1 WSFS Financial Corporation 4Q 2024 Earnings Release Supplement January 2025 Exhibit 99.2

2 Forward Looking Statements & Non-GAAP Forward Looking Statements: This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward- looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including the impacts related to or resulting from bank failures and other economic and industry volatility, including potential increased regulatory requirements and costs and potential impacts to macroeconomic conditions, the uncertain effects of geopolitical instability, armed conflicts, public health crises, inflation, interest rates and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail in the Company’s Form 10-K for the year ended December 31, 2023, Form 10-Q for the quarter ended March 31, 2024, Form 10-Q for the quarter ended June 30, 2024, Form 10-Q for the quarter ended September 30, 2024, and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures: This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include Core Earnings Per Share (“EPS”), Core Net Income, Core Fee Revenue, Core Fee Revenue ratio, Core Efficiency ratio, Pre-provision Net Revenue (“PPNR”), Core PPNR, PPNR to average assets ratio, Core PPNR to average assets ratio, Core Return on Assets (“ROA”), core net interest income, Core Net Interest Margin (“NIM”), Tangible Common Equity (“TCE”), tangible assets, Return on Average Tangible Common Equity (“ROTCE”), Core ROTCE, Core Fee Revenue, Core Fee Revenue ratio, net tangible income, tangible common book value (“TBV”), coverage ratio including the remaining credit marks, and Effective AOCI. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. For a reconciliation of these non-GAAP measures to their comparable GAAP measures, see the Appendix. Trade names, trademarks and service marks of other companies appearing in this presentation are the property of their respective holders.

