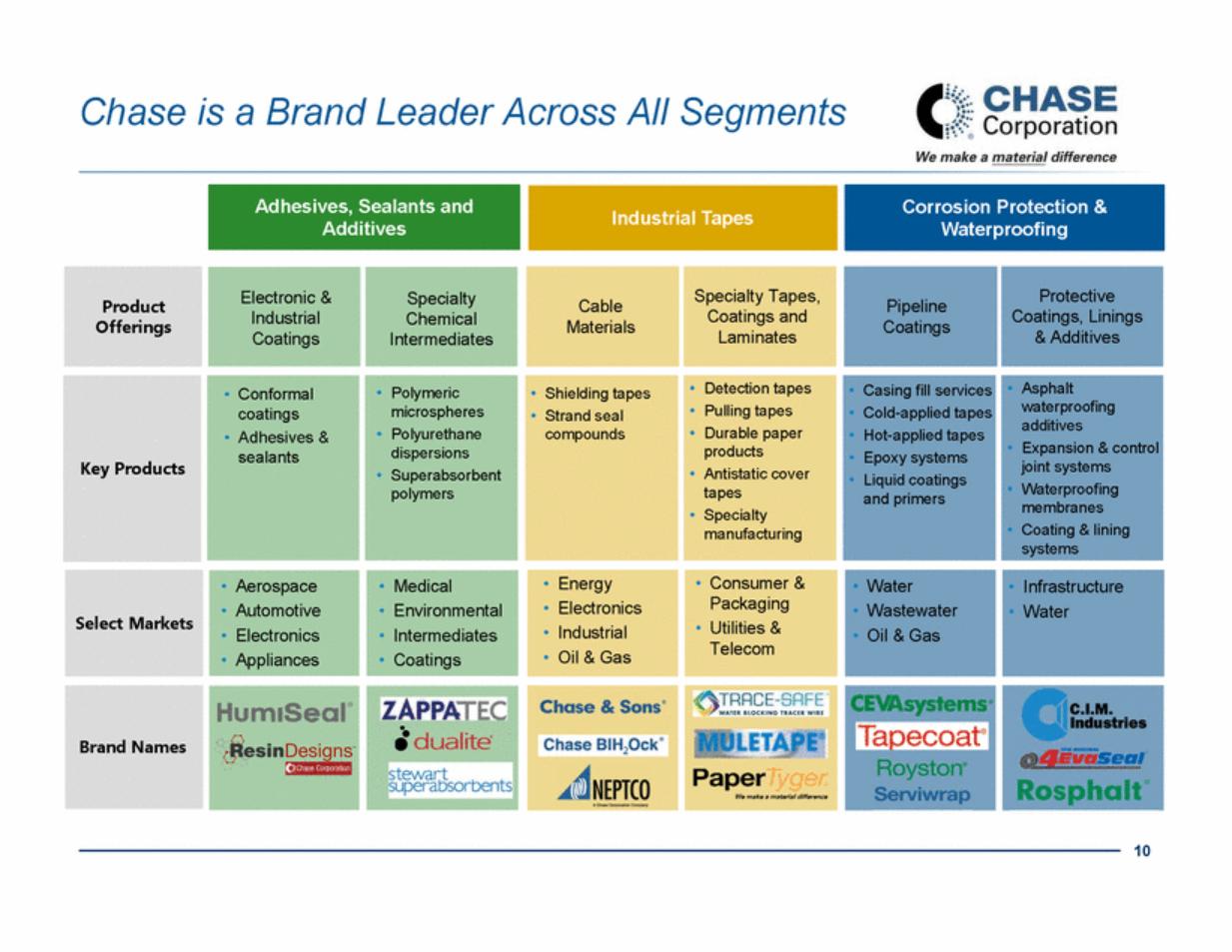

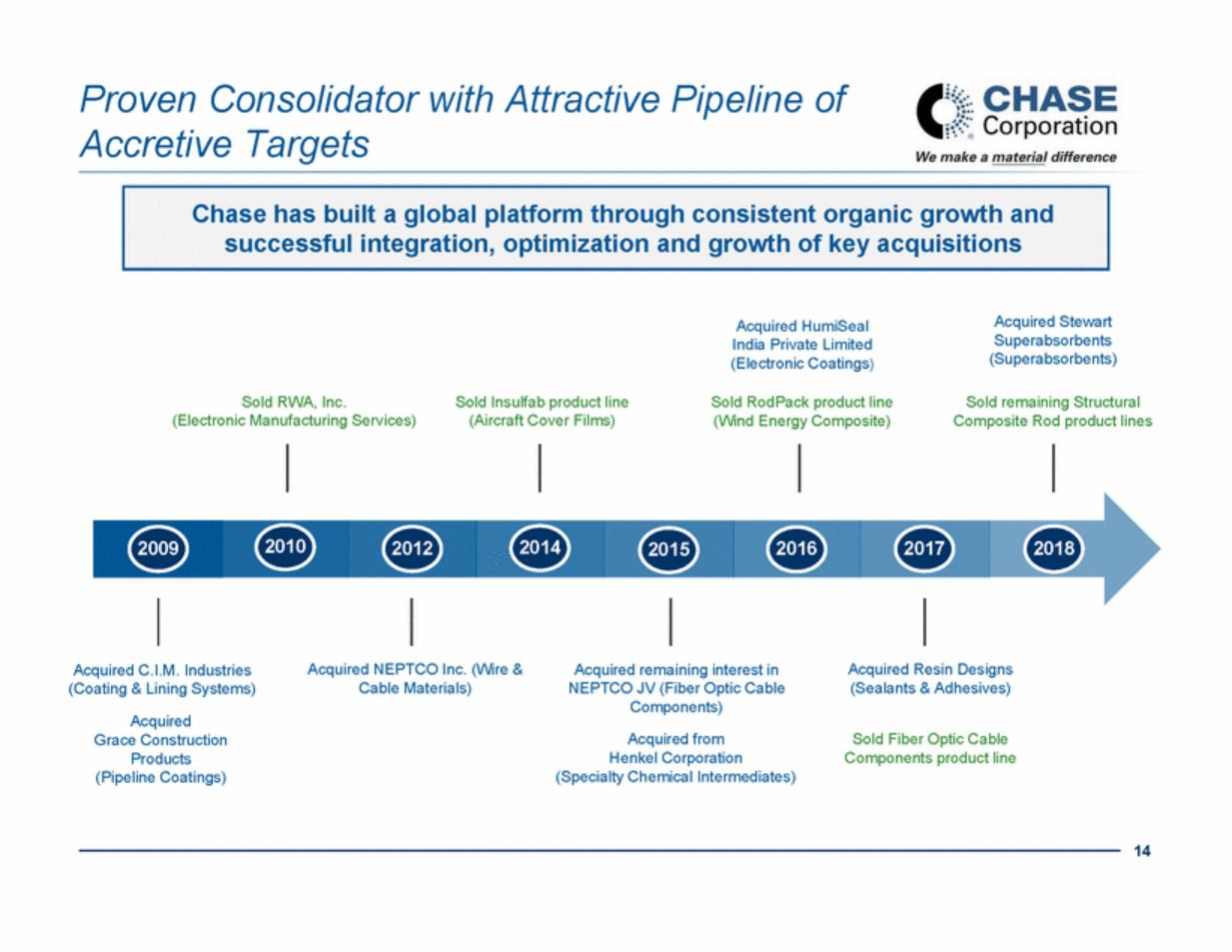

| Q&A Section 5: Products & Markets Review your product mix now and how it has changed over time? Chase has grown from its wire and cable roots into a broad range of industrial and construction-related markets, specializing in protective materials for high-reliability applications with specialized properties and formulations. What end-markets are your products sold into? Changes over time? Our primary markets span multiple industries (telecommunication, electronics, energy distribution, automotive, appliance, general industrial, infrastructure (water, oil, natural gas), bridge & highway, commercial building, housing, medical, consumer, environmental, mining/drilling, etc.). Our fiscal 2015 acquisition of our specialty chemical intermediates product line, our fiscal 2017 acquisition of Resin Designs and our fiscal 2018 acquisition of Stewart Superabsorbents/Zappa-Tec (“Zappa Stewart”) represent major immediate and long-term opportunities for growth by providing us entry into new markets and expansion in certain markets we already serve. Do you have any significant customer concentration? No. During fiscal 2017, 2018 and 2019, no one customer accounted for as much as 10% of sales. The acquisitions that we have made in recent years have expanded our customer roster and broadened our end-market reach, reducing our customer and industry concentration as a welcome side-benefit. What is the cost of your product as a percent of the product it is being sold into? It obviously varies by product line, but we believe it to generally be a very small part of the cost of the end product or project. How critical are your products to the performance of the products that they are incorporated into? Our products are not typically the “active” part of an end product (e.g., they do not transmit a signal or energy), but rather allow the end product to perform more reliably over time, protect its warranty and increase its durability. 28 |