NYSE MKT: INUV Richard Howe, CEO Wally Ruiz, CFO A Digital Publishing and Advertising Technology Company

Safe Harbor Statement This presentation includes or incorporates by reference statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward‐looking statements. These statements include, but are not limited to, information or assumptions about expenses, capital and other expenditures, financing plans, capital structure, cash flow, liquidity, management’s plans, goals and objectives for future operations and growth. In some cases, you can identify forward‐looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward‐looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could cause actual performance or results to differ materially from those expressed in or suggested by forward-looking statements. These statements are based on the current expectations or beliefs of the Company’s management and are subject to various known and unknown risks that could cause actual results to differ materially from those described in the forward-looking statements, including, but not limited to, product demand, pricing, market acceptance, changing economic conditions, risks in product and technology development, the effect of the Company's accounting policies, increasing competition, the Company’s ability to integrate companies and businesses acquired by it and certain other risk factors, including those that are set forth from time to time in the Company's filings with the United States Securities and Exchange Commission, which may cause the actual results, performance and achievements of the Company to be materially different from any future results, performance and achievements implied by such forward-looking statements. Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

• Scalable TTM Revenue $70.4m, Adjusted EBITDA $4.7m, Free Cash Flow $4.6m • Simple Cap Structure - 24.8m fully diluted shares, no bank debt and $4.3m cash • Fast growing – 42% in 2015 with both segments up significantly • Delivering profits since 2013 and cash flow since 2012 • With proprietary content, ad-tech, marketing tech and big data • Where IP is protected through Patents and barriers to entry • Long standing contracts with Yahoo! & Google • NOL carry forward of $78 million • Attractive valuation at 0.7x EV/Rev compared to industry 1.3x An internet advertising technology & digital publishing business Who is inuvo? (NYSE MKT: INUV) Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Sites Various Verticals Proprietary Content: Advertising Relationships: Distribution & Ad Technology: Marketing Competency: Business listings, Health, Careers, Finance, Travel & Living Content Yahoo, Google and other Direct Advertisers Serving hundreds of millions of ads delivered to customers monthly. Data driven analytical marketing technology drives campaigns (57%) Digital Publishing Business Advertising Technology Business (43%) Two Segments Both Growing Through a network of owned sites & apps, we develop ad technology that we then commercialize for other publishers and app owners Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