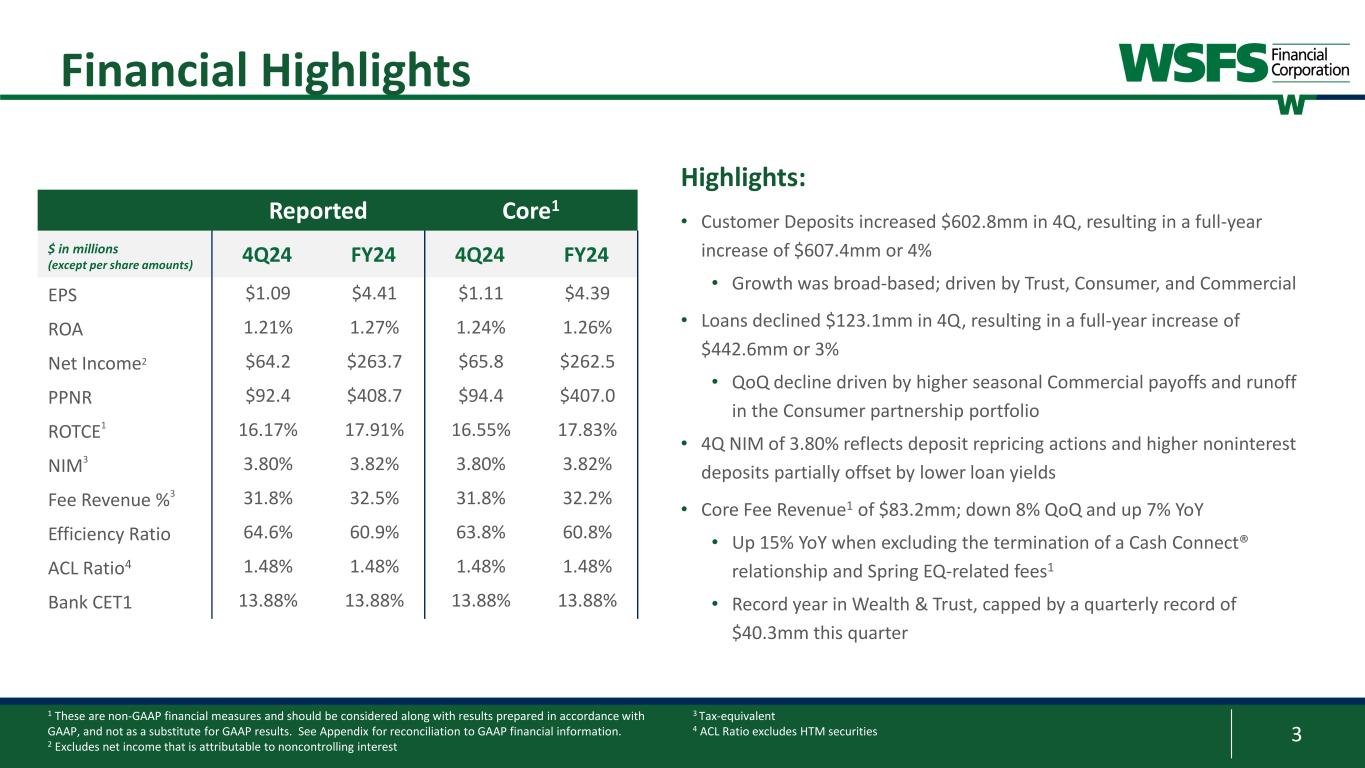

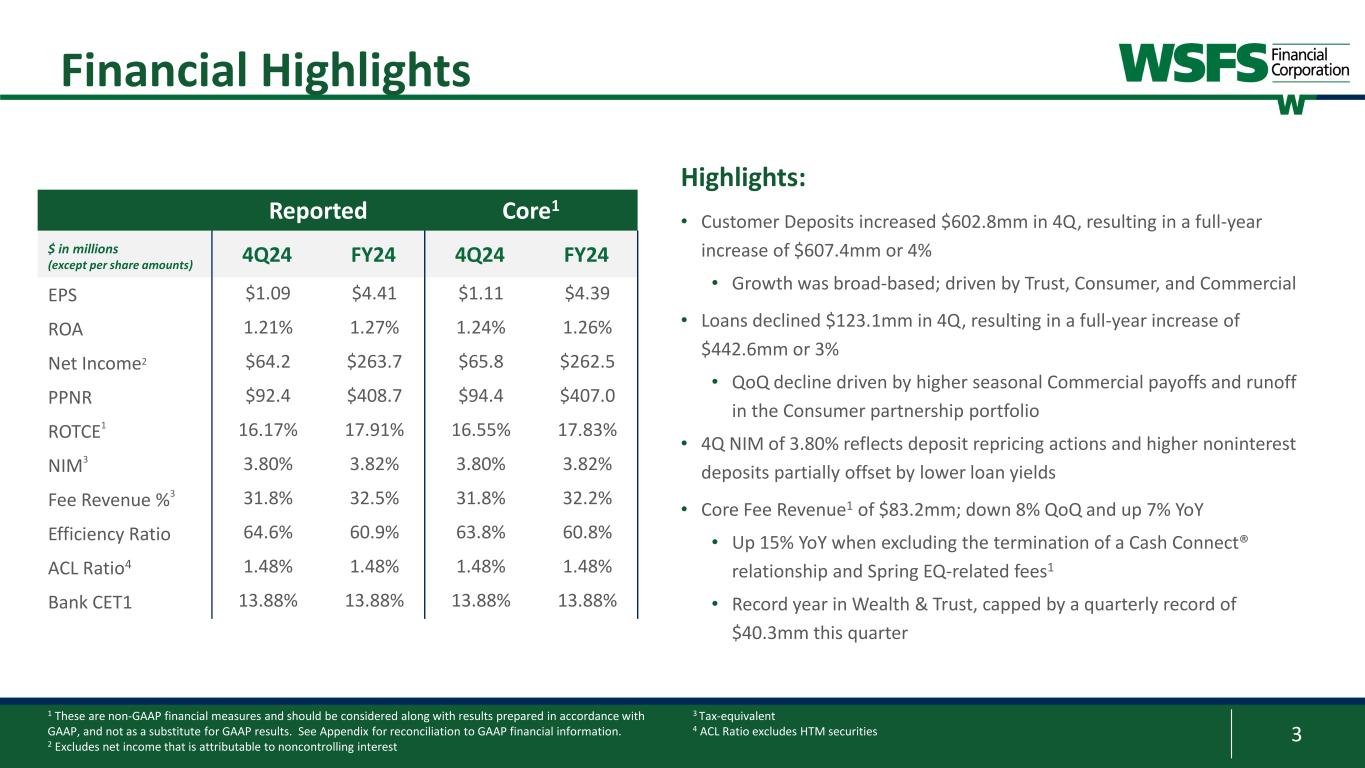

3 Financial Highlights Highlights: • Customer Deposits increased $602.8mm in 4Q, resulting in a full-year increase of $607.4mm or 4% • Growth was broad-based; driven by Trust, Consumer, and Commercial • Loans declined $123.1mm in 4Q, resulting in a full-year increase of $442.6mm or 3% • QoQ decline driven by higher seasonal Commercial payoffs and runoff in the Consumer partnership portfolio • 4Q NIM of 3.80% reflects deposit repricing actions and higher noninterest deposits partially offset by lower loan yields • Core Fee Revenue1 of $83.2mm; down 8% QoQ and up 7% YoY • Up 15% YoY when excluding the termination of a Cash Connect® relationship and Spring EQ-related fees1 • Record year in Wealth & Trust, capped by a quarterly record of $40.3mm this quarter 1 These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Excludes net income that is attributable to noncontrolling interest Reported Core1 $ in millions (except per share amounts) 4Q24 FY24 4Q24 FY24 EPS $1.09 $4.41 $1.11 $4.39 ROA 1.21% 1.27% 1.24% 1.26% Net Income2 $64.2 $263.7 $65.8 $262.5 PPNR $92.4 $408.7 $94.4 $407.0 ROTCE1 16.17% 17.91% 16.55% 17.83% NIM3 3.80% 3.82% 3.80% 3.82% Fee Revenue %3 31.8% 32.5% 31.8% 32.2% Efficiency Ratio 64.6% 60.9% 63.8% 60.8% ACL Ratio4 1.48% 1.48% 1.48% 1.48% Bank CET1 13.88% 13.88% 13.88% 13.88% 3 Tax-equivalent 4 ACL Ratio excludes HTM securities

4 Up-cycle Deposit Betas3,4 50% 51% 35% 36% 0% 15% 30% 45% 60% 2Q 2024 3Q 2024 De po sit B et a Int-Only Total Net Interest Margin Trends Reflects growing core deposits while maintaining favorable funding costs 1 Includes noninterest and interest-bearing; interest-bearing deposits include demand, money market, savings, and customer time deposits 2 Average total loans yield excludes PAA 3 Deposit betas are based on cumulative customer deposit costs for the up-cycle rate and down-cycle rate (9/24); assumes Fed Funds of 4.50% 4 Betas are the average of the last month in a respective quarter; exit is based on the last business date in a respective quarter • 4Q NIM up 2bps QoQ to 3.80% • Reduced total funding cost by 23bps in 4Q • Benefited from active repricing actions and higher noninterest deposits, partially offset by lower loan yields • Dec’24 Average: NIM of 3.80% and total deposit cost of 1.75% 26% ~35% 22% ~25% 0% 15% 30% 45% 60% 4Q 2024 Dec'24 Exit De po sit B et a Int-Only Total Down-cycle Deposit Betas3,4 1.62% 1.79% 1.89% 1.95% 1.83% 1.83% 1.99% 2.09% 2.15% 1.92% 6.92% 6.95% 7.03% 7.01% 6.72% 2.0% 3.2% 4.4% 5.6% 6.8% 8.0% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Lo an Y ie ld (% ) Cu st om er D ep os it Co st (% ) Total Deposit Cost Total Funding Cost Total Loans Ex PAA Yield Average Deposit Cost and Loan Yield 1 2

