Exhibit 4.1

This Note is a Global Security within the meaning of the Indenture hereinafter referred to and is registered in the name of the Depository named below or a nominee of the Depository. This Note is not exchangeable for Notes registered in the name of a Person other than the Depository or its nominee except in the limited circumstances described herein and in the Indenture, and no transfer of this Note (other than a transfer of this Note as a whole by the Depository to a nominee of the Depository or by a nominee of the Depository to the Depository or another nominee of the Depository) may be registered except in the limited circumstances described herein.

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (the “Depository”), to the Company or its agent for registration of transfer, exchange, or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as is requested by an authorized representative of the Depository (and any payment is made to Cede & Co. or to such other entity as is requested by an authorized representative of the Depository), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

CITIGROUP INC.

3.290% Fixed Rate / Floating Rate Callable Senior Notes due March 17, 2026

| | |

| REGISTERED | | REGISTERED |

| |

| | CUSIP: 172967NL1 |

| | ISIN: US172967NL16 |

| |

| No. R-00* | | $ |

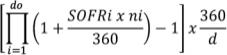

CITIGROUP INC., a Delaware corporation (the “Company”, which term includes any successor Person under the Indenture), for value received, hereby promises to pay to Cede & Co., or registered assigns, the principal sum of $ on March 17, 2026 (the “Maturity Date”) and to pay interest thereon from and including March 17, 2022 or from the most recent Interest Payment Date to which interest has been paid or duly provided for. The Company shall pay interest (i) from March 17, 2022 to, but excluding, March 17, 2025 (the “Fixed Rate Period”) at a fixed rate of 3.290% per annum semi-annually, on March 17th and September 17th of each year (each such date, a “Fixed Rate Period Interest Payment Date”), commencing September 17, 2022 and (ii) from, and including, March 17, 2025 (the “Floating Rate Period”), at an annual rate equal to Compounded SOFR (and defined on the reverse hereof) plus 1.528% quarterly, on the second business day following each Interest Period End Date (each such business day, a “Floating Rate Period Interest Payment Date” and together with any Fixed Rate Period Payment Date, an “Interest Payment Date”), commencing June 19, 2025, until the principal hereof is paid or made available for payment and provided that the Interest Payment Date with respect to the final Interest Period will be a redemption date or the Maturity Date. An Interest Period End Date is the 17th of each March, June, September and December, beginning on June 17, 2025 and ending on a redemption date or the Maturity Date. The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Note is registered at the close of business on the Record Date for such interest, which shall be the Business Day immediately preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the holder on such Record Date and may either be paid to the Person in whose name this Note is registered at the close of business on a subsequent Record Date, such subsequent Record Date to be not less than ten days prior to the date of payment of such defaulted interest, notice whereof shall be given to holders of Notes of this series not less than ten days prior to such subsequent Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Notes of this series may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture.