Exhibit 99.2

Exhibit 99.2

PICO Holdings

PICO Holdings, Inc.

Nasdaq: PICO

May 2009

Safe Harbor Statement

This presentation may contain “forward-looking statements.” Forward- looking statements often address current expected future business and financial performance, and may contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements may address matters that are uncertain. These uncertainties may cause actual future results to be materially different than those expressed in the forward-looking statements. PICO does not undertake to update any forward-looking statements, and undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Other risks and uncertainties are detailed from time to time in PICO’s filings with the U.S. Securities and Exchange Commission, including those described under the heading “Risk Factors” in the Company’s annual report, quarterly reports and other periodic reports.

PICO Holdings, Inc.

We are a diversified holding company that seeks to acquire assets and businesses that we identify as undervalued and are unique or strategic and where our participation in operations can result in the recognition of fair value for the business as well as create additional value.

Our objective is to maximize long-term growth in book value per share.

“Opportunism is PICO’s stock-in-trade. It buys assets not because they are pretty, or because they seem to make a coherent fit with assets previously acquired; it buys them because they are value-laden” (Grant’s, May 30, 2008).

PICO Overview

Acquires and develops unique undervalued assets including:

Water Assets, primarily in the southwestern United States

Undeveloped Real Estate

Book value per share increase from $5.83 in 1994 to $25.36 as of December 31, 2008

15 year CAGR of approximately 15% pre-tax with minimal leverage

Increasing supply/demand imbalances due to continued population growth in core markets

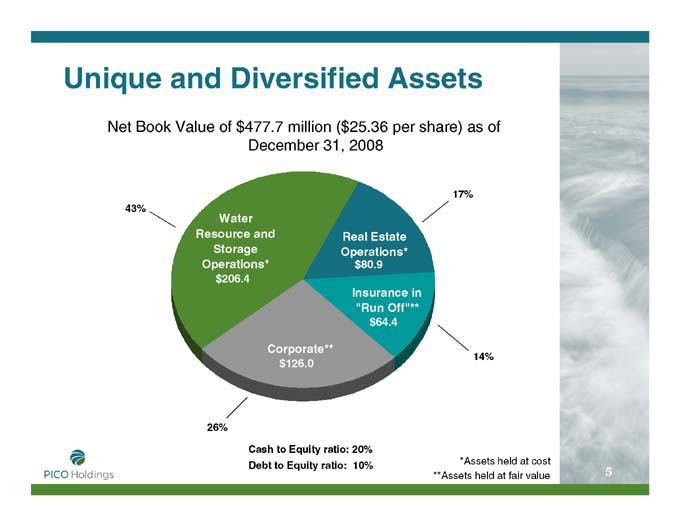

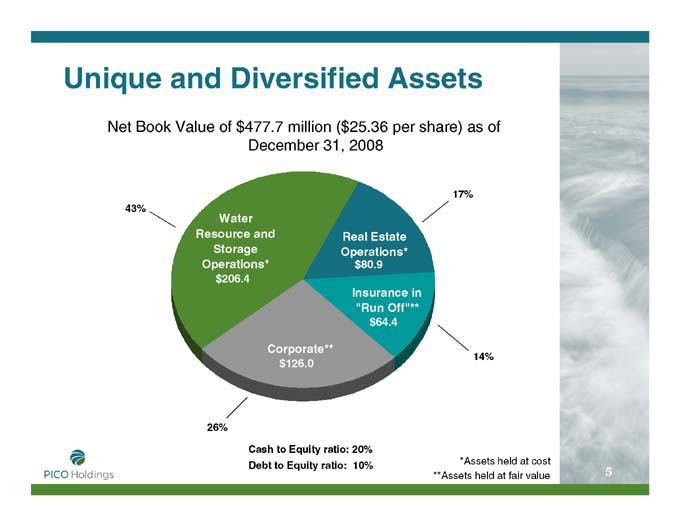

Unique and Diversified Assets

Net Book Value of $477.7 million ($25.36 per share) as of December 31, 2008

17% 43% Water Resource and Real Estate Storage Operations* Operations* $80.9 $206.4 Insurance in “Run Off”**