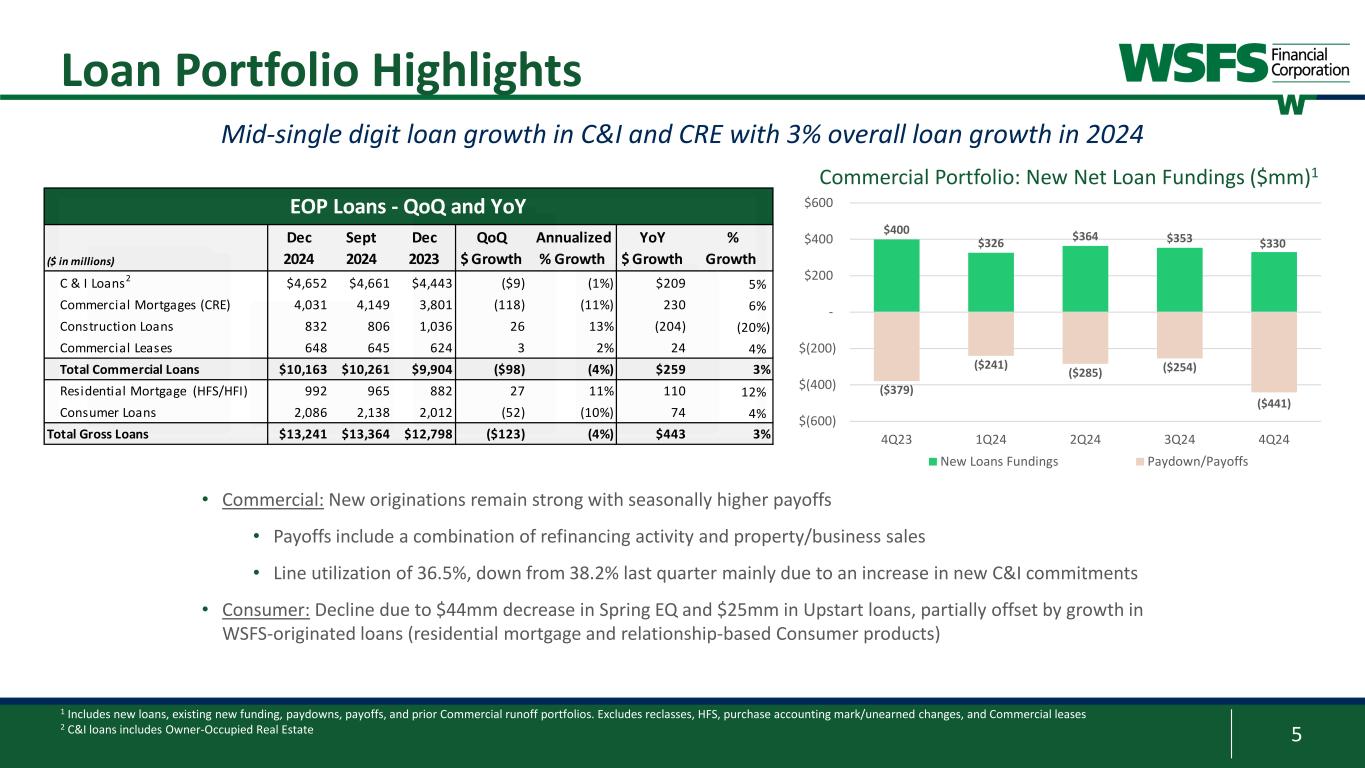

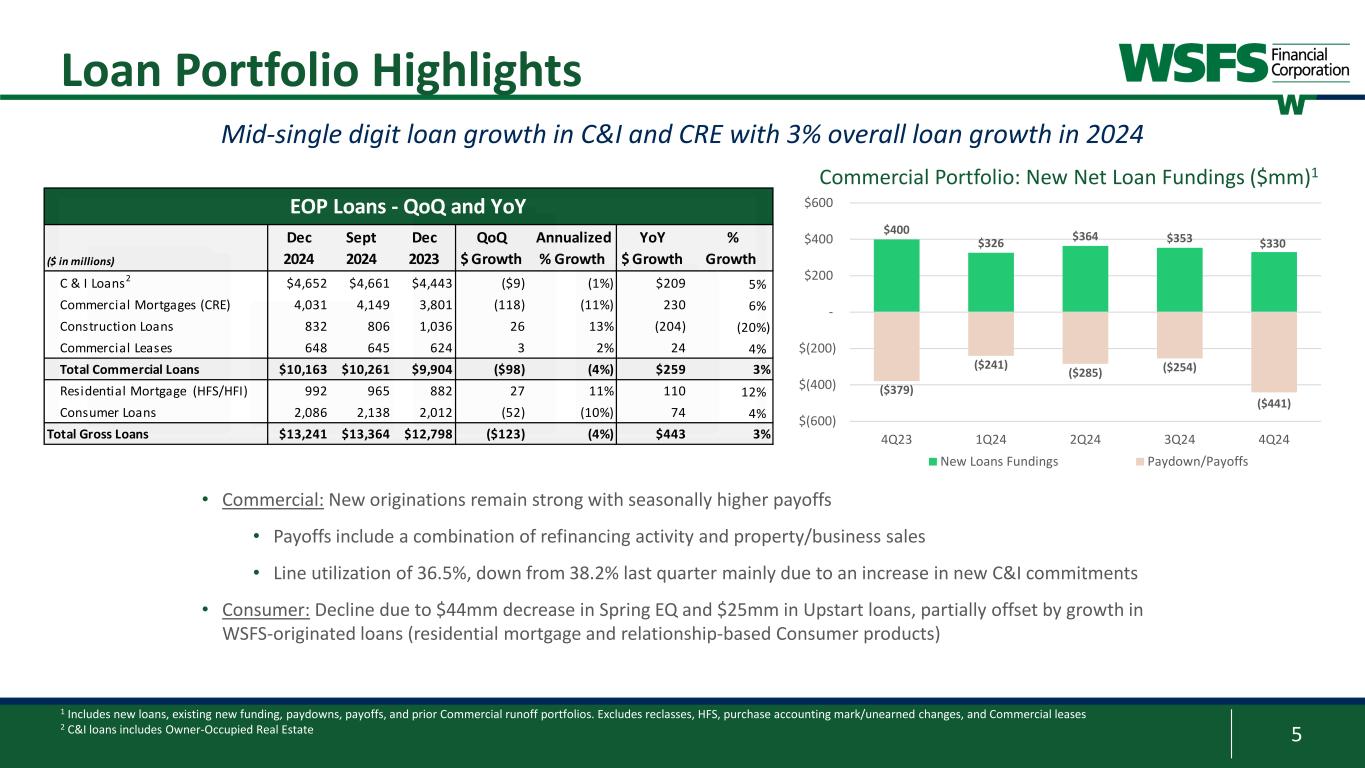

5 Loan Portfolio Highlights • Commercial: New originations remain strong with seasonally higher payoffs • Payoffs include a combination of refinancing activity and property/business sales • Line utilization of 36.5%, down from 38.2% last quarter mainly due to an increase in new C&I commitments • Consumer: Decline due to $44mm decrease in Spring EQ and $25mm in Upstart loans, partially offset by growth in WSFS-originated loans (residential mortgage and relationship-based Consumer products) Mid-single digit loan growth in C&I and CRE with 3% overall loan growth in 2024 1 Includes new loans, existing new funding, paydowns, payoffs, and prior Commercial runoff portfolios. Excludes reclasses, HFS, purchase accounting mark/unearned changes, and Commercial leases 2 C&I loans includes Owner-Occupied Real Estate ($ in millions) Dec 2024 Sept 2024 Dec 2023 QoQ $ Growth Annualized % Growth YoY $ Growth % Growth C & I Loans2 $4,652 $4,661 $4,443 ($9) (1%) $209 5% Commercial Mortgages (CRE) 4,031 4,149 3,801 (118) (11%) 230 6% Construction Loans 832 806 1,036 26 13% (204) (20%) Commercial Leases 648 645 624 3 2% 24 4% Total Commercial Loans $10,163 $10,261 $9,904 ($98) (4%) $259 3% Residential Mortgage (HFS/HFI) 992 965 882 27 11% 110 12% Consumer Loans 2,086 2,138 2,012 (52) (10%) 74 4% Total Gross Loans $13,241 $13,364 $12,798 ($123) (4%) $443 3% EOP Loans - QoQ and YoY $400 $326 $364 $353 $330 ($379) ($241) ($285) ($254) ($441) $(600) $(400) $(200) - $200 $400 $600 4Q23 1Q24 2Q24 3Q24 4Q24 New Loans Fundings Paydown/Payoffs Commercial Portfolio: New Net Loan Fundings ($mm)1

6 Deposit Highlights • $602.8mm (4% not annualized) increase in ending Customer Deposits this quarter • Driven by Trust, Consumer, and Commercial deposits, partially offset by expected declines in Munis • 51% of Customer Deposits are coming from Commercial, Small Business, and Wealth & Trust • Consistently averaging over 30% noninterest deposits Broad-based core deposit growth while actively managing pricing Consumer 48% Commercial 24% Small Business 12% Trust 10% Wealth 5% Other 1% Average Customer Deposits By Business Line 11% 11% 12% 13% 12% 40% 42% 41% 40% 40% 18% 17% 17% 17% 17% 31% 30% 30% 30% 31% 0% 20% 40% 60% 80% 100% 4Q23 1Q24 2Q24 3Q24 4Q24 Noninterest Interest-bearing Savings/MM Time Average Total Customer Deposit Mix ($ in millions) Dec 2024 Sept 2024 Dec 2023 QoQ $ Growth Annualized % Growth YoY $ Growth % Growth Noninterest Demand $4,988 $4,686 $4,917 $302 26% $71 1% Interest-bearing Demand 2,973 2,931 2,936 42 6% 37 1% Savings 1,466 1,489 1,610 (23) (6%) (144) (9%) Money Market 5,472 5,178 5,175 294 23% 297 6% Total Core Deposits $14,899 $14,284 $14,638 $615 17% $261 2% Customer Time Deposits 2,131 2,143 1,784 (12) (2%) 347 19% Total Customer Deposits $17,030 $16,427 $16,422 $603 15% $608 4% EOP Deposits by Product - QoQ and YoY

7 $19 $17 $17 $21 $18 $23 $26 $31 $32 $25 $36 $33 $38 $37 $40 $78 $76 $86 $90 $83 $- $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 4Q 2023 1Q 2024 2Q 2024 3Q 2024 4Q 2024 Co re F ee R ev en ue ($ m m )2 Banking Cash Connect Wealth Management3 Core Fee Revenue1 31.8% Core Fee Revenue ratio with record quarterly fees in Wealth Management 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 2 Tax-equivalent basis 3 Banking includes deposit service charges, SBA loan sales, loan and lease fees, credit and debit revenue, capital markets, mortgage, and other banking related fees Wealth Management: • Institutional Services growth driven by higher paying agent, custody, and verification fees • The Bryn Mawr Trust Company of Delaware grew from new relationships and higher volume Cash Connect®: • Impacted by lower interest rates as well as one relationship that was terminated in 4Q • This relationship reduced 4Q fees by $2.8mm; excluding this termination, Cash Connect® would be down $3.6mm ($2.1mm rate-driven and $1.5mm seasonally lower volume) Banking: • Decline driven by prior quarter’s Spring EQ annual earnout as well as lower Capital Markets and Mortgage fees ®

