SEMI - ANNUAL REPORT

June 30, 2006

Phone: (800) 860-3863

E-mail: fund@muhlenkamp.com

Web Site: www.muhlenkamp.com

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus of the Muhlenkamp Fund. Please call 1-800-860-3863 for a current copy of the prospectus. Read it carefully before you invest.

This page intentionally left blank.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Dear Fellow Shareholders:

The Trustees and Management of the Muhlenkamp Fund are pleased to present this Semi-Annual Report of your Fund.

The moderating economic trends of the past year continue with the economy growing nicely in the 3%+ range and inflation contained in the 2%+ range. But the numbers reported on a monthly and quarterly basis have become much more volatile.

Similarly, the stock and bond markets have become quite volatile. Some parts of it we foresaw; some we didn’t (see Muhlenkamp Memorandum #79 — copies are available on our website or upon request).

Suffice it to say that part of our job is to shield your assets when markets turn volatile on the downside, and we haven’t done that to our standard in the recent months.

I have frequently been asked to compare the current economy and markets to prior periods. In this vein, I believe the following:

| · | The economic and investment climate is most similar to the early 1960s; good GDP growth and contained inflation. |

| · | The current stage of the business cycle looks most like 1994-1995 — a soft landing or slowdown after a nice recovery from recession. |

| · | The current psychology and market action are volatile. There is so much money, managed both professionally and privately, which is seeking to latch onto the latest fad or trend and then to be the first one off (which is the hard part) that the markets will remain quite volatile. We think this will continue. |

Many think that volatility is a bad thing. We think it is a good thing, allowing us to buy cheap or sell dear.

Because we like the climate and the seasons and, most importantly, we think we’re finding good companies at cheap prices (some of which we own — and have gotten cheaper), we think it’s an opportune time to be investing money in our companies’ stocks.

Ronald H. Muhlenkamp

President

August, 2006

Opinions expressed are those of Ronald H. Muhlenkamp and are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Average Annual Total Returns

as of June 30, 2006 (Unaudited)

| Muhlenkamp Fund | | One Year | | Three Year | | Five Year | | Ten Year | | Fifteen Year | | Since Inception* |

| | | | | | | | | | | | | |

| Return Before Taxes | | 0.37% | | 16.44% | | 8.70% | | 14.41% | | 15.26% | | 13.93% |

| Return After Taxes on | | | | | | | | | | | | |

Distributions** | | 0.24% | | 16.38% | | 8.67% | | 14.19% | | 14.96% | | 13.58% |

| Return After Taxes on | | | | | | | | | | | | |

Distributions and Sale of | | | | | | | | | | | | |

Fund Shares** | | 0.43% | | 14.27% | | 7.57% | | 12.94% | | 13.95% | | 12.71% |

| | | | | | | | | | | | | |

| S&P 500 Index*** | | 8.63% | | 11.22% | | 2.49% | | 8.32% | | 10.73% | | 11.41% |

| | | | | | | | | | | | | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.muhlenkamp.com. The Fund imposes a 2.00% redemption fee on shares held less than 30 days. Performance shown does not reflect this fee. If reflected, returns would be lower.

Investment returns can vary significantly between returns before taxes and returns after taxes.

The Muhlenkamp Fund is providing the returns in the above table to help our shareholders understand the magnitude of tax costs and the impact of taxes on the performance of the Fund.

| * | Operations commenced on November 1, 1988. |

| ** | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Remember, the Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. |

| *** | The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The figures for the S&P 500 Index reflect all dividends reinvested but do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index. |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

| | | Total Return % | | Cumulative Return % |

| | | | | | | | | |

Period Ending | | Muhlenkamp Fund | | S&P 500 Index | | Muhlenkamp Fund | | S&P 500 Index |

| 12/31/96 | | 30.0 | | 23.0 | | 30.0 | | 23.0 |

| 12/31/97 | | 33.3 | | 33.4 | | 73.3 | | 64.1 |

| 12/31/98 | | 3.2 | | 28.6 | | 78.8 | | 111.0 |

| 12/31/99 | | 11.4 | | 21.0 | | 99.2 | | 155.3 |

| 12/31/00 | | 25.3 | | (9.1) | | 149.6 | | 132.1 |

| 12/31/01 | | 9.3 | | ( 11.9) | | 172.8 | | 104.5 |

| 12/31/02 | | (19.9) | | (22.1) | | 118.5 | | 59.3 |

| 12/31/03 | | 48.1 | | 28.7 | | 223.7 | | 105.0 |

| 12/31/04 | | 24.5 | | 10.9 | | 303.0 | | 127.3 |

| 12/31/05 | | 7.9 | | 4.9 | | 334.8 | | 138.5 |

| 06/30/06 | | (3.7) | | 2.7 | | 318.7 | | 144.9 |

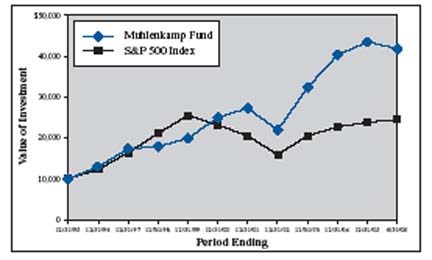

A Hypothetical $10,000 Investment in the Muhlenkamp Fund

The Standard & Poor’s 500 Stock Index (‘‘S&P 500 Index’’) is a market value-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on 12/31/95. The line graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all dividends.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

EXPENSE EXAMPLE

June 30, 2006 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/06 - 6/30/06).

