MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

Dear Fellow Shareholders:

In 2009, we had a good year.

We identified the end of the forced selling in the spring and put our cash to work, allowing us to participate nicely in the rebound that has since occurred. No, we’ve not recouped the declines in price of the prior two years, but it’s a good start.

In 2001, we argued that the recession at that time was “a normal, cyclical recession” that the U.S. went into, and would come out of, in normal fashion. We do not believe that to be true at this time. A number of the differences are discussed in the “Questions and Responses” article in Muhlenkamp Memorandum #93. A full discussion of our thoughts on the differences was presented at our November 5, 2009 seminar which is available on our website or by request. A brief recap follows: Some of the items that occurred this time, and our responses to them, will have far-reaching effects. Specifically, the public witnessed declines in price in both their homes and their investment portfolios. As a result, many appear to have changed their habits of saving vers us spending. Business enterprise witnessed a fall-off in orders in the fourth quarter of 2008 that was unprecedented in size and rapidity, resulting in record low levels of capacity utilization. The credit markets seized up. The velocity of money turnover collapsed.

In response, the U.S. Treasury and the Federal Reserve took unprecedented steps to support the credit markets. This appears to have worked. Funds that were provided on an emergency basis, e.g. TARP, (Troubled Asset Relief Program) are being paid back with interest. At the same time, the U.S. government spent — and is spending — huge amounts of money on various stimulus programs with no prospect of recouping the funds except through taxes. Further, the U.S. government is increasing the mandates (healthcare) and regulations on business enterprise, increasing the cost of hiring people and doing business.

We are now embarking on the second great economic experiment of my adult lifetime. At the most basic level, I believe that prosperity and economic growth result from the incentives that some people (employees) see in being gainfully employed, and that other people (employers) see in employing them. After the stagflation (inflation and slow economic growth) of the 1970s, Paul Volcker and Ronald Reagan used monetary and tax policy to encourage individuals to hire other individuals. In farmer terms, they fed the goose that lays the golden eggs. After 1980, we enjoyed a generation of growth and prosperity. My fear is that current policies, while designed to provide incentives to employees, will also penalize employers and may result in strangling the goose.

Our challenge as investors is to find companies which can thrive despite these penalties. We’re finding some, but until the additional rules, regulations, and taxes are defined, consumer and business confidence (and ours) is likely to remain subdued.

Ronald H. Muhlenkamp

President,

February 2010

Past performance does not guarantee future results.

Opinions expressed are those of Ronald H. Muhlenkamp and are subject to change, are not guaranteed, and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in smaller companies which involve additional risks such as limited liquidity and greater volatility. The Fund may also invest in foreign securities which involve political, economic, and currency risks, greater volatility and differences in accounting methods.

Current and future portfolio holdings are subject to change.

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| Average Annual Total Returns (Unaudited) |

| as of December 31, 2009 |

| | | | | | | | | | | | |

| | One | | Three | | Five | | Ten | | Fifteen | | Since |

| Muhlenkamp Fund | Year | | Years | | Years | | Years | | Years | | Inception* |

| Return Before Taxes | 31.49% | | -10.87% | | -4.48% | | 4.87% | | 10.15% | | 10.10% |

| Return After Taxes on | | | | | | | | | | | |

| Distributions** | 31.47% | | -11.67% | | -5.05% | | 4.45% | | 9.76% | | 9.67% |

| Return After Taxes on | | | | | | | | | | | |

| Distributions and Sale of | | | | | | | | | | | |

| Fund Shares** | 20.51% | | -8.89% | | -3.62% | | 4.29% | | 9.20% | | 9.20% |

| S&P 500*** | 26.46% | | -5.63% | | 0.42% | | -0.95% | | 8.04% | | 9.16% |

Performance data quoted, before and after taxes, represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.muhlenkamp.com.

Investment returns can vary significantly between returns before taxes and returns after taxes.

The Muhlenkamp Fund is providing the returns in the above table to help our shareholders understand the magnitude of tax costs and the impact of taxes on the performance of the Fund.

| * | Operations commenced on November 1, 1988. |

| ** | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your situation and may differ from those shown. The Fund’s return after taxes on distributions and sale of Fund shares may be higher than its return before taxes and its return after taxes on distributions because it may include a tax benefit resulting from the capital losses that would have resulted. Furthermore, the after-tax returns shown are not relevant to those who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. Remember, the Fund’s past performance, before and after taxes, is not necessarily how the Fund will perform in the future. |

The calculation for the One Year “Return After Taxes on Distributions and Sale of Fund Shares” assumes the following:

| | 1. | You bought shares of the Fund at the price on 12/31/08. |

| | 2. | You received dividends (and income distributions) at year end, and paid a 15% tax on these dividends on the payable date. |

| | 3. | You reinvested the rest of the dividend when received, increasing your cost basis for tax purposes. |

| | 4. | You sold the entire position on 12/31/09 and paid tax on ordinary income at a tax rate of 35%. |

*** The S&P 500 Index is a widely recognized, unmanaged index of common stock prices. The figures for the S&P 500 Index reflect all dividends reinvested but do not reflect any deductions for fees, expenses or taxes. One cannot invest directly in an index.

The Standard & Poor’s 500 Stock Index (“S&P 500 Index”) is a market value-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. This chart assumes an initial gross investment of $10,000 made on 12/31/99. The line graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all dividends. Past performance does not guarantee future results.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

EXPENSE EXAMPLE

December 31, 2009 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. The expense example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/09 – 12/31/09).

