SCHEDULE 14A

Information Required in Proxy Statement

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Under Rule 14a-12 |

SUPERCONDUCTIVE COMPONENTS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

SUPERCONDUCTIVE COMPONENTS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held

June 25, 2007

and

PROXY STATEMENT

IMPORTANT

Please mark, sign and date your proxy

and promptly return it in the enclosed envelope.

SUPERCONDUCTIVE COMPONENTS, INC.

2839 Charter Street

Columbus, Ohio 43228

(614) 486-0261

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 25, 2007

May 9, 2007

To Our Shareholders:

The Annual Meeting of Shareholders of Superconductive Components, Inc. (the “Company”) will be held at our offices located at 2839 Charter Street, Columbus, Ohio 43228, on Friday, June 25, 2007, at 9:30 a.m. local time, for the following purposes:

| | 1. | To elect five directors of the Company, each to serve for terms expiring at the next Annual Meeting of Shareholders; |

| | 2. | To approve the change of the corporate name to SCI Engineered Materials, Inc., and to amend the Company’s Articles of Incorporation. |

| | 3. | To ratify the selection of the independent registered public accounting firm for the year ending December 31, 2007; and |

| | 4. | To transact any other business which may properly come before the meeting or any adjournment thereof. |

Accompanying this Notice of Annual Meeting is a form of a Proxy, Proxy Statement, and a copy of the Company’s Form 10-KSB Annual Report for the year ended December 31, 2006, all to be mailed on or about May 9, 2007.

Our Board of Directors has fixed April 25, 2007, as the record date for the determination of shareholders entitled to notice and to vote at the annual meeting and any adjournment thereof. A list of shareholders will be available for examination by any shareholder at the annual meeting and for a period of 10 days before the annual meeting at our executive offices.

You will be most welcome at the annual meeting and we hope you can attend. Our directors and officers as well as representatives of our registered independent public accounting firm are expected to be present to answer your questions and to discuss the Company’s business.

We urge you to execute and return the enclosed proxy as soon as possible so that your shares may be voted in accordance with your wishes. If you attend the annual meeting, you may cast your vote in person and your proxy will not be used. If your shares are held in an account at a brokerage firm or bank, you must instruct them on how to vote your shares.

| | |

| | By Order of the Board of Directors, Daniel Rooney President, Chief Executive Officer, and Chairman of the Board of Directors |

|

PLEASE SIGN AND MAIL THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE NO POSTAGE NECESSARY IF MAILED IN THE UNITED STATES |

SUPERCONDUCTIVE COMPONENTS, INC.

2839 Charter Street

Columbus, Ohio 43228

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 25, 2007

This proxy statement is furnished to the shareholders of Superconductive Components, Inc., an Ohio corporation (the “Company”), in connection with the solicitation of proxies to be used in voting at the Annual Meeting of Shareholders to be held at our executive offices located at 2839 Charter Street, Columbus, Ohio 43228 on June 25, 2007 at 9:30 a.m., and at any adjournment or postponement thereof (the “Annual Meeting”). The enclosed proxy is being solicited by our Board of Directors. This proxy statement and the enclosed proxy will be first sent or given to our shareholders on approximately May 9, 2007.

We will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of stock. Representatives of the Company may solicit proxies by mail, telegram, telephone, fax, or personal interview.

The shares represented by the accompanying proxy will be voted as directed if the proxy is properly signed and received by us prior to the Annual Meeting. If no directions are made to the contrary, the proxy will be votedFOR the election of Daniel Rooney, Robert J. Baker, Jr., Walter J. Doyle, Robert H. Peitz, and Edward W. Ungar as directors of the Company and, at the discretion of persons acting under the proxy, to approve the change of the Corporate name to SCI Engineered Materials, Inc., to ratify the selection of Hausser + Taylor LLC as our independent registered public accounting firm for the year ending December 31, 2007 and to transact such other business as may properly come before the meeting or any adjournment thereof. Any shareholder voting the accompanying proxy has the power to revoke it at any time before its exercise by giving notice of revocation to us, by duly executing and delivering to us a proxy card bearing a later date, or by voting in person at the annual meeting. The officers, directors, and nominees for directors of the Company are the beneficial owners of 21.6% of the Company’s issued and outstanding shares. The officers, directors and nominees for directors of the Company have indicated that they will vote in favor of each nominee for director, in favor of the name change of the Company and in favor of the ratification of the selection of the independent public accountants of the Company.

Only holders of record of our common stock at the close of business on April 25, 2007 will be entitled to vote at the Annual Meeting. At that time, we had 3,467,100 shares of common stock outstanding and entitled to vote. Each share of our common stock outstanding on the record date entitles the holder to one vote on each matter submitted at the Annual Meeting.

The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Broker non-votes occur when brokers, who hold their customers’ shares in street name, sign and submit proxies for such shares and vote such shares on some matters, but not others. Typically, this would occur when brokers have not received any instructions from their customers, in which case the brokers, as the holders of record, are permitted to vote on “routine” matters, which typically include the election of directors.

The proposal to ratify the selection of the independent registered public accounting firm for the year ending December 31, 2007, is considered a routine matter and broker/dealers who hold their customers’ shares in street name may, under the applicable rules of the exchanges and other self-regulatory organizations of which such broker/dealers are members, sign and submit proxies for such shares and may vote such shares on this matter. The proposal to approve

the change of the corporate name to SCI Engineered Materials, Inc. is not considered a routine matter and broker/dealers who hold their customers’ shares in street name may not vote such shares on this matter.

The election of the director nominees requires the favorable vote of a plurality of all votes cast by the holders of our common stock at a meeting at which a quorum is present. Proxies that are marked “Withhold Authority” and broker non-votes will not be counted toward such nominee’s achievement of a plurality and thus will have no effect. The amendment of the Articles of Incorporation of the Company to change the name of the Company to SCI Engineered Materials, Inc. requires a favorable vote of a majority of the voting power of the Company. Each other matter to be submitted to the shareholders for approval or ratification at the Annual Meeting requires the affirmative vote of the holders of a majority of our common stock present and entitled to vote on the matter. For purposes of determining the number of shares of our common stock voting on the matter, abstentions will be counted and will have the effect of a negative vote; broker non-votes will not be counted and thus will have no effect.

ELECTION OF DIRECTORS

Our Restated Code of Regulations provides that the number of directors shall be fixed by the Board. The total number of authorized directors currently is fixed at five. The nominees for director, if elected, will serve for one-year terms expiring at the next Annual Meeting of Shareholders. Daniel Rooney, Robert J. Baker, Jr., Walter J. Doyle, Robert H. Peitz, and Edward W. Ungar currently serve as directors of the Company and are being nominated by the Board of Directors for re-election as directors.

It is intended that, unless otherwise directed, the shares represented by the enclosed proxy will be votedFOR the election of Messrs. Rooney, Baker, Doyle, Peitz, and Ungar as directors. In the event that any nominee for director should become unavailable, the number of directors of the Company may be decreased pursuant to the Restated Code of Regulations or the Board of Directors may designate a substitute nominee, in which event the shares represented by the enclosed proxy will be voted for such substitute nominee.

The Board of Directors recommends that the shareholders vote FOR the election of the nominees for director.

The following table sets forth each nominee’s name, age, and his position with the Company:

| | | | | | | | |

| | Name | | Age | | | | Position |

| | | | |

| | Daniel Rooney | | 53 | | | | President, Chief Executive Officer and Chairman of the Board of Directors |

| | | | |

| | Robert J. Baker, Jr. | | 67 | | | | Director |

| | | | |

| | Walter J. Doyle | | 72 | | | | Director |

| | | | |

| | Robert H. Peitz | | 46 | | | | Director |

| | | | |

| | Edward W. Ungar | | 70 | | | | Director |

Daniel Rooney has served as a Director of our Company since joining us in March 2002 as President and Chief Executive Officer. Mr. Rooney was elected as the Chairman of the Board of Directors of our Company on January 8, 2003. Prior to joining us, Mr. Rooney was General Manager for Johnson Matthey, Color and Coatings Division, Structural Ceramics Sector North America from 1994 to 2001. Prior to that, Mr. Rooney held various management positions at TAM Ceramics, Inc., a Cookson Group Company. Mr. Rooney has a Bachelor of Science in Ceramic Engineering from Rutgers College of Engineering and an MBA from Niagara University.

