UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2017

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | | 52-1568099 (I.R.S. Employer Identification No.) |

388 Greenwich Street, New York, NY (Address of principal executive offices) | | 10013 (Zip code) |

(212) 559-1000 (Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | | | | |

Large accelerated filer x | | Accelerated filer o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Number of shares of Citigroup Inc. common stock outstanding on June 30, 2017: 2,724,556,095

Available on the web at www.citigroup.com

CITIGROUP’S SECOND QUARTER 2017—FORM 10-Q

|

| |

| OVERVIEW | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

| Executive Summary | |

| Summary of Selected Financial Data | |

SEGMENT AND BUSINESS—INCOME (LOSS) AND REVENUES | |

| SEGMENT BALANCE SHEET | |

| Global Consumer Banking (GCB) | |

| North America GCB | |

| Latin America GCB | |

| Asia GCB | |

| Institutional Clients Group | |

| Corporate/Other | |

OFF-BALANCE SHEET ARRANGEMENTS | |

| CAPITAL RESOURCES | |

MANAGING GLOBAL RISK TABLE OF CONTENTS | |

| MANAGING GLOBAL RISK | |

| INCOME TAXES | |

DISCLOSURE CONTROLS AND PROCEDURES | |

| DISCLOSURE PURSUANT TO SECTION 219 OF THE IRAN THREAT REDUCTION AND SYRIA HUMAN RIGHTS ACT | |

| FORWARD-LOOKING STATEMENTS | |

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS | |

| CONSOLIDATED FINANCIAL STATEMENTS | |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | |

| UNREGISTERED SALES OF EQUITY SECURITIES, PURCHASES OF EQUITY SECURITIES AND DIVIDENDS | |

OVERVIEW

This Quarterly Report on Form 10-Q should be read in conjunction with Citigroup’s Annual Report on Form 10-K for the year ended December 31, 2016, including the historical audited consolidated financial statements of Citigroup reflecting certain reclassifications set forth in Citigroup’s Current Report on Form 8-K filed with the SEC on June 16, 2017 (2016 Annual Report on Form 10-K), and Citigroup’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2017 (First Quarter of 2017 Form 10-Q).

Additional information about Citigroup is available on Citi’s website at www.citigroup.com. Citigroup’s recent annual reports on Form 10-K, quarterly reports on Form 10-Q and proxy statements, as well as other filings with the U.S. Securities and Exchange Commission (SEC), are available free of charge through Citi’s website by clicking on the “Investors” page and selecting “All SEC Filings.” The SEC’s website also contains current reports on Form 8-K, and other information regarding Citi at www.sec.gov.

Certain reclassifications, including a realignment of certain businesses, have been made to the prior periods’ financial statements and disclosures to conform to the current period’s presentation. For additional information on certain recent reclassifications, see Note 3 to the Consolidated Financial Statements in Citi’s 2016 Annual Report on Form 10-K.

Throughout this report, “Citigroup,” “Citi” and “the Company” refer to Citigroup Inc. and its consolidated subsidiaries.

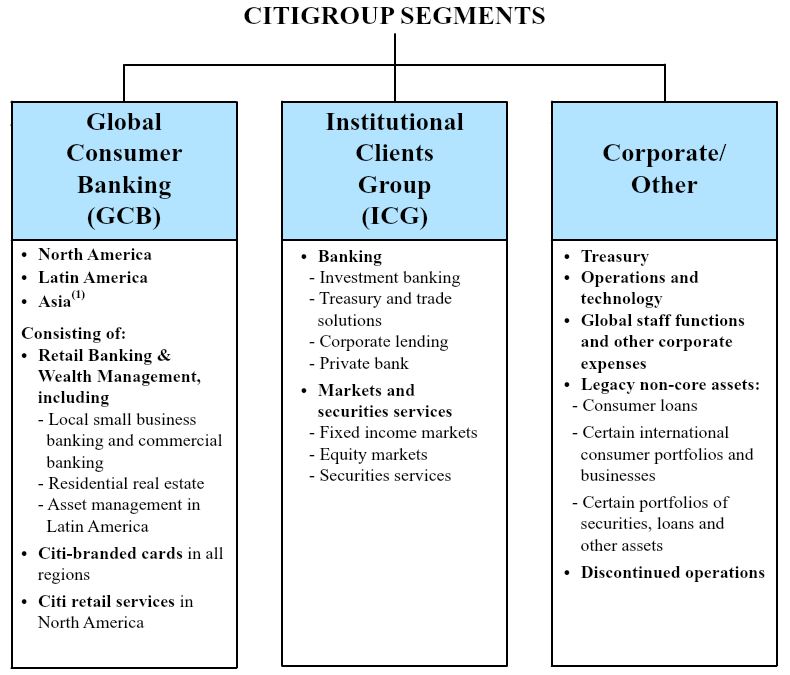

Citigroup is managed pursuant to the following segments:

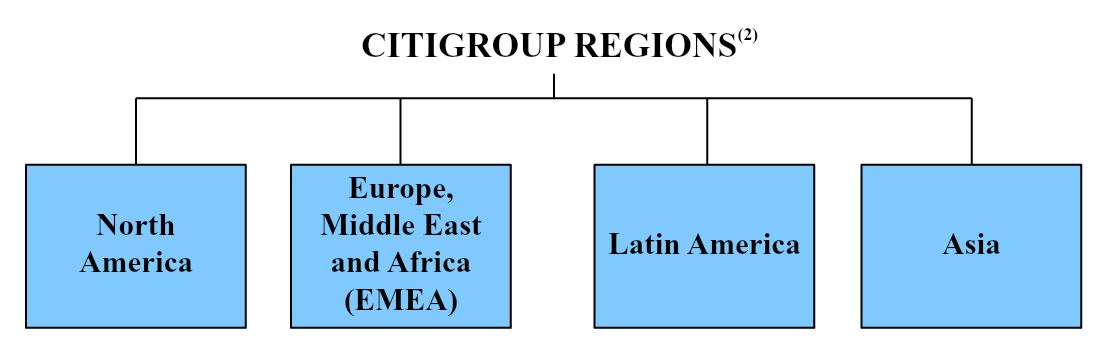

The following are the four regions in which Citigroup operates. The regional results are fully reflected in the segment results above.

| |

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

| |

| (2) | North America includes the U.S., Canada and Puerto Rico, Latin America includes Mexico and Asia includes Japan. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

EXECUTIVE SUMMARY

Second Quarter of 2017—Solid Performance Across Citi’s Businesses

As described further throughout this Executive Summary, Citi reported solid operating results in the second quarter of 2017, reflecting continued momentum across its businesses, notably those where Citi has been making investments. During the quarter, Citi had loan and revenue growth in both Global Consumer Banking (GCB) and the Institutional Clients Group (ICG) compared to the prior-year quarter, while continuing to wind-down the legacy assets in Corporate/Other.

In North America GCB, retail banking showed significant growth outside of mortgage operations, while Citi-branded cards continued to benefit from the acquisition of the Costco portfolio. International GCB generated positive operating leverage driven by year-over-year revenue growth in both, Latin America and Asia, excluding the impact of foreign currency translation into U.S. dollars for reporting purposes (FX translation). ICG had a strong quarter with revenue growth across all Banking businesses, particularly in investment banking, partially offset by declines in fixed income and equity markets revenues. These increases in revenues were partially offset by lower revenues in Corporate/Other, reflecting the continued wind-down of legacy non-core assets.

Citi also continued to generate significant regulatory capital during the quarter driven mostly by earnings. Citi generated approximately $4.7 billion in regulatory capital during the quarter, before returning approximately $2.2 billion to its common shareholders in the form of common stock repurchases and dividends. Citi repurchased approximately 29 million common shares, as outstanding common shares declined 1% from the prior quarter and 6% from the prior-year period. Despite this capital return, each of Citigroup’s key regulatory capital metrics remained strong as of the end of the second quarter of 2017 (see “Capital” below). Citi utilized approximately $100 million of deferred tax assets (DTAs) during the quarter and $900 million of its DTAs during the first half of 2017.

The Federal Reserve Board did not object to the capital plan Citi submitted as part of the 2017 Comprehensive Capital Analysis and Review (CCAR). Accordingly, as previously disclosed, Citi intends to return $18.9 billion of capital to its common shareholders over the next four quarters beginning with the third quarter of 2017 (for additional information, see “Equity Security Repurchases” and “Dividends” below).

While economic sentiment has improved, there continues to be various economic and political uncertainties and changes that could impact Citi’s businesses. For a more detailed discussion of these risks and uncertainties, see each respective business’s results of operations and “Forward-Looking Statements” below, as well as each respective business’s results of operations and the “Managing Global Risk” and “Risk Factors” sections in Citi’s 2016 Annual Report on Form 10-K.

Second Quarter of 2017 Summary Results

Citigroup

Citigroup reported net income of $3.9 billion, or $1.28 per share, compared to $4.0 billion, or $1.24 per share, in the prior-year period. The 3% decrease in net income from the prior-year period was primarily driven by higher credit costs and operating expenses, as well as a higher effective tax rate, partially offset by higher revenues. Earnings per share increased 3% largely due to a 6% reduction in average shares outstanding.

Citigroup revenues of $17.9 billion in the second quarter of 2017 increased 2%, driven by a 6% increase in ICG, as well as a 5% increase in GCB, partially offset by a 45% decrease in Corporate/Other due primarily to the continued wind-down of legacy non-core assets.

