1 WSFS Financial Corporation 3Q 2022 Investor Update October 2022

2 Forward Looking Statements & Non-GAAP Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including ability to successfully integrate and fully realize the cost savings and other benefits of our recent acquisition of Bryn Mawr Bank Corporation (“BMT”) and the uncertain effects of the COVID-19 pandemic and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company's Form 10-K for the year ended December 31, 2021, Form 10-Q for the quarter ended March 31, 2022, Form 10-Q for the quarter ended June 30, 2022, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core earnings per share (“EPS”), core EPS, core net income, core return on equity (“ROE”), core efficiency ratio, pre-provision net revenue (“PPNR”), core PPNR, PPNR to average assets ratio, core PPNR to average assets ratio, core return on assets (“ROA”), core ROA, core net interest income, core net interest margin (“NIM”), tangible common equity (“TCE”), tangible assets, tangible equity, return on tangible common equity (“ROTCE”), core ROTCE, core fee revenue and core fee revenue as a percentage of total core net revenue. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. Trade names, trademarks and service marks of other companies appearing in this presentation are the property of their respective holders.

3 Table of Contents 3Q 2022 Earnings Release Supplement Page 4 Franchise and Markets Page 13 Selected Financial and Performance Metrics Page 27

4 3Q 2022 Earnings Release Supplement As Published on October 24th, 2022

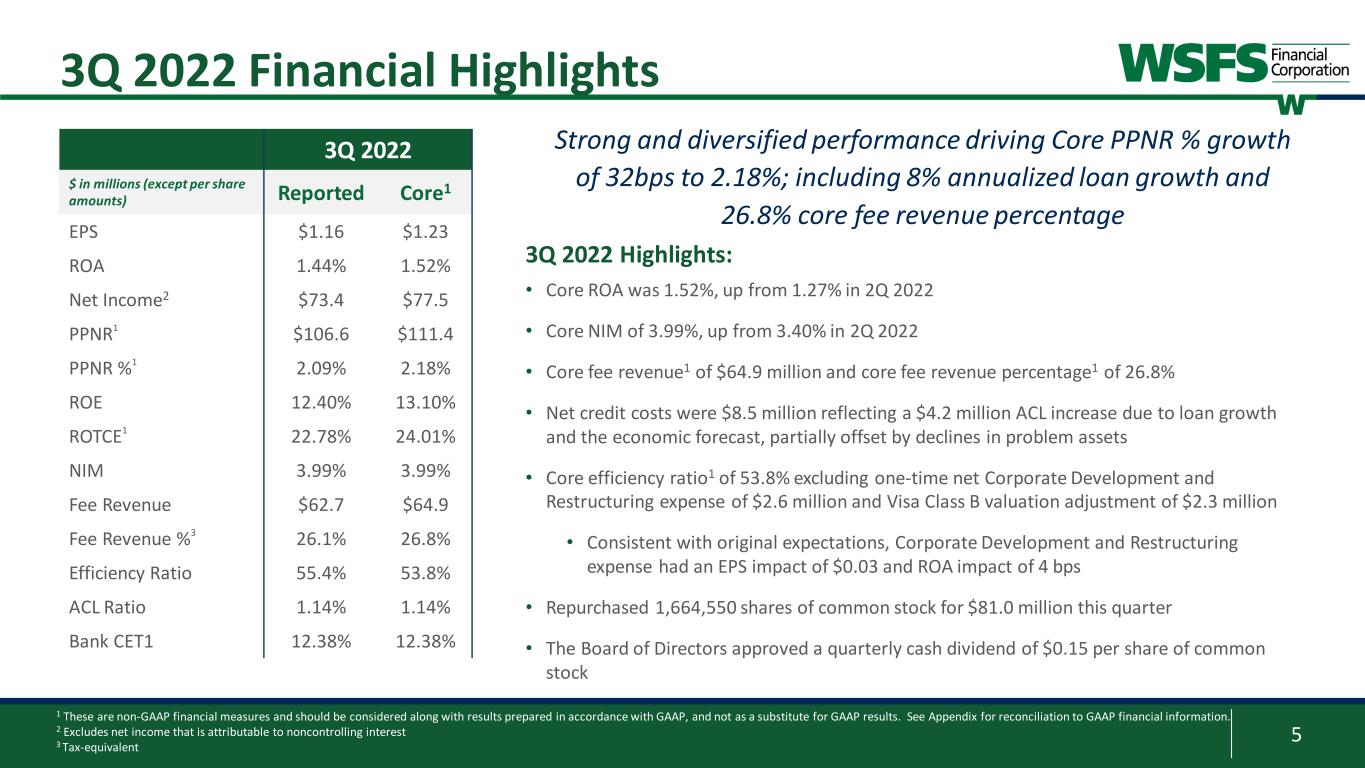

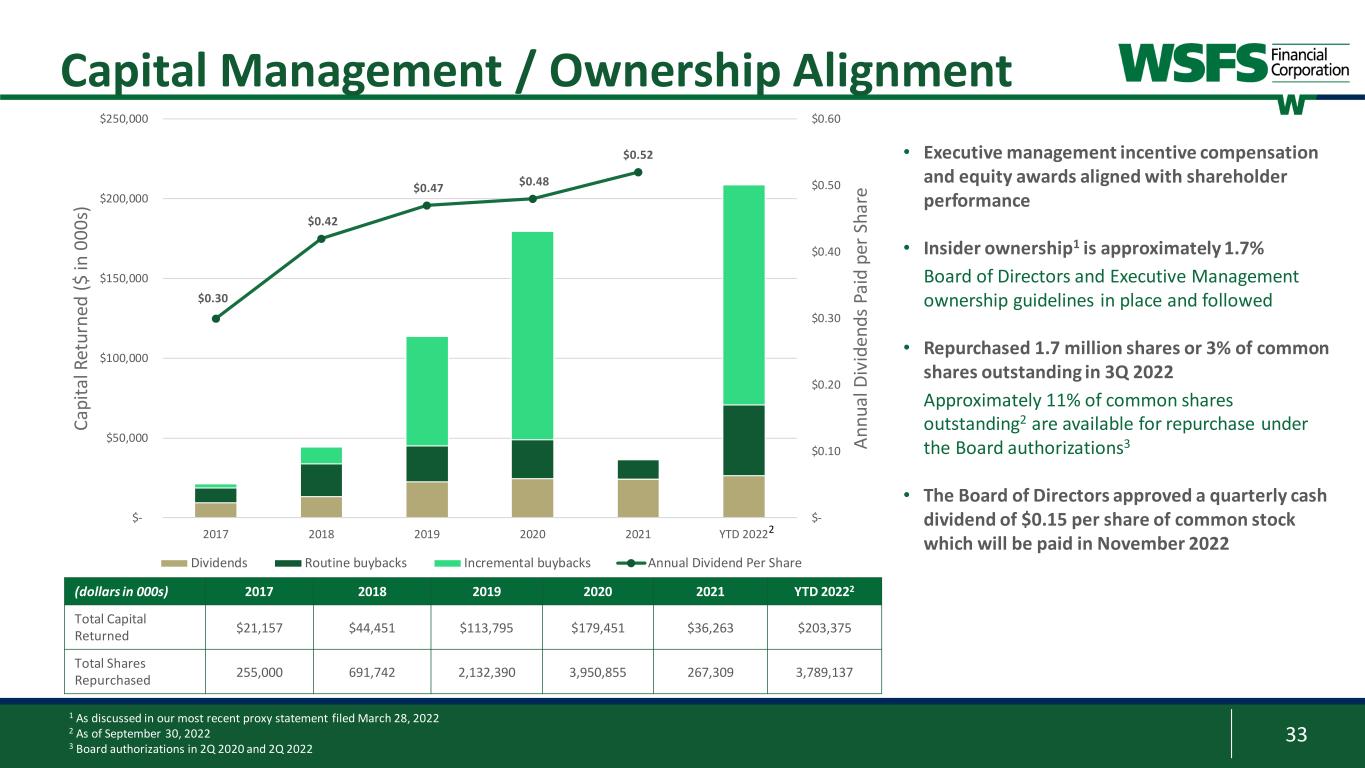

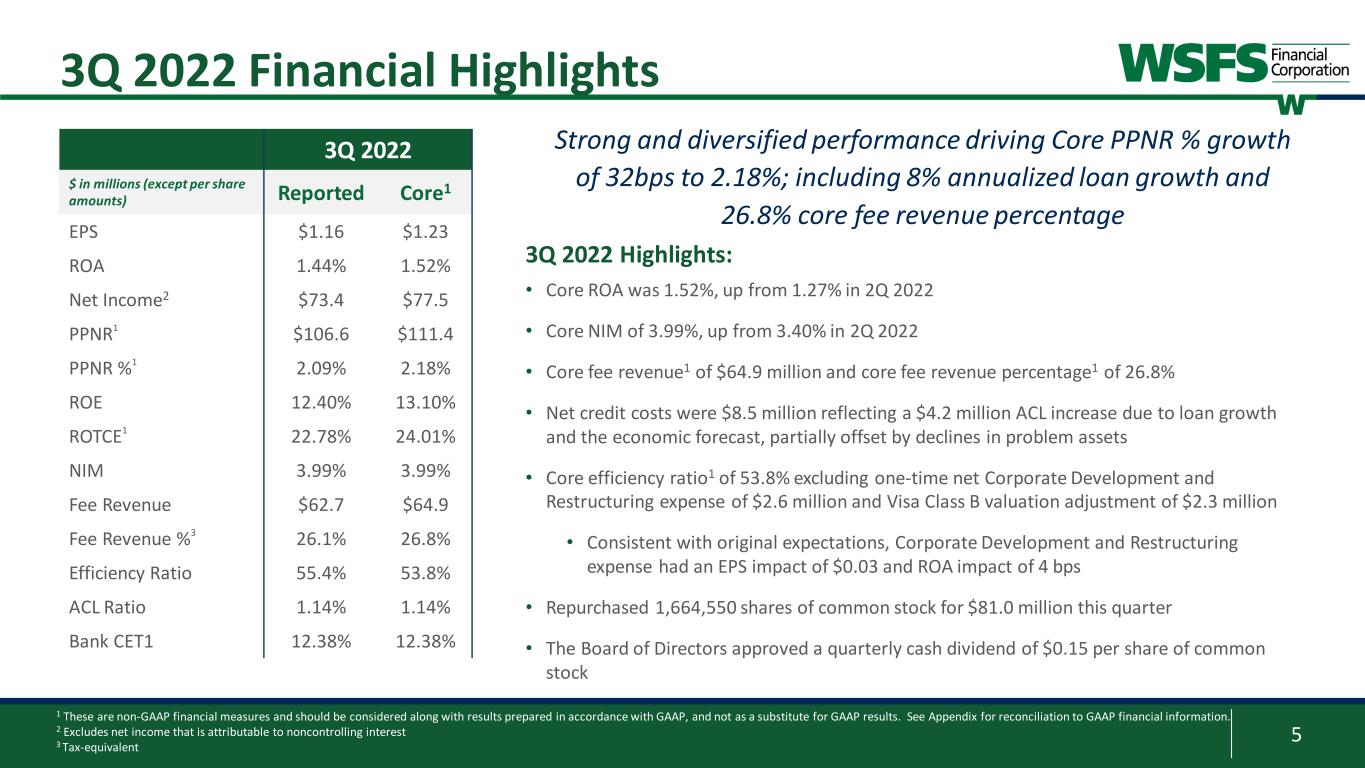

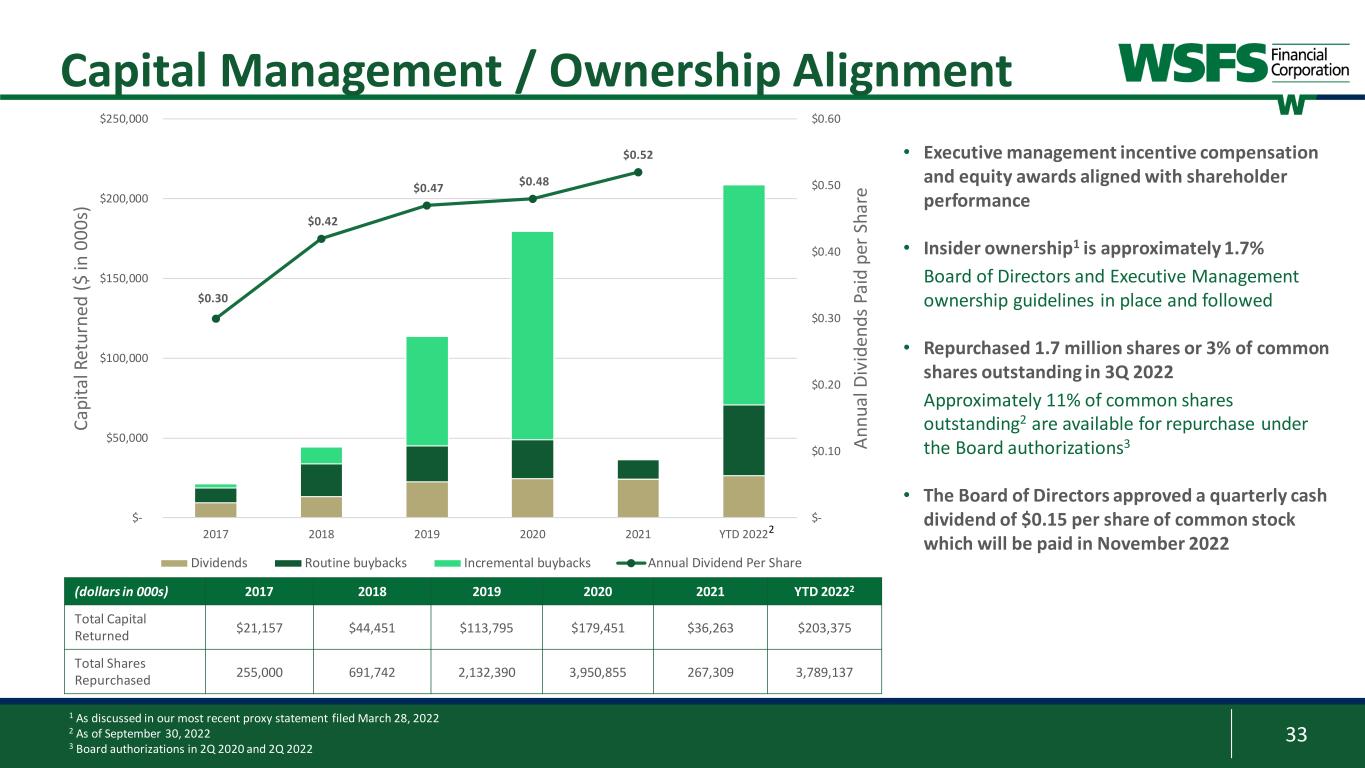

5 3Q 2022 Financial Highlights Strong and diversified performance driving Core PPNR % growth of 32bps to 2.18%; including 8% annualized loan growth and 26.8% core fee revenue percentage 3Q 2022 $ in millions (except per share amounts) Reported Core1 EPS $1.16 $1.23 ROA 1.44% 1.52% Net Income2 $73.4 $77.5 PPNR1 $106.6 $111.4 PPNR %1 2.09% 2.18% ROE 12.40% 13.10% ROTCE1 22.78% 24.01% NIM 3.99% 3.99% Fee Revenue $62.7 $64.9 Fee Revenue %3 26.1% 26.8% Efficiency Ratio 55.4% 53.8% ACL Ratio 1.14% 1.14% Bank CET1 12.38% 12.38% 3Q 2022 Highlights: • Core ROA was 1.52%, up from 1.27% in 2Q 2022 • Core NIM of 3.99%, up from 3.40% in 2Q 2022 • Core fee revenue1 of $64.9 million and core fee revenue percentage1 of 26.8% • Net credit costs were $8.5 million reflecting a $4.2 million ACL increase due to loan growth and the economic forecast, partially offset by declines in problem assets • Core efficiency ratio1 of 53.8% excluding one-time net Corporate Development and Restructuring expense of $2.6 million and Visa Class B valuation adjustment of $2.3 million • Consistent with original expectations, Corporate Development and Restructuring expense had an EPS impact of $0.03 and ROA impact of 4 bps • Repurchased 1,664,550 shares of common stock for $81.0 million this quarter • The Board of Directors approved a quarterly cash dividend of $0.15 per share of common stock 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Excludes net income that is attributable to noncontrolling interest 3 Tax-equivalent

6 Status 3 2022 Core Outlook Loan Growth2 Mid single digit growth; excluding acquired residential mortgage portfolio On Track Deposit Growth2 Flat deposit growth Low single digit decline Net Interest Margin Range of 3.60% - 3.65%; assumed thirteen 25bp interest rate increases On Track3 Fee Revenue Growth2 Low single digit growth; Fee revenue percentage in high 20’s to low 30’s Low single digit decline Provision Costs $15-$25 million; excluding the LD1 impact of BMT acquisition On Track Efficiency Ratio Mid 50’s; 4Q efficiency ratio expected in the low 50’s On Track Tax Rate Approximately 25% On Track 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy 2 Growth rates from pro forma 2021 combined WSFS and BMT 3 Assumes seventeen 25bp interest rate increases; the additional rate increases anticipated late 4th quarter, largely offset by slightly higher anticipated deposit betas 2022 Updated Mid-year Core Outlook1 On Track for 4Q Core ROA 1.60% - 1.70% and 4Q Core PPNR% of 2.35% - 2.45%; Full Year Core ROA 1.30% - 1.40% and Core PPNR % of 1.90% - 2.00%

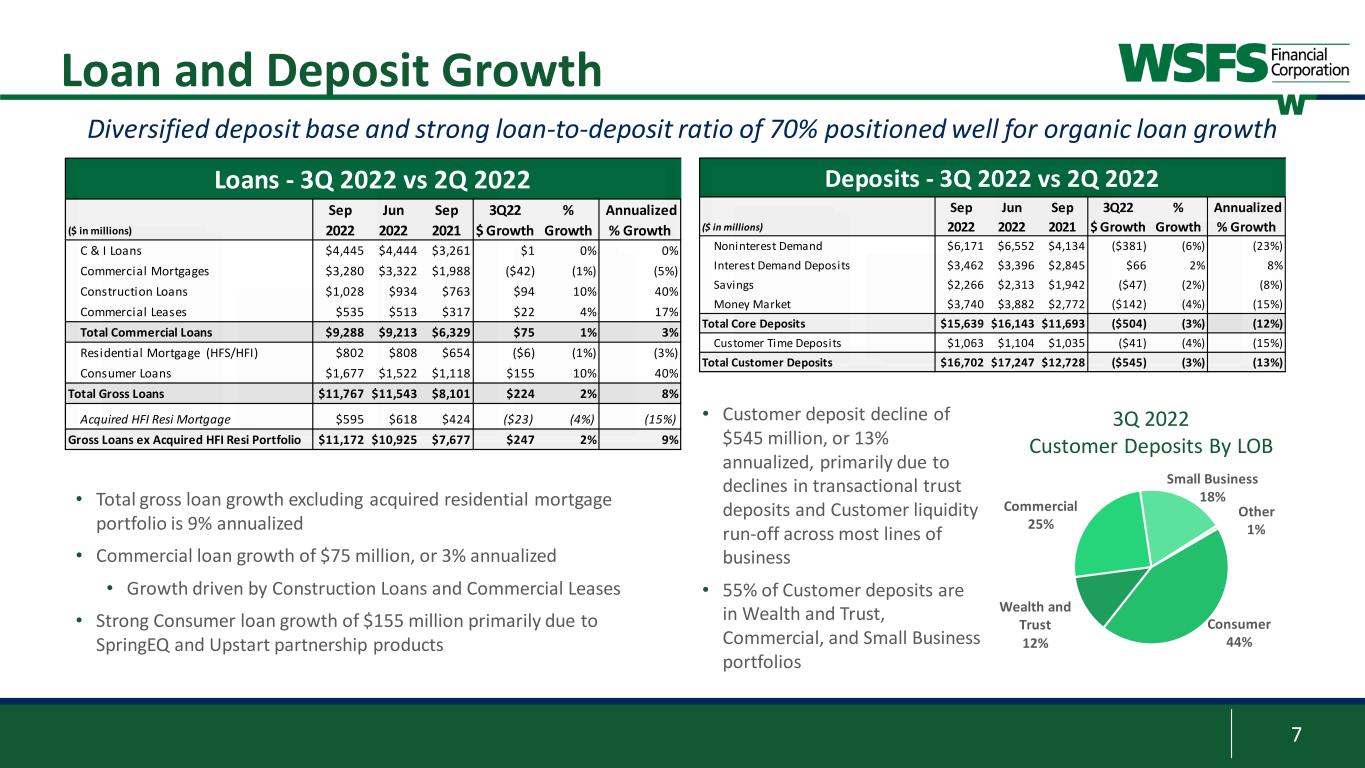

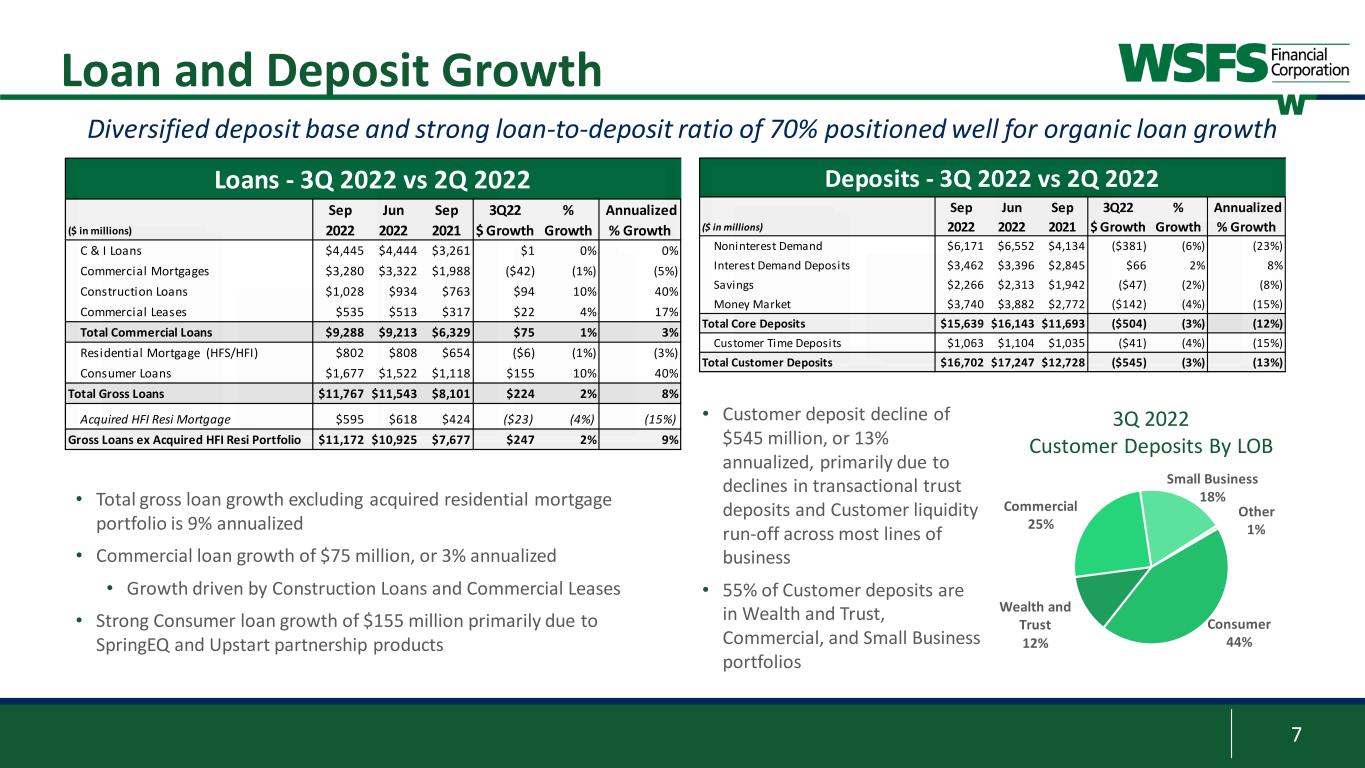

7 Loan and Deposit Growth • Customer deposit decline of $545 million, or 13% annualized, primarily due to declines in transactional trust deposits and Customer liquidity run-off across most lines of business • 55% of Customer deposits are in Wealth and Trust, Commercial, and Small Business portfolios • Total gross loan growth excluding acquired residential mortgage portfolio is 9% annualized • Commercial loan growth of $75 million, or 3% annualized • Growth driven by Construction Loans and Commercial Leases • Strong Consumer loan growth of $155 million primarily due to SpringEQ and Upstart partnership products Consumer 44% Wealth and Trust 12% Commercial 25% Small Business 18% Other 1% 3Q 2022 Customer Deposits By LOB Diversified deposit base and strong loan-to-deposit ratio of 70% positioned well for organic loan growth ($ in millions) Sep 2022 Jun 2022 Sep 2021 3Q22 $ Growth % Growth Annualized % Growth C & I Loans $4,445 $4,444 $3,261 $1 0% 0% Commercial Mortgages $3,280 $3,322 $1,988 ($42) (1%) (5%) Construction Loans $1,028 $934 $763 $94 10% 40% Commercial Leases $535 $513 $317 $22 4% 17% Total Commercial Loans $9,288 $9,213 $6,329 $75 1% 3% Residential Mortgage (HFS/HFI) $802 $808 $654 ($6) (1%) (3%) Consumer Loans $1,677 $1,522 $1,118 $155 10% 40% Total Gross Loans $11,767 $11,543 $8,101 $224 2% 8% Acquired HFI Resi Mortgage $595 $618 $424 ($23) (4%) (15%) Gross Loans ex Acquired HFI Resi Portfolio $11,172 $10,925 $7,677 $247 2% 9% Loans - 3Q 2022 vs 2Q 2022 ($ in millions) Sep 2022 Jun 2022 Sep 2021 3Q22 $ Growth % Growth Annualized % Growth Noninterest Demand $6,171 $6,552 $4,134 ($381) (6%) (23%) Interest Demand Deposits $3,462 $3,396 $2,845 $66 2% 8% Savings $2,266 $2,313 $1,942 ($47) (2%) (8%) Money Market $3,740 $3,882 $2,772 ($142) (4%) (15%) Total Core Deposits $15,639 $16,143 $11,693 ($504) (3%) (12%) Customer Time Deposits $1,063 $1,104 $1,035 ($41) (4%) (15%) Total Customer Deposits $16,702 $17,247 $12,728 ($545) (3%) (13%) Deposits - 3Q 2022 vs 2Q 2022

