| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811–05498) |

| | |

| Exact name of registrant as specified in charter: | Putnam Master Intermediate Income Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292–1000 |

| | |

| Date of fiscal year end: | September 30, 2020 |

| | |

| Date of reporting period: | October 1, 2019 — September 30, 2020 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Master Intermediate

Income Trust

Annual report

9 | 30 | 20

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

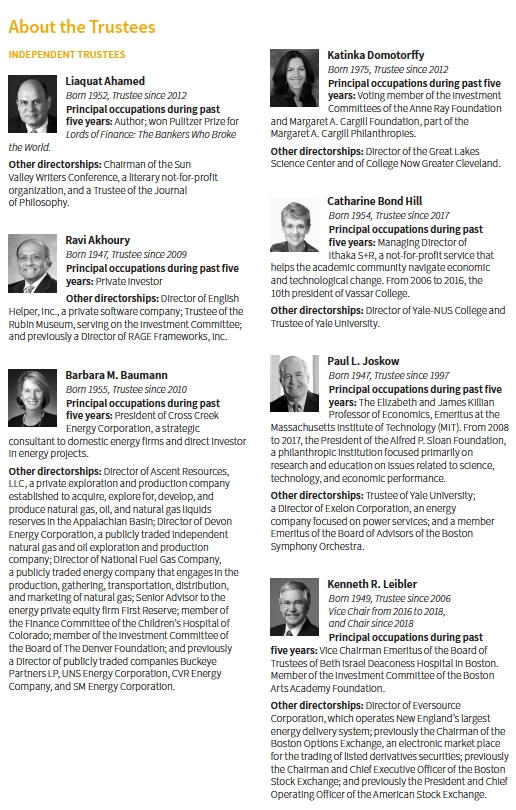

Message from the Trustees

November 11, 2020

Dear Fellow Shareholder:

In the final months of 2020, the world continues to confront the challenges of the COVID-19 pandemic. Economic activity and employment remain well below levels at the start of the year. The stock and bond markets have fared better, displaying confidence in the early stages of recovery and indicating optimism that successful vaccines will be approved by early next year. Putnam, as in all market conditions, continues to pursue superior investment performance for you and your fellow shareholders. Committed to racial equity, Putnam continues to work toward its goals of improving diversity and inclusion within its organization.

Also, we would like to take this opportunity to thank Robert E. Patterson, who retired as a Trustee on June 30, 2020, for his 36 years of service. We will miss Bob’s experienced judgment and insights, and we wish him well.

As always, thank you for investing with Putnam.

When Putnam Master Intermediate Income Trust was launched in 1988, its three-pronged focus on U.S. investment-grade bonds, high-yield corporate bonds, and non-U.S. bonds was considered innovative.

In the more than 30 years since then, the fixed-income landscape has undergone a dramatic transformation, but the spirit of ingenuity that helped launch the fund is still with it today.

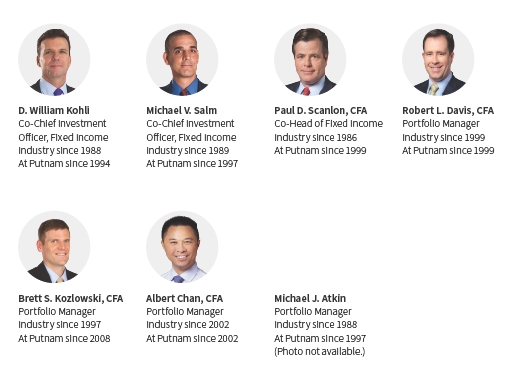

A veteran portfolio management team

The fund’s managers strive to build a well-diversified portfolio that carefully balances risk and return, targeting opportunities in interest rates, credit, mortgages, and currencies from across the full spectrum of the global bond markets.

|

| 2 Master Intermediate Income Trust |

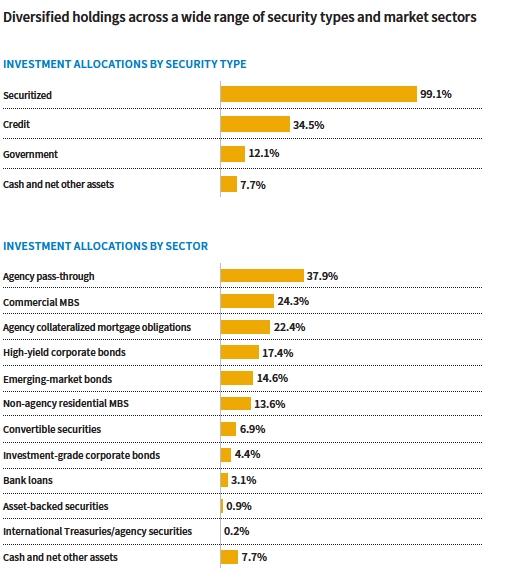

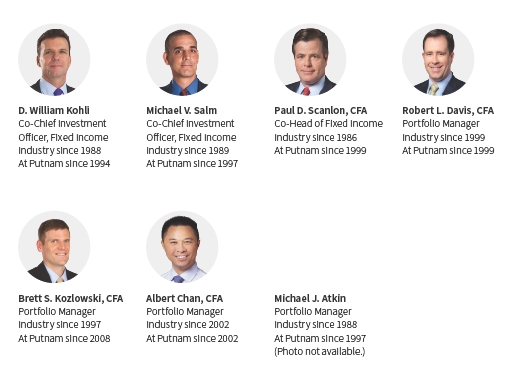

Allocations are shown as a percentage of the fund’s net assets as of 9/30/20. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding.

Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

|

| Master Intermediate Income Trust 3 |

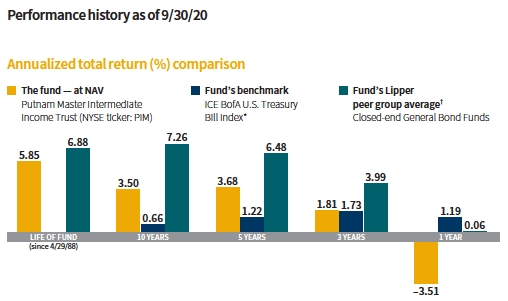

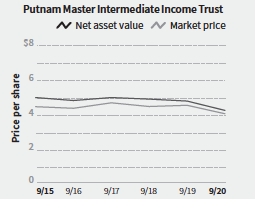

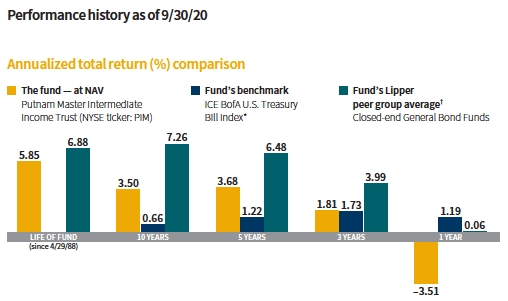

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and net asset value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart are at NAV. See below and pages 11–12 for additional performance information, including fund returns at market price. Index and Lipper results should be compared with fund performance at NAV.

* The fund’s benchmark, the ICE BofA U.S. Treasury Bill Index, was introduced on 6/30/92, which post-dates the inception of the fund.

