UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ Preliminary Proxy Statement | | ¨ | | Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

| | |

¨ Definitive Additional Materials | | | | |

| | |

¨ Soliciting Material Pursuant to §240.14a-12 | | | | |

Multi-Fineline Electronix, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

January 24, 2007

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Multi-Fineline Electronix, Inc. that will be held on Tuesday, March 20, 2007, at 9:00 a.m. at the Hilton Hotel at 3050 Bristol Street, Costa Mesa, California 92626.

The formal notice of the Annual Meeting and the Proxy Statement are included with this invitation.

After reading the Proxy Statement, please mark, date, sign and return, at your earliest convenience, the enclosed proxy in the enclosed prepaid envelope, to ensure that your shares will be represented. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY, OR ATTEND THE ANNUAL MEETING IN PERSON. Your vote is important, so please return your proxy promptly. A copy of our 2006 Annual Report to Stockholders is also enclosed.

The Board of Directors and management look forward to seeing you at the meeting.

|

Sincerely yours, |

|

|

Philip A. Harding |

Chairman of the Board and CEO |

MULTI-FINELINE ELECTRONIX, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 20, 2007

To the Stockholders of Multi-Fineline Electronix, Inc.:

The Annual Meeting of Stockholders of Multi-Fineline Electronix, Inc., a Delaware corporation (the “Company”), will be held at the Hilton Hotel at 3050 Bristol Street, Costa Mesa, California 92626 on Tuesday, March 20, 2007, at 9:00 a.m. Pacific Standard Time, for the following purposes:

1. To elect two Class III directors to serve until the 2010 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

2. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm; and

3. To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement of the Annual Meeting.

Stockholders of record as of the close of business on January 22, 2007 are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. A complete list of stockholders entitled to vote at the Annual Meeting will be available at the Secretary’s office, 3140 East Coronado Street, Anaheim, California 92806, for ten days before the meeting.

It is important that your shares are represented at the meeting. Even if you plan to attend the meeting, we hope that you will promptly mark, sign, date and return the enclosed proxy. This will not limit your right to attend or vote at the meeting.

|

By Order of the Board of Directors |

|

|

Christine Besnard |

Vice President, General Counsel and Secretary |

January 24, 2007

MULTI-FINELINE ELECTRONIX, INC.

3140 EAST CORONADO STREET

ANAHEIM, CALIFORNIA 92806

(714) 238-1488

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Multi-Fineline Electronix, Inc., a Delaware corporation (the “Company”), of proxies in the accompanying form to be used at the Annual Meeting of Stockholders of the Company to be held at the Hilton Hotel at 3050 Bristol Street, Costa Mesa, California 92626, on Tuesday, March 20, 2007, at 9:00 a.m. Pacific Standard Time, and any postponement or adjournment thereof (the “Annual Meeting”). This Proxy Statement and the accompanying form of proxy are first being mailed to stockholders on or about February 2, 2007.

Who Can Vote

Stockholders of record at the close of business on January 22, 2007 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the close of business on the Record Date, the Company had 24,481,232 shares of common stock, $0.0001 par value (the “Common Stock”), outstanding. The presence in person or by proxy of the holders of a majority of outstanding Common Stock constitutes a quorum for the transaction of business at the Annual Meeting. Each holder of Common Stock is entitled to one vote for each share held as of the Record Date.

How You Can Vote

You may vote your shares at the Annual Meeting either in person or by proxy. To vote by proxy, you should mark, date, sign and mail the enclosed proxy in the prepaid envelope. Giving a proxy will not affect your right to vote your shares if you attend the Annual Meeting and want to vote in person. The shares represented by the proxies received in response to this solicitation and not properly revoked will be voted at the Annual Meeting in accordance with the instructions therein. On the matters coming before the Annual Meeting for which a choice has been specified by a stockholder on the proxy card, the shares will be voted accordingly. If you return your proxy, but do not mark your voting preference, the individuals named as proxies will vote your sharesFOR the election of the two nominees for Class III director listed in this Proxy Statement andFOR the ratification of the appointment of the Company’s independent registered public accounting firm.

Revocation of Proxies

Stockholders can revoke their proxies at any time before they are exercised in any of three ways:

| | • | | by voting in person at the Annual Meeting; |

| | • | | by submitting written notice of revocation to the Secretary of the Company prior to the Annual Meeting; or |

| | • | | by submitting another proxy of a later date that is properly executed prior to or at the Annual Meeting. |

1

Required Vote

Directors are elected by a plurality vote. The two nominees for Class III director who receive the most votes cast in their favor will be elected to serve as directors. The other proposals submitted for stockholder approval at the Annual Meeting will be decided by the affirmative vote of the majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposals. Abstentions with respect to any proposal are treated as shares present or represented and entitled to vote on that proposal and thus have the same effect as negative votes. If a broker which is the record holder of shares indicates on a proxy that it does not have discretionary authority to vote on a particular proposal as to such shares, or if shares are not voted in other circumstances in which proxy authority is defective or has been withheld with respect to a particular proposal, these non-voted shares will be counted for quorum purposes but are not deemed to be present or represented for purposes of determining whether stockholder approval of that proposal has been obtained.

IMPORTANT

Please mark, sign and date the enclosed proxy and return it at your earliest convenience in the enclosed postage-prepaid return envelope, so that, whether you intend to be present at the Annual Meeting or not, your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board currently consists of seven members divided into three classes, each serving staggered three-year terms as follows:

| | • | | Class I, whose term will expire at the annual meeting of stockholders to be held in 2008; |

| | • | | Class II, whose term will expire at the annual meeting of stockholders to be held in 2009; and |

| | • | | Class III, whose term will expire at the Annual Meeting. |

The Nominating and Corporate Governance Committee (the “Nominating Committee”) of the Board has recommended, and the Board has designated, Sanford L. Kane and Huat Seng Lim, Ph.D. to be elected at the Annual Meeting. If elected at the Annual Meeting, each Class III director will hold office until the Annual Meeting of Stockholders in 2010 and until their successors are duly elected and qualified unless they resign or are removed.

If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, an event not currently anticipated, proxies will be voted for any nominee designated by the Board, taking into account any recommendation by the Nominating Committee, to fill the vacancy.

Biographical information concerning each of the directors and nominees for director as of the date of this Proxy Statement is set forth below.

| | | | |

Name

| | Age

| | Position

|

Peter Blackmore | | 59 | | Class I director |

Richard J. Dadamo | | 78 | | Class II director |

Philip A. Harding | | 74 | | CEO, Chairman of the Board (Class I director) |

Sanford L. Kane | | 64 | | Class III director and nominee for election as Class III director |

Huat Seng Lim, Ph.D. | | 62 | | Class III director and nominee for election as Class III director |

Choon Seng Tan | | 54 | | Class II director |

Sam Yau | | 58 | | Class I director |

2

Peter Blackmorehas served on the Board since March 2005. Since February 2005, Mr. Blackmore has served as Executive Vice President of Unisys Corporation and is a corporate officer of that company. From 1991 through August 2004, Mr. Blackmore served in various roles at Compaq Computer Corporation, or Compaq, and Hewlett-Packard Company, or HP, most recently as Executive Vice President of the Customer Solutions Group at HP from May 2004 through August 2004, and as Executive Vice President of the Enterprise Systems Group at HP from 2002 through May 2004. Prior to the merger of Compaq and HP, Mr. Blackmore served as Senior Vice President of Worldwide Sales and Service of Compaq from 2000 through 2002 and Senior Vice President of Worldwide Sales and Marketing of Compaq from 1998 through 2000. Prior to joining Compaq, Mr. Blackmore served as the Marketing Director, UK for Xerox Corporation from 1988 through 1991 and the Strategy Director, UK for Xerox from 1986 through 1988. Mr. Blackmore also spent 16 years at Burroughs Business Systems (now Unisys Corporation) from 1970 through 1986 in various management positions in both Europe and the United States. Since April 2006, Mr. Blackmore has served on the board of directors of MEMC Electronic Materials Inc. Mr. Blackmore holds an M.A. in economics from Trinity College, Cambridge and has attended the Advanced Management Program at INSEAD, France and Compaq’s Management Courses at Harvard Business School and London Business School.