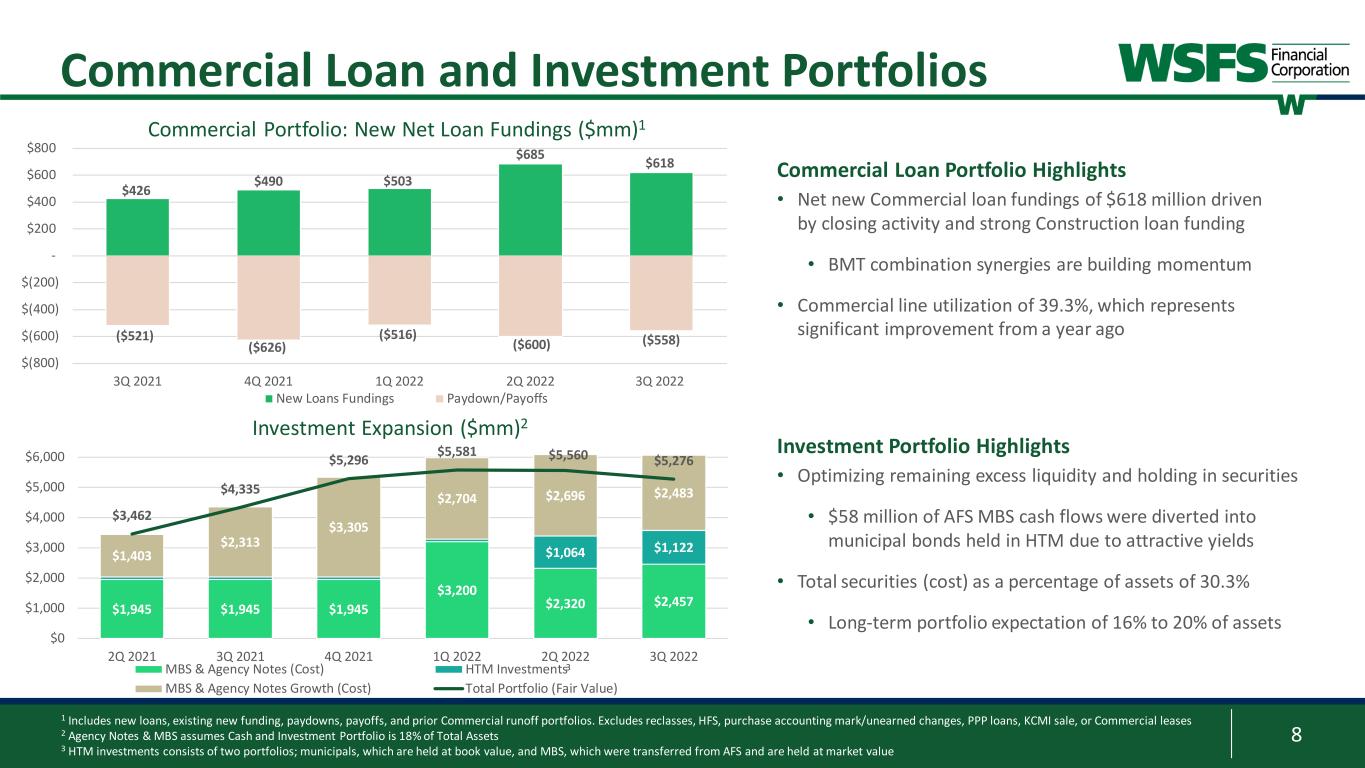

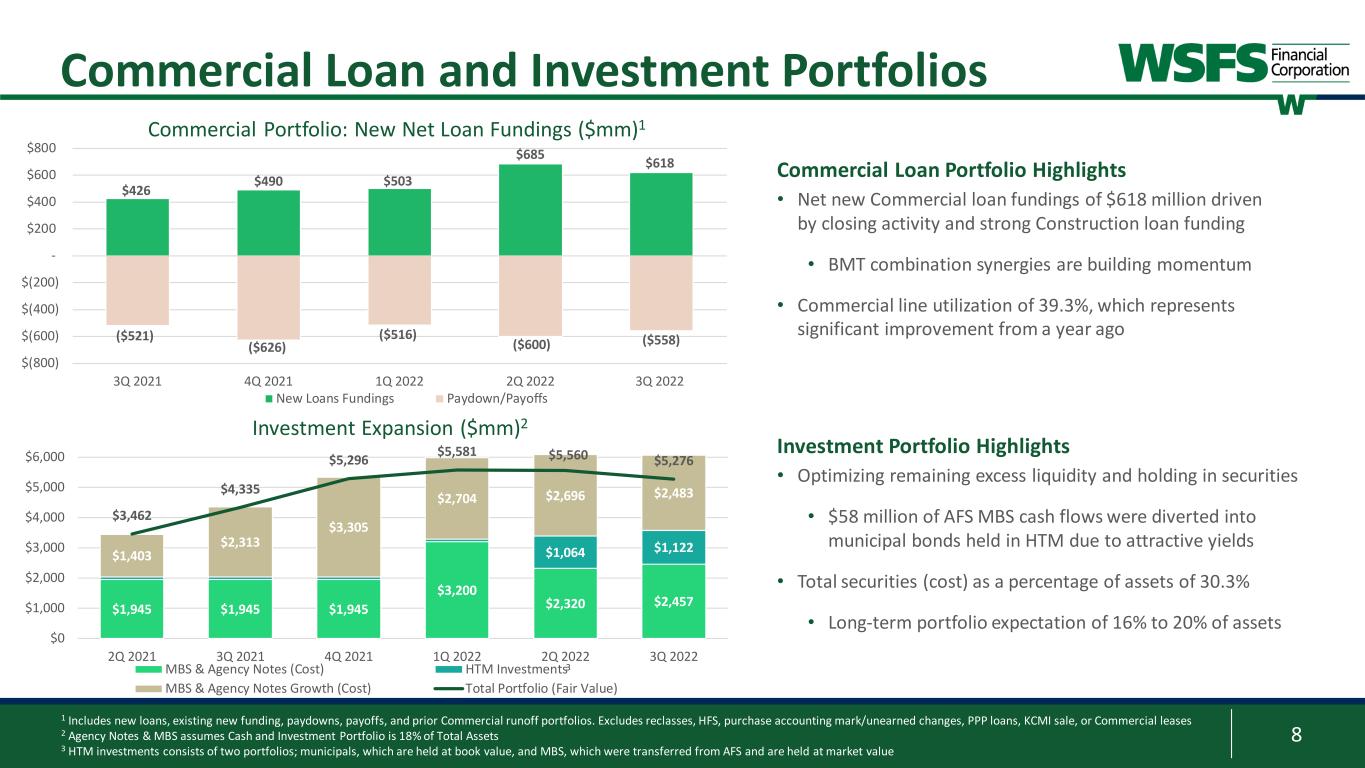

8 $426 $490 $503 $685 $618 ($521) ($626) ($516) ($600) ($558) $(800) $(600) $(400) $(200) - $200 $400 $600 $800 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Commercial Portfolio: New Net Loan Fundings ($mm)1 New Loans Fundings Paydown/Payoffs Commercial Loan and Investment Portfolios Investment Portfolio Highlights • Optimizing remaining excess liquidity and holding in securities • $58 million of AFS MBS cash flows were diverted into municipal bonds held in HTM due to attractive yields • Total securities (cost) as a percentage of assets of 30.3% • Long-term portfolio expectation of 16% to 20% of assets 1 Includes new loans, existing new funding, paydowns, payoffs, and prior Commercial runoff portfolios. Excludes reclasses, HFS, purchase accounting mark/unearned changes, PPP loans, KCMI sale, or Commercial leases 2 Agency Notes & MBS assumes Cash and Investment Portfolio is 18% of Total Assets 3 HTM investments consists of two portfolios; municipals, which are held at book value, and MBS, which were transferred from AFS and are held at market value Commercial Loan Portfolio Highlights • Net new Commercial loan fundings of $618 million driven by closing activity and strong Construction loan funding • BMT combination synergies are building momentum • Commercial line utilization of 39.3%, which represents significant improvement from a year ago $1,945 $1,945 $1,945 $3,200 $2,320 $2,457 $1,064 $1,122$1,403 $2,313 $3,305 $2,704 $2,696 $2,483 $3,462 $4,335 $5,296 $5,581 $5,560 $5,276 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Investment Expansion ($mm)2 MBS & Agency Notes (Cost) HTM Investments MBS & Agency Notes Growth (Cost) Total Portfolio (Fair Value) 3

9 0.10% 0.09% 0.07% 0.08% 0.15% 4.16% 4.23% 4.13% 4.40% 5.12% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 0.0% 0.2% 0.3% 0.5% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Lo an Y ie ld (% ) Cu st om er D ep os it Co st (% ) Total Deposit Cost Total Loans Ex PPP/PAA Yield 2.87% 2.91% 2.94% 3.29% 3.90%0.18% 0.19% 0.07% 0.11% 0.09% 2.00% 2.50% 3.00% 3.50% 4.00% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 NIM Ex PAA PAA Deposit Betas3 Net Interest Margin Trends Asset sensitive balance sheet and diversified low funding costs driving NIM expansion Average Deposit Cost and Loan Yield 1 Includes non-interest and interest-bearing; interest-bearing deposits include demand, money market, savings, and customer time deposits 2 Average total loans yield excludes PAA and PPP 3 Deposit betas are cumulative for the current cycle; Federal Funds Target rates are end-of-period value 21 3.05% 3.10% 3% 7% 0% 2% 4% 0.25% 0.25% 0.50% 1.75% 3.25% 0.0% 2.0% 4.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Fe de ra l F un ds T ar ge t R at e De po sit B et a Interest-bearing Dep Beta Total Dep Beta Fed Funds Target 3.01% 3.40% 3.99%

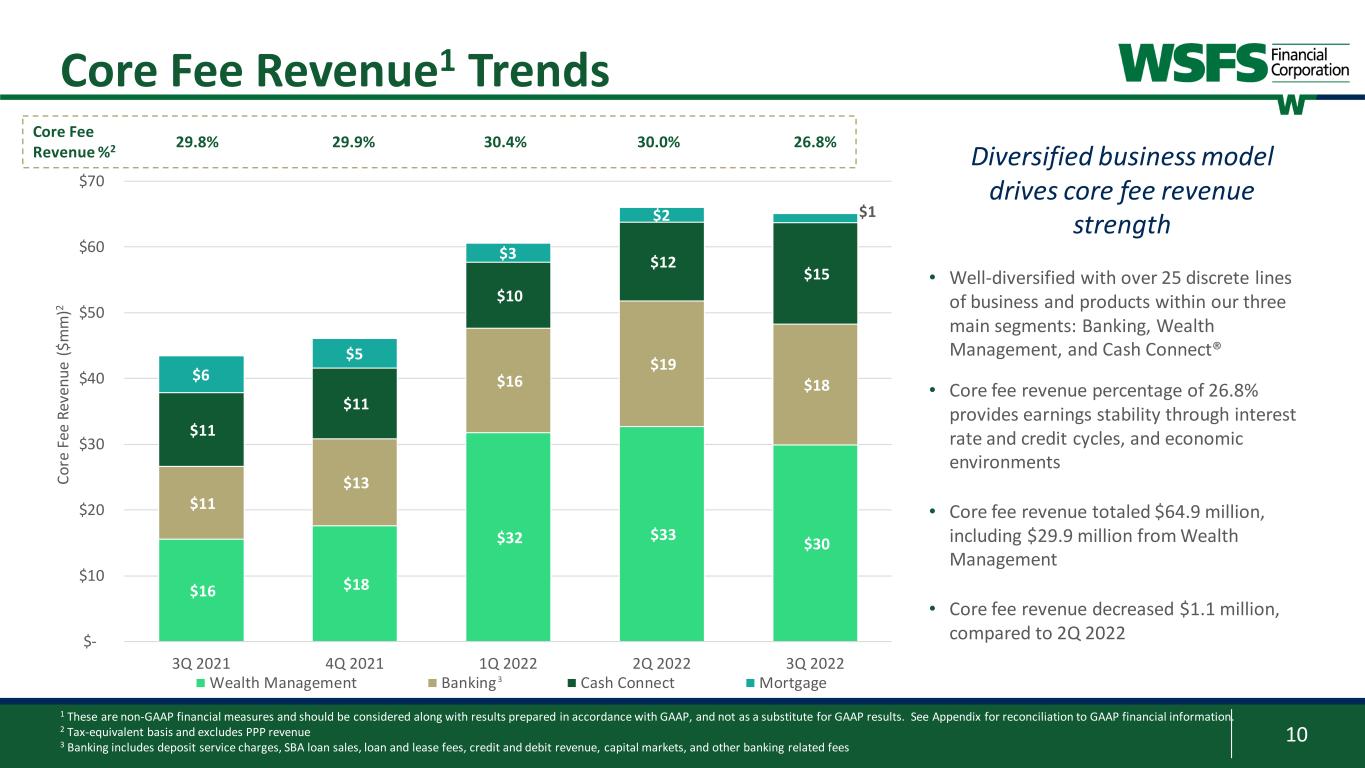

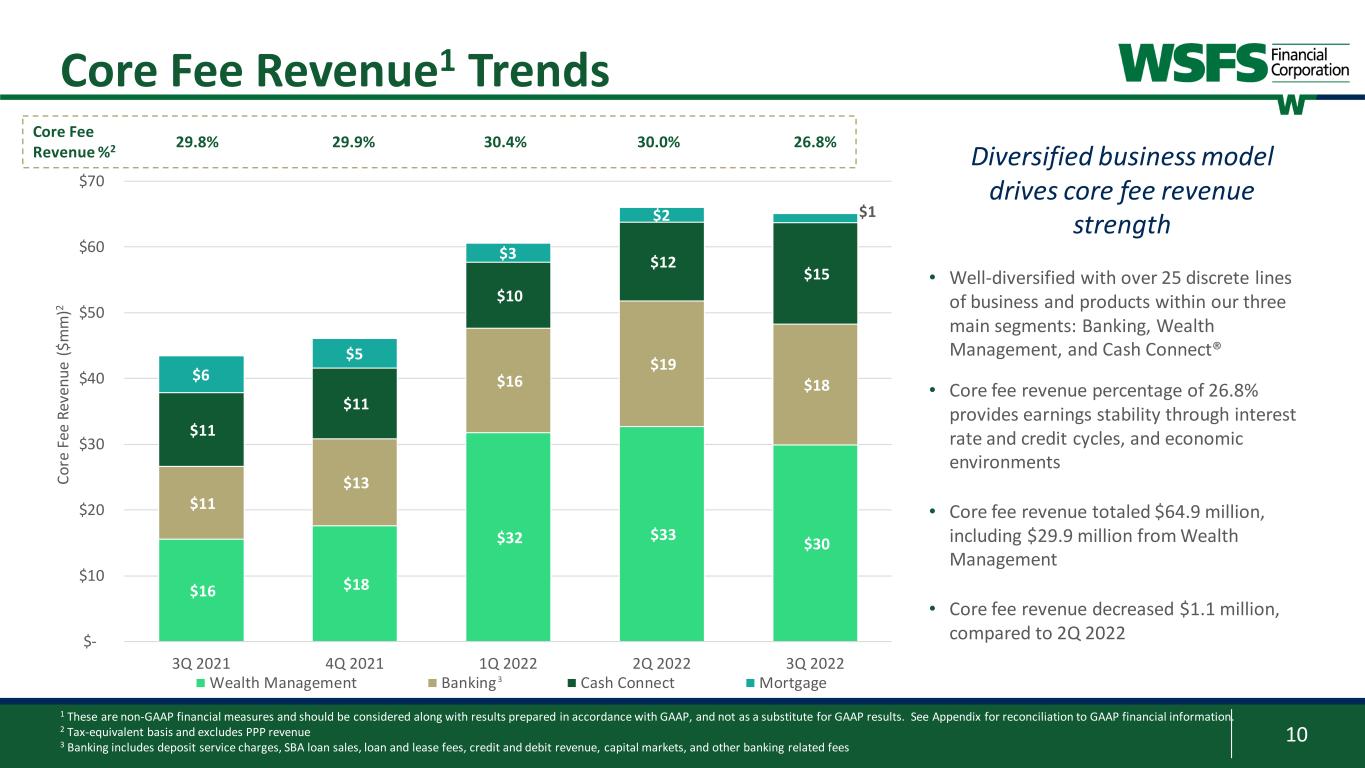

10 $16 $18 $32 $33 $30 $11 $13 $16 $19 $18 $11 $11 $10 $12 $15 $6 $5 $3 $2 $1 $- $10 $20 $30 $40 $50 $60 $70 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 Co re F ee R ev en ue ( $m m )2 Wealth Management Banking Cash Connect Mortgage 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Tax-equivalent basis and excludes PPP revenue 3 Banking includes deposit service charges, SBA loan sales, loan and lease fees, credit and debit revenue, capital markets, and other banking related fees • Well-diversified with over 25 discrete lines of business and products within our three main segments: Banking, Wealth Management, and Cash Connect® • Core fee revenue percentage of 26.8% provides earnings stability through interest rate and credit cycles, and economic environments • Core fee revenue totaled $64.9 million, including $29.9 million from Wealth Management • Core fee revenue decreased $1.1 million, compared to 2Q 2022 Core Fee Revenue1 Trends Diversified business model drives core fee revenue strength 3 Core Fee Revenue %2 29.8% 29.9% 30.4% 30.0% 26.8%

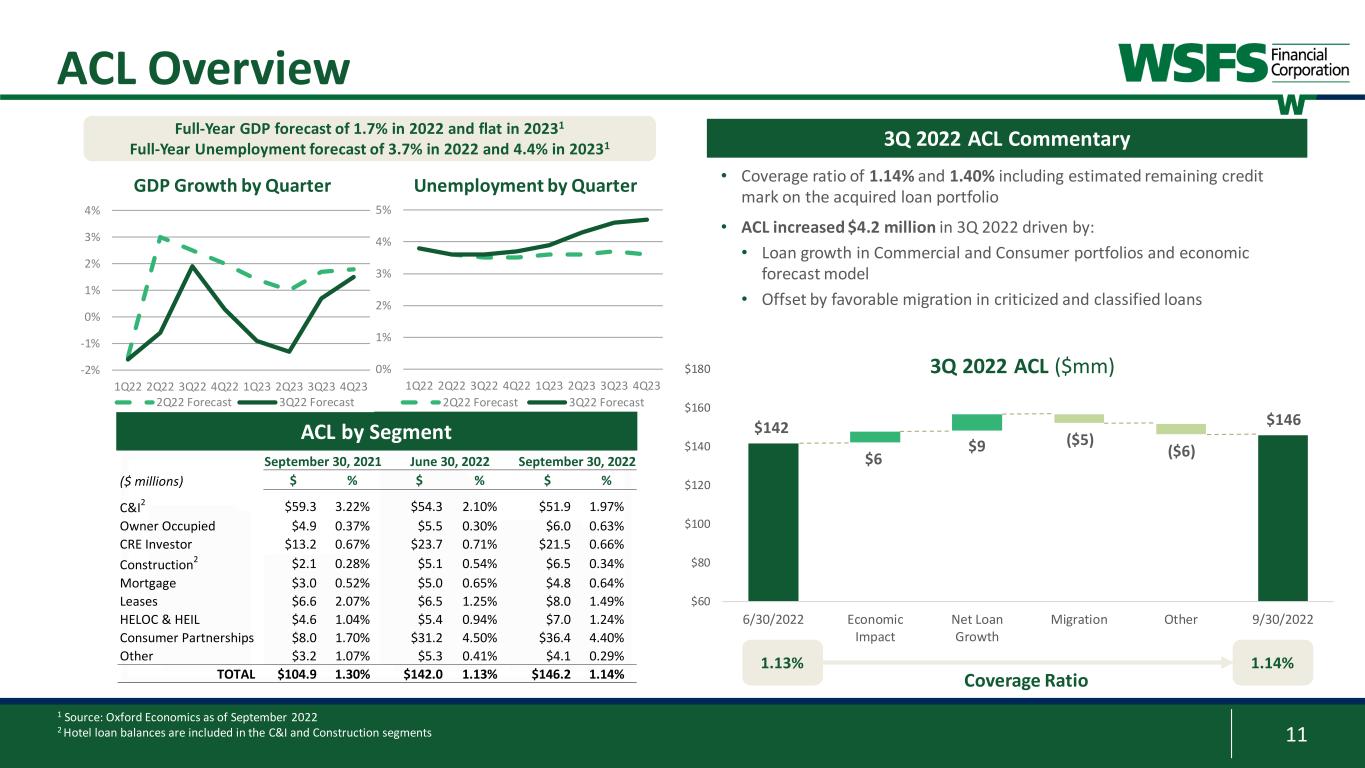

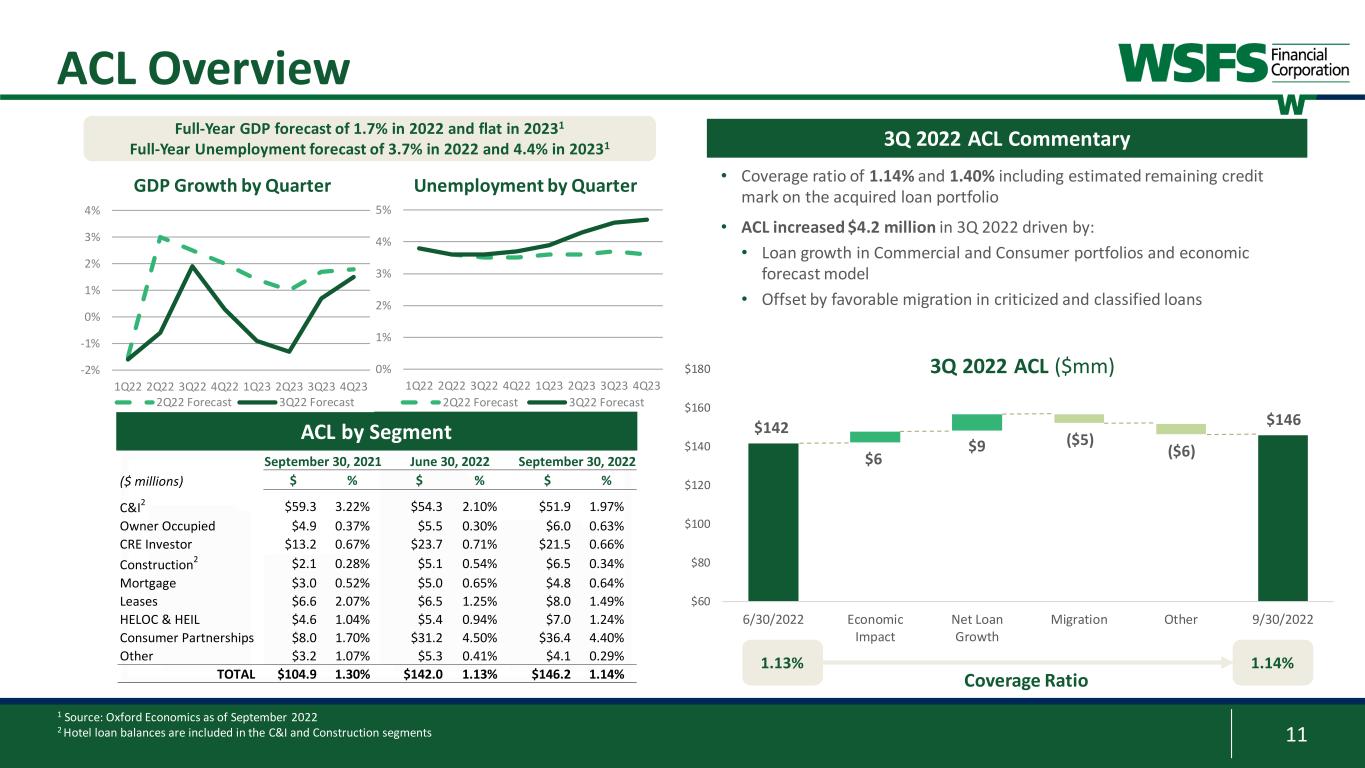

11 $60 $80 $100 $120 $140 $160 $180 6/30/2022 Economic Impact Net Loan Growth Migration Other 9/30/2022 0% 1% 2% 3% 4% 5% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 2Q22 Forecast 3Q22 Forecast Coverage Ratio 1 Source: Oxford Economics as of September 2022 2 Hotel loan balances are included in the C&I and Construction segments ACL Overview ACL by Segment Full-Year GDP forecast of 1.7% in 2022 and flat in 20231 Full-Year Unemployment forecast of 3.7% in 2022 and 4.4% in 20231 3Q 2022 ACL Commentary 1.13% 1.14% GDP Growth by Quarter Unemployment by Quarter • Coverage ratio of 1.14% and 1.40% including estimated remaining credit mark on the acquired loan portfolio • ACL increased $4.2 million in 3Q 2022 driven by: • Loan growth in Commercial and Consumer portfolios and economic forecast model • Offset by favorable migration in criticized and classified loans 3Q 2022 ACL ($mm)-2% -1% 0% 1% 2% 3% 4% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 2Q22 Forecast 3Q22 Forecast $6 $142 ($6) $146 ($5)$9 ($ millions) $ % $ % $ % C&I2 $59.3 3.22% $54.3 2.10% $51.9 1.97% Owner Occupied $4.9 0.37% $5.5 0.30% $6.0 0.63% CRE Investor $13.2 0.67% $23.7 0.71% $21.5 0.66% Construction2 $2.1 0.28% $5.1 0.54% $6.5 0.34% Mortgage $3.0 0.52% $5.0 0.65% $4.8 0.64% Leases $6.6 2.07% $6.5 1.25% $8.0 1.49% HELOC & HEIL $4.6 1.04% $5.4 0.94% $7.0 1.24% Consumer Partnerships $8.0 1.70% $31.2 4.50% $36.4 4.40% Other $3.2 1.07% $5.3 0.41% $4.1 0.29% TOTAL $104.9 1.30% $142.0 1.13% $146.2 1.14% September 30, 2021 June 30, 2022 September 30, 2022

