QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

ý |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2007 |

OR |

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number 1-9924

Citigroup Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization) | | 52-1568099

(I.R.S. Employer Identification No.) |

399 Park Avenue, New York, New York

(Address of principal executive offices) |

|

10043

(Zip Code) |

(212) 559-1000

(Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý Accelerated filer o Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock as of the latest practicable date:

Common stock outstanding as of September 30, 2007: 4,981,134,274

Available on the Web at www.citigroup.com

Citigroup Inc.

TABLE OF CONTENTS

Part I—Financial Information

| |

| | Page No.

|

|---|

| Item 1. | | Financial Statements: | | |

|

|

Consolidated Statement of Income (Unaudited)—Three and Nine Months Ended September 30, 2007 and 2006 |

|

50 |

|

|

Consolidated Balance Sheet—September 30, 2007 (Unaudited) and December 31, 2006 |

|

51 |

|

|

Consolidated Statement of Changes in Stockholders' Equity (Unaudited)—Nine Months Ended September 30, 2007 and 2006 |

|

52 |

|

|

Consolidated Statement of Cash Flows (Unaudited)—Nine Months Ended September 30, 2007 and 2006 |

|

53 |

|

|

Consolidated Balance Sheet—Citibank, N.A. and Subsidiaries September 30, 2007 (Unaudited) and December 31, 2006 |

|

54 |

|

|

Notes to Consolidated Financial Statements (Unaudited) |

|

55 |

Item 2. |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

5 - 47 |

|

|

Summary of Selected Financial Data |

|

4 |

|

|

Third Quarter of 2007 Management Summary |

|

5 |

|

|

Events in 2007 and 2006 |

|

6 |

|

|

Segment, Product and Regional Net Income and Net Revenues |

|

10 - 13 |

|

|

Risk Management |

|

31 |

|

|

Interest Revenue/Expense and Yields |

|

33 |

|

|

Capital Resources and Liquidity |

|

41 |

|

|

Off-Balance Sheet Arrangements |

|

45 |

|

|

Forward-Looking Statements |

|

48 |

Item 3. |

|

Quantitative and Qualitative Disclosures About Market Risk |

|

30 |

| | | | | 29 - 30 |

| | | | | 75 - 77 |

Item 4. |

|

Controls and Procedures |

|

48 |

Part II—Other Information |

Item 1. |

|

Legal Proceedings |

|

103 |

Item 1A. |

|

Risk Factors |

|

103 |

Item 2. |

|

Unregistered Sales of Equity Securities and Use of Proceeds |

|

104 |

Item 6. |

|

Exhibits |

|

105 |

Signatures |

|

106 |

Exhibit Index |

|

107 |

2

THE COMPANY

Citigroup Inc. (Citigroup and, together with its subsidiaries, the Company) is a diversified global financial services holding company. Our businesses provide a broad range of financial services to consumer and corporate customers. Citigroup has more than 200 million customer accounts and does business in more than 100 countries. Citigroup was incorporated in 1988 under the laws of the State of Delaware.

The Company is a bank holding company within the meaning of the U.S. Bank Holding Company Act of 1956 registered with, and subject to examination by, the Board of Governors of the Federal Reserve System (FRB). Some of the Company's subsidiaries are subject to supervision and examination by their respective federal, state and foreign authorities.

This quarterly report on Form 10-Q should be read in conjunction with Citigroup's 2006 Annual Report on Form 10-K and Citigroup's Quarterly Reports on Form 10-Q for the quarter ended March 31, 2007 and June 30, 2007. Additional financial, statistical, and business-related information, as well as business and segment trends, is included in a Financial Supplement that was filed as Exhibit 99.2 to the Company's Current Report on Form 8-K, filed with the Securities and Exchange Commission (SEC) on October 15, 2007.

The principal executive offices of the Company are located at 399 Park Avenue, New York, New York 10043. The telephone number is 212 559 1000. Additional information about Citigroup is available on the Company's Web site atwww.citigroup.com. Citigroup's annual report on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K, and all amendments to these reports are available free of charge through the Company's web site by clicking on the "Investor Relations" page and selecting "SEC Filings." The SEC's web site contains reports, proxy and information statements, and other information regarding the Company atwww.sec.gov.

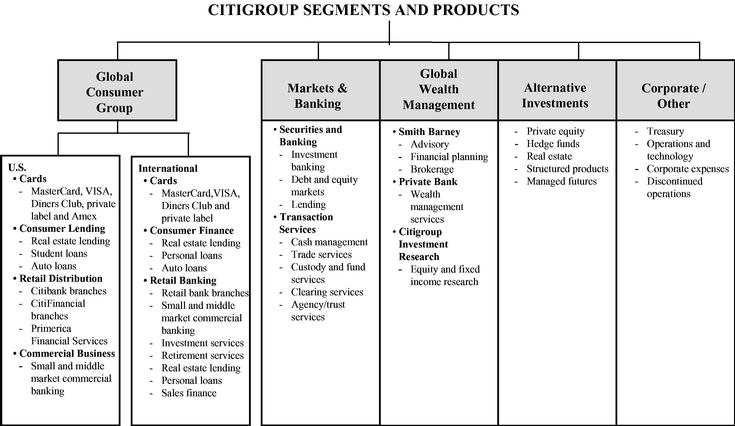

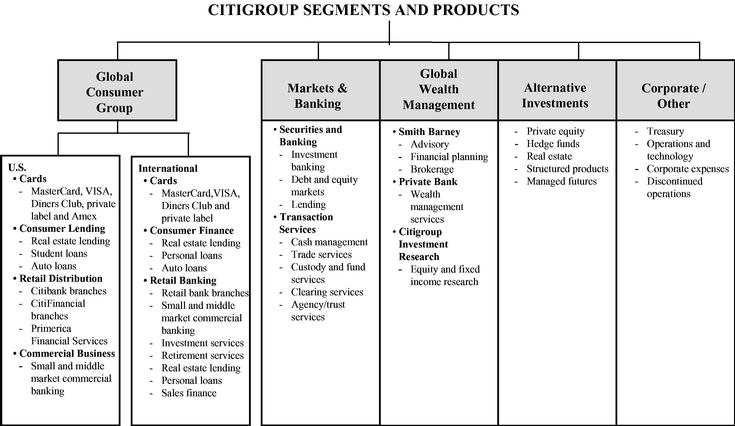

Citigroup was managed along the following segment and product lines through the third quarter of 2007:

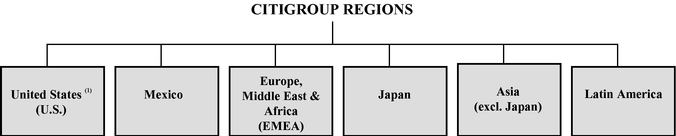

The following are the six regions in which Citigroup operates. The regional results are fully reflected in the product results.

- (1)

- Disclosure includes Canada and Puerto Rico.

3

CITIGROUP INC. AND SUBSIDIARIES

SUMMARY OF SELECTED FINANCIAL DATA

The Company has revised its financial results for the third quarter of 2007 from the results released in the Company's October 15, 2007 Earnings Release and Current Report on Form 8-K filing. The revision relates to the correction of the valuation on the Company's $43 billion in Asset-Backed Securities Collateralized Debt Obligations (ABS CDOs) super senior exposures (see page 6 and 9 for further detail). The impact of this correction is a $270 million reduction in Principal Transactions Revenue, a $166 million reduction in Net Income and a $0.03 reduction in Diluted Earnings per Share.

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars,

except per share amounts

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Net interest revenue | | $ | 12,157 | | $ | 9,828 | | 24 | % | $ | 34,153 | | $ | 29,449 | | 16 | % |

| Non-interest revenue | | | 10,236 | | | 11,594 | | (12 | ) | | 40,329 | | | 36,338 | | 11 | |

| | |

| |

| |

| |

| |

| |

| |

| Revenues, net of interest expense | | $ | 22,393 | | $ | 21,422 | | 5 | % | $ | 74,482 | | $ | 65,787 | | 13 | % |

| Restructuring expense | | | 35 | | | — | | — | | | 1,475 | | | — | | — | |

| Other operating expenses | | | 14,526 | | | 11,936 | | 22 | | | 43,512 | | | 38,063 | | 14 | |

| Provisions for credit losses and for benefits and claims | | | 5,062 | | | 2,117 | | NM | | | 10,746 | | | 5,607 | | 92 | |

| | |

| |

| |

| |

| |

| |

| |

| Income from continuing operations before taxes and minority interest | | $ | 2,770 | | $ | 7,369 | | (62 | )% | $ | 18,749 | | $ | 22,117 | | (15 | )% |

| Income taxes | | | 538 | | | 2,020 | | (73 | ) | | 5,109 | | | 5,860 | | (13 | ) |

| Minority interest, net of taxes | | | 20 | | | 46 | | (57 | ) | | 190 | | | 137 | | 39 | |