Citigroup’s end-of-period loans increased 2% to $645 billion versus the prior-year period. Excluding the impact of FX translation, Citigroup’s end-of-period loans also grew 2%, as 4% growth in both GCB and ICG was partially offset by the continued wind-down of legacy assets in Corporate/Other. (Citi’s results of operations excluding the impact of FX translation are non-GAAP financial measures.) Citigroup’s end-of-period deposits increased 2% to $959 billion versus the prior-year period. Excluding the impact of FX translation, Citigroup’s deposits were also up 2%, driven by a 3% increase in both GCB and ICG deposits, slightly offset by a decline in Corporate/Other deposits.

Expenses

Citigroup’s operating expenses were up slightly at $10.5 billion versus the prior-year period, as the impact of higher volume-related expenses, performance-based compensation and ongoing investments were partially offset by efficiency savings and the wind-down of legacy assets. Year-over-year, GCB and ICG operating expenses were up each 5% while Corporate/Other operating expenses declined 24%.

Cost of Credit

Citi’s total provisions for credit losses and for benefits and claims of $1.7 billion increased 22% from the prior-year period. The increase was driven by an increase in net credit losses of $94 million and a net loan loss reserve release of $16 million, compared to a net release of $256 million mostly related to legacy assets in the prior-year period.

Net credit losses of $1.7 billion increased 6% versus the prior-year period. Consumer net credit losses of $1.6 billion increased 11%, primarily driven by the Costco portfolio acquisition, organic volume growth and seasoning, and the impact of changes in collections processes in the North America cards businesses, partially offset by the continued wind-down of legacy assets in Corporate/Other. Corporate net credit losses decreased 45% from the prior-year period to $77 million, driven by improvement in the energy sector. Citi

expects consumer cost of credit to increase in the near term due to continued volume growth.

For additional information on Citi’s consumer and corporate credit costs and allowance for loan losses, see “Credit Risk” below.

Capital

Citigroup’s Common Equity Tier 1 Capital and Tier 1 Capital ratios , on a fully implemented basis, were 13.1% and 14.7% as of June 30, 2017 (based on Basel III Standardized Approach for determining risk-weighted assets), respectively, compared to 12.5% and 14.1% as of June 30, 2016 (based on the Basel III Advanced Approaches for determining risk-weighted assets). Citigroup’s Supplementary Leverage ratio as of June 30, 2017, on a fully implemented basis, was 7.2%, compared to 7.5% as of June 30, 2016. For additional information on Citi’s capital ratios and related components, including the impact of Citi’s DTAs on its capital ratios, see “Capital Resources” below.

Global Consumer Banking

GCB net income decreased 12% to $1.1 billion, as higher revenues were more than offset by higher cost of credit and higher operating expenses. Operating expenses were $4.5 billion, an increase of 5% on both a reported basis and excluding the impact of FX, driven by the addition of the Costco portfolio, volume growth and continued investments, partially offset by ongoing efficiency savings.

GCB revenues of $8.0 billion increased 5% versus the prior-year period. Excluding the impact of FX translation, GCB revenues also increased 5%, driven by a 5% increase in both North America GCB and international GCB. North America GCB revenues increased 5% to $4.9 billion, as higher revenues in Citi-branded cards and Citi retail services were partially offset by lower revenues in retail banking, driven by lower mortgage revenues. Citi-branded cards revenues of $2.1 billion were up 10% versus the prior-year period, reflecting the impact of the Costco portfolio acquisition as well as modest organic growth in core portfolios, partially offset by the run-off of non-core portfolios. Citi retail services revenues of $1.6 billion increased 4% versus the prior-year period, reflecting continued loan growth and a favorable prior period comparison. Retail banking revenues decreased 2% from the prior-year period, mainly driven by the lower mortgage revenues. Excluding mortgage revenues, retail banking revenues were up 7% from the prior-year period, driven by continued growth in average loans, deposits and assets under management, as well as a benefit from higher interest rates.

North America GCB average deposits of $185 billion were up 2% versus the prior-year period, average retail loans of $56 billion grew 2%, and assets under management of $57 billion grew 10%. Average branded card loans of $83 billion increased 25%, while branded card purchase sales of $81 billion increased 52% versus the prior-year period, both driven by the Costco portfolio acquisition as well as organic growth. Average retail services loans of $45 billion were up 4%, while retail services purchase sales of $21 billion were up 2%. For additional information on the results of operations of North

America GCB for the second quarter of 2017, see “Global Consumer Banking—North America GCB” below.

International GCB revenues (consisting of Latin America GCB and Asia GCB (which includes the results of operations in certain EMEA countries)) increased 4% to $3.1 billion versus the prior-year period. Excluding the impact of FX translation, international GCB revenues increased 5% versus the prior-year period. Latin America GCB revenues increased 8% versus the prior-year period, driven by growth in retail loans and deposits, as well as improved deposit spreads, partially offset by a modest decline in cards revenues. Asia GCB revenues increased 3% versus the prior-year period, driven by improvement in cards and wealth management revenues, partially offset by lower retail lending revenues. For additional information on the results of operations of Latin America GCB and Asia GCB for the second quarter of 2017, including the impact of FX translation, see “Global Consumer Banking—Latin America GCB” and “—Asia GCB” below.

Year-over-year, international GCB average deposits of $122 billion increased 7%, average retail loans of $87 billion were roughly flat, assets under management of $96 billion increased 7%, average card loans of $24 billion increased 6% and card purchase sales of $24 billion increased 7%, all excluding the impact of FX translation.

Institutional Clients Group

ICG net income of $2.8 billion increased 6%, driven by higher revenues, partially offset by higher operating expenses. ICG operating expenses increased 5% to $5.0 billion, as higher incentive compensation, investments and volume-related expenses were partially offset by efficiency savings.

ICG revenues were $9.2 billion in the second quarter of 2017, up 6% from the prior-year period, driven by a 19% increase in Banking revenues partially offset by a 5% decrease in Markets and securities services revenues. The increase in Banking revenues included the impact of $9 million of mark-to-market gains on loan hedges related to accrual loans within corporate lending compared to losses of $203 million in the prior-year period.

Banking revenues of $4.8 billion (excluding the impact of mark-to-market losses on hedges related to accrual loans within corporate lending) increased 13% compared to the prior-year period, driven by significant growth in investment banking as well as solid performance in treasury and trade solutions and the private bank. Investment banking revenues of $1.5 billion increased 22% versus the prior-year period. Advisory revenues increased 32% to $314 million, equity underwriting revenues increased 70% to $295 million and debt underwriting revenues increased 9% to $877 million, all versus the prior-year period.

Private bank revenues increased 17% versus the prior-year period to $788 million, driven by loan and deposit growth, improved spreads and increased investment activity. Corporate lending revenues increased $306 million to $486 million. Excluding the mark-to-market impact of loan hedges, corporate lending revenues increased 25% to $477 million versus the prior-year period reflecting lower hedging costs as well as the absence of a prior period adjustment to the residual value of a lease financing. Treasury and trade solutions

revenues increased 3% to $2.1 billion versus the prior-year period, reflecting continued volume growth and improved deposit spreads.

Markets and securities services revenues decreased 5% to $4.4 billion versus the prior-year period. Fixed income markets revenues decreased 6% to $3.2 billion versus the prior-year period, primarily reflecting lower G10 currencies revenue, given low volatility in the current quarter and the comparison to higher Brexit-related activity a year ago. Equity markets revenues decreased 11% to $691 million versus the prior-year period, reflecting episodic activity in the prior-year period, as well as low volatility in the current quarter. Securities services revenues increased 10% to $584 million versus the prior-year period, driven by growth in client volumes across the global custody business. For additional information on the results of operations of ICG for the second quarter of 2017, see “Institutional Clients Group” below.

Corporate/Other

Corporate/Other net loss was $15 million in the second quarter of 2017, compared to net income of $116 million in the prior-year period, reflecting lower revenues, partially offset by lower operating expenses and lower cost of credit. Expenses of $990 million declined 24% from the prior-year period, reflecting the wind-down of legacy assets.

Corporate/Other revenues were $653 million, down 45% from the prior-year period, reflecting the wind-down of legacy assets, divestiture activity and the absence of gains related to debt buybacks in the prior-year period.

Corporate/Other end-of-period assets decreased 21% to $92 billion from the prior-year period as Citi continued to wind-down legacy assets. For additional information on the results of operations of Corporate/Other for the second quarter of 2017, see “Corporate/Other” below.