Actual Expenses

The first line of the table provides information about actual account values and actual expenses. Although the Fund charges no sales load, redemption fees or other transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. Individual Retirement Accounts (“IRAs”) will be charged a $15.00 annual maintenance fee. For any direct registered shareholder of the Fund having an IRA balance exceeding $50,000, the amount of such IRA annual maintenance fee will be a Fund expense. To the extent the Fund invests in shares of other investment companies as par t of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses or other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “ Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exc hange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

December 31, 2009 (Unaudited)

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 7/1/09 | 12/31/09 | 7/1/09 – 12/31/09* |

| Actual | $1,000.00 | $1,212.80 | $6.86 |

| Hypothetical | | | |

| (5% return before | | | |

| expenses) | 1,000.00 | 1,019.00 | 6.26 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.23% multiplied by the average account value over the period multiplied by 184/365 (to reflect the one-half year period).

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

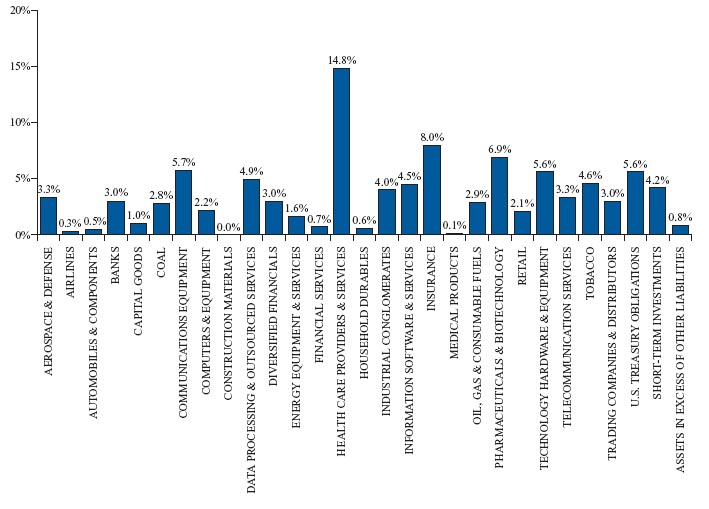

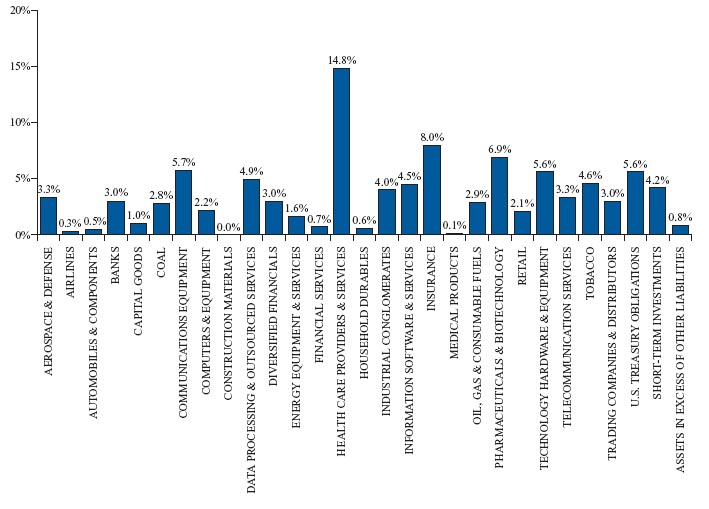

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

December 31, 2009

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| STATEMENT OF ASSETS & LIABILITIES |

| December 31, 2009 |

| | | |

| ASSETS |

| INVESTMENTS, AT VALUE (Cost $638,860,511) | $ | 709,769,596 |

| CASH | | 9,229,728 |

| RECEIVABLE FOR FUND SHARES SOLD | | 572,232 |

| DIVIDENDS RECEIVABLE | | 739,786 |

| OTHER ASSETS | | 61,362 |

| Total assets | | 720,372,704 |

| | | |

| LIABILITIES |

| WRITTEN OPTIONS, AT VALUE (Premiums received $2,082,660) | | 2,250,000 |

| PAYABLE FOR FUND SHARES REDEEMED | | 815,450 |

| PAYABLE FOR INVESTMENTS PURCHASED | | 730,114 |

| PAYABLE TO ADVISER | | 608,950 |

| ACCRUED EXPENSES AND OTHER LIABILITIES | | 273,022 |

| Total liabilities | | 4,677,536 |

| NET ASSETS | $ | 715,695,168 |

| | | |

| NET ASSETS |

| PAID IN CAPITAL | $ | 681,321,370 |

| ACCUMULATED NET INVESTMENT INCOME | | — |

| ACCUMULATED NET REALIZED LOSS ON INVESTMENTS | | |

| SOLD AND WRITTEN OPTION CONTRACTS EXPIRED OR | | |

| CLOSED | | (36,367,947) |

| NET UNREALIZED APPRECIATION (DEPRECIATION) ON: | | |

| Investments | | 70,909,085 |

| Written option contracts | | (167,340) |

| NET ASSETS | $ | 715,695,168 |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | | |

| (unlimited number of shares authorized, $.01 par value) | | 14,118,833 |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE | | |

| PER SHARE | $ | 50.69 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| STATEMENT OF OPERATIONS |

| For the Year Ended December 31, 2009 |

| INVESTMENT INCOME: | | | | | |

| Dividends (Net of foreign taxes withheld of $986) | | | | $ | 8,818,938 |

| Interest | | | | | 106,802 |

| Total investment income | | | | | 8,925,740 |

| | | | | | |

| EXPENSES: | | | | | |

| Investment advisory fees | $ | 6,377,720 | | | |

| Shareholder servicing and accounting costs | | 656,909 | | | |

| Reports to shareholders | | 122,808 | | | |

| Federal & state registration fees | | 47,224 | | | |

| Custody fees | | 37,769 | | | |

| Administration fees | | 422,083 | | | |

| Trustees’ fees and expenses | | 134,858 | | | |

| Auditor fees | | 21,944 | | | |

| Legal fees | | 93,818 | | | |

| Other | | 108,947 | | | |

| Total operating expenses before expense reductions | | 8,024,080 | | | |

| Expense reductions (see Note 10) | | (39,279) | | | |

| Total expenses | | | | | 7,984,801 |

| NET INVESTMENT INCOME | | | | | 940,939 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON | | | | | |

