As filed with the Securities and Exchange Commission on 03/06/2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-05518

Investment Company Act file number

THE RBB FUND, INC.

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Steven Plump, President

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(609) 731-6256

Registrant's telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a)

Semi-Annual Report

December 31, 2023

(Unaudited)

F/m Investments

Large Cap Focused Fund

of

The RBB Fund, Inc.

Investor Class Shares (Nasdaq: IAFMX)

Institutional Class Shares (Nasdaq: IAFLX)

Table of Contents |

|

Performance Data | 1 |

Fund Expense Example | 3 |

Portfolio Information | 4 |

Schedule of Investments | 5 |

Financial Statements | 7 |

Financial Highlights | 10 |

Notes to Financial Statements | 12 |

Other Information | 19 |

F/m Investments Large Cap Focused Fund

Performance Data

(Unaudited)

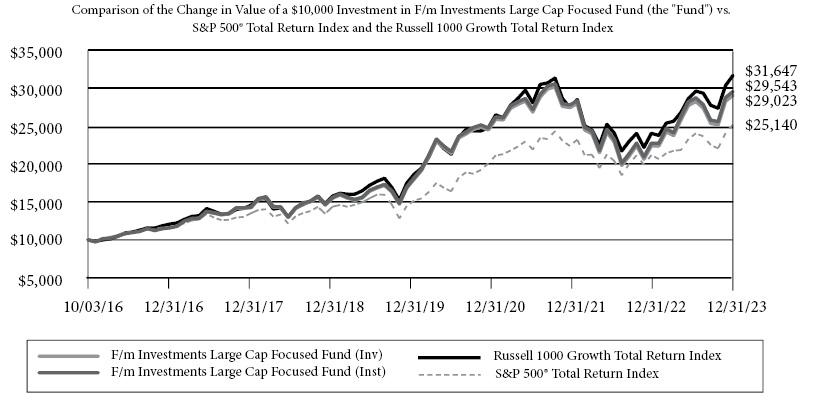

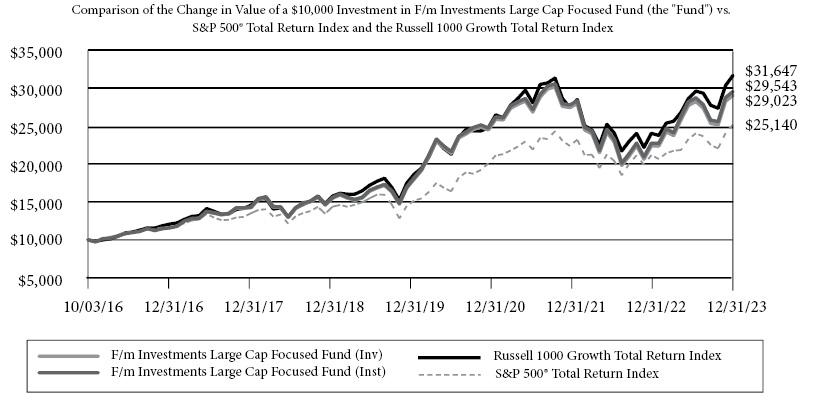

This chart illustrates the performance of a hypothetical $10,000 investment made on October 3, 2016, and reflects all Fund expenses. The chart is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains and dividends for the Fund and dividends for an index. Index returns do not reflect the effects of fees and expenses. It is not possible to invest directly in an index.

AVERAGE ANNUAL TOTAL RETURNS FOR THE PERIODs ENDED December 31, 2023 |

| | 6 Months† | 1 Year | 5 Year | Since

Inception

(10/03/2016) |

F/m Investments Large Cap Focused Fund - Investor Shares(a) | 4.78% | 40.72% | 17.50% | 15.85% |

F/m Investments Large Cap Focused Fund - Institutional Shares(a) | 4.84% | 41.05% | 17.79% | 16.13% |

S&P 500® Total Return Index | 8.04% | 26.29% | 15.69% | 13.57%(b) |

Russell 1000 Growth Total Return Index | 10.59% | 42.68% | 19.50% | 17.24%(b) |

(a) | The Fund commenced operations on October 3, 2016 as a separate series (the “Predecessor Fund”) of F/m Funds Trust. Effective as of the close of business on October 27, 2023, the Predecessor Fund was reorganized as a new series of The RBB Fund, Inc. (the “Reorganization”). The performance shown for periods prior to October 30, 2023 represents the performance of the Predecessor Fund. |

(b) | Benchmark performance is from inception date of the Fund only and is not the inception date of the benchmark itself. |

Performance data quoted represents past performance; past performance does not guarantee future results. Must be preceded or accompanied by a prospectus. The performance data quoted reflects fee waivers in effect and would have been less in their absence. The investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance

F/m Investments Large Cap Focused Fund

Performance Data

(Unaudited)

quoted. Performance data current to the most recent month end may be obtained by calling 1-800-292-6775. The Total Annual Fund Operating Expenses as stated in the Fund’s Prospectus dated October 30, 2023, are 1.14% and 0.89% for Investor Class and Institutional Class, respectively.

