NYSE MKT: INUV Richard Howe, CEO Wally Ruiz, CFO A Digital Publishing and Advertising Technology Company

Safe Harbor Statement This presentation includes or incorporates by reference statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward‐looking statements. These statements include, but are not limited to, information or assumptions about expenses, capital and other expenditures, financing plans, capital structure, cash flow, liquidity, management’s plans, goals and objectives for future operations and growth. In some cases, you can identify forward‐looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. You should not place undue reliance on forward‐looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could cause actual performance or results to differ materially from those expressed in or suggested by forward-looking statements. These statements are based on the current expectations or beliefs of the Company’s management and are subject to various known and unknown risks that could cause actual results to differ materially from those described in the forward-looking statements, including, but not limited to, product demand, pricing, market acceptance, changing economic conditions, risks in product and technology development, the effect of the Company's accounting policies, increasing competition, the Company’s ability to integrate companies and businesses acquired by it and certain other risk factors, including those that are set forth from time to time in the Company's filings with the United States Securities and Exchange Commission, which may cause the actual results, performance and achievements of the Company to be materially different from any future results, performance and achievements implied by such forward-looking statements. Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

• Scalable TTM Revenue $75m, Non-GAAP Net Inc* $3m, GAAP Net Inc $1.1m • Simple Cap Structure - 24.8m fully diluted shares, no bank debt and $4m cash • Fast growing – 42% in 2015, 27% on Q2-2016 TTM basis • Delivering profits since 2013 and cash flow since 2012 • With proprietary content, ad-tech, marketing tech assets • Where IP is protected through patents and barriers to entry • Long standing contracts with Yahoo! & Google • NOL carry forward of $78 million • Stock traded between $1.05 - $3.25 ($26M - $81M), insiders own ~ 20% An internet advertising technology & digital publishing business Who is Inuvo? (NYSE MKT: INUV) Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. * Please see appendix for reconciliation of Non-GAAP Net Income

Mi lli o n s of D o llar s Strong Revenue Growth Strategic objective to get to $100M run rate by Q4 – 2017, a 27% CAGR off Q1-2014 Have been and expect to be profitable on GAAP basis annually throughout. Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 27% CAGR Actual Performance Linear Trend Line Seasonality Seasonality & Demand Weakness Upwards Trend $100m Annual Run Rate

Develop relationships with Publishers where inuvo proprietary technologies are used to develop custom Native Ad-Units Native Advertising Solutions Invest in building Digital Publishing business as laboratory for building Ad-Units. Invest in Analytics & Machine Learning. Content & R&D Ensure every piece of content and every Ad-Unit works on every screen Mobile (>40%) Channel Diversification Build relationships with suppliers of Ad’s. Develop direct relationships with Advertisers over time. The Inuvo Growth Strategy Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

A Network of Owned Properties (69%) Written by Inuvo, marketed by Inuvo and served with ads from Inuvo Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Content Developed & Owned by INUV Engaging our consumers with Inuvo produced content Video Slide Shows Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. Written PodCasts

A Network of Publishing Partners (31%) Web properties that display INUV Ad-Tech Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