Richard J. Dadamo has served on the Board since July 1999. Since March 1981, Mr. Dadamo has served as the principal of RJD Associates, Inc., a management consulting firm. From August 1998 to February 1999, Mr. Dadamo served as interim Chief Executive Officer of DPAC Technologies Corp., a technology component packaging company, and served as the Chairman of the board of directors of DPAC from March 1999 until 2006. Mr. Dadamo has also been the Chief Executive Officer of The Earth Technology Corporation, and has held senior positions at American International Devices, TRW, Inc. and Electronic Memories and Magnetics Corporation. Mr. Dadamo has published six books on management. Mr. Dadamo holds an M.S. from Drexel Institute of Technology, a B.S. from Pennsylvania State University and has completed the Executive Management Program at the University of Southern California.

Philip A. Harding has served as the Company’s Chief Executive Officer since January 1988 and as a director since September 1988. In December 2003, Mr. Harding assumed the position of Chairman of the Board. Prior to joining the Company, Mr. Harding served as the Chief Executive Officer of Weltec Digital Corporation from 1984 to 1987. From 1981 to 1984, Mr. Harding served as the President of the Remex Division of Excello Corporation, or Excello, after joining Excello in 1979 as the Vice President of Engineering. Prior to joining Excello, Mr. Harding served as the General Manager of the Commercial Systems Division of Electronic Memories and Magnetics Corporation from 1973 to 1979. Each of these companies manufactured computer peripherals and components. From February 1988 to March 2004, Mr. Harding served as Chief Executive Officer of Wearnes Hollingsworth Corporation, an electronic connector company and a member of the WBL Corporation group of companies. Mr. Harding served as Chairman of the board of directors of Advanced Logic Research, Inc., a former member of the WBL Corporation group of companies, from October 1985 to March 1988. Mr. Harding also served as a member of the board of directors of MFS Technology Pte Ltd., a member of the WBL Corporation group of companies, from October 1994 to September 2000. Mr. Harding holds a B.S.E.E. from Cooper Union College and an M.S. from Columbia University.

Sanford L. Kane has served on the Board since June 2004. From April 2005 to August 15, 2006, Mr. Kane served as the interim Chief Executive Officer (CEO) of Metara, Inc., a privately held semiconductor equipment manufacturer. Since 1992, Mr. Kane has served as the President of Kane Concepts Incorporated, a management consulting firm. From January 2000 to December 2000, Mr. Kane served as the Chairman of the board of directors and Chief Executive Officer of Legacy Systems Incorporated, a semiconductor equipment manufacturer. From January 1993 to April 1995, Mr. Kane served as Chairman of the board of directors and Chief Executive Officer of Tower Semiconductor Ltd. From October 1990 to January 1992, Mr. Kane served as President and Chief Executive Officer of PCO, Inc., a manufacturer of fiber optic electronic products. From July 1989 to June 1990, Mr. Kane served as President and Chief Executive Officer of U.S. Memories, Inc. Prior to July 1989, Mr. Kane spent 27 years with International Business Machines, Inc., or IBM, in various managerial and technical positions, most recently as Vice President of Industry Operations-General Technology Division.

3

While at IBM, Mr. Kane served as a director of SEMATECH, an industry consortium, and the Semiconductor Industry Association. Mr. Kane currently serves as a member of the board of directors of two privately held companies. Mr. Kane holds a B.S. in industrial engineering from New York University and an M.S. in engineering administration from Syracuse University.

Huat Seng Lim, Ph.D., has served on the Board since December 2001. Currently, Dr. Lim is the Group Managing Director (Technology Manufacturing) of WBL Corporation Limited (“WBL Corporation”), a multi-national company listed on the Singapore Exchange and parent company of Wearnes Technology (Private) Limited (“Wearnes Technology”) and United Wearnes Technology Pte Ltd (“United Wearnes”). Previously, Dr. Lim served as the Group General Manager (WearnesTech Solutions & Special Projects) for WBL Corporation. From July 1, 2001 through December 2004, Dr. Lim served as the Group General Manager of Wearnes Technology, a subsidiary of WBL Corporation engaged in contract manufacturing services and technology. Dr. Lim has also served on the boards of directors of several of WBL Corporation’s associate companies. From June 2000 to July 2001, Dr. Lim served as Executive Vice President of Trans Capital Berhad, an EMS company listed on the Malaysian Stock Exchange. From September 1998 to May 2000, Dr. Lim served as President of COB Technology Sdn. Bhd., an EMS company in Malaysia. From 1995 to September 1998, Dr. Lim served as Vice President and Managing Director Asia Pacific of Packard Bell NEC Inc. and, from 1989 to 1994, Dr. Lim served in various capacities, and finally as a Vice President and a division officer of Compaq Computer Corporation. He also held senior management positions in several multinational corporations, including Digital Equipment Corporation and Sime Darby Berhad. Dr. Lim has also served as a professor at the University of Science of Malaysia and as a computer consultant to the Prime Minister’s Department of Malaysia. Dr. Lim holds a B.E.E. (Honors) from the University of Queensland, Brisbane, Australia and a Ph.D. in computer science from the University of London, Institute of Computer Science, London, United Kingdom.

Choon Seng Tan has served on the Board since January 2005. Since December 2004, Mr. Tan has served as the Chief Executive Officer and a director of WBL Corporation. Mr. Tan served as the Vice President and Managing Director, South East Asia of Hewlett-Packard Singapore, an IT product and services company from June 2002 through November 2004. From 1996 through 2002, Mr. Tan served in various senior management roles with Compaq, including Vice President and Managing Director of Compaq Computer Asia and Corporate VP, Director and Director of Finance and Strategic Planning for Compaq Computers Asia Pacific. Mr. Tan held various management positions at Hewlett-Packard Far East Ltd. from 1989 through 1996, including Director-Finance and Human Resources and Chief Financial Officer, Singapore. Mr. Tan holds a B.A.C.C. from the University of Singapore.

Sam Yau has served on the Board since June 2004. Since 1997, Mr. Yau has been a private investor. From 1995 to 1997, Mr. Yau served as Chief Executive Officer of National Education Corporation. From 1993 through 1994, Mr. Yau served as Chief Operating Officer of Advacare, Inc., a medical services company. Mr. Yau currently serves as a member of the board of directors of SRS Labs, Inc., a provider of audio and voice technology solutions. Mr. Yau also served as a Past Chairman of the Forum for Corporate Directors in Orange County. Mr. Yau holds a B.S.S. in economics from the University of Hong Kong and an M.B.A. from the University of Chicago.

Board Meetings and Committees

The Board held nine meetings during the fiscal year ended September 30, 2006. In fiscal year 2006, all incumbent directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which such directors serve with the exception of Mr. Tan who attended 66% of the Board meetings and Dr. Lim who attended 66% of the Compensation Committee and Nominating Committee meetings. The Board encourages the directors to attend the annual meetings of its stockholders. In 2006, all of the directors then serving on the Board attended the annual meeting.