The S&P 500® Total Return Index is the total return version of the S&P 500® Index. Dividends are reinvested on a daily basis and all regular cash dividends are assumed reinvested in the index on the ex-dividend date.

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index which represent about 93% of the total market capitalization of that index.

F/m Investments Large Cap Focused Fund

Fund Expense Example

DECEMBER 31, 2023 (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the current fiscal period (July 1, 2023) and held until the end of the current fiscal period (December 31, 2023).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual EXPENSES – This section helps you to estimate the actual expenses that you paid over the current fiscal period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical EXAMPLES FOR COMPARISON PURPOSES – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor do they carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

| | Beginning

Account

Value

July 1,

2023 | | | Ending

Account

Value

December 31,

2023 | | | Expenses

Paid During

Period* | | | ANNUALIZED

EXPENSE

RATIO | *

| | Actual

Six-Month

Total

Investment

Returns

for the Fund | |

Investor Class | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,047.80 | | | $ | 5.92 | | | 1.15 | % | | | 4.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.36 | | | $ | 5.84 | | | 1.15 | % | | | N/A | |

| | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,048.40 | | | $ | 4.63 | | | 0.90 | % | | | 4.84 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | 0.90 | % | | | N/A | |

* | Expenses are equal to the Fund’s Investor Class and Institutional Class Shares annualized six-month expense ratio for the period July 1, 2023 through December 31, 2023, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. The Fund’s ending account values on the first line in the table are based on the actual six-month total investment return for the Fund’s respective share classes. |

F/m Investments Large Cap Focused Fund

Portfolio Information

(Unaudited)

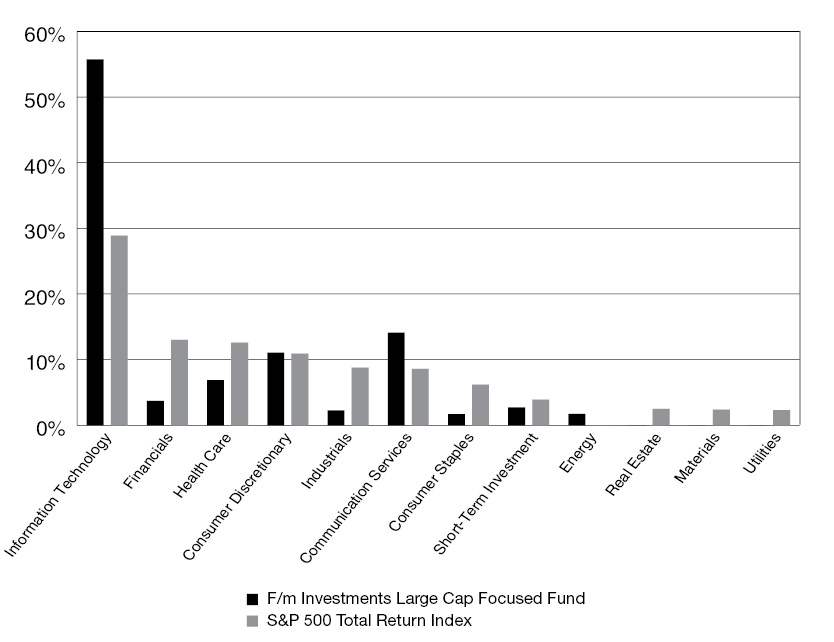

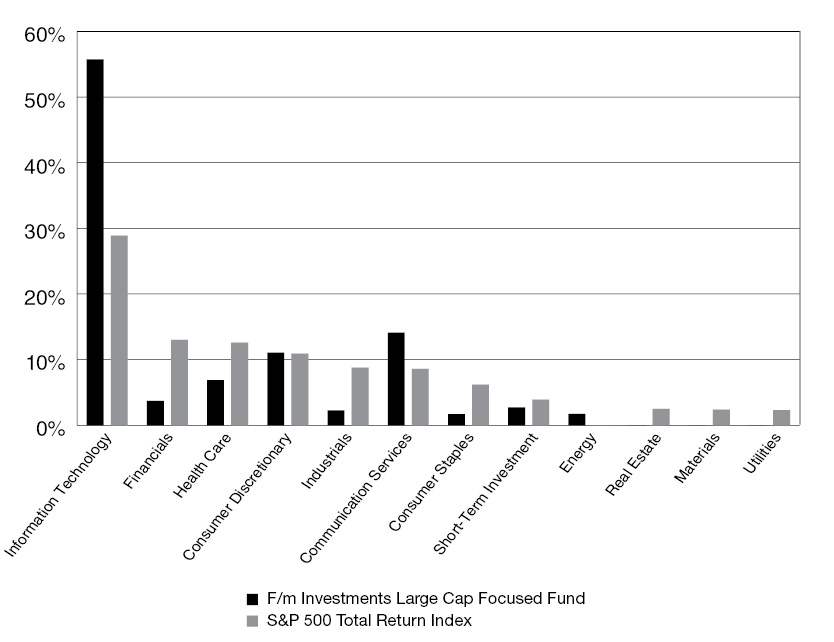

Sector Allocation (% of Net Assets)