† Source: Lipper, a Refinitiv company.

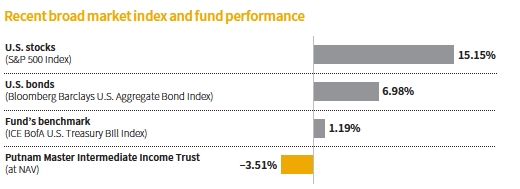

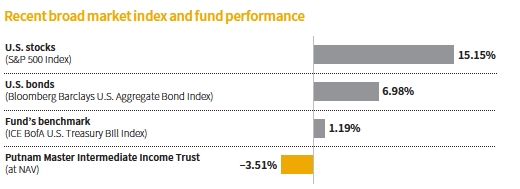

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 9/30/20. See above and pages 11–12 for additional fund performance information. Index descriptions can be found on pages 17–18.

|

| 4 Master Intermediate Income Trust |

Bill, what was the fund’s investment environment like during the reporting period?

For much of the period, it was a generally favorable environment for risk assets. In October 2019, the U.S. Federal Reserve [Fed] reduced its policy interest rate for the third time in as many months. Sentiment toward global trade improved as the United States and China agreed to cooperate on an initial round of trade measures.

Cracks began to appear in the benign backdrop early in the new year, however, leading to an eventual collapse in March. Intensifying investor anxiety about the COVID-19 outbreak sparked a global sell-off in risk assets. The pandemic quickly developed into an economic crisis that led to unprecedented measures from government policy makers. Also, a poorly timed dispute between Russia and Saudi Arabia over oil production levels pushed crude prices steadily lower until the end of April, further unnerving market participants.

Early in the crisis, the Fed quickly slashed its policy rate to near zero. Risk assets began to rebound in late March on hopes that massive government stimulus efforts would be enough to offset the near-term economic fallout from the pandemic.

|

| Master Intermediate Income Trust 5 |

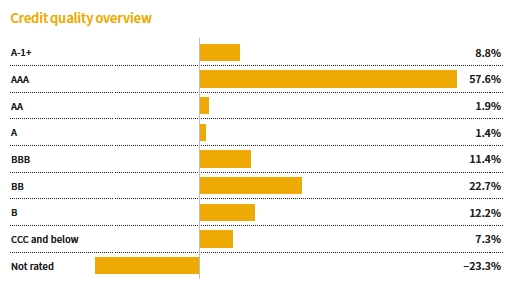

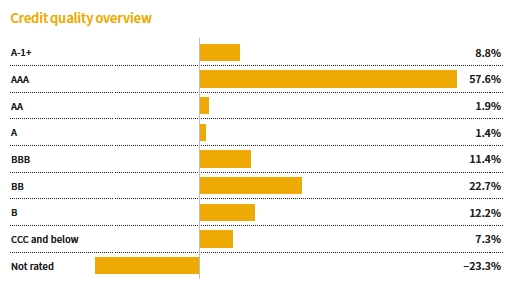

Credit qualities are shown as a percentage of the fund’s net assets as of 9/30/20. A bond rated BBB or higher (A-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. To-be-announced (TBA) mortgage commitments, if any, are included based on their issuer ratings. Ratings may vary over time.

Cash, derivative instruments, and net other assets are shown in the not-rated category. Payables and receivables for TBA mortgage commitments are included in the not-rated category and may result in negative weights. The fund itself has not been rated by an independent rating agency.

After a moderate pullback in early May, risk assets generally rose through August amid positive developments on a potential vaccine, negotiations for additional economic relief, and corporate earnings that came in above consensus expectations. These factors boosted sentiment in the face of heightening U.S.–China tensions and rising COVID-19 case counts across parts of the globe.

The market environment weakened moderately in September, partly due to increased global economic concerns stemming from an upsurge in virus cases in Europe. Fading hope for another U.S. stimulus package and uncertainty surrounding upcoming U.S. elections also weighed on investor sentiment.

Credit spreads tightened during the second half of the period, recovering from an extreme widening amid March’s market turmoil. [Spreads are the yield advantage credit-sensitive bonds offer over comparable-maturity U.S. Treasuries.

Bond prices fall as spreads widen and rise as spreads tighten.] Meanwhile, interest rates declined sharply. For example, the yield on the benchmark 10-year U.S. Treasury reached a period high of 1.92% during the fourth quarter of 2019 but finished the period at 0.68%.

Which holdings and strategies hampered the fund’s performance?

The fund at NAV underperformed both the ICE BofA U.S. T-Bill Index and the average of the Lipper Closed-End General Bond Funds category. Mortgage-credit investments were the biggest detractor for the period. Our exposure to commercial mortgage-backed securities [CMBS] — both cash bonds and synthetic exposure via CMBX — performed poorly for most of the period as spreads widened substantially. By way of explanation, CMBX includes a group of tradeable indexes that reference a basket of 25 CMBS issued in a particular year. Investors feared that the escalating pandemic would severely impact cash flows

| |

| 6 Master Intermediate Income Trust |

in various segments of the market, including retail, lodging, restaurants, and office space. Public health policies that curtailed shopping and travel for millions of people constrained the revenues for many malls and travel destinations. Beginning in August, however, these fears gradually receded and our holdings began to slowly rebound.

In the residential mortgage market, our positions in agency credit-risk transfer securities [CRT] struggled amid uncertainty about the effect that a government-mandated mortgage-forbearance program would have on CRT cash flows. However, after some clarification about the program in April, CRT recovered during the remainder of the period.

Elsewhere, emerging-market debt modestly detracted, as the sector declined along with other risk assets during the first quarter of 2020. Our holdings rallied in the second half of the period, buoyed by the general market uptrend.

What about contributors?

Our interest-rate and yield-curve positioning added considerable value for the period. During the first quarter of 2020, we shifted the portfolio’s duration modestly above zero, thereby increasing its interest-rate sensitivity. This positioning aided results as rates fell sharply across the curve during the height of the market turmoil.

Strategies targeting prepayment risk also meaningfully drove performance during the 12-month reporting period. Holdings of interest-only [IO] and inverse IO securities performed well during the first half of calendar 2020, except in March. We emphasized securities that tend to be less sensitive to declining interest rates, such as those structured from jumbo loans and older mortgages. Toward the end of the period, our mortgage basis positioning also helped. Mortgage basis is a strategy that seeks to exploit the yield differential between 30-year agency pass-throughs and 30-year U.S. Treasuries. The strategy added value as spreads on agency