The Board has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The Board has determined that each director who serves on these committees is

4

“independent,” as that term is defined by applicable listing standards of The Nasdaq Global Select Market and the Securities and Exchange Commission (“SEC”) rules, with the exception of Dr. Lim who serves on both the Compensation Committee and the Nominating Committee. Dr. Lim is not deemed independent under the applicable rules because he serves as Group Managing Director (Technology Manufacturing) of WBL Corporation, whose subsidiaries in turn own a majority of the outstanding Common Stock. However, in accordance with the Nasdaq rules, the Board has determined that exceptional and limited circumstances exist, due in part to the majority stockholder position of the WBL Corporation entities, and that it is in the best interests of the Company and its stockholders that Dr. Lim serve as a member of these committees.

In addition, each member of the Compensation Committee qualifies as a non-employee director for purposes of Section 162(m) of the Internal Revenue Code. The Board has approved a charter for each of these committees that can be found on the Company’s website atwww.mflex.com.

Audit Committee

Functions: | The Audit Committee provides assistance to the Board in fulfilling its legal and fiduciary obligations in matters involving the Company’s accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by the Company’s independent registered public accounting firm and reviewing their reports regarding the Company’s accounting practices and systems of internal accounting controls. The Audit Committee is responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm and for ensuring that such accounting firm is independent of management. Mr. Kane is the Company’s audit committee financial expert as currently defined under the rules of the SEC. |

Compensation Committee

Functions: | The Compensation Committee determines the Company’s general compensation policies and practices. The Compensation Committee also reviews and approves compensation packages for the Company’s officers and, based upon such review, recommends overall compensation packages for the officers to the entire Board. In addition, the Compensation Committee reviews and determines equity-based compensation for the Company’s directors, officers, employees and consultants and administers the Company’s stock option plans. |

5

Nominating and Corporate Governance Committee

Functions: | The Nominating and Corporate Governance Committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board and for overseeing the Company’s corporate governance guidelines and reporting and making recommendations to the Board concerning corporate governance matters. |

Director Nominations

The Board nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies when they arise. The Nominating Committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the Board for nomination or election.

The Board has as an objective that its membership be composed of experienced and dedicated individuals with diversity of backgrounds, perspectives and skills. The Nominating Committee will select candidates for director based on their character, judgment, diversity of experience, business acumen and ability to act on behalf of all stockholders. The Nominating Committee believes that nominees for director should have experience, such as experience in management or accounting and finance, or industry and technology knowledge that may be useful to the Company and the Board, high personal and professional ethics, and the willingness and ability to devote sufficient time to effectively carry out his or her duties as a director. The Nominating Committee believes it appropriate for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and for a majority of the members of the Board to meet the definition of “independent director” under the rules of The Nasdaq Global Select Market and the SEC. The Nominating Committee also believes it appropriate for certain key members of the Company’s management to participate as members of the Board.

Prior to each annual meeting of stockholders, the Nominating Committee identifies nominees first by evaluating the current directors whose term will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, including as demonstrated by the candidate’s prior service as a director, and the needs of the Board with respect to the particular talents and experience of its directors. In the event that a director does not wish to continue in service, the Nominating Committee determines not to re-nominate a director, or a vacancy is created on the Board as a result of a resignation, an increase in the size of the Board or other event, the Nominating Committee will consider various candidates for Board membership, including those suggested by the Nominating Committee members, by other Board members, by any executive search firm engaged by the Nominating Committee and by stockholders. A stockholder who wishes to suggest a prospective nominee for the Board should notify the Secretary of the Company or any member of the Nominating Committee in writing with any supporting material the stockholder considers appropriate. Once a slate of candidates is chosen by the Nominating Committee, the Nominating Committee recommends the candidates to the entire Board, and the Board then determines whether to recommend the slate to the stockholders.

6

In addition, the Company’s Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at the Company’s annual meeting of stockholders. In order to nominate a candidate for director, a stockholder must give timely notice in writing to the Secretary of the Company and otherwise comply with the provisions of the Company’s Bylaws. To be timely, the Company’s Bylaws provide that a stockholder’s notice shall be delivered by a nationally recognized courier service or mailed by first class United States mail, postage or delivery charges prepaid, and received at the Company’s principal executive offices, addressed to the attention of the Company’s Secretary, not less than 90 days nor more than 120 days in advance of the date the Company’s proxy statement was released to the stockholders in connection with the previous year’s annual meeting. However, in the event that no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than 30 days from the date contemplated at the time of the previous year’s proxy statement, notice by the stockholder must be received by the Company’s Secretary not later than the close of business on the later of (i) the 90th day prior to such annual meeting and (ii) the seventh day following the day on which public announcement of the date of such meeting is first made. Information required by the Bylaws to be in the notice include the name, contact information and share ownership information for the candidate and the person making the nomination and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities Exchange Act of 1934 and the related rules and regulations under that Section. The Nominating Committee may also require any proposed nominee to furnish such other information as may reasonably be required by the Nominating Committee to determine the eligibility of such proposed nominee to serve as director of the Company.

Stockholder nominations must be made in accordance with the procedures outlined in, and include the information required by, the Company’s Bylaws and must be addressed to: Secretary, Multi-Fineline Electronix, Inc., 3140 East Coronado Street, Anaheim, California 92806. You can obtain a copy of the Company’s Bylaws by writing to the Secretary at this address.

Stockholder Communications with the Board

If you wish to communicate with the Board, you may send your communication in writing to: General Counsel, Multi-Fineline Electronix, Inc., 3140 East Coronado Street, Anaheim, California 92806. You must include your name and address in the written communication and indicate whether you are a stockholder of the Company. The General Counsel will review any communication received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Compensation of Directors

Although employees of WBL Corporation and its subsidiaries who serve on the Board are entitled to receive the same compensation as other non-employee members of the Board, they have informed the Company that they are not authorized by WBL Corporation or its subsidiaries to accept monetary payments or equity awards, and thus, the Company has not made any payments or granted any stock options in fiscal 2006 to directors who are employees of WBL Corporation or its subsidiaries.

The Company pays its other non-employee Board members the following fees related to their service on the Board:

| | • | | annual retainer of $15,000, payable in equal quarterly installments; |

| | • | | per Board meeting fee of $2,500 for meetings attended; |

| | • | | per committee meeting fee of $1,500 for meetings attended; and |

| | • | | annual retainer for serving as Board or committee chairman of $4,000, payable in equal quarterly installments. |

7

If a Board member attends less than 75% of the Board meetings held in any given year, the Board member would receive (i) the per meeting fee for the meetings he/she actually attended during such year and (ii) a percentage of the annual Board retainer equal to the proportion of total Board meetings attended to the total Board meetings scheduled. Additionally, the Company reimburses the directors for reasonable expenses in connection with attendance at Board and committee meetings.

Effective January 2006, the Board amended the 2004 Stock Incentive Plan to provide that in lieu of nonstatutory stock options, non-employee directors will be eligible to receive non-discretionary, automatic grants of a restricted stock unit (“RSU”). As amended, the plan provides that (i) a non-employee director will automatically be granted an initial RSU for 4,000 shares upon first becoming a member of the Board and (ii) immediately after each annual meeting of stockholders, each non-employee director will automatically be granted an RSU for 2,000 shares, provided the director served on the Board for at least six months, was not elected to the Board for the first time at such meeting and will continue to serve as a member of the Board. The initial RSU grant will vest equally over three years, and each annual RSU grant will be fully vested on the earlier to occur of (a) the anniversary of the date of grant and (b) the next annual meeting of stockholders. Both the initial RSU grants and the annual RSU grants are subject to accelerated vesting if the Company is subject to a change of control. RSUs are typically settled on the vesting date in shares of Common Stock or cash based on the fair market value of the Common Stock at the time of settlement. During the 2006 fiscal year, the Company’s non-employee directors, except directors who are employees of WBL Corporation or its subsidiaries, received a non-discretionary, automatic RSU grant for 2,000 shares.