Top 10 Long-Term Holdings

Security Description | | % of

Net Assets |

Apple, Inc. | | 11.5% |

Microsoft Corporation | | 9.6% |

Amazon.com, Inc. | | 9.0% |

Alphabet, Inc. - Class A | | 5.3% |

Adobe, Inc. | | 4.6% |

NVIDIA Corporation | | 4.5% |

Netflix, Inc. | | 4.4% |

Palo Alto Networks, Inc. | | 4.1% |

Advanced Micro Devices, Inc. | | 3.9% |

Penumbra, Inc. | | 3.2% |

F/m Investments Large Cap Focused Fund

Schedule of Investments

December 31, 2023 (UNAUDITED)

| | Shares | | | Value | |

COMMON STOCKS — 97.3% | | | | | | | | |

Communication Services — 14.1% | | | | | | | | |

Alphabet, Inc. - Class A(a) | | | 21,537 | | | $ | 3,008,503 | |

Meta Platforms, Inc. - Class A(a) | | | 7,257 | | | | 2,568,688 | |

Netflix, Inc.(a) | | | 5,141 | | | | 2,503,050 | |

| | | | | | | | 8,080,241 | |

Consumer Discretionary — 11.1% | | | | | | | | |

Amazon.com, Inc.(a) | | | 33,920 | | | | 5,153,805 | |

McDonald’s Corp. | | | 3,973 | | | | 1,178,034 | |

| | | | | | | | 6,331,839 | |

Consumer Staples — 1.7% | | | | | | | | |

Casey’s General Stores, Inc. | | | 3,536 | | | | 971,481 | |

| | | | | | | | | |

Energy — 1.7% | | | | | | | | |

Diamondback Energy, Inc. | | | 6,440 | | | | 998,715 | |

| | | | | | | | | |

Financials — 3.7% | | | | | | | | |

Arthur J Gallagher & Co. | | | 4,183 | | | | 940,673 | |

Everest Group Ltd. | | | 3,374 | | | | 1,192,979 | |

| | | | | | | | 2,133,652 | |

Health Care — 6.9% | | | | | | | | |

Cardinal Health, Inc. | | | 11,833 | | | | 1,192,766 | |

Veeva Systems, Inc. - Class A(a) | | | 7,181 | | | | 1,382,486 | |

Vertex Pharmaceuticals, Inc.(a) | | | 3,312 | | | | 1,347,620 | |

| | | | | | | | 3,922,872 | |

Industrials — 2.3% | | | | | | | | |

TransDigm Group, Inc. | | | 1,284 | | | | 1,298,894 | |

| | | | | | | | | |

Information Technology — 55.8%(b) | | | | | | | | |

Adobe, Inc.(a) | | | 3,703 | | | | 2,209,210 | |

Advanced Micro Devices, Inc.(a) | | | 15,866 | | | | 2,338,807 | |

Apple, Inc. | | | 34,114 | | | | 6,567,969 | |

Aspen Technology, Inc.(a) | | | 4,777 | | | | 1,051,657 | |

Datadog, Inc. - Class A(a) | | | 15,082 | | | | 1,830,653 | |

Microsoft Corp. | | | 14,637 | | | | 5,504,098 | |

MongoDB, Inc.(a) | | | 3,624 | | | | 1,481,672 | |

NVIDIA Corp. | | | 5,356 | | | | 2,652,398 | |

Palo Alto Networks, Inc.(a) | | | 4,197 | | | | 1,237,611 | |

Salesforce, Inc.(a) | | | 4,836 | | | | 1,272,545 | |

ServiceNow, Inc.(a) | | | 2,253 | | | | 1,591,722 | |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Schedule of Investments (Continued)

