- C Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B2 Filing

Citigroup (C) 424B2Prospectus for primary offering

Filed: 19 Dec 23, 12:42pm

The information in this preliminary pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary pricing supplement and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED DECEMBER 19, 2023 | |

| Citigroup Global Markets Holdings Inc. | December , 2023 Medium-Term Senior Notes, Series N Pricing Supplement No. 2023-USNCH19903 Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333-270327 and 333-270327-01 |

| ■ | The securities offered by this pricing supplement are unsecured debt securities issued by Citigroup Global Markets Holdings Inc. and guaranteed by Citigroup Inc. The securities offer the potential for periodic contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the same maturity. In exchange for this higher potential yield, you must be willing to accept the risks that (i) your actual yield may be lower than the yield on our conventional debt securities of the same maturity because you may not receive one or more, or any, contingent coupon payments, and (ii) the value of what you receive at maturity may be significantly less than the stated principal amount of your securities, and may be zero. Each of these risks will depend solely on the performance of the worst performing of the underlyings specified below. |

| ■ | We have the right to call the securities for mandatory redemption on any potential redemption date specified below. |

| ■ | You will be subject to risks associated with each of the underlyings and will be negatively affected by adverse movements in any one of the underlyings. Although you will have downside exposure to the worst performing underlying, you will not receive dividends with respect to any underlying or participate in any appreciation of any underlying. |

| ■ | Investors in the securities must be willing to accept (i) an investment that may have limited or no liquidity and (ii) the risk of not receiving any payments due under the securities if we and Citigroup Inc. default on our obligations. All payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. |

KEY TERMS | |||

Issuer: | Citigroup Global Markets Holdings Inc., a wholly owned subsidiary of Citigroup Inc. | ||

Guarantee: | All payments due on the securities are fully and unconditionally guaranteed by Citigroup Inc. | ||

Underlyings: | Underlying Initial underlying value* Coupon barrier value** Final barrier value*** Nasdaq-100 Index® Russell 2000® Index Technology Select Sector SPDR® Fund $ $ $ *For each underlying, its closing value on the pricing date **For each underlying, 75.00% of its initial underlying value ***For each underlying, 70.00% of its initial underlying value | ||

Stated principal amount: | $1,000 per security | ||

Pricing date: | December 29, 2023 | ||

Issue date: | January 4, 2024 | ||

Valuation dates: | January 29, 2024, February 29, 2024, April 1, 2024, April 29, 2024, May 29, 2024, July 1, 2024, July 29, 2024, August 29, 2024, September 30, 2024, October 29, 2024, November 29, 2024, December 30, 2024, January 29, 2025, February 28, 2025, March 31, 2025, April 29, 2025, May 29, 2025, June 30, 2025, July 29, 2025, August 29, 2025, September 29, 2025, October 29, 2025, December 1, 2025, December 29, 2025, January 29, 2026, March 2, 2026, March 30, 2026, April 29, 2026, May 29, 2026 and June 29, 2026 (the “final valuation date”), each subject to postponement if such date is not a scheduled trading day or certain market disruption events occur | ||

Maturity date: | Unless earlier redeemed, July 2, 2026 | ||

Contingent coupon payment dates: | The third business day after each valuation date, except that the contingent coupon payment date following the final valuation date will be the maturity date | ||

Contingent coupon: | On each contingent coupon payment date, unless previously redeemed, the securities will pay a contingent coupon equal to at least 0.9333% of the stated principal amount of the securities (equivalent to a contingent coupon rate of approximately at least 11.20% per annum) (to be determined on the pricing date) if and only if the closing value of the worst performing underlying on the immediately preceding valuation date is greater than or equal to its coupon barrier value. If the closing value of the worst performing underlying on any valuation date is less than its coupon barrier value, you will not receive any contingent coupon payment on the immediately following contingent coupon payment date. | ||

