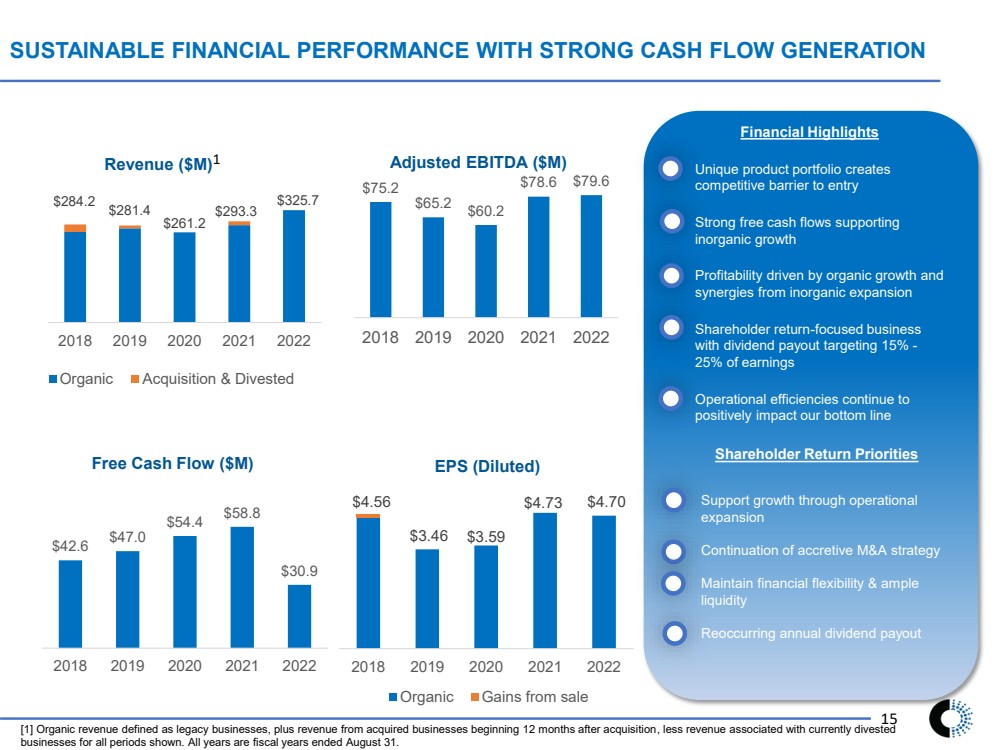

| 2 SAFE HARBOR, REFERENCE TO PUBLIC FILINGS AND NON-GAAP MEASURES STATEMENTS Forward-Looking Statements Certain statements in this presentation are forward-looking. These may be identified by the use of forward-looking words or phrases including, but not limited to “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated”; “forecasted”; “projected”; and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company's actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company's forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company's business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; expected impact of the coronavirus disease 2019 (COVID-19) pandemic on the Company's businesses; rapid technology changes and the highly competitive environment in which the Company operates. This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in our public filings. The Company does not assume any obligation to update or revise any forward-looking statement made in this release or that may from time to time be made by or on behalf of the Company. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in the Company’s filings with the Securities and Exchange Commission, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of the Company’s Annual Report on Form 10-K for the year ended August 31, 2022. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. Non-GAAP Financial Measures We believe that EBITDA, Adjusted EBITDA, Free Cash Flow and Organic Revenue are useful performance measures. They are used by our executive management team to measure operating performance, to allocate resources, to evaluate the effectiveness of our business strategies and to communicate with our Board of Directors concerning our financial performance. The Company believes EBITDA, Adjusted EBITDA, Free Cash Flow and Organic Revenue are also useful to investors. EBITDA is useful in comparing the core operations of the business from period to period by removing the impact of the Company’s capital structure (through interest expense), asset base (through depreciation and amortization) and tax rate, and in evaluating operating performance relative to others in the industry. Adjusted EBITDA allows for comparison to the Company’s performance in prior periods without the effect of items that, by their nature, tend to obscure the Company’s core operating results due to the potential variability across periods based on their timing, frequency and magnitude. Free Cash Flow provides a means for measuring the cash generated from operations that is available for mandatory obligations, including interest payments and debt repayment, and discretionary investment opportunities such as funding acquisitions, product and market development and paying dividends. As a result, management believes these metrics, which are commonly used by financial analysts and others in the industries in which the Company operates, enhance the ability of investors to analyze trends in the Company’s business and evaluate the Company’s performance relative to peer companies and the past performance of the Company itself. EBITDA, Adjusted EBITDA, Free Cash Flow and Organic Revenue are non-U.S. GAAP financial measures. We define EBITDA as net income before interest expense from borrowings, income tax expense, depreciation expense from fixed assets, and amortization expense from intangible assets. We define Adjusted EBITDA as EBITDA excluding costs and (gains) losses related to our acquisitions and divestitures, costs of products sold related to inventory step-up to fair value, settlement (gains) losses resulting from lump-sum distributions to participants from our defined benefit plans, operations optimization costs, impairment losses on long-lived assets, and other significant items. We define Free Cash Flow as net cash provided by operating activities less purchases of property, plant and equipment. Organic revenue is defined as legacy businesses, plus revenue from acquired businesses beginning 12 months after acquisition, less revenue associated with currently divested businesses for all periods shown. The use of EBITDA, Adjusted EBITDA, Free Cash Flow and Organic Revenue has limitations. These performance measures should not be considered in isolation from, or as an alternative to, U.S. GAAP measures such as net income, net cash provided by operating activities and revenue. Since we may have certain non-discretionary expenditures that are not deducted from these measures, including scheduled principal payments on outstanding debt, none of these measures should be interpreted as representing the residual cash flow of the Company available solely for discretionary expenditures or to invest in the growth of our business. Our measurement of EBITDA, Adjusted EBITDA, Free Cash Flow and Organic Revenue may not be comparable to similarly-titled measures used by other companies. |