| | |

| |

| |

| |

| |

| |

| |

| Income from continuing operations | | $ | 2,212 | | $ | 5,303 | | (58 | )% | $ | 13,450 | | $ | 16,120 | | (17 | )% |

| Income from discontinued operations, net of taxes(1) | | | — | | | 202 | | (100 | ) | | — | | | 289 | | (100 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net Income | | $ | 2,212 | | $ | 5,505 | | (60 | )% | $ | 13,450 | | $ | 16,409 | | (18 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Earnings per share | | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 0.45 | | $ | 1.08 | | (58 | )% | $ | 2.74 | | $ | 3.28 | | (16 | )% |

| Net income | | | 0.45 | | | 1.13 | | (60 | ) | | 2.74 | | | 3.34 | | (18 | ) |

| Diluted: | | | | | | | | | | | | | | | | | |

| Income from continuing operations | | | 0.44 | | | 1.06 | | (58 | ) | | 2.69 | | | 3.22 | | (16 | ) |

| Net income | | | 0.44 | | | 1.10 | | (60 | ) | | 2.69 | | | 3.28 | | (18 | ) |

| Dividends declared per common share | | $ | 0.54 | | $ | 0.49 | | 10 | | $ | 1.62 | | $ | 1.47 | | 10 | |

| | |

| |

| |

| |

| |

| |

| |

| At September 30: | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 2,358,266 | | $ | 1,746,248 | | 35 | % | | | | | | | | |

| Total deposits | | | 812,850 | | | 669,278 | | 21 | | | | | | | | | |

| Long-term debt | | | 364,526 | | | 260,089 | | 40 | | | | | | | | | |

| Mandatorily redeemable securities of subsidiary trusts | | | 11,542 | | | 7,992 | | 44 | | | | | | | | | |

| Common stockholders' equity | | | 126,913 | | | 116,865 | | 9 | | | | | | | | | |

| Total stockholders' equity | | | 127,113 | | | 117,865 | | 8 | | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

| Ratios: | | | | | | | | | | | | | | | | | |

| Return on common stockholders' equity(2) | | | 6.9 | % | | 18.9 | % | | | | 14.6 | % | | 19.3 | % | | |

| Return on risk capital(3) | | | 12 | % | | 37 | % | | | | 25 | % | | 39 | % | | |

| Return on invested capital(3) | | | 7 | % | | 19 | % | | | | 15 | % | | 19 | % | | |

| | |

| |

| |

| |

| |

| |

| |

| Tier 1 Capital | | | 7.32 | % | | 8.64 | % | | | | | | | | | | |

| Total Capital | | | 10.61 | % | | 11.88 | % | | | | | | | | | | |

| Leverage(4) | | | 4.13 | % | | 5.24 | % | | | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- Discontinued operations relates to residual items from the Company's sale of Travelers Life & Annuity, which closed during the 2005 third quarter, and the Company's sale of substantially all of its Asset Management Business, which closed during the 2005 fourth quarter. See Note 2 on page 57.

- (2)

- The return on average common stockholders' equity is calculated using net income minus preferred stock dividends.

- (3)

- Risk capital is a measure of risk levels and the trade-off of risk and return. It is defined as the amount of capital required to absorb potential unexpected economic losses resulting from extremely severe events over a one-year time period. Return on risk capital is calculated as annualized income from continuing operations divided by average risk capital. Invested capital is defined as risk capital plus goodwill and intangible assets excluding mortgage servicing rights (which are a component of risk capital). Return on invested capital is calculated using income adjusted to exclude a net internal charge Citigroup levies on the goodwill and intangible assets of each business, offset by each business' share of the rebate of the goodwill and intangible asset charge. Return on risk capital and return on invested capital are non-GAAP performance measures; because they are measures of risk with no basis in GAAP, there is no comparable GAAP measure to which they can be reconciled. Management uses return on risk capital to assess businesses' operational performance and to allocate Citigroup's balance sheet and risk capital capacity. Return on invested capital is used to assess returns on potential acquisitions and to compare long-term performance of businesses with differing proportions of organic and acquired growth. See page 26 for a further discussion of risk capital.

- (4)

- Tier 1 Capital divided by adjusted average assets.

- NM

- Not meaningful

4

MANAGEMENT'S DISCUSSION AND ANALYSIS

THIRD QUARTER 2007 MANAGEMENT SUMMARY

Income from continuing operations declined 58% to $2,212 billion and diluted EPS from continuing operations was down 58%. The write-downs of highly-leveraged loans, losses in our Fixed Income structured credit and credit trading business and higher credit costs in our Global Consumer business drove the earnings decline. Results include a $729 million pretax gain on the sale of Redecard shares.

Revenues were $22.4 billion, up 5% from a year ago, primarily due to 29% growth in international revenues and partially offset by weakness in ourSecurities and Bankingbusiness, where revenues were down 50%. International Consumer revenues were up 35% and International Global Wealth Management revenues more than doubled reflecting double-digit organic growth and results from Nikko Cordial. U.S. Consumer revenues were flat to a year-ago while Alternative Investments revenues declined 63%.Transaction Serviceshad another record quarter, with revenues up 38%.

Customer volume growth was strong, with average loans up 18%, average deposits up 20%, and average interest-earning assets up 36%.International Cardspurchase sales were up 37%, whileU.S. Cardssales were up 6%. In Global Wealth Management, client assets under fee-based management were up 38%. Branch activity included the opening or acquisition of 96 new branches during the quarter (47 internationally and 49 in the U.S.).

Since October of 2006, ten international acquisitions have been announced, consistent with our goal of expanding our international franchise through targeted acquisitions. On October 2, 2007, we announced an agreement to acquire the remaining 32% public stake in Nikko Cordial in a share-for-share exchange using Citigroup stock.

International businesses contributed 54% of the Company's revenue in the third quarter of 2007 and 79% of income, up from 44% and 43%, respectively, a year ago.

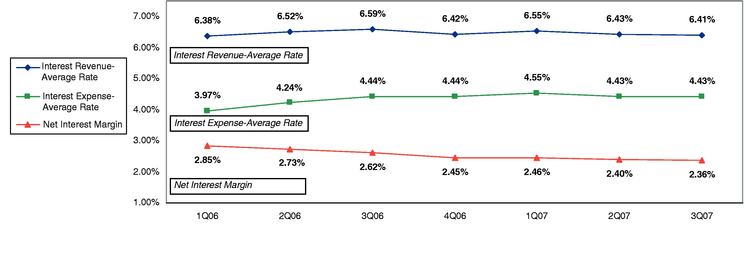

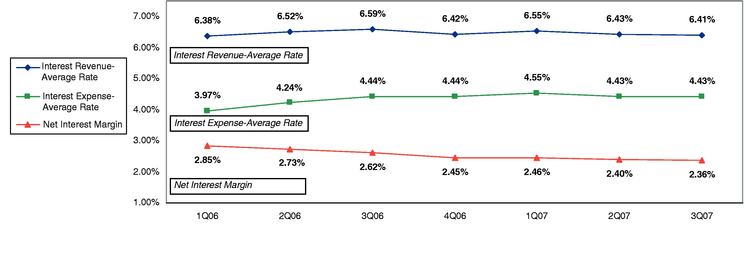

Net interest revenue increased 24% from last year reflecting volume increases across all products. Net interest margin in the third quarter of 2007 was 2.36%, down 26 basis points from the third quarter of 2006, as lower funding costs were offset by growth in lower-yielding assets in our trading businesses, and increased ownership in Nikko Cordial (see discussion of net interest margin on page 33).

Operating expenses increased 22% from the third quarter of 2006 driven by increased business volumes and acquisitions (which contributed 8%). The increase is due in large part to an unusually low level of expenses in the third quarter of 2006, which were the lowest in the last seven quarters, primarily reflecting reductions in advertising and marketing in U.S. Consumer, and lower expenses in Markets & Banking. Our business as usual expense growth of 14% was driven by higher business volumes throughout the franchise and the opening of more than 800 branches in the last 12 months. We are ahead of commitments on our Strategic Expense Initiatives. Expenses were down from the second quarter of 2007, primarily on lower compensation costs inSecurities and Banking.

Credit costs increased $2.98 billion from year-ago levels, primarily driven by an increase in net credit losses of $780 million and a net charge of $2.24 billion to increase loan loss reserves. In U.S. Consumer, higher credit costs reflected an increase in net credit losses of $278 million and a net charge of $1.30 billion to increase loan loss reserves. The $1.30 billion net charge compares to a net reserve release of $197 million in the prior-year period. The increase in credit costs primarily reflected a weakening of leading credit indicators, including increased delinquencies in first and second mortgages and unsecured personal loans, as well as trends in the U.S. macro-economic environment, portfolio growth, and a change in estimate of loan losses inherent in the portfolio but not yet visible in delinquencies (referred to hereinafter as the change in estimate of loan losses). In International Consumer, higher credit costs reflected an increase in net credit losses of $460 million and a net charge of $717 million to increase loan loss reserves. The $717 million net charge compares to a net charge of $101 million in the prior-year period. The increase in credit costs primarily reflected the impact of recent acquisitions, portfolio growth, and a change in estimate of loan losses. Markets & Banking credit costs increased $98 million, primarily reflecting higher net credit losses and a $123 million net charge to increase loan loss reserves for specific counterparties. Credit costs reflected a slight weakening in portfolio credit quality. The Global Consumer loss rate was 1.81%, a 32 basis-point increase from the third quarter of 2006. Corporate cash-basis loans increased 76% from year-ago levels to $1.218 billion.