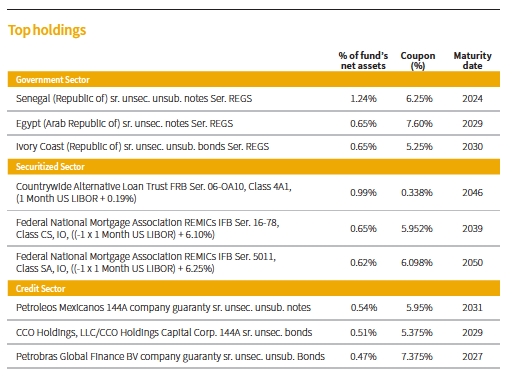

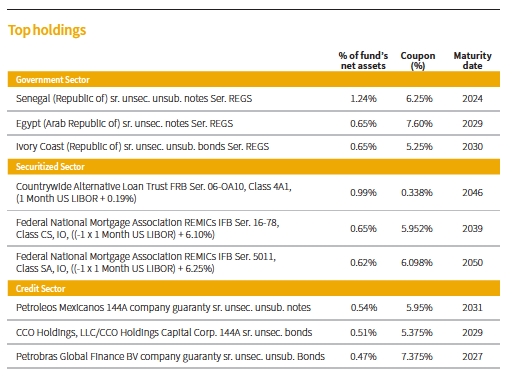

This table shows the fund’s top holdings across three key sectors and the percentage of the fund’s net assets that each represented as of 9/30/20. Short-term investments, TBA commitments, and derivatives, if any, are excluded. Holdings may vary over time.

|

| Master Intermediate Income Trust 7 |

pass-throughs tightened throughout 2020’s third quarter [meaning their prices rose relative to Treasuries].

Our corporate credit holdings — primarily high-yield bonds and convertible securities — were a further modest contributor. Following a sizable widening of corporate spreads in first quarter of 2020, spreads tightened during the remainder of the period.

How did you use derivatives during the period?

We used credit default swaps to gain exposure to CMBS via CMBX, and also to hedge the fund’s credit and market risks. We used bond futures and interest-rate swaps to take tactical positions at various points along the yield curve, and to hedge the risk associated with the fund’s curve positioning. We employed interest-rate swaps to gain exposure to rates in various countries. We also utilized options to hedge the fund’s interest-rate risk, to isolate the prepayment risk associated with our CMO holdings, and to help manage overall downside risk. In addition, we used total return swaps as a hedging tool, and to help manage the portfolio’s sector exposure as well as its inflation risk. Lastly, we used currency forward contracts to hedge the foreign exchange risk associated with non-U.S. bonds and to efficiently gain exposure to foreign currencies.

What is your near-term outlook?

Recent data have shown recovery in key sectors of the global economy, including manufacturing, housing, and consumer spending. However, the service sector continues to be constrained by the limitations resulting from the pandemic. We expect this trend to continue until a vaccine becomes widely available.

We are not anticipating a V-shaped economic recovery. While we expect intervals of rapid growth, we believe it will take an extended period of time for the global economy to fully recover from the damage done by the mobility restrictions needed to curb the pandemic. Also, we believe renewed virus outbreaks are likely to constrain the service sector and limit growth.

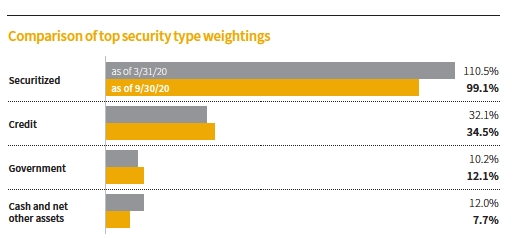

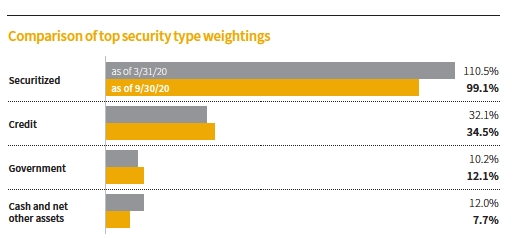

This chart shows how the fund’s security type weightings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding.

Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

|

| 8 Master Intermediate Income Trust |

How was the fund positioned as of September 30?

We think measures by the Fed and other central banks to shore up marketplace liquidity amid the COVID-19 crisis may keep U.S. interest rates range bound for an extended period of time. As a result, we shifted the fund’s duration from positive to close to zero late in the period. In our view, having a positive portfolio duration in the current environment is not an effective hedge against credit risk within the portfolio.

We have a relatively positive medium-term outlook for corporate credit. While acknowledging the risks mentioned above, we believe there are factors that will be supportive for the U.S. corporate credit market. These include demand for comparatively higher yields in the face of much lower yields globally. Also, investors know that the Fed is prepared to provide further support to the market via its bond purchase facilities if necessary. So far, the central bank has invested only a small portion of the $750 billion earmarked for corporate debt purchases. However, knowing that the Fed stands ready to step in if needed has provided an important boost to market sentiment.

In high-yield credit, we are closely watching sectors vulnerable to the disruption caused by the pandemic, including energy, gaming, lodging & leisure, and retail. Within these groups, we are focusing on the health of issuers’ balance sheets and liquidity metrics, as well as the increasing risk of defaults or credit-rating downgrades.

COVID-19 created significant headwinds for the CMBS market due to the negative impact on commercial real estate. That said, we began to see some improvement in higher-rated cash bonds during the latter months of the period. We continue to have conviction in the

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use currency forward contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

|

| Master Intermediate Income Trust 9 |

fund’s CMBX positions, which we believe fairly compensate investors for current risk levels.

Within the residential mortgage market, we believe the agency CRT sector directly benefits from the efforts of the federal government, as well as government-sponsored enterprises such as Fannie Mae and Freddie Mac, to keep people in their homes. We also believe the dislocations that occurred in March have been mitigated by U.S. monetary and fiscal policy and the gradual reopening of the economy. Consequently, we continue to find value in various segments of the CRT market as well as in the non-agency residential mortgage-backed market.

In non-U.S. sovereign debt, we continue to favor countries that we believe have responded effectively to COVID-19. We also like countries with younger populations, more favorable prospects for economic growth, and reasonably effective debt management.

In prepayment-sensitive areas of the market, despite a recent increase in refinancing activity leading to faster prepayment speeds on underlying securities, we continue to find value in agency interest-only collateralized mortgage obligations and inverse IOs backed by more seasoned collateral. We also believe IO securities structured from reverse mortgages continue to offer value.

Thanks for your time and for bringing us up to date, Bill.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk. Statements in the Q&A concerning the fund’s performance or portfolio composition relative to those of the fund’s Lipper peer group may reference information produced by Lipper Inc. or through a third party.

HOW CLOSED-END FUNDS DIFFER

FROM OPEN-END FUNDS

Closed-end funds and open-end funds share many common characteristics but also have some key differences that you should understand as you consider your portfolio strategies.

More assets at work Open-end funds are subject to ongoing sales and redemptions that can generate transaction costs for long-term shareholders. Closed-end funds, however, are typically fixed pools of capital that do not need to hold cash in connection with sales and redemptions, allowing the funds to keep more assets actively invested.

Traded like stocks Closed-end fund shares are traded on stock exchanges and, as a result, their prices fluctuate because of the influence of several factors.

They have a market price Like an open-end fund, a closed-end fund has a per-share net asset value (NAV). However, closed-end funds also have a “market price” for their shares —which is how much you pay when you buy shares of the fund, and how much you receive when you sell them.