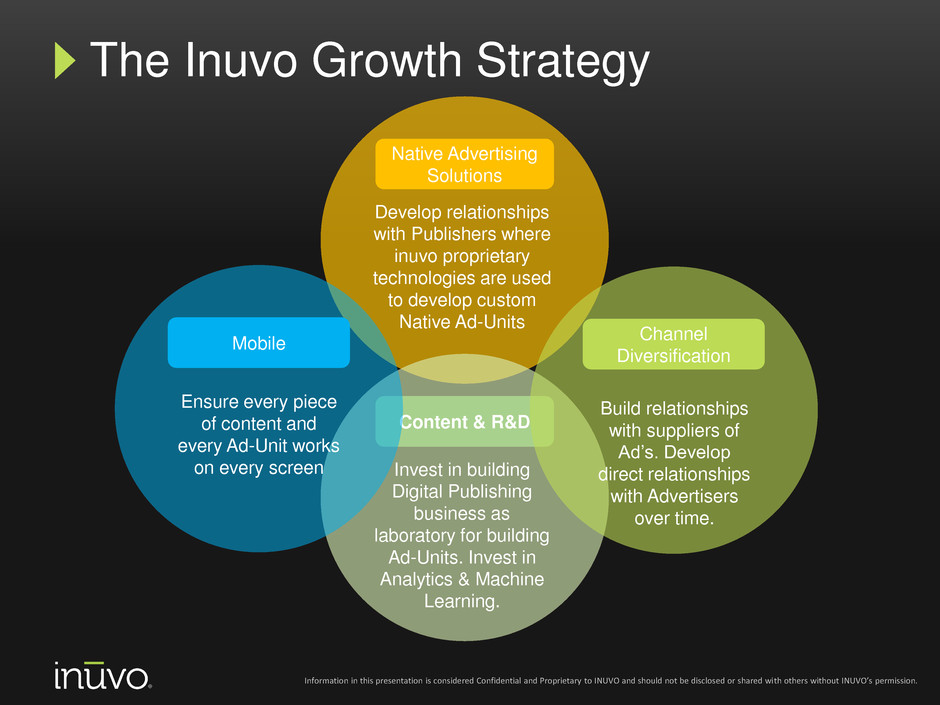

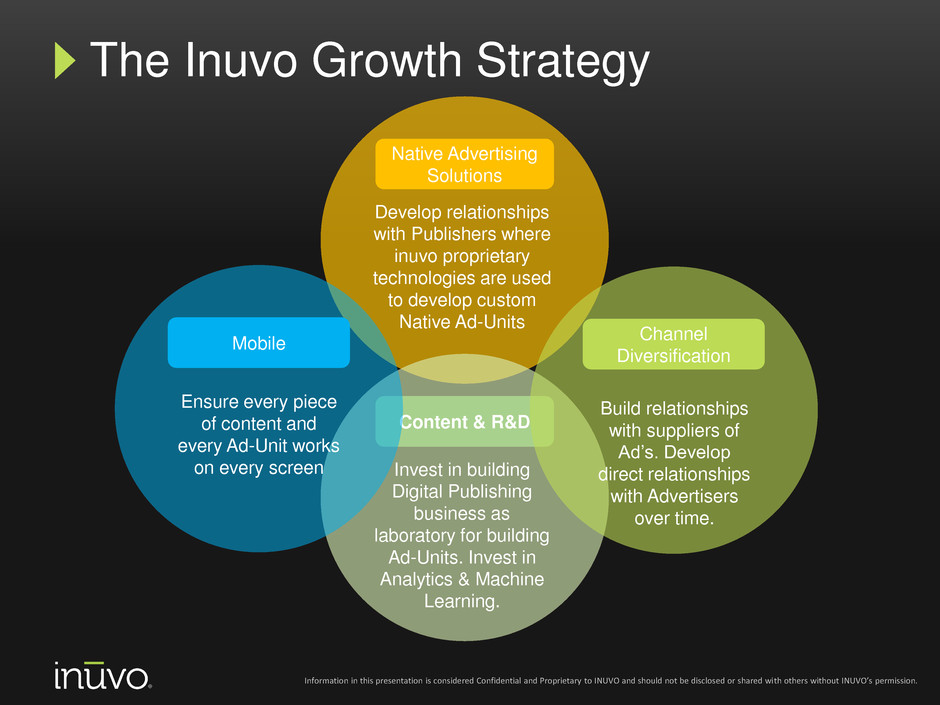

Develop relationships with Publishers where inuvo proprietary technologies are used to develop custom Native Ad-Units Native Advertising Solutions Invest in building Digital Publishing business as laboratory for building Ad-Units. Invest in Analytics & Machine Learning. Content & R&D Ensure every piece of content and every Ad-Unit works on every screen Mobile Channel Diversification Build relationships with suppliers of Ad’s. Develop direct relationships with Advertisers over time. The Inuvo Growth Strategy Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Mi lli o n s of D o llar s Strong Revenue Growth Strong quarterly compound growth that is well above market performance Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. 0.00 7.00 14.00 21.00 Q1-2014 Q2-2014 Q3-2014 Q4-2014 Q1-2015 Q2-2015 Q3-2015 Q4-2015

Reaching Consumers Through a Network of O/O Sites & Applications

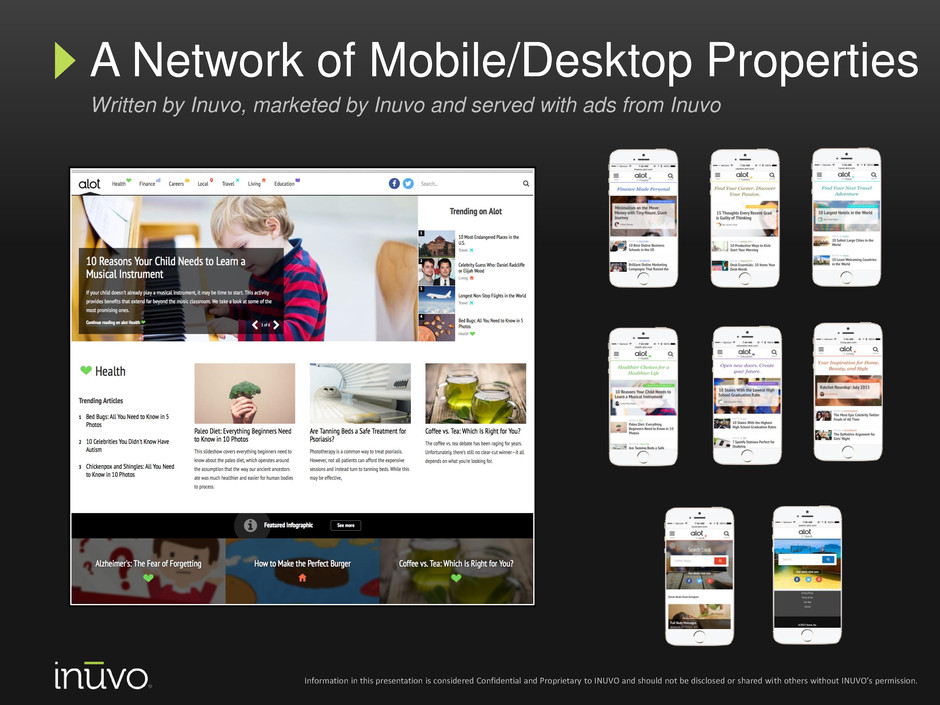

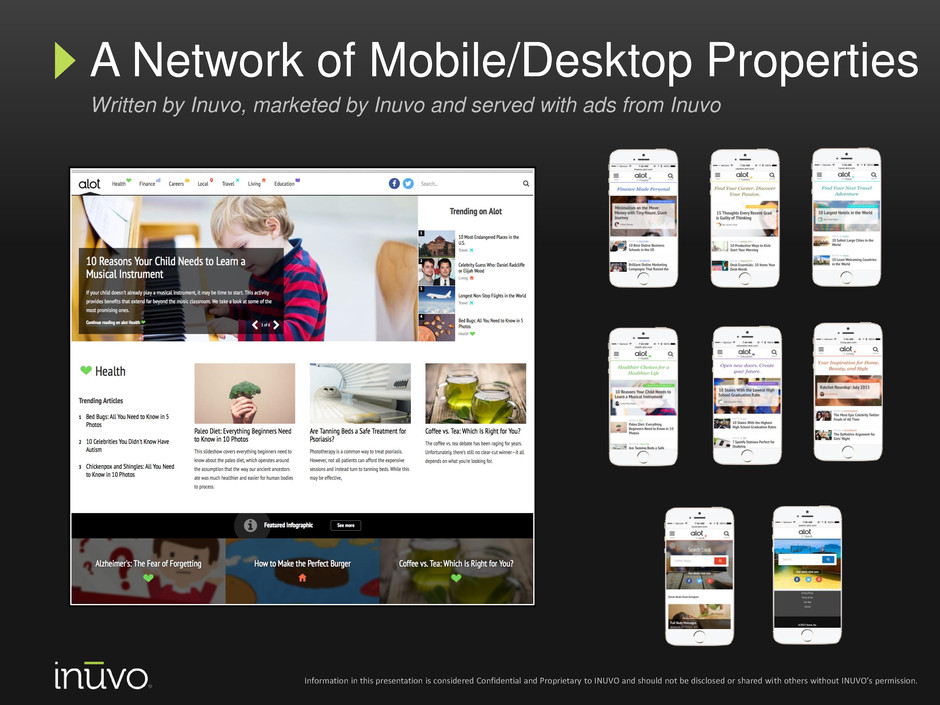

A Network of Mobile/Desktop Properties Written by Inuvo, marketed by Inuvo and served with ads from Inuvo Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Connected Content Editor Curated Featured Articles Prominent Social Connections Editor Curated Next Reads on Articles Inuvo Targeted Ads Website Technology Designed for Scale A proprietary content management system is key to the design Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Search Home Tablet Mobile Alot.com Fully Integrated With brand and content consistency across device types Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