Actual Expenses

The first line of the table provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing

MUHLENKAMP (A Portfolio of the Wexford Trust) |

EXPENSE EXAMPLE (Continued)

June 30, 2006 (Unaudited)

ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 1/1/06 | | Ending Account Value 6/30/06 | | Expenses Paid During Period 1/1/06 - 6/30/06* |

| | | | | | |

| Actual | $1,000.00 | | $962.60 | | $5.01 |

| Hypothetical | | | | | |

(5% return before | | | | | |

expenses) | 1,000.00 | | 1,019.69 | | 5.16 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.03% multiplied by the average account value over the period multiplied by 181/365 (to reflect the one-half year period). |

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

June 30, 2006 (Unaudited)

MUHLENKAMP (A Portfolio of the Wexford Trust) |

STATEMENT OF ASSETS & LIABILITIES

June 30, 2006 (Unaudited)

ASSETS |

| INVESTMENTS, AT VALUE | |

(Cost $2,304,228,984) | $3,056,754,149 |

| CASH | 190 |

| RECEIVABLE FOR FUND SHARES SOLD | 3,391,164 |

| DIVIDENDS RECEIVABLE | 2,109,405 |

| OTHER ASSETS | 80,728 |

Total assets | 3,062,335,636 |

| | |

| | |

LIABILITIES |

| OPTIONS WRITTEN, AT VALUE | |

(Premiums received $1,317,839) | 1,340,000 |

| PAYABLE FOR FUND SHARES REDEEMED | 1,344,006 |

| PAYABLE TO ADVISOR | 2,309,695 |

| ACCRUED EXPENSES AND OTHER LIABILITIES | 696,600 |

Total liabilities | 5,690,301 |

| NET ASSETS | $3,056,645,335 |

| | |

| | |

NET ASSETS |

| PAID IN CAPITAL | 2,393,513,233 |

| UNDISTRIBUTED NET INVESTMENT INCOME | 13,739,304 |

| ACCUMULATED NET REALIZED LOSS ON INVESTMENTS | |

SOLD, AND OPTION CONTRACTS EXPIRED OR CLOSED | |

| NET UNREALIZED APPRECIATION (DEPRECIATION) ON: | (103,110,206) |

Investments | 752,525,165 |

Written options | (22,161) |

| NET ASSETS | $3,056,645,335 |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | |

(unlimited number of shares authorized, $.001 par value) | 37,606,934 |

| | |

| NET ASSET VALUE PER SHARE | $81.28 |

| | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

STATEMENT OF OPERATIONS

Six Months Ended June 30, 2006 (Unaudited)

| INVESTMENT INCOME: | | | | | |

Dividends | | | | | |

(Net of foreign taxes withheld of $28,241) | | | | | $ | 30,391,440 | |

Interest | | | | | | 581,319 | |

Total investment income | | | | | | 30,972,759 | |

| | | | | | | | |

| EXPENSES: | | | | | | | |

Investment advisory fees | | $ | 14,714,148 | | | | |

Shareholder servicing and accounting costs | | | 559,891 | | | | |

Reports to shareholders | | | 81,402 | | | | |

Federal & state registration fees | | | 69,296 | | | | |

Custody fees | | | 56,706 | | | | |

Administration fees | | | 650,146 | | | | |

Trustees’ fees and expenses | | | 51,772 | | | | |

Auditor fees | | | 14,347 | | | | |

Legal fees | | | 50,823 | | | | |

Other | | | 65,052 | | | | |

Total operating expenses before expense | | | | | | | |

reductions | | | 16,313,583 | | | | |

Expense reductions (see Note 9) | | | (34,586 | ) | | | |

Total expenses | | | | | | 16,278,997 | |

| NET INVESTMENT INCOME | | | | | | 14,693,762 | |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | | |

ON INVESTMENTS | | | | | | | |

Net realized loss on: | | | | | | | |

Investments | | | (7,669,957 | ) | | | |

Net realized loss | | | | | | (7,669,957 | ) |

Change in unrealized appreciation | | | | | | | |

(depreciation) on: | | | | | | | |

Investments | | | (133,520,952 | ) | | | |

Written options | | | (22,161 | ) | | | |

Net unrealized loss | | | | | | (133,543,113 | ) |

Net realized and unrealized loss on | | | | | | | |

investments | | | | | | (141,213,070 | ) |

| NET DECREASE IN NET ASSETS RESULTING | | | | | | | |

FROM OPERATIONS | | | | | $ | (126,519,308 | ) |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended June 30, 2006 | | Year Ended December 31, 2005 | |

| | | (Unaudited) | | | |

| OPERATIONS: | | | | | |

Net investment income | | $ | 14,693,762 | | $ | 26,988,403 | |

Net realized loss on investments sold and | | | | | | | |

option contracts expired or closed | | | (7,669,957 | ) | | (40,290,930 | ) |

Change in unrealized appreciation | | | | | | | |

(depreciation) on investments and written | | | | | | | |

options | | | (133,543,113 | ) | | 220,684,666 | |

Net increase (decrease) in net assets | | | | | | | |

resulting from operations | | | (126,519,308 | ) | | 207,382,139 | |

| | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | |

Proceeds from shares sold | | | 642,692,167 | | | 1,593,884,281 | |

Dividends reinvested | | | — | | | 26,036,143 | |

Redemption fees | | | 41,304 | | | 105,737 | |

Cost of shares redeemed | | | (544,040,282 | ) | | (707,256,218 | ) |

Net increase in net assets resulting from | | | | | | | |

capital share transactions | | | 98,693,189 | | | 912,769,943 | |

| | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

From net investment income | | | — | | | (27,390,370 | ) |

Net decrease in net assets resulting from | | | | | | | |

distributions to shareholders | | | — | | | (27,390,370 | ) |

Total increase (decrease) in net assets | | | (27,826,119 | ) | | 1,092,761,712 | |

| NET ASSETS: | | | | | | | |

Beginning of year | | | 3,084,471,454 | | | 1,991,709,742 | |

End of period | | $ | 3,056,645,335 | | $ | 3,084,471,454 | |

| | | | | | | | |

| ACCUMULATED NET INVESTMENT | | | | | | | |

INCOME (LOSS): | | $ | 13,739,304 | | $ | (954,458 | ) |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

FINANCIAL HIGHLIGHTS

| | | Six Months Ended June 30, | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | (Unaudited) | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING | | | | | | | | | | | | | |

