- WSFS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

WSFS Financial (WSFS) 425Business combination disclosure

Filed: 3 Mar 15, 12:00am

WSFS Financial Corporation to acquire Alliance Bancorp, Inc. of Pennsylvania March 3, 2015 Exhibit 99.2 |

2 FORWARD-LOOKING STATEMENT DISCLAIMER This presentation contains estimates, predictions, opinions, projections and other “forward-looking statements” as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company’s financial goals, management’s plans and objectives for future operations, financial and business trends, business prospects, and management’s outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to the economic environment, particularly in the market areas in which the Company operates, including an increase in unemployment levels; the volatility of the financial and securities markets, including changes with respect to the market value of financial assets; changes in market interest rates may increase funding costs and reduce earning asset yields thus reducing margin; increases in benchmark rates would increase debt service requirements for customers whose terms include a variable interest rate, which may negatively impact the ability of borrowers to pay as contractually obligated; changes in government regulation affecting financial institutions, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules being issued in accordance with this statute and potential expenses and elevated capital levels associated therewith; possible additional loan losses and impairment of the collectability of loans; seasonality, which may impact customer, such as construction-related businesses, the availability of public funds, and certain types of the Company’s fee revenue, such as mortgage originations; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations, may have an adverse effect on business; possible rules and regulations issued by the Consumer Financial Protection Bureau or other regulators which might adversely impact our business model or products and services; possible stresses in the real estate markets, including possible continued deterioration in property values that affect the collateral value of underlying real estate loans; the Company’s ability to expand into new markets, develop competitive new products and services in a timely manner and to maintain profit margins in the face of competitive pressures; possible changes in consumer and business spending and savings habits could affect the Company’s ability to increase assets and to attract deposits; the Company’s ability to effectively manage credit risk, interest rate risk market risk, operational risk, legal risk, liquidity risk, reputational risk, and regulatory and compliance risk; the effects of increased competition from both banks and non-banks; the effects of geopolitical instability and risks such as terrorist attacks; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes, and the effects of man- made disasters; possible changes in the speed of loan prepayments by the Company’s customers and loan origination or sales volumes; possible acceleration of prepayments of mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on prepayments on mortgage-backed securities due to low interest rates; and the costs associated with resolving any problem loans, litigation and other risks and uncertainties, discussed in the Company’s Form 10-K for the year ended December 31, 2013 and other documents filed by the Company with the Securities and Exchange Commission from time to time. Forward looking statements are as of the date they are made, and the Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. This presentation speaks only as of its date, and WSFS disclaims any duty to update the information herein. |

3 IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger, WSFS will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Alliance and a prospectus of WSFS, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF ALLIANCE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Proxy Statement/Prospectus, as well as other filings containing information about WSFS and Alliance, may be obtained at the SEC’s Internet site (http://www.sec.gov), when they are filed. You will also be able to obtain these documents, when they are filed, free of charge, from WSFS at www.wsfsbank.com under the heading “About WSFS” and then under the heading “Investor Relations” and then under “SEC Filings” or from Alliance by accessing Alliance's website at www.allianceanytime.com under the heading “Stockholder Information” and then under “Corporate and Market Information”. Copies of the Proxy Statement/Prospectus can also be obtained, when it becomes available, free of charge, by directing a request to WSFS Financial Corporation, WSFS Bank Center, 500 Delaware Avenue, Wilmington, Delaware 19801, Attention: Corporate Secretary, Telephone: (302) 792-6000 or to Alliance Bancorp,Inc. of Pennsylvania, 541 Lawrence Road, Broomall, Pennsylvania 19008, Attention: Corporate Secretary, Telephone: (610) 353-2900. PARTICIPANTS IN THE SOLICITATION Alliance and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Alliance in connection with the proposed merger. Information about the directors and executive officers of Alliance and their ownership of Alliance common stock is set forth in the proxy statement for Alliance’s 2014 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 19, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the section above. |