Payment at maturity: | If the securities are not redeemed prior to maturity, you will receive at maturity for each security you then hold (in addition to the final contingent coupon payment, if applicable): ■ If the final underlying value of the worst performing underlying on the final valuation date is greater than or equal to its final barrier value: $1,000 ■ If the final underlying value of the worst performing underlying on the final valuation date is less than its final barrier value: $1,000 + ($1,000 × the underlying return of the worst performing underlying on the final valuation date) If the securities are not redeemed prior to maturity and the final underlying value of the worst performing underlying on the final valuation date is less than its final barrier value, you will receive significantly less than the stated principal amount of your securities, and possibly nothing, at maturity, and you will not receive any contingent coupon payment at maturity. | ||

Listing: | The securities will not be listed on any securities exchange | ||

Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal | ||

Underwriting fee and issue price: | Issue price(1) | Underwriting fee(2) | Proceeds to issuer(3) |

Per security: | $1,000.00 | $6.00 | $994.00 |

Total: | $ | $ | $ |

| Citigroup Global Markets Holdings Inc. |

KEY TERMS (continued) | |

Redemption: | We may call the securities, in whole and not in part, for mandatory redemption on any potential redemption date upon not less than three business days’ notice. Following an exercise of our call right, you will receive for each security you then hold an amount in cash equal to $1,000 plus the related contingent coupon payment, if any. |

Potential redemption dates: | The contingent coupon payment dates related to the valuation dates scheduled to occur on July 1, 2024, July 29, 2024, August 29, 2024, September 30, 2024, October 29, 2024, November 29, 2024, December 30, 2024, January 29, 2025, February 28, 2025, March 31, 2025, April 29, 2025, May 29, 2025, June 30, 2025, July 29, 2025, August 29, 2025, September 29, 2025, October 29, 2025, December 1, 2025, December 29, 2025, January 29, 2026, March 2, 2026, March 30, 2026, April 29, 2026 and May 29, 2026 |

Final underlying value: | For each underlying, its closing value on the final valuation date |

Worst performing underlying: | For any valuation date, the underlying with the lowest underlying return determined as of that valuation date |

Underlying return: | For each underlying on any valuation date, (i) its closing value on that valuation date minus its initial underlying value, divided by (ii) its initial underlying value |

CUSIP / ISIN: | 17291TSU3 / US17291TSU33 |

| PS-2 |

| Citigroup Global Markets Holdings Inc. |

| PS-3 |

| Citigroup Global Markets Holdings Inc. |

Underlying | Hypothetical initial underlying value | Hypothetical coupon barrier value | Hypothetical final barrier value |

Nasdaq-100 Index® | 100.00 | 75.00 (75.00% of its hypothetical initial underlying value) | 70.00 (70.00% of its hypothetical initial underlying value) |

Russell 2000® Index | 100.00 | 75.00 (75.00% of its hypothetical initial underlying value) | 70.00 (70.00% of its hypothetical initial underlying value) |

Technology Select Sector SPDR® Fund | $100.00 | $75.00 (75.00% of its hypothetical initial underlying value) | $70.00 (70.00% of its hypothetical initial underlying value) |

Hypothetical closing value of the Nasdaq-100 Index® on hypothetical valuation date | Hypothetical closing value of the Russell 2000® Index on hypothetical valuation date | Hypothetical closing value of the Technology Select Sector SPDR® Fund on hypothetical valuation date | Hypothetical payment per $1,000.00 security on related contingent coupon payment date | |

Example 1 | 120 (underlying return = (120 - 100) / 100 = 20%) | 85 (underlying return = (85 - 100) / 100 = -15%) | $105 (underlying return = ($105 - $100) / $100 = 5%) | $9.333 (contingent coupon is paid) |

Example 2 | 45 (underlying return = (45 - 100) / 100 = -55%) | 120 (underlying return = (120 - 100) / 100 = 20%) | $150 (underlying return = ($150 - $100) / $100 = 50%) | $0.00 (no contingent coupon) |

Example 3 | 50 (underlying return = (50 - 100) / 100 = -50%) | 40 (underlying return = (40 - 100) / 100 = -60%) | $10 (underlying return = ($10 - $100) / $100 = -90%) | $0.00 (no contingent coupon) |

| PS-4 |

| Citigroup Global Markets Holdings Inc. |

Hypothetical final underlying value of the Nasdaq-100 Index® | Hypothetical final underlying value of the Russell 2000® Index | Hypothetical final underlying value of the Technology Select Sector SPDR® Fund | Hypothetical payment at maturity per $1,000.00 security | |