OF YEAR | | $ | 84.44 | | $ | 78.97 | | $ | 63.51 | | $ | 42.89 | | $ | 53.55 | | $ | 48.98 | |

| INCOME FROM INVESTMENT | | | | | | | | | | | | | | | | | | | |

OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.39 | (1) | | 0.76 | (1) | | 0.11 | (2) | | (0.02 | )(2) | | (0.06 | )(1) | | (0.11 | )(1) |

Net realized and unrealized gains | | | | | | | | | | | | | | | | | | | |

(losses) on investments and | | | | | | | | | | | | | | | | | | | |

written options | | | (3.55 | ) | | 5.47 | | | 15.46 | | | 20.64 | | | (10.60 | ) | | 4.68 | |

Total from investment | | | | | | | | | | | | | | | | | | | |

operations | | | (3.16 | ) | | 6.23 | | | 15.57 | | | 20.62 | | | (10.66 | ) | | 4.57 | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | (0.76 | ) | | (0.11 | ) | | — | | | — | | | — | |

Total distributions | | | — | | | (0.76 | ) | | (0.11 | ) | | — | | | — | | | — | |

| NET ASSET VALUE, END OF | | | | | | | | | | | | | | | | | | | |

PERIOD | | $ | 81.28 | | $ | 84.44 | | $ | 78.97 | | $ | 63.51 | | $ | 42.89 | | $ | 53.55 | |

| | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (3.74 | %)(4) | | 7.88 | % | | 24.51 | % | | 48.07 | % | | (19.92 | )% | | 9.33 | % |

| NET ASSETS, END OF PERIOD | | | | | | | | | | | | | | | | | | | |

(in millions) | | $ | 3,057 | | $ | 3,084 | | $ | 1,992 | | $ | 1,157 | | $ | 600 | | $ | 540 | |

RATIO OF OPERATING | | | | | | | | | | | | | | | | | | | |

EXPENSES TO AVERAGE NET | | | | | | | | | | | | | | | | | | | |

ASSETS(3) | | | 1.03 | %(5) | | 1.06 | % | | 1.14 | % | | 1.18 | % | | 1.17 | % | | 1.17 | % |

| RATIO OF NET INVESTMENT | | | | | | | | | | | | | | | | | | | |

INCOME (LOSS) TO AVERAGE | | | | | | | | | | | | | | | | | | | |

NET ASSETS | | | 0.93 | %(5) | | 1.02 | % | | 0.16 | % | | (0.04 | )% | | (0.10 | )% | | (0.14 | )% |

| PORTFOLIO TURNOVER RATE | | | 2.96 | % | | 6.05 | % | | 7.00 | % | | 9.15 | % | | 11.17 | % | | 10.52 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Net investment income (loss) per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (2) | Net investment income (loss) per share represents net investment income (loss) for the respective period divided by the monthly average shares of beneficial interest outstanding throughout each year. |

| (3) | The operating expense ratio includes expense reductions for soft dollar credits and minimum account maintenance fees deposited into the Fund. The ratios excluding expense reductions for the six months ending June 30, 2006 and the years ended December 31, 2005, 2004, 2003, 2002 and 2001 were 1.03%, 1.06%, 1.14%, 1.18%, 1.18% and 1.21% respectively (See Note 9). |

BROKER COMMISSIONS (UNAUDITED)

Some people have asked how much the Muhlenkamp Fund pays in commissions:

For the six months ended June 30, 2006, the Fund paid $178,347 in broker commissions. These commissions are included in the cost basis of investments purchased, and deducted from the proceeds of securities sold. This accounting method is the industry standard for mutual funds. Were these commissions itemized as expenses, they would equal one half cent (0.5¢) per Fund share and would have increased the operating expense ratio from 1.03% to 1.04%.

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS

June 30, 2006 (Unaudited)

Name of Issuer or Title of Issue | | Shares | | Value | |

| | | | | | |

COMMON STOCK — 99.4% | | | | | |

Automobiles & Components — 3.9% | | | | | |

Harley-Davidson, Inc. | | | 400,000 | | $ | 21,956,000 | |

National R.V. Holdings, Inc. (a) | | | 418,350 | | | 2,263,274 | |

Thor Industries, Inc. | | | 1,447,100 | | | 70,111,995 | |

Winnebago Industries, Inc. | | | 828,200 | | | 25,707,328 | |

| | | | | | | | |

| | | | | | | 120,038,597 | |

| | | | | | | | |

Banks — 1.8% | | | | | | | |

Washington Mutual, Inc. | | | 1,211,687 | | | 55,228,694 | |

| | | | | | | | |

Capital Goods — 5.8% | | | | | | | |

Caterpillar, Inc. | | | 1,000,000 | | | 74,480,000 | |

Eagle Materials, Inc. | | | 303,996 | | | 14,439,810 | |

Graco, Inc. | | | 206,707 | | | 9,504,388 | |

The Lamson & Sessions Co. (a) | | | 138,000 | | | 3,913,680 | |

Rush Enterprises, Inc. - Class A (a) | | | 226,605 | | | 4,117,413 | |

Rush Enterprises, Inc. - Class B (a) | | | 282,005 | | | 4,765,885 | |

Terex Corp. (a) | | | 564,100 | | | 55,676,670 | |

Tyco International, Ltd. (b) | | | 335,600 | | | 9,229,000 | |

| | | | | | | | |

| | | | | | | 176,126,846 | |

| | | | | | | | |

Commercial Services & Supplies — 1.2% | | | | | | | |

Cendant Corp. | | | 2,029,600 | | | 33,062,184 | |

PHH Corp. (a) | | | 98,000 | | | 2,698,920 | |

| | | | | | | | |

| | | | | | | 35,761,104 | |

| | | | | | | | |

Consumer Durables — 6.8% | | | | | | | |

American Woodmark Corp. | | | 402,500 | | | 14,103,600 | |

The Black & Decker Corp. | | | 706,100 | | | 59,637,206 | |

Masco Corp. | | | 1,050,000 | | | 31,122,000 | |

Mohawk Industries, Inc. (a) | | | 330,663 | | | 23,262,142 | |

Polaris Industries, Inc. | | | 519,200 | | | 22,481,360 | |

Stanley Furniture Co., Inc. | | | 621,800 | | | 14,904,546 | |

Whirlpool Corp. | | | 501,400 | | | 41,440,710 | |

| | | | | | | | |

| | | | | | | 206,951,564 | |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2006 (Unaudited)