| INVESTMENTS | | | | | |

| Net realized gain (loss) on: | | | | | |

| Investments sold | | | | | |

| Non Affiliates | | (37,423,145) | | | |

| Affiliates (see Note 7) | | 512,124 | | | |

| Written option contracts expired or closed | | 5,295,876 | | | |

| | | | | | (31,615,145) |

| Change in unrealized appreciation (depreciation) on: | | | | | |

| Investments | | 207,239,831 | | | |

| Written option contracts | | (167,340) | | | |

| | | | | | 207,072,491 |

| Net realized and unrealized gain on investments | | | | | 175,457,346 |

| NET INCREASE IN NET ASSETS RESULTING | | | | | |

| FROM OPERATIONS | | | | | $176,398,285 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | | | | |

| | Year Ended | | Year Ended |

| | December 31, 2009 | | December 31, 2008 |

| | | | | | |

| OPERATIONS: | | | | | |

| Net investment income | $ | 940,939 | | $ | 2,934,816 |

| Net realized loss on investments sold and | | | | | |

| written option contracts expired or closed | | (31,615,145) | | | (3,400,141) |

| Change in unrealized appreciation | | | | | |

| (depreciation) on investments and written | | | | | |

| option contracts | | 207,072,491 | | | (493,780,728) |

| Net increase (decrease) in net assets | | | | | |

| resulting from operations | | 176,398,285 | | | (494,246,053) |

| | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | |

| Proceeds from shares sold | | 51,478,828 | | | 81,779,671 |

| Dividends reinvested | | 912,689 | | | 2,162,766 |

| Redemption fees | | 1,929 | | | 12,696 |

| Cost of shares redeemed | | (120,093,539) | | | (470,637,092) |

| Net decrease in net assets resulting from | | | | | |

| capital share transactions | | (67,700,093) | | | (386,681,959) |

| | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | |

| From net investment income | | (951,404) | | | (2,242,068) |

| Net decrease in net assets resulting from | | | | | |

| distributions to shareholders | | (951,404) | | | (2,242,068) |

| Total increase (decrease) in net assets | | 107,746,788 | | | (883,170,080) |

| NET ASSETS: | | | | | |

| Beginning of year | | 607,948,380 | | | 1,491,118,460 |

| End of year | | $ 715,695,168 | | $ | 607,948,380 |

| | | | | | |

| ACCUMULATED NET INVESTMENT | | | | | |

| INCOME | $ | — | | $ | 5,908 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

(A Portfolio of the Wexford Trust) |

| |

| FINANCIAL HIGHLIGHTS |

| | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

| | | | | | | | | | | | | | | |

| NET ASSET VALUE, BEGINNING OF YEAR | $ | 38.60 | | $ | 65.00 | | $ | 87.15 | | $ | 84.44 | | $ | 78.97 |

| INCOME FROM INVESTMENT | | | | | | | | | | | | | | |

| OPERATIONS: | | | | | | | | | | | | | | |

| Net investment income | | 0.07(1) | | | 0.17(1) | | | 0.58(2) | | | 0.64(1) | | | 0.76(1) |

| Net realized and unrealized gains (losses) on | | | | | | | | | | | | | | |

| investments | | 12.09 | | | (26.43) | | | (8.91) | | | 2.81 | | | 5.47 |

| Total from investment operations | | 12.16 | | | (26.26) | | | (8.33) | | | 3.45 | | | 6.23 |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | |

| From net investment income | | (0.07) | | | (0.14) | | | (0.49) | | | (0.74) | | | (0.76) |

| From realized gains | | — | | | — | | | (13.33) | | | — | | | — |

| Total distributions | | (0.07) | | | (0.14) | | | (13.82) | | | (0.74) | | | (0.76) |

| | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF YEAR | $ | 50.69 | | $ | 38.60 | | $ | 65.00 | | $ | 87.15 | | $ | 84.44 |

| | | | | | | | | | | | | | | |

| TOTAL RETURN | 31.49% | | | -40.39% | | | -9.66% | | | 4.08% | | | 7.88% |

| NET ASSETS, END OF YEAR (in millions) | $ | 716 | | $ | 608 | | $ | 1,491 | | $ | 2,880 | | $ | 3,084 |

| RATIO OF OPERATING EXPENSES | | | | | | | | | | | | | | |

TO AVERAGE NET ASSETS(3) | | 1.25% | | | 1.18% | | | 1.15% | | | 1.06% | | | 1.06% |

| RATIO OF NET INVESTMENT INCOME | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS | | 0.15% | | | 0.28% | | | 0.57% | | | 0.69% | | | 1.02% |

| PORTFOLIO TURNOVER RATE | 64.78% | | | 39.88% | | | 22.30% | | | 11.58% | | | 6.05% |

| | | | | | | | | | | | | | | |

| (1) | Net investment income per share is calculated using ending balances prior to consideration ofadjustments for permanent book and tax differences. |

| (2) | Net investment income per share is calculated using ending balances after consideration ofadjustments for permanent book and tax differences. |

| (3) | The operating expense ratio includes expense reductions for soft dollar credits and minimum accountmaintenance fees deposited into the Fund. The ratios excluding expense reductions for the years ended December 31, 2009, 2008, 2007, 2006 and 2005 were 1.26%, 1.18%, 1.15%, 1.06% and 1.06% respectively (See Note 10). |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| SCHEDULE OF INVESTMENTS |

