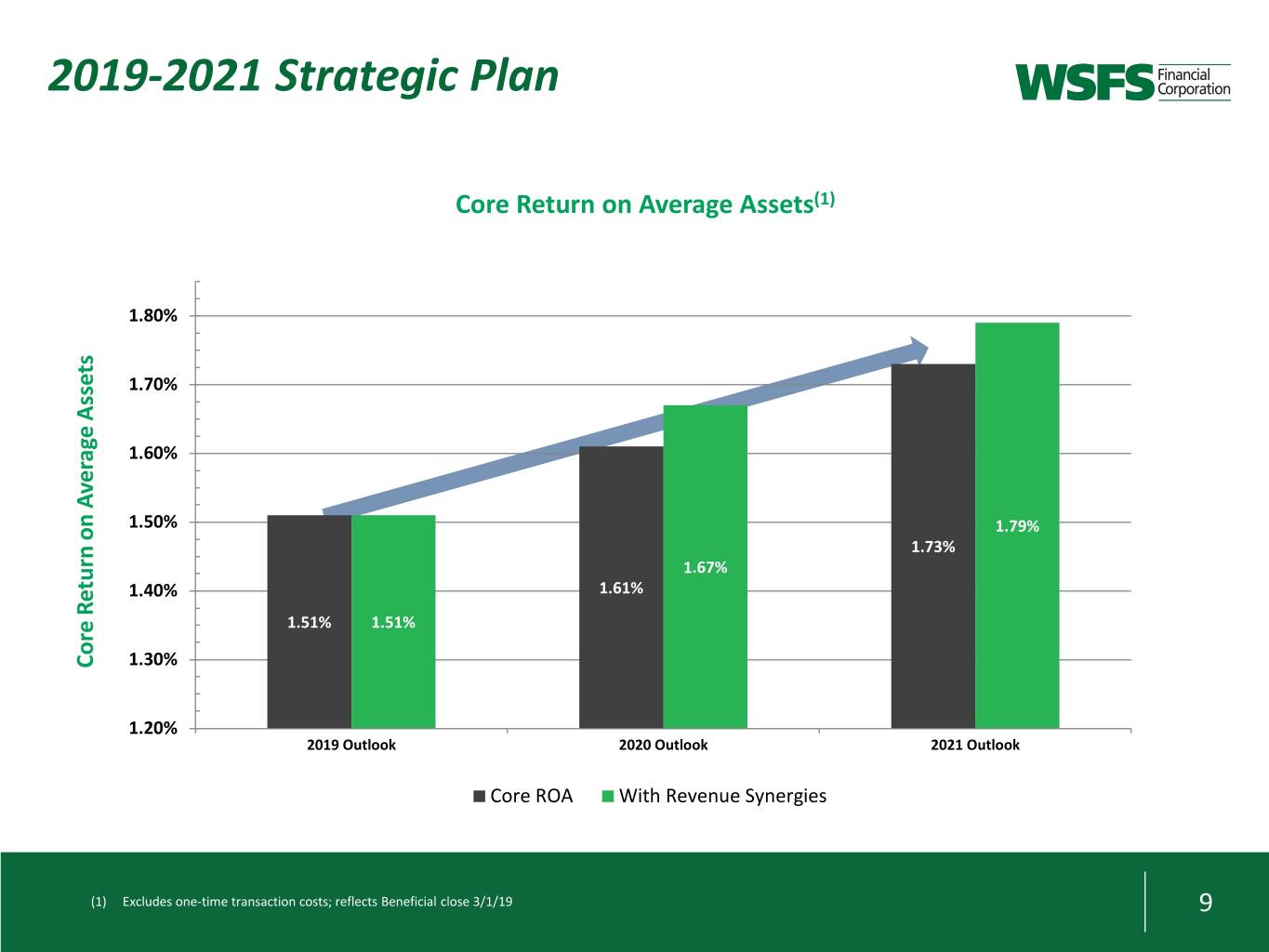

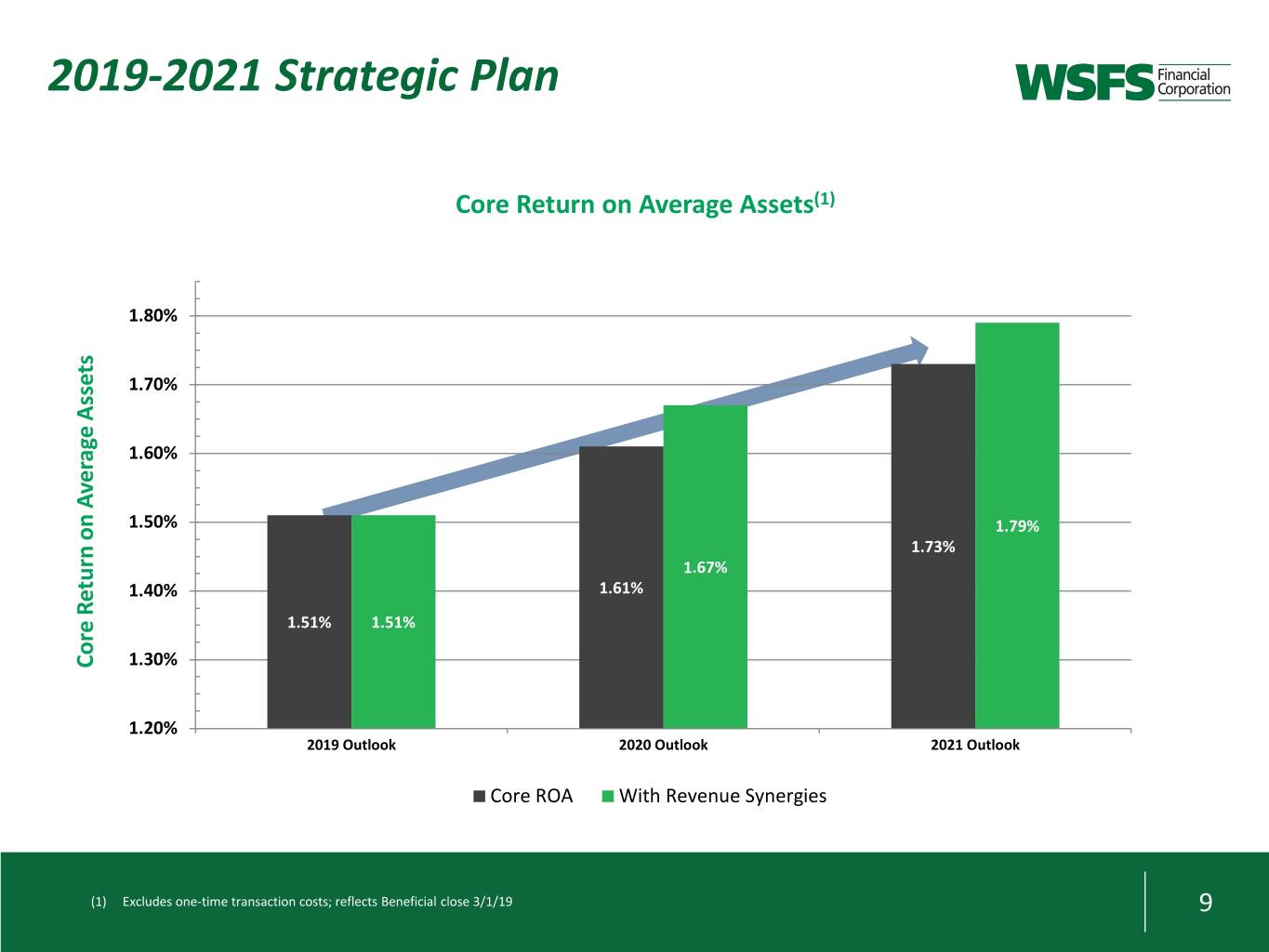

2019-2021 Strategic Plan Core Return on Average Assets(1) 1.80% 1.70% 1.60% 1.50% 1.79% 1.73% 1.67% 1.40% 1.61% 1.51% 1.51% Core Return on Average Assets on Average Return Core 1.30% 1.20% 2019 Outlook 2020 Outlook 2021 Outlook Core ROA With Revenue Synergies (1) Excludes one-time transaction costs; reflects Beneficial close 3/1/19 9

Compelling Strategic Growth Opportunity At $12.3 billion in assets at 9/30/19, WSFS fills a long-standing service gap in the Delaware Valley market between larger regional / national banks and smaller community banks MSA: Philadelphia-Camden-Wilmington (PA/NJ/DE/MD) Market Position Total Deposits Market th # Institution Name ($MM) Share • 5 largest depository MSA in the U.S. 1 Wells Fargo Bank NA $30,865 18.75% • 2x the market share of the next largest local community 2 TD Bank NA $28,192 17.13% bank 3 Bank of America NA $15,805 9.60% 4 PNC Bank NA $15,168 9.21% 5 Citizens Bank NA $11,373 6.91% 6 WSFS Bank $8,697 5.28% 7 M & T Bank $8,204 4.98% 8 BB & T $4,667 2.84% Former Iconic 9 Univest Bank and Trust Co. $3,656 2.22% Delaware Valley Banks 10 Bryn Mawr Trust Co. $3,483 2.12% 11 Santander Bank NA $3,134 1.90% 12 Fulton Bank NA $3,046 1.85% 13 Republic First Bank $2,526 1.53% 14 Firstrust Savings Bank $2,402 1.46% 15 KeyBank NA $2,400 1.46% 16 Investors Bank $1,576 0.96% • WSFS is filling the service gap left by the acquisitions of 17 Penn Community Bank $1,552 0.94% 18 Customers Bank $1,289 0.78% former iconic local banks by larger out-of-market banks 19 QNB Bank $860 0.52% 20 First National Bank and Trust Co. of Newtown $831 0.50% Note: Market share data as of June 30, 2019; Source: FDIC Market Share data excludes brokered deposits and non-traditional banks (e.g. credit card companies) 10

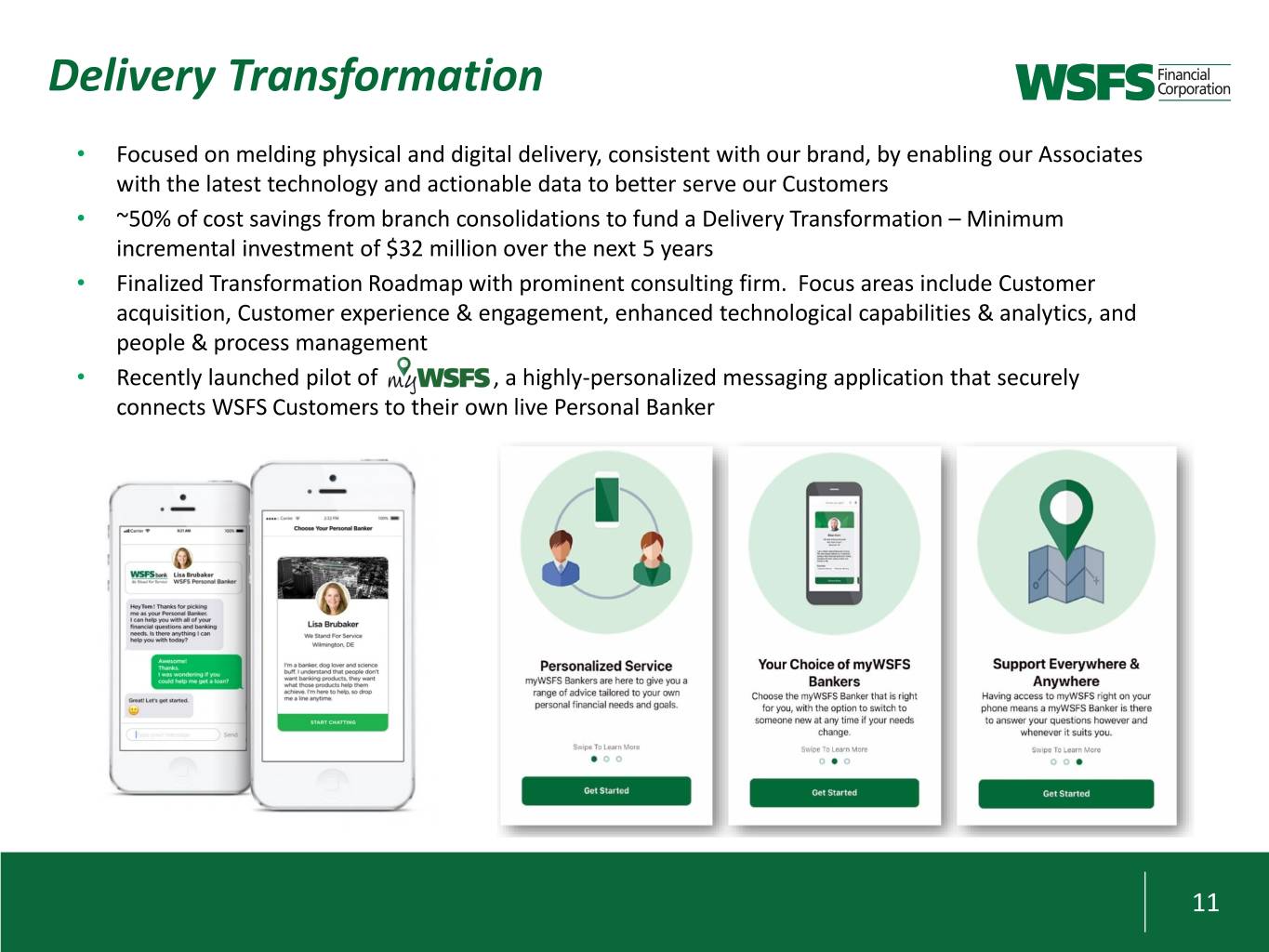

Delivery Transformation • Focused on melding physical and digital delivery, consistent with our brand, by enabling our Associates with the latest technology and actionable data to better serve our Customers • ~50% of cost savings from branch consolidations to fund a Delivery Transformation – Minimum incremental investment of $32 million over the next 5 years • Finalized Transformation Roadmap with prominent consulting firm. Focus areas include Customer acquisition, Customer experience & engagement, enhanced technological capabilities & analytics, and people & process management • Recently launched pilot of , a highly-personalized messaging application that securely connects WSFS Customers to their own live Personal Banker 11