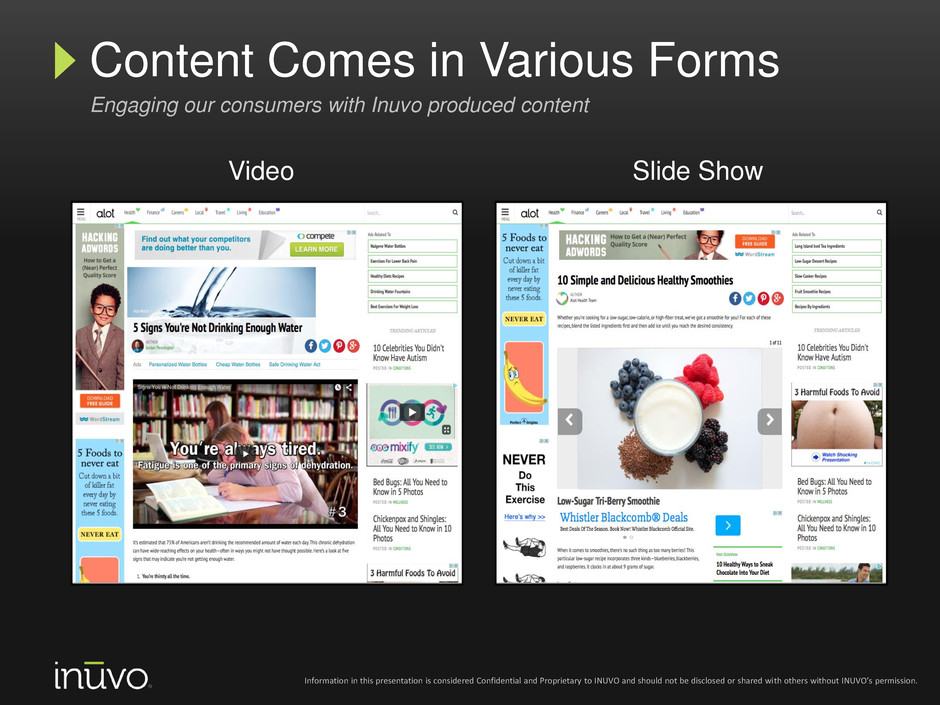

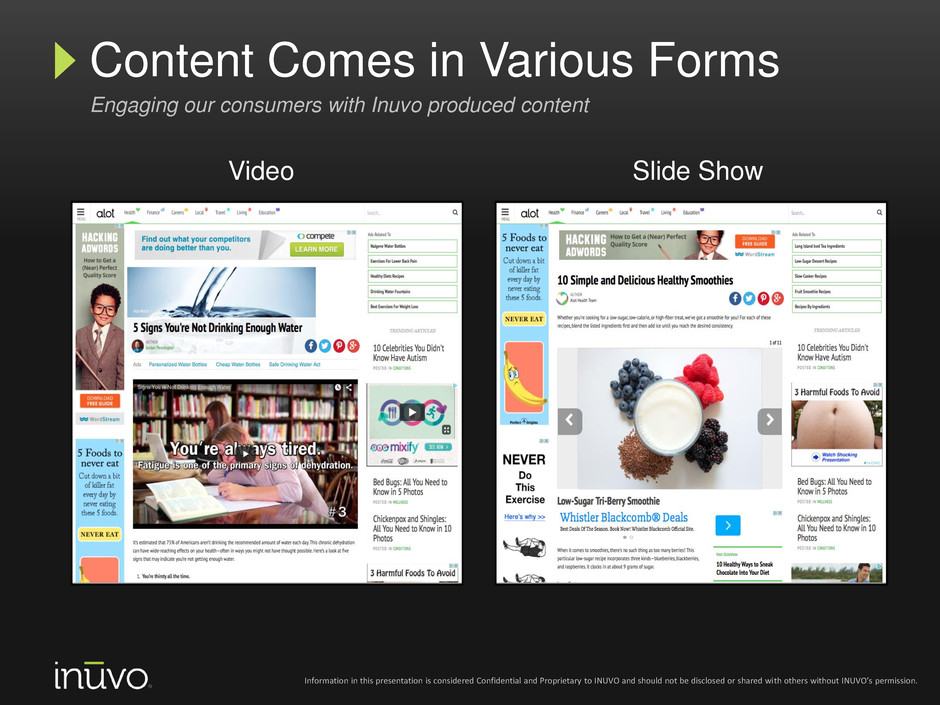

Video Slide Show Content Comes in Various Forms Engaging our consumers with Inuvo produced content Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

• Over 8 million unique visitors monthly • Tens of millions of page views monthly • 7 categories with video, slideshows, written content, YouTube channels • Millions of searches per month at search.alot.com • Over 3 million advertising clicks per month • Proprietary content and technology supporting the sites • Fully integrated alot.com across desktop, tablet & mobile Building an Audience to Build Ad-Tech A family of proprietary digital properties with proprietary content and technology Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Reaching Consumers Through a Network of Partners

Developing Ads for Partners Inuvo serves ads across 1000s of sites in numerous interest categories Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

SearchLinks: Where Native Ads Meet Search With ads that integrate directly into the content, contextually & tastefully Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

The Other Guys SearchLinks SearchLinks: A Native Ad Service Example Technology sophisticated enough to understand context & self optimize Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

