UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6–K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of March 2021

Commission File Number 001-31583

NAM TAI PROPERTY INC.

(Translation of registrant’s name into English)

Namtai Industrial Estate

No. 2 Namtai Road, Gushu Community, Xixiang Township

Baoan District, Shenzhen City, Guangdong Province

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| NAM TAI PROPERTY INC. |

| | |

| | |

Date: March 22, 2021 | By: | /s/ Dr. Lai Ling Tam |

| | Name: Dr. Lai Ling Tam |

| | Title: Director |

NAMTAI NAM TAI PROPERTY INC. NOTICE OF 2021 SPECIAL MEETING OF SHAREHOLDERS

Chairman’s Message DEAR SHAREHOLDERS, I would like to inform you that a 2021 Special Meeting of Shareholders of Nam Tai Property Inc. (the “Meeting”) will be held at 10:00 a.m. (Eastern Time) on Monday, April 26, 2021 virtually at www.virtualshareholdermeeting.com/NTP2021SM. At the Meeting, our shareholders will vote on the following matters either by proxy or virtually in person: Removal of directors under Resolutions 1 through 6 and election of directors under Resolutions 7 through 12 to serve until the next annual meeting of shareholders. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

This page left intentionally blank

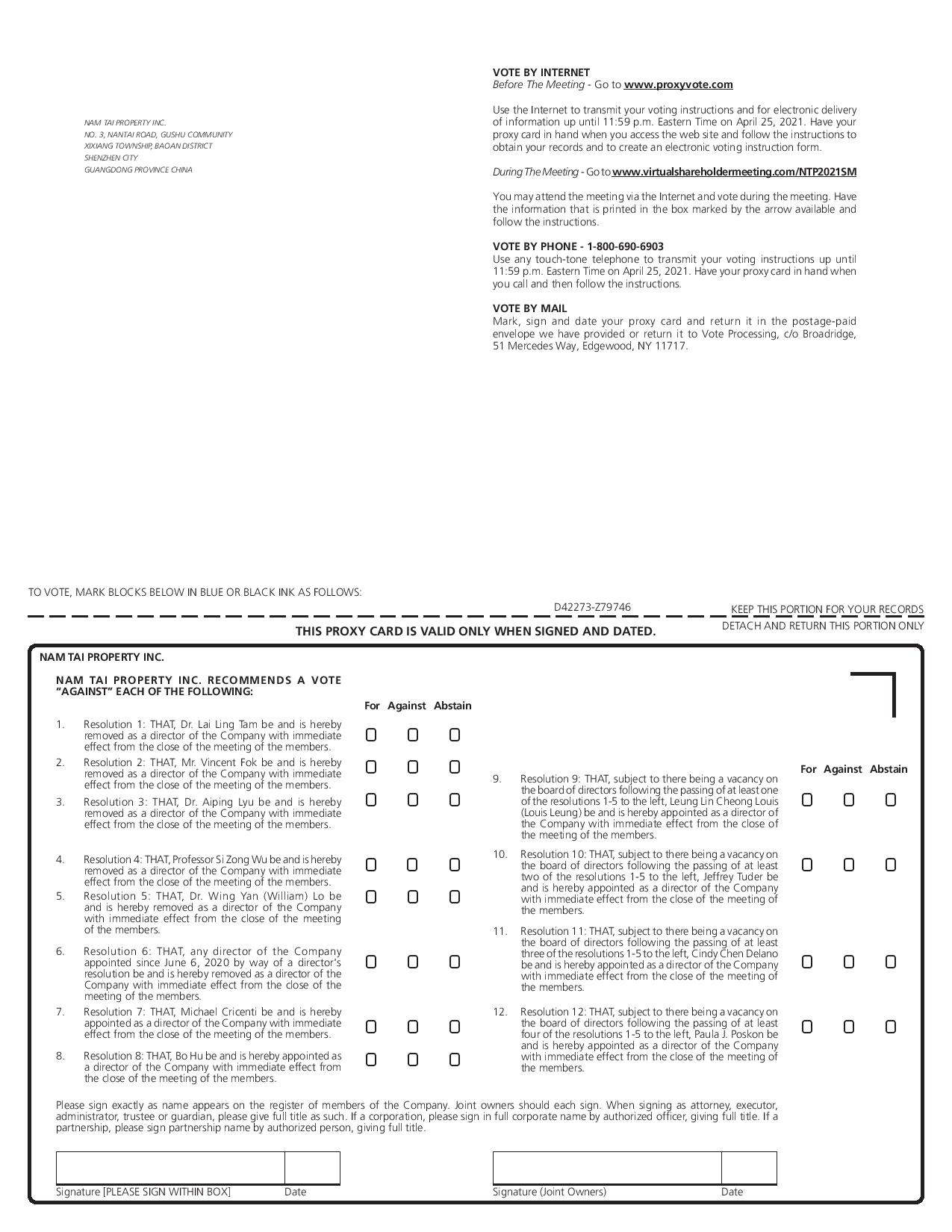

March 22, 2021 DEAR SHAREHOLDERS, Nam Tai Property Inc., Company No. 3805 (the “Company”) In accordance with Regulation 22 of the Company’s Articles of Association, shareholders holding more than 30 percent of the outstanding voting shares of the Company have requested that the directors convene a meeting of the shareholders of the Company. In accordance with Regulation 23 of the Company’s Articles of Association, we hereby give you notice that such meeting of the shareholders of the Company (the “Meeting”) shall be held virtually on April 26, 2021 at 10 a.m. Eastern Time. The purpose of the meeting will be to consider and, if thought fit, pass the following resolutions: 1. THAT, Dr. Lai Ling Tam be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 2. THAT, Mr. Vincent Fok be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 3. THAT, Dr. Aiping Lyu be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 4. THAT, Professor Si Zong Wu be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 5. THAT, Dr. Wing Yan (William) Lo be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 6. THAT, any director of the Company appointed since 6 June 2020 by way of a director’s resolution be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 7. THAT, Michael Cricenti be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 8. THAT, Bo Hu be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 9. THAT, subject to there being a vacancy on the board of directors following the passing of at least one of the resolutions 1-5 above, Leung Lin Cheong Louis (Louis Leung) be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 10. THAT, subject to there being a vacancy on the board of directors following the passing of at least two of the resolutions 1-5 above, Jeffrey Tuder be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 11. THAT, subject to there being a vacancy on the board of directors following the passing of at least three of the resolutions 1-5 above, Cindy Chen Delano be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; and 12. THAT, subject to there being a vacancy on the board of directors following the passing of at least four of the resolutions 1-5 above, Paula J. Poskon be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders i

Only holders of common shares of record at the close of business on March 15, 2021 (Eastern Time) will be entitled to vote at the Meeting. Shareholders interested in attending the virtual Meeting may do so via the following link www.virtualshareholdermeeting.com/NTP2021SM. Regardless of your plan to attend or not attend the Meeting, please vote either by phone, or over the internet following the instructions set forth on the enclosed WHITE proxy card, or complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage paid envelope accompanying the proxy card. The Company is furnishing shareholders a WHITE proxy card and IsZo Capital LP (“IsZo”) is furnishing to shareholders a green proxy card. Each of the WHITE and green proxy cards include identical resolutions for shareholders to consider and vote upon at the Meeting. The only differences between the two proxy cards are the named proxies shareholders are appointing to vote their shares at the Meeting, and that IsZo is recommending shareholders vote “For” each resolution and the Company is recommending shareholders vote “AGAINST” each resolution. Shareholders are not required to complete both proxy cards. An executed proxy card will be voted as marked and a vote “For” or “Against” a resolution on either proxy card will have the same effect. The latest dated proxy completed by a shareholder is the only one that counts. Any proxy may be revoked at any time prior to the Meeting by delivering a written notice of revocation or a later dated proxy for the Meeting or by voting in person at the Meeting. By order of the Board of Directors, /s/ Dr. Lai Ling Tam Dr. Lai Ling Tam II Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

TABLE OF CONTENTS GENERAL INFORMATION 1 Background to the Solicitation 1 Meeting Logistics 6 Questions and Answers About the Meeting and Voting 8 PROXY SUMMARY 13 Matters to be Voted Upon at the Special Meeting 13 Security Ownership of Certain Beneficial Owners, Directors and Management 13 Information About Our Directors 14 2020 Performance Highlights 18 Borrowings 18 Corporate Governance Highlights 19 RESOLUTIONS 1 THROUGH 12: ELECTION OF DIRECTORS 20 CORPORATE GOVERNANCE MATTERS 21 Director Independence 21 Responsibilities of the Board 21 Board Committees 21 Meetings and Attendance 23 Governing Documents 23 Communication with the Board 23 Related Party Transactions 23 Director Compensation 24 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders III

This page left intentionally blank

GENERAL INFORMATION Background to the Solicitation The following is a chronology of material communications and events leading up to this proxy solicitation. Since Kaisa Group Holdings Limited (“Kaisa Group”) first invested in the Company in mid-2017, remarkable progress has been made in the transformation of the Company from an electronic manufacturer to a leading real estate company in the Greater Bay Area of China. In less than four years: former manufactory sites of the Company have been successfully converted into commercial uses; in Nam Tai Inno Park, the Company’s first project that has been recently completed, a significant estimated cost reduction of approximately $108 million has been achieved; prior to the events described in this proxy, access to bank financing has been made possible; as of June 30, 2020, the Company had approximately $125 million in long-term bank loans, up from none prior to 2017; a prime residential land parcel in the city of Dongguan has been acquired through a public auction in March 2020 to strategically expand the small land bank of the Company despite the COVID-19 pandemic, and in 2020, average transaction price of commercial housing in Dongguan increased by approximately 15%; and the Company has returned to profitability in the year ended December 31, 2020. Competition for management talent is intense in the property development sector in the PRC, especially in industrial property development where in-depth industry knowledge and well-rounded abilities are required. In mid-2017, Kaisa Group, which has extensive experience in real estate development, became the Company’s single largest shareholder and remains so today. Following Kaisa Group’s initial investment, the Company commenced certain strategic cooperation with Kaisa Group, including bringing certain management and real estate specialists from Kaisa Group to the Company’s board of directors (the “Board”) and management team. The Company also consults with Kaisa Group from time to time, leveraging Kaisa Group’s knowledge and experience in the areas of real estate development. In February 2018, the Company formed its new leadership team led by the then Chief Executive Officer, Mr. Ying Chi Kwok. The new leadership team has significant experience in planning, developing and operating large-scale industrial and urban renewal projects in China and has successfully transformed the Company into a leading industrial real estate developer and operator in the Greater Bay Area of China. The new leadership team is committed to shaping the Company into a leading industrial ecosystem operator with a clear development strategy by unleashing the value of the existing projects, improving product and service quality and prudently managing financing and control costs. The Company relies on the industrial insights and services provided by these key management members. In 2020, the Board and management team successfully navigated the COVID-19 pandemic. In addition, over the past few years, the Board and management team have launched multiple initiatives to grow the Company’s business and set the Company on a path of long-term sustainable growth. The Company has made bold enhancements to its strategic plan to accelerate top line growth and improve profitability. The Company recorded revenue of $71.2 million for fiscal 2020, representing a year-on-year growth of 2,301.6%. Its real estate properties under development was $312.1 million as of December 31, 2020, an increase of $60.5 million or 24.0% year-on-year. The Company has also sought to enhance its governance by expanding the skill set and experience of its Board to allow for a more diverse perspective in the Company’s boardroom. The current Board is comprised of six members, five of whom are independent, with members from North America and China who collectively bring significant expertise in areas that are critical to the Company’s business, including in-depth knowledge of the Chinese real estate market, international perspective, local government and regulatory affairs, capital allocation and finance. The current Board also has significant independent shareholder representation, including Mr. Peter R. Kellogg (“Mr. Kellogg”). All of the three committees of the Board are composed entirely of independent directors. The Company’s Nominating and Corporate Governance Committee works to ensure that the Board is comprised of individuals who are diverse in terms of background, perspectives, industry experience and financial expertise. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 1