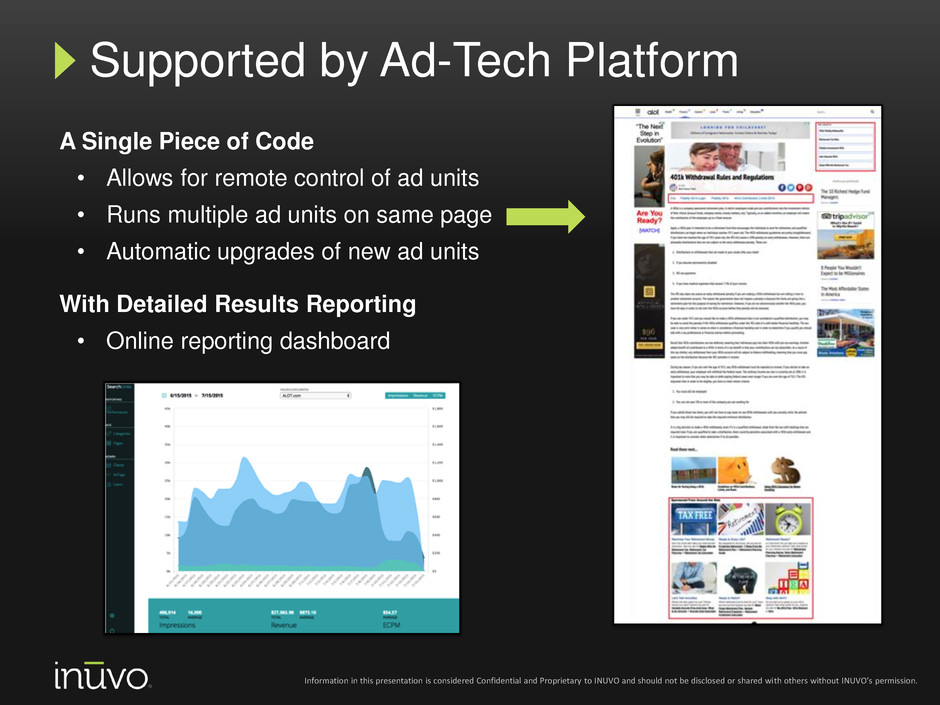

A Single Piece of Code • Allows for remote control of ad units • Runs multiple ad units on same page • Automatic upgrades of new ad units With Detailed Results Reporting • Online reporting dashboard Supported by Ad-Tech Platform Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

A Strategy That Leverages Digital Publishing to Develop Ad-Tech and Ad-Tech to Drive Traffic to Digital Publishing

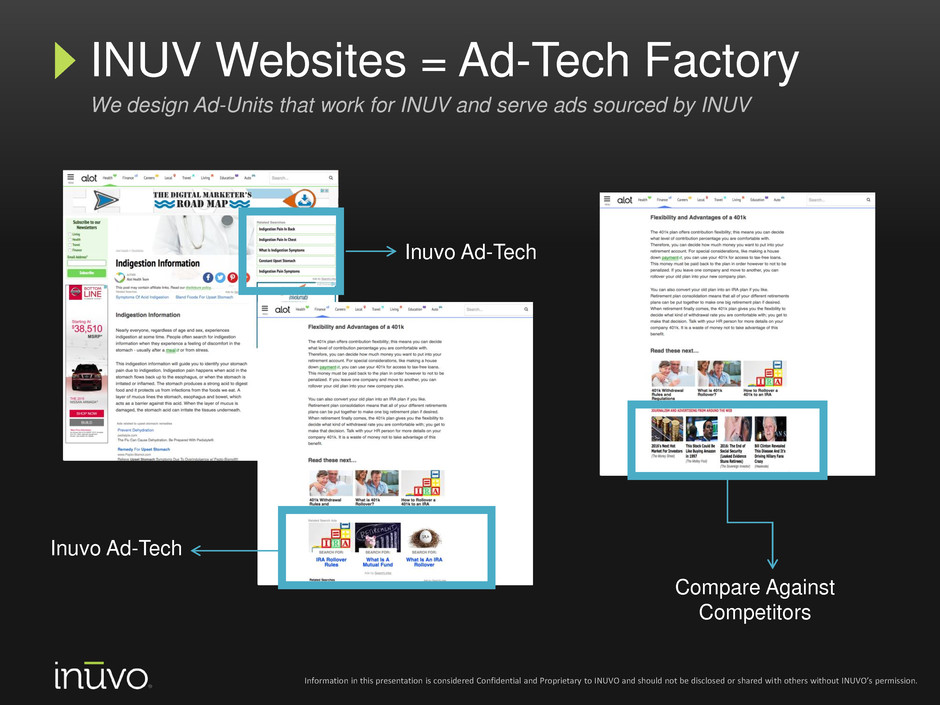

Compare Against Competitors Inuvo Ad-Tech INUV Websites = Ad-Tech Factory We design Ad-Units that work for INUV and serve ads sourced by INUV Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. Inuvo Ad-Tech

