February 10, 2016 WSFS Financial Corporation 4Q 2015 Investor Update Exhibit 99.2

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-571-7264 stockholderrelations@wsfsbank.com www.wsfsbank.com Mark A. Turner President and CEO 302-571-7160 mturner@wsfsbank.com Rodger Levenson Chief Financial Officer 302-571-7296 rlevenson@wsfsbank.com

Forward-Looking Statements This presentation contains estimates, predictions, opinions, projections and other “forward-looking statements” as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company’s predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management’s outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "target," "estimate," "continue," "positions," "prospects" or "potential," by future conditional verbs such as "will," "would," "should," "could" or "may", or by variations of such words or by similar expressions. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties (which change over time) and other factors which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties include, but are not limited to, those related to difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which the Company operates and in which its loans are concentrated, including the effects of declines in housing markets, an increase in unemployment levels and slowdowns in economic growth; the Company’s level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; changes in market interest rates may increase funding costs and reduce earning asset yields thus reducing margin; the impact of changes in interest rates and the credit quality and strength of underlying collateral and the effect of such changes on the market value of the Company’s investment securities portfolio; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial and industrial loans in our loan portfolio; the extensive federal and state regulation, supervision and examination governing almost every aspect of the Company’s operations including the changes in regulations affecting financial institutions, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations being issued in accordance with this statute and potential expenses associated with complying with such regulations; possible additional loan losses and impairment of the collectability of loans; the Company’s ability to comply with applicable capital and liquidity requirements (including the finalized Basel III capital standards), including our ability to generate liquidity internally or raise capital on favorable terms; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations; any impairment of the Company’s goodwill or other intangible assets; failure of the financial and operational controls of the Company’s Cash Connect division; conditions in the financial markets that may limit the Company’s access to additional funding to meet its liquidity needs; the success of the Company’s growth plans, including the successful integration of past and future acquisitions; the Company’s ability to complete the pending merger with Penn Liberty on the terms and conditions proposed which are subject to a number of conditions, risks and uncertainties including receipt of regulatory approvals and satisfaction of other closing conditions to the merger (including approval by Penn Liberty shareholders), delay in closing the merger, difficulties and delays in integrating the Penn Liberty business or fully realizing cost savings and other benefits of the merger, business disruption following the merger, Penn Liberty’s customer acceptance of the Company’s products and services and related customer disintermediation; negative perceptions or publicity with respect to the Company’s trust and wealth management business; system failure or cybersecurity breaches of the Company’s network security; the Company’s ability to recruit and retain key employees; the effects of problems encountered by other financial institutions that adversely affect the Company or the banking industry generally; the effects of weather and natural disasters such as floods, droughts, wind, tornadoes and hurricanes as well as effects from geopolitical instability and man-made disasters including terrorist attacks; possible changes in the speed of loan prepayments by the Company’s customers and loan origination or sales volumes; possible acceleration of prepayments of mortgage-backed securities due to low interest rates, and the related acceleration of premium amortization on prepayments on mortgage-backed securities due to low interest rates; regulatory limits on the Company’s ability to receive dividends from its subsidiaries and pay dividends to its shareholders; the effects of any reputational, credit, interest rate, market, operational, legal, liquidity, regulatory and compliance risk resulting from developments related to any of the risks discussed above; and the costs associated with resolving any problem loans, litigation and other risks and uncertainties, discussed in the Company’s Form 10-K for the year ended December 31, 2014 and other documents filed by the Company with the Securities and Exchange Commission from time to time. Forward looking statements are as of the date they are made, and the Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

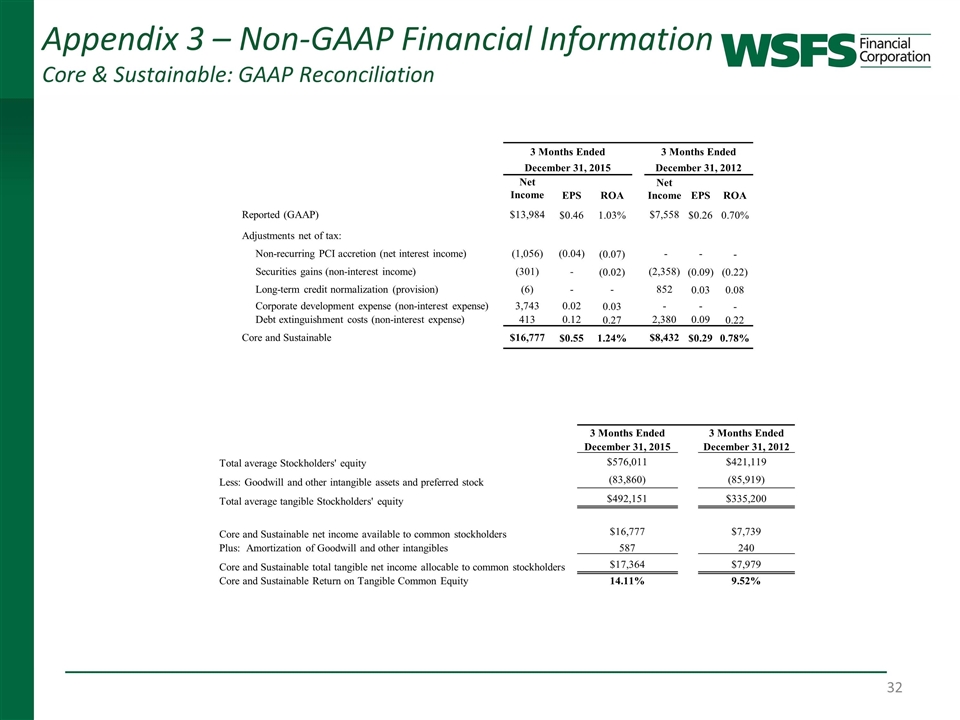

Non-GAAP Information This presentation contains financial information and performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company’s management uses these non-GAAP measures to measure the Company’s performance and believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP. The following are the non-GAAP measures used in this presentation: Core net income is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains (losses), corporate development expenses, debt extinguishment costs, and other extraordinary items Core and Sustainable net income is a non-GAAP measure that adjusts net income determined in accordance with GAAP by taking core net income and normalizing for long-term credit costs, non-recurring accretion from purchased credit impaired loans (“PCI”), and a normal tax rate Tangible common equity is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other intangible assets and preferred stock. Return on average tangible common equity is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity.

4Q 2015 Highlights

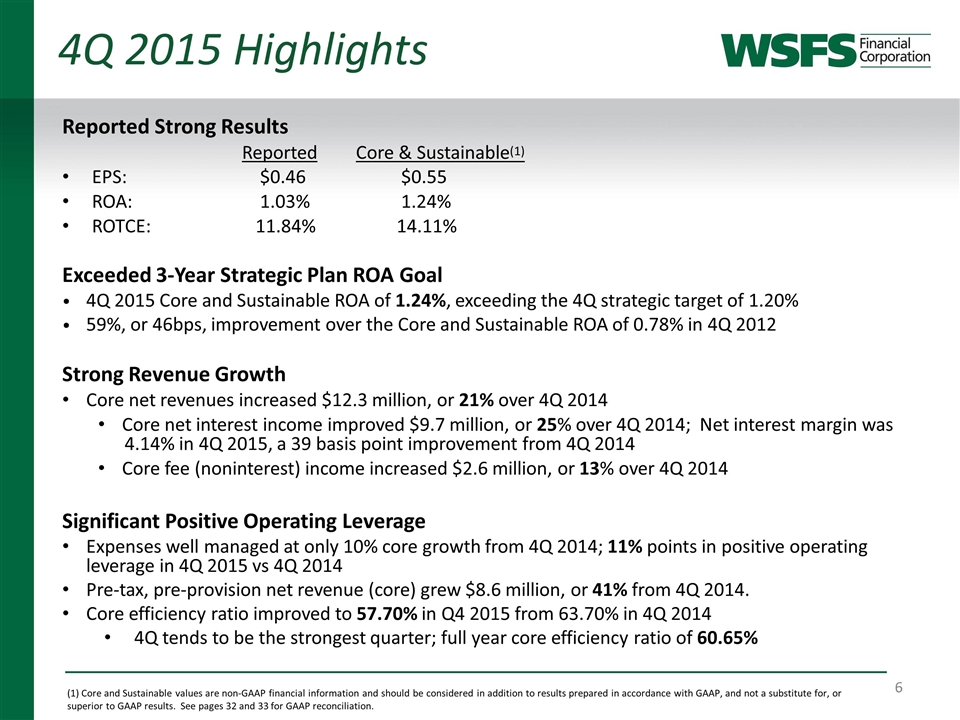

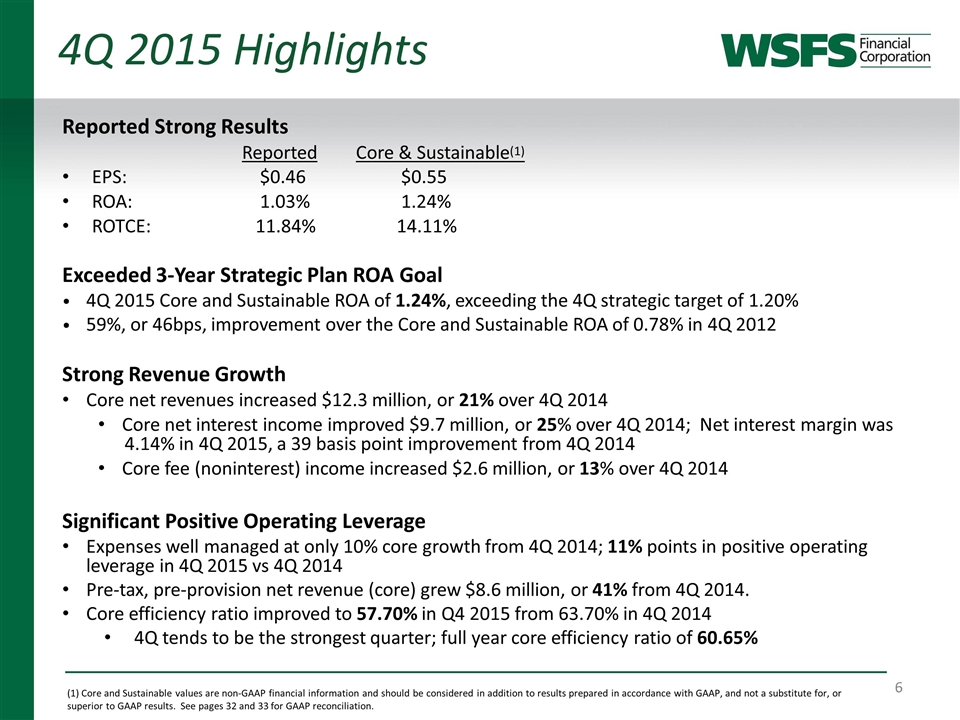

4Q 2015 Highlights Reported Strong Results Reported Core & Sustainable(1) EPS: $0.46 $0.55 ROA: 1.03% 1.24% ROTCE: 11.84% 14.11% Exceeded 3-Year Strategic Plan ROA Goal 4Q 2015 Core and Sustainable ROA of 1.24%, exceeding the 4Q strategic target of 1.20% 59%, or 46bps, improvement over the Core and Sustainable ROA of 0.78% in 4Q 2012 Strong Revenue Growth Core net revenues increased $12.3 million, or 21% over 4Q 2014 Core net interest income improved $9.7 million, or 25% over 4Q 2014; Net interest margin was ___4.14% in 4Q 2015, a 39 basis point improvement from 4Q 2014 Core fee (noninterest) income increased $2.6 million, or 13% over 4Q 2014 Significant Positive Operating Leverage Expenses well managed at only 10% core growth from 4Q 2014; 11% points in positive operating leverage in 4Q 2015 vs 4Q 2014 Pre-tax, pre-provision net revenue (core) grew $8.6 million, or 41% from 4Q 2014. Core efficiency ratio improved to 57.70% in Q4 2015 from 63.70% in 4Q 2014 4Q tends to be the strongest quarter; full year core efficiency ratio of 60.65% (1) Core and Sustainable values are non-GAAP financial information and should be considered in addition to results prepared in accordance with GAAP, and not a substitute for, or superior to GAAP results. See pages 32 and 33 for GAAP reconciliation.

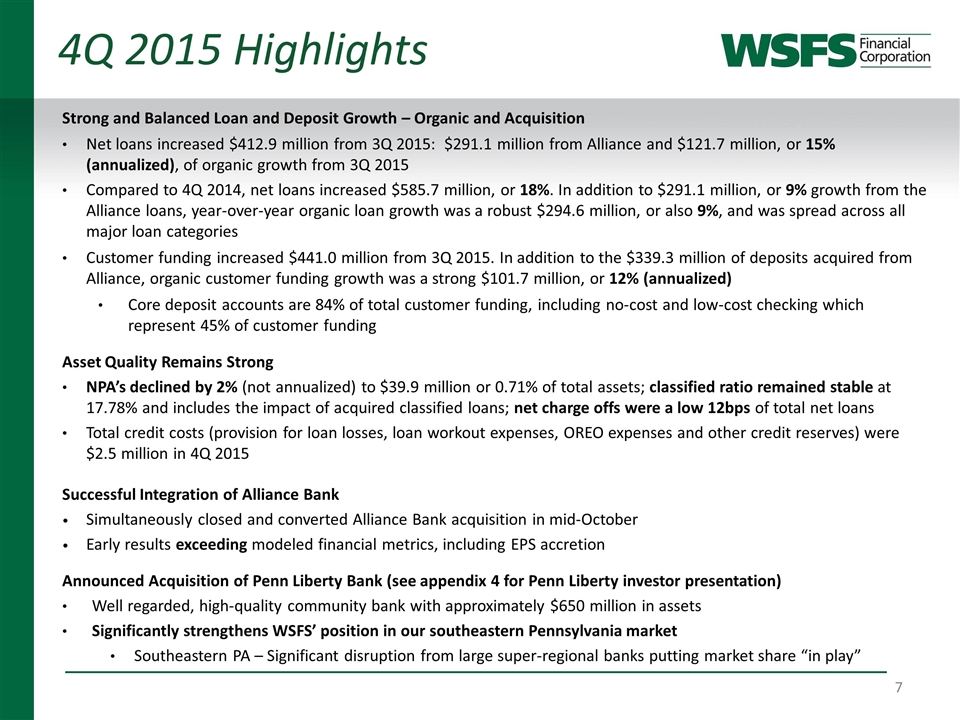

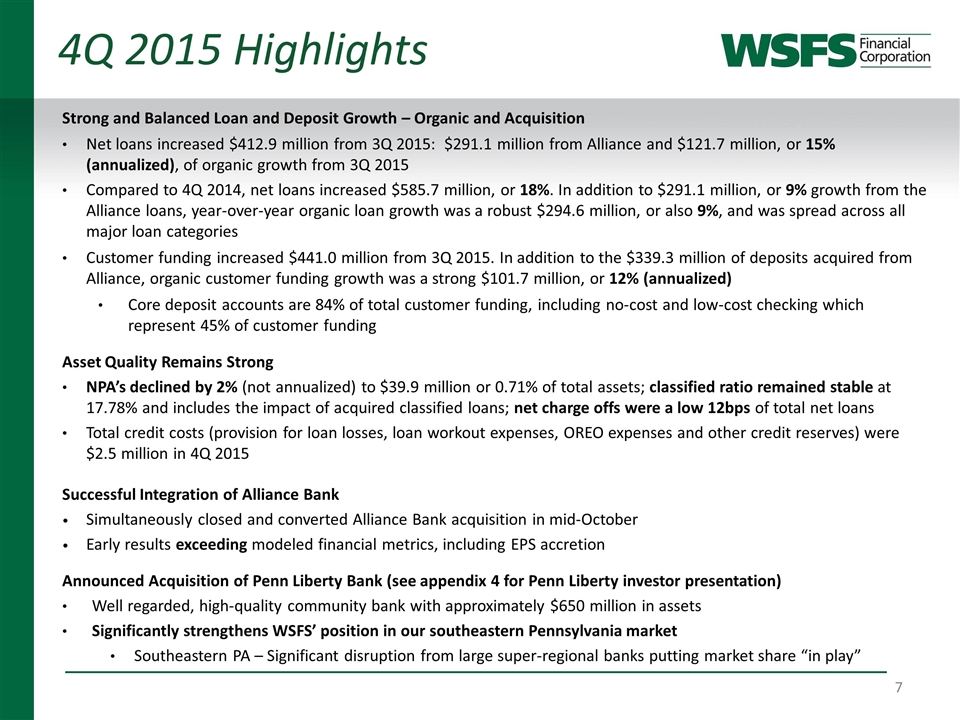

4Q 2015 Highlights Strong and Balanced Loan and Deposit Growth – Organic and Acquisition Net loans increased $412.9 million from 3Q 2015: $291.1 million from Alliance and $121.7 million, or 15% (annualized), of organic growth from 3Q 2015 Compared to 4Q 2014, net loans increased $585.7 million, or 18%. In addition to $291.1 million, or 9% growth from the Alliance loans, year-over-year organic loan growth was a robust $294.6 million, or also 9%, and was spread across all major loan categories Customer funding increased $441.0 million from 3Q 2015. In addition to the $339.3 million of deposits acquired from Alliance, organic customer funding growth was a strong $101.7 million, or 12% (annualized) Core deposit accounts are 84% of total customer funding, including no-cost and low-cost checking which represent 45% of customer funding Asset Quality Remains Strong NPA’s declined by 2% (not annualized) to $39.9 million or 0.71% of total assets; classified ratio remained stable at 17.78% and includes the impact of acquired classified loans; net charge offs were a low 12bps of total net loans Total credit costs (provision for loan losses, loan workout expenses, OREO expenses and other credit reserves) were $2.5 million in 4Q 2015 Successful Integration of Alliance Bank Simultaneously closed and converted Alliance Bank acquisition in mid-October Early results exceeding modeled financial metrics, including EPS accretion Announced Acquisition of Penn Liberty Bank (see appendix 4 for Penn Liberty investor presentation) Well regarded, high-quality community bank with approximately $650 million in assets Significantly strengthens WSFS’ position in our southeastern Pennsylvania market Southeastern PA – Significant disruption from large super-regional banks putting market share “in play”

