- C Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

Citigroup (C) 424B2Prospectus for primary offering

Filed: 30 Mar 21, 4:52pm

| Citigroup Global Markets Holdings Inc. | March 29, 2021 Medium-Term Senior Notes, Series N Pricing Supplement No. 2021–USNCH7011 Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333-224495 and 333-224495-03 |

Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031

| § | The notes offered by this pricing supplement are unsecured senior debt securities issued by Citigroup Global Markets Holdings Inc. and guaranteed by Citigroup Inc. The notes will bear interest at a fixed rate for one year and, thereafter, will bear interest at a floating rate based on the CMS spread, subject to the maximum interest rate specified below. The CMS spread is the 30-year constant maturity swap rate (“CMS30”) minus the 5-year constant maturity swap rate (“CMS5”) and will be reset quarterly. The notes offer an above-market fixed interest rate in the first year. Thereafter, however, interest payments on the notes will vary based on fluctuations in the CMS spread and may be as low as 0%. |

| § | We may call the notes for mandatory redemption on any interest payment date beginning one year after issuance. |

| § | Investors in the notes must be willing to accept (i) an investment that may have limited or no liquidity and (ii) the risk of not receiving any amount due under the notes if we and Citigroup Inc. default on our obligations. All payments on the notes are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. |

| KEY TERMS | |

| Issuer: | Citigroup Global Markets Holdings Inc., a wholly owned subsidiary of Citigroup Inc. |

| Guarantee: | All payments due on the notes are fully and unconditionally guaranteed by Citigroup Inc. |

| Aggregate stated principal amount: | $1,508,000 |

| Stated principal amount: | $1,000 per note |

| Pricing date: | March 29, 2021 |

| Issue date: | March 31, 2021 |

| Maturity date: | Unless earlier called by us, March 31, 2031 |

| Payment at maturity: | At maturity, unless we have earlier called the notes, you will receive for each note you then hold an amount in cash equal to $1,000 plus any accrued and unpaid interest |

| Interest: | § During each interest period from and including the issue date to but excluding March 31, 2022, the notes will bear interest at a fixed rate of 5.00% per annum § During each interest period commencing on or after March 31, 2022, the notes will bear interest at a floating rate equal to (i) 6.0 times (ii) the CMS spread minus 0.25%, as determined on the interest determination date for that interest period, subject to a maximum interest rate of 8.00% per annum and a minimum interest rate of 0.00% per annum After the first year of the term of the notes, interest payments will vary based on fluctuations in the CMS spread. After the first year, the notes may pay a below-market rate or no interest at all for an extended period of time, or even throughout the entire remaining term. |

| CMS spread: | On any interest determination date, CMS30 minus CMS5, each as determined on that interest determination date |

| Interest determination date: | For any interest period commencing on or after March 31, 2022, the second U.S. government securities business day prior to the first day of that interest period |

| Interest period: | Each three-month period from and including an interest payment date (or the issue date, in the case of the first interest period) to but excluding the next interest payment date |

| Interest payment dates: | The last day of each March, June, September and December, beginning on June 30, 2021 and ending on the maturity date or, if applicable, the date when the notes are redeemed |

| Call right: | We may call the notes, in whole and not in part, for mandatory redemption on any interest payment date beginning on March 31, 2022, upon not less than five business days’ notice. Following an exercise of our call right, you will receive for each note you then hold an amount in cash equal to $1,000 plus any accrued and unpaid interest. |

| Listing: | The notes will not be listed on any securities exchange |

| CUSIP / ISIN: | 17328YYU2 / US17328YYU27 |

| Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal |

| Underwriting fee and issue price: | Issue price(1)(2) | Underwriting fee(3) | Proceeds to issuer(3) |

| Per note: | $1,000.00 | $22.50 | $977.50 |

| Total: | $1,508,000.00 | $33,930.00 | $1,474,070.00 |

(1) On the date of this pricing supplement, the estimated value of the notes is $954.90 per note, which is less than the issue price. The estimated value of the notes is based on CGMI’s proprietary pricing models and our internal funding rate. It is not an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you at any time after issuance. See “Valuation of the Notes” in this pricing supplement.

(2) The issue price for eligible institutional investors and investors purchasing the notes in fee-based advisory accounts will vary based on then-current market conditions and the negotiated price determined at the time of each sale; provided, however, that the issue price for such investors will not be less than $977.50 per note and will not be more than $1,000 per note. The issue price for such investors reflects a forgone selling concession or underwriting fee with respect to such sales as described in footnote (3) below. See “Supplemental Plan of Distribution” in this pricing supplement.

(3) CGMI will receive an underwriting fee of up to $22.50 per note, and from such underwriting fee will allow selected dealers a selling concession of up to $22.50 per note depending on market conditions that are relevant to the value of the notes at the time an order to purchase the notes is submitted to CGMI. Dealers who purchase the notes for sales to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts may forgo some or all selling concessions, and CGMI may forgo some or all of the underwriting fee for sales it makes to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts. The per note underwriting fee in the table above represents the maximum underwriting fee payable per note. The total underwriting fee and proceeds to issuer in the table above give effect to the actual total proceeds to issuer. You should refer to “Supplemental Plan of Distribution” in this pricing supplement for more information. In addition to the underwriting fee, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. See “Use of Proceeds and Hedging” in the accompanying prospectus.