Example 4 | 110 (underlying return = (110 - 100) / 100 = 10%) | 120 (underlying return = (120 - 100) / 100 = 20%) | $135 (underlying return = ($135 - $100) / $100 = 35%) | $1,009.333 (contingent coupon is paid) |

Example 5 | 130 (underlying return = (130 - 100) / 100 = 30%) | 72 (underlying return = (72 - 100) / 100 = -28%) | $120 (underlying return = ($120 - $100) / $100 = 20%) | $1,000.00 |

Example 6 | 110 (underlying return = (110 - 100) / 100 = 10%) | 110 (underlying return = (110 - 100) / 100 = 10%) | $50 (underlying return = ($50 - $100) / $100 = -50%) | $500.00 |

Example 7 | 20 (underlying return = (20 - 100) / 100 = -80%) | 60 (underlying return = (60 - 100) / 100 = -40%) | $35 (underlying return = ($35 - $100) / $100 = -65%) | $200.00 |

| PS-5 |

| Citigroup Global Markets Holdings Inc. |

| ■ | You may lose a significant portion or all of your investment. Unlike conventional debt securities, the securities do not provide for the repayment of the stated principal amount at maturity in all circumstances. If the securities are not redeemed prior to maturity, your payment at maturity will depend on the final underlying value of the worst performing underlying on the final valuation date. If the final underlying value of the worst performing underlying on the final valuation date is less than its final barrier value, you will lose 1% of the stated principal amount of your securities for every 1% by which the worst performing underlying on the final valuation date has declined from its initial underlying value. There is no minimum payment at maturity on the securities, and you may lose up to all of your investment. |

| ■ | You will not receive any contingent coupon on the contingent coupon payment date following any valuation date on which the closing value of the worst performing underlying on that valuation date is less than its coupon barrier value. A contingent coupon payment will be made on a contingent coupon payment date if and only if the closing value of the worst performing underlying on the immediately preceding valuation date is greater than or equal to its coupon barrier value. If the closing value of the worst performing underlying on any valuation date is less than its coupon barrier value, you will not receive any contingent coupon payment on the immediately following contingent coupon payment date. If the closing value of the worst performing underlying on each valuation date is below its coupon barrier value, you will not receive any contingent coupon payments over the term of the securities. |

| ■ | Higher contingent coupon rates are associated with greater risk. The securities offer contingent coupon payments at an annualized rate that, if all are paid, would produce a yield that is generally higher than the yield on our conventional debt securities of the same maturity. This higher potential yield is associated with greater levels of expected risk as of the pricing date for the securities, including the risk that you may not receive a contingent coupon payment on one or more, or any, contingent coupon payment dates and the risk that the value of what you receive at maturity may be significantly less than the stated principal amount of your securities and may be zero. The volatility of, and correlation between, the closing values of the underlyings are important factors affecting these risks. Greater expected volatility of, and lower expected correlation between, the closing values of the underlyings as of the pricing date may result in a higher contingent coupon rate, but would also represent a greater expected likelihood as of the pricing date that the closing value of the worst performing underlying on one or more valuation dates will be less than its coupon barrier value, such that you will not receive one or more, or any, contingent coupon payments during the term of the securities and that the final underlying value of the worst performing underlying on the final valuation date will be less than its final barrier value, such that you will not be repaid the stated principal amount of your securities at maturity. |

| ■ | The securities are subject to heightened risk because they have multiple underlyings. The securities are more risky than similar investments that may be available with only one underlying. With multiple underlyings, there is a greater chance that any one underlying will perform poorly, adversely affecting your return on the securities. |

| ■ | The securities are subject to the risks of each of the underlyings and will be negatively affected if any one underlying performs poorly. You are subject to risks associated with each of the underlyings. If any one underlying performs poorly, you will be negatively affected. The securities are not linked to a basket composed of the underlyings, where the blended performance of the underlyings would be better than the performance of the worst performing underlying alone. Instead, you are subject to the full risks of whichever of the underlyings is the worst performing underlying. |