The Company's effective tax rate of 19.4% in the third quarter of 2007 reflects the tax benefits of permanent differences applied to the lower level of consolidated pretax earnings. These permanent differences primarily include the tax benefit for not providing U.S. income taxes on the earnings of certain foreign subsidiaries that are indefinitely invested. The third quarter of 2006 effective tax rate of 27.4% included a $237 million tax reserve release in continuing operations relating to the resolution of the 2006 New York Tax Audits.

Our stockholders' equity and trust preferred securities were $138.7 billion at September 30, 2007. We distributed $2.7 billion in dividends to shareholders during the quarter. Return on common equity was 6.9% for the quarter. Citigroup maintained its "well-capitalized" position with a Tier 1 Capital Ratio of 7.32% at September 30, 2007.

In our U.S. Consumer business, revenue generated was affected by the market dislocation that also affected our fixed income business; however, the underlying business momentum that we have seen over the last few quarters continues to be very good. The Company expects that credit costs in the fourth quarter of 2007 will increase compared to the fourth quarter of 2006 with the expectation that the U.S. consumer credit environment will continue to deteriorate causing higher credit costs.

On October 12, 2007, we announced the formation of our Institutional Clients Group which combines our Markets & Banking and Alternative Investments businesses which will

5

enhance our ability to serve institutional clients across the entire capital market spectrum. Vikram Pandit will lead this newly formed Group.

On November 4, 2007, the Company announced significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in its Securities and Banking business. Citigroup estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis). See page 9 for a further discussion.

On November 4, 2007, the Company's Board of Directors announced that Charles Prince, Chairman and Chief Executive Officer, has elected to retire from Citigroup. Robert E. Rubin, Chairman of the Executive Committee of Citigroup and a member of the Board of Directors, will serve as Chairman of the Board. In addition, Sir Win Bischoff, Chairman of Citi Europe and a member of Citigroup's Business Heads, Operating and Management Committees, will serve as acting Chief Executive Officer (CEO). The Board also announced that The Board has designated a special committee consisting of Mr. Rubin, Alain J.P. Belda, Richard D. Parsons, and Franklin A. Thomas to conduct the search for a new CEO.

Certain of the statements above are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. See "Forward-Looking Statements" on page 48.

EVENTS IN 2007 AND 2006

Certain of the following statements are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. See "Forward-Looking Statements" on page 48. Additional information regarding "Events in 2007 and 2006" is available in the Company's Quarterly Reports on Form 10-Q for the quarters ended March 31, 2007 and June 30, 2007, and in the Company's Annual Report on Form 10-K for the year ended December 31, 2006.

3Q07 Items Impacting the Securities and Banking Business

CDO- and CLO-Related Losses

During the third quarter of 2007, unrealized losses of approximately $1.8 billion pre-tax, net of hedges, were recorded in theSecurities and Bankingbusiness due to a decline in value of sub-prime mortgage-backed securities warehoused for future collateralized debt obligation (CDO) securitizations, CDO positions, and leveraged loans warehoused for future collateralized loan obligation (CLO) securitizations.

The $1.8 billion pretax of net write-downs consisted of $1.0 billion on asset-backed CDOs (primarily taken on the Company's CDO inventory which totaled $2.7 billion at September 30, 2007 inclusive of the write-down), $0.5 billion on super senior tranches of CDOs (senior-most positions of the capital structure where the predominant collateral is sub-prime U.S. residential mortgage-backed securities) and $0.3 billion on CLOs.

Certain types of credit instruments, such as investments in CDOs, high-yield bonds, debt issued in leveraged buyout transactions, mortgage- and asset-backed securities, and short-term asset- backed commercial paper, became very illiquid in the third quarter of 2007 and this contributed to the declines in value of those securities.

Write-downs on Highly-Leveraged Loans and Commitments

During the third quarter of 2007, Citigroup recorded write downs of approximately $1.352 billion pre-tax, net of underwriting fees, on funded and unfunded highly-leveraged finance commitments in theSecurities and Bankingbusiness. Of this amount, approximately $901 million related to debt underwriting activities and $451 million related to lending activities. Write-downs were recorded on all highly-leveraged finance commitments where there was value impairment, regardless of the expected funding date.

Fixed Income Credit Trading Losses

During the third quarter of 2007, Citigroup recognized approximately $636 million in credit trading losses due to significant market volatility and the disruption of historical pricing relationships. This was primarily a result of the sharp decrease in the sub-prime markets in both North America and Europe. The resulting trading losses are reflected in theSecurities and Bankingbusiness.

Market Value Gains Due to the Change in Citigroup Credit Spreads

SFAS 159 provides companies the ability to elect fair value accounting for many financial assets and liabilities. As part of Citigroup's adoption of this standard in the first quarter of 2007, the Company elected the fair value option on debt instruments that are provided to customers so that this debt and the associated assets the Company purchased to meet this liability are on the same fair value basis in earnings. At the end of the third quarter, $28.6 billion of debt related to customer products was classified as either short- or long-term debt on the Consolidated Balance Sheet.

Under fair value accounting, we are required to use Citigroup credit spreads in determining the market value of any Citigroup liabilities for which the fair value option was elected, as well as for Citigroup trading liabilities such as derivatives. The inclusion of Citigroup credit spreads in valuing Citigroup's liabilities gave rise to a pre-tax gain of $466 million in the third quarter of 2007 and is reflected in theSecurities and Bankingbusiness.

Credit Reserves

During the third quarter of 2007, the Company recorded a net build of $2.24 billion to its credit reserves, including an increase in the allowance for unfunded lending commitments, consisting of a net build of $2.07 billion in Global Consumer and Global Wealth Management and $171 million in Markets & Banking.

The build of $2.07 billion in Global Consumer and Global Wealth Management primarily reflected a weakening of leading credit indicators, including increased delinquencies in first and second mortgages and unsecured personal loans, as well as trends in the U.S. macro-economic environment, portfolio growth, recent acquisitions, and the change in estimate of loan losses.

The build of $171 million in Markets & Banking primarily reflected loan loss reserves for specific counterparties. Credit costs reflected a slight weakening in portfolio credit quality.

6

The net build to the Company's credit reserves in the third quarter of 2007 compares to the third quarter of 2006 net build of $37 million, which consisted of a net release/ utilization of $79 million in Global Consumer and Global Wealth Management, and a net build of $116 million in Markets & Banking.

Redecard IPO

During July and August 2007, Citigroup (a 31.9% shareholder in Redecard S.A., the only merchant acquiring company for MasterCard in Brazil) sold approximately 48.8 million Redecard shares in connection with Redecard's initial public offering in Brazil. Following the sale of these shares, Citigroup retained approximately 23.9% ownership in Redecard. An after-tax gain of approximately $469 million ($729 million pretax) was recorded in Citigroup's third quarter of 2007 financial results in theInternational Cardsbusiness.

CAI's Structured Investment Vehicles (SIVs)

CAI's Global Credit Structures investment center is the investment manager for seven Structured Investment Vehicles (SIVs). SIVs are special purpose investment companies that seek to generate attractive risk-adjusted floating-rate returns through the use of financial leverage and credit management skills, while hedging interest rate and currency risks and managing credit, liquidity and operational risks. The basic investment strategy is to earn a spread between relatively inexpensive short-term funding (commercial paper and medium-term notes) and high quality asset portfolios with a medium-term duration, with the leverage effect providing attractive returns to junior note holders, who are third-party investors and who provide the capital to the SIVs.

Citigroup has no contractual obligation to provide liquidity facilities or guarantees to any of the Citi-advised SIVs and does not own any equity positions in the SIVs. The SIVs have no direct exposure to U.S. sub-prime assets and have approximately $70 million of indirect exposure to sub-prime assets through CDOs which are AAA rated and carry credit enhancements. Approximately 98% of the SIVs' assets are fully funded through the end of 2007. Beginning in July 2007, the SIVs which Citigroup advises sold more than $19 billion of SIV assets, bringing the combined assets of the Citigroup-advised SIVs to approximately $83 billion at September 30, 2007. See additional discussion on page 46.

The current lack of liquidity in the Asset-Backed Commercial Paper (ABCP) market and the resulting slowdown of the CP market for SIV-issued CP have put significant pressure on the ability of all SIVs, including the Citi-advised SIVs, to refinance maturing CP.