When looking at a closed-end fund’s performance, you will usually see that the NAV and the market price differ. The market price can be influenced by several factors that cause it to vary from the NAV, including fund distributions, changes in supply and demand for the fund’s shares, changing market conditions, and investor perceptions of the fund or its investment manager. A fund’s performance at market price typically differs from its results at NAV.

|

| 10 Master Intermediate Income Trust |

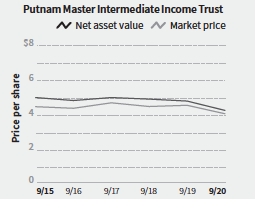

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended September 30, 2020, the end of its most recent fiscal year. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

| | | | | | | | |

| Fund performance Total return for periods ended 9/30/20 | | | | |

| |

| | Annual | | | | | | | |

| | average | | | | | | | |

| | Life of fund | | | | | | | |

| | (since | | Annual | | Annual | | Annual | |

| | 4/29/88) | 10 years | average | 5 years | average | 3 years | average | 1 year |

| NAV | 5.85% | 41.09% | 3.50% | 19.81% | 3.68% | 5.52% | 1.81% | –3.51% |

| Market price | 5.97 | 29.90 | 2.65 | 29.88 | 5.37 | 8.13 | 2.64 | –2.85 |

Performance assumes reinvestment of distributions and does not account for taxes.

Performance includes the deduction of management fees and administrative expenses.

| | | | | | | | |

| Comparative index returns For periods ended 9/30/20 | | | | |

| |

| | Annual | | | | | | | |

| | average | | | | | | | |

| | Life of fund | | | | | | | |

| | (since | | Annual | | Annual | | Annual | |

| | 4/29/88) | 10 years | average | 5 years | average | 3 years | average | 1 year |

| ICE BofA U.S. Treasury | | | | | | | | |

| Bill Index* | — | 6.84% | 0.66% | 6.25% | 1.22% | 5.27% | 1.73% | 1.19% |

| Bloomberg Barclays | | | | | | | | |

| Government/Credit | 6.35% | 46.22 | 3.87 | 25.55 | 4.66 | 18.61 | 5.86 | 8.03 |

| Bond Index | | | | | | | | |

| FTSE Non-U.S. World | | | | | | | | |

| Government Bond Index | 5.17 | 13.29 | 1.26 | 21.05 | 3.89 | 10.99 | 3.54 | 5.60 |

| JPMorgan Global High | | | | | | | | |

| Yield Index† | — | 50.27 | 4.16 | 23.41 | 4.30 | 5.85 | 1.91 | 0.79 |

| Lipper Closed-end | | | | | | | | |

| General Bond Funds | 6.88 | 107.45 | 7.26 | 37.35 | 6.48 | 12.66 | 3.99 | 0.06 |

| category average‡ | | | | | | | | |

Index and Lipper results should be compared with fund performance at net asset value. Lipper calculates performance differently than the closed-end funds it ranks, due to varying methods for determining a fund’s monthly reinvestment net asset value.

* The fund’s benchmark, the ICE BofA U.S. Treasury Bill Index, was introduced on 6/30/92, which post-dates the inception of the fund.

† The JPMorgan Global High Yield Index was introduced on 12/31/93, which post-dates the fund’s inception.

‡ Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 9/30/20 , there were 47, 34, 29, 17, and 4 funds, respectively, in this Lipper category.

|

| Master Intermediate Income Trust 11 |

| | |

| Fund price and distribution information For the 12-month period ended 9/30/20 |

| Distributions | | |

| Number | 12 |

| Income | $0.209188 |

| Capital gains | — |

| Return of capital* | 0.150812 |

| Total | $0.360000 |

| Share value | NAV | Market price |

| 9/30/19 | $4.83 | $4.59 |

| 9/30/20 | 4.30 | 4.11 |

| Share value | NAV | Market price |

| Current dividend rate† | 8.37% | 8.76% |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

* See page 128.

† Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by NAV or market price at end of period.

|

| 12 Master Intermediate Income Trust |

Information about the fund’s goal, investment strategies, and principal risks

Goal

The goal of the fund is to seek with equal emphasis high current income and relative stability of net asset value by allocating its investments among the U.S. investment grade sector, high-yield sector, and international sector.

The fund’s main investment strategies and related risks

This section contains detail regarding the fund’s main investment strategies and the related risks you face as a fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk.

We pursue the fund’s goal by investing mainly in bonds, securitized debt instruments (such as residential mortgage-backed securities (“RMBS”) and commercial mortgage-backed securities (“CMBS”)), and other obligations of companies and governments worldwide that are either investment-grade or below-investment-grade in quality (sometimes referred to as “junk bonds”), that have intermediate- to long-term maturities (three years or longer), and that are from multiple sectors. We may consider, among other factors, credit, interest rate and prepayment risks, as well as general market conditions, when deciding whether to buy or sell investments. We typically use to a significant extent derivatives, such as futures, options, certain foreign currency transactions and swap contracts, for hedging and non-hedging purposes and to obtain leverage.

The fund currently has significant investment exposure to CMBS, which are subject to risks associated with the commercial real estate markets and the servicing of mortgage loans secured by commercial properties. During periods of difficult economic conditions, delinquencies and losses on CMBS in particular generally increase, including as a result of the effects of those conditions on commercial real estate markets, the ability of commercial tenants to make loan payments, and the ability of a property to attract and retain commercial tenants. The fund achieves exposure to CMBS via cash securities and CMBX, an index that references a basket of CMBS.

• Interest rate risk. The values of bonds and other debt instruments usually rise and fall in response to changes in interest rates. Declining interest rates generally increase the value of existing debt instruments, and rising interest rates generally decrease the value of existing debt instruments. Changes in a debt instrument’s value usually will not affect the amount of interest income paid to the fund, but will affect the value of the fund’s shares. Interest rate risk is generally greater for investments with longer maturities.

Some investments give the issuer the option to call or redeem an investment before its maturity date. If an issuer calls or redeems an investment during a time of declining interest rates, we might have to reinvest the proceeds in an investment offering a lower yield, and, therefore, the fund might not benefit from any increase in value as a result of declining interest rates.

• Credit risk. Investors normally expect to be compensated in proportion to the risk they are assuming. Thus, debt of issuers with poor credit prospects usually offers higher yields than debt of issuers with more secure credit. Higher-rated investments generally have lower credit risk.

Investments rated below BBB or its equivalent are below investment-grade in quality (sometimes referred to as “junk bonds”). This rating reflects a greater possibility that the issuers may be unable to make timely payments of interest and principal and thus default. If a default occurs, or is perceived as likely to occur, the values of those investments will usually be more volatile and could decrease. A default or expected default could also make it difficult for us to sell the investments at prices approximating the values previously placed on them. Lower-rated debt usually has a more limited market than higher-rated debt, which may at times make it difficult for us to buy or sell certain debt instruments or to establish their fair values. Credit risk is generally greater for zero-coupon bonds and other investments that are issued at less than their face value and that are required to make interest payments only at maturity rather than at intervals during the life of the investment.