Robert J. Baker, Jr., Ph.D.has served as a Director of our Company since 1992. Dr. Baker is the president and founder of Venture Resources International and the co-founder of Business Owners Consulting Group, which assist companies in the development of growth strategies, including marketing position and competitive strategies. Dr. Baker is currently a visiting member of the Capital University faculty serving the MBA program. Dr. Baker graduated from the

2

University of Illinois with B.S., M.S., and Ph.D. degrees in Ceramic Engineering. In addition, he is a Sloan Fellow at MIT where he earned a Management Science degree.

Edward W. Ungar has been a Director of our Company since 1990. Mr. Ungar is the President and founder of Taratec Corporation, a technology business-consulting firm in Columbus, Ohio. Prior to forming Taratec Corporation in 1986, Mr. Ungar was an executive with Battelle Memorial Institute. Mr. Ungar earned Ph.D. and M.S. degrees in Mechanical Engineering from The Ohio State University and a B.M.E. in Mechanical Engineering from The City College of New York.

Walter J. Doyle has served as a Director of our Company since 2004. Mr. Doyle is the President of Forest Capital, an angel capital firm. Previously, Mr. Doyle was President and CEO of Industrial Data Technologies Corp. for 21 years. Mr. Doyle earned an Electrical Engineering degree from City College of New York (CCNY) and an MBA from the Harvard Business School.

Robert H. Peitz has served as a Director of our Company since 2004. Prior to being appointed as a director of our Company, Mr. Peitz was a managing director and head of financial markets for PB Capital. Mr. Peitz’s 15 years of experience at PB Capital include 10 years as Treasurer. Mr. Peitz is a graduate of the University of Cincinnati with a Bachelor of Arts in Economics. Mr. Peitz also has an MBA from the American Graduate School of International Management. He also attended the European Business School and completed the Executive Development Program at the Kellogg School of Management at Northwestern University.

The Board of Directors is seeking an individual(s) to strengthen our board.

INFORMATION CONCERNING THE BOARD OF DIRECTORS, EXECUTIVE OFFICERS,

AND PRINCIPAL SHAREHOLDERS

Meetings and Compensation of the Board of Directors

Our Board of Directors had a total of ten meetings during the year ended December 31, 2006. During 2006, all directors attended all of the meetings of the Board of Directors. Additionally, each director attended all meetings held by all committees of the Board of Directors, on which he served. Directors who are employed by us receive no compensation for serving as directors.

As compensation for their service as directors of our Company, non-employee directors periodically receive grants of stock or grants of stock options with an exercise price equal to the fair market value of our common stock on the date of grant and a ten-year term. Directors are also reimbursed for all reasonable out-of-pocket expenses. On December 16, 2005, for services to be performed in 2006, each of Messrs. Baker, Jr., Doyle, Peitz and Ungar received an option to purchase 10,000 shares of our common stock, exercisable on or after December 16, 2006 and expiring 10 years from the date of grant at a price of $4.00 per share.

It is our expectation that all members of the Board of Directors attend the Annual Meeting of Shareholders. All members of our Board of Directors were present at our 2006 Annual Meeting of Shareholders.

Shareholder Communication

Our Board of Directors welcomes communications from shareholders. Shareholders may send communications to the Board of Directors or to any director in particular, c/o Gerald S. Blaskie, Superconductive Components, Inc., 2839 Charter Street, Columbus, Ohio 43228. Any correspondence addressed to the Board of Directors or to any one of our directors in care of our offices will be forwarded to the addressee without review by management.

Committees of the Board of Directors

We have an Audit Committee and a Stock Option and Compensation Committee (the “Compensation Committee”).

3

The Audit Committee consults with our Chief Financial Officer and other key members of our management and with our independent auditors with regard to the plan of audit; reviews, in consultation with the independent auditors, their report of audit, or proposed report of audit and the accompanying management letter, if any; and consults with our Chief Financial Officer and other key members of our management and with our independent auditors with regard to the adequacy of the internal accounting controls. The Chairman of the Audit Committee is Mr. Ungar, and the members are Messrs. Baker and Doyle. The Audit Committee met one time during 2006. The Board of Directors has not adopted a charter for the Audit Committee. The Board of Directors has determined that Messrs. Doyle and Ungar qualify as “audit committee financial experts” as that term is defined in Item 401(e) of Regulation S-B. Messrs. Doyle and Ungar and Dr. Baker each meet the criteria for audit committee independence as defined in NASDAQ Rule 4350, and Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended.

The Compensation Committee of the Board of Directors reviews executive compensation and administers our stock incentive and incentive compensation performance plans. The Chairman of the Compensation Committee is Dr. Baker and the members are Messrs. Doyle and Ungar. The Compensation Committee met three times during 2006.

Due to the limited size of our Board of Directors, the Board of Directors has determined that it is not necessary to establish a nominating committee. Nominations for directors are considered by the entire Board of Directors. The directors take a critical role in guiding the strategic direction and oversee the management of the Company. Director candidates are considered based on various criteria, such as their broad based business and professional skills and experiences, a global business and social perspective, concern for long term interests of shareholders, and personal integrity and judgment. In addition, directors must have available time to devote to Board activities and to enhance their knowledge of the industry.

Accordingly, we seek to attract and retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities to the Company. Recent developments in corporate governance and financial reporting have resulted in an increased demand for such highly qualified and productive public company directors.

The Board of Directors will consider the recommendations of shareholders regarding potential director candidates. In order for shareholder recommendations regarding possible director candidates to be considered by the Board of Directors:

| | · | | such recommendations must be provided to the Board of Directors c/o Gerald S. Blaskie, Superconductive Components, Inc., 2839 Charter Street, Columbus, Ohio 43228, in writing at least 120 days prior to the date of the next scheduled annual meeting; |

| | · | | the nominating shareholder must meet the eligibility requirements to submit a valid shareholder proposal under Rule 14a-8 of the Securities Exchange Act of 1934, as amended; and |

| | · | | the shareholder must describe the qualifications, attributes, skills or other qualities of the recommended director candidate. |

Compensation Committee Interlocks and Insider Participation

None of our executive officers have served:

| | · | | as a member of the Compensation Committee of another entity which has had an executive officer who has served on our Compensation Committee; |

| | · | | as a director of another entity which has had an executive officer who has served on our Compensation Committee; or |

| | · | | as a member of the Compensation Committee of another entity which has had an executive officer who has served as one of our directors. |

4

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 1701.13(E) of the Ohio Revised Code gives a corporation incorporated under the laws of Ohio power to indemnify any person who is or has been a director, officer or employee of that corporation, or of another corporation at the request of that corporation, against expenses, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with any threatened, pending or completed action, suit or proceeding, criminal or civil, to which he is or may be made a party because of being or having been such director, officer, employee or agent, provided that in connection therewith, such person is determined to have acted in good faith in what he reasonably believed to be in or not opposed to the best interest of the corporation of which he is a direct, officer, employee or agent and without reasonable cause, in the case of a criminal matter, to believe that his conduct was unlawful. The determination as to the conditions precedent to the permitted indemnification of such person is made by the directors of the indemnifying corporation acting at a meeting at which, for the purpose, any director who is a party to or threatened with any such action, suit or proceeding may not be counted in determining the existence of a quorum and may not vote. If, because of the foregoing limitations, the directors are unable to act in this regard, such determination may be made by the majority vote for the corporation’s voting shareholders (or without a meeting upon two-thirds written consent of such shareholders), by judicial proceeding or by written opinion of legal counsel not retained by the corporation or any person to be indemnified during the five years preceding the date of determination.

Section 1701.13(E) of the Ohio Revised Code further provides that the indemnification thereby permitted shall not be exclusive of, and shall be in addition to, any other rights that directors, officers, employees or agents have, including rights under insurance purchased by the corporation.

Article 5 of the Company’s Restated Code of Regulations contains extensive provisions related to indemnification of officers, directors, employees and agents. The Company is required to indemnify its directors against expenses, including attorney fees, judgments, fines and amounts paid in settlement of civil, criminal, administrative, and investigative proceedings, if the director acted in good faith and in a manner he reasonably believed to be in, or not opposed to, the best interests of the Company. When criminal proceedings are involved, indemnification is further conditioned upon the director having no reasonable cause to believe that his conduct was unlawful.

Entitlement of a director to indemnification shall be made by vote of the disinterested directors of the Company. If there are an insufficient number of such directors to constitute a quorum, the determination to indemnify directors shall be made by one of the following methods: (1) a written opinion of independent legal counsel, (2) vote by the shareholders, or (3) by the court in which the action, suit or proceeding was brought.

