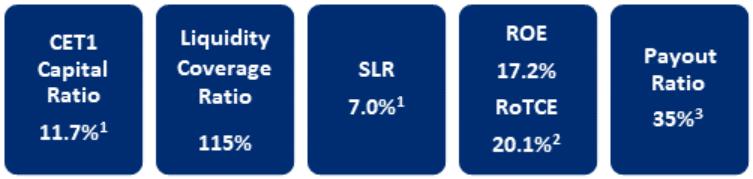

NET INCOME OF $7.9 BILLION ($3.62 PER SHARE) REVENUES OF $19.3 BILLION RETURNED $2.7 BILLION OF CAPITAL TO COMMON SHAREHOLDERS REPURCHASED 23 MILLION COMMON SHARES BOOK VALUE PER SHARE OF $88.18 TANGIBLE BOOK VALUE PER SHARE OF $75.504 New York, April 15, 2021 – Citigroup Inc. today reported net income for the first quarter 2021 of $7.9 billion, or $3.62 per diluted share, on revenues of $19.3 billion. This compared to net income of $2.5 billion, or $1.06 per diluted share, on revenues of $20.7 billion for the first quarter 2020. Revenues decreased 7% from the prior-year period, as higher revenues in Investment Banking and Equity Markets were more than offset by lower rates, the absence of prior year mark-to-market gains on loan hedges within the Institutional Clients Group (ICG), and lower card volumes in Global Consumer Banking (GCB). Net income of $7.9 billion increased significantly from the prior-year period driven by the lower cost of credit. Earnings per share of $3.62 increased significantly from the prior-year period, reflecting the increase in net income, as well as a slight decline in shares outstanding. Percentage comparisons throughout this press release are calculated for the first quarter 2021 versus the first quarter 2020, unless otherwise specified. | | Jane Fraser, Citi CEO, said, “It’s been a better than expected start to the year, and we are optimistic about the macro environment. We are committed to serving our clients through the recovery and positioning the bank for a period of sustained growth. "We reported record net income driven by strong performance in our Institutional Clients Group and a significant release from our Allowance for Credit Losses, as a result of the improving economic outlook. While Global Consumer Banking revenues were down quarter‐over‐quarter as a result of the pandemic, this is the healthiest we have seen the consumer emerge from a crisis in recent history. "Our capital levels remained strong and stable, allowing us to respond to the needs of our clients and return capital to our shareholders. At 11.7%, our Common Equity Tier One Ratio was unchanged from the fourth quarter and we resumed the repurchase of common stock, which we had voluntarily paused at the onset of the pandemic. |