RESULTS OF OPERATIONS

SUMMARY OF SELECTED FINANCIAL DATA—PAGE 1

Citigroup Inc. and Consolidated Subsidiaries

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | |

| In millions of dollars, except per-share amounts and ratios | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| Net interest revenue | $ | 11,165 |

| $ | 11,236 |

| (1 | )% | $ | 22,022 |

| $ | 22,463 |

| (2 | )% |

| Non-interest revenue | 6,736 |

| 6,312 |

| 7 |

| 13,999 |

| 12,640 |

| 11 |

|

| Revenues, net of interest expense | $ | 17,901 |

| $ | 17,548 |

| 2 | % | $ | 36,021 |

| $ | 35,103 |

| 3 | % |

| Operating expenses | 10,506 |

| 10,369 |

| 1 |

| 20,983 |

| 20,892 |

| — |

|

| Provisions for credit losses and for benefits and claims | 1,717 |

| 1,409 |

| 22 |

| 3,379 |

| 3,454 |

| (2 | ) |

| Income from continuing operations before income taxes | $ | 5,678 |

| $ | 5,770 |

| (2 | )% | $ | 11,659 |

| $ | 10,757 |

| 8 | % |

| Income taxes | 1,795 |

| 1,723 |

| 4 |

| 3,658 |

| 3,202 |

| 14 |

|

| Income from continuing operations | $ | 3,883 |

| $ | 4,047 |

| (4 | )% | $ | 8,001 |

| $ | 7,555 |

| 6 | % |

Income (loss) from discontinued operations, net of taxes(1) | 21 |

| (23 | ) | NM |

| 3 |

| (25 | ) | NM |

|

Net income before attribution of noncontrolling interests | $ | 3,904 |

| $ | 4,024 |

| (3 | )% | $ | 8,004 |

| $ | 7,530 |

| 6 | % |

| Net income attributable to noncontrolling interests | 32 |

| 26 |

| 23 |

| 42 |

| 31 |

| 35 |

|

| Citigroup’s net income | $ | 3,872 |

| $ | 3,998 |

| (3 | )% | $ | 7,962 |

| $ | 7,499 |

| 6 | % |

| Less: | | |

|

| | | |

| Preferred dividends—Basic | $ | 320 |

| $ | 322 |

| (1 | )% | $ | 621 |

| $ | 532 |

| 17 | % |

| Dividends and undistributed earnings allocated to employee restricted and deferred shares that contain nonforfeitable rights to dividends, applicable to basic EPS | 48 |

| 53 |

| (9 | ) | 103 |

| 93 |

| 11 |

|

Income allocated to unrestricted common shareholders for basic and diluted EPS | $ | 3,504 |

| $ | 3,623 |

| (3 | )% | $ | 7,238 |

| $ | 6,874 |

| 5 | % |

| Earnings per share | | |

|

| | |

| |

| Basic | | |

|

| | |

| |

| Income from continuing operations | $ | 1.27 |

| 1.25 |

| 2 |

| $ | 2.63 |

| 2.36 |

| 11 |

|

| Net income | 1.28 |

| 1.24 |

| 3 |

| 2.63 |

| 2.35 |

| 12 |

|

| Diluted | | |

|

| | | |

| Income from continuing operations | $ | 1.27 |

| $ | 1.25 |

| 2 | % | $ | 2.63 |

| $ | 2.36 |

| 11 | % |

| Net income | 1.28 |

| 1.24 |

| 3 |

| 2.63 |

| 2.35 |

| 12 |

|

| Dividends declared per common share | 0.16 |

| 0.05 |

| NM |

| 0.32 |

| 0.10 |

| NM |

|

Statement continues on the next page, including notes to the table.

SUMMARY OF SELECTED FINANCIAL DATA—PAGE 2

|

| | | | | | | | | | | | | |

| Citigroup Inc. and Consolidated Subsidiaries |

| | Second Quarter | | Six Months | |

In millions of dollars, except per-share amounts, ratios and direct staff | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| At June 30: | | | | | | |

| Total assets | $ | 1,864,063 |

| $ | 1,818,771 |

| 2 | % | | | |

| Total deposits | 958,743 |

| 937,852 |

| 2 |

| | | |

| Long-term debt | 225,179 |

| 207,448 |

| 9 |

| | | |

| Citigroup common stockholders’ equity | 210,766 |

| 212,635 |

| (1 | ) | | | |

| Total Citigroup stockholders’ equity | 230,019 |

| 231,888 |

| (1 | ) | | | |

Direct staff (in thousands) | 214 |

| 220 |

| (3 | ) | | | |

| Performance metrics | | |

|

| | | |

| Return on average assets | 0.83 | % | 0.89 | % |

|

| 0.87 | % | 0.84 | % | |

Return on average common stockholders’ equity(2) | 6.8 |

| 7.0 |

|

|

| 7.1 |

| 6.7 |

| |

Return on average total stockholders’ equity(2) | 6.8 |

| 7.0 |

|

|

| 7.1 |

| 6.7 |

| |

| Efficiency ratio (Total operating expenses/Total revenues) | 59 |

| 59 |

|

|

| 58 |

| 60 |

| |

| Basel III ratios—full implementation | | | | | | |

Common Equity Tier 1 Capital(3) | 13.06 | % | 12.53 | % | | | | |

Tier 1 Capital(3) | 14.74 |

| 14.12 |

| | | | |

Total Capital(3) | 16.93 |

| 16.13 |

| | | | |

Supplementary Leverage ratio(4) | 7.24 |

| 7.48 |

| | | | |

| Citigroup common stockholders’ equity to assets | 11.31 | % | 11.69 | % | |

|

| | |

| Total Citigroup stockholders’ equity to assets | 12.34 |

| 12.75 |

| |

|

| | |

Dividend payout ratio(5) | 12.5 |

| 4.0 |

| | 12.2 | % | 4.3 | % | |

Total payout ratio(6) | 63 |

| 40 |

| | 61 |

| 42 |

| |

| Book value per common share | $ | 77.36 |

| $ | 73.19 |

| 6 | % |

|

| | |

Tangible book value (TBV) per share(7) | 67.32 |

| 63.53 |

| 6 |

| | | |

| Ratio of earnings to fixed charges and preferred stock dividends | 2.28x |

| 2.63x |

| | 2.39x |

| 2.59x |

| |

| |

| (1) | See Note 2 to the Consolidated Financial Statements for additional information on Citi’s discontinued operations. |

| |

| (2) | The return on average common stockholders’ equity is calculated using net income less preferred stock dividends divided by average common stockholders’ equity. The return on average total Citigroup stockholders’ equity is calculated using net income divided by average Citigroup stockholders’ equity. |

| |

| (3) | Citi’s reportable Common Equity Tier 1 (CET1) Capital and Tier 1 Capital ratios were the lower derived under the U.S. Basel III Standardized Approach at June 30, 2017, and U.S. Basel III Advanced Approaches at June 30, 2016. Citi’s reportable Total Capital ratios were derived under the U.S. Basel III Advanced Approaches for both periods presented. This reflects the U.S. Basel III requirement to report the lower of risk-based capital ratios under both the Standardized Approach and Advanced Approaches in accordance with the Collins Amendment of the Dodd-Frank Act. |

| |

| (4) | Citi’s Supplementary Leverage ratio reflects full implementation of the U.S. Basel III rules. |

| |

| (5) | Dividends declared per common share as a percentage of net income per diluted share. |

| |

| (6) | Total common dividends declared plus common stock repurchases as a percentage of net income available to common shareholders. See “Consolidated Statement of Changes in Stockholders’ Equity,” Note 9 to the Consolidated Financial Statements and “Equity Security Repurchases” below for the component details. |

| |

| (7) | For information on TBV, see “Capital Resources—Tangible Common Equity, Book Value Per Share, Tangible Book Value Per Share and Returns on Equity” below. |

NM Not Meaningful

SEGMENT AND BUSINESS—INCOME (LOSS) AND REVENUES

CITIGROUP INCOME

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | |

| In millions of dollars | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| Income from continuing operations | | | | | | |

| Global Consumer Banking | | | | | | |

| North America | $ | 670 |

| $ | 815 |

| (18 | )% | $ | 1,297 |

| $ | 1,648 |

| (21 | )% |

| Latin America | 136 |

| 173 |

| (21 | ) | 266 |

| 319 |

| (17 | ) |

Asia(1) | 323 |

| 297 |

| 9 |

| 569 |

| 512 |

| 11 |

|

| Total | $ | 1,129 |

| $ | 1,285 |

| (12 | )% | $ | 2,132 |

| $ | 2,479 |

| (14 | )% |

| Institutional Clients Group |

|

| |

|

|

|

| |

|

|

| North America | $ | 1,112 |

| $ | 1,005 |

| 11 | % | $ | 2,212 |

| $ | 1,551 |

| 43 | % |

| EMEA | 779 |

| 695 |

| 12 |

| 1,634 |

| 1,069 |

| 53 |

|

| Latin America | 333 |

| 392 |

| (15 | ) | 808 |

| 722 |

| 12 |

|

| Asia | 556 |

| 523 |

| 6 |

| 1,137 |

| 1,142 |

| — |

|

| Total | $ | 2,780 |

| $ | 2,615 |

| 6 | % | $ | 5,791 |

| $ | 4,484 |

| 29 | % |

| Corporate/Other | (26 | ) | 147 |

| NM |

| 78 |

| 592 |

| (87 | ) |

| Income from continuing operations | $ | 3,883 |

| $ | 4,047 |

| (4 | )% | $ | 8,001 |

| $ | 7,555 |

| 6 | % |

| Discontinued operations | $ | 21 |

| $ | (23 | ) | NM |

| $ | 3 |

| $ | (25 | ) | NM |

|

| Net income attributable to noncontrolling interests | 32 |

| 26 |

| 23 |

| 42 |

| 31 |

| 35 |

|

| Citigroup’s net income | $ | 3,872 |

| $ | 3,998 |

| (3 | )% | $ | 7,962 |

| $ | 7,499 |

| 6 | % |

| |

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

CITIGROUP REVENUES |

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | |

| In millions of dollars | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| Global Consumer Banking | | | | | | |

