Citigroup (C) 8-KRegulation FD Disclosure

Filed: 8 Dec 04, 12:00am

Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

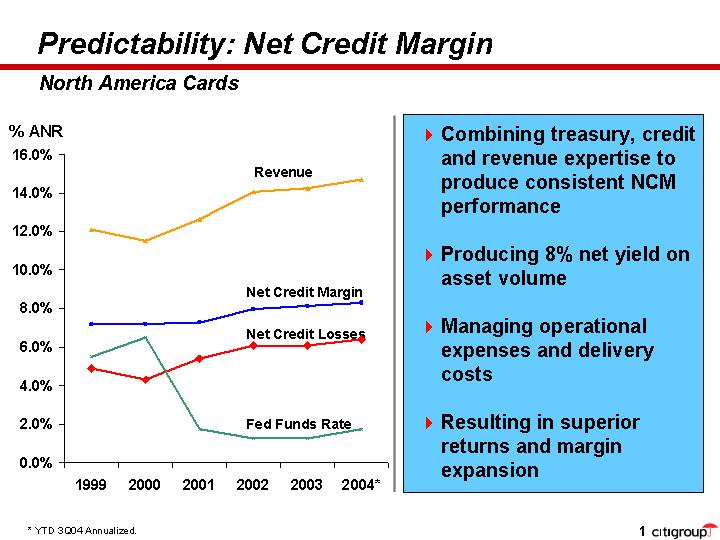

Predictability: Net Credit Margin

North America Cards

[CHART]

* YTD 3Q04 Annualized.

• Combining treasury, credit and revenue expertise to produce consistent NCM performance

• Producing 8% net yield on asset volume

• Managing operational expenses and delivery costs

• Resulting in superior returns and margin expansion

[LOGO]

1

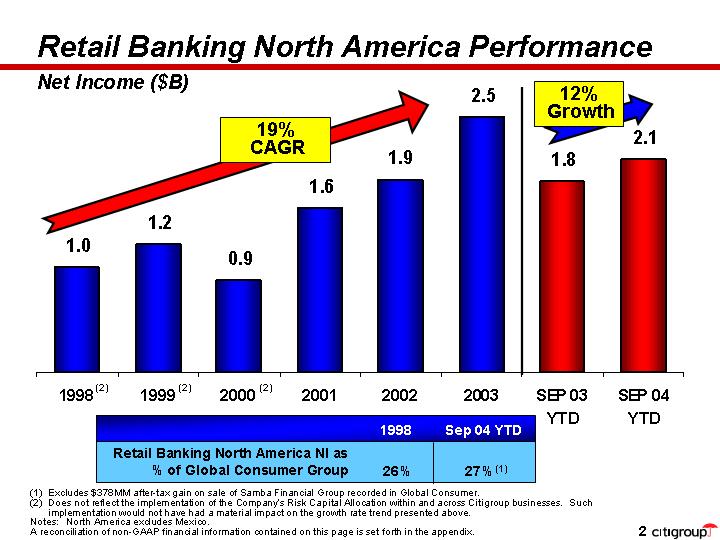

Retail Banking North America Performance

Net Income ($B)

[CHART]

|

| 1998 |

| Sep 04 YTD |

|

Retail Banking North America NI as % of Global Consumer Group |

| 26 | % | 27 | %(1) |

(1) Excludes $378MM after-tax gain on sale of Samba Financial Group recorded in Global Consumer.

(2) Does not reflect the implementation of the Company’s Risk Capital Allocation within and across Citigroup businesses. Such implementation would not have had a material impact on the growth rate trend presented above.

Notes: North America excludes Mexico.

A reconciliation of non-GAAP financial information contained on this page is set forth in the appendix.