The Path to High Performing

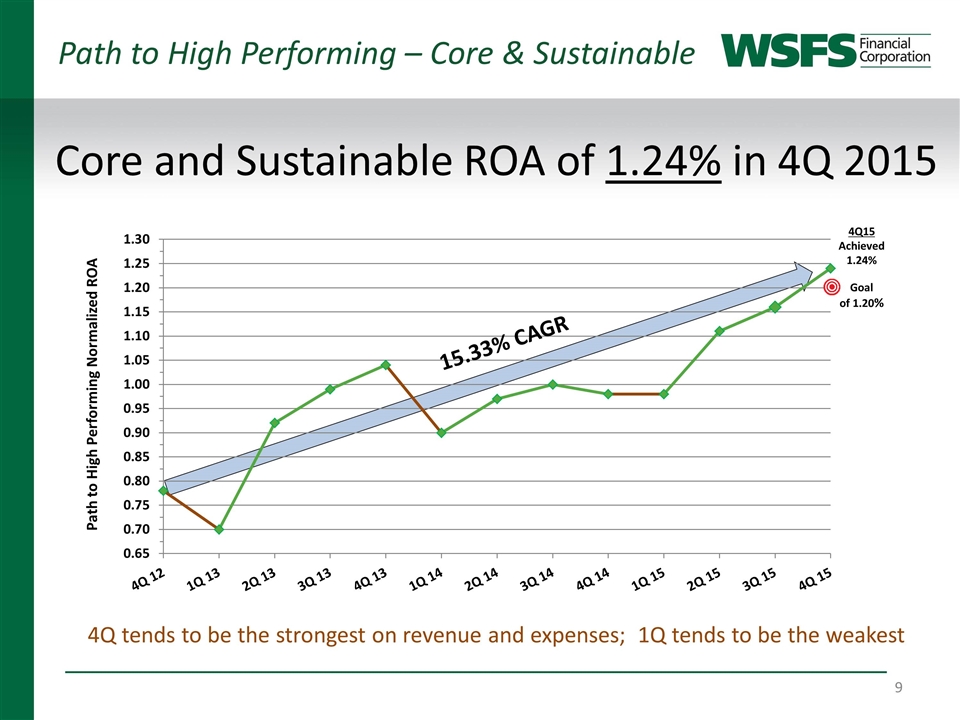

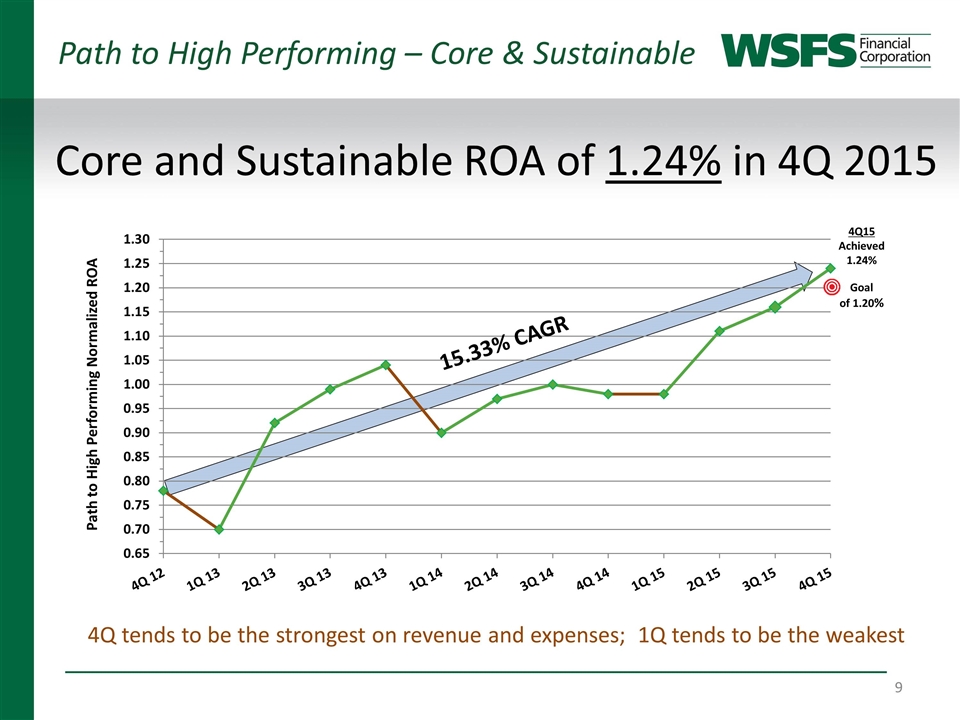

Path to High Performing – Core & Sustainable Core and Sustainable ROA of 1.24% in 4Q 2015 Path to High Performing Normalized ROA 15.33% CAGR 4Q15 Achieved 1.24% Goal of 1.20% 4Q tends to be the strongest on revenue and expenses; 1Q tends to be the weakest

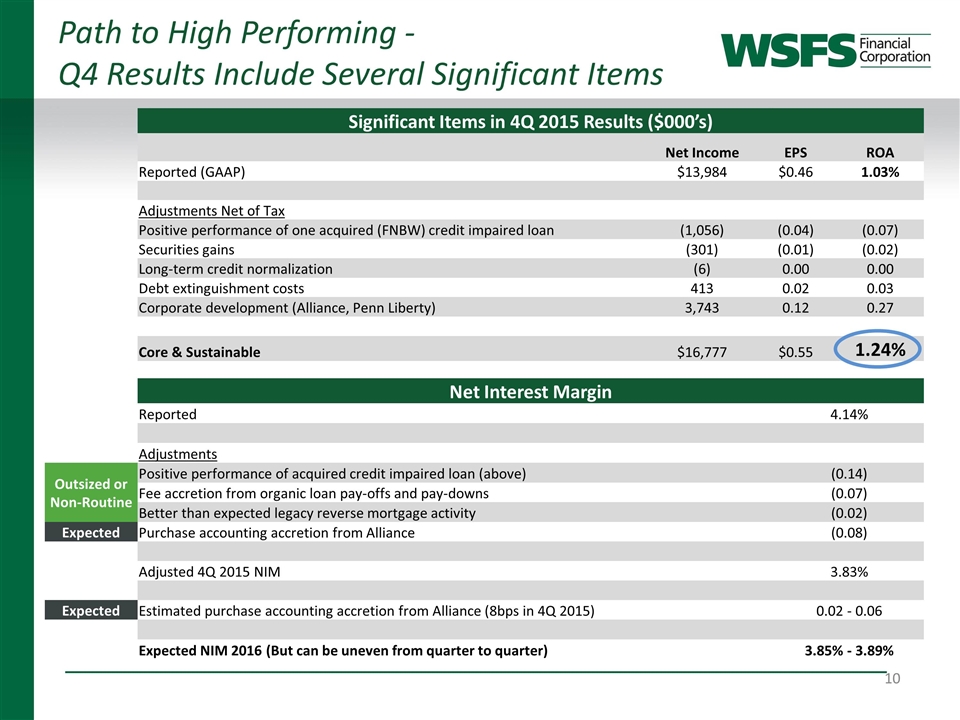

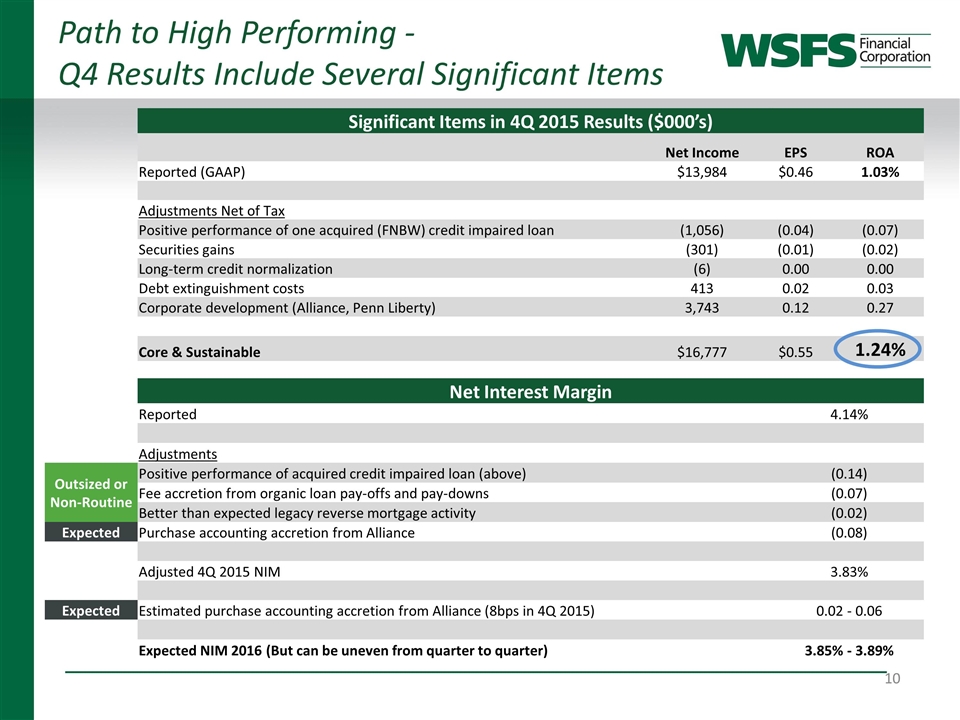

Path to High Performing - Q4 Results Include Several Significant Items Significant Items in 4Q 2015 Results ($000’s) Net Income EPS ROA Reported (GAAP) $13,984 $0.46 1.03% Adjustments Net of Tax Positive performance of one acquired (FNBW) credit impaired loan (1,056) (0.04) (0.07) Securities gains (301) (0.01) (0.02) Long-term credit normalization (6) 0.00 0.00 Debt extinguishment costs 413 0.02 0.03 Corporate development (Alliance, Penn Liberty) 3,743 0.12 0.27 Core & Sustainable $16,777 $0.55 1.24% Net Interest Margin Reported 4.14% Adjustments Outsized or Non-Routine Positive performance of acquired credit impaired loan (above) (0.14) Fee accretion from organic loan pay-offs and pay-downs (0.07) Better than expected legacy reverse mortgage activity (0.02) Expected Purchase accounting accretion from Alliance (0.08) Adjusted 4Q 2015 NIM 3.83% Expected Estimated purchase accounting accretion from Alliance (8bps in 4Q 2015) 0.02 - 0.06 Expected NIM 2016 (But can be uneven from quarter to quarter) 3.85% - 3.89%

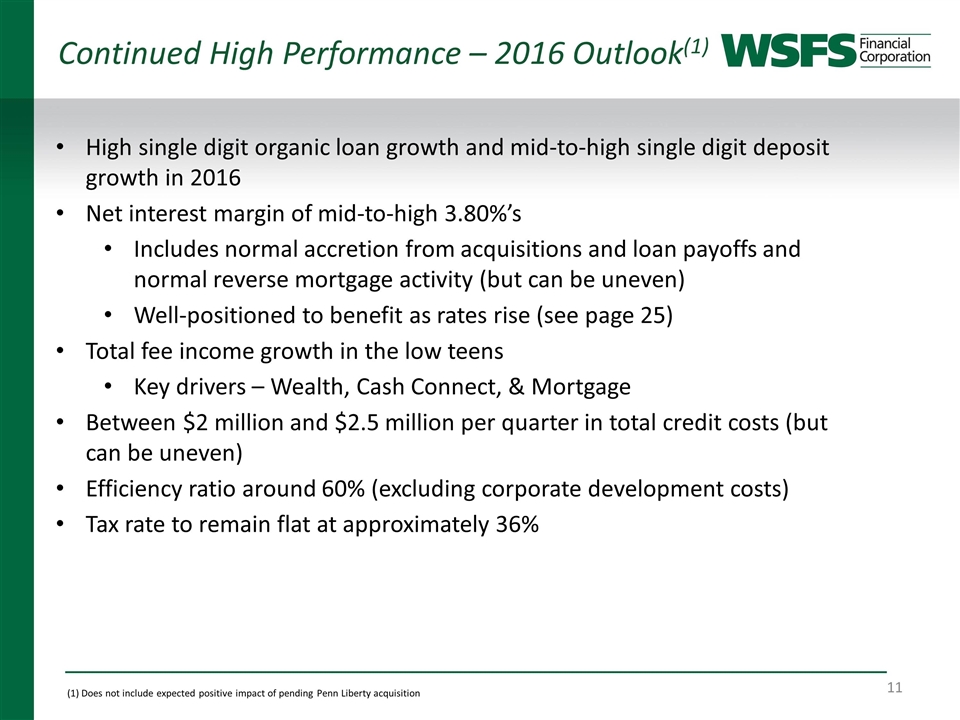

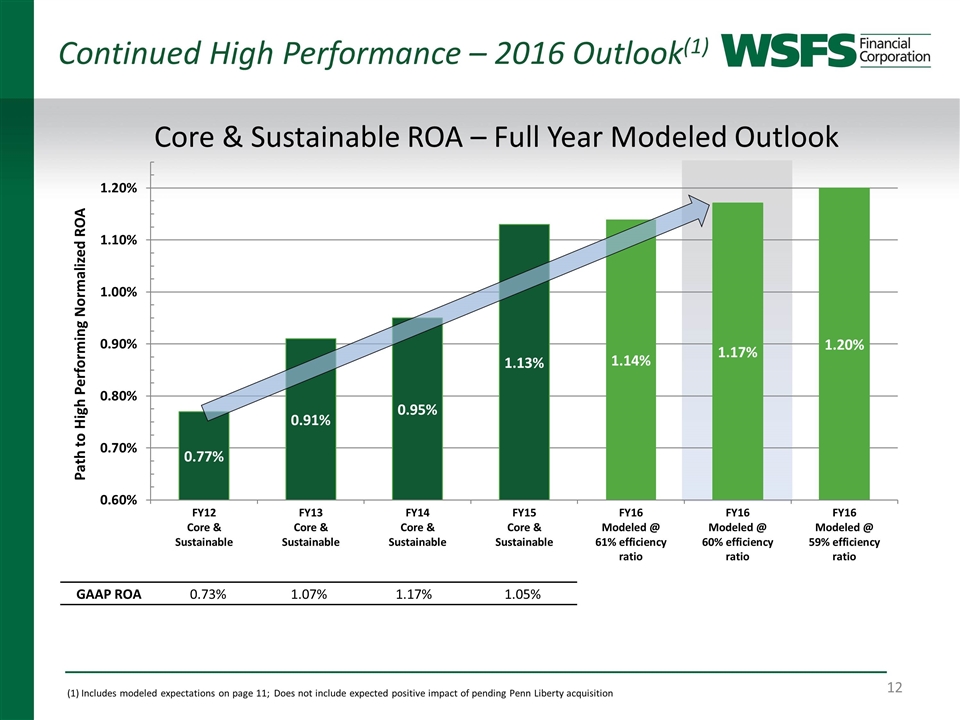

Continued High Performance – 2016 Outlook(1) High single digit organic loan growth and mid-to-high single digit deposit growth in 2016 Net interest margin of mid-to-high 3.80%’s Includes normal accretion from acquisitions and loan payoffs and normal reverse mortgage activity (but can be uneven) Well-positioned to benefit as rates rise (see page 25) Total fee income growth in the low teens Key drivers – Wealth, Cash Connect, & Mortgage Between $2 million and $2.5 million per quarter in total credit costs (but can be uneven) Efficiency ratio around 60% (excluding corporate development costs) Tax rate to remain flat at approximately 36% (1) Does not include expected positive impact of pending Penn Liberty acquisition

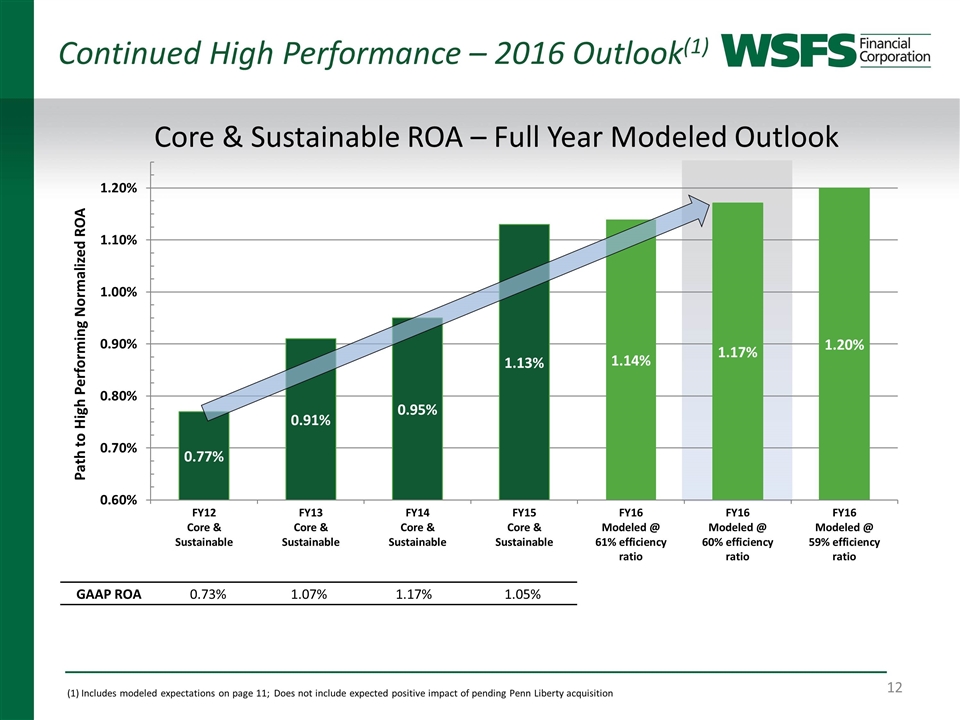

Path to High Performing Normalized ROA Core & Sustainable ROA – Full Year Modeled Outlook GAAP ROA 0.73% 1.07% 1.17% 1.05% Continued High Performance – 2016 Outlook(1) (1) Includes modeled expectations on page 11; Does not include expected positive impact of pending Penn Liberty acquisition