The WSFS Franchise

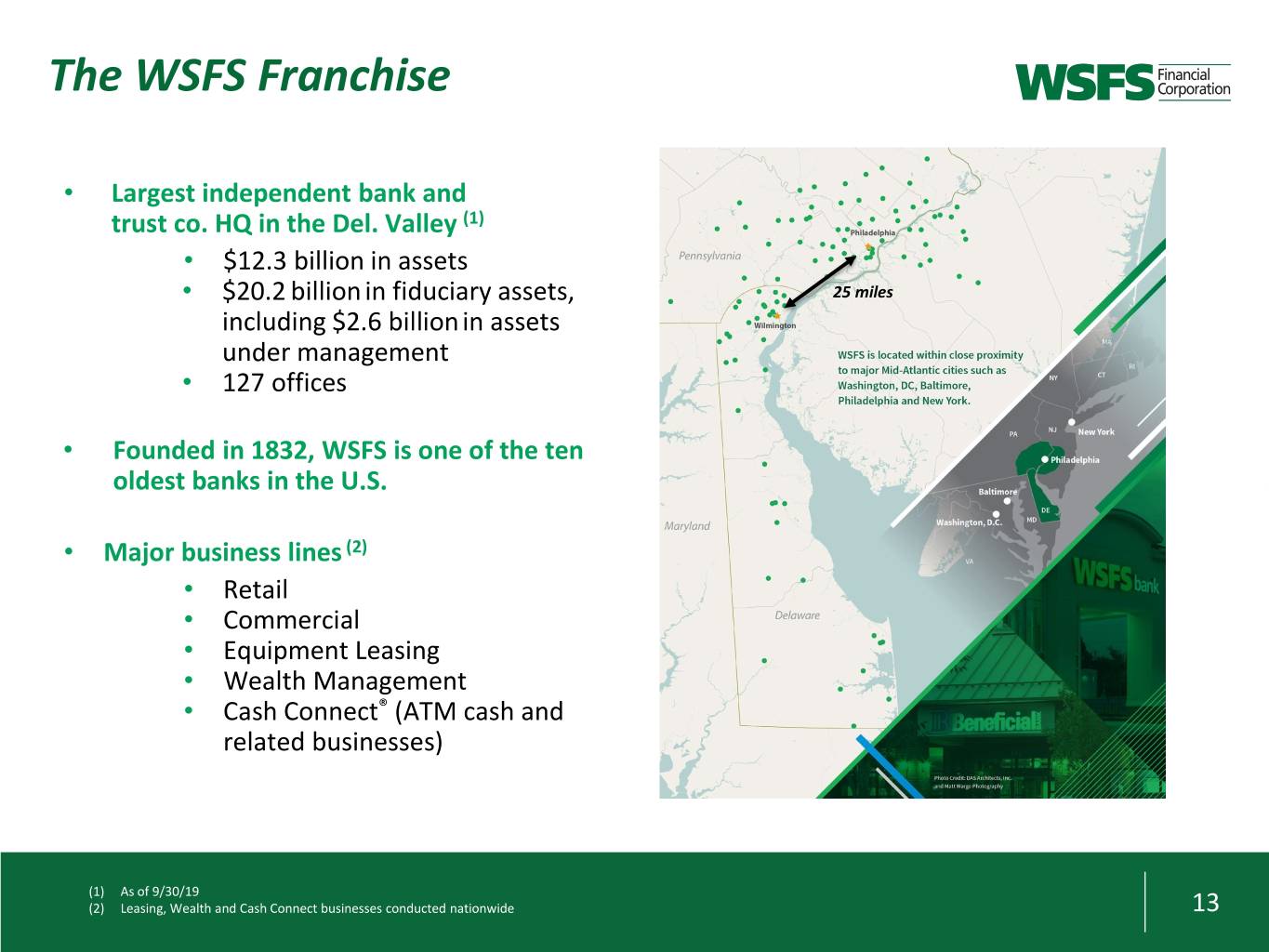

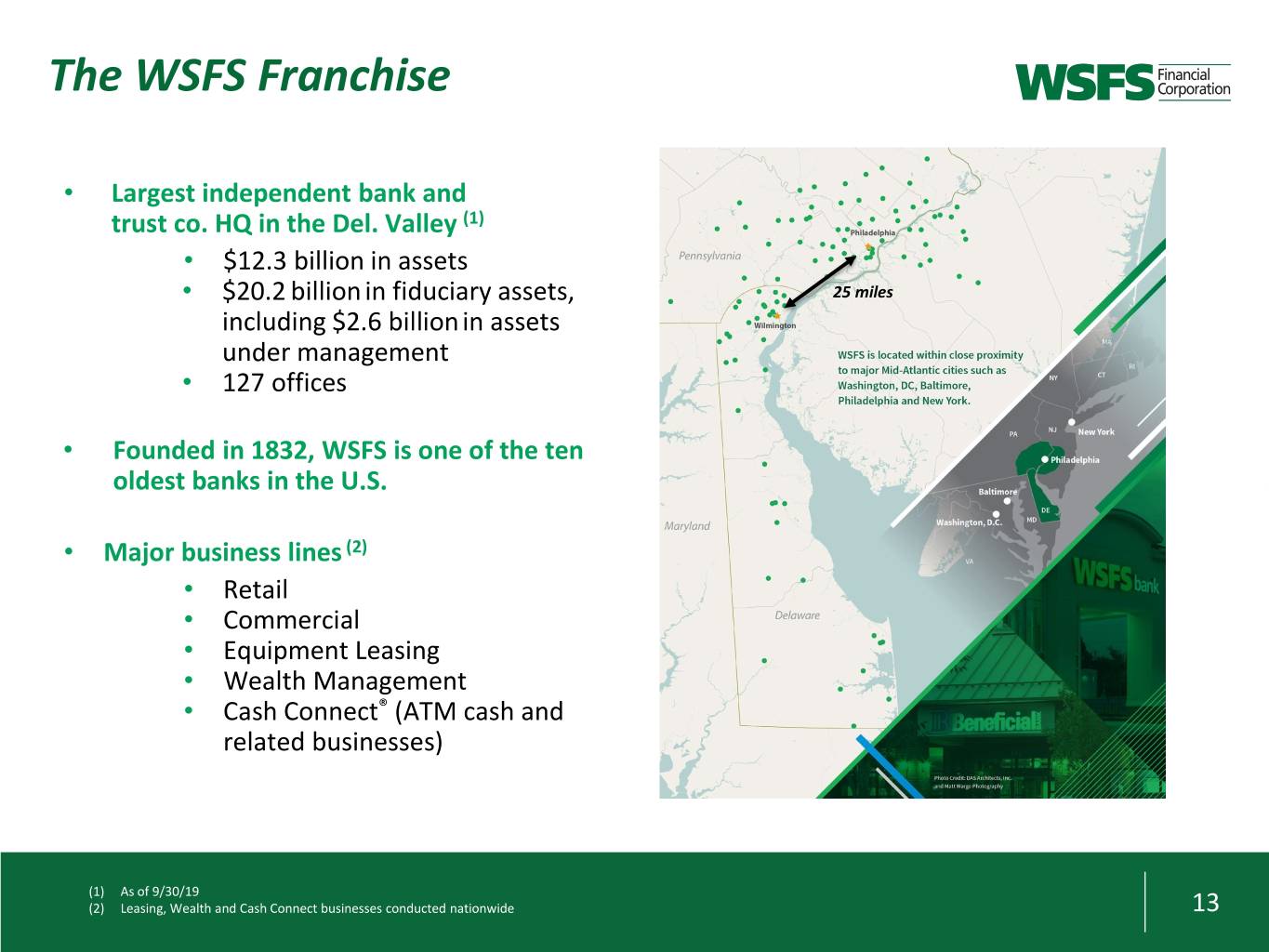

The WSFS Franchise • Largest independent bank and trust co. HQ in the Del. Valley (1) • $12.3 billion in assets • $20.2 billionin fiduciary assets, 25 miles including $2.6 billionin assets under management • 127 offices • Founded in 1832, WSFS is one of the ten oldest banks in the U.S. • Major business lines (2) • Retail • Commercial • Equipment Leasing • Wealth Management • Cash Connect® (ATM cash and related businesses) (1) As of 9/30/19 (2) Leasing, Wealth and Cash Connect businesses conducted nationwide 13

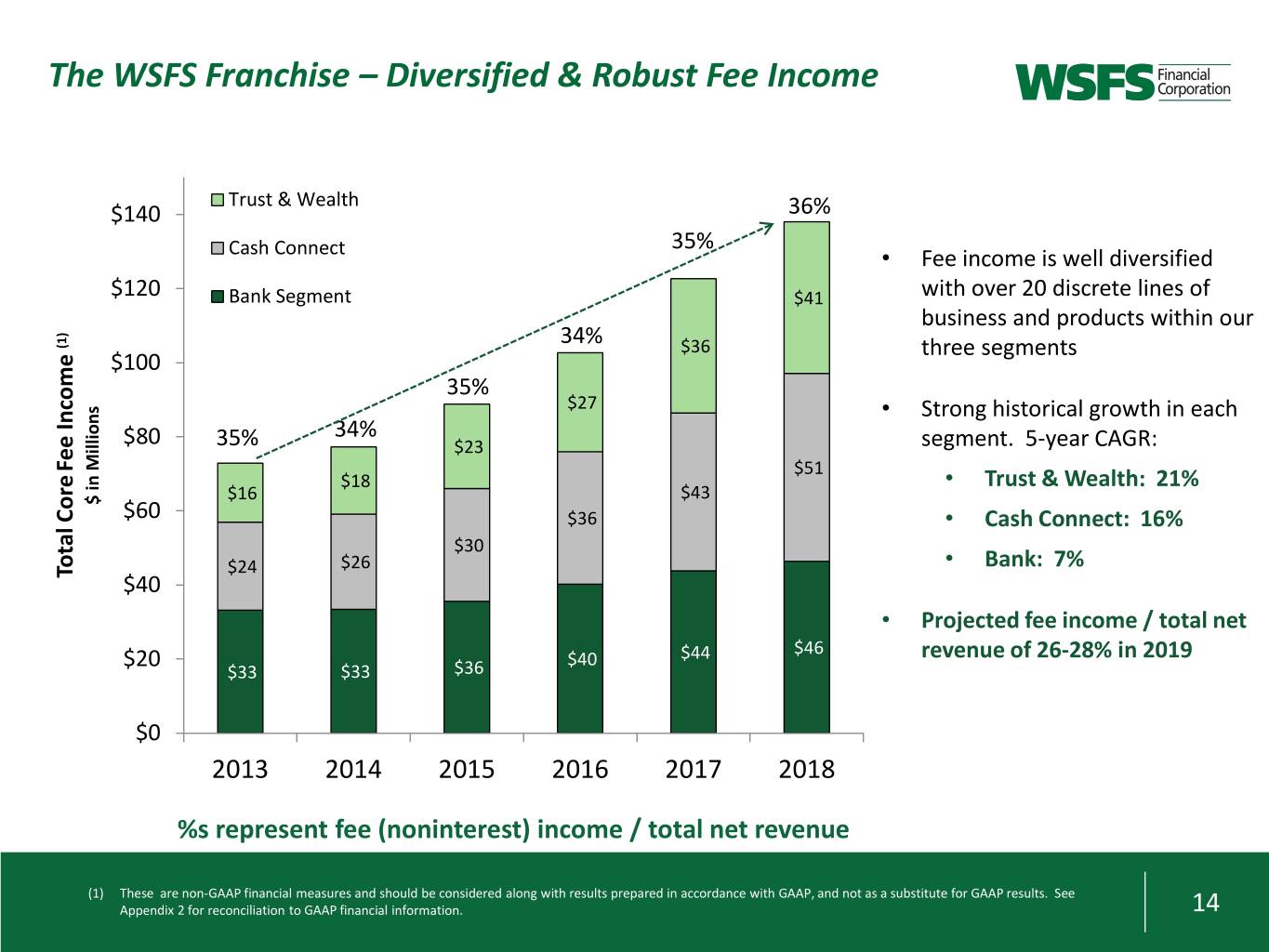

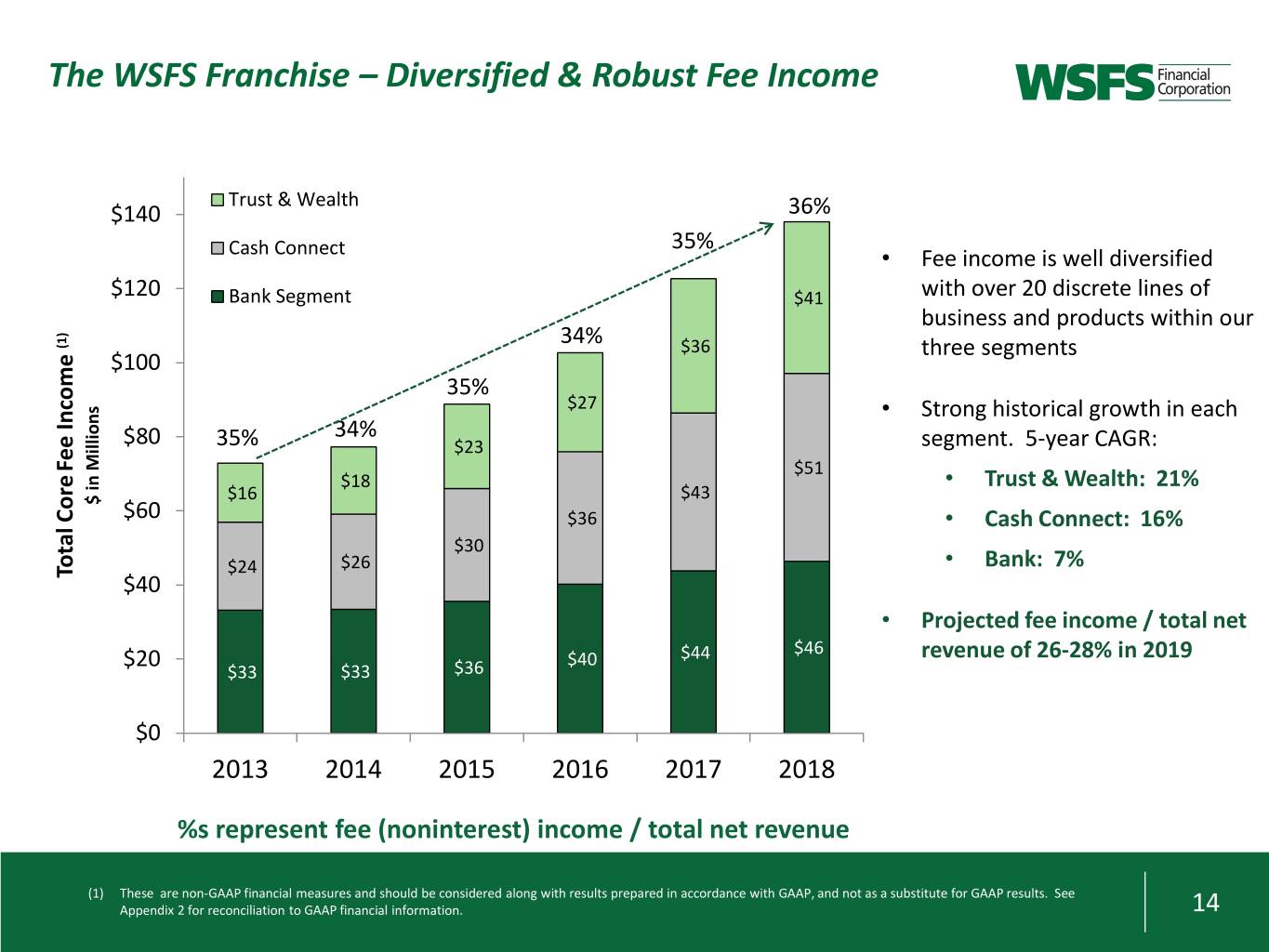

The WSFS Franchise – Diversified & Robust Fee Income Trust & Wealth $140 36% 35% Cash Connect • Fee income is well diversified $120 Bank Segment $41 with over 20 discrete lines of business and products within our (1) 34% $36 three segments $100 35% $27 • Strong historical growth in each Income Income 34% $80 35% $23 segment. 5-year CAGR: Fee Fee $51 $18 • Trust & Wealth: 21% $43 $ in Millions $ in Millions $16 Core $60 $36 • Cash Connect: 16% $30 $26 • Bank: 7% Total Total $24 $40 • Projected fee income / total net $46 $20 $40 $44 revenue of 26-28% in 2019 $33 $33 $36 $0 2013 2014 2015 2016 2017 2018 %s represent fee (noninterest) income / total net revenue (1) These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix 2 for reconciliation to GAAP financial information. 14

