UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05476 |

|

LORD ABBETT GLOBAL FUND, INC. |

(Exact name of registrant as specified in charter) |

|

90 Hudson Street, Jersey City, NJ | | 07302 |

(Address of principal executive offices) | | (Zip code) |

|

Thomas R. Phillips, Vice President & Assistant Secretary 90 Hudson Street, Jersey City, NJ 07302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 201-6984 | |

|

Date of fiscal year end: | 12/31 | |

|

Date of reporting period: | 12/31/2007 | |

| | | | | | | | |

Item 1: Reports to Stockholders.

2007

LORD ABBETT ANNUAL REPORT

Lord Abbett

Global Equity Fund

Developing Local Markets Fund

For the fiscal year ended December 31, 2007

Lord Abbett Global Fund

Annual Report

For the fiscal year ended December 31, 2007

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Lord Abbett Global Equity Fund and the Lord Abbett Developing Local Markets Fund (formerly the Lord Abbett Global Income Fund) for the year ended December 31, 2007. On this and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Funds, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries of the Funds' portfolio managers.

General information about Lord Abbett mutual funds, as well as in-depth discussion of market trends and investment strategies, is also provided in Lord Abbett Insights, a newsletter accompanying your quarterly account statements. We also encourage you to call Lord Abbett at 888-522-2388 and speak to one of our professionals if you would like more information.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Q: What were the overall market conditions during the year ended December 31, 2007?

A: International equity markets posted strong returns for the 12-month period ended December 31, 2007. The MSCI EAFE® Index with Net Dividends,1 primarily a large company index, rose 11.17% (in U.S. dollar terms), and the S&P/Citigroup Extended Market World ex-U.S. Index,2 primarily a small company index, rose 7.32% (in U.S. dollar terms), outperforming the U.S. equity markets, as measured by the S&P 500® Index,3 which rose 5.49% (in U.S. dollar terms). Developed markets, including Europe, which made up 70% of the MSCI EAFE Index as of December 31, 2007, had a strong 12-month period with positive

1

returns posted by developed market indexes. Emerging markets also performed well, as the MSCI Emerging Markets Index with Net Dividends4 returned 39.39% (in U.S. dollar terms) over the period.

While markets outside the U.S. performed well during the 12-month period, the performance belies the volatility experienced during the year owing to concerns about rising oil prices, the U.S. subprime market, and the subsequent deterioration in credit markets. As a result, financial stocks were hit hardest globally. The U.S. Federal Reserve Board (the Fed) reacted by cutting the discount rate by 50 basis points (bps) on September 18 in an attempt to allow banks access to funding. This provided a brief respite for global markets, but bank/financial stocks began to falter again as third quarter earnings disappointed. By the end of October, bank/financial stocks rallied in anticipation of the Fed's rate cut of 25 bps on October 31. However, the last two months of the year proved to be volatile as renewed credit worries sapped confidence.

Oil prices for most of the year were quite volatile owing to geopolitical concerns. At the beginning of the year, oil was trading at below $60 per barrel, which contrasts with its sharp increase over the subsequent 12 months, when it reached its all-time high of almost $100 per barrel.

Emerging equity markets finished the year quite strongly, reflecting the strong economic fundamentals in developing economies. Global demand for commodity exports from countries like Brazil and Chile remained strong, although prices in some commodities, like Chilean copper, seemed to stabilize. Latin America and Asia, in particular, significantly outperformed the developed markets. The U.S. dollar lost ground in global currency markets during much of the year.

Lord Abbett Global Equity Fund

Q: How did the Global Equity Fund perform during the year ended December 31, 2007?

A: The Fund returned 11.82%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the MSCI World Index with Gross Dividends,5 which returned 9.57% over the same period.

Q: What were the most significant factors affecting performance?

A: The greatest contributors to the Fund's performance relative to its benchmark for the one-year period were the financials sector (owing to an underweight position), the materials sector, and the healthcare sector.

Among the individual holdings that contributed to performance were materials holdings Monsanto Co. (the Fund's number-one contributor), a

2

provider of technology-based solutions and agricultural products for growers and downstream customers in the agricultural markets, and Alcan Inc., a multinational aluminum industry company; financials holdings National Bank of Greece S.A., an international provider of retail and corporate banking services, and Agile Property Holdings Ltd., a developer of properties in the Guangdong province, China; and consumer discretionary holding GameStop Corp., an operator of specialty electronic game and PC entertainment software stores.

The worst detractors from the Fund's performance were the energy sector and the consumer discretionary sector.

Among the individual holdings that detracted from performance were energy holding Electromagnetic GeoServices AS (the Fund's number-one detractor), a specialist in seabed logging, a technique used in the search for offshore hydrocarbons; and four financials holdings: Citigroup Inc., a worldwide provider of a broad range of financial services, Orix Corp., a worldwide provider of comprehensive financial services, The Royal Bank of Scotland Group plc, a provider of banking, insurance, and finance-related activities, and Sumitomo Mitsui Financial Group, Inc., a Japanese supplier of commercial banking and a variety of financial services.

The Fund's portfolio is actively managed and, therefore, its holdings and weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

Lord Abbett Developing Local Markets Fund

(Prior to June 29, 2007, the Lord Abbett Developing Local Markets Fund was known as the Lord Abbett Global Income Fund. Performance commentary in this report is divided into two components of six months each. The first six months of the calendar year reflect the Fund's investment strategy and benchmark as a global bond fund. Effective June 29, 2007, the Fund adopted a new investment objective, investment strategy, and benchmark. Since that date, the Fund seeks high total return through investing primarily in instruments that provide investment exposure to the currencies of, and in fixed-income instruments denominated in the currencies of, developing markets. Developing markets include countries in Asia, Africa, the Middle East, Latin America, and Europe. Accordingly, the performance discussed for the second six–month period of the calendar year reflects this new strategy.)

3

Q: How did the Developing Local Markets Fund perform during the year ended December 31, 2007?

A: The Fund returned 7.98%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Lehman Brothers Global Aggregate Bond Index,6 which returned 9.41% over the same period. The Fund's new benchmark, the JPMorgan Emerging Local Markets Index Plus,7 returned 9.33% for the six-month period ended December 31, 2007.

Q: What were the most significant factors affecting performance?

A: The Fund was managed as a global bond fund in the first six months of the calendar year. The following performance discussion reflects the global bond fund strategy from January 1, 2007, through June 28, 2007. Performance is relative to the Lehman Brothers Global Aggregate Bond Index6. Detracting from performance relative to its benchmark was the portfolio's overweight position in mortgage-backed securities, particularly commercial mortgage-backed securities, which were negatively affected by the distress in the U.S. subprime mortgage market. Spreads between mortgages and U.S. Treasuries widened in the period.

Contributing to performance relative to its benchmark were the portfolio's holdings in Brazilian and Mexican bonds, both of which were bought and then sold during the period. In the currency market, the portfolio's underweight position in the U.S. dollar and overweight in euro and British pound added to performance as the Bank of England and the European Central Bank raised rates. Also helping performance was the portfolio's overweight position in long–term European bonds and an underweight position in intermediate-term bonds. An underweight position in investment-grade bonds aided performance as spreads between that sector and U.S. Treasuries widened.

The Fund was managed as a developing local markets currency fund in the second half of the year. The following performance discussion reflects the local developing markets strategy from June 29, 2007, through December 31, 2007. Performance is relative to the JPMorgan Emerging Local Markets Index Plus7. A key strategy employed by the Fund was to overweight currencies of countries that are benefiting from high commodity prices, such as the Brazilian real and Chilean peso. The portfolio was overweight in both currencies in the calendar year. The portfolio also had an overweight position in the Turkish lira, as that currency benefited from that nation's continuing economic strength. Also contributing to performance in the period was the portfolio's underweight in lower-yielding Asian currencies, such as the Taiwan and Hong Kong dollars. Detracting from performance during the calendar year was the portfolio's overweight in the Indonesi an rupiah.

The Fund's portfolio is actively managed and, therefore, its holdings and weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

4

A prospectus contains important information about a fund, including its investment objectives, risks, charges, and ongoing expenses, which an investor should carefully consider before investing. To obtain a prospectus on any Lord Abbett mutual fund, please contact your investment professional or Lord Abbett Distributor LLC at 888-522-2388 or visit our Website at www.lordabbett.com. Read the prospectus carefully before investing.

1 The MSCI EAFE® Index with Net Dividends—The MSCI Europe, Australasia, and Far East (EAFE)® Index includes stocks traded on 21 exchanges in Europe, Australasia, and the Far East. It is an unmanaged capitalization index representing the industry composition and a sampling of small, medium, and large capitalization companies from the aforementioned global markets.

2 The S&P/Citigroup Global Equity Index System and the names of each of the indexes and subindexes that it comprises (each an "Index" and collectively, the "Indexes") are service marks of Citigroup. The S&P/Citigroup EMI World ex-U.S. Index is a subset of the Global Citigroup Extended Market Index (EMI). The World ex-U.S. composite includes all developed countries except the United States.

3 The S&P 500® Index is widely regarded as the standard for measuring large-cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

4 The MSCI Emerging Markets Index with Net Dividends is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 2007, the MSCI Emerging Markets Index consisted of the following 25 emerging market country indexes: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

5 The MSCI World Index with Gross Dividends is an unmanaged capitalization index representing the industry composition and a sampling of small, medium and large capitalization companies from global markets. It is a Morgan Stanley International Index that includes stocks traded on 21 exchanges in Europe, Australasia, and the Far East.