| December 31, 2009 |

| | | | | |

| | | | |

| Name of Issuer or Title of Issue | Shares | | Value |

| | | | | |

| COMMON STOCKS — 89.4% | | | | |

| Aerospace & Defense — 3.3% | | | | |

| Alliant Techsystems Inc. (a) | 240,000 | | $ | 21,184,800 |

| Innovative Solutions and Support, Inc. (a) | 540,000 | | | 2,478,600 |

| | | | | 23,663,400 |

| Airlines — 0.3% | | | | |

| Allegiant Travel Company (a) | 40,000 | | | 1,886,800 |

| Automobiles & Components — 0.5% | | | | |

| Sonic Automotive, Inc. — Class A | 200,000 | | | 2,078,000 |

| Goodyear Tire & Rubber Company (a) | 100,525 | | | 1,417,403 |

| | | | | 3,495,403 |

| Banks — 3.0% | | | | |

| Bank of America Corp. | 1,431,335 | | | 21,555,905 |

| Capital Goods — 1.0% | | | | |

| Reliance Steel & Aluminum Co. (c) | 172,500 | | | 7,455,450 |

| Coal — 2.8% | | | | |

| CONSOL Energy Inc. (c) | 400,000 | | | 19,920,000 |

| Communications Equipment — 5.7% | | | | |

| Cisco Systems, Inc. (a) | 910,000 | | | 21,785,400 |

| Harris Corp. | 400,000 | | | 19,020,000 |

| | | | | 40,805,400 |

| Computers & Equipment — 2.2% | | | | |

| Intel Corp. | 416,000 | | | 8,486,400 |

| International Business Machines Corp. | 55,000 | | | 7,199,500 |

| PC Connection, Inc. (a) | 60,000 | | | 405,000 |

| | | | | 16,090,900 |

| Construction Materials — 0.0% | | | | |

| Cemex SAB de C.V. — ADR (a)(b) | 1 | | | 10 |

| Data Processing & Outsourced Services — 4.9% | | | | |

| Alliance Data Systems Corporation (a) | 325,000 | | | 20,991,750 |

| iGATE Corporation | 103,300 | | | 1,033,000 |

| Lender Processing Services, Inc. | 318,398 | | | 12,946,063 |

| | | | | 34,970,813 |

| Diversified Financials — 3.0% | | | | |

| State Street Corporation | 500,000 | | | 21,770,000 |

| | | | | |

| | | | | |

| | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2009 |

| | | | |

| | | | | |

| Name of Issuer or Title of Issue | Shares | | | Value |

| | | | | |

| Energy Equipment & Services — 1.6% | | | | |

| Transocean Ltd. (a)(b) | 134,880 | | $ | 11,168,064 |

| Financial Services — 0.7% | | | | |

| Invesco Limited (b) | 200,000 | | | 4,698,000 |

| Health Care Providers & Services — 14.8% | | | | |

| Amedisys, Inc. (a) | 315,000 | | | 15,296,400 |

| Hologic, Inc. (a) | 300,000 | | | 4,350,000 |

| Kinetic Concepts Inc. (a) | 695,700 | | | 26,193,105 |

| Laboratory Corporation of America Holdings (a) | 290,000 | | | 21,703,600 |

| UnitedHealth Group, Inc. | 931,200 | | | 28,382,976 |

| Zimmer Holdings, Inc. (a) | 165,000 | | | 9,753,150 |

| | | | | 105,679,231 |

| Household Durables — 0.6% | | | | |

| Stanley Furniture Co., Inc. (a) | 420,800 | | | 4,271,120 |

| Industrial Conglomerates — 4.0% | | | | |

| General Electric Co. | 1,877,000 | | | 28,399,010 |

| Information Software & Services — 4.5% | | | | |

| Fidelity National Information Services, Inc. | 336,797 | | | 7,894,522 |

| Oracle Corp. | 1,000,000 | | | 24,540,000 |

| | | | | 32,434,522 |

| Insurance — 8.0% | | | | |

| Aflac, Inc. | 480,000 | | | 22,200,000 |

| Berkshire Hathaway Inc. — Class B (a) | 5,436 | | | 17,862,696 |

| The Hartford Financial Services Group, Inc. | 730,000 | | | 16,979,800 |

| | | | | 57,042,496 |

| Medical Products — 0.1% | | | | |

| China Medical Technologies, Inc. (b) | 49,300 | | | 692,665 |

| Oil, Gas & Consumable Fuels — 2.9% | | | | |

| Chesapeake Energy Corp. | 800,000 | | | 20,704,000 |

| Pharmaceuticals & Biotechnology — 6.9% | | | | |

| Abbott Laboratories | 400,000 | | | 21,596,000 |

| Marshall Edwards, Inc. (a) | 75,607 | | | 52,925 |

| Novogen, Ltd. — ADR (a)(b) | 250,360 | | | 610,878 |

| Pfizer, Inc. | 1,500,000 | | | 27,285,000 |

| | | | | 49,544,803 |

| Retail — 2.1% | | | | |

| Aeropostale, Inc. (a) | 440,000 | | | 14,982,000 |

| | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2009 |

| | | | | |

| | | | | |

| Name of Issuer or Title of Issue | Shares | | | Value |

| | | | | |

| Technology Hardware & Equipment — 5.6% | | | | |

| Corning Incorporated | 762,200 | | $ | 14,718,082 |

| Hewlett-Packard Co. | 410,000 | | | 21,119,100 |

| MEMC Electronic Materials Inc. (a) | 325,000 | | | 4,426,500 |

| | | | | 40,263,682 |

| Telecommunication Services — 3.3% | | | | |

| AT&T Inc. | 840,000 | | | 23,545,200 |

| Tobacco — 4.6% | | | | |

| Philip Morris International, Inc. | 690,580 | | | 33,279,050 |

| Trading Companies & Distributors — 3.0% | | | | |

| Rush Enterprises, Inc. — Class A (a) | 299,907 | | | 3,565,894 |

| Rush Enterprises, Inc. — Class B (a) | 31,407 | | | 329,774 |

| WESCO International, Inc. (a) | 650,000 | | | 17,556,500 |

| | | | | 21,452,168 |

| Total Common Stocks | | | | |

| (Cost $568,861,007) | | | | 639,770,092 |

| | | | | |

| | | | | |

| | Principal | | | |

| Name of Issuer or Title of Issue | Amount | | | Value |

| | | | | |

| U.S. TREASURY OBLIGATIONS — 5.6% | | | | |

| U.S. Treasury Bill | | | | |

| 0.002%, 02/11/2010 | $40,000,000 | | $ | 39,999,909 |

| Total U.S. Treasury Obligations | | | | |

| (Cost $39,999,909) | | | | 39,999,909 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| SCHEDULE OF INVESTMENTS (Continued) |