The WSFS Franchise

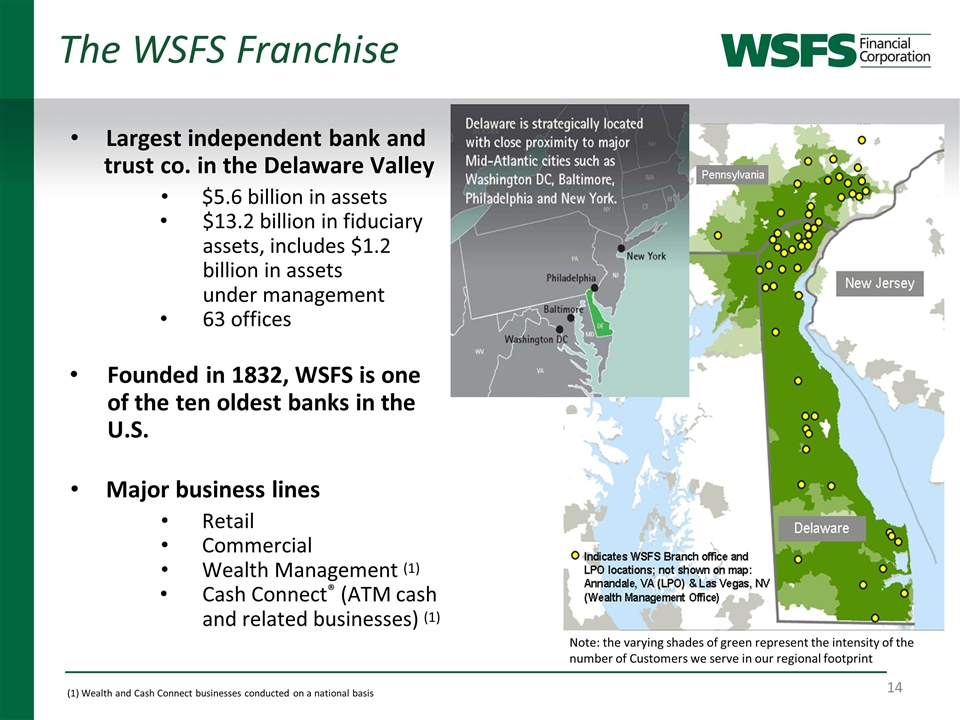

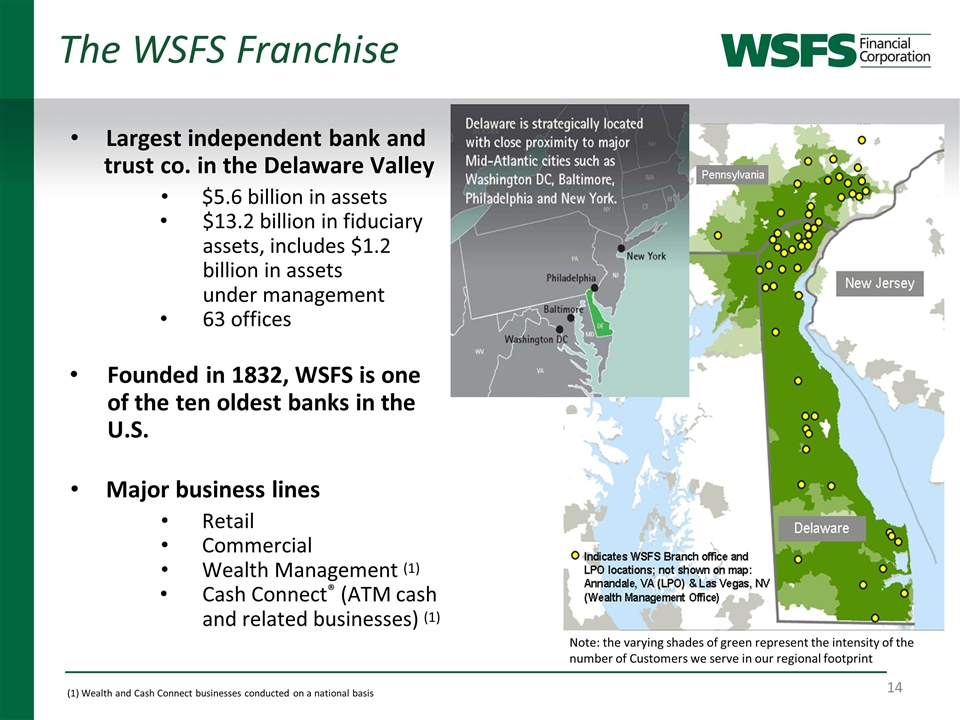

Largest independent bank and trust co. in the Delaware Valley $5.6 billion in assets $13.2 billion in fiduciary assets, includes $1.2 billion in assets under management 63 offices Founded in 1832, WSFS is one of the ten oldest banks in the U.S. Major business lines Retail Commercial Wealth Management (1) Cash Connect® (ATM cash and related businesses) (1) The WSFS Franchise Note: the varying shades of green represent the intensity of the number of Customers we serve in our regional footprint (1) Wealth and Cash Connect businesses conducted on a national basis

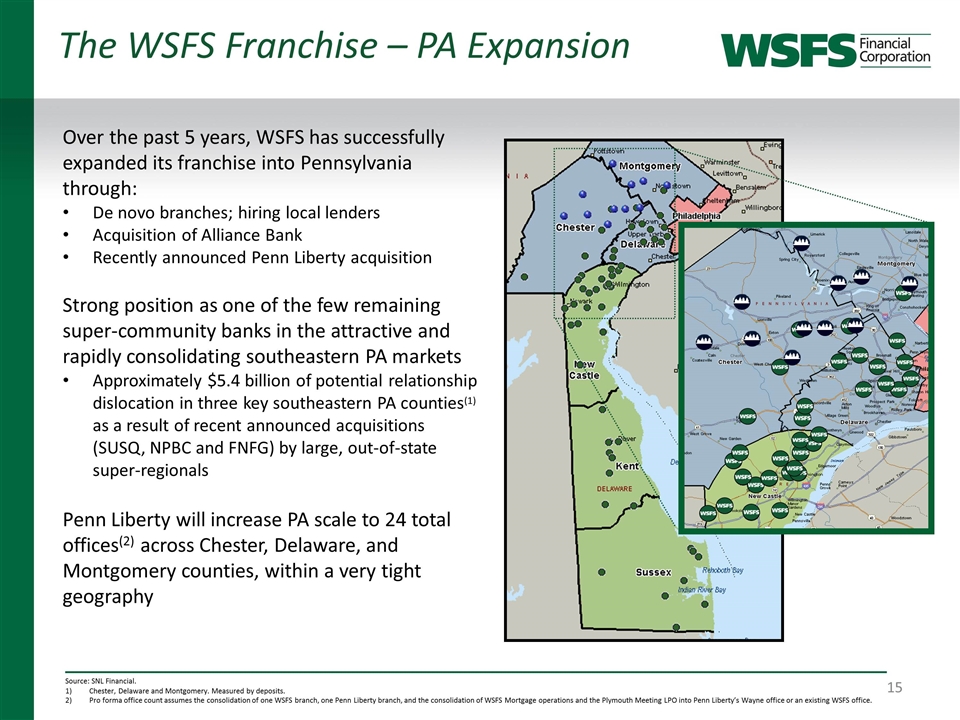

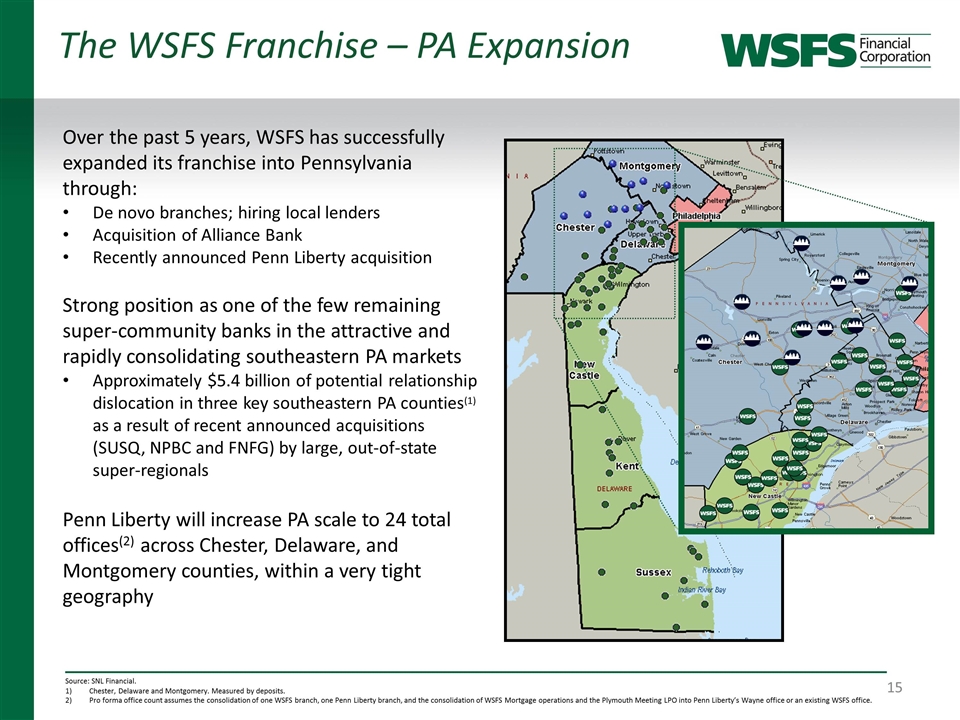

The WSFS Franchise – PA Expansion Over the past 5 years, WSFS has successfully expanded its franchise into Pennsylvania through: De novo branches; hiring local lenders Acquisition of Alliance Bank Recently announced Penn Liberty acquisition Strong position as one of the few remaining super-community banks in the attractive and rapidly consolidating southeastern PA markets Approximately $5.4 billion of potential relationship dislocation in three key southeastern PA counties(1) as a result of recent announced acquisitions (SUSQ, NPBC and FNFG) by large, out-of-state super-regionals Penn Liberty will increase PA scale to 24 total offices(2) across Chester, Delaware, and Montgomery counties, within a very tight geography Source: SNL Financial. Chester, Delaware and Montgomery. Measured by deposits. Pro forma office count assumes the consolidation of one WSFS branch, one Penn Liberty branch, and the consolidation of WSFS Mortgage operations and the Plymouth Meeting LPO into Penn Liberty’s Wayne office or an existing WSFS office.

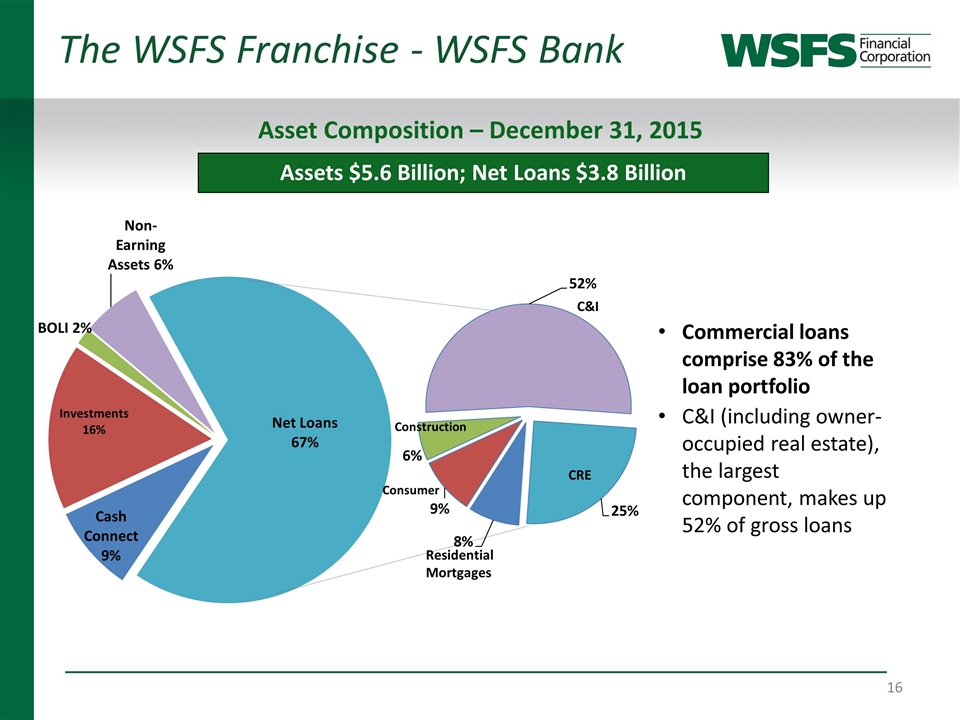

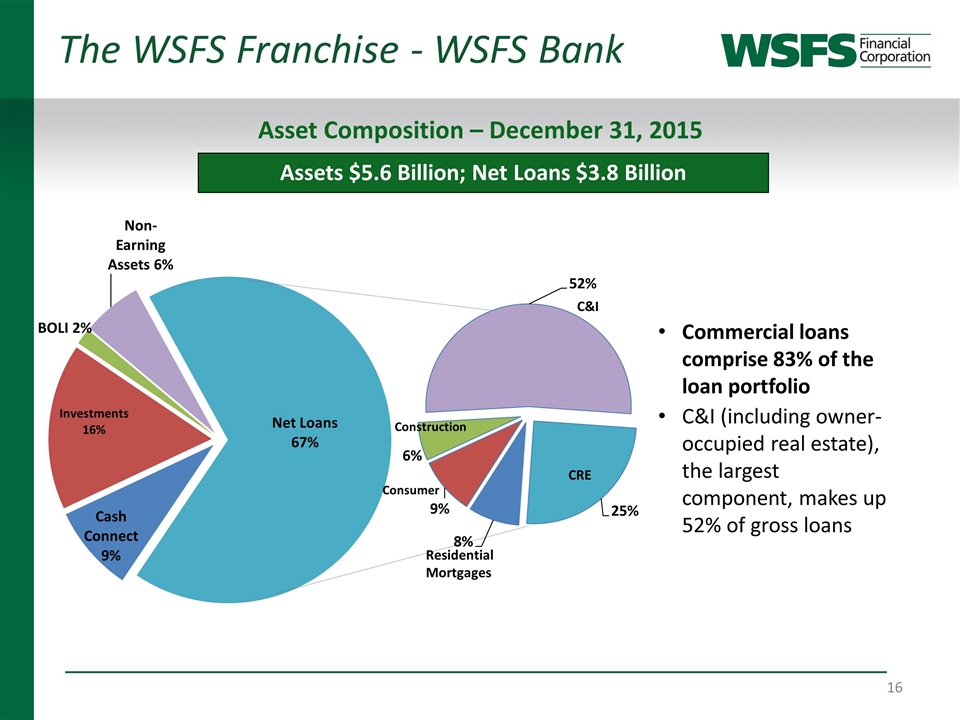

The WSFS Franchise - WSFS Bank Assets $5.6 Billion; Net Loans $3.8 Billion Asset Composition – December 31, 2015 Commercial loans comprise 83% of the loan portfolio C&I (including owner-occupied real estate), the largest component, makes up 52% of gross loans

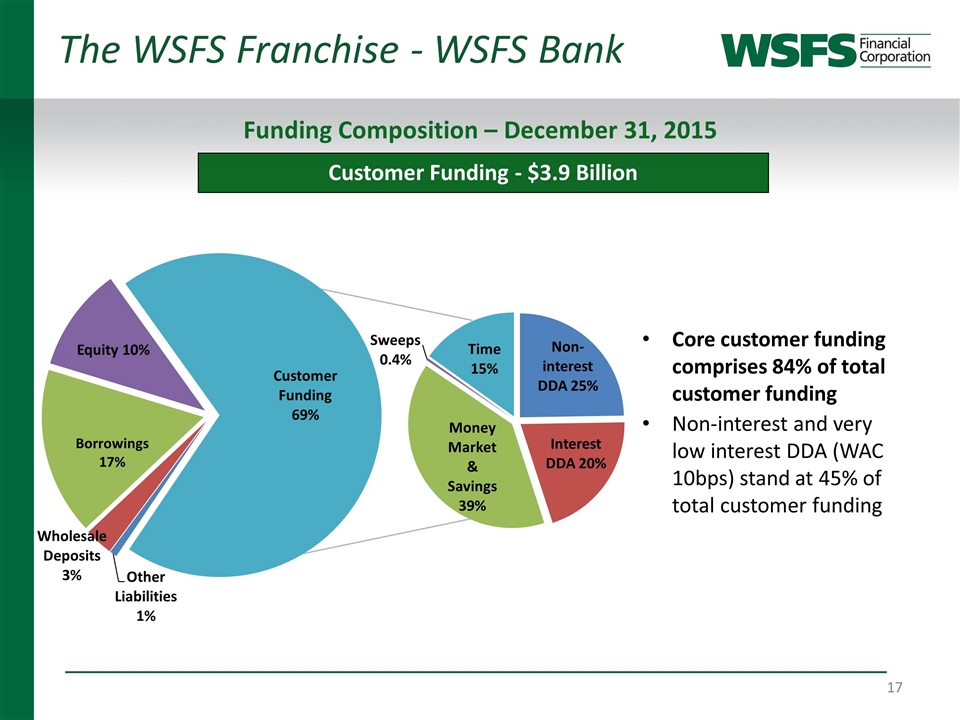

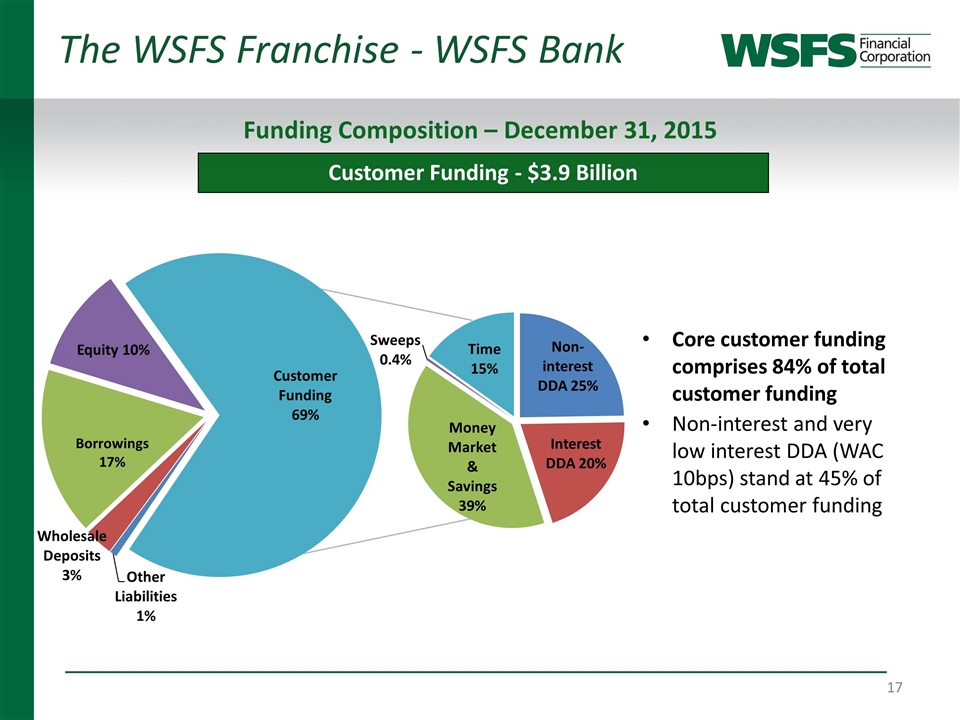

Customer Funding - $3.9 Billion Funding Composition – December 31, 2015 Core customer funding comprises 84% of total customer funding Non-interest and very low interest DDA (WAC 10bps) stand at 45% of total customer funding The WSFS Franchise - WSFS Bank

