- C Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Citigroup (C) DEF 14ADefinitive proxy

Filed: 11 Mar 03, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x | Definitive Proxy Statement | ||

| o | Definitive Additional Materials | ||

| o | Soliciting Material Pursuant to §240.14a-12 |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies:

| ||

| (2) | Aggregate number of securities to which transaction applies:

| ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| ||

| (4) | Proposed maximum aggregate value of transaction:

| ||

| (5) | Total fee paid:

| ||

| o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

Citigroup Inc.

399 Park Avenue

New York, NY 10043

March 11, 2003

Dear Stockholder:

We cordially invite you to attend Citigroup’s annual stockholders’ meeting. The meeting will be held on Tuesday, April 15, 2003, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue.

At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached proxy statement.

Thank you for your support of Citigroup.

Sincerely,

Sanford I. Weill

Chairman of the Board

and Chief Executive Officer

This proxy statement and the accompanying proxy card are being mailed to

Citigroup stockholders beginning about March 11, 2003.

Citigroup Inc.

399 Park Avenue

New York, NY 10043

Notice of Annual Meeting of Stockholders

Dear Stockholder:

Citigroup’s annual stockholders’ meeting will be held on Tuesday, April 15, 2003, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. You will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting.

At the meeting, stockholders will be asked to

| Ø | elect directors, |

| Ø | ratify the selection of Citigroup’s independent auditors for 2003, |

| Ø | act on certain stockholder proposals, and |

| Ø | consider any other business properly brought before the meeting. |

The close of business on February 27, 2003, is the record date for determining stockholders entitled to vote at the annual meeting. A list of these stockholders will be available at Citigroup’s headquarters, 399 Park Avenue, New York City, before the annual meeting.

Please sign, date and promptly return the enclosed proxy card in the enclosed envelope, or vote by telephone or Internet (instructions are on your proxy card), so that your shares will be represented whether or not you attend the annual meeting.

By order of the board of directors

Michael S. Helfer

Corporate Secretary

March 11, 2003

1 | ||

3 | ||

3 | ||

3 | ||

5 | ||

5 | ||

5 | ||

5 | ||

6 | ||

8 | ||

8 | ||

8 | ||

11 | ||

11 | ||

18 | ||

18 | ||

18 | ||

Personnel and Compensation Committee Interlocks and Insider Participation | 20 | |

20 | ||

22 | ||

Report of the Personnel and Compensation Committee on Executive Compensation | 24 | |

26 | ||

26 | ||

31 | ||

32 | ||

33 | ||

34 |

35 | ||

35 | ||

35 | ||

37 | ||

47 | ||

47 | ||

47 | ||

47 | ||

ANNEX A | A-1 | |

ANNEX B | B-1 | |

ANNEX C | C-1 | |

ANNEX D | D-1 | |

ANNEX E | E-1 |

Who is soliciting my vote?

The board of directors of Citigroup is soliciting your vote at the 2003 annual meeting of Citigroup’s stockholders.

What will I be voting on?

| • | Election of directors (see page 11). |

| • | Ratification of KPMG LLP (KPMG) as Citigroup’s auditors for 2003 (see page 35). |

| • | six stockholder proposals (see page37). |

How many votes do I have?

You will have one vote for every share of Citigroup common stock you owned on February 27, 2003 (therecord date).

How many votes can be cast by all stockholders?

5,171,079,443, consisting of one vote for each of Citigroup’s shares of common stock that were outstanding on the record date. There is no cumulative voting.

How many votes must be present to hold the meeting?

A majority of the votes that can be cast, or 2,585,539,723 votes. We urge you to vote by proxy even if you plan to attend the annual meeting, so that we will know as soon as possible that enough votes will be present for us to hold the meeting.

Does any single stockholder control as much as 5% of any class of Citigroup’s voting stock?

No single stockholder controls as much as 5% of any class of Citigroup’s voting stock.

How do I vote?

You can vote eitherin person at the annual meeting orby proxy whether or not you attend the annual meeting.

To vote by proxy, you must either:

| • | fill out the enclosedproxy card, date and sign it, and return it in the enclosed postage-paid envelope, |

| • | vote bytelephone (instructions are on the proxy card), or |

| • | vote byInternet (instructions are on the proxy card). |

Citigroup employees who participate in equity programs may receive their proxy cards separately.

If you want to vote in person at the annual meeting, and you hold your Citigroup stock through a securities broker (that is, in street name), you must obtain a proxy from your broker and bring that proxy to the meeting.

Can I change my vote?

Yes. Just send in a new proxy card with a later date, or cast a new vote by telephone or Internet, or send a written notice of revocation to Citigroup’s Corporate Secretary at the address on the cover of this proxy statement. If you attend the annual meeting and want to vote in person, you can request that your previously submitted proxy not be used.

What if I don’t vote for some of the matters listed on my proxy card?

If you return a proxy card without indicating your vote, your shares will be votedforthe nominees listed on the card,forKPMG as auditors for 2003 andagainst the other proposals.

What if I vote “abstain”?

A vote to “abstain” on any matter other than the election of directors will have the effect of a voteagainst.

Can my shares be voted if I don’t return my proxy card and don’t attend the annual meeting?

If you don’t vote your shares held in street name, your broker can vote your shares on any of the matters scheduled to come before the meeting, other than the stockholder proposals.

If your broker does not have discretion to vote your shares held in street name on a particular

1

proposal and you don��t give your broker instructions on how to vote your shares, the votes will bebroker nonvotes, which will have no effect on the vote for any matter scheduled to be considered at the annual meeting. If you don’t vote your shares held in your name, your shares will not be voted.

Could other matters be decided at the annual meeting?

We have been notified by the Neighborhood Assistance Corporation of America that it intends to raise a matter at the meeting concerning the lending practices of CitiFinancial Credit Company. If the matter is raised at the meeting, we will vote the proxiesagainst any proposal offered. We don’t know of any other matters that will be considered at the annual meeting. If a stockholder proposal that was excluded from this proxy statement is brought before the meeting, we will vote the proxiesagainst the proposal. If any other matters arise at the annual meeting, the proxies will be voted at the discretion of the proxy holders.

What happens if the meeting is postponed or adjourned?

Your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy until it is voted.

Do I need a ticket to attend the annual meeting?

Yes, you will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting. If you are a stockholder of record, you will find an admission ticket attached to the proxy card sent to you. If you plan to attend the meeting, please so indicate when you vote and bring the ticket with you to the meeting. If your shares are held in the name of a bank, broker or other holder of record,your admission ticket is the left side of your voting information form. If you don’t bring your admission ticket, or opted to receive your proxy materials electronically, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker is an example of proof of ownership. If you arrive at the meeting without an admission ticket, we will admit you only if we are able to verify that you are a Citigroup stockholder.

How can I access Citigroup’s proxy materials and annual report electronically?

This proxy statement and the 2002 annual report are available on Citigroup’s Internet site at http://www.citigroup.com. Click on “Corporate Governance”, then “Financial Disclosure”, and then “Annual Reports & Proxy Statements.” Most stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail.

If you are a stockholder of record, you can choose this option and save Citigroup the cost of producing and mailing these documents by following the instructions provided when you vote over the Internet. If you hold your Citigroup stock through a bank, broker, or other holder of record, please refer to the information provided by that entity for instructions on how to elect to view future proxy statements and annual reports over the Internet.

If you choose to view future proxy statements and annual reports over the Internet, you will receive an e-mail message next year containing the Internet address to use to access Citigroup’s proxy statement and annual report. Your choice will remain in effect until you tell us otherwise. You do not have to elect Internet access each year. To view, cancel or change your enrollment profile, please go to www.InvestorDelivery.com.

2

By now you should have received Citigroup’s annual report to stockholders for 2002. We urge you to read it carefully.