Each non-employee director who became a director prior the plan being amended was automatically granted an initial nonstatutory option to purchase 30,000 shares of Common Stock upon first becoming a member of the Board (other than Mr. Tan, who declined such grant). The initial option vested and became exercisable over four years, with the first 25% of the shares subject to the initial option vesting on the first anniversary of the date of grant date and the remainder vesting monthly thereafter. Also prior to the plan being amended, the day following the Company’s regularly scheduled annual meeting of stockholders, each non-employee director was automatically granted a nonstatutory option to purchase 15,000 shares of Common Stock, provided the director had served on the Board for at least six months. Each of these options fully vested and became exercisable on the first anniversary of the date of grant. All of the options granted to non-employee directors had a per share exercise price equal to 100% of the fair market value of the underlying shares on the date of grant and are subject to accelerated vesting if the Company is subject to a change of control.

Compensation Committee Interlocks and Insider Participation

During various times within the 2006 fiscal year, Messrs. Blackmore, Dadamo and Yau and Dr. Lim each served as members of the Compensation Committee. None of the members of the Compensation Committee at any time has been one of the Company’s officers or employees. No interlocking relationship exists, or has existed in the past, between the Board or Compensation Committee and the board of directors or compensation committee of any other entity.

Dr. Lim, a member of the Company’s Compensation Committee, currently serves as Group Managing Director (Technology Manufacturing) of WBL Corporation, whose subsidiaries own a majority of the outstanding Common Stock. As discussed below under “Certain Relationships and Related Transactions,” the Company has several agreements and relationships with WBL Corporation and its affiliated entities.

Required Vote

The two Class III nominees receiving the highest number of affirmative votes of the shares present and voting at the Annual Meeting in person or by proxy will be elected as directors. A proxy cannot be voted for a greater number of persons than two.

The Board recommends a vote “FOR” election as director of the Class III nominees.

8

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2007. PricewaterhouseCoopers LLP has audited the Company’s financial statements since fiscal year 1989. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to questions. Although stockholder ratification of the Company’s appointment of its independent registered public accounting firm is not required by the Company’s Bylaws or otherwise, the Company is submitting the selection of PricewaterhouseCoopers LLP to its stockholders for ratification to permit stockholders to participate in this important corporate decision.

Principal Accountant Fees and Services

The following table presents fees for professional audit services rendered by PricewaterhouseCoopers LLP for the audit of the Company’s financial statements for fiscal 2006 and 2005 and fees billed for other services rendered by PricewaterhouseCoopers LLP.

| | | | | | |

| | | Fiscal Year Ended September 30,

|

| | | 2006

| | 2005

|

Audit Fees(1) | | $ | 1,675,000 | | $ | 1,025,789 |

Audit-Related Fees(2) | | | 265,943 | | | — |

Tax Fees(3) | | | 560,174 | | | 511,057 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 2,501,117 | | $ | 1,536,846 |

| | |

|

| |

|

|

| (1) | Audit fees in fiscal 2006 consisted of fees paid for the annual audit, the Sarbanes-Oxley 404 audit, quarterly reviews, and review of the Company’s registration statement on Form S-4. Audit fees in fiscal 2005 consisted of fees paid for the annual audit, Sarbanes-Oxley 404 audit and quarterly reviews. |

| (2) | Audit-related fees in fiscal 2006 consisted of fees paid for services rendered in connection with due diligence assistance in Singapore with the potential MFS acquisition in February and March 2006. |

| (3) | Tax fees related to compliance with Federal, State, local and foreign tax regulations as well as tax return preparation services were $112,275 and $99,380 for the years ended September 30, 2006 and 2005, respectively. Tax fees related to assistance provided with respect to the review and audit of tax matters by government agencies and tax authorities, including consultations on technical tax matters were $447,899 and $411,677 for the years ended September 30, 2006 and 2005, respectively. |

Pre-Approval Policies and Procedures

It is the Company’s policy that all audit and non-audit services to be performed by the Company’s principal independent registered public accounting firm be approved in advance by the Audit Committee. The Audit Committee will not approve the engagement of the Company’s principal independent registered public accounting firm to perform any service that the independent registered public accounting firm would be prohibited from providing under applicable securities laws or Nasdaq requirements. In assessing whether to approve use of the Company’s principal independent registered public accounting firm for permitted non-audit services, the Audit Committee tries to minimize relationships that could appear to impair the objectivity of the firm. The Audit Committee will approve permitted non-audit services by the Company’s principal independent registered public accounting firm only when it will be more effective or economical to have such services provided by the independent registered public accounting firm. The Audit Committee has granted Mr. Kane,

9

Chairman of the Audit Committee, the discretion to determine whether non-audit services proposed to be performed by PricewaterhouseCoopers LLP require the review of the entire Audit Committee, and in any situation where he deems it appropriate, Mr. Kane, acting alone, has been granted authority by the Audit Committee to negotiate and approve the engagement and/or terms of any non-audit service for the Company by PricewaterhouseCoopers LLP within the guidelines mentioned above. Mr. Kane reports regularly to the Audit Committee on any non-audit services he approves pursuant to such authority. During the fiscal year ended September 30, 2006, all audit and non-audit services performed by the Company’s principal independent registered public accounting firm were approved in advance by the Audit Committee, or by Mr. Kane on behalf of the Audit Committee.

Required Vote

Ratification will require the affirmative vote of a majority of the shares present and voting at the Annual Meeting in person or by proxy. If ratification is not obtained, the Audit Committee will review its future selection of the Company’s independent registered public accounting firm but will not be required to select different independent auditors for the Company.

The Board recommends a vote “FOR” ratification of appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm.

OTHER MATTERS

The Company knows of no other business that will be presented at the Annual Meeting. If any other business is properly brought before the Annual Meeting, it is intended that proxies in the enclosed form will be voted in accordance with the judgment of the persons voting the proxies.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of January 22, 2007 as to shares of the Common Stock beneficially owned by: (i) each person who is known by the Company to own beneficially more than 5% of its Common Stock, (ii) each of the Company’s executive officers named under “Executive Compensation—Summary Compensation Table,” (iii) each of the Company’s current directors, (iv) each of the Company’s nominees for director and (v) all directors and executive officers of the Company as a group. Ownership information is based upon information furnished by the respective individuals or entities, as the case may be. Unless otherwise noted below, the address of each beneficial owner is c/o Multi-Fineline Electronix, Inc., 3140 East Coronado, Anaheim, California 92806. Except as indicated in the footnotes to this table, the persons or entities named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, subject to community property laws, where applicable. The percentage of Common Stock beneficially owned is based on 24,481,232 shares outstanding as of January 22, 2007. In addition, shares issuable pursuant to options which may be exercised within 60 days of January 22, 2007 are deemed to be issued and outstanding and have been treated as outstanding in calculating the percentage ownership of those individuals possessing such interest, but not for any other individual. Thus, the number of shares considered to be outstanding for the purposes of this table may vary depending on the individual’s particular circumstances.

| | | | | |

Name and Address of Beneficial Owner

| | Number of Shares of Common Stock Beneficially Owned

| | Percentage of Common Stock Beneficially Owned

| |

Stockholders Owning More Than 5% of the Common Stock: | | | | | |

Entities affiliated with WBL Corporation Limited(1) | | 14,817,052 | | 60.5 | % |