$64.4

Corporate**

14% $126.0

26%

Cash to Equity ratio: 20%

Debt to Equity ratio: 10%

*Assets held at cost

**Assets held at fair value

Water: A Critical Issue for the Southwest

Significant population growth relative to decreasing availability of water resources

Key challenges:

Access to new sources of economic water

Limited and finite clean water supply

Inadequate water storage infrastructure

Water and land policies influencing resource utilization

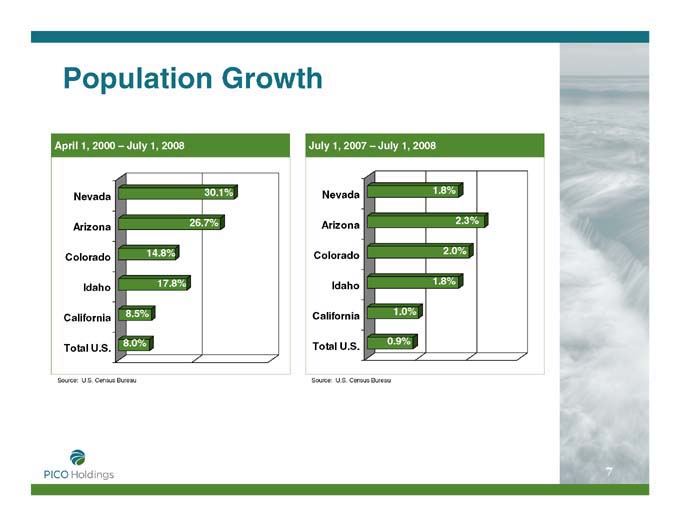

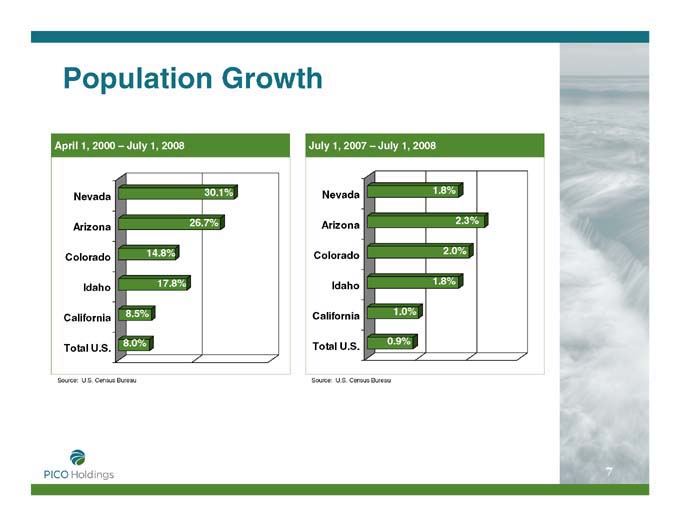

Population Growth

April 1, 2000 – July 1, 2008

Nevada 30.1% Arizona 26.7% Colorado 14.8% Idaho 17.8% California 8.5%

8.0% Total U.S.

Source: U.S. Census Bureau

July 1, 2007 – July 1, 2008

Nevada 1.8% Arizona 2.3% Colorado 2.0% Idaho 1.8% California 1.0%

0.9% Total U.S.

Source: U.S. Census Bureau

PICO’s Water Assets Located in Areas of Greatest Need

Southwestern U.S. water supply forecast through 2025

Salt Lake City

Denver Carson City Sacramento

Santa Fe

Phoenix

Unmet rural water needs Conflict potential – Moderate Conflict potential – Substantial Conflict potential – Highly likely

Colorado water rights

Vidler Water Recharge Facility

Harquahala Valley Irrigation District

Lincoln County Project

Tule desert groundwater and Toquop Energy, Inc.