While Citigroup does not consolidate the assets of the SIVs, the Company has provided liquidity to the SIVs at arm's-length commercial terms totaling $10 billion of committed liquidity, $7.6 billion of which has been drawn as of October 31, 2007. Citigroup will not take actions that will require the Company to consolidate the SIVs.

Master Liquidity Enhancing Conduit (M-LEC)

In October 2007, Citigroup, J.P. Morgan Chase and Bank of America initiated a plan to back a new fund, called the Master Liquidity Enhancing Conduit (M-LEC) that intends to buy assets from SIVs advised by Citigroup and other third-party institutions. This is being done as part of an effort to avert the situation where the SIVs will be forced to liquidate significant amounts of mortgage-backed securities, resulting in a broad-based repricing of these assets in the market at steep discounts.

SIVs, including those advised by Citigroup, have experienced difficulties in refinancing maturing commercial paper and medium-term notes, due to reduced liquidity in the market for commercial paper.

Nikko Cordial

Citigroup began consolidating Nikko Cordial's financial results and the appropriate minority interest on May 9, 2007, when Nikko Cordial became a 61%-owned subsidiary. Citigroup later increased its ownership stake in Nikko Cordial to 68%. Nikko Cordial results are included within Citigroup'sSecurities and Banking, Global Wealth ManagementandGlobal Consumer Groupbusinesses.

On October 31, 2007, Citigroup announced a definitive agreement with Nikko Cordial to acquire all Nikko Cordial shares that Citigroup does not already own in exchange for shares of Citigroup. The agreement provides for the exchange ratio to be determined in mid-January 2008 and for the transaction to close on January 29, 2008. As of the date of the agreement, the transaction value for the acquisition of the remaining Nikko shares was approximately $4.6 billion.

On October 29, 2007, Citigroup received approval from the Tokyo Stock Exchange (TSE) to list Citigroup's shares on the TSE effective on November 5, 2007.

Acquisition of Bisys

On August 1, 2007, the Company completed its acquisition of Bisys Group, Inc. (Bisys) for $1.47 billion in cash. In addition, Bisys' shareholders received $18.2 million in the form of a special dividend paid by Bisys. Citigroup completed the sale of the Retirement and Insurance Services Divisions of Bisys to affiliates of J.C. Flowers & Co. LLC, making the net cost of the transaction to Citigroup approximately $800 million. Citigroup retained the Fund Services and Alternative Investment services businesses of Bisys which provides administrative services for hedge funds, mutual funds and private equity funds. Results for Bisys are included within Citigroup'sTransaction Servicesbusiness from August 1, 2007 forward.

Agreement to Establish Partnership with Quiñenco—Banco de Chile

On July 19, 2007, Citigroup and Quiñenco entered into a definitive agreement to establish a strategic partnership that combines Citi operations in Chile with Banco de Chile's local banking franchise to create a banking and financial services institution with about 20% market share of the Chilean banking industry. The agreement gives Citigroup the option to acquire up to 50% of LQIF, the holding company through which Quiñenco controls Banco de Chile.

Under the agreement, Citigroup will initially acquire 18.77% interest in Banco de Chile through its approximate 32.85% stake in LQIF. In the initial phase, Citigroup will contribute Citigroup Chile and other assets (in cash or other businesses). As part of the overall transaction, Citigroup will also acquire the U.S. businesses of Banco de Chile. Citigroup has the option to acquire an additional 17.04% stake in LQIF within three years. The new partnership calls for active

7

participation by Citigroup in management of Banco de Chile, including board representation at both LQIF and Banco de Chile.

The transaction is expected to close in the first quarter of 2008, and is subject to customary regulatory reviews. Citigroup will account for the investment in LQIF under the equity method of accounting.

Acquisition of Automated Trading Desk

On October 3, 2007, Citigroup completed its acquisition of Automated Trading Desk (ATD), a leader in electronic market making and proprietary trading, for approximately $680 million ($102.6 million in cash and approximately 11.17 million shares of Citigroup stock). ATD will operate as a unit of Citigroup's Global Equities business, adding a network of broker/dealer customers to Citigroup's diverse base of institutional, broker/dealer and retail customers.

Resolution of 2006 Tax Audits

New York State and New York City

In September 2006, Citigroup reached a settlement agreement with the New York State and New York City taxing authorities regarding various tax liabilities for the years 1998–2005 (referred to hereinafter as the "resolution of the 2006 New York Tax Audits").

For the 2006 third quarter, the Company released $254 million from its tax contingency reserves, which resulted in increases of $237 million in after-tax income from continuing operations and $17 million in after-tax income from discontinued operations, which are reflected in the year-to-date 2006 totals.

Federal

In March 2006, the Company received a notice from the Internal Revenue Service (IRS) that they had concluded the tax audit for the years 1999 through 2002 (referred to hereinafter as the "resolution of the 2006 Federal Tax Audit"). For the 2006 first quarter, the Company released a total of $657 million from its tax contingency reserves related to the resolution of the Federal Tax Audit, which are reflected in the segment and product year-to-date 2006 income tax expense disclosures.

The following table summarizes the 2006 tax benefits, by business, from the resolution of the New York Tax Audits and Federal Tax Audit (collectively, the 2006 Tax Audits):

In millions of dollars

| | New York City

and New York

State Audits

(2006 Third

Quarter)

| | Federal

Audit

(2006 First

Quarter)

| | Total

|

|---|

| Global Consumer | | $ | 79 | | $ | 290 | | $ | 369 |

| Markets & Banking | | | 116 | | | 176 | | | 292 |

| Global Wealth Management | | | 34 | | | 13 | | | 47 |

| Alternative Investments | | | — | | | 58 | | | 58 |

| Corporate/Other | | | 8 | | | 61 | | | 69 |

| | |

| |

| |

|

| Continuing Operations | | $ | 237 | | $ | 598 | | $ | 835 |

| | |

| |

| |

|

| Discontinued Operations | | | 17 | | | 59 | | | 76 |

| | |

| |

| |

|

| Total | | $ | 254 | | $ | 657 | | $ | 911 |

| | |

| |

| |

|

Adoption of the Accounting for Share-Based Payments

On January 1, 2006, the Company adopted Statement of Financial Accounting Standards (SFAS) No. 123 (revised 2004),"Share-Based Payment"(SFAS 123(R)), which replaced the existing SFAS 123 and superseded Accounting Principles Board (APB) Opinion No. 25. SFAS 123(R) requires companies to measure and record compensation expense for stock options and other share-based payments based on the instruments' fair value, reduced by expected forfeitures.

In adopting this standard, the Company conformed to recent accounting guidance that restricted or deferred stock awards issued to retirement-eligible employees who meet certain age and service requirements must be either expensed on the grant date or accrued over a service period prior to the grant date. This charge consisted of $398 million after-tax ($648 million pretax) for the immediate expensing of awards granted to retirement-eligible employees in January 2006.

The following table summarizes the SFAS 123(R) impact, by segment, on the first quarter of 2006 and year-to-date 2006 pretax compensation expense for stock awards granted to retirement-eligible employees in January 2006 ("the 2006 initial adoption of SFAS 123(R)"):

In millions of dollars

| | 2006 First Quarter

|

|---|

| Global Consumer | | $ | 121 |

| Markets & Banking | | | 354 |

| Global Wealth Management | | | 145 |

| Alternative Investments | | | 7 |

| Corporate/Other | | | 21 |

| | |

|

| Total | | $ | 648 |

| | |

|

The Company recorded the quarterly accrual for the stock awards that were granted in January 2007 during each of the quarters in 2006. During the first, second and third quarters of 2007, the Company recorded the quarterly accrual for the estimated stock awards that will be granted in January 2008.

8

Fourth Quarter of 2007 Subsequent Event

Sub-prime Related Exposure inSecurities and Banking

On November 4, 2007, the Company announced significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in itsSecurities and Banking (S&B) business. Citi estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis).

These declines in the fair value of Citi's sub-prime related direct exposures followed a series of rating agency downgrades of sub-prime U.S. mortgage related assets and other market developments, which occurred after the end of the third quarter. The impact on Citi's financial results for the fourth quarter from changes in the fair value of these exposures will depend on future market developments and could differ materially from the range above.

Citi also announced that, while significant uncertainty continues to prevail in financial markets, it expects, taking into account maintaining its current dividend level, that its capital ratios will return within the range of targeted levels by the end of the second quarter of 2008. Accordingly, Citi has no plans to reduce its current dividend level.

The $55 billion in U.S. sub-prime direct exposure in S&B as of September 30, 2007 consisted of (a) approximately $11.7 billion of sub-prime related exposures in its lending and structuring business, and (b) approximately $43 billion of exposures in the most senior tranches (super senior tranches) of collateralized debt obligations which are collateralized by asset-backed securities (ABS CDOs).