| ■ | You will not benefit in any way from the performance of any better performing underlying. The return on the securities depends solely on the performance of the worst performing underlying, and you will not benefit in any way from the performance of any better performing underlying. |

| ■ | You will be subject to risks relating to the relationship between the underlyings. It is preferable from your perspective for the underlyings to be correlated with each other, in the sense that their closing values tend to increase or decrease at similar times and by similar magnitudes. By investing in the securities, you assume the risk that the underlyings will not exhibit this relationship. The less correlated the underlyings, the more likely it is that any one of the underlyings will perform poorly over the term of the securities. All that is necessary for the securities to perform poorly is for one of the underlyings to perform poorly. It is impossible to predict what the relationship between the underlyings will be over the term of the securities. The underlyings differ in significant ways and, therefore, may not be correlated with each other. |

| ■ | You may not be adequately compensated for assuming the downside risk of the worst performing underlying. The potential contingent coupon payments on the securities are the compensation you receive for assuming the downside risk of the worst performing underlying, as well as all the other risks of the securities. That compensation is effectively “at risk” and may, therefore, be less than you currently anticipate. First, the actual yield you realize on the securities could be lower than you anticipate because the coupon is “contingent” and you may not receive a contingent coupon payment on one or more, or any, of the contingent coupon payment dates. |

| PS-6 |

| Citigroup Global Markets Holdings Inc. |

| ■ | We may redeem the securities at our option, which will limit your ability to receive the contingent coupon payments. We may redeem the securities on any potential redemption date. In the event that we redeem the securities, you will receive the stated principal amount of your securities and the related contingent coupon payment, if any. Thus, the term of the securities may be limited. If we redeem the securities prior to maturity, you will not receive any additional contingent coupon payments. Moreover, you may not be able to reinvest your funds in another investment that provides a similar yield with a similar level of risk. If we redeem the securities prior to maturity, it is likely to be at a time when the underlyings are performing in a manner that would otherwise have been favorable to you. By contrast, if the underlyings are performing unfavorably from your perspective, we are less likely to redeem the securities. If we redeem the securities, we will do so at a time that is advantageous to us and without regard to your interests. |

| ■ | The securities offer downside exposure to the worst performing underlying, but no upside exposure to any underlying. You will not participate in any appreciation in the value of any underlying over the term of the securities. Consequently, your return on the securities will be limited to the contingent coupon payments you receive, if any, and may be significantly less than the return on any underlying over the term of the securities. In addition, as an investor in the securities, you will not receive any dividends or other distributions or have any other rights with respect to any of the underlyings. |

| ■ | The performance of the securities will depend on the closing values of the underlyings solely on the valuation dates, which makes the securities particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates. Whether the contingent coupon will be paid on any given contingent coupon payment date will depend on the closing values of the underlyings solely on the applicable valuation dates, regardless of the closing values of the underlyings on other days during the term of the securities. If the securities are not redeemed prior to maturity, what you receive at maturity will depend solely on the closing value of the worst performing underlying on the final valuation date, and not on any other day during the term of the securities. Because the performance of the securities depends on the closing values of the underlyings on a limited number of dates, the securities will be particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates. You should understand that the closing value of each underlying has historically been highly volatile. |

| ■ | The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. |

| ■ | The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities. CGMI currently intends to make a secondary market in relation to the securities and to provide an indicative bid price for the securities on a daily basis. Any indicative bid price for the securities provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the securities can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the securities because it is likely that CGMI will be the only broker-dealer that is willing to buy your securities prior to maturity. Accordingly, an investor must be prepared to hold the securities until maturity. |

| ■ | The estimated value of the securities on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, will be less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the securities that are included in the issue price. These costs include (i) any selling concessions or other fees paid in connection with the offering of the securities, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the securities and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the securities. These costs adversely affect the economic terms of the securities because, if they were lower, the economic terms of the securities would be more favorable to you. The economic terms of the securities are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the securities. See “The estimated value of the securities would be lower if it were calculated based on our secondary market rate” below. |