6 The Lehman Brothers Global Aggregate Bond Index is a broad-based measure of the global investment-grade, fixed income markets. The three major components of this index are the U.S. Aggregate, the Pan-European Aggregate, and the Asian-Pacific Aggregate Indexes. The index also includes eurodollar and euro/yen corporate bonds, Canadian government securities, and U.S. dollar investment-grade 144A securities.

7 The JPMorgan Emerging Local Markets Index Plus (ELMI+) tracks total returns for emerging markets local-currency-denominated money market instruments. The benchmark instrument of the index is FX forward contracts, and these are laddered with maturities ranging from one to three months. Country weights are based on a trade-weighted allocation, with maximum weight of 10% for countries with convertible currencies and 2% for countries with nonconvertible currencies.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end by calling Lord Abbett at 888-522-2388 or referring to our Website at www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers additional classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Funds' prospectuses.

During certain periods shown, expense reimbursements were in place. Without such expense reimbursements, the Funds' returns would have been lower.

The views of the Funds' management and the portfolio holdings described in this report are as of December 31, 2007; these views and portfolio holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the Funds. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Funds, please see the Funds' prospectuses.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by banks, and are subject to investment risks including possible loss of principal amount invested.

5

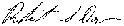

Global Equity Fund

Investment Comparison

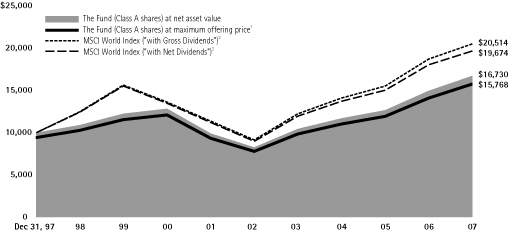

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) World Index ("With Gross Dividends") and the MSCI World Index ("With Net Dividends"), assuming reinvestment of all dividends and distributions. "With Net Dividends" reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI World Index. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2007

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | | 5.41 | % | | | 13.77 | % | | | 4.65 | % | | | — | | |

| Class B4 | | | 7.13 | % | | | 14.27 | % | | | 4.59 | % | | | — | | |

| Class C5 | | | 11.14 | % | | | 14.40 | % | | | 4.59 | % | | | — | | |

| Class F6 | | | — | | | | — | | | | — | | | | - | 1.67%* | |

| Class I7 | | | 12.25 | % | | | — | | | | — | | | | 16.09 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the indexes is not necessarily representative of the Fund's performance.

3 Total return, which is the percent change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all distributions reinvested for the periods shown ending December 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for 10 years.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares were first offered on October 19, 2004. Performance is at net asset value.

* Because Class F shares have existed for less than one year, average annual returns are not provided.

6

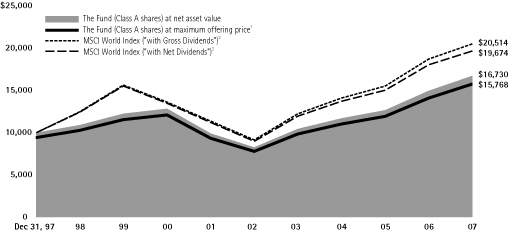

Developing Local Markets

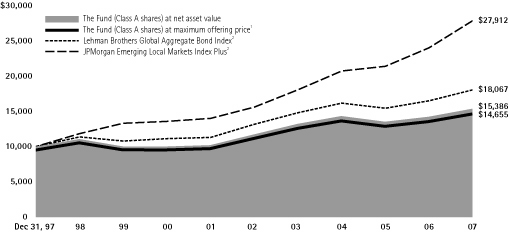

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Lehman Brothers Global Aggregate Bond Index and the JPMorgan Emerging Local Markets Index Plus, assuming reinvestment of all dividends and distributions. The Fund believes that the JPMorgan Emerging Local Markets Index Plus is a more appropriate benchmark for the Fund as a measure of the Fund's performance, and therefore will remove Lehman Brothers Global Aggregate Bond Index in its 2008 Annual Report. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2007

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | | 2.87 | % | | | 4.56 | % | | | 3.90 | % | | | — | | |

| Class B4 | | | 3.33 | % | | | 4.73 | % | | | 3.74 | % | | | — | | |

| Class C5 | | | 7.27 | % | | | 4.93 | % | | | 3.77 | % | | | — | | |

| Class F6 | | | — | | | | — | | | | — | | | | 3.56 | %* | |

| Class I7 | | | 8.20 | % | | | — | | | | — | | | | 4.36 | % | |

| Class P8 | | | 7.96 | % | | | 5.38 | % | | | — | | | | 4.12 | % | |

| Class R29 | | | — | | | | — | | | | — | | | | 3.45 | %* | |

| Class R310 | | | — | | | | — | | | | — | | | | 3.48 | %* | |

1 Reflects the deduction of the maximum initial sales charge of 4.75%.

2 Performance for each unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the indexes is not necessarily representative of the Fund's performance.

3 Total return, which is the percent change in net asset value, after deduction of the maximum initial sales charge of 4.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ending December 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for 10 years.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

7 Effective September 28, 2007, Class Y was renamed Class I. Class I shares were first offered on October 19, 2004. Performance is at net asset value.

8 Class P shares were first offered on March 4, 1999. Performance is at net asset value.

9 Class R2 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations on September 28, 2007. The SEC effective date was September 14, 2007. Performance for the Class began September 28, 2007. Performance is at net asset value.

* Because Class F, R2 and R3 shares have existed for less than one year, average annual returns are not provided.

7

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2007 through December 31, 2007).

Actual Expenses

For each class of each Fund, the first line of the table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period 7/1/07 – 12/31/07" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

8

Global Equity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 7/1/07 | | 12/31/07 | | 7/1/07 –

12/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,022.00 | | | $ | 8.15 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.14 | | | $ | 8.13 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,018.20 | | | $ | 11.45 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.86 | | | $ | 11.42 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 11.45 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,013.86 | | | $ | 11.42 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 983.30 | | | $ | 2.99 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.18 | | | $ | 3.05 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,023.90 | | | $ | 6.38 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.91 | | | $ | 6.36 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.60% for Class A, 2.25% for Classes B and C, 1.16% for Class F and 1.25% for Class I) multiplied by the average value the period, multiplied by 184/365 for Class A, B, C and I (to reflect one-half year period) and multiplied by 95/365 for Class F (to reflect the period September 28, 2007, commencement of investment operations, to December 31, 2007).

Portfolio Holdings Presented by Sector

December 31, 2007

| Sector* | | %** | |

| Consumer Discretionary | | | 6.47 | % | |

| Consumer Staples | | | 14.56 | % | |

| Energy | | | 6.90 | % | |

| Financials | | | 15.80 | % | |

| Health Care | | | 11.00 | % | |

| Industrials | | | 10.71 | % | |

| Information Technology | | | 11.89 | % | |

| Materials | | | 6.11 | % | |

| Telecommunication Services | | | 6.91 | % | |

| Utilities | | | 5.89 | % | |

| Short-Term Investments | | | 3.76 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

9

Developing Local Markets Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 7/1/07 | | 12/31/07 | | 7/1/07 –

12/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,080.70 | | | $ | 5.09 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.33 | | | $ | 4.94 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,077.10 | | | $ | 8.48 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.06 | | | $ | 8.24 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,077.10 | | | $ | 8.48 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.06 | | | $ | 8.24 | | |

| Class F | |

| Actual | | $ | 1,000.00 | | | $ | 1,035.10 | | | $ | 1.69 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | $ | 1.69 | | |

| Class I | |

| Actual | | $ | 1,000.00 | | | $ | 1,081.00 | | | $ | 3.15 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.16 | | | $ | 3.06 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,080.70 | | | $ | 5.40 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 5.24 | | |

| Class R2 | |

| Actual | | $ | 1,000.00 | | | $ | 1,034.00 | | | $ | 2.70 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.56 | | | $ | 2.68 | | |

| Class R3 | |

| Actual | | $ | 1,000.00 | | | $ | 1,034.20 | | | $ | 2.49 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,022.75 | | | $ | 2.47 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (0.97% for Class A, 1.62% for Classes B and C, 0.64% for Class F, 0.60% for Class I, 1.03% for Class P, 1.02% for Class R2 and 0.94% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 for Class A, B, C, I and P (to reflect one-half year period) and mutiplied by 95/365 for Class F, R2 and R3 (to reflect the period September 28, 2007, commencement of investment operations, to December 31, 2007).