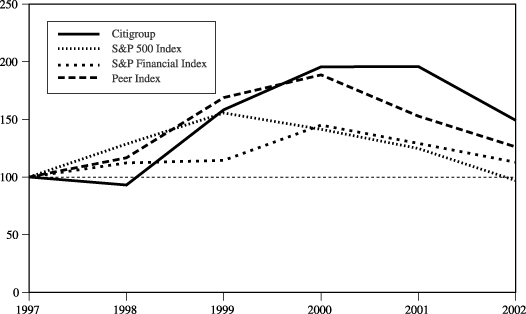

Five-Year Cumulative Total Return

The following graph and table compare the annual changes in Citigroup’s cumulative total return for the last five years with the cumulative total return of:

| • | the S&P 500 Index, |

| • | the S&P Financial Index, and |

| • | a Peer Index. |

The S&P Financial Index is made up of the following Standard & Poor’s industry groups: Money Center Banks, Major Regional Banks, Consumer Finance, Diversified Financial, Insurance Brokers, Investment Management, Life/Health Insurance, Multi-Line Insurance, Property and Casualty Insurance, Investment Banking/Brokerage and Savings & Loan Companies.

Citigroup and the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association (each government sponsored entities) have been excluded from the S&P Financial Index. The Peer Index comprises ABN Amro Holding N.V., J.P. Morgan Chase & Co., The Hartford Financial Services Group, Inc., HSBC Holdings plc, MBNA Corporation, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Morgan Stanley Dean Witter & Co.

The following graph and table show the value at year-end 2002 of $100 invested at the closing price on December 31, 1997 in Citigroup common stock, the S&P 500, the S&P Financial Index and the Peer Index. The comparisons in this table are set forth in response to Securities and Exchange Commission (SEC) disclosure requirements, and therefore are not intended to forecast or be indicative of future performance of the common stock.

3

Comparison of Five-Year Cumulative Total Return

December 31 | Citigroup | S&P 500 Index | S&P Financial Index | Peer Index | ||||

1997 | 100.00 | 100.00 | 100.00 | 100.00 | ||||

1998 | 93.15 | 128.58 | 112.16 | 116.80 | ||||

1999 | 158.44 | 155.63 | 114.63 | 169.03 | ||||

2000 | 195.72 | 141.46 | 144.99 | 188.61 | ||||

2001 | 195.90 | 124.66 | 129.27 | 152.84 | ||||

2002 | 149.20 | 97.12 | 112.77 | 126.15 |

4

Citigroup aspires to the highest standards of ethical conduct: doing what we say; reporting results with accuracy and transparency; and maintaining full compliance with the laws, rules and regulations that govern Citigroup’s businesses.

Citigroup has taken several steps during 2002 to ensure that we are a leader in corporate governance.

Nomination and Governance Committee

Citigroup created a new board committee whose mandate is to review corporate governance issues on an ongoing basis.

Citigroup established a Business Practices Committee at the corporate level and in each of its business units to help ensure that our most senior executives regularly scrutinize our practices and products; that our policies are appropriate; and that our basic values are emphasized at every level throughout the organization. These committees identify business practices that may raise integrity concerns, subject them to rigorous scrutiny, present them to senior executives to decide whether changes are required, and monitor the execution of any decisions that result from the process.

Corporate Governance Guidelines

Citigroup adopted a formal set of Corporate Governance Guidelines which embody many of our long-standing practices and incorporate new policies and procedures which strengthen our commitment to best practices. The following is a summary of certain key elements of our Corporate Governance Guidelines. The full text of the Guidelines is set forth in Annex A to this proxy statement.

The Guidelines outline the composition, operations and responsibilities of the board of directors. At least two-thirds of the members of the board should be independent. A description of our independence criteria and our independencedeterminations are set forth below. The number of other public company boards on which a director may serve is subject to a case-by-case review by the nomination and governance committee, in order to ensure that each director is able to devote sufficient time to perform his or her duties as a director. Interlocking directorates are prohibited (inside directors and executive officers of Citigroup may not sit on boards of companies where a Citigroup outside director is an executive officer).

The Guidelines require that all members of the committees of the board, other than the executive committee, must be independent. Committee members are appointed by the board upon recommendation of the nomination and governance committee. Committee membership and chairs are rotated periodically. The board and each committee have the power to hire and fire independent legal, financial or other advisors, as they may deem necessary, without consulting or obtaining the approval of any officer of Citigroup.

The Guidelines provide for executive sessions at each board meeting, both with and without the CEO present. The chair of the nomination and governance committee presides at the executive sessions. The nomination and governance committee conducts an annual review of board performance, and each committee shall conduct its own self-evaluation and report the results of its findings to the board. Directors have full and free access to senior management and other employees of Citigroup and are provided with an orientation program for new directors and a continuing education program for all members of the board.

The board reviews the personnel and compensation committee’s report on the CEO’s performance in order to ensure that the CEO is providing the best leadership for Citigroup in the long and short term. The board also works with the personnel and compensation committee to evaluate potential successors to the CEO.

The Guidelines affirm Citigroup’s stock ownership commitment, which is described in greater detail in

5

this proxy statement. Citigroup prohibits the repricing of stock options and requires that new equity compensation plans be submitted to stockholders for approval.

The Guidelines restrict certain financial transactions between Citigroup and its subsidiaries and senior management and their immediate families. Personal loans to directors and their immediate family members other than credit cards, charge cards, and overdraft checking privileges made on market terms in the ordinary course of business are prohibited. Also prohibited are personal loans to executive officers and members of the management committee, comprised of our most senior executives (management committee), or their immediate family members, except for mortgage loans, home equity loans, consumer loans, credit cards, charge cards, overdraft checking privileges, and margin loans to employees of a broker dealer subsidiary of Citigroup made on market terms in the ordinary course of business.

The Guidelines prohibit investments by Citigroup or any member of senior management in a private entity in which a director is a principal or a publicly-traded entity in which a director owns or controls a 10% interest. Directors and their family members are not permitted to receive IPO allocations. Directors and their family members may participate in Citigroup-sponsored investment activities, provided they are offered on terms substantially similar to those offered to similarly situated non-affiliated persons. Under certain circumstances, and only with the approval of the appropriate committee, members of senior management may participate in Citigroup-sponsored investment opportunities. Finally, there is a prohibition on investments by directors and members of senior management in third party entities when the opportunity comes solely as a result of their position with Citigroup.

The board has determined that all directors other than Alfredo Harp, Roberto Hernández, Robert Rubin and Sanford Weill are “independent” within the meaning of the proposed rules of the New York Stock Exchange (theNYSE), based on currentapplication of the standards set forth below that were proposed by the nomination and governance committee and adopted by the board.

| • | Relationships as Client |

| Ø | Neither a director nor any immediate family member shall have any personal loans from Citigroup, except for credit cards, charge cards and overdraft checking privileges made in the ordinary course of business on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. |

| Ø | Any brokerage services, private banking services, insurance and other financial services provided to a director or any member of his/her immediate family must be made in the ordinary course of business on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. |

| • | Consulting Arrangements/Other Compensation Neither a director nor any immediate family member shall: |

| Ø | have received any compensation from Citigroup directly or indirectly as an advisor or consultant within the last five years; |

| Ø | have received from Citigroup or any executive officer of Citigroup any compensatory fees or personal benefits other than standard compensation arrangements applicable to directors generally; nor |

| Ø | have had a personal services contract with Citigroup or with any executive officer of Citigroup within the last five years. |

| • | Investments A director and each member of his/her immediate family must comply with Citigroup’s policy on investments as set forth in the Corporate Governance Guidelines. |

| • | IPO Allocations Neither a director nor any member of his/her immediate family may receive an IPO allocation. |

| • | Business Relationships |

| Ø | Any payments by Citigroup to a director’s primary business affiliation or the primary business affiliation of an immediate family |

6

member of a director for goods or services, or other contractual arrangements, must be made in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. In addition, the aggregate amount of such payments must not exceed 1% of the gross revenues of the company receiving the payment.