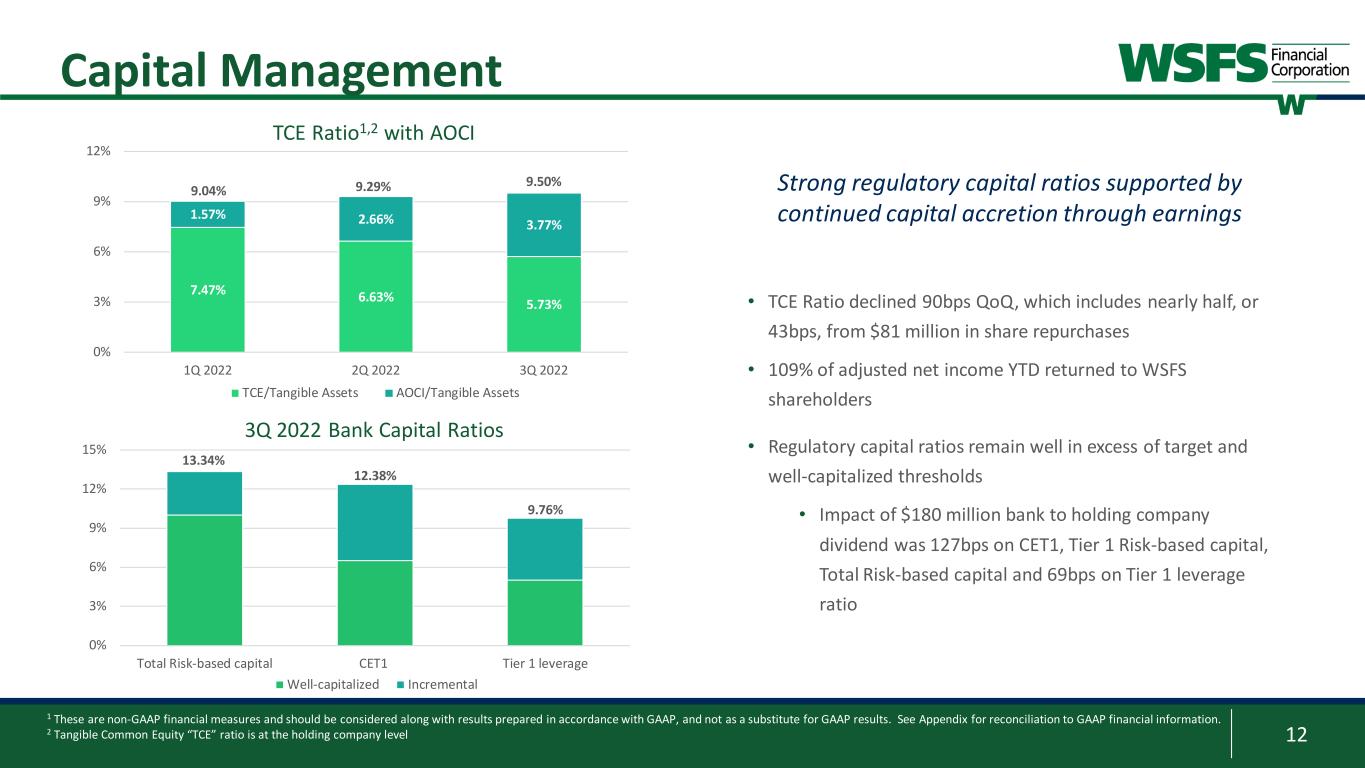

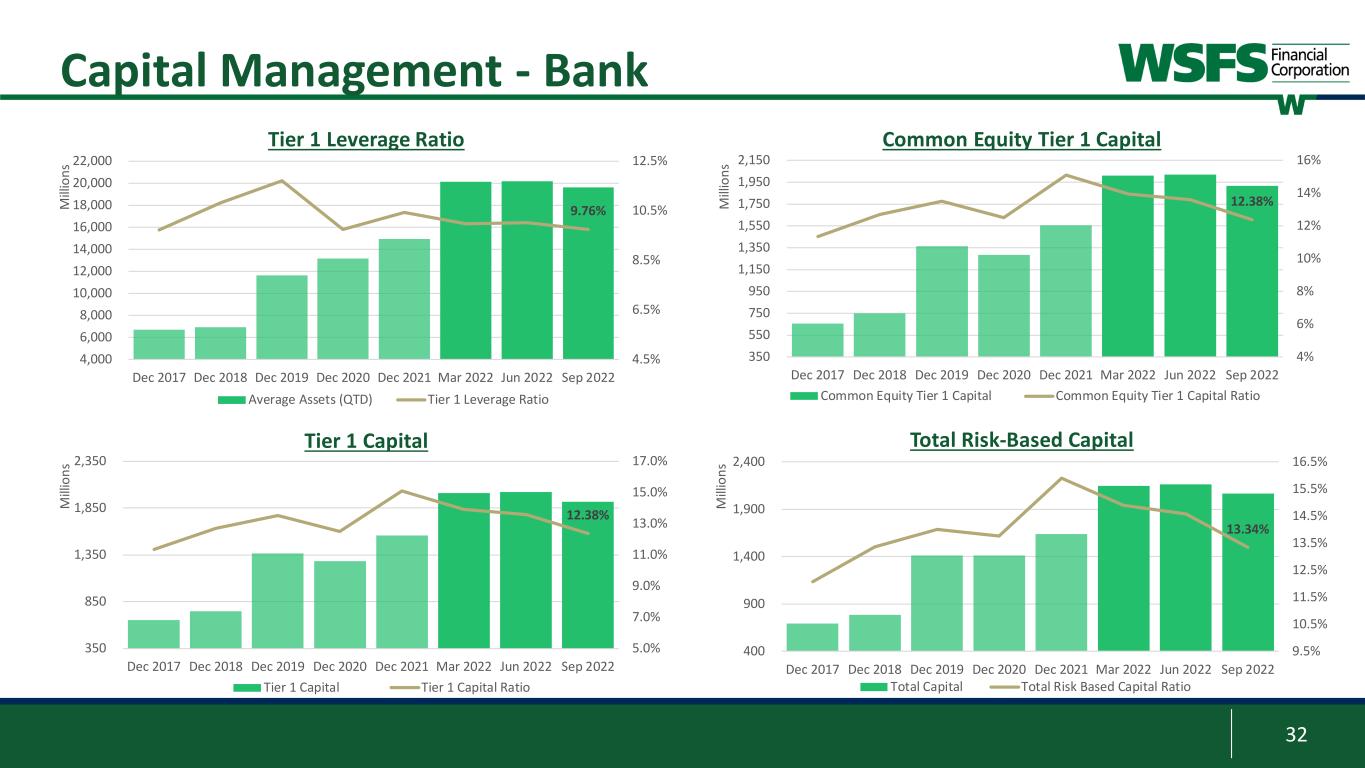

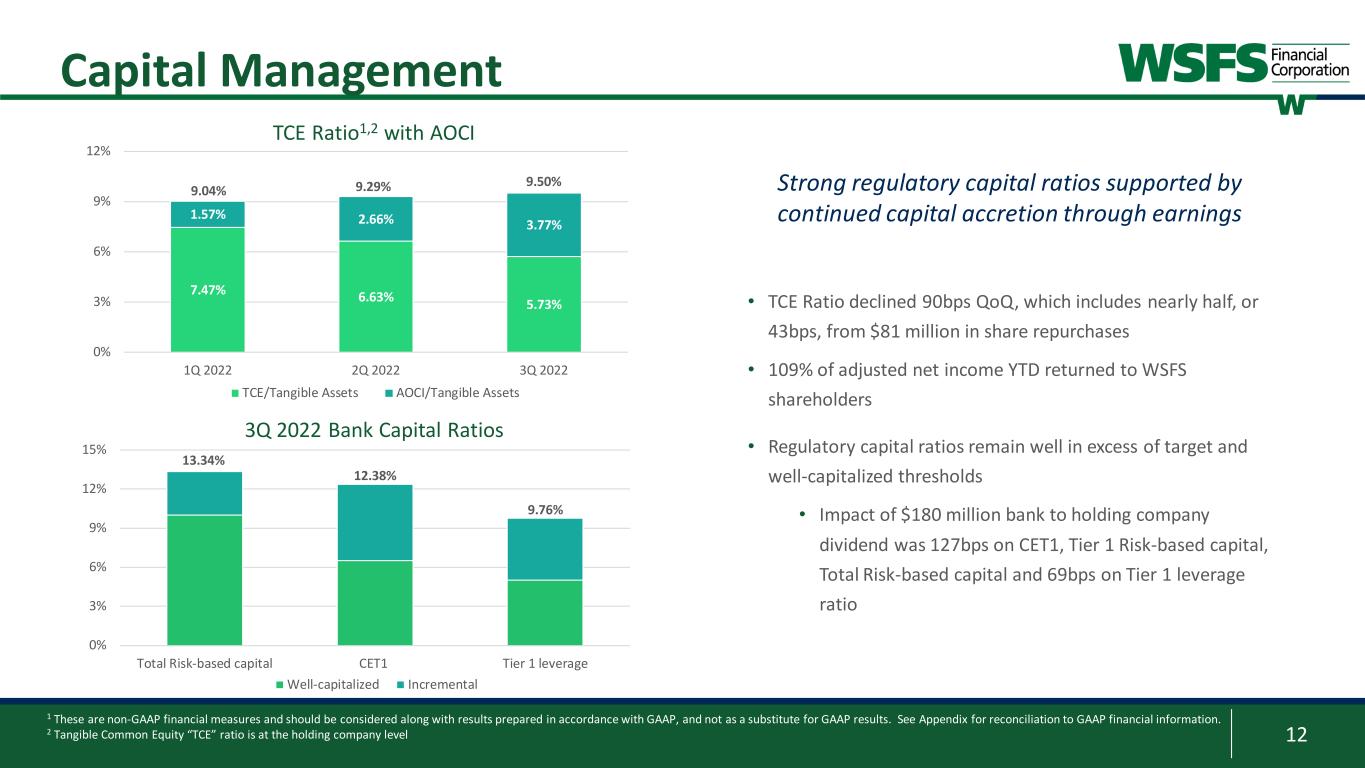

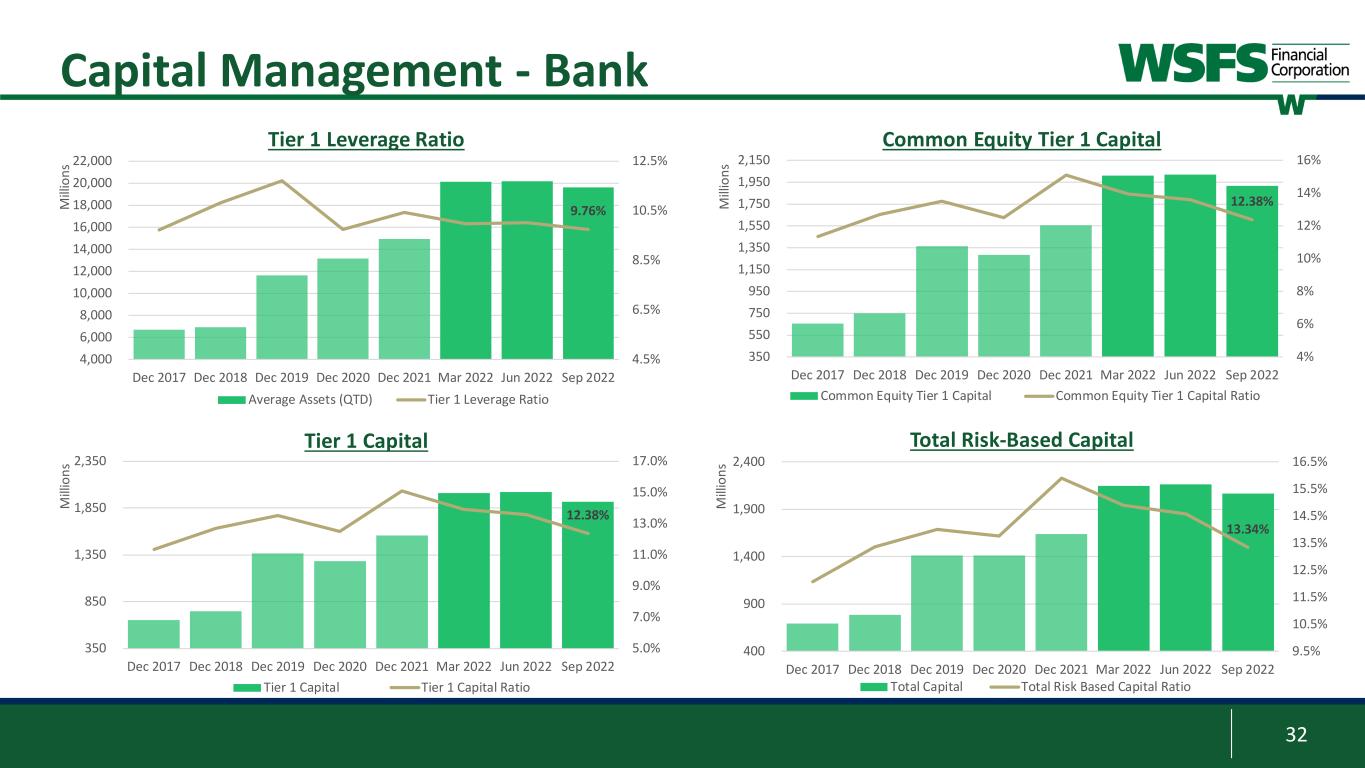

12 Capital Management TCE Ratio1,2 with AOCI 3Q 2022 Bank Capital Ratios 7.47% 6.63% 5.73% 1.57% 2.66% 3.77% 9.04% 9.29% 9.50% 0% 3% 6% 9% 12% 1Q 2022 2Q 2022 3Q 2022 TCE/Tangible Assets AOCI/Tangible Assets • TCE Ratio declined 90bps QoQ, which includes nearly half, or 43bps, from $81 million in share repurchases • 109% of adjusted net income YTD returned to WSFS shareholders • Regulatory capital ratios remain well in excess of target and well-capitalized thresholds • Impact of $180 million bank to holding company dividend was 127bps on CET1, Tier 1 Risk-based capital, Total Risk-based capital and 69bps on Tier 1 leverage ratio 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Tangible Common Equity “TCE” ratio is at the holding company level 13.34% 12.38% 9.76% 0% 3% 6% 9% 12% 15% Total Risk-based capital CET1 Tier 1 leverage Well-capitalized Incremental Strong regulatory capital ratios supported by continued capital accretion through earnings

13 Franchise and Markets

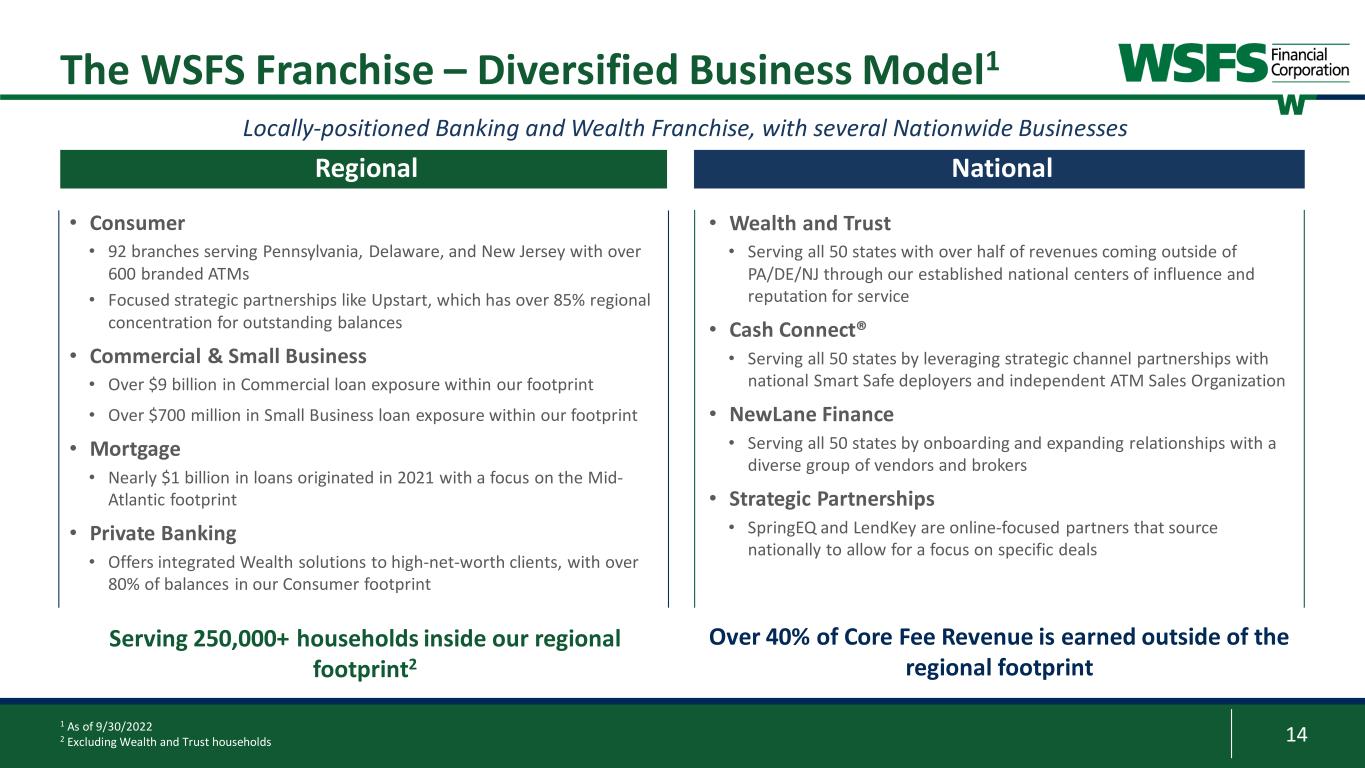

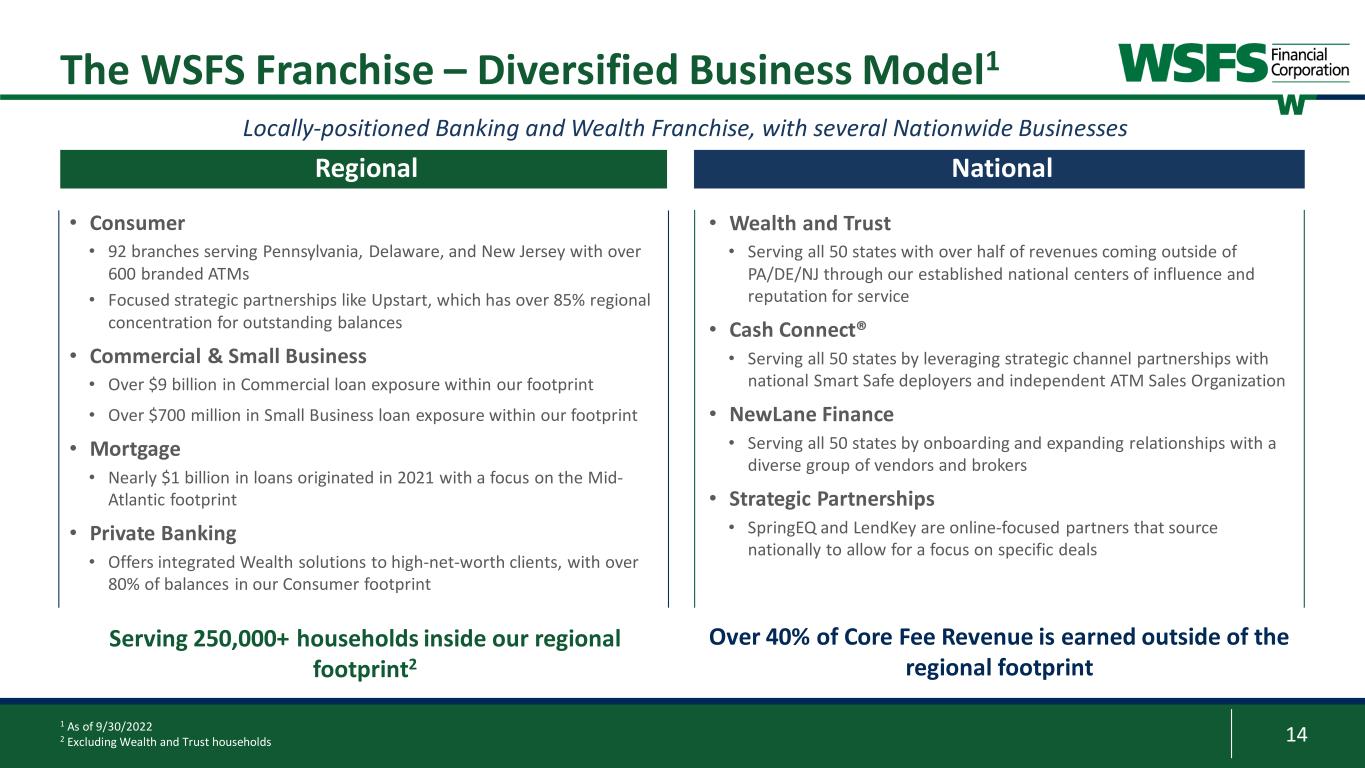

14 • Consumer • 92 branches serving Pennsylvania, Delaware, and New Jersey with over 600 branded ATMs • Focused strategic partnerships like Upstart, which has over 85% regional concentration for outstanding balances • Commercial & Small Business • Over $9 billion in Commercial loan exposure within our footprint • Over $700 million in Small Business loan exposure within our footprint • Mortgage • Nearly $1 billion in loans originated in 2021 with a focus on the Mid- Atlantic footprint • Private Banking • Offers integrated Wealth solutions to high-net-worth clients, with over 80% of balances in our Consumer footprint • Wealth and Trust • Serving all 50 states with over half of revenues coming outside of PA/DE/NJ through our established national centers of influence and reputation for service • Cash Connect® • Serving all 50 states by leveraging strategic channel partnerships with national Smart Safe deployers and independent ATM Sales Organization • NewLane Finance • Serving all 50 states by onboarding and expanding relationships with a diverse group of vendors and brokers • Strategic Partnerships • SpringEQ and LendKey are online-focused partners that source nationally to allow for a focus on specific deals Regional National The WSFS Franchise – Diversified Business Model1 Locally-positioned Banking and Wealth Franchise, with several Nationwide Businesses 1 As of 9/30/2022 2 Excluding Wealth and Trust households Over 40% of Core Fee Revenue is earned outside of the regional footprint Serving 250,000+ households inside our regional footprint2

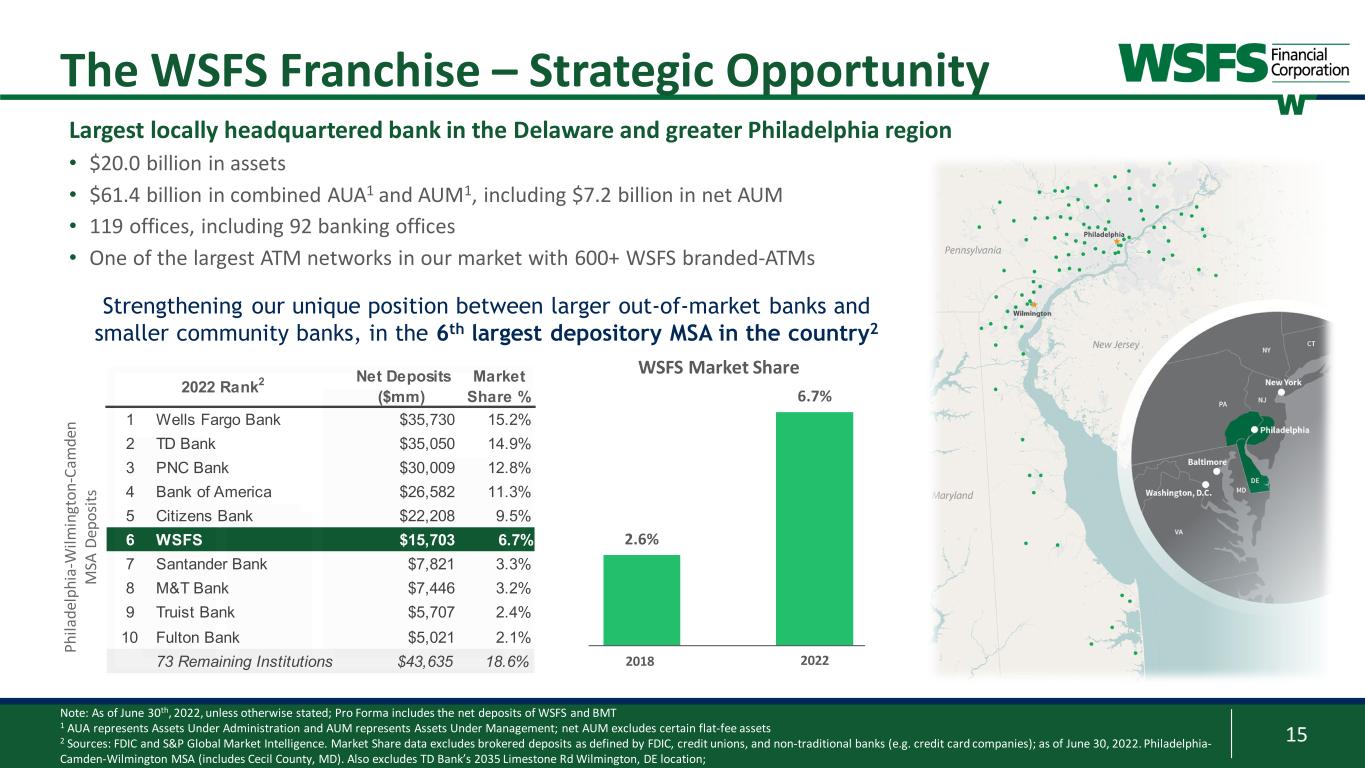

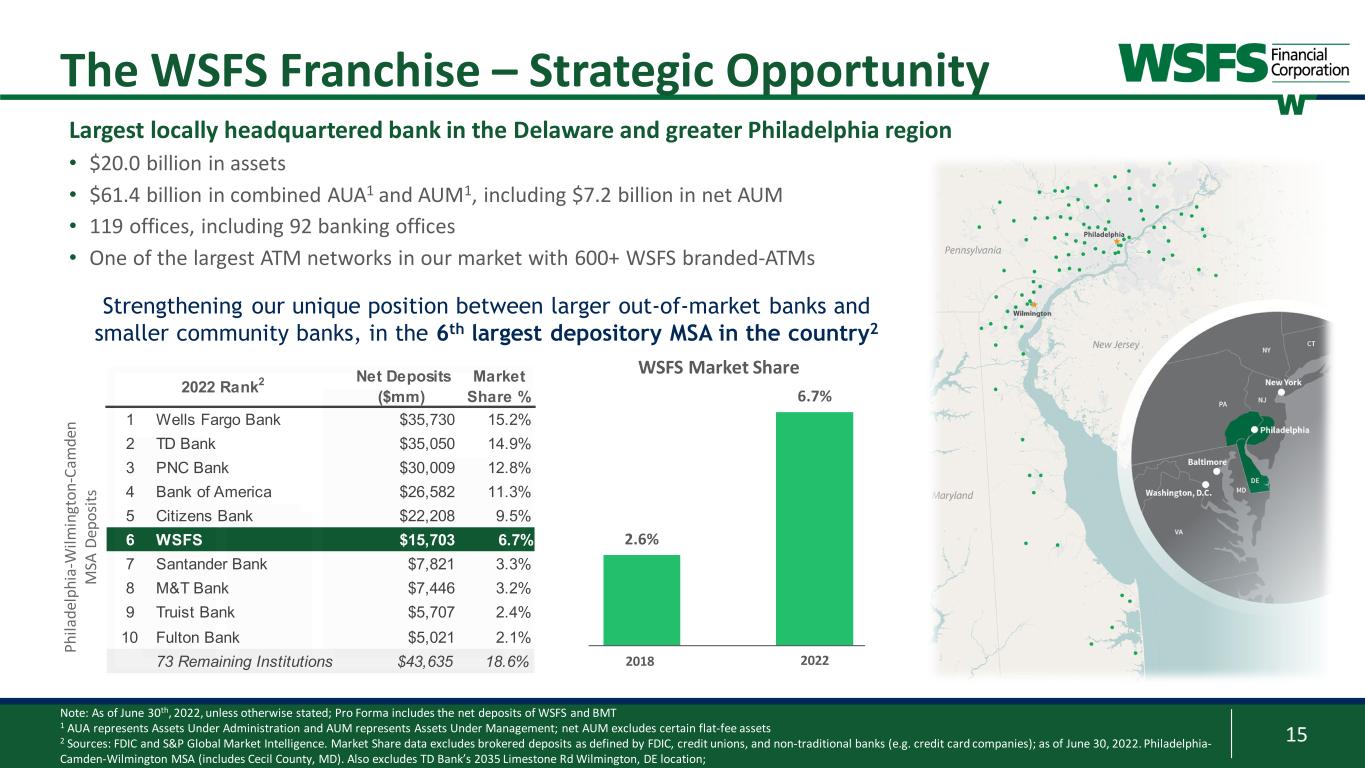

15 2.6% 6.7% WSFS Market Share 2018 2022 Note: As of June 30th, 2022, unless otherwise stated; Pro Forma includes the net deposits of WSFS and BMT 1 AUA represents Assets Under Administration and AUM represents Assets Under Management; net AUM excludes certain flat-fee assets 2 Sources: FDIC and S&P Global Market Intelligence. Market Share data excludes brokered deposits as defined by FDIC, credit unions, and non-traditional banks (e.g. credit card companies); as of June 30, 2022. Philadelphia- Camden-Wilmington MSA (includes Cecil County, MD). Also excludes TD Bank’s 2035 Limestone Rd Wilmington, DE location; The WSFS Franchise – Strategic Opportunity Strengthening our unique position between larger out-of-market banks and smaller community banks, in the 6th largest depository MSA in the country2 Largest locally headquartered bank in the Delaware and greater Philadelphia region • $20.0 billion in assets • $61.4 billion in combined AUA1 and AUM1, including $7.2 billion in net AUM • 119 offices, including 92 banking offices • One of the largest ATM networks in our market with 600+ WSFS branded-ATMs Net Deposits ($mm) Market Share % 1 Wells Fargo Bank $35,730 15.2% 2 TD Bank $35,050 14.9% 3 PNC Bank $30,009 12.8% 4 Bank of America $26,582 11.3% 5 Citizens Bank $22,208 9.5% 6 WSFS $15,703 6.7% 7 Santander Bank $7,821 3.3% 8 M&T Bank $7,446 3.2% 9 Truist Bank $5,707 2.4% 10 Fulton Bank $5,021 2.1% 73 Remaining Institutions $43,635 18.6% 2022 Rank2 Ph ila de lp hi a- W ilm in gt on -C am de n M SA D ep os its

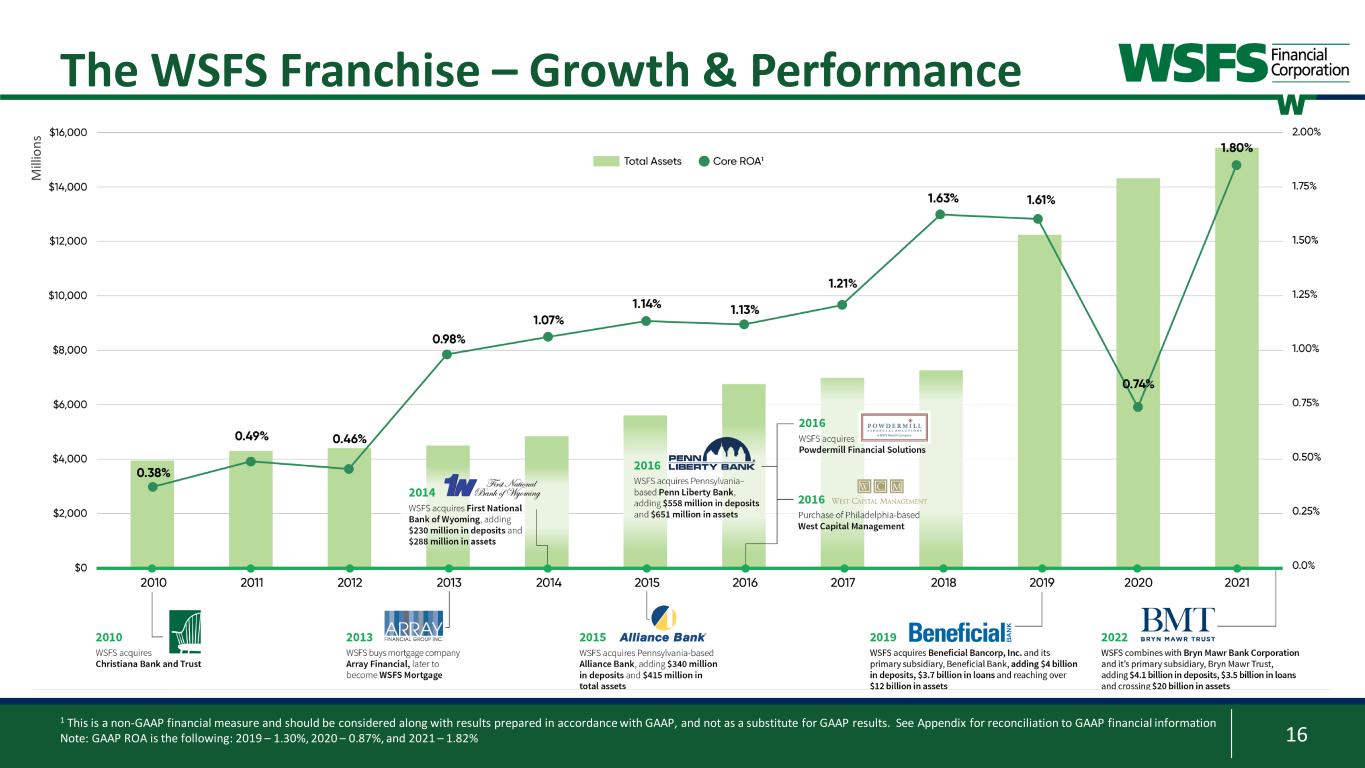

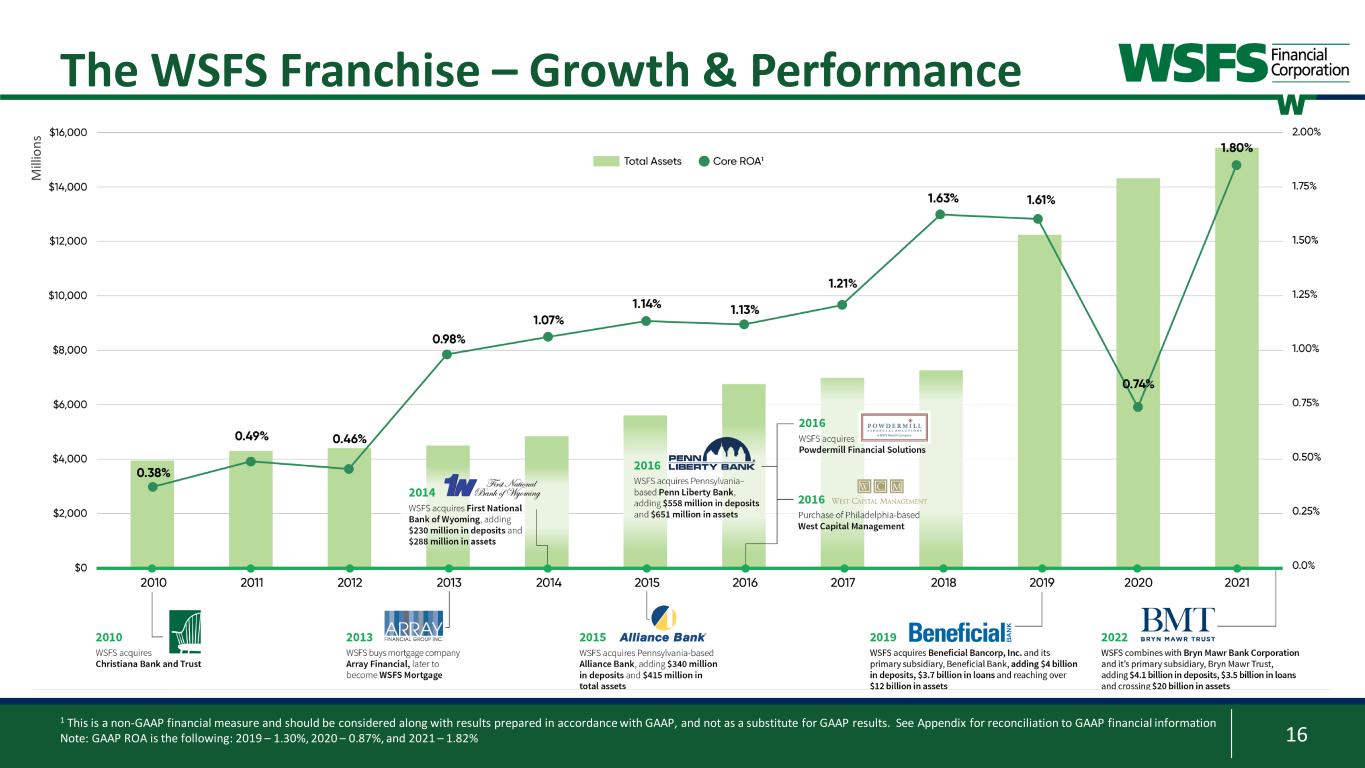

16 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information Note: GAAP ROA is the following: 2019 – 1.30%, 2020 – 0.87%, and 2021 – 1.82% The WSFS Franchise – Growth & Performance M ill io ns