Portfolio Holdings Presented by Sector

| December 31, 2007 | |

| Sector* | | %** | |

| Agency | | | 0.64 | % | |

| Asset Backed | | | 47.31 | % | |

| Banking | | | 13.56 | % | |

| Basic Industry | | | 0.05 | % | |

| Consumer Cyclical | | | 0.04 | % | |

| Consumer Non-Cyclical | | | 0.13 | % | |

| Finance & Investment | | | 6.19 | % | |

| Government Guaranteed | | | 0.25 | % | |

| Sector* | | %** | |

| Media | | | 0.80 | % | |

| Mortgage Backed | | | 21.61 | % | |

| Services Cyclical | | | 0.09 | % | |

| Sovereign | | | 6.12 | % | |

| Telecommunications | | | 1.93 | % | |

| Short-Term Investments | | | 1.28 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

10

Schedule of Investments

GLOBAL EQUITY FUND December 31, 2007

| Investments | | Shares | | U.S. $

Value

(000) | |

| LONG-TERM INVESTMENTS 96.94% | |

| COMMON STOCKS 96.63% | |

| Australia 0.78% | |

| Boart Longyear Group* | | | 234,682 | | | $ | 484 | | |

| Sonic Healthcare Ltd. | | | 33,086 | | | | 486 | | |

| Total | | | 970 | | |

| Belgium 1.21% | |

| Delhaize Group | | | 9,431 | | | | 830 | | |

| KBC Group NV | | | 4,768 | | | | 671 | | |

| Total | | | 1,501 | | |

| Brazil 1.13% | |

| Bovespa Holding S.A.* | | | 28,700 | | | | 553 | | |

| EDP-Energias do Brasil S.A. | | | 20,100 | | | | 326 | | |

| Rossi Residencial S.A. | | | 6,400 | | | | 164 | | |

| Souza Cruz S.A. | | | 13,100 | | | | 355 | | |

| Total | | | 1,398 | | |

| Canada 3.12% | |

| Addax Petroleum Corp. | | | 28,650 | | | | 1,247 | | |

| Barrick Gold Corp. | | | 27,506 | | | | 1,157 | | |

| Equinox Minerals Ltd.* | | | 135,400 | | | | 749 | | |

| OPTI Canada Inc.* | | | 15,490 | | | | 260 | | |

| Teck Cominco Ltd. Class B | | | 12,504 | | | | 449 | | |

| Total | | | 3,862 | | |

| China 0.67% | |

Guangzhou R&F Properties

Co., Ltd. | | | 93,600 | | | | 334 | | |

Yanzhou Coal Mining

Co., Ltd. | | | 253,000 | | | | 501 | | |

| Total | | | 835 | | |

| Czech Republic 0.23% | |

| CEZ, a.s. | | | 3,834 | | | | 285 | | |

| Egypt 0.81% | |

Orascom Telecom Holding

(S.A.E.) GDR | | | 12,100 | | | | 1,004 | | |

| Investments | | Shares | | U.S. $

Value

(000) | |

| Finland 0.81% | |

| Nokia Oyj ADR | | | 26,100 | | | $ | 1,002 | | |

| France 4.30% | |

| AXA | | | 12,977 | | | | 520 | | |

| BNP Paribas S.A. | | | 10,518 | | | | 1,141 | | |

Casino Guichard-Perrachon

S.A. | | | 7,332 | | | | 797 | | |

| Schneider Electric S.A. | | | 7,025 | | | | 952 | | |

| SUEZ S.A. | | | 13,990 | | | | 953 | | |

| Vivendi S.A. | | | 20,949 | | | | 961 | | |

| Total | | | 5,324 | | |

| Germany 6.25% | |

Bayerische Motoren

Werke AG | | | 10,654 | | | | 661 | | |

Deutsche Telekom AG

Registered Shares | | | 42,537 | | | | 936 | | |

| E. On AG | | | 4,928 | | | | 1,048 | | |

Fresenius Medical Care

AG & Co. KGaA | | | 23,614 | | | | 1,268 | | |

| Henkel KGaA | | | 20,308 | | | | 1,038 | | |

| Linde AG | | | 7,268 | | | | 963 | | |

| Merck KGaA | | | 3,973 | | | | 514 | | |

| Siemens AG | | | 5,463 | | | | 868 | | |

| Symrise GmbH & Co. AG* | | | 15,731 | | | | 444 | | |

| Total | | | 7,740 | | |

| Greece 1.98% | |

| Folli-Follie S.A. | | | 6,609 | | | | 247 | | |

Hellenic Telecomn

Organization S.A. | | | 13,742 | | | | 506 | | |

National Bank of

Greece S.A. | | | 24,738 | | | | 1,699 | | |

| Total | | | 2,452 | | |

| Hong Kong 1.52% | |

BOC Hong Kong

(Holdings) Ltd. | | | 282,500 | | | | 792 | | |

| China Unicom Ltd. | | | 164,860 | | | | 378 | | |

Galaxy Entertainment

Group Ltd.* | | | 558,000 | | | | 525 | | |

See Notes to Financial Statements.

11

Schedule of Investments (continued)

GLOBAL EQUITY FUND December 31, 2007

| Investments | | Shares | | U.S. $

Value

(000) | |

| Hong Kong (continued) | |

REXCAPITAL Financial

Holdings Ltd.* | | | 950,000 | | | $ | 181 | | |

| Total | | | 1,876 | | |

| India 0.50% | |

Tata Consultancy

Services Ltd. | | | 22,714 | | | | 621 | | |

| Indonesia 0.59% | |

| Indosat tbk PT | | | 805,500 | | | | 735 | | |

| Italy 1.36% | |

| Finmeccanica S.p.A. | | | 23,781 | | | | 763 | | |

| Telecom Italia S.p.A. | | | 298,609 | | | | 926 | | |

| Total | | | 1,689 | | |

| Japan 6.17% | |

| Capcom Co., Ltd. | | | 12,200 | | | | 311 | | |

| Don Quijote Co., Ltd. | | | 18,100 | | | | 356 | | |

| East Japan Railway Co. | | | 109 | | | | 897 | | |

| Nintendo Co., Ltd. | | | 1,000 | | | | 587 | | |

Nippon Commercial

Investment REIT | | | 199 | | | | 878 | | |

| NSK Ltd. | | | 85,000 | | | | 871 | | |

| NTT DoCoMo, Inc. | | | 292 | | | | 481 | | |

| Ricoh Co., Ltd. | | | 49,600 | | | | 905 | | |

| Sumitomo Corp. | | | 53,100 | | | | 743 | | |

| Tokyo Tatemono Co., Ltd. | | | 71,000 | | | | 666 | | |

| Yamada Denki Co., Ltd. | | | 8,410 | | | | 949 | | |

| Total | | | 7,644 | | |

| Mexico 0.41% | |

Desarrolladora Homex,

S.A. de C.V. ADR* | | | 10,300 | | | | 509 | | |

| Netherlands 1.37% | |

| ING Groep N.V. CVA | | | 12,577 | | | | 492 | | |

| Koninklijke Ahold N.V.* | | | 22,759 | | | | 317 | | |

| Schlumberger Ltd. | | | 9,046 | | | | 890 | | |

| Total | | | 1,699 | | |

| Investments | | Shares | | U.S. $

Value

(000) | |

| Norway 1.29% | |

Electromagnetic

Geo-Services ASA* | | | 30,800 | | | $ | 287 | | |

Petroleum

Geo-Services ASA* | | | 45,290 | | | | 1,304 | | |

| Total | | | 1,591 | | |

| Philippines 0.21% | |

| Manila Electric Co. | | | 129,800 | | | | 256 | | |

| Portugal 0.51% | |

EDP-Electricidade De

Portugal, S.A. | | | 97,456 | | | | 637 | | |

| South Africa 1.13% | |

Impala Platinum

Holdings Ltd. | | | 25,425 | | | | 882 | | |

| MTN Group Ltd. | | | 27,898 | | | | 523 | | |

| Total | | | 1,405 | | |

| South Korea 1.20% | |

| Kookmin Bank* | | | 8,150 | | | | 601 | | |

| Pusan Bank* | | | 18,760 | | | | 312 | | |

Samsung Electronics

Co., Ltd. | | | 982 | | | | 578 | | |

| Total | | | 1,491 | | |

| Switzerland 3.28% | |

| Credit Suisse Group | | | 6,800 | | | | 409 | | |

Julius Baer Holding AG

Registered Shares | | | 12,645 | | | | 1,038 | | |

Lonza Group Ltd. AG

Registered Shares | | | 3,743 | | | | 453 | | |

Nestle S.A.

Registered Shares | | | 2,386 | | | | 1,096 | | |

| Roche Holding Ltd. AG | | | 6,179 | | | | 1,068 | | |

| Total | | | 4,064 | | |

| Taiwan 1.09% | |

| Acer Inc. | | | 342,830 | | | | 671 | | |

Taiwan Semiconductor

Manufacturing Co.,

Ltd. ADR | | | 67,924 | | | | 677 | | |

| Total | | | 1,348 | | |

See Notes to Financial Statements.

12

Schedule of Investments (continued)