Sandy Valley

Semitropic Water Storage District

Fish Springs Ranch

Diablo Plateau

Austin

Source: Department of Interior and Vidler Water Company

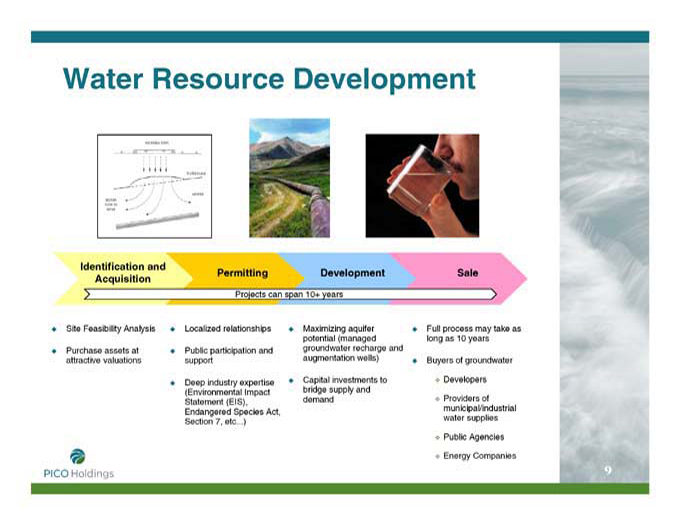

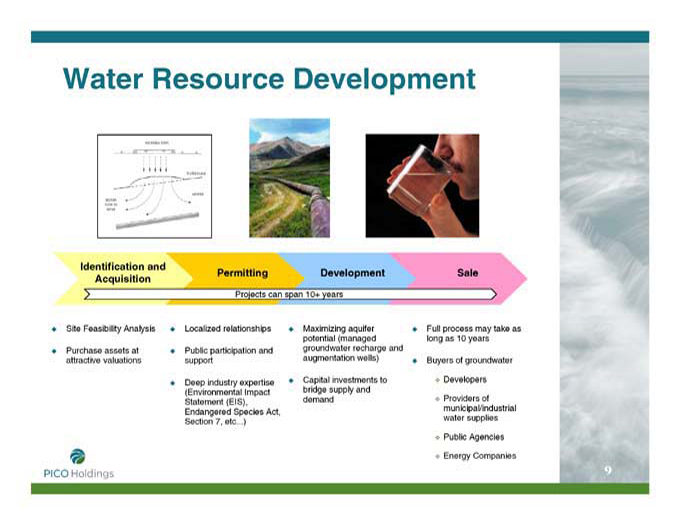

Water Resource Development

Identification and Acquisition

Permitting Development Sale

Projects can span 10+ years

Site Feasibility Analysis

Purchase assets at attractive valuations

Localized relationships

Public participation and support

Deep industry expertise (Environmental Impact Statement (EIS), Endangered Species Act, Section 7, etc...)

Maximizing aquifer potential (managed groundwater recharge and augmentation wells)