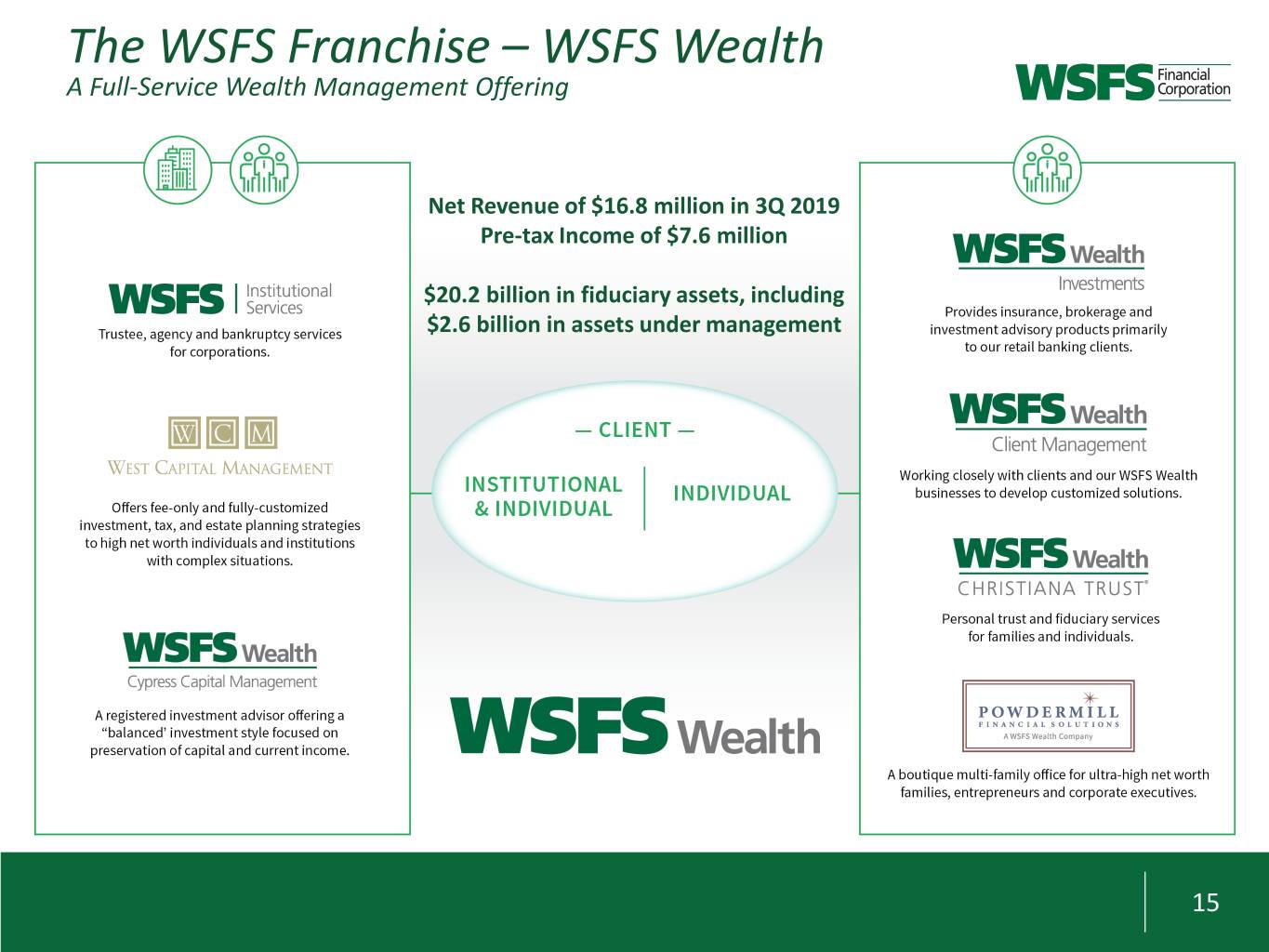

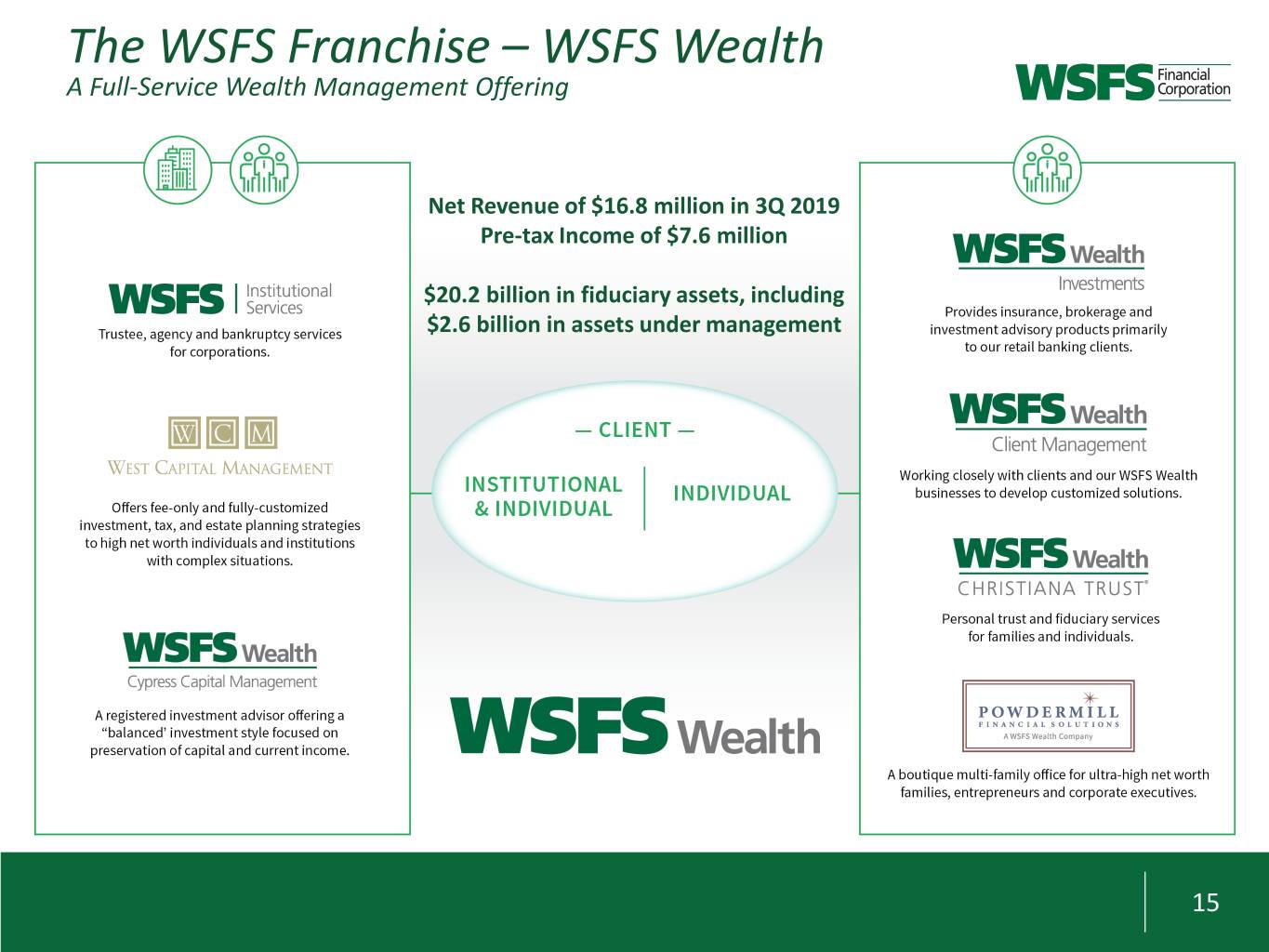

The WSFS Franchise – WSFS Wealth A Full-Service Wealth Management Offering Net Revenue of $16.8 million in 3Q 2019 Pre-tax Income of $7.6 million $20.2 billion in fiduciary assets, including $2.6 billion in assets under management 15

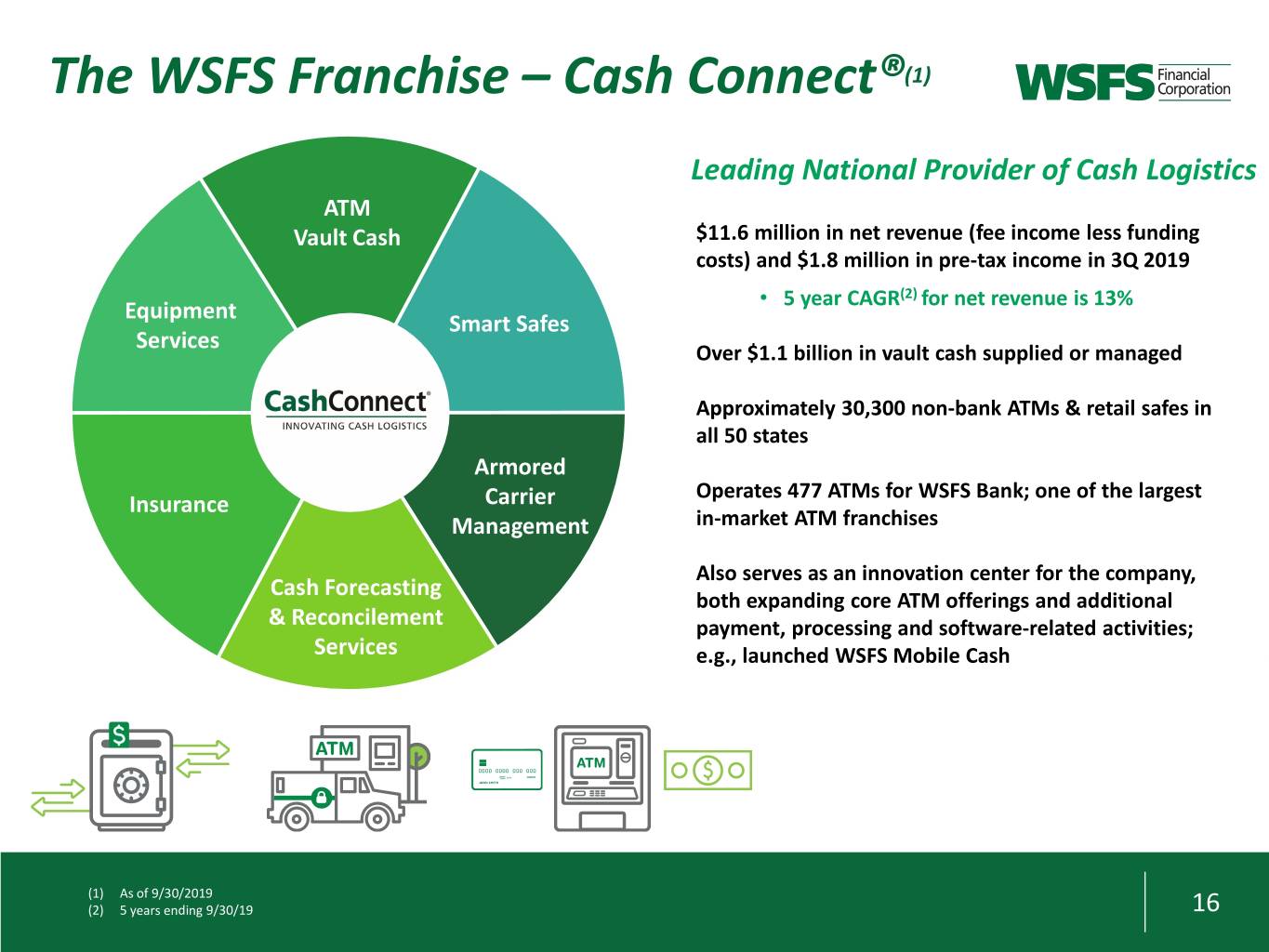

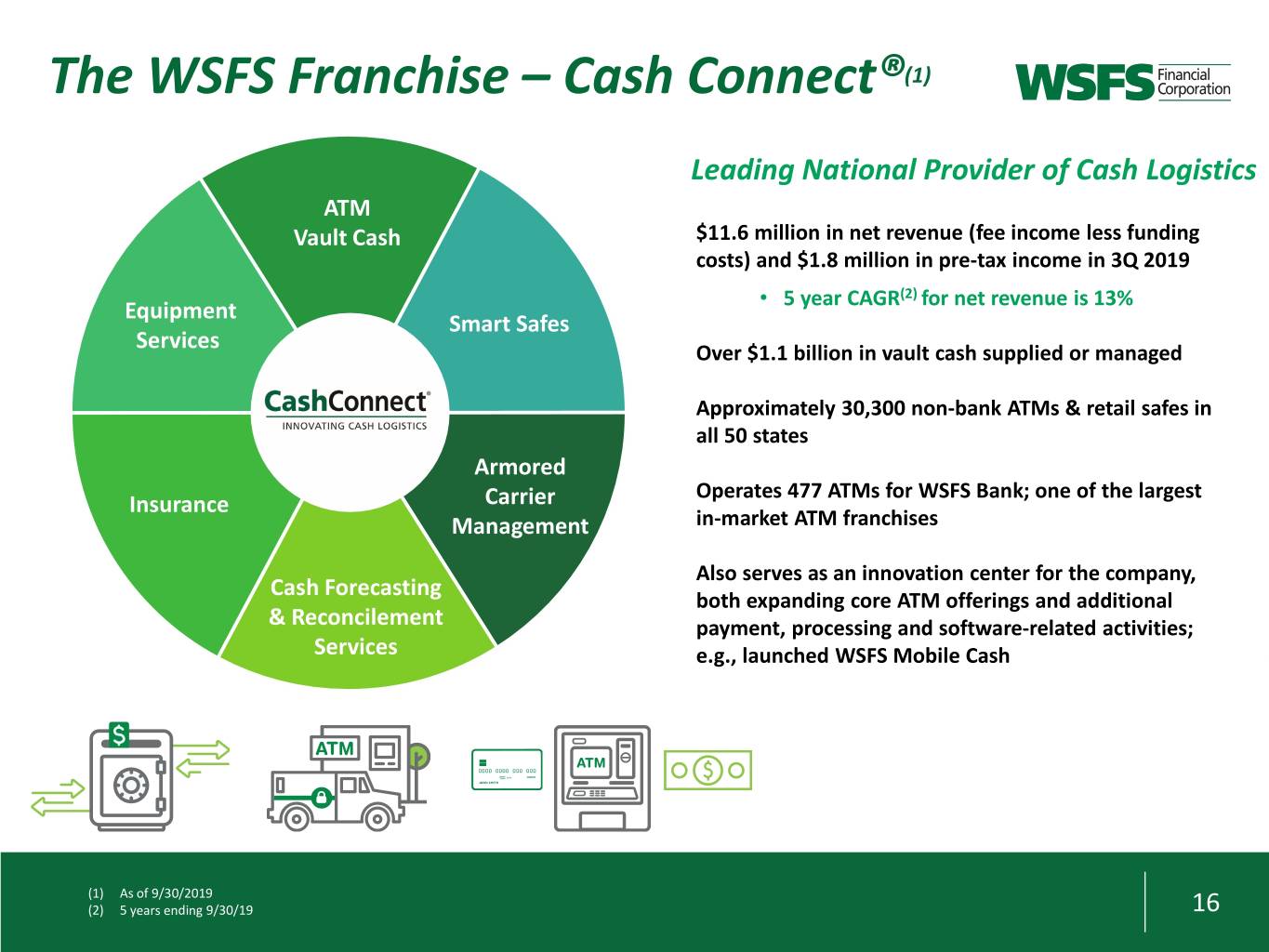

The WSFS Franchise – Cash Connect®(1) Leading National Provider of Cash Logistics ATM Vault Cash $11.6 million in net revenue (fee income less funding costs) and $1.8 million in pre-tax income in 3Q 2019 • 5 year CAGR(2) for net revenue is 13% Equipment Smart Safes Services Over $1.1 billion in vault cash supplied or managed Approximately 30,300 non-bank ATMs & retail safes in all 50 states Armored Operates 477 ATMs for WSFS Bank; one of the largest Insurance Carrier Management in-market ATM franchises Also serves as an innovation center for the company, Cash Forecasting both expanding core ATM offerings and additional & Reconcilement payment, processing and software-related activities; Services e.g., launched WSFS Mobile Cash (1) As of 9/30/2019 (2) 5 years ending 9/30/19 16