Credit ratings are based largely on the issuer’s historical financial condition and the rating agencies’ investment analysis at the time of rating. The rating assigned to any particular investment does not necessarily reflect the issuer’s current financial condition, and does not reflect an assessment of the investment’s volatility or liquidity. Although we consider credit ratings in making investment decisions, we perform our own investment analysis and do not rely only on ratings assigned by the rating agencies. Our success in achieving the fund’s goal may depend more on our own credit analysis when we buy lower-rated debt than when we buy investment-grade debt.

|

| Master Intermediate Income Trust 13 |

We may have to participate in legal proceedings involving the issuer. This could increase the fund’s operating expenses and decrease its net asset value.

Although investment-grade investments generally have lower credit risk, they may share some of the risks of lower-rated investments. U.S. government investments generally have the least credit risk, but are not completely free of credit risk. While some investments, such as U.S. Treasury obligations and Ginnie Mae certificates, are backed by the full faith and credit of the U.S. government, others are backed only by the credit of the issuer. Mortgage-backed securities may be subject to the risk that underlying borrowers will be unable to meet their obligations. RMBS and CMBS with payments not guaranteed by a government agency, including collateralized investment vehicles, which comprise a substantial portion of the fund’s investments, generally involve greater credit risk than securities guaranteed by government agencies.

• Prepayment risk. Traditional debt investments typically pay a fixed rate of interest until maturity, when the entire principal amount is due. In contrast, payments on securitized debt instruments, including mortgage-backed and asset-backed investments, typically include both interest and partial payment of principal. Principal may also be prepaid voluntarily or as a result of refinancing or foreclosure. We may have to invest the proceeds from prepaid investments in other investments with less attractive terms and yields.

Compared to debt that cannot be prepaid, mortgage-backed investments are less likely to increase in value during periods of declining interest rates and have a higher risk of decline in value during periods of rising interest rates. These investments may increase the volatility of the fund. Some mortgage-backed investments receive only the interest portion or the principal portion of payments on the underlying mortgages. The yields and values of these investments are extremely sensitive to changes in interest rates and in the rate of principal payments on the underlying mortgages. The market for these investments may be volatile and limited, which may make them difficult to buy or sell. Asset-backed securities are structured like mortgage-backed securities, but instead of mortgage loans or interests in mortgage loans, the underlying assets may include such items as motor vehicle installment sales or installment loan contracts, leases of various types of real and personal property and receivables from credit card agreements. Asset-backed securities are subject to risks similar to those of mortgage-backed securities.

• Foreign investments . We consider any securities issued by a foreign government or a supranational organization (such as the World Bank) or denominated in a foreign currency to be securities of a foreign issuer. In addition, we consider an issuer to be a foreign issuer if we determine that (i) the issuer is headquartered or organized outside the United States, (ii) the issuer’s securities trade in a market outside the United States, (iii) the issuer derives a majority of its revenues or profits outside the United States, or (iv) the issuer is significantly exposed to the economic fortunes and risks of regions outside the United States. Foreign investments involve certain special risks, including:

– Unfavorable changes in currency exchange rates: Foreign investments are typically issued and traded in foreign currencies. As a result, their values may be affected by changes in exchange rates between foreign currencies and the U.S. dollar.

– Political and economic developments: Foreign investments may be subject to the risks of seizure by a foreign government, direct or indirect impact of sovereign debt default, imposition of economic sanctions or restrictions on the exchange or export of foreign currency, and tax increases.

– Unreliable or untimely information: There may be less information publicly available about a foreign company than about most publicly-traded U.S. companies, and foreign companies are usually not subject to accounting, auditing and financial reporting standards and practices as stringent as those in the United States. Foreign securities may trade on markets that are closed when U.S. markets are open. As a result, accurate pricing information based on foreign market prices may not always be available.

– Limited legal recourse: Legal remedies for investors may be more limited than the remedies available in the United States.

– Limited markets: Certain foreign investments may be less liquid (harder to buy and sell) and more volatile than most U.S. investments, which means we may at times be unable to sell these foreign investments at desirable prices. In addition, there may be limited or no markets for bonds of issuers that become distressed. For the same reason, we may at times find it difficult to value the fund’s foreign investments.

– Trading practices: Brokerage commissions and other fees are generally higher for foreign investments than for U.S. investments. The procedures and rules governing foreign transactions and custody may also involve delays in payment, delivery or recovery of money or investments.

| |

| 14 Master Intermediate Income Trust |

– Sovereign issuers: The willingness and ability of sovereign issuers to pay principal and interest on government securities depends on various economic factors, including the issuer’s balance of payments, overall debt level, and cash flow from tax or other revenues. In addition, there may be no legal recourse for investors in the event of default by a sovereign government.

The risks of foreign investments are typically increased in countries with less developed markets, which are sometimes referred to as emerging markets. Emerging markets may have less developed economies and legal and regulatory systems, and may be susceptible to greater political and economic instability than developed foreign markets. Countries with emerging markets are also more likely to experience high levels of inflation, or currency devaluation, and investments in emerging markets may be more volatile and less liquid than investments in developed markets. For these and other reasons, investments in emerging markets are often considered speculative.

Certain risks related to foreign investments may also apply to some extent to U.S.- traded investments that are denominated in foreign currencies, investments in U.S. companies that are traded in foreign markets, or investments in U.S. companies that have significant foreign operations.

• Derivatives. We may engage in a variety of transactions involving derivatives, such as futures, options, certain foreign currency transactions and swap contracts. Derivatives are financial instruments whose value depends upon, or is derived from, the value of something else, such as one or more underlying investments, pools of investments, indexes or currencies. We may make use of “short” derivatives positions, the values of which typically move in the opposite direction from the price of the underlying investment, pool of investments, index or currency. We may use derivatives for hedging and non-hedging purposes and to obtain leverage. For example, we may use derivatives to increase or decrease the fund’s exposure to long- or short-term interest rates (in the United States or abroad) or as a substitute for a direct investment in the securities of one or more issuers. However, we may also choose not to use derivatives based on our evaluation of market conditions or the availability of suitable derivatives. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on our ability to manage these sophisticated instruments. Some derivatives are “leveraged,” which means they provide the fund with investment exposure greater than the value of the fund’s investment in the derivatives. As a result, these derivatives may magnify or otherwise increase investment losses to the fund. The risk of loss from certain short derivatives positions is theoretically unlimited. The value of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility.

Other risks arise from the potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the fund’s derivatives positions. In fact, many over-the-counter instruments (investments not traded on an exchange) will not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivatives transaction will not meet its obligations.

• Floating rate loans. Floating rate loans are debt obligations with interest rates that adjust or “float” periodically (normally on a monthly or quarterly basis) based on a generally recognized base rate, such as the London Inter-Bank Offered Rate or the prime rate offered by one or more major U.S. banks. While most floating rate loans are below-investment-grade in quality, many also are senior in rank in the event of bankruptcy to most other securities of the borrower, such as common stock or public bonds. Floating rate loans are also normally secured by specific collateral or assets of the borrower so that the holders of the loans will have a priority claim on those assets in the event of default or bankruptcy of the issuer.