GLOBAL EQUITY FUND December 31, 2007

| Investments | | Shares | | U.S. $

Value

(000) | |

| United Kingdom 10.20% | |

| Aegis Group plc | | | 237,279 | | | $ | 553 | | |

| Aviva plc | | | 23,820 | | | | 319 | | |

| BAE Systems plc | | | 146,880 | | | | 1,456 | | |

BlueBay Asset

Management plc | | | 48,669 | | | | 344 | | |

British American

Tobacco plc | | | 19,850 | | | | 776 | | |

| Diageo plc | | | 36,769 | | | | 790 | | |

| Diageo plc ADR | | | 3,537 | | | | 304 | | |

| easyJet plc* | | | 52,749 | | | | 644 | | |

| National Grid plc | | | 62,009 | | | | 1,029 | | |

| Prudential plc | | | 60,868 | | | | 863 | | |

| Reckitt Benckiser plc | | | 8,233 | | | | 478 | | |

| Reed Elsevier Group plc | | | 75,843 | | | | 1,026 | | |

| SABMiller plc | | | 35,555 | | | | 1,002 | | |

| Shire plc | | | 19,846 | | | | 454 | | |

| Tesco plc | | | 59,521 | | | | 565 | | |

| Tullow Oil plc | | | 59,220 | | | | 768 | | |

| Vodafone Group plc | | | 337,468 | | | | 1,262 | | |

| Total | | | 12,633 | | |

| United States 44.51% | |

| Abbott Laboratories | | | 23,100 | | | | 1,297 | | |

| Activision, Inc.* | | | 10,664 | | | | 317 | | |

| Adobe Systems Inc.* | | | 10,933 | | | | 467 | | |

Advanced Micro

Devices, Inc.* | | | 2,500 | | | | 19 | | |

| Agilent Technologies, Inc.* | | | 11,100 | | | | 408 | | |

| Altria Group, Inc. | | | 5,900 | | | | 446 | | |

| American Express Co. | | | 2,803 | | | | 146 | | |

American International

Group, Inc. | | | 7,199 | | | | 420 | | |

| Amgen Inc.* | | | 10,500 | | | | 488 | | |

Amylin Pharmaceuticals,

Inc.* | | | 5,100 | | | | 189 | | |

| Anheuser-Busch Cos., Inc. | | | 4,200 | | | | 220 | | |

| Aon Corp. | | | 12,200 | | | | 582 | | |

| Archer Daniels Midland Co. | | | 20,500 | | | | 952 | | |

| Investments | | Shares | | U.S. $

Value

(000) | |

| AT&T Inc. | | | 38,310 | | | $ | 1,592 | | |

| Baker Hughes, Inc. | | | 4,088 | | | | 332 | | |

| Bank of America Corp. | | | 11,164 | | | | 461 | | |

Bank of New York

Mellon Corp. | | | 20,205 | | | | 985 | | |

| Baxter International, Inc. | | | 8,183 | | | | 475 | | |

| Best Buy Co., Inc. | | | 8,500 | | | | 448 | | |

| Boeing Co. (The) | | | 7,500 | | | | 656 | | |

| Bristol-Myers Squibb Co. | | | 10,700 | | | | 284 | | |

| Campbell Soup Co. | | | 11,500 | | | | 411 | | |

| Caterpillar Inc. | | | 2,258 | | | | 164 | | |

| Celgene Corp.* | | | 12,100 | | | | 559 | | |

| Chevron Corp. | | | 9,671 | | | | 903 | | |

| Cisco Systems, Inc.* | | | 31,800 | | | | 861 | | |

| Citigroup, Inc. | | | 11,444 | | | | 337 | | |

| Coach, Inc.* | | | 6,200 | | | | 190 | | |

| Coca-Cola Co. (The) | | | 20,600 | | | | 1,264 | | |

| Colgate-Palmolive Co. | | | 10,167 | | | | 793 | | |

| Comcast Corp. Class A* | | | 6,837 | | | | 124 | | |

| ConocoPhillips | | | 3,658 | | | | 323 | | |

| Corning, Inc. | | | 20,754 | | | | 498 | | |

| CVS Caremark Corp. | | | 23,952 | | | | 952 | | |

| Dominion Resources, Inc. | | | 12,700 | | | | 603 | | |

| Electronic Arts Inc.* | | | 17,100 | | | | 999 | | |

| Eli Lilly & Co. | | | 8,600 | | | | 459 | | |

| Emerson Electric Co. | | | 9,620 | | | | 545 | | |

| Express Scripts, Inc.* | | | 12,100 | | | | 883 | | |

| ExxonMobil Corp. | | | 18,842 | | | | 1,765 | | |

| FannieMae | | | 10,800 | | | | 432 | | |

| FPL Group, Inc. | | | 7,500 | | | | 508 | | |

Freeport-McMoRan

Copper & Gold Inc. | | | 1,005 | | | | 103 | | |

| GameStop Corp.* | | | 11,900 | | | | 739 | | |

| General Dynamics Corp. | | | 4,606 | | | | 410 | | |

| General Electric Co. | | | 32,756 | | | | 1,214 | | |

| Genzyme Corp.* | | | 6,800 | | | | 506 | | |

| Gilead Sciences, Inc.* | | | 13,056 | | | | 601 | | |

See Notes to Financial Statements.

13

Schedule of Investments (continued)

GLOBAL EQUITY FUND December 31, 2007

| Investments | | Shares | | U.S. $

Value

(000) | |

| United States (continued) | |

| Harris Corp. | | | 2,400 | | | $ | 150 | | |

Hartford Financial Group,

Inc. (The) | | | 3,451 | | | | 301 | | |

| Hewlett-Packard Co. | | | 20,190 | | | | 1,019 | | |

| Honeywell International, Inc. | | | 6,358 | | | | 391 | | |

| ImClone Systems Inc.* | | | 6,878 | | | | 296 | | |

| Intel Corp. | | | 35,388 | | | | 943 | | |

International Business

Machines Corp. | | | 6,700 | | | | 724 | | |

| Johnson & Johnson | | | 7,060 | | | | 471 | | |

| JPMorgan Chase & Co. | | | 13,723 | | | | 599 | | |

| Kellogg Co. | | | 8,700 | | | | 456 | | |

| Kohl's Corp.* | | | 8,000 | | | | 366 | | |

| Kraft Foods, Inc. Class A | | | 22,830 | | | | 745 | | |

| Kroger Co. (The) | | | 8,963 | | | | 239 | | |

| Lockheed Martin Corp. | | | 5,500 | | | | 579 | | |

| Macy's, Inc. | | | 4,100 | | | | 106 | | |

| Marathon Oil Corp. | | | 500 | | | | 30 | | |

| Marshall & Ilsley Corp. (The) | | | 3,799 | | | | 101 | | |

Medco Health

Solutions, Inc.* | | | 3,117 | | | | 316 | | |

| Medtronic, Inc. | | | 6,000 | | | | 302 | | |

| Merck & Co., Inc. | | | 15,500 | | | | 901 | | |

| Merrill Lynch & Co., Inc. | | | 5,700 | | | | 306 | | |

| MetLife, Inc. | | | 4,400 | | | | 271 | | |

| Microsoft Corp. | | | 27,470 | | | | 978 | | |

| Monsanto Co. | | | 14,450 | | | | 1,614 | | |

| Morgan Stanley | | | 7,300 | | | | 388 | | |

| Northeast Utilities | | | 9,400 | | | | 294 | | |

| NVIDIA Corp.* | | | 6,300 | | | | 214 | | |

| Occidental Petroleum Corp. | | | 400 | | | | 31 | | |

| Oracle Corp.* | | | 25,926 | | | | 585 | | |

| PepsiCo, Inc. | | | 9,839 | | | | 747 | | |

| Pfizer, Inc. | | | 14,349 | | | | 326 | | |

| PG&E Corp. | | | 12,913 | | | | 556 | | |

PNC Financial Services

Group, Inc. (The) | | | 9,200 | | | | 604 | | |

| Investments | | Shares | | U.S. $

Value

(000) | |

| Polo Ralph Lauren Corp. | | | 900 | | | $ | 56 | | |

| Praxair, Inc. | | | 8,599 | | | | 763 | | |

| Procter & Gamble Co. (The) | | | 24,590 | | | | 1,805 | | |

| Progress Energy, Inc. | | | 9,651 | | | | 467 | | |

| QUALCOMM Inc. | | | 22,096 | | | | 869 | | |

| Quest Diagnostics, Inc. | | | 8,226 | | | | 435 | | |

| Raytheon Co. | | | 9,333 | | | | 567 | | |

| Safeco Corp. | | | 901 | | | | 50 | | |

| Schering-Plough Corp. | | | 8,300 | | | | 221 | | |

| Sprint Nextel Corp. | | | 5,040 | | | | 66 | | |

| St. Jude Medical, Inc.* | | | 11,600 | | | | 471 | | |

| SunTrust Banks, Inc. | | | 3,000 | | | | 187 | | |

| Target Corp. | | | 7,000 | | | | 350 | | |

| Texas Instruments Inc. | | | 6,861 | | | | 229 | | |

| Tiffany & Co. | | | 1,100 | | | | 51 | | |

| Time Warner Inc. | | | 9,400 | | | | 155 | | |

| U.S. Bancorp | | | 9,800 | | | | 311 | | |

United Parcel Service, Inc.

Class B | | | 5,210 | | | | 368 | | |

| United Technologies Corp. | | | 10,400 | | | | 796 | | |

| Valero Energy Corp. | | | 5,200 | | | | 364 | | |

| Verizon Communications, Inc. | | | 5,012 | | | | 219 | | |

| Wachovia Corp. | | | 3,785 | | | | 144 | | |

| Walgreen Co. | | | 2,644 | | | | 101 | | |

| Wal-Mart Stores, Inc. | | | 7,202 | | | | 342 | | |

| Walt Disney Co. (The) | | | 6,462 | | | | 209 | | |

WebMD Health Corp.

Class A* | | | 200 | | | | 8 | | |

| Wells Fargo & Co. | | | 14,364 | | | | 434 | | |

| Western Union Co. (The) | | | 7,500 | | | | 182 | | |

| Wm. Wrigley Jr. Co. | | | 6,000 | | | | 351 | | |

| XTO Energy, Inc. | | | 1,980 | | | | 102 | | |

| Yahoo! Inc.* | | | 8,300 | | | | 193 | | |

| Total | | | 55,145 | | |

Total Common Stocks

(cost $106,097,879) | | | 119,716 | | |

See Notes to Financial Statements.

14

Schedule of Investments (concluded)

GLOBAL EQUITY FUND December 31, 2007

| Investments | | Shares | | U.S. $

Value

(000) | |

| FOREIGN PREFERRED STOCKS 0.31% | |

| Brazil 0.31% | |

Cia Energetica Minas Gerais

(cost $384,135) | | | 21,090 | | | $ | 385 | | |

Total Long-Term Investments

(cost $106,482,014) | | $ | 120,101 | | |

| | | Principal

Amount

(000) | | | |

| SHORT-TERM INVESTMENT 3.79% | |

| Repurchase Agreement | |

Repurchase Agreement

dated 12/31/2007,

3.38% due 1/2/2008

with State Street

Bank & Trust Co.

collateralized by

$4,725,000 of U.S.