| North America | $ | 4,944 |

| $ | 4,709 |

| 5 | % | $ | 9,888 |

| $ | 9,539 |

| 4 | % |

| Latin America | 1,290 |

| 1,236 |

| 4 |

| 2,441 |

| 2,465 |

| (1 | ) |

Asia(1) | 1,801 |

| 1,729 |

| 4 |

| 3,523 |

| 3,384 |

| 4 |

|

| Total | $ | 8,035 |

| $ | 7,674 |

| 5 | % | $ | 15,852 |

| $ | 15,388 |

| 3 | % |

| Institutional Clients Group |

|

| |

|

| | |

|

|

| North America | $ | 3,568 |

| $ | 3,393 |

| 5 | % | $ | 7,023 |

| $ | 6,373 |

| 10 | % |

| EMEA | 2,837 |

| 2,577 |

| 10 |

| 5,644 |

| 4,744 |

| 19 |

|

| Latin America | 1,042 |

| 1,022 |

| 2 |

| 2,169 |

| 1,984 |

| 9 |

|

| Asia | 1,766 |

| 1,697 |

| 4 |

| 3,503 |

| 3,483 |

| 1 |

|

| Total | $ | 9,213 |

| $ | 8,689 |

| 6 | % | $ | 18,339 |

| $ | 16,584 |

| 11 | % |

| Corporate/Other | 653 |

| 1,185 |

| (45 | ) | 1,830 |

| 3,131 |

| (42 | ) |

| Total Citigroup net revenues | $ | 17,901 |

| $ | 17,548 |

| 2 | % | $ | 36,021 |

| $ | 35,103 |

| 3 | % |

| |

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

SEGMENT BALANCE SHEET(1)

|

| | | | | | | | | | | | | | | |

| In millions of dollars | Global Consumer Banking | Institutional Clients Group | Corporate/Other and consolidating eliminations(2) | Citigroup Parent company- issued long-term debt and stockholders’ equity(3) | Total Citigroup consolidated |

| Assets | | | | | |

| Cash and deposits with banks | $ | 9,260 |

| $ | 65,850 |

| $ | 110,972 |

| $ | — |

| $ | 186,082 |

|

Federal funds sold and securities borrowed or purchased under agreements to resell | 358 |

| 233,076 |

| 631 |

| — |

| 234,065 |

|

| Trading account assets | 6,414 |

| 251,170 |

| 2,022 |

| — |

| 259,606 |

|

| Investments | 10,255 |

| 113,078 |

| 228,377 |

| — |

| 351,710 |

|

Loans, net of unearned income and allowance for loan losses

| 290,001 |

| 316,842 |

| 25,827 |

| — |

| 632,670 |

|

| Other assets | 38,143 |

| 103,046 |

| 58,741 |

| — |

| 199,930 |

|

Liquidity assets(4) | 64,378 |

| 269,709 |

| (334,087 | ) | — |

| — |

|

| Total assets | $ | 418,809 |

| $ | 1,352,771 |

| $ | 92,483 |

| $ | — |

| $ | 1,864,063 |

|

| Liabilities and equity | | | | | |

| Total deposits | $ | 309,320 |

| $ | 623,533 |

| $ | 25,890 |

| $ | — |

| $ | 958,743 |

|

Federal funds purchased and securities loaned or sold under agreements to repurchase | 4,061 |

| 150,711 |

| 8 |

| — |

| 154,780 |

|

| Trading account liabilities | 13 |

| 136,273 |

| 459 |

| — |

| 136,745 |

|

| Short-term borrowings | 602 |

| 20,455 |

| 15,462 |

| — |

| 36,519 |

|

Long-term debt(3) | 1,178 |

| 34,179 |

| 42,565 |

| 147,257 |

| 225,179 |

|

| Other liabilities | 17,999 |

| 83,118 |

| 19,873 |

| — |

| 120,990 |

|

Net inter-segment funding (lending)(3) | 85,636 |

| 304,502 |

| (12,862 | ) | (377,276 | ) | — |

|

| Total liabilities | $ | 418,809 |

| $ | 1,352,771 |

| $ | 91,395 |

| $ | (230,019 | ) | $ | 1,632,956 |

|

Total equity(5) | — |

| — |

| 1,088 |

| 230,019 |

| 231,107 |

|

| Total liabilities and equity | $ | 418,809 |

| $ | 1,352,771 |

| $ | 92,483 |

| $ | — |

| $ | 1,864,063 |

|

| |

| (1) | The supplemental information presented in the table above reflects Citigroup’s consolidated GAAP balance sheet by reporting segment as of June 30, 2017. The respective segment information depicts the assets and liabilities managed by each segment as of such date. |

| |

| (2) | Consolidating eliminations for total Citigroup and Citigroup parent company assets and liabilities are recorded within Corporate/Other. |

| |

| (3) | The total stockholders’ equity and the majority of long-term debt of Citigroup reside in the Citigroup parent company Consolidated Balance Sheet. Citigroup allocates stockholders’ equity and long-term debt to its businesses through inter-segment allocations as shown above. |

| |

| (4) | Represents the attribution of Citigroup’s liquidity assets (primarily consisting of cash and available-for-sale securities) to the various businesses based on Liquidity Coverage Ratio (LCR) assumptions. |

| |

| (5) | Corporate/Other equity represents noncontrolling interests. |

This page intentionally left blank.

GLOBAL CONSUMER BANKING

Global Consumer Banking (GCB) consists of consumer banking businesses in North America, Latin America (consisting of Citi’s consumer banking business in Mexico) and Asia. GCB provides traditional banking services to retail customers through retail banking, including commercial banking, and Citi-branded cards and Citi retail services (for additional information on these businesses, see “Citigroup Segments” above). GCB is focused on its priority markets in the U.S., Mexico and Asia with 2,570 branches in 19 countries and jurisdictions as of June 30, 2017. At June 30, 2017, GCB had approximately $419 billion in assets and $309 billion in deposits.

GCB’s overall strategy is to leverage Citi’s global footprint and be the preeminent bank for the emerging affluent and affluent consumers in large urban centers. In credit cards and in certain retail markets, Citi serves customers in a somewhat broader set of segments and geographies.

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | |

| In millions of dollars except as otherwise noted | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| Net interest revenue | $ | 6,699 |

| $ | 6,308 |

| 6 | % | $ | 13,221 |

| $ | 12,660 |

| 4 | % |

| Non-interest revenue | 1,336 |

| 1,366 |

| (2 | )% | 2,631 |

| 2,728 |

| (4 | )% |

| Total revenues, net of interest expense | $ | 8,035 |

| $ | 7,674 |

| 5 | % | $ | 15,852 |

| $ | 15,388 |

| 3 | % |

| Total operating expenses | $ | 4,497 |

| $ | 4,297 |

| 5 | % | $ | 8,912 |

| $ | 8,698 |

| 2 | % |

| Net credit losses | $ | 1,615 |

| $ | 1,374 |

| 18 | % | $ | 3,218 |

| $ | 2,745 |

| 17 | % |

| Credit reserve build (release) | 125 |

| 23 |

| NM |

| 302 |

| 108 |

| NM |

|

| Provision (release) for unfunded lending commitments | (1 | ) | 8 |

| NM |

| 5 |

| 9 |

| (44 | )% |

| Provision for benefits and claims | 23 |

| 20 |

| 15 | % | 52 |

| 48 |

| 8 | % |

| Provisions for credit losses and for benefits and claims | $ | 1,762 |

| $ | 1,425 |

| 24 | % | $ | 3,577 |

| $ | 2,910 |

| 23 | % |

| Income from continuing operations before taxes | $ | 1,776 |

| $ | 1,952 |

| (9 | )% | $ | 3,363 |

| $ | 3,780 |

| (11 | )% |

| Income taxes | 647 |

| 667 |

| (3 | ) | 1,231 |

| 1,301 |

| (5 | ) |

| Income from continuing operations | $ | 1,129 |

| $ | 1,285 |

| (12 | )% | $ | 2,132 |

| $ | 2,479 |

| (14 | )% |

| Noncontrolling interests | 4 |

| 1 |

| NM |

| 5 |

| 3 |

| 67 |

|

| Net income | $ | 1,125 |

| $ | 1,284 |

| (12 | )% | $ | 2,127 |

| $ | 2,476 |

| (14 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

|

| | |

|

|

| Total EOP assets | $ | 419 |

| $ | 399 |

| 5 | % | | |

|

|

| Average assets | 414 |

| 387 |

| 7 |

| $ | 413 |

| $ | 382 |

| 8 | % |

| Return on average assets | 1.09 | % | 1.33 | % |

|

| 1.04 | % | 1.30 | % |

|

|

| Efficiency ratio | 56 | % | 56 | % |

|

| 56 | % | 57 | % |

|

|

| Average deposits | $ | 307 |

| $ | 297 |

| 3 | % | $ | 305 |

| $ | 296 |

| 3 | % |

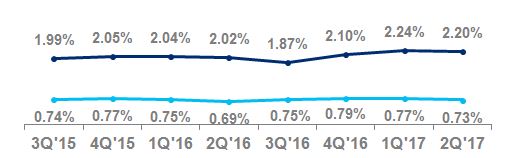

| Net credit losses as a percentage of average loans | 2.20 | % | 2.02 | % |

|

| 2.22 | % | 2.03 | % |

|

|

| Revenue by business |

|

| |

|

| | |

|

|

| Retail banking | $ | 3,299 |

| $ | 3,242 |

| 2 | % | $ | 6,454 |

| $ | 6,429 |

| — | % |

Cards(1) | 4,736 |

| 4,432 |

| 7 |

| 9,398 |

| 8,959 |

| 5 |

|

| Total | $ | 8,035 |

| $ | 7,674 |

| 5 | % | $ | 15,852 |

| $ | 15,388 |

| 3 | % |

| Income from continuing operations by business |

|

| |

|

| | |

|

|

| Retail banking | $ | 420 |

| $ | 472 |

| (11 | )% | $ | 759 |

| $ | 770 |

| (1 | )% |

Cards(1) | 709 |

| 813 |

| (13 | ) | 1,373 |

| 1,709 |

| (20 | ) |

| Total | $ | 1,129 |

| $ | 1,285 |

| (12 | )% | $ | 2,132 |

| $ | 2,479 |

| (14 | )% |

Table continues on the next page.