Inuvo Ad-Tech INUV Ad-Tech is Distributed to Others Ad-Units that work for INUV will work for others so we offer that service to publishers Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

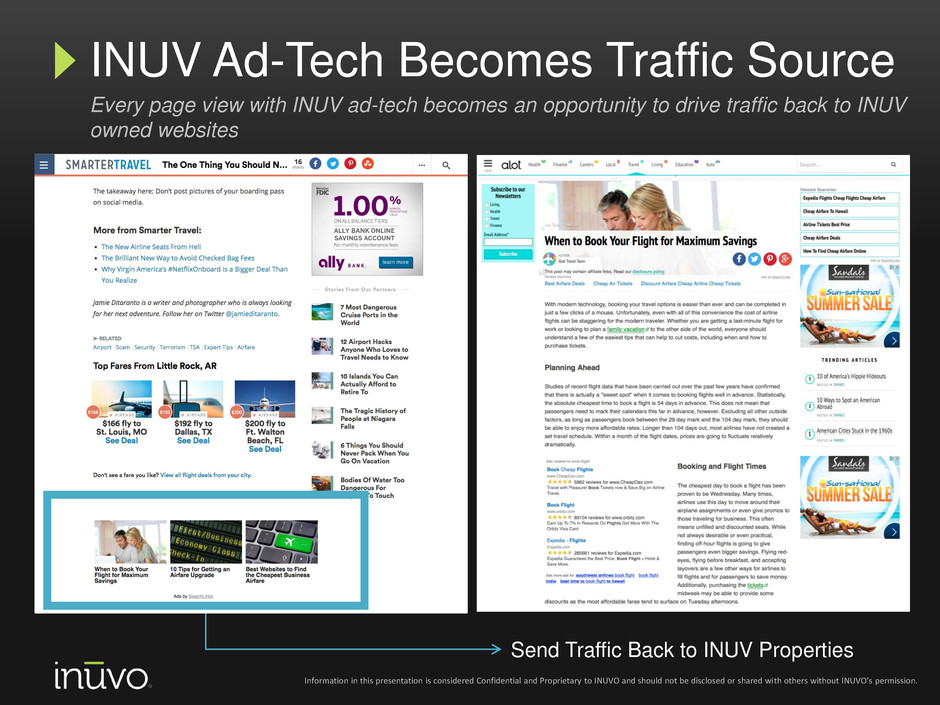

Send Traffic Back to INUV Properties INUV Ad-Tech Becomes Traffic Source Every page view with INUV ad-tech becomes an opportunity to drive traffic back to INUV owned websites Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

INUV Partner Bed Bug Ads Bed Bugs Consumer Interest INUV Network = Interests Collector Visits to any INUV website or partner website become retargeting opportunities Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. INUV website Finance Page Bed Bug Ads

• Profitable $75m TTM microcap technology company. • Network of owned properties with >8m unique visitors monthly. • Network of thousands of published pages using INUV ad-technology. • Proprietary content and patented technology platforms. • Scaling already to hundreds of millions of ads served annually. • Collecting data and building analytics for better ad-targeting. • Serving a large ad-supported marketplace. A Business With Significant Scale A family of proprietary digital properties and a network of publishing partners using INUV ad-tech Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Sending Visitors to Leading Brands Every day, INUV sends visitors to thousands of recognizable merchants Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