The Company may pay the expenses, including attorney fees of any director, as incurred, in advance of a final disposition of such action, suit or proceeding, upon receipt by the Company of an undertaking by the affected director(s) in which he (they) agree(s) to cooperate with the Company concerning the action, suit or proceeding, and agree(s) to repay the Company in the event that a court determines that the director’s action, or failure to act, involved an act, or omission, undertaken with reckless disregard for the best interests of the Company.

The indemnification provisions of the Articles of Incorporation relating to officers, employees and agents of the Company are similar to those relating to directors, but are not mandatory in nature. On a case-by-case basis, the Company may elect to indemnify them, and may elect to pay their expenses, including attorney fees, in advance of a final disposition of the action, suit or proceeding, upon the same conditions and subject to legal standards as relate to directors. These indemnification provisions are also applicable to actions brought against directors, officers, employees and agents in the right of the Company. However, no indemnification shall be made to any person adjudged to be liable for negligence or misconduct in the performance of his duty to the Company unless, and only to the extent that a court determines, that despite the adjudication of liability, but in view of all of the circumstances of the case, shall deem proper. The Company currently carries directors and officers insurance in the amount of one million dollars.

The above discussion of the Company’s Restated Code of Regulations and of Section 1701.13(E) of the Ohio Revised Code is not intended to be exhaustive and is respectively qualified in its entirety by such documents and statutes.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 (the “Act”) may be permitted to directors, officers and controlling persons of the Company issuer pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

5

REPORT OF AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee consults with our Chief Financial Officer and other key members of our management and with our independent auditors with regard to the plan of audit; reviews, in consultation with the independent auditors, their report of audit, or proposed report of audit and the accompanying management letter, if any; and consults with our Chief Financial Officer and other key members of our management and with our independent auditors with regard to the adequacy of the internal accounting controls.

In fulfilling its responsibilities, the Audit Committee selected Hausser + Taylor LLC as our independent accountants for purposes of auditing our financial statements for 2006. The Audit Committee has reviewed and discussed with management and the independent auditors our audited financial statements; discussed with the independent auditors the matters required to be discussed by Codification of Statements on Auditing Standards No. 61; received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1; and discussed with the independent accountants their independence from our Company.

Based on the reviews and discussions with management and Hausser + Taylor LLC, the Audit Committee recommended to the Board of Directors that our audited consolidated financial statements be included in our Annual Report on Form 10-KSB for the fiscal year ended December 31, 2006, filed with the Securities and Exchange Commission.

The Board of Directors evaluated the independence of each member of the Audit Committee. As part of its evaluation, the Board of Directors determined, in the exercise of its business judgment, that Messrs. Ungar and Doyle, and Dr. Baker are independent under Rule 4350(d) of the Nasdaq Stock Market and are financially literate each in his own capacity.

Based upon its work and the information received in the inquiries outlined above, the Audit Committee is satisfied that its responsibilities for the period ended December 31, 2006, were met and that our financial reporting and audit processes are functioning effectively.

|

Submitted by the Audit Committee |

of the Board of Directors: |

|

Robert J. Baker, Jr. |

Walter J. Doyle |

Edward W. Ungar |

Executive Officers

In addition to Mr. Rooney, the following persons serve as executive officers of the Company:

Gerald S. Blaskie, age 49, has served as our Chief Financial Officer since April 2001. On March 2, 2006, our Board of Directors appointed Mr. Blaskie to the position of Vice President and Chief Financial Officer. Prior to joining us, Mr. Blaskie was the Controller at Cable Link, Inc. from February 2000 to March 2001. From 1997 to 2000, he was the Plant Manager at Central Ohio Plastics Corporation, where he also served as Controller from 1993 to 1997. Mr. Blaskie earned a B.S. degree in Accounting from Central Michigan University and passed the CPA exam in the State of Ohio.

Scott Campbell, Ph.D., age 49, has served as our Vice President of Technology since March 2005. Dr. Campbell served as our Vice-President of Research and Engineering from July 2004 to March 2005. Dr. Campbell joined us in July 2002 as our Technical Director. Prior to joining us, he was Senior Research Manager at Oxynet, Inc. for five years. Dr. Campbell earned his Ph.D., Metallurgy, from the University of Illinois at Chicago. In addition, he earned M.S. and B.S. degrees in Ceramic Engineering from The Ohio State University. He is a member of the American Ceramic Society.

Michael K. Barna, age 49, has served as Vice President, Sales-Photonics, since March 2, 2006. Mr. Barna joined us as Director of Sales and Marketing in January 2004. Prior to joining us, Mr. Barna had more than 20 years of experience in thin film sales, including major account sales of Physical Vapor Deposition equipment, high purity targets

6

and evaporation materials for these systems, hybrid microelectronic, telecommunications, and the commercial glass coating markets. Mr. Barna earned a B.S. degree in Mechanical Engineering from the University of Kentucky.

Officers are elected annually by our Board of Directors and serve at its discretion.

Ownership of Common Stock by Directors and Executive Officers

The following table sets forth, as of April 25, 2007, the beneficial ownership of our common stock by each of our directors, each executive officer named in the Summary Compensation Table, and by all directors and executive officers as a group.

| | | | |

Name of Beneficial Owner(1) | | Number of Shares Beneficially Owned(2) | | Percentage of

Class(3) |

| | |

Robert H. Peitz(4) | | 313,609 | | 8.8% |

Daniel Rooney(5) | | 132,300 | | 3.7% |

Walter J. Doyle(6) | | 108,419 | | 3.1% |

Robert J. Baker, Jr.(7) | | 73,232 | | 2.1% |

Scott Campbell(8) | | 66,000 | | 1.8% |

Edward W. Ungar(9) | | 54,369 | | 1.5% |

Michael K. Barna(10) | | 52,000 | | 1.4% |

| | |

All directors and executive officers as a group (8 persons)(11) | | 858,929 | | 21.6% |

(1) The address of all directors and executive officers is c/o Superconductive Components, Inc., 2839 Charter Street, Columbus, Ohio 43228.

(2) For purposes of the above table, a person is considered to “beneficially own” any shares with respect to which he exercises sole or shared voting or investment power or as to which he has the right to acquire the beneficial ownership within 60 days of April 25, 2007. Unless otherwise indicated, voting power and investment power are exercised solely by the person named above or shared with members of his or her household.

(3) “Percentage of Class” is calculated by dividing the number of shares beneficially owned by the total number of our outstanding shares on April 25, 2007, plus the number of shares such person has the right to acquire within 60 days of April 25, 2007.

(4) Includes 110,962 common shares, which may be acquired by Mr. Peitz under stock purchase options and stock purchase warrants exercisable within 60 days of April 25, 2007.

(5) Includes 123,000 common shares, which may be acquired by Mr. Rooney under stock purchase options exercisable within 60 days of April 25, 2007.

(6) Includes 24,250 common shares, which may be acquired by Mr. Doyle under stock options and stock purchase warrants exercisable within 60 days of April 25, 2007.

(7) Includes 51,000 common shares, which may be acquired by Dr. Baker under stock purchase options exercisable within 60 days of April 25, 2007, and 16,603 shares which are held in Dr. Baker’s IRA.

(8) Includes 66,000 common shares, which may be acquired by Mr. Campbell under stock purchase options exercisable within 60 days of April 25, 2007.

(9) Includes 51,000 common shares, which may be acquired by Mr. Ungar under stock purchase options exercisable within 60 days of April 25, 2007.

(10) Includes 52,000 common shares, which may be acquired by Mr. Barna under stock purchase options exercisable within 60 days of April 25, 2007

7

(11) Includes 539,212 common shares, which may be acquired under stock options and stock purchase warrants exercisable within 60 days of April 25, 2007.