| Ø | Any payments to Citigroup by a director’s primary business affiliation or the primary business affiliation of an immediate family member of a director must be made in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. |

| Ø | All lending relationships, deposit relationships, or other banking relationships between Citigroup, on the one hand, and a director’s primary business affiliation or the primary business affiliation of an immediate family member of a director, on the other hand, must be made in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable transactions with non-affiliated persons. Any extensions of credit by Citigroup or its subsidiaries to such entity or its subsidiaries must comply with applicable law, including Regulation O of the Federal Reserve and FDIC guidelines. |

| • | Charitable Contributions Neither a director nor any immediate family member may be an officer, director, or trustee of a foundation, university, or other non-profit organization that receives from Citigroup or the Citigroup Foundation, contributions in an amount which exceeds the greater of $25,000 or 10% of the total annual receipts received by the entity in a year. Contributions in excess of 5% but less than 10% shall be reported to the nomination and governance committee for consideration in making the independence determination. |

| • | Interlocking Directorates No inside director or executive officer of Citigroup shall serve as a director of a company where a Citigroup outside director is an executive officer. |

| • | Employment |

| Ø | A director shall not: |

| (i) | be or have been an employee of Citigroup within the last five years; |

| (ii) | be part of, or within the past five years have been part of, an interlocking directorate in which an executive officer of Citigroup serves or has served on the compensation committee of a company that concurrently employs or employed the director; or |

| (iii) | be or have been affiliated with or employed by a present or former auditor of Citigroup within the five year period following the auditing relationship. |

| Ø | A director may not have a family member who: |

| (i) | is a member of senior management of Citigroup or has been within the last five years; |

| (ii) | is part of an interlocking directorate in which an executive officer of Citigroup serves on the compensation committee of a company that concurrently employs such family member; or |

| (iii) | is or has been affiliated with or employed by a present or former auditor of Citigroup within the five year period following the auditing relationship. |

| • | Other Transactions |

Relationships not specifically mentioned above, or transactions that may have taken place prior to the adoption of these independence standards, may, in the board’s judgment, be deemed not to be material and the director will be deemed independent if, after taking into account all relevant facts and circumstances, the board determines that the existence of such relationship or transaction would not impair the director’s exercise of independent judgment.

7

| • | Definitions For purposes of these independence standards, (i) immediate family members of a director include the director’s spouse and other “family members” (including children) who share the director’s home or who are financially dependent on the director, (ii) the term “primary business affiliation” means an entity of which the director is a principal/executive officer or in which the director holds at least a 5% equity interest, and (iii) the term “family member” means any of the director’s spouse, parents, children, brothers, sisters, mother- and father-in-law, sons- and daughters-in-law, and brothers- and sisters-in-law and anyone (other than domestic employees) who shares the director’s home. |

The board has adopted a Code of Ethics for Financial Professionals governing the principal executive officer of Citigroup and its reporting subsidiaries and all Citigroup professionalsworldwide serving in a finance, accounting, treasury, tax, or investor relations role. A copy of the Code of Ethics is available on our website at www.citigroup.com. Click on “Corporate Governance” and then “Code of Ethics for Financial Professionals.” It has also been filed as an exhibit to our Annual Report on Form 10-K. We intend to disclose amendments to, or waivers from, the Code of Ethics, if any, on our website.

The board has adopted a Code of Conduct which outlines the principles, policies, and laws that govern the activities of Citigroup, and establishes guidelines for professional conduct in the workplace. The Code of Conduct applies to directors as well as employees. Every employee is required to read and sign the Code of Conduct. A copy of the Code of Conduct is available on our website at www.citigroup.com. Click on “Corporate Governance” and then “Code of Conduct.” The Code of Conduct supersedes and replaces Citigroup’s Statement of Business Practices.

Citigroup has long encouraged stock ownership by its directors, officers, and employees to align their interests with the interests of stockholders. We believe that these policies, which are a unique and distinguishing characteristic of Citigroup, have been a significant factor in the superior financial results we have achieved for Citigroup’s stockholders.

As part of our commitment to aligning employee and stockholder interests:

| • | we pay a significant portion of directors’ fees and senior management compensation in common stock and/or stock options, and |

| • | our directors and senior management, approximately 125 individuals in all, have entered into astock ownership commitment, which provides that each of such individuals will hold at least 75% of all Citigroup common stock owned by him or her on the date he or she becomes subject to the commitment and awarded to him or her in the future, subject to certain minimum ownership guidelines, as longas he or she remains a director or member of senior management. |

For these purposes, “senior management” includes:

| • | our management committee, comprised of our most senior executives, |

| • | the planning groups for the Global Consumer, Global Corporate and Investment Bank, Private Client Services, Global Investment Management, and Proprietary Investment Activities businesses, and |

| • | the most senior members of our corporate staff. |

The only exceptions to the stock ownership commitment are gifts to charity, limited estate planning transactions with family members, and transactions with Citigroup in connection with exercising employee stock options or paying withholding taxes under equity compensation plans.

We provide numerous opportunities for employees around the world to own common stock through

8

periodic management stock option grants, broad-based stock option grants, restricted or deferred stock awards which are granted at the time annual cash incentive awards are paid, a Citigroup common stock fund in the 401(k) plan, various equity-based incentive programs for employeeswho are paid on commission, and participation in Citigroup’s employee stock purchase programs. Our goal is to provide all employees the opportunity to own stock, and almost two-thirds of our employees have participated in at least one of these programs.

The following table shows the beneficial ownership of Citigroup common stock by our directors and certain executive officers at February 28, 2003.

Amount and Nature of Beneficial Ownership | ||||||||

Name | Position | Common Stock Beneficially Owned Excluding Options | Stock Options Exercisable Within 60 Days of Record Date (A) | Total Common Stock Beneficially Owned (A) | ||||

C. Michael Armstrong | Director | 93,093 | 10,720 | 103,813 | ||||

Alain J.P. Belda | Director | 17,403 | 22,740 | 40,143 | ||||

George David | Director | 12,959 | 0 | 12,959 | ||||

Kenneth T. Derr | Director | 55,142 | 12,946 | 68,088 | ||||

John M. Deutch | Director | 54,749 | 16,728 | 71,477 | ||||

Alfredo Harp | Director | 17,134,285 | 0 | 17,134,285 | ||||

Roberto Hernández | Director | 19,461,525 | 0 | 19,461,525 | ||||

Ann Dibble Jordan | Director | 20,325 | 10,720 | 31,045 | ||||

Reuben Mark | Director | 53,843 | 24,182 | 78,025 | ||||

Deryck C. Maughan | Executive Officer | 1,517,288 | 1,593,715 | 3,111,003 | ||||

Dudley C. Mecum | Director | 326,194 | 10,720 | 336,914 | ||||

Richard D. Parsons | Director | 79,579 | 10,720 | 90,299 | ||||

Andrall E. Pearson | Director | 258,497 | 10,720 | 269,217 | ||||

Charles Prince | Executive Officer | 752,618 | 461,646 | 1,214,264 | ||||

Robert E. Rubin | Director, Member of the Office of the Chairman and Chairman of the Executive Committee | 376,181 | 2,165,838 | 2,542,019 | ||||

Franklin A. Thomas | Director | 96,867 | 19,569 | 116,436 | ||||

Sanford I. Weill | Chairman and Chief Executive Officer | 22,777,290 | 5,408,529 | 28,185,819 | ||||

Robert B. Willumstad | Executive Officer | 1,159,116 | 602,427 | 1,761,543 | ||||

Arthur Zankel | Director | 476,240 | 24,182 | 500,422 | ||||

The Hon. Gerald R. Ford | Honorary Director | 106,313 | 10,720 | 117,033 | ||||

All directors and executive officers as a group (33 persons) | 71,135,312 | 14,529,451 | 85,664,763 | |||||

(A) The share numbers in these columns have been restated to reflect equitable adjustments made to all Citigroup options outstanding on August 20, 2002 in respect of the distribution to allstockholders of shares of Travelers Property Casualty Corp. Such adjustments are more fully detailed in footnote A to the “2002 Option Grants” table below.

9

At February 28, 2003, no director or executive officer owned

| • | any shares of Citigroup’s preferred stock, or |

| • | as much as 1% of Citigroup’s common stock; |

however, all of the directors and executive officers as a group beneficially owned approximately 1.67% of Citigroup’s common stock.