Stark Investments and its affiliated hedge funds(2) | | 4,503,220 | | 18.4 | % |

Directors, Director Nominees and Executive Officers: | | | | | |

Philip A. Harding(3) | | 711,444 | | 2.8 | % |

Reza Meshgin(4) | | 119,925 | | * | |

Craig Riedel(5) | | 162,441 | | * | |

Thomas Lee(6) | | 82,896 | | * | |

Charles Tapscott(7) | | 39,397 | | * | |

Peter Blackmore(8) | | 16,998 | | * | |

Richard J. Dadamo(9) | | 59,498 | | * | |

Sanford L. Kane(10) | | 39,588 | | * | |

Huat Seng Lim, Ph.D.(11) | | 19,998 | | * | |

Choon Seng Tan | | 0 | | * | |

Sam Yau(12) | | 36,998 | | * | |

All current directors and executive officers as a group (11 persons)(13) | | 1,289,183 | | 5 | % |

| (1) | Represents 3,000,000 shares held by United Wearnes Technology Pte Ltd (“United Wearnes”) and 11,817,052 shares held by Wearnes Technology (Private) Limited (“Wearnes Technology”). Wearnes Technology is a 99.97% owned subsidiary of WBL Corporation and United Wearnes is a 60% owned subsidiary of Wearnes Technology. Huat Seng Lim, Ph.D., one of the Company’s directors, is the Group Managing Director (Technology Manufacturing) of WBL Corporation and Choon Seng Tan, one of the Company’s directors, is the Chief Executive Officer and a director of WBL Corporation. The principal business address for United Wearnes and Wearnes Technology is Wearnes Technology Building, 801 Lorong #07-00, Toa Payoh, Singapore 319319. |

| (2) | In an amended Schedule 13D filed by Michael A. Roth and Brian J. Stark (the “Reporting Persons”) with the SEC on November 8, 2006, the Reporting Persons stated: “represents an aggregate of 4,503,220 shares of Common Stock held directly by Stark Master Fund Ltd. (“Stark Master”), Stark Onshore Master Holding LLC (“Stark Onshore”) and Stark Asia Master Fund Ltd. (“Stark Asia”) (Stark Master, Stark Onshore and Stark Asia shall collectively be referred to as “Stark”). The Reporting Persons direct the management of Stark Offshore Management LLC (“Stark Offshore”), which acts as the investment manager and has sole |

11

| | power to direct the management of Stark Master and Stark Onshore, and Stark Asia Management LLC (“Stark Asia Management”), which acts as investment manager and has sole power to direct the management of Stark Asia. As the Managing Members of Stark Offshore and Stark Asia Management, the Reporting Persons possess shared voting and dispositive power over all of the foregoing shares. Therefore, for the purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, the Reporting Persons may be deemed to be the beneficial owners of, but hereby disclaim such beneficial ownership of, the foregoing shares.” The address for Stark Investments is 3600 South Lake Drive, St. Francis, WI 53235. |

| (3) | Includes 18,085 shares held of record by the Philip A. Harding and Barbara R. Harding Family Trust dated January 18, 1994, 100,000 shares held of record by Philip A. Harding, trustee of the P Harding 2006-1 Annuity Trust UDT dated December 15, 2006, 100,000 shares held of record by Philip A. Harding, trustee of the B Harding 2006-1 Annuity Trust UDT dated December 15, 2006, 490,359 shares subject to options held by Mr. Harding that are exercisable within 60 days of January 22, 2007 and 3,000 shares subject to a vested RSU grant which has yet to be transferred to Mr. Harding in accordance with the terms of the grant. |

| (4) | Consists of 118,561 shares subject to options that are exercisable within 60 days of January 22, 2007 and 1,364 shares held of record. |

| (5) | Includes 159,896 shares subject to options that are exercisable within 60 days of January 22, 2007 and 2,545 shares held of record. |

| (6) | Includes 82,896 shares subject to options that are exercisable within 60 days of January 22, 2007. |

| (7) | Includes 23,997 shares subject to options that are exercisable within 60 days of January 22, 2007 and 15,400 shares held of record. |

| (8) | Includes 14,998 shares subject to options that are exercisable within 60 days of January 22, 2007 and 2,000 shares subject to an RSU grant which will vest within 60 days of January 22, 2007. |

| (9) | Includes 57,498 shares subject to options that are exercisable within 60 days of January 22, 2007 and 2,000 shares subject to an RSU grant which will vest within 60 days of January 22, 2007. |

| (10) | Includes 34,998 shares subject to options that are exercisable within 60 days of January 22, 2007, 2,000 shares subject to an RSU grant which will vest within 60 days of January 22, 2007 and 2,590 shares held of record. |

| (11) | Consists of 19,998 shares subject to options that are exercisable within 60 days of January 22, 2007. |

| (12) | Includes 34,998 shares subject to options that are exercisable within 60 days of January 22, 2007 and 2,000 shares subject to an RSU grant which will vest within 60 days of January 22, 2007. |

| (13) | Includes 239,984 shares held of record, 1,038,199 shares subject to options that are exercisable within 60 days of January 22, 2007, 3,000 shares subject to a vested RSU grant which has yet to be transferred to grantee in accordance with the terms of the grant and 8,000 shares subject to RSU grants which will vest within 60 days of January 22, 2007. |

12

EXECUTIVE COMPENSATION

The following table summarizes all compensation paid to the Company’s Chief Executive Officer and to the Company’s four other most highly compensated executive officers, whom are referred to collectively as the named executive officers, whose total annual salary and bonus exceeded $100,000 for all services rendered in all capacities to the Company during each of the fiscal years ended September 30, 2006, 2005 and 2004. The compensation described in this table does not include medical, group life insurance or other benefits which are generally available to all of the Company’s salaried employees.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long-Term Compensation

| | | |

Name and Position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | Restricted

Stock Unit

Award(s) ($)(2)

| | | Shares Underlying

Options (#)

| | All Other

Compensation ($)

| |

Philip A. Harding Chief Executive Officer and Chairman | | 2006

2005

2004 | | $

$

$ | 320,962

272,356

259,615 | | $

$

$ | 129,493

186,400

198,000 | | $

$

$ | 463,800

0

0 | (3)

| | 0

0

115,000 | | $

$

$ | 13,353

10,676

14,197 | (4)

(5)

(6) |

| | | | | | |

Reza Meshgin President and Chief Operating Officer | | 2006

2005

2004 | | $

$

$ | 242,307

195,058

169,820 | | $

$

$ | 80,657

117,000

100,000 | | $

$

$ | 386,500

0

0 | (7)

| | 0

0

85,000 | | $

$

$ | 7,927

8,127

11,454 | (8)

(9)

(10) |

| | | | | | |

Craig Riedel Chief Financial Officer | | 2006

2005

2004 | | $

$

$ | 180,692

158,521

143,716 | | $

$

$ | 42,781

50,220

50,893 | | $

$

$ | 154,600

0

0 | (11)

| | 0

0

57,000 | | $

$

$ | 14,149

8,110

16,245 | (12)

(13)

(14) |

| | | | | | |

Thomas Lee Executive Vice President of Operations | | 2006

2005

2004 | | $

$

$ | 200,769

173,702

147,316 | | $

$

$ | 58,604

57,600

53,393 | | $

$

$ | 193,250

0

0 | (15)

| | 0

0

57,000 | | $

$

$ | 7,947

11,630

36,772 | (16)

(17)

(18) |

| | | | | | |

Charles Tapscott Executive Vice President and Chief Technology Officer | | 2006

2005

2004 | | $

$

$ | 153,154

129,763

123,660 | | $

$

$ | 22,487

41,100

30,505 | | $

$

$ | 61,840

0

0 | (19)

| | 0

0

36,000 | | $

$

$ | 7,890

9,087

8,053 | (20)