Investing in the notes involves risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” beginning on page PS-3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined that this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying product supplement, prospectus supplement and prospectus, which can be accessed via the following hyperlinks:

| Product Supplement No. IE-07-05 dated June 4, 2019 | Prospectus Supplement and Prospectus each dated May 14, 2018 |

The notes are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

| March 2021 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

Additional Information

General. The terms of the notes are set forth in the accompanying product supplement, prospectus supplement and prospectus, as supplemented by this pricing supplement. The accompanying product supplement, prospectus supplement and prospectus contain important disclosures that are not repeated in this pricing supplement. For example, for complete information about the manner in which interest payments on the notes will be calculated and paid, you should read the section “Description of the Notes” in the accompanying product supplement together with the information in this pricing supplement. It is important that you read the accompanying product supplement, prospectus supplement and prospectus together with this pricing supplement in connection with your investment in the notes. Certain terms used but not defined in this pricing supplement are defined in the accompanying product supplement.

No Survivor’s Option. For the avoidance of doubt, the notes offered hereby are not survivor’s option notes and the provisions related to survivor’s option notes in the accompanying product supplement are not applicable.

Business Day Convention. Notwithstanding what is otherwise provided in the accompanying product supplement, if an interest payment date falls on a day that is not a business day (as defined in the accompanying product supplement), the interest payment to be made on that interest payment date will be made on the next succeeding business day. Such payment will have the same force and effect as if made on that interest payment date, and no interest will accrue as a result of delayed payment.

Prospectus. The first sentence of “Description of Debt Securities—Events of Default and Defaults” in the accompanying prospectus shall be amended to read in its entirety as follows:

Events of default under the indenture are:

| • | failure of Citigroup Global Markets Holdings or Citigroup to pay required interest on any debt security of such series for 30 days; |

| • | failure of Citigroup Global Markets Holdings or Citigroup to pay principal, other than a scheduled installment payment to a sinking fund, on any debt security of such series for 30 days; |

| • | failure of Citigroup Global Markets Holdings or Citigroup to make any required scheduled installment payment to a sinking fund for 30 days on debt securities of such series; |

| • | failure of Citigroup Global Markets Holdings to perform for 90 days after notice any other covenant in the indenture applicable to it other than a covenant included in the indenture solely for the benefit of a series of debt securities other than such series; and |

| • | certain events of bankruptcy or insolvency of Citigroup Global Markets Holdings, whether voluntary or not (Section 6.01). |

Hypothetical Examples

The table below presents examples of hypothetical quarterly interest payments after the first year of the term of the notes based on various hypothetical CMS spread values.

As illustrated below, if the CMS spread is less than or equal to 0.25% on the applicable interest determination date, the floating interest rate will be the minimum interest rate of 0% and no interest will accrue on the notes for the related interest period. If, on the other hand, the CMS spread, minus 0.25%, is greater than approximately 1.334% (taking into account that the CMS spread will be multiplied by 6.0 on the applicable interest determination date), the floating rate of interest for the related interest period will be limited to the maximum interest rate of 8.00% per annum and you will not receive any interest in excess of that maximum per annum rate.

The examples are for purposes of illustration only and have been rounded for ease of analysis. The actual interest payments after the first year of the term of the notes will depend on the actual value of the CMS spread on each interest determination date. The applicable interest rate for each interest period will be determined on a per annum basis but will apply only to that interest period.

| Hypothetical CMS Spread(1) | Hypothetical Interest Rate per Annum(2) | Hypothetical Quarterly Interest Payment per Note(3) |

| -1.0000% | 0.00% | $0.00 |

| -0.8000% | 0.00% | $0.00 |

| -0.6000% | 0.00% | $0.00 |

| -0.4000% | 0.00% | $0.00 |

| -0.2000% | 0.00% | $0.00 |

| 0.0000% | 0.00% | $0.00 |

| 0.2000% | 0.00% | $0.00 |

| 0.4000% | 0.90% | $2.25 |

| March 2021 | PS-2 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

| 0.6000% | 2.10% | $5.25 |

| 0.8000% | 3.30% | $8.25 |

| 1.0000% | 4.50% | $11.25 |

| 1.2000% | 5.70% | $14.25 |

| 1.4000% | 6.90% | $17.25 |

| 1.6000% | 8.00% | $20.00 |

| 1.8000% | 8.00% | $20.00 |

| 2.0000% | 8.00% | $20.00 |

| 2.2000% | 8.00% | $20.00 |

| 2.4000% | 8.00% | $20.00 |

| 2.6000% | 8.00% | $20.00 |

| 2.8000% | 8.00% | $20.00 |

| 3.0000% | 8.00% | $20.00 |

_______________________________

(1) Hypothetical CMS spread = (CMS30 – CMS5), where CMS30 and CMS5 are each determined on the second U.S. government securities business day prior to the beginning of the applicable interest period.

(2) Hypothetical interest rate per annum for the interest period = 6.0 × (the CMS spread minus 0.25%), subject to the maximum interest rate and the minimum interest rate.

(3) Hypothetical quarterly interest payment per note = (i) the stated principal amount of $1,000 multiplied by the applicable interest rate per annum divided by (ii) 4.