Selected Financial Information

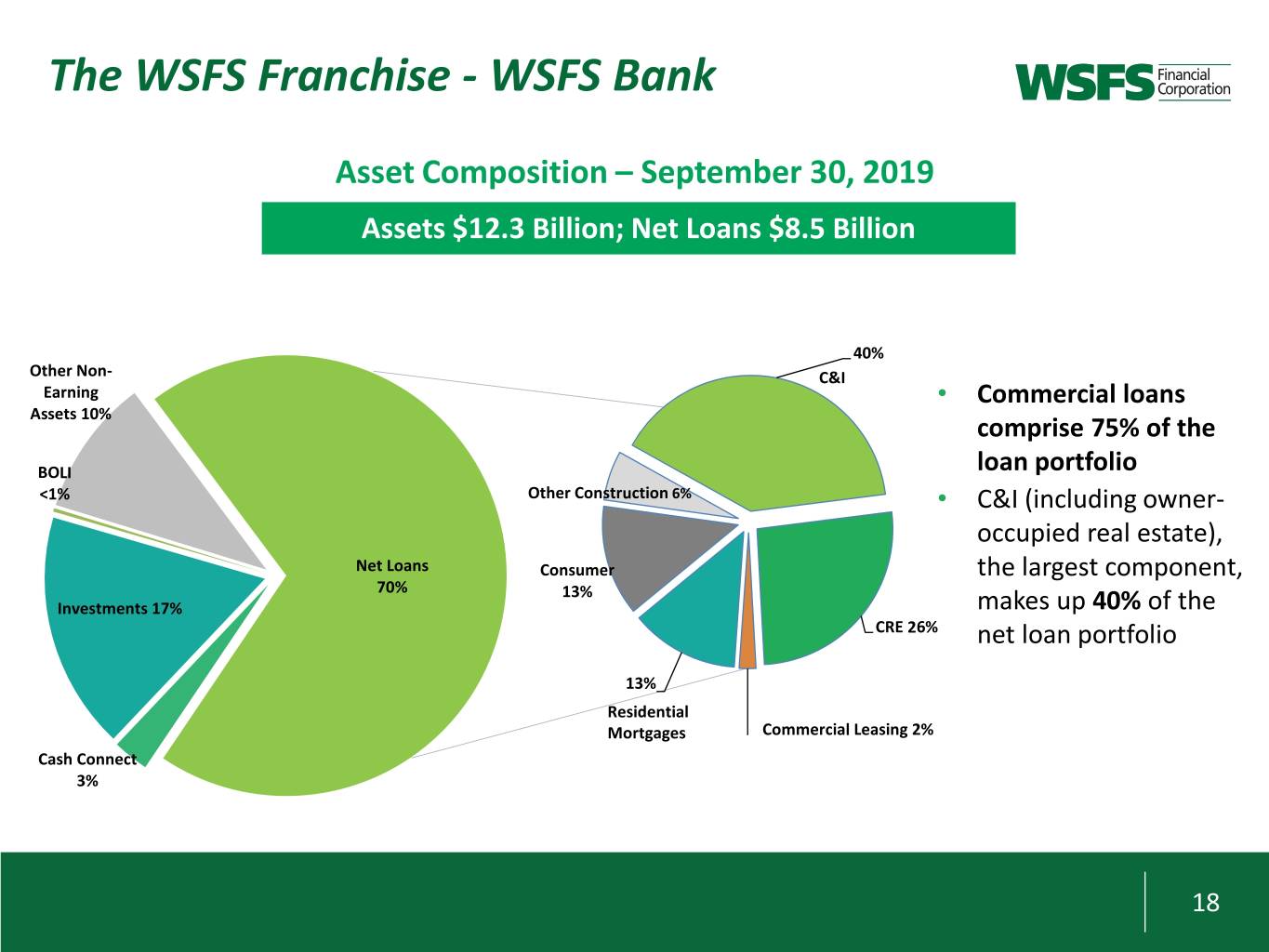

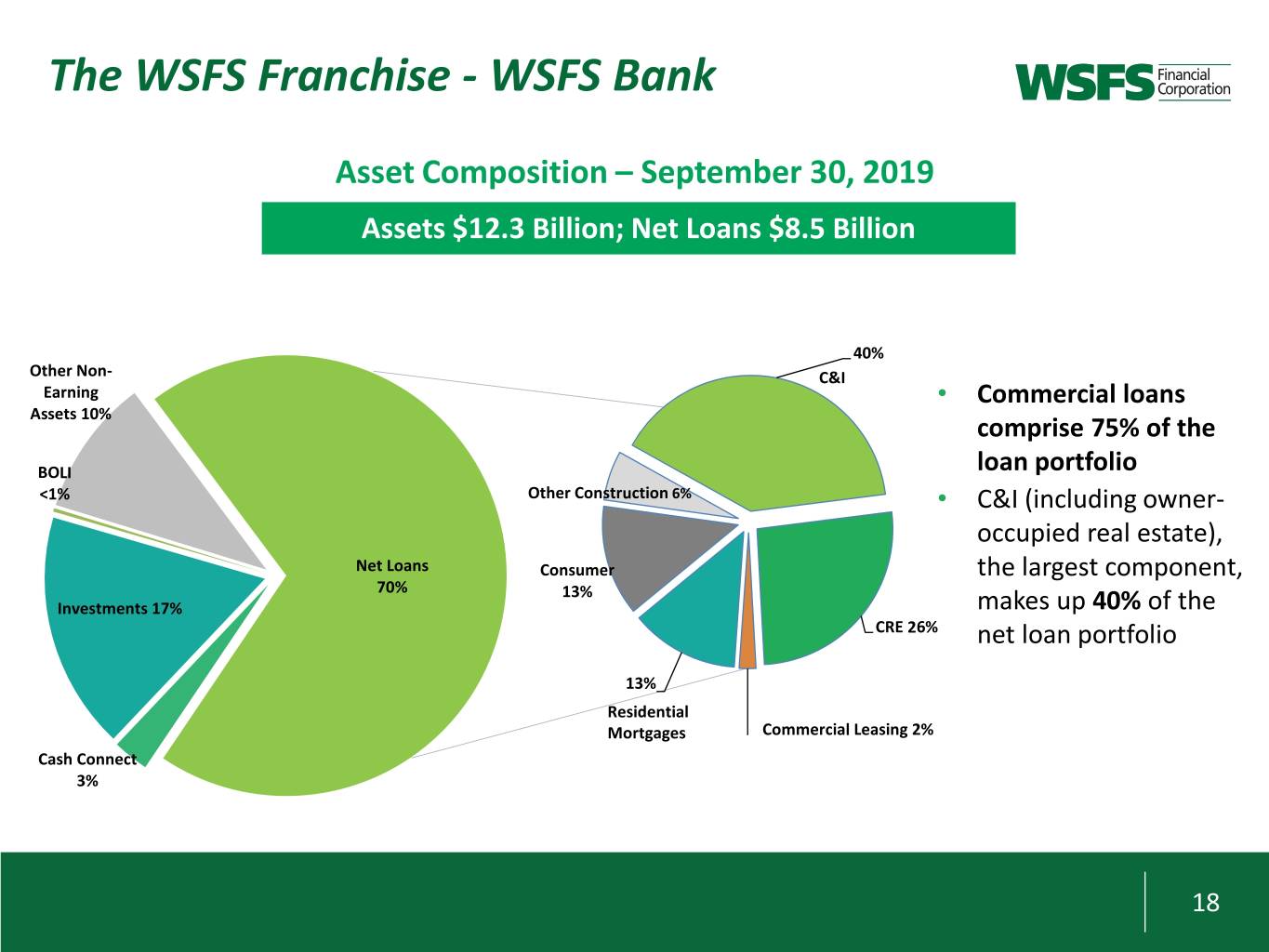

The WSFS Franchise - WSFS Bank Asset Composition – September 30, 2019 Assets $12.3 Billion; Net Loans $8.5 Billion 40% Other Non- C&I Earning • Commercial loans Assets 10% comprise 75% of the BOLI loan portfolio <1% Other Construction 6% • C&I (including owner- occupied real estate), Net Loans Consumer the largest component, 70% 13% Investments 17% makes up 40% of the CRE 26% net loan portfolio 13% Residential Mortgages Commercial Leasing 2% Cash Connect 3% 18

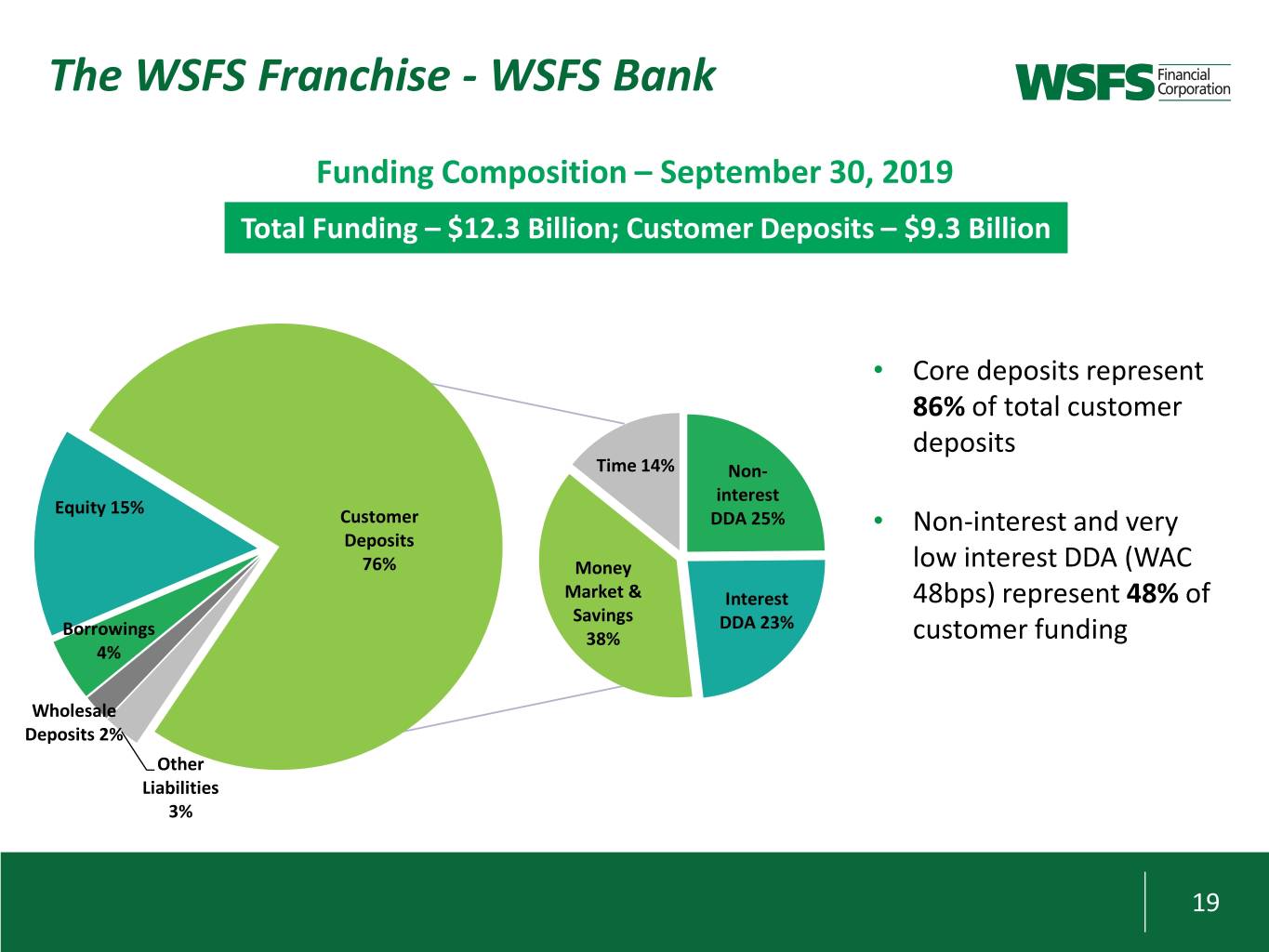

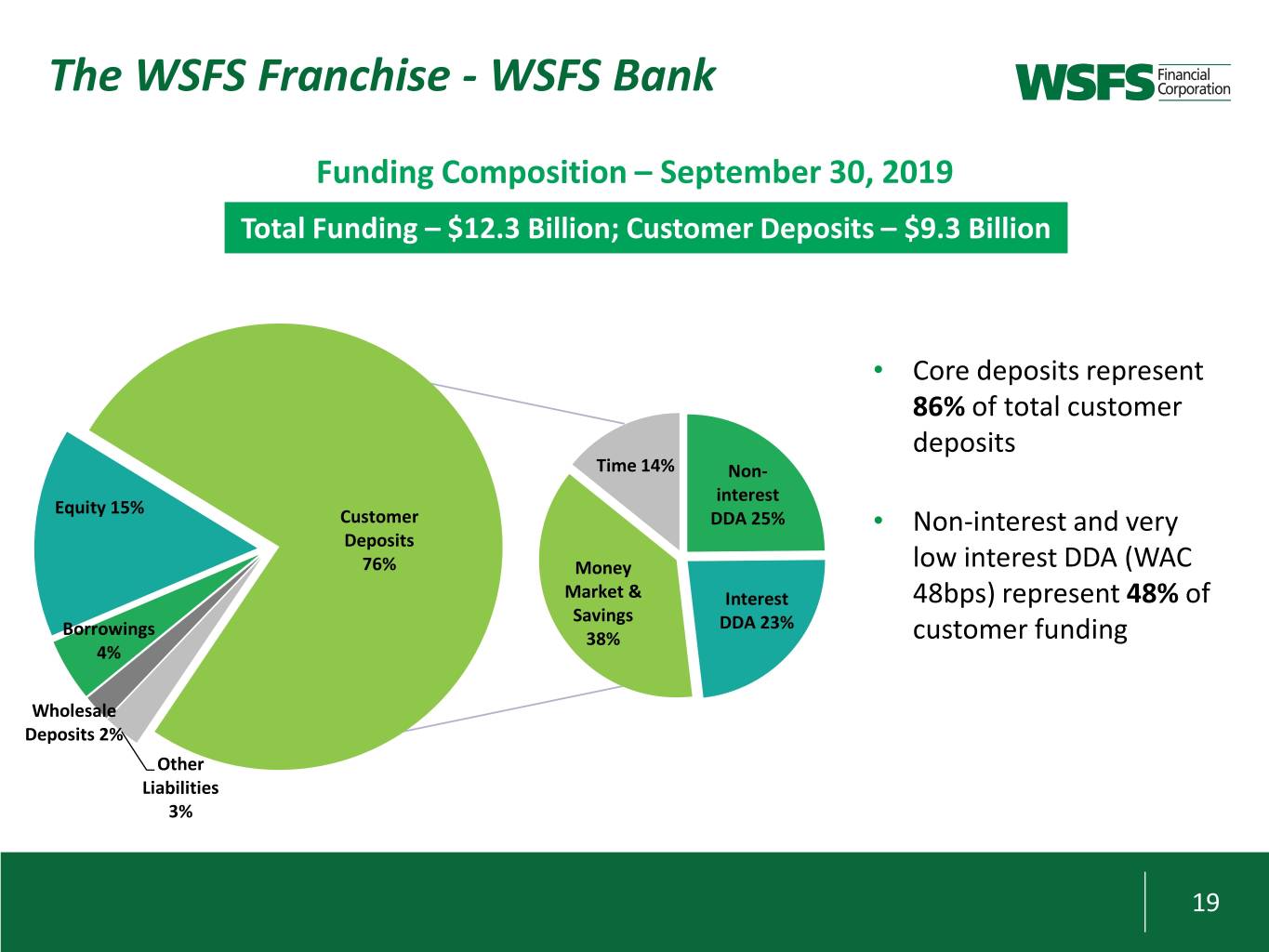

The WSFS Franchise - WSFS Bank Funding Composition – September 30, 2019 Total Funding – $12.3 Billion; Customer Deposits – $9.3 Billion • Core deposits represent 86% of total customer deposits Time 14% Non- interest Equity 15% Customer DDA 25% • Non-interest and very Deposits 76% Money low interest DDA (WAC Market & Interest 48bps) represent 48% of Savings Borrowings DDA 23% 38% customer funding 4% Wholesale Deposits 2% Other Liabilities 3% 19