Name of Issuer or Title of Issue | | Shares | | Value | |

| | | | | | |

Diversified Financials 18.8% | | | | | |

Capital One Financial Corp. | | | 1,454,700 | | $ | 124,304,115 | |

Citigroup, Inc. | | | 2,270,000 | | | 109,504,800 | |

Countrywide Financial Corp. | | | 3,191,998 | | | 121,551,284 | |

Fannie Mae | | | 1,799,000 | | | 86,531,900 | |

GAMCO Investors, Inc. | | | 121,600 | | | 4,470,016 | |

Merrill Lynch & Co., Inc. | | | 1,631,700 | | | 113,501,052 | |

Morgan Stanley | | | 243,000 | | | 15,360,030 | |

| | | | | | | | |

| | | | | | | 575,223,197 | |

| | | | | | | | |

Energy — 17.7% | | | | | | | |

Anadarko Petroleum Corp. | | | 2,285,600 | | | 109,000,264 | |

ConocoPhillips | | | 1,695,400 | | | 111,099,562 | |

Devon Energy Corp. | | | 1,337,700 | | | 80,810,457 | |

The Houston Exploration Co. (a) | | | 677,000 | | | 41,425,630 | |

Maverick Tube Corp. (a) | | | 157,200 | | | 9,933,468 | |

Nabors Industries, Ltd. (a)(b) | | | 3,180,000 | | | 107,452,200 | |

Patterson-UTI Energy, Inc. | | | 2,826,400 | | | 80,015,384 | |

| | | | | | | | |

| | | | | | | 539,736,965 | |

| | | | | | | | |

Food Beverage & Tobacco — 3.0% | | | | | | | |

Altria Group, Inc. | | | 1,265,580 | | | 92,931,539 | |

| | | | | | | | |

Health Care Equipment & Services — 2.5% | | | | | | | |

UnitedHealth Group, Inc. | | | 1,711,200 | | | 76,627,536 | |

| | | | | | | | |

Homebuilding — 9.9% | | | | | | | |

Beazer Homes USA, Inc. | | | 678,900 | | | 31,141,143 | |

Centex Corp. | | | 1,760,000 | | | 88,528,000 | |

Meritage Corp. (a) | | | 983,200 | | | 46,456,200 | |

NVR, Inc. (a) | | | 145,000 | | | 71,231,250 | |

Pulte Homes, Inc. | | | 640,460 | | | 18,438,843 | |

Toll Brothers, Inc. (a)(c) | | | 1,873,800 | | | 47,913,066 | |

| | | | | | | | |

| | | | | | | 303,708,502 | |

| | | | | | | | |

Insurance — 9.5% | | | | | | | |

The Allstate Corp. | | | 2,220,200 | | | 121,511,546 | |

American International Group, Inc. | | | 1,746,100 | | | 103,107,205 | |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2006 (Unaudited)

Name of Issuer or Title of Issue | | Shares | | Value | |

| | | | | | |

Insurance — 9.5% (Continued) | | | | | |

Fidelity National Financial, Inc. | | | 1,557,094 | | $ | 60,648,811 | |

Fidelity National Title Group, Inc. | | | 272,491 | | | 5,359,898 | |

| | | | | | | | |

| | | | | | | 290,627,460 | |

Materials — 7.7% | | | | | | | |

BHP Billiton, Ltd. - ADR | | | 1,280,100 | | | 55,133,907 | |

Cemex S.A. de C.V. - ADR (a) | | | 2,354,495 | | | 134,135,580 | |

Chaparral Steel Company (a) | | | 201,900 | | | 14,540,838 | |

NovaGold Resources, Inc. (a)(b) | | | 434,700 | | | 5,572,854 | |

RTI International Metals, Inc. (a) | | | 278,800 | | | 15,568,192 | |

Texas Industries, Inc. | | | 201,900 | | | 10,720,890 | |

| | | | | | | | |

| | | | | | | 235,672,261 | |

| | | | | | | | |

Pharmaceuticals & Biotechnology — 4.8% | | | | | | | |

Johnson & Johnson | | | 1,277,500 | | | 76,547,800 | |

Marshall Edwards, Inc. (a) | | | 75,607 | | | 256,308 | |

Novogen, Ltd. - ADR (a) | | | 250,360 | | | 2,303,312 | |

Pfizer, Inc. | | | 2,900,000 | | | 68,063,000 | |

| | | | | | | | |

| | | | | | | 147,170,420 | |

| | | | | | | | |

Software & Services — 0.4% | | | | | | | |

eResearch Technology, Inc. (a) | | | 1,137,400 | | | 10,350,340 | |

OpenTV Corp. - Class A (a) | | | 200,000 | | | 772,000 | |

| | | | | | | | |

| | | | | | | 11,122,340 | |

| | | | | | | | |

Technology Hardware & Equipment — 0.6% | | | | | | | |

Intel Corp. | | | 16,000 | | | 304,000 | |

International Business Machines Corp. | | | 140,000 | | | 10,754,800 | |

MasTec, Inc. (a) | | | 461,700 | | | 6,099,057 | |

| | | | | | | | |

| | | | | | | 17,157,857 | |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of Wexford Trust) |

SCHEDULE OF INVESTMENTS (Continued)

June 30, 2006 (Unaudited)