2

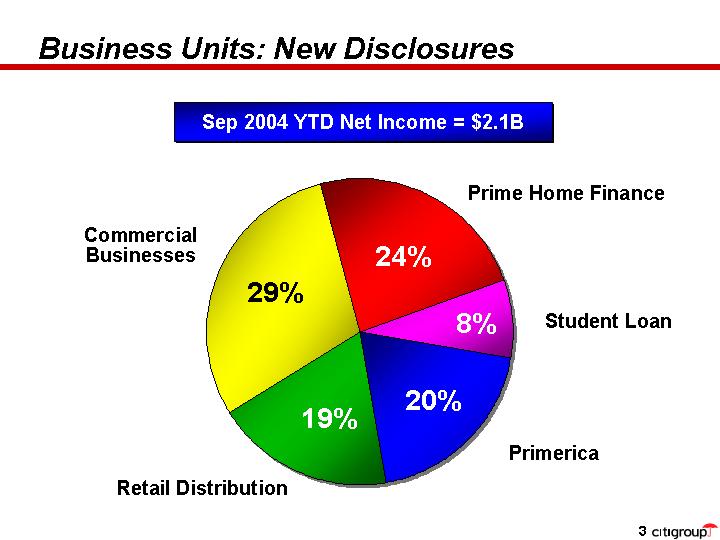

Business Units: New Disclosures

Sep 2004 YTD Net Income = $2.1B

[CHART]

3

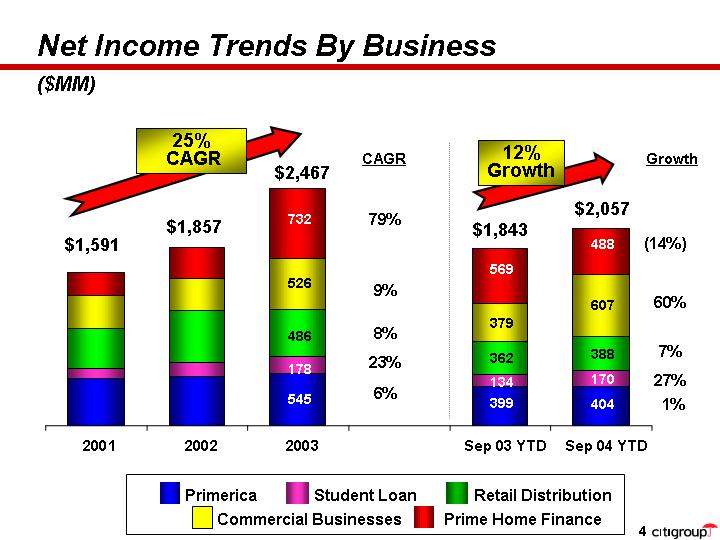

Net Income Trends By Business

($MM)

[CHART]

4

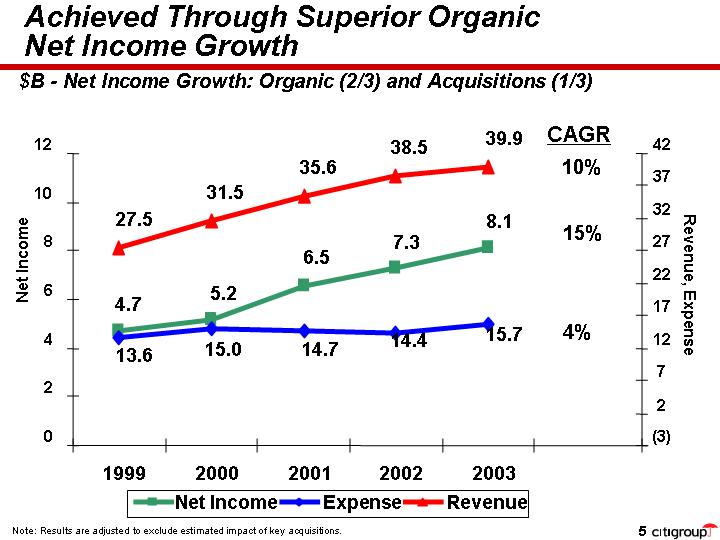

Achieved Through Superior Organic

Net Income Growth

$B - Net Income Growth: Organic (2/3) and Acquisitions (1/3)

[CHART]

Note: Results are adjusted to exclude estimated impact of key acquisitions.