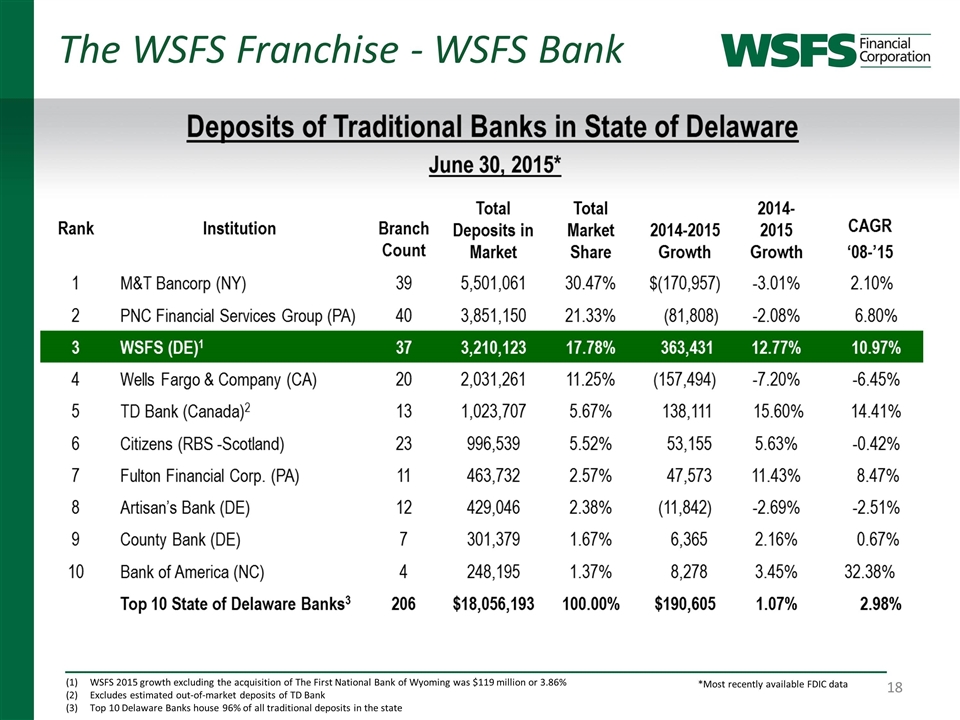

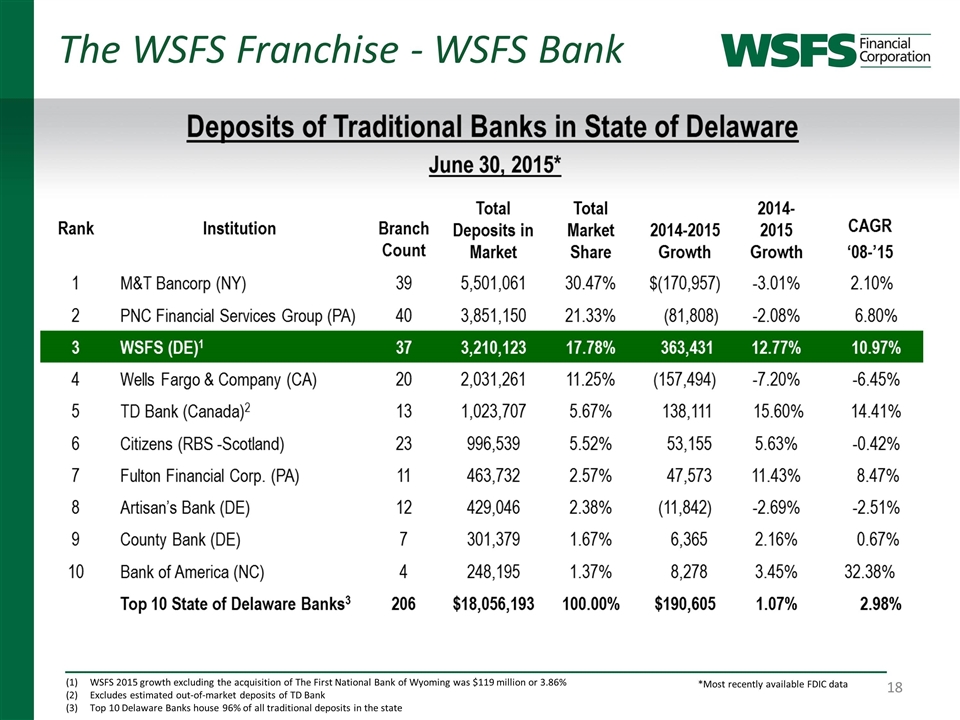

*Most recently available FDIC data WSFS 2015 growth excluding the acquisition of The First National Bank of Wyoming was $119 million or 3.86% Excludes estimated out-of-market deposits of TD Bank Top 10 Delaware Banks house 96% of all traditional deposits in the state The WSFS Franchise - WSFS Bank

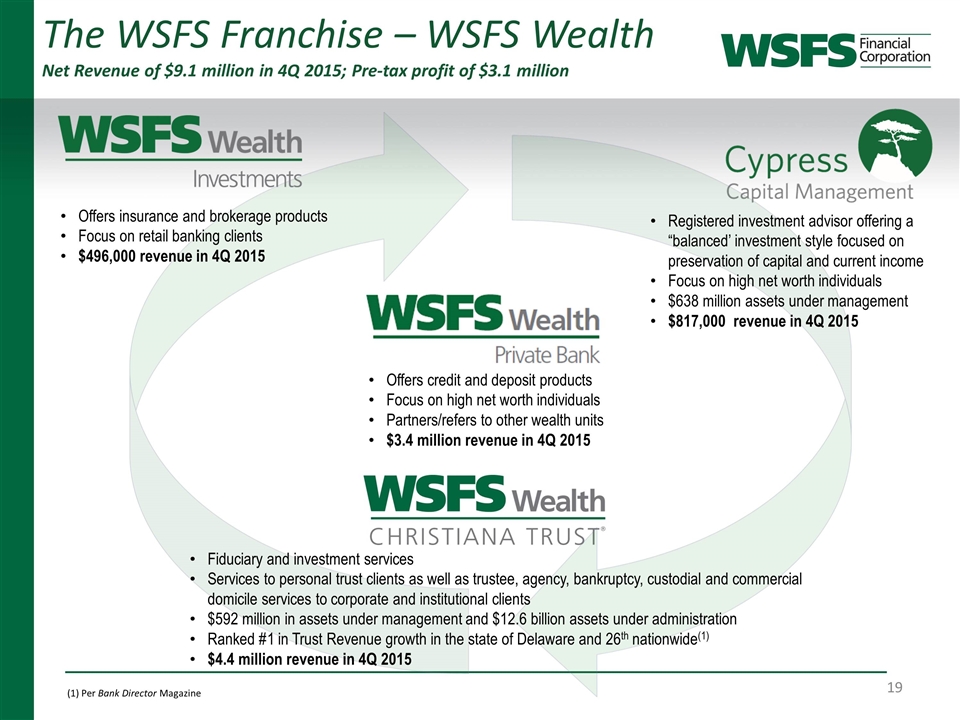

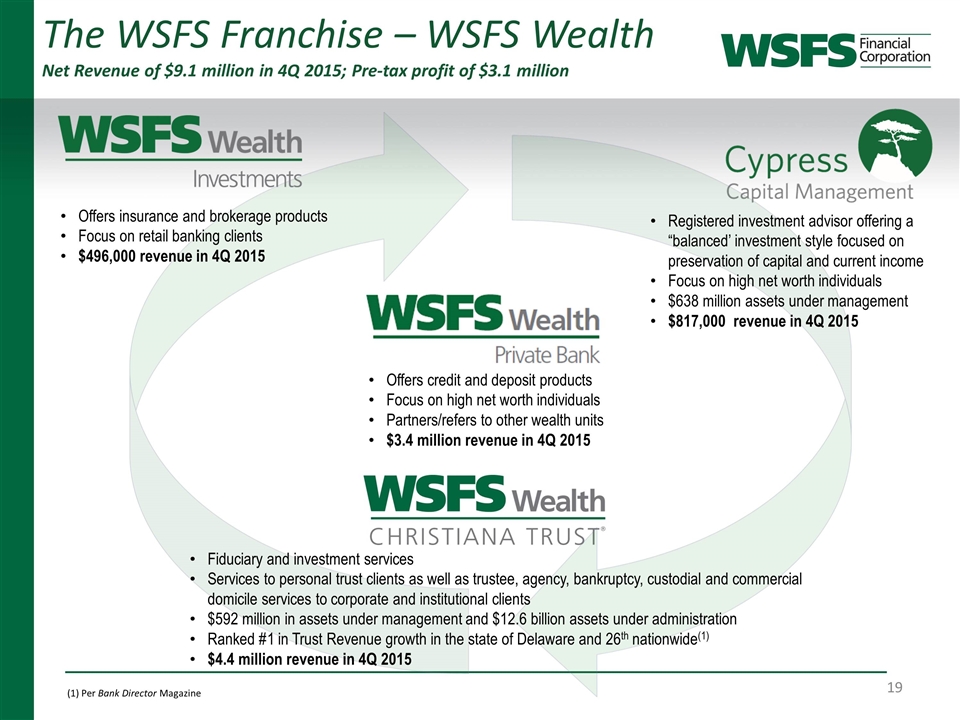

The WSFS Franchise – WSFS Wealth Net Revenue of $9.1 million in 4Q 2015; Pre-tax profit of $3.1 million (1) Per Bank Director Magazine Registered investment advisor offering a “balanced’ investment style focused on preservation of capital and current income Focus on high net worth individuals $638 million assets under management $817,000 revenue in 4Q 2015 Offers credit and deposit products Focus on high net worth individuals Partners/refers to other wealth units $3.4 million revenue in 4Q 2015 Fiduciary and investment services Services to personal trust clients as well as trustee, agency, bankruptcy, custodial and commercial domicile services to corporate and institutional clients $592 million in assets under management and $12.6 billion assets under administration Ranked #1 in Trust Revenue growth in the state of Delaware and 26th nationwide(1) $4.4 million revenue in 4Q 2015 Offers insurance and brokerage products Focus on retail banking clients $496,000 revenue in 4Q 2015

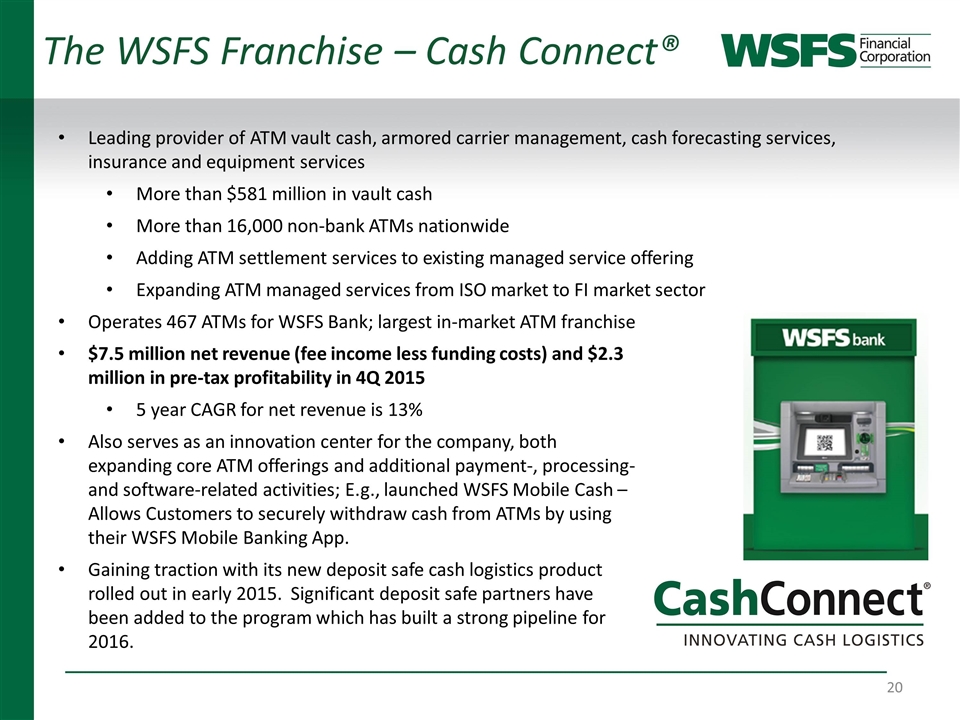

The WSFS Franchise – Cash Connect® Leading provider of ATM vault cash, armored carrier management, cash forecasting services, insurance and equipment services More than $581 million in vault cash More than 16,000 non-bank ATMs nationwide Adding ATM settlement services to existing managed service offering Expanding ATM managed services from ISO market to FI market sector Operates 467 ATMs for WSFS Bank; largest in-market ATM franchise $7.5 million net revenue (fee income less funding costs) and $2.3 million in pre-tax profitability in 4Q 2015 5 year CAGR for net revenue is 13% Also serves as an innovation center for the company, both expanding core ATM offerings and additional payment-, processing- and software-related activities; E.g., launched WSFS Mobile Cash – Allows Customers to securely withdraw cash from ATMs by using their WSFS Mobile Banking App. Gaining traction with its new deposit safe cash logistics product rolled out in early 2015. Significant deposit safe partners have been added to the program which has built a strong pipeline for 2016.

Additional Information

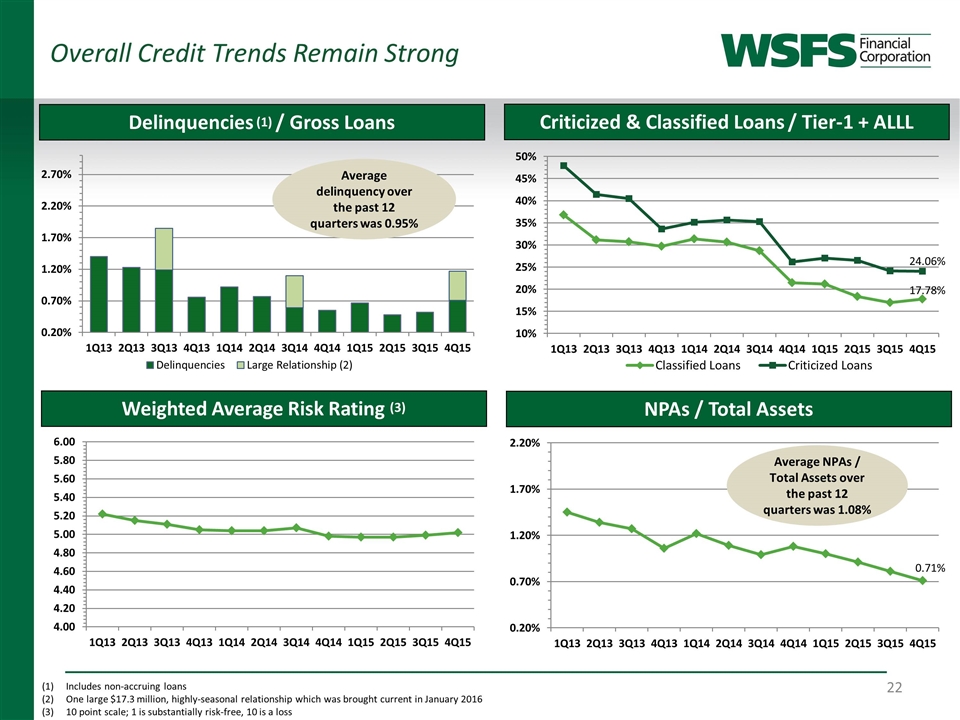

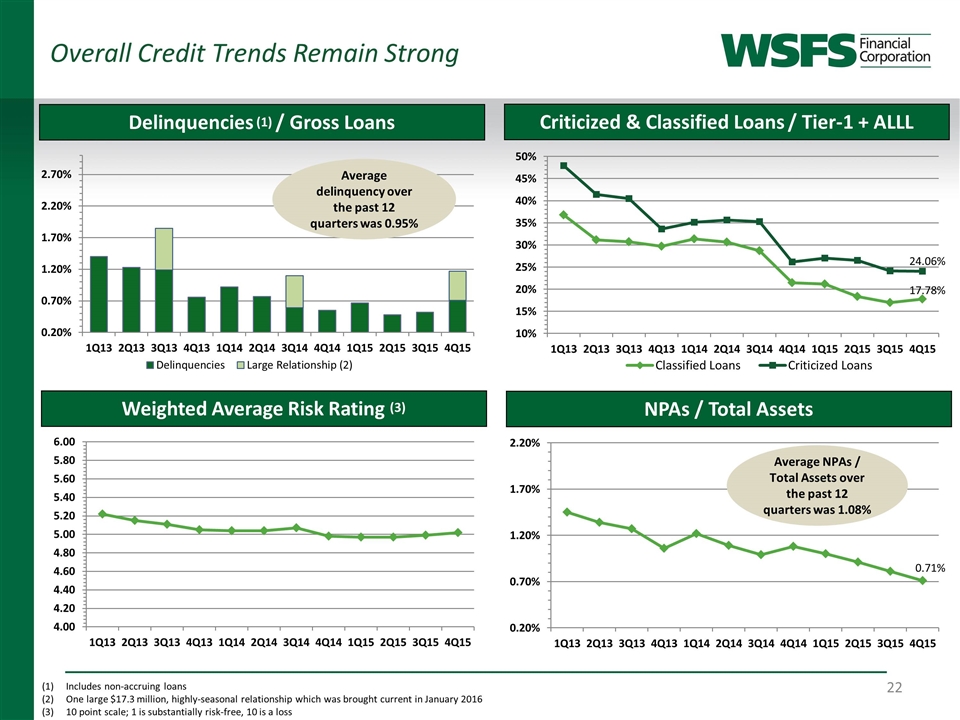

Overall Credit Trends Remain Strong Delinquencies (1) / Gross Loans Weighted Average Risk Rating (3) Includes non-accruing loans One large $17.3 million, highly-seasonal relationship which was brought current in January 2016 10 point scale; 1 is substantially risk-free, 10 is a loss Criticized & Classified Loans / Tier-1 + ALLL NPAs / Total Assets Average delinquency over the past 12 quarters was 0.95% Average NPAs / Total Assets over the past 12 quarters was 1.08%