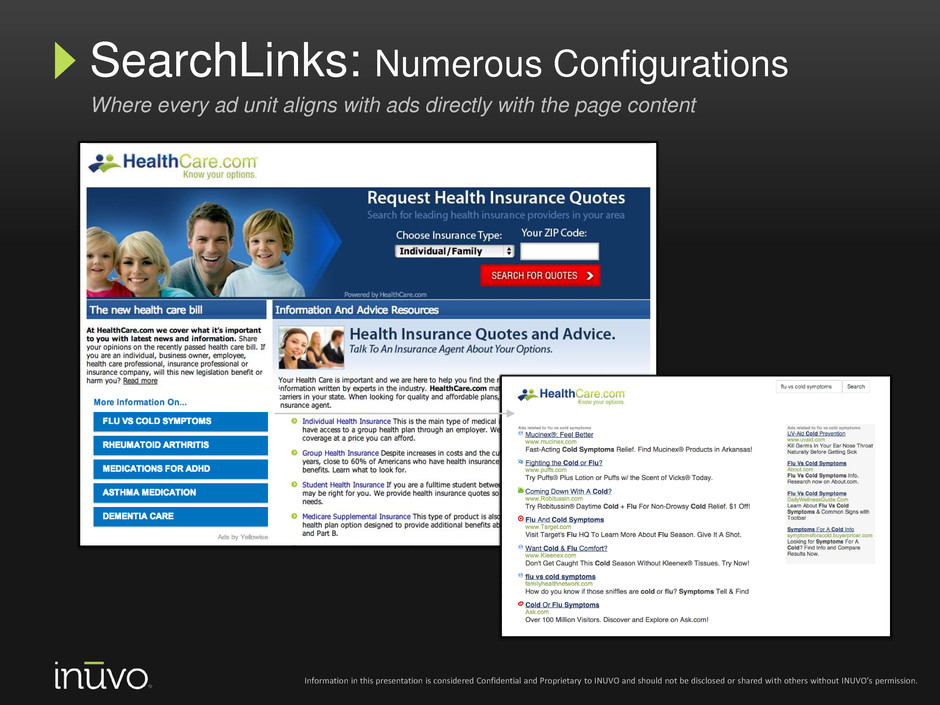

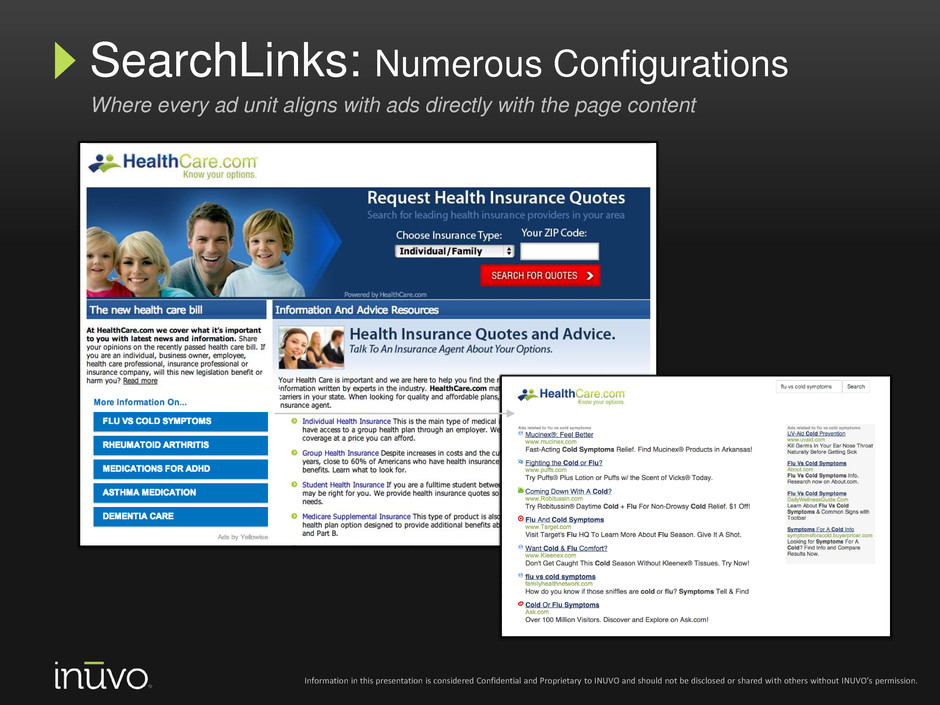

SearchLinks: Numerous Configurations Where every ad unit aligns with ads directly with the page content Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

SearchLinks: Numerous Configurations Where every ad unit aligns with ads directly with the page content Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Native Mobile Ad – Craigslist App In App Search Ad – Workout App Content Native Ad – Mobile Web SearchLinks: Optimized for Mobile Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