In March 2020, local governments in the Greater Bay Area issued favorable policies for the real estate market as the COVID-19 outbreak started to come under control in China. The Board and management team invested significant time and resources to enable the Company to capitalize on market opportunities and produce sustainable returns for shareholders, including pursuit of strategic development opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area. Under their leadership, the Company was focused on maintaining an efficient cost structure and executing a prudent capital allocation strategy, and proactively sought to invest in high-quality land resources. On March 19, 2020, the Company won a bid for a commercial and residential land parcel in Machong Town, Dongguan (“the Dongguan land”) at a consideration of RMB705.48 million ($101.07 million) through a public auction. Prior to its investment in the Dongguan land, the Company carried out a comprehensive and rigorous assessment, and conducted land surveys and market research in the local area. The Dongguan land has an area of approximately 33,763 square meters, with a plot ratio of no more than 2.5. It is located in the central area of Machong Town, less than one kilometer away from Machong Town Government, and surrounded by a wealth of educational, medical, commercial, leisure and transportation facilities. According to CRIC Research, the average transaction price of commercial housing in Dongguan in 2020 increased by as much as approximately 15%. The Company is currently developing residential apartments and commercial properties on the Dongguan land. This strategic land investment is expected to produce attractive returns for the Company’s shareholders, and also help the Company expand to Dongguan, a key growth potential city in the Greater Bay Area, grow the Company’s residential and commercial property portfolio, create powerful synergies with other existing projects in the nearby Shenzhen, form new relationship networks within the local communities and enhance brand awareness in Dongguan and Guangzhou. IsZo has been a shareholder of the Company since 2017. Since the Company’s learning of IsZo’s filing of a Schedule 13G disclosing its shareholding in the Company in February 2019, the Company has actively engaged with IsZo, including arranging for a project site visit in Shenzhen in May 2019, a teleconference meeting in June 2019 and an in-person meeting in New York in December 2019. In April 2020, Railroad Ranch Capital Management LP, another shareholder of the Company, sent a letter to the Company, in which it commented on the Company’s share price, corporate governance, land acquisition strategy and shareholder engagement, to which the Company replied in May 2020. On May 27, 2020, IsZo filed a Schedule 13D, disclosing a combined 9.8% stake in the Company and noting its intent to remove five of the seven then existing Board members for the election of its control-slate of nominees to the Board. On the same day, IsZo released an open letter to the Company’s shareholders, in which it commented on the composition of the Board, the Company’s performance and its relationship with Kaisa Group. The Company has been open to maintaining a constructive dialogue with IsZo, as it does with all shareholders, seeking to understand IsZo’s ideas and underlying assumptions about the Company. Despite the Company’s multiple efforts to engage with IsZo, IsZo did not provide any detailed plan for the Company to consider prior to its release of a public letter to the Company’s shareholders on May 27, 2020. On June 3, 2020, the Company issued a press release noting that it was committed to maintaining constructive engagement with all shareholders. The press release highlighted: the achievements of the Company’s new management team, as demonstrated by the stringent cost control, improved development and construction management, strengthened operation structure and systems and enhanced financing capabilities; the Company achieved a significant reduction in the development cost of Nam Tai Inno Park with an estimated saving of RMB 770 million (approximately $108 million) from the budget of RMB 2.17 billion (approximately $312 million) disclosed in 2017; the Company’s robust corporate governance, as demonstrated by the fact that all of the directors but one are independent, as determined under the standards of the New York Stock Exchange and the Board’s three standing committees are comprised solely of independent directors; 2 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

the Company’s prudent capital expenditures, including the investment decision to acquire the Dongguan land and the strategic importance of the Dongguan land to the Company’s sustainable development; and the Company’s commitment to maintaining transparency and communication with shareholders. On June 5, 2020, at the Company’s 2020 Annual Meeting of Shareholders, all seven of the then existing directors were re-elected, reflecting shareholders’ trust and support for the Board. The shareholders decided not to elect one new nominee to the Board, keeping the Board’s composition consistent. On July 20, 2020, IsZo issued a letter to the Company’s shareholders seeking support to convene a shareholders meeting (“Special Meeting”) in order to (i) remove a majority of the Company’s directors and any new director(s) appointed by the Board since the conclusion of the Company’s 2020 Annual Meeting of Shareholders; and (ii) appoint a control slate of six individuals nominated by IsZo as directors of the Company. On the same day, IsZo and its relevant reporting persons filed a Schedule 13D noting the aforementioned intent. On August 5, 2020, the Company issued a press release in response to the letters published by IsZo on May 27 and July 20, 2020, urging shareholders to reject IsZo’s attempt to take control of the Board. In its press release, the Company commented on the differed understanding from IsZo on the Company’s strategic plan and project value. The press release highlighted that: the Board and management team have a prominent track record of strategic foresight and sound decision-making regarding the Company’s portfolio of assets, and are executing a clear and differentiated strategy to enhance shareholder value; the Company has been proactively seeking opportunities to invest in high-quality land resources; the Company’s actively engaged, professional management team has made significant progress in creating value for shareholders over the past few years; the Company’s reputable and well-functioning Board has been dedicated to overseeing the Company’s strategic direction and operational execution for the interests of all shareholders; Kaisa Group is a strategic investor that supports the long-term development of the Company; and the Company is taking actions to drive shareholder value. On September 11, 2020, IsZo delivered to the Company requests to convene a Special Meeting from a group of shareholders. On the same day, Mr. Kellogg, a shareholder and a director of the Company, together with his relevant reporting persons, filed a Schedule 13D noting their intent to support IsZo’s request for convening a Special Meeting. However, Mr. Kellogg and his relevant reporting persons did not commit to vote the shares that they own beneficially in favor (or against) the proposals being made by IsZo at the Special Meeting, assuming that it would be called. On September 14, 2020, the Company announced that Mr. Ying Chi Kwok resigned as a director of the Board and Chief Executive Officer of the Company due to personal reasons and not as a result of any disagreement with the Company’s policies or practices. On September 18, 2020, IsZo issued a letter to the Company’s shareholders in connection with its control slate of director candidates. On September 21, 2020, the Company announced that the Board appointed Dr. Lai Ling Tam to the role of Executive Chairman of the Board and named Mr. Jiabiao Wang as Chief Executive Officer of the Company. On September 23, 2020, the Company issued a press release in response to allegations made by IsZo about the Company in its previous public letters. The Company also highlighted that IsZo’s proposed plan lacked specific detail, was untested and highly speculative. The press release noted that: the strategic relationship with Kaisa Group will benefit the Company’s long-term development; the Company’s stock has outperformed since Kaisa Group’s investment; Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 3

the Company is financially and strategically allocating capital to high-quality land resources and its actions are fully aligned with shareholder interests; IsZo’s purported valuation estimates are wrong and lack foundation in clear methodology; the Board and new leadership team comprise individuals who have broad and diverse experience and are committed to effective, independent oversight to lead the Company on its next phase of growth; succession planning has always been a top priority for the Board and it has been a part of an ongoing dialogue; and IsZo and its candidates have presented no credible path for how they will create value and lack the experience and qualifications to lead the Company or any real estate company. In late September of 2020, the Company’s lending banks notified the Company that substantial uncertainties may be cast upon the Company’s operations and management control in light of recent actions taken by IsZo. If the Board was to lose its relationship with Kaisa Group, which would be the case if IsZo’s control slate of nominees were elected to the Board, the Company would run the risk of loans being canceled, consequently leading to significant liquidity issues with its operating and construction works. Furthermore, the requisition notice and further actions related to a potential change in control pursued by IsZo could trigger an early repayment of outstanding loans demanded by the banks under relevant loan covenants. On October 5, 2020, the Company placed 16,051,219 newly issued shares with Greater Sail Limited (“Greater Sail”) for $146.9 million and 2,603,366 newly issued shares with West Ridge Investment Company Limited (“West Ridge”) for $23.8 million (collectively, the “Private Placement”). Greater Sail is a wholly owned indirect subsidiary of Kaisa Group. West Ridge is an affiliate of a large-scale integrated financial group based in Hong Kong. The net proceeds of the Private Placement were to be used for paying down debt that is at risk of cancellation or early repayment demands as a result of the campaign by IsZo, and increasing the Company’s financial flexibility. On October 6, 2020, the Company announced that its Board requested additional information from IsZo to complete the Board’s previously announced evaluation of IsZo’s request to call for a Special Meeting. The Company pointed out, while the Board continued to review the request from IsZo, based on the information provided, the Board had not yet determined whether the request from IsZo was valid and in accordance with the Company’s governing documents and relevant British Virgin Island laws. In line with its fiduciary duties, the Board requested additional information from IsZo to help it determine the validity of the request. On October 13, 2020, IsZo commenced legal proceedings against the Company, Greater Sail and West Ridge, in the High Court of Justice of the British Virgin Islands of the Eastern Caribbean Supreme Court (the “Proceedings”). IsZo sought orders from the Court that, among other things, the Private Placement was invalid and should be set aside, and the Company should hold the Special Meeting as per the requisition to remove and elect directors to the Board. The Company’s position was that the Private Placement was necessary for raising capital to prevent an imminent liquidity crisis threatening the Company, which had arisen due to the early repayment notices and demands issued by lending banks of the Company’s subsidiaries. On October 30, 2020, the Company announced its earnings for the third quarter of 2020. The earnings release highlighted the following: revenue was $1.1 million in the third quarter of 2020, growing 35.4% year-on-year; consolidated net loss was $4.9 million in the third quarter of 2020, decreasing 23.4% year-on-year; real estate property under development was $385.2 million as of September 30, 2020, increasing 72.0% year-on-year; and assets held for lease increased by $30.4 million in the third quarter of 2020, mainly due to the transfer of Towers 1, 6 and 7 of Nam Tai Inno Park from real estate properties under development. The trial of the Proceedings in the BVI Court was held between January 25, 2021 and February 24, 2021. 4 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