Capital investments to bridge supply and demand

Full process may take as long as 10 years

Buyers of groundwater

Developers

Providers of municipal/industrial water supplies

Public Agencies

Energy Companies

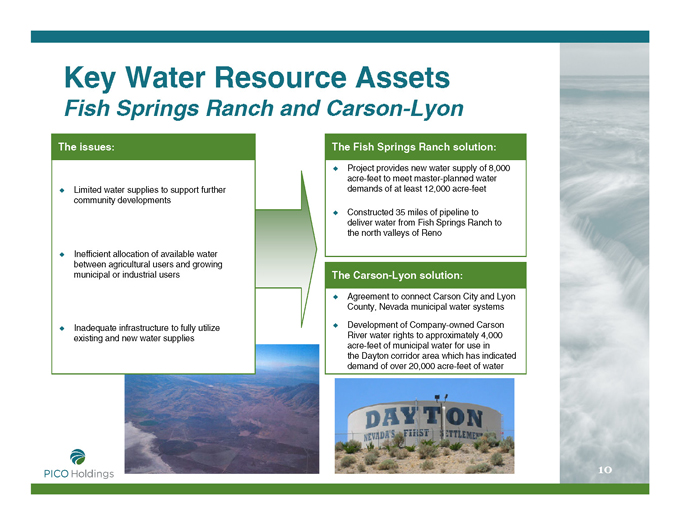

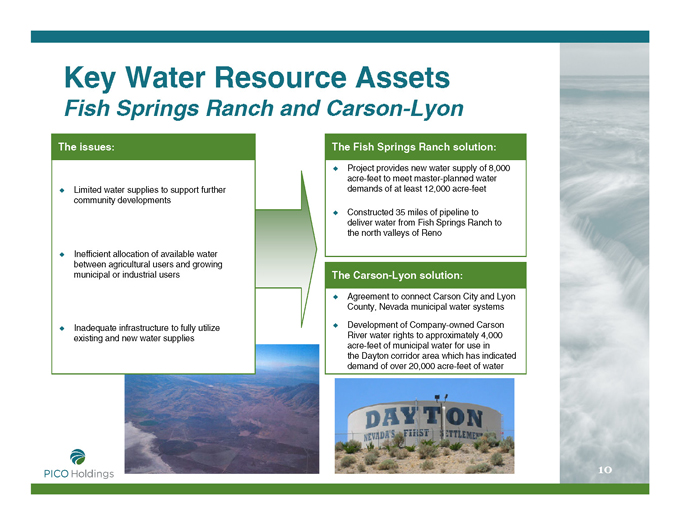

Key Water Resource Assets

Fish Springs Ranch and Carson-Lyon

The issues:

Limited water supplies to support further community developments

Inefficient allocation of available water between agricultural users and growing municipal or industrial users

Inadequate infrastructure to fully utilize existing and new water supplies

The Fish Springs Ranch solution:

Project provides new water supply of 8,000 acre-feet to meet master-planned water demands of at least 12,000 acre-feet

Constructed 35 miles of pipeline to deliver water from Fish Springs Ranch to the north valleys of Reno

The Carson-Lyon solution:

Agreement to connect Carson City and Lyon County, Nevada municipal water systems

Development of Company-owned Carson River water rights to approximately 4,000 acre-feet of municipal water for use in the Dayton corridor area which has indicated demand of over 20,000 acre-feet of water

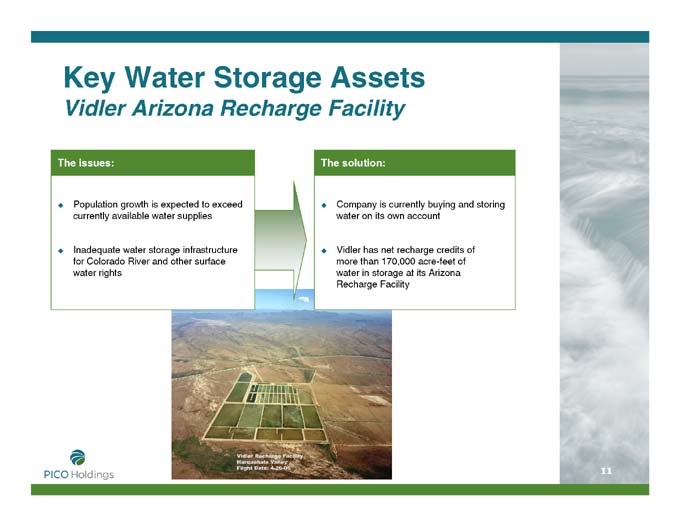

Key Water Storage Assets

Vidler Arizona Recharge Facility

The issues:

Population growth is expected to exceed currently available water supplies

Inadequate water storage infrastructure for Colorado River and other surface water rights

The solution:

Company is currently buying and storing water on its own account

Vidler has net recharge credits of more than 170,000 acre-feet of water in storage at its Arizona Recharge Facility