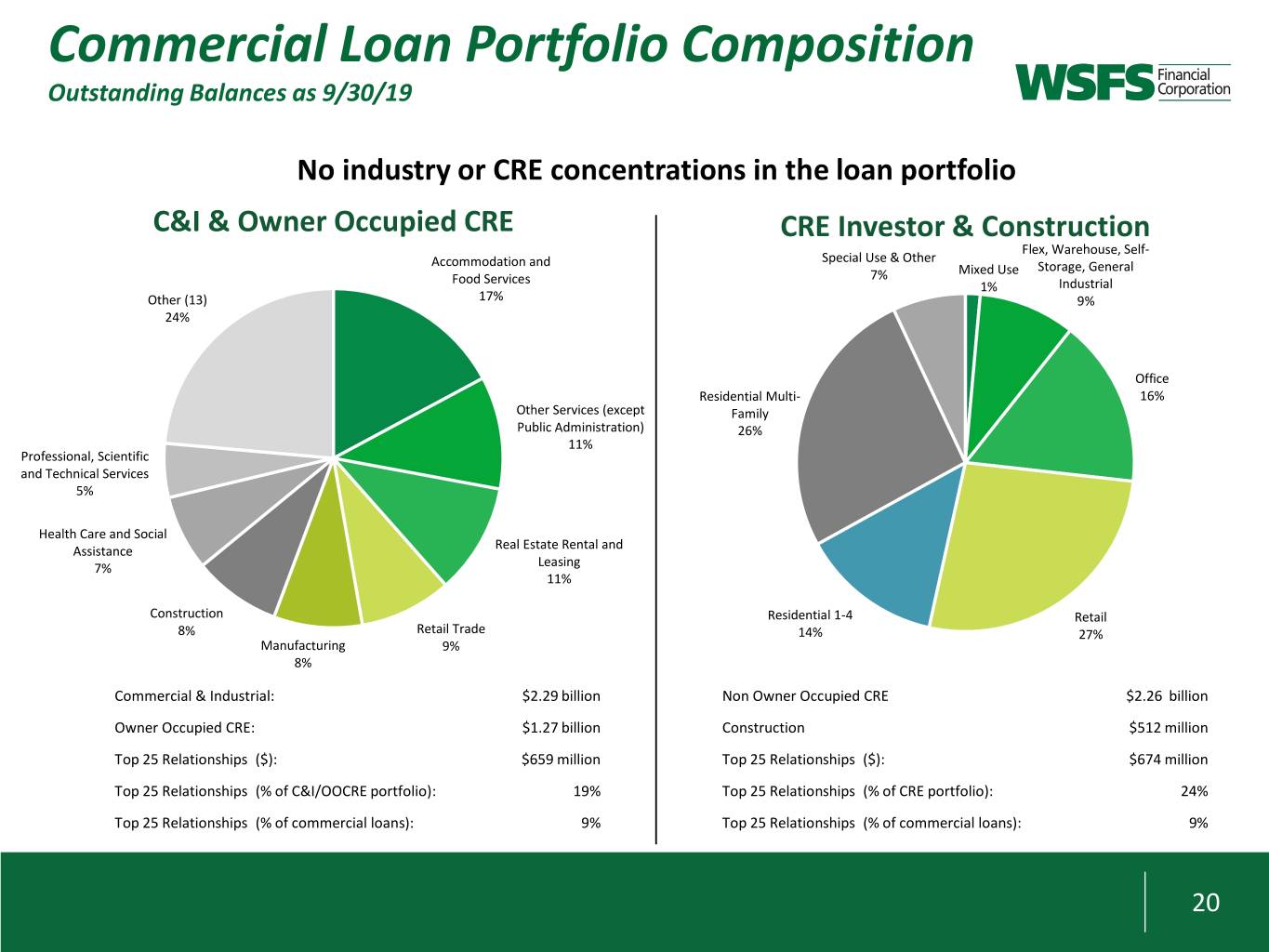

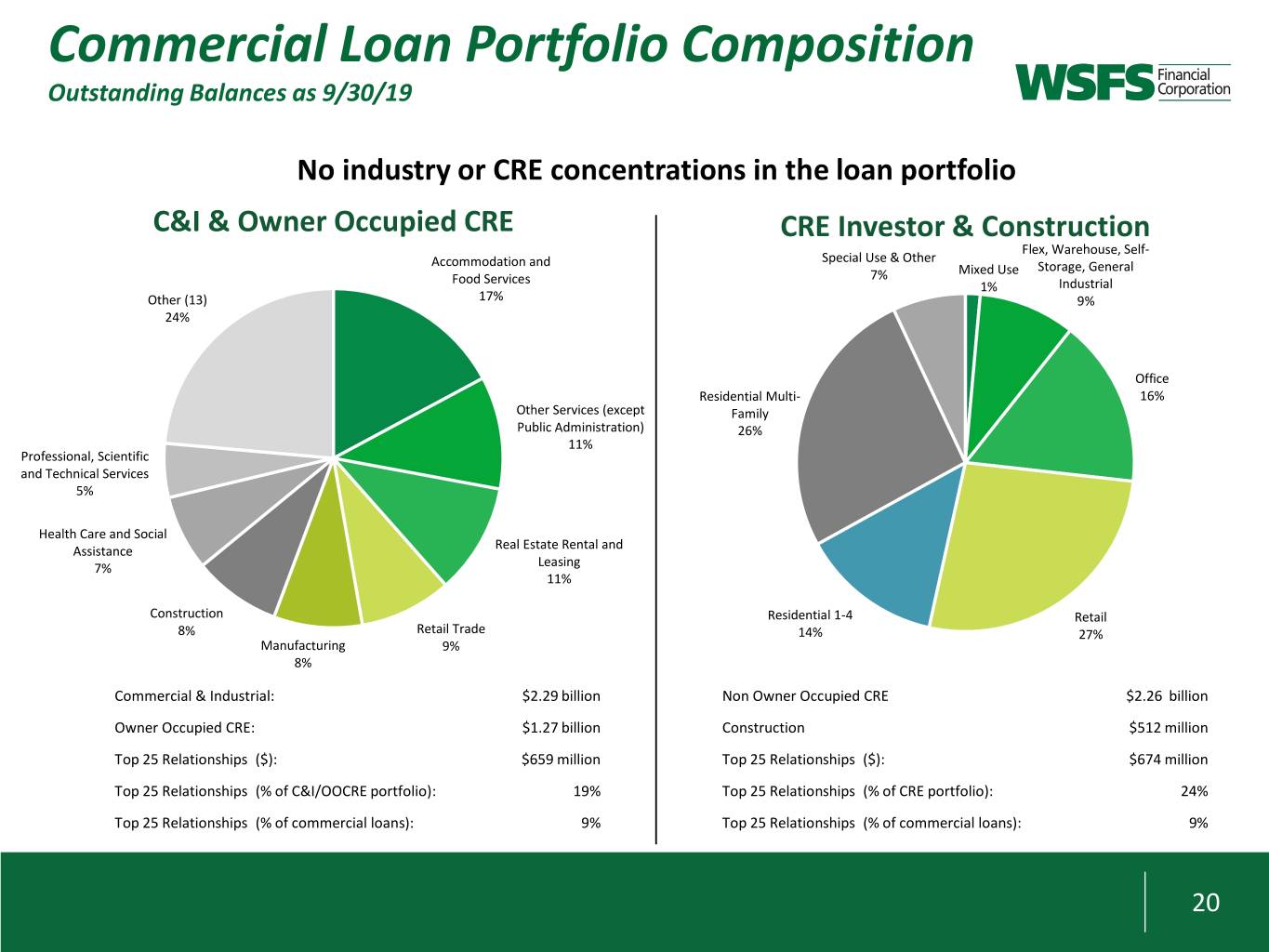

Commercial Loan Portfolio Composition Outstanding Balances as 9/30/19 No industry or CRE concentrations in the loan portfolio C&I & Owner Occupied CRE CRE Investor & Construction Flex, Warehouse, Self- Accommodation and Special Use & Other Mixed Use Storage, General Food Services 7% 1% Industrial Other (13) 17% 9% 24% Office Residential Multi- 16% Other Services (except Family Public Administration) 26% 11% Professional, Scientific and Technical Services 5% Health Care and Social Assistance Real Estate Rental and 7% Leasing 11% Construction Residential 1-4 Retail 8% Retail Trade 14% 27% Manufacturing 9% 8% Commercial & Industrial: $2.29 billion Non Owner Occupied CRE $2.26 billion Owner Occupied CRE: $1.27 billion Construction $512 million Top 25 Relationships ($): $659 million Top 25 Relationships ($): $674 million Top 25 Relationships (% of C&I/OOCRE portfolio): 19% Top 25 Relationships (% of CRE portfolio): 24% Top 25 Relationships (% of commercial loans): 9% Top 25 Relationships (% of commercial loans): 9% 20

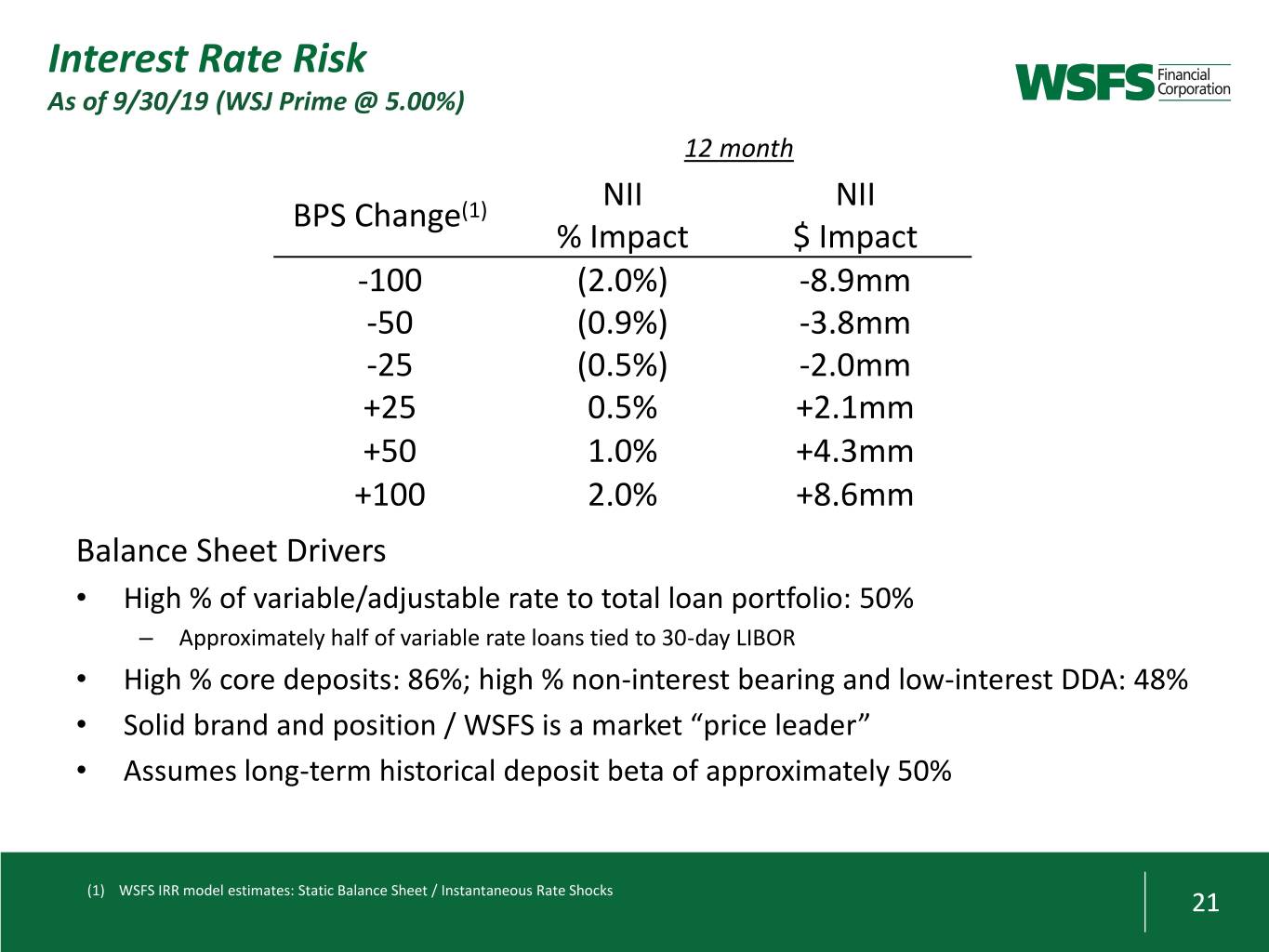

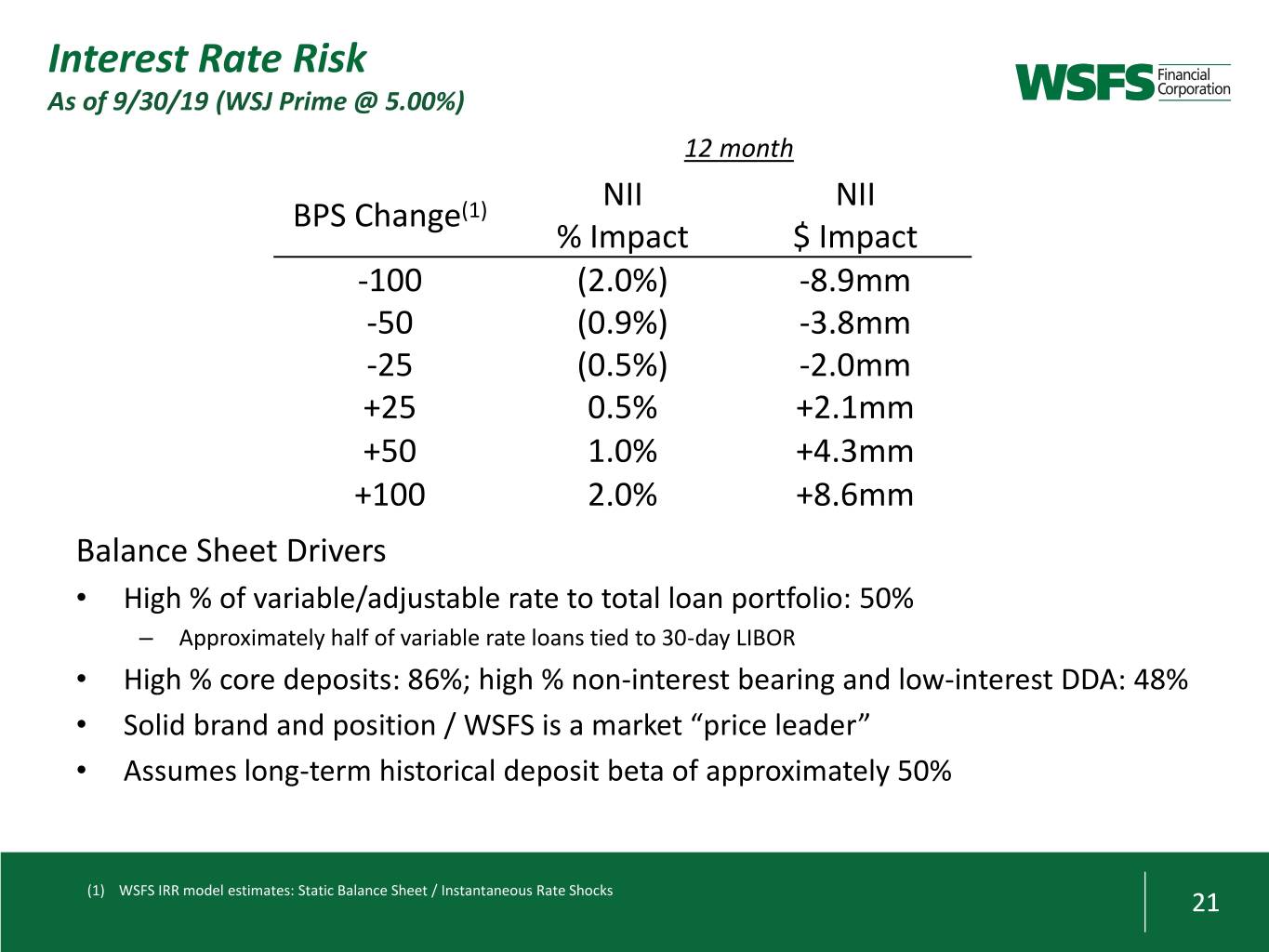

Interest Rate Risk As of 9/30/19 (WSJ Prime @ 5.00%) 12 month NII NII BPS Change(1) % Impact $ Impact -100 (2.0%) -8.9mm -50 (0.9%) -3.8mm -25 (0.5%) -2.0mm +25 0.5% +2.1mm +50 1.0% +4.3mm +100 2.0% +8.6mm Balance Sheet Drivers • High % of variable/adjustable rate to total loan portfolio: 50% – Approximately half of variable rate loans tied to 30-day LIBOR • High % core deposits: 86%; high % non-interest bearing and low-interest DDA: 48% • Solid brand and position / WSFS is a market “price leader” • Assumes long-term historical deposit beta of approximately 50% (1) WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks 21

