1 WSFS Financial Corporation 2Q 2022 Earnings Release Supplement July 2022 Exhibit 99.2

2 Forward Looking Statements & Non-GAAP Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including ability to successfully integrate and fully realize the cost savings and other benefits of our recent acquisition of Bryn Mawr Bank Corporation (“BMT”) and the uncertain effects of the COVID-19 pandemic and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company's Form 10-K for the year ended December 31, 2021, Form 10-Q for the quarter ended March 31, 2022, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core earnings per share (“EPS”), core EPS excluding initial BMT ACL provision, core net income, core return on equity (“ROE”), core efficiency ratio, pre-provision net revenue (“PPNR”), core PPNR, PPNR to average assets ratio, core PPNR to average assets ratio, core return on assets (“ROA”), core ROA excluding initial BMT ACL provision, core net interest income, core net interest margin (“NIM”), return on tangible common equity (“ROTCE”), tangible book value (“TBV”) per share, TBV Dilution, core ROTCE, core fee revenue and core fee revenue as a percentage of total core net revenue. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. Trade names, trademarks and service marks of other companies appearing in this presentation are the property of their respective holders.

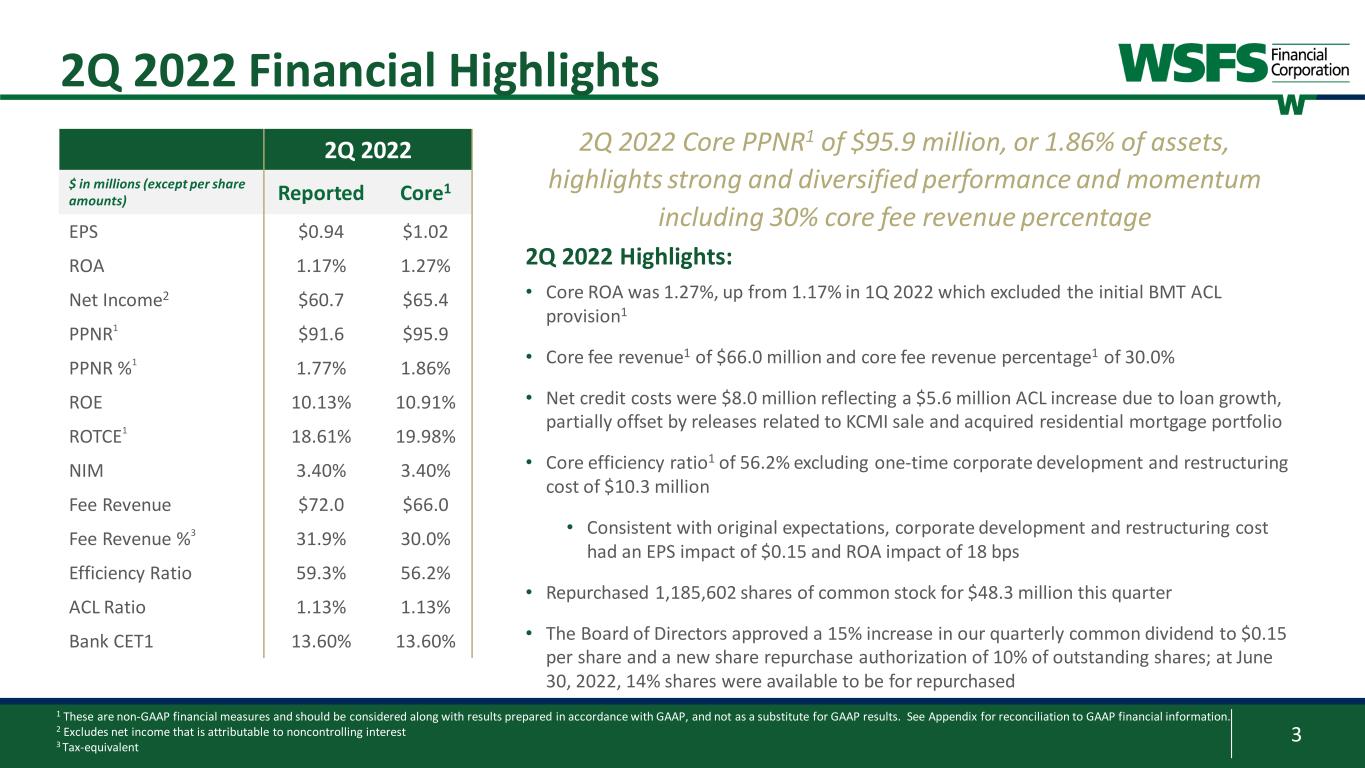

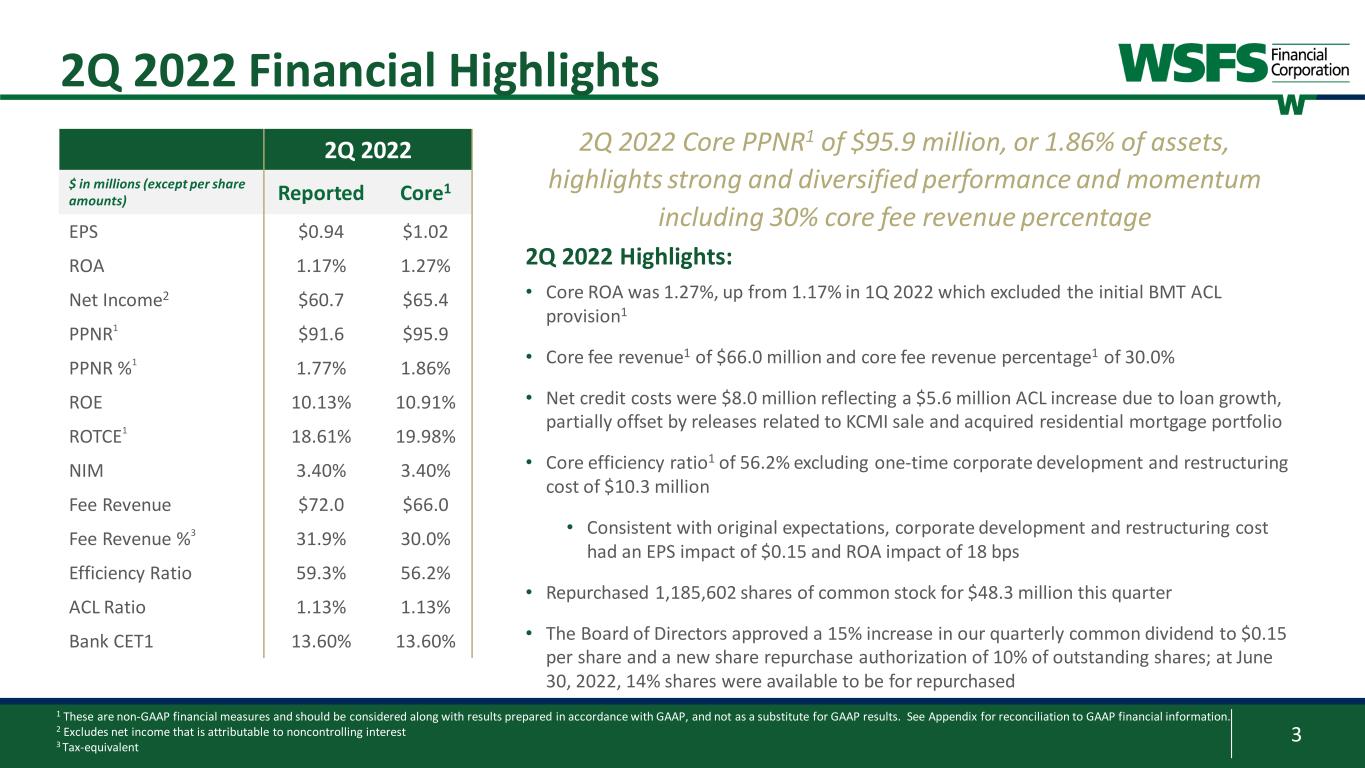

3 2Q 2022 Financial Highlights 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Excludes net income that is attributable to noncontrolling interest 3 Tax-equivalent 2Q 2022 Core PPNR1 of $95.9 million, or 1.86% of assets, highlights strong and diversified performance and momentum including 30% core fee revenue percentage 2Q 2022 Highlights: • Core ROA was 1.27%, up from 1.17% in 1Q 2022 which excluded the initial BMT ACL provision1 • Core fee revenue1 of $66.0 million and core fee revenue percentage1 of 30.0% • Net credit costs were $8.0 million reflecting a $5.6 million ACL increase due to loan growth, partially offset by releases related to KCMI sale and acquired residential mortgage portfolio • Core efficiency ratio1 of 56.2% excluding one-time corporate development and restructuring cost of $10.3 million • Consistent with original expectations, corporate development and restructuring cost had an EPS impact of $0.15 and ROA impact of 18 bps • Repurchased 1,185,602 shares of common stock for $48.3 million this quarter • The Board of Directors approved a 15% increase in our quarterly common dividend to $0.15 per share and a new share repurchase authorization of 10% of outstanding shares; at June 30, 2022, 14% shares were available to be for repurchased 2Q 2022 $ in millions (except per share amounts) Reported Core1 EPS $0.94 $1.02 ROA 1.17% 1.27% Net Income2 $60.7 $65.4 PPNR1 $91.6 $95.9 PPNR %1 1.77% 1.86% ROE 10.13% 10.91% ROTCE1 18.61% 19.98% NIM 3.40% 3.40% Fee Revenue $72.0 $66.0 Fee Revenue %3 31.9% 30.0% Efficiency Ratio 59.3% 56.2% ACL Ratio 1.13% 1.13% Bank CET1 13.60% 13.60%