Some of the Citigroup shares shown in the preceding table are considered as beneficially owned underSEC rules, but are shares

| • | for which receipt has been deferred under certain directors deferred compensation plans, |

| • | held as a tenant-in-common with a family member or trust, |

| • | owned by a family member or held by a trust for which the director or executive officer is a trustee but not a beneficiary, |

| • | for which the director or executive officer has direct or indirect voting power but not dispositive power, or |

| • | for which the director or executive officer has direct or indirect voting power but that are subject to restrictions on disposition, as shown in the following table: |

Director/Officer | Receipt Deferred | Tenant-in- | Owned by Family Member or Trust | Voting Power, but Not Dispositive Power | Voting Power, but Subject to Restrictions on Disposition | |||||

C. Michael Armstrong | 87,198 | |||||||||

Alain J.P. Belda | 12,403 | |||||||||

George David | 2,959 | |||||||||

Kenneth T. Derr | 24,406 | |||||||||

John M. Deutch | 4,632 | |||||||||

The Hon. Gerald R. Ford | 106,313 | |||||||||

Alfredo Harp | 17,134,285 | |||||||||

Roberto Hernández | 19,461,525 | |||||||||

Ann Dibble Jordan | 7,420 | |||||||||

Reuben Mark | 18,843 | |||||||||

Deryck C. Maughan | 12,500 | 11,370 | 171,188 | |||||||

Dudley C. Mecum | 245,540 | 5,0541 | ||||||||

Richard D. Parsons | 25,229 | 49,350 | ||||||||

Andrall E. Pearson | 229,623 | |||||||||

Charles Prince | 4,0801 | 2,089 | 141,121 | |||||||

Robert E. Rubin | 356,664 | |||||||||

Franklin A. Thomas | 83,021 | |||||||||

Sanford I. Weill | 6,442 | 1,000,6002 | 35,903 | 340,975 | ||||||

Robert B. Willumstad | 215,794 | 8,459 | 132,087 | |||||||

Arthur Zankel | 398,363 | |||||||||

All directors and executive officers as a group | 917,279 | 350,593 | 38,320,9833 | 83,527 | 2,498,142 | |||||

| 1 | disclaims beneficial ownership |

| 2 | disclaims beneficial ownership of 600 shares |

| 3 | disclaims beneficial ownership of an aggregate of 9,734 shares |

10

Proposal 1: Election of Directors

The board of directors has nominated all of the current directors for re-election at the 2003 annual meeting except Alfredo Harp and Reuben Mark who will be retiring from the Board, effective at the annual meeting. The one-year terms of all of Citigroup’s directors expire at the annual meeting.Directors are not eligible to stand for re-election after reaching the age of 72, except for Andrall Pearson.

Directors will be elected by a plurality of the votes cast.

The following tables give information — provided by the nominees — about their principal occupation, business experience, and other matters.

The board of directors recommends that you votefor each of the following nominees.

Name and Age at | Position, Principal Occupation, Business Experience | |

C. Michael Armstrong 64

| Chairman Comcast Corporation • Chairman, Comcast Corporation — 2002 to present • Chairman and Chief Executive Officer, AT&T Corp. — 1997 to 2002 • Chairman and Chief Executive Officer, Hughes Electronic Corporation — 1992 to 1997 • Officer, International Business Machines Corporation — 1961 to 1992 Member, IBM Management Committee Chairman, IBM World Trade Corporation • Director of Citigroup (or predecessor) since 1993 • Other Activities: Board of Trustees of Johns Hopkins University, Yale School of Management (Advisory Board), President’s Export Council (member), Council on Foreign Relations (member), Carnegie Hall (Trustee), Parsons (Director), The Business Roundtable (member), Schroder Venture Capital (Advisory Board), and Thyssen-Bornemisza Group (Supervisory Board) | |

11

Name and Age at | Position, Principal Occupation, Business Experience | |

Alain J.P. Belda 59

| Chairman and Chief Executive Officer Alcoa Inc. • Chairman, Alcoa Inc. — 2001 to present • Chief Executive Officer — 1999 to present • Director — 1999 to present • President — 1997 to 2001 • Chief Operating Officer — 1997 to 1999 • Vice Chairman — 1995 to 1997 • Executive Vice President — 1994 to 1995 • President, Alcoa (Latin America) — 1991 to 1994 • Vice President — 1982 to 1991 • President, Alcoa Aluminio SA (Brazil) — 1979 to 1994 • Joined Alcoa — 1969 • Director of Citigroup (or predecessor) since 1997 • Other Directorships: E. I. du Pont de Nemours and Company • Other Activities: The Ford Foundation (Trustee), and The Conference Board (Trustee) | |

George David 60

| Chairman and Chief Executive Officer United Technologies Corporation • Chairman, United Technologies Corporation — 1997 to present • Chief Executive Officer — 1994 to present • President — 1992 to 1999; 2002 to present • Director — 1992 to present • Director of Citigroup since 2002 • Other Activities: National Academy Foundation (member), The Business Roundtable (member), The Business Council (member), and Carnegie Hall (member) | |

12

Name and Age at | Position, Principal Occupation, Business Experience | |

Kenneth T. Derr 66

| Chairman, Retired ChevronTexaco Corporation • Chairman and Chief Executive Officer, Chevron Corporation — 1989 to 1999 • Vice Chairman — 1985 to 1988 • Director — 1981 to 1999 • President and Chief Executive Officer, Chevron USA Inc. — 1979 to 1984 • Vice President — 1972 to 1979 • Assistant to the President — 1969 to 1972 • Joined Chevron Corporation — 1960 • Director of Citigroup (or predecessor) since 1987 • Other Directorships: AT&T Corp., Halliburton Company, Calpine Corporation, and American Productivity and Quality Center • Other Activities: American Petroleum Institute (Director), The Business Council (member), Council on Foreign Relations (member), Board of Overseers, Hoover Institution (member), Committee to Encourage Corporate Philanthropy (Co-Chairman), and Cornell University (Trustee Emeritus) | |

John M. Deutch 64

| Institute Professor Massachusetts Institute of Technology • Institute Professor, M.I.T. — 1990 to present • Director of Central Intelligence — 1995 to 1996 • Deputy Secretary, U.S. Department of Defense — 1994 • Under Secretary, U.S. Department of Defense — 1993 • Provost and Karl T. Compton Professor of Chemistry, M.I.T. — 1985 to 1990 • Dean of Science, M.I.T. — 1982 to 1985 • Under Secretary, U.S. Department of Energy — 1979 to 1980 • Director, Energy Research of the U.S. Department of Energy — 1978 • Director of Citigroup (or predecessor) since 1996 (and 1987 to 1993) • Citibank, N.A. director — 1987 to 1993 and 1996 to 1998 • Other Directorships: CMS Energy, Cummins Engine Company, Inc., Raytheon Company, and Schlumberger, Ltd. | |

13

Name and Age at | Position, Principal Occupation, Business Experience | |

Roberto Hernández Ramirez 60

| Chairman Banco Nacional de México • Chairman, Banco Nacional de México, S.A. — 1991 to present • Chief Executive Officer, Banco Nacional de México, S.A. — 1997 to 2001 • Director, Grupo Financiero Banamex, S.A. de C.V. — 1991 to present • Co-founder, Chairman of the Board, Acciones y Valores de México, S.A. de C.V. — 1971 to present • Chairman of the Board, Bolsa Mexicana de Valores, S.A. de C.V. (Mexican Stock Exchange) — 1974 to 1979, Director — 1972 to present • Advisory Board Member, Federal Reserve Bank of New York — 2002 to present • Chairman of the Board, Asociación Mexicana de Bancos (Mexican Bankers Association) — 1993 to 1994 • Member, Bolsa Mexicana de Valores, S.A. de C.V. — 1967 to 1986 • Director of Citigroup since 2001 • Other Directorships: Empresas ICA Sociedad Controladora, S.A. de C.V., Grupo Ma Seca, S.A. de C.V., Grupo Modelo, S.A. de C.V. and Grupo Televisa, S.A. • Other Activities: Consejo Mexicano de Hombres de Negocios (Mexican Businessmen Council) (member), Museo Nacional del Arte (Chairman), Patronato Pro-Universidad Veracruzana (Chairman), Club de Banqueros de México (Chairman), Museo de Arte del Estado de Veracruz (Honorary Chairman), Patronato Pro-Rescate y Preservación del Patrimonio Arquitectónico de San Luis Potosí (Chairman), Fomento Cultural Banamex, A.C. (member), Fomento Social Banamex, A.C. (member), Fondo Ecológico Banamex, A.C. (member), Museo Nacional del Arte (member), Centro Mexicano de Filantropia (member), Patronato del Museo Dolores Olmedo Patiño (member), Universidad Iberoamericana, A.C. (member), Instituto de Fomento e Investigación Educativa, A.C. (member), Canal Once (member), Auditorio Nacional (member), Consejo Consultivo Ciudadano de Desarrollo Social del Distrito Federal (Advisor), and Universidad de Las Américas — Puebla (Advisor) | |