Floating rate loans generally are less sensitive to interest rate changes than obligations with fixed interest rates but may decline in value if their interest rates do not rise as much, or as quickly, as interest rates in general. Conversely, floating rate instruments will not generally increase in value if interest rates decline. Changes in interest rates will also affect the amount of interest income the fund earns on its floating rate investments. Most floating rate loans allow for prepayment of principal without penalty. If a borrower prepays a loan, we might have to reinvest the proceeds in an investment that may have lower yields than the yield on the prepaid loan or might not be able to take advantage of potential gains from increases in the credit quality of the issuer.

The value of collateral, if any, securing a floating rate loan can decline, and may be insufficient to meet the borrower’s obligations or difficult to liquidate. In addition, the fund’s access to collateral may be limited by bankruptcy or other insolvency proceedings. Floating rate loans may not be fully collateralized and may decline in value. Loans may not be considered “securities,” and it is possible that the fund may not be entitled to rely on anti-fraud and other protections under the federal securities laws when it purchases loans.

|

| Master Intermediate Income Trust 15 |

Although the market for the types of floating rate loans in which the fund invests has become increasingly liquid over time, this market is still developing, and there can be no assurance that adverse developments with respect to this market or particular borrowers will not prevent the fund from selling these loans at their market values when we consider such a sale desirable. In addition, the settlement period (the period between the execution of the trade and the delivery of cash to the purchaser) for floating rate loan transactions may be significantly longer than the settlement period for other investments, and in some cases longer than seven days. Requirements to obtain consent of borrower and/or agent can delay or impede the fund’s ability to sell the floating rate loans and can adversely affect the price that can be obtained. It is possible that sale proceeds from floating rate loan transactions will not be available to meet redemption obligations.

• Liquidity and illiquid investments. We may invest the fund’s assets in illiquid investments, which may be considered speculative and which may be difficult to sell. The sale of many of these investments is prohibited or limited by law or contract. Some investments may be difficult to value for purposes of determining the fund’s net asset value. We may not be able to sell these investments when we consider it desirable to do so, or we may be able to sell them only at less than their value.

• Market risk. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions; investor sentiment and market perceptions (including perceptions about monetary policy, interest rates or the risk of default); government actions (including protectionist measures, intervention in the financial markets or other regulation, and changes in fiscal, monetary or tax policies); geopolitical events or changes (including natural disasters, epidemics or pandemics, terrorism and war); and factors related to a specific issuer, geography, industry or sector. Foreign financial markets have their own market risks, and they may be more or less volatile than U.S. markets and may move in different directions. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings.

• Management risk. The fund is actively managed and its performance will reflect, in part, our ability to make investment decisions that seek to achieve the fund’s investment objective. There is no guarantee that the investment techniques, analyses, or judgments that we apply in making investment decisions for the fund will produce the intended outcome or that the investments we select for the fund will perform as well as other securities that were not selected for the fund. As a result, the fund may underperform its benchmark or other funds with a similar investment goal and may realize losses. In addition, we, or the fund’s other service providers, may experience disruptions or operating errors that could negatively impact the fund. Although service providers may have operational risk management policies and procedures and take appropriate precautions to avoid and mitigate risks that could lead to disruptions and operating errors, it may not be possible to identify all of the operational risks that may affect the fund or to develop processes and controls to completely eliminate or mitigate their occurrence or effects.

• Other investments. In addition to the main investment strategies described above, the fund may make other types of investments, such as investments in asset-backed, hybrid and structured bonds and notes, preferred securities that would be characterized as debt securities under applicable accounting standards and tax laws, and assignments of and participations in fixed and floating rate loans. The fund may also loan portfolio securities to earn income.

• Temporary defensive strategies. In response to adverse market, economic, political or other conditions, we may take temporary defensive positions, such as investing some or all of the fund’s assets in cash and cash equivalents, that differ from the fund’s usual investment strategies. However, we may choose not to use these temporary defensive strategies for a variety of reasons, even in very volatile market conditions. These strategies may cause the fund to miss out on investment opportunities, and may prevent the fund from achieving its goal. Additionally, while temporary defensive strategies are mainly designed to limit losses, such strategies may not work as intended.

• Changes in policies. The Trustees may change the fund’s goal, investment strategies and other policies without shareholder approval.

| |

| 16 Master Intermediate Income Trust |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the value of all your fund’s assets, minus any liabilities, divided by the number of outstanding shares.

Market price is the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the New York Stock Exchange.

Fixed-income terms

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Mortgage-backed security (MBS), also known as a mortgage “pass-through,” is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The following are types of MBSs:

• Agency credit-risk transfer security (CRT) is backed by a reference pool of agency mortgages. Unlike a regular agency pass-through, the principal invested in a CRT is not backed by a U.S. government agency. To compensate investors for this risk, a CRT typically offers a higher yield than conventional pass-through securities. Similar to a CMBS, a CRT is structured into various tranches for investors, offering different levels of risk and yield based on the underlying reference pool.

• Agency “pass-through” has its principal and interest backed by a U.S. government agency, such as the Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and Federal Home Loan Mortgage Corporation (Freddie Mac).

• Collateralized mortgage obligation (CMO) represents claims to specific cash flows from pools of home mortgages. The streams of principal and interest payments on the mortgages are distributed to the different classes of CMO interests in “tranches.” Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates. A CMO is highly sensitive to changes in interest rates and any resulting change in the rate at which homeowners sell their properties, refinance, or otherwise prepay loans. CMOs are subject to prepayment, market, and liquidity risks.

° Interest-only (IO) security is a type of CMO in which the underlying asset is the interest portion of mortgage, Treasury, or bond payments.

• Non-agency residential mortgage-backed security (RMBS) is an MBS not backed by Fannie Mae, Ginnie Mae, or Freddie Mac. One type of RMBS is an Alt-A mortgage-backed security.

• Commercial mortgage-backed security (CMBS) is secured by the loan on a commercial property.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Bloomberg Barclays Government/ Credit Bond Index is an unmanaged index of U.S. Treasuries, agency securities, and investment-grade corporate bonds.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

CMBX Index tracks the performance of a basket of CMBS issued in a particular year.

ICE BofA (Intercontinental Exchange Bank of America) U.S. Treasury Bill Index is an

|

| Master Intermediate Income Trust 17 |

unmanaged index that tracks the performance of U.S. dollar-denominated U.S. Treasury bills publicly issued in the U.S. domestic market. Qualifying securities must have a remaining term of at least one month to final maturity and a minimum amount outstanding of $1 billion.

FTSE Non-U.S. World Government Bond Index is an unmanaged index generally considered to be representative of the world bond market, excluding the United States.

JPMorgan Global High Yield Index is an unmanaged index that is designed to mirror the investable universe of the U.S. dollar global high-yield corporate debt market, including domestic (U.S.) and international (non-U.S.) issues. International issues comprise both developed and emerging markets.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

FTSE Russell is the source and owner of the trademarks, service marks, and copyrights related to the FTSE Indexes. FTSE® is a trademark of FTSE Russell.

Lipper, a Refinitiv company, is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding share repurchase program

In September 2020, the Trustees of your fund approved the renewal of a share repurchase program that had been in effect since 2005. This renewal allows your fund to repurchase, in the 365 days beginning October 1, 2020, up to 10% of the fund’s common shares outstanding as of September 30, 2020.