Treasury Notes at 4.75%

due 12/31/2008;

value: $4,789,969;

proceeds: $4,692,848

(cost $4,691,966) | | $ | 4,692 | | | | 4,692 | | |

Total Investments in

Securities 100.73%

(cost $111,173,980) | | | 124,793 | | |

Liabilities in Excess of

Foreign Cash and

Other Assets (0.73%) | | | (900 | ) | |

| Net Assets 100.00% | | $ | 123,893 | | |

ADR American Depositary Receipt.

GDR Global Depositary Receipt.

REIT Real Estate Investment Trust.

* Non-income producing security.

Industry classifications have not been audited by Deloitte & Touche LLP.

See Notes to Financial Statements.

15

Schedule of Investments

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | Value | |

| LONG-TERM INVESTMENTS 94.62% | |

| ASSET-BACKED SECURITIES 39.62% | |

| Automobile 16.95% | |

BMW Vehicle Owner Trust

Series 2005-A Class A4 | | | 4.28 | % | | 2/25/2010 | | $ | 1,135 | | | $ | 1,132,496 | | |

BMW Vehicle Owner Trust

Series 2006-A Class A3 | | | 5.13 | % | | 9/27/2010 | | | 610 | | | | 611,679 | | |

Capital Auto Receivables Asset Trust

Series 2006-1 Class A4 | | | 5.04 | % | | 5/17/2010 | | | 830 | | | | 833,849 | | |

| Capital One Prime Auto 2006-1 A3 | | | 4.99 | % | | 9/15/2010 | | | 1,061 | | | | 1,063,318 | | |

Daimler Chrysler Auto Trust

Series 2005-A Class A4 | | | 3.74 | % | | 2/8/2010 | | | 819 | | | | 816,025 | | |

Daimler Chrysler Auto Trust

Series 2005-B Class A4 | | | 4.20 | % | | 7/8/2010 | | | 850 | | | | 847,454 | | |

Daimler Chrysler Auto Trust

Series 2006-B Class A3 | | | 5.33 | % | | 8/8/2010 | | | 437 | | | | 438,671 | | |

Ford Credit Auto Owner Trust

Series 2005-A Class A4 | | | 3.72 | % | | 10/15/2009 | | | 1,095 | | | | 1,089,673 | | |

Ford Credit Auto Owner Trust

Series 2005-B Class A4 | | | 4.38 | % | | 1/15/2010 | | | 517 | | | | 516,188 | | |

Ford Credit Auto Owner Trust

Series 2005-B Class B | | | 4.64 | % | | 4/15/2010 | | | 530 | | | | 530,113 | | |

Honda Auto Receivables Owner Trust

Series 2005-3 Class A3 | | | 3.87 | % | | 4/20/2009 | | | 473 | | | | 472,000 | | |

USAA Auto Owner Trust

Series 2005-4 Class A3 | | | 4.83 | % | | 4/15/2010 | | | 540 | | | | 539,825 | | |

USAA Auto Owner Trust

Series 2006-2 Class A3 | | | 5.32 | % | | 9/15/2010 | | | 317 | | | | 317,997 | | |

| Total | | | 9,209,288 | | |

| Credit Cards 21.68% | |

American Express Credit Master Trust

Series 2001-5 Class A | | | 5.208 | %# | | 11/15/2010 | | | 1,400 | | | | 1,400,780 | | |

American Express Credit Master Trust

Series 2004-4 Class A | | | 5.118 | %# | | 3/15/2012 | | | 600 | | | | 599,135 | | |

Chase Credit Card Master Trust

Series 2003-3 Class A | | | 5.138 | %# | | 10/15/2010 | | | 400 | | | | 400,132 | | |

Chase Credit Card Master Trust

Series 2003-5 Class A | | | 5.148 | %# | | 1/17/2011 | | | 1,000 | | | | 1,000,151 | | |

| Chase Issuance Trust 2005-A3 Class A | | | 5.048 | %# | | 10/17/2011 | | | 600 | | | | 598,965 | | |

Citibank Credit Card Issuance Trust

Series 2001-A1 Class A1 | | | 5.045 | %# | | 2/7/2010 | | | 350 | | | | 350,094 | | |

See Notes to Financial Statements.

16

Schedule of Investments (continued)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | Value | |

| Credit Cards (continued) | |

Citibank Credit Card Issuance Trust

Series 2003-A3 Class A3 | | | 3.10 | % | | 3/10/2010 | | $ | 270 | | | $ | 269,220 | | |

Citibank Credit Card Issuance Trust

Series 2003-A6 Class A6 | | | 2.90 | % | | 5/17/2010 | | | 1,085 | | | | 1,077,753 | | |

Citibank Credit Card Issuance Trust

Series 2006-A2 Class A2 | | | 4.85 | % | | 2/10/2011 | | | 605 | | | | 608,761 | | |

Discover Card Master Trust I

Series 2003-4 Class A1 | | | 5.138 | %# | | 5/15/2011 | | | 975 | | | | 974,732 | | |

First USA Credit Card Master Trust

Series 1998-6 Class A | | | 5.156 | %# | | 4/18/2011 | | | 1,600 | | | | 1,600,759 | | |

Household Affinity Credit Card Master Trust

Series 2003-1 Class A | | | 5.148 | %# | | 2/15/2010 | | | 400 | | | | 400,111 | | |

MBNA Credit Card Master Note Trust

Series 2003-A3 Class A3 | | | 5.148 | %# | | 8/16/2010 | | | 600 | | | | 600,207 | | |

MBNA Credit Card Master Note Trust

Series 2003-A7 Class A7 | | | 2.65 | % | | 11/15/2010 | | | 505 | | | | 500,468 | | |

MBNA Credit Card Master Note Trust

Series 2005-A1 Class A1 | | | 4.20 | % | | 9/15/2010 | | | 1,400 | | | | 1,397,981 | | |

| Total | | | 11,779,249 | | |

| Home Equity 0.99% | |

Bank One Issuance Trust

Series 2003-A6 Class A6 | | | 5.138 | %# | | 2/15/2011 | | | 540 | | | | 540,178 | | |

| Total Asset-Backed Securities (cost $21,427,937) | | | 21,528,715 | | |

| CORPORATE BONDS 3.99% | |

| Auto Loans 0.04% | |

| General Motors Acceptance Corp. LLC | | | 6.75 | % | | 12/1/2014 | | | 25 | | | | 20,190 | | |

| Banking 0.53% | |

| Citigroup, Inc. | | | 7.25 | % | | 10/1/2010 | | | 275 | | | | 291,036 | | |

| Food - Wholesale 0.13% | |

| Corn Products International, Inc. | | | 8.45 | % | | 8/15/2009 | | | 65 | | | | 69,354 | | |

Investments & Miscellaneous

Financial Services 0.55% | |

| Goldman Sachs Group, Inc. | | | 4.50 | % | | 6/15/2010 | | | 300 | | | | 299,185 | | |

| Media - Broadcast 0.24% | |

| Cox Communications, Inc. | | | 7.75 | % | | 11/1/2010 | | | 125 | | | | 133,415 | | |

See Notes to Financial Statements.

17

Schedule of Investments (continued)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | Value | |

| Media-Cable 0.52% | |

| Comcast Corp. | | | 5.85 | % | | 1/15/2010 | | $ | 275 | | | $ | 281,678 | | |

| Steel Producers/Products 0.05% | |

| Allegheny Technologies Inc. | | | 8.375 | % | | 12/15/2011 | | | 25 | | | | 26,750 | | |

| Support-Services 0.08% | |

| Corrections Corp. of America | | | 7.50 | % | | 5/1/2011 | | | 45 | | | | 45,787 | | |

| Telecommunications-Integrated/Services 1.85% | |

Deutsche Telekom International

Finance B.V. (Netherlands)(a) | | | 8.00 | % | | 6/15/2010 | | | 275 | | | | 293,751 | | |

| France Telecom S.A. (France)(a) | | | 7.75 | % | | 3/1/2011 | | | 275 | | | | 295,784 | | |

| SBC Communications, Inc. | | | 5.30 | % | | 11/15/2010 | | | 275 | | | | 280,072 | | |

| Telefonica Europe B.V. (Netherlands)(a) | | | 7.75 | % | | 9/15/2010 | | | 125 | | | | 133,876 | | |

| Total | | | 1,003,483 | | |

| Total Corporate Bonds (cost $2,136,238) | | | 2,170,878 | | |

| FOREIGN BONDS 5.86% | |

| Nigeria 1.34% | |

| Nigeria Treasury(b) | | | 12.50 | % | | 2/24/2009 | | | 81,000 | | | | 726,355 | | |

| Poland 2.57% | |

| Poland Government(b) | | | 5.75 | % | | 6/24/2008 | | | 3,435 | | | | 1,396,190 | | |

| South Africa 1.95% | |

| Republic of South Africa(b) | | | 10.00 | % | | 2/28/2008 | | | 7,250 | | | | 1,060,075 | | |

| Total Foreign Bonds (cost $2,973,454) | | | 3,182,620 | | |

GOVERNMENT SPONSORED ENTERPRISES

PASS-THROUGHS 4.51% | |

| Federal Home Loan Mortgage Corp. | | | 4.198 | %# | | 1/1/2034 | | | 695 | | | | 703,113 | | |

| Federal Home Loan Mortgage Corp. | | | 7.00 | % | | 2/1/2032 | | | 59 | | | | 61,435 | | |

| Federal National Mortgage Assoc. | | | 3.494 | %# | | 8/1/2033 | | | 198 | | | | 199,320 | | |

| Federal National Mortgage Assoc. | | | 4.51 | %# | | 7/1/2035 | | | 213 | | | | 212,475 | | |

| Federal National Mortgage Assoc. | | | 5.475 | %# | | 4/1/2036 | | | 307 | | | | 311,076 | | |

| Federal National Mortgage Assoc. | | | 5.505 | %# | | 4/1/2036 | | | 152 | | | | 153,531 | | |

| Federal National Mortgage Assoc. | | | 5.654 | %# | | 8/1/2036 | | | 533 | | | | 539,305 | | |

| Federal National Mortgage Assoc. | | | 5.936 | %# | | 5/1/2036 | | | 264 | | | | 270,192 | | |

| Total Government Sponsored Enterprises Pass-Throughs (cost $2,418,592) | | | 2,450,447 | | |

See Notes to Financial Statements.