Name of Issuer or Title of Issue | | Shares | | Value | |

| | | | | | |

Telecommunication Services — 2.7% | | | | | |

Embarq Corp. (a) | | | 46,773 | | $ | 1,917,225 | |

Sprint Nextel Corp. | | | 935,466 | | | 18,699,965 | |

Telefonos de Mexico S.A. de C.V. - ADR | | | 3,010,000 | | | 62,698,300 | |

| | | | | | | | |

| | | | | | | 83,315,490 | |

| | | | | | | | |

Transportation — 1.8% | | | | | | | |

YRC Worldwide, Inc. (a) | | | 1,292,400 | | | 54,422,964 | |

| | | | | | | | |

Utilities — 0.5% | | | | | | | |

Dynegy, Inc. - Class A (a) | | | 920,000 | | | 5,032,400 | |

El Paso Corp. | | | 791,450 | | | 11,871,750 | |

| | | | | | | | |

| | | | | | | 16,904,150 | |

Total Common Stocks | | | | | | | |

(Cost $2,286,202,321) | | | | | | 3,038,727,486 | |

| | | | | | | | |

| | | | | | | | |

Name of Issuer or Title of Issue | | | Principal Amount | | | Value | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS — 0.6% | | | | | | | |

Prudential Funding Capital | | | | | | | |

5.150%, due 07/03/2006 | | $ | 14,351,000 | | $ | 14,346,940 | |

United States Treasury Bill | | | | | | | |

4.315%, due 07/20/2006 | | | 3,688,000 | | | 3,679,723 | |

Total Short-Term Investment | | | | | | | |

(Cost $18,026,663) | | | | | | 18,026,663 | |

TOTAL INVESTMENTS | | | | | | | |

(Cost $2,304,228,984) — 100.0% | | | | | | 3,056,754,149 | |

LIABILITIES IN EXCESS OF OTHER | | | | | | | |

ASSETS — 0.0% | | | | | | (108,814 | ) |

TOTAL NET ASSETS — 100.0% | | | | | $ | 3,056,645,335 | |

| | | | | | | | |

ADR American Depository Receipt (a) Non income producing.

(b) Foreign company.

(c) Shares are held to cover all or a portion of a corresponding written option contract.

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

SCHEDULE OF OPTIONS WRITTEN

June 30, 2006 (Unaudited)

Name of Issuer or Title of Issue | | Contracts (100 Shares Per Contract) | | Value | |

| | | | | | |

WRITTEN CALL OPTIONS — 0.0% | | | | | |

Toll Brothers, Inc. | | | | | |

Expiration January 2008, | | | | | |

Exercise Price $35.00 | | | 1,000 | | $ | 300,000 | |

| | | | | | | | |

WRITTEN PUT OPTIONS — 0.0% | | | | | | | |

Toll Brothers, Inc. | | | | | | | |

Expiration January 2008, | | | | | | | |

Exercise Price $35.00 | | | 1,000 | | | 1,040,000 | |

Total Written Options | | | | | | | |

(Premiums received $1,317,839) | | | | | | 1,340,000 | |

| | | | | | | | |

Total Options Written | | | | | | | |

(Premiums received $1,317,839) — 0.0% | | | | | $ | 1,340,000 | |

| | | | | | | | |

See notes to financial statements.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS

Six Months Ended June 30, 2006 (Unaudited)

1. ORGANIZATION

The Wexford Trust (the ‘‘Trust’’) was organized as a Massachusetts Business Trust on September 21, 1987 and operations commenced on November 1, 1988. The Trust is registered under the Investment Company Act of 1940, as amended. The Muhlenkamp Fund (the ‘‘Fund’’) is a portfolio of the Trust and is currently the only fund in the Trust.

The Fund operates as a diversified open-end mutual fund that continuously offers its shares for sale to the public. The Fund will manage its assets to seek a maximum total return to its shareholders, primarily through a combination of interest and dividends and capital appreciation by holding a diversified list of publicly traded stocks. The Fund may acquire and hold fixed-income or debt investments as market conditions warrant and when, in the opinion of its adviser, it is deemed desirable or necessary in order to attempt to achieve its investment objective.

The primary focus of the Fund is long-term and the investment options diverse. This allows for greater flexibility in the daily management of Fund assets. However, with flexibility also comes the risk that assets will be invested in various classes of securities at the wrong time and price.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of significant accounting policies applied by management in the preparation of the accompanying financial statements follows:

| a. | Investment Valuations — Stocks, bonds, options and warrants are valued at the latest sales price on the last business day of the fiscal period as reported by the securities exchange on which the issue is traded. If no sale is reported, the security is valued at the last quoted bid price. Short-term debt instruments (those with remaining maturities of 60 days or less) are valued at amortized cost, which approximates market value. Restricted securities, private placements, other illiquid securities and other securities for which market value quotations are not readily available are valued at fair value as determined by a designated Pricing Committee, comprised of personnel of the Adviser, under the supervision of the Board of Trustees, in accordance with pricing procedures approved by the Board. Fair value is defined as the amount the owner of a security might reasonably expect to receive upon a current sale. For each applicable investment that is fair valued, the Pricing Committee considers, to the extent applicable, various factors including, but not limited to, the financial condition of the company or limited partnership, operating results, prices paid in follow-on rounds, comparable companies in the public market, the nature and duration of the restrictions for holding the securities, and other relevant factors. |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

Additionally, a Fund’s investments will be valued at fair value by the Pricing Committee if the Adviser determines that an event impacting the value of an investment occurred between the closing time of a security’s primary market or exchange (for example, a foreign exchange or market) and the time the Fund’s share price is calculated. Significant events include, but are not limited to the following: significant fluctuations in domestic markets, foreign markets or foreign currencies; occurrences not directly tied to the securities markets such as natural disasters, armed conflicts or significant governmental actions; and major announcements affecting a single issuer or an entire market or market sector. In responding to a significant event, the Pricing Committee would determine the fair value of affected securities considering factors including, but not limited to: index options and futures traded subsequent to the close; ADRs, GDRs or other related receipts; currency spot or forward markets that trade after pricing of the foreign exchange; other derivative securities traded after the close such as WEBs and SPDRs; and alternative market quotes on the affected securities.