On March 3, 2021, the Eastern Caribbean Supreme Court in the High Court of Justice in the British Virgin Islands handed down a judgment holding that the Private Placement was void and should be set aside, and that the Company shall convene the Special Meeting regarding the removal and election of directors as soon as possible. The Company intends to exercise its right to appeal the decision and seek a stay until the appeal is decided. The Board continues to execute their fiduciary duties to act in the best interests of the Company and all shareholders as the Company moves forward in its mission to become a leading technology park developer and operator committed to long-term and sustainable growth, bringing long-term benefits to shareholders. On March 4, 2021, the Company announced that Mr. Vincent Fok, a member of the Board, resigned as the director of the Board of the Company due to personal reasons and did not arise or result from any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. On March 5, 2021, one of the Company’s subsidiaries received a demand letter (the “BOC Demand Letter”) from Bank of China (“BOC”). BOC indicated in the BOC Demand Letter that due to the recent significant uncertainty relating to the share ownership and strategic decision-making situation of the Company, it is making a demand upon the subsidiary for payment in full of amounts due under the loan agreement dated September 27, 2019 between BOC and the subsidiary, which, as of the date of the BOC Demand Letter, were RMB621.8 million ($96.1 million) in principal amount and the interest accrued. The Company has been negotiating with BOC on this matter, including contesting the BOC Demand Letter. The BOC Demand Letter states that if the amounts due are not paid in full by the due date, the lender will commence legal actions to collect the outstanding indebtedness. On March 9, 2021, two of the Company’s subsidiaries received demand letters (the “Demand Letters”) from Bank of Beijing (“BOB”) and Xiamen International Bank (“XIB”), respectively. BOB and XIB indicated in their respective Demand Letters that due to the uncertainty of ownership and the upcoming election of directors of the Company relating to the recent litigation of the Company, they are making demand upon the respective subsidiaries for payment in full of the amounts due under their loan agreements with subsidiaries, which as of the date of the Demand Letters, were RMB44.9 million ($6.9 million) and RMB103.4 million ($15.9 million) in principal amounts, respectively, and the interests accrued. The Company has been negotiating with BOB and XIB on this matter, including contesting the Demand Letters. On March 15, 2021, the Company instructed Computershare to update its register of members to delete all entries in respect of the Private Placement. Also on March 15, 2021, another subsidiary of the Company received a demand letter from The Industrial Bank Co., Ltd., Shenzhen Branch (“Industrial Bank”) for payment in full amounts due under the loan agreement prior to March 18, 2021, which is RMB27.5 million ($4.2 million) in principal, due to potential changes in the Board relating to its recent litigation in the BVI. The Company has been negotiating with Industrial Bank, including contesting the demand letter. Following the issuance of the demand letters above, the lending banks have restricted the remittance from the bank accounts of the subsidiaries of the Company in their banks in China. Approximately RMB 160 million ($24.6 million) have been affected. The Company is negotiating with the lending banks. On March 16, 2021, a member of the Board spoke with a representative of IsZo to provide an update of the Company’s current situation based on publicly available information, to express a willingness of the Board to work constructively with IsZo and to extend an invitation for the representative of IsZo to meet with the Executive Chairman of the Board. On March 17, 2021, prior to responding to the invitation to meet with the Company, IsZo mailed its proxy card and a letter to the Company’s shareholders in connection with its control slate of director candidates. On March 18, 2021, the Board appointed Mr. Terrence Lu as Chief Financial Officer of the Company, succeeding Mr. David Wan, the former Chief Financial Officer, effective immediately. Mr. Wan has been retained as an advisor to the Company. Mr. Lu has extensive experience in overall strategic planning and investment and financing management. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 5

The Company continues in good faith to seek an agreed resolution of these matters and take steps to safeguard the interest of all shareholders. As of the date of this proxy statement, however, the Company has not reached any settlement with IsZo or other relevant parties. Meeting Logistics Date, Time and Place of the Special Meeting The Special Meeting of Shareholders of the Company will be held virtually at www.virtualshareholdermeeting.com/ NTP2021SM on April 26, 2021, at 10:00 a.m. Eastern Time. Due to the continuing public health implications of the COVID-19 pandemic and our desire to promote the health and welfare of our shareholders, the Special Meeting will be held exclusively online via a live interactive webcast on the internet. You will not be able to attend the Special Meeting in person at a physical location. Quorum A quorum shall consist of one or more members present in person or by proxy representing at least one half of the votes of the shares of each class or series of shares entitled to vote as a class or series and the same proportion of the votes of the remaining shares entitled to vote. Vote Required Pursuant to the articles of association of the Company, at every meeting of the members, every holder of a share shall be entitled to one (1) vote, in person or by proxy, on all matters, including the election of directors, for each share standing in his, her or its name on the Register of Members. Directors elected by shareholders may be removed, with or without cause, only by a vote of the holders of a majority of the shares then outstanding. Any director elected to fill any vacancy by the remaining directors then in office may be removed from office by vote of the holders of a majority of the shares then outstanding. As such, the proposals to approve Resolutions 1 through 6 must be approved by the affirmative vote of a majority of the shares then outstanding. Resolutions 7 and 8 to appoint new directors must be approved by the affirmative vote of a majority of our outstanding voting shares present in person and voting on the proposals or represented by proxy and voting on the proposals. Subject to there being a vacancy on the board of directors following the passing of at least one, two, three or four of Resolutions 1 through 5, respectively, the proposals to approve Resolutions 9 to 12, as applicable, must be approved by the affirmative vote of a majority of our outstanding voting shares present in person and voting on the proposals or represented by proxy and voting on the proposals. Record Date; Shares Entitled to Vote All shareholders who owned our shares at the close of business on March 15, 2021 (the record date for the meeting) or their duly appointed proxies may attend and vote at the meeting and at any adjournment of the meeting. As of the record date, there were 39,197,991 shares outstanding. Each share outstanding on the record date is entitled to one vote on each proposal. Voting by the Directors and Executive Officers You should be aware that certain members of our board of directors and certain of our executive officers have interests in the proposals. These interests may be different from, in conflict with, or in addition to, the interests of our shareholders generally. 6 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

Proxy Holders for Registered Shareholders Shareholders registered in the register of members of the Company as of the share record date who are unable to participate in the Special Meeting may appoint as a representative another shareholder, a third party or the Company as proxy holder by completing and returning the form of proxy in accordance with the instructions printed thereon. With regard to the items listed on the agenda and without any explicit instructions to the contrary, the management of the Company as proxy holder will vote against all resolutions according to the recommendation of the Board. If new proposals (other than those on the agenda) are put forth before the Special Meeting, the management of the Company as proxy holder will vote in accordance with the position of the proxy holders. Voting of Proxies and Failure to Vote If you are a shareholder of record and you do not vote by proxy, your shares will not be voted unless you vote during the Special Meeting. If you are a beneficial owner and you do not provide your broker with specific voting instructions, your broker will not be able to vote your shares and it will result in a broker non-vote for the Proposal. Abstentions and Broker Non-Votes Under BVI law, an abstaining vote and a broker non-vote are counted as present and, therefore, will be included for purposes of determining whether a quorum of shares is present at the Special Meeting. A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner signs and returns a proxy with respect to common shares held in a fiduciary capacity (typically referred to as being held in “street name”) but does not vote on a particular matter because the nominee does not have the discretionary voting power with respect to that matter and has not received instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters but not on non-routine matters. The proposals that the shareholders are being asked to vote on at the Special Meeting are not considered routine matters and accordingly brokers or other nominees may not vote on these proposals without instructions. A broker non-vote will have the same effect as a vote “AGAINST” the proposals to approve the Resolutions 1 through 12. An abstention also will have the same effect as a vote “AGAINST” the proposals to approve the Resolutions 1 through 12. Revocability of Proxies If you are a shareholder of record and wish to change your vote, you may: cast a new vote following the instructions on the WHITE proxy card to vote by telephone or via the internet; cast a new vote by mailing a new proxy card with a later date; or attend the virtual Special Meeting of Shareholders and follow the instructions to vote during the meeting. If you are a beneficial owner, you can revoke any prior voting instructions by contacting the bank, broker, or other nominee that holds your shares or by obtaining a legal proxy from your bank, broker, or other nominee and voting at the virtual Special Meeting. If you wish to revoke your proxy rather than change your vote, our Board Secretary must receive your written revocation prior to the meeting. Whom to Call for Assistance If you have any questions or need assistance in voting your Shares, you may contact Innisfree M&A Incorporated, the firm assisting us with this proxy solicitation. Shareholders may call toll free: (877) 825-8777 Banks and Brokers may call collect: (212) 750-5833 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 7

Other Business We are not currently aware of any business to be acted upon at the Special Meeting other than the matters discussed in this proxy statement. Questions and Answers About the Meeting and Voting When and where will the meeting take place? The Special Meeting of Shareholders of the Company will be held virtually at www.virtualshareholdermeeting.com/ NTP2021SM on April 26, 2021, at 10:00 a.m. Eastern Time. Due to the continuing public health implications of the COVID-19 pandemic and our desire to promote the health and welfare of our shareholders, the Special Meeting will be held exclusively online via a live interactive webcast on the internet. You will not be able to attend the Special Meeting in person at a physical location. How can I attend the meeting? Admission to the Special Meeting is restricted to shareholders of record as of the record date and/or their designated representatives. All shareholders will be pre-registered once they received their control numbers. Pre-registration by 9:45 am Eastern Time on April 26, 2021, is required. You may pre-register by visiting www.virtualshareholdermeeting.com/ NTP2021SM and following the instructions to complete your registration request. What is the purpose of the meeting? At the virtual Special Meeting of Shareholders, you will be asked to vote on the following matters: 1. THAT, Dr. Lai Ling Tam be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 2. THAT, Mr. Vincent Fok be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 3. THAT, Dr. Aiping Lyu be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 4. THAT, Professor Si Zong Wu be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 5. THAT, Dr. Wing Yan (William) Lo be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 6. THAT, any director of the Company appointed since 6 June 2020 by way of a director’s resolution be and is hereby removed as a director of the Company with immediate effect from the close of the meeting of the members; 7. THAT, Michael Cricenti be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 8. THAT, Bo Hu be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 9. THAT, subject to there being a vacancy on the board of directors following the passing of at least one of the resolutions 1-5 above, Leung Lin Cheong Louis (Louis Leung) be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 10. THAT, subject to there being a vacancy on the board of directors following the passing of at least two of the resolutions 1-5 above, Jeffrey Tuder be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; 8 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

11. THAT, subject to there being a vacancy on the board of directors following the passing of at least three of the resolutions 1-5 above, Cindy Chen Delano be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members; and 12. THAT, subject to there being a vacancy on the board of directors following the passing of at least four of the resolutions 1-5 above, Paula J. Poskon be and is hereby appointed as a director of the Company with immediate effect from the close of the meeting of the members. Who is entitled to attend and vote at the meeting? All shareholders who owned our common shares at the close of business on March 15, 2021 (the record date for the meeting) or their duly appointed proxies may attend and vote at the meeting and at any adjournment of the meeting. As of the record date, there were 39,197,991 shares of our common shares outstanding. Each share of our common shares outstanding on the record date is entitled to one vote on each of the 12 Resolutions. How many votes must be present to hold the meeting? The presence in person or by proxy of the holders of at least one half of the outstanding shares of our common shares entitled to vote at the meeting will constitute a quorum for the transaction of business. Abstentions and broker “nonvotes” (described below) are counted as present for purposes of determining whether there is a quorum. Am I a shareholder of record or a beneficial owner, and why does it matter? Shareholder of record (also known as a record holder) If your shares are registered directly in your name with the Company’s transfer agent, you are considered the shareholder of record with respect to those shares. Beneficial owner (also known as holding shares in “street name”) If your shares are held on your behalf by a bank, broker, or other nominee, then you are the beneficial owner of shares held in “street name.” As a beneficial owner, you have the right to instruct your nominee on how to vote the shares held in your account. Because IsZo has indicated its intention to deliver proxy materials in opposition to our Board of Directors to your broker to forward to you on their behalf, with respect to accounts to which IsZo mails its proxy materials, brokers will not have discretion to vote on any of the Proposals to be considered at the Special Meeting. Therefore, if you do not provide specific voting instructions, your nominee may not vote on any of the Proposals. If your nominee cannot vote on Proposals because you haven’t provided instructions, this is known as a “broker non-vote.” How do I vote? If you are a shareholder of record as of the record date, you may vote at the virtual Special Meeting or vote by proxy as described below. Even if you plan to attend the meeting, we encourage you to vote in advance in one of three ways: n Follow the instructions on your WHITE proxy card to vote over the internet; n Follow the instructions on your WHITE proxy card to vote over the telephone; or n Sign and return the enclosed WHITE proxy card in the pre-paid envelope provided according to the included instructions. THE WHITE PROXY CARDS ARE BEING SOLICITED ON BEHALF OF OUR BOARD OF DIRECTORS. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 9