Summary Risk Factors

An investment in the notes is significantly riskier than an investment in conventional debt securities. The notes are subject to all of the risks associated with an investment in our conventional debt securities (guaranteed by Citigroup Inc.), including the risk that we and Citigroup Inc. may default on our obligations under the notes, and are also subject to risks associated with fluctuations in the CMS spread. Accordingly, the notes are suitable only for investors who are capable of understanding the complexities and risks of the notes. You should consult your own financial, tax and legal advisors as to the risks of an investment in the notes and the suitability of the notes in light of your particular circumstances.

The following is a summary of certain key risk factors for investors in the notes. You should read this summary together with the more detailed description of risks relating to an investment in the notes contained in the section “Risk Factors Relating to the Notes” beginning on page IE-6 in the accompanying product supplement. You should also carefully read the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally.

| § | After the first year, the notes will pay interest at a floating rate that may be as low as 0% on one or more interest payment dates. The floating interest payments on the notes will vary based on fluctuations in the CMS spread. If the CMS spread narrows, interest payments on the notes will be reduced, and if the CMS spread is equal to or less than 0.25% for any interest period, the notes will pay no interest at all for that interest period. The CMS spread is influenced by many complex economic factors and is impossible to predict. After the first year, it is possible that the notes will pay a below-market rate or no interest at all for an extended period of time, or even throughout the entire remaining term of the notes. Although the notes provide for the repayment of the stated principal amount at maturity, you may nevertheless suffer a loss on your investment in the notes, in real value terms, if you receive below-market or no interest payments after the first year of the term of the notes. |

| § | The notes may pay below-market or no interest if short-term interest rates rise. Although there is no single factor that determines CMS spreads, CMS spreads have historically tended to fall when short-term interest rates rise. Short-term interest rates have historically been highly sensitive to the monetary policy of the Federal Reserve Board. Accordingly, one significant risk assumed by investors in the notes is that the Federal Reserve Board may pursue a policy of raising short-term interest rates, which, if historical patterns hold, would lead to a decrease in the CMS spread. In that event, the floating rate payable on the notes may decline significantly, possibly to 0%. It is important to understand, however, that short-term interest rates are affected by many factors and may increase even in the absence of a Federal Reserve Board policy to increase short-term interest rates. Furthermore, it is important to understand that the CMS spread may decrease even in the absence of an increase in short-term interest rates because it, too, is influenced by many complex factors. See “About Constant Maturity Swap Rates” in the accompanying product supplement. |

| § | The floating interest rate on the notes may be lower than other market interest rates. The floating interest rate on the notes will not necessarily move in line with general U.S. market interest rates or even CMS rates and, in fact, may move inversely with general U.S. market interest rates, as described in the preceding risk factor. For example, if there is a general increase in CMS rates but shorter-term rates rise more than longer-term rates, the CMS spread will decrease, as will the floating rate payable on the notes. Accordingly, the notes are not appropriate for investors who seek floating interest payments based on general market interest rates. |

| § | The interest rate on the notes is subject to a cap. As a result, the notes may pay interest at a lower rate than an alternative instrument that is not so capped. |

| March 2021 | PS-3 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

| § | The notes may be called for mandatory redemption at our option beginning one year after issuance, which will limit your potential to benefit from favorable CMS spread performance. If we call the notes, we will do so at a time that is advantageous to us and without regard to your interests. We are more likely to call the notes at a time when the CMS spread is performing favorably from your perspective and we expect it to continue to do so. Accordingly, our call right may limit your potential to receive above-market interest payments. Conversely, when the CMS spread is performing unfavorably from your perspective or when we expect it to do so in the future, we are less likely to call the notes, so that you may continue to hold notes paying below-market or no interest for an extended period of time. If we call the notes, you may have to reinvest the proceeds in a lower interest rate environment. |

| § | The notes are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the notes and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the notes. |

| § | Secondary market sales of the notes may result in a loss of principal. You will be entitled to receive at least the full stated principal amount of your notes, subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc., only if you hold the notes to maturity or until the date when the notes are redeemed. The value of the notes may fluctuate, and if you sell your notes in the secondary market prior to maturity or the date when the notes are redeemed, you may receive less than your initial investment. |

| § | The notes are riskier than notes with a shorter term. The notes are relatively long-dated, subject to our call right. Because the notes are relatively long-dated, many of the risks of the notes are heightened as compared to notes with a shorter term, because you will be subject to those risks for a longer period of time. In addition, the value of a longer-dated note is typically less than the value of an otherwise comparable note with a shorter term. |

| § | The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity. |

| § | The difference between CMS30 and CMS5 may not be as great as the difference between CMS30 and a CMS rate with a shorter maturity. The floating interest payments on the notes may be less than they would be if the notes were linked to the spread between CMS30 and a CMS rate with a shorter maturity than 5 years. |

| § | The estimated value of the notes on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, is less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the notes that are included in the issue price. These costs include (i) the selling concessions paid in connection with the offering of the notes, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the notes and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the notes. These costs adversely affect the economic terms of the notes because, if they were lower, the economic terms of the notes would be more favorable to you. The economic terms of the notes are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the notes. See “The estimated value of the notes would be lower if it were calculated based on our secondary market rate” below. |