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2020, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

| |

| 18 Master Intermediate Income Trust |

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of September 30, 2020, Putnam employees had approximately $495,000,000 and the Trustees had approximately $76,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Changes to the fund’s bylaws

On September 18, 2020, the Board of Trustees of Putnam Master Intermediate Income Trust amended and restated the Bylaws of the fund (the “Amended and Restated Bylaws”). The Amended and Restated Bylaws have been revised to include provisions (collectively, the “Control Share Amendment”) pursuant to which, in summary, a shareholder who obtains beneficial ownership of fund shares in a “Control Share Acquisition” may exercise voting rights with respect to such shares only to the extent the authorization of such voting rights is approved by other shareholders of the fund. The Control Share Amendment is primarily intended to protect the interests of the fund and its shareholders by limiting the risk that the fund will become subject to undue influence by activist investors. As described further below, the Control Share Amendment does not eliminate voting rights for shares acquired in Control Share Acquisitions, but rather, it entrusts the fund’s other “non-interested” shareholders with determining whether to approve the authorization of voting rights for such shares.

Subject to various conditions and exceptions, the Amended and Restated Bylaws define a “Control Share Acquisition” to include an acquisition of fund shares that, but for the Control Share Amendment, would entitle the beneficial owner, upon the acquisition of such shares, to vote or direct the voting of shares having voting power in the election of fund Trustees within any of the following ranges:

(i) One-tenth or more, but less than one-fifth of all voting power;

(ii) One-fifth or more, but less than one-third of all voting power;

(iii) One-third or more, but less than a majority of all voting power; or

(iv) A majority or more of all voting power.

Shares acquired prior to September 18, 2020 are excluded from the definition of Control Share Acquisition, though such shares are included in assessing whether any subsequent share acquisition exceeds one of the enumerated thresholds. Subject to various conditions and procedural requirements set forth in the Amended and Restated Bylaws, including the delivery of a “Control Share Acquisition Statement” to the fund’s Clerk setting forth certain required information, a shareholder who obtains beneficial ownership of shares in a Control Share Acquisition generally may request a vote of fund shareholders (excluding such acquiring shareholder and certain other interested shareholders) to approve the authorization of voting rights for such shares at the next annual meeting of fund shareholders, notice of which has not been given prior to the receipt by the fund of the Control Share Acquisition Statement.

The above discussion is only a high-level summary of certain aspects of the Control Share Amendment, and is qualified in its entirety by reference to the full Amended and Restated Bylaws, which may be obtained at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

|

| Master Intermediate Income Trust 19 |

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

| |

| 20 Master Intermediate Income Trust |

Summary of Putnam Closed-End Funds’ Amended and Restated Dividend Reinvestment Plans

Putnam Managed Municipal Income Trust, Putnam Master Intermediate Income Trust, Putnam Municipal Opportunities Trust and Putnam Premier Income Trust (each, a “Fund” and collectively, the “Funds”) each offer a dividend reinvestment plan (each, a “Plan” and collectively, the “Plans”). If you participate in a Plan, all income dividends and capital gain distributions are automatically reinvested in Fund shares by the Fund’s agent, Putnam Investor Services, Inc. (the “Agent”). If you are not participating in a Plan, every month you will receive all dividends and other distributions in cash, paid by check and mailed directly to you.

Upon a purchase (or, where applicable, upon registration of transfer on the shareholder records of a Fund) of shares of a Fund by a registered shareholder, each such shareholder will be deemed to have elected to participate in that Fund’s Plan. Each such shareholder will have all distributions by a Fund automatically reinvested in additional shares, unless such shareholder elects to terminate participation in a Plan by instructing the Agent to pay future distributions in cash. Shareholders who were not participants in a Plan as of January 31, 2010, will continue to receive distributions in cash but may enroll in a Plan at any time by contacting the Agent.

If you participate in a Fund’s Plan, the Agent will automatically reinvest subsequent distributions, and the Agent will send you a confirmation in the mail telling you how many additional shares were issued to your account.

To change your enrollment status or to request additional information about the Plans, you may contact the Agent either in writing, at P.O. Box 8383, Boston, MA 02266-8383, or by telephone at 1-800-225-1581 during normal East Coast business hours.

How you acquire additional shares through a Plan If the market price per share for your Fund’s shares (plus estimated brokerage commissions) is greater than or equal to their net asset value per share on the payment date for a distribution, you will be issued shares of the Fund at a value equal to the higher of the net asset value per share on that date or 95% of the market price per share on that date.

If the market price per share for your Fund’s shares (plus estimated brokerage commissions) is less than their net asset value per share on the payment date for a distribution, the Agent will buy Fund shares for participating accounts in the open market. The Agent will aggregate open-market purchases on behalf of all participants, and the average price (including brokerage commissions) of all shares purchased by the Agent will be the price per share allocable to each participant. The Agent will generally complete these open-market purchases within five business days following the payment date. If, before the Agent has completed open-market purchases, the market price per share (plus estimated brokerage commissions) rises to exceed the net asset value per share on the payment date, then the purchase price may exceed the net asset value per share, potentially resulting in the acquisition of fewer shares than if the distribution had been paid in newly issued shares.

How to withdraw from a Plan Participants may withdraw from a Fund’s Plan at any time by notifying the Agent, either in writing or by telephone. Such withdrawal will be effective immediately if notice is received by the Agent with sufficient time prior to any distribution record date; otherwise, such withdrawal will be effective with respect to any subsequent distribution following notice of withdrawal. There is no penalty for withdrawing from or not participating in a Plan.

Plan administration The Agent will credit all shares acquired for a participant under a Plan to the account in which the participant’s common shares are held. Each participant will

|

| Master Intermediate Income Trust 21 |

be sent reasonably promptly a confirmation by the Agent of each acquisition made for his or her account.

About brokerage fees Each participant pays a proportionate share of any brokerage commissions incurred if the Agent purchases additional shares on the open market, in accordance with the Plans. There are no brokerage charges applied to shares issued directly by the Funds under the Plans.

About taxes and Plan amendments

Reinvesting dividend and capital gain distributions in shares of the Funds does not relieve you of tax obligations, which are the same as if you had received cash distributions. The Agent supplies tax information to you and to the IRS annually. Each Fund reserves the right to amend or terminate its Plan upon 30 days’ written notice. However, the Agent may assign its rights, and delegate its duties, to a successor agent with the prior consent of a Fund and without prior notice to Plan participants.

If your shares are held in a broker or nominee name If your shares are held in the name of a broker or nominee offering a dividend reinvestment service, consult your broker or nominee to ensure that an appropriate election is made on your behalf. If the broker or nominee holding your shares does not provide a reinvestment service, you may need to register your shares in your own name in order to participate in a Plan.