If you are a beneficial owner and have not received instructions, please contact the bank, broker, or other nominee that holds your shares for instructions on how to vote. What is a proxy? A proxy is your legal designation of another person to vote on matters transacted at the Special Meeting based upon the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. The form of WHITE proxy card accompanying this proxy statement designates LL Tam, or failing him, David Wan, or failing him, Olivia Tan, or failing her, Raymond Wen, as proxies for the Special Meeting. If I submit a proxy, how will my shares be voted? By giving us your proxy, you authorize the individuals named as proxies on the WHITE proxy card to vote your shares in accordance with the instructions you provide. If you sign and return a WHITE proxy card without indicating your instructions, your vote will be cast in accordance with the recommendation of our Board of Directors: X “AGAINST” RESOLUTIONS 1 THROUGH 12, AS DESCRIBED IN THIS PROXY STATEMENT If any other matters are brought before the meeting, LL Tam, or failing him, David Wan, or failing him, Olivia Tan, or failing her, Raymond Wen will vote your shares on such matters at their discretion. May my broker vote my shares for me? Applicable SEC and stock exchange regulations limit the matters your broker may vote on without having been instructed to do so by you. In particular, your broker may not vote on Resolutions 1 through 12 without instructions from you. What should I do if I receive a proxy card from IsZo? Resolutions 7 through 12 nominates individuals proposed by IsZo as Directors to fill vacancies or replace each of our current Directors named in Resolutions 1 through 6. You may receive proxy solicitation materials from IsZo, including an opposing proxy statement and green proxy card. Our Board of Directors urges you to discard and not sign or return any green proxy card sent to you by IsZo. If you have previously voted using a proxy card sent to you by IsZo, you have the right to change your vote by using the WHITE proxy card to vote by internet, telephone or mail or by attending the Special Meeting as described in the answer to the question above captioned “How do I vote?” Only the latest-dated proxy you submit will be counted. X OUR BOARD URGES YOU TO VOTE “AGAINST” RESOLUTIONS 1 THROUGH 12 May I change or revoke my vote after I submit my proxy? Yes. If you are a shareholder of record and wish to change your vote, you may: cast a new vote following the instructions on the WHITE proxy card to vote by telephone or via the internet; cast a new vote by mailing a new proxy card with a later date; or attend the virtual Special Meeting of Shareholders and follow the instructions to vote during the meeting. If you are a beneficial owner, you can revoke any prior voting instructions by contacting the bank, broker, or other nominee that holds your shares or by obtaining a legal proxy from your bank, broker, or other nominee and voting at the virtual Special Meeting. If you wish to revoke your proxy rather than change your vote, our Board Secretary must receive your written revocation prior to the meeting. 10 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

What are the Board’s voting recommendations, and how many votes are required to approve each Resolution? Resolution RESOLUTIONS 1 THROUGH 12 Removal of Current Directors and Election of Directors Votes Required to Pass Because Resolutions 7 through 12 nominate individuals proposed by IsZo as Directors at the Special Meeting in opposition to the current Directors named in Resolutions 1 through 6, the election of Directors is considered a “contested election”. Accordingly, in accordance with our Amended and Restated Memorandum and Articles of Association, the proposals to approve Resolutions 1 through 6 must be approved by the affirmative vote of a majority of the shares then outstanding. Resolutions 7 and 8 to appoint new directors must be approved by the affirmative vote of a majority of our outstanding voting shares present in person and voting on the proposals or represented by proxy and voting on the proposals. Subject to there being a vacancy on the board of directors following the passing of at least one, two, three or four of Resolutions 1 through 5 respectively, the proposals to approve Resolutions 9 to 12, as applicable, must be approved by the affirmative vote of a majority of our outstanding voting shares present in person and voting on the proposals or represented by proxy and voting on the proposals. Board’s Recommendation AGAINST RESOLUTIONS 1 THROUGH 12 Effect of Abstentions and Broker Non-Votes A broker non-vote will have the same effect as a vote “AGAINST” the proposals to approve the Resolutions 1 through 12. An abstention also will have the same effect as a vote “AGAINST” the proposals to approve the Resolutions 1 through 12. For additional information on how your shares will be voted, see “If I submit a proxy, how will my shares be voted?” above. We recommend that you discard any proxy card you receive from IsZo, including any green proxy card. What happens if I do not vote by proxy? If you are a shareholder of record and you do not vote by proxy, your shares will not be voted unless you vote during the meeting. If you are a beneficial owner and you do not provide your broker with specific voting instructions, your broker will declare a broker non-vote for the Proposal. What happens if the meeting is postponed or adjourned? If the meeting is postponed or adjourned, your proxy will remain valid and may be voted when the meeting is convened or reconvened. You may change or revoke your proxy as set forth above under the caption “May I change or revoke my vote after I submit my proxy?” Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 11

Are members of the Board of Directors required to attend the meeting? While the Board has not adopted a formal policy requiring Directors to attend Special Meetings, Directors are encouraged to do so. Who is soliciting my proxy? The Company is soliciting your proxy to be used at the meeting. The WHITE proxy appoints LL Tam, or failing him, David Wan, or failing him, Olivia Tan, or failing her, Raymond Wen, as your representatives to vote your shares as you instruct on your proxy card. This way, your shares will be voted even if you do not attend the meeting. Even if you plan to attend the meeting, it is a good idea to vote your shares in advance, just in case your plans change. Who will pay the expenses incurred in connection with the solicitation of my vote? The Company will pay the expenses of soliciting proxies on the WHITE proxy card. Proxies on the WHITE proxy card may be solicited by our Directors, officers or employees in person or by telephone, mail, electronic transmission or facsimile transmission. We also pay all expenses related to the Special Meeting of Shareholders. In addition to soliciting proxies by mail, we may solicit proxies by telephone, personal contact, and electronic means. None of our Directors, officers, or employees will be specially compensated for these activities. Can I view these proxy materials electronically? Yes. You may view our 2021 proxy materials at HTTP://materials.proxyvote.com/G63907. You may also use our corporate website at www.namtai.com to view all of our filings with the Securities and Exchange Commission, including this proxy statement and our Annual Report on Form 20-F for the fiscal year ended December 31, 2020. How can I receive copies of Nam Tai’s year-end Securities and Exchange Commission filings? We will furnish without charge to any shareholder, upon request, a copy of this proxy statement and/or our Annual Report on Form 20-F, including financial statements, for the fiscal year ended December 31, 2020. Any such request should be directed to Nam Tai Property Inc., Nam Tai Estate, No. 2, Namtai Road, Gushu Community, Xixiang Township, Baoan District, Shenzhen City, Guangdong Province, People’s Republic of China, Attention: Investor Relations Department, or ir@namtai.com.cn. We will provide the exhibits to the Form 20-F upon payment of the reasonable expenses of furnishing them. What if I have additional questions? If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor at the contact listed below: Innisfree M&A Incorporated Shareholders may call toll free: (877) 825-8777 Banks and Brokers may call collect: (212) 750-5833 12 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