(21)

(22) |

| (1) | The amount set forth under the column “Bonus” consists of the bonus awarded for such fiscal year, regardless of the year in which the amount was actually paid. |

| (2) | The Restricted Stock Unit (“RSU”) awards reported in this column vest in four equal annual installments on December 5 of 2006, 2007, 2008 and 2009. The unvested portion of each RSU is subject to forfeiture if the executive officer’s employment terminates. Dividends will not be paid on any RSU reported in this column until the unit vests and is settled with Common Stock. Based on the September 30, 2006 closing price of the Common Stock of $25.37 per share, as of September 30, 2006: Mr. Harding held 12,000 RSUs having an aggregate value of $304,440; Mr. Meshgin held 10,000 RSUs having an aggregate value of $253,700; Mr. Riedel held 4,000 RSUs having an aggregate value of $101,480; Mr. Lee held 5,000 RSUs having an aggregate value of $126,850; and Mr. Tapscott held 1,600 RSUs having an aggregate value of $40,592. |

| (3) | Represents the aggregate value on date of grant of a RSU award made on December 5, 2005 with respect to 12,000 shares of Common Stock based on the closing price on that date. |

| (4) | This amount represents a $12,352 car allowance paid to the employee and $1,001 in long-term disability insurance (“LTD”) premiums. |

| (5) | This amount represents a $9,200 car allowance paid to the employee and $1,476 in LTD premiums. |

| (6) | From time to time, M-Flex allows employees to cash in a portion of their accrued vacation time (“vacation pay-out”). This amount represents $4,808 in vacation pay-out, a $7,913 car allowance paid to the employee and $1,476 in LTD premiums. |

| (7) | Represents the aggregate value on date of grant of a RSU award made on December 5, 2005 with respect to 10,000 shares of Common Stock based on the closing price on that date. |

13

| (8) | This amount represents a $7,200 car allowance paid to the employee and $727 in LTD premiums. |

| (9) | This amount represents a $7,200 car allowance paid to the employee and $927 in LTD premiums. |

| (10) | This amount represents $3,327 in vacation pay-out, a $7,200 car allowance paid to the employee and $927 in LTD premiums. |

| (11) | Represents the aggregate value on date of grant of a RSU award made on December 5, 2005 with respect to 4,000 shares of Common Stock based on the closing price on that date. |

| (12) | This amount represents $6,231 in vacation pay-out, a $7,200 car allowance paid to the employee and $718 in LTD premiums. |

| (13) | This amount represents a $7,200 car allowance paid to the employee and $910 in LTD premiums. |

| (14) | This amount represents $8,135 in vacation pay-out, a $7,200 car allowance paid to the employee and $910 in LTD premiums. |

| (15) | Represents the aggregate value on date of grant of a RSU award made on December 5, 2005 with respect to 5,000 shares of Common Stock based on the closing price on that date. |

| (16) | This amount represents a $7,200 car allowance paid to the employee and $747 in LTD premiums. |

| (17) | This amount represents $3,462 in vacation pay-out, a $7,200 car allowance paid to the employee and $968 in LTD premiums. |

| (18) | This amount represents $20,700 paid to the employee in connection with running M-Flex’s operations in China, $7,904 in vacation pay-out, a $7,200 car allowance paid to the employee and $968 in LTD premiums. |

| (19) | Represents the aggregate value on date of grant of a RSU award made on December 5, 2005 with respect to 1,600 shares of Common Stock based on the closing price on that date. |

| (20) | This amount represents a $7,200 car allowance paid to the employee and $690 in LTD premiums. |

| (21) | This amount represents $1,034 in vacation pay-out, a $7,200 car allowance paid to the employee and $853 in LTD premiums. |

| (22) | This amount represents a $7,200 car allowance paid to the employee and $853 in LTD premiums. |

Stock Options

The following table sets forth certain information with respect to the stock options exercised by the named executive officers during the fiscal year ended September 30, 2006, and the number and value of the options held by each such individual as of September 30, 2006. No stock options or stock appreciation rights were granted to the named executive officers during the fiscal year ended September 30, 2006.

Aggregated Option Exercises in Fiscal Year 2006 and 2006 Fiscal Year-End Option Values

| | | | | | | | | | | | | | | |

| | | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Options at September 30, 2006 (#)

| | Value of Unexercised In-the-Money Options at September 30, 2006 ($)(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Philip A. Harding | | — | | $ | — | | 478,381 | | 50,319 | | $ | 10,171,646 | | $ | 773,403 |

Reza Meshgin | | — | | | — | | 109,708 | | 37,192 | | | 2,076,912 | | | 571,641 |

Craig Riedel | | — | | | — | | 153,959 | | 24,941 | | | 3,278,935 | | | 383,343 |

Thomas Lee | | 10,000 | | | 272,500 | | 93,959 | | 24,941 | | | 1,949,729 | | | 383,343 |

Charles Tapscott | | — | | | — | | 20,248 | | 15,752 | | | 311,212 | | | 242,108 |

| (1) | Calculated on the basis of the fair market value of the underlying securities at September 30, 2006 ($25.37 per share) minus the exercise price. |

14

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company has entered into indemnification agreements with each of its executive officers, directors and certain other employees. In addition, the Company’s executive officers and directors are indemnified under Delaware General Corporation Law and the Company’s Bylaws to the fullest extent permitted under Delaware law. The Company has an insurance policy covering its directors and officers with respect to specified liabilities, including liabilities arising under the Securities Act or otherwise.

As discussed above under “Security Ownership of Certain Beneficial Owners and Management,” WBL Corporation and its affiliated entities beneficially own 60.5% of the Company’s outstanding Common Stock. Choon Seng Tan, the Chief Executive Officer of WBL Corporation, and Huat Seng Lim, Ph.D., the Group Managing Director (Technology Manufacturing) of WBL Corporation, are members of the Board.

On October 25, 2005, the Company entered into an Amended and Restated Stockholders Agreement with WBL Corporation, Wearnes Technology and United Wearnes. The amended agreement provides, among other things, that:

| | • | | The WBL Corporation entities will have the right to approve the appointment of any new chief executive officer or the issuance of securities that would reduce the WBL Corporation entities’ effective stock ownership below a majority of the shares outstanding; and |

| | • | | WBL Corporation will, for a period of two years and thereafter subject to the parties’ mutual agreement, use reasonable efforts to provide the Company with access to additional manufacturing facilities and packaging services while the Company’s manufacturing facilities are being expanded. |

The agreement will terminate when the WBL Corporation entities no longer own at least one-third of the outstanding Common Stock, measured on a fully diluted basis.

From time to time, the Company makes sales to, and purchases from, WBL Corporation and its affiliates. During the fiscal year ended September 30, 2006, the Company did not purchase any products and materials from these entities and sold products and materials for $25,000 to these entities. As of September 30, 2006, the Company owed a total of $417,000 to WBL Corporation and its affiliates, and WBL Corporation and its affiliates owed the Company a total of $267,000. The Company believes that the commercial transactions described above were made or entered into on terms that are no less favorable to the Company than those the Company could obtain from unaffiliated third parties.

The Company files a combined California income tax return with Wearnes Hollingsworth Corporation, an affiliate of WBL Corporation, pursuant to a tax sharing agreement. The tax sharing agreement provides that the Company will pay Wearnes Hollingsworth Corporation for the California state income tax benefit realized by filing the combined California tax return. During the year ended September 30, 2006, the Company made no payment to Wearnes Hollingsworth Corporation pursuant to the tax sharing agreement.