STRATEGIC RATIONALE Strategic Rationale Financially Attractive 4 • Consistent with WSFS’s strategic growth plan in Southeastern PA • Only remaining independent community bank of scale headquartered in attractive Delaware County market • Favorable demographics, similar to WSFS core markets • 8 offices in overlapping and adjacent market; WSFS will have 17 locations in Southeastern PA at close • Alliance - Assets of $421mm; Loans $310mm; Deposits of $345mm • Alliance customer base provides appealing cross-sell opportunities for WSFS products and services including Array Financial (residential mortgages), Treasury Management, Mobile Banking, and Wealth Management. • Platform for future growth in Southeastern PA • Compatible culture; client focused community banking model • Accretive to first full year earnings per share excluding one-time costs • Slight dilution to tangible book value earned back in 4.7 years • WSFS pro forma capital ratios well in excess of “well-capitalized” guidelines following close • 17% anticipated IRR Pro forma ownership by Alliance shareholders in WSFS – 8.0% |

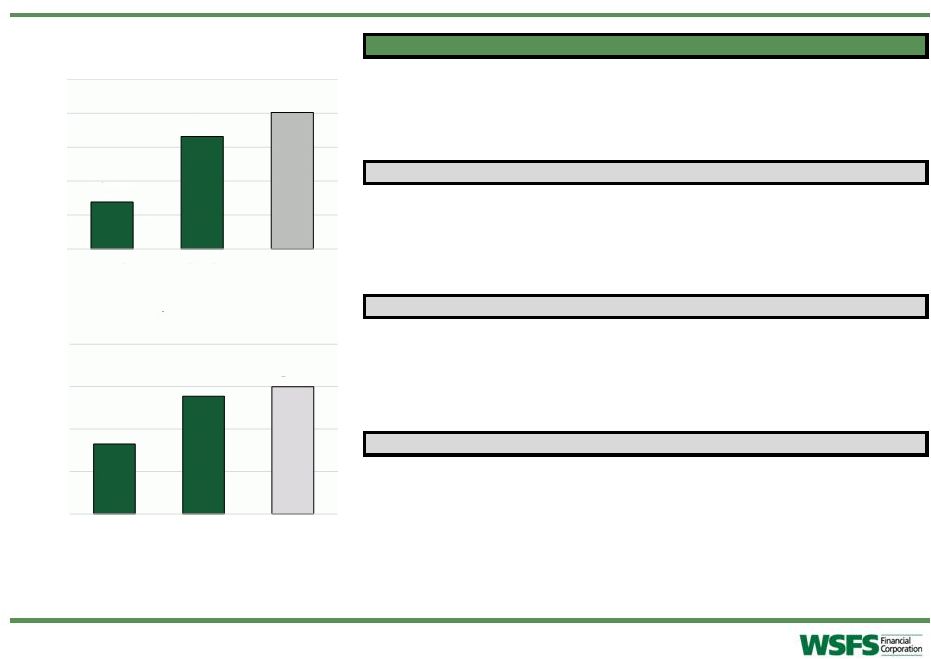

OVERVIEW OF ALLIANCE BANCORP, INC. 1) Represents bank level (Alliance Bank) financial data as of and for the year ended December 31, 2014. Source: SNL Financial and Company provided information. As of 12/31/14 5 $284 $303 $310 $270 $280 $290 $300 $310 $320 2012 2013 2014 Total Gross Loans ($mm) 76% 88% 90% 60% 70% 80% 90% 100% 2012 2013 2014 Loan / Deposits (%) Financial Highlights Total Assets ($mm) 420.8 Gross Loans ($mm) 310.2 Total Deposits ($mm) 344.8 Loans / Deposits 89.98% Capital Ratios Tangible Equity ($mm) 66.5 Tangible Equity / Tangible Assets 15.79% Total Risk-Based Ratio 1 23.19% Leverage Ratio 1 14.39% Asset Quality Metrics NPAs / Total Assets 1 1.72% NPAs Ex. TDRs / Total Assets 1 0.60% LLR / Gross Loans 1.44% NCOs / Avg. Loans 1 0.07% Profitability Metrics Net Income ($mm) 2.6 Return on Average Assets 0.60% Return on Average Equity 3.74% Net Interest Margin 1 3.61% |