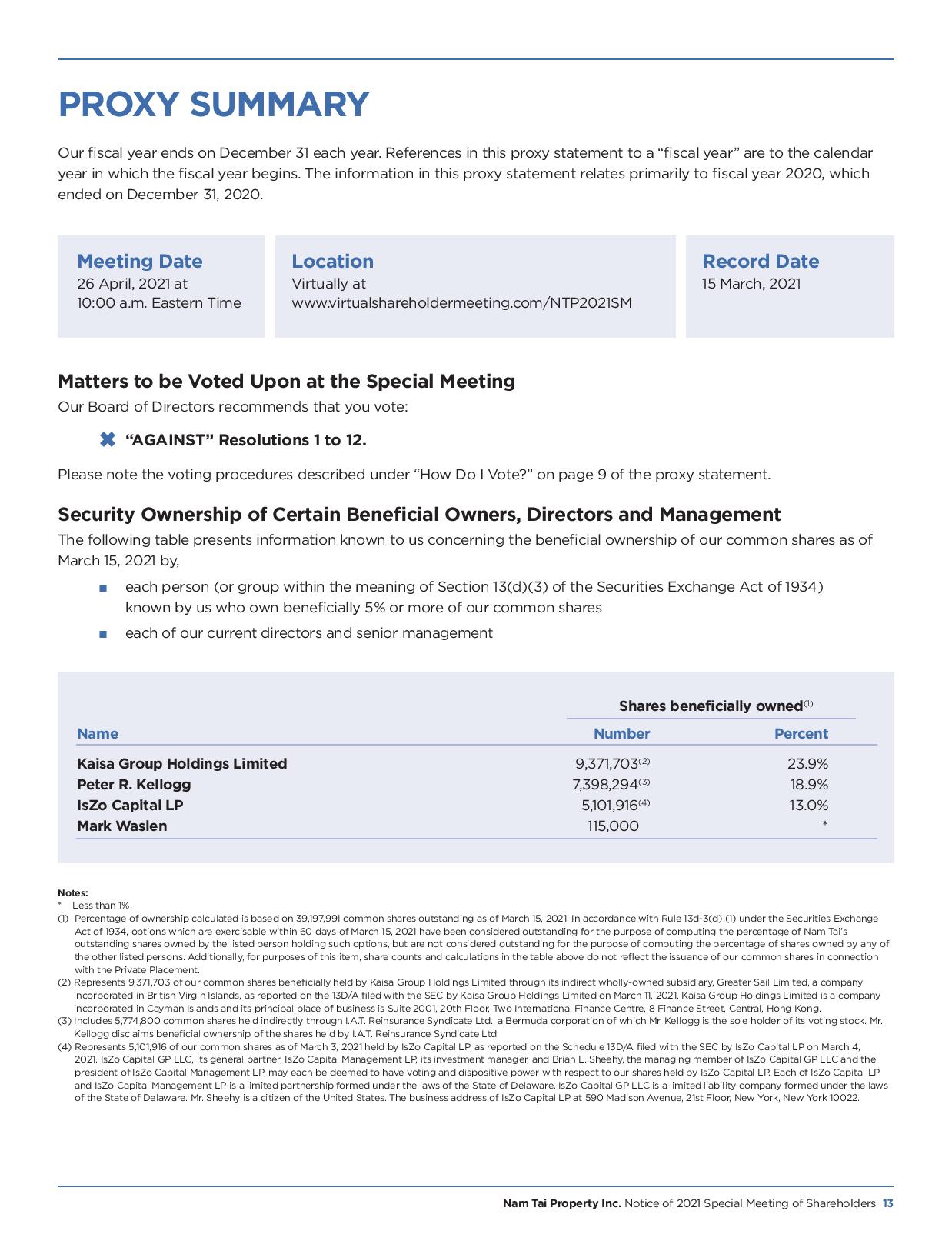

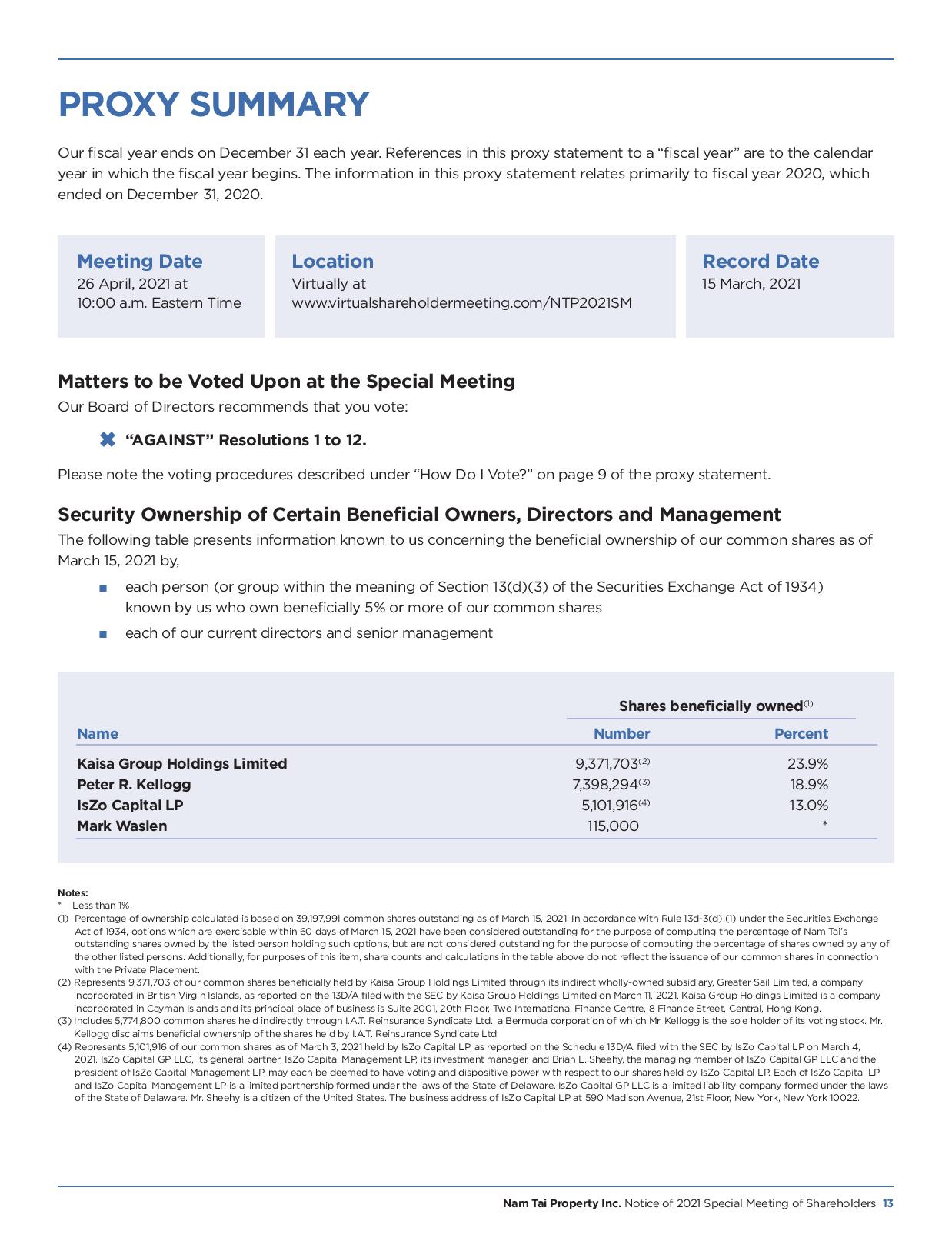

PROXY SUMMARY Our fiscal year ends on December 31 each year. References in this proxy statement to a “fiscal year” are to the calendar year in which the fiscal year begins. The information in this proxy statement relates primarily to fiscal year 2020, which ended on December 31, 2020. Meeting Date 26 April, 2021 at 10:00 a.m. Eastern Time Location Virtually at www.virtualshareholdermeeting.com/NTP2021SM Record Date 15 March, 2021 Matters to be Voted Upon at the Special Meeting Our Board of Directors recommends that you vote: X “AGAINST” Resolutions 1 to 12. Please note the voting procedures described under “How Do I Vote?” on page 9 of the proxy statement. Security Ownership of Certain Beneficial Owners, Directors and Management The following table presents information known to us concerning the beneficial ownership of our common shares as of March 15, 2021 by, each person (or group within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934) known by us who own beneficially 5% or more of our common shares each of our current directors and senior management Shares beneficially owned(1) Name Number Percent Kaisa Group Holdings Limited 9,371,703(2) 23.9% Peter R. Kellogg 7,398,294(3) 18.9% IsZo Capital LP 5,101,916(4) 13.0% Mark Waslen 115,000 * Notes: * Less than 1%. (1) Percentage of ownership calculated is based on 39,197,991 common shares outstanding as of March 15, 2021. In accordance with Rule 13d-3(d) (1) under the Securities Exchange Act of 1934, options which are exercisable within 60 days of March 15, 2021 have been considered outstanding for the purpose of computing the percentage of Nam Tai’s outstanding shares owned by the listed person holding such options, but are not considered outstanding for the purpose of computing the percentage of shares owned by any of the other listed persons. Additionally, for purposes of this item, share counts and calculations in the table above do not reflect the issuance of our common shares in connection with the Private Placement. (2) Represents 9,371,703 of our common shares beneficially held by Kaisa Group Holdings Limited through its indirect wholly-owned subsidiary, Greater Sail Limited, a company incorporated in British Virgin Islands, as reported on the 13D/A filed with the SEC by Kaisa Group Holdings Limited on March 11, 2021. Kaisa Group Holdings Limited is a company incorporated in Cayman Islands and its principal place of business is Suite 2001, 20th Floor, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. (3) Includes 5,774,800 common shares held indirectly through I.A.T. Reinsurance Syndicate Ltd., a Bermuda corporation of which Mr. Kellogg is the sole holder of its voting stock. Mr. Kellogg disclaims beneficial ownership of the shares held by I.A.T. Reinsurance Syndicate Ltd. (4) Represents 5,101,916 of our common shares as of March 3, 2021 held by IsZo Capital LP, as reported on the Schedule 13D/A filed with the SEC by IsZo Capital LP on March 4, 2021. IsZo Capital GP LLC, its general partner, IsZo Capital Management LP, its investment manager, and Brian L. Sheehy, the managing member of IsZo Capital GP LLC and the president of IsZo Capital Management LP, may each be deemed to have voting and dispositive power with respect to our shares held by IsZo Capital LP. Each of IsZo Capital LP and IsZo Capital Management LP is a limited partnership formed under the laws of the State of Delaware. IsZo Capital GP LLC is a limited liability company formed under the laws of the State of Delaware. Mr. Sheehy is a citizen of the United States. The business address of IsZo Capital LP at 590 Madison Avenue, 21st Floor, New York, New York 10022. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 13