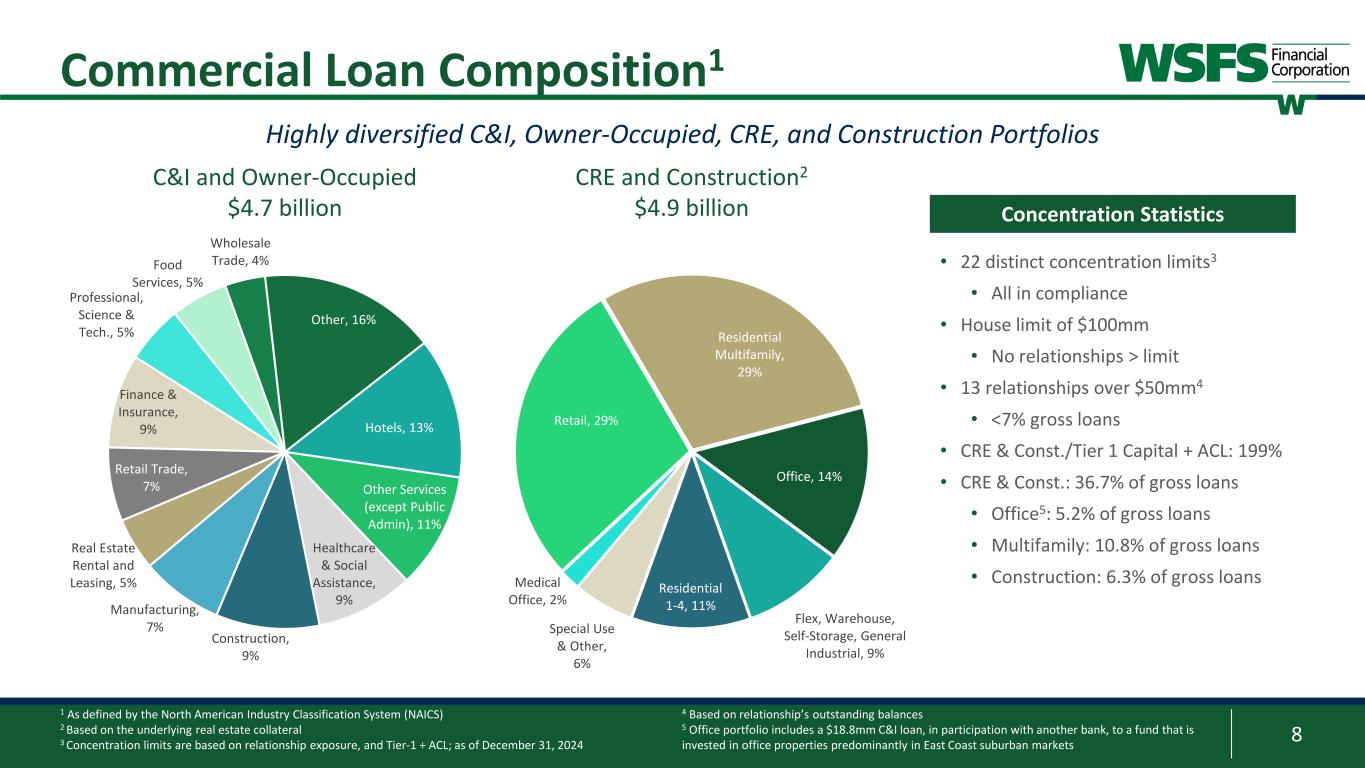

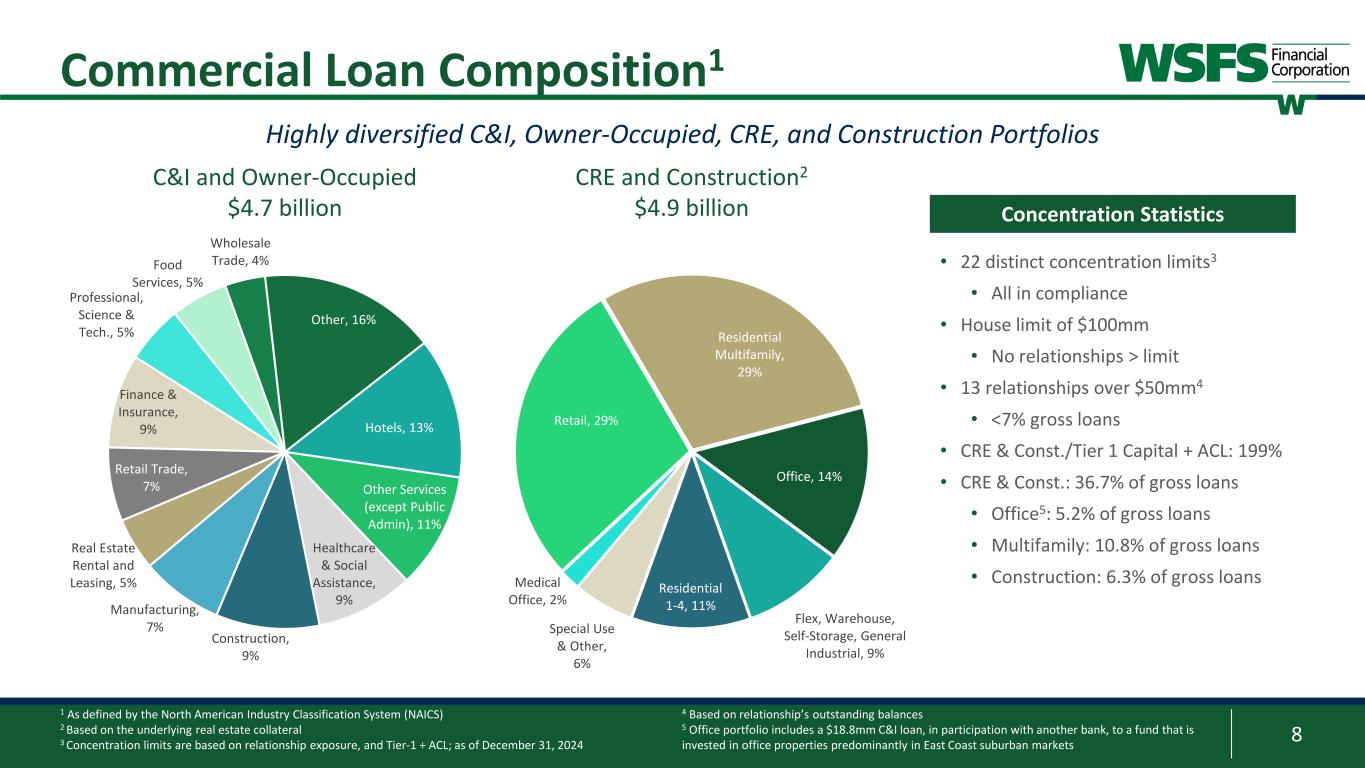

8 3 Commercial Loan Composition1 1 As defined by the North American Industry Classification System (NAICS) 2 Based on the underlying real estate collateral 3 Concentration limits are based on relationship exposure, and Tier-1 + ACL; as of December 31, 2024 2 Highly diversified C&I, Owner-Occupied, CRE, and Construction Portfolios C&I and Owner-Occupied $4.7 billion CRE and Construction2 $4.9 billion Hotels, 13% Other Services (except Public Admin), 11% Healthcare & Social Assistance, 9% Construction, 9% Manufacturing, 7% Real Estate Rental and Leasing, 5% Retail Trade, 7% Finance & Insurance, 9% Professional, Science & Tech., 5% Food Services, 5% Wholesale Trade, 4% Other, 16% Retail, 29% Residential Multifamily, 29% Office, 14% Flex, Warehouse, Self-Storage, General Industrial, 9% Residential 1-4, 11% Special Use & Other, 6% Medical Office, 2% • 22 distinct concentration limits3 • All in compliance • House limit of $100mm • No relationships > limit • 13 relationships over $50mm4 • <7% gross loans • CRE & Const./Tier 1 Capital + ACL: 199% • CRE & Const.: 36.7% of gross loans • Office5: 5.2% of gross loans • Multifamily: 10.8% of gross loans • Construction: 6.3% of gross loans Concentration Statistics 4 Based on relationship’s outstanding balances 5 Office portfolio includes a $18.8mm C&I loan, in participation with another bank, to a fund that is invested in office properties predominantly in East Coast suburban markets