| December 31, 2009 |

| | | �� | | | |

| | | Principal | | | |

| Name of Issuer or Title of Issue | Amount | | | Value |

| | | | | | |

| SHORT-TERM INVESTMENTS — 4.2% | | | | |

| | HSBC Finance Commercial Paper | | | | |

| | 0.123%, 01/05/2010 | $30,000,000 | | $ | 29,999,595 |

| | Total Short-Term Investments | | | | |

| | (Cost $29,999,595) | | | | 29,999,595 |

| TOTAL INVESTMENTS | | | | |

| (Cost $638,860,511) — 99.2% | | | | 709,769,596 |

| ASSETS IN EXCESS OF OTHER | | | | |

| LIABILITIES — 0.8% | | | | 5,925,572 |

| TOTAL NET ASSETS — 100.0% | | | $ | 715,695,168 |

| | | | | | |

| ADR American Depository Receipt | | | | |

| (a) | Non-income producing security. | | | | |

| (b) | Foreign company. | | | | |

| (c) | Shares are held as collateral for all or a portion of a corresponding written option contract. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. |

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| SCHEDULE OF WRITTEN OPTIONS |

| December 31, 2009 |

| |

| | Contracts | | |

| Name of Issuer or Title of Issue | (100 Shares Per Contract) | | Value |

| | | | |

| WRITTEN CALL OPTIONS — 0.3% | | | |

| CONSOL Energy Inc. | | | |

| Expiration January 2011 | | | |

| Exercise Price $50.00 | 2,000 | $ | 1,860,000 |

| Reliance Steel & Aluminum Co. | | | |

| Expiration June 2010 | | | |

| Exercise Price $45.00 | 1,000 | | 390,000 |

| Total Written Call Options | | | |

| (Premiums received $2,082,660) | | $ | 2,250,000 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS

Year Ended December 31, 2009

The Wexford Trust (the “Trust”) was organized as a Massachusetts Business Trust on September 21, 1987 and operations commenced on November 1, 1988. The Trust is registered under the Investment Company Act of 1940, as amended. The Muhlenkamp Fund (the “Fund”) is a portfolio of the Trust and is currently the only fund in the Trust.

The Fund operates as a diversified open-end mutual fund that continuously offers its shares for sale to the public. The Fund manages its assets to seek a maximum total return to its shareholders, primarily through a combination of interest and dividends and capital appreciation by holding a diversified list of publicly traded stocks. The Fund may acquire and hold fixed-income or debt investments as market conditions warrant and when, in the opinion of its Adviser, it is deemed desirable or necessary in order to attempt to achieve its investment objective.

The primary focus of the Fund is long-term and the investment options are diverse. This allows for greater flexibility in the daily management of Fund assets. However, with flexibility also comes the risk that assets will be invested in various classes of securities at the wrong time and price.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

A summary of significant accounting policies applied by management in the preparation of the accompanying financial statements is as follows:

| a. | Investment Valuations — Stocks, bonds, options and warrants are valued at the latest sales price on the last business day of the fiscal period as reported by the securities exchange on which the issue is traded. If no sale is reported, the security is valued at the last quoted bid price. Short-term debt instruments (those with remaining maturities of 60 days or less) are valued at amortized cost, which approximates fair value. Restricted securities, private placements, other illiquid securities and other securities for which market value quotations are not readily available are valued at fair value as determined by a designated Pricing Committee, comprised of personnel of the Adviser, under the supervision of the Board of Trustees, in accordance with pricing procedures ap proved by the Board. For each applicable investment that is fair valued, the Pricing Committee considers, to the extent applicable, various factors including, but not limited to, the financial condition of the company or limited partnership, operating results, prices paid in follow-on rounds, comparable companies in the public market, the nature and duration of the restrictions for holding the securities, and other relevant factors. |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

Additionally, the Fund’s investments will be valued at fair value by the Pricing Committee if the Adviser determines that an event impacting the value of an investment occurred between the closing time of a security’s primary market or exchange (for example, a foreign exchange or market) and the time the Fund’s share price is calculated. Significant events include, but are not limited to the following: significant fluctuations in domestic markets, foreign markets or foreign currencies; occurrences not directly tied to the securities markets such as natural disasters, armed conflicts or significant governmental actions; and major announcements affecting a single issuer or an entire market or market sector. In responding to a significant event, the Pricing Committee would determine the fair value of affected securitie s considering factors including, but not limited to: index options and futures traded subsequent to the close; ADRs, GDRs or other related receipts; currency spot or forward markets that trade after pricing of the foreign exchange; other derivative securities traded after the close such as WEBs and SPDRs; and alternative market quotes on the affected securities.