18

Schedule of Investments (continued)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | Value | |

NON-AGENCY COMMERCIAL

MORTGAGE-BACKED SECURITIES 40.64% | |

Banc of America Commercial Mortgage Inc.

Series 2004-2 Class A2 | | | 3.52 | % | | 11/10/2038 | | $ | 912 | | | $ | 900,181 | | |

Banc of America Commercial Mortgage Inc.

Series 2004-4 Class A3 | | | 4.128 | % | | 7/10/2042 | | | 970 | | | | 962,547 | | |

Banc of America Commercial Mortgage Inc.

Series 2005-3 Class A2 | | | 4.501 | % | | 7/10/2043 | | | 1,382 | | | | 1,365,848 | | |

Bear Stearns Commercial Mortgage

Series 2006-PW11 Class A1 | | | 5.266 | % | | 3/11/2039 | | | 820 | | | | 824,011 | | |

Bear Stearns Commercial Mortgage

Series 2004-PWR4 Class A1 | | | 4.361 | % | | 6/11/2041 | | | 279 | | | | 277,346 | | |

Bear Stearns Commercial Mortgage

Series 2004-PWR6 Class A2 | | | 4.133 | % | | 11/11/2041 | | | 1,300 | | | | 1,290,301 | | |

Bear Stearns Commercial Mortgage

Series 2005-PWR8 Class A1 | | | 4.212 | % | | 6/11/2041 | | | 102 | | | | 101,092 | | |

Bear Stearns Commercial Mortgage

Series 2005-PW10 Class A2 | | | 5.27 | % | | 12/11/2040 | | | 1,200 | | | | 1,206,534 | | |

Citigroup/Deutsche Bank Commercial

Mortgage Trust 2006-CD2 Class AAB | | | 5.392 | %# | | 1/15/2046 | | | 920 | | | | 928,228 | | |

Credit Suisse First Boston Mortgage Corp.

Series 2004-C3 Class A2 | | | 3.913 | % | | 7/15/2036 | | | 775 | | | | 767,293 | | |

Credit Suisse First Boston Mortgage Corp.

Series 2004-C5 Class A2 | | | 4.183 | % | | 11/15/2037 | | | 500 | | | | 496,288 | | |

Credit Suisse Mortgage

Capital Series 2005-C6 Class A1 | | | 4.938 | % | | 12/15/2040 | | | 898 | | | | 894,907 | | |

CS First Boston Mortgage

Securities Corp. Series 2005-C1 Class A2 | | | 4.609 | % | | 2/15/2038 | | | 500 | | | | 495,920 | | |

GE Capital Commercial

Mortgage Corp. Series 2004-C2 Class A2 | | | 4.119 | % | | 3/10/2040 | | | 400 | | | | 396,469 | | |

GE Capital Commercial

Mortgage Corp. Series 2004-C3 Class A2 | | | 4.433 | % | | 7/10/2039 | | | 500 | | | | 498,263 | | |

GMAC Commercial Mortgage Securities Inc.

Series 2003-C2 Class A1 | | | 4.576 | % | | 5/10/2040 | | | 453 | | | | 452,714 | | |

JPMorgan Chase Commercial

Mortgage Series 2005-LDP1 Class A1 | | | 4.116 | % | | 3/15/2046 | | | 807 | | | | 799,134 | | |

JPMorgan Chase Commercial

Mortgage Series 2006-LDP6 Class ASB | | | 5.49 | %# | | 4/15/2043 | | | 990 | | | | 1,001,367 | | |

LB-UBS Commercial Mortgage Trust

Series 2003-C8 Class A2 | | | 4.207 | % | | 11/15/2027 | | | 600 | | | | 596,317 | | |

LB-UBS Commercial Mortgage Trust

Series 2004-C1 Class A1 | | | 2.964 | % | | 1/15/2029 | | | 1,274 | | | | 1,257,177 | | |

See Notes to Financial Statements.

19

Schedule of Investments (continued)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Investments | | Interest

Rate | | Maturity

Date | | Principal

Amount

(000) | | Value | |

NON-AGENCY COMMERCIAL

MORTGAGE-BACKED SECURITIES (continued) | |

LB-UBS Commercial Mortgage Trust

Series 2004-C6 Class A2 | | | 4.187 | % | | 8/15/2029 | | $ | 1,000 | | | $ | 993,263 | | |

Merrill Lynch Mortgage Trust Series

2005-CKI1 Class A1 | | | 5.077 | % | | 11/12/2037 | | | 776 | | | | 776,447 | | |

Merrill Lynch Mortgage Trust Series

2005-LC1 Class ASB | | | 5.282 | %# | | 1/12/2044 | | | 70 | | | | 70,353 | | |

Merrill Lynch Mortgage Trust Series

2006-C1 Class A2 | | | 5.614 | %# | | 5/12/2039 | | | 1,080 | | | | 1,098,074 | | |

Morgan Stanley Capital I Series

2004-HQ3 Class A2 | | | 4.05 | % | | 1/13/2041 | | | 1,000 | | | | 990,432 | | |

Morgan Stanley Capital I Series

2004-IQ7 Class A1 | | | 4.03 | % | | 6/15/2038 | | | 407 | | | | 404,365 | | |

Morgan Stanley Capital I Series

2004-T15 Class A2 | | | 4.69 | % | | 6/13/2041 | | | 600 | | | | 600,716 | | |

Morgan Stanley Capital I Series

2006-T23 Class A1 | | | 5.682 | % | | 8/12/2041 | | | 138 | | | | 139,977 | | |

Wachovia Bank Commercial Mortgage

Trust Series 2004-C14 Class A2 | | | 4.368 | % | | 8/15/2041 | | | 1,500 | | | | 1,492,780 | | |

| Total Non-Agency Commercial Mortgage-Backed Securities (cost $21,746,152) | | | 22,078,344 | | |

| Total Long-Term Investments (cost $50,702,373) | | | 51,411,004 | | |

| SHORT-TERM INVESTMENT 1.23% | |

| Repurchase Agreement | |

Repurchase Agreement dated 12/31/2007,

3.38% due 1/2/2008 with State Street

Bank & Trust Co. collateralized by

$655,000 of U.S. Treasury Notes at

4.625% due 7/31/2009; value: $683,094;

proceeds: $665,146 (cost $665,021) | | | | | | | | | 665 | | | | 665,021 | | |

| Total Investments in Securities 95.85% (cost $51,367,394) | | | 52,076,025 | | |

| Cash, Foreign Cash and Other Assets in Excess of Liabilities(c) 4.15% | | | 2,256,241 | | |

| Net Assets 100.00% | | $ | 54,332,266 | | |

# Variable rate security. The interest rate represents the rate at December 31, 2007.

(a) Foreign security traded in U.S. dollars.

(b) Investment in non-U.S. dollar denominated securities.

(c) Cash, Foreign Cash and Other Assets in Excess of Liabilities include net unrealized appreciation (depreciation) on futures contracts and forward currency exchange contracts, as follows:

See Notes to Financial Statements.

20

Schedule of Investments (continued)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

| Open Futures Contracts at December 31, 2007: | |

| Type | | Expiration | | Contracts | | Position | | Market Value | | Unrealized

Depreciation | |

| U.S. 5-Year Treasury Note | | March 2008 | | | 134 | | | Short | | $ | (14,777,688 | ) | | $ | (79,970 | ) | |

| Forward Foreign Currency Contracts Open as of December 31, 2007: | |

Forward

Foreign Currency

Contracts | | Transaction

Type | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost on

Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation/

(Depreciation) | |

| Argentine Peso | | Buy | | 1/11/2008 | | | 1,400,000 | | | $ | 436,477 | | | $ | 444,019 | | | $ | 7,542 | | |

| Argentine Peso | | Buy | | 2/1/2008 | | | 1,850,000 | | | | 584,519 | | | | 585,664 | | | | 1,145 | | |

| Brazilian Real | | Buy | | 1/11/2008 | | | 600,000 | | | | 322,840 | | | | 336,508 | | | | 13,668 | | |

| Brazilian Real | | Buy | | 2/1/2008 | | | 2,290,000 | | | | 1,290,672 | | | | 1,280,211 | | | | (10,461 | ) | |

| Brazilian Real | | Buy | | 4/1/2008 | | | 1,100,000 | | | | 587,607 | | | | 610,337 | | | | 22,730 | | |

| Chilean Peso | | Buy | | 1/11/2008 | | | 520,000,000 | | | | 1,033,788 | | | | 1,044,006 | | | | 10,218 | | |

| Chilean Peso | | Buy | | 2/1/2008 | | | 477,000,000 | | | | 926,483 | | | | 957,194 | | | | 30,711 | | |

| Chilean Peso | | Buy | | 3/4/2008 | | | 500,000,000 | | | | 973,520 | | | | 1,002,657 | | | | 29,137 | | |

| Colombian Peso | | Buy | | 1/11/2008 | | | 2,200,000,000 | | | | 1,092,353 | | | | 1,088,583 | | | | (3,770 | ) | |