9 $0.0 $0.1 $0.2 $0.3 $0.4 $0.5 $0.6 2025 2026 2027 2028 2029 Bi lli on s Volume of Maturing CRE Loans by Industry Office Multi-Family Industrial/Flex Retail Resi 1-4 Other CRE and Select Portfolios 1 Inclusive of Construction 2 Includes a $18.8mm C&I loan, in participation with another bank, to a fund that is invested in office properties predominantly in East Coast suburban markets 3 Office CRE portfolio excludes $97.1mm ($98.6mm exposure) of Medical Office CRE/Construction 4 Central Business District CRE Portfolio: • Granular with an average loan of $1.2mm; 9 relationships over $50mm • ~81% of the portfolio effectively has a fixed rate (~38% of the portfolio fixed with ~70% of the variable rate portfolio swapped) • Continually reviewing $2.5mm+ loans maturing in the next 24 months • ~$125mm of loans maturing in 2025 and ~$100mm in 2026 have a DSCR below 1.05x in a 7.50% interest rate scenario; proactively addressing all maturing loans • $689mm with $711mm exposure3; 5.2% of gross loans • $1.8mm average loan size • 78% Suburban and 22% Urban; 7% of Office is in CBD4 • 15 loans over $10mm; 3 loans >$20mm (largest ~$27mm) • Average LTV of ~60% at origination • 0% DLQ; 0% NCO; 2.7% NPA; 14% problem loans • 81% with recourse Office Portfolio1,2 • $1.4bn with $1.7bn exposure; 10.8% of gross loans • $3.0mm average loan size • 51% Suburban and 49% Urban; 6% of CRE Multifamily is in CBD4 • 23 loans over $20mm; largest loan ~$33mm • Average LTV of ~56% at origination • 2.3% DLQ; 0% NCO; <2% NPA; 7% problem loans • 88% with recourse Multifamily Portfolio1 13.7% 8.5% 11.0% 10.9% 13.3% Portfolio Maturity %

10 Asset Quality Metrics Problem Assets Nonperforming Assets (NPA) Delinquencies (DLQ) Net Charge-offs (NCO) $556 $573 $629 $722 $645 4.34% 4.41% 4.76% 5.40% 4.87% 0.0% 1.2% 2.4% 3.6% 4.8% 6.0% $300 $400 $500 $600 $700 $800 4Q23 1Q24 2Q24 3Q24 4Q24 M ill io ns Problem Assets % of Gross Loans $102 $105 $89 $148 $122 0.80% 0.81% 0.68% 1.11% 0.92% 0.0% 0.3% 0.6% 0.9% 1.2% 1.5% $0 $25 $50 $75 $100 $125 $150 $175 $200 4Q23 1Q24 2Q24 3Q24 4Q24 M ill io ns Delinquencies % of Gross Loans $8 $3 $9 $14 $6 $5 $5 $5 $4 $4 $1 $1 $1 $1 $1 0.46% 0.27% 0.44% 0.58% 0.31% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% $0 $4 $8 $12 $16 $20 $24 $28 4Q23 1Q24 2Q24 3Q24 4Q24 M ill io ns Commercial Upstart Consumer % of Avg. Gross Loans $76 $67 $65 $91 $127 0.37% 0.33% 0.32% 0.44% 0.61% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% $0 $25 $50 $75 $100 $125 $150 4Q23 1Q24 2Q24 3Q24 4Q24 M ill io ns Nonperforming Assets % of Total Assets • Problem Assets: Decreased 53bps QoQ • 16bps driven by the full payoff of a large loan; remainder driven by upgrades • NPA: Increased 17bps QoQ • Primarily due to migration of one relationship in land and multifamily construction • NCO: Decreased 27bps QoQ • 20bps NCO excluding Upstart • Upstart expected to continue to decline as the portfolio runs off 4Q 2024 Performance 1 Includes NewLane 1 FY24 Commercial1 NCO: 24bps