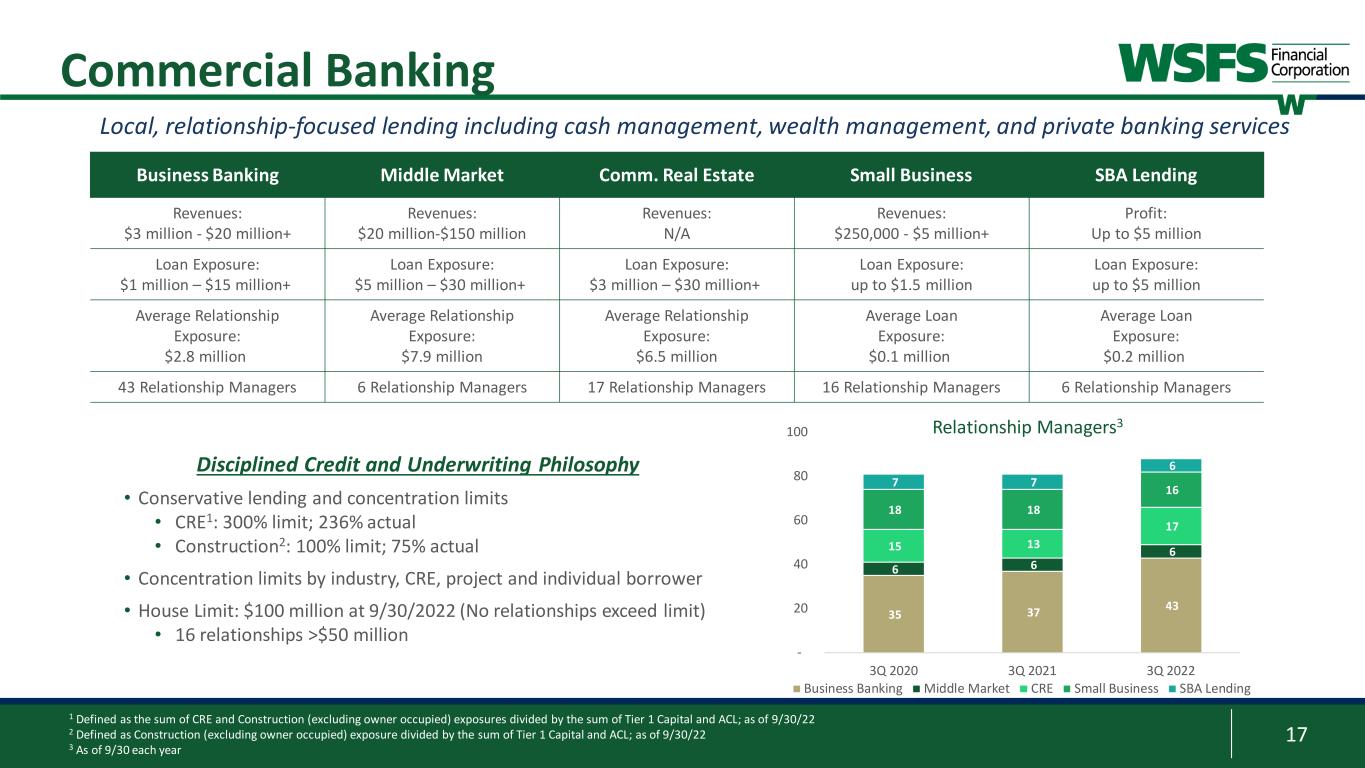

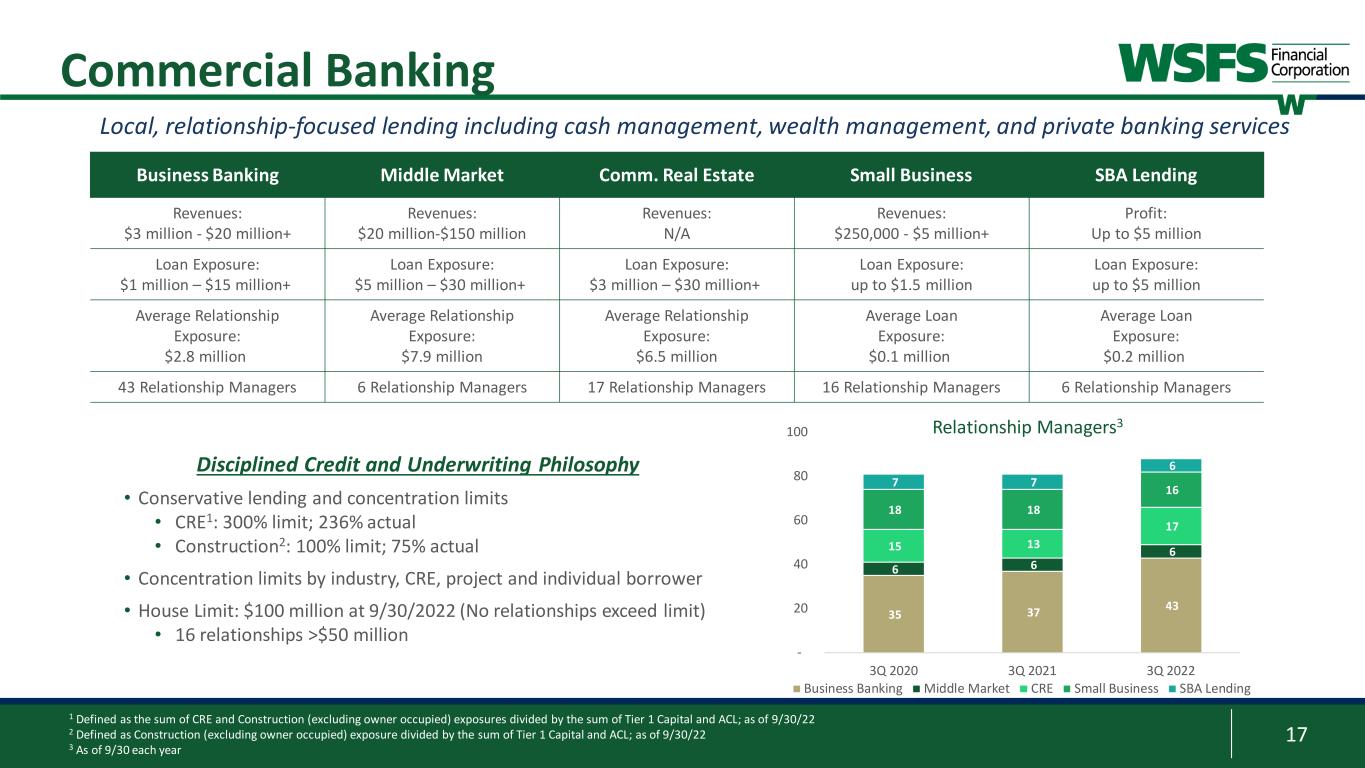

17 35 37 43 6 6 6 15 13 17 18 18 16 7 7 6 - 20 40 60 80 100 3Q 2020 3Q 2021 3Q 2022 Relationship Managers3 Business Banking Middle Market CRE Small Business SBA Lending Disciplined Credit and Underwriting Philosophy • Conservative lending and concentration limits • CRE1: 300% limit; 236% actual • Construction2: 100% limit; 75% actual • Concentration limits by industry, CRE, project and individual borrower • House Limit: $100 million at 9/30/2022 (No relationships exceed limit) • 16 relationships >$50 million Business Banking Middle Market Comm. Real Estate Small Business SBA Lending Revenues: $3 million - $20 million+ Revenues: $20 million-$150 million Revenues: N/A Revenues: $250,000 - $5 million+ Profit: Up to $5 million Loan Exposure: $1 million – $15 million+ Loan Exposure: $5 million – $30 million+ Loan Exposure: $3 million – $30 million+ Loan Exposure: up to $1.5 million Loan Exposure: up to $5 million Average Relationship Exposure: $2.8 million Average Relationship Exposure: $7.9 million Average Relationship Exposure: $6.5 million Average Loan Exposure: $0.1 million Average Loan Exposure: $0.2 million 43 Relationship Managers 6 Relationship Managers 17 Relationship Managers 16 Relationship Managers 6 Relationship Managers Local, relationship-focused lending including cash management, wealth management, and private banking services 1 Defined as the sum of CRE and Construction (excluding owner occupied) exposures divided by the sum of Tier 1 Capital and ACL; as of 9/30/22 2 Defined as Construction (excluding owner occupied) exposure divided by the sum of Tier 1 Capital and ACL; as of 9/30/22 3 As of 9/30 each year Commercial Banking

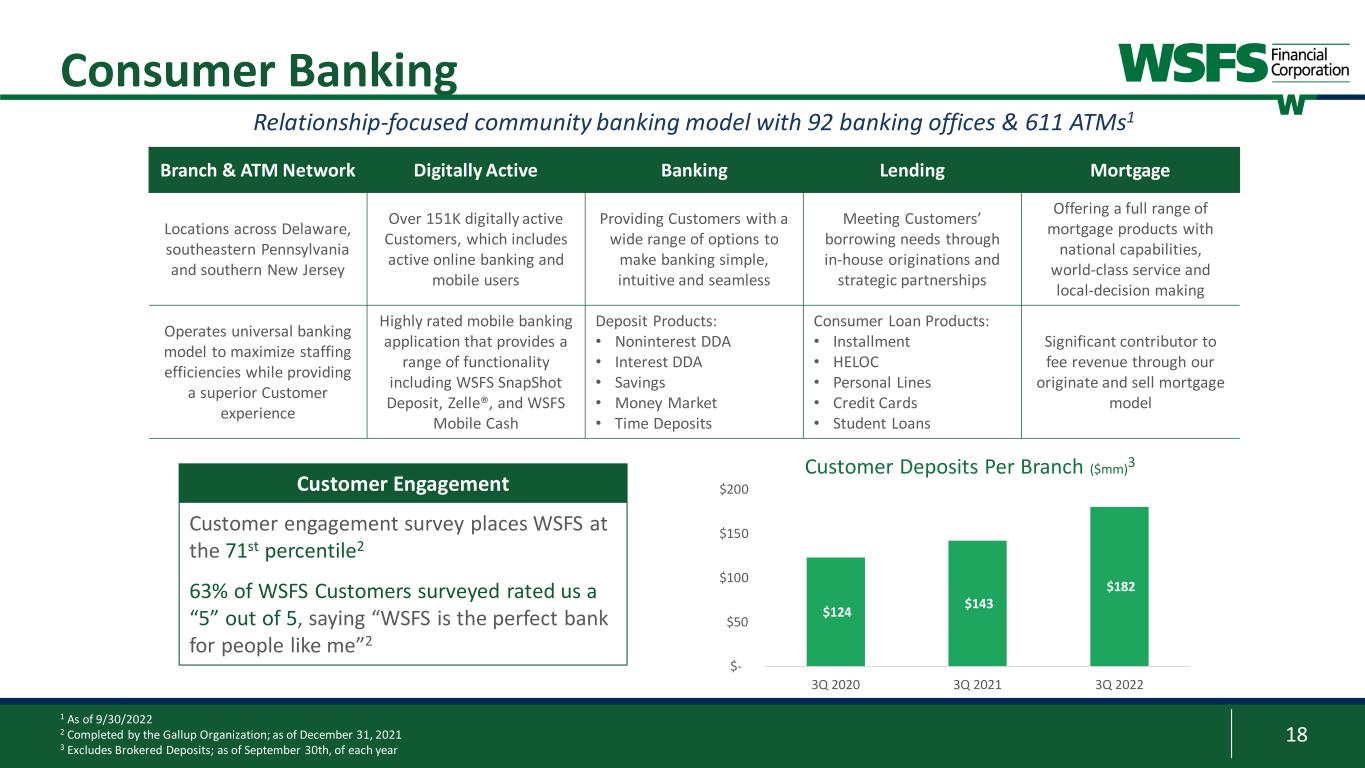

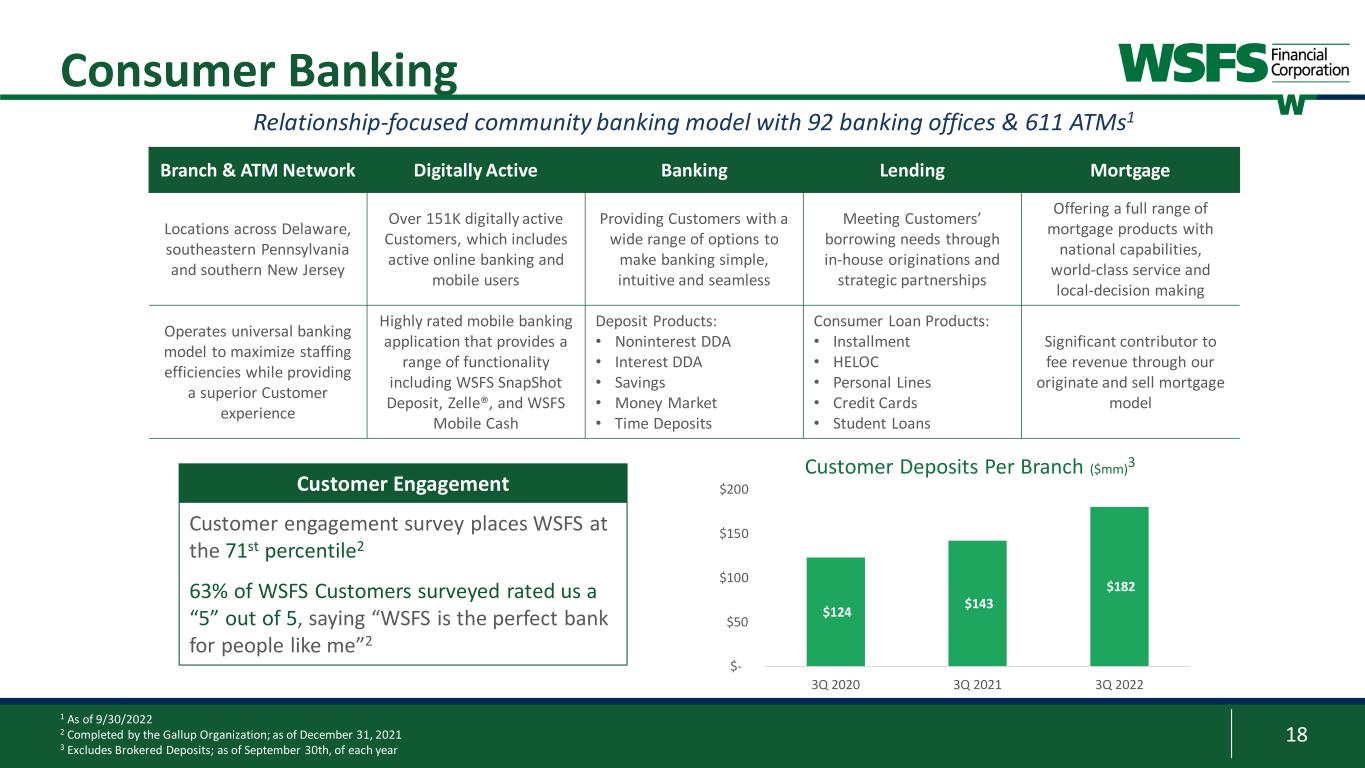

18 Branch & ATM Network Digitally Active Banking Lending Mortgage Locations across Delaware, southeastern Pennsylvania and southern New Jersey Over 151K digitally active Customers, which includes active online banking and mobile users Providing Customers with a wide range of options to make banking simple, intuitive and seamless Meeting Customers’ borrowing needs through in-house originations and strategic partnerships Offering a full range of mortgage products with national capabilities, world-class service and local-decision making Operates universal banking model to maximize staffing efficiencies while providing a superior Customer experience Highly rated mobile banking application that provides a range of functionality including WSFS SnapShot Deposit, Zelle®, and WSFS Mobile Cash Deposit Products: • Noninterest DDA • Interest DDA • Savings • Money Market • Time Deposits Consumer Loan Products: • Installment • HELOC • Personal Lines • Credit Cards • Student Loans Significant contributor to fee revenue through our originate and sell mortgage model 1 As of 9/30/2022 2 Completed by the Gallup Organization; as of December 31, 2021 3 Excludes Brokered Deposits; as of September 30th, of each year Relationship-focused community banking model with 92 banking offices & 611 ATMs1 Consumer Banking Customer engagement survey places WSFS at the 71st percentile2 63% of WSFS Customers surveyed rated us a “5” out of 5, saying “WSFS is the perfect bank for people like me”2 Customer Engagement Customer Deposits Per Branch ($mm)3 $124 $143 $182 $- $50 $100 $150 $200 3Q 2020 3Q 2021 3Q 2022

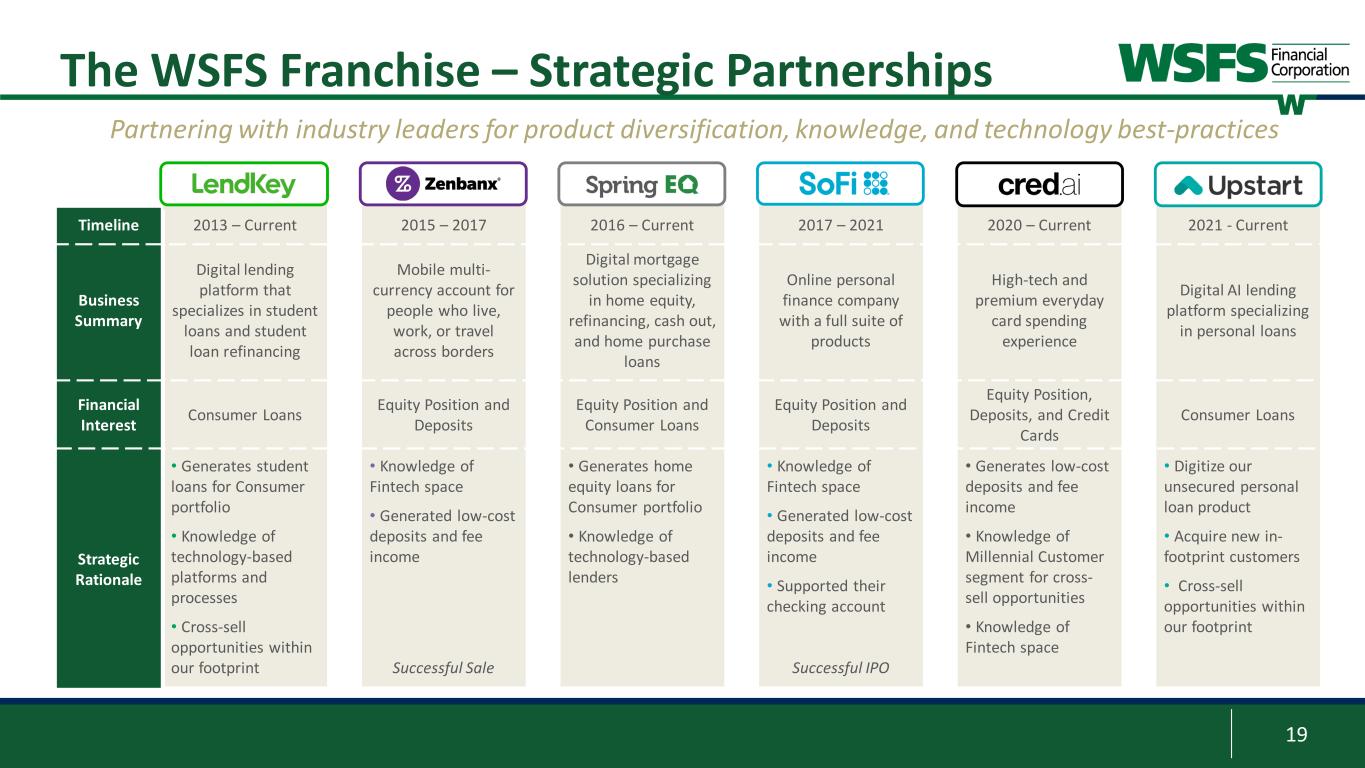

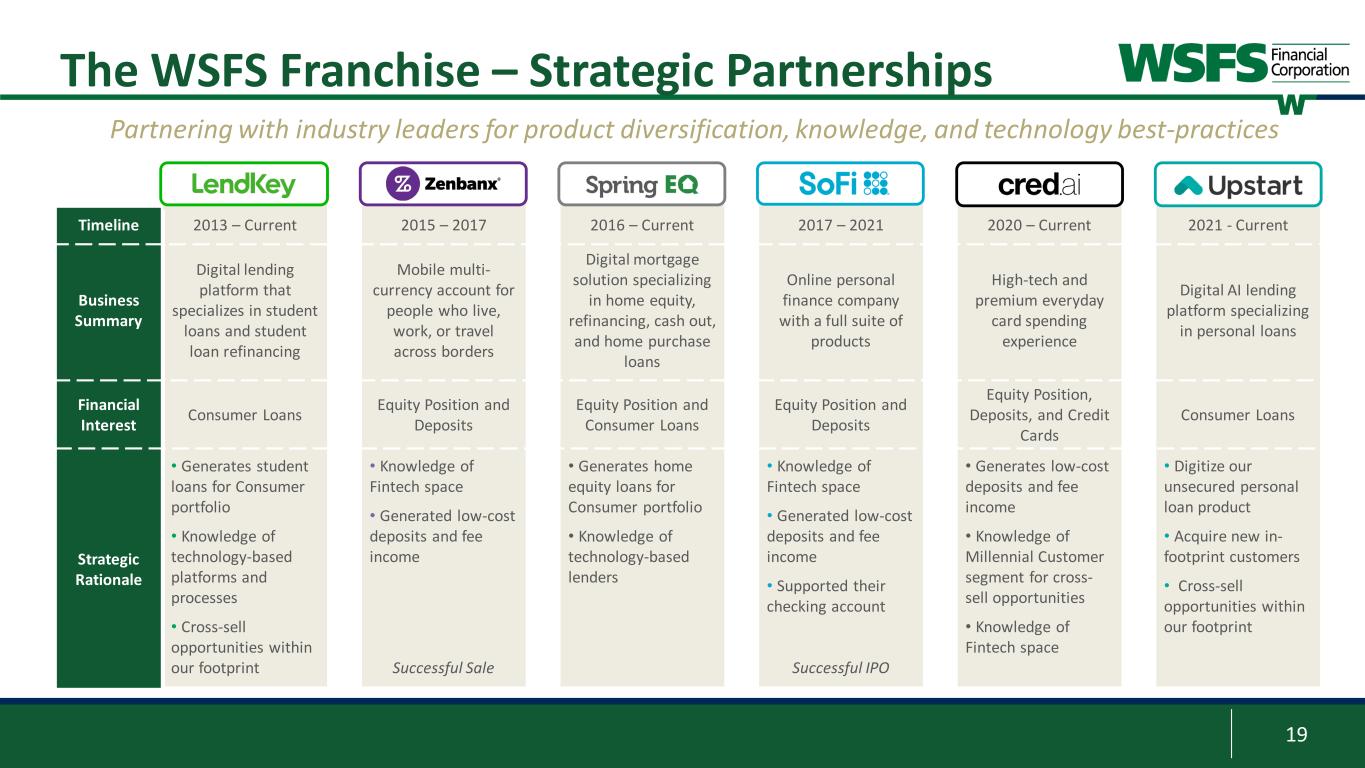

19 Timeline 2013 – Current 2015 – 2017 2016 – Current 2017 – 2021 2020 – Current 2021 - Current Business Summary Digital lending platform that specializes in student loans and student loan refinancing Mobile multi- currency account for people who live, work, or travel across borders Digital mortgage solution specializing in home equity, refinancing, cash out, and home purchase loans Online personal finance company with a full suite of products High-tech and premium everyday card spending experience Digital AI lending platform specializing in personal loans Financial Interest Consumer Loans Equity Position and Deposits Equity Position and Consumer Loans Equity Position and Deposits Equity Position, Deposits, and Credit Cards Consumer Loans Strategic Rationale • Generates student loans for Consumer portfolio • Knowledge of technology-based platforms and processes • Cross-sell opportunities within our footprint • Knowledge of Fintech space • Generated low-cost deposits and fee income Successful Sale • Generates home equity loans for Consumer portfolio • Knowledge of technology-based lenders • Knowledge of Fintech space • Generated low-cost deposits and fee income • Supported their checking account Successful IPO • Generates low-cost deposits and fee income • Knowledge of Millennial Customer segment for cross- sell opportunities • Knowledge of Fintech space • Digitize our unsecured personal loan product • Acquire new in- footprint customers • Cross-sell opportunities within our footprint Partnering with industry leaders for product diversification, knowledge, and technology best-practices The WSFS Franchise – Strategic Partnerships