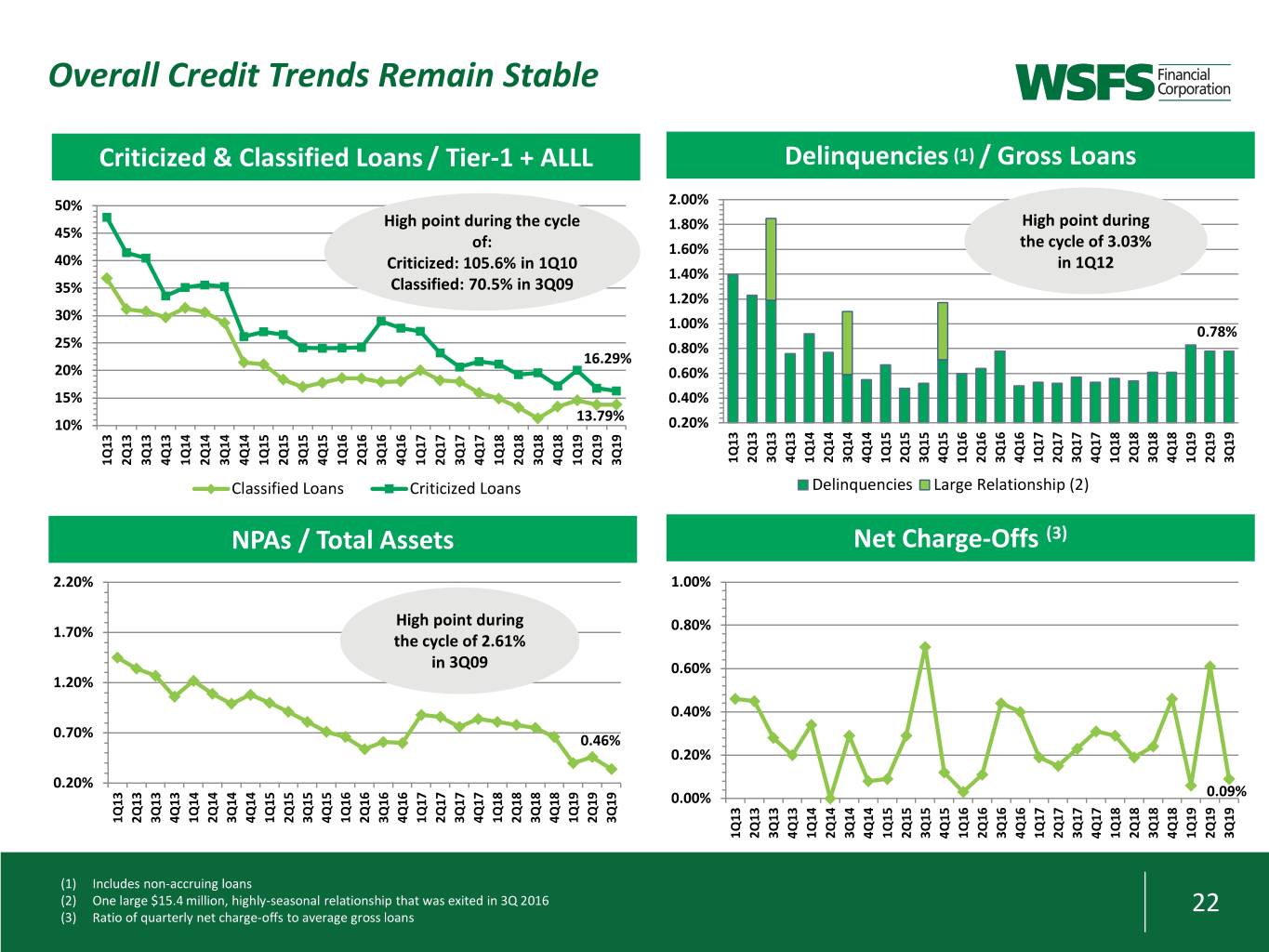

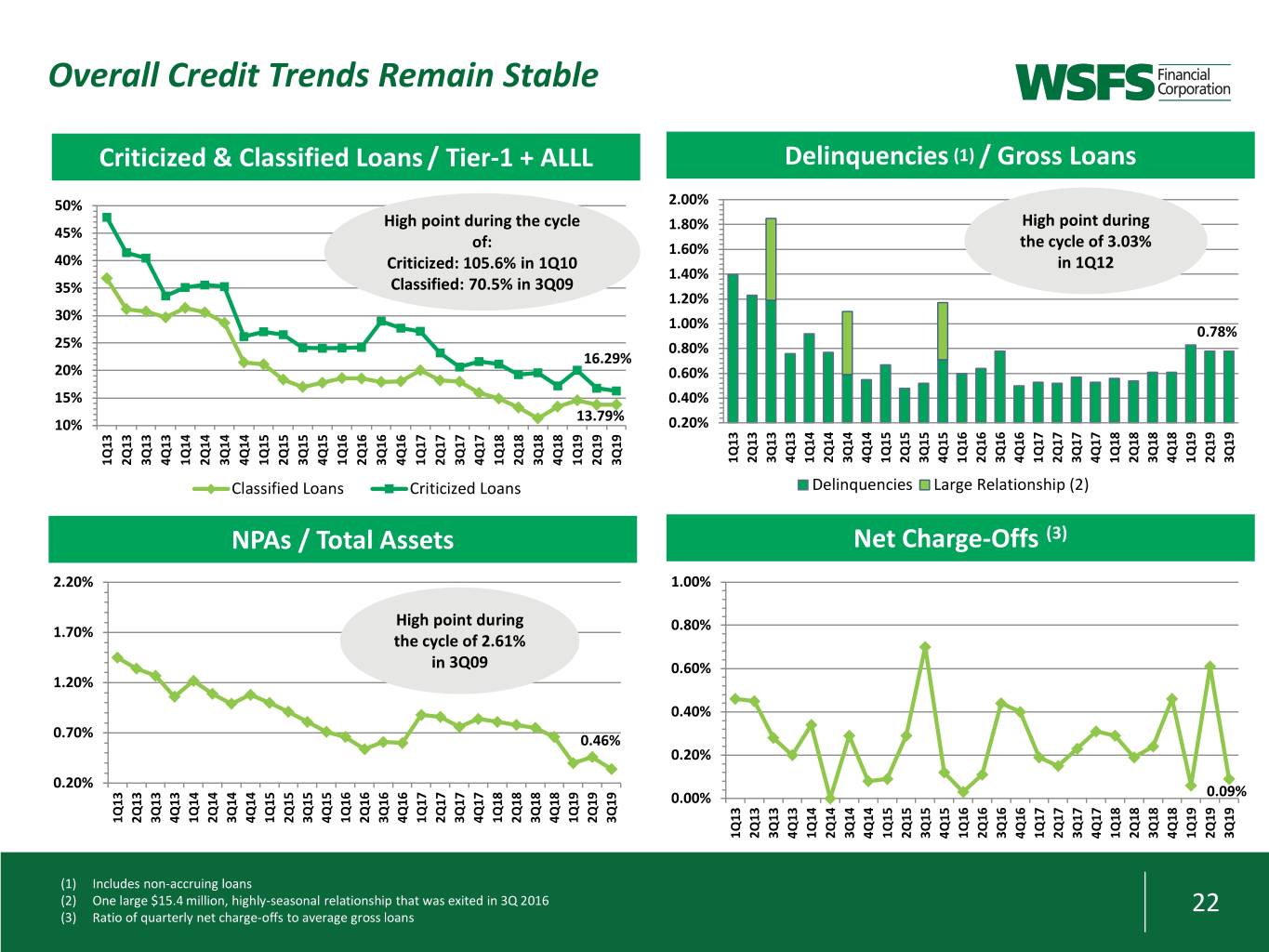

Overall Credit Trends Remain Stable Criticized & Classified Loans / Tier-1 + ALLL Delinquencies (1) / Gross Loans 50% 2.00% High point during the cycle 1.80% High point during 45% of: 1.60% the cycle of 3.03% 40% Criticized: 105.6% in 1Q10 in 1Q12 1.40% 35% Classified: 70.5% in 3Q09 1.20% 30% 1.00% 0.78% 25% 0.80% 16.29% 20% 0.60% 15% 0.40% 13.79% 10% 0.20% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 Classified Loans Criticized Loans Delinquencies Large Relationship (2) NPAs / Total Assets Net Charge-Offs (3) 2.20% 1.00% High point during 1.70% 0.80% the cycle of 2.61% in 3Q09 0.60% 1.20% 0.40% 0.70% 0.46% 0.20% 0.20% 0.00% 0.09% 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 (1) Includes non-accruing loans (2) One large $15.4 million, highly-seasonal relationship that was exited in 3Q 2016 (3) Ratio of quarterly net charge-offs to average gross loans 22