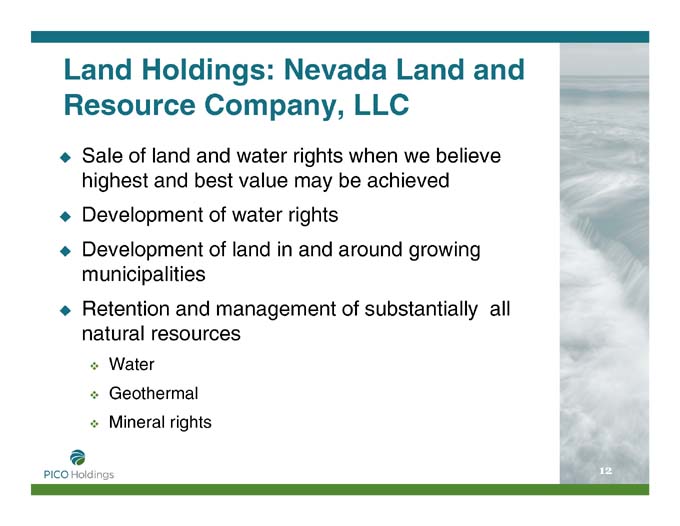

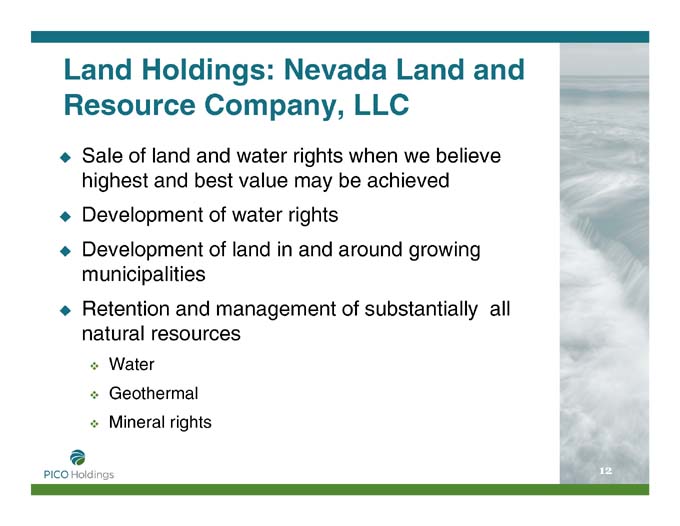

Land Holdings: Nevada Land and Resource Company, LLC

Sale of land and water rights when we believe highest and best value may be achieved

Development of water rights

Development of land in and around growing municipalities

Retention and management of substantially all natural resources

Water

Geothermal

Mineral rights

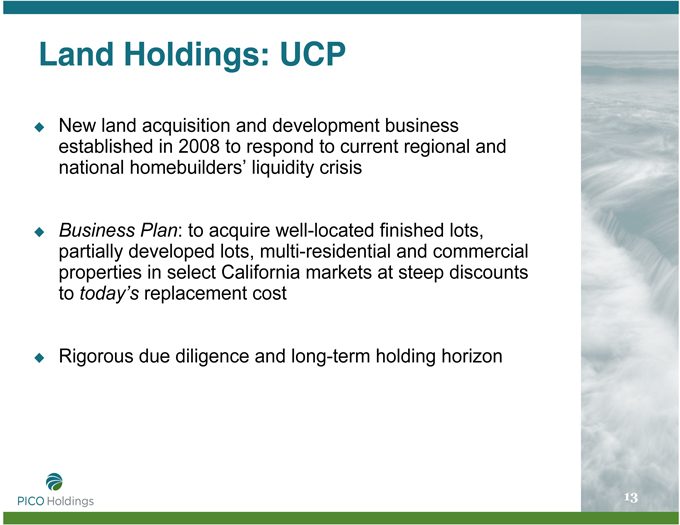

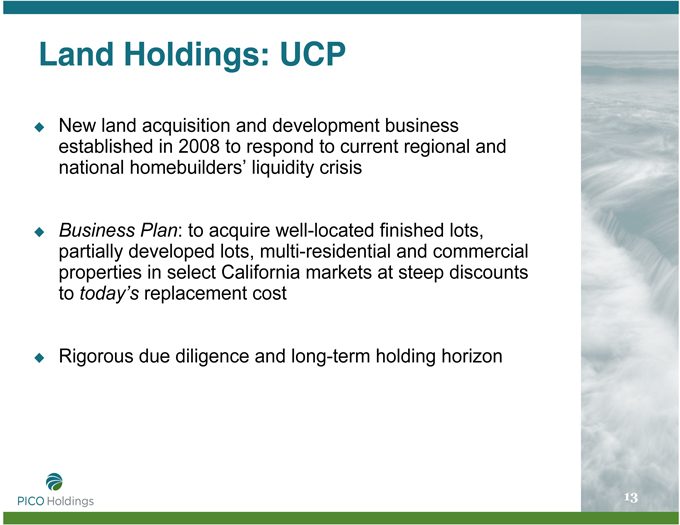

Land Holdings: UCP

New land acquisition and development business established in 2008 to respond to current regional and national homebuilders’ liquidity crisis