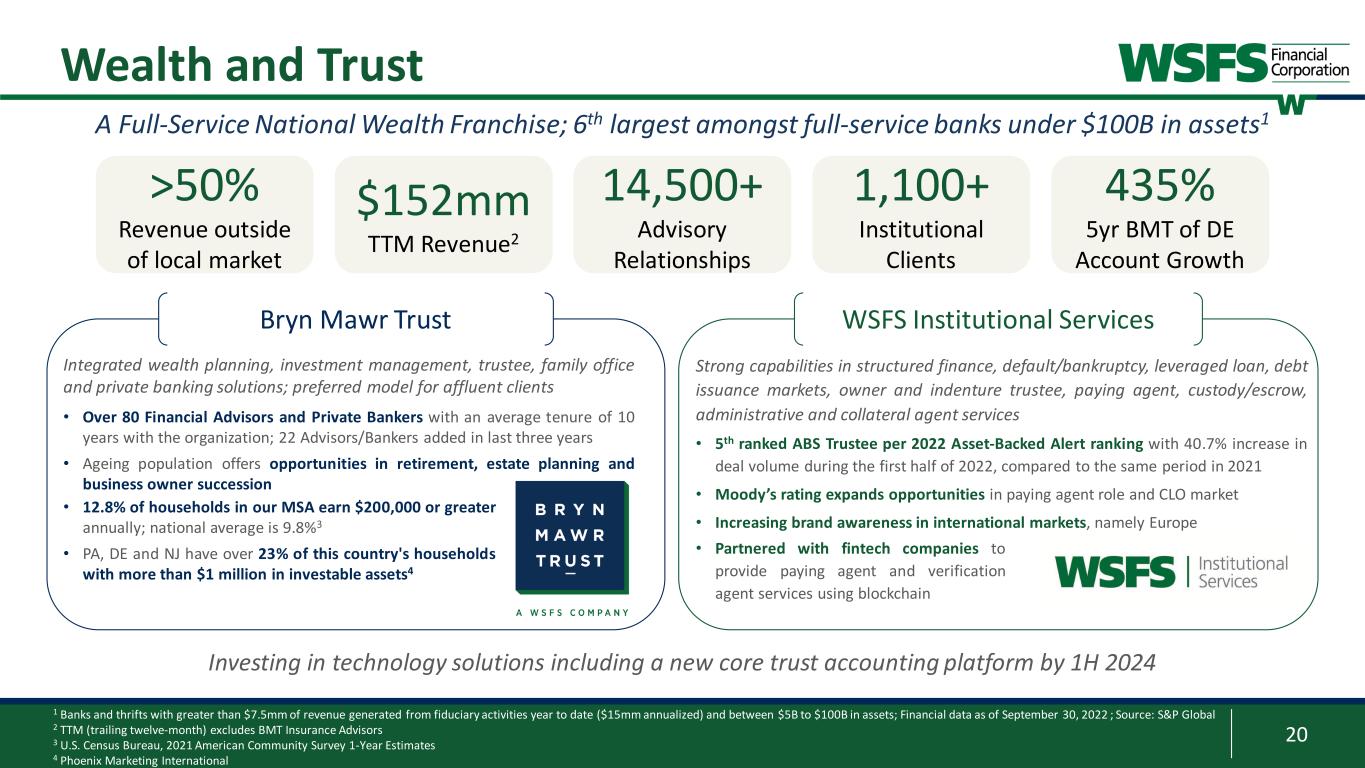

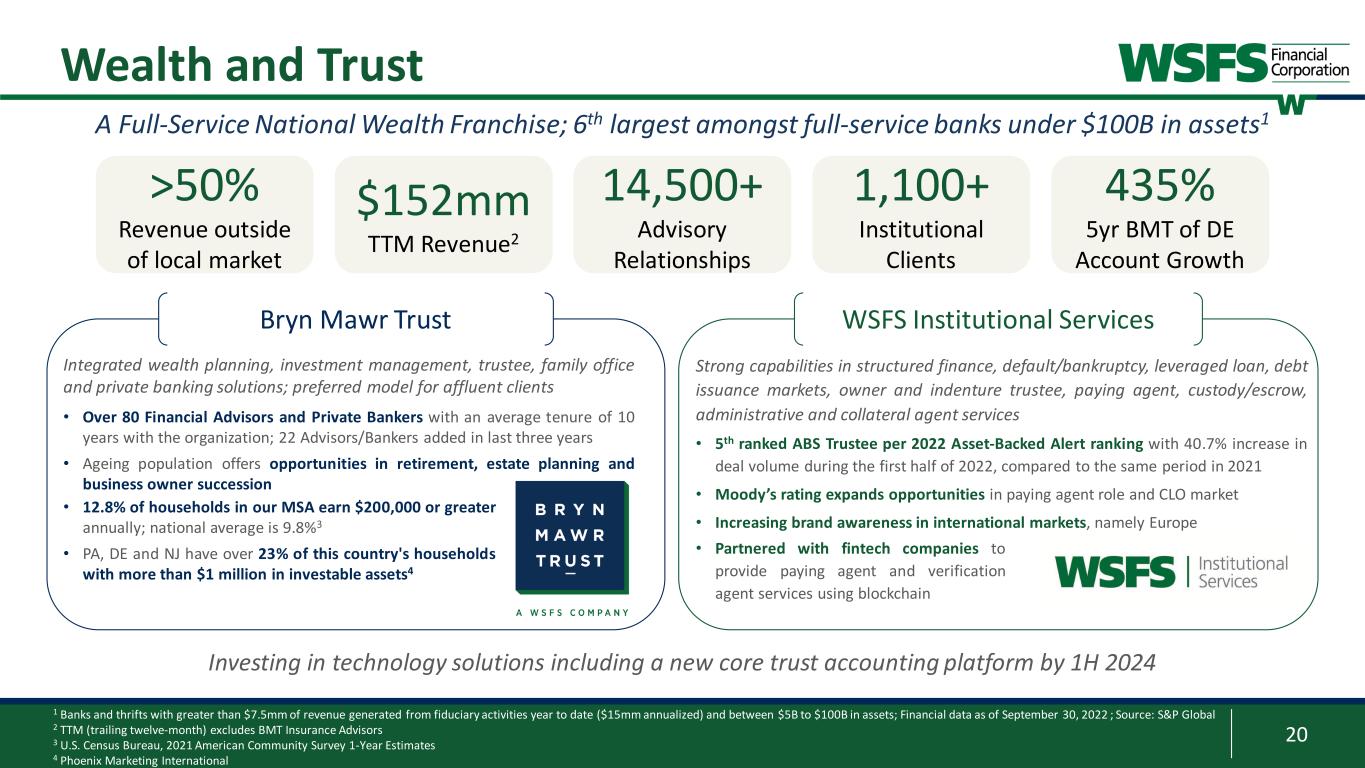

20 1 Banks and thrifts with greater than $7.5mm of revenue generated from fiduciary activities year to date ($15mm annualized) and between $5B to $100B in assets; Financial data as of September 30, 2022 ; Source: S&P Global 2 TTM (trailing twelve-month) excludes BMT Insurance Advisors 3 U.S. Census Bureau, 2021 American Community Survey 1-Year Estimates 4 Phoenix Marketing International Wealth and Trust A Full-Service National Wealth Franchise; 6th largest amongst full-service banks under $100B in assets1 Integrated wealth planning, investment management, trustee, family office and private banking solutions; preferred model for affluent clients • Over 80 Financial Advisors and Private Bankers with an average tenure of 10 years with the organization; 22 Advisors/Bankers added in last three years • Ageing population offers opportunities in retirement, estate planning and business owner succession Bryn Mawr Trust • 12.8% of households in our MSA earn $200,000 or greater annually; national average is 9.8%3 • PA, DE and NJ have over 23% of this country's households with more than $1 million in investable assets4 Strong capabilities in structured finance, default/bankruptcy, leveraged loan, debt issuance markets, owner and indenture trustee, paying agent, custody/escrow, administrative and collateral agent services • 5th ranked ABS Trustee per 2022 Asset-Backed Alert ranking with 40.7% increase in deal volume during the first half of 2022, compared to the same period in 2021 • Moody’s rating expands opportunities in paying agent role and CLO market • Increasing brand awareness in international markets, namely Europe WSFS Institutional Services • Partnered with fintech companies to provide paying agent and verification agent services using blockchain Investing in technology solutions including a new core trust accounting platform by 1H 2024 1,100+ Institutional Clients 14,500+ Advisory Relationships $152mm TTM Revenue2 >50% Revenue outside of local market 435% 5yr BMT of DE Account Growth

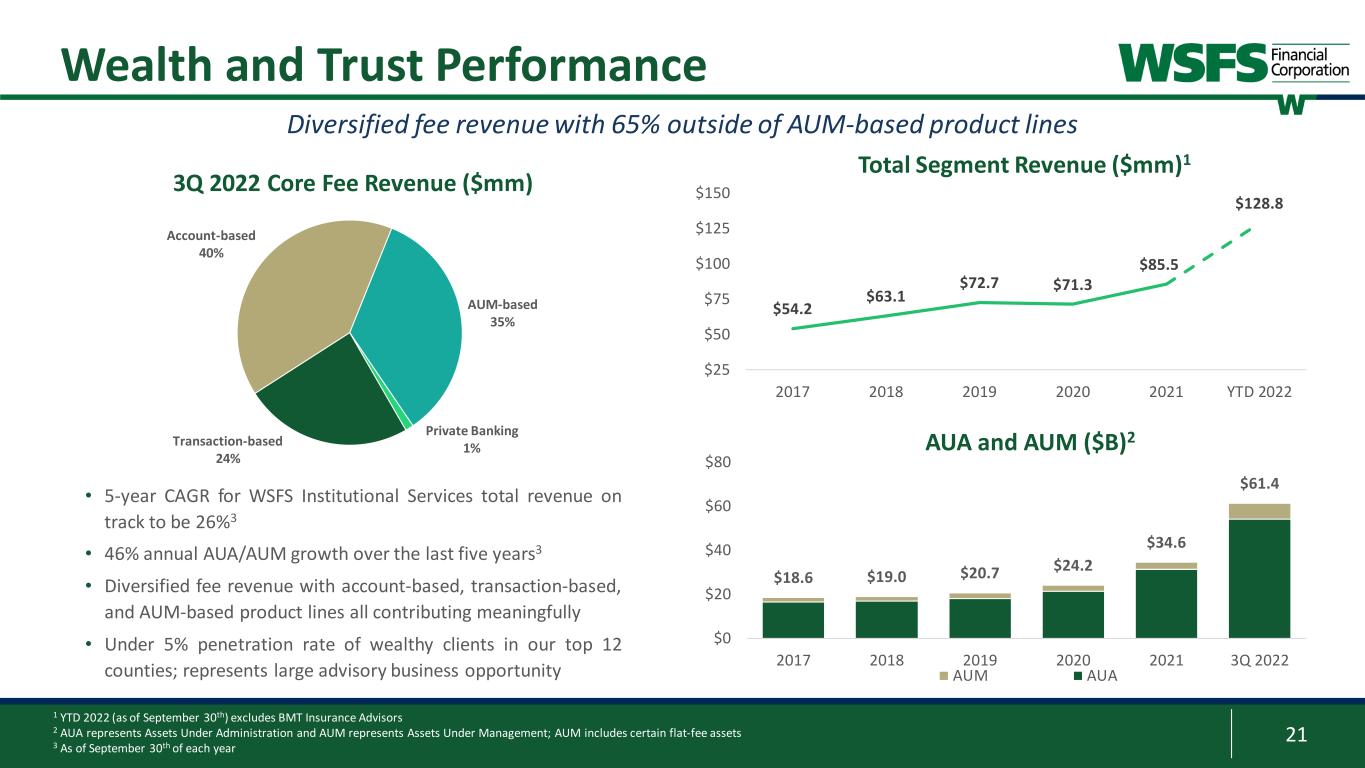

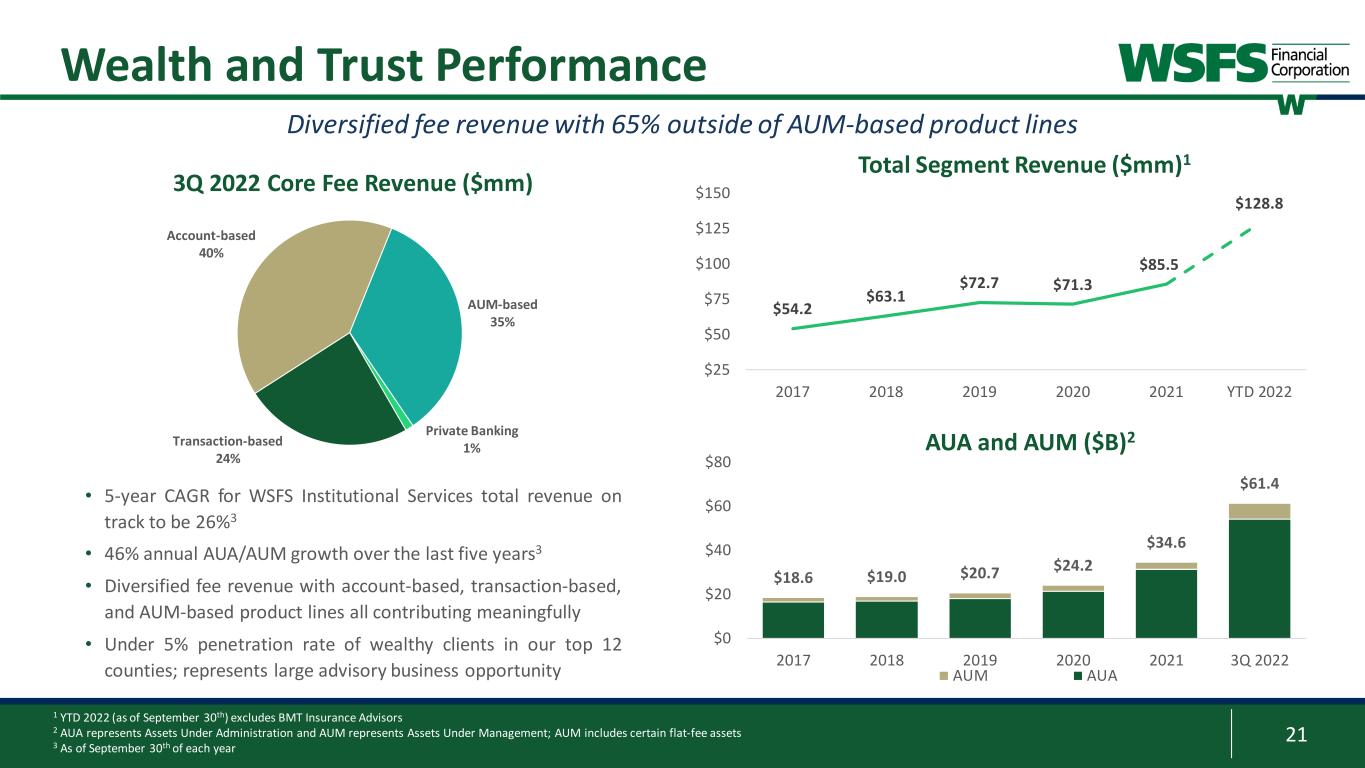

21 Transaction-based 24% Account-based 40% AUM-based 35% Private Banking 1% 3Q 2022 Core Fee Revenue ($mm) $18.6 $19.0 $20.7 $24.2 $34.6 $61.4 $0 $20 $40 $60 $80 2017 2018 2019 2020 2021 3Q 2022 AUM AUA AUA and AUM ($B)2 1 YTD 2022 (as of September 30th) excludes BMT Insurance Advisors 2 AUA represents Assets Under Administration and AUM represents Assets Under Management; AUM includes certain flat-fee assets 3 As of September 30th of each year Wealth and Trust Performance Total Segment Revenue ($mm)1 $54.2 $63.1 $72.7 $71.3 $85.5 $128.8 $25 $50 $75 $100 $125 $150 2017 2018 2019 2020 2021 YTD 2022 • 5-year CAGR for WSFS Institutional Services total revenue on track to be 26%3 • 46% annual AUA/AUM growth over the last five years3 • Diversified fee revenue with account-based, transaction-based, and AUM-based product lines all contributing meaningfully • Under 5% penetration rate of wealthy clients in our top 12 counties; represents large advisory business opportunity Diversified fee revenue with 65% outside of AUM-based product lines

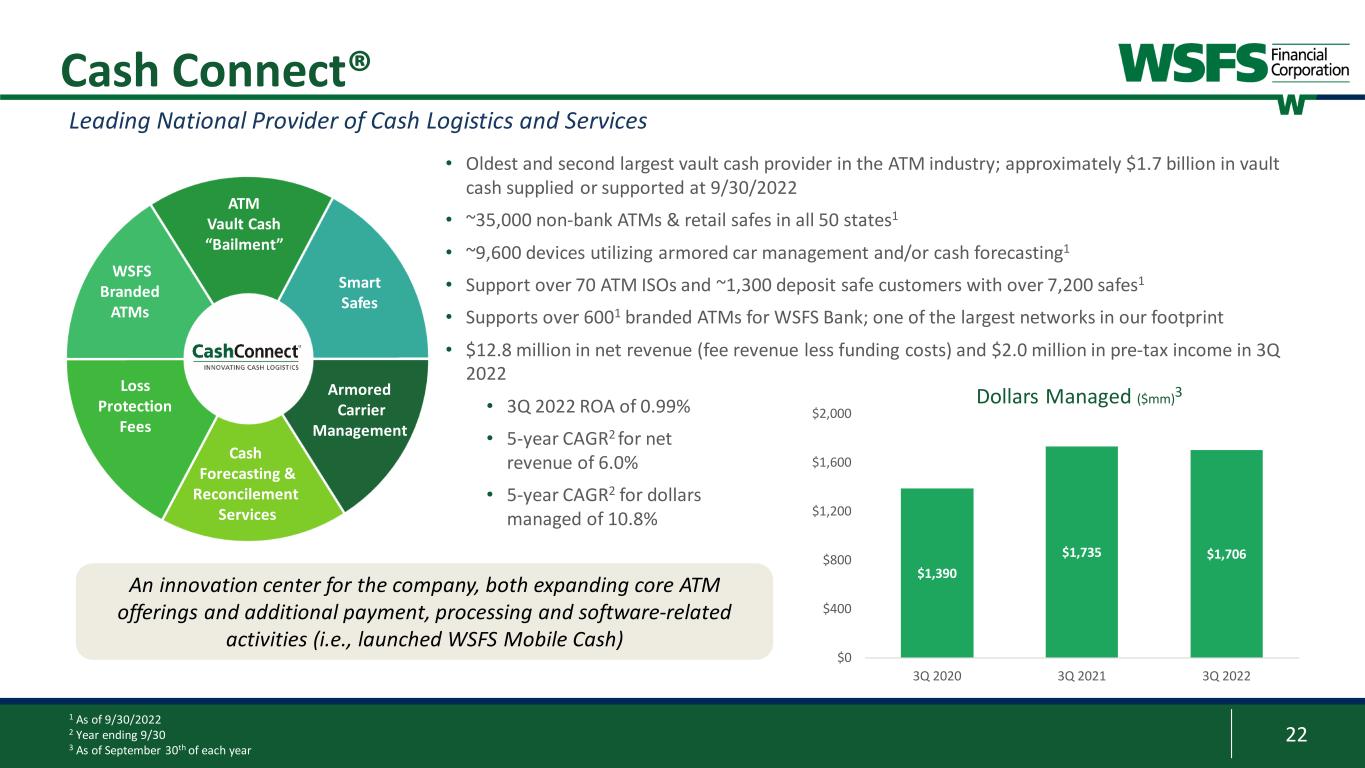

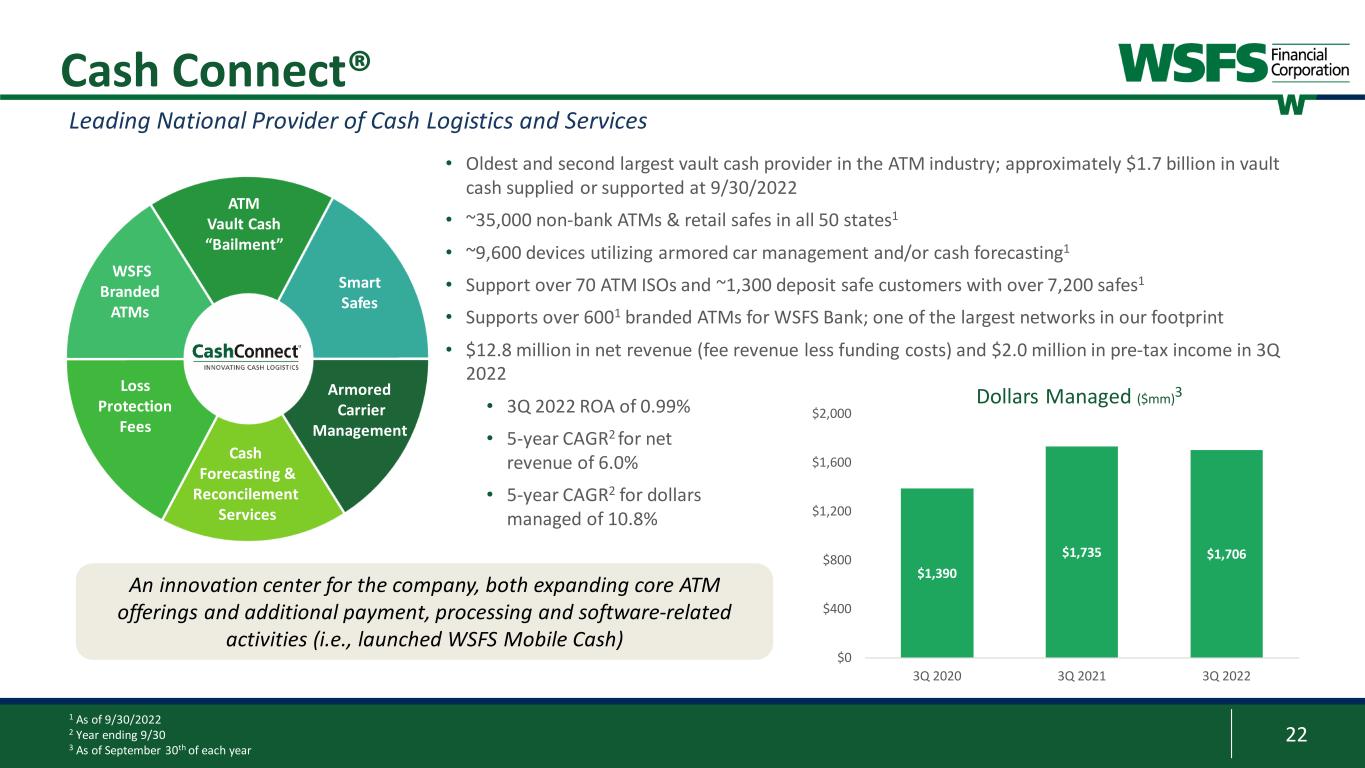

22 • Oldest and second largest vault cash provider in the ATM industry; approximately $1.7 billion in vault cash supplied or supported at 9/30/2022 • ~35,000 non-bank ATMs & retail safes in all 50 states1 • ~9,600 devices utilizing armored car management and/or cash forecasting1 • Support over 70 ATM ISOs and ~1,300 deposit safe customers with over 7,200 safes1 • Supports over 6001 branded ATMs for WSFS Bank; one of the largest networks in our footprint • $12.8 million in net revenue (fee revenue less funding costs) and $2.0 million in pre-tax income in 3Q 2022 • 3Q 2022 ROA of 0.99% • 5-year CAGR2 for net revenue of 6.0% • 5-year CAGR2 for dollars managed of 10.8% 1 As of 9/30/2022 2 Year ending 9/30 3 As of September 30th of each year ATM Vault Cash “Bailment” Smart Safes Armored Carrier Management Cash Forecasting & Reconcilement Services Loss Protection Fees WSFS Branded ATMs Leading National Provider of Cash Logistics and Services Cash Connect® An innovation center for the company, both expanding core ATM offerings and additional payment, processing and software-related activities (i.e., launched WSFS Mobile Cash) Dollars Managed ($mm)3 $1,390 $1,735 $1,706 $0 $400 $800 $1,200 $1,600 $2,000 3Q 2020 3Q 2021 3Q 2022

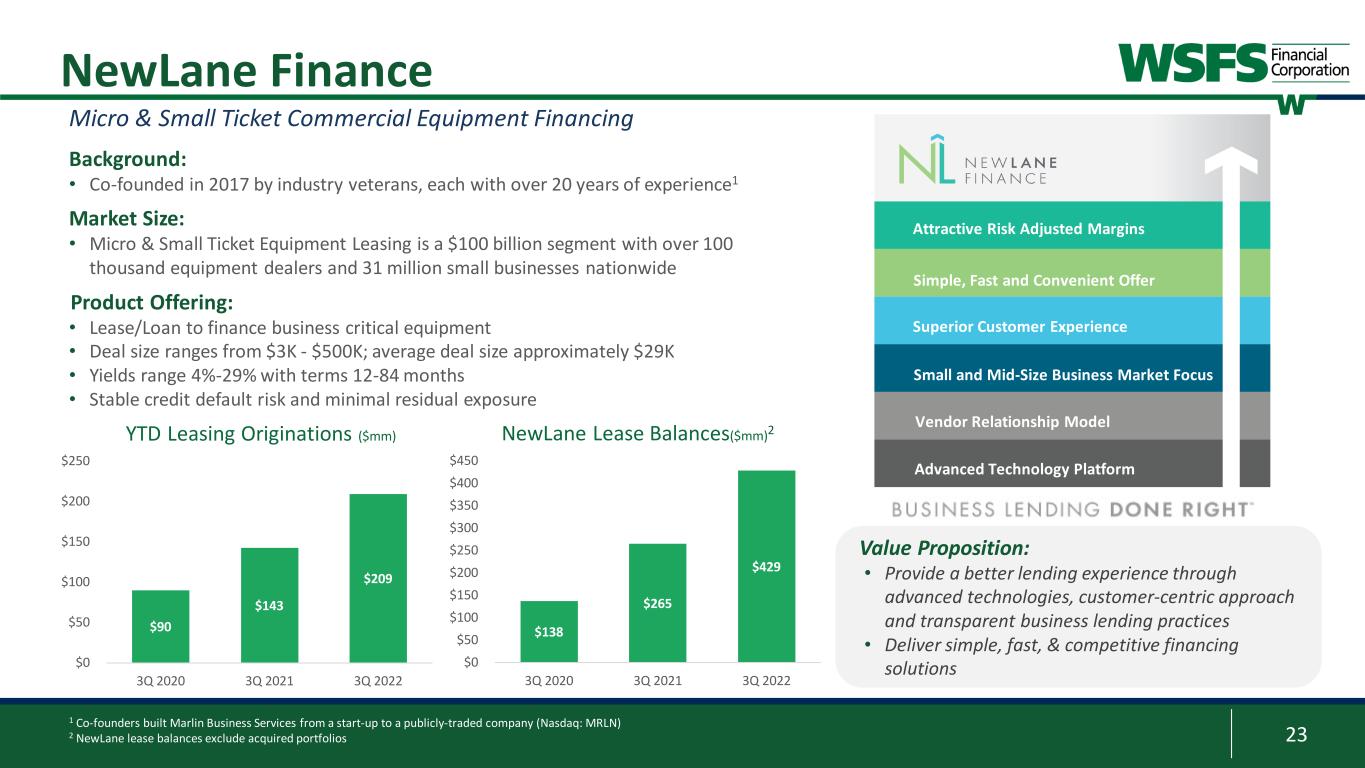

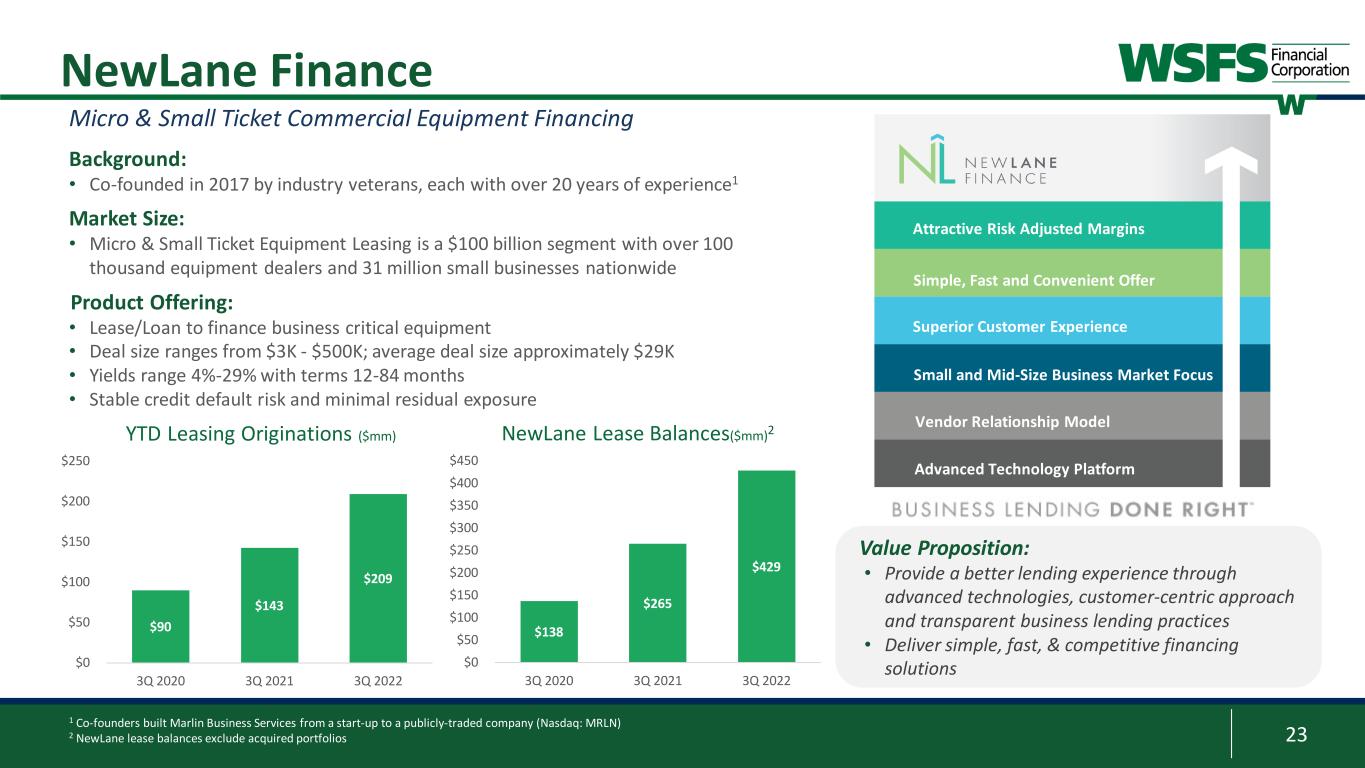

23 NewLane Finance Background: • Co-founded in 2017 by industry veterans, each with over 20 years of experience1 Market Size: • Micro & Small Ticket Equipment Leasing is a $100 billion segment with over 100 thousand equipment dealers and 31 million small businesses nationwide Product Offering: • Lease/Loan to finance business critical equipment • Deal size ranges from $3K - $500K; average deal size approximately $29K • Yields range 4%-29% with terms 12-84 months • Stable credit default risk and minimal residual exposure Vendor Relationship Model Small and Mid-Size Business Market Focus Advanced Technology Platform Superior Customer Experience Simple, Fast and Convenient Offer Attractive Risk Adjusted Margins Micro & Small Ticket Commercial Equipment Financing Value Proposition: • Provide a better lending experience through advanced technologies, customer-centric approach and transparent business lending practices • Deliver simple, fast, & competitive financing solutions 1 Co-founders built Marlin Business Services from a start-up to a publicly-traded company (Nasdaq: MRLN) 2 NewLane lease balances exclude acquired portfolios $90 $143 $209 $0 $50 $100 $150 $200 $250 3Q 2020 3Q 2021 3Q 2022 YTD Leasing Originations ($mm) $138 $265 $429 $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 3Q 2020 3Q 2021 3Q 2022 NewLane Lease Balances($mm)2