In the case of record shareholders such as banks, brokers or nominees that hold shares for others who are the beneficial owners of such shares, the Agent will administer the Plan on the basis of the number of shares certified by the record shareholder as representing the total amount registered in such shareholder’s name and held for the account of beneficial owners who are to participate in the Plan.

|

| 22 Master Intermediate Income Trust |

Trustee approval of management contract

General conclusions

The Board of Trustees of The Putnam Funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management, LLC (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”). The Board, with the assistance of its Contract Committee, requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. The Contract Committee consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of The Putnam Funds (“Independent Trustees”).

At the outset of the review process, members of the Board’s independent staff and independent legal counsel considered any possible changes to the annual contract review materials furnished to the Contract Committee during the course of the previous year’s review and, as applicable, identified those changes to Putnam Management. Following these discussions and in consultation with the Contract Committee, the Independent Trustees’ independent legal counsel requested that Putnam Management and its affiliates furnish specified information, together with any additional information that Putnam Management considered relevant, to the Contract Committee. Over the course of several months ending in June 2020, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management provided. Throughout this process, the Contract Committee was assisted by the members of the Board’s independent staff and by independent legal counsel for The Putnam Funds and the Independent Trustees.

In May 2020, the Contract Committee met in executive session to discuss and consider its recommendations with respect to the continuance of the contracts. At the Trustees’ June 2020 meeting, the Contract Committee met in executive session with the other Independent Trustees to review a summary of the key financial, performance and other data that the Contract Committee considered in the course of its review. The Contract Committee then presented its written report, which summarized the key factors that the Committee had considered and set forth its recommendations. The Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contracts, effective July 1, 2020. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not attempted to evaluate PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services to the fund; and

• That the fee schedule in effect for your fund represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years.

|

| Master Intermediate Income Trust 23 |

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. The Trustees also reviewed the total expenses of each Putnam fund, recognizing that in most cases management fees represented the major, but not the sole, determinant of total costs to fund shareholders. (Two funds have implemented so-called “all-in” management fees covering substantially all routine fund operating costs.)

In reviewing fees and expenses, the Trustees generally focus their attention on material changes in circumstances — for example, changes in assets under management, changes in a fund’s investment strategy, changes in Putnam Management’s operating costs or profitability, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not indicate that changes to the management fee schedule for your fund would be appropriate at this time.

Under its management contract, your fund has the benefit of breakpoints in its management fee schedule that provide shareholders with economies of scale in the form of reduced fee rates as the fund’s assets under management increase. The Trustees noted, however, that because your fund is a closed-end management investment company, it has relatively stable levels of assets under management and is not expected to be affected significantly by breakpoints in its management fee schedule. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale between fund shareholders and Putnam Management.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Broadridge Financial Solutions, Inc. (“Broadridge”). This comparative information included your fund’s percentile ranking for effective management fees and total expenses, which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the first quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the third quintile in total expenses as of December 31, 2019. The first quintile represents the least expensive funds and the fifth quintile the most expensive funds. The fee and expense data reported by Broadridge as of December 31, 2019 reflected the most recent fiscal year-end data available in Broadridge’s database at that time.

In connection with their review of fund management fees and total expenses, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of the revenues, expenses and profitability of Putnam Management and its affiliates, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the Putnam funds at that time.

The information examined by the Trustees in connection with their annual contract review for the Putnam funds included information regarding services provided and fees charged by Putnam Management and its affiliates to other clients, including defined benefit pension and profit-sharing plans, sub-advised mutual funds, private funds sponsored by affiliates of Putnam Management, and model-only separately managed accounts. This information included, in cases where a product’s investment strategy corresponds with a fund’s strategy, comparisons of those fees with fees charged to the Putnam funds, as well as an assessment of the differences in the services provided to these clients as compared to the services provided to the Putnam funds. The Trustees observed that the differences in fee rates between these clients and the Putnam funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of

| |

| 24 Master Intermediate Income Trust |

investment management services to these types of clients may reflect, among other things, historical competitive forces operating in separate marketplaces. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for other clients, and the Trustees also considered the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its other clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of Putnam Management’s investment process and performance by the work of the investment oversight committees of the Trustees and the full Board of Trustees, which meet on a regular basis with individual portfolio managers and with senior management of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period.

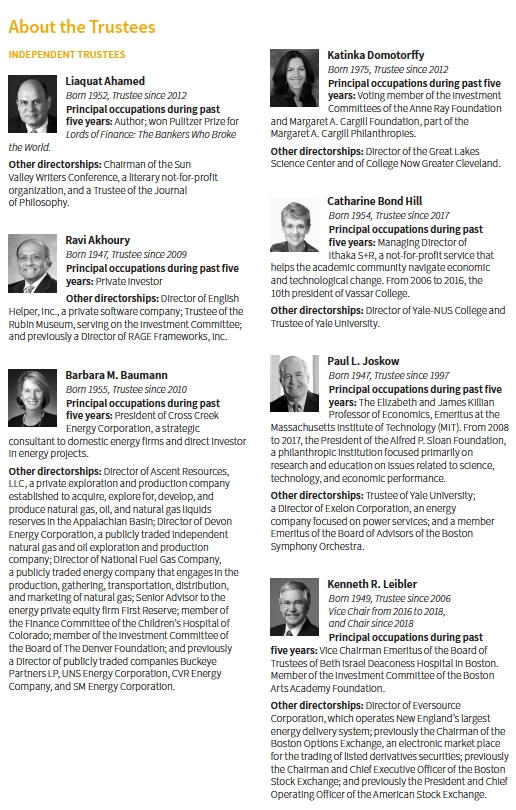

The Trustees considered that, in the aggregate, 2019 was a strong year of performance for The Putnam Funds, with the Putnam funds, on an asset-weighted basis, ranking in the top quartile of their Lipper Inc. (“Lipper”) peers for the year ended December 31, 2019. For those funds that are evaluated based on their total returns versus selected investment benchmarks, the Trustees observed that the funds, on an asset-weighted-basis, delivered a gross return that was 2.3% ahead of their benchmarks in 2019. In addition to the performance of the individual Putnam funds, the Trustees considered, as they had in prior years, the performance of The Putnam Fund complex versus competitor fund complexes. In this regard, the Trustees observed that The Putnam Funds’ relative performance, as reported in the Barron’s/Lipper Fund Families survey, was exceptionally strong over both the short and long term, with The Putnam Funds ranking as the 8th best performing mutual fund complex out of 55 complexes for the one-year period ended December 31, 2019 and the 8th best performing mutual fund complex out of 45 complexes for the ten-year period, with 2019 marking the third consecutive year that The Putnam Funds have ranked in the top ten fund complexes for the ten-year period. The Trustees also noted that The Putnam Funds ranked 26th out of 52 complexes for the five-year period ended December 31, 2019. In addition to the Barron’s/Lipper Fund Families Survey, the Trustees also considered the funds’ ratings assigned by Morningstar Inc., noting that 22 of the funds were four- or five-star rated at the end of 2019 and that this included five funds that had achieved a five-star rating. They also noted, however, the disappointing investment performance of some funds for periods ended December 31, 2019 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor closely the performance of those funds, including the effectiveness of any efforts Putnam Management has undertaken to address underperformance and whether additional actions to address areas of underperformance are warranted.