| ■ | The estimated value of the securities was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of, and correlation between, the closing values of the underlyings, dividend yields on the underlyings and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the securities. Moreover, the estimated value of the securities set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the securities for other purposes, including for accounting purposes. You should not invest in the securities because of the estimated value of the securities. Instead, you should be willing to hold the securities to maturity irrespective of the initial estimated value. |

| ■ | The estimated value of the securities would be lower if it were calculated based on our secondary market rate. The estimated value of the securities included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the securities. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the securities for purposes of any purchases of the securities from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather |

| PS-7 |

| Citigroup Global Markets Holdings Inc. |

| ■ | The estimated value of the securities is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you in the secondary market. Any such secondary market price will fluctuate over the term of the securities based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the securities determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the securities than if our internal funding rate were used. In addition, any secondary market price for the securities will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the securities to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the securities will be less than the issue price. |

| ■ | The value of the securities prior to maturity will fluctuate based on many unpredictable factors. The value of your securities prior to maturity will fluctuate based on the closing values of the underlyings, the volatility of, and correlation between, the closing values of the underlyings, dividend yields on the underlyings, interest rates generally, the time remaining to maturity and our and Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate, among other factors described under “Risk Factors Relating to the Securities—Risk Factors Relating to All Securities—The value of your securities prior to maturity will fluctuate based on many unpredictable factors” in the accompanying product supplement. Changes in the closing values of the underlyings may not result in a comparable change in the value of your securities. You should understand that the value of your securities at any time prior to maturity may be significantly less than the issue price. |

| ■ | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Securities” in this pricing supplement. |

| ■ | The Russell 2000® Index is subject to risks associated with small capitalization stocks. The stocks that constitute the Russell 2000® Index are issued by companies with relatively small market capitalization. The stock prices of smaller companies may be more volatile than stock prices of large capitalization companies. These companies tend to be less well-established than large market capitalization companies. Small capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative to larger companies. Small capitalization companies are less likely to pay dividends on their stocks, and the presence of a dividend payment could be a factor that limits downward stock price pressure under adverse market conditions. |

| ■ | The index tracked by the Technology Select Sector SPDR® Fund underwent a significant change in September 2018 and, as a result, the index tracked by the Technology Select Sector SPDR® Fund will differ in important ways from the index tracked by the Technology Select Sector SPDR® Fund in the past. The Technology Select Sector SPDR® Fund seeks to track the Technology Select Sector Index. S&P Dow Jones Indices LLC announced that, in September 2018 (the “rebalance date”), the Technology Select Sector Index would be reconstituted by eliminating the stocks of the telecommunication services industry group, the internet software & services sub-industry, the home entertainment software sub-industry and companies operating online marketplaces for consumer products and services (“communication services stocks”). The Technology Select Sector SPDR® Fund implemented corresponding changes to its portfolio by divesting communication services stocks representing nearly 25% of the net asset value of the Technology Select Sector SPDR® Fund. As a result, the Technology Select Sector SPDR® Fund no longer holds any communication services stocks. Consequently, the Technology Select Sector SPDR® Fund is less diversified and is more concentrated in the information technology sector than it was before this change to its portfolio. |

| ■ | The Technology Select Sector SPDR® Fund is subject to risks associated with the technology sector. All or substantially all of the equity securities held by the Technology Select Sector SPDR® Fund are issued by companies whose primary line of business is directly associated with the technology sector, including the following industries: technology hardware, storage, and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components. The Technology Select Sector SPDR® Fund is concentrated in the technology sector, which means the Technology Select Sector SPDR® Fund will be more affected by the performance of the technology sector than a fund or index that was more diversified. |

| PS-8 |

| Citigroup Global Markets Holdings Inc. |

| ■ | Our offering of the securities is not a recommendation of any underlying. The fact that we are offering the securities does not mean that we believe that investing in an instrument linked to the underlyings is likely to achieve favorable returns. In fact, as we are part of a global financial institution, our affiliates may have positions (including short positions) in the underlyings or in instruments related to the underlyings, and may publish research or express opinions, that in each case are inconsistent with an investment linked to the underlyings. These and other activities of our affiliates may affect the closing values of the underlyings in a way that negatively affects the value of and your return on the securities. |