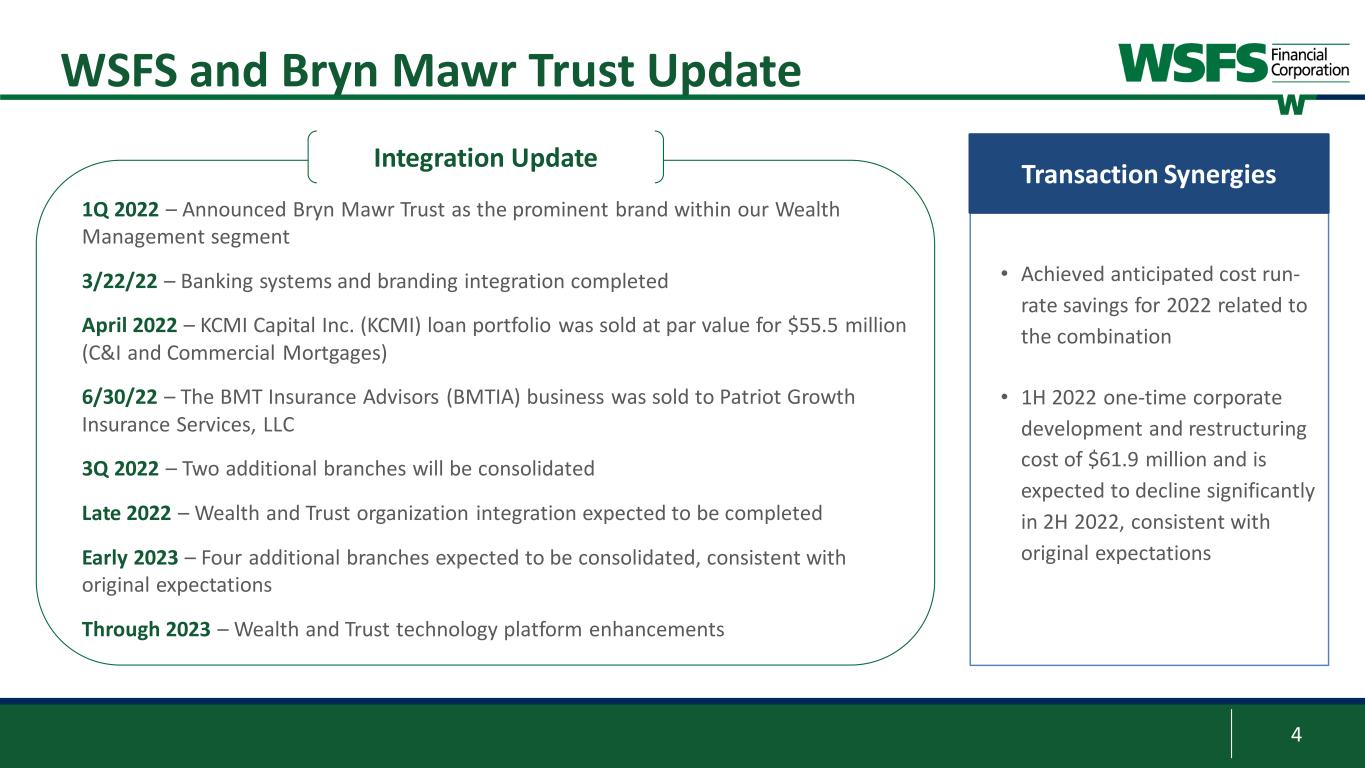

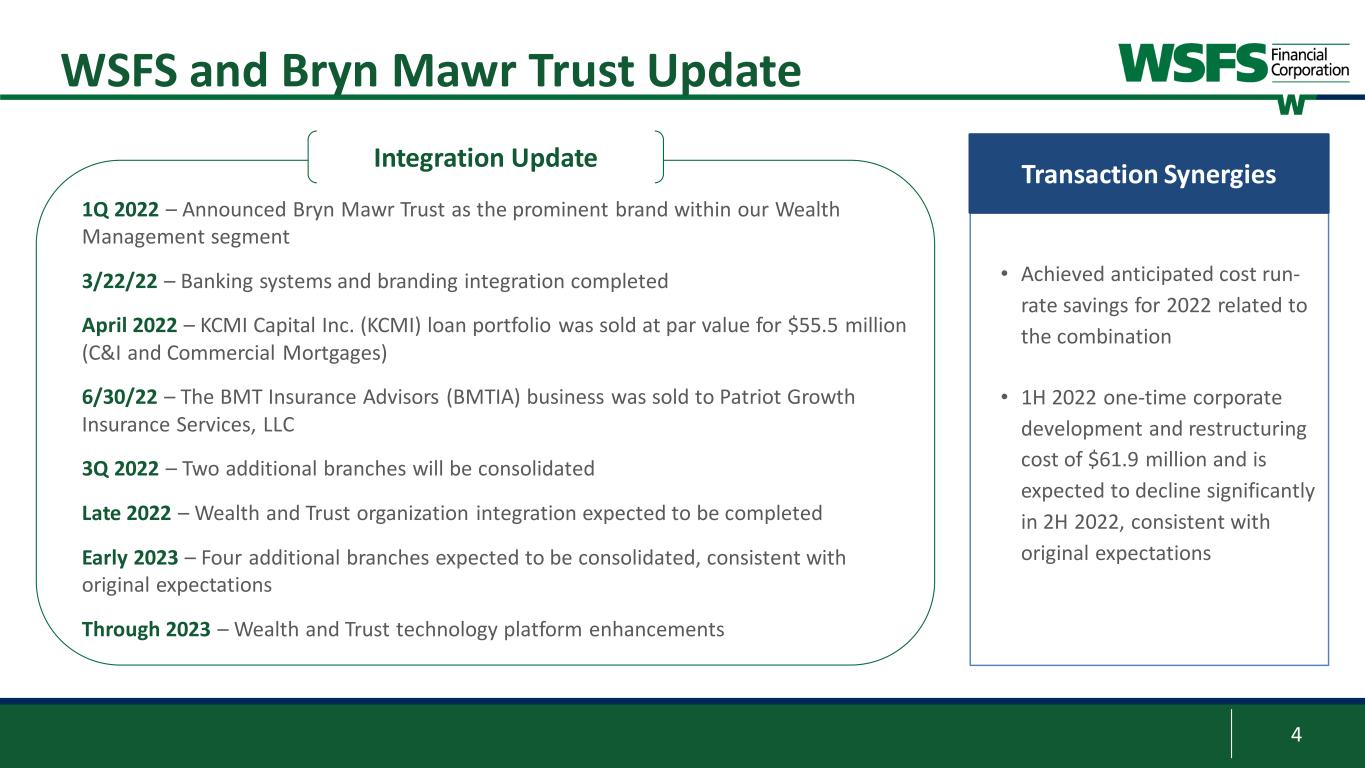

4 WSFS and Bryn Mawr Trust Update 1Q 2022 – Announced Bryn Mawr Trust as the prominent brand within our Wealth Management segment 3/22/22 – Banking systems and branding integration completed April 2022 – KCMI Capital Inc. (KCMI) loan portfolio was sold at par value for $55.5 million (C&I and Commercial Mortgages) 6/30/22 – The BMT Insurance Advisors (BMTIA) business was sold to Patriot Growth Insurance Services, LLC 3Q 2022 – Two additional branches will be consolidated Late 2022 – Wealth and Trust organization integration expected to be completed Early 2023 – Four additional branches expected to be consolidated, consistent with original expectations Through 2023 – Wealth and Trust technology platform enhancements Integration Update • Achieved anticipated cost run- rate savings for 2022 related to the combination • 1H 2022 one-time corporate development and restructuring cost of $61.9 million and is expected to decline significantly in 2H 2022, consistent with original expectations Transaction Synergies

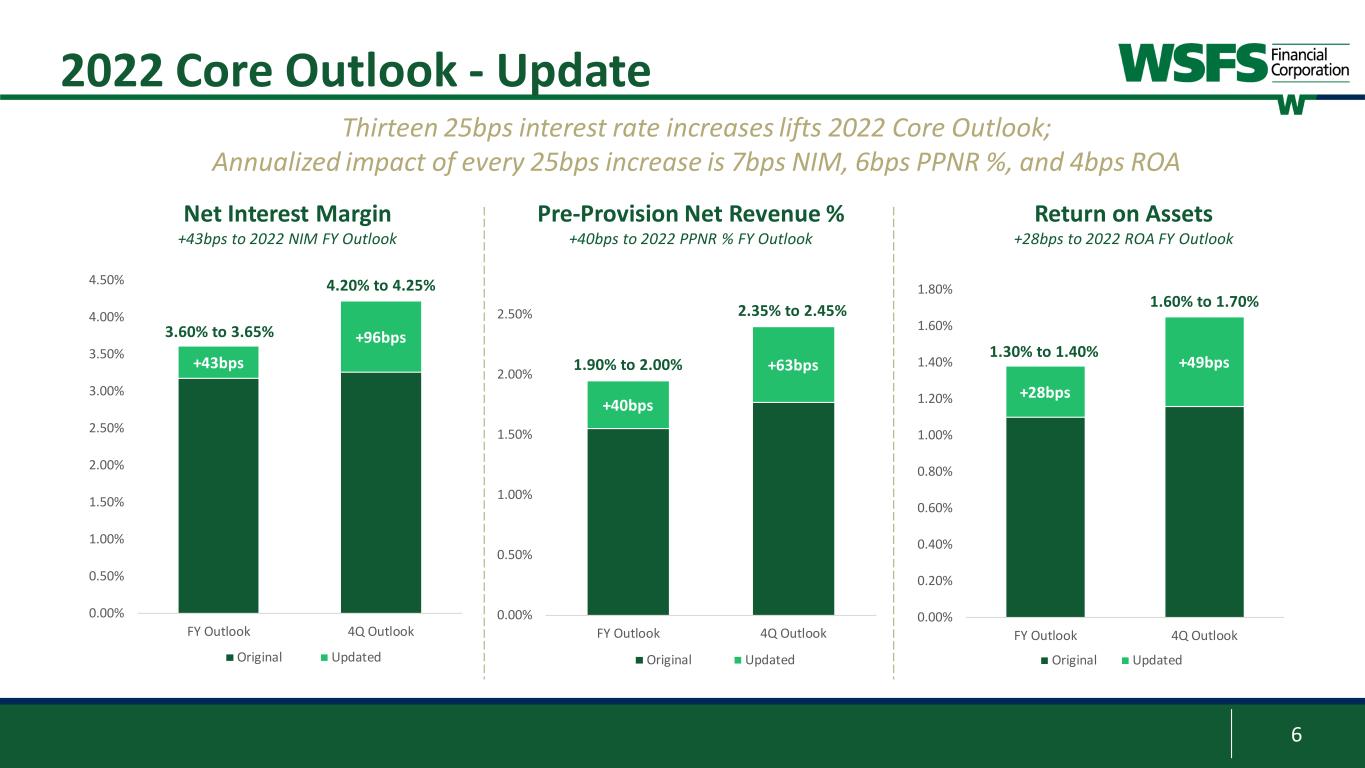

5 3 2022 Core Outlook - Update Loan Growth2 Mid-to-high single digit growth; excluding acquired residential mortgage portfolio Mid single digit growth; excluding acquired residential mortgage portfolio Deposit Growth2 Flat deposit growth Flat deposit growth Net Interest Margin Range of 3.15% - 3.20%; assumes three 25bp interest rate increases Range of 3.60% - 3.65%; assumes thirteen 25bp interest rate increases Fee Revenue Growth2 Mid single digit growth; Fee revenue percentage in low-to-mid 30’s Low single digit growth; Fee revenue percentage in high 20’s to low 30’s Provision Costs $15-$25 million; excluding the LD1 impact of BMT acquisition $15-$25 million; excluding the LD1 impact of BMT acquisition Efficiency Ratio Low 60’s; 4Q efficiency ratio expected in the high 50’s Mid 50’s; 4Q efficiency ratio expected in the low 50’s Tax Rate Approximately 24% Approximately 25% 2022 Updated Core Outlook1 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy 2 Growth rates from pro forma 2021 combined WSFS and BMT 2022 Original Core Outlook1 Updated FY Core 2022 ROA range of 1.35% - 1.40%, up from original 1.05% - 1.15%; 4Q range of 1.60% - 1.70%, up from original 1.20% +/-

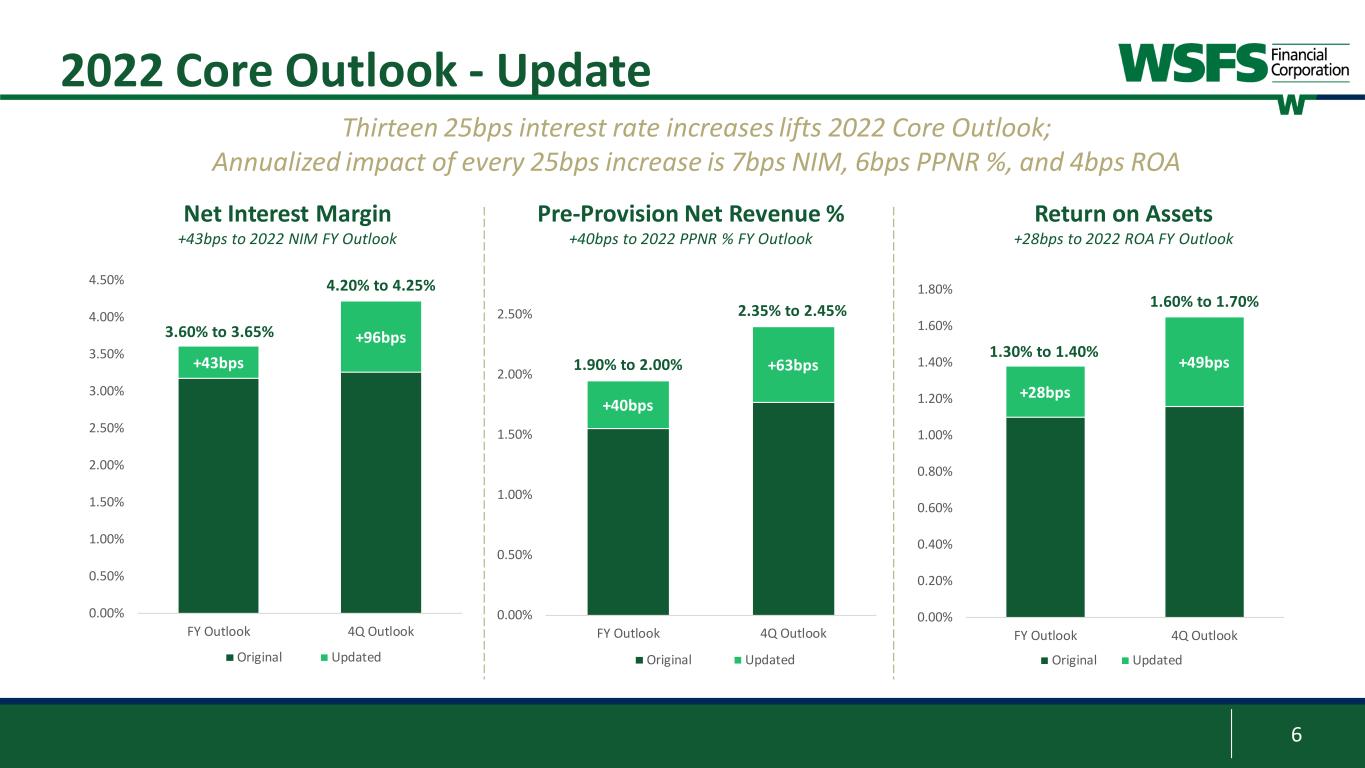

6 +43bps +96bps 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% FY Outlook 4Q Outlook Original Updated 2022 Core Outlook - Update Net Interest Margin +43bps to 2022 NIM FY Outlook Return on Assets +28bps to 2022 ROA FY Outlook 4.20% to 4.25% +28bps +49bps 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% FY Outlook 4Q Outlook Original Updated 1.30% to 1.40% Pre-Provision Net Revenue % +40bps to 2022 PPNR % FY Outlook Thirteen 25bps interest rate increases lifts 2022 Core Outlook; Annualized impact of every 25bps increase is 7bps NIM, 6bps PPNR %, and 4bps ROA 3.60% to 3.65% +40bps +63bps 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% FY Outlook 4Q Outlook Original Updated 1.90% to 2.00% 2.35% to 2.45% 1.60% to 1.70%