|

| | | | | | | | | | | | | | | | |

| Foreign currency (FX) translation impact | | |

|

| | | |

| Total revenue—as reported | $ | 8,035 |

| $ | 7,674 |

| 5 | % | $ | 15,852 |

| $ | 15,388 |

| 3 | % |

Impact of FX translation(2) | — |

| (23 | ) |

|

| — |

| (126 | ) |

|

|

Total revenues—ex-FX(3) | $ | 8,035 |

| $ | 7,651 |

| 5 | % | $ | 15,852 |

| $ | 15,262 |

| 4 | % |

| Total operating expenses—as reported | $ | 4,497 |

| $ | 4,297 |

| 5 | % | $ | 8,912 |

| $ | 8,698 |

| 2 | % |

Impact of FX translation(2) | — |

| (9 | ) |

|

| — |

| (50 | ) |

|

|

Total operating expenses—ex-FX(3) | $ | 4,497 |

| $ | 4,288 |

| 5 | % | $ | 8,912 |

| $ | 8,648 |

| 3 | % |

| Total provisions for LLR & PBC—as reported | $ | 1,762 |

| $ | 1,425 |

| 24 | % | $ | 3,577 |

| $ | 2,910 |

| 23 | % |

Impact of FX translation(2) | — |

| (7 | ) |

|

| — |

| (37 | ) |

|

|

Total provisions for LLR & PBC—ex-FX(3) | $ | 1,762 |

| $ | 1,418 |

| 24 | % | $ | 3,577 |

| $ | 2,873 |

| 25 | % |

| Net income—as reported | $ | 1,125 |

| $ | 1,284 |

| (12 | )% | $ | 2,127 |

| $ | 2,476 |

| (14 | )% |

Impact of FX translation(2) | — |

| (6 | ) |

|

| — |

| (30 | ) |

|

|

Net income—ex-FX(3) | $ | 1,125 |

| $ | 1,278 |

| (12 | )% | $ | 2,127 |

| $ | 2,446 |

| (13 | )% |

| |

| (1) | Includes both Citi-branded cards and Citi retail services. |

| |

| (2) | Reflects the impact of FX translation into U.S. dollars at the second quarter of 2017 and year-to-date 2017 average exchange rates for all periods presented. |

| |

| (3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

NORTH AMERICA GCB

North America GCB provides traditional retail banking, including commercial banking, and its Citi-branded cards and Citi retail services card products to retail customers and small to mid-size businesses, as applicable, in the U.S. North America GCB’s U.S. cards product portfolio includes its proprietary portfolio (including the Citi Double Cash, Thank You and Value cards) and co-branded cards (including, among others, American Airlines and Costco) within Citi-branded cards as well as its co-brand and private label relationships (including, among others, Sears, The Home Depot, Macy’s and Best Buy) within Citi retail services. As previously announced, the Hilton Honors co-brand credit card partnership with Citi will terminate as of year-end 2017. The termination is not expected to have a material impact to North America GCB’s results of operations or financial condition.

As of June 30, 2017, North America GCB’s 695 retail bank branches are concentrated in the six key metropolitan areas of New York, Chicago, Miami, Washington, D.C., Los Angeles and San Francisco. Also as of June 30, 2017, North America GCB had approximately 9.5 million retail banking customer accounts, $55.6 billion in retail banking loans and $185.2 billion in deposits. In addition, North America GCB had approximately 120 million Citi-branded and Citi retail services credit card accounts with $130.8 billion in outstanding card loan balances.

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | |

| In millions of dollars, except as otherwise noted | 2017 | 2016 | % Change | 2017 | 2016 | % Change |

| Net interest revenue | $ | 4,633 |

| $ | 4,331 |

| 7 | % | $ | 9,250 |

| $ | 8,729 |

| 6 | % |

| Non-interest revenue | 311 |

| 378 |

| (18 | ) | 638 |

| 810 |

| (21 | ) |

| Total revenues, net of interest expense | $ | 4,944 |

| $ | 4,709 |

| 5 | % | $ | 9,888 |

| $ | 9,539 |

| 4 | % |

| Total operating expenses | $ | 2,577 |

| $ | 2,426 |

| 6 | % | $ | 5,153 |

| $ | 4,926 |

| 5 | % |

| Net credit losses | $ | 1,181 |

| $ | 954 |

| 24 | % | $ | 2,371 |

| $ | 1,887 |

| 26 | % |

| Credit reserve build (release) | 101 |

| 49 |

| NM |

| 253 |

| 128 |

| 98 |

|

| Provision for unfunded lending commitments | 2 |

| 7 |

| (71 | ) | 9 |

| 7 |

| 29 |

|

| Provisions for benefits and claims | 8 |

| 8 |

| — | % | 14 |

| 17 |

| (18 | ) |

| Provisions for credit losses and for benefits and claims | $ | 1,292 |

| $ | 1,018 |

| 27 | % | $ | 2,647 |

| $ | 2,039 |

| 30 | % |

| Income from continuing operations before taxes | $ | 1,075 |

| $ | 1,265 |

| (15 | )% | $ | 2,088 |

| $ | 2,574 |

| (19 | )% |

| Income taxes | 405 |

| 450 |

| (10 | ) | 791 |

| 926 |

| (15 | ) |

| Income from continuing operations | $ | 670 |

| $ | 815 |

| (18 | )% | $ | 1,297 |

| $ | 1,648 |

| (21 | )% |

| Noncontrolling interests | — |

| (1 | ) | NM |

| — |

| (1 | ) | NM |

|

| Net income | $ | 670 |

| $ | 816 |

| (18 | )% | $ | 1,297 |

| $ | 1,649 |

| (21 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

|

| | |

|

|

|

| Average assets | $ | 243 |

| $ | 218 |

| 11 | % | $ | 244 |

| $ | 215 |

| 13 | % |

| Return on average assets | 1.11 | % | 1.51 | % |

|

| 1.07 | % | 1.54 | % |

|

|

| Efficiency ratio | 52 | % | 52 | % |

|

| 52 | % | 52 | % |

|

|

| Average deposits | $ | 185.1 |

| $ | 182.1 |

| 2 | % | $ | 185.3 |

| $ | 181.4 |

| 2 | % |

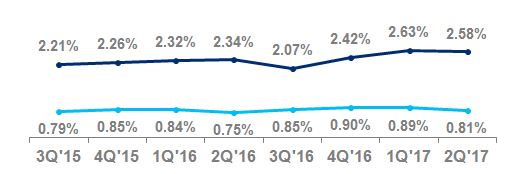

| Net credit losses as a percentage of average loans | 2.58 | % | 2.34 | % |

|

| 2.61 | % | 2.33 | % |

|

|

| Revenue by business |

|

| |

|

| | |

|

|

|

| Retail banking | $ | 1,291 |

| $ | 1,313 |

| (2 | )% | $ | 2,547 |

| $ | 2,603 |

| (2 | )% |

| Citi-branded cards | 2,079 |

| 1,886 |

| 10 |

| 4,175 |

| 3,746 |

| 11 |

|

| Citi retail services | 1,574 |

| 1,510 |

| 4 |

| 3,166 |

| 3,190 |

| (1 | ) |

| Total | $ | 4,944 |

| $ | 4,709 |

| 5 | % | $ | 9,888 |

| $ | 9,539 |

| 4 | % |

| Income from continuing operations by business |

|

| |

|

| | |

|

|

|

| Retail banking | $ | 140 |

| $ | 172 |

| (19 | )% | $ | 223 |

| $ | 261 |

| (15 | )% |

| Citi-branded cards | 305 |

| 320 |

| (5 | ) | 553 |

| 673 |

| (18 | ) |

| Citi retail services | 225 |

| 323 |

| (30 | ) | 521 |

| 714 |

| (27 | ) |

| Total | $ | 670 |

| $ | 815 |

| (18 | )% | $ | 1,297 |

| $ | 1,648 |

| (21 | )% |

NM Not meaningful

2Q17 vs. 2Q16

Net income decreased 18% due to significantly higher cost of credit, driven by the impact of the Costco portfolio acquisition (completed June 17, 2016), and higher expenses, partially offset by higher revenues.

Revenues increased 5%, reflecting higher revenues in Citi-branded cards and Citi retail services, partially offset by lower revenues in retail banking.

Retail banking revenues declined 2%, reflecting lower mortgage revenues. The decline in mortgage revenues was driven by lower origination activity and higher cost of funds, as well as the impact of the previously announced sale of a portion of Citi’s mortgage servicing rights (MSR). Excluding mortgage revenues, retail banking revenues were up 7%, driven by continued growth in average loans (6%), deposits (2%), and asset under management (10%), as well as a benefit from higher interest rates. Citi expects higher interest rates and the impact of the MSR sale to continue to negatively impact mortgage revenues during the remainder of 2017.

Cards revenues increased 8%. In Citi-branded cards, revenues increased 10%, largely reflecting the impact of the Costco portfolio acquisition and modest organic growth in Citi’s core portfolios. This increase in revenues was partially offset by the runoff of non-core portfolios, which is expected to be an ongoing headwind during the remainder of 2017. Average loans grew 25% (3% excluding Costco) and purchase sales grew 52% (3% excluding Costco).