Ownership of Common Stock by Principal Shareholders

The following table sets forth information as of April 25, 2007, relating to the beneficial ownership of common stock by each person known by us to beneficially own more than 5% of our outstanding shares of common stock.

| | | | |

Name of Beneficial Owner(1) | | Number of Shares Beneficially Owned(2) | | Percentage of

Class(3) |

Curtis A. Loveland (4) | | 1,235,064 | | 33.1% |

The Estate of Ingeborg V. Funk (5) | | 462,852 | | 13.0% |

The Estate of Edward R. Funk (6) | | 437,256 | | 12.2% |

Thomas G. Berlin (7) | | 392,400 | | 11.1% |

Windcom Investments SA(8) | | 332,905 | | 9.5% |

Lake Street Fund L.P. (9) | | 310,300 | | 8.8% |

Robert H. Peitz (10) | | 313,609 | | 8.8% |

Berlin Capital Growth L.P. (11) | | 275,200 | | 7.8% |

Mid South Investor Fund L.P. (12) | | 250,000 | | 7.1% |

(1) The address of Curtis A. Loveland is c/o Porter, Wright, Morris & Arthur LLP, 41 South High Street, Columbus, Ohio 43215. The address of Thomas G. Berlin is c/o Berlin Financial Ltd., 1325 Carnegie Avenue, Cleveland, Ohio 44115. The address of Windcom Investments SA is Corso Elvezia 25, 6900 Lugan, CH. The address of Lake Street Fund L.P. is 600 South Lake Avenue, Suite 100, Pasadena, California 91106. The address of Mid South Investor Fund L.P. is 1776 Peachtree St. NW, Suite 412 North, Atlanta, Georgia 30309. The address of Robert H. Peitz is c/o Superconductive Components, Inc., 2839 Charter Street, Columbus, Ohio 43228. The address of the Estates of Ingeborg and Edward Funk is c/o Curtis A. Loveland, Porter, Wright, Morris & Arthur LLP, 41 South High Street, Columbus, Ohio 43215. The address of Berlin Capital Fund, L.P. is c/o Thomas G. Berlin, Berlin Financial Ltd., 1325 Carnegie Avenue, Cleveland, Ohio 44115.

(2)�� For purposes of this table, a person is considered to “beneficially own” any shares with respect to which he or she exercises sole or shared voting or investment power or as to which he or she has the right to acquire the beneficial ownership within 60 days of April 25, 2007. Unless otherwise indicated, voting power and investment power are exercised solely by the person named above or shared with members of his or her household.

(3) “Percentage of Class” is calculated by dividing the number of shares beneficially owned by the total number of our outstanding shares on April 25, 2007, plus the number of shares such person has the right to acquire within 60 days of April 25, 2007.

(4) Includes (i) 51,000 shares of common stock which can be acquired by Mr. Loveland under stock options exercisable within 60 days of April 25, 2007; (ii) 437,256 shares of common stock beneficially owned by Mr. Loveland as the executor of the Estate of Edward R. Funk, of which 127,900 shares of common stock can be acquired by Mr. Loveland on behalf of the estate under stock options and warrants exercisable within 60 days of April 25, 2007; (iii) 462,852 shares of common stock beneficially owned by Mr. Loveland as the executor of the Estate of Ingeborg V. Funk, of which 87,500 shares of common stock can be acquired by Mr. Loveland on behalf of the estate under stock options and warrants exercisable within 60 days of April 25, 2007; and (iv) 283,756 shares beneficially owned by Mr. Loveland as the trustee of generation-skipping irrevocable trusts established by Edward R. and Ingeborg V. Funk.

(5) Includes 87,500 shares of common stock, which can be acquired by The Estate of Ingeborg V. Funk under stock options and warrants exercisable within 60 days of April 25, 2007. Mr. Loveland holds the voting and investment power for the shares of common stock owned by the Estate of Ingeborg V. Funk.

(6) Includes 127,900 shares of common stock, which can be acquired by The Estate of Edward R. Funk under stock options and warrants exercisable within 60 days of April 25, 2007. Mr. Loveland holds the voting and investment power for the shares of common stock held by the Estate of Edward R. Funk.

8

(7) Mr. Berlin’s ownership includes 275,200 shares of common stock beneficially owned by Berlin Capital Growth L.P., of which 52,083 shares of common stock can be acquired under stock purchase warrants exercisable within 60 days of April 25, 2007. Mr. Berlin has shared voting and dispositive power over the shares of common stock in this limited partnership as the controlling principal of Berlin Capital Growth L.P. Mr. Berlin’s ownership also includes 20,833 shares of common stock, which can be acquired by Mr. Berlin under stock purchase warrants exercisable within 60 days of April 25, 2007.

(8) Based on the Schedule 13G/A filed on February 14, 2005, Dr. Karl Kohlbrenner, CEO of Windcom Investments SA, has voting and dispositive power over the shares of common stock on behalf of the Company. Windcom Investments SA’s ownership includes 20,286 shares of common stock, which can be acquired by Windcom Investments SA under stock purchase warrants exercisable within 60 days of April 25, 2007.

(9) Includes 62,500 shares of common stock, which can be acquired by Lake Street Fund L.P. under stock purchase warrants exercisable within 60 days of April 25, 2007.

(10) Includes 110,962 shares of common stock, which can be acquired by Mr. Peitz under stock options and stock purchase warrants exercisable within 60 days of April 25, 2007.

(11) Includes 52,083 shares of common stock, which can be acquired by Berlin Capital Growth L.P. under stock purchase warrants exercisable within 60 days of April 25, 2007.

(12) Includes 50,000 shares of common stock, which can be acquired by Mid South Investor Fund L.P. under stock purchase warrants exercisable within 60 days of April 25, 2007.

Executive Compensation

The following summary compensation table sets forth information regarding compensation paid during 2006 to our Principal Executive Officer, and our two most highly compensated officers other than the principal executive officer.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

Name and

principal

position | | Year | | Salary | | Bonus | | Stock

awards | | Option

awards

(d) | | Non-equity

incentive plan

compensation | | All other

compensation | | Total |

PEO

Daniel

Rooney | | 2006 | | $149,615 | | $0 | | $0 | | $45,395 | | $37,477 (a) | | $0 | | $232,487 |

VP- Sales

Photonics

Michael K.

Barna | | 2006 | | 86,404 | | 0 | | 0 | | 30,260 | | 93,240 (b) | | 0 | | 209,904 |

VP-

Technology

Scott

Campbell | | 2006 | | 114,230 | | 0 | | 0 | | 15,132 | | 6,000 (c) | | 0 | | 135,362 |

| | a- | Deferred under our incentive compensation plan; paid in 2007. |

| | b- | $34,420 deferred under our incentive compensation plan; paid in 2007. |

| | c- | $3,000 deferred under our incentive compensation plan; paid in 2007. |

| | d- | Options granted under our 2006 Stock Option Plan – Mr. Rooney 15,000 shares; Mr. Barna 10,000 shares; Mr. Campbell 5,000 shares. The shares vest 20% per year beginning June 19, 2007 and the weighted average fair values at date of grant were $3.03 and were estimated using the Black-Scholes option valuation model with the following assumptions: Interest rate of 5%; Volatility of 107.55%; and Dividend yield of 0%. |

9

Salaries

The salaries of the Named Executive Officers are reviewed on an annual basis. Increases in salary are based on an evaluation of the individual’s performance and level of pay compared to general industry peer group pay levels. Merit increases normally take effect on January 1st of each year.

Executive Annual Incentive Plan

Mr. Rooney received the following incentive compensation award for services during 2006: (i) $10,819 upon attaining a gross profit of a certain amount (as determined from the audited statements), (ii) $20,000 for attaining an adjusted gross profit of a certain amount and (iii) 2% of adjusted gross profit in excess of a certain amount. Adjusted gross profit is defined as the gross profit from the audited statements plus depreciation expense.

Mr. Barna received the following incentive compensation award for services during 2006: (i) $51,098 for attaining and exceeding quarterly bookings goals, (ii) $32,642 for attaining and exceeding quarterly gross profit goals, (iii) $3,000 for the Company exceeding quarterly revenue and net income goals and (iv) $6,500 for exceeding annual booking and gross profit goals and for the Company exceeding annual revenue and net income goals.

Mr. Campbell received the following incentive compensation award for services during 2006: (i) $1,000 for reducing scrap a specified amount , (ii) $1,000 for the Company meeting specified on-time delivery goals; (iii) $3,000 for the Company exceeding quarterly revenue and net income goals and (iv) $1,000 for the Company exceeding annual revenue and net income goals.

Employment Agreement for Principal Executive Officer

The Principal Executive Officer, Mr. Daniel Rooney has an employment contract that entitles him to 100% of his compensation for six months following his termination without cause. Following the initial six-month period after his termination, Mr. Rooney is also entitled to receive six months of pay at a rate of 50% of his compensation at the time of his termination.