ATTRACTIVE COMBINED FRANCHISE 6 (1) Does not include purchase accounting adjustments. (2) Based on 20 Day Average WSFS share price as of 2/26/2015 of $77.77. Source: SNL Financial and Company provided information. The combination creates the largest, most diversified, community bank headquartered in the Delaware Valley (Philadelphia-Camden-Wilmington MSA). ($mm) 12/31/2014 Combined (1) Assets: 4,853 421 5,274 Gross Loans: 3,225 310 3,535 Deposits: 3,649 345 3,994 Market Cap (2) : 731 - 794 Offices: 55 8 63 Assets Under Management: 1,187 - 1,187 Assets Under Administration: 9,416 - 9,416 Deposit Market Share (Delaware County) as of 6/30/2014 Rank Institution Branches Deposits ($mm) Market Share (%) 1 Toronto-Dominion Bank 15 2,354 19.8% 2 Wells Fargo & Co. (CA) 23 2,333 19.6% 3 Royal Bank of Scotland Group 21 1,625 13.7% 4 PNC Financial Services Group (PA) 11 1,111 9.4% 5 Banco Santander 13 832 7.0% 6 Bryn Mawr Bank Corp. (PA) 14 589 5.0% 7 Beneficial Bancorp Inc (PA) 6 413 3.5% 8 Bank of America Corp. (NC) 9 404 3.4% Pro Forma 10 388 3.3% 9 Alliance Bancorp of Penn (PA) 7 342 2.9% 10 M&T Bank Corp. (NY) 9 261 2.2% 22 WSFS Financial Corp. (DE) 3 46 0.4% Total (1-10) 128 10,263 86.4% Total (1-31) 169 11,881 100.0% |

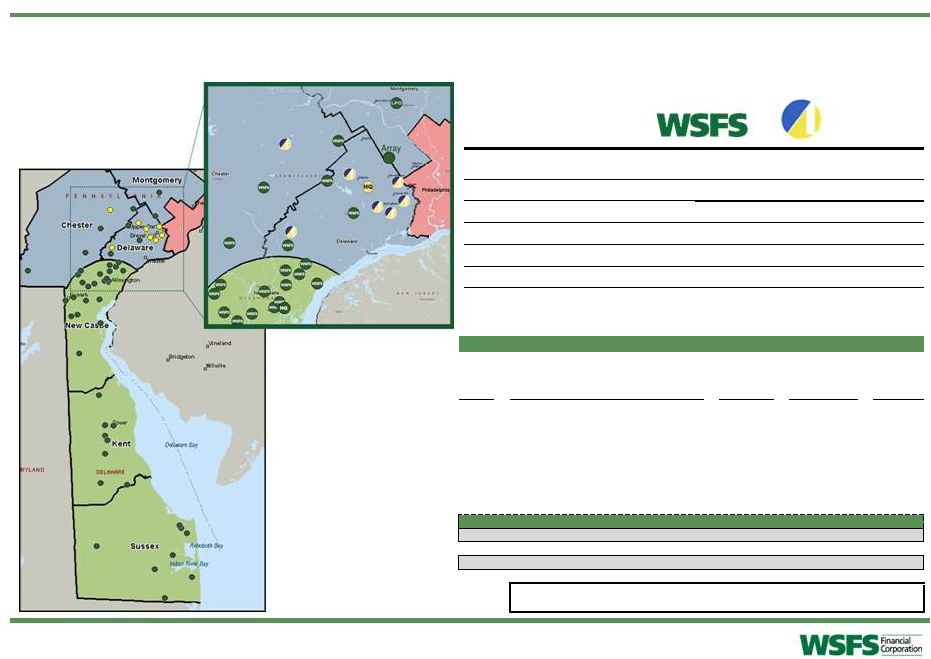

MARKET DEMOGRAPHICS Delaware Pennsylvania New Castle Kent Sussex Delaware Chester County County County County County Total Population 551,010 171,028 207,614 562,633 511,036 Median Household Income $66,757 $52,489 $56,481 $61,896 $80,383 % of Household Income > $100k 30.6% 16.5% 21.6% 28.5% 39.3% Median Home Value $254,448 $199,798 $245,039 $240,250 $324,247 Current Unemployment Rate 4.4% 4.6% 5.1% 4.5% 3.4% WSFS Offices (3) 28 9 8 4 / 11 (1) 4 (2) / 5 (1) Distance from WSFS HQ to Alliance HQ 25 miles 25 miles (1) Pro Forma for Alliance. (2) Pro Forma including new WSFS Devon, PA office opening March 2015 (3) WSFS offices in Nevada, Virginia, and Montgomery County, PA are not included in this chart. Source: SNL Financial. 7 Alliance operates in a contiguous market with similar demographics to WSFS’s home market, where we have had success for 183 years. |