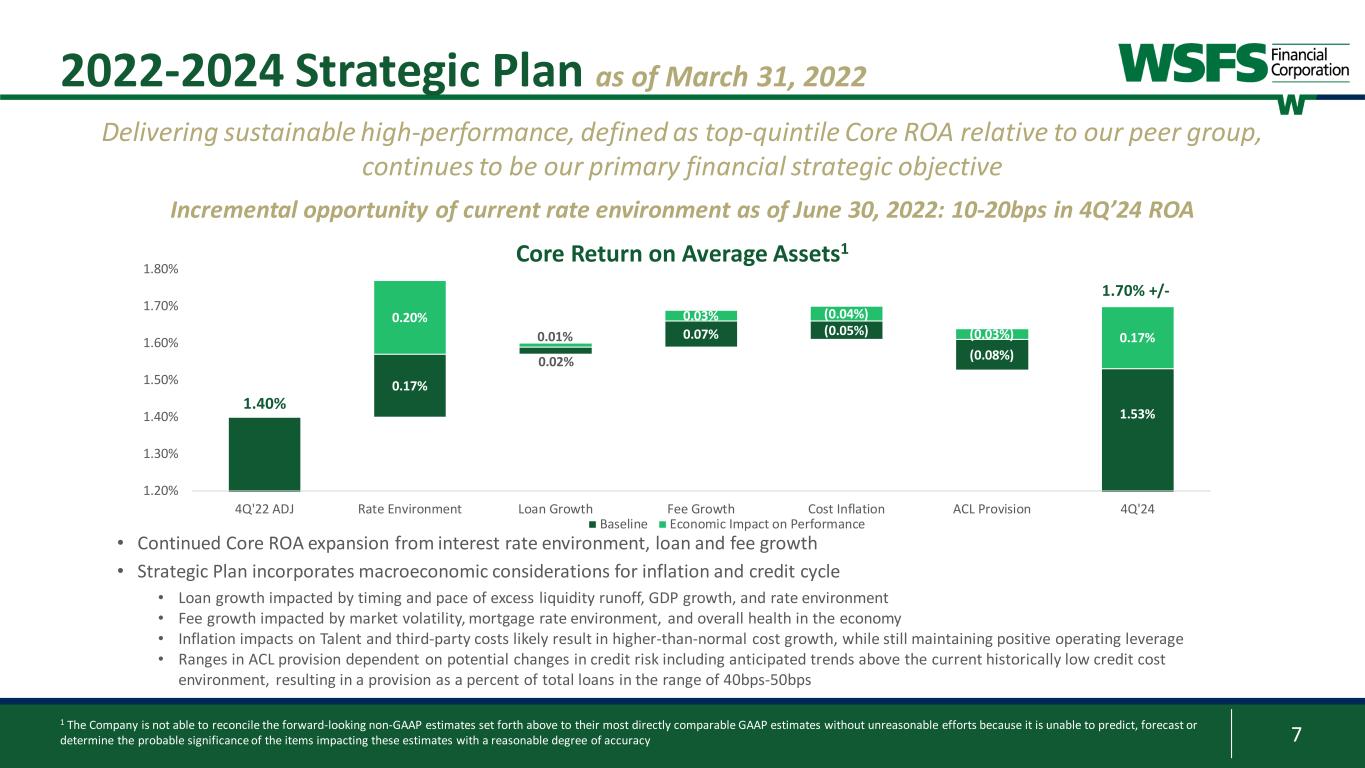

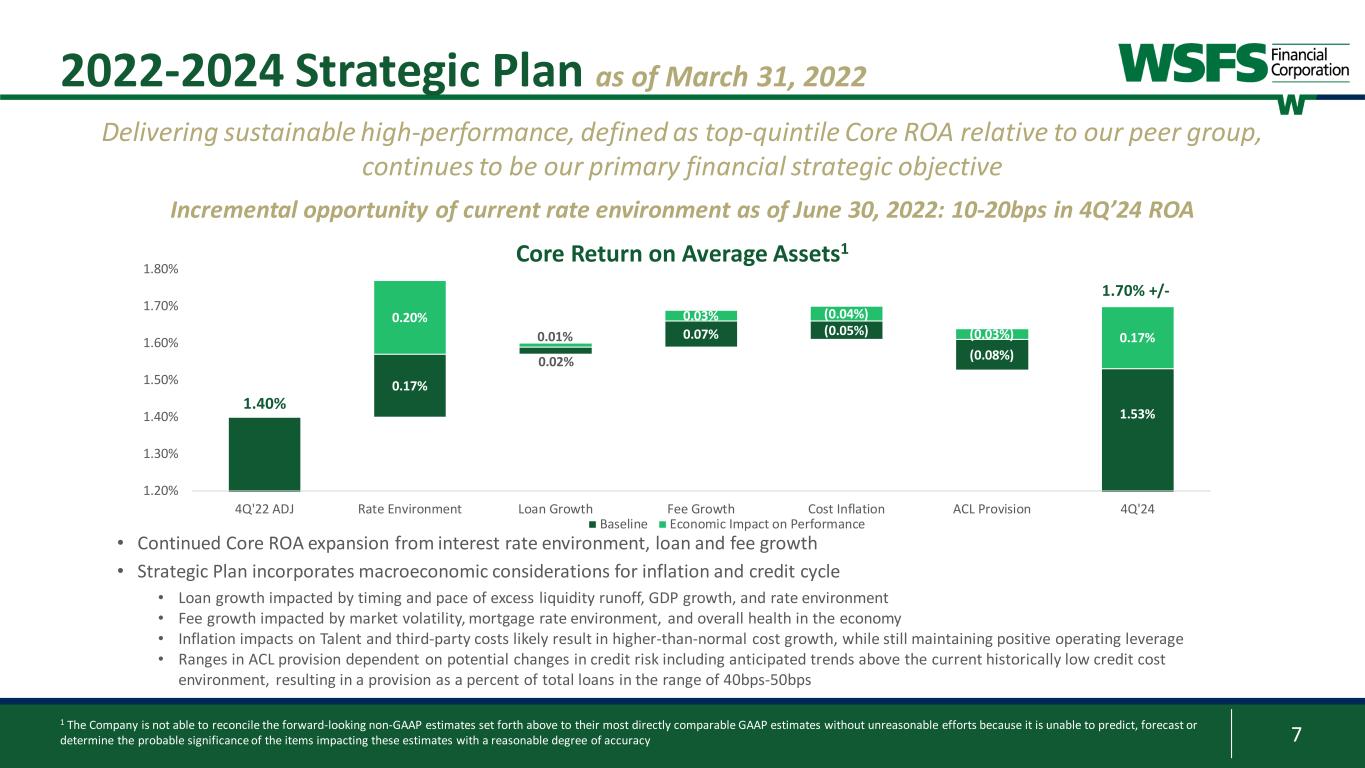

7 3 2022-2024 Strategic Plan as of March 31, 2022 Core Return on Average Assets1 • Continued Core ROA expansion from interest rate environment, loan and fee growth • Strategic Plan incorporates macroeconomic considerations for inflation and credit cycle • Loan growth impacted by timing and pace of excess liquidity runoff, GDP growth, and rate environment • Fee growth impacted by market volatility, mortgage rate environment, and overall health in the economy • Inflation impacts on Talent and third-party costs likely result in higher-than-normal cost growth, while still maintaining positive operating leverage • Ranges in ACL provision dependent on potential changes in credit risk including anticipated trends above the current historically low credit cost environment, resulting in a provision as a percent of total loans in the range of 40bps-50bps Delivering sustainable high-performance, defined as top-quintile Core ROA relative to our peer group, continues to be our primary financial strategic objective 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy 0.17% 0.02% 0.07% (0.05%) (0.08%) 1.53% 0.20% 0.01% 0.03% (0.04%) (0.03%) 0.17% 1.20% 1.30% 1.40% 1.50% 1.60% 1.70% 1.80% 4Q'22 ADJ Rate Environment Loan Growth Fee Growth Cost Inflation ACL Provision 4Q'24 Baseline Economic Impact on Performance 1.40% 1.70% +/- Incremental opportunity of current rate environment as of June 30, 2022: 10-20bps in 4Q’24 ROA