| § | The estimated value of the notes was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of the CMS spread and interest rates. CGMI’s views on these inputs and assumptions may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the notes. Moreover, the estimated value of the notes set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the notes for other purposes, including for accounting purposes. You should not invest in the notes because of the estimated value of the notes. Instead, you should be willing to hold the notes to maturity irrespective of the initial estimated value. |

| § | The estimated value of the notes would be lower if it were calculated based on our secondary market rate. The estimated value of the notes included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the notes. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the notes for purposes of any purchases of the notes from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the notes, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not the same as the interest that is payable on the notes. |

| March 2021 | PS-4 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

Because there is not an active market for traded instruments referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the notes, but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the notes prior to maturity. Our internal funding rate is not an interest rate that we will pay to investors in the notes.

| § | The estimated value of the notes is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the notes from you in the secondary market. Any such secondary market price will fluctuate over the term of the notes based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the notes determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the notes than if our internal funding rate were used. In addition, any secondary market price for the notes will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the notes to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the notes will be less than the issue price. |

| § | The value of the notes prior to maturity will fluctuate based on many unpredictable factors. The value of your notes prior to maturity will fluctuate based on the level and volatility of the CMS spread and a number of other factors, including expectations of future levels of CMS30 and CMS5, the level of general market interest rates, the time remaining to maturity and our and Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate. You should understand that the value of your notes at any time prior to maturity may be significantly less than the issue price. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Notes” in this pricing supplement. |

| § | Our offering of the notes does not constitute a recommendation to invest in an instrument linked to the CMS spread. You should not take our offering of the notes as an expression of our views about how the CMS spread will perform in the future or as a recommendation to invest in any instrument linked to the CMS spread, including the notes. As we are part of a global financial institution, our affiliates may, and often do, have positions (including short positions), and may publish research or express opinions, that in each case conflict with an investment in the notes. You should undertake an independent determination of whether an investment in the notes is suitable for you in light of your specific investment objectives, risk tolerance and financial resources. |

| § | The manner in which CMS rates are calculated may change in the future. The method by which CMS30 and CMS5 are calculated may change in the future, as a result of governmental actions, actions by the publisher of CMS30 and CMS5 or otherwise. We cannot predict whether the method by which CMS30 or CMS5 is calculated will change or what the impact of any such change might be. Any such change could affect the level of the CMS spread in a way that has a significant adverse effect on the notes. |

| § | Hedging and other trading activities by our affiliates may affect the determinations of CMS30 and CMS5. CMS rates are determined based on tradable quotes for U.S. dollar fixed-for-floating interest rate swaps of the relevant maturities sourced from electronic trading venues. Our affiliates may engage in trading activities on these electronic trading venues, in order to hedge our obligations under the notes, as part of their general business activities or otherwise. These trading activities could affect the levels of CMS30 and CMS5 in a way that has a negative effect on the interest rate payable under the notes. They could also result in substantial returns for our affiliates while the value of the notes declines. In engaging in these trading activities, our affiliates will have no obligation to consider your interests as an investor in the notes. |

| § | Since August 2019, CMS30 and CMS5 have not been published on a significant number of scheduled publication days. If CMS30 or CMS5 is not published and at least three reference bank quotations are not provided, the relevant CMS rate will be determined by the calculation agent. Since August 2019, ICE Benchmark Administration Limited has not published CMS30 and CMS5 on a significant number of scheduled publication days. For example, in March and April 2020, CMS30 and CMS5 were not published on any of the scheduled publication days. It is possible that such non-publication may continue and that the frequency of non-publication may increase. If, with respect to any interest determination date during the term of the notes, CMS30 or CMS5 is not published and at least three reference bank quotations are not provided as further described in the accompanying product supplement, the relevant CMS rate will be determined by the calculation agent in good faith and in a commercially reasonable manner. As a result, any such increase in the frequency of non-publication may increase the likelihood that CMS30 or CMS5 for one or more interest determination dates will be so determined by the calculation agent. See also “—The calculation agent, which is an affiliate of ours, will make important determinations with respect to the notes.” |

| § | Uncertainty about the future of LIBOR may affect CMS30 and CMS5 in a way that adversely affects the return on and the value of the notes. A CMS rate is a market rate for the fixed leg of a fixed-for-floating interest rate swap, where the floating leg is based on 3-month U.S. dollar LIBOR. As a result, CMS30 and CMS5 are significantly influenced by 3-month U.S. dollar LIBOR and expectations about future levels of 3-month U.S. dollar LIBOR. On July 27, 2017, the Chief Executive of the U.K. Financial Conduct Authority (the “FCA”), which regulates LIBOR, announced that the FCA intends to stop persuading or compelling banks to submit rates for the calculation of LIBOR to the LIBOR administrator. The announcement indicates that the continuation of LIBOR on the |

| March 2021 | PS-5 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

current basis cannot and will not be guaranteed after 2021. It is impossible to predict whether and to what extent banks will continue to provide LIBOR submissions to the administrator of LIBOR, whether LIBOR rates will cease to be published or supported before or after 2021 or whether any additional reforms to LIBOR may be enacted in the United Kingdom or elsewhere. It is also impossible to predict the impact of any LIBOR-related developments on the method of calculation or the values of CMS30 and CMS5. At this time, no consensus exists as to what rate or rates may become accepted alternatives to LIBOR, including for purposes of the interest rate swaps underlying CMS30 and CMS5, and it is impossible to predict the effect of any such alternatives on the value of securities, such as the securities, that are linked to CMS rates. Any changes to 3-month U.S. dollar LIBOR or the calculation of CMS30 and CMS5, and any uncertainty at what these changes may be, may affect CMS30 and CMS5 in a way that adversely affects your return on and value of the securities.