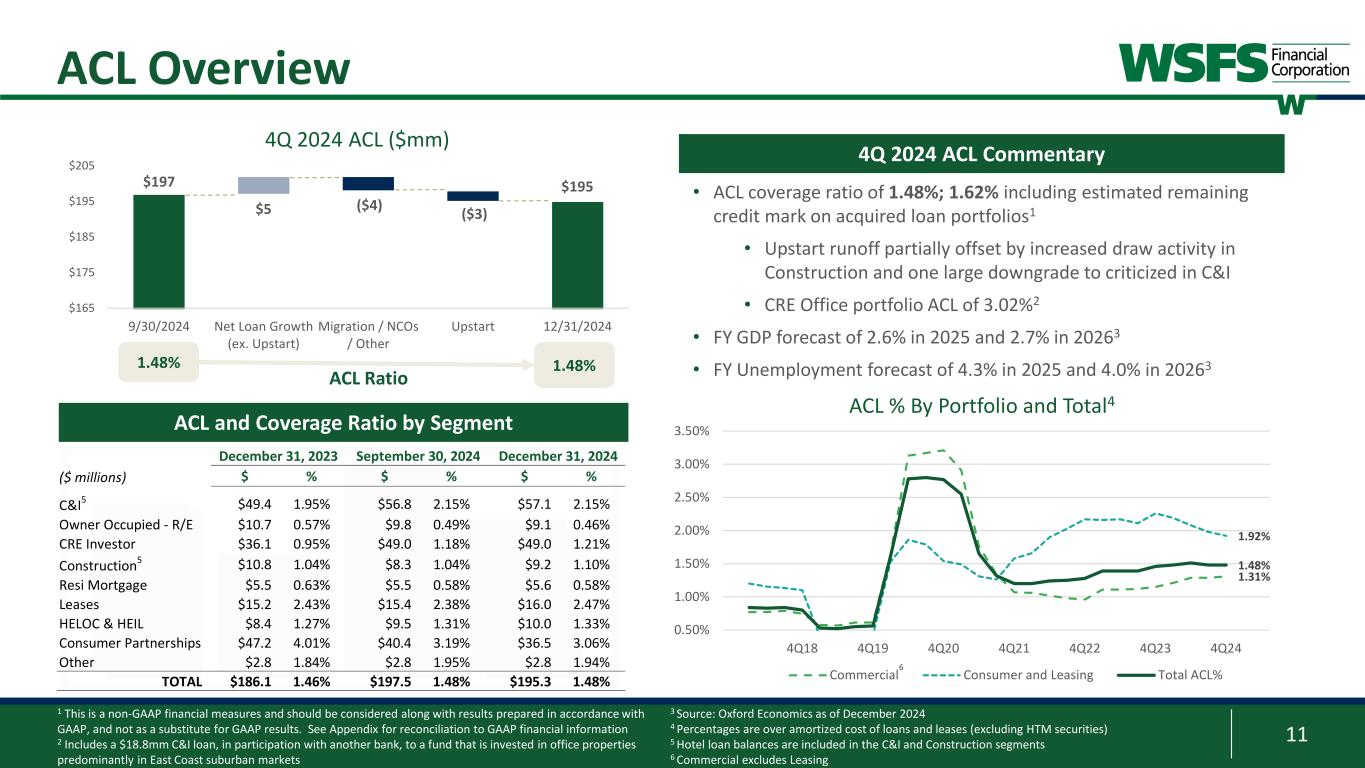

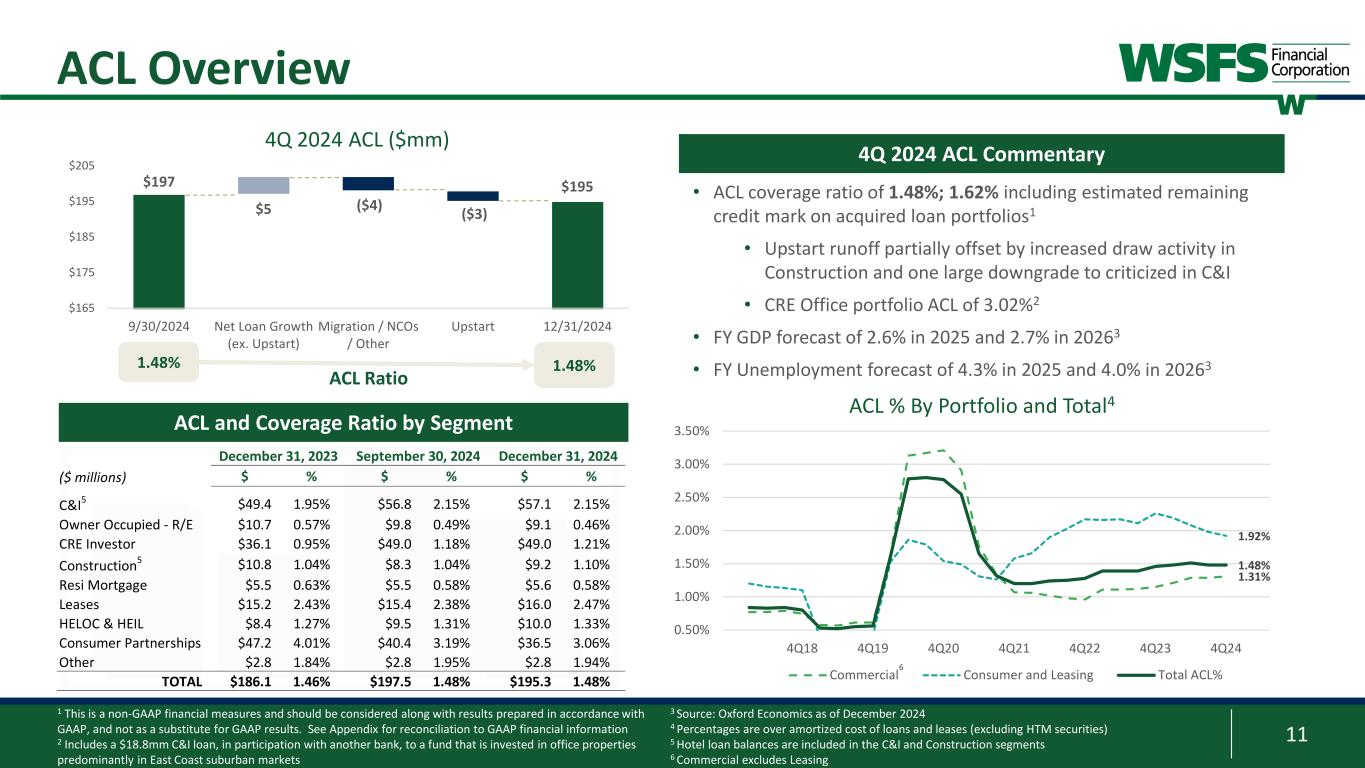

11 ACL Ratio $165 $175 $185 $195 $205 9/30/2024 Net Loan Growth (ex. Upstart) Migration / NCOs / Other Upstart 12/31/2024 4Q 2024 ACL ($mm) $5 ($3) $195 ($4) 1 This is a non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information 2 Includes a $18.8mm C&I loan, in participation with another bank, to a fund that is invested in office properties predominantly in East Coast suburban markets ACL Overview ACL and Coverage Ratio by Segment 4Q 2024 ACL Commentary 1.48% • ACL coverage ratio of 1.48%; 1.62% including estimated remaining credit mark on acquired loan portfolios1 • Upstart runoff partially offset by increased draw activity in Construction and one large downgrade to criticized in C&I • CRE Office portfolio ACL of 3.02%2 • FY GDP forecast of 2.6% in 2025 and 2.7% in 20263 • FY Unemployment forecast of 4.3% in 2025 and 4.0% in 202631.48% 1.31% 1.92% 1.48% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4Q18 4Q19 4Q20 4Q21 4Q22 4Q23 4Q24 ACL % By Portfolio and Total4 Commercial Consumer and Leasing Total ACL% 6 3 Source: Oxford Economics as of December 2024 4 Percentages are over amortized cost of loans and leases (excluding HTM securities) 5 Hotel loan balances are included in the C&I and Construction segments 6 Commercial excludes Leasing $197 ($ millions) $ % $ % $ % C&I5 $49.4 1.95% $56.8 2.15% $57.1 2.15% Owner Occupied - R/E $10.7 0.57% $9.8 0.49% $9.1 0.46% CRE Investor $36.1 0.95% $49.0 1.18% $49.0 1.21% Construction5 $10.8 1.04% $8.3 1.04% $9.2 1.10% Resi Mortgage $5.5 0.63% $5.5 0.58% $5.6 0.58% Leases $15.2 2.43% $15.4 2.38% $16.0 2.47% HELOC & HEIL $8.4 1.27% $9.5 1.31% $10.0 1.33% Consumer Partnerships $47.2 4.01% $40.4 3.19% $36.5 3.06% Other $2.8 1.84% $2.8 1.95% $2.8 1.94% TOTAL $186.1 1.46% $197.5 1.48% $195.3 1.48% December 31, 2023 September 30, 2024 December 31, 2024

12 Investment Portfolio High-quality investment portfolio providing consistent cash flows and borrowing capacity 1 Investment portfolio value includes market value AFS and book value of HTM 2 Weighted average duration and yield of the MBS portfolio 3 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information 4 Effective AOCI ($733.8mm) AFS and unrecognized fair value of HTM as of December 31, 2024 ; assumes all securities, including HTM, are sold at market prices; reported AOCI of ($624.9mm) • Targeting 18% - 20% of total assets over time • Forecasting P&I cash flows of $1bn+ over the next 24 months • Anticipated cash flows could fund ~3.5% annualized loan growth • Reported AOCI grew $124.9mm or 25.0% quarter-over-quarter Investments Investment Portfolio1 $4.53bn % of Total Assets 22% Portfolio Duration2 5.9yrs Portfolio Yield2 2.33% Agency MBS/Notes % >95% Reported AOCI ($624.9mm) Effective AOCI3,4 ($733.8mm) AFS Agency MBS Agency CMOs GNMA MBS/CMOs Agency Debent. HTM Agency MBS Munis $3.51bn $1.02bn $594 $637 $643 $500 $625 $0 $100 $200 $300 $400 $500 $600 $700 4Q23 1Q24 2Q24 3Q24 4Q24 M ill io ns Reported AOCI Trend

13 -$10.58 $27.30 -$20 -$10 $0 $10 $20 $30 $40 4Q20 2Q21 4Q21 2Q22 4Q22 2Q23 4Q23 2Q24 4Q24 TBV and AOCI per Share AOCI/share TBV/share 10.03% 9.64% 11.36% 8.08% 3.85% 1.39% 3.77% 1.61% 13.88% 11.03% 15.13% 9.69% 0% 4% 8% 12% 16% Bank CET1 Bank Leverage Bank TRBC Corp. TCE Effective AOCI Well-capitalized Reported Capital All capital ratios remain above “well-capitalized”; TBV impacted by AOCI 4Q24 Capital Ratios including Effective AOCI1 Impact 1 Effective AOCI ($733.8mm) includes AFS and unrecognized fair value of HTM as of December 31, 2024; reported AOCI of ($624.9mm) 2 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information 2 • $27.30 TBV per share includes a negative impact of $10.58 per share related to Reported AOCI1 • 12% YoY growth in TBV • Effective AOCI represents the impact of a full liquidation of the investment portfolio • Corp. TCE increases 1.61% to 9.69%, when considering Effective AOCI 2