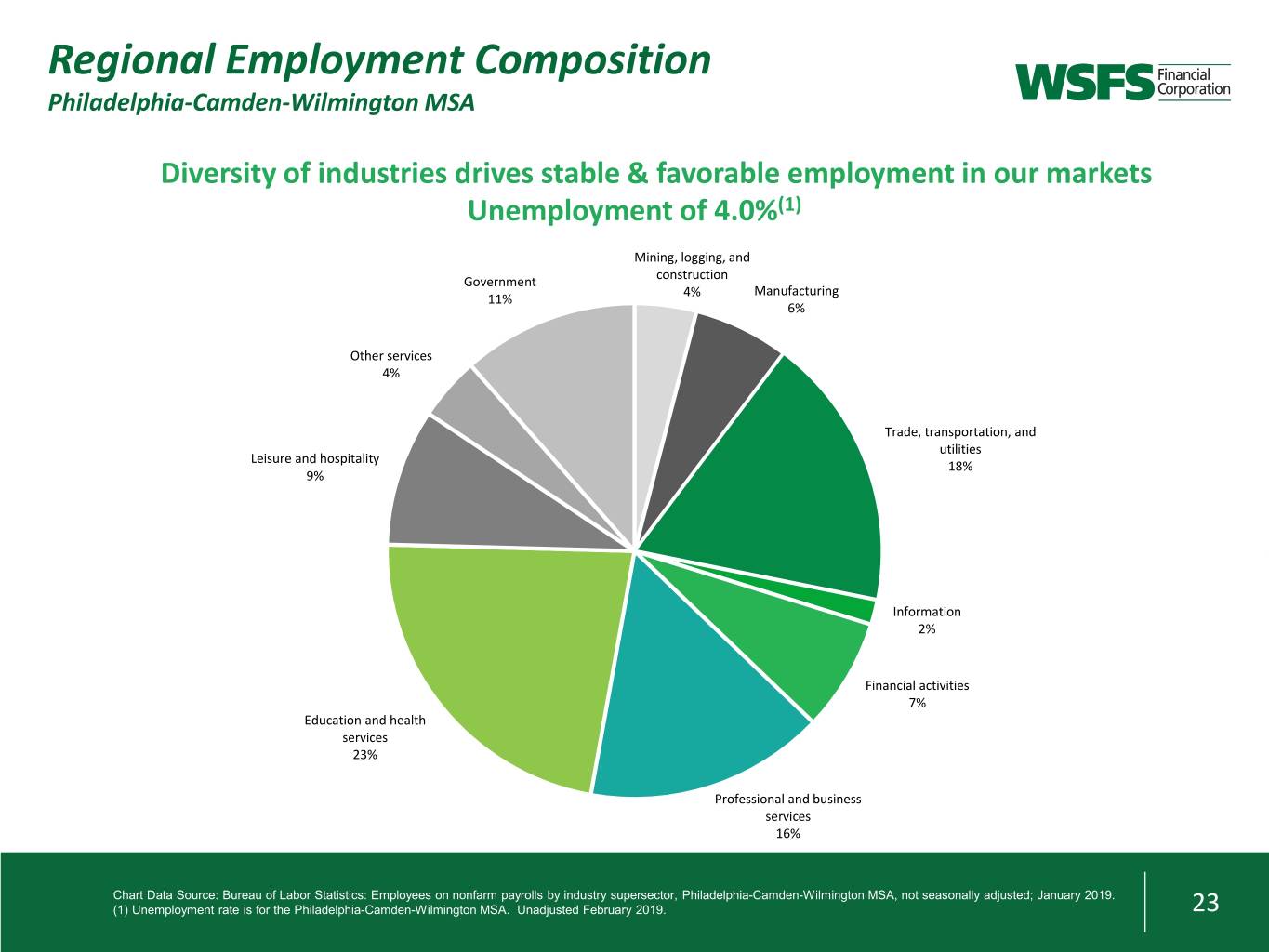

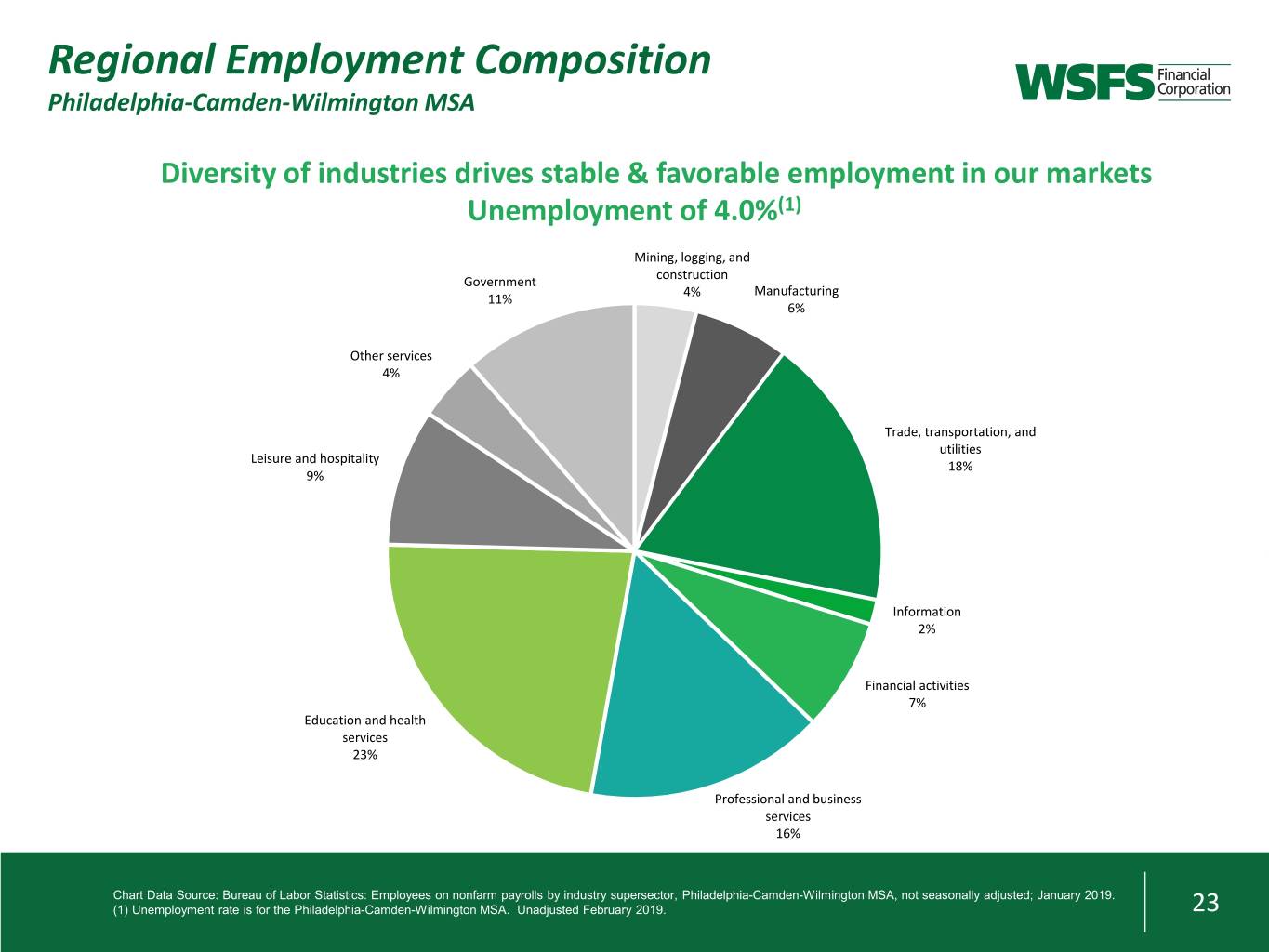

Regional Employment Composition Philadelphia-Camden-Wilmington MSA Diversity of industries drives stable & favorable employment in our markets Unemployment of 4.0%(1) Mining, logging, and construction Government 4% Manufacturing 11% 6% Other services 4% Trade, transportation, and utilities Leisure and hospitality 18% 9% Information 2% Financial activities 7% Education and health services 23% Professional and business services 16% Chart Data Source: Bureau of Labor Statistics: Employees on nonfarm payrolls by industry supersector, Philadelphia-Camden-Wilmington MSA, not seasonally adjusted; January 2019. (1) Unemployment rate is for the Philadelphia-Camden-Wilmington MSA. Unadjusted February 2019. 23

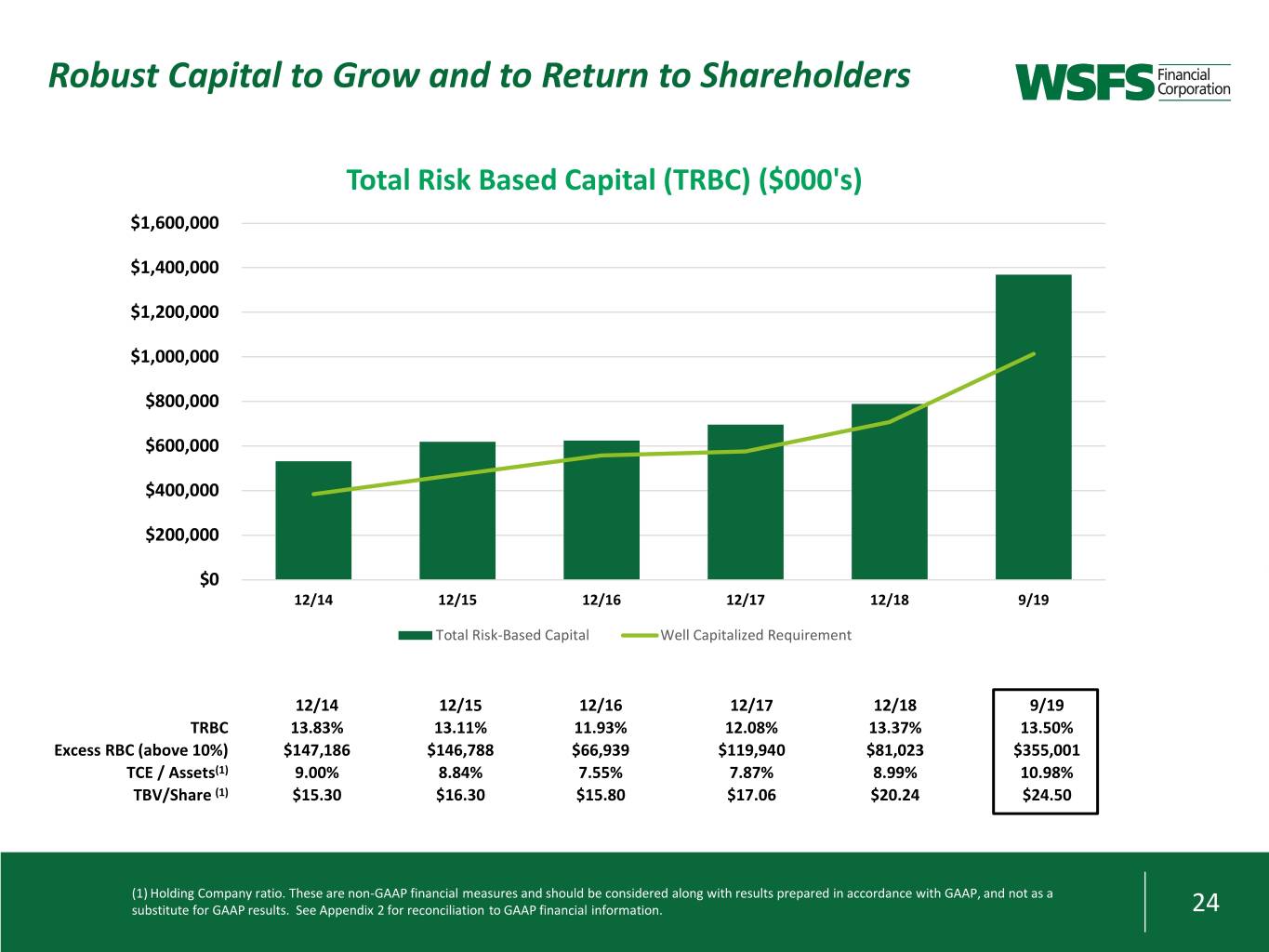

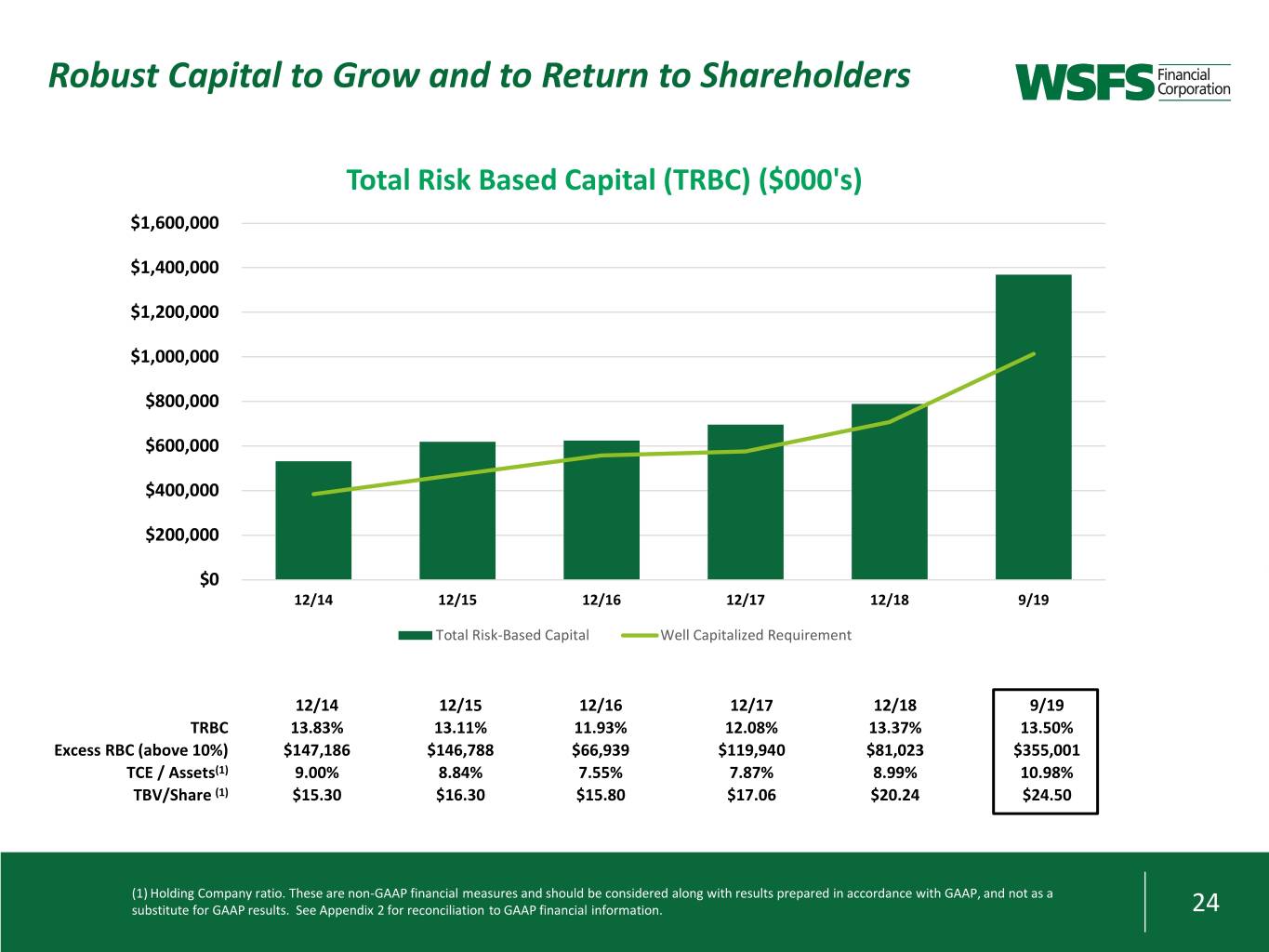

Robust Capital to Grow and to Return to Shareholders Total Risk Based Capital (TRBC) ($000's) $1,600,000 $1,400,000 $1,200,000 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 12/14 12/15 12/16 12/17 12/18 9/19 Total Risk-Based Capital Well Capitalized Requirement 12/14 12/15 12/16 12/17 12/18 9/19 TRBC 13.83% 13.11% 11.93% 12.08% 13.37% 13.50% Excess RBC (above 10%) $147,186 $146,788 $66,939 $119,940 $81,023 $355,001 TCE / Assets(1) 9.00% 8.84% 7.55% 7.87% 8.99% 10.98% TBV/Share (1) $15.30 $16.30 $15.80 $17.06 $20.24 $24.50 (1) Holding Company ratio. These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix 2 for reconciliation to GAAP financial information. 24

Strong Alignment / Capital Management • Executive management bonuses and equity awards based on bottom-line performance • ROA, ROTCE and EPS growth – equally weighted • Insider ownership is over 2.5% • Board of Directors and Executive Management ownership guidelines in place and followed • In 3Q 2019, WSFS repurchased 959,300 shares of common stock at an average price of $42.33 per share as part of our share buyback program approved by the Board in 4Q 2018 • $131 million in cash remains in the Holding Company as of 9/30/19 • 1,906,338 shares, or approximately 4% of outstanding shares, remaining to repurchase under this authorization • We continue to execute the Board-approved share buyback plan, including opportunistically repurchasing shares, based on current valuation levels, above our stated practice of returning a minimum of 25% of annual net income to stockholders through dividends and share repurchases • The Board of Directors approved a quarterly cash dividend of $0.12 per share of common stock. This will be paid on 11/21/19 to stockholders of record as of 11/7/19 25