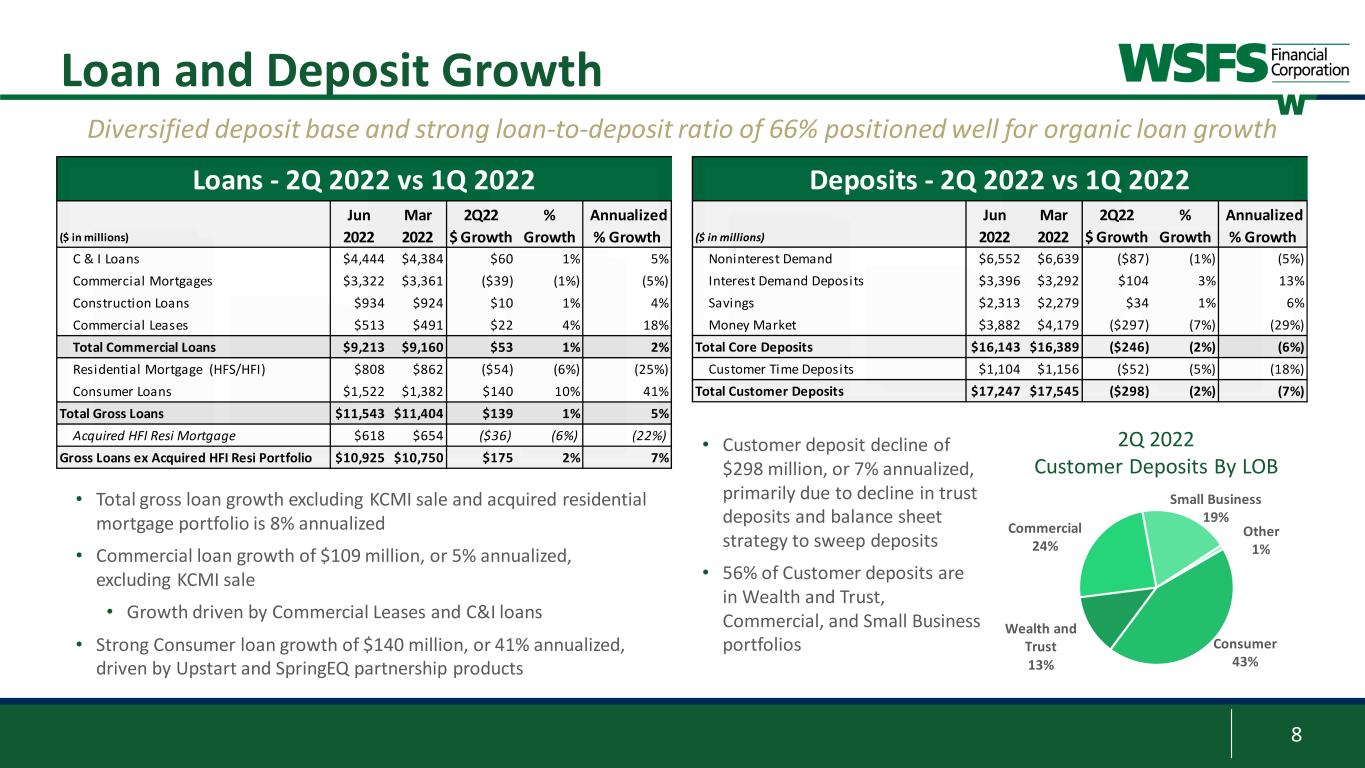

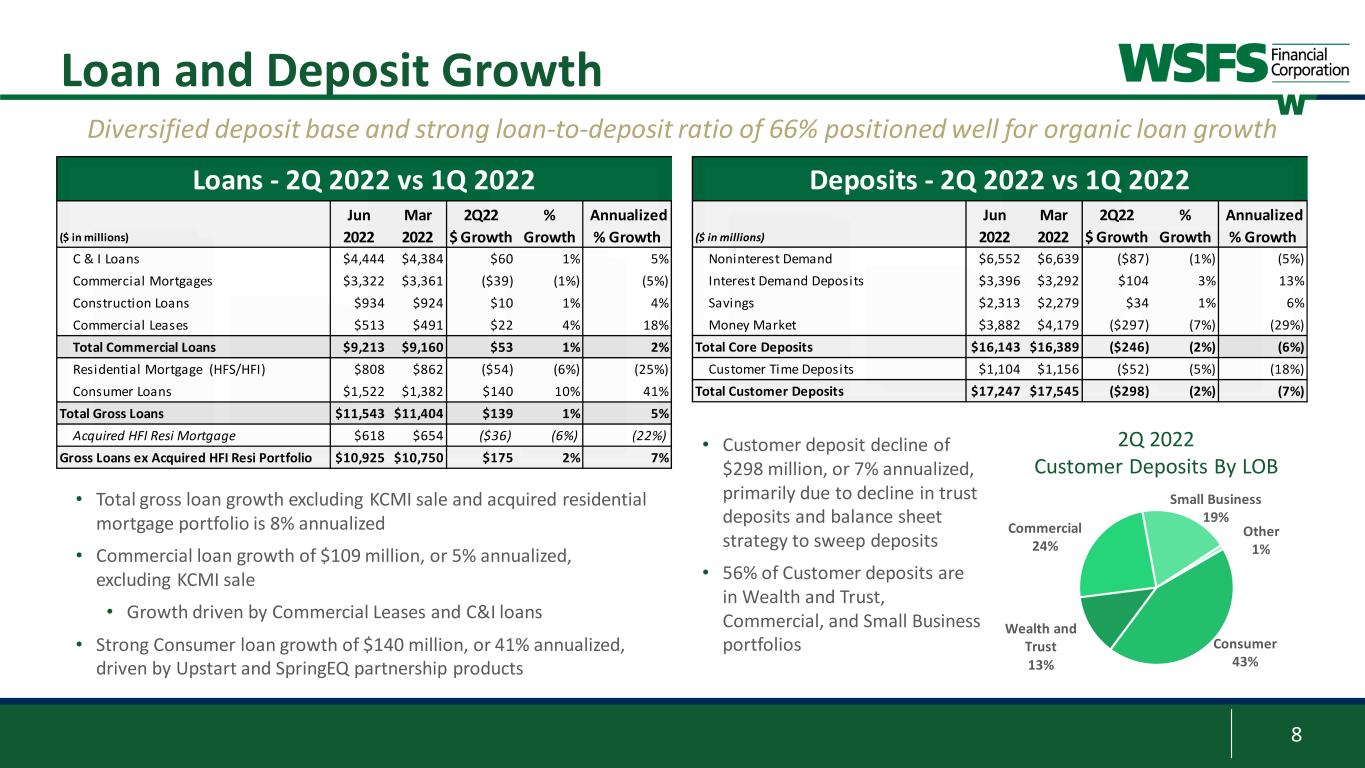

8 Loan and Deposit Growth • Customer deposit decline of $298 million, or 7% annualized, primarily due to decline in trust deposits and balance sheet strategy to sweep deposits • 56% of Customer deposits are in Wealth and Trust, Commercial, and Small Business portfolios • Total gross loan growth excluding KCMI sale and acquired residential mortgage portfolio is 8% annualized • Commercial loan growth of $109 million, or 5% annualized, excluding KCMI sale • Growth driven by Commercial Leases and C&I loans • Strong Consumer loan growth of $140 million, or 41% annualized, driven by Upstart and SpringEQ partnership products Consumer 43% Wealth and Trust 13% Commercial 24% Small Business 19% Other 1% 2Q 2022 Customer Deposits By LOB Diversified deposit base and strong loan-to-deposit ratio of 66% positioned well for organic loan growth ($ in millions) Jun 2022 Mar 2022 2Q22 $ Growth % Growth Annualized % Growth C & I Loans $4,444 $4,384 $60 1% 5% Commercial Mortgages $3,322 $3,361 ($39) (1%) (5%) Construction Loans $934 $924 $10 1% 4% Commercial Leases $513 $491 $22 4% 18% Total Commercial Loans $9,213 $9,160 $53 1% 2% Residential Mortgage (HFS/HFI) $808 $862 ($54) (6%) (25%) Consumer Loans $1,522 $1,382 $140 10% 41% Total Gross Loans $11,543 $11,404 $139 1% 5% Acquired HFI Resi Mortgage $618 $654 ($36) (6%) (22%) Gross Loans ex Acquired HFI Resi Portfolio $10,925 $10,750 $175 2% 7% Loans - 2Q 2022 vs 1Q 2022 ($ in millions) Jun 2022 Mar 2022 2Q22 $ Growth % Growth Annualized % Growth Noninterest Demand $6,552 $6,639 ($87) (1%) (5%) Interest Demand Deposits $3,396 $3,292 $104 3% 13% Savings $2,313 $2,279 $34 1% 6% Money Market $3,882 $4,179 ($297) (7%) (29%) Total Core Deposits $16,143 $16,389 ($246) (2%) (6%) Customer Time Deposits $1,104 $1,156 ($52) (5%) (18%) Total Customer Deposits $17,247 $17,545 ($298) (2%) (7%) Deposits - 2Q 2022 vs 1Q 2022

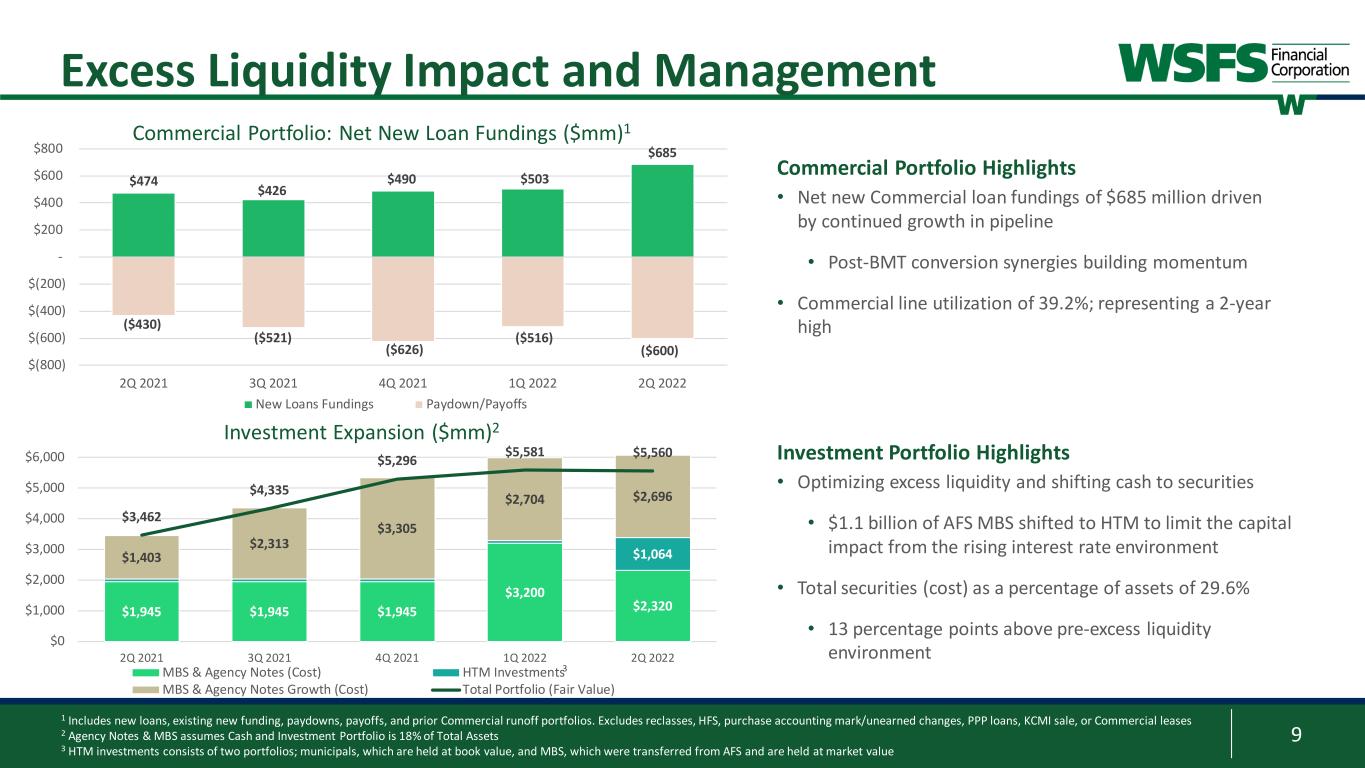

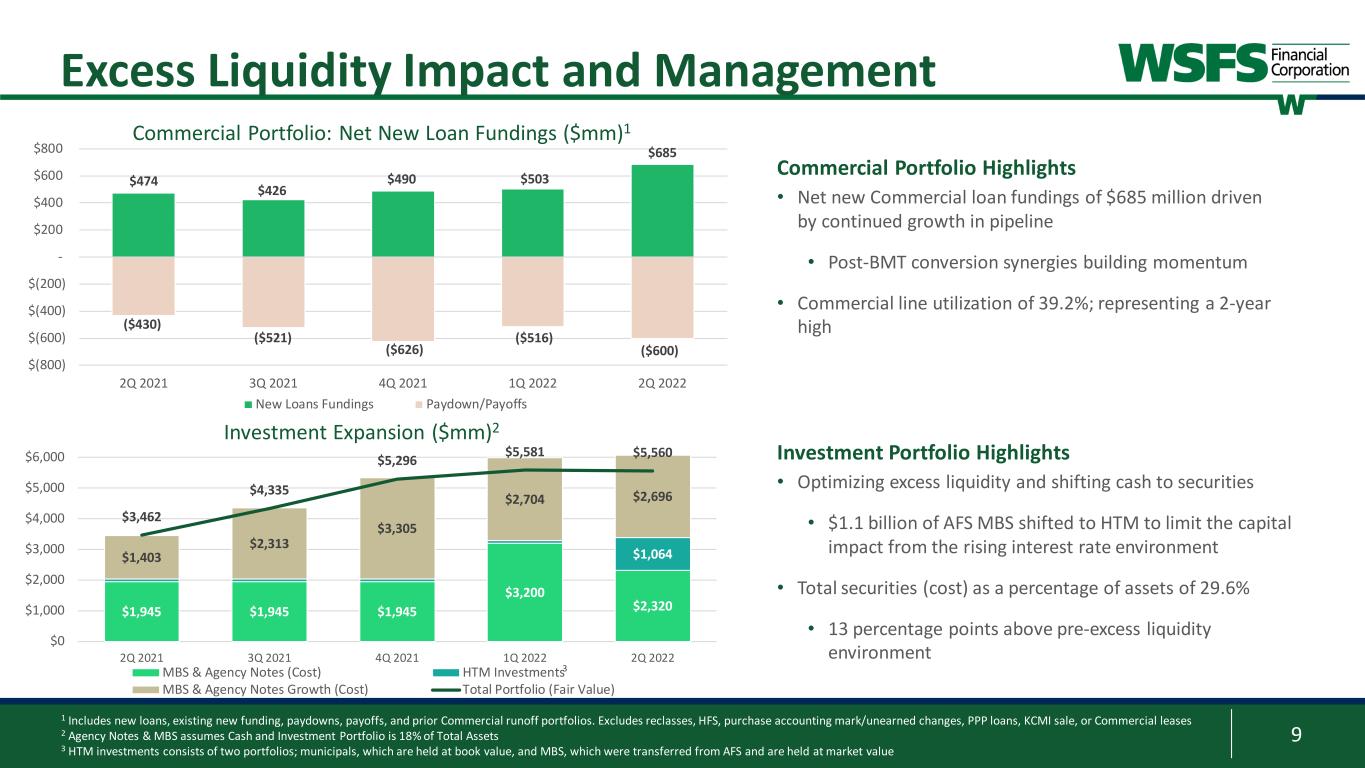

9 Excess Liquidity Impact and Management Commercial Portfolio: Net New Loan Fundings ($mm)1 Investment Portfolio Highlights • Optimizing excess liquidity and shifting cash to securities • $1.1 billion of AFS MBS shifted to HTM to limit the capital impact from the rising interest rate environment • Total securities (cost) as a percentage of assets of 29.6% • 13 percentage points above pre-excess liquidity environment 1 Includes new loans, existing new funding, paydowns, payoffs, and prior Commercial runoff portfolios. Excludes reclasses, HFS, purchase accounting mark/unearned changes, PPP loans, KCMI sale, or Commercial leases 2 Agency Notes & MBS assumes Cash and Investment Portfolio is 18% of Total Assets 3 HTM investments consists of two portfolios; municipals, which are held at book value, and MBS, which were transferred from AFS and are held at market value Commercial Portfolio Highlights • Net new Commercial loan fundings of $685 million driven by continued growth in pipeline • Post-BMT conversion synergies building momentum • Commercial line utilization of 39.2%; representing a 2-year high $1,945 $1,945 $1,945 $3,200 $2,320 $1,064$1,403 $2,313 $3,305 $2,704 $2,696 $3,462 $4,335 $5,296 $5,581 $5,560 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Investment Expansion ($mm)2 MBS & Agency Notes (Cost) HTM Investments MBS & Agency Notes Growth (Cost) Total Portfolio (Fair Value) $474 $426 $490 $503 $685 ($430) ($521) ($626) ($516) ($600) $(800) $(600) $(400) $(200) - $200 $400 $600 $800 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 New Loans Fundings Paydown/Payoffs 3