Ann Dibble Jordan 68

| Consultant • Director of the Department of Social Services for the University of Chicago Medical Center — 1986 to 1987 • Field Work Associate Professor at the School of Social Service Administration of the University of Chicago — 1970 to 1987 • Director of Social Services of Chicago Lying-in Hospital — 1970 to 1985 • Director of Citigroup (or predecessor) since 1989 • Other Directorships: Johnson & Johnson Corporation and Automatic Data Processing, Inc. • Other Activities: The National Symphony Orchestra (Director), The Phillips Collection (Director), Catalyst (Director), The University of Chicago (Trustee), Memorial Sloan-Kettering Cancer Center (member), and WETA (member) | |

14

Name and Age at | Position, Principal Occupation, Business Experience | |

Dudley C. Mecum 68

| Managing Director Capricorn Holdings, LLC • Managing Director, Capricorn Holdings, LLC — 1997 to present • Partner, G.L. Ohrstrom & Co. — 1989 to 1996 • Managing Partner, KPMG LLP (New York office) — 1979 to 1985 • Assistant Secretary of the Army (I&L) — 1971 to 1973 • Director of Citigroup (or predecessor) since 1986 • Other Directorships: Dyncorp, Lyondell Chemical Company, Suburban Propane Partners MLP, CCC Information Services, Inc., and Mrs. Fields Famous Brands, Inc. | |

Richard D. Parsons 54

| Chief Executive Officer AOL Time Warner Inc. • Chief Executive Officer, AOL Time Warner Inc. — 2002 to present; Chairman designate, effective May 2003 • Co-Chief Operating Officer, AOL Time Warner Inc. — 2001 to 2002 • Director, AOL Time Warner Inc. (or predecessor) — 1991 to present • President, Time Warner Inc. — 1995 to 2000 • Chairman and Chief Executive Officer, Dime Savings Bank of New York — 1991 to 1995 • President and Chief Operating Officer — 1988 to 1990 • Associate, Partner, and Managing Partner, Patterson, Belknap, Webb & Tyler — 1977 to 1988 • General Counsel and Associate Director, Domestic Council, White House — 1975 to 1977 • Deputy Counsel to the Vice President, Office of the Vice President of the United States — 1975 • Assistant and First Assistant Counsel to the Governor, State of New York — 1971 to 1974 • Director of Citigroup (or predecessor) since 1996 • Citibank, N.A. director 1996 to 1998 • Other Directorships: Estee Lauder Companies Inc. • Other Activities: Apollo Theatre Foundation (Chairman), President’s Commission to Strengthen Social Security (Co-Chairman), Colonial Williamsburg Foundation (member), Museum of Modern Art (member), and Howard University (member) | |

15

Name and Age at | Position, Principal Occupation, Business Experience | |

Andrall E. Pearson 77

| Founding Chairman Yum! Brands • Founding Chairman and Chairman of the Executive Committee, Yum! Brands — 2001 to present • Chairman and Chief Executive Officer — 1997 to 2000 • Operating Partner, Clayton, Dubilier & Rice, Inc. — 1993 to 1997 Chairman of the Board and Director, Alliant Foodservice Inc., a subsidiary of Clayton, Dubilier & Rice, Inc. Director, KINKO’s Inc., a subsidiary of Clayton, Dubilier & Rice, Inc. • Professor, Harvard Business School — 1985 • President and Chief Operating Officer, PepsiCo, Inc. — 1971 to 1984 • Director of Citigroup (or predecessor) since 1986 | |

Robert E. Rubin 64

| Member of the Office of the Chairman and Chairman of the Executive Committee Citigroup Inc. • Member of the Office of the Chairman and Chairman of the Executive Committee, Citigroup Inc. — 1999 to present • Secretary of the Treasury of the United States — 1995 to 1999 • Assistant to the President for Economic Policy — 1993 to 1995 • Co-Senior Partner and Co-Chairman, Goldman, Sachs & Co. — 1990 to 1992 • Vice-Chairman and Co-Chief Operating Officer — 1987 to 1990 • Management Committee — 1980 • General Partner — 1971 • Joined Goldman, Sachs & Co. — 1966 • Director of Citigroup since 1999 • Other Directorships: Ford Motor Company and Insight Capital Partners (Advisory Board) • Other Activities: Local Initiatives Support Corporation (Chairman), The Mount Sinai School of Medicine (Trustee), and the Harvard Corporation (member) | |

Franklin A. Thomas 68

| Consultant TFF Study Group • Consultant, TFF Study Group — 1996 to present • President, The Ford Foundation — 1979 to 1996 • Private practice of law — 1978 to 1979 • President, Bedford-Stuyvesant Restoration Corporation — 1967 to 1977 • Director of Citigroup (or predecessor) since 1970 • Citibank, N.A. director — 1970 to 1998 • Other Directorships: Alcoa Inc., Cummins Engine Company, Inc., Lucent Technologies, Inc., and Pepsico, Inc. • Other Activities: September 11th Fund (Chairman) | |

16

Name and Age at | Position, Principal Occupation, Business Experience | |

Sanford I. Weill 69

| Chairman Chief Executive Officer Citigroup Inc. • Chairman and Chief Executive Officer, Citigroup Inc. — 1998 to present • Member of the Office of the Chairman — 1999 to present • Chairman of the Board and Chief Executive Officer, Travelers Group — 1986 to 1998 • President — 1986 to 1991 • President, American Express Company — 1983 to 1985 • Chairman of the Board and Chief Executive Officer, American Express Insurance Services, Inc. — 1984 to 1985 • Chairman of the Board, Shearson Lehman Brothers Holdings • Chairman of the Board and Chief Executive Officer, or a principal executive officer, Shearson Lehman Brothers Inc. — 1965 to 1984 • Founding Partner, Shearson Lehman Brothers Inc.’s predecessor partnership — 1960 to 1965 • Director of Citigroup (or predecessor) since 1986 • Other Directorships: United Technologies Corporation (until April 9, 2003) • Other Activities: The Business Roundtable (member), The Business Council (member), Board of Directors, Federal Reserve Bank of New York (Director), Board of Trustees, Carnegie Hall (Chairman), Baltimore Symphony Orchestra (Director), Board of Governors of New York Hospital (member), Board of Overseers of the Joan and Sanford I. Weill Medical College & Graduate School of Medical Sciences of Cornell University (Chairman), The New York and Presbyterian Hospitals (Trustee), Cornell University’s Johnson Graduate School of Management Advisory Council (member), Cornell University (Trustee Emeritus), National Academy Foundation (Chairman), and United States Treasury Department’s Working Group on Child Care (member) | |

Arthur Zankel 71

| Senior Managing Member High Rise Capital Management, LP • Senior Managing Member, High Rise Capital Management, LP — 2000 to present • Co-Managing Partner, First Manhattan Co. — 1979 to 1997 • General Partner, First Manhattan Co. — 1965 to 1999 • Director of Citigroup (or predecessor) since 1986 • Other Directorships: White Mountains Insurance Group Ltd. • Other Activities: Carnegie Hall (Vice Chairman) and Teachers College (Trustee) | |

17

Name and Age at | Position, Principal Occupation, Business Experience | |

The Honorable Gerald R. Ford, Honorary Director* 89

| Former President of the United States • President of the United States — August 1974 through January 1977 • Vice President of the United States — December 1973 through August 1974 • Director or Honorary Director of Citigroup (or predecessor) since 1986 • Other Positions: American Express Company (Advisor to the Board)

*The Hon. Gerald R. Ford is an honorary director and as such is appointed by the Board and does not stand for election. | |

Meetings of the Board of Directors

The board of directors met 16 times in 2002. Each director attended at least 75 percent of the total number of meetings of the board of directors andboard committees of which he or she was a member in 2002.