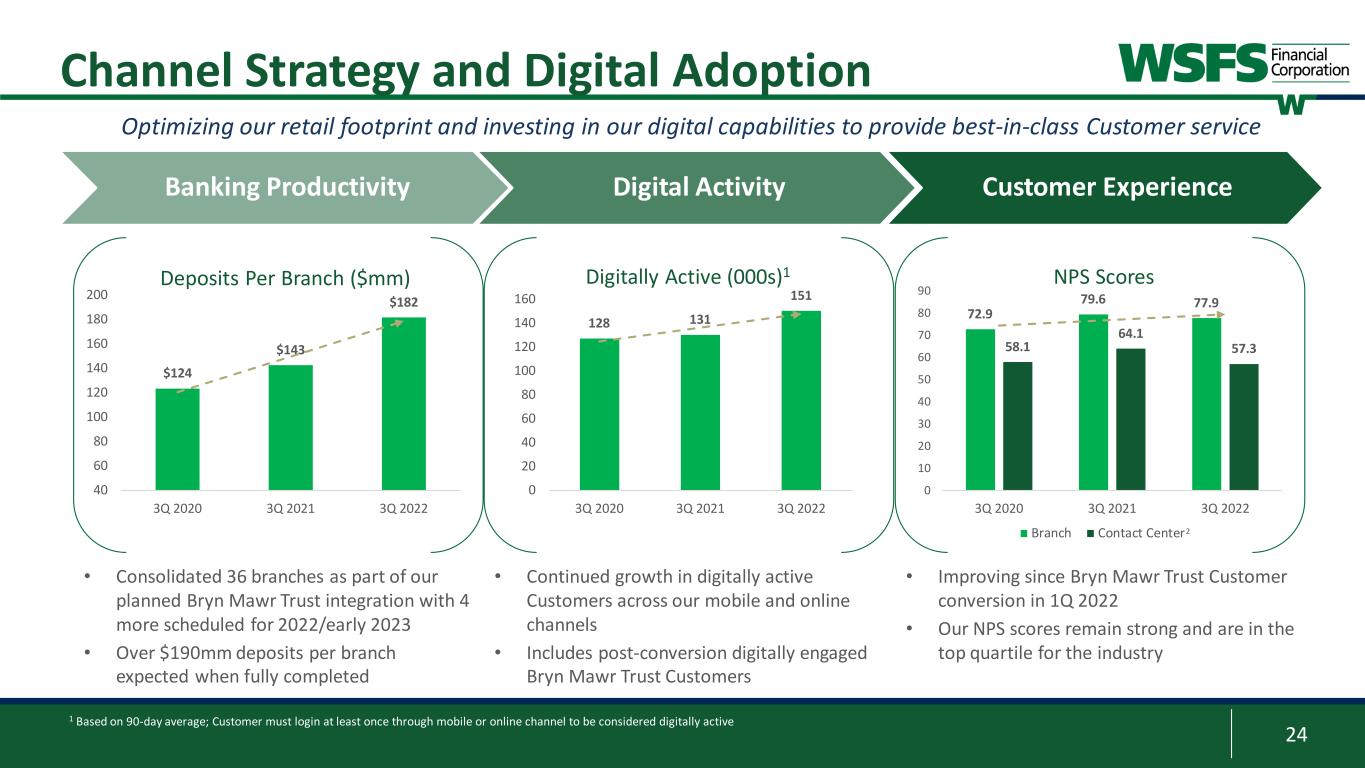

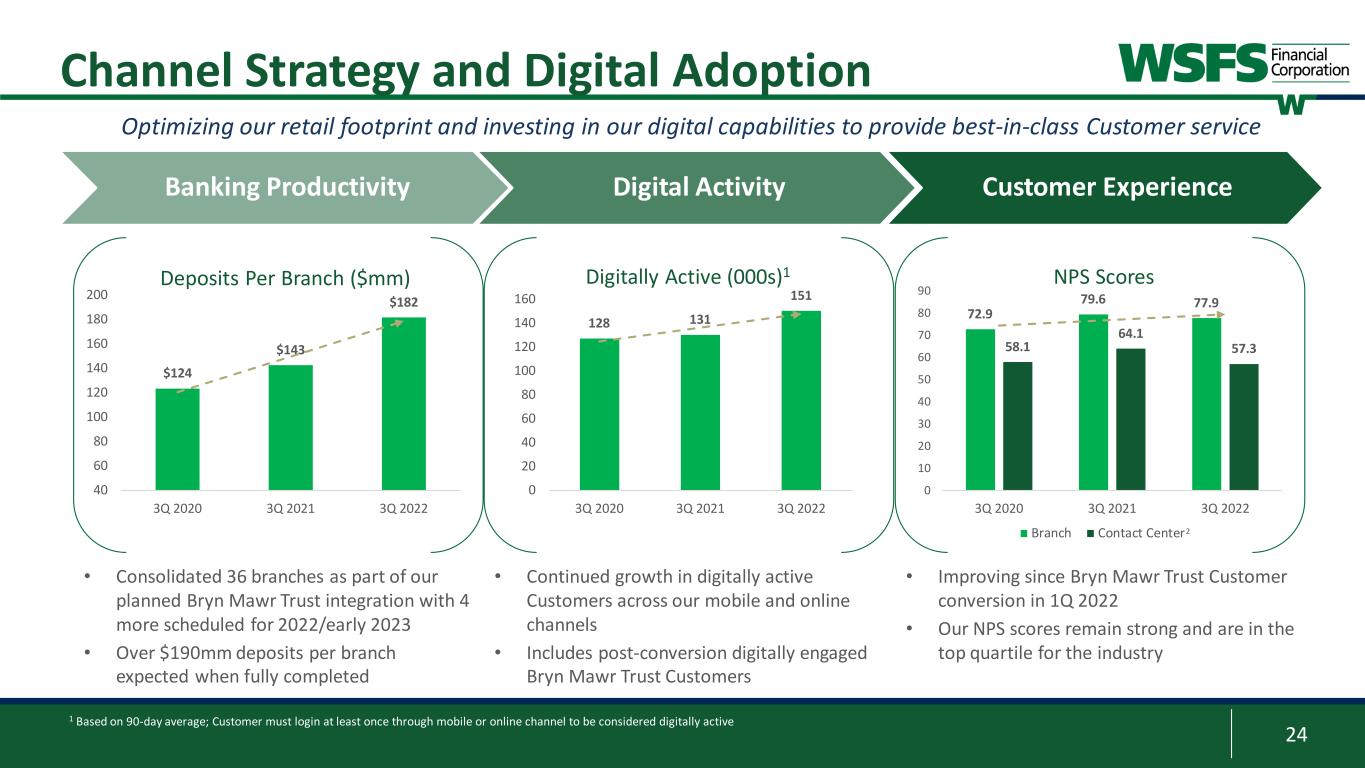

24 1 Based on 90-day average; Customer must login at least once through mobile or online channel to be considered digitally active Channel Strategy and Digital Adoption $124 $143 $182 40 60 80 100 120 140 160 180 200 3Q 2020 3Q 2021 3Q 2022 Deposits Per Branch ($mm) 128 131 151 0 20 40 60 80 100 120 140 160 3Q 2020 3Q 2021 3Q 2022 Digitally Active (000s)1 72.9 79.6 77.9 58.1 64.1 57.3 0 10 20 30 40 50 60 70 80 90 3Q 2020 3Q 2021 3Q 2022 NPS Scores Branch Contact Center Banking Productivity Digital Activity Customer Experience Optimizing our retail footprint and investing in our digital capabilities to provide best-in-class Customer service • Consolidated 36 branches as part of our planned Bryn Mawr Trust integration with 4 more scheduled for 2022/early 2023 • Over $190mm deposits per branch expected when fully completed • Continued growth in digitally active Customers across our mobile and online channels • Includes post-conversion digitally engaged Bryn Mawr Trust Customers • Improving since Bryn Mawr Trust Customer conversion in 1Q 2022 • Our NPS scores remain strong and are in the top quartile for the industry 2

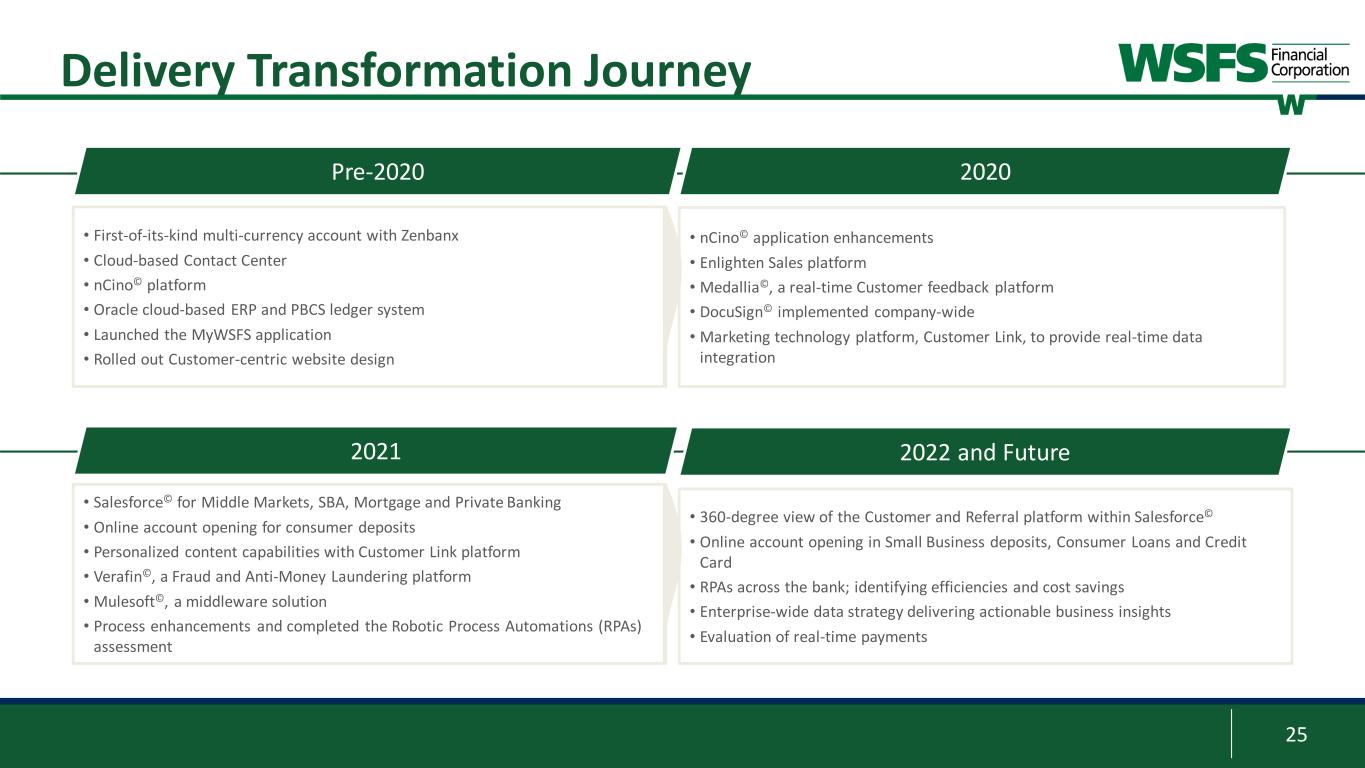

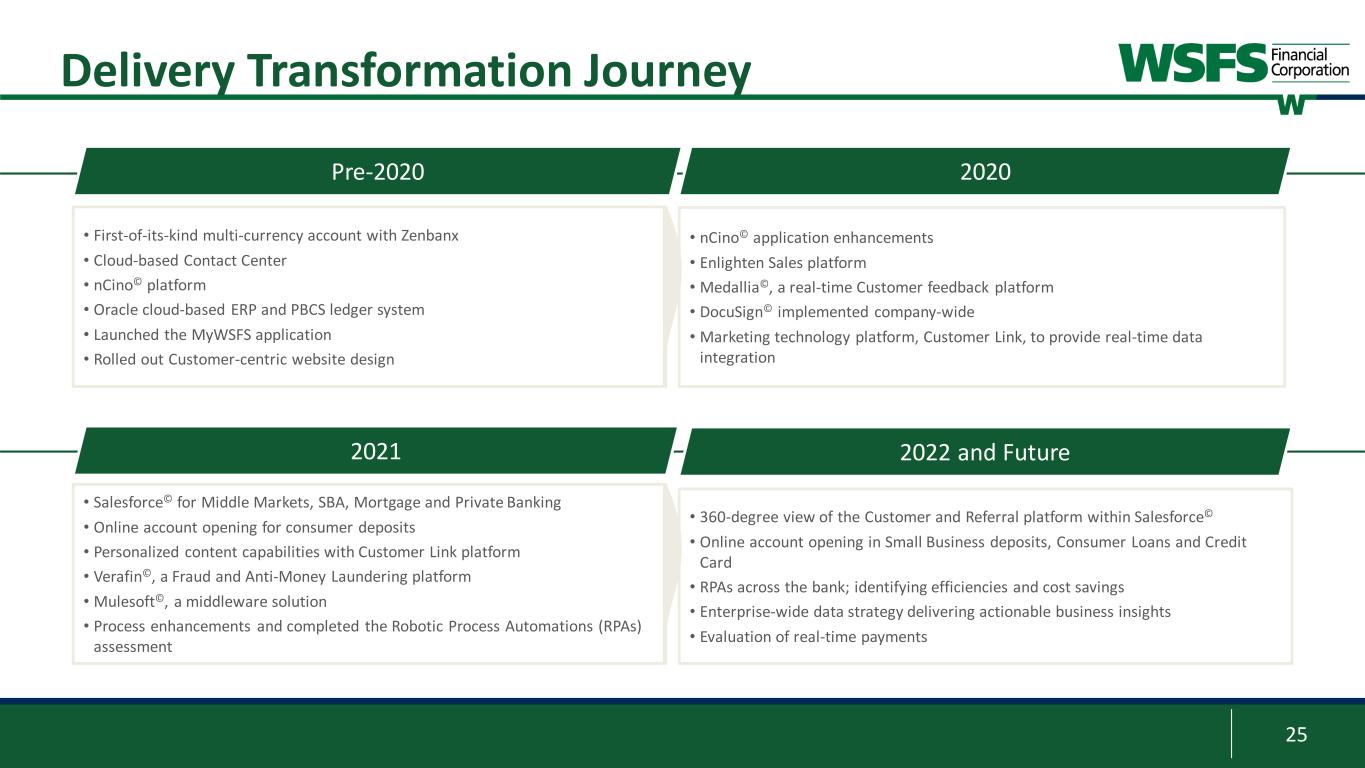

25 Delivery Transformation Journey OneWSFS Pre-2020 2020 2021 2022 and Future • First-of-its-kind multi-currency account with Zenbanx • Cloud-based Contact Center • nCino© platform • Oracle cloud-based ERP and PBCS ledger system • Launched the MyWSFS application • Rolled out Customer-centric website design • 360-degree view of the Customer and Referral platform within Salesforce© • Online account opening in Small Business deposits, Consumer Loans and Credit Card • RPAs across the bank; identifying efficiencies and cost savings • Enterprise-wide data strategy delivering actionable business insights • Evaluation of real-time payments • nCino© application enhancements • Enlighten Sales platform • Medallia©, a real-time Customer feedback platform • DocuSign© implemented company-wide • Marketing technology platform, Customer Link, to provide real-time data integration • Salesforce© for Middle Markets, SBA, Mortgage and Private Banking • Online account opening for consumer deposits • Personalized content capabilities with Customer Link platform • Verafin©, a Fraud and Anti-Money Laundering platform • Mulesoft©, a middleware solution • Process enhancements and completed the Robotic Process Automations (RPAs) assessment

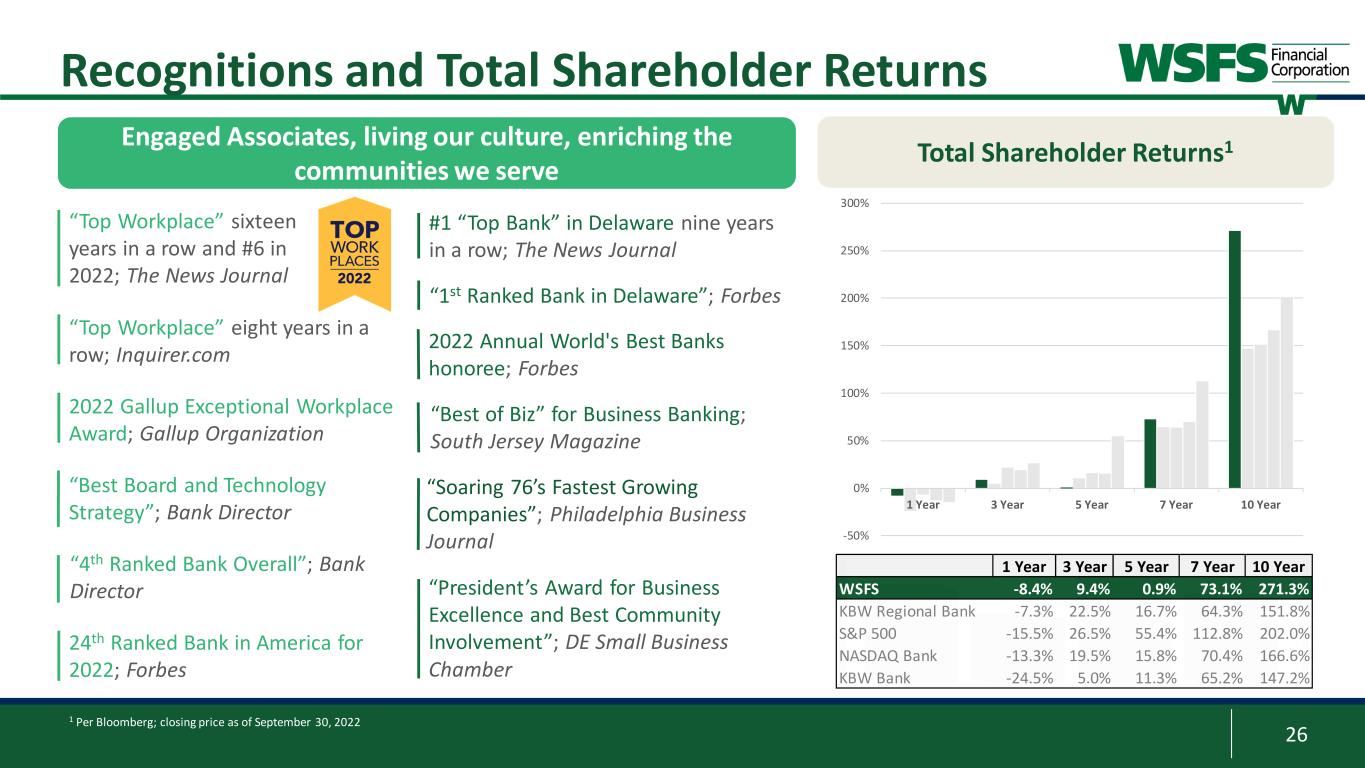

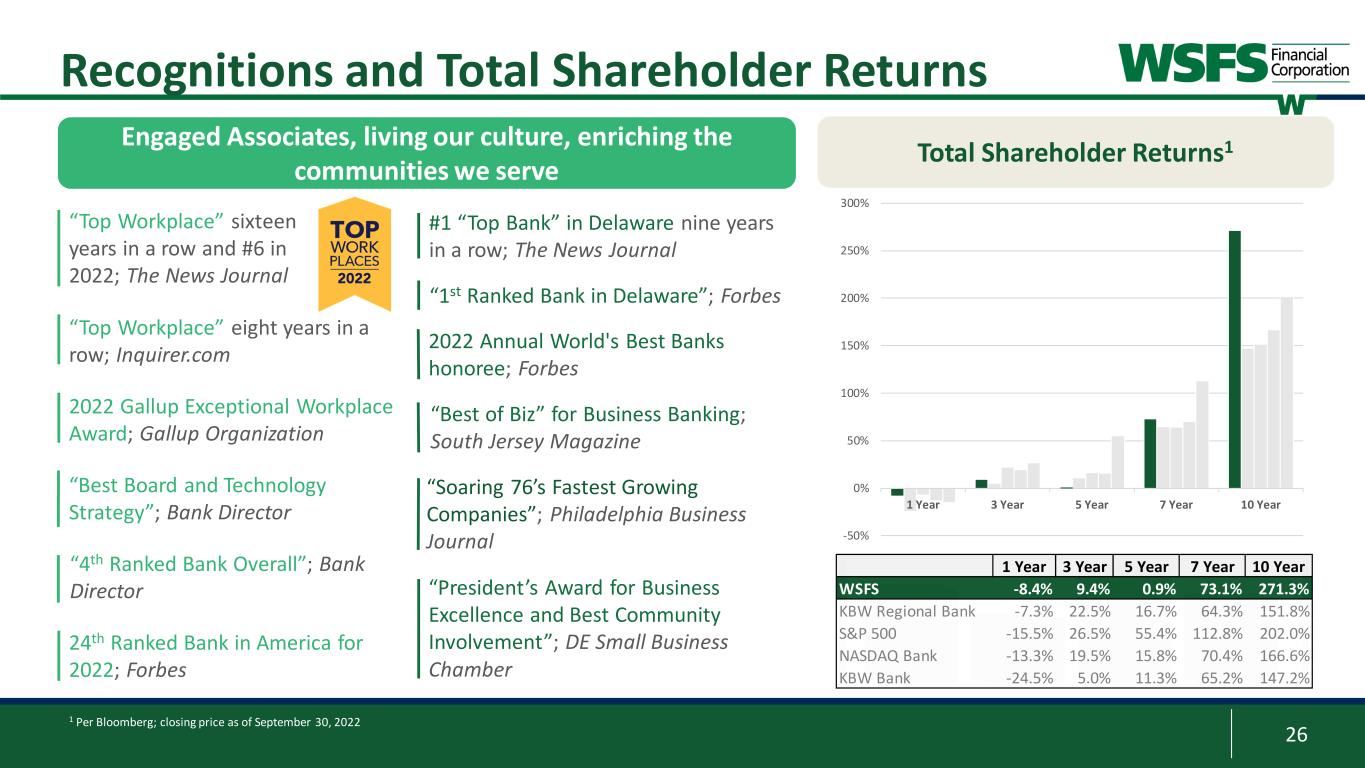

26 “President’s Award for Business Excellence and Best Community Involvement”; DE Small Business Chamber “Soaring 76’s Fastest Growing Companies”; Philadelphia Business Journal “Best of Biz” for Business Banking; South Jersey Magazine 2022 Annual World's Best Banks honoree; Forbes #1 “Top Bank” in Delaware nine years in a row; The News Journal “1st Ranked Bank in Delaware”; Forbes “Best Board and Technology Strategy”; Bank Director 1 Per Bloomberg; closing price as of September 30, 2022 Recognitions and Total Shareholder Returns “Top Workplace” sixteen years in a row and #6 in 2022; The News Journal “Top Workplace” eight years in a row; Inquirer.com 24th Ranked Bank in America for 2022; Forbes 2022 Gallup Exceptional Workplace Award; Gallup Organization Engaged Associates, living our culture, enriching the communities we serve Total Shareholder Returns1 “4th Ranked Bank Overall”; Bank Director -50% 0% 50% 100% 150% 200% 250% 300% 1 Year 3 Year 5 Year 7 Year 10 Year 1 Year 3 Year 5 Year 7 Year 10 Year WSFS -8.4% 9.4% 0.9% 73.1% 271.3% KBW Regional Bank -7.3% 22.5% 16.7% 64.3% 151.8% S&P 500 -15.5% 26.5% 55.4% 112.8% 202.0% NASDAQ Bank -13.3% 19.5% 15.8% 70.4% 166.6% KBW Bank -24.5% 5.0% 11.3% 65.2% 147.2%

27 Selected Financial and Performance Metrics

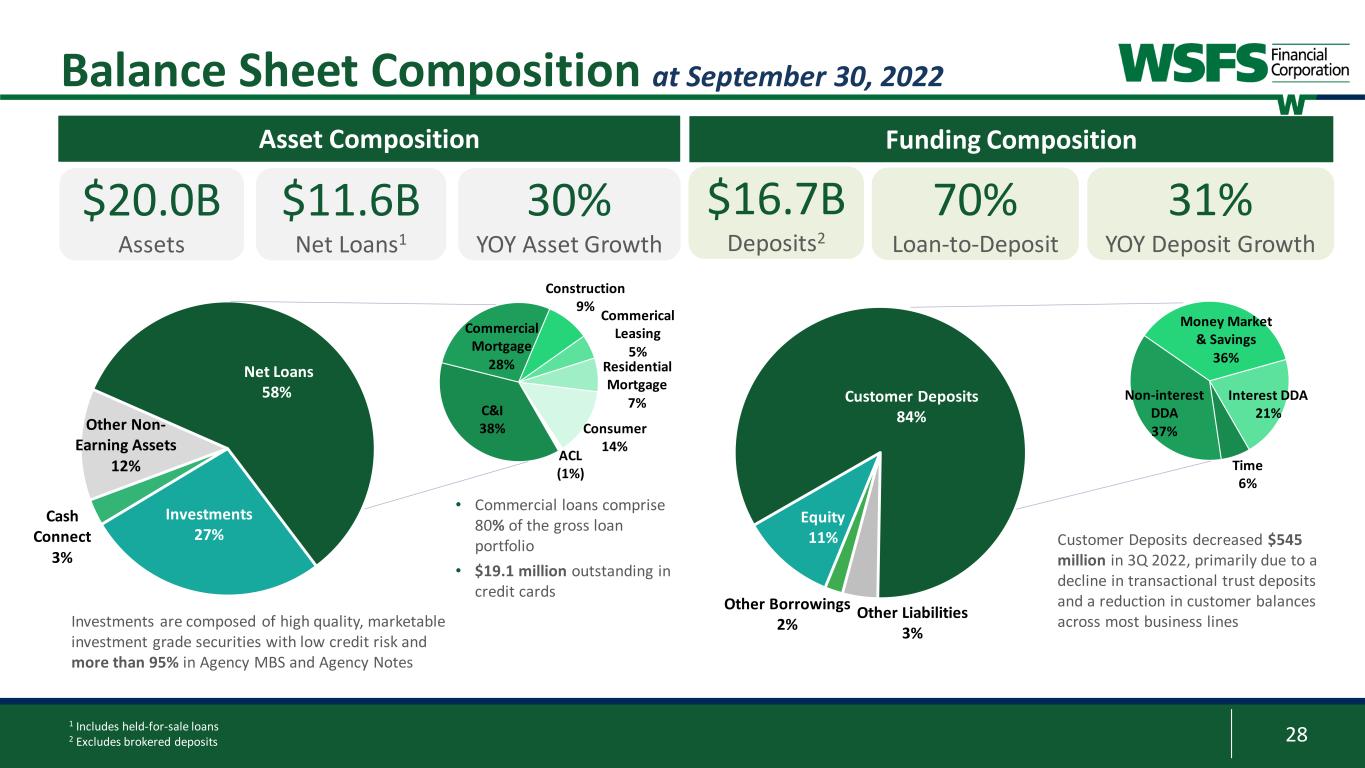

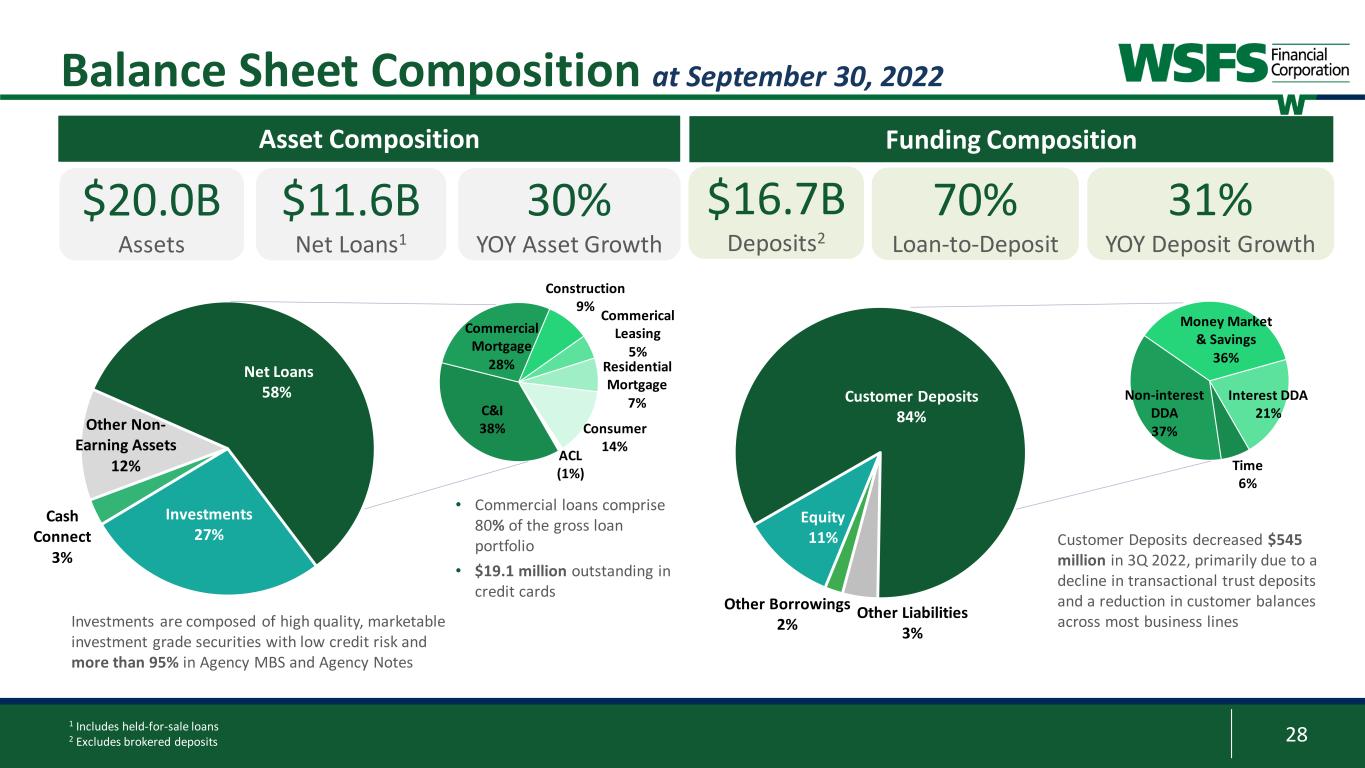

28 Time 6% Non-interest DDA 37% Money Market & Savings 36% Interest DDA 21% Customer Deposits decreased $545 million in 3Q 2022, primarily due to a decline in transactional trust deposits and a reduction in customer balances across most business lines Balance Sheet Composition at September 30, 2022 C&I 38% Commercial Mortgage 28% Construction 9% Commerical Leasing 5% Residential Mortgage 7% Consumer 14%ACL (1%) Investments 27% Cash Connect 3% Other Non- Earning Assets 12% Net Loans 58% • Commercial loans comprise 80% of the gross loan portfolio • $19.1 million outstanding in credit cards Equity 11% Customer Deposits 84% Investments are composed of high quality, marketable investment grade securities with low credit risk and more than 95% in Agency MBS and Agency Notes $20.0B Assets $11.6B Net Loans1 Asset Composition 30% YOY Asset Growth Funding Composition $16.7B Deposits2 70% Loan-to-Deposit 31% YOY Deposit Growth Other Borrowings 2% Other Liabilities 3% 1 Includes held-for-sale loans 2 Excludes brokered deposits

