This Note is one of a duly authorized issue of Securities of the Company (the “Notes”), issued and to be issued in one or more series under the senior debt indenture, dated as of November 13, 2013 (as amended and supplemented from time to time, the “Indenture”), between the Company and The Bank of New York Mellon, as trustee (the “Trustee”, which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the holders of the Notes and of the terms upon which the Notes are, and are to be, authenticated and delivered. This Note is one of the series designated on the face hereof, initially limited in aggregate principal to $2,500,000,000.

During the Floating Rate Period, this Note will bear interest for each Interest Period at a rate determined by Citibank, N.A., London Branch, acting as Calculation Agent. The interest rate on this Note for a particular Interest Period during the Floating Rate Period will be a per annum rate equal to SOFR (compounding daily over each Interest Period as described below) plus 0.765%. Interest during the Floating Rate Period will be calculated by multiplying the principal amount of the Notes by an accrued interest factor equal to the sum of the interest factors calculated for each day during the applicable Interest Period; provided that in no event will the interest payable on the Notes be less than zero. The interest factor for each such day will be computed by dividing the interest rate applicable to that day by 360. The interest rate applicable to such day will be the sum of the Accrued Interest Compounding Factor plus 0.765%. Promptly upon determination, the Calculation Agent will inform the Trustee and the Company of the interest rate for the next Interest Period. Absent manifest error, the determination of the interest rate by the Calculation Agent shall be binding and conclusive on the holders of Notes, the Trustee and the Company.

For the purposes of calculating interest with respect to any Interest Period during the Floating Rate Period:

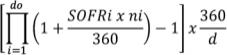

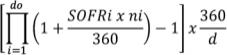

“Accrued Interest Compounding Factor” means the result of the following formula:

where

“do”, for any Interest Period, is the number of U.S. Government Securities Business Days in the relevant Interest Period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Interest Period.

“SOFRi”, for any day “i” in the relevant Interest Period, is a reference rate equal to SOFR in respect of that day.

“ni”, for any day “i” in the relevant Interest Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day.