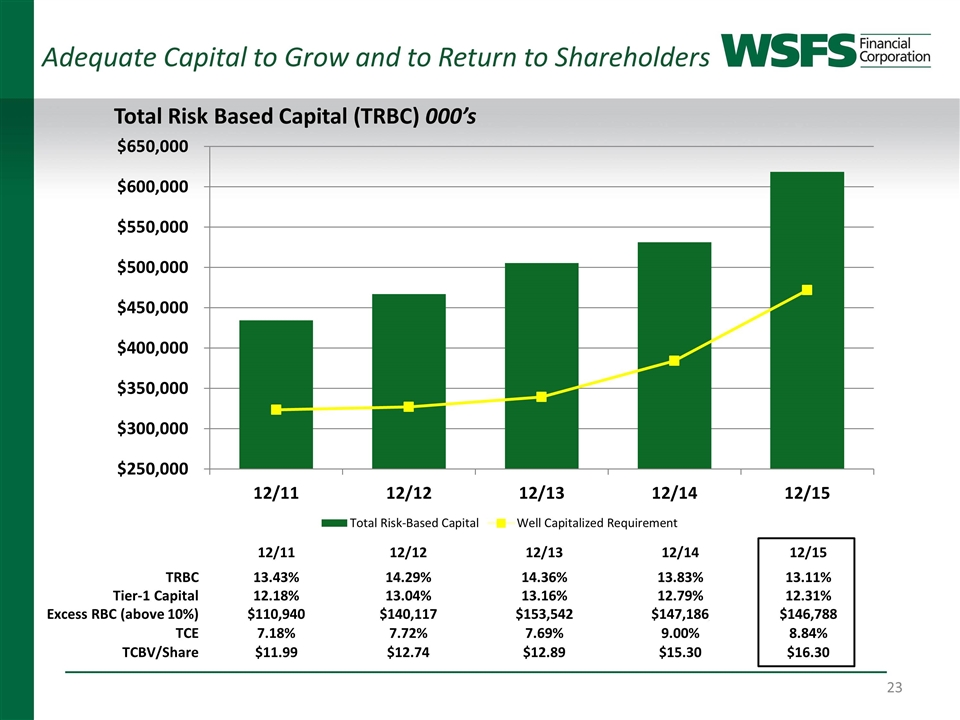

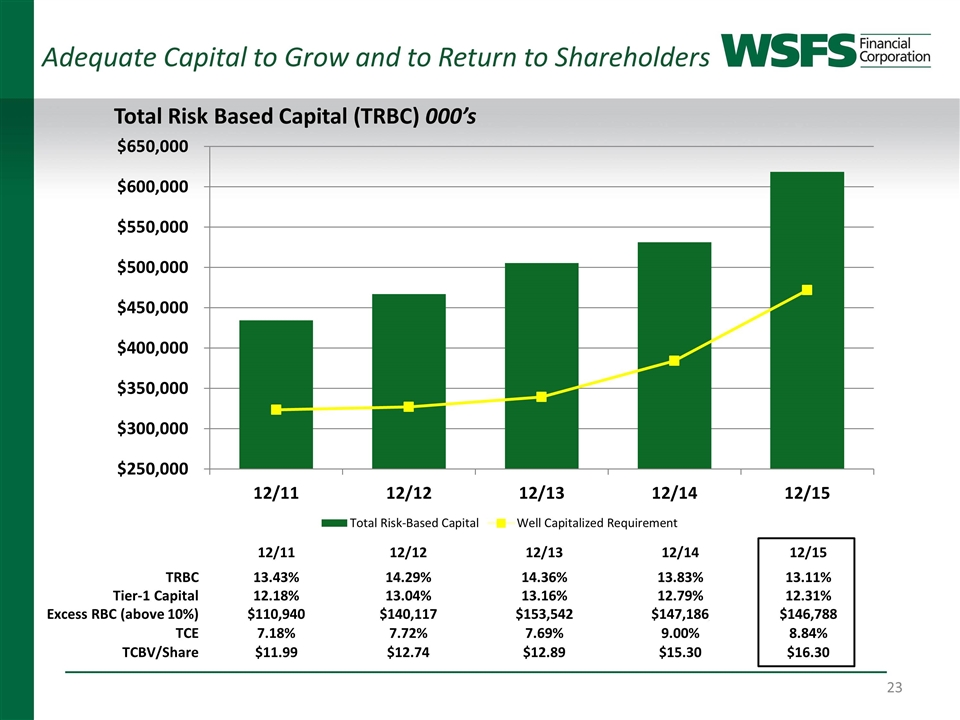

Adequate Capital to Grow and to Return to Shareholders 12/11 12/12 12/13 12/14 12/15 TRBC 13.43% 14.29% 14.36% 13.83% 13.11% Tier-1 Capital 12.18% 13.04% 13.16% 12.79% 12.31% Excess RBC (above 10%) $110,940 $140,117 $153,542 $147,186. $146,788 TCE 7.18% 7.72% 7.69% 9.00% 8.84% TCBV/Share $11.99 $12.74 $12.89 $15.30 $16.30 Total Risk Based Capital (TRBC) 000’s

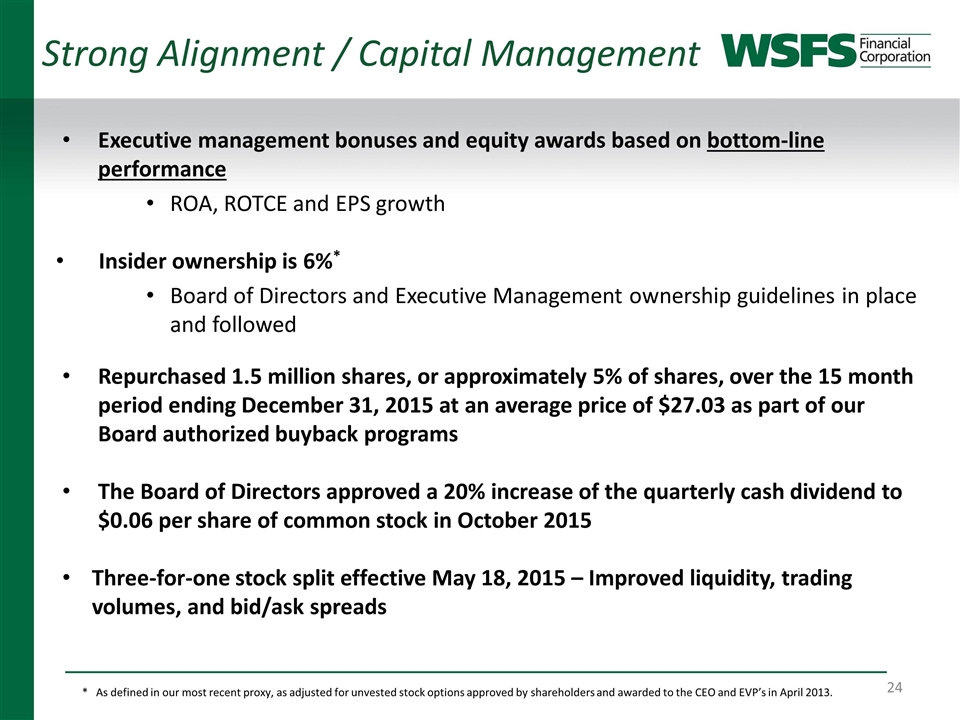

Strong Alignment / Capital Management Executive management bonuses and equity awards based on bottom-line performance ROA, ROTCE and EPS growth Insider ownership is 6%* Board of Directors and Executive Management ownership guidelines in place and followed Repurchased 1.5 million shares, or approximately 5% of shares, over the 15 month period ending December 31, 2015 at an average price of $27.03 as part of our Board authorized buyback programs The Board of Directors approved a 20% increase of the quarterly cash dividend to $0.06 per share of common stock in October 2015 Three-for-one stock split effective May 18, 2015 – Improved liquidity, trading volumes, and bid/ask spreads * As defined in our most recent proxy, as adjusted for unvested stock options approved by shareholders and awarded to the CEO and EVP’s in April 2013.

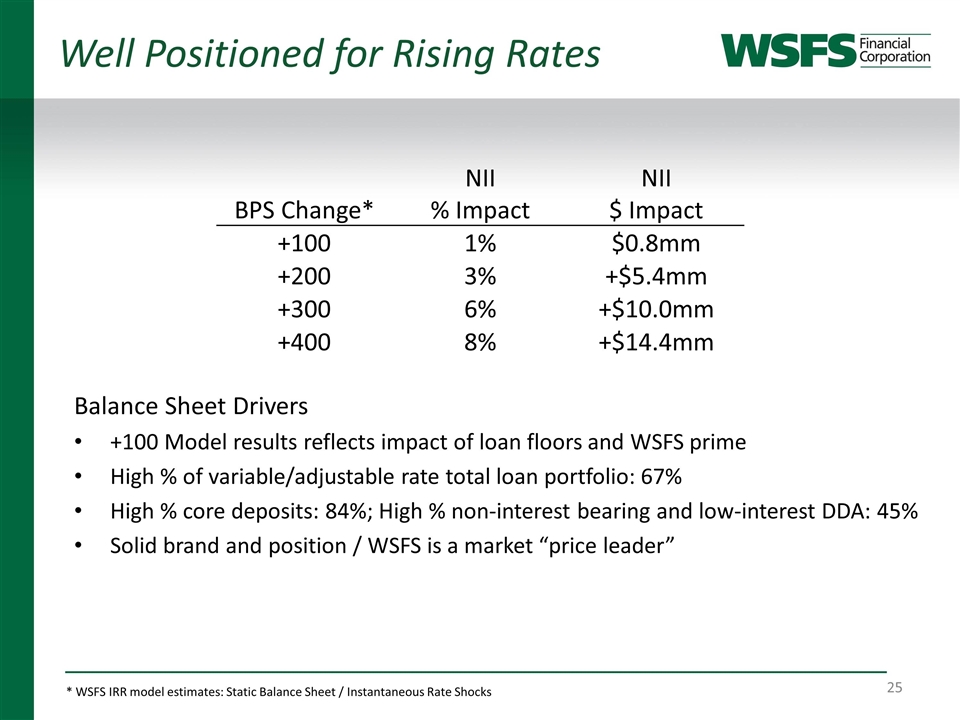

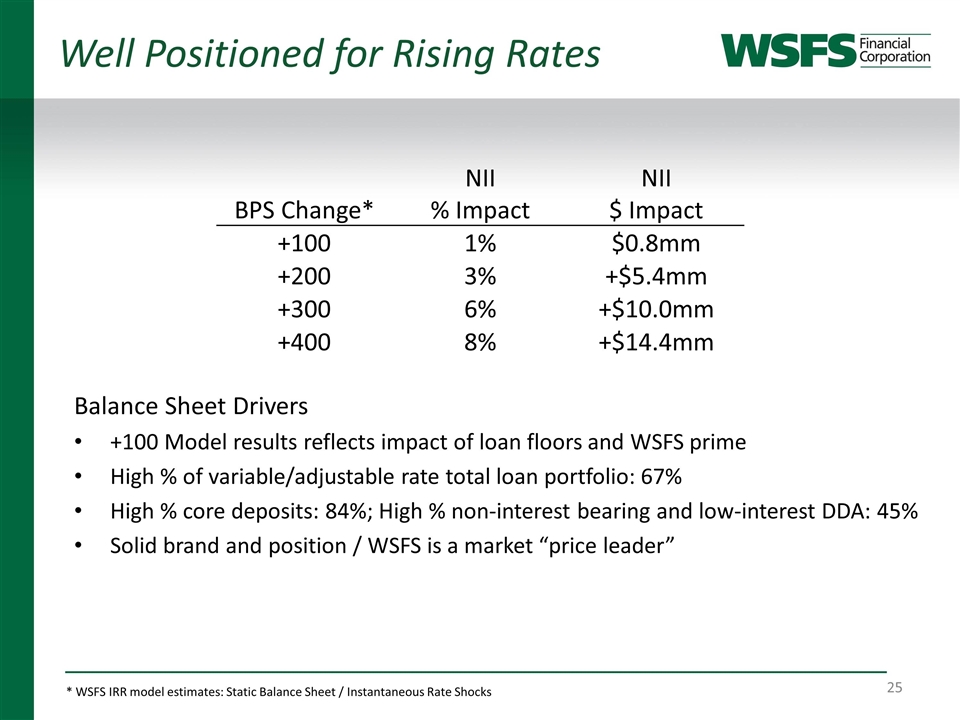

Well Positioned for Rising Rates BPS Change* NII % Impact NII $ Impact +100 1% $0.8mm +200 3% +$5.4mm +300 6% +$10.0mm +400 8% +$14.4mm Balance Sheet Drivers +100 Model results reflects impact of loan floors and WSFS prime High % of variable/adjustable rate total loan portfolio: 67% High % core deposits: 84%; High % non-interest bearing and low-interest DDA: 45% Solid brand and position / WSFS is a market “price leader” * WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks

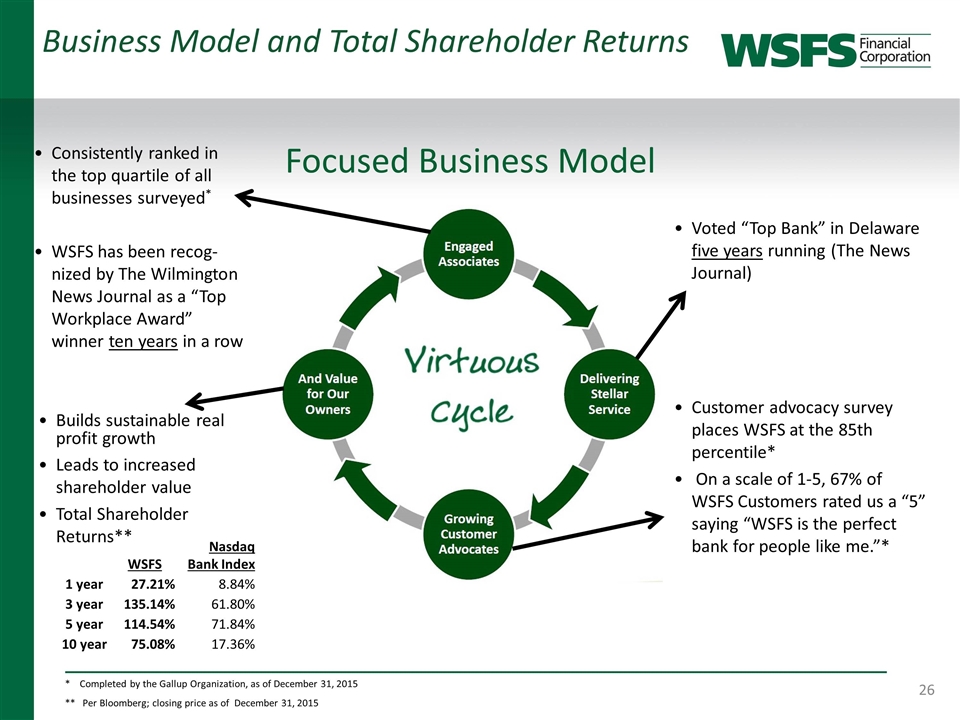

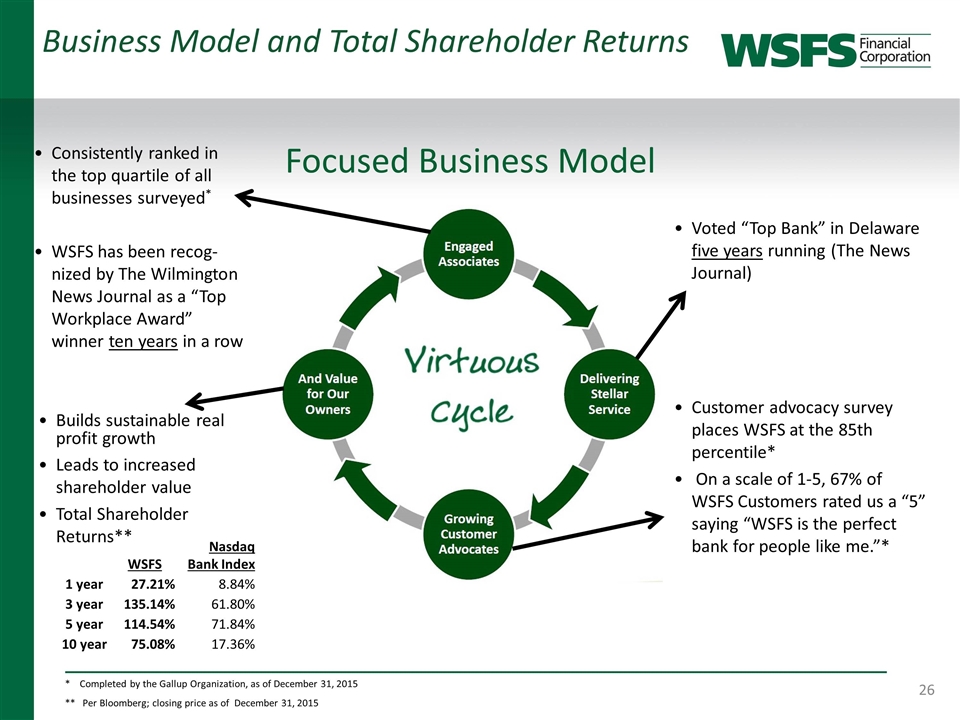

Business Model and Total Shareholder Returns * Completed by the Gallup Organization, as of December 31, 2015 ** Per Bloomberg; closing price as of December 31, 2015 Focused Business Model Consistently ranked in the top quartile of all businesses surveyed* WSFS has been recog- nized by The Wilmington News Journal as a “Top Workplace Award” winner ten years in a row Voted “Top Bank” in Delaware five years running (The News Journal) Customer advocacy survey places WSFS at the 85th percentile* On a scale of 1-5, 67% of WSFS Customers rated us a “5” saying “WSFS is the perfect bank for people like me.”* Builds sustainable real profit growth Leads to increased shareholder value Total Shareholder Returns** WSFS Nasdaq Bank Index 1 year 27.21% 8.84% 3 year 135.14% 61.80% 5 year 114.54% 71.84% 10 year 75.08% 17.36%

Appendices

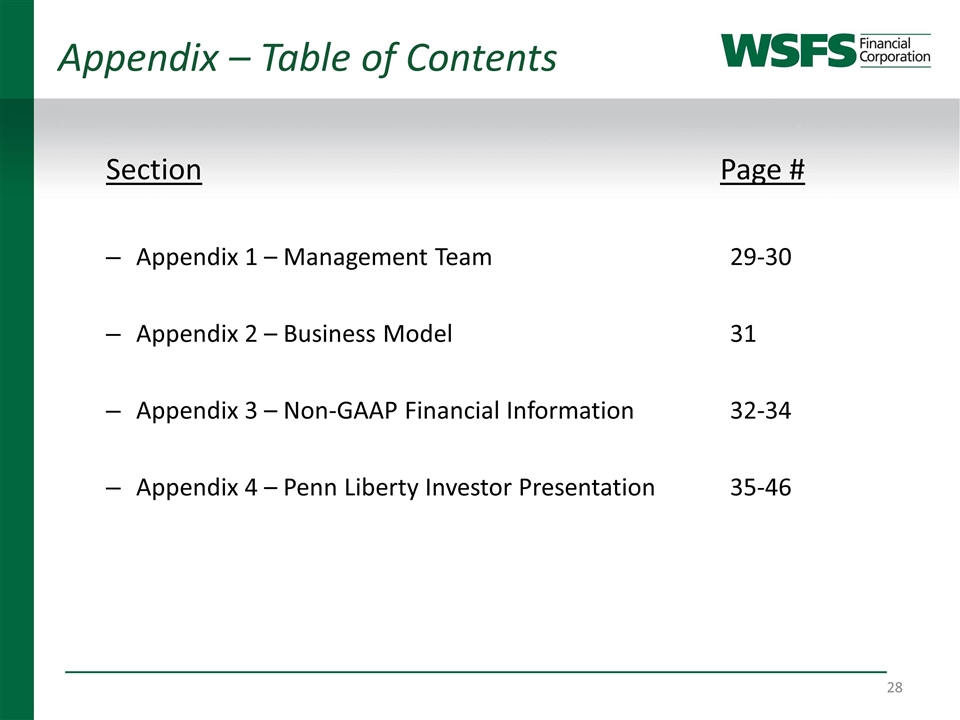

Appendix – Table of Contents Section Page # Appendix 1 – Management Team29-30 Appendix 2 – Business Model31 Appendix 3 – Non-GAAP Financial Information32-34 Appendix 4 – Penn Liberty Investor Presentation35-46

Appendix 1 – Management Team Mark A. Turner, 52, has served as President and Chief Executive Officer since 2007. Mr. Turner was previously Chief Operating Officer and the Chief Financial Officer for WSFS. Prior to joining WSFS, his experience includes working at CoreStates Bank and Meridian Bancorp. Mr. Turner started his career at the international professional services firm of KPMG, LLP. He received his MBA from the Wharton School of the University of Pennsylvania, his Masters Degree in Executive Leadership from the University of Nebraska and his Bachelor’s Degree in Accounting and Management from LaSalle University. Rodger Levenson, 54, Executive Vice President and Chief Financial Officer since 2015. Mr. Levenson was previously the Chief Commercial Banking Officer from 2006. From 2003 to 2006, Mr. Levenson was Senior Vice President and Manager of the Specialized Banking and Business Banking Divisions of Citizens Bank. Mr. Levenson received his MBA in Finance from Drexel University and his Bachelor’s Degree in Finance from Temple University. Peggy H. Eddens, 60, Executive Vice President, Chief Human Capital Officer since 2007. From 2003 to 2007 she was Senior Vice President for Human Resources and Development for NexTier Bank, Butler PA. Ms. Eddens received a Master of Science Degree in Human Resource Management from La Roche College and her Bachelor of Science Degree in Business Administration with minors in Management and Psychology from Robert Morris University. Paul D. Geraghty, 61, Executive Vice President and Chief Wealth Officer since 2011. From 2007 to 2010, he was Chief Executive Officer at Harleysville National Corporation, Harleysville, PA. Mr. Geraghty received his Bachelor of Science in Accounting from Villanova University and pursued graduate study in business at Lehigh University.