| § | The calculation agent, which is our affiliate, will make important determinations with respect to the notes. If certain events occur, Citibank, N.A., as calculation agent, will be required to make certain discretionary judgments that could significantly affect one or more payments owed to you under the notes. Such judgments could include, among other things, determining the level of CMS30 or CMS5 if it is not otherwise available on an interest determination date and selecting a successor rate if either CMS30 or CMS5 is discontinued. Any of these determinations made by Citibank, N.A. in its capacity as calculation agent may adversely affect any floating interest payment owed to you under the notes. |

| March 2021 | PS-6 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

Information About the CMS Spread

The notes are CMS spread notes, which means that they pay interest (after the first year) based on the difference, or spread, between two constant maturity swap (“CMS”) rates of different maturities—CMS30 and CMS5. A CMS rate of a given maturity is, at any time, a market rate for the fixed leg of a conventional fixed-for-floating U.S. dollar interest rate swap entered into at that time with that maturity, as more fully described in the section “About Constant Maturity Swap Rates” in the accompanying product supplement. The relationship between CMS rates of different maturities may be depicted by a curve on a graph that plots maturities on the x-axis and the applicable CMS rate on the y-axis. See “About Constant Maturity Swap Rates” in the accompanying product supplement for examples of CMS rate curves. Interest payments on the notes will depend on changes in the steepness of this CMS rate curve. If the CMS rate curve steepens, such that the difference between CMS30 and CMS5 becomes greater, the floating interest payments on the notes will generally increase, subject to the maximum interest rate on the notes. Conversely, if the CMS rate curve flattens or becomes inverted, such that the difference between CMS30 and CMS5 becomes smaller or negative, the floating interest payments on the notes will generally decrease, possibly to zero.

Many complex economic factors may influence CMS rates and the spread between CMS rates of different maturities. Accordingly, it is not possible to predict the future performance of any CMS rate or the spread between CMS rates of different maturities. You should not purchase the notes unless you understand and are willing to accept the significant risks associated with exposure to future changes in the CMS spread.

For information about how CMS30 and CMS5 will be determined on each interest determination date, see “Description of the Notes—Terms Related to the Specified CMS Rate(s)—Determining a Specified CMS Rate” in the accompanying product supplement. CMS30 and CMS5 are calculated by ICE Benchmark Administration Limited based on tradable quotes for U.S. dollar fixed-for-floating interest rate swaps of the relevant maturity that are sourced from electronic trading venues.

Historical Information

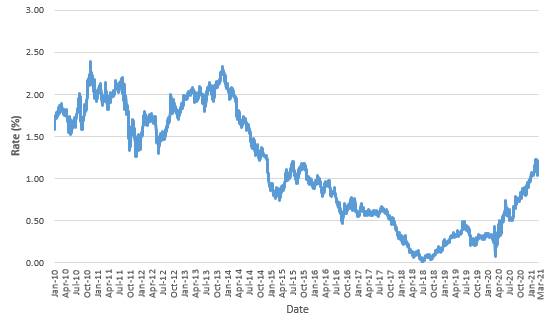

The graph below shows the daily values of the CMS spread from January 4, 2010 through March 29, 2021 using historical data obtained from Bloomberg. For days on which CMS30 or CMS5 was not published by Reuters, the graph repeats the CMS spread from the last scheduled publication date on which both CMS30 and CMS5 were published by Reuters. Since August 2019, CMS30 and CMS5 have not been published on a significant number of scheduled publication days. The historical values of the CMS spread should not be taken as an indication of the future values of the CMS spread during the term of the notes.

The CMS spread at 11:00 a.m. (New York time) on March 29, 2021 was 1.200%.

| Historical CMS Spread (%) January 4, 2010 through March 29, 2021 |

|

| March 2021 | PS-7 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

United States Federal Tax Considerations

In the opinion of our tax counsel, Davis Polk & Wardwell LLP, based on current market conditions, the notes should be treated as “contingent payment debt instruments” for U.S. federal income tax purposes, as described in the section of the accompanying prospectus supplement called “United States Federal Tax Considerations—Tax Consequences to U.S. Holders—Notes Treated as Contingent Payment Debt Instruments,” and the remaining discussion assumes this treatment is respected. This discussion herein does not address the consequences to taxpayers subject to special tax accounting rules under Section 451(b) of the Internal Revenue Code of 1986, as amended.

If you are a U.S. Holder, you will be required to recognize interest income at the “comparable yield,” which generally is the yield at which we could issue a fixed-rate debt instrument with terms similar to those of the notes, including the level of subordination, term, timing of payments and general market conditions, but excluding any adjustments for the riskiness of the contingencies or the liquidity of the notes. We are required to construct a “projected payment schedule” in respect of the notes representing a payment or a series of payments the amount and timing of which would produce a yield to maturity on the notes equal to the comparable yield. The amount of interest you include in income in each taxable year based on the comparable yield will be adjusted upward or downward to reflect the difference, if any, between the actual and projected payments on the notes as determined under the projected payment schedule.