Business Plan: to acquire well-located finished lots, partially developed lots, multi-residential and commercial properties in select California markets at steep discounts to today’s replacement cost

Rigorous due diligence and long-term holding horizon

Insurance in “Run Off”

Insurance in “Run Off”

Description of Assets

Two holdings:

Physicians Insurance of Ohio – running off medical professional liability insurance loss reserves

Citation Insurance Company

– running off property and casualty and workers’ compensation loss reserves

Strategy

Earn excess investment returns which accrue to shareholders, not policy holders

Since 2000, equities within PICO’s insurance companies’ investment portfolios have generated a total return of 109%

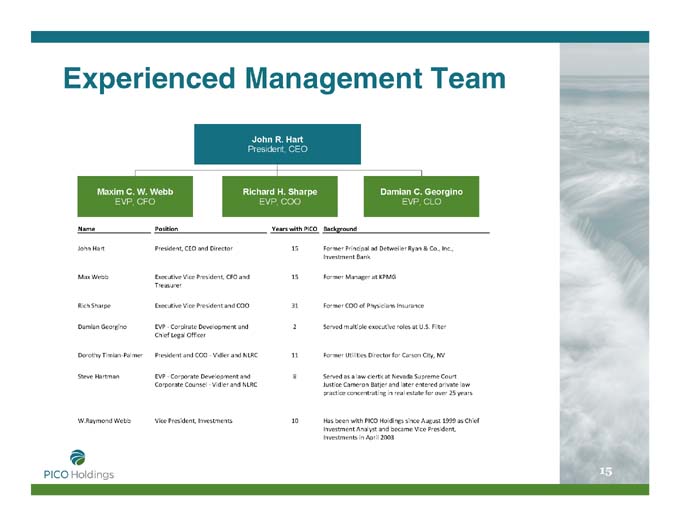

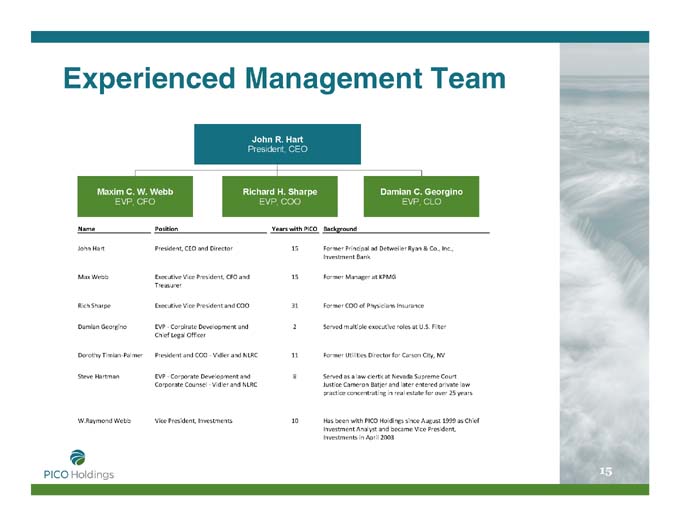

Experienced Management Team

John R. Hart

President, CEO

Maxim C. W. Webb Richard H. Sharpe Damian C. Georgino

EVP, CFO EVP, COO EVP, CLO

Name Position Years with PICO Background

John Hart President, CEO and Director 15 Former Principal ad Detweiler Ryan & Co., Inc., Investment Bank

Max Webb Executive Vice President, CFO and 15 Former Manager at KPMG Treasurer

Rich Sharpe Executive Vice President and COO 31 Former COO of Physicians Insurance

Damian Georgino EVP - Corpirate Development and 2 Served multiple executive roles at U.S. Filter Chief Legal Officer

Dorothy Timian-Palmer President and COO - Vidler and NLRC 11 Former Utilities Director for Carson City, NV

Steve Hartman EVP - Corporate Development and 8 Served as a law clertk at Nevada Supreme Court Corporate Counsel - Vidler and NLRC Justice Cameron Batjer and later entered private law practice concentrating in real estate for over 25 years