Appendix 1 – Management Team Thomas W. Kearney, 67, Executive Vice President and Chief Risk Officer has been with WSFS since 1998. Mr. Kearney holds a Bachelor’s degree in Business Administration (Finance and Accounting) from Drexel University. He also holds the professional designations of Certified Bank Auditor (CBA) and Certified Financial Services Auditor (CFSA). As Chief Risk Officer, Mr. Kearney’s primary responsibility is to manage and direct the various oversight functions throughout the Company. These oversight functions include Enterprise Risk Management, Loan Review, In-house Counsel, Security/Fraud Investigations, Regulatory Compliance, Internal Control/Audit and Credit Administration. S. James Mazarakis, 58, Executive Vice President and Chief Technology Officer since 2010. Mr. Mazarakis served in a senior leadership role as Chief Information Officer for T. Rowe Price, and Managing Director and Divisional CIO at JP Morgan Investment Asset Management. He received his Master of Science degree in Management of Technology from Polytechnic Institute of New York University. Thomas Stevenson, 62, has served as President of Cash Connect Division since 2003. Mr. Stevenson joined WSFS in 1996 as Executive Vice President and Chief Information Officer. Prior to joining WSFS, Mr. Stevenson was the Manager of Quality Assurance at Electronic Payment Services. Mr. Stevenson attended Wayne State University and the Banking and Financial Services program at the University of Michigan’s Graduate School of Business Administration. Richard M. Wright, 62, Executive Vice President and Chief Retail Banking Officer since 2006. From 2003 to 2006, Mr. Wright was Executive Vice President, Retail Banking and Marketing for DNB First in Downingtown, PA. Mr. Wright received his MBA in Management Decision Systems from the University of Southern California and his Bachelor’s Degree in Marketing and Economics from California State University.

Appendix 2 – Business Model

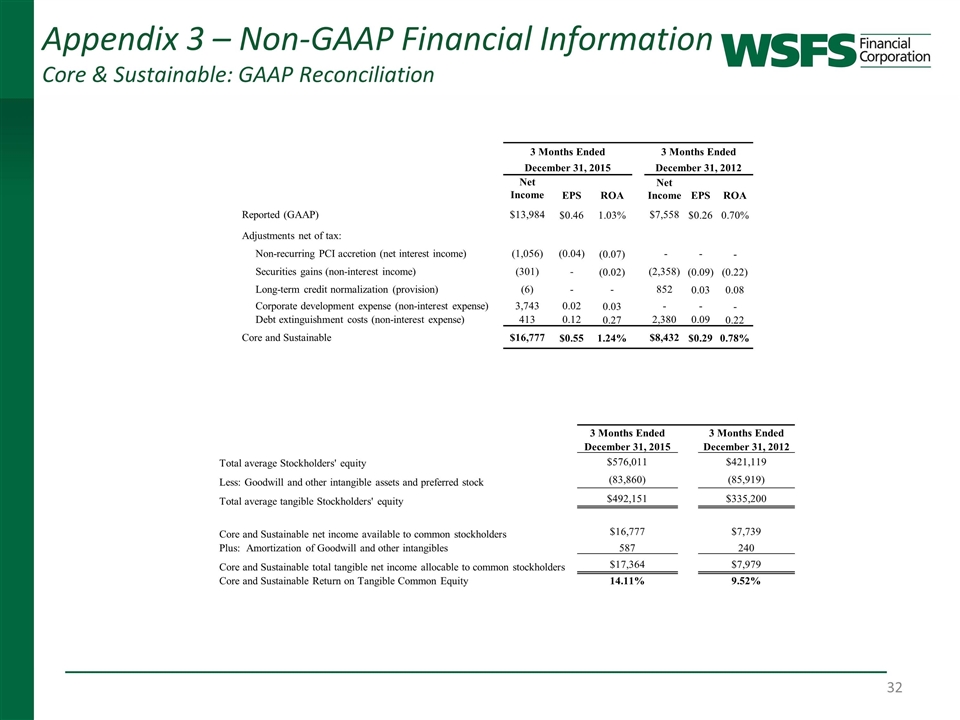

Appendix 3 – Non-GAAP Financial Information Core & Sustainable: GAAP Reconciliation 3 Months Ended 3 Months Ended December 31, 2015 December 31, 2012 Net Income EPS ROA Net Income EPS ROA Reported (GAAP) $13,984 $0.46 1.03% $7,558 $0.26 0.70% Adjustments net of tax: Non-recurring PCI accretion (net interest income) (1,056) (0.04) (0.07) - - - Securities gains (non-interest income) (301) - (0.02) (2,358) (0.09) (0.22) Long-term credit normalization (provision) (6) - - 852 0.03 0.08 Corporate development expense (non-interest expense) 3,743 0.02 0.03 - - - Debt extinguishment costs (non-interest expense) 413 0.12 0.27 2,380 0.09 0.22 Core and Sustainable $16,777 $0.55 1.24% $8,432 $0.29 0.78% 3 Months Ended 3 Months Ended December 31, 2015 December 31, 2012 Total average Stockholders' equity $576,011 $421,119 Less: Goodwill and other intangible assets and preferred stock (83,860) (85,919) Total average tangible Stockholders' equity $492,151 $335,200 Core and Sustainable net income available to common stockholders $16,777 $7,739 Plus: Amortization of Goodwill and other intangibles 587 240 Core and Sustainable total tangible net income allocable to common stockholders $17,364 $7,979 Core and Sustainable Return on Tangible Common Equity 14.11% 9.52%

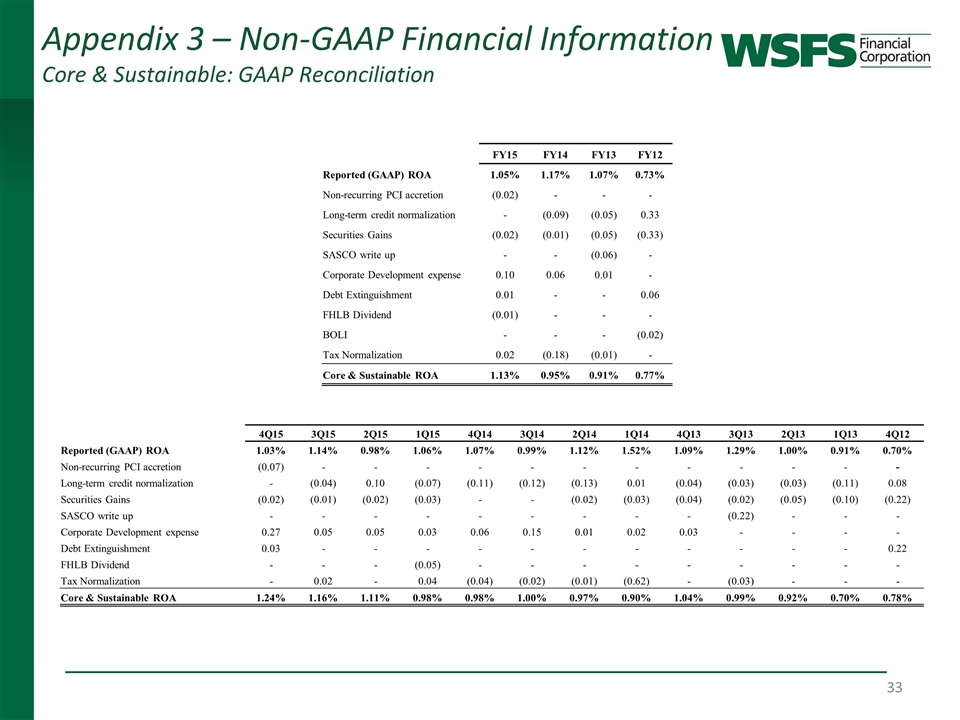

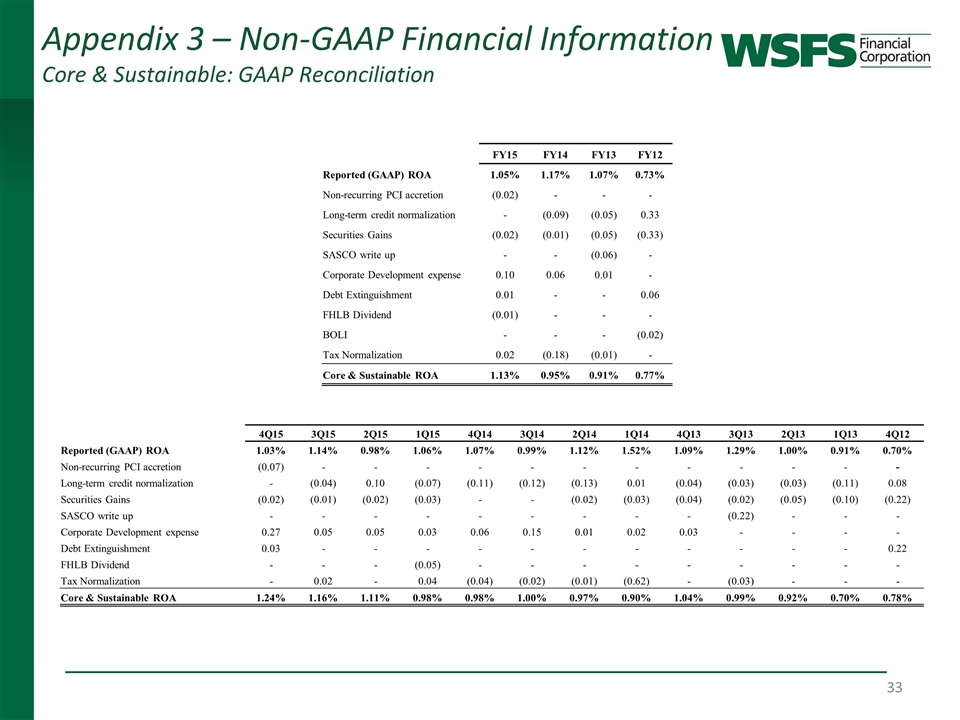

Appendix 3 – Non-GAAP Financial Information Core & Sustainable: GAAP Reconciliation FY15 FY14 FY13 FY12 Reported (GAAP) ROA 1.05% 1.17% 1.07% 0.73% Non-recurring PCI accretion (0.02) - - - Long-term credit normalization - (0.09) (0.05) 0.33 Securities Gains (0.02) (0.01) (0.05) (0.33) SASCO write up - - (0.06) - Corporate Development expense 0.10 0.06 0.01 - Debt Extinguishment 0.01 - - 0.06 FHLB Dividend (0.01) - - - BOLI - - - (0.02) Tax Normalization 0.02 (0.18) (0.01) - Core & Sustainable ROA 1.13% 0.95% 0.91% 0.77% 4Q15 3Q15 2Q15 1Q15 4Q14 3Q14 2Q14 1Q14 4Q13 3Q13 2Q13 1Q13 4Q12 Reported (GAAP) ROA 1.03% 1.14% 0.98% 1.06% 1.07% 0.99% 1.12% 1.52% 1.09% 1.29% 1.00% 0.91% 0.70% Non-recurring PCI accretion (0.07) - - - - - - - - - - - - Long-term credit normalization - (0.04) 0.10 (0.07) (0.11) (0.12) (0.13) 0.01 (0.04) (0.03) (0.03) (0.11) 0.08 Securities Gains (0.02) (0.01) (0.02) (0.03) - - (0.02) (0.03) (0.04) (0.02) (0.05) (0.10) (0.22) SASCO write up - - - - - - - - - (0.22) - - - Corporate Development expense 0.27 0.05 0.05 0.03 0.06 0.15 0.01 0.02 0.03 - - - - Debt Extinguishment 0.03 - - - - - - - - - - - 0.22 FHLB Dividend - - - (0.05) - - - - - - - - - Tax Normalization - 0.02 - 0.04 (0.04) (0.02) (0.01) (0.62) - (0.03) - - - Core & Sustainable ROA 1.24% 1.16% 1.11% 0.98% 0.98% 1.00% 0.97% 0.90% 1.04% 0.99% 0.92% 0.70% 0.78%

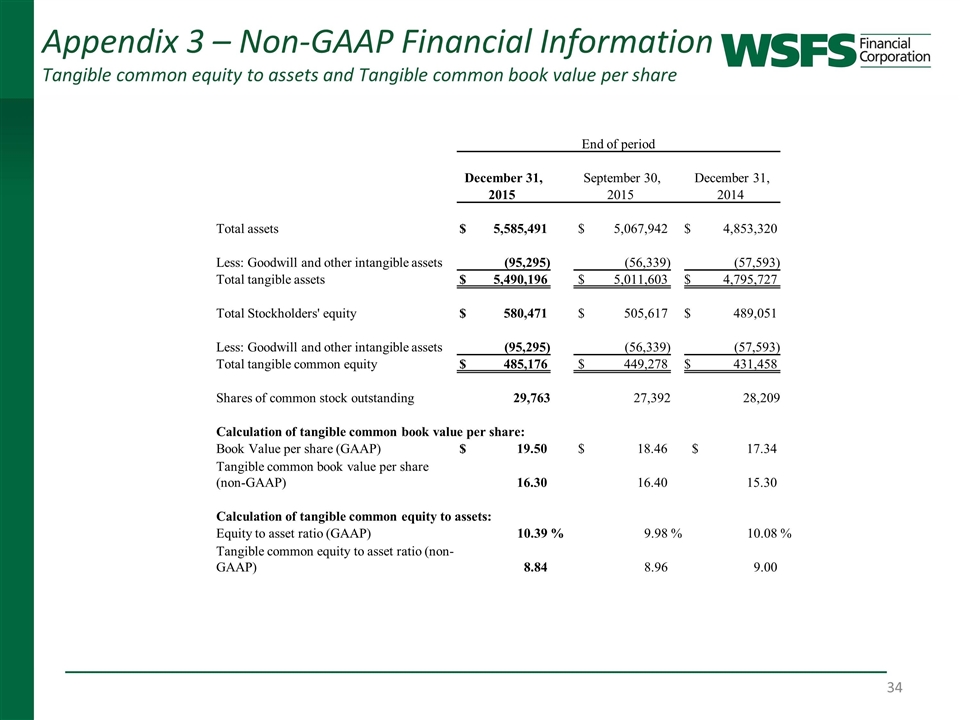

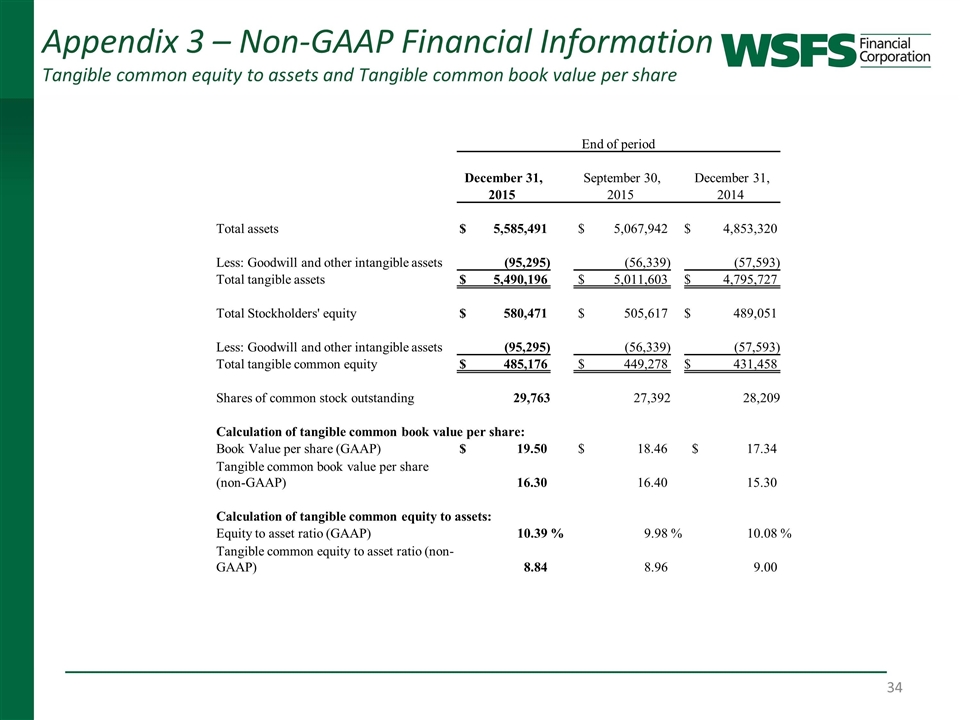

Appendix 3 – Non-GAAP Financial Information Tangible common equity to assets and Tangible common book value per share End of period December 31, September 30, December 31, 2015 2015 2014 Total assets $ 5,585,491 $ 5,067,942 $ 4,853,320 Less: Goodwill and other intangible assets (95,295) (56,339) (57,593) Total tangible assets $ 5,490,196 $ 5,011,603 $ 4,795,727 Total Stockholders' equity $ 580,471 $ 505,617 $ 489,051 Less: Goodwill and other intangible assets (95,295) (56,339) (57,593) Total tangible common equity $ 485,176 $ 449,278 $ 431,458 Shares of common stock outstanding 29,763 27,392 28,209 Calculation of tangible common book value per share: Book Value per share (GAAP) $ 19.50 $ 18.46 $ 17.34 Tangible common book value per share (non-GAAP) 16.30 16.40 15.30 Calculation of tangible common equity to assets: Equity to asset ratio (GAAP) 10.39 % 9.98 % 10.08 % Tangible common equity to asset ratio (non-GAAP) 8.84 8.96 9.00

WSFS Financial Corporation to Combine with Penn Liberty Financial Corp. As Published on November 23, 2015

Additional Information IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger, WSFS will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Penn Liberty and a prospectus of WSFS, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF PENN LIBERTY ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY WSFS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the proxy statement/prospectus, as well as other filings containing information about WSFS, may be obtained at the SEC's Internet site (http://www.sec.gov), when they are filed by WSFS. You will also be able to obtain these documents, when they are filed, free of charge, from WSFS at www.wsfsbank.com under the heading "About WSFS" and then under the heading "Investor Relations" and then under "SEC Filings". Copies of the proxy statement/prospectus can also be obtained, when it becomes available, free of charge, by directing a request to WSFS Financial Corporation, WSFS Bank Center, 500 Delaware Avenue, Wilmington, Delaware 19801, Attention: Corporate Secretary, Telephone: (302) 792-6000 or to Penn Liberty Financial Corp., 724 West Lancaster Avenue, Suite 210, Wayne, PA, 19087, Attention: Ted Aicher, Telephone: (610) 535-4500. PARTICIPANTS IN THE SOLICITATION Penn Liberty and its directors, executive officers and certain other members of their management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information concerning all of the participants in the solicitation will be included in the proxy statement/prospectus relating to the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