The Fund performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s net assets as of December 31, 2009:

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | | |

| Common Stocks* | $ | 639,770,092 | $ | — | $ | — | $ | 639,770,092 |

| U.S. Treasury | | | | | | | | |

| Obligations | | — | | 39,999,909 | | — | | 39,999,909 |

| Short-Term Investments | | — | | 29,999,595 | | — | | 29,999,595 |

| | | | | | | | | |

| Total Investments | $ | 639,770,092 | $ | 69,999,504 | $ | — | $ | 709,769,596 |

| | | | | | | | | |

| Written Option | | | | | | | | |

| Contracts | $ | 2,250,000 | $ | — | $ | — | $ | 2,250,000 |

| | | | | | | | | |

| | * | Please refer to the Schedule of Investments to view Common Stocks segregated by industry type. |

The Fund did not invest in any Level 3 investments during the year.

| b. | Foreign Securities — Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. |

| c. | Foreign Currency Translations — The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) fair value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market price of such securities. However, for federal income tax purposes the Fund does isolate and treat the effect of changes in foreign exchange ra tes on realized gain or loss from the sale of equity securities and payables/receivables arising from trade date and settlement date differences as ordinary income. |

| d. | Investment Transactions and Related Investment Income — Investment transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the yield to maturity basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

| e. | Federal Taxes — It is the Fund’s policy to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is recorded. In addition, the Fund plans to make sufficient distributions of its income and realized gains, if any, to avoid the payment of any federal excise taxes. Accounting principles generally accepted in the United States of America require that permanent differences between financial reporting and tax reporting be reclassified between various components of net assets. |

There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the fiscal year-end December 31, 2009, or for any other tax years which are open for exam. As of December 31, 2009, open tax years include the tax years ended December 31, 2006 through 2009. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next year (or twelve months). The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

| f. | Dividends and Distributions to Shareholders of Beneficial Interest — Dividends from net investment income, if any, are declared and paid at least annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income dividends and capital gain distributions are recorded on the ex-dividend date. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and finan cial reporting purposes. |

| g. | Use of Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates. In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through February 25, 2010, the date the financial statements were issued. h. Options Transactions — The Fun d is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may use written option contracts to hedge against the changes in the value of equities. The Fund may write put and call options only if it (i) owns an offsetting position in the underlying security or (ii) maintains cash or other liquid assets in an amount equal to or greater than its obligation under the option. |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

When the Fund writes a call or put option, an amount equal to the premium received is included in the Statement of Assets & Liabilities as a liability. The amount of the liability is subsequently adjusted to reflect the current fair value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. If a written put option is exercised, the cost of the security acquired is decreased by the premium originally received. As writer of an option, the Fund has no control over whether the underlying securities are subsequently sold (call) or purchased (put) an d, as a result, bears the market risk of an unfavorable change in the price of the security underlying the written option.

As of December 31, 2009, the Fund held written option contracts as hedging instruments. Written option contracts are a liability on the Statement of Assets and Liabilities with a fair value of $2,250,000 and premiums received of $2,082,660. On the Statement of Operations, there was a realized gain of $5,295,876 and a change in unrealized depreciation of $167,340 for written option contracts. Written call options expose the Fund to minimal counterparty risk since they are exchange traded and the exchange’s clearinghouse guarantee the options against default. See Note 6 for additional disclosure related to transactions in written option contracts during the year. The Fund may purchase call and put options. When the Fund purchases a call or put option, an amount equal to the premium paid is included in the Statement of Assets & Liabilities as an investment, and is subsequently adjusted to reflect the fair market value of the option. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If the Fund exercises a call option, the cost of the security acquired is increased by the premium paid for the call. If the Fund exercises a put option, a gain or loss is realized from the sale of the underlying

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

security, and the proceeds from such a sale are decreased by the premium originally paid. Written and purchased options are non-income producing securities.

The Fund did not purchase any options during the year.

| 3. | INVESTMENT ADVISORY AND OTHER AGREEMENTS |

Muhlenkamp & Company, Inc. (the “Adviser”), an officer/stockholder of which is a trustee of the Trust, receives a fee for investment management. The Adviser charges a management fee equal to 1% per annum of the average daily market value of the Fund’s net assets up to $1 billion and 0.90% per annum of those net assets in excess of $1 billion. Under terms of the advisory agreement, which is approved annually, total annual Fund operating expenses cannot under any circumstances exceed 1.50% of the Fund’s net assets. Should actual expenses incurred ever exceed the 1.50% limitation, such excess expenses shall be reimbursed by the Adviser. The Fund has no obligation to reimburse the Adviser for such payments. U.S. Bancorp Fund Services, LLC serves as transfer agent, administrator and accounting services agent for the Fund. During the year ended December 31, 2009, total expenses of $1,078,992, related to such services were paid to U.S. Bancorp Fund Services, LLC. U.S. Bank, N.A. serves as custodian for the Fund.

The Fund has established an unsecured Line of Credit agreement (“LOC”) with U.S. Bank, N.A., which expires April 30, 2010, to be used for temporary or emergency purposes, primarily for financing redemption payments. Borrowings of the Fund are subject to a $26 million cap on the total LOC. The interest rate paid by the Fund on outstanding borrowing is equal to the Prime Rate, which was 3.25% as of December 31, 2009. The Fund did not have any borrowings outstanding under the LOC as of and during the year ended December 31, 2009.

| 5. | CAPITAL SHARE TRANSACTIONS |

Transactions in capital shares of the Fund were as follows:

| | Year Ended | | Year Ended |

| | December 31, 2009 | | December 31, 2008 |

| | | | |

| Shares outstanding, beginning of year | 15,750,271 | | 22,939,221 |

| Shares sold | 1,238,585 | | 1,572,729 |

| Dividends reinvested | 17,801 | | 58,173 |

| Shares redeemed | (2,887,824) | | (8,819,852) |

| | | | |

| Shares outstanding, end of year | 14,118,833 | | 15,750,271 |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

| 6. | WRITTEN OPTION CONTRACTS |

The number of written option contracts and the premiums received by the Fund during the year ended December 31, 2009, were as follows:

| | Number of Contracts | | | Premium Amount |

| | | | | |

| Options outstanding, beginning of year | — | | $ | — |

| Options written | 46,400 | | | 14,248,985 |

| Options closed | (21,467) | | | (6,027,815) |

| Options exercised | (9,533) | | | (3,226,896) |

| Options expired | (12,400) | | | (2,911,614) |

| | | | | |

| Options outstanding, end of year | 3,000 | | $ | 2,082,660 |

See Note 2 for additional disclosure about written option contracts.