Lending and Structuring Exposures

Citi's approximately $11.7 billion of sub-prime related exposures in the lending and structuring business as of September 30, 2007 compares to approximately $13 billion of sub-prime related exposures in the lending and structuring business at the end of the second quarter and approximately $24 billion at the beginning of the year. (See Note 1 below.) The $11.7 billion of sub-prime related exposures includes approximately $2.7 billion of CDO warehouse inventory and unsold tranches of ABS CDOs, approximately $4.2 billion of actively managed sub-prime loans purchased for resale or securitization at a discount to par primarily in the last six months, and approximately $4.8 billion of financing transactions with customers secured by sub-prime collateral. (See Note 2 below.) These amounts represent fair value determined based on observable transactions and other market data. Following the downgrades and market developments referred to above, the fair value of the CDO warehouse inventory and unsold tranches of ABS CDOs has declined significantly, while the declines in the fair value of the other sub-prime related exposures in the lending and structuring business have not been significant.

ABS CDO Super Senior Exposures

Citi's $43 billion in ABS CDO super senior exposures as of September 30, 2007 is backed primarily by sub-prime RMBS collateral. These exposures include approximately $25 billion in commercial paper principally secured by super senior tranches of high grade ABS CDOs and approximately $18 billion of super senior tranches of ABS CDOs, consisting of approximately $10 billion of high grade ABS CDOs, approximately $8 billion of mezzanine ABS CDOs and approximately $0.2 billion of ABS CDO-squared transactions. Although the principal collateral underlying these super senior tranches is U.S. sub-prime RMBS, as noted above, these exposures represent the most senior tranches of the capital structure of the ABS CDOs. These super senior tranches are not subject to valuation based on observable market transactions. Accordingly, fair value of these super senior exposures is based on estimates about, among other things, future housing prices to predict estimated cash flows, which are then discounted to a present value. The rating agency downgrades and market developments referred to above have led to changes in the appropriate discount rates applicable to these super senior tranches, which have resulted in significant declines in the estimates of the fair value of S&B super senior exposures.

Other Information

The fair value of S&B sub-prime related exposures depends on market conditions and assumptions that are subject to change over time. In addition, if sales of super senior tranches of ABS CDOs occur in the future, these sales might represent observable market transactions that could then be used to determine fair value of the S&B super senior exposures described above. As a result, the fair value of these exposures at the end of the fourth quarter will depend on future market developments.

Citi has provided specific targets for its two primary capital ratios: the Tier 1 capital ratio and the ratio of tangible common equity to risk-weighted managed assets (TCE/RWMA ratio). Those targets are 7.5% for Tier 1 and 6.5% for TCE/RWMA. At September 30, 2007, Citi had a Tier 1 ratio of 7.3% and a TCE/RWMA ratio of 5.9%.

Citi expects that market conditions will continue to evolve, and that the fair value of Citi's positions will frequently change.

- (1)

- In the third quarter, Citi recorded declines in the aggregate of approximately $1.0 billion on a revenue basis in the lending and structuring business, and to a much lesser extent the trading positions described in footnote 2 below, and declines of approximately $0.5 billion on a revenue basis on its super senior exposures (approximately $0.3 billion greater on a revenue basis than the losses reported in Citi's October 15 earnings release). Citi also recorded declines in the third quarter of approximately $0.3 billion on a revenue basis on collateralized loan obligations warehouse inventory unrelated to sub-prime exposures.

- (2)

- S&B also has trading positions, both long and short, in U.S. sub-prime residential mortgage-backed securities (RMBS) and related products, including ABS CDOs, that are not included in these figures. The exposure from these positions is actively managed and hedged, although the effectiveness of the hedging products used may vary with material changes in market conditions. Since the end of the third quarter, such trading positions have not had material losses.

9

SEGMENT, PRODUCT AND REGIONAL—NET INCOME AND REVENUE

The following tables show the net income (loss) and revenue for Citigroup's businesses on a segment and product view and on a regional view:

Citigroup Net Income—Segment and Product View

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Global Consumer | | | | | | | | | | | | | | | | | |

| | U.S. Cards | | $ | 852 | | $ | 1,085 | | (21 | )% | $ | 2,475 | | $ | 2,889 | | (14 | )% |

| | U.S. Retail Distribution | | | 257 | | | 481 | | (47 | ) | | 1,098 | | | 1,564 | | (30 | ) |

| | U.S. Consumer Lending | | | (227 | ) | | 521 | | NM | | | 573 | | | 1,428 | | (60 | ) |

| | U.S. Commercial Business | | | 122 | | | 151 | | (19 | ) | | 394 | | | 415 | | (5 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | Total U.S. Consumer(1) | | $ | 1,004 | | $ | 2,238 | | (55 | )% | $ | 4,540 | | $ | 6,296 | | (28 | )% |

| | |

| |

| |

| |

| |

| |

| |

| | International Cards | | $ | 647 | | $ | 287 | | NM | | $ | 1,386 | | $ | 906 | | 53 | % |

| | International Consumer Finance | | | (320 | ) | | 50 | | NM | | | (301 | ) | | 391 | | NM | |

| | International Retail Banking | | | 552 | | | 701 | | (21 | ) | | 1,763 | | | 2,092 | | (16 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | Total International Consumer | | $ | 879 | | $ | 1,038 | | (15 | )% | $ | 2,848 | | $ | 3,389 | | (16 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Other | | $ | (100 | ) | $ | (81 | ) | (23 | )% | $ | (276 | ) | $ | (240 | ) | (15 | )% |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Global Consumer | | $ | 1,783 | | $ | 3,195 | | (44 | )% | $ | 7,112 | | $ | 9,445 | | (25 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Markets & Banking | | | | | | | | | | | | | | | | | |

| | Securities and Banking | | $ | (290 | ) | $ | 1,344 | | NM | | $ | 4,028 | | $ | 4,374 | | (8 | )% |

| | Transaction Services | | | 590 | | | 385 | | 53 | % | | 1,551 | | | 1,048 | | 48 | |

| | Other | | | (20 | ) | | (8 | ) | NM | | | 154 | | | (49 | ) | NM | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Markets & Banking | | $ | 280 | | $ | 1,721 | | (84 | )% | $ | 5,733 | | $ | 5,373 | | 7 | % |

| | |

| |

| |

| |

| |

| |

| |

| Global Wealth Management | | | | | | | | | | | | | | | | | |

| | Smith Barney | | $ | 379 | | $ | 294 | | 29 | % | $ | 1,024 | | $ | 700 | | 46 | % |

| | Private Bank | | | 110 | | | 105 | | 5 | | | 427 | | | 333 | | 28 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Global Wealth Management | | $ | 489 | | $ | 399 | | 23 | % | $ | 1,451 | | $ | 1,033 | | 40 | % |

| | |

| |

| |

| |

| |

| |

| |

| Alternative Investments | | $ | (67 | ) | $ | 117 | | NM | | $ | 611 | | $ | 727 | | (16 | )% |

| Corporate/Other | | | (273 | ) | | (129 | ) | NM | | | (1,457 | ) | | (458 | ) | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Income from Continuing Operations | | $ | 2,212 | | $ | 5,303 | | (58 | )% | $ | 13,450 | | $ | 16,120 | | (17 | )% |

| Income from Discontinued Operations(2) | | | — | | | 202 | | (100 | ) | | — | | | 289 | | (100 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Total Net Income | | $ | 2,212 | | $ | 5,505 | | (60 | )% | $ | 13,450 | | $ | 16,409 | | (18 | )% |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- U.S. disclosure includes Canada and Puerto Rico.

- (2)

- See footnote 2 on page 57.

- NM

- Not meaningful

10

Citigroup Net Income—Regional View

| |

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars

| | % of

Total(1)

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| U.S.(2) | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 904 | | $ | 2,157 | | (58 | )% | $ | 4,264 | | $ | 6,056 | | (30 | )% |

| | Markets & Banking | | | | | (692 | ) | | 540 | | NM | | | 1,291 | | | 1,802 | | (28 | ) |

| | Global Wealth Management | | | | | 333 | | | 342 | | (3 | ) | | 1,029 | | | 860 | | 20 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalU.S. | | 21 | % | $ | 545 | | $ | 3,039 | | (82 | )% | $ | 6,584 | | $ | 8,718 | | (24 | )% |

| | |

| |

| |

| |

| |

| |

| |

| |

| Mexico | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 244 | | $ | 395 | | (38 | )% | $ | 976 | | $ | 1,128 | | (13 | )% |

| | Markets & Banking | | | | | 125 | | | 95 | | 32 | | | 334 | | | 261 | | 28 | |

| | Global Wealth Management | | | | | 10 | | | 9 | | 11 | | | 37 | | | 27 | | 37 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalMexico | | 15 | % | $ | 379 | | $ | 499 | | (24 | )% | $ | 1,347 | | $ | 1,416 | | (5 | )% |

| | |

| |

| |

| |

| |

| |

| |

| |

| EMEA | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 58 | | $ | 213 | | (73 | )% | $ | 289 | | $ | 613 | | (53 | )% |

| | Markets & Banking | | | | | (25 | ) | | 489 | | NM | | | 1,472 | | | 1,466 | | — | |