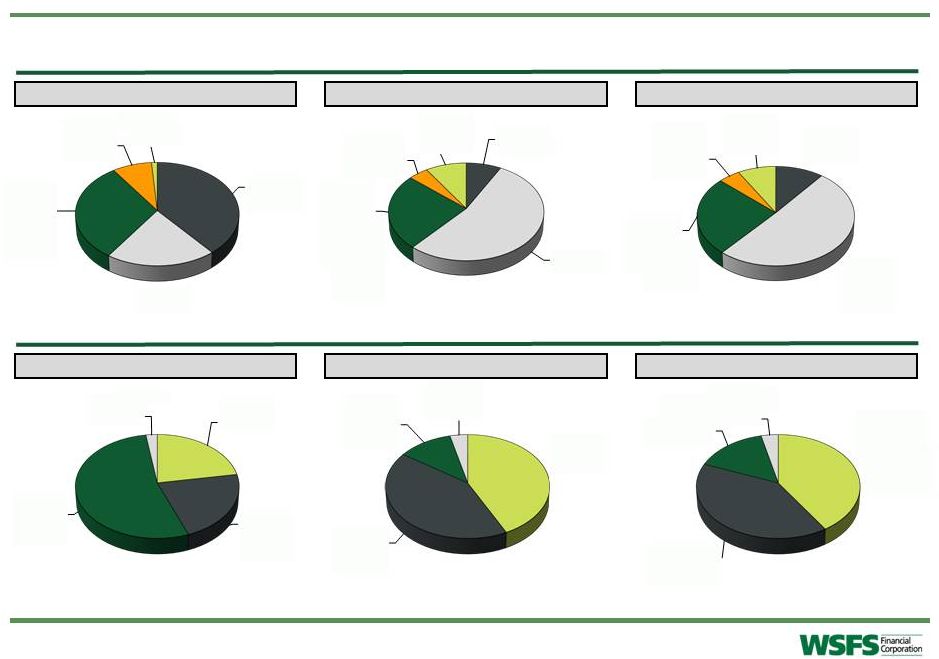

PRO FORMA LOANS AND DEPOSITS Note: Financial data as of 12/31/2014. No purchase accounting assumptions are incorporated in the pro forma loan and deposit composition. Owner occupied CRE is classified as C&I. Source: SNL Financial and Company provided information. ALLB: $310.2 mm WSFS: $3,224.6 mm Pro Forma: $3,534.8 mm ALLB: $344.8 mm WSFS: $3,649.2 mm Pro Forma: $3,994.0 mm Pro Forma Loan Composition Pro Forma Deposit Composition 8 1-4 Family 39% C&I 20% CRE & Multi Family 31% Constr. and Dev. 8% Other Loans 1% 1-4 Family 8% C&I 54% Multi Family 25% Constr. and Dev. 4% Other Loans CRE & 9.1% 1-4 Family 10% C&I 51% CRE & Multi Family 26% Constr. and Dev. 5% Other Loans 8% Transaction 41% MMDA & Savings 40% Retail CDs 15% Jumbo CDs 4% Transaction 22% MMDA & Savings 22% Retail CDs 54% Jumbo CDs 2% Transaction 43% MMDA & Savings 42% Retail CDs 11% Jumbo CDs 4% |

Approximately $92.0 million transaction value 70% common stock / 30% cash 0.28955 shares of WSFS or $22.00 in cash Price / Tangible Book Value of 138.4% Anticipated closing date in early fourth quarter 2015. TRANSACTION OVERVIEW AND FINANCIAL IMPACT Transaction Structure Assumptions based on comprehensive due diligence One-time pre-tax transaction costs of $9.3 million Cost savings of ~40% of Alliance’s non-interest expense base Substantial credit diligence undertaken; expected credit mark of 3.5% No revenue synergies are modeled, but they are expected. Assumptions 3.2% accretive to first full year earnings per share excluding one-time costs Tangible book value dilution of 1.8%, earned back in 4.7 years 17% anticipated IRR WSFS pro forma capital ratios well in excess of “well-capitalized” guidelines following close Financial Impact 9 |

For more information please contact: Investor Relations: Steven Fowle (302) 571-6833 or sfowle@wsfsbank.com www.wsfsbank.com Corporate Headquarters 500 Delaware Avenue Wilmington, DE 19801 10 |