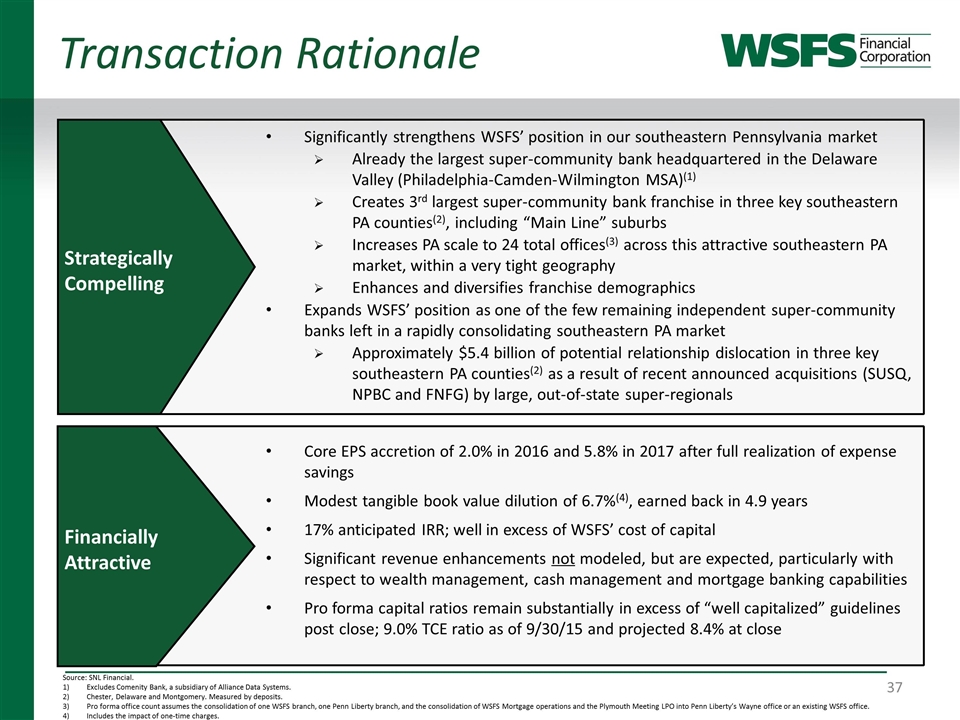

Financially Attractive Core EPS accretion of 2.0% in 2016 and 5.8% in 2017 after full realization of expense savings Modest tangible book value dilution of 6.7%(4), earned back in 4.9 years 17% anticipated IRR; well in excess of WSFS’ cost of capital Significant revenue enhancements not modeled, but are expected, particularly with respect to wealth management, cash management and mortgage banking capabilities Pro forma capital ratios remain substantially in excess of “well capitalized” guidelines post close; 9.0% TCE ratio as of 9/30/15 and projected 8.4% at close Strategically Compelling Significantly strengthens WSFS’ position in our southeastern Pennsylvania market Already the largest super-community bank headquartered in the Delaware Valley (Philadelphia-Camden-Wilmington MSA)(1) Creates 3rd largest super-community bank franchise in three key southeastern PA counties(2), including “Main Line” suburbs Increases PA scale to 24 total offices(3) across this attractive southeastern PA market, within a very tight geography Enhances and diversifies franchise demographics Expands WSFS’ position as one of the few remaining independent super-community banks left in a rapidly consolidating southeastern PA market Approximately $5.4 billion of potential relationship dislocation in three key southeastern PA counties(2) as a result of recent announced acquisitions (SUSQ, NPBC and FNFG) by large, out-of-state super-regionals Transaction Rationale Source: SNL Financial. Excludes Comenity Bank, a subsidiary of Alliance Data Systems. Chester, Delaware and Montgomery. Measured by deposits. Pro forma office count assumes the consolidation of one WSFS branch, one Penn Liberty branch, and the consolidation of WSFS Mortgage operations and the Plymouth Meeting LPO into Penn Liberty’s Wayne office or an existing WSFS office. Includes the impact of one-time charges.

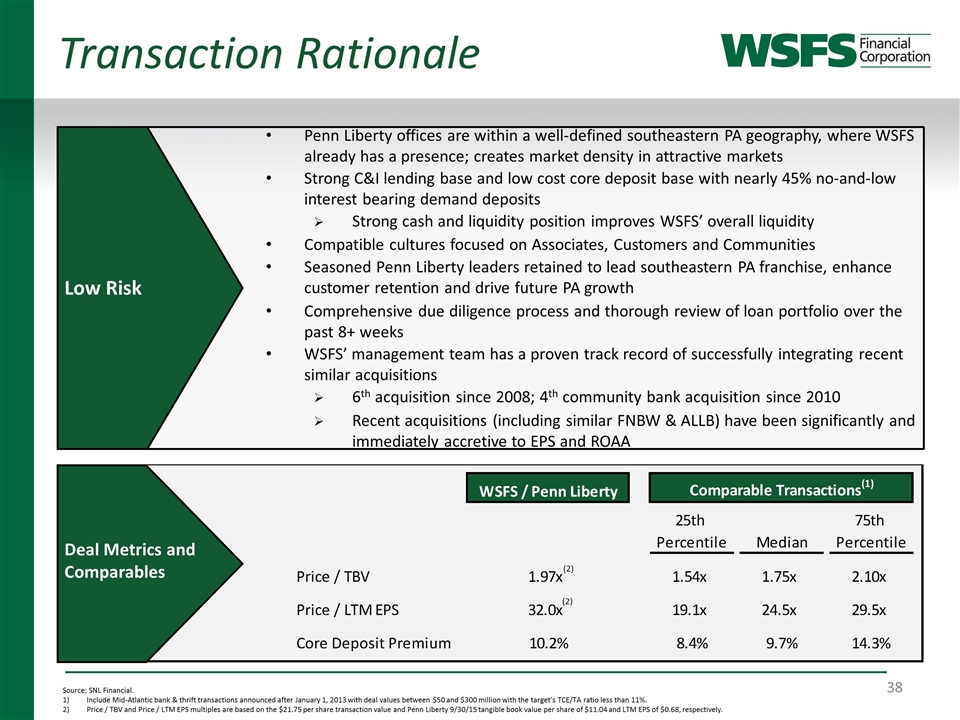

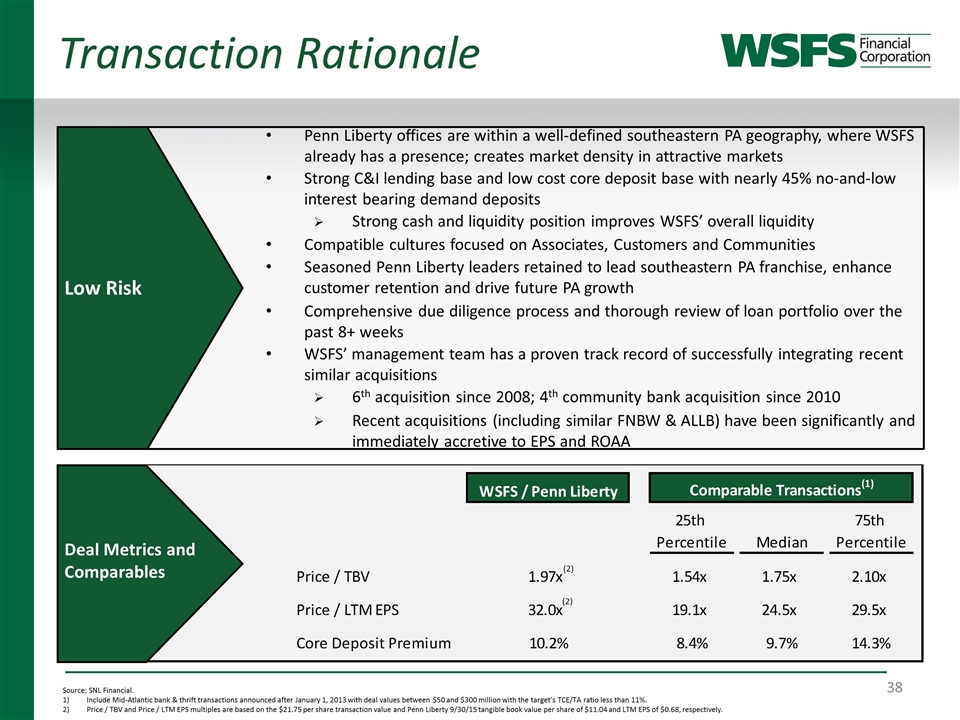

Low Risk Penn Liberty offices are within a well-defined southeastern PA geography, where WSFS already has a presence; creates market density in attractive markets Strong C&I lending base and low cost core deposit base with nearly 45% no-and-low interest bearing demand deposits Strong cash and liquidity position improves WSFS’ overall liquidity Compatible cultures focused on Associates, Customers and Communities Seasoned Penn Liberty leaders retained to lead southeastern PA franchise, enhance customer retention and drive future PA growth Comprehensive due diligence process and thorough review of loan portfolio over the past 8+ weeks WSFS’ management team has a proven track record of successfully integrating recent similar acquisitions 6th acquisition since 2008; 4th community bank acquisition since 2010 Recent acquisitions (including similar FNBW & ALLB) have been significantly and immediately accretive to EPS and ROAA Transaction Rationale Source: SNL Financial. Include Mid-Atlantic bank & thrift transactions announced after January 1, 2013 with deal values between $50 and $300 million with the target’s TCE/TA ratio less than 11%. Price / TBV and Price / LTM EPS multiples are based on the $21.75 per share transaction value and Penn Liberty 9/30/15 tangible book value per share of $11.04 and LTM EPS of $0.68, respectively. Deal Metrics and Comparables (2) (2)

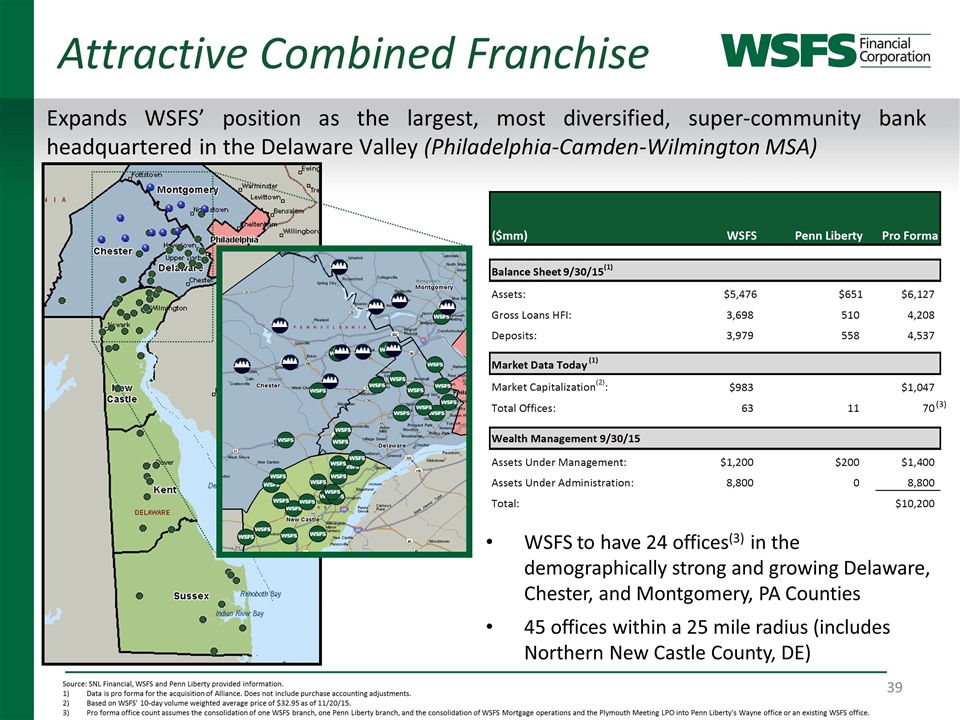

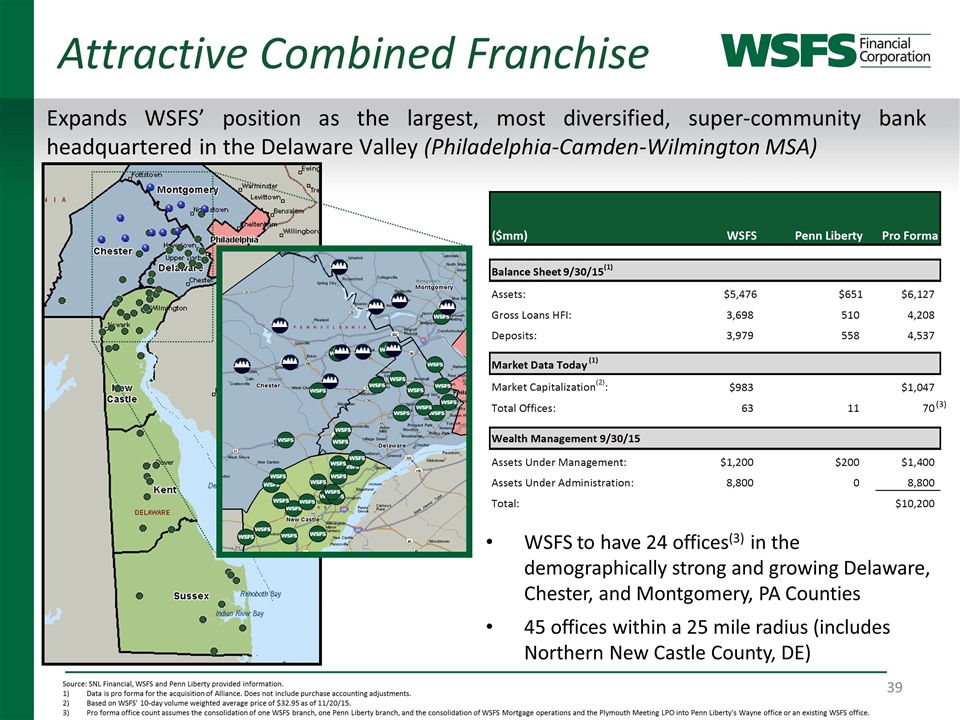

Expands WSFS’ position as the largest, most diversified, super-community bank headquartered in the Delaware Valley (Philadelphia-Camden-Wilmington MSA) Attractive Combined Franchise Source: SNL Financial, WSFS and Penn Liberty provided information. Data is pro forma for the acquisition of Alliance. Does not include purchase accounting adjustments. Based on WSFS’ 10-day volume weighted average price of $32.95 as of 11/20/15. Pro forma office count assumes the consolidation of one WSFS branch, one Penn Liberty branch, and the consolidation of WSFS Mortgage operations and the Plymouth Meeting LPO into Penn Liberty’s Wayne office or an existing WSFS office. (3) WSFS to have 24 offices(3) in the demographically strong and growing Delaware, Chester, and Montgomery, PA Counties 45 offices within a 25 mile radius (includes Northern New Castle County, DE)

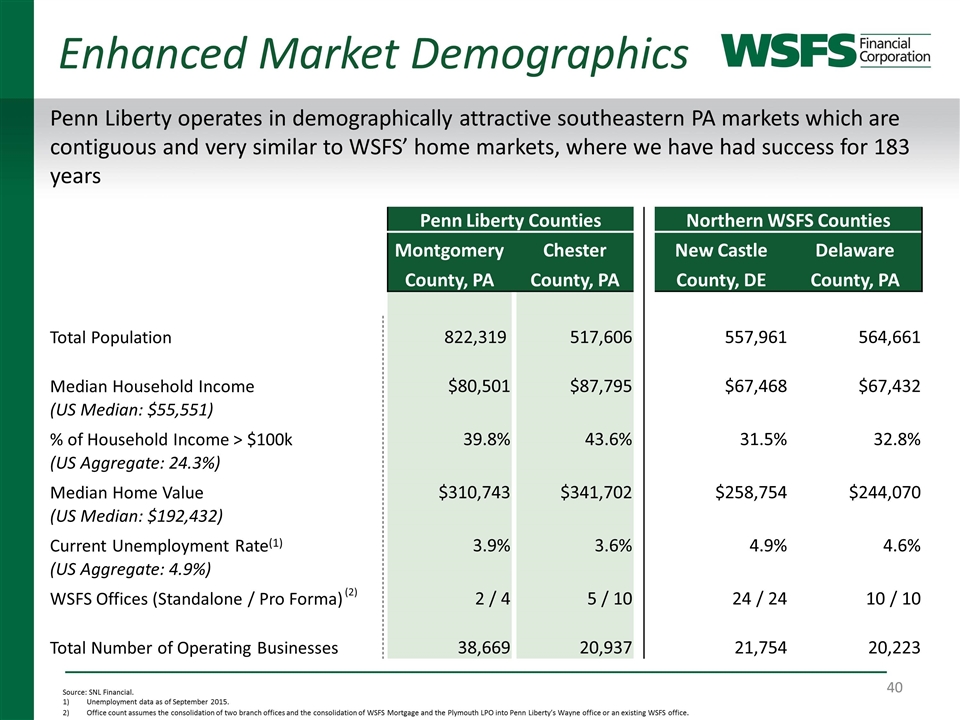

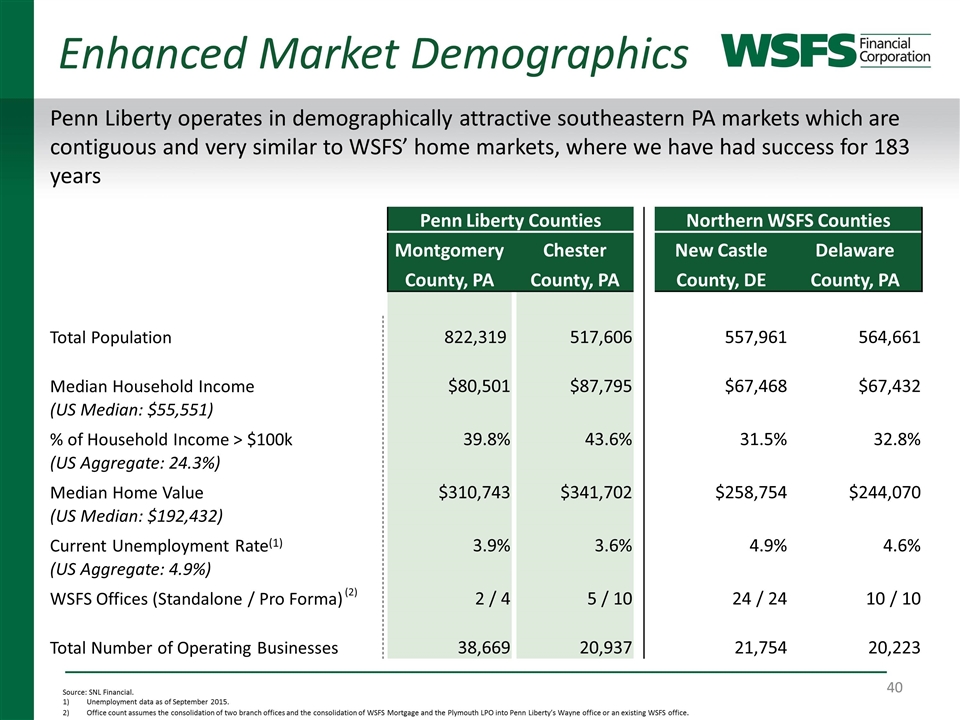

Enhanced Market Demographics Penn Liberty operates in demographically attractive southeastern PA markets which are contiguous and very similar to WSFS’ home markets, where we have had success for 183 years Source: SNL Financial. Unemployment data as of September 2015. Office count assumes the consolidation of two branch offices and the consolidation of WSFS Mortgage and the Plymouth LPO into Penn Liberty’s Wayne office or an existing WSFS office. Penn Liberty Counties Northern WSFS Counties Montgomery Chester New Castle Delaware County, PA County, PA County, DE County, PA Total Population 822,319 517,606 557,961 564,661 Median Household Income $80,501 $87,795 $67,468 $67,432 (US Median: $55,551) % of Household Income > $100k 39.8% 43.6% 31.5% 32.8% (US Aggregate: 24.3%) Median Home Value $310,743 $341,702 $258,754 $244,070 (US Median: $192,432) Current Unemployment Rate(1) 3.9% 3.6% 4.9% 4.6% (US Aggregate: 4.9%) WSFS Offices (Standalone / Pro Forma) 2 / 4 5 / 10 24 / 24 10 / 10 Total Number of Operating Businesses 38,669 20,937 21,754 20,223 (2)