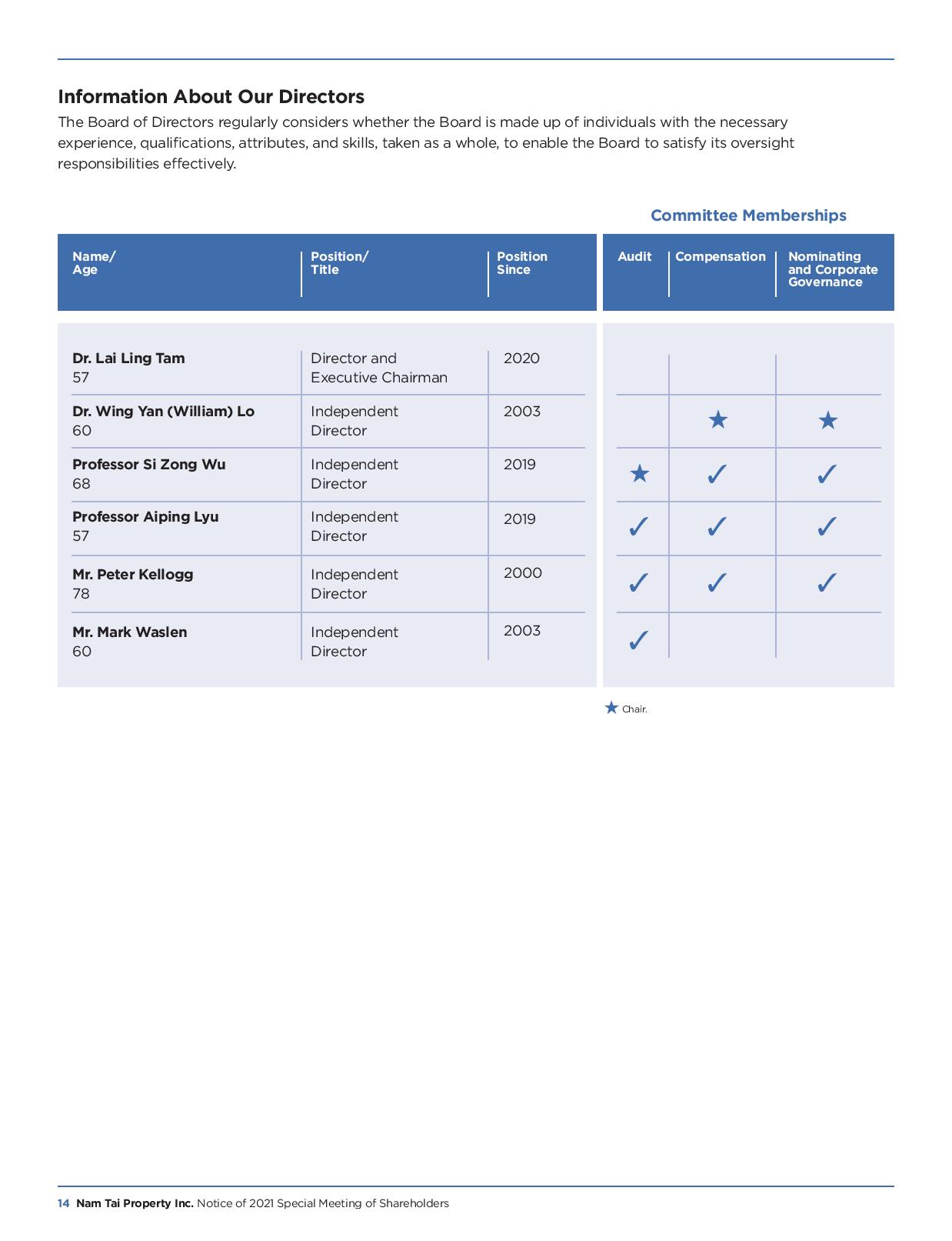

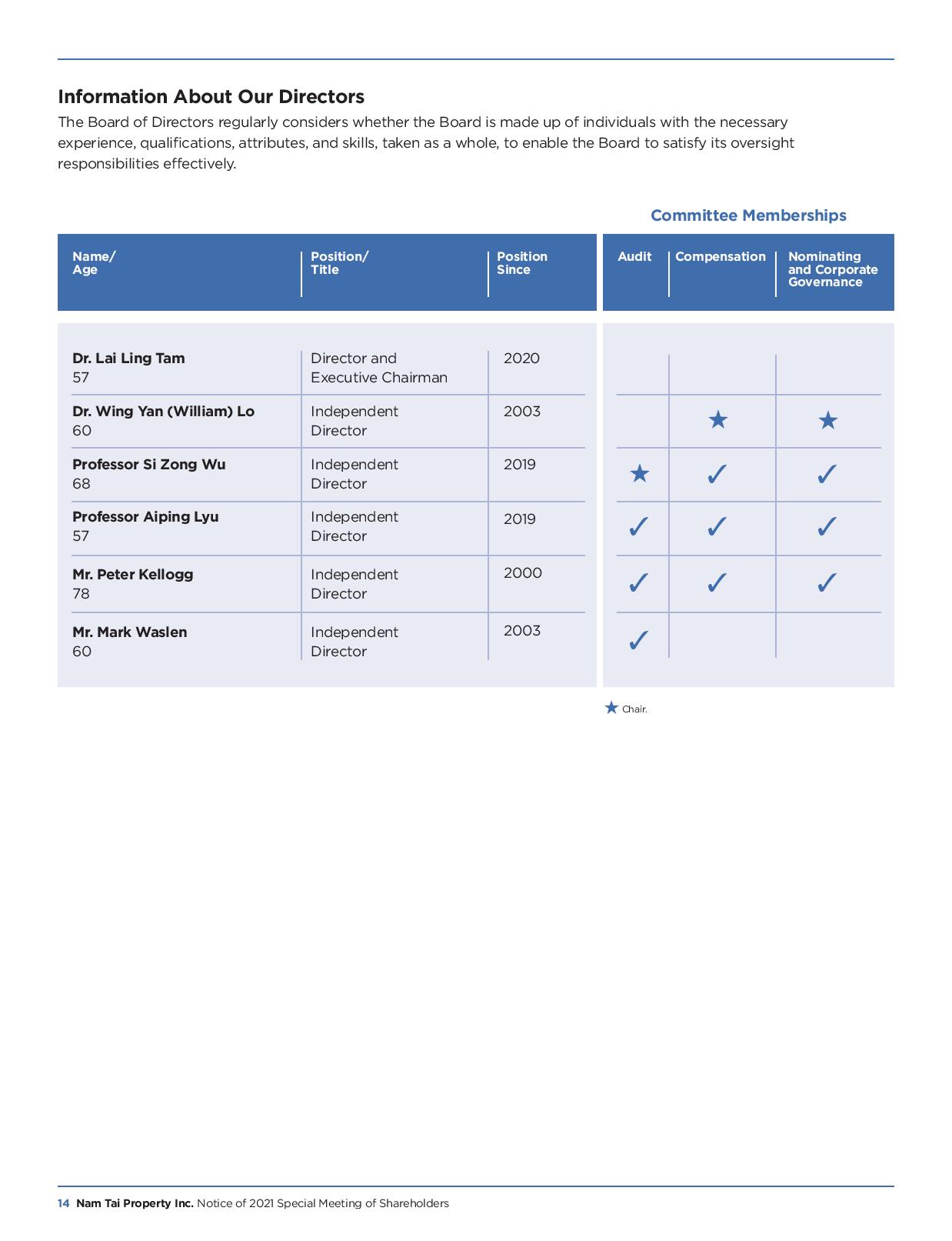

Information About Our Directors The Board of Directors regularly considers whether the Board is made up of individuals with the necessary experience, qualifications, attributes, and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively. Name/ Age Position/ Title Position Since Audit Compensation Nominating and Corporate Governance Dr. Lai Ling Tam 57 Dr. Wing Yan (William) Lo 60 Professor Si Zong Wu 68 Professor Aiping Lyu 57 Mr. Peter Kellogg 78 Mr. Mark Waslen 60 Director and Executive Chairman Independent Director Independent Director Independent Director Independent Director Independent Director 2020 2003 2019 2019 2000 2003 Chair. 14 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

Directors for Election Dr. Lai Ling Tam Age: 57 Position: Director and Executive Chairman Position held since: 2020 Biography Dr. Tam has been our Executive Chairman of the Board of Directors since September 2020. Dr. Tam has almost 30 years of experience across the finance and the real estate sectors. In addition, he has substantial experience in managing companies and dealing with investors to create value for shareholders. Dr. Tam is a holder of Chartered Financial Analyst and received his bachelor’s degree in Engineering from University College London, and a Ph.D. from the University of Cambridge. Experience Kaisa Group Holdings Limited: Senior advisor, since May 2015; Kaisa Group Holdings Limited: Vice Chairman and Executive Director, February 2010 to December 2014 SPG Land (Holdings): Executive Director, December 2007 to November 2008 Hopson Development (754.HK): Deputy Managing Director and Chief Financial Officer, April 2005 to November 2007 Tsingtao Brewery Company (168.HK).: Independent Non- Executive Director, June 2002 to June 2005 ICEA Capital Limited: Managing Director of the Investment Banking Division, March 1998 to April 2005 Smith New Court/Merrill Lynch: 2 years in corporate finance Shell Oil China Ltd: 4 years in business development Dr. Wing Yan (William) Lo Age: 60 Position: Independent Director Position held since: 2003 Committee memberships: Compensation (Chair) Nominating and Corporate Governance (Chair) Biography Dr. Lo has served on our Board of Directors since July 2003 and is the chairman of our compensation committee and nominating and corporate governance committee. Dr. Lo has over 34 years of experience in the TMT (technology, media and telecommunications) and consumer sectors. Dr. Lo has held numerous Government appointments during his career and is currently a member of the Cyberport Advisory Panel and a Member of the Hospital Governing Committee of HK Red Cross Blood Transfusion Service and an Advisory Committee member of Chinese Medicine, Hong Kong Baptist University. In 1998, Dr. Lo was appointed as a Hong Kong Justice of the Peace. Dr. Lo received his M.Phil. degree in Pharmacology and a Ph.D. degree in Molecular Neuroscience from the University of Cambridge. Experience Captcha Media Ltd: Chairman, since January 2015 Television Broadcasts Ltd (SEHK: 511): Independent Non-Executive Director, since February 2015 CSI Properties Ltd (SEHK: 497): Independent Non-Executive Director, since April 2014 Jing Rui Holdings Limited (SEHK:1862): Independent Non-Executive Director, since October 2013 South Shore Holdings Limited (SEHK: 577): Independent Non- Executive Director, since April 2020 SITC International Limited (SEHK: 1308): Independent Non- Executive Director, October 2010 – October 2020 Brightoil Petroleum Holdings Limited (SEHK:0933): Independent Non-Executive Director, June 2019 – December 2020 China Unicom: Executive Director, from October 2001 to May 2006 Hongkong Telecom: Managing Director, from January 1990 to June 1998 Citi HK/Macau Consumer Bank: Chief Executive Officer, from September 1998 to January 2000 I.T. Limited: Vice Chairman & Managing Director, from June 2006 to September 2009 South China Media Group: Vice Chairman, from September 2011 to September 2014 Kidsland International Holdings Limited: Vice-Chairman, Chief Financial Officer & Managing Director, from January 2013 to December 2018 Junior Achievement HK: Chairman, since June 2012 Cyberport: Advisory Panel Member, since August 2017 Hospital Governing Committee of the Hong Kong Red Cross Blood Transfusion Service: Member, since April 2017 Shantou People’s Political Consultative Conference: Committee Member, from 2003 to 2016 Hong Kong Baptist University: Advisory Committee member of Chinese Medicine, since September 2020 Our Hong Kong Foundation: Advisor, since April 2020 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 15

Professor Si Zong Wu Age: 68 Position: Independent Director Position held since: 2019 Committee memberships: Audit (Chair) Compensation Nominating and Corporate Governance Biography Professor Wu has served on our Board of Directors since June 2019 and is the Chairman of our audit committee and a member of our compensation committee and nominating and corporate governance committee. Professor Wu has over 40 years of experience in teaching and researching business management, marketing and international trade. Between 2001 and 2020, Professor Wu published several theses and was involved in various research projects in his fields of expertise. He also published various books in marketing, commerce and trade from 2000 to 2007. Professor Wu received his bachelor’s degree in Economics from Jiangxi University of Finance in 1982 and a master’s degree in Economics at the Shanghai University of Finance and Economics in 1995. Experience Guanzong Investment Management Co., Ltd: Executive Director and General Manager, since 2016 Shanghai Shimao Co., Ltd (SSE: 600823): Independent Director, since 2018 Top Spring International Holdings Ltd (SEHK: 2688): Independent Non-Executive Director, since 2011 Chitina Holding Ltd (TPE: 4137),: Director, since 2010 AnHui Higasket Plastics Co., Ltd: Independent Director, since 2017 Shanghai Marketing Society: Vice President, since 2008 China Marketing Society: Standing Director, since 2006 Tongji University: Professor and Doctoral Tutor, since 1997; Secretary of the Party Committee, 2004-2009; and Vice Dean of the Economic and Management School, 1998-2004 Jiangxi University of Finance and Economics: Head of Affairs Committee, from 1994 to 1997 Dr. Aiping Lyu Age: 57 Position: Independent Director Position held since: 2019 Committee memberships: Audit Compensation Nominating and Corporate Governance Biography Dr. Lyu has served on our Board of Directors since June 2019 and is a member of our audit committee, compensation committee and nominating and corporate governance committee. Dr. Lyu has over 22 years of experience in the management of research institutes and pharmaceutical companies in Mainland China and Hong Kong. Dr. Lyu had been focused on the translational research in Chinese medicine, including pharmacological and clinical evaluation on rheumatoid arthritis with traditional Chinese medicine pattern diagnosis and interventions, and development of new drugs based on Chinese medicines. Dr. Lyu is also actively involved in the research on the standardization of Chinese medicine and strategic plan research for Chinese medicine development in China. Over the years, Dr. Lyu has obtained more than 60 patents from his research activities and published more than 30 books and over 500 articles. Dr. Lyu received his bachelor’s degree in 1983 from Jiangxi University of Traditional Chinese Medicine, and a master’s and PhD degrees in 1987 and 1997, respectively from the China Academy of Traditional Chinese Medicine in Beijing (presently known as the China Academy of Chinese Medical Sciences). Experience Kaisa Health Group (SEHK: 876): Independent Non-Executive Director, since March 2018 Hong Kong Baptist University: Chair Professor and Dean of School of Chinese Medicine, since February 2012 Chinese Medicine Development Committee, Hong Kong: Member, since 2014 Biology and Medicine Panel of The Research Grants Council, Hong Kong: Member, 2013 - 2019 Chinese Pharmacopoeia Commission of the People’s Republic of China: Member, since 2009 Technical Committee of the International Organization for Standardization on traditional Chinese medicine (ISO/TC249): Head of Chinese Delegation, since October 2009 16 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

Continuing Directors Peter R. Kellogg Age: 78 Position: Independent Director Committee memberships: Audit Compensation Nominating and Corporate Governance Biography Mr. Kellogg has served on our Board of Directors since June 2000 and is a member of our audit committee, compensation committee and nominating and corporate governance committee. Mr. Kellogg was a senior managing director of Spear, Leeds & Kellogg, a registered broker-dealer in the United States and a specialist firm on the NYSE until the firm merged with Goldman Sachs in 2000. Mr. Kellogg is also a member of the board of the Ziegler Companies and the U.S. Ski Team. Mark Waslen Age: 60 Position: Independent Director Committee memberships: Audit Biography Mr. Waslen has served on our Board of Directors since July 2003 and is a member of our audit committee. From 1990 to 1995 and from June 1998 to October 1999, Mr. Waslen was employed by Nam Tai in various capacities, including financial controller, secretary and treasurer. Since June 1, 2010, Mr. Waslen is employed as a partner with MNP, a Canadian Chartered Accountant and business advisory firm. From 2001 to 2010, Mr. Waslen was employed by Berris Mangan Chartered Accountants, an accounting firm located in Vancouver, BC. Prior to joining Berris Mangan, Mr. Waslen worked at various other accounting firms, including Peat Marwick Thorne and Deloitte & Touche. Mr. Waslen is a CFA, CA and a CPA and received a Bachelor’s of Commerce (Accounting Major) from University of Saskatchewan in 1982. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 17