Although it is not entirely clear how the comparable yield and projected payment schedule must be determined when a debt instrument may be redeemed by the issuer prior to maturity, we have determined that the comparable yield for a note is a rate of 1.614%, compounded quarterly, and that the projected payment schedule with respect to a note consists of the following payments (subject to the applicable business day convention):

| June 30, 2021 | $12.500 | December 31, 2023 | $6.341 | June 30, 2026 | $0.000 | December 31, 2028 | $0.000 |

| September 30, 2021 | $12.500 | March 31, 2024 | $4.426 | September 30, 2026 | $0.000 | March 31, 2029 | $0.000 |

| December 31, 2021 | $12.500 | June 30, 2024 | $2.766 | December 31, 2026 | $0.000 | June 30, 2029 | $0.000 |

| March 31, 2022 | $12.500 | September 30, 2024 | $1.277 | March 31, 2027 | $0.000 | September 30, 2029 | $0.000 |

| June 30, 2022 | $20.000 | December 31, 2024 | $0.000 | June 30, 2027 | $0.000 | December 31, 2029 | $0.000 |

| September 30, 2022 | $19.005 | March 31, 2025 | $0.000 | September 30, 2027 | $0.000 | March 31, 2030 | $0.000 |

| December 31, 2022 | $16.113 | June 30, 2025 | $0.000 | December 31, 2027 | $0.000 | June 30, 2030 | $0.000 |

| March 31, 2023 | $13.285 | September 30, 2025 | $0.000 | March 31, 2028 | $0.000 | September 30, 2030 | $0.000 |

| June 30, 2023 | $10.704 | December 31, 2025 | $0.000 | June 30, 2028 | $0.000 | December 31, 2030 | $0.000 |

| September 30, 2023 | $8.486 | March 31, 2026 | $0.000 | September 30, 2028 | $0.000 | March 31, 2031 | $1,000.000 |

Neither the comparable yield nor the projected payment schedule constitutes a representation by us regarding the actual amounts that we will pay on the notes.

Upon the sale or exchange of the notes (including retirement upon early redemption or at maturity), you generally will recognize gain or loss equal to the difference between the proceeds received and your adjusted tax basis in the notes. Your adjusted tax basis will equal your purchase price for the notes increased by interest income previously included on the notes (without regard to the adjustments described above) and decreased by prior payments according to the projected payment schedule. Any gain generally will be treated as ordinary income, and any loss generally will be treated as ordinary loss to the extent of prior net interest inclusions on the note and as capital loss thereafter.

Subject to the discussions in “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” in the accompanying prospectus supplement and “FATCA” below, if you are a Non-U.S. Holder (as defined in the accompanying prospectus supplement) of notes, under current law you generally will not be subject to U.S. federal withholding or income tax in respect of payments on or amounts received on the sale, exchange, redemption or retirement of the notes, provided that (i) income in respect of the notes is not effectively connected with your conduct of a trade or business in the United States, and (ii) you comply with the applicable certification requirements. See “United States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” in the accompanying prospectus supplement for a more detailed discussion of the rules applicable to Non-U.S. Holders of the notes.

FATCA. You should review the section entitled “United States Federal Tax Considerations—FATCA” in the accompanying prospectus supplement regarding withholding rules under the “FATCA” regime. The discussion in that section is hereby modified to reflect regulations proposed by the U.S. Treasury Department indicating an intent to eliminate the requirement under FATCA of withholding on

| March 2021 | PS-8 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

gross proceeds of the disposition of affected financial instruments. The U.S. Treasury Department has indicated that taxpayers may rely on these proposed regulations pending their finalization.

If withholding tax applies to the notes, we will not be required to pay any additional amounts with respect to amounts withheld.

You should read the section entitled “United States Federal Tax Considerations” in the accompanying prospectus supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences of owning and disposing of the notes.

You should also consult your tax adviser regarding all aspects of the U.S. federal tax consequences of an investment in the notes and any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

Supplemental Plan of Distribution

The issue price is $1,000 per note; provided that the issue price for an eligible institutional investor or an investor purchasing the notes in a fee-based advisory account will vary based on then-current market conditions and the negotiated price determined at the time of each sale. The issue price for such investors will not be less than $977.50 per note and will not be more than $1,000 per note. The issue price for such investors reflects a forgone selling concession with respect to such sales as described in the next paragraph.

CGMI, an affiliate of Citigroup Global Markets Holdings Inc., is the underwriter of the sale of the notes and is acting as principal. CGMI may resell the notes to other securities dealers at the issue price of $1,000 per note less a selling concession not in excess of the underwriting fee. CGMI will receive an underwriting fee of up to $22.50 per note, and from such underwriting fee will allow selected dealers a selling concession of up to $22.50 per note depending on market conditions that are relevant to the value of the notes at the time an order to purchase the notes is submitted to CGMI. Dealers who purchase the notes for sales to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts may forgo some or all selling concessions, and CGMI may forgo some or all of the underwriting fee for sales it makes to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts. For the avoidance of doubt, any fees or selling concessions described in this pricing supplement will not be rebated if the notes are redeemed prior to maturity.

