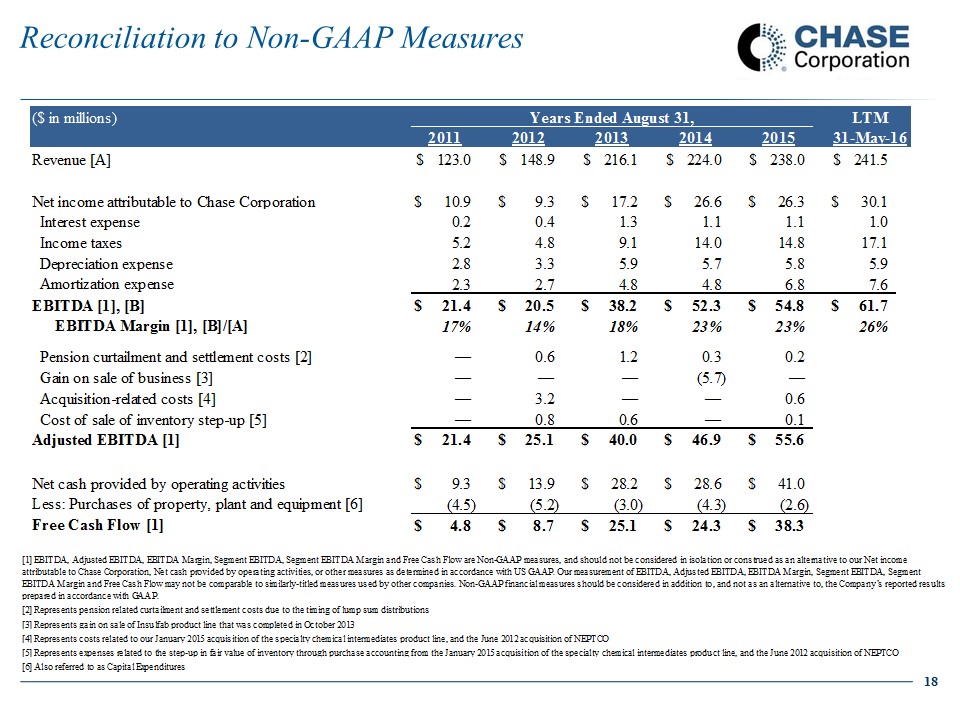

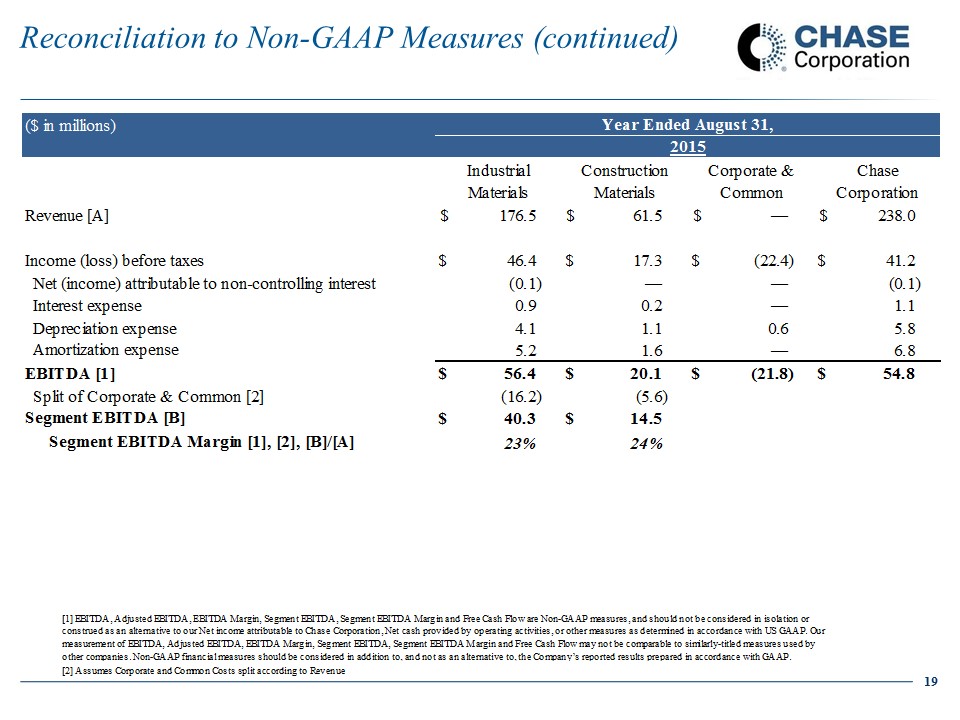

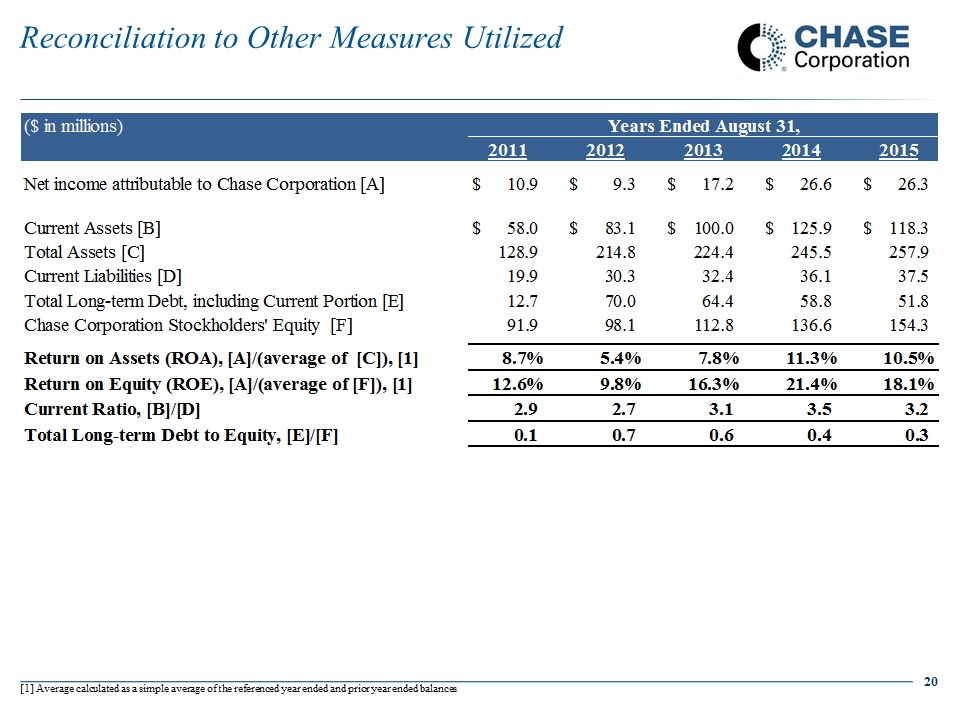

| Safe Harbor Statement Forward-Looking Statements Certain statements in this presentation are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated”; “forecasted”; and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. In order to comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company's actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company's forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company's business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes and the highly competitive environment in which the Company operates. Important factors that could cause actual results to differ materially from our expectations are disclosed under Item 1A (“Risk Factors”) in our latest Annual Report on Form 10-K filed with the Securities and Exchange Commission, and should be read together with this presentation. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. Further Information This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in our public filings. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP financial measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided within this presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those measures provided. EBITDA, EBITDA Margin, Adjusted EBITDA, Segment EBITDA, Segment EBITDA Margin and Free Cash Flow are non-GAAP financial measures. The Company believes that EBITDA, EBITDA Margin, Adjusted EBITDA, Segment EBITDA, Segment EBITDA Margin and Free Cash Flow are useful performance measures which are used by its executive management team and board of directors to measure operating performance, to allocate resources, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes EBITDA, EBITDA Margin, Adjusted EBITDA, Segment EBITDA, Segment EBITDA Margin and Free Cash Flow are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. Our measurement of EBITDA, EBITDA Margin, Adjusted EBITDA, Segment EBITDA, Segment EBITDA Margin and Free Cash Flow may not be comparable to similarly-titled measures used by other companies. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. See the Financial Appendix for a reconciliation of these non-GAAP measures to the most comparable GAAP financial measures. 3 |