Management fees may be charged to the Company by an affiliate of WBL Corporation, pursuant to a Corporate Services Agreement between the Company and such entity. Under this agreement, the Company may be billed for services on a time and materials basis. For the year ended September 30, 2006, no services were provided under this agreement.

15

Litigation

On October 17, 2006, the Company filed suit in the Chancery Court for the State of Delaware against WBL Corporation and certain of its affiliates asserting claims for declaratory and injunctive relief arising from the WBL Corporation undertaking agreement, which expired December 31, 2006, in which WBL Corporation agreed to vote its M-Flex shares in favor of the Company’s voluntary general offer for all of the outstanding shares of MFS Technology Ltd, a subsidiary of WBL Corporation (the “Offer”). The complaint asserts that declaratory and injunctive relief is necessary to prevent WBL Corporation from taking action which the Company believes to be in breach of WBL Corporation’s fiduciary duties as a controlling stockholder that will harm the Company and its minority stockholders and seeks to require WBL Corporation to vote against the Offer.

The case against WBL in the Delaware Chancery Court has been set for trial in late February 2007. However, WBL Corporation has filed a motion to dismiss the Company’s case against it. On December 6, 2006, a hearing was held on WBL Corporation’s motion to dismiss, during which the court took the matter under submission. As of the date of the filing of this proxy, the court has not ruled on the motion.

16

The following pages contain a report issued by the Compensation Committee relating to executive compensation for 2006, a report issued by the Audit Committee relating to its review of the accounting, auditing and financial reporting practices of the Company and a chart titled “Stock Price Performance Graph.” Stockholders should be aware that under SEC rules, the Report of the Compensation Committee of the Board on Executive Compensation, the Report of the Audit Committee of the Board and the Stock Price Performance Graph are not deemed to be “soliciting material” or “filed” with the SEC under the Securities Exchange Act of 1934, and are not incorporated by reference in any past or future filing by the Company under the Securities Exchange Act of 1934 or the Securities Act of 1933, unless these sections are specifically referenced.

REPORT OF THE COMPENSATION COMMITTEE

OF THE BOARD ON EXECUTIVE COMPENSATION

The Compensation Committee operates under a written charter adopted by the Board of Directors (the “Board”) on April 12, 2004, as amended from time to time and amended on December 5, 2005. A copy of the Compensation Committee Charter is available on the Company’s website atwww.mflex.com. The members of the Compensation Committee are Peter Blackmore, Richard J. Dadamo (Chairman), Huat Seng Lim, Ph.D., and Sam Yau, each of whom is a non-employee director under Section 162(m) of the Internal Revenue Code, and each of whom, except for Dr. Lim, meets the independence standards established by The Nasdaq Global Select Market. The Compensation Committee is responsible for developing and monitoring compensation arrangements for the executive officers of the Company, administering the Company’s stock incentive plans and other compensation plans and performing other activities and functions related to executive compensation as may be assigned from time to time by the Board.

Compensation Philosophy and Objectives for Executive Officer Compensation

The Compensation Committee believes that compensation of the Company’s executive officers should encourage creation of stockholder value and achievement of strategic corporate objectives. It is the Compensation Committee’s philosophy to align the interests of the Company’s stockholders and management by integrating compensation with the Company’s annual and long-term corporate strategic and financial objectives. In order to attract and retain the most qualified personnel, the Company intends to offer a total compensation package competitive with companies in the flexible printed circuit, electronic products packaging and electronic manufacturing services industries, taking into account relative company size, performance and geographic location as well as individual responsibilities and performance. The components of executive officer compensation consist of base salary, performance-based bonuses and periodic stock grants, which are discussed separately below.

The Company generally intends to qualify executive compensation for deductibility without limitation under section 162(m) of the Internal Revenue Code. Section 162(m) provides that, for purposes of regular income tax and the alternative minimum tax, the otherwise allowable deduction for compensation paid or accrued with respect to a covered employee of a publicly-held corporation (other than certain exempt performance-based compensation) is limited to no more than $1 million per year. The Company does not expect that the non-exempt compensation to be paid to any of its executive officers for fiscal 2006 as calculated for purposes of section 162(m) will exceed the $1 million limit.

Executive Officer Base Salary

The Compensation Committee reviews salaries recommended by (i) the CEO for the President/COO and (ii) the President/COO for the Company’s other executive officers (other than the CEO), and based upon such review approves salaries and raises for such executive officers and makes a recommendation to the entire Board for approval of these salaries. The Compensation Committee sets the salary level of each executive officer on a case by case basis, taking into account the individual’s level of responsibilities and performance. The Compensation Committee also considers market information and the base salaries and other incentives paid to executive officers of other similarly sized companies within the Company’s industry.

Executive Officer Bonuses

The Compensation Committee believes that a portion of executive officer compensation should be contingent upon the Company’s performance and an individual’s contribution to the Company’s success in

17

meeting corporate and financial objectives. Bonuses paid for fiscal 2006 were determined on a case by case basis, with fifty percent of such bonuses being based on Company financial metrics, namely revenue and profit after tax, and fifty percent of such bonuses being based on individual goals. For officers other than the CEO, the Compensation Committee evaluated each executive officer with the CEO and/or the President/COO as described above to determine the bonus for the fiscal year. The Compensation Committee approved the executive officer bonuses and then recommended them to the Board, where they were approved by the entire Board.

Stock Grants

The Compensation Committee administers the Company’s 2004 Stock Incentive Plan (the “2004 Plan”) for executive officers, employees, consultants and outside directors, under which, prior to December 2005, it granted options to purchase the Company’s Common Stock with an exercise price equal to the fair market value of a share of the Common Stock on the date of grant. Beginning in December 2005, the Compensation Committee began granting restricted stock units under the 2004 Plan in lieu of stock options. Prior to 2004, the Company made stock option grants under its 1994 Stock Plan. The Compensation Committee believes that providing executive officers who have responsibility for the management and growth of the Company with an opportunity to increase their ownership of Company stock aligns the interests of the Company’s executive officers with those of its stockholders and promotes retention of key personnel, which is also in the best interest of the stockholders. Accordingly, the Compensation Committee, when reviewing executive officer compensation, also considers stock grants as appropriate. At its discretion, from time to time the Compensation Committee may also make stock grants based on individual and corporate achievements.

Grants made to the CEO and other executive officers of the Company are approved by the Compensation Committee, and then recommended for approval by the Compensation Committee to the entire Board. The Compensation Committee determines the number of shares underlying each grant of stock options or restricted stock units based upon the executive officer’s and the Company’s performance, the executive officer’s role and responsibilities within the Company, the executive officer’s base salary and comparison with comparable awards to individuals in similar positions in the industry. During the first quarter of fiscal 2006, the Compensation Committee made grants of restricted stock units to executive officers, at the same time as the Compensation Committee made grants to other employees of the Company.

Chief Executive Officer Compensation

The Compensation Committee determines the compensation (including bonus and stock grants) of the CEO using generally the same criteria as for the other executive officers. For fiscal 2006, the Compensation Committee reviewed Mr. Harding’s performance as CEO based on factors which included the Company’s financial results, Mr. Harding’s execution of planning initiatives and growth strategies and the Company’s industry concentration. Fifty percent of such review was based upon financial metrics, with the other half being split among the qualitative factors. In November 2006, the Compensation Committee approved, and recommended to the Board for approval (which approval was granted by the Board), a bonus of $129,493 for Mr. Harding’s service in fiscal 2006. In the first quarter of fiscal 2006, Mr. Harding was awarded a restricted stock unit grant equal to 12,000 shares of Common Stock. The grant vests over a four-year period in equal annual installments, with the first 1/4 vesting on December 5, 2006. In determining the size of Mr. Harding’s grant, the Compensation Committee considered the growth of the business, the financial performance of the Company and the posturing of the Company for continued success.