CGMI is an affiliate of ours. Accordingly, this offering will conform with the requirements addressing conflicts of interest when distributing the securities of an affiliate set forth in Rule 5121 of the Financial Industry Regulatory Authority. Client accounts over which Citigroup Inc. or its subsidiaries have investment discretion will not be permitted to purchase the notes, either directly or indirectly, without the prior written consent of the client.

See “Plan of Distribution; Conflicts of Interest” in the accompanying product supplement and “Plan of Distribution” in each of the accompanying prospectus supplement and prospectus for additional information.

A portion of the net proceeds from the sale of the notes will be used to hedge our obligations under the notes. We have hedged our obligations under the notes through CGMI or other of our affiliates. CGMI or such other of our affiliates may profit from this hedging activity even if the value of the notes declines. For additional information on the ways in which our counterparties may hedge our obligations under the notes, see “Use of Proceeds and Hedging” in the accompanying prospectus.

Valuation of the Notes

CGMI calculated the estimated value of the notes set forth on the cover page of this pricing supplement based on proprietary pricing models. CGMI’s proprietary pricing models generated an estimated value for the notes by estimating the value of a hypothetical package of financial instruments that would replicate the payout on the notes, which consists of a fixed-income bond (the “bond component”) and one or more derivative instruments underlying the economic terms of the notes (the “derivative component”). CGMI calculated the estimated value of the bond component using a discount rate based on our internal funding rate. CGMI calculated the estimated value of the derivative component based on a proprietary derivative-pricing model, which generated a theoretical price for the instruments that constitute the derivative component based on various inputs, including the factors described under “Summary Risk Factors—The value of the notes prior to maturity will fluctuate based on many unpredictable factors” in this pricing supplement, but not including our or Citigroup Inc.’s creditworthiness. These inputs may be market-observable or may be based on assumptions made by CGMI in its discretionary judgment.

For a period of approximately six months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the six-month temporary adjustment period. However, CGMI is not obligated to buy the notes from investors at any time. See “Summary Risk Factors—The notes will not be listed on a securities exchange and you may not be able to sell them prior to maturity.”

| March 2021 | PS-9 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

Certain Selling Restrictions

Hong Kong Special Administrative Region

The contents of this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus have not been reviewed by any regulatory authority in the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”). Investors are advised to exercise caution in relation to the offer. If investors are in any doubt about any of the contents of this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus, they should obtain independent professional advice.

The notes have not been offered or sold and will not be offered or sold in Hong Kong by means of any document, other than

| (i) | to persons whose ordinary business is to buy or sell shares or debentures (whether as principal or agent); or |

| (ii) | to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “Securities and Futures Ordinance”) and any rules made under that Ordinance; or |

| (iii) | in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and |

There is no advertisement, invitation or document relating to the notes which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to securities which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and Futures Ordinance and any rules made under that Ordinance.

Non-insured Product: These notes are not insured by any governmental agency. These notes are not bank deposits and are not covered by the Hong Kong Deposit Protection Scheme.

Singapore

This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus have not been registered as a prospectus with the Monetary Authority of Singapore, and the notes will be offered pursuant to exemptions under the Securities and Futures Act, Chapter 289 of Singapore (the “Securities and Futures Act”). Accordingly, the notes may not be offered or sold or made the subject of an invitation for subscription or purchase nor may this pricing supplement or any other document or material in connection with the offer or sale or invitation for subscription or purchase of any notes be circulated or distributed, whether directly or indirectly, to any person in Singapore other than (a) to an institutional investor pursuant to Section 274 of the Securities and Futures Act, (b) to a relevant person under Section 275(1) of the Securities and Futures Act or to any person pursuant to Section 275(1A) of the Securities and Futures Act and in accordance with the conditions specified in Section 275 of the Securities and Futures Act, or (c) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act. Where the notes are subscribed or purchased under Section 275 of the Securities and Futures Act by a relevant person which is:

| (a) | a corporation (which is not an accredited investor (as defined in Section 4A of the Securities and Futures Act)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or |

| (b) | a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary is an individual who is an accredited investor, securities (as defined in Section 239(1) of the Securities and Futures Act) of that corporation or the beneficiaries’ rights and interests (howsoever described) in that trust shall not be transferable for 6 months after that corporation or that trust has acquired the relevant securities pursuant to an offer under Section 275 of the Securities and Futures Act except: |

| (i) | to an institutional investor or to a relevant person defined in Section 275(2) of the Securities and Futures Act or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the Securities and Futures Act; or |

| (ii) | where no consideration is or will be given for the transfer; or |

| (iii) | where the transfer is by operation of law; or |

| (iv) | pursuant to Section 276(7) of the Securities and Futures Act; or |

| (v) | as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore. |

Any notes referred to herein may not be registered with any regulator, regulatory body or similar organization or institution in any jurisdiction.