| b. | Foreign Securities — Investing in securities of foreign companies and foreign governments involves special risks and consideration not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. |

| c. | Foreign Currency Translations — The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market price of such securities. However, for federal income tax purposes the Fund does isolate and treat the effect of changes in foreign exchange rates on realized gain or loss from the sale of equity securities and payables/receivables arising from trade date and settlement date differences as ordinary income. |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

| d. | Investment Transactions and Related Investment Income — Investment transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the yield to maturity basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. |

| e. | Federal Taxes — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is recorded. In addition, the Fund plans to make sufficient distributions of its income and realized gains, if any, to avoid the payment of any federal excise taxes. Accounting principles generally accepted in the United States of America require that permanent differences between financial reporting and tax reporting be reclassified between various components of net assets. |

| f. | Dividends and Distributions to Shareholders of Beneficial Interest — Dividends from net investment income, if any, are declared and paid annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. |

| g. | Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates. |

| h. | Options Transactions — The Fund may write put and call options only if it (i) owns an offsetting position in the underlying security or (ii) maintains cash or other liquid assets in an amount equal to or greater than its obligation under the option. |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

When the Fund writes a call or put option, an amount equal to the premium received is included in the statement of assets and liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current market value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. If a written put option is exercised, the cost of the security acquired is decreased by the premium originally received. As writer of an option, the Fund has no control over whether the underlying securities are subsequently sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the security underlying the written option.

The Fund may purchase put and call options. When the Fund purchases a call or put option, an amount equal to the premium paid is included in the Fund’s statement of assets and liabilities as an investment, and is subsequently marked-to-market to reflect the current market value of the option. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If the Fund exercises a call, the cost of the security acquired is increased by the premium paid for the call. If the Fund exercises a put option, a gain or loss is realized from the sale of the underlying security, and the proceeds from such a sale are decreased by the premium originally paid. Written and purchased options are non-income producing securities.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Muhlenkamp & Co., Inc. (the ‘‘Adviser’’), an officer/stockholder of which is a trustee of the Trust, receives a fee for investment management. Effective January 1, 2005, the Adviser charges a management fee equal to 1% per annum of the average daily market value of the Fund’s net assets up to $1 billion and 0.9% per annum on Fund net assets in excess of $1 billion. Under terms of the advisory agreement, which is approved annually, total annual Fund operating expenses cannot under any circumstances exceed 1.50% of the Fund’s net assets. Should actual expenses incurred ever exceed the 1.50% limitation, such excess expenses shall be reimbursed by the Adviser. The Fund has no obligation to reimburse the Adviser for such payments. U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and accounting services agent for the Fund. During the six months ended June 30, 2006 and the year ended December 31, 2005, total expenses of $1,210,037 and $2,368,391, respectively, related to such services were performed by U.S. Bancorp Fund Services LLC. U.S. Bank, N.A. serves as custodian for the Fund.

4. LINE OF CREDIT

The Fund has established a line of credit agreement (‘‘LOC’’) with U.S. Bank, N.A., which expires April 30, 2007, to be used for temporary or emergency purposes, primarily for financing redemption payments. Borrowings of the Fund are subject to a $100 million cap on the total LOC. At June 30, 2006, there were no borrowings by the Muhlenkamp Fund outstanding under the LOC.

5. CAPITAL SHARE TRANSACTIONS

Transactions in capital shares of the Fund were as follows:

| | Six Months Ended June 30, 2006 | | Year Ended December 31, 2005 |

| | | | |

| Shares outstanding, beginning of year | 36,528,358 | | 25,221,404 |

| Shares sold | 7,495,629 | | 19,687,151 |

| Shares reinvested | — | | 307,296 |

| Shares redeemed | (6,417,053) | | (8,687,493) |

| Shares outstanding, end of period | 37,606,934 | | 36,528,358 |

| | | | |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

6. OPTION CONTRACTS WRITTEN

The number of option contracts written and the premiums received by the Muhlenkamp Fund during the six months ended June 30, 2006, were as follows:

| | Number of Contracts | | | Premiums Received |

| Options outstanding, beginning of period | — | | $ | $— |

| Options written | 2,000 | | | 1,317,839 |

| Options closed | — | | | — |

| Options exercised | — | | | — |

| Options expired | — | | | — |

| Options outstanding, end of period | 2,000 | | | $1,317,839 |

| | | | | |

7. INVESTMENT TRANSACTIONS

Purchases and sales of investment securities, excluding short-term securities, for the six months ended June 30, 2006 were as follows:

Purchases | | Sales |

U.S. Government | | Other | | U.S. Government | | Other |

| | | | | | | |

| $0 | | $221,647,850 | | $0 | | $93,140,093 |

| | | | | | | |

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

8. FEDERAL TAX INFORMATION

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for eight years following the year of loss and offset such losses against any future realized capital gains. At December 31, 2005, the Fund had capital loss carryovers as follows:

Net Capital Loss Carryovers* | | Capital Loss Carryover Expiration |

| | | |

| $ 3,833,114 | | 12/31/2009 |

| 17,656,856 | | 12/31/2010 |

| 18,459,729 | | 12/31/2011 |

| 12,339,605 | | 12/31/2012 |

| 40,431,141 | | 12/31/2013 |

| $92,720,445 | | |

* Capital gain distributions will resume in the future to the extent gains are realized in excess of the available carryforwards.

As of December 31, 2005, the components of distributable earnings on a tax basis were as follows:

| Cost of investments | $ | 2,197,737,371 |

| | | |

| Gross tax unrealized appreciation | $ | 974,023,929 |

| Gross tax unrealized depreciation | | (91,616,620) |

| | | |

| Net tax unrealized appreciation | $ | 882,407,309 |

| | | |

| Undistributed ordinary income | $ | — |

| Undistributed long-term capital gain | | — |

| | | |

| Total distributable earnings | $ | — |

| | | |

| Other accumulated losses | $ | (92,755,899) |

| | | |

| Total accumulated earnings | $ | 789,651,410 |

| | | |

The Fund plans to distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

On December 29, 2005, a distribution of $.76 per share was declared and paid to shareholders of record on December 28, 2005.