Citi retail services revenues increased 4%, primarily driven by continued loan growth and a favorable prior-period comparison, partially offset by the continued impact of the previously disclosed renewal and extension of certain partnerships within the portfolio. Average loans were up 4% and purchase sales were up 2%.

Expenses increased 6%, primarily driven by the addition of the Costco portfolio, volume growth and continued investments, partially offset by efficiency savings.

Provisions increased 27% from the prior-year period, driven by higher net credit losses and a higher net loan loss reserve build.

Net credit losses increased 24%, primarily driven by higher losses in Citi-branded cards and Citi retail services. In Citi-branded cards, net credit losses increased 31% to $611 million, primarily due to the Costco portfolio acquisition, organic volume growth and seasoning. In Citi retail services, net credit losses increased 20% to $531 million, primarily due to volume growth and seasoning and the impact of changes in collection processes. The net loan loss reserve build in the second quarter of 2017 was $103 million, compared to a build of $56 million in the prior-year period, largely supporting volume growth and the impact of changes in collections processes in Citi retail services.

For additional information on North America GCB’s retail banking, including commercial banking, and its Citi-branded cards and Citi retail services portfolios, see “Credit Risk—Consumer Credit” below.

2017 YTD vs. 2016 YTD

Year-to-date, North America GCB has experienced similar trends to those described above. Net income decreased 21% due to higher cost of credit and higher expenses, partially offset by higher revenues.

Revenues increased 4%, reflecting higher revenues in cards, partially offset by lower revenues in retail banking. Retail banking revenues decreased 2%, driven by the same factors described above. Cards revenues increased 6%. In Citi-branded cards, revenues increased 11%, driven by the same factors described above. Citi retail services revenues were down 1%, driven by the continued impact of the renewal and extension of certain partnerships, as well as the absence of gains on sales of two cards portfolios in the first quarter of 2016, partially offset by loan growth.

Expenses increased 5%, driven by the same factors described above.

Provisions increased 30%, driven by the same factors described above. Net credit losses increased 26% and the net loan loss reserve build of $262 million increased $127 million.

LATIN AMERICA GCB

Latin America GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses in Mexico through Citibanamex, one of Mexico’s largest banks.

At June 30, 2017, Latin America GCB had 1,496 retail branches in Mexico, with approximately 28.0 million retail banking customer accounts, $21.0 billion in retail banking loans and $28.7 billion in deposits. In addition, the business had approximately 5.7 million Citi-branded card accounts with $5.5 billion in outstanding loan balances.

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | % Change |

| In millions of dollars, except as otherwise noted | 2017 | 2016 | % Change | 2017 | 2016 |

| Net interest revenue | $ | 917 |

| $ | 861 |

| 7 | % | $ | 1,717 |

| $ | 1,714 |

| — | % |

| Non-interest revenue | 373 |

| 375 |

| (1 | )% | 724 |

| 751 |

| (4 | )% |

| Total revenues, net of interest expense | $ | 1,290 |

| $ | 1,236 |

| 4 | % | $ | 2,441 |

| $ | 2,465 |

| (1 | )% |

| Total operating expenses | $ | 735 |

| $ | 725 |

| 1 | % | $ | 1,394 |

| $ | 1,443 |

| (3 | )% |

| Net credit losses | $ | 277 |

| $ | 260 |

| 7 | % | $ | 530 |

| $ | 538 |

| (1 | )% |

| Credit reserve build (release) | 50 |

| (2 | ) | NM |

| 62 |

| 15 |

| NM |

|

| Provision (release) for unfunded lending commitments | (1 | ) | 1 |

| NM |

| (1 | ) | 2 |

| NM |

|

| Provision for benefits and claims | 15 |

| 12 |

| 25 | % | 38 |

| 31 |

| 23 | % |

| Provisions for credit losses and for benefits and claims (LLR & PBC) | $ | 341 |

| $ | 271 |

| 26 | % | $ | 629 |

| $ | 586 |

| 7 | % |

| Income from continuing operations before taxes | $ | 214 |

| $ | 240 |

| (11 | )% | $ | 418 |

| $ | 436 |

| (4 | )% |

| Income taxes | 78 |

| 67 |

| 16 |

| 152 |

| 117 |

| 30 |

|

| Income from continuing operations | $ | 136 |

| $ | 173 |

| (21 | )% | $ | 266 |

| $ | 319 |

| (17 | )% |

| Noncontrolling interests | 2 |

| 1 |

| 100 |

| 3 |

| 2 |

| 50 |

|

| Net income | $ | 134 |

| $ | 172 |

| (22 | )% | $ | 263 |

| $ | 317 |

| (17 | )% |

Balance Sheet data (in billions of dollars) |

|

| |

|

| | |

|

|

|

| Average assets | $ | 46 |

| $ | 50 |

| (8 | )% | $ | 45 |

| $ | 50 |

| (10 | )% |

| Return on average assets | 1.17 | % | 1.38 | % |

|

| 1.18 | % | 1.27 | % |

|

|

| Efficiency ratio | 57 | % | 59 | % |

|

| 57 | % | 59 | % |

|

|

| Average deposits | $ | 27.8 |

| $ | 25.9 |

| 7 | % | $ | 26.6 |

| $ | 26.0 |

| 2 | % |

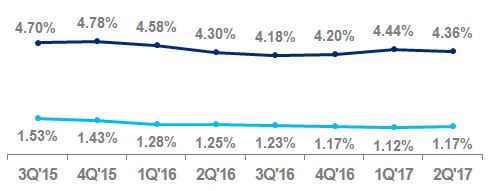

| Net credit losses as a percentage of average loans | 4.36 | % | 4.30 | % |

|

| 4.38 | % | 4.43 | % |

|

|

| Revenue by business |

|

| |

|

| | |

|

|

| Retail banking | $ | 923 |

| $ | 853 |

| 8 | % | $ | 1,759 |

| $ | 1,709 |

| 3 | % |

| Citi-branded cards | 367 |

| 383 |

| (4 | ) | 682 |

| 756 |

| (10 | ) |

| Total | $ | 1,290 |

| $ | 1,236 |

| 4 | % | $ | 2,441 |

| $ | 2,465 |

| (1 | )% |

| Income from continuing operations by business |

|

| |

|

| | |

|

|

|

| Retail banking | $ | 87 |

| $ | 96 |

| (9 | )% | $ | 173 |

| $ | 186 |

| (7 | )% |

| Citi-branded cards | 49 |

| 77 |

| (36 | ) | 93 |

| 133 |

| (30 | ) |

| Total | $ | 136 |

| $ | 173 |

| (21 | )% | $ | 266 |

| $ | 319 |

| (17 | )% |

|

| | | | | | | | | | | | | | | | |

| FX translation impact |

|

| |

|

| | |

|

|

|

| Total revenues—as reported | $ | 1,290 |

| $ | 1,236 |

| 4 | % | $ | 2,441 |

| $ | 2,465 |

| (1 | )% |

Impact of FX translation(1) | — |

| (37 | ) |

|

| — |

| (160 | ) |

|

|

Total revenues—ex-FX(2) | $ | 1,290 |

| $ | 1,199 |

| 8 | % | $ | 2,441 |

| $ | 2,305 |

| 6 | % |

| Total operating expenses—as reported | $ | 735 |

| $ | 725 |

| 1 | % | $ | 1,394 |

| $ | 1,443 |

| (3 | )% |

Impact of FX translation(1) | — |

| (18 | ) |

|

| — |

| (73 | ) |

|

|

Total operating expenses—ex-FX(2) | $ | 735 |

| $ | 707 |

| 4 | % | $ | 1,394 |

| $ | 1,370 |

| 2 | % |

| Provisions for LLR & PBC—as reported | $ | 341 |

| $ | 271 |

| 26 | % | $ | 629 |

| $ | 586 |

| 7 | % |

Impact of FX translation(1) | — |

| (8 | ) |

|

| — |

| (39 | ) |

|

|

Provisions for LLR & PBC—ex-FX(2) | $ | 341 |

| $ | 263 |

| 30 | % | $ | 629 |

| $ | 547 |

| 15 | % |

| Net income—as reported | $ | 134 |

| $ | 172 |

| (22 | )% | $ | 263 |

| $ | 317 |

| (17 | )% |

Impact of FX translation(1) | — |

| (9 | ) |

|

| — |

| (37 | ) |

|

|

Net income—ex-FX(2) | $ | 134 |

| $ | 163 |

| (18 | )% | $ | 263 |

| $ | 280 |

| (6 | )% |

| |

| (1) | Reflects the impact of FX translation into U.S. dollars at the second quarter of 2017 and year-to-date 2017 average exchange rates for all periods presented. |

| |

| (2) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

The discussion of the results of operations for Latin America GCB below excludes the impact of FX translation for all periods presented. Presentations of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. For a reconciliation of certain of these metrics to the reported results, see the table above.

2Q17 vs. 2Q16

Net income decreased 18%, primarily driven by higher credit costs and expenses, partially offset by higher revenues.

Revenues increased 8%, driven by higher revenues in

retail banking, partially offset by modestly lower revenues in

cards.

Retail banking revenues grew by 12%, reflecting continued growth in volumes, including an increase in average loans (8%), largely driven by the commercial and small business portfolios, and an increase in average deposits (10%), as well as improved deposit spreads. Cards revenues decreased 1%, reflecting continued higher cost to fund non-revolving loans, largely offset by increased purchase sales (10%). Average card loans grew 6%. While revolving card loan balance trends continued to improve during the quarter, Latin America GCB expects cards revenues to remain under pressure in the near term.

Expenses increased 4%, as ongoing investment spending and business growth were partially offset by efficiency savings.