W.Raymond Webb Vice President, Investments 10 Has been with PICO Holdings since August 1999 as Chief Investment Analyst and became Vice President, Investments in April 2003

Value Creation and Preservation

Book Value per Share

$30.00

$27.92

$25.52 $25.36

$25.00

$22.67

$20.00 $19.40

$15.00

$10.00

2004 2005 2006 2007 2008

Year End

Shareholders’ Equity

($ in millions) $600.0 $525.9 $500.0 $477.7

$405.2 $400.0

$300.9 $300.0 $239.9

$200.0

$100.0

–

2004 2005 2006 2007 2008

Year End

15 Year Book Value per Share CAGR of Approximately 15% Pre-Tax

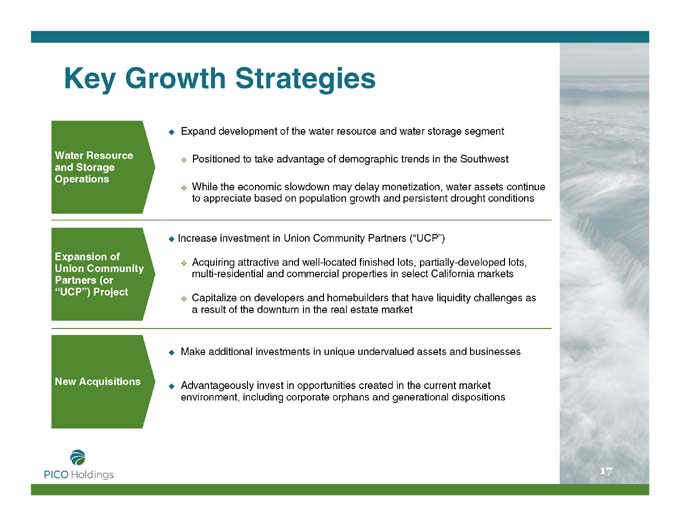

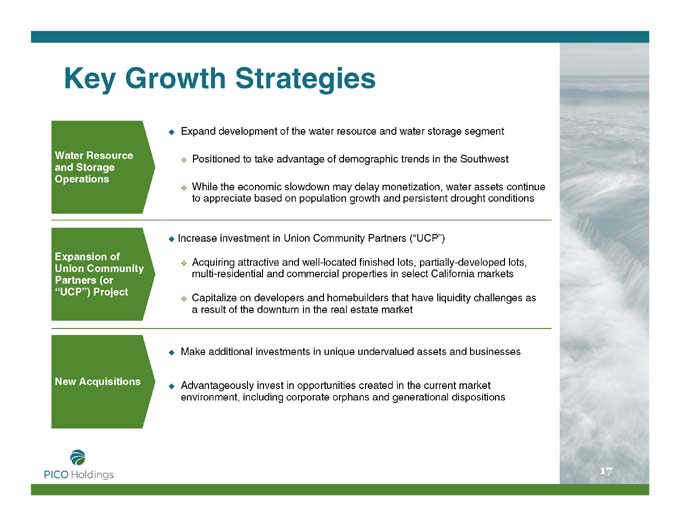

Key Growth Strategies

Expand development of the water resource and water storage segment

Water Resource and Storage Operations

Positioned to take advantage of demographic trends in the Southwest

While the economic slowdown may delay monetization, water assets continue to appreciate based on population growth and persistent drought conditions

Increase investment in Union Community Partners (“UCP”)

Expansion of Union Community Partners (or “UCP”) Project

Acquiring attractive and well-located finished lots, partially-developed lots,

multi-residential and commercial properties in select California markets

Capitalize on developers and homebuilders that have liquidity challenges as a result of the downturn in the real estate market

Make additional investments in unique undervalued assets and businesses

New Acquisitions

Advantageously invest in opportunities created in the current market environment, including corporate orphans and generational dispositions

Investment Considerations

Unique, diversified assets

Strategic water and land assets

Opportunity for liquid investment in compelling but typically non-liquid businesses and asset classes

Increasing supply/demand imbalances due to continued population growth in core markets

Book value per share increase from $5.83 in 1994 to $25.36 as of December 31, 2008

15 year CAGR of approximately 15% pre-tax with minimal leverage

PICO Holdings