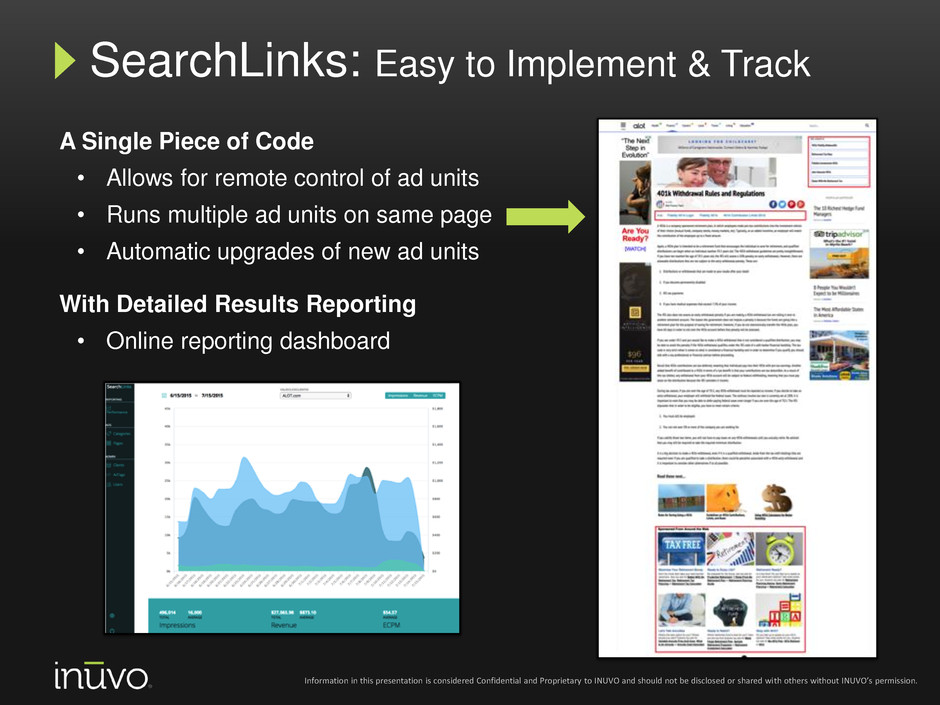

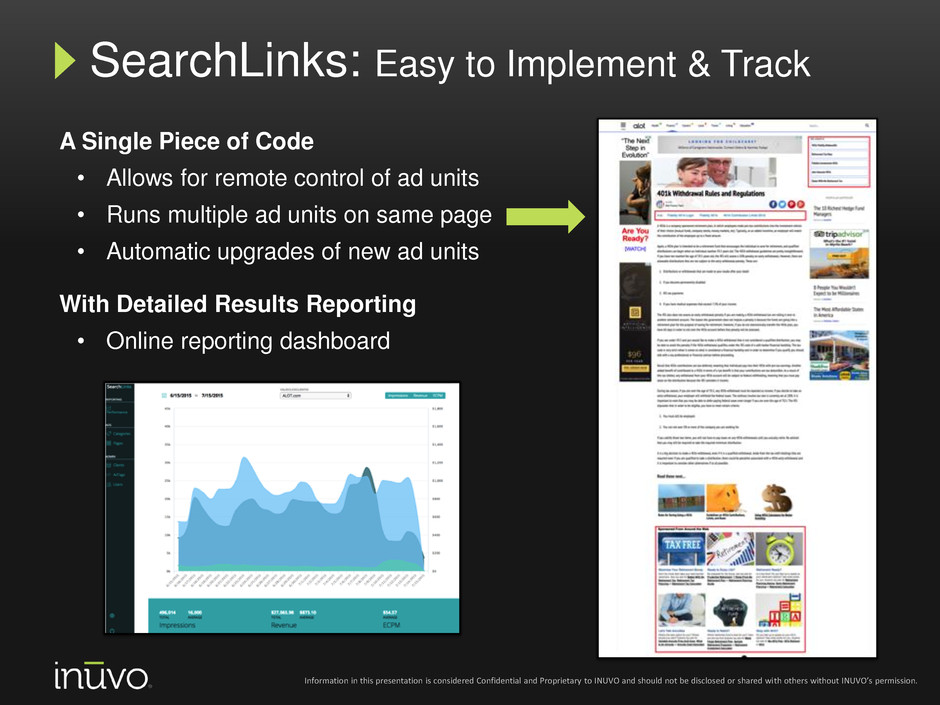

A Single Piece of Code • Allows for remote control of ad units • Runs multiple ad units on same page • Automatic upgrades of new ad units With Detailed Results Reporting • Online reporting dashboard SearchLinks: Easy to Implement & Track Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

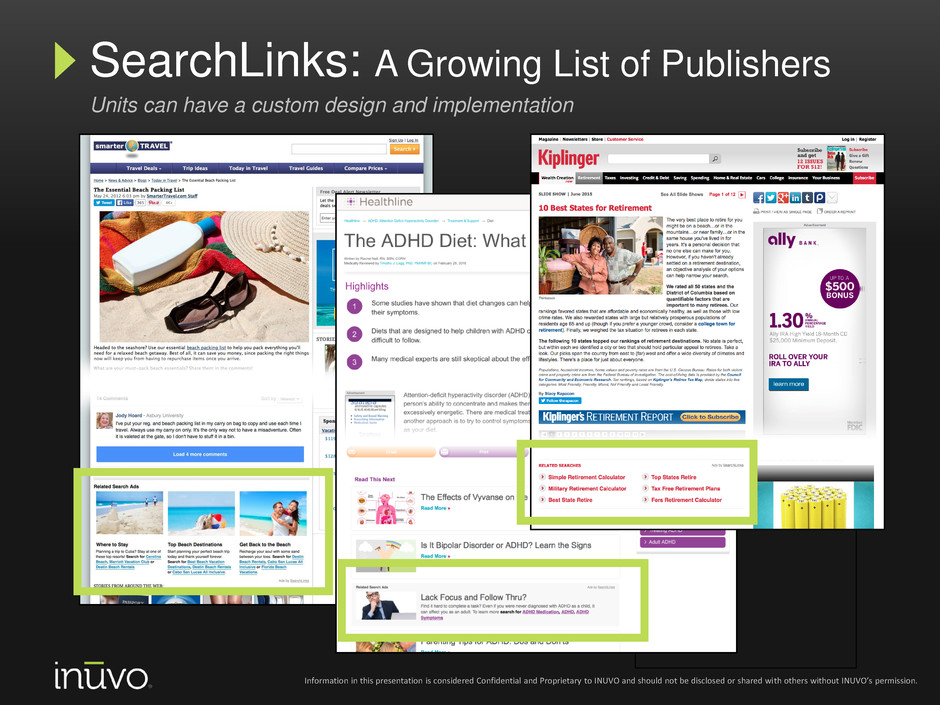

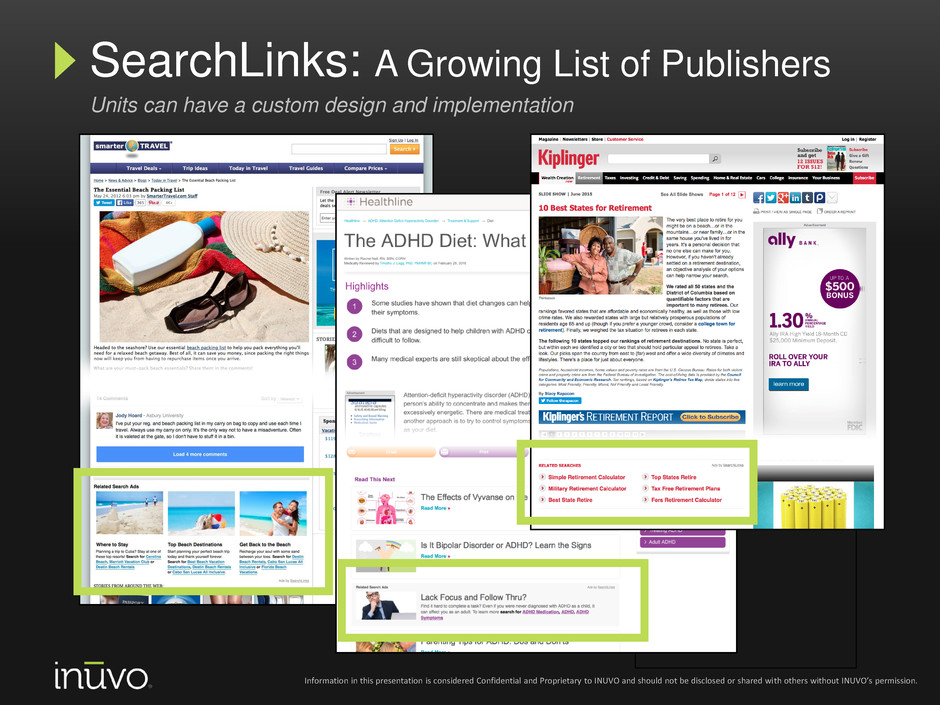

SearchLinks: A Growing List of Publishers Units can have a custom design and implementation Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

• Thousands of individual pages with inuvo ad-tech • Tens of thousands of advertisers across every vertical • Hundreds of millions of ads being served annually • Millions of consumer clicks on ads monthly sold to advertisers • Proprietary platform for serving and managing publishers • Billions of individual pieces of data utilized for performance optimization • $8 billion (and growing) dollar Native advertising market Building a Stable of Happy Partners A network of publishing partners with best in class content monetization Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