| 7. | TRANSACTIONS WITH AFFILIATES |

The following issuer was affiliated with the Fund; that is, the Fund held 5% or more of the outstanding voting securities during the year ended December 31, 2009. As defined in Section (2)(a)(3) of the Investment Company Act of 1940, such issuer was:

| | | Share | | | | | | Share | | | | |

| | | Balance At | | | | | | Balance At | | Value At | | Realized |

| Issuer Name | | | December 31, 2008 | | Purchases | | Sales | | December 31, 2009 | | December 31, 2009 | | Gains |

| | | | | | | | | | | | | |

| Stanley Furniture | | | | | | | | | | | | |

| Co., Inc.*† | | 570,800 | | — | | 150,000 | | 420,800 | | $4,271,120 | | $512,124 |

| | | | | | | | | | | | | |

| | * | Issuer was not an affiliate as of December 31, 2009. |

| | † | Non-income producing security. |

| 8. | INVESTMENT TRANSACTIONS |

Purchases and sales of investment securities, excluding short-term securities and options, for the year ended December 31, 2009, were as follows:

| Purchases | | | Sales |

| U.S. Government | | Other | | | U.S. Government | | Other |

| | | | | | | | | |

| $ — | | $363,484,636 | | | | | $415,351,160 |

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

| 9. | FEDERAL TAX INFORMATION |

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for eight years following the year of loss and offset such losses against any future realized capital gains. Capital gain distributions will resume in the future to the extent gains are realized in excess of the available carryover. The capital loss carryover as of December 31, 2009 were as follows:

| | | Capital Loss |

| Capital Loss | | Carryover |

| Carryover | | Expiration |

| (4,752,802) | | 12/31/2016 |

| (31,615,145) | | 12/31/2017 |

As of December 31, 2009, the components of distributable earnings on a tax basis were as follows:

| Tax cost of investments | $ | 638,860,511 |

| Gross tax unrealized appreciation | $ | 133,298,097 |

| Gross tax unrealized depreciation | | (62,389,012) |

| Net unrealized appreciation | $ | 70,909,085 |

| Undistributed ordinary income | $ | — |

| Undistributed long term capital gains | | — |

| Total distributable earnings | $ | — |

| Other accumulated losses | $ | (36,535,287) |

| Total accumulated gain | $ | 34,373,798 |

The Fund plans to distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

On December 29, 2009, a dividend distribution of $0.07 per share, was declared and paid to shareholders of record as of December 28, 2009.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2009

The tax character of distributions paid were as follows:

| | Year Ended | | Year Ended |

| | December 31, 2009 | | December 31, 2008 |

| | | | |

| Ordinary income | $951,404 | | $2,242,068 |

| Long-term capital gain | — | | — |

| | $951,404 | | $2,242,068 |

On the Statement of Assets and Liabilities, the follow adjustments were made for permanent tax adjustments.

| Undistributed | | Accumulated Net | | |

| Net Investment Income | | Realized Gain | | Paid In Capital |

| $4,557 | | — | | $(4,557) |

Beginning in 2000, expenses are reduced through the deposit of minimum account maintenance fees into the Fund. By November 30th of each year, all accounts must have net investments (purchases less redemptions) totaling $1,500 or more, an account value greater than $1,500, or be enrolled in the Automatic Investment Plan. Accounts that do not meet one of these three criteria will be charged a $15 fee. These fees are used to lower the Fund’s expense ratio. For the year ended December 31, 2009, the Fund’s expenses were reduced $39,279 by utilizing minimum account maintenance fees pertaining to account balances as of November 30, 2008, resulting in a decrease in the expenses being charged to shareholders.

Effective April 1, 2005, those who bought and sold the Fund within 30 calendar days incurred a 2% redemption fee. For the year ended December 31, 2009, the Fund retained $1,929 in redemption fees which increased paid in capital. Effective March 1, 2009, the Fund discontinued the redemption fee.

| 12. | GUARANTEES AND INDEMNIFICATIONS |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Shareholders and Board of Trustees Muhlenkamp Fund (a series of the Wexford Trust)

We have audited the accompanying statement of assets and liabilities, including the schedules of investments and written options, of Muhlenkamp Fund (the “Fund”), a series of the Wexford Trust, as of December 31, 2009, and the related statement of operations for the year then ended, and the statements of changes in net assets and financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods indicated prior to December 31, 2008 were audited by another independent registered public accounting firm, who expressed unqualified opinions on those highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Muhlenkamp Fund, a series of the Wexford Trust, as of December 31, 2009, the results of its operations for the year then ended, and the changes in its net assets and financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Westlake, Ohio

February 25, 2010

| MUHLENKAMP FUND |

| (A Portfolio of the Wexford Trust) |

| |

| TRUSTEES AND OFFICERS (Unaudited) |

| | | | | | | | | | | |

| | | | | | | | | Number of | | |

| | | | | | | | | Portfolios | | Other |

| | | Position(s) | | Term of Office | | Principal | | in Complex | | Directorships |

| Name, Address, | | Held | | and Length of | | Occupation(s) | | Overseen | | Held |

| and Age | | | with Fund | | Time Served | | During Past 5 Years | | by Trustee | | by Trustee |

| Independent Trustees: | | | | | | | | | | | |

| Alfred E. Kraft | | Trustee | | Indefinite Term; | | An independent | | 1 | | None |

| 411 Saddle Ridge Drive | | | | Served as | | management consultant | | | | |

| Silverthorne, CO 80498 | | | | Trustee from | | from 1986 to present. | | | | |

| Age: 72 | | | | 1998 to present | | | | | | |

| | | | | | | | | | | |

| Terrence McElligott | | Trustee | | Indefinite Term; | | President of West Penn | | 1 | | None |

| 4103 Penn Avenue | | | | Served as | | Brush & Supply, Inc., a | | | | |

| Pittsburgh, PA 15224 | | | | Trustee from | | wholesale industrial brush | | | | |