| Colombian Peso | | Buy | | 2/1/2008 | | | 1,100,000,000 | | | | 541,213 | | | | 542,409 | | | | 1,196 | | |

| Czech Koruna | | Buy | | 1/11/2008 | | | 41,000,000 | | | | 2,109,053 | | | | 2,255,041 | | | | 145,988 | | |

| Czech Koruna | | Buy | | 2/1/2008 | | | 20,500,000 | | | | 1,109,415 | | | | 1,128,067 | | | | 18,652 | | |

| Czech Koruna | | Buy | | 4/1/2008 | | | 12,000,000 | | | | 642,077 | | | | 660,977 | | | | 18,900 | | |

| Hong Kong Dollar | | Buy | | 1/11/2008 | | | 22,000,000 | | | | 2,836,148 | | | | 2,822,686 | | | | (13,462 | ) | |

| Hong Kong Dollar | | Buy | | 2/1/2008 | | | 5,700,000 | | | | 736,082 | | | | 731,941 | | | | (4,141 | ) | |

| Hong Kong Dollar | | Buy | | 3/3/2008 | | | 5,536,400 | | | | 713,316 | | | | 711,744 | | | | (1,572 | ) | |

| Hong Kong Dollar | | Sell | | 1/11/2008 | | | 4,500,000 | | | | 577,886 | | | | 577,367 | | | | 519 | | |

| Hungarian Forint | | Buy | | 1/11/2008 | | | 280,000,000 | | | | 1,578,007 | | | | 1,617,997 | | | | 39,990 | | |

| Hungarian Forint | | Buy | | 3/4/2008 | | | 270,000,000 | | | | 1,564,764 | | | | 1,554,261 | | | | (10,503 | ) | |

| Indian Rupee | | Buy | | 1/11/2008 | | | 48,500,000 | | | | 1,217,675 | | | | 1,229,610 | | | | 11,935 | | |

| Indian Rupee | | Buy | | 3/14/2008 | | | 22,000,000 | | | | 557,145 | | | | 556,318 | | | | (827 | ) | |

| Indonesian Rupiah | | Buy | | 2/1/2008 | | | 7,300,000,000 | | | | 800,614 | | | | 776,220 | | | | (24,394 | ) | |

| Indonesian Rupiah | | Buy | | 3/4/2008 | | | 12,380,000,000 | | | | 1,324,678 | | | | 1,313,640 | | | | (11,038 | ) | |

| Israeli Shekel | | Buy | | 1/11/2008 | | | 4,000,000 | | | | 998,303 | | | | 1,039,269 | | | | 40,966 | | |

| Israeli Shekel | | Buy | | 3/4/2008 | | | 4,100,000 | | | | 1,075,692 | | | | 1,065,303 | | | | (10,389 | ) | |

| Malaysian Ringgit | | Buy | | 1/11/2008 | | | 2,545,500 | | | | 747,577 | | | | 769,966 | | | | 22,389 | | |

| Malaysian Ringgit | | Buy | | 2/4/2008 | | | 800,000 | | | | 239,106 | | | | 242,147 | | | | 3,041 | | |

| Malaysian Ringgit | | Sell | | 1/11/2008 | | | 2,545,500 | | | | 764,644 | | | | 769,966 | | | | (5,322 | ) | |

| Mexican Peso | | Buy | | 1/11/2008 | | | 16,300,000 | | | | 1,482,074 | | | | 1,492,325 | | | | 10,251 | | |

| Mexican Peso | | Buy | | 2/1/2008 | | | 8,100,000 | | | | 752,158 | | | | 740,519 | | | | (11,639 | ) | |

| Mexican Peso | | Buy | | 3/4/2008 | | | 20,695,000 | | | | 1,884,876 | | | | 1,887,879 | | | | 3,003 | | |

| Mexican Peso | | Buy | | 3/14/2008 | | | 6,000,000 | | | | 550,055 | | | | 546,909 | | | | (3,146 | ) | |

| New Romania Leu | | Buy | | 1/11/2008 | | | 2,100,000 | | | | 889,039 | | | | 854,801 | | | | (34,238 | ) | |

| New Romania Leu | | Buy | | 3/4/2008 | | | 2,200,000 | | | | 911,501 | | | | 891,365 | | | | (20,136 | ) | |

| New Romania Leu | | Sell | | 3/14/2008 | | | 1,500,000 | | | | 620,091 | | | | 607,230 | | | | 12,861 | | |

See Notes to Financial Statements.

21

Schedule of Investments (concluded)

DEVELOPING LOCAL MARKETS FUND December 31, 2007

Forward

Foreign Currency

Contracts | | Transaction

Type | | Expiration

Date | | Foreign

Currency | | U.S. $ Cost on

Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation/

(Depreciation) | |

| New Turkish Lira | | Buy | | 1/11/2008 | | | 3,000,000 | | | $ | 2,401,922 | | | $ | 2,549,912 | | | $ | 147,990 | | |

| New Turkish Lira | | Buy | | 2/1/2008 | | | 1,500,000 | | | | 1,222,992 | | | | 1,266,229 | | | | 43,237 | | |

| New Turkish Lira | | Buy | | 3/4/2008 | | | 2,375,000 | | | | 1,959,086 | | | | 1,985,756 | | | | 26,670 | | |

| Philippines Peso | | Buy | | 1/11/2008 | | | 27,000,000 | | | | 596,421 | | | | 653,876 | | | | 57,455 | | |

| Philippines Peso | | Buy | | 2/1/2008 | | | 24,000,000 | | | | 559,963 | | | | 580,762 | | | | 20,799 | | |

| Philippines Peso | | Buy | | 3/4/2008 | | | 22,655,000 | | | | 531,583 | | | | 547,568 | | | | 15,985 | | |

| Philippines Peso | | Sell | | 2/1/2008 | | | 24,000,000 | | | | 578,871 | | | | 580,762 | | | | (1,891 | ) | |

| Polish Zloty | | Buy | | 1/11/2008 | | | 4,300,000 | | | | 1,622,642 | | | | 1,748,029 | | | | 125,387 | | |

| Polish Zloty | | Buy | | 2/1/2008 | | | 3,800,000 | | | | 1,507,279 | | | | 1,544,094 | | | | 36,815 | | |

| Polish Zloty | | Buy | | 3/4/2008 | | | 2,400,000 | | | | 977,597 | | | | 974,570 | | | | (3,027 | ) | |

| Russian Ruble | | Buy | | 1/10/2008 | | | 28,000,000 | | | | 1,087,028 | | | | 1,141,032 | | | | 54,004 | | |

| Russian Ruble | | Buy | | 3/6/2008 | | | 15,000,000 | | | | 612,182 | | | | 610,944 | | | | (1,238 | ) | |

| Singapore Dollar | | Buy | | 1/11/2008 | | | 3,900,000 | | | | 2,661,003 | | | | 2,711,608 | | | | 50,605 | | |

| Singapore Dollar | | Buy | | 2/1/2008 | | | 1,300,000 | | | | 892,796 | | | | 905,284 | | | | 12,488 | | |

| Singapore Dollar | | Buy | | 3/4/2008 | | | 1,425,000 | | | | 992,616 | | | | 994,202 | | | | 1,586 | | |

| Slovakian Koruna | | Buy | | 1/11/2008 | | | 34,000,000 | | | | 1,420,811 | | | | 1,479,523 | | | | 58,712 | | |

| Slovakian Koruna | | Buy | | 2/1/2008 | | | 17,300,000 | | | | 738,244 | | | | 753,017 | | | | 14,773 | | |

| Slovakian Koruna | | Sell | | 2/1/2008 | | | 14,000,000 | | | | 620,898 | | | | 609,378 | | | | 11,520 | | |

| Slovakian Koruna | | Sell | | 3/14/2008 | | | 14,000,000 | | | | 620,832 | | | | 609,952 | | | | 10,880 | | |

| South African Rand | | Buy | | 1/11/2008 | | | 6,700,000 | | | | 1,004,558 | | | | 978,386 | | | | (26,172 | ) | |

| South African Rand | | Buy | | 2/1/2008 | | | 5,400,000 | | | | 810,993 | | | | 785,553 | | | | (25,440 | ) | |

| South African Rand | | Buy | | 3/4/2008 | | | 3,000,000 | | | | 435,603 | | | | 433,813 | | | | (1,790 | ) | |

| Taiwan Dollar | | Buy | | 2/1/2008 | | | 23,500,000 | | | | 728,231 | | | | 728,595 | | | | 364 | | |

| Taiwan Dollar | | Sell | | 2/1/2008 | | | 23,500,000 | | | | 731,631 | | | | 728,594 | | | | 3,037 | | |

Net Unrealized Appreciation on Forward Foreign Currency

Contracts | | | | | | | | | | | | | | | | | | $ | 912,553 | | |

Industry classifications have not been audited by Deloitte & Touche LLP.

See Notes to Financial Statements.