Provisions increased 30%, primarily driven by a higher net loan loss reserve build (increase of $51 million) and higher net credit losses (10%), largely reflecting volume growth and seasonality.

For additional information on Latin America GCB’s retail banking, including commercial banking, and its Citi-branded

cards portfolios, see “Credit Risk—Consumer Credit” below.

2017 YTD vs. 2016 YTD

Year-to-date, Latin America GCB has experienced similar trends to those described above. Net income decreased 6%, driven by the same factors described above.

Revenues increased 6%, primarily due to higher revenues in retail banking, partially offset by lower revenues in cards. Retail banking revenues increased 10%, driven by the same factors described above as well as the impact of business divestitures. Cards revenues decreased 3%, driven by the same factors described above.

Expenses increased 2%, as ongoing investment spending was partially offset by efficiency savings.

Provisions increased 15% largely driven by the same factors described above.

ASIA GCB

Asia GCB provides traditional retail banking, including commercial banking, and its Citi-branded card products to retail customers and small to mid-size businesses, as applicable. During the second quarter of 2017, Citi’s most significant revenues in the region were from Hong Kong, Singapore, Korea, Australia, India, Taiwan, Indonesia, Philippines, Thailand and Malaysia. Included within Asia GCB, traditional retail banking and Citi-branded card products are also provided to retail customers in certain EMEA countries, primarily in Poland, Russia and the United Arab Emirates.

At June 30, 2017, on a combined basis, the businesses had 379 retail branches, approximately 16.3 million retail banking customer accounts, $66.8 billion in retail banking loans and $95.4 billion in deposits. In addition, the businesses had approximately 16.7 million Citi-branded card accounts with $18.8 billion in outstanding loan balances.

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | % Change |

In millions of dollars, except as otherwise noted (1) | 2017 | 2016 | % Change | 2017 | 2016 |

| Net interest revenue | $ | 1,149 |

| $ | 1,116 |

| 3 | % | $ | 2,254 |

| $ | 2,217 |

| 2 | % |

| Non-interest revenue | 652 |

| 613 |

| 6 |

| 1,269 |

| 1,167 |

| 9 |

|

| Total revenues, net of interest expense | $ | 1,801 |

| $ | 1,729 |

| 4 | % | $ | 3,523 |

| $ | 3,384 |

| 4 | % |

| Total operating expenses | $ | 1,185 |

| $ | 1,146 |

| 3 | % | $ | 2,365 |

| $ | 2,329 |

| 2 | % |

| Net credit losses | $ | 157 |

| $ | 160 |

| (2 | )% | $ | 317 |

| $ | 320 |

| (1 | )% |

| Credit reserve build (release) | (26 | ) | (24 | ) | (8 | ) | (13 | ) | (35 | ) | 63 |

|

| Provision (release) for unfunded lending commitments | (2 | ) | — |

| NM |

| (3 | ) | — |

| NM |

|

| Provisions for credit losses | $ | 129 |

| $ | 136 |

| (5 | )% | $ | 301 |

| $ | 285 |

| 6 | % |

| Income from continuing operations before taxes | $ | 487 |

| $ | 447 |

| 9 | % | $ | 857 |

| $ | 770 |

| 11 | % |

| Income taxes | 164 |

| 150 |

| 9 |

| 288 |

| 258 |

| 12 |

|

| Income from continuing operations | $ | 323 |

| $ | 297 |

| 9 | % | $ | 569 |

| $ | 512 |

| 11 | % |

| Noncontrolling interests | 2 |

| 1 |

| 100 |

| 2 |

| 2 |

| — |

|

| Net income | $ | 321 |

| $ | 296 |

| 8 | % | $ | 567 |

| $ | 510 |

| 11 | % |

Balance Sheet data (in billions of dollars) |

|

|

|

|

|

| | |

|

|

|

| Average assets | $ | 125 |

| $ | 119 |

| 5 | % | $ | 124 |

| $ | 118 |

| 5 | % |

| Return on average assets | 1.03 | % | 1.00 | % |

|

| 0.92 | % | 0.87 | % |

|

|

| Efficiency ratio | 66 | % | 66 | % | | 67 | % | 69 | % |

|

|

| Average deposits | $ | 94.3 |

| $ | 89.4 |

| 5 | % | $ | 93.5 |

| $ | 88.3 |

| 6 | % |

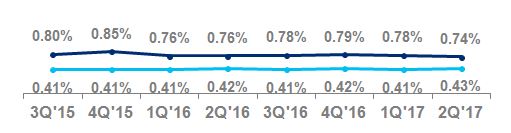

| Net credit losses as a percentage of average loans | 0.74 | % | 0.76 | % |

|

| 0.76 | % | 0.76 | % |

|

|

| Revenue by business | | | | | |

|

|

| Retail banking | $ | 1,085 |

| $ | 1,076 |

| 1 | % | $ | 2,148 |

| $ | 2,117 |

| 1 | % |

| Citi-branded cards | 716 |

| 653 |

| 10 |

| 1,375 |

| 1,267 |

| 9 |

|

| Total | $ | 1,801 |

| $ | 1,729 |

| 4 | % | $ | 3,523 |

| $ | 3,384 |

| 4 | % |

| Income from continuing operations by business |

|

|

|

|

|

| | |

|

|

| Retail banking | $ | 193 |

| $ | 204 |

| (5 | )% | $ | 363 |

| $ | 323 |

| 12 | % |

| Citi-branded cards | 130 |

| 93 |

| 40 |

| 206 |

| 189 |

| 9 |

|

| Total | $ | 323 |

| $ | 297 |

| 9 | % | $ | 569 |

| $ | 512 |

| 11 | % |

|

| | | | | | | | | | | | | | | | |

| FX translation impact |

|

|

| | |

|

|

| Total revenues—as reported | $ | 1,801 |

| $ | 1,729 |

| 4 | % | $ | 3,523 |

| $ | 3,384 |

| 4 | % |

Impact of FX translation(2) | — |

| 14 |

|

|

| — |

| 34 |

|

|

|

Total revenues—ex-FX(3) | $ | 1,801 |

| $ | 1,743 |

| 3 | % | $ | 3,523 |

| $ | 3,418 |

| 3 | % |

| Total operating expenses—as reported | $ | 1,185 |

| $ | 1,146 |

| 3 | % | $ | 2,365 |

| $ | 2,329 |

| 2 | % |

Impact of FX translation(2) | — |

| 9 |

|

|

| — |

| 23 |

|

|

|

Total operating expenses—ex-FX(3) | $ | 1,185 |

| $ | 1,155 |

| 3 | % | $ | 2,365 |

| $ | 2,352 |

| 1 | % |

| Provisions for loan losses—as reported | $ | 129 |

| $ | 136 |

| (5 | )% | $ | 301 |

| $ | 285 |

| 6 | % |

Impact of FX translation(2) | — |

| 1 |

|

|

| — |

| 2 |

|

|

|

Provisions for loan losses—ex-FX(3) | $ | 129 |

| $ | 137 |

| (6 | )% | $ | 301 |

| $ | 287 |

| 5 | % |

| Net income—as reported | $ | 321 |

| $ | 296 |

| 8 | % | $ | 567 |

| $ | 510 |

| 11 | % |

Impact of FX translation(2) | — |

| 3 |

|

|

| — |

| 7 |

|

|

|

Net income—ex-FX(3) | $ | 321 |

| $ | 299 |

| 7 | % | $ | 567 |

| $ | 517 |

| 10 | % |

| |

| (1) | Asia GCB includes the results of operations of GCB activities in certain EMEA countries for all periods presented. |

| |

| (2) | Reflects the impact of FX translation into U.S. dollars at the second quarter of 2017 and year-to-date 2017 average exchange rates for all periods presented. |

| |

| (3) | Presentation of this metric excluding FX translation is a non-GAAP financial measure. |

The discussion of the results of operations for Asia GCB below excludes the impact of FX translation for all periods presented. Presentations of the results of operations, excluding the impact of FX translation, are non-GAAP financial measures. For a reconciliation of certain of these metrics to the reported results, see the table above.

2Q17 vs. 2Q16

Net income increased 7%, reflecting higher revenues and lower cost of credit, partially offset by higher expenses.

Revenues increased 3%, driven by improvement in cards and wealth management revenues, partially offset by lower retail lending revenues.

Retail banking revenues were largely unchanged, primarily due to an increase in wealth management revenues, offset by the repositioning of the retail loan portfolio. Wealth management revenues increased due to improvement in investor sentiment, stronger equity markets and an increase in assets under management (9%) and investment sales (27%). These increases were offset by continued lower lending revenues (down 3%), reflecting continued lower average loans (decrease of 2%) due to the optimization of this portfolio away from lower-yielding mortgage loans to focus on growing higher-return personal loans.

Cards revenues increased 9%, reflecting 6% growth in average loans and 7% growth in purchase sales, both of which benefited from the previously disclosed portfolio acquisition in Australia in the first quarter of 2017. Cards revenues also benefitted from a modest gain from the sale of merchant acquiring businesses in certain countries.

Expenses increased 3%, resulting from volume growth and ongoing investment spending, partially offset by efficiency savings.

Provisions decreased 6%, driven by an increase in net loan loss reserve releases and lower net credit losses. Overall credit quality continued to remain stable in the region.

For additional information on Asia GCB’s retail banking, including commercial banking, and its Citi-branded cards portfolios, see “Credit Risk—Consumer Credit” below.

2017 YTD vs. 2016 YTD

Year-to-date, Asia GCB has experienced similar trends to

those described above. Net income increased 10% due to higher revenues, partially offset by higher expenses and cost of credit.