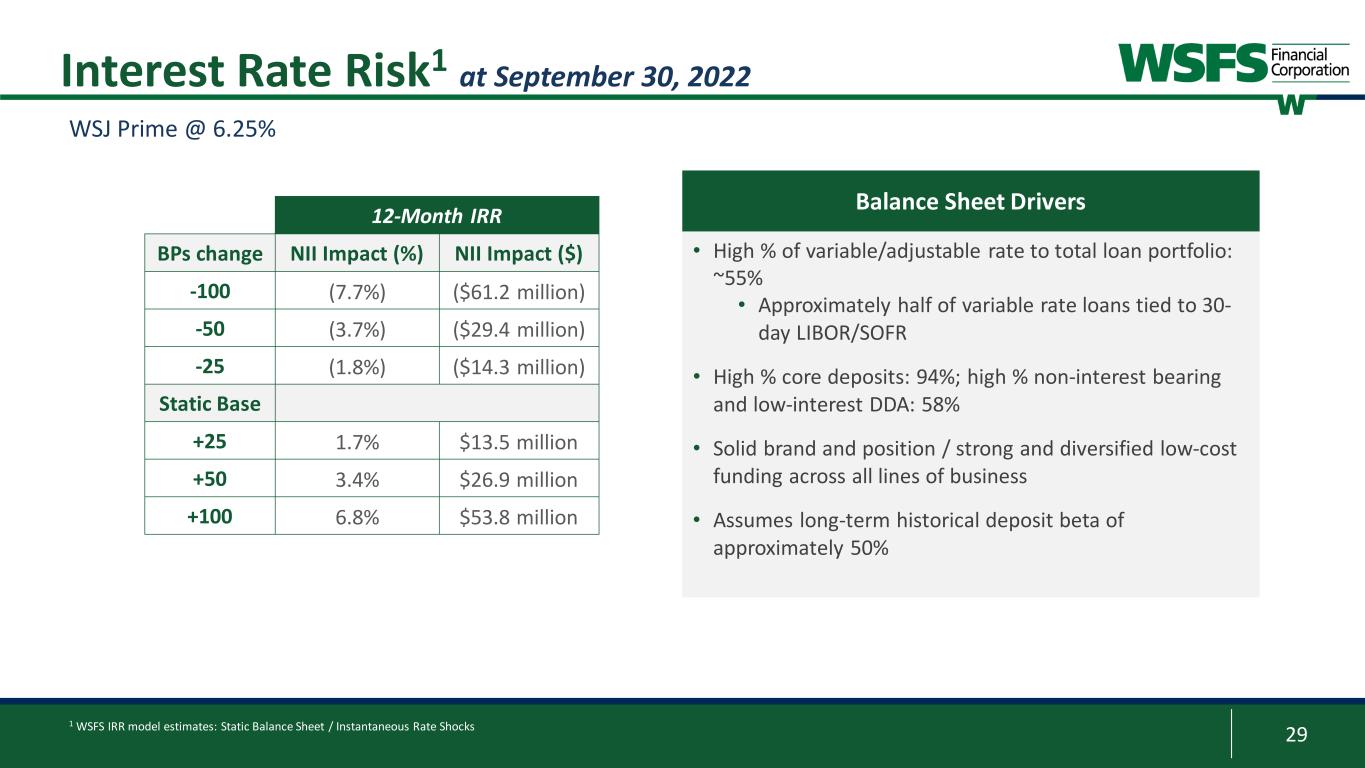

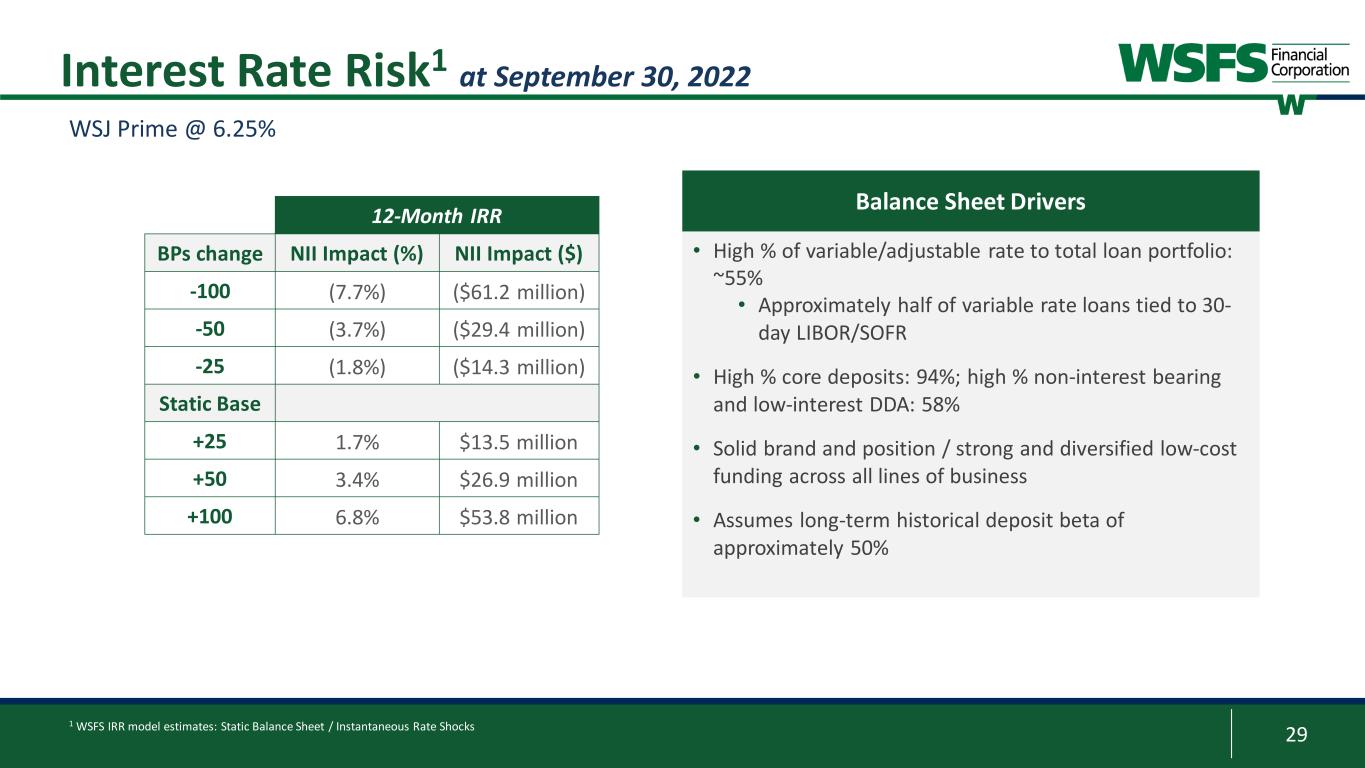

29 1 WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks • High % of variable/adjustable rate to total loan portfolio: ~55% • Approximately half of variable rate loans tied to 30- day LIBOR/SOFR • High % core deposits: 94%; high % non-interest bearing and low-interest DDA: 58% • Solid brand and position / strong and diversified low-cost funding across all lines of business • Assumes long-term historical deposit beta of approximately 50% Interest Rate Risk1 at September 30, 2022 WSJ Prime @ 6.25% Balance Sheet Drivers12-Month IRR BPs change NII Impact (%) NII Impact ($) -100 (7.7%) ($61.2 million) -50 (3.7%) ($29.4 million) -25 (1.8%) ($14.3 million) Static Base +25 1.7% $13.5 million +50 3.4% $26.9 million +100 6.8% $53.8 million

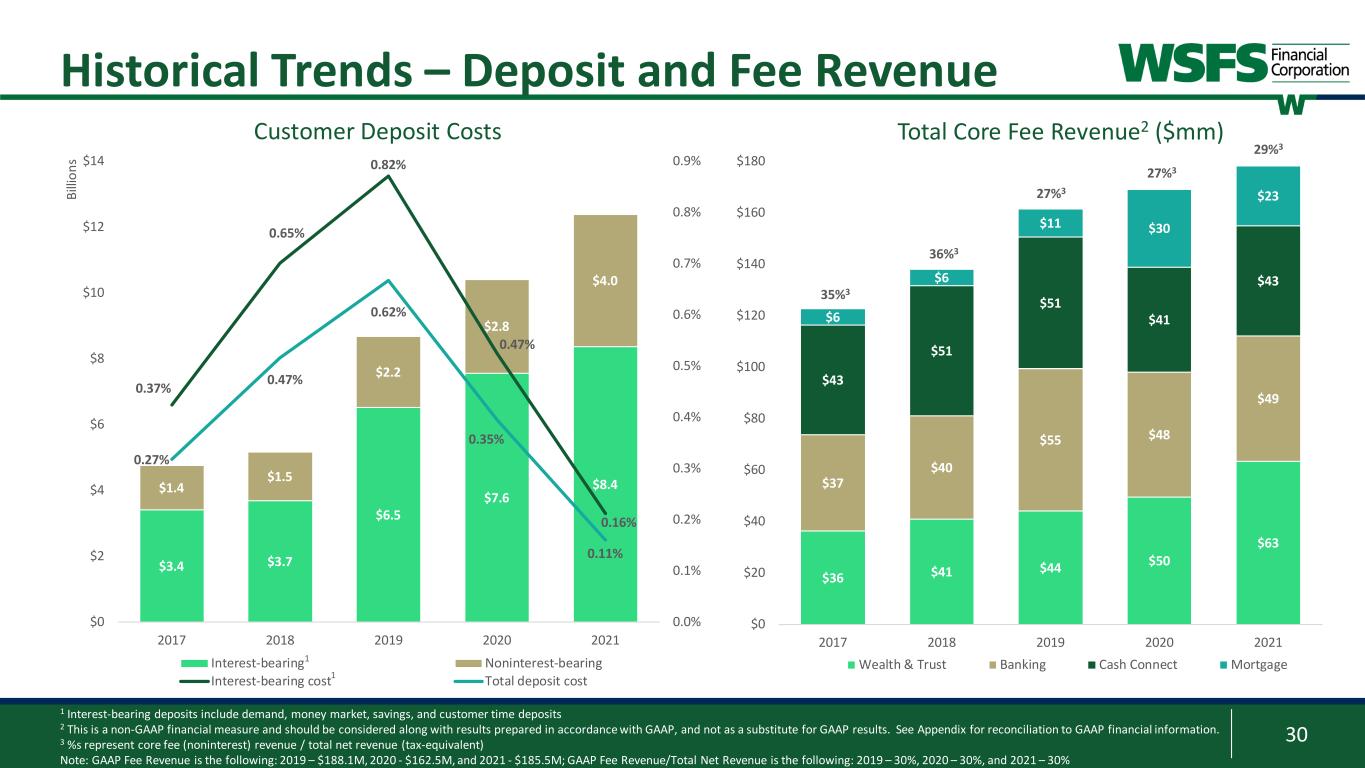

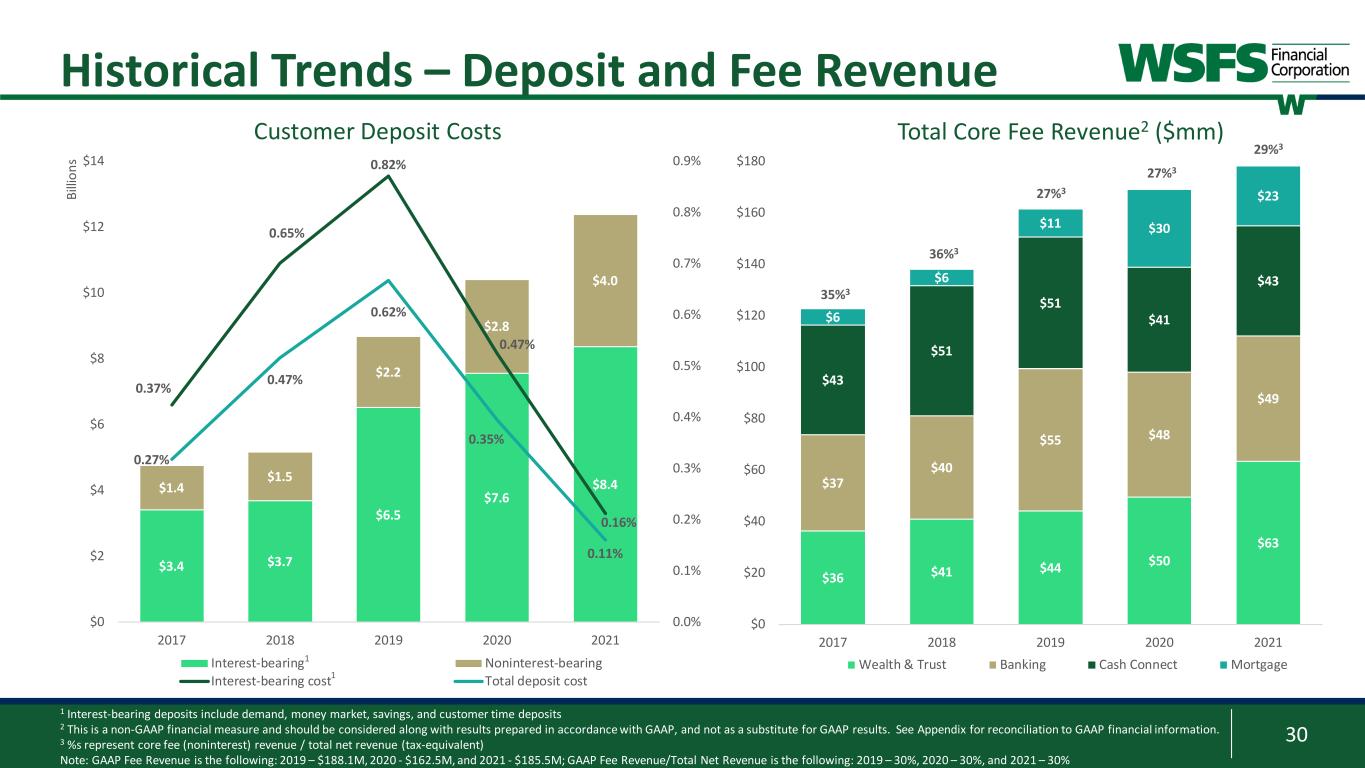

30 $3.4 $3.7 $6.5 $7.6 $8.4$1.4 $1.5 $2.2 $2.8 $4.0 0.37% 0.65% 0.82% 0.47% 0.16% 0.27% 0.47% 0.62% 0.35% 0.11% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% $0 $2 $4 $6 $8 $10 $12 $14 2017 2018 2019 2020 2021 Bi lli on s Interest-bearing Noninterest-bearing Interest-bearing cost Total deposit cost Historical Trends – Deposit and Fee Revenue 1 Interest-bearing deposits include demand, money market, savings, and customer time deposits 2 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 3 %s represent core fee (noninterest) revenue / total net revenue (tax-equivalent) Note: GAAP Fee Revenue is the following: 2019 – $188.1M, 2020 - $162.5M, and 2021 - $185.5M; GAAP Fee Revenue/Total Net Revenue is the following: 2019 – 30%, 2020 – 30%, and 2021 – 30% $36 $41 $44 $50 $63 $37 $40 $55 $48 $49 $43 $51 $51 $41 $43 $6 $6 $11 $30 $23 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2017 2018 2019 2020 2021 Wealth & Trust Banking Cash Connect Mortgage 27%3 27%3 36%3 35%3 29%3 Total Core Fee Revenue2 ($mm)Customer Deposit Costs 1 1

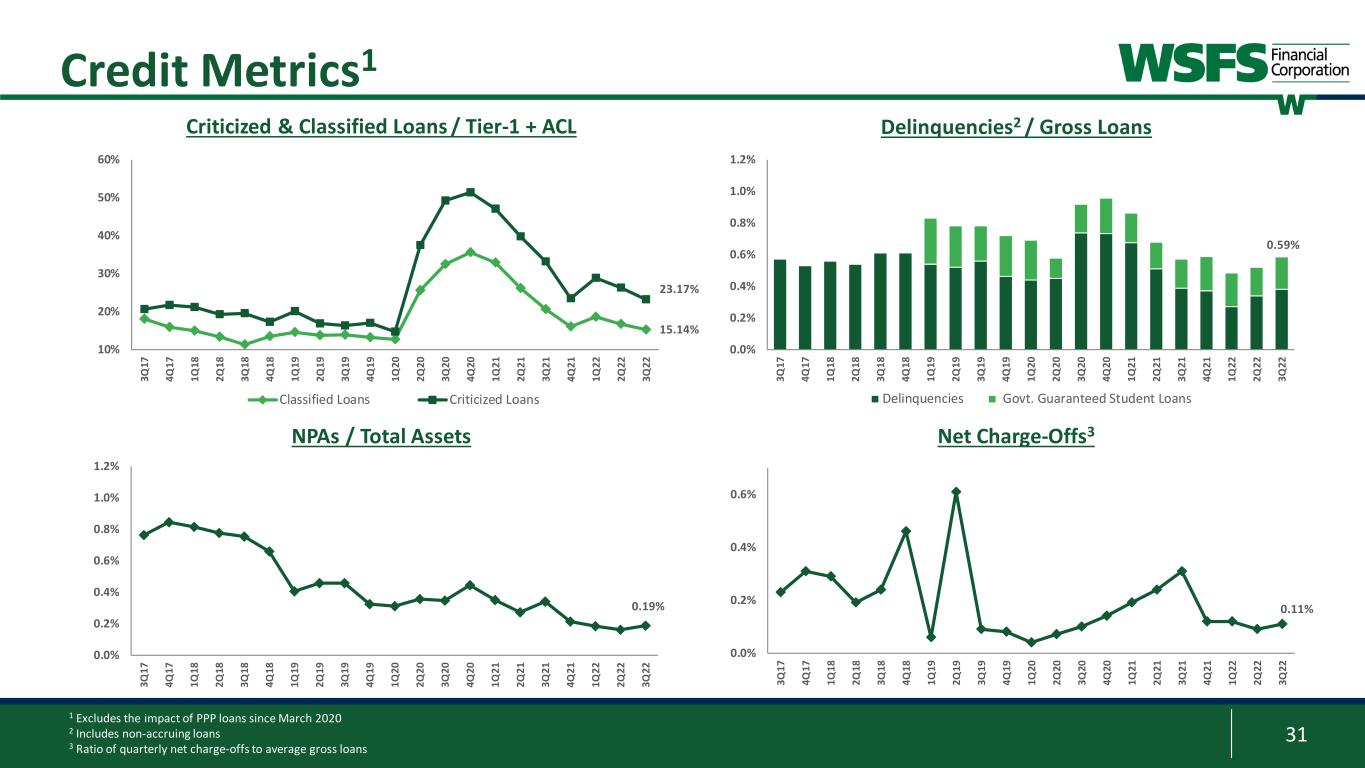

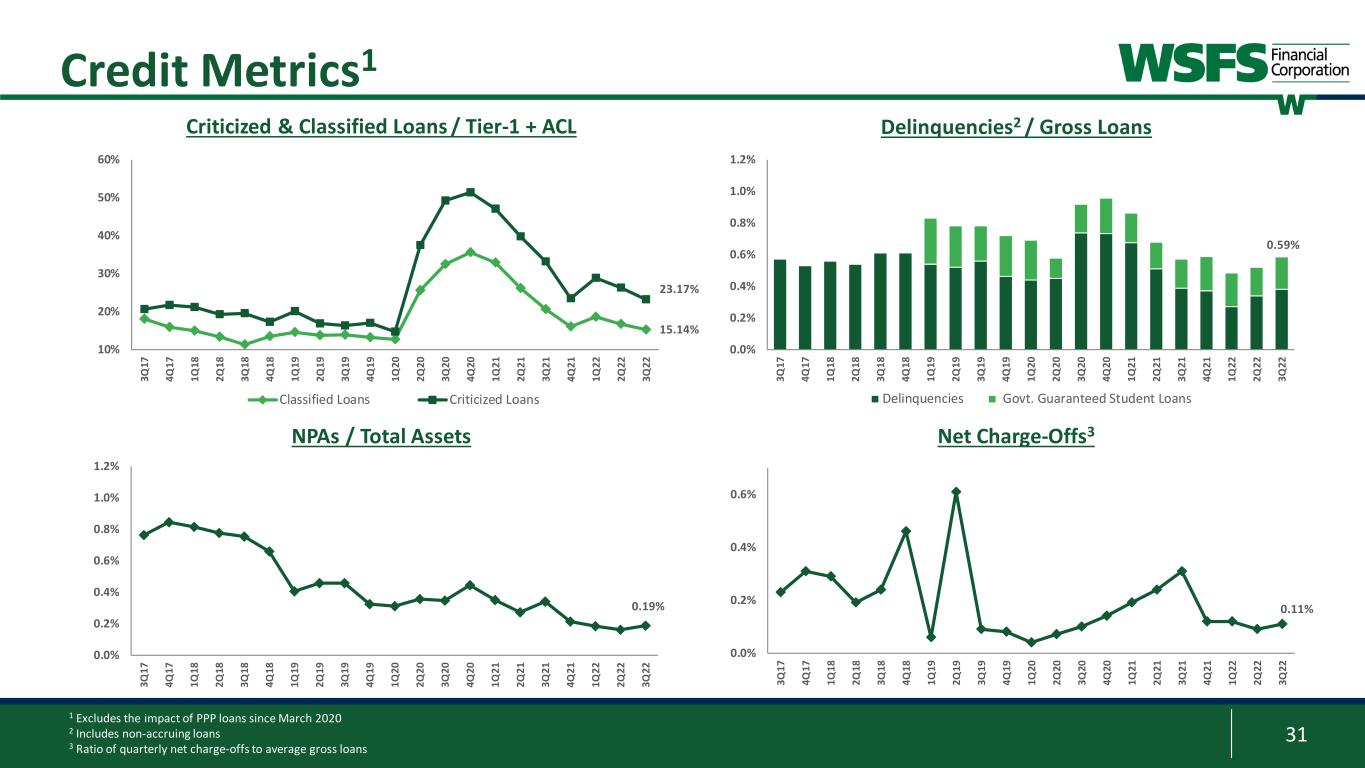

31 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 Delinquencies Govt. Guaranteed Student Loans 0.59% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 0.0% 0.2% 0.4% 0.6% 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 10% 20% 30% 40% 50% 60% 3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 Classified Loans Criticized Loans Delinquencies2 / Gross Loans Net Charge-Offs3 1 Excludes the impact of PPP loans since March 2020 2 Includes non-accruing loans 3 Ratio of quarterly net charge-offs to average gross loans Criticized & Classified Loans / Tier-1 + ACL NPAs / Total Assets 0.19% 0.11% Credit Metrics1 23.17% 15.14%

32 9.76% 4.5% 6.5% 8.5% 10.5% 12.5% 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 22,000 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Dec 2021 Mar 2022 Jun 2022 Sep 2022 Average Assets (QTD) Tier 1 Leverage Ratio 13.34% 9.5% 10.5% 11.5% 12.5% 13.5% 14.5% 15.5% 16.5% 400 900 1,400 1,900 2,400 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Dec 2021 Mar 2022 Jun 2022 Sep 2022 Total Capital Total Risk Based Capital Ratio 12.38% 5.0% 7.0% 9.0% 11.0% 13.0% 15.0% 17.0% 350 850 1,350 1,850 2,350 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Dec 2021 Mar 2022 Jun 2022 Sep 2022 Tier 1 Capital Tier 1 Capital Ratio Capital Management - Bank Tier 1 Leverage Ratio Common Equity Tier 1 Capital Tier 1 Capital Total Risk-Based Capital M ill io ns M ill io ns M ill io ns M ill io ns 12.38% 4% 6% 8% 10% 12% 14% 16% 350 550 750 950 1,150 1,350 1,550 1,750 1,950 2,150 Dec 2017 Dec 2018 Dec 2019 Dec 2020 Dec 2021 Mar 2022 Jun 2022 Sep 2022 Common Equity Tier 1 Capital Common Equity Tier 1 Capital Ratio M ill io ns

33 1 As discussed in our most recent proxy statement filed March 28, 2022 2 As of September 30, 2022 3 Board authorizations in 2Q 2020 and 2Q 2022 (dollars in 000s) 2017 2018 2019 2020 2021 YTD 20222 Total Capital Returned $21,157 $44,451 $113,795 $179,451 $36,263 $203,375 Total Shares Repurchased 255,000 691,742 2,132,390 3,950,855 267,309 3,789,137 $0.30 $0.42 $0.47 $0.48 $0.52 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $- $50,000 $100,000 $150,000 $200,000 $250,000 2017 2018 2019 2020 2021 YTD 2022 An nu al D iv id en ds P ai d pe r S ha re Ca pi ta l R et ur ne d ($ in 0 00 s) Dividends Routine buybacks Incremental buybacks Annual Dividend Per Share Capital Management / Ownership Alignment • Executive management incentive compensation and equity awards aligned with shareholder performance • Insider ownership1 is approximately 1.7% Board of Directors and Executive Management ownership guidelines in place and followed • Repurchased 1.7 million shares or 3% of common shares outstanding in 3Q 2022 Approximately 11% of common shares outstanding2 are available for repurchase under the Board authorizations3 • The Board of Directors approved a quarterly cash dividend of $0.15 per share of common stock which will be paid in November 2022 2

34 WSFS Mission, Vision, Strategy and Values

35 Non-GAAP Financial Information Appendix:

36 Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted net income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of securities gains, realized/unrealized gains (losses) on equity investments, net, Visa derivative valuation adjustment, loss on debt extinguishment, corporate development and restructuring expense, and Contribution to WSFS CARES Foundation; • Core noninterest income, also called core fee revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of securities gains, realized/unrealized gains (losses) on equity investments, net, and Visa derivative valuation adjustment; • Core fee revenue percentage is a non-GAAP measure that divides (i) core fee revenue by (ii) core net revenue (tax-equivalent); • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of FHLB special dividend; • Core earnings per share (EPS) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core net revenue is a non-GAAP measure that adds (i) core net interest income and (ii) core fee revenue; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude loss on debt extinguishment, corporate development and restructuring expenses, and contribution to WSFS CARES Foundation; • Core efficiency ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and core fee revenue; • Core return on average assets (ROA) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Tangible common equity (TCE) is a non-GAAP measure and is defined as total stockholders’ equity of WSFS less goodwill, other intangible assets; • Tangible common equity ratio is a non-GAAP measure that divides (i) TCE by (ii) tangible assets; • Tangible assets is a non-GAAP measure and is defined as total assets less goodwill, other intangible assets; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Pre-provision net revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) provision for (recovery of) for credit losses; • Core PPNR is a non-GAAP measure that adjusts PPNR to exclude the impact of securities gains, realized/unrealized gains on equity investments, net, Visa derivative valuation adjustment, loss on debt extinguishment, corporate development and restructuring expenses, and Contribution to WSFS CARES Foundation; • PPNR percentage is a non-GAAP measure that divides (i) PPNR (annualized) by (ii) average assets for the applicable period; • Core PPNR percentage is a non-GAAP measure that divides (i) core PPNR (annualized) by (ii) average assets for the applicable period; and • Core return on average equity (ROE) is a non-GAAP measure that divides (i) adjusted net income (non-GAAP) attributable to WSFS by (ii) average stockholders’ equity for the applicable period