Meetings of Non-Management Directors

Citigroup’s non-management directors meet in executive sessions without any management directors in attendance each time the full board convenes for a regularly scheduled meeting, which is usually 7 times each year, and, if the board convenes a special meeting, the non-managementdirectors may meet in executive session if the circumstances warrant. The chair of the nomination and governance committee presides at each executive session of the non-management directors.

Committees of the Board of Directors

The standing committees of the board of directors are:

The executive committee, which acts on behalf of the board if a matter requires board action before a meeting of the full board can be held.

The audit committee, which assists the board in fulfilling its oversight responsibility relating to (i) the integrity of Citigroup’s financial statements and financial reporting process and Citigroup’s systems of internal accounting and financial controls; (ii) the performance of the internal audit function — Audit and Risk Review; (iii) the annual independent audit of Citigroup’s financial statements, the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence and performance; (iv) the compliance by Citigroupwith legal and regulatory requirements, including Citigroup’s disclosure controls and procedures; and (v) the fulfillment of the other responsibilities set out in its charter. The report of the committee required by the rules of theSEC is included in this proxy statement.

Subcommittees of the audit committee cover Citigroup’s corporate and investment banking businesses, consumer businesses and investment management businesses.

The audit committee charter is attached to this proxy statement as Annex B.

The nomination and governance committee,which takes a leadership role in shaping corporate governance policies and practices including recommending to the board the Corporate Governance Guidelines applicable to Citigroup

18

and monitoring Citigroup’s compliance with these policies and the Guidelines. The committee is responsible for identifying individuals qualified to be board members, and recommending to the board the director nominees for the next annual meeting of stockholders. It leads the board in its annual review of the board’s performance and recommends to the board director candidates for each committee for appointment by the board. Nominations from stockholders, properly submitted in writing to Citigroup’s Corporate Secretary, will be referred to the committee for consideration.

The nomination and governance committee charter is attached to this proxy statement as Annex C.

The personnel and compensation committee, which is responsible for determining the compensation for the Office of the Chairman, comprised of Sanford Weill and Robert Rubin, and approving the compensation structure for senior management, including members of the business planning groups, the most senior managers of corporate staff, and other highly paid professionals. The committee has produced an annual report on executive compensation that is included in thisproxy statement. Further, the committee is responsible for administering Citigroup’s stock incentive plans, and approves broad-based and special compensation plans across Citigroup.

Additionally, the committee will regularly review Citigroup’s management resources, succession planning and development activities, as well as the performance of senior management. The committee is charged with monitoring Citigroup’s performance relating to employee diversity.

The personnel and compensation committee charter is attached to this proxy statement as Annex D.

The public affairs committee,which is responsible for reviewing Citigroup’s policies and programs that relate to public issues of significance to Citigroup and the public at large and reviewing Citigroup’s relationships with external constituencies and issues that impact Citigroup.

The public affairs committee charter is attached to this proxy statement as Annex E.

All of the committees except the executive committee are comprised entirely of independent directors.

19

The following table shows the current membership of each committee and the number of meetings held by each committee during 2002. As Reuben Mark is not standing for re-election, his committee memberships will terminate on the date of the annual meeting.

Director | Executive | Audit | Personnel and Compensation | Nomination and Governance | Public Affairs | |||||

C. Michael Armstrong | X | |||||||||

Alain J.P. Belda | X | |||||||||

George David | X | |||||||||

Kenneth T. Derr | X | X | X | |||||||

John M. Deutch | X | X | X | |||||||

Alfredo Harp | ||||||||||

Roberto Hernández | ||||||||||

Ann Dibble Jordan | X | X | chair | |||||||

Reuben Mark | X | X | X | |||||||

Dudley C. Mecum | X | chair | X | |||||||

Richard D. Parsons | chair | X | ||||||||

Andrall E. Pearson | X | |||||||||

Robert E. Rubin | chair | |||||||||

Franklin A. Thomas | X | X | chair | X | ||||||

Sanford I. Weill | X | |||||||||

Arthur Zankel | X | X | ||||||||

2002 meetings | 0 | 11 | 10 | 2 | 4 | |||||

Personnel and Compensation Committee

Interlocks and Insider Participation

The persons shown above as the members of the personnel and compensation committee were the only members of the committee during 2002, other than Michael Masin who replaced Arthur Zankel as chair of the committee in April 2002 and then retired from the board and all committees on which he served upon his appointment in October2002 as a Vice Chairman and the Chief Operating Officer of Citigroup.

Except for Alfredo Harp, Roberto Hernández, Robert Rubin and Sanford Weill, no director is a current or former officer or employee of Citigroup or any of its subsidiaries.

Directors’ compensation is determined by the board. Since its initial public offering in 1986, Citigroup has paid outside directors in common stock, to assure that the directors have an ownership interest in common with other stockholders. Outside directors and the honorary director currently receive an annual retainer of $125,000, payable either 100% in common stock, receipt of which may be deferred at the director’s election, or up to 50% in cash to cover taxes and the remainder in common stock. Directors may elect to receive all or a portion of this compensation in theform of an option to purchase shares of Citigroup common stock. The number of shares in the option grant are calculated by dividing the dollar amount elected by one-third of the fair market value of Citigroup common stock on the grant date. The exercise price of the option is the closing price of Citigroup common stock on theNYSE on the trading day immediately preceding the grant date. The options vest and become exercisable in two equal annual installments beginning one year from the grant date and expire ten years after the grant date. In addition, the outside directors and the honorary

20

director receive an annual option grant to purchase 5,000 shares of Citigroup common stock. The calculation of the exercise price and other terms of these options are identical to those described in the previous paragraph.

The board has made changes to the terms of future option awards to directors. For example, the term of stock options granted in 2003 has been shortened to six years. In addition, with respect to an election by a director to receive a portion of compensation in the form of options, the number of shares comprising such grant is calculated by dividing the dollar amount elected by one-quarter of the fair market value of Citigroup common stock on the grant date.

Directors who are employees of Citigroup or its subsidiaries do not receive any compensation for their services as directors. Directors who are not employees of Citigroup or any of its subsidiaries or affiliates may not enter into any consulting arrangements with Citigroup.

Except as described below, directors receive no additional compensation for participation on board committees and subcommittees. Committee andsubcommittee chairs receive additional compensation of $15,000, except for the chair of the audit committee, who receives $25,000. This additional compensation is paid in the same manner as the annual retainer, but directors may not elect stock options for this portion of their fee. Additional compensation for special assignments is determined on a case by case basis, but no such additional compensation was paid to any director in 2002; however, in connection with their service as non-executive Chairmen of Grupo Financiero Banamex and Banco Nacional de México, respectively, each of which is an indirect wholly owned subsidiary of Citigroup, and other duties and services performed for such entities and their affiliates during 2002, including governmental and client relations and strategic development, Citigroup, or certain of its Mexican affiliates, provided certain security services to Alfredo Harp and Roberto Hernández and members of their immediate families as well as office, secretarial, and related services, and reimbursed them for certain costs related to airplane and helicopter usage. The aggregate amount of such expenses for Mr. Harp was $1,830,000. For Mr. Hernández, the aggregate amount of such expenses was $1,035,200.