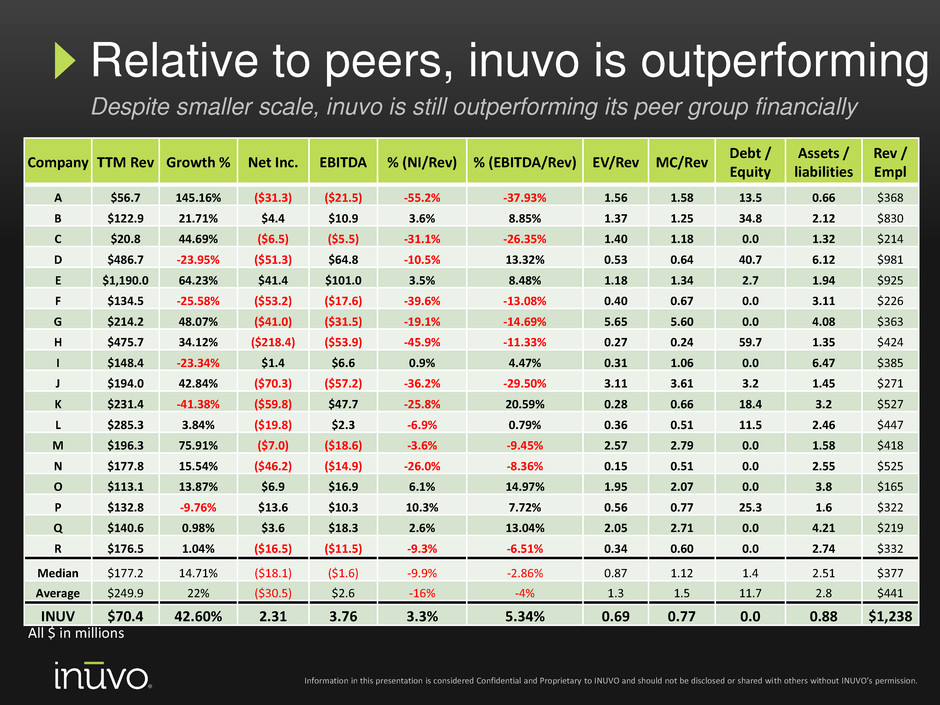

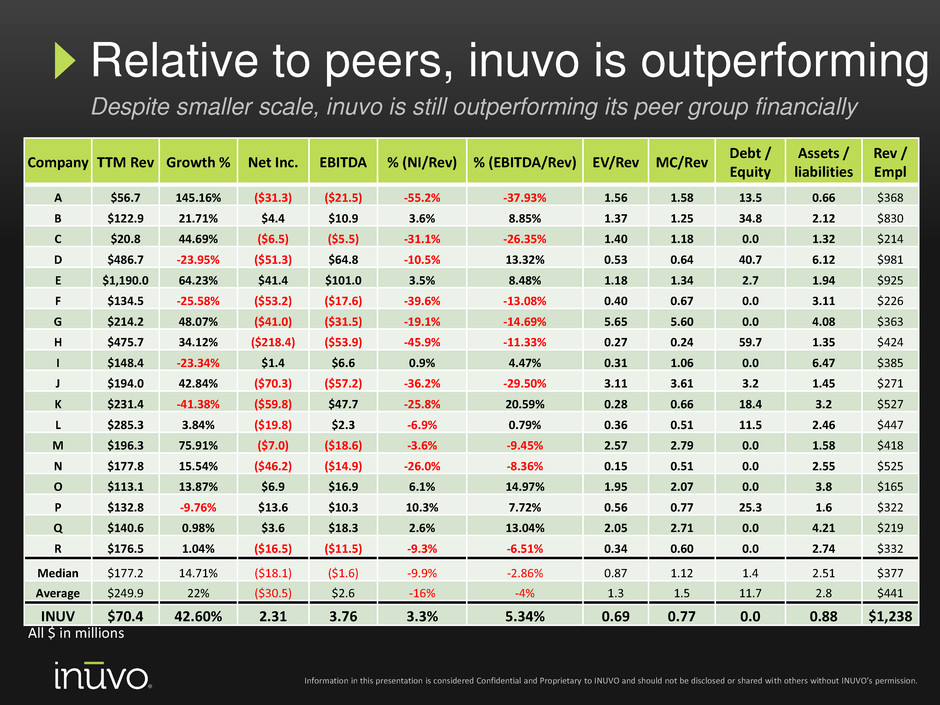

Relative to peers, inuvo is outperforming Despite smaller scale, inuvo is still outperforming its peer group financially Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. Company TTM Rev Growth % Net Inc. EBITDA % (NI/Rev) % (EBITDA/Rev) EV/Rev MC/Rev Debt / Equity Assets / liabilities Rev / Empl A $56.7 145.16% ($31.3) ($21.5) -55.2% -37.93% 1.56 1.58 13.5 0.66 $368 B $122.9 21.71% $4.4 $10.9 3.6% 8.85% 1.37 1.25 34.8 2.12 $830 C $20.8 44.69% ($6.5) ($5.5) -31.1% -26.35% 1.40 1.18 0.0 1.32 $214 D $486.7 -23.95% ($51.3) $64.8 -10.5% 13.32% 0.53 0.64 40.7 6.12 $981 E $1,190.0 64.23% $41.4 $101.0 3.5% 8.48% 1.18 1.34 2.7 1.94 $925 F $134.5 -25.58% ($53.2) ($17.6) -39.6% -13.08% 0.40 0.67 0.0 3.11 $226 G $214.2 48.07% ($41.0) ($31.5) -19.1% -14.69% 5.65 5.60 0.0 4.08 $363 H $475.7 34.12% ($218.4) ($53.9) -45.9% -11.33% 0.27 0.24 59.7 1.35 $424 I $148.4 -23.34% $1.4 $6.6 0.9% 4.47% 0.31 1.06 0.0 6.47 $385 J $194.0 42.84% ($70.3) ($57.2) -36.2% -29.50% 3.11 3.61 3.2 1.45 $271 K $231.4 -41.38% ($59.8) $47.7 -25.8% 20.59% 0.28 0.66 18.4 3.2 $527 L $285.3 3.84% ($19.8) $2.3 -6.9% 0.79% 0.36 0.51 11.5 2.46 $447 M $196.3 75.91% ($7.0) ($18.6) -3.6% -9.45% 2.57 2.79 0.0 1.58 $418 N $177.8 15.54% ($46.2) ($14.9) -26.0% -8.36% 0.15 0.51 0.0 2.55 $525 O $113.1 13.87% $6.9 $16.9 6.1% 14.97% 1.95 2.07 0.0 3.8 $165 P $132.8 -9.76% $13.6 $10.3 10.3% 7.72% 0.56 0.77 25.3 1.6 $322 Q $140.6 0.98% $3.6 $18.3 2.6% 13.04% 2.05 2.71 0.0 4.21 $219 R $176.5 1.04% ($16.5) ($11.5) -9.3% -6.51% 0.34 0.60 0.0 2.74 $332 Median $177.2 14.71% ($18.1) ($1.6) -9.9% -2.86% 0.87 1.12 1.4 2.51 $377 Average $249.9 22% ($30.5) $2.6 -16% -4% 1.3 1.5 11.7 2.8 $441 INUV $70.4 42.60% 2.31 3.76 3.3% 5.34% 0.69 0.77 0.0 0.88 $1,238 All $ in millions

Contact Us

Go to inuvo.com/investor-email to sign up today Investor Newsletter: Keeping Up with Inuvo Download the Inuvo App! Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

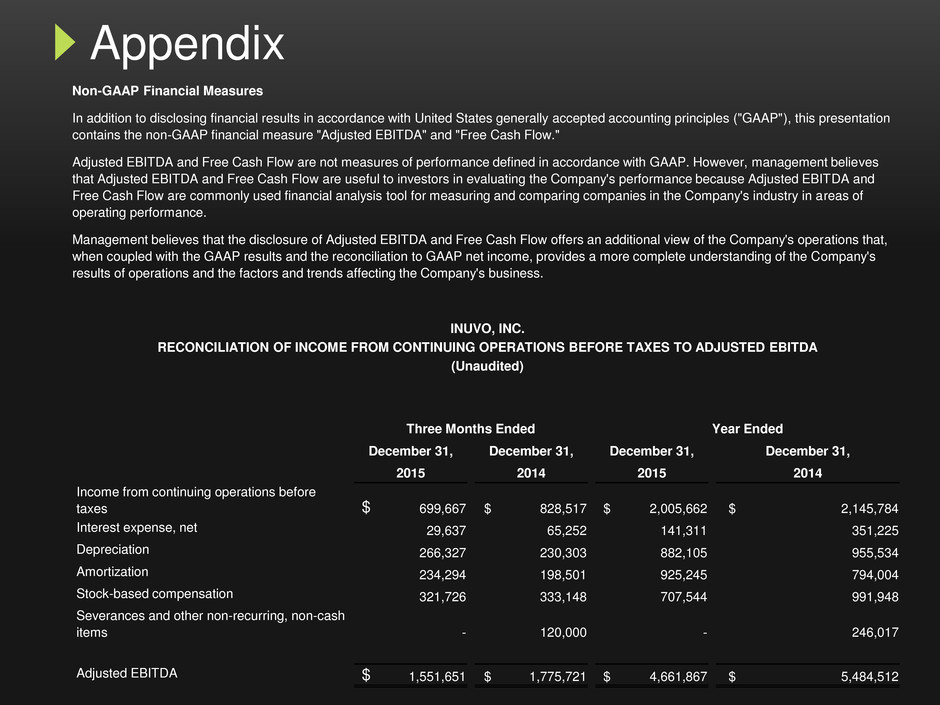

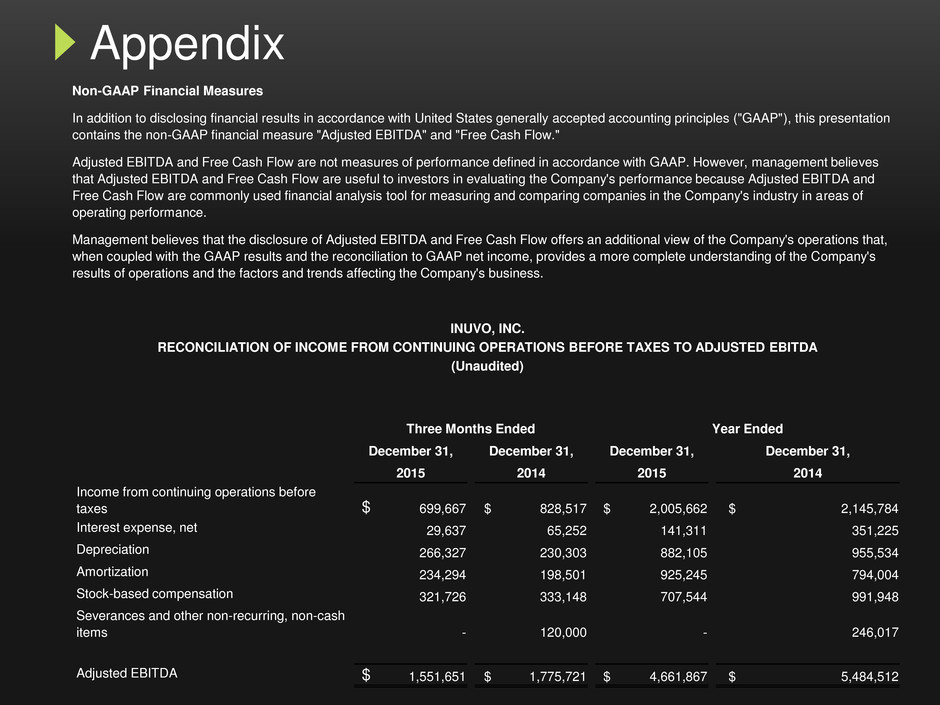

Appendix Non-GAAP Financial Measures In addition to disclosing financial results in accordance with United States generally accepted accounting principles ("GAAP"), this presentation contains the non-GAAP financial measure "Adjusted EBITDA" and "Free Cash Flow." Adjusted EBITDA and Free Cash Flow are not measures of performance defined in accordance with GAAP. However, management believes that Adjusted EBITDA and Free Cash Flow are useful to investors in evaluating the Company's performance because Adjusted EBITDA and Free Cash Flow are commonly used financial analysis tool for measuring and comparing companies in the Company's industry in areas of operating performance. Management believes that the disclosure of Adjusted EBITDA and Free Cash Flow offers an additional view of the Company's operations that, when coupled with the GAAP results and the reconciliation to GAAP net income, provides a more complete understanding of the Company's results of operations and the factors and trends affecting the Company's business. INUVO, INC. RECONCILIATION OF INCOME FROM CONTINUING OPERATIONS BEFORE TAXES TO ADJUSTED EBITDA (Unaudited) Three Months Ended Year Ended December 31, December 31, December 31, December 31, 2015 2014 2015 2014 Income from continuing operations before taxes $ 699,667 $ 828,517 $ 2,005,662 $ 2,145,784 Interest expense, net 29,637 65,252 141,311 351,225 Depreciation 266,327 230,303 882,105 955,534 Amortization 234,294 198,501 925,245 794,004 Stock-based compensation 321,726 333,148 707,544 991,948 Severances and other non-recurring, non-cash items - 120,000 - 246,017 Adjusted EBITDA $ 1,551,651 $ 1,775,721 $ 4,661,867 $ 5,484,512