10

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| | | | | | | | | | | | | | | | | | |

| ------------------------- OPTION AWARDS----------------------------- | | ------ STOCK AWARDS---- |

| | | | | | | | | | | | | | | | | | |

Name and

Principal

Position | | Number of

securities

underlying

unexercised

options (#) -

exercisable | | Number of

securities

underlying

unexercised

options (#) –

unexercisable | | Equity

incentive

plan

awards:

number of

securities

underlying

unexercised

earned

options (#) | | Option

exercise

price | | Option

expiration

date | | Number of

shares or

units of

stock that

have not

vested | | Market

value of

stock that is

not vested | | Total

number of

unearned

shares, units

or other

rights that

have not

vested | | Market or

payout

value of

unearned

shares,

units or

other rights

that have

not vested |

PEO

Daniel

Rooney | | 100,000 | | 0 | | 0 | | $1.55 | | 3-1-12 | | 0 | | $0 | | $0 | | $0 |

| Rooney | | 10,000 | | 0 | | 0 | | 2.60 | | 1-21-14 | | 0 | | 0 | | 0 | | 0 |

| Rooney | | 10,000 | | 0 | | 0 | | 2.40 | | 3-8-15 | | 0 | | 0 | | 0 | | 0 |

| Rooney | | 0 | | 15,000

(a) | | 0 | | 3.25 | | 6-19-16 | | 15,000 | | 0 | | 0 | | 0 |

VP- Sales

Photonics

Michael

K. Barna | | 40,000 | | 0 | | 0 | | 2.85 | | 4-28-14 | | 0 | | 0 | | 0 | | 0 |

| Barna | | 10,000 | | 0 | | 0 | | 2.40 | | 3-8-15 | | 0 | | 0 | | 0 | | 0 |

| Barna | | 0 | | 10,000 (a) | | 0 | | 3.25 | | 6-19-16 | | 10,000 | | 0 | | 0 | | 0 |

VP-

Technology

Scott

Campbell | | 50,000 | | 0 | | 0 | | 1.55 | | 7-15-12 | | 0 | | 0 | | 0 | | 0 |

| Campbell | | 5,000 | | 0 | | 0 | | 2.60 | | 1-21-14 | | 0 | | 0 | | 0 | | 0 |

| Campbell | | 10,000 | | 0 | | 0 | | 2.40 | | 3-8-15 | | 0 | | 0 | | 0 | | 0 |

| Campbell | | 0 | | 5,000 (a) | | 0 | | 3.25 | | 6-19-16 | | 5,000 | | 0 | | 0 | | 0 |

a – Options granted June 19, 2006 vest in five equal annual installments on each anniversary of the date of the grant beginning June 19, 2007.

Stock Options

At our 2006 Annual Meeting, our shareholders approved our 2006 Stock Incentive Plan (the “2006 Plan”). The purpose of the 2006 Plan was to further the growth and profitability of the Company by providing increased incentives to and encourage share ownership on the part of key employees, officers and directors of, and consultants and advisors who render services to the Company and any future parent or subsidiary of the Company. The 2006 Plan permits the granting of stock options and restricted stock awards (collectively “Awards”) to eligible participants. The maximum number of shares of common stock which may be issued pursuant to the 2006 Plan is 600,000 shares. If an Award expires or is cancelled without having been fully exercised or vested, the unvested or cancelled shares will be available again for grants of Awards. The 2006 Plan is administered by the Company’s Stock Option and Compensation Committee (the “Committee”). All the members of the Committee qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934 and as “outside directors” under Section 162(m) of the Internal Revenue Code (the “Code”). Pursuant to the 2006 Plan, the Committee has the sole discretion to determine the employees, directors and consultants who may be granted Awards, the terms and conditions of such Awards and to construe and interpret the 2006 Plan. The Committee is also responsible for making adjustments in outstanding Awards, the shares available for Awards, and the numerical limitations for Awards to reflect any transactions such as stock splits or stock dividends. The Committee may delegate its authority to one or more directors or officers; provided, however, that the Committee may not delegate its authority and powers (a) with respect to any Section 16b-3 Persons, or (b) in any way which would jeopardize the Plan’s qualifications under Section 162(n) of the Code or Rule 16b-3. The Board of Directors may amend to terminate the 2006 Plan at any time and for any reason. To the extent required under Rule 16b-3 material amendments to the 2006 Plan must be approved by the shareholders.

Eligibility to participate in the 2006 Plan extends to management, key employees, directors and consultants of the Company. The estimated number of eligible participants is approximately 25 persons. The actual number of individuals who may receive options of restrictive stock awards under the 2006 Plan cannot be determined because eligibility for participation of the 2006 Plan is at discretion of the Committee. No participant may receive Awards covering more than 300,000 shares under the 2006 Plan.

11

The Committee granted stock options to each executive officer in June 2006 under our 2006 Stock Incentive Plan. The executive officers were awarded incentive stock options with an exercise price equal to the fair market value of our common stock on the date of the grant. Accordingly, those stock options will have value only if the market price of the common stock increases after that date. In determining the size of stock option grants, the Committee considers Company performance against the strategic plan and individual performance. The Named Executive Officers were awarded the number of stock options shown in the table above. The stock options vest in five equal annual installments on each anniversary of the date of the grant beginning June 19, 2007. Also shown in the table are the total stock options outstanding and held by each Named Executive Officer.

Director Compensation

The following Director Compensation table sets forth information regarding compensation paid to our non-employee directors. Directors who are employed by us do not receive any compensation for their board activities.

DIRECTOR COMPENSATION - 2006

| | | | | | | | | | | | | | |

Name | | Fees

earned

or paid

in cash | | Stock

awards | | Option

awards | | Non-equity

incentive plan

compensation | | Change in pension

value and non-

qualified deferred

compensation

earnings | | All other

compensation | | Total |

Robert J. Baker, Jr., Walter J. Doyle, Robert H. Peitz, Edward W. Ungar | | $0 | | $0 | | $37,376 | | $0 | | $0 | | $0 | | $37,376 |

1 – Compensation for Dr. Baker, Jr., Messrs. Doyle, Peitz, and Ungar is identical.

2 – Daniel Rooney is the Principal Executive Officer and is Chairman of the Board of Directors. Mr. Rooney does not appear on this table and receives no director compensation.

3 - Options were granted December 16, 2005 for the 2006 fiscal year. The shares vested on the date of the grant and were exercisable on December 16, 2006. The weighted average fair values at date of grant were $3.74 and were estimated using the Black-Scholes option valuation model with the following assumptions: Interest rate of 5%; Volatility of 108.98%; and Dividend yield of 0%.

The following discloses the aggregate number of stock option awards outstanding for all directors:

Mr. Peitz - 110,962 common shares may be acquired by Mr. Peitz under stock options and stock purchase warrants exercisable within 60 days of April 25, 2007.

Mr. Rooney - 125,000 common shares may be acquired by Mr. Rooney under stock purchase options exercisable within 60 days of April 25, 2007.

Mr. Doyle - 24,250 common shares may be acquired by Mr. Doyle under stock options and stock purchase warrants exercisable within 60 days of April 25, 2007.

Dr. Baker - 51,000 common shares, which may be acquired by Dr. Baker under stock purchase options exercisable within 60 days of April 25, 2007, and 16,603 shares which are held in Dr. Baker’s IRA.

Mr. Ungar - 51,000 common shares may be acquired by Mr. Ungar under stock options exercisable within 60 days of April 25, 2007.

12

Non-Employee Director Reimbursement

Non-employee directors are reimbursed for travel and other out-of-pocket expenses connected to Board travel.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth additional information as of December 31, 2006, concerning shares of our common stock that may be issued upon the exercise of options and other rights under our existing equity compensation plans and arrangements, divided between plans approved by our shareholders and plans or arrangements not submitted to our shareholders for approval. The information includes the number of shares covered by, and the weighted average exercise price of, outstanding options and other rights and the number of shares remaining available for future grants excluding the shares to be issued upon exercise of outstanding options, warrants, and other rights.

| | | | | | |

| | | Number of Securities to

be issued upon exercise of

outstanding options,

warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities

remaining available for issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| | | |

Equity compensation plans approved by security holders(1) | | 590,750 | | $2.25 | | 274,950 |

| | | |

Equity compensation plans not approved by security holders(2) | | 17,500 | | $2.88 | | -- |

| | | | | | |

| | | |

Total | | 608,250 | | $2.27 | | 274,950 |

| | | | | | |

(1) | Equity compensation plans approved by shareholders includes our 1995 Stock Option Plan and our 2006 Plan. |

(2) | Includes 17,500 stock purchase warrants that can be exercised to purchase 17,500 shares of our common stock, which were issued by us in exchange for consideration in the form of goods and services. |

CORPORATE NAME CHANGE

At the Annual Meeting, the shareholders will be requested to consider and act upon a proposal to approve the change of our corporate name from “Superconductive Components, Inc.” to “SCI Engineered Materials, Inc.” and to amend the our Articles of Incorporation to effect the change in corporate name (the “Amendment”).