The tax character of distributions paid were as follows:

| | Six Months Ended June 30, 2006 | | Year Ended December 31, 2005 |

| | | | |

| Ordinary income | $ — | | $27,390,370 |

| | | | |

9. EXPENSE REDUCTIONS

Beginning in 2000, expenses are reduced through the deposit of minimum account maintenance fees into the Fund. By November 30th of each year, all accounts must have net investments (purchases less redemptions) totaling $1,500 or more, an account value greater than $1,500, or be enrolled in the Automatic Investment Plan. Accounts that do not meet one of these three criteria will be charged a $15 fee. These fees are used to lower the Fund’s expense ratio. For the six months ended June 30, 2006, the Fund’s expenses were reduced $34,586 by utilizing minimum account maintenance fees, resulting in a decrease in the expenses being charged to shareholders.

10. REDEMPTION FEE

Effective April 1, 2005, those who buy and sell the Fund within 30 calendar days will incur a 2% redemption fee. For the six months ended June 30, 2006 and the year ended December 31, 2005, the Fund retained $41,304 and $105,737, respectively, in redemption fees which increased paid in capital.

11. GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts with the service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

12. INVESTMENT ADVISORY AGREEMENT

The Board of Trustees of The Wexford Trust (the ‘‘Board’’) oversees the management of the Muhlenkamp Fund (the ‘‘Fund’’) and, as required by law, determines annually whether to approve the continuance of the Fund’s Advisory Agreement with Muhlenkamp & Co., Inc. (the ‘‘Adviser’’). Based upon the recommendation of the Independent Trustees of the Board, at a meeting held on May 23, 2006, the Board, including all of the Independent

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

Trustees, approved the continuance of the Advisory Agreement (the ‘‘Advisory Agreement’’) between the Fund and the Adviser for another year, effective June 30, 2006.

Prior to the meeting on May 23, 2006, the Independent Trustees met with the Adviser on March 17, 2006, and met again but without the Adviser on April 17, 2006 and May 17, 2006 to discuss the renewal of the Advisory Agreement. At these meetings, the Independent Trustees considered the factors discussed below in evaluating the fairness and reasonableness of the Advisory Agreement. In their deliberations, they did not identify any particular factor that was controlling, and each Trustee attributed different weights to different factors.

The discussion below serves as a summary of the material factors and the conclusions with respect thereto that formed the bases for the Independent Trustees’ and the full Board’s approval of the Advisory Agreement. After consideration of all of the factors below, and based on their business judgment, the Independent Trustees and the Board determined that the Advisory Agreement is in the best interest of the Fund and its shareholders, and that the compensation to the Adviser under the Advisory Agreement is fair and reasonable.

The Nature and Extent of the Advisory Services Provided and To Be Provided by the Adviser — The Independent Trustees reviewed the services which had been provided by the Adviser under the Advisory Agreement. The Independent Trustees requested and received from the Adviser and others, including the Chief Compliance Officer, written and oral information on the extent of services provided by the Adviser, information on the Adviser’s key personnel, the Adviser’s adherence to the Fund’s investment restrictions, and the Adviser’s compliance with the Fund’s policies and procedures. The Independent Trustees noted that the Adviser had consistently and adequately provided the Fund with the types of services customarily provided by investment advisers to mutual funds in the industry. The Independent Trustees specifically noted the substantial promotion efforts taken by the Adviser to grow the Fund and to retain existing shareholders. These included numerous speaking engagements by Ronald Muhlenkamp and others on the Adviser’s staff.

The Independent Trustees and the Board reviewed the services to be provided by the Adviser under the Advisory Agreement. Based on such review, they concluded that the range of services to be provided by the Adviser under the Advisory Agreement was appropriate and that the Adviser currently is providing services in accordance with the terms of the Advisory Agreement.

The Quality of Services Provided by the Adviser — The Independent Trustees reviewed the credentials, experience and qualifications of the officers and employees of the Adviser who provided and will provide investment advisory

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

services to the Fund. They considered various issues, such as the Adviser’s research process, and the process for identifying stocks to be purchased and sold by the Fund. Based on a review of these and other factors, the Independent Trustees concluded that the quality of services provided by the Adviser was appropriate and that the Adviser currently is providing satisfactory services in accordance with the terms of the Advisory Agreement.

The Performance of the Fund — The Independent Trustees and the Board reviewed the performance of the Fund during the past 1, 3, 5, 10 and 15 calendar year periods against the performance of Funds with investment strategies comparable to those of the Fund. They noted that the Fund has grown significantly over the last few years and is being recommended by several noted investment advisers. The Fund continues to be named in the Forbes Magazine honor roll and is highly rated in other fund surveys. In considering the performance of the Fund and the Adviser, the Board reviewed information provided by an independent data services provider. The information compared performance and expenses with those of the Fund’s peers. The Board noted that although the performance of the Fund in the last two quarters was not at the same level as the performance over a longer term periods, the Fund’s performance over such longer term periods was a more accurate indicator of the performance of the Adviser. The performance of the Fund, measured over 1, 3, 5, 10 and 15 years, was above the median performance of comparable funds. Based on this review, the Board concluded that the Fund and its shareholders were benefiting from the Adviser’s investment management of the Fund and no changes should be made to the Fund or to the Fund’s portfolio management team at this time.

Meeting with the Fund’s Portfolio Managers and Investment Personnel — The Independent Trustees met on several occasions with the Fund’s portfolio managers and other investment personnel, and believe that such individuals are competent and able to continue to carry out their responsibilities under the Advisory Agreement.

Overall Performance of Adviser — The Independent Trustees considered the overall performance of the Adviser in addition to providing investment advisory services to the Fund and concluded that such performance was satisfactory.