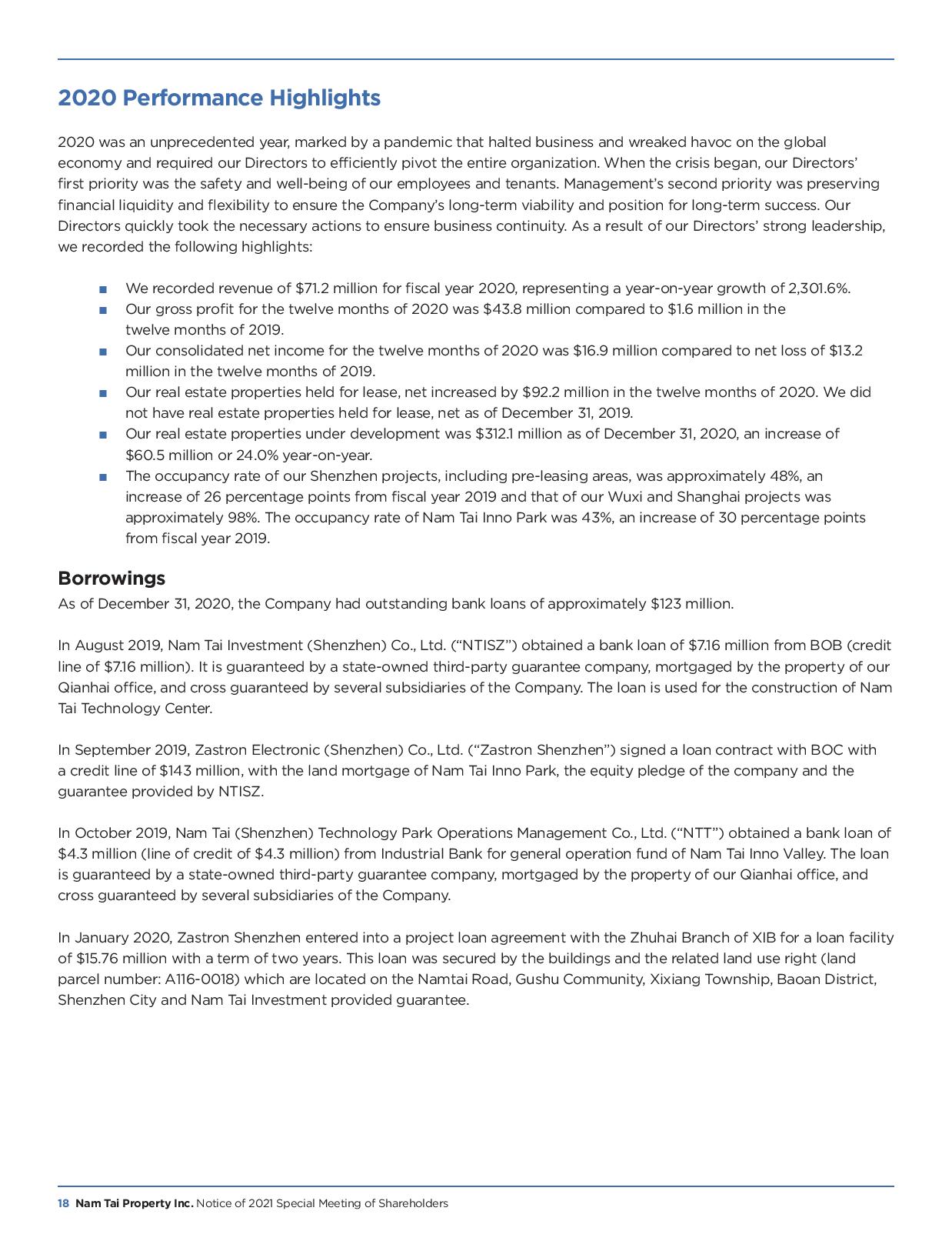

2020 Performance Highlights 2020 was an unprecedented year, marked by a pandemic that halted business and wreaked havoc on the global economy and required our Directors to efficiently pivot the entire organization. When the crisis began, our Directors’ first priority was the safety and well-being of our employees and tenants. Management’s second priority was preserving financial liquidity and flexibility to ensure the Company’s long-term viability and position for long-term success. Our Directors quickly took the necessary actions to ensure business continuity. As a result of our Directors’ strong leadership, we recorded the following highlights: We recorded revenue of $71.2 million for fiscal year 2020, representing a year-on-year growth of 2,301.6%. Our gross profit for the twelve months of 2020 was $43.8 million compared to $1.6 million in the twelve months of 2019. Our consolidated net income for the twelve months of 2020 was $16.9 million compared to net loss of $13.2 million in the twelve months of 2019. Our real estate properties held for lease, net increased by $92.2 million in the twelve months of 2020. We did not have real estate properties held for lease, net as of December 31, 2019. Our real estate properties under development was $312.1 million as of December 31, 2020, an increase of $60.5 million or 24.0% year-on-year. The occupancy rate of our Shenzhen projects, including pre-leasing areas, was approximately 48%, an increase of 26 percentage points from fiscal year 2019 and that of our Wuxi and Shanghai projects was approximately 98%. The occupancy rate of Nam Tai Inno Park was 43%, an increase of 30 percentage points from fiscal year 2019. Borrowings As of December 31, 2020, the Company had outstanding bank loans of approximately $123 million. In August 2019, Nam Tai Investment (Shenzhen) Co., Ltd. (“NTISZ”) obtained a bank loan of $7.16 million from BOB (credit line of $7.16 million). It is guaranteed by a state-owned third-party guarantee company, mortgaged by the property of our Qianhai office, and cross guaranteed by several subsidiaries of the Company. The loan is used for the construction of Nam Tai Technology Center. In September 2019, Zastron Electronic (Shenzhen) Co., Ltd. (“Zastron Shenzhen”) signed a loan contract with BOC with a credit line of $143 million, with the land mortgage of Nam Tai Inno Park, the equity pledge of the company and the guarantee provided by NTISZ. In October 2019, Nam Tai (Shenzhen) Technology Park Operations Management Co., Ltd. (“NTT”) obtained a bank loan of $4.3 million (line of credit of $4.3 million) from Industrial Bank for general operation fund of Nam Tai Inno Valley. The loan is guaranteed by a state-owned third-party guarantee company, mortgaged by the property of our Qianhai office, and cross guaranteed by several subsidiaries of the Company. In January 2020, Zastron Shenzhen entered into a project loan agreement with the Zhuhai Branch of XIB for a loan facility of $15.76 million with a term of two years. This loan was secured by the buildings and the related land use right (land parcel number: A116-0018) which are located on the Namtai Road, Gushu Community, Xixiang Township, Baoan District, Shenzhen City and Nam Tai Investment provided guarantee. 18 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

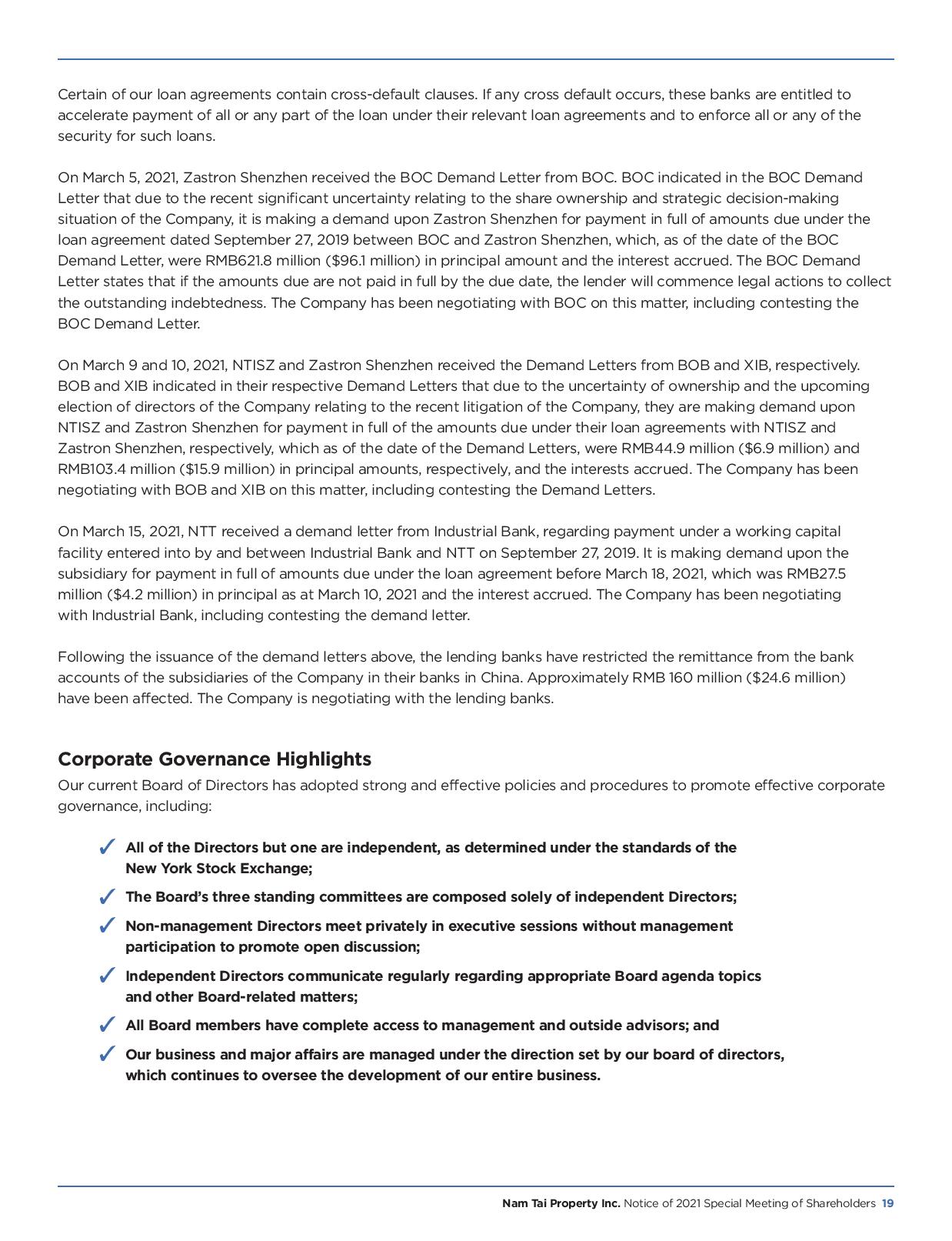

Certain of our loan agreements contain cross-default clauses. If any cross default occurs, these banks are entitled to accelerate payment of all or any part of the loan under their relevant loan agreements and to enforce all or any of the security for such loans. On March 5, 2021, Zastron Shenzhen received the BOC Demand Letter from BOC. BOC indicated in the BOC Demand Letter that due to the recent significant uncertainty relating to the share ownership and strategic decision-making situation of the Company, it is making a demand upon Zastron Shenzhen for payment in full of amounts due under the loan agreement dated September 27, 2019 between BOC and Zastron Shenzhen, which, as of the date of the BOC Demand Letter, were RMB621.8 million ($96.1 million) in principal amount and the interest accrued. The BOC Demand Letter states that if the amounts due are not paid in full by the due date, the lender will commence legal actions to collect the outstanding indebtedness. The Company has been negotiating with BOC on this matter, including contesting the BOC Demand Letter. On March 9 and 10, 2021, NTISZ and Zastron Shenzhen received the Demand Letters from BOB and XIB, respectively. BOB and XIB indicated in their respective Demand Letters that due to the uncertainty of ownership and the upcoming election of directors of the Company relating to the recent litigation of the Company, they are making demand upon NTISZ and Zastron Shenzhen for payment in full of the amounts due under their loan agreements with NTISZ and Zastron Shenzhen, respectively, which as of the date of the Demand Letters, were RMB44.9 million ($6.9 million) and RMB103.4 million ($15.9 million) in principal amounts, respectively, and the interests accrued. The Company has been negotiating with BOB and XIB on this matter, including contesting the Demand Letters. On March 15, 2021, NTT received a demand letter from Industrial Bank, regarding payment under a working capital facility entered into by and between Industrial Bank and NTT on September 27, 2019. It is making demand upon the subsidiary for payment in full of amounts due under the loan agreement before March 18, 2021, which was RMB27.5 million ($4.2 million) in principal as at March 10, 2021 and the interest accrued. The Company has been negotiating with Industrial Bank, including contesting the demand letter. Following the issuance of the demand letters above, the lending banks have restricted the remittance from the bank accounts of the subsidiaries of the Company in their banks in China. Approximately RMB 160 million ($24.6 million) have been affected. The Company is negotiating with the lending banks. Corporate Governance Highlights Our current Board of Directors has adopted strong and effective policies and procedures to promote effective corporate governance, including: All of the Directors but one are independent, as determined under the standards of the New York Stock Exchange; The Board’s three standing committees are composed solely of independent Directors; Non-management Directors meet privately in executive sessions without management participation to promote open discussion; Independent Directors communicate regularly regarding appropriate Board agenda topics and other Board-related matters; All Board members have complete access to management and outside advisors; and Our business and major affairs are managed under the direction set by our board of directors, which continues to oversee the development of our entire business. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 19