DESCRIPTION OF THE AMENDMENT

On March 5, 2007, our Board of Directors adopted a resolution to change our corporate name from “Superconductive Components, Inc.” to “SCI Engineered Materials, Inc.” and, subject to approval of the shareholders, to amend article 1 of our Articles of Incorporation to effect the change in corporate name. The resolution also provided that the Amendment be proposed to our shareholders for consideration at the Annual Meeting of Shareholders on June 25, 2007, all in accordance with Section 1701.71 of the Ohio Revised Code.

The Amendment is consistent with use of the “SCI Engineered Materials” name in our markets and is integral relationship to current corporate branding activities. The Amendment and the new identity are all part of our transformation, growing from a company incorporated in 1987 to develop, manufacture and market products utilizing high temperature superconductive materials to a more diversified manufacturer of ceramic and metal targets serving multiple industrial markets.

The stock symbol will remain SCCI.

Required Vote

Approval of the Corporate name change requires the affirmative vote of a majority of our outstanding shares.

13

The Board of Directors recommends that our shareholders vote “FOR” the change of the corporate name to SCI Engineered Materials, Inc.

REGISTERED INDEPENDENT PUBLIC ACCOUNTING FIRM

We have selected Hausser + Taylor LLC to serve as our registered independent public accounting firm for 2007. Hausser + Taylor LLC served as the registered independent public accounting firm for us for 2006 and throughout the periods covered by our financial statements. Representatives of Hausser + Taylor LLC are expected to attend the Annual Meeting of Shareholders in order to respond to appropriate questions from shareholders, and they will have the opportunity to make a statement.

Hausser + Taylor has a continuing relationship with RSM McGladrey, Inc. (“RSM”) (formerly with American Express Tax and Business Services, Inc.) from which it leases auditing staff who are full time, permanent employees of RSM and through which its shareholders provide non-audit services. As a result of this arrangement, Hausser + Taylor has no full time employees and, therefore, none of the audit services performed were provided by permanent full time employees of Hausser + Taylor. Hausser + Taylor manages and supervises the audit and audit staff, and is exclusively responsible for the opinion rendered in connection with its examination.

FEES OF THE REGISTERED INDEPENDENT PUBLIC ACCOUNTING FIRM FOR

THE YEAR ENDED DECEMBER 31, 2006

Audit Fees

The aggregate fees billed and to be billed by Hausser + Taylor LLC for professional services rendered for the audit of our annual financial statements and review of financial statements included in our Form 10-QSB were $52,620 for 2006, and $49,700 for 2005.

Tax Fees

We paid $300 in 2006 and $0 in 2005 in aggregate tax fees for professional services rendered for tax compliance and tax advice in connection with our internally prepared corporate tax return.

All Other Fees

The aggregate fees billed by Hausser + Taylor LLC and RSM for professional services rendered in connection with the research relative to incentive stock options and relating reporting requirements, review of S-8 registration statement and issuance of consent and review of Form SB-2 registration statement were $13,640 in 2006. The aggregate fees billed by Hausser + Taylor LLC for professional services rendered in connection with the research and review for the acceleration of employee stock options were $4,140 for 2005.

Pre-Approval Policy

The Audit Committee is required to pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our independent auditor or other registered public accounting firm, subject to thede minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934 that are approved by the Audit Committee prior to completion of the audit.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Our Audit Committee has appointed Hausser + Taylor LLC, an independent registered public accounting firm, as our independent auditors for the fiscal year ending December 31, 2007, and has further directed that management submit the selection of independent auditors for ratification by the shareholders at the 2007 Annual Meeting of Shareholders. Hausser + Taylor LLC has audited our financial statements since the fiscal year ending December 31,

14

1995. The Audit Committee believes that Hausser + Taylor LLC’s experience with us and knowledge of us is important, and would like to continue this relationship.

Hausser + Taylor LLC, has advised us that the firm does not have any direct or indirect financial interest in us, nor has Hausser + Taylor LLC, had any such interest since the inception of our Company in 1987, other than as a provider of auditing and accounting services. In making the selection of Hausser + Taylor LLC to continue as our independent registered public accounting firm for the year ending December 31, 2007, the Audit Committee reviewed past audit results and the non-audit services performed during fiscal year 2006 and which are proposed to be performed during fiscal year 2007. In selecting Hausser + Taylor LLC, the Audit Committee carefully considered Hausser + Taylor LLC’s independence. Hausser + Taylor LLC confirmed to us that it is in compliance with all rules, standards and policies of the Independence Standards Board and the SEC governing auditor independence.

Neither our Code of Regulations nor other governing documents require shareholder ratification of the selection of Hausser + Taylor LLC as the Company’s independent auditors. However, we are submitting the selection of Hausser + Taylor LLC to the shareholders for ratification as a matter of good corporate practice. If our shareholders fail to ratify this selection, the Audit Committee will reconsider whether or not to continue to retain Hausser + Taylor LLC, but may still retain them. Even if this selection is ratified, the Audit Committee, in its discretion, may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the 2007 Annual Meeting will be required to ratify the selection of Hausser + Taylor LLC. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the shareholders and will have the same effect as negative votes. Broker non-votes are counted toward a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board of Directors recommends that our shareholders vote “FOR” the ratification of the independent registered public accounting firm.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our officers, directors and greater than 10% shareholders to file reports of ownership and changes in ownership of our securities with the Securities and Exchange Commission (“SEC”). Copies of the reports are required by SEC regulation to be furnished to us. Based on our review of such reports, and written representations from reporting persons, we believe that all reporting persons complied with all filing requirements during the year ended December 31, 2006.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Notes Payable and Capital Lease

On October 14, 2005, we entered into an agreement with the Estates of Edward R. Funk and Ingeborg V. Funk. We were indebted to the Estates in the amount of $289,391.92. The Estates agreed to cancel $288,000 of the indebtedness in exchange for 144,000 shares of common stock and warrants to purchase an additional 36,000 shares of common stock at $3.00 per share, which expire October 2010. We transferred $1,391.92 to the Estates in full satisfaction of the remaining amount of the indebtedness.

Convertible Promissory Notes and Stock Purchase Warrants

On January 7, 2000, we issued common stock purchase warrants at $2.50 per share for 150,000 shares of common stock related to the subordinated notes payable to Edward R. and Ingeborg V. Funk. The warrants are 100% vested and expire ten years from the date of grant. The Estate of Edward R. Funk and the Estate of Ingeborg V. Funk are both greater than 5% beneficial owners of our Company.

On June 30, 2003, we issued a $100,000 convertible promissory note payable to Windcom Investments SA, a greater than 5% beneficial owner of our Company. The interest on the convertible promissory note was determined by

15

the Prime Commercial Rate in effect at Bank One, N.A., Columbus, Ohio. In addition, we issued warrants to purchase 20,333 shares of our common stock to Windcom Investments SA, at $1.00 per share expiring June 2008. The warrants vested according to the following schedule: (1) 8,333 vested on the date of grant; and (2) 12,000 vested at a rate of 333 per month for 32 months, then 336 per month for 4 months. On May 13, 2004, in accordance with the terms of the convertible promissory note, the balance and accrued and unpaid interest owed automatically converted to 43,119 shares of common stock after we raised over $500,000 in private equity financing. As of May 13, 2004, the vested warrants were fixed at 11,633; no additional warrants will vest. In connection with the private equity financing, we also issued 8,623 warrants to Windcom Investments SA to purchase shares of common stock at $2.88 per share. These warrants expire May 2009.

On June 30, 2003, we issued warrants to purchase 10,000 shares of common stock at $1.00 per share to the Estate of Edward R. Funk in connection with a lease guarantee. The warrants vested according to the following schedule: (1) 4,600 vested on the date of grant; and (2) 5,400 vested at a rate of 150 per month for 36 months. These warrants expire June 2008.