| ■ | The closing value of an underlying may be adversely affected by our or our affiliates’ hedging and other trading activities. We expect to hedge our obligations under the securities through CGMI or other of our affiliates, who may take positions in the underlyings or in financial instruments related to the underlyings and may adjust such positions during the term of the securities. Our affiliates also take positions in the underlyings or in financial instruments related to the underlyings on a regular basis (taking long or short positions or both), for their accounts, for other accounts under their management or to facilitate transactions on behalf of customers. These activities could affect the closing values of the underlyings in a way that negatively affects the value of and your return on the securities. They could also result in substantial returns for us or our affiliates while the value of the securities declines. |

| ■ | We and our affiliates may have economic interests that are adverse to yours as a result of our affiliates’ business activities. Our affiliates engage in business activities with a wide range of companies. These activities include extending loans, making and facilitating investments, underwriting securities offerings and providing advisory services. These activities could involve or affect the underlyings in a way that negatively affects the value of and your return on the securities. They could also result in substantial returns for us or our affiliates while the value of the securities declines. In addition, in the course of this business, we or our affiliates may acquire non-public information, which will not be disclosed to you. |

| ■ | The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities. If certain events occur during the term of the securities, such as market disruption events and other events with respect to an underlying, CGMI, as calculation agent, will be required to make discretionary judgments that could significantly affect your return on the securities. In making these judgments, the calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the securities. See “Risk Factors Relating to the Securities—Risk Factors Relating to All Securities—The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities” in the accompanying product supplement. |

| ■ | In the case of an underlying that is an underlying ETF, even if the underlying pays a dividend that it identifies as special or extraordinary, no adjustment will be required under the securities for that dividend unless it meets the criteria specified in the accompanying product supplement. In general, an adjustment will not be made under the terms of the securities for any cash dividend paid by the underlying unless the amount of the dividend per share, together with any other dividends paid in the same quarter, exceeds the dividend paid per share in the most recent quarter by an amount equal to at least 10% of the closing value of that underlying on the date of declaration of the dividend. Any dividend will reduce the closing value of the underlying by the amount of the dividend per share. If the underlying pays any dividend for which an adjustment is not made under the terms of the securities, holders of the securities will be adversely affected. See “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Company or an Underlying ETF—Dilution and Reorganization Adjustments—Certain Extraordinary Cash Dividends” in the accompanying product supplement. |

| ■ | In the case of an underlying that is an underlying ETF, the securities will not be adjusted for all events that may have a dilutive effect on or otherwise adversely affect the closing value of the underlying. For example, we will not make any adjustment for ordinary dividends or extraordinary dividends that do not meet the criteria described above, partial tender offers or additional underlying share issuances. Moreover, the adjustments we do make may not fully offset the dilutive or adverse effect of the particular event. Investors in the securities may be adversely affected by such an event in a circumstance in which a direct holder of the underlying shares of the underlying would not. |

| ■ | In the case of an underlying that is an underlying ETF, the securities may become linked to an underlying other than the original underlying upon the occurrence of a reorganization event or upon the delisting of the underlying shares of that original underlying. For example, if the underlying enters into a merger agreement that provides for holders of its underlying shares to receive shares of another entity and such shares are marketable securities, the closing value of that underlying following consummation of the merger will be based on the value of such other shares. Additionally, if the underlying shares of the underlying are delisted, the calculation agent may select a successor underlying. See “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Company or an Underlying ETF” in the accompanying product supplement. |

| ■ | In the case of the underlying that is an underlying ETF, the value and performance of the underlying shares of the underlying may not completely track the performance of the underlying index that the underlying seeks to track or the net asset value per share of the underlying. In the case of the underlying that is an underlying ETF, the underlying does not fully replicate the underlying |