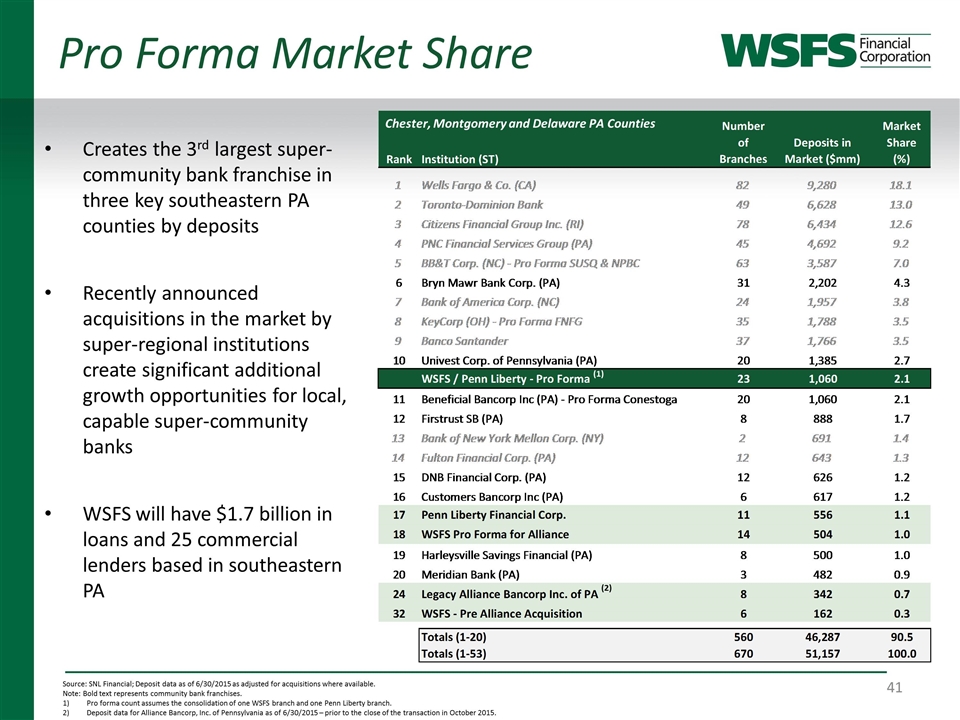

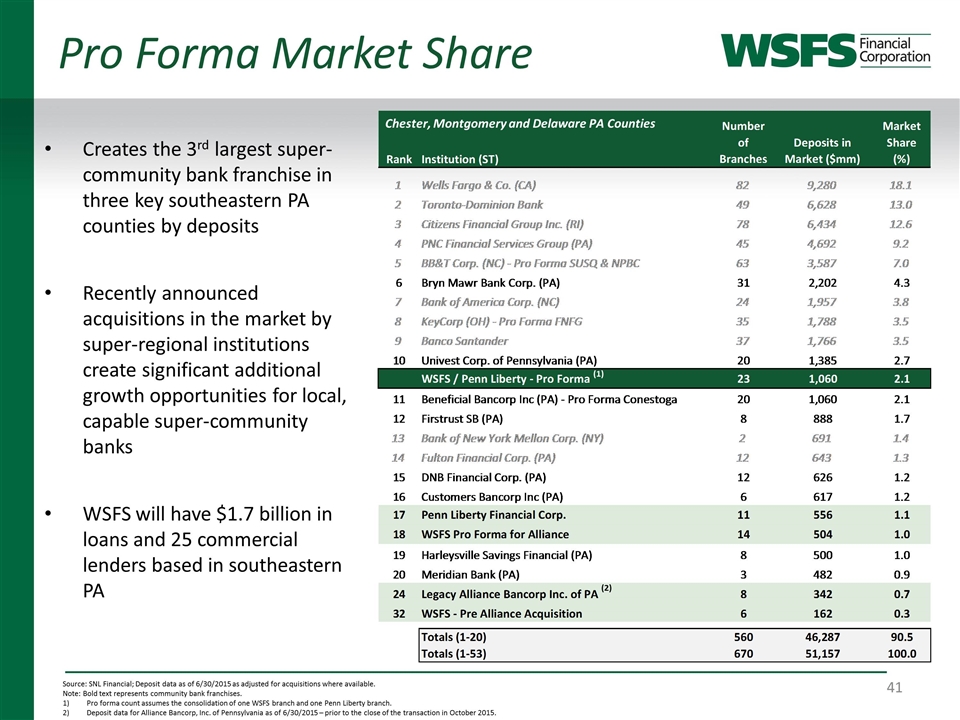

Low Risk Pro Forma Market Share Creates the 3rd largest super-community bank franchise in three key southeastern PA counties by deposits Recently announced acquisitions in the market by super-regional institutions create significant additional growth opportunities for local, capable super-community banks WSFS will have $1.7 billion in loans and 25 commercial lenders based in southeastern PA Source: SNL Financial; Deposit data as of 6/30/2015 as adjusted for acquisitions where available. Note: Bold text represents community bank franchises. Pro forma count assumes the consolidation of one WSFS branch and one Penn Liberty branch. Deposit data for Alliance Bancorp, Inc. of Pennsylvania as of 6/30/2015 – prior to the close of the transaction in October 2015. (2) (1) Chester, Montgomery and Delaware PA Counties

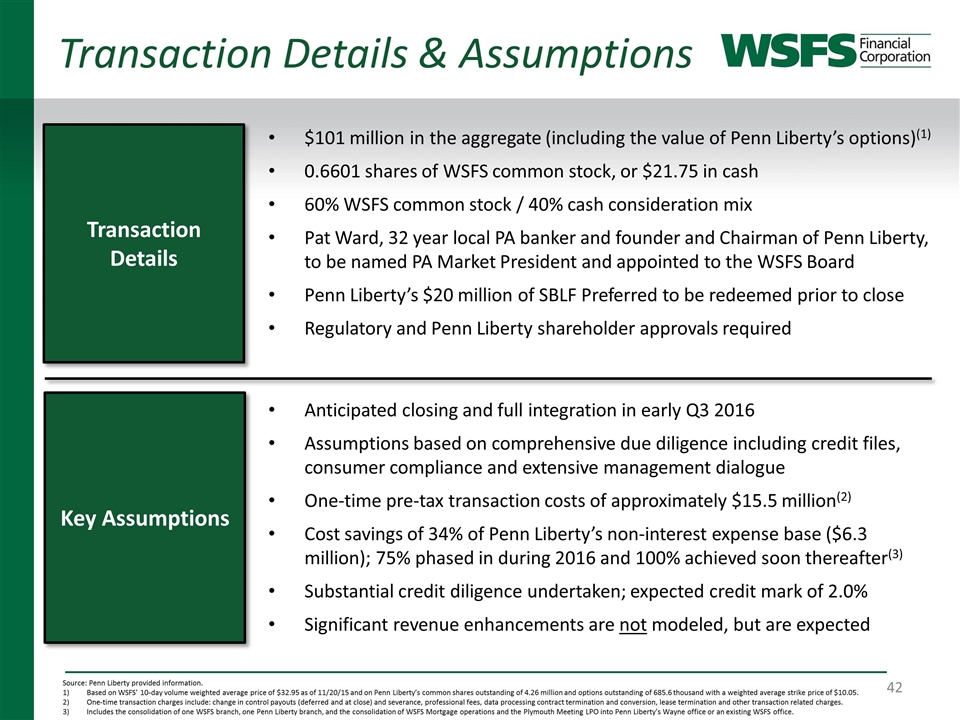

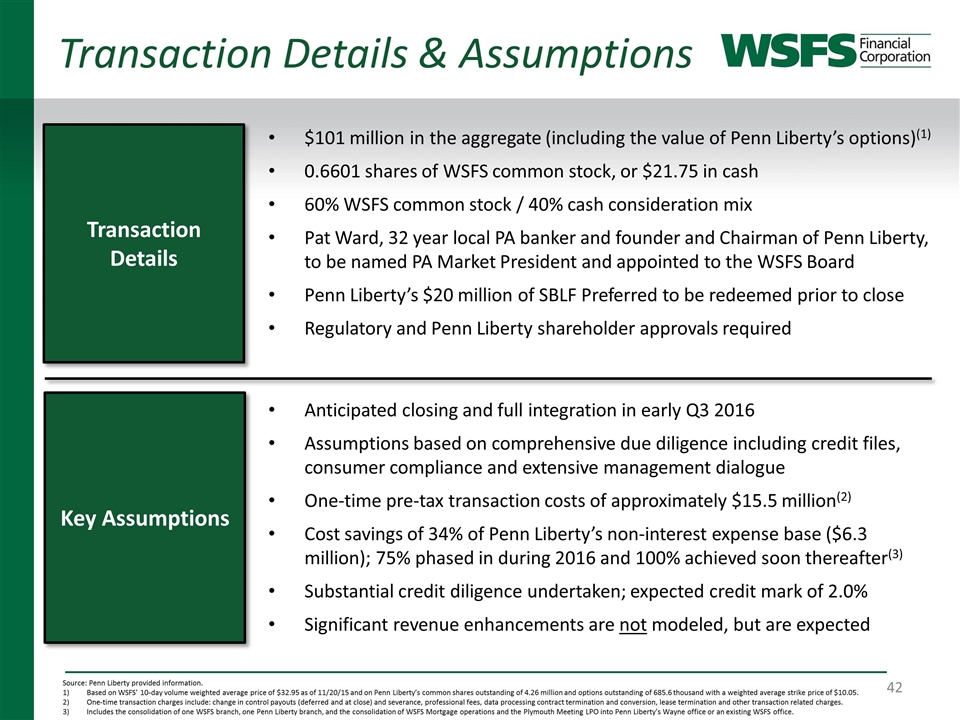

$101 million in the aggregate (including the value of Penn Liberty’s options)(1) 0.6601 shares of WSFS common stock, or $21.75 in cash 60% WSFS common stock / 40% cash consideration mix Pat Ward, 32 year local PA banker and founder and Chairman of Penn Liberty, to be named PA Market President and appointed to the WSFS Board Penn Liberty’s $20 million of SBLF Preferred to be redeemed prior to close Regulatory and Penn Liberty shareholder approvals required Transaction Details Anticipated closing and full integration in early Q3 2016 Assumptions based on comprehensive due diligence including credit files, consumer compliance and extensive management dialogue One-time pre-tax transaction costs of approximately $15.5 million(2) Cost savings of 34% of Penn Liberty’s non-interest expense base ($6.3 million); 75% phased in during 2016 and 100% achieved soon thereafter(3) Substantial credit diligence undertaken; expected credit mark of 2.0% Significant revenue enhancements are not modeled, but are expected Key Assumptions Source: Penn Liberty provided information. Based on WSFS’ 10-day volume weighted average price of $32.95 as of 11/20/15 and on Penn Liberty’s common shares outstanding of 4.26 million and options outstanding of 685.6 thousand with a weighted average strike price of $10.05. One-time transaction charges include: change in control payouts (deferred and at close) and severance, professional fees, data processing contract termination and conversion, lease termination and other transaction related charges. Includes the consolidation of one WSFS branch, one Penn Liberty branch, and the consolidation of WSFS Mortgage operations and the Plymouth Meeting LPO into Penn Liberty’s Wayne office or an existing WSFS office. Transaction Details & Assumptions

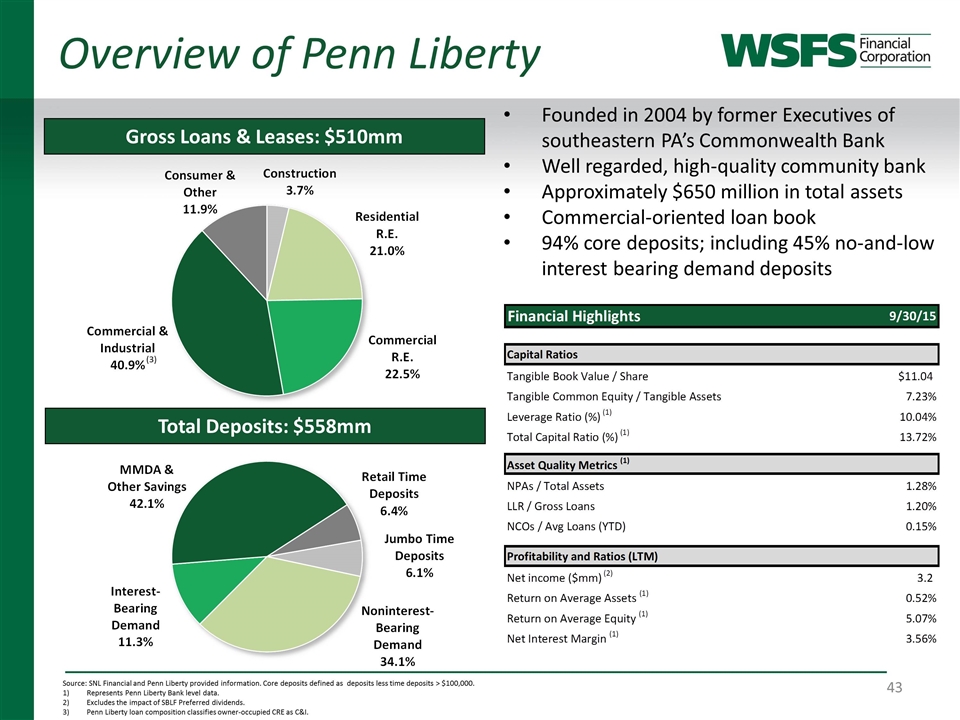

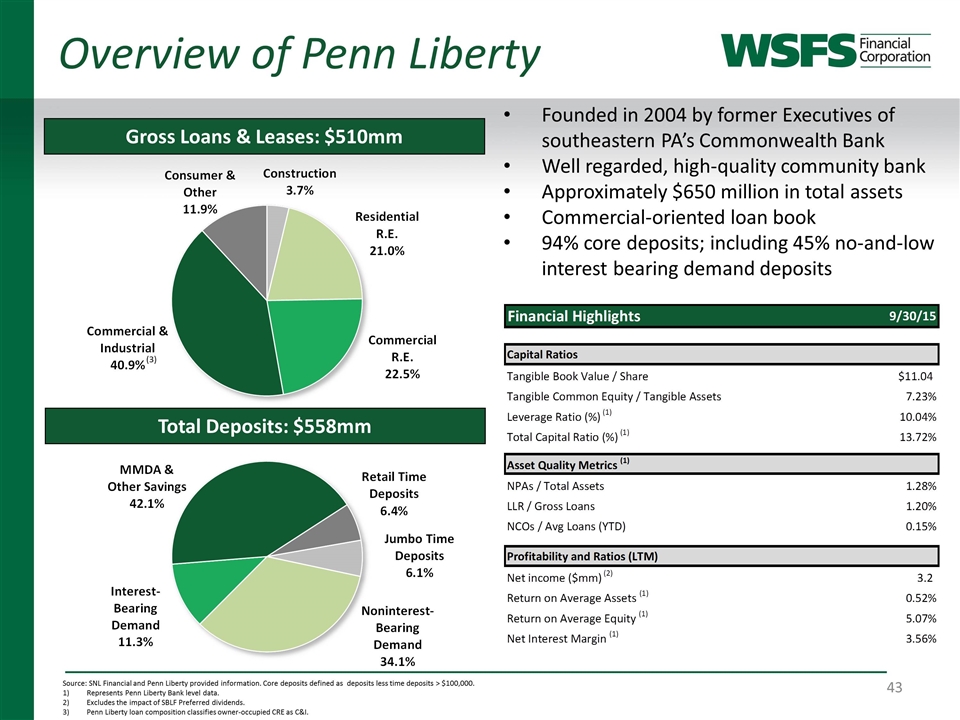

Overview of Penn Liberty Source: SNL Financial and Penn Liberty provided information. Core deposits defined as deposits less time deposits > $100,000. Represents Penn Liberty Bank level data. Excludes the impact of SBLF Preferred dividends. Penn Liberty loan composition classifies owner-occupied CRE as C&I. Gross Loans & Leases: $510mm Total Deposits: $558mm Founded in 2004 by former Executives of southeastern PA’s Commonwealth Bank Well regarded, high-quality community bank Approximately $650 million in total assets Commercial-oriented loan book 94% core deposits; including 45% no-and-low interest bearing demand deposits (3)

Fee Income Opportunities Penn Liberty operates in the large, growing and demographically attractive counties of Montgomery and Chester, PA Existing wealth management platform can be significantly enhanced with WSFS’ more extensive product offerings Christiana Trust and Cypress Capital Management represent $1.2B in AUM and $8.8B in AUA Christiana Trust ranked #1 in Trust Revenue growth in the state of Delaware and 26th nationwide(1) WSFS’ robust cash management and digital delivery platforms enhance Penn Liberty’s capabilities WSFS Mortgage provides a strong mortgage origination platform These additional fee income opportunities not modeled into pro forma transaction impacts, but are expected over time Source: SNL Financial, WSFS and Penn Liberty provided information. Per Bank Director Magazine.

Summary A WSFS combination with Penn Liberty represents a strategically compelling, low risk franchise expansion that meets or exceeds WSFS’ financial return hurdles while providing significant upside opportunities for both revenue enhancements and capturing significant market share that is “in-play” in southeastern Pennsylvania.

For more information please contact: Investor Relations: Rodger Levenson (302) 571-7296 or rlevenson@wsfsbank.com www.wsfsbank.com Corporate Headquarters 500 Delaware Avenue Wilmington, DE 19801