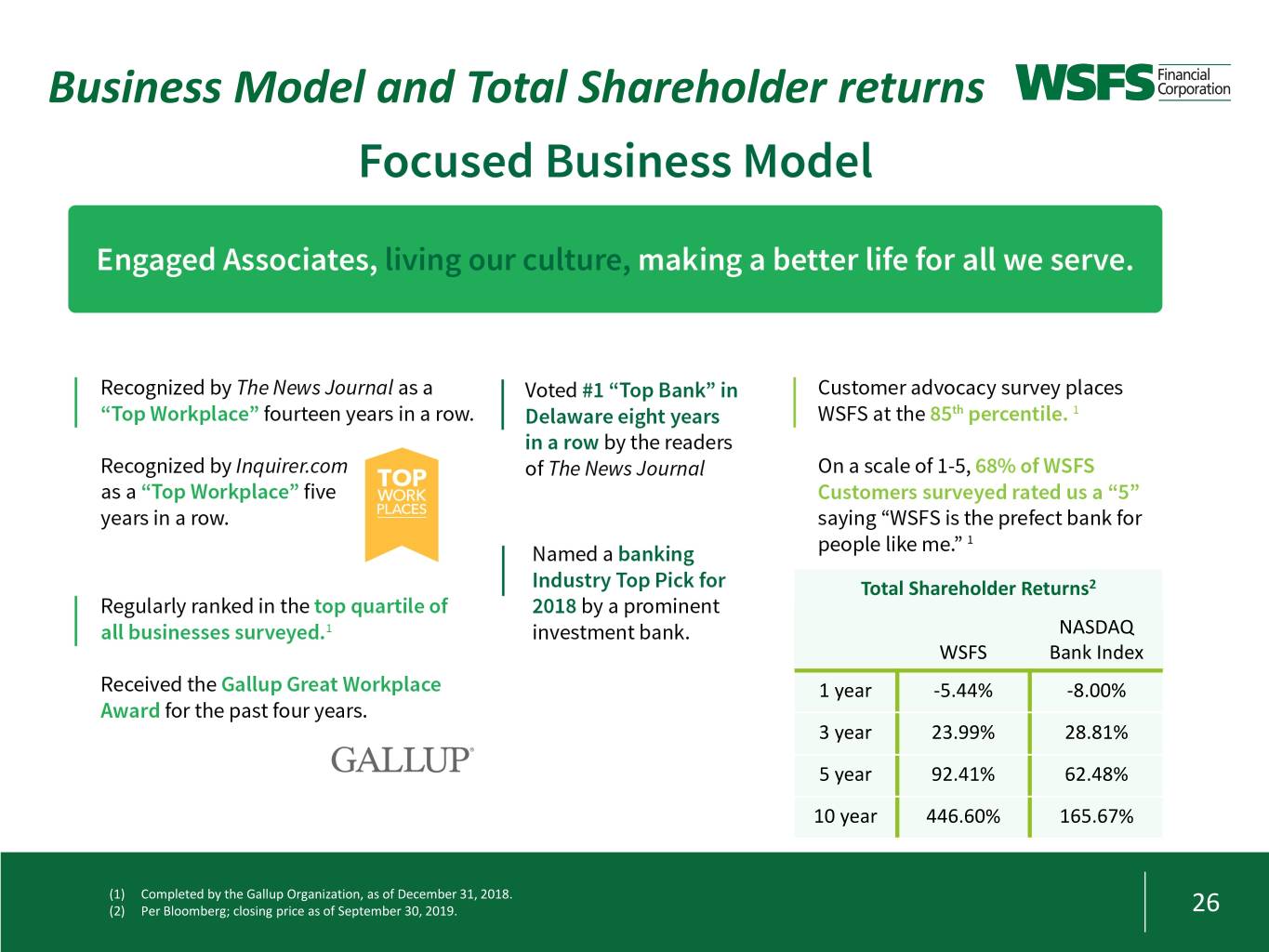

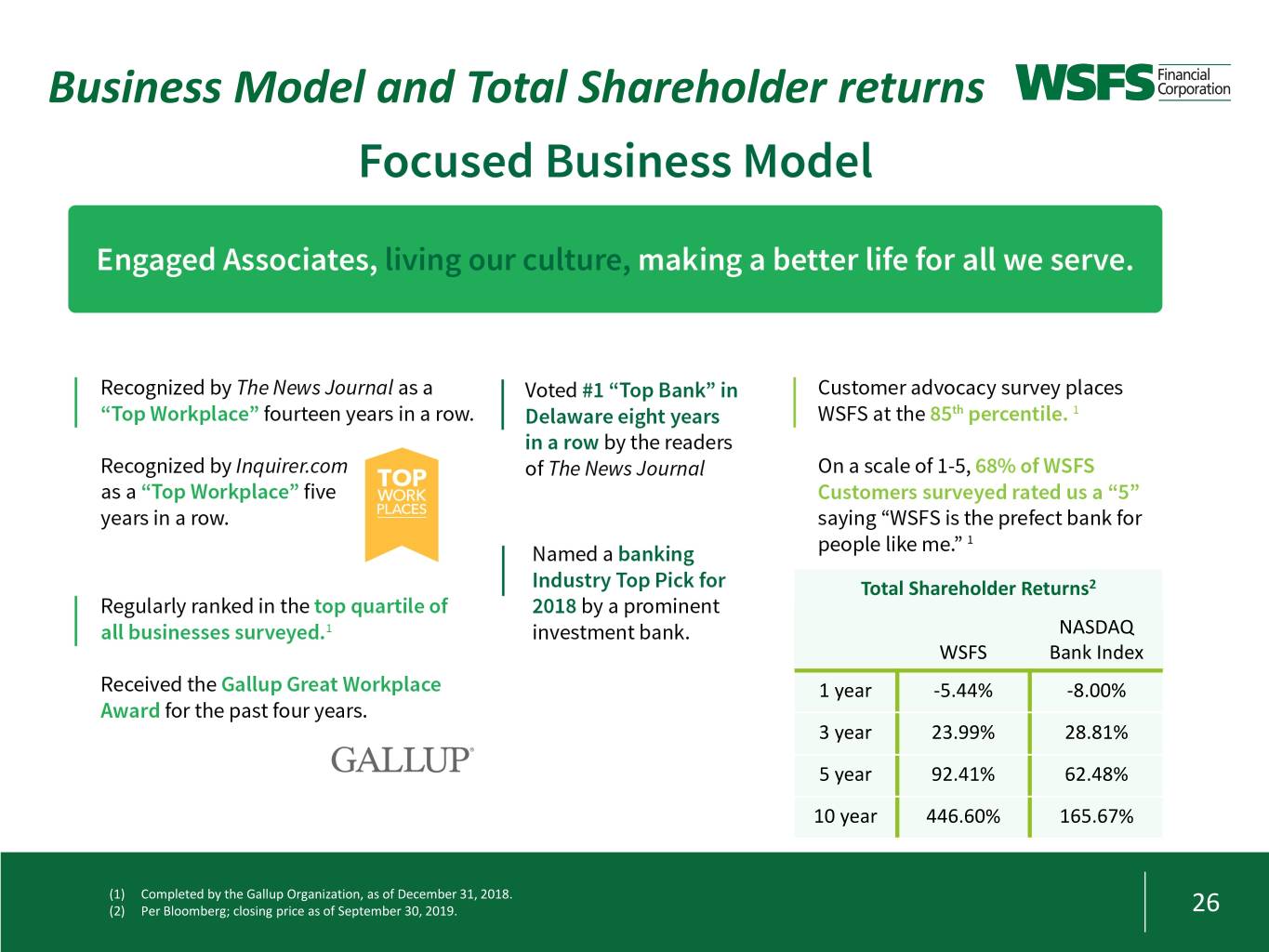

Business Model and Total Shareholder returns Total Shareholder Returns2 NASDAQ WSFS Bank Index 1 year -5.44% -8.00% 3 year 23.99% 28.81% 5 year 92.41% 62.48% 10 year 446.60% 165.67% (1) Completed by the Gallup Organization, as of December 31, 2018. (2) Per Bloomberg; closing price as of September 30, 2019. 26

Business Model 27

Appendices

Appendix 1 – Management Team Rodger Levenson, 58, has served as President and Chief Executive Officer since January 2019. Mr. Levenson previously served in various executive leadership roles, including Executive Vice President (EVP) and Chief Operating Officer from July 2017 to December 2018, WSFS’ EVP and Chief Corporate Development Officer from June 2016 to July 2017, interim EVP and Chief Financial Officer from April 2015 to June 2016, and EVP and Chief Commercial Banking Officer from 2006 to April 2015. From 2003 to 2006, Mr. Levenson was Senior Vice President and Manager of the Specialized Banking and Business Banking Divisions of Citizens Bank. Mr. Levenson received his MBA in Finance from Drexel University and his Bachelor’s Degree in Finance from Temple University. Dominic C. Canuso, CFA, 44, joined WSFS in 2016 as Executive Vice President and Chief Financial Officer. He also assumed executive leadership of WSFS’ Cash Connect® business in mid-2019. From 2006 to 2016, he was Finance Director at Barclays’ Bank, most recently serving as Line of Business Chief Financial Officer for the US Credit Card business. Prior to Barclays, he was employed by Advanta Bank, after beginning his career at Arthur Andersen Consulting. Mr. Canuso received his Executive MBA and Bachelor’s Degree from Villanova University. Arthur Bacci, 60, joined WSFS as Executive Vice President and Chief Wealth Officer in April 2018. Prior to joining WSFS, Art was a Vice President at Principal Financial Group, a diversified global investment management firm, where he most recently served as Head of Principal’s Hong Kong business from 2013 to 2018. Art joined Principal in 2002 as chief financial officer of Principal Trust Company (in Delaware). He subsequently was named CEO/President of the trust company and Principal Bank. He began his career with Bank of America and has held management positions with the William E. Simon & Sons private equity group and with a fin-tech company involved with financial advisory and trading products. Art received his BS in Finance from San Jose State and a MBA from Santa Clara University. He has also participated in leadership and management programs at the University of Pennsylvania Wharton School. Lisa M. Brubaker, 55, has served as Chief Technology Officer since May 2018. Ms. Brubaker previously served as Senior Vice President, Director of Retail Strategies since 2006 and has held of a variety of management positions with WSFS Bank over her 31 year career. Ms. Brubaker received a Bachelor’s degree from the University of Delaware and is an Aresty Scholar of the Wharton School of Executive Education. 29

Appendix 1 – Management Team Steve Clark, 62, joined WSFS Bank in 2002 and has served as Executive Vice President and Chief Commercial Banking Officer since May 2016. From 2002 thru 2006, Mr. Clark led and managed the establishment of the Middle Market lending unit, and in 2007 became Division Manager of the Business Banking and Middle Market Divisions. Prior to 2002, he spent 23 years in various commercial banking positions at PNC Bank and its predecessor companies. Mr. Clark received his MBA in Finance from Widener University and his Bachelor’s Degree in Business Administration (Marketing) from the University of Delaware. Paul S. Greenplate, 61, Executive Vice President and Chief Risk Officer, joined WSFS in 1999 and prior to his leadership role in the Risk Division, he served as Senior Vice President and Treasurer. As Executive Vice President and Chief Risk Officer, Mr. Greenplate oversees all independent Risk Management functions including, Credit Risk Management, Real Estate Services, Asset Recovery, Enterprise Risk Management, Legal, Internal Audit, Loan Review and Regulatory Compliance. Mr. Greenplate graduated from the University of Delaware with a Bachelor’s Degree in Economics. Peggy H. Eddens, 64, Executive Vice President, Chief Associate and Customer Experience Officer, joined WSFS Bank in 2007. From 2003 to 2007 she was Senior Vice President for Human Resources and Development for NexTier Bank, Butler PA. Ms. Eddens received a Master of Science Degree in Human Resource Management from La Roche College and her Bachelor’s Degree in Business Administration with minors in Management and Psychology from Robert Morris University. Patrick J. Ward, 63, joined WSFS in August 2016 as Executive Vice President, Pennsylvania Market President. He also serves on the Board of Directors of WSFS Financial Corporation. Mr. Ward has over 32 years of banking industry experience and previously served as Chairman and CEO of Penn Liberty Bank. He was an EVP of Citizens Bank of Pennsylvania from January 2003 until January 2004. Prior thereto, Mr. Ward served as President and CEO of Commonwealth Bancorp, Inc., the holding company for Commonwealth Bank, until its acquisition by Citizens Bank in January 2003. Mr. Ward is a graduate of Carnegie Mellon University with a Bachelor’s Degree in Economics and earned an MBA from the University of Notre Dame. Richard M. Wright, 67, Executive Vice President and Chief Retail Banking Officer since 2006. From 2003 to 2006, Mr. Wright was Executive Vice President, Retail Banking and Marketing for DNB First in Downingtown, PA. Mr. Wright received his MBA in Management Decision Systems from the University of Southern California and his Bachelor’s Degree in Marketing and Economics from California State University. 30

Appendix 2 – Non-GAAP Financial Information Tangible common book value per share and Tangible common equity to tangible assets End of Period September 30, December 31, December 31, December 31, December 31, December 31, (dollars in thousands, except per share data) 2019 2018 2017 2016 2015 2014 Total assets 12,272,673 7,248,870 6,999,540 6,765,270 5,584,719 4,851,749 Less: Goodwill and other intangible assets 571,850 186,023 188,444 191,247 95,295 57,594 Total tangible assets $ 11,700,823 $ 7,062,847 $ 6,811,096 $ 6,574,023 $ 5,489,424 $ 4,794,155 Total stockholders’ equity 1,856,992 820,920 724,345 687,336 580,471 489,051 Less: Goodwill and other intangible assets 571,850 186,023 188,444 191,247 95,295 57,594 Total tangible common equity (non-GAAP) $ 1,285,142 $ 634,897 $ 535,901 $ 496,089 $ 485,176 $ 431,457 Calculation of tangible common book value per share: Book value per share (GAAP) $ 35.41 $ 26.17 $ 23.05 $ 21.90 $ 19.50 $ 17.34 Tangible common book value per share (non- GAAP) 24.50 20.24 17.06 15.80 16.30 15.30 Calculation of tangible common equity to tangible assets: Equity to asset ratio (GAAP) 15.13% 11.32% 10.35% 10.16% 10.39% 10.08% Tangible common equity to tangible assets ratio (non-GAAP) 10.98% 8.99% 7.87% 7.55% 8.84% 9.00% 31

Appendix 2 – Non-GAAP Financial Information Core ROA and Core EPS Three months ended (dollars in thousands, except per share data) September 30, 2019 June 30, 2019 September 30, 2018 GAAP net income attributable to WSFS $ 53,882 $ 36,200 $ 38,935 (1) Plus (less): Pre-tax adjustments (2,467) 14,731 (11,160) (Plus)/less: Tax impact of pre-tax adjustments 590 (3,580) 3,140 Adjusted net income (non-GAAP) attributable to WSFS $ 52,005 $ 47,351 $ 30,915 GAAP return on average assets (ROA) 1.72% 1.20% 2.18% (1) Plus (less): Pre-tax adjustments -0.08% 0.49% -0.63% (Plus) less: Tax impact of pre-tax adjustments (ROA) 0.02% -0.12% 0.18% Core ROA (non-GAAP) 1.66% 1.57% 1.73% EPS (GAAP) $ 1.02 $ 0.68 $ 1.20 (1) Plus (less): Pre-tax adjustments (0.05) 0.28 (0.34) (Plus) less: Tax impact of pre-tax adjustments (EPS) 0.01 (0.08) 0.10 Core EPS (non-GAAP) $ 0.98 $ 0.88 $ 0.96 (1) Includes securities gains, unrealized gains on equity investment, corporate development and restructuring expense 32

Appendix 2 – Non-GAAP Financial Information Return on average tangible common equity and Core return on average tangible common equity End of period (dollars in thousands) September 30, 2019 June 30, 2019 September 30, 2018 GAAP net income attributable to WSFS $ 53,882 $ 36,200 $ 38,935 Plus: Tax-effected amortization of intangible assets 2,113 2,104 543 Net tangible income (non-GAAP) $ 55,995 $ 38,304 $ 39,478 Average shareholder's equity $ 1,842,759 $ 1,812,302 $ 782,100 less: Average goodwill and intangible assets 574,253 579,283 187,007 Net average tangible common equity $ 1,268,506 $ 1,233,019 $ 595,093 Return on average tangible common equity (non-GAAP) 17.51% 12.46% 26.32% Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 52,005 $ 47,351 $ 30,915 Plus: Tax-effected amortization of intangible assets 2,113 2,104 543 Core net tangible income (non-GAAP) $ 54,118 $ 49,455 $ 31,458 Net average tangible common equity $ 1,268,506 $ 1,233,019 $ 595,093 Core return on average tangible common equity (non-GAAP) 16.93% 16.09% 20.97% 33

Appendix 2 – Non-GAAP Financial Information Reconciliation of Core Efficiency Ratio Three months ended (dollars in thousands) September 30, 2019 June 30, 2019 September 30, 2018 Net interest income (GAAP) $ 120,833 $ 123,232 $ 63,097 Core net interest income (non-GAAP) $ 120,833 $ 123,232 $ 63,097 Noninterest income (GAAP) $ 62,346 $ 42,871 $ 41,901 Less: Securities gains - 63 - Less: Unrealized gains on equity investment 21,344 1,033 3,249 Less: Gain on sale of Visa Class B shares - - 3,757 Core fee income (non-GAAP) $ 41,002 $ 41,775 $ 34,895 Core net revenue (non-GAAP) $ 161,835 $ 165,007 $ 97,992 Core net revenue (non-GAAP)(tax-equivalent) $ 162,135 $ 165,325 $ 98,323 Noninterest expense (GAAP) $ 109,561 $ 107,848 $ 52,454 (Plus)/less: Recovery of fraud loss - - (10) Plus/(less): Recovery for legal settlement - - (7,938) Less: Corporate development expense 10,517 13,946 3,794 Less: Restructuring expense 8,360 1,881 - Core noninterest expense (non-GAAP) $ 90,684 $ 92,021 $ 56,608 (1) Core efficiency ratio 55.9% 55.7% 57.6% Core fee income as a percentage of total core net revenue (tax equivalent) 25.29% 25.27% 35.49% (1) Noninterest expense divided by (tax-equivalent) net interest income and noninterest income. 34

Appendix 3 - Reconciliation of conversion-related reclassifications Loans • June 30, 2019 reported As reported Conversion Adjusted (Dollars in millions) June 30, 2019 reclassifications June 30, 2019 balances for certain loan and Commercial & Industrial $ 3,465 $ (44) $ 3,421 deposit categories have been Commercial Real Estate 2,237 44 2,281 adjusted for system conversion- Construction 539 - 539 related reclassifications that Commercial Small Business Leases 157 - 157 were made in the 3rd quarter Total Commercial Loans 6,398 - 6,398 Residential Mortgage 1,135 - 1,135 of 2019. These adjustments Consumer 1,132 - 1,132 were made to allow for Allowance for Losses (45) - (45) comparability between Net Loans $ 8,619 $ - $ 8,619 September 2019 and June 2019 results. Deposits As reported Conversion Adjusted (Dollars in millions) June 30, 2019 reclassifications June 30, 2019 Noninterest Demand $ 2,206 $ (16) $ 2,190 Interest-bearing Demand 2,040 52 2,092 Savings 1,601 24 1,625 Money Market 1,987 18 2,005 Total Core Deposits 7,834 78 7,912 Customer Time Deposits 1,438 (78) 1,360 Total Customer Deposits $ 9,272 $ - $ 9,272 35

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 36