The notes are Specified Investment Products (as defined in the Notice on Recommendations on Investment Products and Notice on the Sale of Investment Product issued by the Monetary Authority of Singapore on 28 July 2011) that is neither listed nor quoted on a securities market or a futures market.

| March 2021 | PS-10 |

| Citigroup Global Markets Holdings Inc. |

| Callable Fixed to Floating Rate Leveraged CMS Spread Notes Due March 31, 2031 |

Non-insured Product: These notes are not insured by any governmental agency. These notes are not bank deposits. These notes are not insured products subject to the provisions of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme.

Validity of the Notes

In the opinion of Davis Polk & Wardwell LLP, as special products counsel to Citigroup Global Markets Holdings Inc., when the notes offered by this pricing supplement have been executed and issued by Citigroup Global Markets Holdings Inc. and authenticated by the trustee pursuant to the indenture, and delivered against payment therefor, such notes and the related guarantee of Citigroup Inc. will be valid and binding obligations of Citigroup Global Markets Holdings Inc. and Citigroup Inc., respectively, enforceable in accordance with their respective terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of the date of this pricing supplement and is limited to the laws of the State of New York, except that such counsel expresses no opinion as to the application of state securities or Blue Sky laws to the notes.

In giving this opinion, Davis Polk & Wardwell LLP has assumed the legal conclusions expressed in the opinions set forth below of Alexia Breuvart, General Counsel of Citigroup Global Markets Inc., and Barbara Politi, Assistant General Counsel—Capital Markets of Citigroup Inc. In addition, this opinion is subject to the assumptions set forth in the letter of Davis Polk & Wardwell LLP dated March 19, 2021, which has been filed as an exhibit to a Current Report on Form 8-K filed by Citigroup Inc. on March 19, 2021, that the indenture has been duly authorized, executed and delivered by, and is a valid, binding and enforceable agreement of, the trustee and that none of the terms of the notes nor the issuance and delivery of the notes and the related guarantee, nor the compliance by Citigroup Global Markets Holdings Inc. and Citigroup Inc. with the terms of the notes and the related guarantee respectively, will result in a violation of any provision of any instrument or agreement then binding upon Citigroup Global Markets Holdings Inc. or Citigroup Inc., as applicable, or any restriction imposed by any court or governmental body having jurisdiction over Citigroup Global Markets Holdings Inc. or Citigroup Inc., as applicable.

In the opinion of Alexia Breuvart, General Counsel of Citigroup Global Markets Inc., (i) the terms of the notes offered by this pricing supplement have been duly established under the indenture and the Board of Directors (or a duly authorized committee thereof) of Citigroup Global Markets Holdings Inc. has duly authorized the issuance and sale of such notes and such authorization has not been modified or rescinded; (ii) Citigroup Global Markets Holdings Inc. is validly existing and in good standing under the laws of the State of New York; (iii) the indenture has been duly authorized, executed and delivered by Citigroup Global Markets Holdings Inc.; and (iv) the execution and delivery of such indenture and of the notes offered by this pricing supplement by Citigroup Global Markets Holdings Inc., and the performance by Citigroup Global Markets Holdings Inc. of its obligations thereunder, are within its corporate powers and do not contravene its certificate of incorporation or bylaws or other constitutive documents. This opinion is given as of the date of this pricing supplement and is limited to the laws of the State of New York.

Alexia Breuvart, or other internal attorneys with whom she has consulted, has examined and is familiar with originals, or copies certified or otherwise identified to her satisfaction, of such corporate records of Citigroup Global Markets Holdings Inc., certificates or documents as she has deemed appropriate as a basis for the opinions expressed above. In such examination, she or such persons has assumed the legal capacity of all natural persons, the genuineness of all signatures (other than those of officers of Citigroup Global Markets Holdings Inc.), the authenticity of all documents submitted to her or such persons as originals, the conformity to original documents of all documents submitted to her or such persons as certified or photostatic copies and the authenticity of the originals of such copies.

In the opinion of Barbara Politi, Assistant General Counsel—Capital Markets of Citigroup Inc., (i) the Board of Directors (or a duly authorized committee thereof) of Citigroup Inc. has duly authorized the guarantee of such notes by Citigroup Inc. and such authorization has not been modified or rescinded; (ii) Citigroup Inc. is validly existing and in good standing under the laws of the State of Delaware; (iii) the indenture has been duly authorized, executed and delivered by Citigroup Inc.; and (iv) the execution and delivery of such indenture, and the performance by Citigroup Inc. of its obligations thereunder, are within its corporate powers and do not contravene its certificate of incorporation or bylaws or other constitutive documents. This opinion is given as of the date of this pricing supplement and is limited to the General Corporation Law of the State of Delaware.

Barbara Politi, or other internal attorneys with whom she has consulted, has examined and is familiar with originals, or copies certified or otherwise identified to her satisfaction, of such corporate records of Citigroup Inc., certificates or documents as she has deemed appropriate as a basis for the opinions expressed above. In such examination, she or such persons has assumed the legal capacity of all natural persons, the genuineness of all signatures (other than those of officers of Citigroup Inc.), the authenticity of all documents submitted to her or such persons as originals, the conformity to original documents of all documents submitted to her or such persons as certified or photostatic copies and the authenticity of the originals of such copies.

Contact

Clients may contact their local brokerage representative. Third-party distributors may contact Citi Structured Investment Sales at (212) 723-7005.

© 2021 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

| March 2021 | PS-11 |