On June 30, 2003, we issued a $166,666.67 convertible promissory note payable to Robert H. Peitz. Mr. Peitz is a greater than 5% beneficial owner of the Company. Mr. Peitz currently serves on our Board of Directors. The Prime Commercial Rate in effect at Bank One, N.A., Columbus, Ohio determined the interest on the convertible promissory note. In addition, we issued warrants to purchase 33,889 shares of our common stock to Mr. Peitz at $1.00 per share, which expire June 2008. The warrants vested according to the following schedule: (1) 13,889 vested on the date of grant; and (2) 20,000 vested at a rate of 556 per month for 32 months, then 552 per month for four months. On May 13, 2004, in accordance with the terms of the convertible promissory note, the balance and accrued and unpaid interest owed on the note automatically converted to 71,873 shares of common stock after we raised over $500,000 in private equity financing. As of May 13, 2004, the vested warrants were fixed at 14,374; no additional warrants will vest. In connection with the 2004 private equity financing, we also issued 19,449 warrants to Mr. Peitz to purchase shares of common stock at $2.88 per share, which expire May 2009.

On November 3, 2004, we entered into a loan agreement between the Company, as borrower, and Robert H. Peitz, as lender. Mr. Peitz agreed to loan us up to $200,000 for working capital, to be drawn by us in increments of $50,000. The interest rate was Huntington National Bank’s prime rate plus 2%, which accrued and compounded monthly. The loan was secured by our assets and perfected by the filing of a UCC-1 financing statement. For each $50,000 increment drawn on the loan Mr. Peitz received 5,000 warrants to purchase our common stock, without par value, at a purchase price of $2.50 per share and exercisable until November 1, 2009. The loan was drawn on the following schedule: November 3, 2004, $100,000; January 7, 2005, $50,000; and April 1, 2005, $50,000. The loan balance (principal and accrued interest) was repaid in October 2005 and the UCC-1 financing statement was terminated.

On April 14, 2005 we entered into a loan agreement between the Company, as borrower, and Robert H. Peitz, as lender. Mr. Peitz agreed to provide a $200,000 convertible secured loan to us for working capital. The interest rate of 10% accrued and compounded monthly. The loan was drawn on the following schedule: April 14, 2005, $100,000; and May 20, 2005, $100,000. Because we completed equity financing of at least $500,000 during the fourth quarter of 2005, the principal and accrued interest totaling $209,110 automatically converted on the same basis as the new financing to 104,555 shares of common stock ($2.00 per share) and warrants to purchase an aggregate of 26,139 shares of our common stock at a purchase price of $3.00 per share exercisable until October 2010.

Legal Services

Curtis A. Loveland is the beneficial owner of greater than 5% of our outstanding common stock. Mr. Loveland is a partner with Porter, Wright, Morris & Arthur LLP, our legal counsel through November of 2006. In November of 2006 we elected to change legal counsel to Carlile Patchen & Murphy LLP. Mr. Loveland’s ownership includes (i) 41,000 shares of common stock, which can be acquired by Mr. Loveland under stock options exercisable within 60 days of April 25, 2007; (ii) 437,256 shares of common stock beneficially owned in his capacity as the executor of the Estate of Edward R. Funk, of which 127,900 shares of common stock can be acquired by Mr. Loveland on behalf of the estate under stock options and warrants exercisable within 60 days of April 25, 2007; (iii) 462,852 shares of common stock beneficially owned by Mr. Loveland in his capacity as the executor of the Estate of Ingeborg V. Funk, of which 87,500 shares of common stock can be acquired by Mr. Loveland on behalf of the estate under stock options and warrants exercisable within 60 days of April 25, 2007; and (iv) 283,756 shares beneficially owned by Mr. Loveland as the trustee of generation-skipping irrevocable trusts established by Edward R. and Ingeborg V. Funk.

16

SHAREHOLDER PROPOSALS FOR 2008 ANNUAL MEETING

Each year our Board of Directors submits its nominations for election of directors at the annual meeting of shareholders. Other proposals may be submitted by the Board of Directors or the shareholders for inclusion in the proxy statement for action at the annual meeting. Any proposal submitted by a shareholder for inclusion in the proxy statement for the annual meeting of shareholders to be held in 2008 must be received by us (addressed to the attention of the Secretary) on or before January 4, 2008. Any shareholder proposal submitted outside the processes of Rule 14a-8 under the Securities Exchange Act of 1934 for presentation at our 2008 annual meeting will be considered untimely for purposes of Rule 14a-4 and 14a-5 if notice thereof is received by us after March 20, 2008. To be submitted at the meeting, any such proposal must be a proper subject for shareholder action under the laws of the State of Ohio.

ANNUAL REPORT

Our annual report on Form 10-KSB for the year ended December 31, 2006, containing financial statements for such year and the signed opinion of Hausser + Taylor LLC, registered independent public accounting firm, with respect to such financial statements, is being sent to shareholders concurrently with this proxy statement. The Annual Report is not to be regarded as proxy soliciting material, and we do not intend to ask, suggest or solicit any action from the shareholders with respect to such report.

OTHER MATTERS

The Board of Directors knows of no other matters to be brought before the Annual Meeting. If other matters should come before the meeting, however, each of the persons named in the proxy intends to vote in accordance with his judgement on such matters.

17

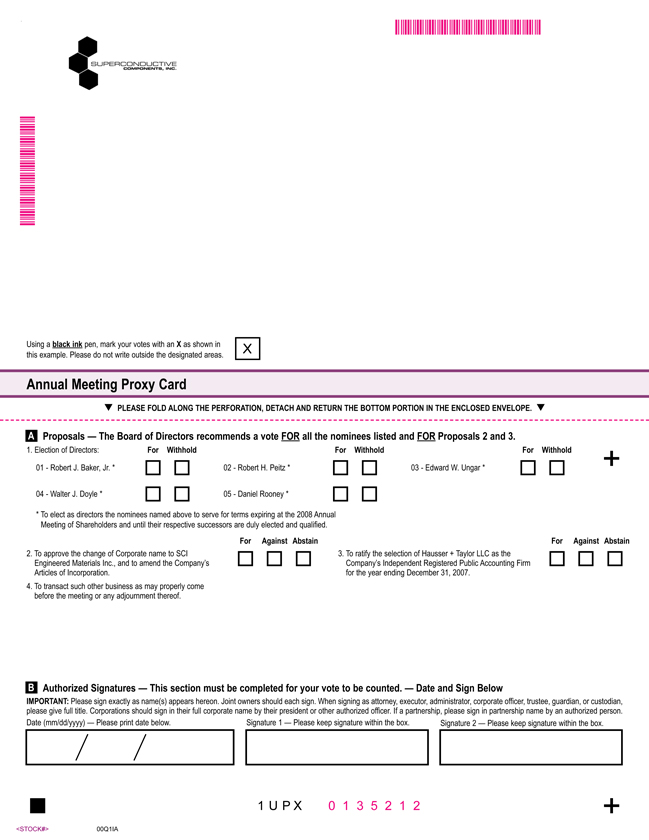

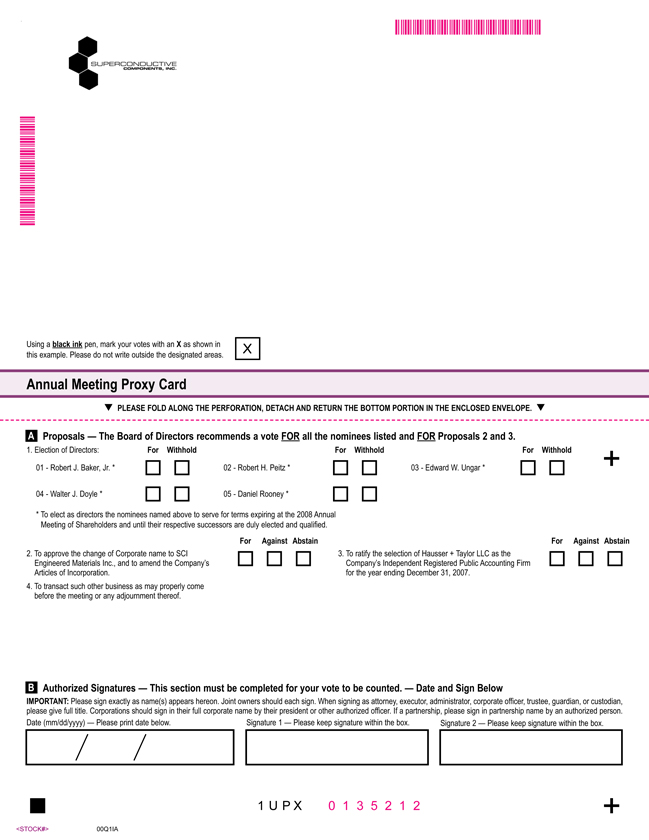

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

A Proposals — The Board of Directors recommends a vote FOR all the nominees listed and FOR Proposals 2 and 3.