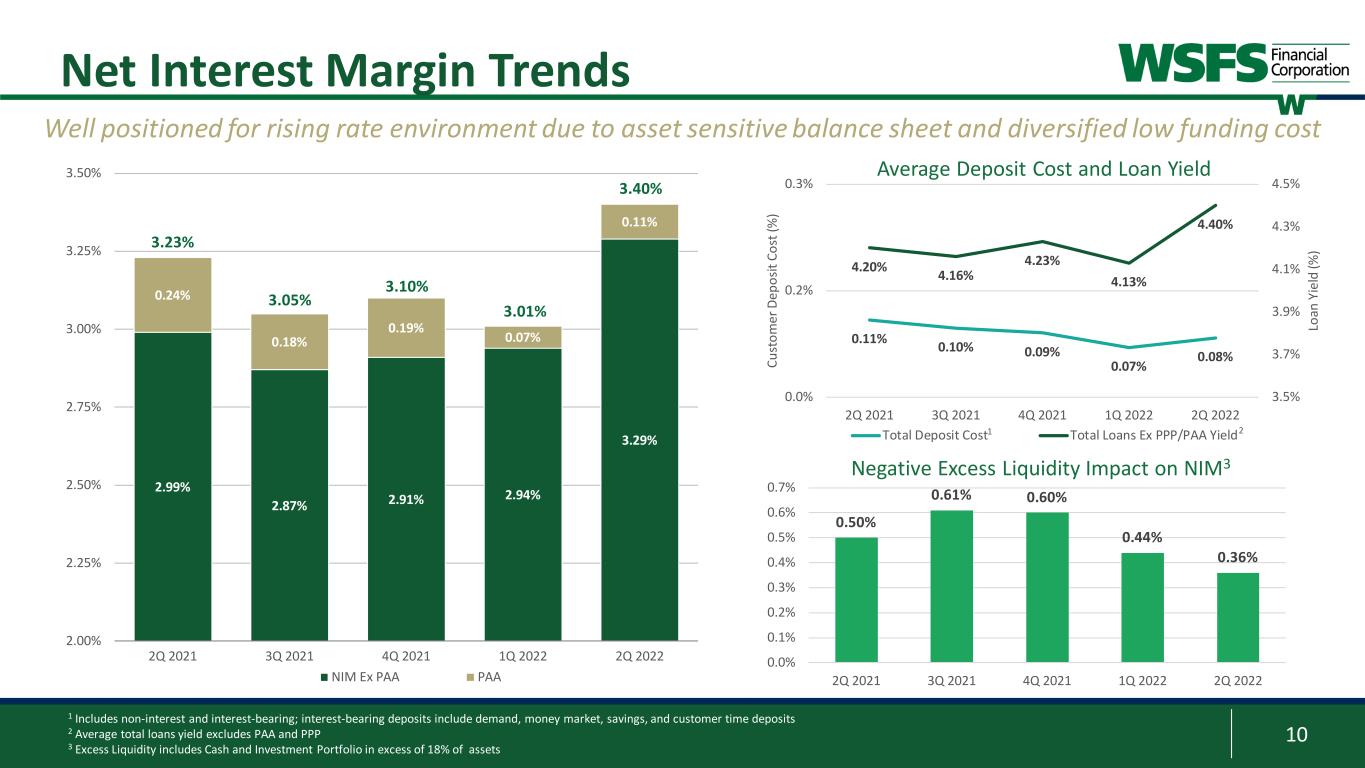

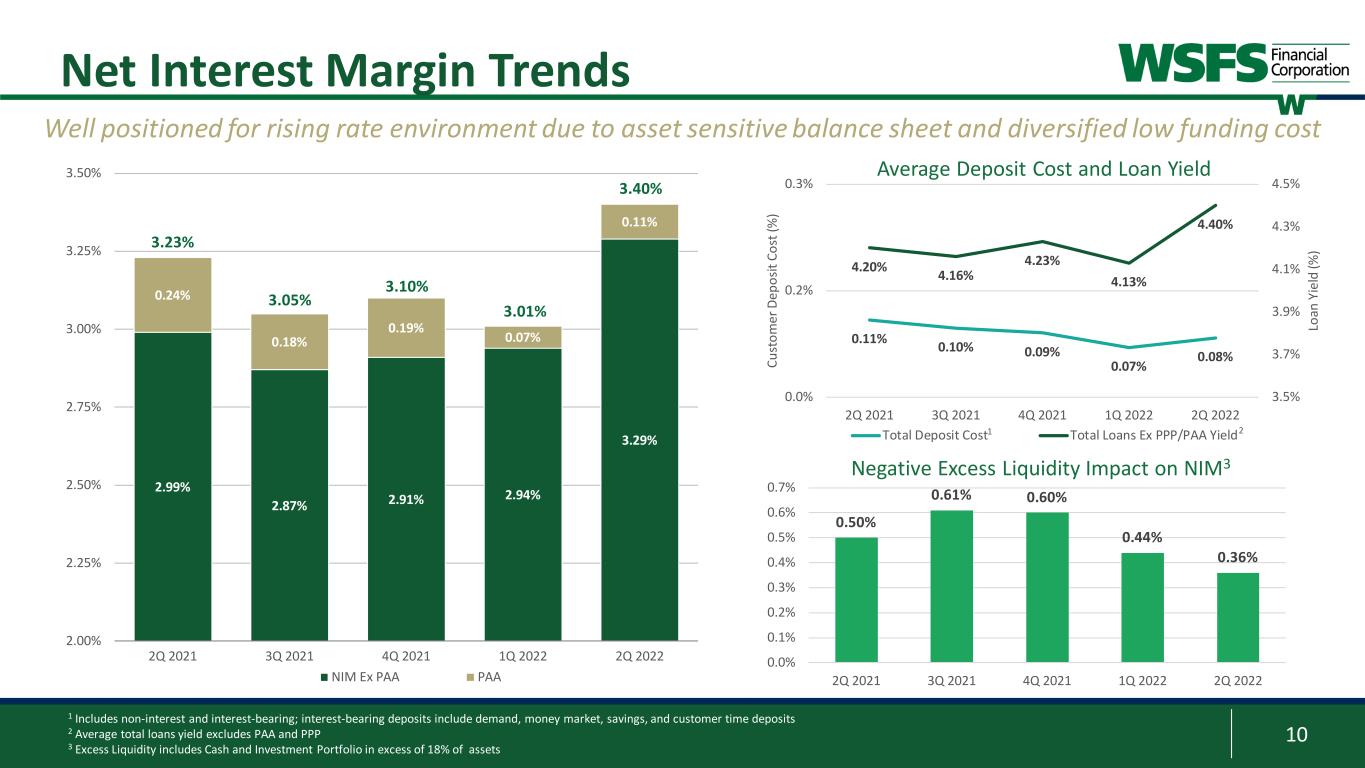

10 0.11% 0.10% 0.09% 0.07% 0.08% 4.20% 4.16% 4.23% 4.13% 4.40% 3.5% 3.7% 3.9% 4.1% 4.3% 4.5% 0.0% 0.2% 0.3% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Lo an Y ie ld (% ) Cu st om er D ep os it Co st (% ) Total Deposit Cost Total Loans Ex PPP/PAA Yield 2.99% 2.87% 2.91% 2.94% 3.29% 0.24% 0.18% 0.19% 0.07% 0.11% 2.00% 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 NIM Ex PAA PAA Negative Excess Liquidity Impact on NIM3 Net Interest Margin Trends Well positioned for rising rate environment due to asset sensitive balance sheet and diversified low funding cost Average Deposit Cost and Loan Yield 1 Includes non-interest and interest-bearing; interest-bearing deposits include demand, money market, savings, and customer time deposits 2 Average total loans yield excludes PAA and PPP 3 Excess Liquidity includes Cash and Investment Portfolio in excess of 18% of assets 21 3.23% 3.05% 3.10% 0.50% 0.61% 0.60% 0.44% 0.36% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3.01% 3.40%

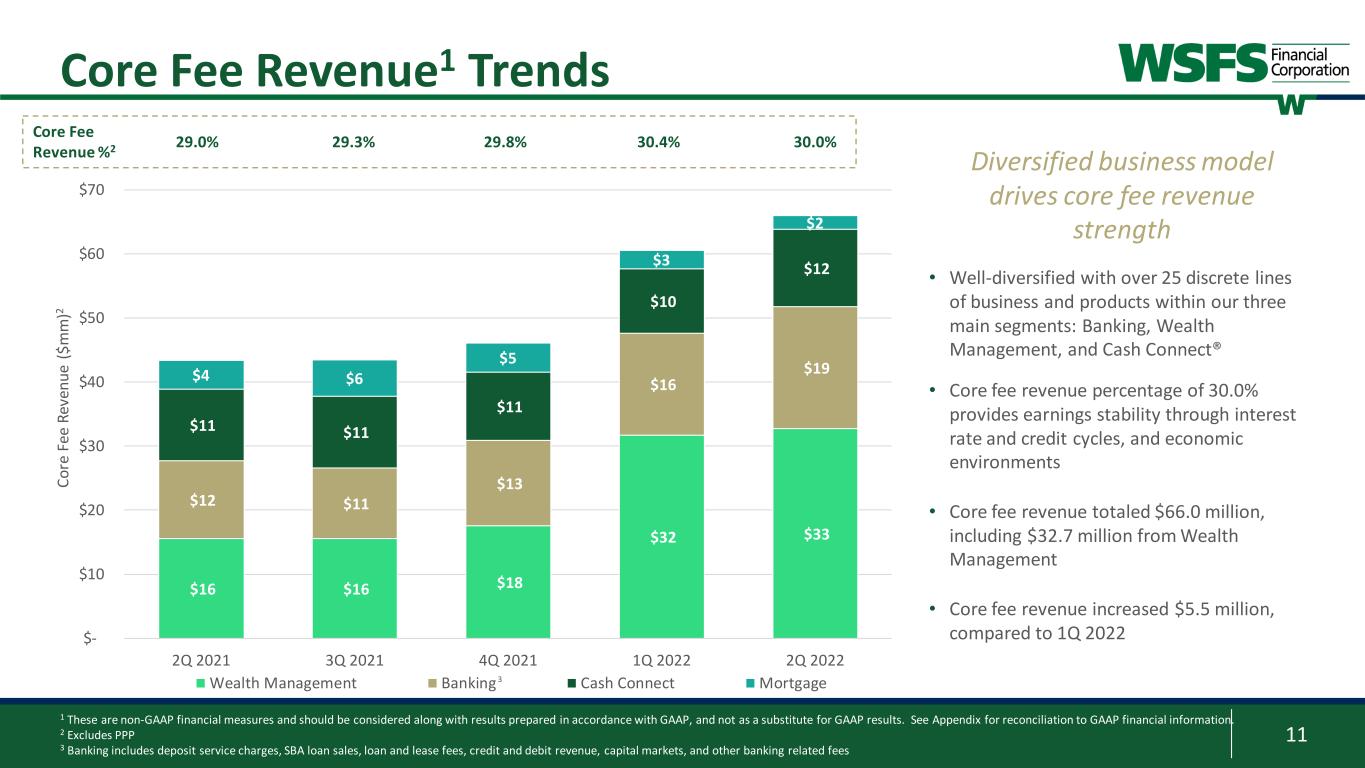

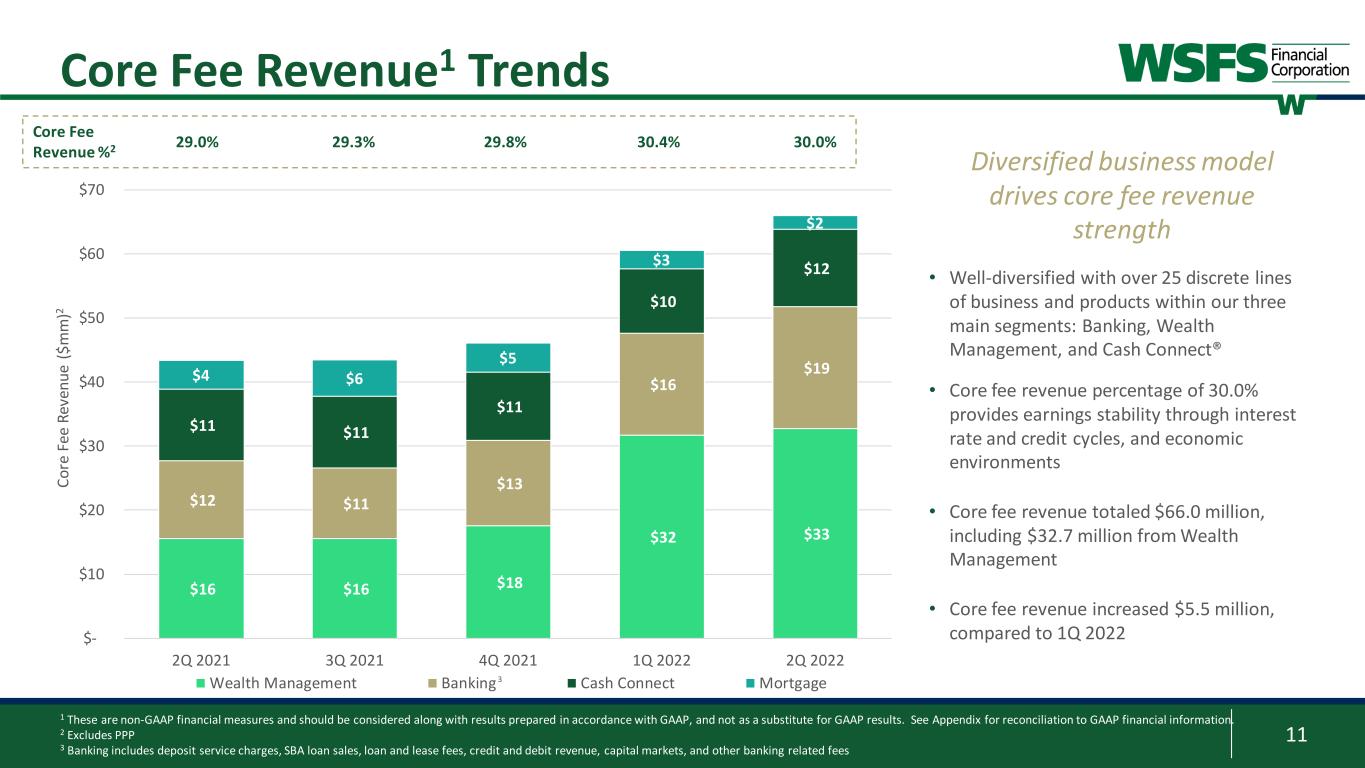

11 $16 $16 $18 $32 $33 $12 $11 $13 $16 $19 $11 $11 $11 $10 $12 $4 $6 $5 $3 $2 $- $10 $20 $30 $40 $50 $60 $70 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Co re F ee R ev en ue ( $m m )2 Wealth Management Banking Cash Connect Mortgage 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Excludes PPP 3 Banking includes deposit service charges, SBA loan sales, loan and lease fees, credit and debit revenue, capital markets, and other banking related fees • Well-diversified with over 25 discrete lines of business and products within our three main segments: Banking, Wealth Management, and Cash Connect® • Core fee revenue percentage of 30.0% provides earnings stability through interest rate and credit cycles, and economic environments • Core fee revenue totaled $66.0 million, including $32.7 million from Wealth Management • Core fee revenue increased $5.5 million, compared to 1Q 2022 Core Fee Revenue1 Trends Diversified business model drives core fee revenue strength 3 Core Fee Revenue %2 29.0% 29.3% 29.8% 30.4% 30.0%