| | Global Wealth Management | | | | | 4 | | | 7 | | (43 | ) | | 57 | | | 15 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalEMEA | | 1 | % | $ | 37 | | $ | 709 | | (95 | )% | $ | 1,818 | | $ | 2,094 | | (13 | )% |

| | |

| |

| |

| |

| |

| |

| |

| |

| Japan | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | (224 | ) | $ | 79 | | NM | | $ | (147 | ) | $ | 445 | | NM | |

| | Markets & Banking | | | | | (96 | ) | | 38 | | NM | | | 63 | | | 195 | | (68 | )% |

| | Global Wealth Management | | | | | 60 | | | — | | — | | | 90 | | | — | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalJapan | | (10 | )% | $ | (260 | ) | $ | 117 | | NM | | $ | 6 | | $ | 640 | | (99 | )% |

| | |

| |

| |

| |

| |

| |

| |

| |

| Asia | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 334 | | $ | 328 | | 2 | % | $ | 1,143 | | $ | 1,034 | | 11 | % |

| | Markets & Banking | | | | | 727 | | | 391 | | 86 | | | 1,855 | | | 1,141 | | 63 | |

| | Global Wealth Management | | | | | 79 | | | 38 | | NM | | | 218 | | | 123 | | 77 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalAsia | | 45 | % | $ | 1,140 | | $ | 757 | | 51 | % | $ | 3,216 | | $ | 2,298 | | 40 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Latin America | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 467 | | $ | 23 | | NM | | $ | 587 | | $ | 169 | | NM | |

| | Markets & Banking | | | | | 241 | | | 168 | | 43 | % | | 718 | | | 508 | | 41 | % |

| | Global Wealth Management | | | | | 3 | | | 3 | | — | | | 20 | | | 8 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalLatin America | | 28 | % | $ | 711 | | $ | 194 | | NM | | $ | 1,325 | | $ | 685 | | 93 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Alternative Investments | | | | $ | (67 | ) | $ | 117 | | NM | | $ | 611 | | $ | 727 | | (16 | )% |

| Corporate/Other | | | | | (273 | ) | | (129 | ) | NM | | | (1,457 | ) | | (458 | ) | NM | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income from Continuing Operations | | | | $ | 2,212 | | $ | 5,303 | | (58 | )% | $ | 13,450 | | $ | 16,120 | | (17 | )% |

| Income from Discontinued Operations(3) | | | | | — | | | 202 | | (100 | ) | | — | | | 289 | | (100 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total Net Income | | | | $ | 2,212 | | $ | 5,505 | | (60 | )% | $ | 13,450 | | $ | 16,409 | | (18 | )% |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total International | | 79 | % | $ | 2,007 | | $ | 2,276 | | (12 | )% | $ | 7,712 | | $ | 7,133 | | 8 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

- (1)

- Third quarter of 2007 as a percent of total Citigroup net income, excluding Alternative Investments and Corporate/Other.

- (2)

- Excludes Alternative Investments and Corporate/Other, which are predominantly related to theU.S. TheU.S. regional disclosure includes Canada and Puerto Rico. Global Consumer for theU.S. includes Other Consumer.

- (3)

- See footnote 2 on page 57.

- NM

- Not meaningful

11

Citigroup Revenues—Segment and Product View

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Global Consumer | | | | | | | | | | | | | | | | | |

| | U.S. Cards | | $ | 3,386 | | $ | 3,452 | | (2 | )% | $ | 9,861 | | $ | 9,937 | | (1 | )% |

| | U.S. Retail Distribution | | | 2,539 | | | 2,382 | | 7 | | | 7,510 | | | 7,177 | | 5 | |

| | U.S. Consumer Lending | | | 1,548 | | | 1,481 | | 5 | | | 4,705 | | | 4,048 | | 16 | |

| | U.S. Commercial Business | | | 359 | | | 489 | | (27 | ) | | 1,248 | | | 1,475 | | (15 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | Total U.S. Consumer(1) | | $ | 7,832 | | $ | 7,804 | | — | | $ | 23,324 | | $ | 22,637 | | 3 | % |

| | |

| |

| |

| |

| |

| |

| |

| | International Cards | | $ | 2,852 | | $ | 1,519 | | 88 | % | $ | 6,604 | | $ | 4,309 | | 53 | % |

| | International Consumer Finance | | | 782 | | | 998 | | (22 | ) | | 2,515 | | | 2,969 | | (15 | ) |

| | International Retail Banking | | | 3,225 | | | 2,550 | | 26 | | | 9,014 | | | 7,572 | | 19 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total International Consumer | | $ | 6,859 | | $ | 5,067 | | 35 | % | $ | 18,133 | | $ | 14,850 | | 22 | % |

| | |

| |

| |

| |

| |

| |

| |

| | Other | | $ | (8 | ) | $ | (37 | ) | 78 | % | $ | (6 | ) | $ | (70 | ) | 91 | % |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Global Consumer | | $ | 14,683 | | $ | 12,834 | | 14 | % | $ | 41,451 | | $ | 37,417 | | 11 | % |

| | |

| |

| |

| |

| |

| |

| |

| Markets & Banking | | | | | | | | | | | | | | | | | |

| | Securities and Banking | | $ | 2,270 | | $ | 4,567 | | (50 | )% | $ | 16,704 | | $ | 15,732 | | 6 | % |

| | Transaction Services | | | 2,063 | | | 1,500 | | 38 | | | 5,548 | | | 4,377 | | 27 | |

| | Other | | | — | | | — | | — | | | (1 | ) | | (2 | ) | 50 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Markets & Banking | | $ | 4,333 | | $ | 6,067 | | (29 | )% | $ | 22,251 | | $ | 20,107 | | 11 | % |

| | |

| |

| |

| |

| |

| |

| |

| Global Wealth Management | | | | | | | | | | | | | | | | | |

| | Smith Barney | | $ | 2,892 | | $ | 1,994 | | 45 | % | $ | 7,749 | | $ | 5,971 | | 30 | % |

| | Private Bank | | | 617 | | | 492 | | 25 | | | 1,775 | | | 1,490 | | 19 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total Global Wealth Management | | $ | 3,509 | | $ | 2,486 | | 41 | % | $ | 9,524 | | $ | 7,461 | | 28 | % |

| | |

| |

| |

| |

| |

| |

| |

| Alternative Investments | | $ | 125 | | $ | 334 | | (63 | )% | $ | 1,719 | | $ | 1,593 | | 8 | % |

| Corporate/Other | | | (257 | ) | | (299 | ) | 14 | | | (463 | ) | | (791 | ) | 41 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Net Revenues | | $ | 22,393 | | $ | 21,422 | | 5 | % | $ | 74,482 | | $ | 65,787 | | 13 | % |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- U.S. disclosure includes Canada and Puerto Rico.

12

Citigroup Revenues—Regional View

| |

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September

| |

| |

|---|

In millions of dollars

| | % of

Total(1)

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| U.S.(2) | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 7,824 | | $ | 7,767 | | 1 | % | $ | 23,318 | | $ | 22,567 | | 3 | % |

| | Markets & Banking | | | | | 37 | | | 2,007 | | (98 | ) | | 6,792 | | | 7,733 | | (12 | ) |

| | Global Wealth Management | | | | | 2,454 | | | 2,153 | | 14 | | | 7,278 | | | 6,456 | | 13 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalU.S. | | 46 | % | $ | 10,315 | | $ | 11,927 | | (12 | )% | $ | 37,388 | | $ | 36,756 | | 2 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Mexico | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 1,404 | | $ | 1,238 | | 13 | % | $ | 4,135 | | $ | 3,579 | | 16 | % |

| | Markets & Banking | | | | | 247 | | | 197 | | 25 | | | 657 | | | 582 | | 13 | |

| | Global Wealth Management | | | | | 38 | | | 32 | | 19 | | | 115 | | | 96 | | 20 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalMexico | | 7 | % | $ | 1,689 | | | 1,467 | | 15 | % | $ | 4,907 | | $ | 4,257 | | 15 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| EMEA | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 1,738 | | $ | 1,353 | | 28 | % | $ | 4,802 | | $ | 3,983 | | 21 | % |

| | Markets & Banking | | | | | 1,398 | | | 2,166 | | (33 | ) | | 7,218 | | | 6,505 | | 11 | |

| | Global Wealth Management | | | | | 139 | | | 83 | | 67 | | | 384 | | | 241 | | 59 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalEMEA | | 15 | % | | 3,275 | | $ | 3,602 | | (8 | )% | $ | 12,404 | | $ | 10,729 | | 16 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Japan | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 649 | | $ | 782 | | (17 | )% | $ | 1,944 | | $ | 2,364 | | (18 | )% |

| | Markets & Banking | | | | | 133 | | | 177 | | (25 | ) | | 798 | | | 742 | | 8 | |