| Age: 62 | | | | 1998 to present | | sales company, from 1979 | | | | |

| | | | | | | to present. | | | | |

| Interested Trustees and Officers: | | | | | | | | | |

| Ronald H. Muhlenkamp | | President, | | Indefinite Term; | | President and Director of | | 1 | | None |

| Muhlenkamp & | | Trustee | | Served as | | Muhlenkamp & Company, | | | | |

| Company, Inc. | | | | President and | | Inc., investment adviser to | | | | |

| 5000 Stonewood Drive, | | | | Trustee from | | the Fund, from 1987 to | | | | |

| Suite 300 | | | | 1987 to present | | present. | | | | |

| Wexford, PA 15090 | | | | | | | | | | |

| Age: 66 | | | | | | | | | | |

| | | | | | | | | | | |

| James S. Head | | Vice | | Indefinite Term; | | Executive Vice President | | N/A | | None |

| Muhlenkamp & | | President, | | Served as Vice | | of Muhlenkamp & | | | | |

| Company, Inc. | | Treasurer | | President and | | Company, Inc., investment | | | | |

| 5000 Stonewood Drive, | | | | Treasurer from | | adviser to the Fund, from | | | | |

| Suite 300 | | | | 1999 to present | | 1999 to present; Branch | | | | |

| Wexford, PA 15090 | | | | | | Manager, Parker/Hunter | | | | |

| Age: 64 | | | | | | Inc., a securities brokerage | | | | |

| | | | | | | firm from 1995 to 1999. | | | | |

| John H. Kunkle, III | | Vice | | Indefinite Term; | | Portfolio analyst with | | N/A | | None |

| Muhlenkamp & | | President | | Served as Vice | | Muhlenkamp & Company, | | | | |

| Company, Inc. | | | | President from | | Inc., investment adviser to | | | | |

| 5000 Stonewood Drive, | | | | 1999 to present | | the Fund, from 1992 to | | | | |

| Suite 300 | | | | | | present. | | | | |

| Wexford, PA 15090 | | | | | | | | | | |

| Age: 47 | | | | | | | | | | |

| | | | | | | | | | | |

| Jean Leister | | Secretary | | Indefinite Term; | | Executive Assistant with | | N/A | | None |

| Muhlenkamp & | | | | Served as | | Muhlenkamp & Company, | | | | |

| Company, Inc. | | | | Secretary from | | Inc., investment adviser to | | | | |

| 5000 Stonewood Drive, | | | | 1992 to present | | the Fund, from 1987 to | | | | |

| Suite 300 | | | | | | present. | | | | |

| Wexford, PA 15090 | | | | | | | | | | |

| Age: 62 | | | | | | | | | | |

Additional information about the Fund’s trustees is available in the Statement of Additional Information and is available, without charge, upon request, by calling 1-800-860-3863.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

ADDITIONAL INFORMATION (Unaudited)

Year Ended December 31, 2009

Some people have asked how much the Muhlenkamp Fund pays in commissions:

For the year ended December 31, 2009, the Fund paid $590,537 in broker commissions. These commissions are included in the cost basis of investments purchased, and deducted from the proceeds of securities sold. This accounting method is the industry standard for mutual funds. Were these commissions itemized as expenses, they would equal four cents (4¢) per Fund share and would have increased the operating expense ratio from 1.25% to 1.34%.

| 2. | QUALIFIED DIVIDEND INCOME PERCENTAGE |

The Fund designated 100% of dividends declared and paid during the year ended December 31, 2009 from net investment income as qualified dividend income under the Jobs Growth and Tax Relief Reconciliation Act of 2003.

| 3. | CORPORATE DIVIDENDS RECEIVED DEDUCTION PERCENTAGE |

Corporate shareholders may be eligible for a dividends received deduction for certain ordinary income distributions paid by the Fund. The Fund designated 100% of dividends declared and paid during the year ended December 31, 2009 from net investment income as qualifying for the dividends received deduction. The deduction is a pass through of dividends paid by domestic corporations (i.e. only equities) subject to taxation.

| 4. | SHORT-TERM CAPITAL GAIN |

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

| 5. | INFORMATION ABOUT PROXY VOTING |

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-800-860-3863 or by accessing the Fund’s website at www.muhlenkamp.com, and the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve month period ending June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

MUHLENKAMP FUND (A Portfolio of the Wexford Trust) |

| 6. | AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE |

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The filing will be available, upon request, by calling 1-800-860-3863. Furthermore, you will be able to obtain a copy of the filing on the SEC’s website at www.sec.gov beginning with the filing for the period ended September 30, 2004. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-202-551-8090.

INVESTMENT ADVISER

Muhlenkamp & Company, Inc.

5000 Stonewood Drive, Suite 300

Wexford, PA 15090

ADMINISTRATOR AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

800 Westpoint Pkwy., Suite 1100

Westlake, OH 44145

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offers the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “Other services” provided by the principal accountant we re N/A. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 12/31/2009 | FYE 12/31/2008 |

| Audit Fees | 19,000 | 18,500 |

| Audit-Related Fees | | |

| Tax Fees | 3,000 | 3,000 |

| All Other Fees | | |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant. All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant. (If more than 50 percent of the accountant’s hours were spent to audit the registrant's financial statements for the most recent fiscal year, state how many hours were attributed to work performed by persons other than the principal accountant's full-time, permanent employees.)

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| Non-Audit Related Fees | FYE 12/31/2009 | FYE 12/31/2008 |

| Registrant | | |

| Registrant’s Investment Adviser | | |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There is no nominating committee charter and there have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer]and Treasurer/Chief Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Filed herewith |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Wexford Trust

By (Signature and Title)* /s/ Ronald H. Mulhenkamp

Ronald H. Muhlenkamp, President

Date 9/27/2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Ronald H. Mulhenkamp

Ronald H. Muhlenkamp, President

Date 9/27/2010

By (Signature and Title)* /s/ James S. Head

James S. Head, Treasurer

Date 9/27/2010

* Print the name and title of each signing officer under his or her signature.