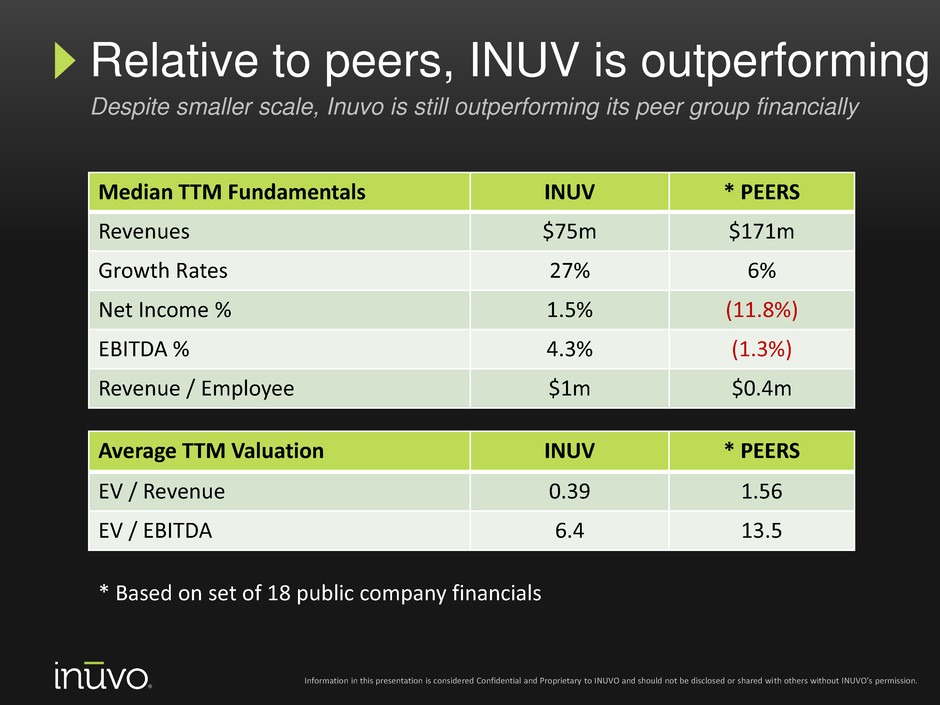

Relative to peers, INUV is outperforming Despite smaller scale, Inuvo is still outperforming its peer group financially Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. Median TTM Fundamentals INUV * PEERS Revenues $75m $171m Growth Rates 27% 6% Net Income % 1.5% (11.8%) EBITDA % 4.3% (1.3%) Revenue / Employee $1m $0.4m Average TTM Valuation INUV * PEERS EV / Revenue 0.39 1.56 EV / EBITDA 6.4 13.5 * Based on set of 18 public company financials

Contact Us

Go to inuvo.com/investor-email to sign up today Investor Newsletter: Keeping Up with Inuvo Download the Inuvo App! Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission.

Appendix In addition to disclosing financial results in accordance with United States generally accepted accounting principles (“GAAP”), our presentation contains the non-GAAP financial measure “Non-GAAP net income”. Non-GAAP net income is not a measure of performance defined in accordance with GAAP. However, management believes that Non- GAAP net income is useful to investors in evaluating the Company’s performance because they are commonly used financial analysis tools for measuring and comparing companies in the Company’s industry in areas of operating performance. Management believes that the disclosure of Non-GAAP net income offers an additional view of the Company’s operations that, when coupled with the GAAP results and the reconciliation to GAAP net income, provides a more complete understanding of the Company’s results of operations and the factors and trends affecting the Company’s business. We define Non-GAAP net income as net income from continuing operations plus (i) stock-based compensation, plus (ii) amortization of intangible assets, less (iii) an adjustment to the income tax provision for stock-based compensation and amortization of intangibles. These further adjustments are itemized below. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Non-GAAP net income, you should be aware that in the future we may incur expenses that are the same or similar to some of the adjustments in the presentation. Our presentation of these metrics should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Reconciliation of Net Income from Continuing Operations to Non-GAAP Net Income Description of Adjustment TTM from June 30, 2016 Net Income from continuing operations $1,039,147 Stock based compensation $1,259,318 Amortization of intangibles $937,176 Income tax adjustment to reflect 9% effective rate ($197,684) Non-GAAP Net Income $3,037,957