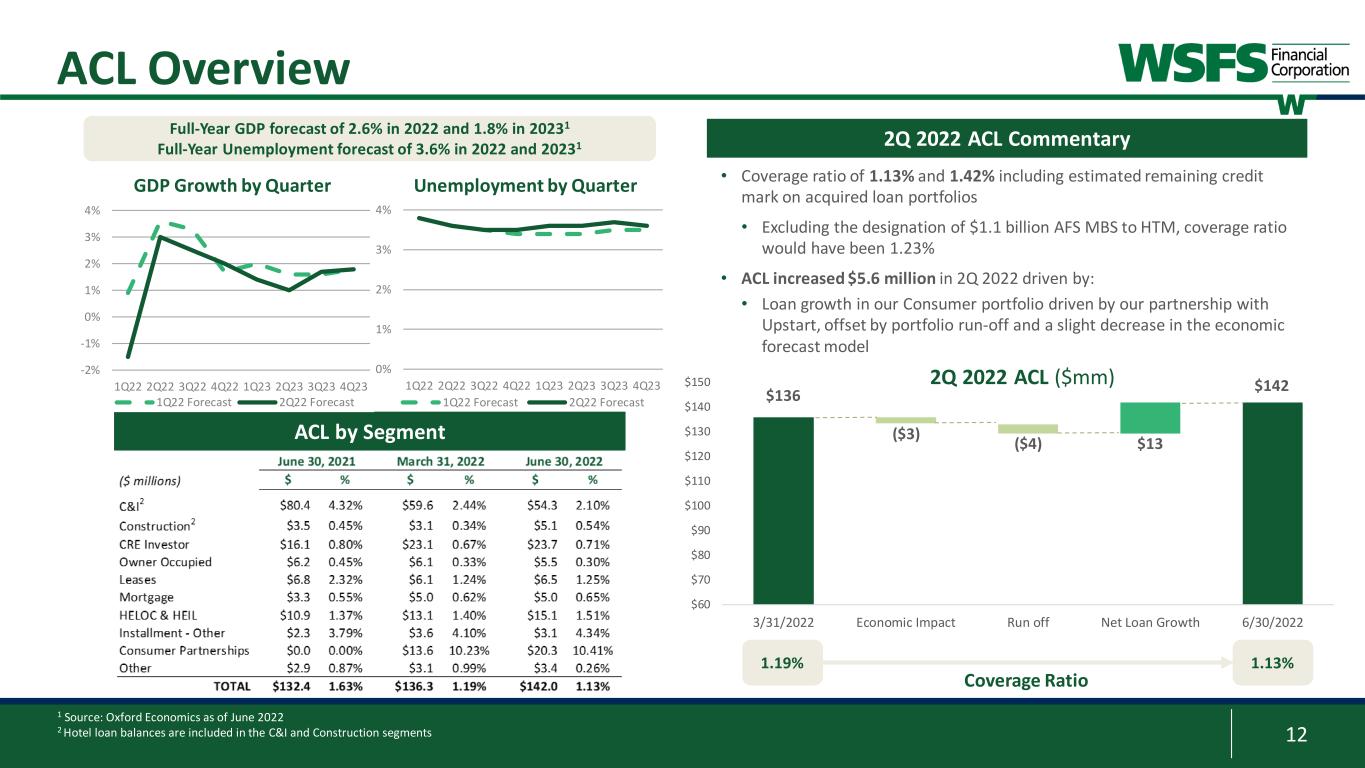

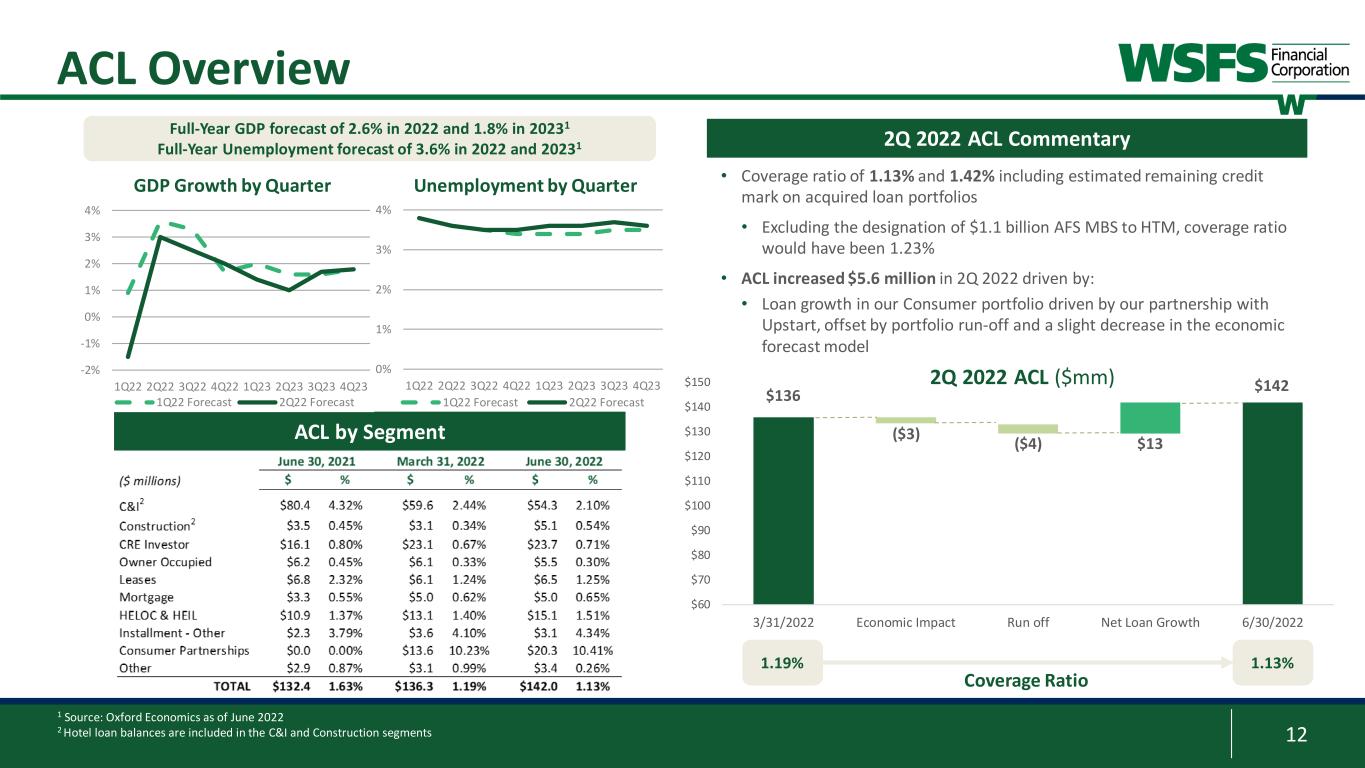

12 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 3/31/2022 Economic Impact Run off Net Loan Growth 6/30/2022 0% 1% 2% 3% 4% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q22 Forecast 2Q22 Forecast Coverage Ratio 1 Source: Oxford Economics as of June 2022 2 Hotel loan balances are included in the C&I and Construction segments ACL Overview ACL by Segment Full-Year GDP forecast of 2.6% in 2022 and 1.8% in 20231 Full-Year Unemployment forecast of 3.6% in 2022 and 20231 2Q 2022 ACL Commentary 1.19% 1.13% GDP Growth by Quarter Unemployment by Quarter • Coverage ratio of 1.13% and 1.42% including estimated remaining credit mark on acquired loan portfolios • Excluding the designation of $1.1 billion AFS MBS to HTM, coverage ratio would have been 1.23% • ACL increased $5.6 million in 2Q 2022 driven by: • Loan growth in our Consumer portfolio driven by our partnership with Upstart, offset by portfolio run-off and a slight decrease in the economic forecast model 2Q 2022 ACL ($mm)-2% -1% 0% 1% 2% 3% 4% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q22 Forecast 2Q22 Forecast ($3) $136 $13 $142 ($4)

13 Non-GAAP Financial Information Appendix:

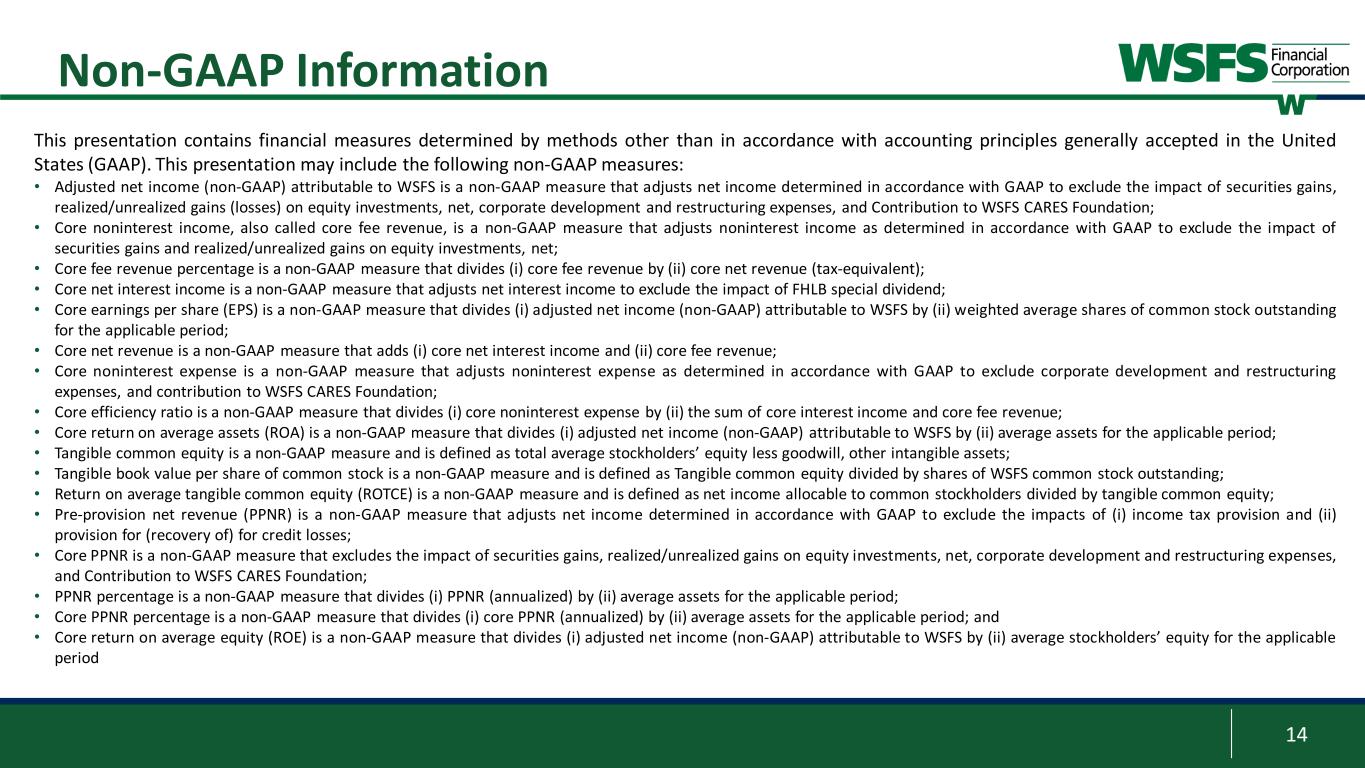

14 Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted net income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains, realized/unrealized gains (losses) on equity investments, net, corporate development and restructuring expenses, and Contribution to WSFS CARES Foundation; • Core noninterest income, also called core fee revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of securities gains and realized/unrealized gains on equity investments, net; • Core fee revenue percentage is a non-GAAP measure that divides (i) core fee revenue by (ii) core net revenue (tax-equivalent); • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of FHLB special dividend; • Core earnings per share (EPS) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core net revenue is a non-GAAP measure that adds (i) core net interest income and (ii) core fee revenue; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude corporate development and restructuring expenses, and contribution to WSFS CARES Foundation; • Core efficiency ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and core fee revenue; • Core return on average assets (ROA) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Tangible common equity is a non-GAAP measure and is defined as total average stockholders’ equity less goodwill, other intangible assets; • Tangible book value per share of common stock is a non-GAAP measure and is defined as Tangible common equity divided by shares of WSFS common stock outstanding; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Pre-provision net revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) provision for (recovery of) for credit losses; • Core PPNR is a non-GAAP measure that excludes the impact of securities gains, realized/unrealized gains on equity investments, net, corporate development and restructuring expenses, and Contribution to WSFS CARES Foundation; • PPNR percentage is a non-GAAP measure that divides (i) PPNR (annualized) by (ii) average assets for the applicable period; • Core PPNR percentage is a non-GAAP measure that divides (i) core PPNR (annualized) by (ii) average assets for the applicable period; and • Core return on average equity (ROE) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average stockholders’ equity for the applicable period