1. Election of Directors: For Withhold For Withhold For Withhold

01—Robert J. Baker, Jr. * 02—Robert H. Peitz * 03—Edward W. Ungar *

04—Walter J. Doyle * 05—Daniel Rooney *

* To elect as directors the nominees named above to serve for terms expiring at the 2008 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified.

For Against Abstain For Against Abstain

2. To approve the change of Corporate name to SCI Engineered Materials Inc., and to amend the Company’s Articles of Incorporation. 3. To ratify the selection of Hausser + Taylor LLC as the Company’s Independent Registered Public Accounting Firm for the year ending December 31, 2007.

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

B Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

IMPORTANT: Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Corporations should sign in their full corporate name by their president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

Proxy — Superconductive Components, Inc.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The undersigned shareholder of Superconductive Components, Inc. (the “Company”) hereby appoints Daniel Rooney, Gerald S. Blaskie, and Michael A. Smith, or any one of them, as attorneys and proxies with full power of substitution to each, to vote all shares of common stock of the Company which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held at the offices of the Company, 2839 Charter Street, Columbus, Ohio, on Monday, June 25, 2007, at 9:30 a.m. local time, and at any adjournment or adjournments thereof, with all of the powers such undersigned shareholder would have if personally present, for the purposes stated on the reverse side.

The undersigned gives unto said attorneys and proxies, or substitutes, full power and authority to do whatsoever in their opinions may be necessary or proper to be done in the exercise of the power hereby conferred, including the right to vote for any adjournment, hereby ratifying all that said attorneys and proxies, or substitutes, may lawfully do or cause to be done by virtue hereof. Any of the said attorneys and proxies, or substitutes, who shall be present and shall act at the meeting shall have and may exercise all powers of said attorneys and proxies hereunder.

The undersigned hereby acknowledges receipt with this Proxy of a copy of the Company’s Notice of Annual Meeting and Proxy Statement dated May 9, 2007. Any proxy heretofore given to vote said shares is hereby revoked.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1, 2 AND 3 ON THE REVERSE SIDE.

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

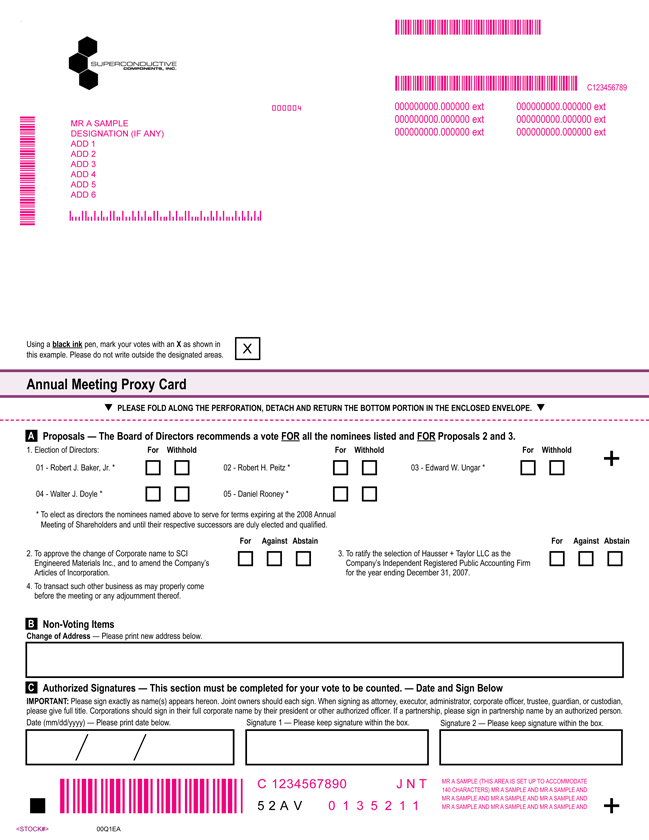

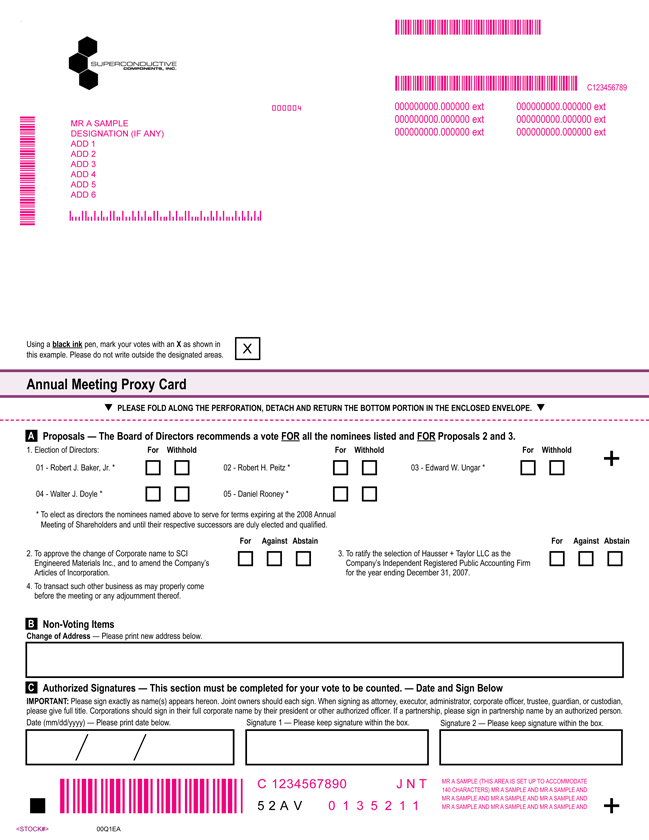

MR A SAMPLE

DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 ADD 5 ADD 6

000004

C123456789

000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

000000000.000000 ext 000000000.000000 ext 000000000.000000 ext

Using a black ink pen, mark your votes with an X as shown in this example. Please do not write outside the designated areas.

Annual Meeting Proxy Card

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

A Proposals — The Board of Directors recommends a vote FOR all the nominees listed and FOR Proposals 2 and 3.

1. Election of Directors: For Withhold For Withhold For Withhold

01—Robert J. Baker, Jr. * 02—Robert H. Peitz * 03—Edward W. Ungar *

04—Walter J. Doyle * 05—Daniel Rooney *

* To elect as directors the nominees named above to serve for terms expiring at the 2008 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified.

For Against Abstain For Against Abstain

2. To approve the change of Corporate name to SCI Engineered Materials Inc., and to amend the Company’s Articles of Incorporation. 3. To ratify the selection of Hausser + Taylor LLC as the Company’s Independent Registered Public Accounting Firm for the year ending December 31, 2007.

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

B Non-Voting Items

Change of Address — Please print new address below.

C Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

IMPORTANT: Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title. Corporations should sign in their full corporate name by their president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. Date (mm/dd/yyyy) — Please print date below. Signature 1 — Please keep signature within the box. Signature 2 — Please keep signature within the box.

C 1234567890

J N T

MR A SAMPLE (THIS AREA IS SET UP TO ACCOMMODATE 140 CHARACTERS) MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND MR A SAMPLE AND

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

Proxy — Superconductive Components, Inc.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The undersigned shareholder of Superconductive Components, Inc. (the “Company”) hereby appoints Daniel Rooney, Gerald S. Blaskie, and Michael A. Smith, or any one of them, as attorneys and proxies with full power of substitution to each, to vote all shares of common stock of the Company which the undersigned is entitled to vote at the Annual Meeting of Shareholders of the Company to be held at the offices of the Company, 2839 Charter Street, Columbus, Ohio, on Monday, June 25, 2007, at 9:30 a.m. local time, and at any adjournment or adjournments thereof, with all of the powers such undersigned shareholder would have if personally present, for the purposes stated on the reverse side.

The undersigned gives unto said attorneys and proxies, or substitutes, full power and authority to do whatsoever in their opinions may be necessary or proper to be done in the exercise of the power hereby conferred, including the right to vote for any adjournment, hereby ratifying all that said attorneys and proxies, or substitutes, may lawfully do or cause to be done by virtue hereof. Any of the said attorneys and proxies, or substitutes, who shall be present and shall act at the meeting shall have and may exercise all powers of said attorneys and proxies hereunder.

The undersigned hereby acknowledges receipt with this Proxy of a copy of the Company’s Notice of Annual Meeting and Proxy Statement dated May 9, 2007. Any proxy heretofore given to vote said shares is hereby revoked.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1, 2 AND 3 ON THE REVERSE SIDE.

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.