21

In accordance with its written charter, which was approved in its current form by the Board of Directors on January 21, 2003, the Audit Committee assists the Board in, among other things, oversight of the financial reporting process, including the effectiveness of internal accounting and financial controls and procedures, and controls over the accounting, auditing, and financial reporting practices of Citigroup. A copy of the Audit Committee charter is attached to Citigroup’s proxy statement as Annex B.

The Audit Committee consists of seven independent members whose independence has been determined by the Board of Directors based upon the independence standards adopted by the Board which incorporate the independence requirements under applicable laws, rules and regulations.

Management is responsible for the financial reporting process, the preparation of consolidated financial statements in accordance with generally accepted accounting principles, the system of internal controls, and procedures designed to insure compliance with accounting standards and applicable laws and regulations. Citigroup’s independent auditors are responsible for auditing the financial statements. The Audit Committee’s responsibility is to monitor and review these processes and procedures. The members of the Audit Committee are not professionally engaged in the practice of accounting or auditing and we are not experts in the fields of accounting or auditing. The Audit Committee relies, without independent verification, on the information provided to us and on the representations made by management that the financial statements have been prepared with integrity and objectivity and on the representations of management and the opinion of the independent auditors that such financial statements have been prepared in conformity with generally accepted accounting principles.

During fiscal 2002, the Audit Committee had eleven meetings (in addition, the Global Consumer Audit Subcommittee and the Global Corporate andInvestment Bank Audit Subcommittee each had four meetings; the Global Insurance Audit Subcommittee, which was dissolved in the third quarter of 2002 in connection with the spin out of a majority interest in Travelers Property Casualty Corp., had three meetings; and the Investment Management Subcommittee, which was formed in July 2002, had one meeting). The meetings were conducted so as to encourage communication among the members of the Audit Committee, management, the internal auditors, and Citigroup’s independent auditors, KPMG LLP. Among other things, the Audit Committee discussed with Citigroup’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee separately met with each of the internal and independent auditors, with and without management, to discuss the results of their examinations and their observations and recommendations regarding Citigroup’s internal controls. The Audit Committee also discussed with Citigroup’s independent auditors all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees.”

The Audit Committee reviewed and discussed the audited consolidated financial statements of Citigroup as of and for the year ended December 31, 2002 with management, the internal auditors, and Citigroup’s independent auditors.

The Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and Citigroup that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee discussed with the auditors any relationships that may have an impact on their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee also reviewed, among other things, the amount of fees paid to KPMG for audit and non-audit services and considered whether the

22

provision of non-audit services by KPMG is compatible with maintaining KPMG’s independence.

At two of its meetings during 2002 and one of its meetings during 2003, the Audit Committee met with members of senior management and the independent auditors to review the certifications provided by the Chief Executive Officer and Chief Financial Officer under the Sarbanes-Oxley Act of 2002, the rules and regulations of the Securities and Exchange Commission and the overall certification process. At these meetings, company officers reviewed each of the Sarbanes-Oxley certification requirements concerning internal controls and any fraud, whether or not material, involving management or other employees with a significant role in internal controls.

Based on the above-mentioned review and discussions with management, the internalauditors, and the independent auditors, and subject to the limitations on our role and responsibilities described above and in the Audit Committee charter, the Audit Committee recommended to the Board of Directors that Citigroup’s audited consolidated financial statements be included in Citigroup’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002, for filing with the Securities and Exchange Commission.

THEAUDIT COMMITTEE:

Dudley C. Mecum (Chair)

C. Michael Armstrong

Alain J.P. Belda

George David

Kenneth T. Derr

John M. Deutch

Reuben Mark

23

Report of the Personnel and Compensation Committee on Executive Compensation

Committee Responsibilities. The Personnel and Compensation Committee (the “Committee”) sets the compensation for the Office of the Chairman. In addition, the Committee reviews the compensation structure for senior management which includes members of the business planning groups and the most senior members of corporate staff as well as the compensation of all highly paid officers. Further, the Committee is responsible for administering the stock incentive plans and approves broad-based and special compensation plans across Citigroup Inc. (the “Company”). In executing its compensation responsibilities, the Committee utilizes the assistance of an independent compensation consulting firm. All members of the Committee are independent directors.

Statement of Philosophy. The Company seeks to attract and retain highly qualified employees at all levels, and in particular, those whose performance is most critical to the Company’s success. To accomplish this, the Company is willing to provide superior compensation for superior performance. Such performance is generally measured on the performance of a business unit or on the performance of the Company as a whole, or using both criteria, as the nature of an executive’s responsibilities may dictate. Factors considered include earnings, earnings per share, return on equity, return on capital, return on assets, balance sheet and capital strength, risk containment, corporate governance, franchise expansion, customer satisfaction, adherence to corporate values, and contributions to both operating unit and Company-wide achievement. In conducting its assessment, the Committee reviews changes in the Company’s and its individual business units’ overall financial results over time, as well as similar data for comparable companies to the extent available. The Chief Executive Officer presents to the Committee his assessment of executives, their accomplishments, and individual and corporate performance.

Stock Ownership Commitment. It is the Company’s longstanding policy to strongly encourage stock ownership by both directors and senior management as it serves to closely align the interests of management with those of the stockholders. This policy is a unique and distinguishing characteristic of the Company, encouraging ownership in the following ways:

| • | at least 50% and, at the director’s election, up to 100% of directors fees are paid in Company stock or in Company stock options |

| • | a broad group of employees, including all members of senior management, are granted awards of restricted or deferred stock at the same time cash incentives are paid |

| • | periodic stock option grants are made globally, with over 120,000 employees currently holding an outstanding option grant |

| • | employees below the senior management level are provided the opportunity to own stock through various broad-based stock option programs, the 401(k) Plan, and a global stock purchase program. |

As noted above, to further underscore the Company’s commitment to stock ownership, each member of the Board of Directors and each senior executive has committed to hold at least 75% of any Company stock owned by him or her on the date he or she became subject to the commitment and awarded to him or her in the future, subject to certain minimum ownership guidelines, as long as he or she remains a director or member of senior management (the “Stock Ownership Commitment”). Senior management includes the Management Committee, members of the business planning groups, and the most senior members of corporate staff. The only exceptions to the Stock Ownership Commitment are gifts to charity, limited estate planning transactions with family members, and transactions with the Company in connection with exercising employee stock options or paying withholding taxes under stock option and restricted or deferred stock plans. The

24

Committee believes that this Stock Ownership Commitment has played, and will continue to play, a significant part in driving the Company’s success in creating value for its stockholders.

Covered Executive Compensation. To secure the deductibility of bonuses awarded to the five executives (the “Covered Executives”) named in the Summary Compensation Table that follows this report, bonuses to these executives, including the special equity awards to Deryck Maugan and Charles Prince, have been awarded under the 1999 Citigroup Executive Performance Plan (the “Compensation Plan”). However, as Robert Rubin’s compensation is governed by an employment agreement (the “Employment Agreement”) which is described on page32 of Citigroup’s proxy statement, his bonus was not awarded under the Compensation Plan. The Compensation Plan was approved by stockholders in 1999 and establishes certain performance criteria for determining the maximum amount of bonus compensation available for the Covered Executives. Under the Compensation Plan, the creation of any bonus pool for Covered Executives is contingent upon the Company achieving at least a 10% return on equity, as defined in the plan. The amount of the bonus pool is calculated based upon the extent to which the return on equity equals or exceeds the 10% minimum threshold.

The Compensation Plan further establishes that the maximum percentage of the bonus pool that may be awarded to a Covered Executive is 30%. The Committee may award a bonus to the Chief Executive Officer in an amount equal to a maximum of 30% of the bonus pool. The total of the maximum percentages for all Covered Executives shall not exceed 100% of the bonus pool. The Committee nevertheless has the discretion to reduce or eliminate payments under the Compensation Plan to account for results relative to subjective factors, including an executive’s individual performance.

The maximum bonus pool for 2002 for the Covered Executives of the Company, other than Robert Rubin, was $199.6 million. The amount awarded tothem from the bonus pool was $17.1 million, which represents less than 10% of the amount permitted to be awarded to the Covered Executives, other than Robert Rubin, under the Compensation Plan. The amounts awarded to these Covered Executives from the bonus pool and to Robert Rubin under his Employment Agreement are set forth in the Summary Compensation Table below and total $32.4 million.