22

Statements of Assets and Liabilities

December 31, 2007

| | | Global

Equity Fund | | Developing Local

Markets Fund | |

| ASSETS: | |

| Investment in securities, at cost | | $ | 111,173,980 | | | $ | 51,367,394 | | |

| Investment in securities, at value | | $ | 124,792,567 | | | $ | 52,076,025 | | |

| Cash | | | – | | | | 6,172 | | |

| Foreign cash, at value (cost $342,223 and $1,489,415, respectively) | | | 346,591 | | | | 1,476,424 | | |

| Deposits with brokers for futures collateral | | | – | | | | 100,500 | | |

| Receivables: | |

| Interest and dividends | | | 158,504 | | | | 296,120 | | |

| Investment securities sold | | | 9,543 | | | | – | | |

| Capital shares sold | | | 449,598 | | | | 31,678 | | |

| From advisor (See Note 3) | | | 17,846 | | | | – | | |

| Unrealized appreciation on forward foreign currency contracts | | | – | | | | 1,137,149 | | |

| Prepaid expenses and other assets | | | 21,946 | | | | 40,032 | | |

| Total assets | | | 125,796,595 | | | | 55,164,100 | | |

| LIABILITIES: | |

| Payables: | |

| Investment securities purchased | | | 1,146,070 | | | | – | | |

| Capital shares reacquired | | | 434,665 | | | | 90,419 | | |

| Management fees | | | 75,988 | | | | 23,493 | | |

| 12b-1 distribution fees | | | 55,142 | | | | 29,031 | | |

| Fund administration | | | 4,068 | | | | 1,887 | | |

| Directors' fees | | | 28,845 | | | | 44,676 | | |

| Variation margin on future contracts | | | – | | | | 35,997 | | |

| Unrealized depreciation on forward foreign currency contracts | | | – | | | | 224,596 | | |

| Distributions payable | | | – | | | | 151,532 | | |

| Accrued expenses and other liabilities | | | 159,306 | | | | 230,203 | | |

| Total liabilities | | | 1,904,084 | | | | 831,834 | | |

| NET ASSETS | | $ | 123,892,511 | | | $ | 54,332,266 | | |

| COMPOSITION OF NET ASSETS: | |

| Paid-in capital | | $ | 108,727,139 | | | $ | 59,960,515 | | |

| Undistributed (distributions in excess of) net investment income | | | (47,960 | ) | | | 1,510,528 | | |

Accumulated net realized gain (loss) on investments,

futures contracts and foreign currency related transactions | | | 1,592,688 | | | | (8,674,837 | ) | |

Net unrealized appreciation on investments,

futures contracts and translation of assets and liabilities

denominated in foreign currencies | | | 13,620,644 | | | | 1,536,060 | | |

| Net Assets | | $ | 123,892,511 | | | $ | 54,332,266 | | |

See Notes to Financial Statements.

23

Statements of Assets and Liabilities (concluded)

December 31, 2007

| | | Global

Equity Fund | | Developing Local

Markets Fund | |

| Net assets by class: | |

| Class A Shares | | $ | 94,321,487 | | | $ | 44,148,379 | | |

| Class B Shares | | $ | 12,653,427 | | | $ | 3,302,777 | | |

| Class C Shares | | $ | 16,103,883 | | | $ | 5,952,403 | | |

| Class F Shares | | $ | 9,861 | | | $ | 10,337 | | |

| Class I Shares | | $ | 803,853 | | | $ | 888,280 | | |

| Class P Shares | | | – | | | $ | 9,454 | | |

| Class R2 Shares | | | – | | | $ | 10,317 | | |

| Class R3 Shares | | | – | | | $ | 10,319 | | |

| Outstanding shares by class: | |

| Class A Shares (430 million and 415 million shares of common stock | |

| authorized respectively, $.001 par value) | | | 7,173,148 | | | | 6,559,097 | | |

| Class B Shares (15 million and 30 million shares of common stock | |

| authorized respectively, $.001 par value) | | | 1,032,710 | | | | 489,909 | | |

| Class C Shares (20 million and 20 million shares of common stock | |

| authorized respectively, $.001 par value) | | | 1,311,677 | | | | 881,736 | | |

| Class F Shares (20 million and 20 million shares of common stock | |

| authorized respectively, $.001 par value) | | | 751.470 | | | | 1,536 | | |

| Class I Shares (15 million and 15 million shares of common stock | |

| authorized respectively, $.001 par value) | | | 61,008 | | | | 131,920 | | |

| Class P Shares (20 million and 20 million shares of common stock | |

| authorized respectively, $.001 par value) | | | – | | | | 1,409 | | |

| Class R2 Shares (20 million and 20 million shares of common stock | |

| authorized respectively, $.001 par value) | | | – | | | | 1,533 | | |

| Class R3 Shares (20 million and 20 million shares of common stock | |

| authorized respectively, $.001 par value) | | | – | | | | 1,534 | | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | |

| Class A Shares–Net asset value | | $ | 13.15 | | | $ | 6.73 | | |

| Class A Shares–Maximum offering price | |

| (Net asset value plus sales charge of 5.75% and 4.75%, respectively) | | $ | 13.95 | | | $ | 7.07 | | |

| Class B Shares–Net asset value | | $ | 12.25 | | | $ | 6.74 | | |

| Class C Shares–Net asset value | | $ | 12.28 | | | $ | 6.75 | | |

| Class F Shares–Net asset value | | $ | 13.12 | | | $ | 6.73 | | |

| Class I Shares–Net asset value | | $ | 13.18 | | | $ | 6.73 | | |

| Class P Shares–Net asset value | | | – | | | $ | 6.71 | | |

| Class R2 Shares–Net asset value | | | – | | | $ | 6.73 | | |

| Class R3 Shares–Net asset value | | | – | | | $ | 6.73 | | |

See Notes to Financial Statements.

24

Statements of Operations

For the Year Ended December 31, 2007

| | | Global

Equity Fund | | Developing Local

Markets Fund | |

| Investment income: | |

| Dividends (net of foreign witholding taxes of $113,793) | | $ | 2,241,643 | | | $ | – | | |

Interest (net of foreign witholding taxes of $0 and

$2,252, respectively) | | | 166,357 | | | | 2,578,603 | | |

| Total investment income | | | 2,408,000 | | | | 2,578,603 | | |

| Expenses: | |

| Management fees | | | 881,275 | | | | 293,741 | | |

| 12b-1 distribution plan–Class A | | | 313,690 | | | | 167,576 | | |

| 12b-1 distribution plan–Class B | | | 123,273 | | | | 36,127 | | |

| 12b-1 distribution plan–Class C | | | 148,966 | | | | 62,510 | | |

| 12b-1 distribution plan–Class F | | | 3 | | | | 3 | | |

| 12b-1 distribution plan–Class P | | | – | | | | 36 | | |

| 12b-1 distribution plan–Class R2 | | | – | | | | 16 | | |

| 12b-1 distribution plan–Class R3 | | | – | | | | 13 | | |

| Shareholder servicing | | | 371,223 | | | | 147,893 | | |

| Professional | | | 56,046 | | | | 164,954 | | |

| Reports to shareholders | | | 98,267 | | | | 114,209 | | |

| Fund administration | | | 47,001 | | | | 23,499 | | |

| Custody | | | 74,250 | | | | 29,150 | | |

| Interest expense (See Note 2(n)) | | | - | | | | 4,387 | | |

| Directors' fees | | | 4,281 | | | | 2,184 | | |

| Registration | | | 62,341 | | | | 71,651 | | |

| Other | | | 5,548 | | | | 18,216 | | |

| Gross expenses | | | 2,186,164 | | | | 1,136,165 | | |

| Expense reductions (See Note 7) | | | (3,788 | ) | | | (4,144 | ) | |

| Expenses assumed by advisor (See Note 3) | | | (127,651 | ) | | | (402,608 | ) | |

| Net expenses | | | 2,054,725 | | | | 729,413 | | |

| Net investment income | | | 353,275 | | | | 1,849,190 | | |

| Net realized and unrealized gain: | |

Net realized gain on investments, futures contracts and

foreign currency related transactions

(net of foreign capital gains tax) | | | 12,750,606 | | | | 2,395,847 | | |

Net change in unrealized appreciation on investments,

futures contracts and translation of assets and liabilities

denominated in foreign currencies | | | (350,004 | ) | | | (49,255 | ) | |

| Net realized and unrealized gain | | | 12,400,602 | | | | 2,346,592 | | |

| Net Increase in Net Assets Resulting From Operations | | $ | 12,753,877 | | | $ | 4,195,782 | | |

See Notes to Financial Statements.

25

Statements of Changes in Net Assets

| | | Global Equity Fund | |

| INCREASE IN NET ASSETS | | For the Year Ended

December 31, 2007 | | For the Year Ended

December 31, 2006 | |

| Operations: | |

| Net investment income | | $ | 353,275 | | | $ | 212,791 | | |

Net realized gain on investments and foreign currency

related transactions (net of foreign capital gains tax) | | | 12,750,606 | | | | 10,002,322 | | |

Net change in unrealized appreciation on investments

and translation of assets and liabilities

denominated in foreign currencies | | | (350,004 | ) | | | 5,744,858 | | |

| Net increase in net assets resulting from operations | | | 12,753,877 | | | | 15,959,971 | | |

| Distributions to shareholders from: | |

| Net investment income | |

| Class A | | | (188,552 | ) | | | (254,181 | ) | |

| Class B | | | – | | | | (10,226 | ) | |

| Class C | | | – | | | | (10,477 | ) | |

| Class F | | | (47 | ) | | | - | | |

| Class I | | | (4,225 | ) | | | (3,566 | ) | |

| Net realized gain | |

| Class A | | | (9,949,992 | ) | | | (7,029,455 | ) | |

| Class B | | | (1,436,997 | ) | | | (1,008,862 | ) | |

| Class C | | | (1,803,400 | ) | | | (1,109,269 | ) | |

| Class F | | | (868 | ) | | | - | | |

| Class I | | | (81,544 | ) | | | (48,203 | ) | |

| Total distributions to shareholders | | | (13,465,625 | ) | | | (9,474,239 | ) | |

| Capital share transactions (Net of share conversions) (See Note 11): | |

| Net proceeds from sales of shares | | | 26,278,759 | | | | 22,199,929 | | |