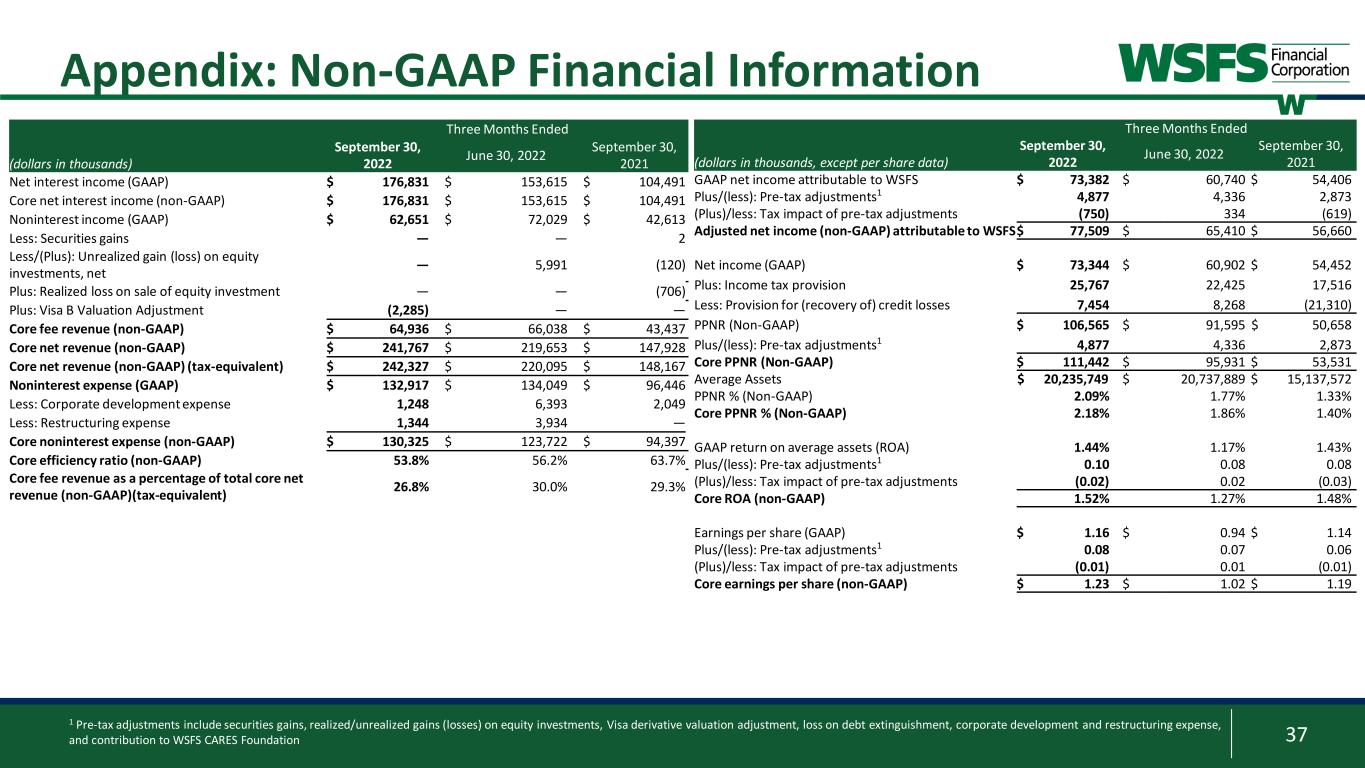

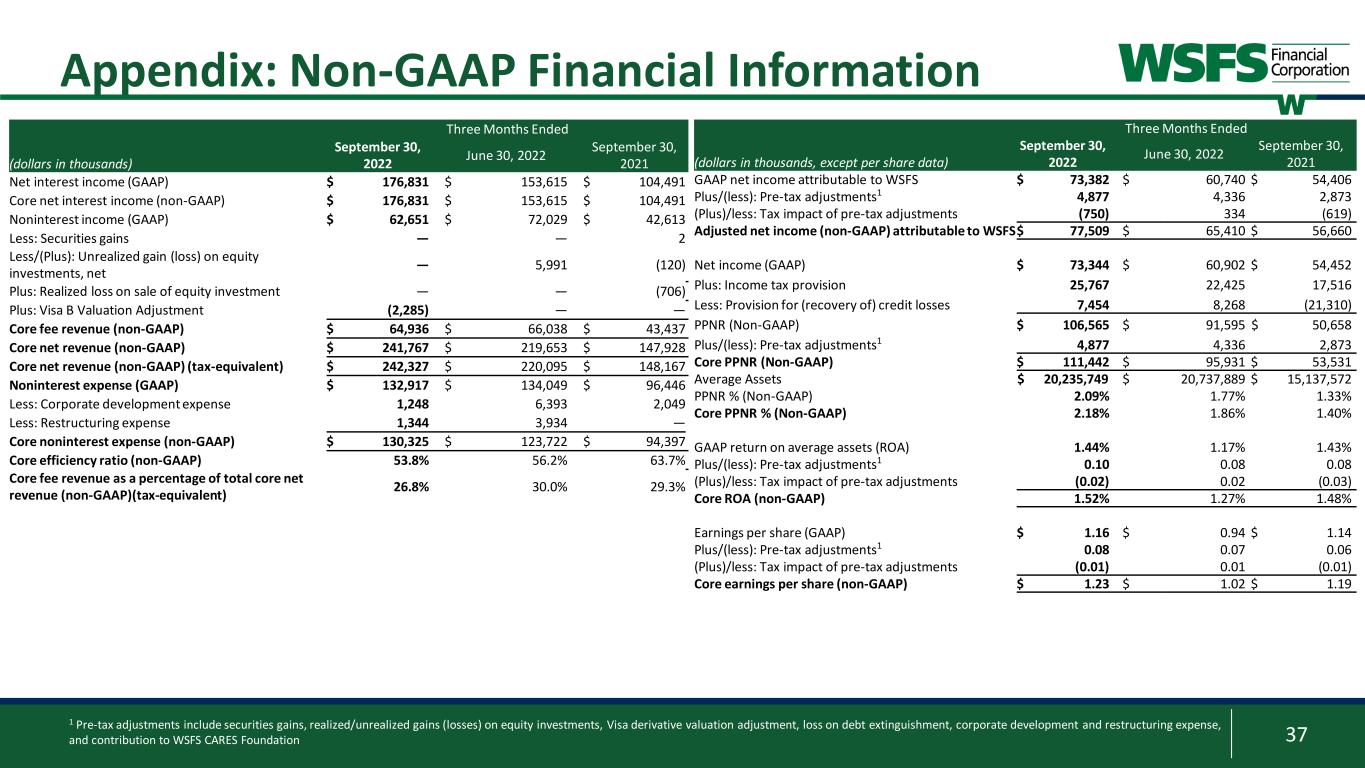

37 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) September 30, 2022 June 30, 2022 September 30, 2021 Net interest income (GAAP) $ 176,831 $ 153,615 $ 104,491 Core net interest income (non-GAAP) $ 176,831 $ 153,615 $ 104,491 Noninterest income (GAAP) $ 62,651 $ 72,029 $ 42,613 Less: Securities gains — — 2 Less/(Plus): Unrealized gain (loss) on equity investments, net — 5,991 (120) Plus: Realized loss on sale of equity investment — — (706) Plus: Visa B Valuation Adjustment (2,285) — — Core fee revenue (non-GAAP) $ 64,936 $ 66,038 $ 43,437 Core net revenue (non-GAAP) $ 241,767 $ 219,653 $ 147,928 Core net revenue (non-GAAP) (tax-equivalent) $ 242,327 $ 220,095 $ 148,167 Noninterest expense (GAAP) $ 132,917 $ 134,049 $ 96,446 Less: Corporate development expense 1,248 6,393 2,049 Less: Restructuring expense 1,344 3,934 — Core noninterest expense (non-GAAP) $ 130,325 $ 123,722 $ 94,397 Core efficiency ratio (non-GAAP) 53.8% 56.2% 63.7% Core fee revenue as a percentage of total core net revenue (non-GAAP)(tax-equivalent) 26.8% 30.0% 29.3% Three Months Ended (dollars in thousands, except per share data) September 30, 2022 June 30, 2022 September 30, 2021 GAAP net income attributable to WSFS $ 73,382 $ 60,740 $ 54,406 Plus/(less): Pre-tax adjustments1 4,877 4,336 2,873 (Plus)/less: Tax impact of pre-tax adjustments (750) 334 (619) Adjusted net income (non-GAAP) attributable to WSFS$ 77,509 $ 65,410 $ 56,660 Net income (GAAP) $ 73,344 $ 60,902 $ 54,452 Plus: Income tax provision 25,767 22,425 17,516 Less: Provision for (recovery of) credit losses 7,454 8,268 (21,310) PPNR (Non-GAAP) $ 106,565 $ 91,595 $ 50,658 Plus/(less): Pre-tax adjustments1 4,877 4,336 2,873 Core PPNR (Non-GAAP) $ 111,442 $ 95,931 $ 53,531 Average Assets $ 20,235,749 $ 20,737,889 $ 15,137,572 PPNR % (Non-GAAP) 2.09% 1.77% 1.33% Core PPNR % (Non-GAAP) 2.18% 1.86% 1.40% GAAP return on average assets (ROA) 1.44% 1.17% 1.43% Plus/(less): Pre-tax adjustments1 0.10 0.08 0.08 (Plus)/less: Tax impact of pre-tax adjustments (0.02) 0.02 (0.03) Core ROA (non-GAAP) 1.52% 1.27% 1.48% Earnings per share (GAAP) $ 1.16 $ 0.94 $ 1.14 Plus/(less): Pre-tax adjustments1 0.08 0.07 0.06 (Plus)/less: Tax impact of pre-tax adjustments (0.01) 0.01 (0.01) Core earnings per share (non-GAAP) $ 1.23 $ 1.02 $ 1.19 1 Pre-tax adjustments include securities gains, realized/unrealized gains (losses) on equity investments, Visa derivative valuation adjustment, loss on debt extinguishment, corporate development and restructuring expense, and contribution to WSFS CARES Foundation

38 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) September 30, 2022 June 30, 2022 September 30, 2021 Calculation of return on average tangible common equity: GAAP net income attributable to WSFS $ 73,382 $ 60,740 $ 54,406 Plus: Tax effected amortization of intangible assets 2,906 2,940 2,006 Net tangible income (non-GAAP) $ 76,288 $ 63,680 $ 56,412 Average stockholders' equity of WSFS $ 2,347,178 $ 2,404,262 $ 1,907,868 Less: average goodwill and intangible assets 1,018,592 1,032,131 550,923 Net average tangible common equity $ 1,328,586 $ 1,372,131 $ 1,356,945 Return on average common equity (GAAP) 12.40% 10.13% 11.31% Return on average tangible common equity (non-GAAP) 22.78% 18.61% 16.49% Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 77,509 $ 65,410 $ 56,660 Plus: Tax effected amortization of intangible assets 2,906 2,940 2,006 Core net tangible income (non-GAAP) $ 80,415 $ 68,350 $ 58,666 Net average tangible common equity $ 1,328,586 $ 1,372,131 $ 1,356,945 Core return on average common equity (non-GAAP) 13.10% 10.91% 11.78% Core return on average tangible common equity (non-GAAP) 24.01% 19.98% 17.15% For the year ended December 31, (dollars in thousands) 2010 2011 2012 2013 Net Income (GAAP) $ 14,117 $ 22,677 $ 31,311 $ 46,882 Adj: Plus/(less) core (after-tax)1 420 (2,664) (11,546) (4,290) Adjusted net income (non-GAAP) $ 14,537 $ 20,013 $ 19,765 $ 42,592 Average Assets $ 3,796,166 $ 4,070,896 $ 4,267,358 $ 4,365,389 GAAP ROA 0.37% 0.56% 0.73% 1.07% Core ROA (non-GAAP) 0.38% 0.49% 0.46% 0.98% For the year ended December 31, (dollars in thousands) 2014 2015 2016 2017 Net Income (GAAP) $ 53,757 $ 53,533 $ 64,080 $ 50,244 Adj: Plus/(less) core (after-tax)1 (4,632) 4,407 4,323 32,597 Adjusted net income (non-GAAP) $ 49,125 $ 57,940 $ 68,403 $ 82,841 Average Assets $ 4,598,121 $ 5,074,129 $ 6,042,824 $ 6,820,471 GAAP ROA 1.17% 1.05% 1.06% 0.74% Core ROA (non-GAAP) 1.07% 1.14% 1.13% 1.21% For the year ended December 31, (dollars in thousands) 2018 2019 2020 2021 Net Income (GAAP) $ 134,743 $ 148,809 $ 114,774 $ 271,442 Adj: Plus/(less) core (after-tax)1 (20,436) 36,295 (18,126) (2,893) Adjusted net income (non-GAAP) $ 114,307 $ 185,104 $ 96,648 $ 268,549 Average Assets $ 7,014,447 $ 11,477,856 $ 13,148,317 $ 14,903,920 GAAP ROA 1.92% 1.30% 0.87% 1.82% Core ROA (non-GAAP) 1.63% 1.61% 0.74% 1.80% 1 For details on our core adjustments for full-year 2010 through 2021 refer to each years’ respective fourth quarter Earnings Release filed at Exhibit 99.1 on Form 8-K

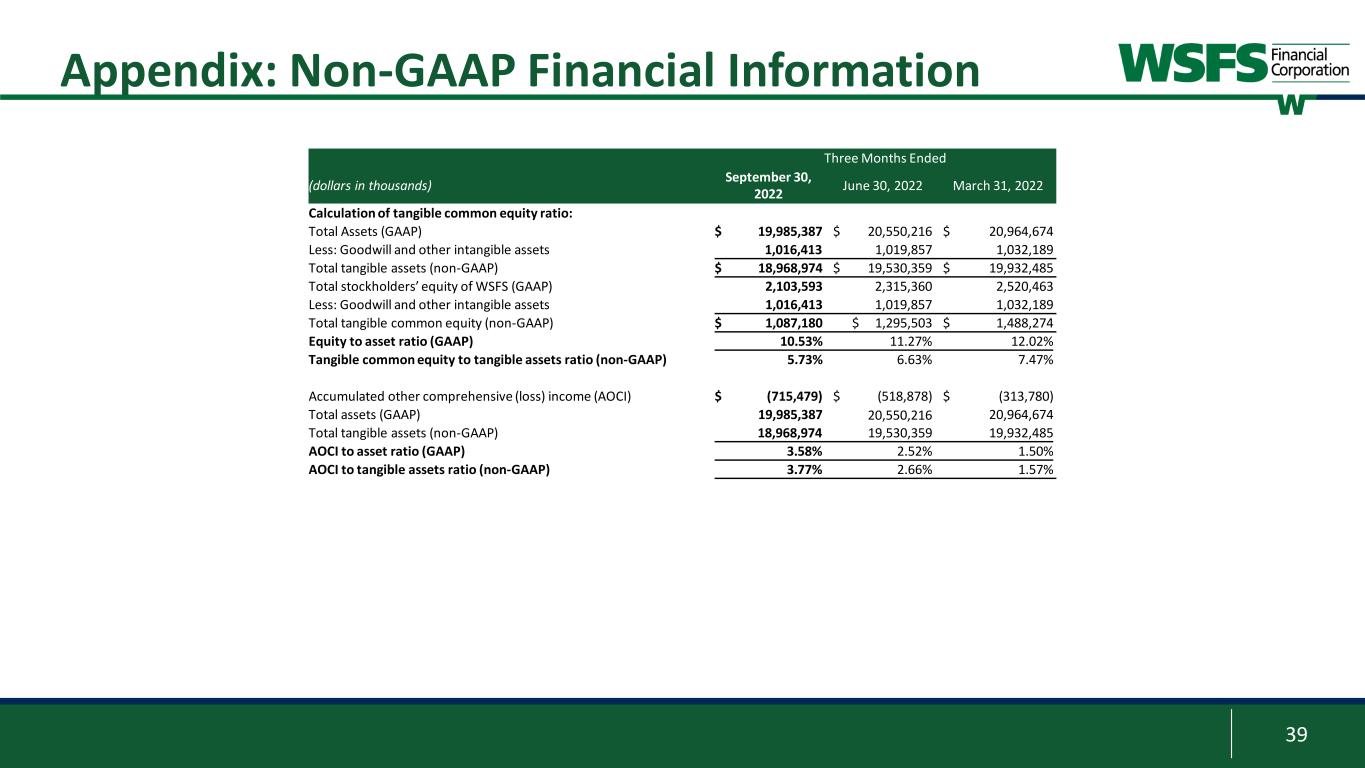

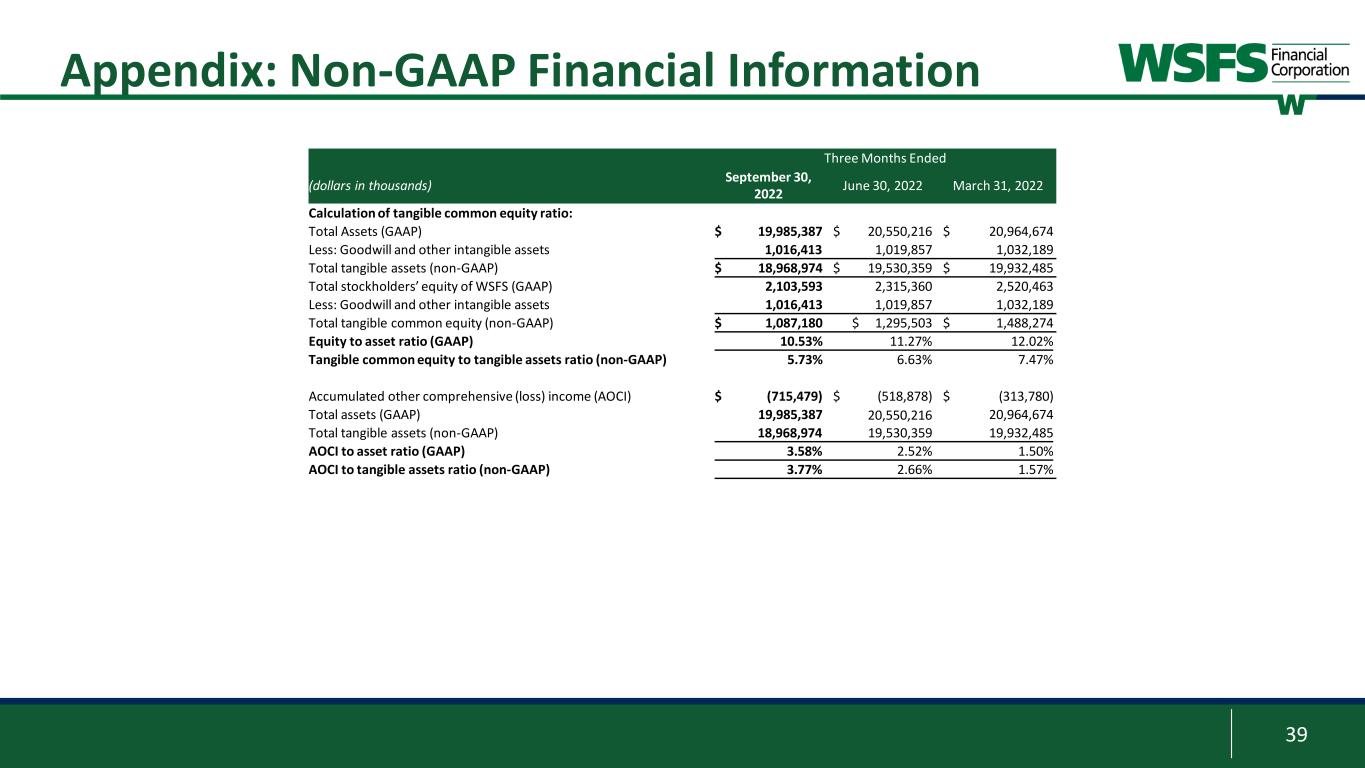

39 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) September 30, 2022 June 30, 2022 March 31, 2022 Calculation of tangible common equity ratio: Total Assets (GAAP) $ 19,985,387 $ 20,550,216 $ 20,964,674 Less: Goodwill and other intangible assets 1,016,413 1,019,857 1,032,189 Total tangible assets (non-GAAP) $ 18,968,974 $ 19,530,359 $ 19,932,485 Total stockholders’ equity of WSFS (GAAP) 2,103,593 2,315,360 2,520,463 Less: Goodwill and other intangible assets 1,016,413 1,019,857 1,032,189 Total tangible common equity (non-GAAP) $ 1,087,180 $ 1,295,503 $ 1,488,274 Equity to asset ratio (GAAP) 10.53% 11.27% 12.02% Tangible common equity to tangible assets ratio (non-GAAP) 5.73% 6.63% 7.47% Accumulated other comprehensive (loss) income (AOCI) $ (715,479) $ (518,878) $ (313,780) Total assets (GAAP) 19,985,387 20,550,216 20,964,674 Total tangible assets (non-GAAP) 18,968,974 19,530,359 19,932,485 AOCI to asset ratio (GAAP) 3.58% 2.52% 1.50% AOCI to tangible assets ratio (non-GAAP) 3.77% 2.66% 1.57%

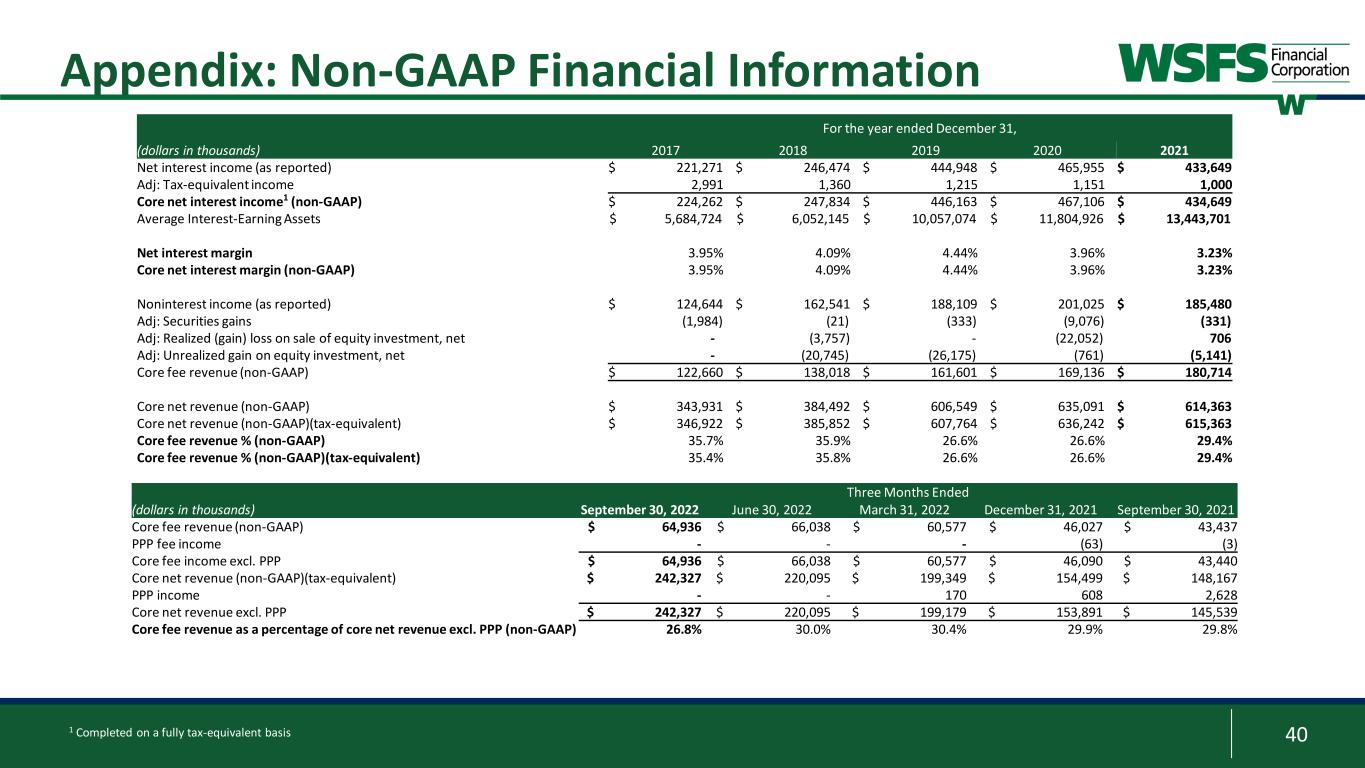

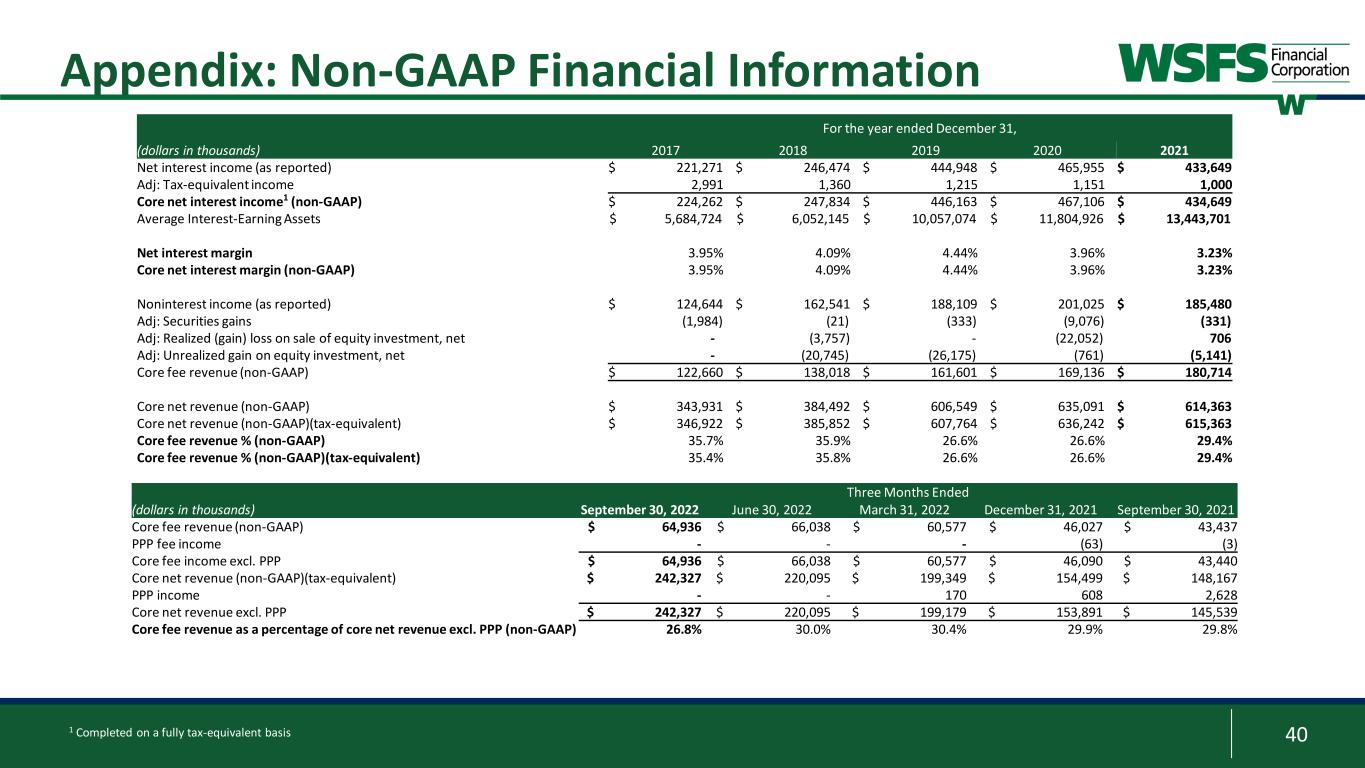

40 Appendix: Non-GAAP Financial Information 1 Completed on a fully tax-equivalent basis For the year ended December 31, (dollars in thousands) 2017 2018 2019 2020 2021 Net interest income (as reported) $ 221,271 $ 246,474 $ 444,948 $ 465,955 $ 433,649 Adj: Tax-equivalent income 2,991 1,360 1,215 1,151 1,000 Core net interest income1 (non-GAAP) $ 224,262 $ 247,834 $ 446,163 $ 467,106 $ 434,649 Average Interest-Earning Assets $ 5,684,724 $ 6,052,145 $ 10,057,074 $ 11,804,926 $ 13,443,701 Net interest margin 3.95% 4.09% 4.44% 3.96% 3.23% Core net interest margin (non-GAAP) 3.95% 4.09% 4.44% 3.96% 3.23% Noninterest income (as reported) $ 124,644 $ 162,541 $ 188,109 $ 201,025 $ 185,480 Adj: Securities gains (1,984) (21) (333) (9,076) (331) Adj: Realized (gain) loss on sale of equity investment, net - (3,757) - (22,052) 706 Adj: Unrealized gain on equity investment, net - (20,745) (26,175) (761) (5,141) Core fee revenue (non-GAAP) $ 122,660 $ 138,018 $ 161,601 $ 169,136 $ 180,714 Core net revenue (non-GAAP) $ 343,931 $ 384,492 $ 606,549 $ 635,091 $ 614,363 Core net revenue (non-GAAP)(tax-equivalent) $ 346,922 $ 385,852 $ 607,764 $ 636,242 $ 615,363 Core fee revenue % (non-GAAP) 35.7% 35.9% 26.6% 26.6% 29.4% Core fee revenue % (non-GAAP)(tax-equivalent) 35.4% 35.8% 26.6% 26.6% 29.4% Three Months Ended (dollars in thousands) September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 Core fee revenue (non-GAAP) $ 64,936 $ 66,038 $ 60,577 $ 46,027 $ 43,437 PPP fee income - - - (63) (3) Core fee income excl. PPP $ 64,936 $ 66,038 $ 60,577 $ 46,090 $ 43,440 Core net revenue (non-GAAP)(tax-equivalent) $ 242,327 $ 220,095 $ 199,349 $ 154,499 $ 148,167 PPP income - - 170 608 2,628 Core net revenue excl. PPP $ 242,327 $ 220,095 $ 199,179 $ 153,891 $ 145,539 Core fee revenue as a percentage of core net revenue excl. PPP (non-GAAP) 26.8% 30.0% 30.4% 29.9% 29.8%

41 Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Chairman, President and CEO 302-571-7296 rlevenson@wsfsbank.com Dominic C. Canuso EVP and Chief Financial Officer 302-571-6833 dcanuso@wsfsbank.com