Components of Compensation. Compensation of Covered Executives consists of base salary, discretionary incentive and retention awards, which include both cash awards and awards of restricted or deferred stock, and stock option grants. Covered Executives also participate in benefit plans available to employees generally. Examination of competitors’ pay practices is conducted periodically to ensure that the Company’s compensation policies continue to enable it to attract outstanding new people, and motivate and retain current valuable employees. Consistent with the Company’s compensation policies, each Covered Executive officer received a restricted or deferred stock award equal to 25% of his or her total annual compensation. Charles Prince and Deryck Maughan were also granted additional restricted or deferred stock awards.

Incentive awards are discretionary for all of the Covered Executives other than Robert Rubin whose compensation is governed by an Employment Agreement. Incentive awards for the Covered Executives, other than Robert Rubin, are subject to certain maximum amounts as specified in the Compensation Plan. Incentive awards generally represent a substantial part of total compensation for the Company’s executives. Incentive awards are awarded in the form of cash and restricted or deferred stock, and therefore provide not only a short-term reward but also a long-term incentive designed to increase retention and relate directly to the enhancement of stockholder value. The vesting period applicable to awards of restricted or deferred stock to executives is three years in furtherance of the long-term nature of such awards.

25

The terms and conditions of discretionary stock option grants awarded after December 31, 2002 have been changed. The term has been shortened to 6 years and grants will vest over 3 years, with the first vesting date occurring 17 months after the grant date. Shares acquired through the exercise of these options will be restricted from sale for two years from the exercise date. The Stock Ownership Commitment described above still applies regardless of the two year sale restriction. Options awarded after December 31, 2002 cannot be exercised under the reload program.

2002 Compensation. 2002 was an extremely challenging year. The Committee believes that the leadership provided by Sanford Weill and other senior executives was critical to the Company’s superior financial performance and that SanfordWeill’s commitment to further improve the Company’s corporate governance has positioned the Company for continued success of the franchise. Sanford Weill informed the Committee that he would not accept a cash bonus or a restricted stock award. Nonetheless, the Committee believes that recognizing the value of Sanford Weill’s efforts is important; therefore, the Committee granted Sanford Weill a supplemental stock option award.

THE PERSONNELAND COMPENSATION COMMITTEE:

Richard D. Parsons (Chair)

Ann Dibble Jordan

Andrall E. Pearson

Franklin A. Thomas

Arthur Zankel

The tables on pages 27 to 31 profile Citigroup’s compensation for the Chief Executive Officer and our four other most highly compensated executive officers (thecovered executives), including salaries and bonuses paid during the last three years and 2002 option grants and exercises. The form of the tables is set bySEC regulations.

Summary Compensation Table

The following table shows the compensation of the covered executives for 2000, 2001, and 2002. Share numbers have been restated to eliminate fractional shares held by covered executives as a result of stock dividends paid in 1993, 1996, 1997, 1999, and 2000 as well as the merger with The Travelers Corporation (1993), the merger with Salomon Inc (1997), and the merger of Travelers Group and Citicorp to form Citigroup (1998).

26

Summary Compensation Table

Annual Compensation | Long-Term Compensation Awards | ||||||||||||||||||

Name and Principal Position at December 31, 2002 | Year | Salary ($) | Bonus ($) | Other | Restricted Stock Awards ($)(B) | Securities Underlying Stock Options (Number of Shares)(C) | All Other Compensation ($) | ||||||||||||

Sanford I. Weill Chairman and CEO | 2002 2001 2000 | $

| 1,000,000 1,000,000 1,000,000 | $

| 0 16,986,748 18,484,414 | $

| 556,610 683,684 449,404 | $

| 0 8,017,669 8,687,442 | 1,044,229 663,793 19,489,579 | $

| 2,286 6,858 6,858 | |||||||

Deryck C. Maughan Vice Chairman; Chairman and CEO, Citigroup International | 2002 2001 2000 |

| 825,000 825,000 825,000 |

| 2,109,375 3,543,750 3,731,290 |

| * 0 * |

| 2,966,667 1,941,667 2,024,946 | 564,456 505,187 1,217,199 |

| 774 1,242 1,242 | |||||||

Charles Prince Chairman and CEO, Global Corporate and Investment Bank | 2002 2001 2000 |

| 500,000 500,000 500,000 |

| 2,312,500 2,350,000 2,125,000 |

| * * * |

| 3,000,000 1,266,667 1,166,667 | 229,386 182,193 669,927 |

| 414 1,242 1,294 | |||||||

Robert E. Rubin Chairman of the Executive Committee and Member of the Office of the Chairman | 2002 2001 2000 |

| 1,000,000 1,000,000 1,000,000 |

| 10,250,000 10,250,000 10,250,018 |

| 214,648 159,050 259,507 |

| 5,000,000 5,000,000 4,999,973 | 214,439 107,220 2,144,398 |

| 1,188 3,564 3,564 | |||||||

Robert B. Willumstad President; Chairman and CEO, Global Consumer Business | 2002 2001 2000 |

| 512,500 500,000 500,000 |

| 4,514,375 3,962,500 1,944,375 |

| * * * |

| 2,234,167 1,983,333 805,625 | 379,294 226,611 817,477 |

| 774 2,322 2,322 | |||||||

Notes to Summary Compensation Table

(A) Except as shown in this column, no executive officer received other annual compensation during 2002 required to be shown in this column. Sanford Weill’s other compensation includes $275,985 for required use of company transportation and Robert Rubin’s other compensation includes $214,648 for use of company transportation. An asterisk (*) indicates that the total amount of perquisites or personal benefits paid to an executive officer during the referenced year was less than $50,000, the minimum, underSEC rules, an executive must have received before any amount is required to be shown in this column.

(B) Restricted stock awards, other than the special equity awards described below made to Deryck Maughan and Charles Prince, are issued under Citigroup’s capital accumulation program(CAP). Generally, awards of restricted stock underCAP are discounted 25% from market value to reflect restrictions on transfer. All of the covered executives participate inCAP, with 25% of their total annual compensation (salary and bonus) paid in restricted stock.CAP is mandatory for Citigroup senior management and certain other employees.

UnderCAP, a recipient may not transfer restricted stock for three years after the award. If the recipient is still employed by Citigroup at the end of three years, the restricted stock becomes fully vested and freely transferable (subject to the stock ownership commitment described above). From the date of award, the recipient can direct the vote on the restricted stock and receive dividends.

Deryck Maughan and Charles Prince each received special equity awards of restricted stock which

(footnotes continued on following page)

27

(footnotes continued from previous page)

were issued under the Citigroup 1999 Stock Incentive Plan. Special equity awards were made to certain employees in the Global Corporate and Investment Bank and Citigroup International businesses. The awards are not discounted and vest over a three-year term beginning on July 12, 2003 with one-sixth of the award vesting every six months. Until the shares vest, a recipient may not transfer the shares. After they vest, the shares become freely transferable (subject to the stock ownership commitment described above). From the date of award, the recipient can direct the vote on the shares and receive regular dividends. Deryck Maughan received a special equity award valued at $1,662,500 and Charles Prince received a special equity award valued at $1,750,000. Such awards are included in the amounts set forth in the summary compensation table above under “Restricted Stock Awards.”

As of December 31, 2002 (excluding awards that vested in January 2003, but including awards madein February 2003), total holdings of restricted stock of Citigroup and the market value of such shares for the covered executives was:

Executive | Shares | Market Value | ||

Sanford I. Weill | 340,976 | $11,998,945 | ||

Deryck C. Maughan | 171,189 | 6,024,141 | ||

Charles Prince | 141,121 | 4,966,048 | ||

Robert E. Rubin | 356,664 | 12,551,006 | ||

Robert B. Willumstad | 132,088 | 4,648,177 | ||

The market price at December 31, 2002 was $35.19 per share.