Fees Relative to Those of Adviser’s Other Clients — The Independent Trustees noted that the Adviser serves as an adviser to private clients with investment strategies comparable to those of the Fund. Based on information provided by the Adviser, the rates charged by the Adviser to such clients are comparable to those rates charged to the Fund.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

Fees Relative to Those of Comparable Funds with Other Advisers — The Independent Trustees reviewed the advisory fee rate for the Fund under the Advisory Contract. They compared effective contractual advisory fee rates at a common asset level, and for similar funds, and noted that the Fund’s rate was at or near the median rate of the funds advised by other advisers with investment strategies comparable to those of the Fund that the Board reviewed. The Board noted that the Adviser had agreed to limit the Fund’s total operating expenses, as discussed below. Based on this review, the Board concluded that the advisory fee rate under the Advisory Agreement was fair and reasonable.

Expense Limitations — The Independent Trustees noted that the Adviser has contractually agreed to limit the expenses of the Fund in an amount necessary to limit total annual operating expenses to a specific percentage of average daily net assets. They considered contractual and voluntary nature of this expense limitation and noted that the Advisory Agreement if renewed, will remain in effect until June, 2007. They considered the effect these expense limitations could have on the Fund’s estimated expenses and concluded that the levels of expense limitations for the Fund were fair and reasonable.

Breakpoints and Economies of Scale — The Independent Trustees reviewed the structure of the Fund’s advisory fee under the Advisory Agreement, noting that it includes a breakpoint. They reviewed the level of the Fund’s advisory fees, and noted that such fees, as a percentage of the Fund’s net assets, would decrease as the net assets increased because the Advisory Agreement includes the breakpoint. They noted that the Fund has already received significant benefits from the breakpoint previously agreed upon with the Adviser. The Independent Trustees noted that they had attempted to negotiate an additional breakpoint with the Adviser, but were unsuccessful. They concluded that as a result of the breakpoint that had been implemented, the Fund’s fee levels under the Advisory Agreement would reflect economies of scale at higher asset levels.

Profitability of the Adviser — The Independent Trustees reviewed information concerning the profitability of the Adviser’s investment advisory and other activities and its financial condition. They considered the overall profitability of the Adviser as well as the profitability of the Adviser in connection with managing the Fund. They noted that the Adviser’s operations remain profitable. Based on the review of the profitability of the Adviser and its financial condition, the Independent Trustees concluded that the compensation to be paid by the Fund to the Adviser under the Advisory Agreement was not excessive and was the best rate they could negotiate with the Adviser at this time.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Six Months Ended June 30, 2006 (Unaudited)

Benefits of Soft Dollars to the Adviser — The Independent Trustees considered the benefits realized by the Adviser as a result of brokerage transactions executed through ‘‘soft dollar’’ arrangements. Under these arrangements, brokerage fees paid by the Fund are used to pay for research and execution services. This research is used by the Adviser in making decisions for the Fund, as well as for its private clients. The Independent Trustees concluded that the total soft dollar arrangements were not excessive, the commission rates were low, and thus such arrangements were appropriate and reasonable with respect to costs.

The Adviser’s Financial Soundness — The Independent Trustees considered whether the Adviser was financially sound and had the resources necessary to perform its obligations under the Advisory Agreement, and concluded that the Adviser has the financial resources necessary to fulfill those obligations.

Historical Relationship Between the Fund and the Adviser — In determining whether to continue the Advisory Agreement for the Fund, the Independent Trustees also considered the prior relationship between the Adviser and the Fund as well as the Adviser’s knowledge of the Fund’s operations, and concluded that it was beneficial to maintain the current relationship, in part, because of such knowledge. They also reviewed the general nature of other services currently provided by the Adviser. Based on a review of these and other factors, the Independent Trustees concluded that the Adviser was qualified to continue to provide services to the Fund.

Other Factors and Current Trends — In determining whether to continue the Advisory Agreement for the Fund, the Independent Trustees considered the fact that the Adviser, along with others in the mutual fund industry, is subject to regulatory inquiries and litigation related to a wide range of issues. They also considered the governance and compliance issues applicable to funds, and the fact that the Adviser has undertaken to cause the Fund to operate in accordance with those policies and practices. They concluded that these actions indicated a good faith effort on the part of the Adviser to adhere to the highest ethical standards, and determined that the current and regulatory environment to which the Adviser is subject should not prevent the Board from continuing the Advisory Agreement for the Fund.

The evaluation of the Independent Trustees was discussed at length before the full Board of Trustees at the meeting of the Board of Trustees on May 23, 2006, at which time the full Board approved the renewal of the Advisory Agreement for the period through June 30, 2007.

MUHLENKAMP (A Portfolio of the Wexford Trust) |

ADDITIONAL INFORMATION (Unaudited)

Six Months Ended June 30, 2006

1. QUALIFIED DIVIDEND INCOME PERCENTAGE

The Fund designated 100% of dividends declared and paid during the year ending December 31, 2005 from net investment income as qualified dividend income under the Jobs Growth and Tax Relief Reconciliation Act of 2003.

2. CORPORATE DIVIDENDS RECEIVED DEDUCTION PERCENTAGE

Corporate shareholders may be eligible for a dividends received deduction for certain ordinary income distributions paid by the Fund. The Fund designated 100% of dividends declared and paid during the year ending December 31, 2005 from net investment income as qualifying for the dividends received deduction. The deduction is a pass through of dividends paid by domestic corporations (i.e. only equities) subject to taxation.

3. INFORMATION ABOUT PROXY VOTING

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-800-860-3863 or by accessing the Funds’ website at www.muhlenkamp.com, and the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve month period ended June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

4. AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The filing will be available, upon request, by calling 1-800-860-3863. Furthermore, you will be able to obtain a copy of the filing on the SEC’s website at http://www.sec.gov beginning with the filing for the period ended September 30, 2004. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

(This Page Intentionally Left Blank.)

This page intentionally left blank.

INVESTMENT ADVISER

Muhlenkamp & Company, Inc.

5000 Stonewood Drive, Suite 300

Wexford, PA 15090

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 Rivercenter Drive, Suite 302

Milwaukee, WI 53212

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PricewaterhouseCoopers LLP

100 E. Wisconsin Avenue

Milwaukee, WI 53202