| | Global Wealth Management | | | | | 547 | | | — | | — | | | 833 | | | — | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalJapan | | 6 | % | $ | 1,329 | | $ | 959 | | 39 | % | $ | 3,575 | | $ | 3,106 | | 15 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Asia | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 1,520 | | $ | 1,209 | | 26 | % | $ | 4,343 | | $ | 3,642 | | 19 | % |

| | Markets & Banking | | | | | 1,822 | | | 1,080 | | 69 | | | 4,861 | | | 3,274 | | 48 | |

| | Global Wealth Management | | | | | 277 | | | 171 | | 62 | | | 753 | | | 532 | | 42 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalAsia | | 16 | % | $ | 3,619 | | $ | 2,460 | | 47 | % | $ | 9,957 | | $ | 7,448 | | 34 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Latin America | | | | | | | | | | | | | | | | | | | |

| | Global Consumer | | | | $ | 1,548 | | $ | 485 | | NM | | $ | 2,909 | | $ | 1,282 | | NM | |

| | Markets & Banking | | | | | 696 | | | 440 | | 58 | % | | 1,925 | | | 1,271 | | 51 | % |

| | Global Wealth Management | | | | | 54 | | | 47 | | 15 | | | 161 | | | 136 | | 18 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | TotalLatin America | | 10 | % | $ | 2,298 | | $ | 972 | | NM | | $ | 4,995 | | $ | 2,689 | | 86 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Alternative Investments | | | | $ | 125 | | $ | 334 | | (63 | )% | $ | 1,719 | | $ | 1,593 | | 8 | % |

| Corporate/Other | | | | | (257 | ) | | (299 | ) | 14 | | | (463 | ) | | (791 | ) | 41 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total Net Revenues | | | | $ | 22,393 | | $ | 21,422 | | 5 | % | $ | 74,482 | | $ | 65,787 | | 13 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total International | | 54 | % | $ | 12,210 | | $ | 9,460 | | 29 | % | $ | 35,838 | | $ | 28,229 | | 27 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

- (1)

- Third quarter of 2007 as a percent of total Citigroup revenues, net of interest expense, excluding Alternative Investments and Corporate/Other.

- (2)

- Excludes Alternative Investments and Corporate/Other, which are predominantly related to theU.S. TheU.S. regional disclosure includes Canada and Puerto Rico. Global Consumer for theU.S. includes Other Consumer.

- NM

- Not meaningful

13

GLOBAL CONSUMER

Citigroup's Global Consumer Group provides a wide array of banking, lending, insurance and investment services through a network of 8,294 branches, approximately 19,500 ATMs, 706 Automated Loan Machines (ALMs), the Internet, telephone and mail, and the Primerica Financial Services salesforce. Global Consumer serves more than 200 million customer accounts, providing products and services to meet the financial needs of both individuals and small businesses.

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Net interest revenue | | $ | 8,285 | | $ | 7,523 | | 10 | % | $ | 24,118 | | $ | 22,228 | | 9 | % |

| Non-interest revenue | | | 6,398 | | | 5,311 | | 20 | | | 17,333 | | | 15,189 | | 14 | |

| | |

| |

| |

| |

| |

| |

| |

| Revenues, net of interest expense | | $ | 14,683 | | $ | 12,834 | | 14 | % | $ | 41,451 | | $ | 37,417 | | 11 | % |

| Operating expenses | | | 7,506 | | | 6,316 | | 19 | | | 21,329 | | | 19,052 | | 12 | |

| Provisions for loan losses and for benefits and claims | | | 4,801 | | | 1,994 | | NM | | | 10,256 | | | 5,311 | | 93 | |

| | |

| |

| |

| |

| |

| |

| |

| Income before taxes and minority interest | | $ | 2,376 | | $ | 4,524 | | (47 | )% | $ | 9,866 | | $ | 13,054 | | (24 | )% |

| Income taxes | | | 568 | | | 1,312 | | (57 | ) | | 2,689 | | | 3,559 | | (24 | ) |

| Minority interest, net of taxes | | | 25 | | | 17 | | 47 | | | 65 | | | 50 | | 30 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 1,783 | | $ | 3,195 | | (44 | )% | $ | 7,112 | | $ | 9,445 | | (25 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Average assets(in billions of dollars) | | $ | 741 | | $ | 620 | | 20 | % | $ | 731 | | $ | 586 | | 25 | % |

| Return on assets | | | 0.95 | % | | 2.04 | % | | | | 1.30 | % | | 2.15 | % | | |

| Average risk capital(1) | | $ | 32,852 | | $ | 27,938 | | 18 | % | $ | 32,701 | | $ | 27,725 | | 18 | % |

| Return on risk capital(1) | | | 22 | % | | 45 | % | | | | 29 | % | | 46 | % | | |

| Return on invested capital(1) | | | 11 | % | | 21 | % | | | | 15 | % | | 21 | % | | |

| | |

| |

| |

| |

| |

| |

| |

| Key Indicators—(in billions of dollars) | | | | | | | | | | | | | | | | | |

| Average loans | | $ | 502.6 | | $ | 440.1 | | 14 | % | | | | | | | | |

| Average deposits | | $ | 298.6 | | $ | 253.9 | | 18 | | | | | | | | | |

| Total branches | | | 8,294 | | | 7,933 | | 5 | % | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- See footnote 3 to the table on page 4.

- NM

- Not meaningful

14

(This page intentionally left blank)

15

U.S. CONSUMER

U.S. Consumer is composed of four businesses:Cards, Retail Distribution, Consumer Lending andCommercial Businesswhich operate in the U.S., Canada and Puerto Rico.

| | Three Months Ended

September 30,

| |

| | Nine Months Ended

September 30,

| |

| |

|---|

In millions of dollars

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Net interest revenue | | $ | 4,252 | | $ | 4,141 | | 3 | % | $ | 12,722 | | $ | 12,468 | | 2 | % |

| Non-interest revenue | | | 3,580 | | | 3,663 | | (2 | ) | | 10,602 | | | 10,169 | | 4 | |

| | |

| |

| |

| |

| |

| |

| |

| Revenues, net of interest expense | | $ | 7,832 | | $ | 7,804 | | — | | $ | 23,324 | | $ | 22,637 | | 3 | % |

| Operating expenses | | | 3,710 | | | 3,426 | | 8 | % | | 10,983 | | | 10,546 | | 4 | |

| Provisions for loan losses and for benefits and claims | | | 2,700 | | | 962 | | NM | | | 5,674 | | | 2,690 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Income before taxes and minority interest | | $ | 1,422 | | $ | 3,416 | | (58 | )% | $ | 6,667 | | $ | 9,401 | | (29 | )% |

| Income taxes | | | 413 | | | 1,162 | | (64 | ) | | 2,100 | | | 3,060 | | (31 | ) |

| Minority interest, net of taxes | | | 5 | | | 16 | | (69 | ) | | 27 | | | 45 | | (40 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 1,004 | | $ | 2,238 | | (55 | )% | $ | 4,540 | | $ | 6,296 | | (28 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Average assets(in billions of dollars) | | $ | 493 | | $ | 422 | | 17 | % | $ | 501 | | $ | 398 | | 26 | % |

| Return on assets | | | 0.81 | % | | 2.10 | % | | | | 1.21 | % | | 2.12 | % | | |

| Average risk capital(1) | | $ | 17,220 | | $ | 15,312 | | 12 | % | $ | 17,748 | | $ | 15,059 | | 18 | % |

| Return on risk capital(1) | | | 23 | % | | 58 | % | | | | 34 | % | | 56 | % | | |

| Return on invested capital(1) | | | 11 | % | | 26 | % | | | | 17 | % | | 25 | % | | |

| | |

| |

| |

| |

| |

| |

| |

| Key Indicators—(in billions of dollars) | | | | | | | | | | | | | | | | | |

| Average loans | | $ | 353.4 | | $ | 324.0 | | 9 | % | | | | | | | | |

| Average deposits | | $ | 122.9 | | $ | 105.5 | | 16 | % | | | | | | | | |

| Total branches | | | 3,482 | | | 3,353 | | 4 | % | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- See footnote 3 to the table on page 4.

- NM

- Not meaningful

3Q07 vs. 3Q06

Net Interest Revenue was 3% higher than the prior year, as growth in average deposits and loans of 16% and 9%, respectively, was partially offset by a decrease in net interest margins (interest revenue less interest expense divided by average interest-earning assets). Net interest margin declined due to a shift in customer deposits to higher cost direct bank and time deposit balances, a mix toward lower-yielding mortgage assets, and the securitization of higher margin credit card receivables, partially offset by lower promotional credit card receivable balances.

Non-Interest Revenue decreased 2% primarily due to the absence of pilot-year gain on sale of Mortgage-Backed Securities (MBS) inConsumer Lending, and lower securitization gains and a decline in the residual interest inCards.

Operating expenses increased primarily due to acquisitions and increased investment spending, including 49 new branch openings during the quarter (35 in CitiFinancial and 14 in Citibank) and lower marketing spending in the prior year.