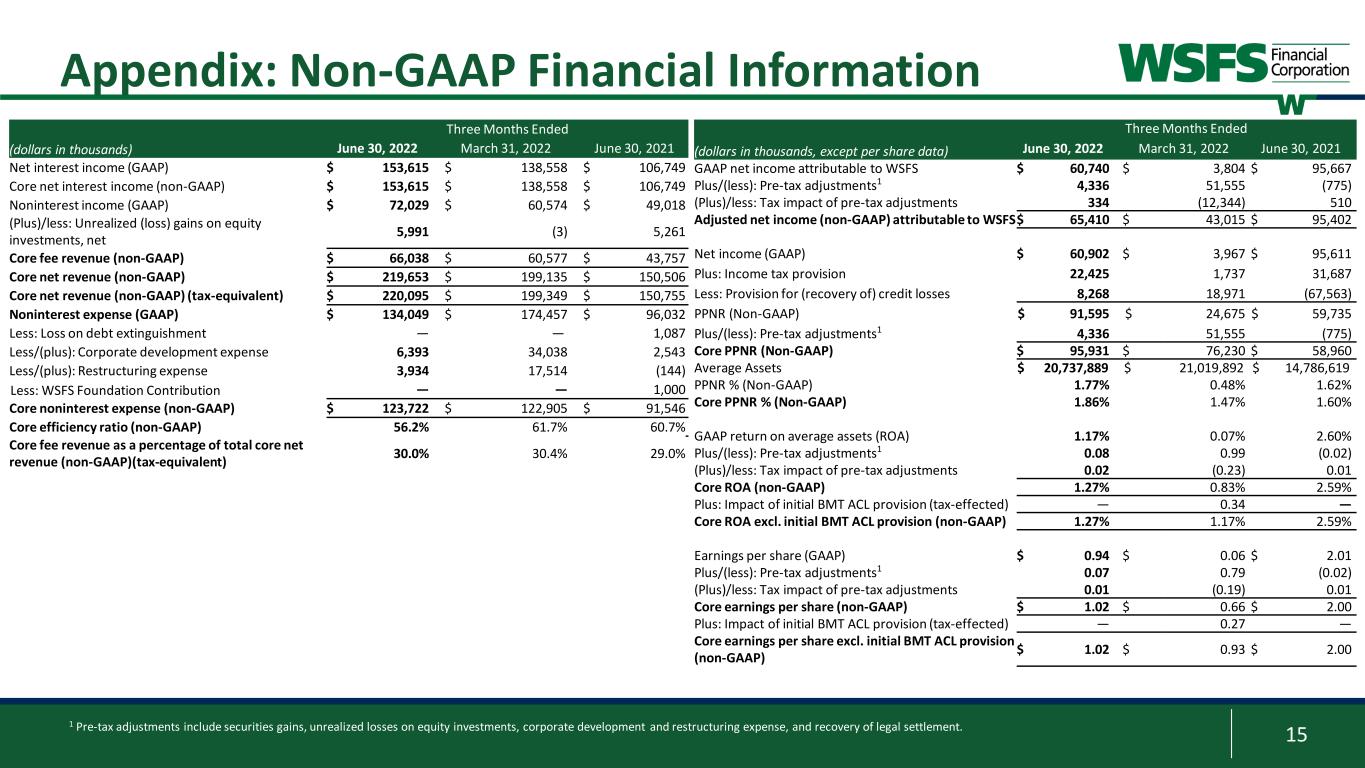

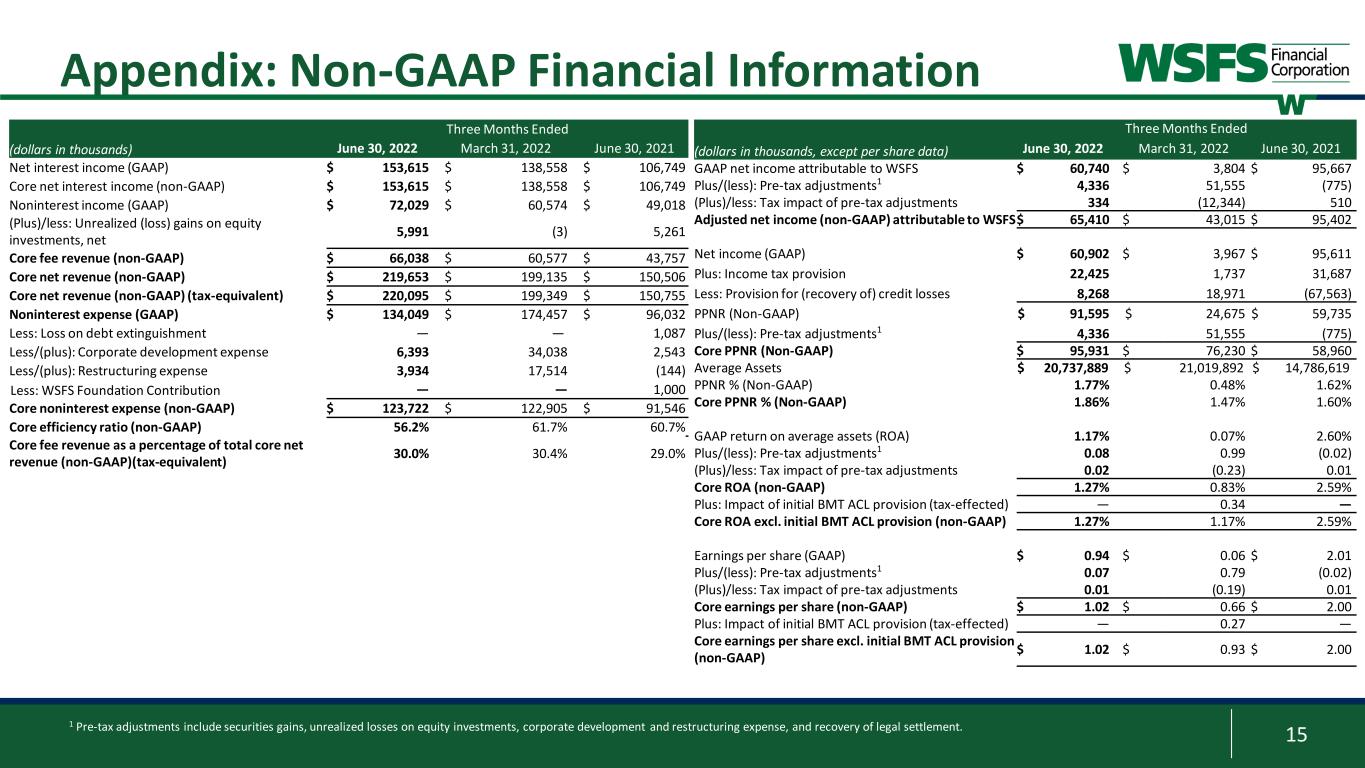

15 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) June 30, 2022 March 31, 2022 June 30, 2021 Net interest income (GAAP) $ 153,615 $ 138,558 $ 106,749 Core net interest income (non-GAAP) $ 153,615 $ 138,558 $ 106,749 Noninterest income (GAAP) $ 72,029 $ 60,574 $ 49,018 (Plus)/less: Unrealized (loss) gains on equity investments, net 5,991 (3) 5,261 Core fee revenue (non-GAAP) $ 66,038 $ 60,577 $ 43,757 Core net revenue (non-GAAP) $ 219,653 $ 199,135 $ 150,506 Core net revenue (non-GAAP) (tax-equivalent) $ 220,095 $ 199,349 $ 150,755 Noninterest expense (GAAP) $ 134,049 $ 174,457 $ 96,032 Less: Loss on debt extinguishment — — 1,087 Less/(plus): Corporate development expense 6,393 34,038 2,543 Less/(plus): Restructuring expense 3,934 17,514 (144) Less: WSFS Foundation Contribution — — 1,000 Core noninterest expense (non-GAAP) $ 123,722 $ 122,905 $ 91,546 Core efficiency ratio (non-GAAP) 56.2% 61.7% 60.7% Core fee revenue as a percentage of total core net revenue (non-GAAP)(tax-equivalent) 30.0% 30.4% 29.0% Three Months Ended (dollars in thousands, except per share data) June 30, 2022 March 31, 2022 June 30, 2021 GAAP net income attributable to WSFS $ 60,740 $ 3,804 $ 95,667 Plus/(less): Pre-tax adjustments1 4,336 51,555 (775) (Plus)/less: Tax impact of pre-tax adjustments 334 (12,344) 510 Adjusted net income (non-GAAP) attributable to WSFS$ 65,410 $ 43,015 $ 95,402 Net income (GAAP) $ 60,902 $ 3,967 $ 95,611 Plus: Income tax provision 22,425 1,737 31,687 Less: Provision for (recovery of) credit losses 8,268 18,971 (67,563) PPNR (Non-GAAP) $ 91,595 $ 24,675 $ 59,735 Plus/(less): Pre-tax adjustments1 4,336 51,555 (775) Core PPNR (Non-GAAP) $ 95,931 $ 76,230 $ 58,960 Average Assets $ 20,737,889 $ 21,019,892 $ 14,786,619 PPNR % (Non-GAAP) 1.77% 0.48% 1.62% Core PPNR % (Non-GAAP) 1.86% 1.47% 1.60% GAAP return on average assets (ROA) 1.17% 0.07% 2.60% Plus/(less): Pre-tax adjustments1 0.08 0.99 (0.02) (Plus)/less: Tax impact of pre-tax adjustments 0.02 (0.23) 0.01 Core ROA (non-GAAP) 1.27% 0.83% 2.59% Plus: Impact of initial BMT ACL provision (tax-effected) — 0.34 — Core ROA excl. initial BMT ACL provision (non-GAAP) 1.27% 1.17% 2.59% Earnings per share (GAAP) $ 0.94 $ 0.06 $ 2.01 Plus/(less): Pre-tax adjustments1 0.07 0.79 (0.02) (Plus)/less: Tax impact of pre-tax adjustments 0.01 (0.19) 0.01 Core earnings per share (non-GAAP) $ 1.02 $ 0.66 $ 2.00 Plus: Impact of initial BMT ACL provision (tax-effected) — 0.27 — Core earnings per share excl. initial BMT ACL provision (non-GAAP) $ 1.02 $ 0.93 $ 2.00 1 Pre-tax adjustments include securities gains, unrealized losses on equity investments, corporate development and restructuring expense, and recovery of legal settlement.