Revenues increased 3%, primarily due to an increase in cards revenues. Retail banking revenues were largely unchanged, driven by the same factors described above. Cards revenues increased 8%, driven by the same factors described above.

Expenses increased 1%, driven by business volumes.

Provisions increased 5%, primarily due to a higher net loan loss reserve build in the first quarter of 2017 related to the card portfolio acquisition in Australia, partially offset by lower net credit losses.

INSTITUTIONAL CLIENTS GROUP

Institutional Clients Group (ICG) includes Banking and Markets and securities services (for additional information on these businesses, see “Citigroup Segments” above). ICG provides corporate, institutional, public sector and high-net-worth clients around the world with a full range of wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative services, equity and fixed income research, corporate lending, investment banking and advisory services, private banking, cash management, trade finance and securities services. ICG transacts with clients in both cash instruments and derivatives, including fixed income, foreign currency, equity and commodity products.

ICG revenue is generated primarily from fees and spreads associated with these activities. ICG earns fee income for assisting clients in clearing transactions, providing brokerage and investment banking services and other such activities. Revenue generated from these activities is recorded in Commissions and fees and Investment banking. Revenue is also generated from transaction processing and assets under custody and administration. Revenue generated from these activities is primarily recorded in Administration and other fiduciary fees. In addition, as a market maker, ICG facilitates transactions, including holding product inventory to meet client demand, and earns the differential between the price at which it buys and sells the products. These price differentials and the unrealized gains and losses on the inventory are recorded in Principal transactions (for additional information on Principal transactions revenue, see Note 6 to the Consolidated Financial Statements). Other primarily includes mark-to-market gains and losses on certain credit derivatives, gains and losses on available-for-sale (AFS) securities and other non-recurring gains and losses. Interest income earned on assets held less interest paid to customers on deposits and long- and short-term debt is recorded as Net interest revenue.

The amount and types of Markets revenues are impacted by a variety of interrelated factors, including market liquidity; changes in market variables such as interest rates, foreign exchange rates, equity prices, commodity prices and credit spreads, as well as their implied volatilities; investor confidence; and other macroeconomic conditions. Assuming all other market conditions do not change, increases in client activity levels or bid/offer spreads generally result in increases in revenues. However, changes in market conditions can significantly impact client activity levels, bid/offer spreads and the fair value of product inventory. For example, a decrease in market liquidity may increase bid/offer spreads, decrease client activity levels and widen credit spreads on product inventory positions.

ICG’s management of the Markets businesses involves daily monitoring and evaluating of the above factors at the trading desk as well as the country level. ICG does not separately track the impact on total Markets revenues of the volume of transactions, bid/offer spreads, fair value changes of product inventory positions and economic hedges because, as noted above, these components are interrelated and are not deemed useful or necessary individually to manage the Markets businesses at an aggregate level.

In the Markets businesses, client revenues are those revenues directly attributable to client transactions at the time of inception, including commissions, interest or fees earned. Client revenues do not include the results of client facilitation activities (for example, holding product inventory in anticipation of client demand) or the results of certain economic hedging activities.

ICG’s international presence is supported by trading floors in approximately 80 countries and a proprietary network in 98 countries and jurisdictions. At June 30, 2017, ICG had approximately $1.4 trillion of assets and $624 billion of deposits, while two of its businesses—securities services and issuer services—managed approximately $16.5 trillion of assets under custody compared to $15.3 trillion at the end of the prior-year period.

|

| | | | | | | | | | | | | | | | |

| | Second Quarter | | Six Months | % Change |

| In millions of dollars, except as otherwise noted | 2017 | 2016 | % Change | 2017 | 2016 |

| Commissions and fees | $ | 1,020 |

| $ | 956 |

| 7 | % | $ | 2,005 |

| $ | 1,960 |

| 2 | % |

| Administration and other fiduciary fees | 719 |

| 638 |

| 13 |

| 1,363 |

| 1,235 |

| 10 |

|

| Investment banking | 1,180 |

| 1,029 |

| 15 |

| 2,224 |

| 1,769 |

| 26 |

|

| Principal transactions | 2,079 |

| 1,912 |

| 9 |

| 4,747 |

| 3,488 |

| 36 |

|

Other(1) | 240 |

| 46 |

| NM |

| 235 |

| 39 |

| NM |

|

| Total non-interest revenue | $ | 5,238 |

| $ | 4,581 |

| 14 | % | $ | 10,574 |

| $ | 8,491 |

| 25 | % |

| Net interest revenue (including dividends) | 3,975 |

| 4,108 |

| (3 | ) | 7,765 |

| 8,093 |

| (4 | ) |

| Total revenues, net of interest expense | $ | 9,213 |

| $ | 8,689 |

| 6 | % | $ | 18,339 |

| $ | 16,584 |

| 11 | % |

| Total operating expenses | $ | 5,019 |

| $ | 4,763 |

| 5 | % | $ | 9,964 |

| $ | 9,635 |

| 3 | % |

| Net credit losses | $ | 71 |

| $ | 141 |

| (50 | )% | $ | 96 |

| $ | 352 |

| (73 | )% |

| Credit reserve build (release) | (15 | ) | (26 | ) | 42 |

| (191 | ) | 82 |

| NM |

|

| Provision (release) for unfunded lending commitments | 31 |

| (33 | ) | NM |

| (23 | ) | 38 |

| NM |

|

| Provisions for credit losses | $ | 87 |

| $ | 82 |

| 6 | % | $ | (118 | ) | $ | 472 |

| NM |

|

| Income from continuing operations before taxes | $ | 4,107 |

| $ | 3,844 |

| 7 | % | $ | 8,493 |

| $ | 6,477 |

| 31 | % |

| Income taxes | 1,327 |

| 1,229 |

| 8 |

| 2,702 |

| 1,993 |

| 36 |

|

| Income from continuing operations | $ | 2,780 |

| $ | 2,615 |

| 6 | % | $ | 5,791 |

| $ | 4,484 |

| 29 | % |

| Noncontrolling interests | 18 |

| 17 |

| 6 |

| 33 |

| 27 |

| 22 |

|

| Net income | $ | 2,762 |

| $ | 2,598 |

| 6 | % | $ | 5,758 |

| $ | 4,457 |

| 29 | % |

EOP assets (in billions of dollars) | $ | 1,353 |

| $ | 1,303 |

| 4 | % | | | |

Average assets (in billions of dollars) | 1,360 |

| 1,300 |

| 5 |

| $ | 1,339 |

| $ | 1,286 |

| 4 | % |

| Return on average assets | 0.81 | % | 0.80 | % |

|

| 0.87 | % | 0.70 | % |

|

|

| Efficiency ratio | 54 |

| 55 |

|

|

| 54 |

| 58 |

|

|

|

| Revenues by region | | |

|

| | |

|

|

| North America | $ | 3,568 |

| $ | 3,393 |

| 5 | % | $ | 7,023 |

| $ | 6,373 |

| 10 | % |

| EMEA | 2,837 |

| 2,577 |

| 10 |

| 5,644 |

| 4,744 |

| 19 |

|

| Latin America | 1,042 |

| 1,022 |

| 2 |

| 2,169 |

| 1,984 |

| 9 |

|

| Asia | 1,766 |

| 1,697 |

| 4 |

| 3,503 |

| 3,483 |

| 1 |

|

| Total | $ | 9,213 |

| $ | 8,689 |

| 6 | % | $ | 18,339 |

| $ | 16,584 |

| 11 | % |

| Income from continuing operations by region | | |

|

| | |

|

|

|

| North America | $ | 1,112 |

| $ | 1,005 |

| 11 | % | $ | 2,212 |

| $ | 1,551 |

| 43 | % |

| EMEA | 779 |

| 695 |

| 12 |

| 1,634 |

| 1,069 |

| 53 |

|

| Latin America | 333 |

| 392 |

| (15 | ) | 808 |

| 722 |

| 12 |

|

| Asia | 556 |

| 523 |

| 6 |

| 1,137 |

| 1,142 |

| — |

|

| Total | $ | 2,780 |

| $ | 2,615 |

| 6 | % | $ | 5,791 |

| $ | 4,484 |

| 29 | % |

Average loans by region (in billions of dollars) | | |

|

| | |

|

|

|

| North America | $ | 146 |

| $ | 138 |

| 6 | % | $ | 143 |

| $ | 135 |

| 6 | % |

| EMEA | 67 |

| 67 |

| — |

| 66 |

| 65 |

| 2 |

|

| Latin America | 37 |

| 38 |

| (3 | ) | 37 |

| 39 |

| (5 | ) |

| Asia | 62 |

| 61 |

| 2 |

| 61 |

| 61 |

| — |

|

| Total | $ | 312 |

| $ | 304 |

| 3 | % | $ | 307 |

| $ | 300 |

| 2 | % |

EOP deposits by business (in billions of dollars) | | | | | |

|

|

| Treasury and trade solutions | $ | 421 |

| $ | 407 |

| 3 | % | | |

|

|

All other ICG businesses | 203 |

| 202 |

| — |

|

|

|

|

|

|

|

| Total | $ | 624 |

| $ | 609 |

| 2 | % |

|

|

|

|

|

|

| |

| (1) | First quarter of 2016 includes a previously disclosed charge of approximately $180 million, primarily reflecting the write-down of Citi’s net investment in Venezuela as a result of changes in the exchange rate during the quarter. |

NM Not meaningful

ICG Revenue Details—Excluding Gain (Loss) on Loan Hedges

|