| PS-9 |

| Citigroup Global Markets Holdings Inc. |

| ■ | Changes that affect the underlyings may affect the value of your securities. The sponsors of the underlyings may at any time make methodological changes or other changes in the manner in which they operate that could affect the values of the underlyings. We are not affiliated with any such underlying sponsor and, accordingly, we have no control over any changes any such sponsor may make. Such changes could adversely affect the performance of the underlyings and the value of and your return on the securities. |

| ■ | The U.S. federal tax consequences of an investment in the securities are unclear. There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as described in “United States Federal Tax Considerations” below. If the IRS were successful in asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively. |

| ■ | The tax disclosure is subject to confirmation. The information set forth under “United States Federal Tax Considerations” in this pricing supplement remains subject to confirmation by our counsel following the pricing of the securities. If that information cannot be confirmed by our counsel, you may be asked to accept revisions to that information in connection with your purchase. Under these circumstances, if you decline to accept revisions to that information, your purchase of the securities will be canceled. |

| PS-10 |

| Citigroup Global Markets Holdings Inc. |

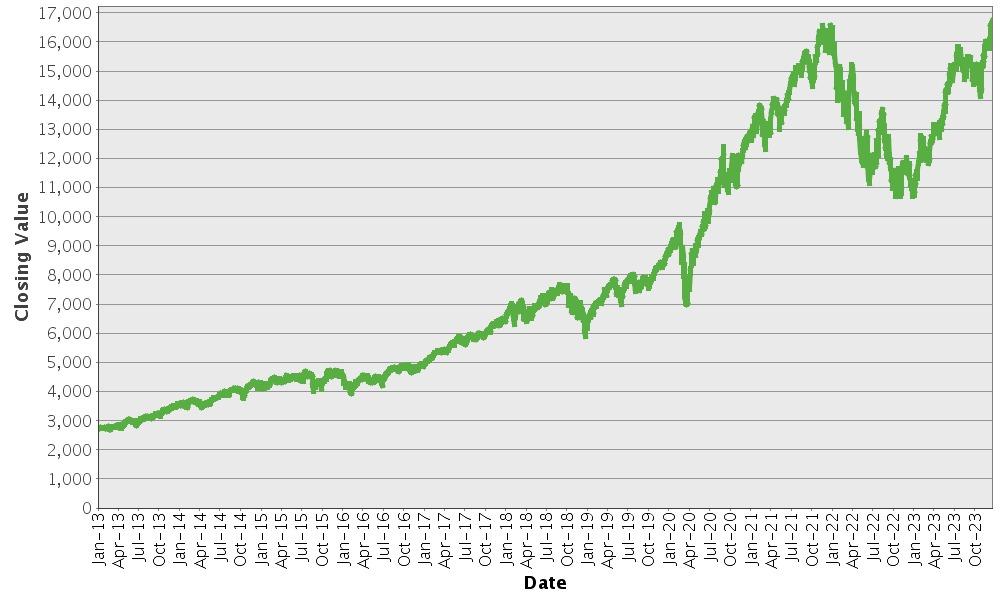

Nasdaq-100 Index® – Historical Closing Values January 2, 2013 to December 18, 2023 |