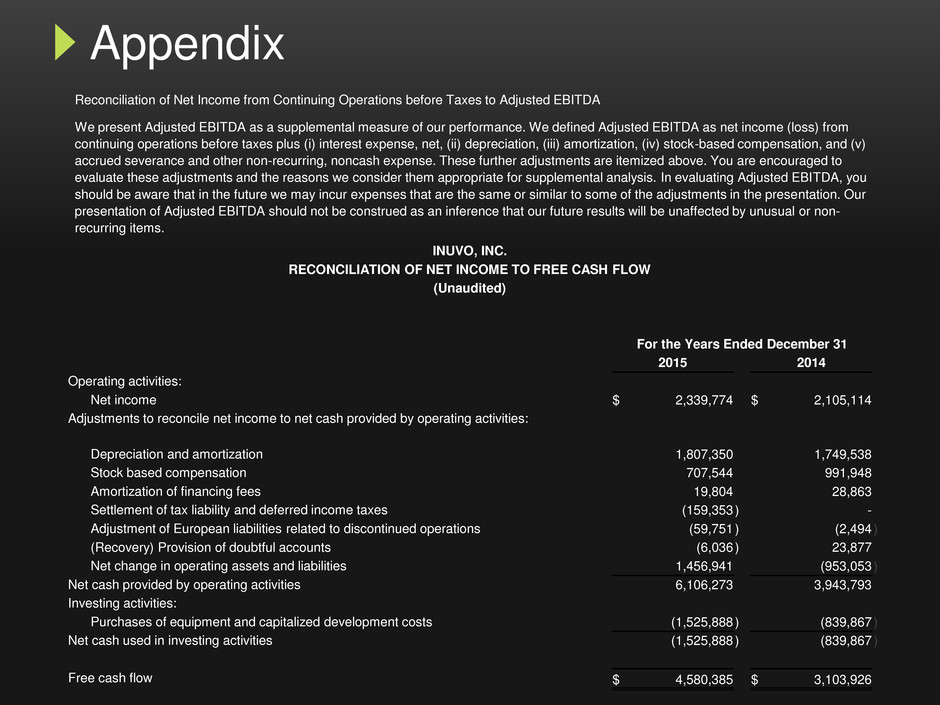

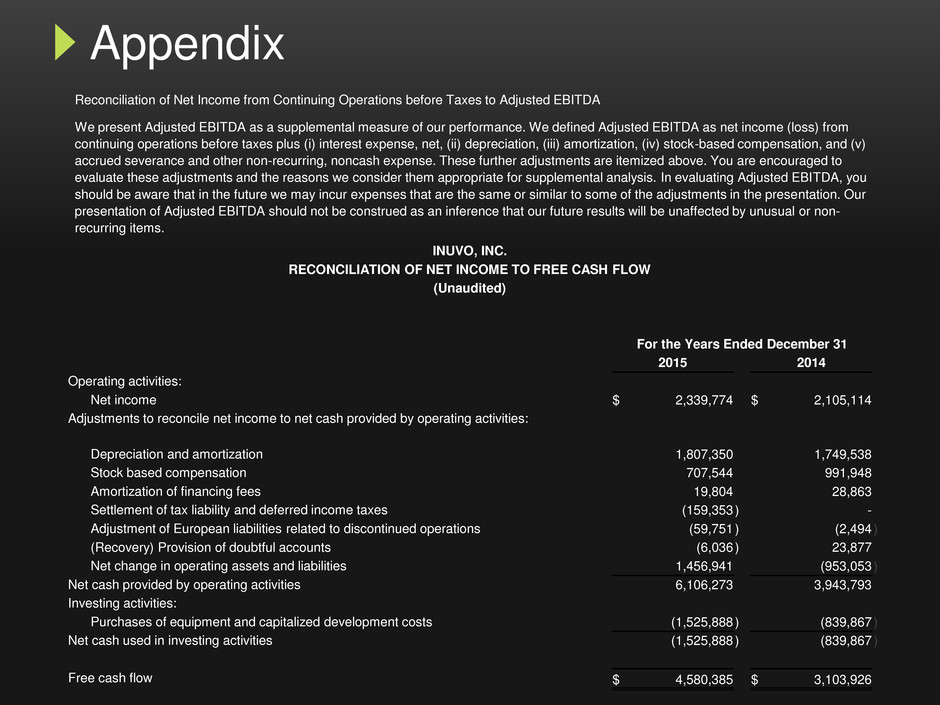

Appendix Reconciliation of Net Income from Continuing Operations before Taxes to Adjusted EBITDA We present Adjusted EBITDA as a supplemental measure of our performance. We defined Adjusted EBITDA as net income (loss) from continuing operations before taxes plus (i) interest expense, net, (ii) depreciation, (iii) amortization, (iv) stock-based compensation, and (v) accrued severance and other non-recurring, noncash expense. These further adjustments are itemized above. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same or similar to some of the adjustments in the presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non- recurring items. INUVO, INC. RECONCILIATION OF NET INCOME TO FREE CASH FLOW (Unaudited) For the Years Ended December 31 2015 2014 Operating activities: Net income $ 2,339,774 $ 2,105,114 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 1,807,350 1,749,538 Stock based compensation 707,544 991,948 Amortization of financing fees 19,804 28,863 Settlement of tax liability and deferred income taxes (159,353 ) - Adjustment of European liabilities related to discontinued operations (59,751 ) (2,494 ) (Recovery) Provision of doubtful accounts (6,036 ) 23,877 Net change in operating assets and liabilities 1,456,941 (953,053 ) Net cash provided by operating activities 6,106,273 3,943,793 Investing activities: Purchases of equipment and capitalized development costs (1,525,888 ) (839,867 ) Net cash used in investing activities (1,525,888 ) (839,867 ) Free cash flow $ 4,580,385 $ 3,103,926

Appendix Reconciliation of Net Income to Free Cash Flow We present Free Cash Flow as a supplemental measure of our performance. We defined Free Cash Flow as GAAP net income plus (i) adjustments to reconcile net income to net cash provided by operating activities and (ii) purchases of equipment and capitalized development costs. These further adjustments are itemized above. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Free Cash Flow, you should be aware that in the future we may incur expenses that are the same or similar to some of the adjustments in the presentation. Our presentation of Free Cash Flow should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.