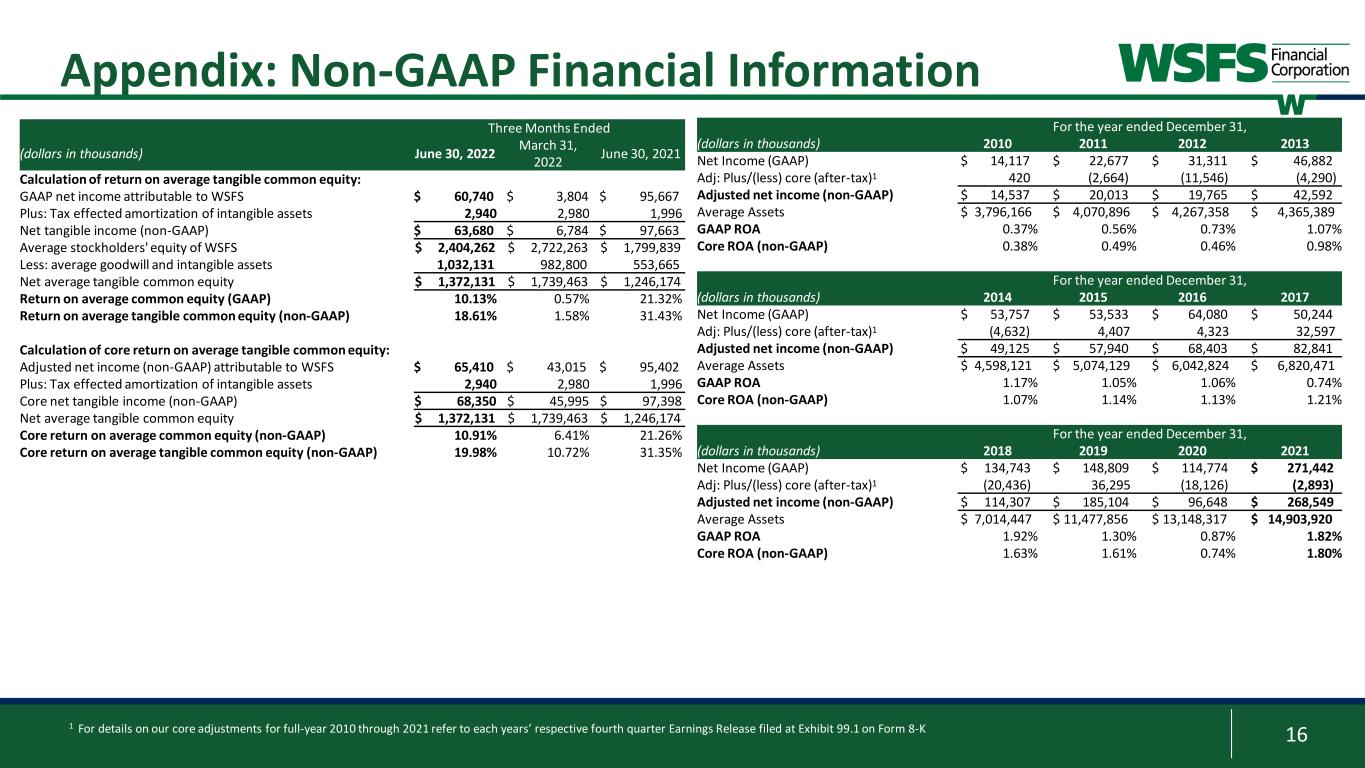

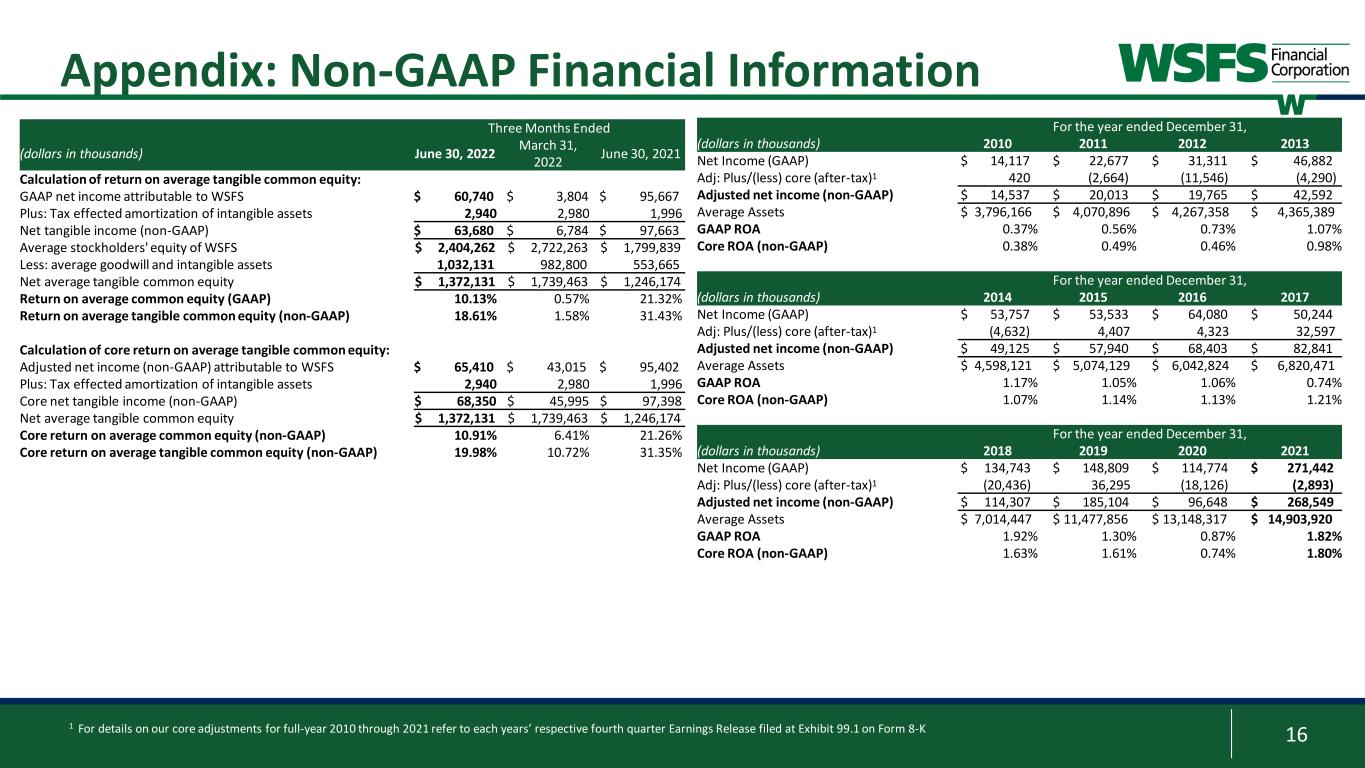

16 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) June 30, 2022 March 31, 2022 June 30, 2021 Calculation of return on average tangible common equity: GAAP net income attributable to WSFS $ 60,740 $ 3,804 $ 95,667 Plus: Tax effected amortization of intangible assets 2,940 2,980 1,996 Net tangible income (non-GAAP) $ 63,680 $ 6,784 $ 97,663 Average stockholders' equity of WSFS $ 2,404,262 $ 2,722,263 $ 1,799,839 Less: average goodwill and intangible assets 1,032,131 982,800 553,665 Net average tangible common equity $ 1,372,131 $ 1,739,463 $ 1,246,174 Return on average common equity (GAAP) 10.13% 0.57% 21.32% Return on average tangible common equity (non-GAAP) 18.61% 1.58% 31.43% Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 65,410 $ 43,015 $ 95,402 Plus: Tax effected amortization of intangible assets 2,940 2,980 1,996 Core net tangible income (non-GAAP) $ 68,350 $ 45,995 $ 97,398 Net average tangible common equity $ 1,372,131 $ 1,739,463 $ 1,246,174 Core return on average common equity (non-GAAP) 10.91% 6.41% 21.26% Core return on average tangible common equity (non-GAAP) 19.98% 10.72% 31.35% For the year ended December 31, (dollars in thousands) 2010 2011 2012 2013 Net Income (GAAP) $ 14,117 $ 22,677 $ 31,311 $ 46,882 Adj: Plus/(less) core (after-tax)1 420 (2,664) (11,546) (4,290) Adjusted net income (non-GAAP) $ 14,537 $ 20,013 $ 19,765 $ 42,592 Average Assets $ 3,796,166 $ 4,070,896 $ 4,267,358 $ 4,365,389 GAAP ROA 0.37% 0.56% 0.73% 1.07% Core ROA (non-GAAP) 0.38% 0.49% 0.46% 0.98% For the year ended December 31, (dollars in thousands) 2014 2015 2016 2017 Net Income (GAAP) $ 53,757 $ 53,533 $ 64,080 $ 50,244 Adj: Plus/(less) core (after-tax)1 (4,632) 4,407 4,323 32,597 Adjusted net income (non-GAAP) $ 49,125 $ 57,940 $ 68,403 $ 82,841 Average Assets $ 4,598,121 $ 5,074,129 $ 6,042,824 $ 6,820,471 GAAP ROA 1.17% 1.05% 1.06% 0.74% Core ROA (non-GAAP) 1.07% 1.14% 1.13% 1.21% For the year ended December 31, (dollars in thousands) 2018 2019 2020 2021 Net Income (GAAP) $ 134,743 $ 148,809 $ 114,774 $ 271,442 Adj: Plus/(less) core (after-tax)1 (20,436) 36,295 (18,126) (2,893) Adjusted net income (non-GAAP) $ 114,307 $ 185,104 $ 96,648 $ 268,549 Average Assets $ 7,014,447 $ 11,477,856 $ 13,148,317 $ 14,903,920 GAAP ROA 1.92% 1.30% 0.87% 1.82% Core ROA (non-GAAP) 1.63% 1.61% 0.74% 1.80% 1 For details on our core adjustments for full-year 2010 through 2021 refer to each years’ respective fourth quarter Earnings Release filed at Exhibit 99.1 on Form 8-K

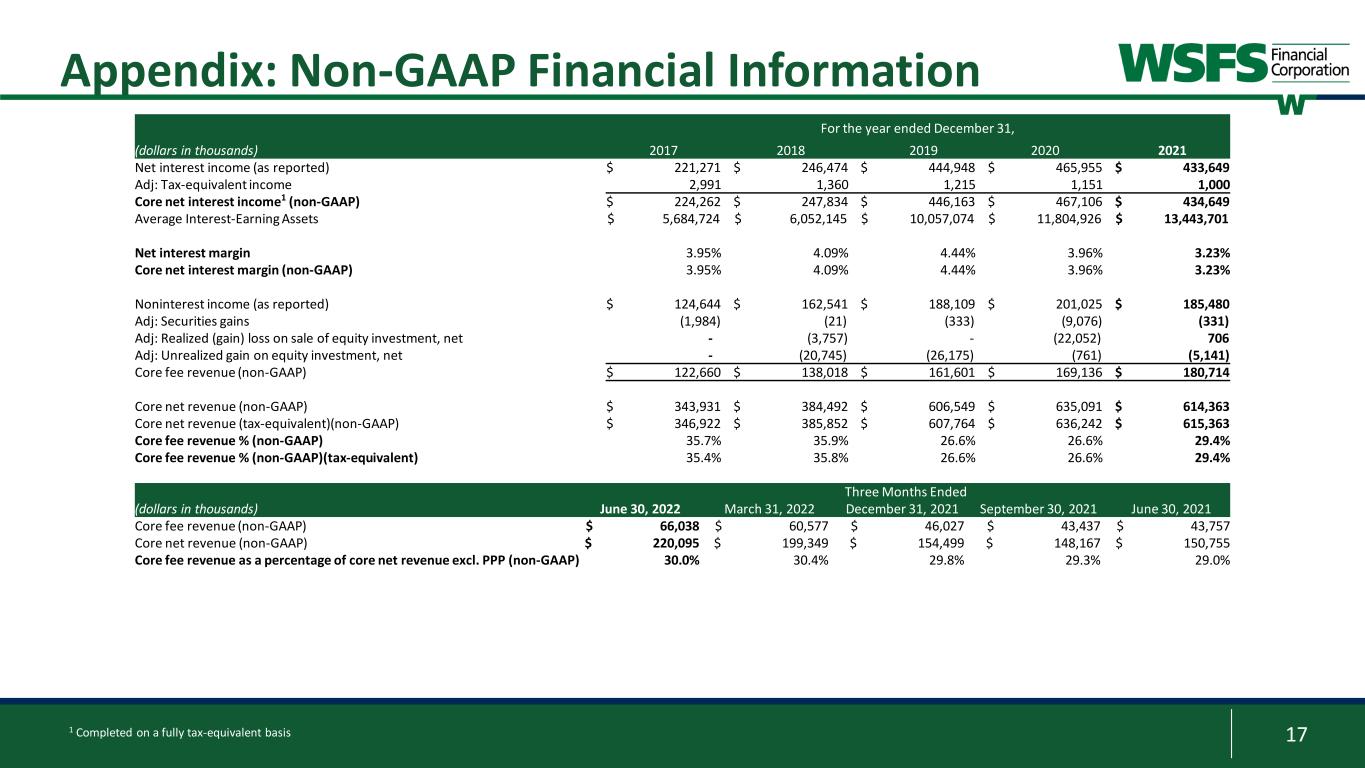

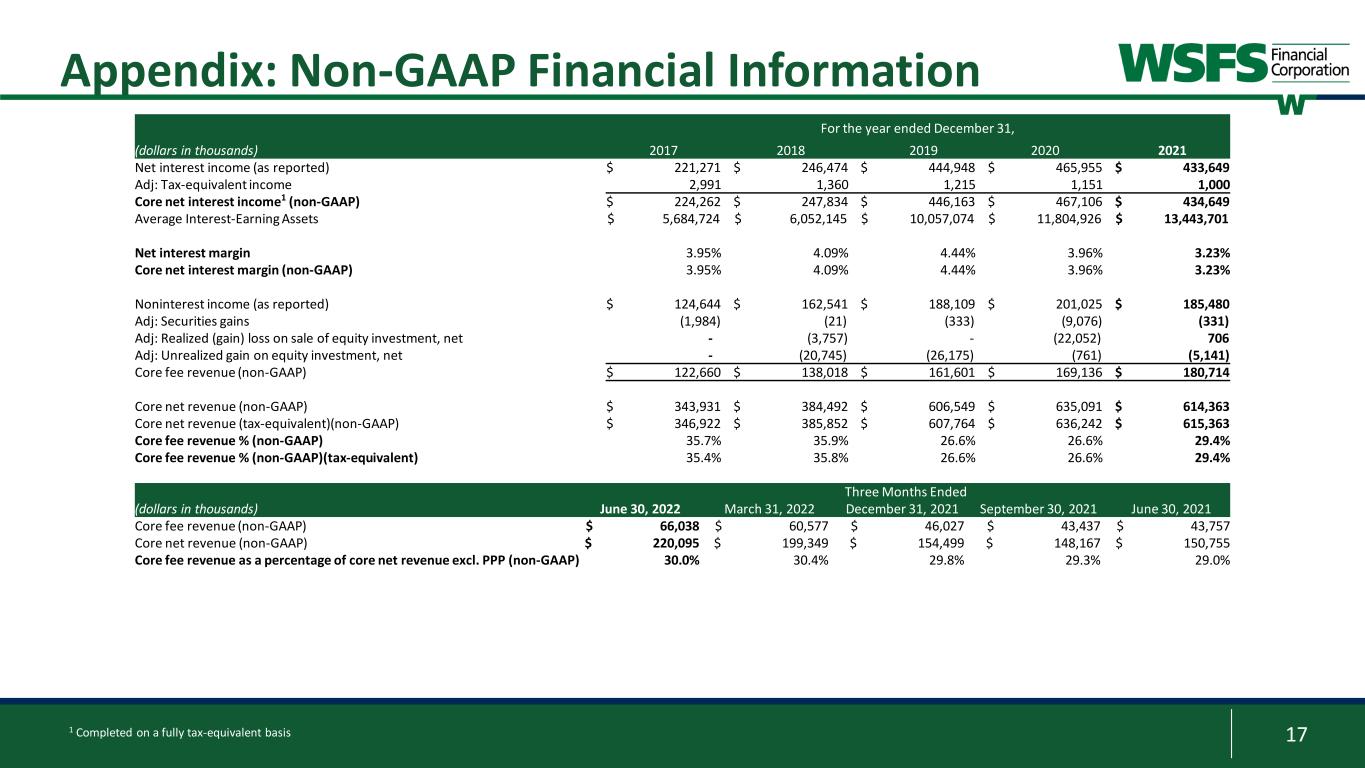

17 Appendix: Non-GAAP Financial Information 1 Completed on a fully tax-equivalent basis For the year ended December 31, (dollars in thousands) 2017 2018 2019 2020 2021 Net interest income (as reported) $ 221,271 $ 246,474 $ 444,948 $ 465,955 $ 433,649 Adj: Tax-equivalent income 2,991 1,360 1,215 1,151 1,000 Core net interest income1 (non-GAAP) $ 224,262 $ 247,834 $ 446,163 $ 467,106 $ 434,649 Average Interest-Earning Assets $ 5,684,724 $ 6,052,145 $ 10,057,074 $ 11,804,926 $ 13,443,701 Net interest margin 3.95% 4.09% 4.44% 3.96% 3.23% Core net interest margin (non-GAAP) 3.95% 4.09% 4.44% 3.96% 3.23% Noninterest income (as reported) $ 124,644 $ 162,541 $ 188,109 $ 201,025 $ 185,480 Adj: Securities gains (1,984) (21) (333) (9,076) (331) Adj: Realized (gain) loss on sale of equity investment, net - (3,757) - (22,052) 706 Adj: Unrealized gain on equity investment, net - (20,745) (26,175) (761) (5,141) Core fee revenue (non-GAAP) $ 122,660 $ 138,018 $ 161,601 $ 169,136 $ 180,714 Core net revenue (non-GAAP) $ 343,931 $ 384,492 $ 606,549 $ 635,091 $ 614,363 Core net revenue (tax-equivalent)(non-GAAP) $ 346,922 $ 385,852 $ 607,764 $ 636,242 $ 615,363 Core fee revenue % (non-GAAP) 35.7% 35.9% 26.6% 26.6% 29.4% Core fee revenue % (non-GAAP)(tax-equivalent) 35.4% 35.8% 26.6% 26.6% 29.4% Three Months Ended (dollars in thousands) June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Core fee revenue (non-GAAP) $ 66,038 $ 60,577 $ 46,027 $ 43,437 $ 43,757 Core net revenue (non-GAAP) $ 220,095 $ 199,349 $ 154,499 $ 148,167 $ 150,755 Core fee revenue as a percentage of core net revenue excl. PPP (non-GAAP) 30.0% 30.4% 29.8% 29.3% 29.0%

18 Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Chairman, President and CEO 302-571-7296 rlevenson@wsfsbank.com Dominic C. Canuso Chief Financial Officer 302-571-6833 dcanuso@wsfsbank.com