Compensation Committee

Peter Blackmore

Richard J. Dadamo (Chairman)

Huat Seng Lim, Ph.D.

Sam Yau

18

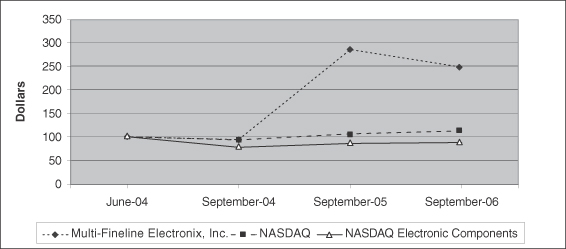

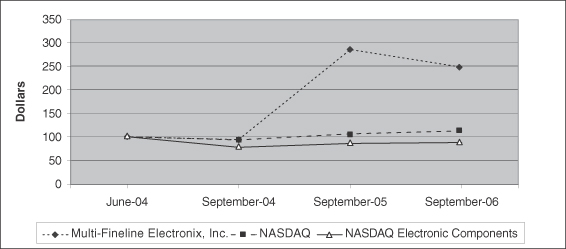

STOCK PRICE PERFORMANCE GRAPH

The following graph shows the cumulative total stockholder return (change in stock price plus reinvested dividends) assuming the investment of $100 on June 25, 2004 (the day of the Company’s initial public offering) in each of the Company’s Common Stock, the NASDAQ Index and the NASDAQ Electronic Components Index. The comparisons in the table are required by the SEC and are not intended to forecast or be indicative of possible future performance of the Company’s Common Stock.

| | | | | | | | | | | | |

| | | 6/30/04

| | 9/30/04

| | 9/30/05

| | 9/30/06

|

Multi-Fineline Electronix, Inc. | | $ | 100.00 | | $ | 93.70 | | $ | 292.70 | | $ | 253.70 |

NASDAQ | | | 100.00 | | | 93.41 | | | 106.85 | | | 112.99 |

NASDAQ Electronic Components | | | 100.00 | | | 76.87 | | | 85.69 | | | 87.67 |

REPORT OF THE AUDIT COMMITTEE OF THE BOARD

The Audit Committee operates under a written charter adopted by the Board of Directors (the “Board”) on April 12, 2004, as amended from time to time and amended on November 30, 2004. A copy of the Audit Committee Charter is available on the Company’s website atwww.mflex.com. The members of the Audit Committee are Richard J. Dadamo, Sanford L. Kane (Chairman) and Sam Yau, each of whom meets the independence standards established by The Nasdaq Global Select Market and the rules of the Securities and Exchange Commission.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board and is responsible for providing independent, objective oversight of the Company’s accounting, auditing, financial reporting, internal control and legal compliance functions. It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for the Company’s financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible in its report for expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

The Audit Committee has reviewed and discussed the Company’s audited financial statements contained in the 2006 Annual Report on Form 10-K with the Company’s management and its independent registered public accounting firm. The Audit Committee met privately with the independent auditors and discussed issues deemed

19

significant by the independent auditors, including those matters required by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards). In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with the Audit Committees) and discussed with the independent auditors their independence from the Company.

Based upon the reviews and discussions outlined above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2006 for filing with the Securities and Exchange Commission.

Audit Committee

Richard J. Dadamo

Sanford L. Kane (Chairman)

Sam Yau

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the securities laws of the United States, the Company’s directors, executive officers and any person holding more than 10% of the Common Stock are required to report their initial ownership of the Common Stock and any subsequent change in that ownership to the SEC. Specific due dates for these reports have been established and the Company is required to identify in this Proxy Statement those persons who failed to timely file these reports. To the Company’s knowledge, based solely on a review of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended September 30, 2006, all Section 16(a) filing requirements applicable to its directors, executive officers and 10% stockholders were complied with, except that the December 5, 2005 restricted stock unit grants to the named executive officers were reported on December 8, 2005, and Mr. Kane, a director, filed his report with respect to his purchase and gifting of 100 shares of Common Stock and Mr. Harding filed his report with respect to the gifting of 6,600 shares in 2004 after the deadlines imposed by the SEC. Furthermore, the Company has not received a written representation from Stark Investments and its affiliated funds that it has timely filed all reports required under Section 16(a).

STOCKHOLDER PROPOSALS FOR THE 2008 ANNUAL MEETING

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company’s 2008 annual meeting of stockholders must be received by the Secretary of the Company no later than September 30, 2007 in order that they may be included in the Company’s proxy statement and form of proxy relating to that meeting.

A stockholder proposal not included in the Company’s proxy statement for the 2008 annual meeting of stockholders will be ineligible for presentation at the meeting unless the stockholder gives timely notice of the proposal in writing to the Secretary of the Company at the principal executive offices of the Company and otherwise complies with the provisions of the Company’s Bylaws. To be timely, the Bylaws provide that the Company must have received the stockholder’s notice not less than 90 days nor more than 120 days in advance of the date this Proxy Statement was released to stockholders in connection with the Annual Meeting. However, if the date of the 2008 annual meeting of stockholders is changed by more than 30 days from the date contemplated at the time of this Proxy Statement, the Company must receive the stockholder’s notice not later than the close of business on (i) the 90th day prior to such annual meeting and (ii) the seventh day following the day on which public announcement of the date of such meeting is first made.

20

PAYMENT OF COSTS

The expense of printing and mailing proxy materials and the solicitation of proxies will be borne by the Company. In addition to the solicitation of proxies by mail, solicitation may be made by proxy solicitors, directors, officers and other employees of the Company by personal interview, telephone or facsimile. No additional compensation will be paid to directors, officers or employees of the Company for such solicitation. The Company has hired The Altman Group, Inc. to act as its proxy solicitor for the Annual Meeting at a cost of approximately $4,500. The Company will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of the Common Stock.

HOUSEHOLDING OF PROXY MATERIALS

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

A number of brokers with account holders who are stockholders of the Company will be “householding” the Company’s proxy materials. A single Proxy Statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Proxy Statement and annual report, please notify your broker, and direct a written request to the Company, Attn: Investor Relations Department, 3140 East Coronado Street, Anaheim, California 92806, or contact Investor Relations at 714-573-1121. The Company will provide a separate copy of this Proxy Statement and the annual report to any stockholder at a shared address to which a single copy was delivered. Any such request should be addressed to the Company, Attn: Investor Relations Department, at the address listed above. Stockholders who currently receive multiple copies of the Proxy Statement and/or annual report at their address and would like to request “householding” of their communications should contact their broker.

Whether or not you intend to be present at the Annual Meeting, the Company urges you to return your signed proxy promptly.

| | |

| | | By Order of the Board |

| |

| | |

|

| | | Christine Besnard |

January 24, 2007 | | Vice President, General Counsel and Secretary |

The Company’s 2006 Annual Report on Form 10-K has been mailed with this Proxy Statement. The Company will provide copies of exhibits to the Annual Report on Form 10-K, but will charge a reasonable fee per page to any requesting stockholder. Any such request should be addressed to the Company at 3140 East Coronado Street, Anaheim, California 92806, Attention: Investor Relations Department. The request must include a representation by the stockholder that as of January 22, 2007, the stockholder was entitled to vote at the Annual Meeting.

21

PROXY

MULTI-FINELINE ELECTRONIX, INC.

Proxy Solicited on Behalf of the Board of Directors of

the Company for Annual Meeting March 20, 2007

| | | | |