RESOLUTIONS 1 THROUGH 12: ELECTION OF DIRECTORS Our Board of Directors currently consists of six members, four of which are standing for election under Resolutions 1 through 6. Furthermore, Resolutions 7 through 12 nominate individuals proposed by IsZo as Directors to replace each of our current Directors named in Resolutions 1 through 6. We believe that our current Directors remain best positioned to serve our Company and our shareholders. Accordingly, our Board of Directors recommends that you vote “AGAINST” Resolutions 1 through 12 on the WHITE proxy card, via the Internet, by telephone or by mail following the instructions set forth on the enclosed WHITE proxy card. In addition, our Board of Directors strongly urges you to discard any proxy card that may be sent to you by IsZo and its affiliates. Electing to “ABSTAIN” with respect to any of Resolutions 1 through 12 on IsZo’s proxy card is not the same as voting for the current Directors of Nam Tai. Instead, an election to “ABSTAIN” with respect to any of Resolutions 1 through 12 on IsZo’s proxy card will revoke any previous proxy that you have already submitted. If you have already voted using a proxy card sent to you by IsZo, you have the right to change your mind. We urge you to revoke that proxy by voting “AGAINST” Resolutions 1 through 12 by using the enclosed WHITE proxy card. ONLY THE LATEST VALIDLY EXECUTED PROXY THAT YOU SUBMIT WILL BE COUNTED. Properly executed proxies will be voted as marked. Unmarked proxies will be voted against Resolutions 1 through 12. THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE AGAINST RESOLUTIONS 1 THROUGH 12 BY USING THE WHITE PROXY CARD. IF YOU SIGN AND DATE YOUR WHITE PROXY CARD BUT NO INSTRUCTIONS ARE SPECIFIED, YOUR SHARES WILL BE VOTED AGAINST RESOLUTIONS 1 THROUGH 12. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor at the number listed below: Innisfree M&A Incorporated Shareholders may call toll free: (877) 825-8777 Banks and Brokers may call collect: (212) 750-5833 20 Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders

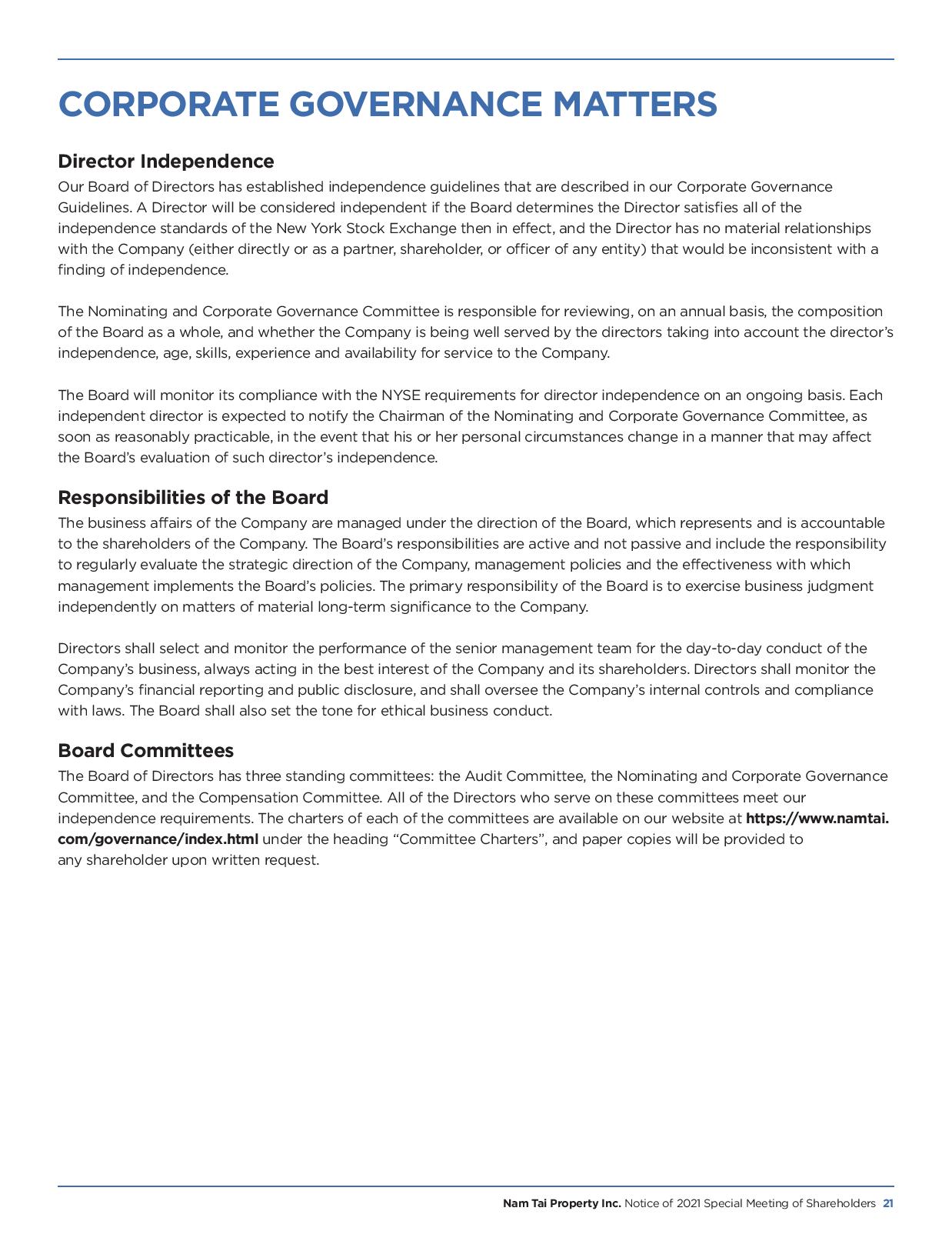

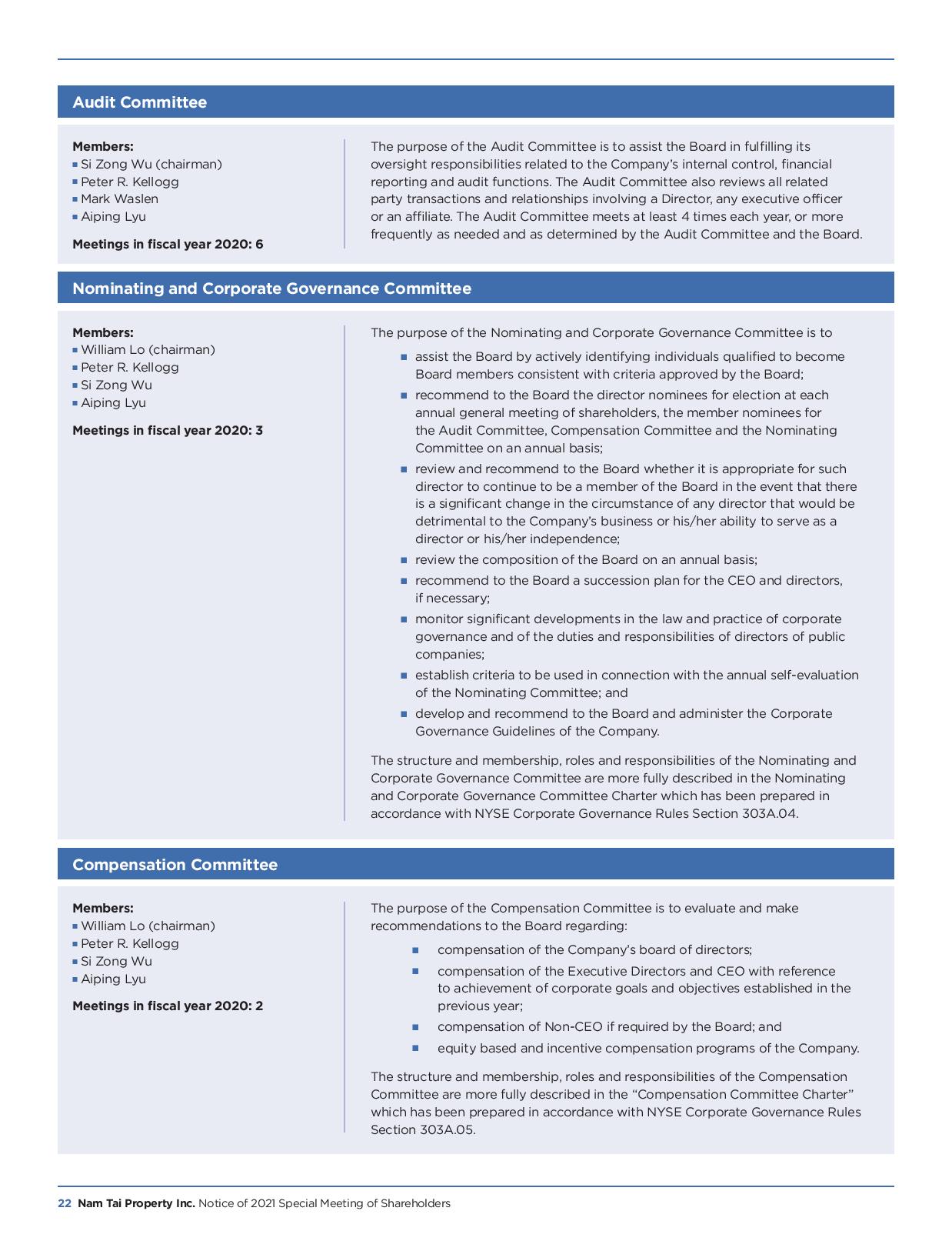

CORPORATE GOVERNANCE MATTERS Director Independence Our Board of Directors has established independence guidelines that are described in our Corporate Governance Guidelines. A Director will be considered independent if the Board determines the Director satisfies all of the independence standards of the New York Stock Exchange then in effect, and the Director has no material relationships with the Company (either directly or as a partner, shareholder, or officer of any entity) that would be inconsistent with a finding of independence. The Nominating and Corporate Governance Committee is responsible for reviewing, on an annual basis, the composition of the Board as a whole, and whether the Company is being well served by the directors taking into account the director’s independence, age, skills, experience and availability for service to the Company. The Board will monitor its compliance with the NYSE requirements for director independence on an ongoing basis. Each independent director is expected to notify the Chairman of the Nominating and Corporate Governance Committee, as soon as reasonably practicable, in the event that his or her personal circumstances change in a manner that may affect the Board’s evaluation of such director’s independence. Responsibilities of the Board The business affairs of the Company are managed under the direction of the Board, which represents and is accountable to the shareholders of the Company. The Board’s responsibilities are active and not passive and include the responsibility to regularly evaluate the strategic direction of the Company, management policies and the effectiveness with which management implements the Board’s policies. The primary responsibility of the Board is to exercise business judgment independently on matters of material long-term significance to the Company. Directors shall select and monitor the performance of the senior management team for the day-to-day conduct of the Company’s business, always acting in the best interest of the Company and its shareholders. Directors shall monitor the Company’s financial reporting and public disclosure, and shall oversee the Company’s internal controls and compliance with laws. The Board shall also set the tone for ethical business conduct. Board Committees The Board of Directors has three standing committees: the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee. All of the Directors who serve on these committees meet our independence requirements. The charters of each of the committees are available on our website at https://www.namtai. com/governance/index.html under the heading “Committee Charters”, and paper copies will be provided to any shareholder upon written request. Nam Tai Property Inc. Notice of 2021 Special Meeting of Shareholders 21