14 3 2025 Outlook Loan Growth Mid-single digit growth in Commercial Consumer flat due to Partnership portfolio runoff Deposit Growth Low-single digit growth Broad-based growth across our businesses Net Interest Margin +/-3.80% IB deposit beta of ~40% by year-end Fee Revenue Growth Mid-single digit growth Double-digit growth in Wealth & Trust Net Charge-offs 0.35% - 0.45% of average loans ~5bps related to Upstart Efficiency Ratio +/-60% Continued franchise investment Tax Rate Approximately 24% Full-Year Core ROA1 Outlook of +/-1.25%; Continuing to deliver high-performance and growth 1 The Company is not able to reconcile the forward-looking non-GAAP estimates set forth above to their most directly comparable GAAP estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates with a reasonable degree of accuracy2 2 Assumes one 25bp rate cut in June and FY GDP of 2.6% in 2025 2025 Core Outlook1

15 Non-GAAP Financial Information Appendix:

16 Non-GAAP Information This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). This presentation may include the following non-GAAP measures: • Adjusted Net Income (non-GAAP) attributable to WSFS is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the realized/unrealized gains (losses) on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expense, remeasurement of lease liability, and contribution to WSFS CARES Foundation; • Core noninterest income, also called Core Fee Revenue, is a non-GAAP measure that adjusts noninterest income as determined in accordance with GAAP to exclude the impact of realized/unrealized gains (losses) on equity investments, net, and Visa derivative valuation adjustment; • Core fee revenue ratio (%) is a non-GAAP measure that divides (i) Core Fee Revenue by (ii) Core Net Revenue (tax-equivalent); • Adjusted core fee revenue is a non-GAAP measure that adjusts core fee revenue to exclude (i) the termination of a Cash Connect® relationship and (ii) Spring EQ-related fees; • Core net interest income is a non-GAAP measure that adjusts net interest income to exclude the impact of certain dividends; • Core Earnings Per Share (EPS) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) weighted average shares of common stock outstanding for the applicable period; • Core Net Revenue is a non-GAAP measure that adds (i) core net interest income and (ii) Core Fee Revenue; • Core noninterest expense is a non-GAAP measure that adjusts noninterest expense as determined in accordance with GAAP to exclude FDIC special assessment, corporate development and restructuring expenses, remeasurement of lease liability, and contribution to WSFS CARES Foundation; • Core Efficiency Ratio is a non-GAAP measure that divides (i) core noninterest expense by (ii) the sum of core interest income and Core Fee Revenue; • Core Return on Average Assets (ROA) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) average assets for the applicable period; • Effective AOCI is a non-GAAP measure that adds (i) unrealized losses on AFS securities, (ii) unrealized holding losses on securities transferred from AFS to HTM, and (iii) unrecognized fair value losses on HTM securities; • Tangible Common Equity (TCE) is a non-GAAP measure and is defined as total stockholders’ equity of WSFS less goodwill and other intangible assets; • TCE Ratio is a non-GAAP measure that divides (i) TCE by (ii) tangible assets; • TCE Ratio including effective AOCI is a non-GAAP measure that adjusts the TCE Ratio to include the impact if the Company were to liquidate its investment securities portfolio; • Tangible assets is a non-GAAP measure and is defined as total assets less goodwill and other intangible assets; • Adjusted tangible assets is a non-GAAP measure that adjusts tangible assets to include the impact of the liquidation of our investment securities portfolio; • Return on average tangible common equity (ROTCE) is a non-GAAP measure and is defined as net income allocable to common stockholders divided by tangible common equity; • Core ROTCE is a non-GAAP measure that is defined as adjusted net income (non-GAAP) attributable to WSFS divided by tangible common equity; • Net tangible income is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the amortization of intangible assets; • Core net tangible income is a non-GAAP measure that adjusts adjusted net income (non-GAAP) attributable to WSFS to exclude the impact of the amortization of intangible assets; • Tangible common book value per share (TBV) is a non-GAAP financial measure that divides (i) TCE by (ii) shares outstanding; • Pre-provision Net Revenue (PPNR) is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impacts of (i) income tax provision and (ii) provision for credit losses; • Core PPNR is a non-GAAP measure that adjusts PPNR to exclude the impact of realized/unrealized gain (losses) on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expenses, remeasurement of lease liability, and contribution to WSFS CARES Foundation; • PPNR % is a non-GAAP measure that divides (i) PPNR (annualized) by (ii) average assets for the applicable period; • Core PPNR % is a non-GAAP measure that divides (i) core PPNR (annualized) by (ii) average assets for the applicable period; and • Core Return on Average Equity (ROE) is a non-GAAP measure that divides (i) Adjusted Net Income (non-GAAP) attributable to WSFS by (ii) average stockholders’ equity for the applicable period. • Coverage ratio including the remaining credit marks is a non-GAAP measure that adjusts the coverage ratio to include the impact of the remaining credit marks on the acquired loan portfolios.

17 Appendix: Non-GAAP Financial Information Three Months Ended For the Year Ended (dollars in thousands) December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 Net interest income (GAAP) $ 178,207 $ 177,504 $ 178,127 $ 705,438 Core net interest income (non-GAAP) $ 178,207 $ 177,504 $ 178,127 $ 705,438 Noninterest income (GAAP) $ 83,307 $ 90,158 $ 87,205 $ 340,920 Less: Unrealized gain on equity investments, net — — 338 — Less: Realized gain on sale of equity investment, net 123 56 9,493 2,309 Less/(plus): Visa derivative valuation adjustment — — (605) 2,829 Core fee revenue (non-GAAP) $ 83,184 $ 90,102 $ 77,979 $ 335,782 Core net revenue (non-GAAP) $ 261,391 $ 267,606 $ 256,106 $ 1,041,220 Core net revenue (non-GAAP) (tax-equivalent) $ 261,811 $ 267,991 $ 256,523 $ 1,042,785 Noninterest expense (GAAP) $ 169,126 $ 163,723 $ 147,646 $ 637,689 Less: FDIC special assessment — — 5,052 880 Less: Corporate development expense 61 46 282 473 Less: Restructuring expense 2,193 — 557 2,193 Plus: Remeasurement of lease liability (112) — — (112) Less: Contribution to WSFS CARES Foundation — — 2,000 — Core noninterest expense (non-GAAP) $ 166,984 $ 163,677 $ 139,755 $ 634,255 Core efficiency ratio (non-GAAP) 63.8 % 61.1 % 54.5 % 60.8 % Core fee revenue ratio (non-GAAP)(tax-equivalent) 31.8 % 33.6 % 30.4 % 32.2 % End of Period (dollars in thousands, except per share data) December 31, 2024 September 30, 2024 December 31, 2023 Calculation of tangible common equity ratio: Total Assets (GAAP) $ 20,814,303 $ 20,905,209 $ 20,594,672 Less: Goodwill and other intangible assets 988,160 992,163 1,004,560 Total tangible assets (non-GAAP) $ 19,826,143 $ 19,913,046 $ 19,590,112 Total stockholders’ equity of WSFS (GAAP) $ 2,589,752 $ 2,678,264 $ 2,477,636 Less: Goodwill and other intangible assets 988,160 992,163 1,004,560 Total tangible common equity (non-GAAP) $ 1,601,592 $ 1,686,101 $ 1,473,076 Equity to asset ratio (GAAP) 12.44 % 12.81 % 12.03 % Tangible common equity to tangible assets ratio (non-GAAP) 8.08 % 8.47 % 7.52 %