5

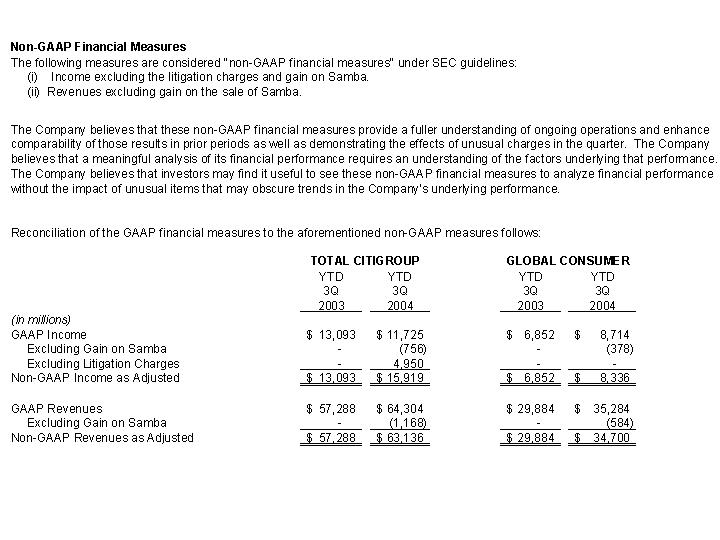

Non-GAAP Financial Measures

The following measures are considered “non-GAAP financial measures” under SEC guidelines:

(i) Income excluding the litigation charges and gain on Samba.

(ii) Revenues excluding gain on the sale of Samba.

The Company believes that these non-GAAP financial measures provide a fuller understanding of ongoing operations and enhance comparability of those results in prior periods as well as demonstrating the effects of unusual charges in the quarter. The Company believes that a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. The Company believes that investors may find it useful to see these non-GAAP financial measures to analyze financial performance without the impact of unusual items that may obscure trends in the Company’s underlying performance.

Reconciliation of the GAAP financial measures to the aforementioned non-GAAP measures follows:

|

| TOTAL CITIGROUP |

| GLOBAL CONSUMER |

| ||||||||

|

| YTD |

| YTD |

| YTD |

| YTD |

| ||||

|

| 3Q |

| 3Q |

| 3Q |

| 3Q |

| ||||

(in millions) |

| 2003 |

| 2004 |

| 2003 |

| 2004 |

| ||||

|

|

|

|

|

|

|

|

|

| ||||

GAAP Income |

| $ | 13,093 |

| $ | 11,725 |

| $ | 6,852 |

| $ | 8,714 |

|

Excluding Gain on Samba |

| — |

| (756 | ) | — |

| (378 | ) | ||||

Excluding Litigation Charges |

| — |

| 4,950 |

| — |

| — |

| ||||

Non-GAAP Income as Adjusted |

| $ | 13,093 |

| $ | 15,919 |

| $ | 6,852 |

| $ | 8,336 |

|

|

|

|

|

|

|

|

|

|

| ||||

GAAP Revenues |

| $ | 57,288 |

| $ | 64,304 |

| $ | 29,884 |

| $ | 35,284 |

|

Excluding Gain on Samba |

| — |

| (1,168 | ) | — |

| (584 | ) | ||||

Non-GAAP Revenues as Adjusted |

| $ | 57,288 |

| $ | 63,136 |

| $ | 29,884 |

| $ | 34,700 |

|

6

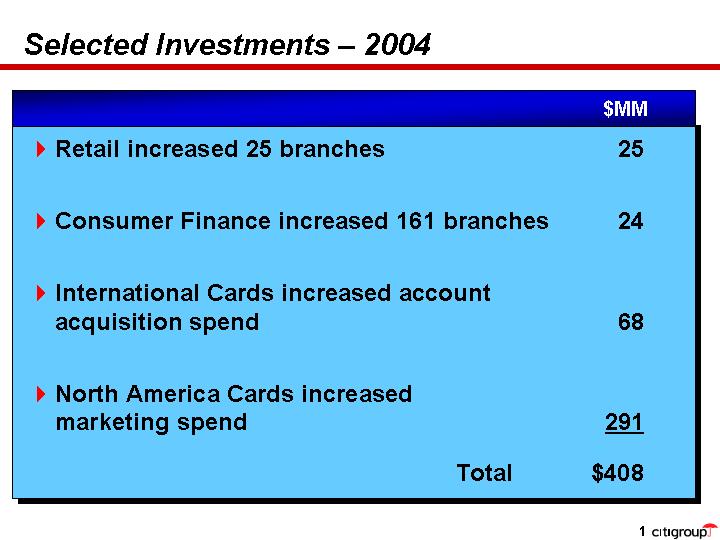

Selected Investments — 2004

|

|

| $MM |

| |

• | Retail increased 25 branches |

| 25 |

| |

|

|

|

|

| |

• | Consumer Finance increased 161 branches |

| 24 |

| |

|

|

|

| ||

• | International Cards increased account acquisition spend |

| 68 |

| |

|

|

|

| ||

• | North America Cards increased marketing spend |

| 291 |

| |

|

|

|

| ||

Total |

| $ | 408 |

| |

7