|

| PS-11 |

| Citigroup Global Markets Holdings Inc. |

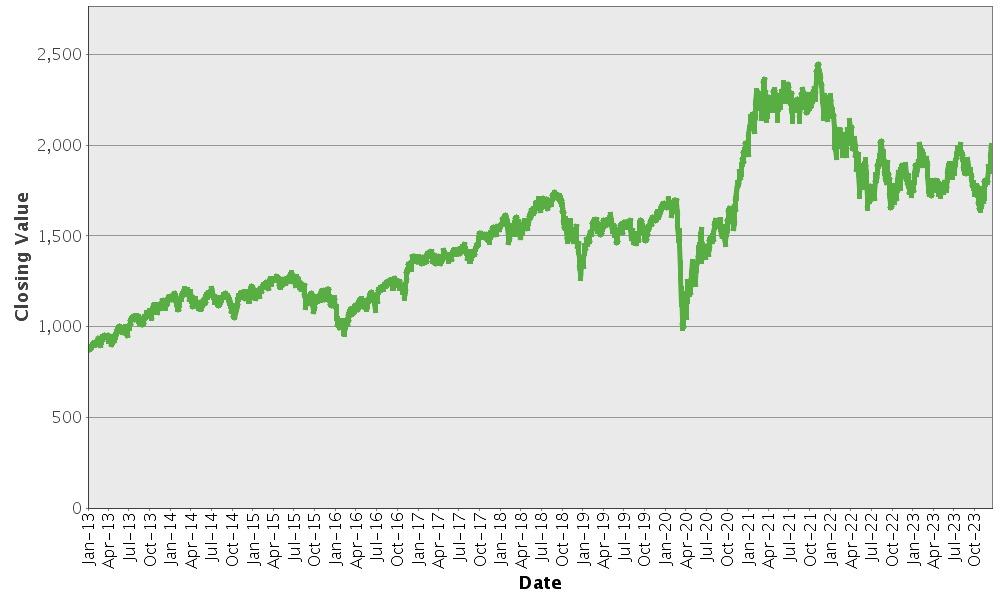

Russell 2000® Index – Historical Closing Values January 2, 2013 to December 18, 2023 |

|

| PS-12 |

| Citigroup Global Markets Holdings Inc. |

| PS-13 |

| Citigroup Global Markets Holdings Inc. |

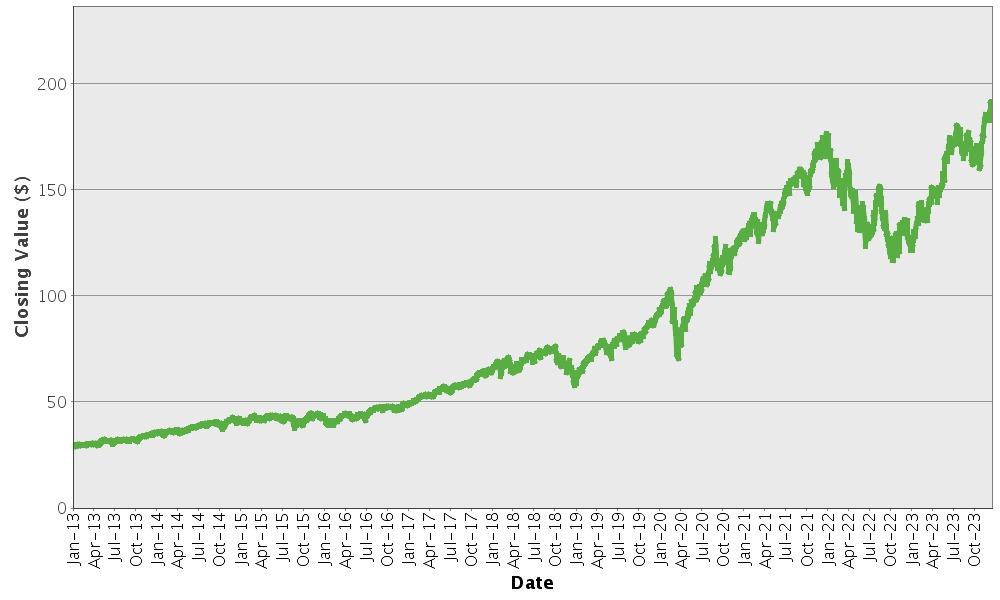

Technology Select Sector SPDR® Fund – Historical Closing Values January 2, 2013 to December 18, 2023 |

|

| PS-14 |

| Citigroup Global Markets Holdings Inc. |

| ● | Any coupon payments on the securities should be taxable as ordinary income to you at the time received or accrued in accordance with your regular method of accounting for U.S. federal income tax purposes. |

| ● | Upon a sale or exchange of a security (including retirement at maturity), you should recognize capital gain or loss equal to the difference between the amount realized and your tax basis in the security. For this purpose, the amount realized does not include any coupon paid on retirement and may not include sale proceeds attributable to an accrued coupon, which may be treated as a coupon payment. Such gain or loss should be long-term capital gain or loss if you held the security for more than one year. |

| PS-15 |

| Citigroup Global Markets Holdings Inc. |

| PS-16 |