18 Appendix: Non-GAAP Financial Information Three Months Ended For the Year Ended (dollars in thousands, except per share data) December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 GAAP net income attributable to WSFS $ 64,202 $ 64,435 $ 63,908 $ 263,671 Plus/(less): Pre-tax adjustments1 2,019 (10) (1,335) (1,704) Plus: Tax adjustments: BOLI surrender — — 7,056 — (Plus)/less: Tax impact of pre-tax adjustments (445) 2 65 485 Adjusted net income (non-GAAP) attributable to WSFS $ 65,776 $ 64,427 $ 69,694 $ 262,452 Net income (GAAP) $ 64,155 $ 64,409 $ 63,505 $ 263,495 Plus: Income tax provision 20,197 21,108 29,365 83,764 Plus: Provision for credit losses 8,036 18,422 24,816 61,410 PPNR (Non-GAAP) 92,388 103,939 117,686 408,669 Plus/(less): Pre-tax adjustments1 2,019 (10) (1,335) (1,704) Core PPNR (Non-GAAP) $ 94,407 $ 103,929 $ 116,351 $ 406,965 GAAP return on average assets (ROA) 1.21 % 1.22 % 1.25 % 1.27 % Plus/(less): Pre-tax adjustments1 0.04 — (0.03) (0.01) Plus: Tax adjustments: BOLI surrender — — 0.14 — (Plus)/less: Tax impact of pre-tax adjustments (0.01) — — — Core ROA (non-GAAP) 1.24 % 1.22 % 1.36 % 1.26 % Earnings per share (diluted)(GAAP) $ 1.09 $ 1.08 $ 1.05 $ 4.41 Plus/(less): Pre-tax adjustments1 0.03 — (0.02) (0.03) Plus: Tax adjustments: BOLI surrender — — 0.12 — (Plus)/less: Tax impact of pre-tax adjustments (0.01) — — 0.01 Core earnings per share (non-GAAP) $ 1.11 $ 1.08 $ 1.15 $ 4.39 1 Pre-tax adjustments include realized/unrealized gains on equity investments, net, Visa derivative valuation adjustment, FDIC special assessment, corporate development and restructuring expense, remeasurement of lease liability, and contribution to WSFS CARES Foundation

19 Appendix: Non-GAAP Financial Information Three Months Ended For the Year Ended (dollars in thousands) December 31, 2024 September 30, 2024 December 31, 2023 December 31, 2024 Calculation of return on average tangible common equity: GAAP net income attributable to WSFS $ 64,202 $ 64,435 $ 63,908 $ 263,671 Plus: Tax effected amortization of intangible assets 2,965 2,949 2,976 11,893 Net tangible income (non-GAAP) $ 67,167 $ 67,384 $ 66,884 $ 275,564 Average stockholders' equity of WSFS $ 2,643,325 $ 2,575,182 $ 2,281,076 $ 2,535,737 Less: Average goodwill and intangible assets 990,762 994,818 1,007,136 996,899 Net average tangible common equity (non-GAAP) $ 1,652,563 $ 1,580,364 $ 1,273,940 $ 1,538,838 Return on average equity (GAAP) 9.66 % 9.95 % 11.12 % 10.40 % Return on average tangible common equity (non-GAAP) 16.17 % 16.96 % 20.83 % 17.91 % Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 65,776 $ 64,427 $ 69,694 $ 262,452 Plus: Tax effected amortization of intangible assets 2,965 2,949 2,976 11,893 Core net tangible income (non-GAAP) $ 68,741 $ 67,376 $ 72,670 $ 274,345 Net average tangible common equity (non-GAAP) $ 1,652,563 $ 1,580,364 $ 1,273,940 $ 1,538,838 Core return on average equity (non-GAAP) 9.90 % 9.95 % 12.12 % 10.35 % Core return on average tangible common equity (non-GAAP) 16.55 % 16.96 % 22.63 % 17.83 % Three Months Ended (dollars in thousands) December 31, 2024 September 30, 2024 December 31, 2023 Calculation of adjusted core fee revenue: Core fee revenue (non-GAAP) $ 83,184 $ 90,102 $ 77,979 Plus: Termination of Cash Connect® relationship 2,818 — — Less: Spring EQ-related fees — — 3,504 Adjusted core fee revenue (non-GAAP) $ 86,002 $ 90,102 $ 74,475

20 Appendix: Non-GAAP Financial Information Three Months Ended (dollars in thousands) December 31, 2024 Calculation of effective AOCI: Unrealized losses on AFS securities $ 537,790 Unrealized losses on securities transferred from AFS to HTM 76,405 Unrecognized fair value on HTM securities 119,651 Effective AOCI (non-GAAP) $ 733,846 Three Months Ended (dollars in thousands) December 31, 2024 Calculation of coverage ratio including the estimated remaining credit marks: Coverage ratio 1.48 % Plus: Estimated remaining credit marks on the acquired loan portfolios 0.14 Coverage ratio including the estimated remaining credit marks (non-GAAP) 1.62 % Three Months Ended (dollars in thousands) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 Calculation of core fee revenue: Noninterest income (GAAP) $ 83,307 $ 90,158 $ 91,598 $ 75,857 $ 87,205 Less: Unrealized gains on equity investment — — — — 338 Less: Realized gain on sale of equity investment 123 56 2,130 — 9,493 Less/(plus): Visa B Valuation Adjustment — — 3,434 (605) (605) Core fee revenue (non-GAAP) $ 83,184 $ 90,102 $ 86,034 $ 76,462 $ 77,979 Three Months Ended (dollars in thousands) December 31, 2024 Calculation of adjusted tangible common equity to tangible assets ratio (non-GAAP) Total tangible assets (non-GAAP) $ 19,826,143 Less: Investment securities, AFS & HTM 4,525,809 Total adjusted tangible assets (non-GAAP) $ 15,300,334 Total tangible common equity (non-GAAP) $ 1,601,592 Less: Unrecognized fair value on HTM securities 119,651 Total adjusted tangible common equity (non-GAAP) $ 1,481,941 Tangible common equity to tangible assets ratio (non- GAAP) 8.08 % Tangible common equity to tangible assets ratio including effective AOCI (non-GAAP) 9.69 %

21 Appendix: Non-GAAP Financial Information (dollars in thousands, except per share data) December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Calculation of tangible common book value per share: Total stockholders’ equity of WSFS (GAAP) $ 2,589,752 $ 2,678,264 $ 2,489,580 $ 2,473,481 $ 2,477,636 $ 2,242,795 $ 2,314,659 $ 2,306,362 $ 2,205,113 Less: Goodwill and other intangible assets 988,160 992,163 996,181 1,000,344 1,004,560 1,008,472 1,004,278 1,008,250 1,012,232 Total tangible common equity (non-GAAP) 1,601,592 1,686,101 1,493,399 1,473,137 1,473,076 1,234,323 1,310,381 1,298,112 1,192,881 Shares outstanding (000s) 58,657 59,033 59,261 60,084 60,538 60,728 61,093 61,387 61,612 Tangible common book value per share (non-GAAP) $ 27.30 $ 28.56 $ 25.20 $ 24.52 $ 24.33 $ 20.33 $ 21.45 $ 21.15 $ 19.36 (dollars in thousands, except per share data) September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 March 31, 2021 December 31, 2020 Calculation of tangible common book value per share: Total stockholders’ equity of WSFS (GAAP) $ 2,103,593 $ 2,315,360 $ 2,520,463 $ 1,939,099 $ 1,908,895 $ 1,884,054 $ 1,770,641 $ 1,791,726 Less: Goodwill and other intangible assets 1,016,413 1,019,857 1,032,189 547,231 549,352 551,951 554,701 557,386 Total tangible common equity (non-GAAP) 1,087,180 1,295,503 1,488,274 1,391,868 1,359,543 1,332,103 1,215,940 1,234,340 Shares outstanding (000s) 61,949 63,587 64,735 47,609 47,548 47,535 47,502 47,756 Tangible common book value per share (non-GAAP) $ 17.55 $ 20.37 $ 22.99 $ 29.24 $ 28.59 $ 28.02 $ 25.60 $ 25.85