Provisions for loan losses and for benefits and claims increased substantially primarily reflecting weakening credit indicators, including increased delinquencies in first and second mortgages and unsecured personal loans, as well as trends in the U.S. macro-economic environment and the change in estimate of loan losses. The increase in provision for loan losses also reflected the absence of loan loss reserve releases recorded in the prior year. The net credit loss ratio increased 22 basis points to 1.37%.

TheNet Income decline also reflected the absence of the 2006 third quarter $54 million tax benefit resulting from the resolution of the 2006 New York Tax Audits.

2007 YTD vs. 2006 YTD

Net Interest Revenue was 2% better than the prior year, as growth in average deposits and loans of 19% and 9%, respectively, and higher risk-based fees in Cards, was partially offset by a decrease in net interest margin. Net interest margin declined due to a shift in customer deposits to higher cost direct bank and time deposit balances and the securitization of higher margin credit card receivables.

Non-Interest Revenue increased 4% primarily due to higher loan and deposit volumes and 6% growth in Card purchase sales. The increase also reflected a pretax gain on the sale of MasterCard shares of $246 million, the impact of the acquisition of ABN AMRO Mortgage Group in the first quarter of 2007, and growth in net servicing revenues. Second quarter of 2006 results also included $132 million pretax gain from the sale of upstate New York branches.

Operating expenses increased primarily due to acquisitions, increased investment spending related to the 124 new branch openings during the nine months of 2007 (80 in CitiFinancial and 44 in Citibank) and costs associated with Citibank Direct. The increase in 2007 was also favorably affected by the absence of the charge related to the initial adoption of SFAS 123(R) in the first quarter of 2006. Higher volume-related expenses primarily reflected 14% growth in loan originations in Consumer Lending businesses.

16

Provisions for loan losses and for benefits and claims increased primarily reflecting portfolio growth and weakening credit indicators, including increased delinquencies in first and second mortgages and unsecured personal loans, as well as trends in the U.S. macro-economic environment and the change in estimate of loan losses. The increase in provision for loan losses also reflects the absence of loan loss reserve releases recorded in the prior year, as well as an increase in bankruptcy filings in 2007 versus unusually low filing levels experienced in the first three quarters of 2006. The net credit loss ratio increased 14 basis points to 1.31%.

TheNet income decline in 2007 also reflects the absence of $229 million tax benefit resulting from the resolution of the 2006 Tax Audits.

17

INTERNATIONAL CONSUMER

International Consumer is composed of three businesses:Cards,Consumer Finance andRetail Banking. International Consumer operates in five regions:Mexico,Latin America,EMEA,Japan, andAsia.

| | Three Months Ended

September 30,

| |

| | Nine Months

Ended September 30,

| |

| |

|---|

In millions of dollars

| | %

Change

| | %

Change

| |

|---|

| | 2007

| | 2006

| | 2007

| | 2006

| |

|---|

| Net interest revenue | | $ | 4,072 | | $ | 3,445 | | 18 | % | $ | 11,499 | | $ | 9,921 | | 16 | % |

| Non-interest revenue | | | 2,787 | | | 1,622 | | 72 | | | 6,634 | | | 4,929 | | 35 | |

| | |

| |

| |

| |

| |

| |

| |

| Revenues, net of interest expense | | $ | 6,859 | | $ | 5,067 | | 35 | % | $ | 18,133 | | $ | 14,850 | | 22 | % |

| Operating expenses | | | 3,627 | | | 2,769 | | 31 | | | 9,867 | | | 8,091 | | 22 | �� |

| Provisions for loan losses and for benefits and claims | | | 2,101 | | | 1,032 | | NM | | | 4,582 | | | 2,621 | | 75 | |

| | |

| |

| |

| |

| |

| |

| |

| Income before taxes and minority interest | | $ | 1,131 | | $ | 1,266 | | (11 | )% | $ | 3,684 | | $ | 4,138 | | (11 | )% |

| Income taxes | | | 232 | | | 227 | | 2 | | | 798 | | | 744 | | 7 | |

| Minority interest, net of taxes | | | 20 | | | 1 | | NM | | | 38 | | | 5 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Net income | | $ | 879 | | $ | 1,038 | | (15 | )% | $ | 2,848 | | $ | 3,389 | | (16 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Revenues, net of interest expense, by region: | | | | | | | | | | | | | | | | | |

| | Mexico | | $ | 1,404 | | $ | 1,238 | | 13 | % | $ | 4,135 | | $ | 3,579 | | 16 | % |

| | EMEA | | | 1,738 | | | 1,353 | | 28 | | | 4,802 | | | 3,983 | | 21 | |

| | Japan—Cards and Retail Banking | | | 368 | | | 195 | | 89 | | | 871 | | | 571 | | 53 | |

| | Asia | | | 1,520 | | | 1,209 | | 26 | | | 4,343 | | | 3,642 | | 19 | |

| | Latin America | | | 1,548 | | | 485 | | NM | | | 2,909 | | | 1,282 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Subtotal | | $ | 6,578 | | $ | 4,480 | | 47 | % | $ | 17,060 | | $ | 13,057 | | 31 | % |

| | Japan Consumer Finance | | $ | 281 | | $ | 587 | | (52 | ) | $ | 1,073 | | $ | 1,793 | | (40 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Total revenues | | $ | 6,859 | | $ | 5,067 | | 35 | % | $ | 18,133 | | $ | 14,850 | | 22 | % |

| | |

| |

| |

| |

| |

| |

| |

| Net income by region | | | | | | | | | | | | | | | | | |

| | Mexico | | $ | 244 | | $ | 395 | | (38 | )% | $ | 976 | | $ | 1,128 | | (13 | )% |

| | EMEA | | | 58 | | | 213 | | (73 | ) | | 289 | | | 613 | | (53 | ) |

| | Japan—Cards and Retail Banking | | | 64 | | | 42 | | 52 | | | 165 | | | 139 | | 19 | |

| | Asia | | | 334 | | | 328 | | 2 | | | 1,143 | | | 1,034 | | 11 | |

| | Latin America | | | 467 | | | 23 | | NM | | | 587 | | | 169 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Subtotal | | $ | 1,167 | | $ | 1,001 | | 17 | % | $ | 3,160 | | $ | 3,083 | | 2 | % |

| | Japan Consumer Finance | | $ | (288 | ) | $ | 37 | | NM | | $ | (312 | ) | $ | 306 | | NM | |

| | |

| |

| |

| |

| |

| |

| |

| Total net income | | $ | 879 | | $ | 1,038 | | (15 | )% | $ | 2,848 | | $ | 3,389 | | (16 | )% |

| | |

| |

| |

| |

| |

| |

| |

| Average assets(in billions of dollars) | | $ | 236 | | $ | 187 | | 26 | % | $ | 219 | | $ | 179 | | 22 | % |

| Return on assets | | | 1.48 | % | | 2.20 | % | | | | 1.74 | % | | 2.53 | % | | |

| Average risk capital(1) | | $ | 15,632 | | $ | 12,626 | | 24 | % | $ | 14,953 | | $ | 12,665 | | 18 | % |

| Return on risk capital(1) | | | 22 | % | | 33 | % | | | | 25 | % | | 36 | % | | |

| Return on invested capital(1) | | | 11 | % | | 16 | % | | | | 13 | % | | 17 | % | | |

| | |

| |

| |

| |

| |

| |

| |

| Key indicators—(in billions of dollars) | | | | | | | | | | | | | | | | | |

| Average loans | | $ | 149.2 | | $ | 116.1 | | 29 | % | | | | | | | | |

| Average deposits | | $ | 175.7 | | $ | 148.4 | | 18 | % | | | | | | | | |

| EOP AUMs | | $ | 158.9 | | $ | 123.1 | | 29 | % | | | | | | | | |

| Total branches | | | 4,812 | | | 4,580 | | 5 | % | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- See footnote 3 to the table on page 4.

- NM

- Not meaningful

3Q07 vs. 3Q06

Net Interest Revenue increased 18%. Growth was driven by higher average deposits and loans of 18% and 29%, respectively, as well as the impact of the acquisitions of Grupo Financiero Uno (GFU), Egg and Grupo Cuscatlan.

Non-Interest Revenue increased 72%, primarily due to the gain on the sale of Redecard shares $(729 million pretax), a 37% increase in Card purchase sales and increased investment product sales. The positive impact of foreign currency translation also contributed to increases in revenues.

Operating expenses increased 31%, reflecting the acquisitions of GFU, Grupo Cuscatlan and Egg, and an increase in ownership in Nikko Cordial. Expense growth also reflects volume growth across the regions (excluding Japan Consumer Finance), the impact of foreign currency translation, write-downs of $152 million on customer intangibles and fixed assets and continued investment spending, including the opening of 47 branches.

18

Provisions for loan losses and for benefits and claims increased substantially, primarily due to the change in estimate of loan losses, portfolio growth, and the impact of recent acquisitions.