December 31, 2023 (UNAUDITED)

| | Shares | | | Value | |

COMMON STOCKS — 97.3% (continued) | | | | | | | | |

Information Technology — 55.8%(b) (continued) | | | | | | | | |

Snowflake, Inc. - Class A(a) | | | 7,109 | | | $ | 1,414,691 | |

Synopsys, Inc.(a) | | | 2,449 | | | | 1,261,015 | |

Workday, Inc. - Class A(a) | | | 5,293 | | | | 1,461,186 | |

| | | | | | | | 31,875,234 | |

TOTAL COMMON STOCKS (Cost $44,703,894) | | | | | | | 55,612,928 | |

| | | | | | | | | |

SHORT-TERM INVESTMENTS — 2.7% | | | | | | | | |

Money Market Funds — 2.7% | | | | | | | | |

First American Treasury Obligations Fund - Class X, 5.29%(c) | | | 1,555,255 | | | | 1,555,255 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,555,255) | | | | | | | 1,555,255 | |

| | | | | | | | | |

TOTAL INVESTMENTS — 100.0% (Cost $46,259,149) | | | | | | $ | 57,168,183 | |

Liabilities in Excess of Other Assets — 0.0%(d) | | | | | | | (23,669 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 57,144,514 | |

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | As of December 31, 2023, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. |

(c) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

(d) | Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Statements of Assets and Liabilities

December 31, 2023 (UNAUDITED)

ASSETS | | | | |

Investments in securities, at value (cost $46,259,149) | | $ | 57,168,183 | |

Dividends receivable | | | 12,401 | |

Prepaid expenses and other assets | | | 27,553 | |

Total assets | | | 57,208,137 | |

| | | | | |

LIABILITIES | | | | |

Payables for: | | | | |

Advisory fees | | | 35,044 | |

Administration and accounting fees | | | 18,941 | |

Distribution fees - Investor Class | | | 5,520 | |

Transfer agent fees | | | 3,181 | |

Other accrued expenses and liabilities | | | 937 | |

Total liabilities | | | 63,623 | |

| | | | | |

Net assets | | $ | 57,144,514 | |

| | | | | |

Net assets consist of: | | | | |

Par value | | $ | 3,894 | |

Paid-in capital | | | 51,881,393 | |

Total distributable earnings/(losses) | | | 5,259,227 | |

Net assets | | $ | 57,144,514 | |

| | | | | |

Investor Class Shares: | | | | |

Net assets | | $ | 13,358,031 | |

Shares outstanding ($0.001 par value, 100,000,000 shares authorized) | | | 922,774 | |

Net asset value, offering and redemption price per share | | $ | 14.48 | |

| | | | | |

Institutional Class Shares: | | | | |

Net assets | | $ | 43,786,483 | |

Shares outstanding ($0.001 par value, 100,000,000 shares authorized) | | | 2,971,003 | |

Net asset value, offering and redemption price per share | | $ | 14.74 | |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Statements of Operations

FOR THE SIX MONTHS ENDED December 31, 2023 (UNAUDITED)

INVESTMENT INCOME | | | | |

Dividends | | $ | 110,241 | |

Interest income | | | 112,271 | |

Total investment income | | | 222,512 | |

| | | | | |

EXPENSES | | | | |

Advisory fees (Note 2) | | | 200,708 | |

Administration and accounting fees | | | 47,760 | |

Distribution fees - Investor Class | | | 15,845 | |

Audit and tax fees | | | 11,861 | |

Director Fees | | | 11,575 | |

Transfer agent fees | | | 9,290 | |

Registration fees | | | 5,874 | |

Insurance fees | | | 5,331 | |

Printing and shareholder reporting fees | | | 5,032 | |

Officer fees | | | 4,000 | |

Custodian fees | | | 3,001 | |

Legal fees | | | 2,811 | |

Other fees | | | 11,197 | |

Total expenses before waivers and/or reimbursements | | | 334,285 | |

Less: waivers and/or reimbursements | | | (60,386 | ) |

Net expenses after waivers and/or reimbursements | | | 273,899 | |

Net investment income/(loss) | | | (51,387 | ) |

| | | | | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) FROM INVESTMENTS | | | | |

Net realized gain/(loss) from investments | | | 340,983 | |

Net change in unrealized appreciation/(depreciation) on investments | | | 2,145,487 | |

Net realized and unrealized gain/(loss) | | | 2,486,470 | |

| | | | | |

NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,435,083 | |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Statements of Changes in Net Assets

| | Six Months

Ended

December 31,

2023

(Unaudited) | | | Year Ended

June 30,

2023 | |

INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | | | | | | |

Net investment income/(loss) | | $ | (51,387 | ) | | $ | 67,379 | |

Net realized gain/(loss) from investments | | | 340,983 | | | | (1,383,722 | ) |

Net change in unrealized appreciation/(depreciation) on investments | | | 2,145,487 | | | | 15,737,874 | |

NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | 2,435,083 | | | | 14,421,531 | |

| | | | | | | | | |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Institutional Class | | | — | | | | (1,103,801 | ) |

Investor Class | | | — | | | | (6,385,005 | ) |

Total distributions to shareholders | | | — | | | | (7,488,806 | ) |

| | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Investor Class | | | | | | | | |

Proceeds from shares sold | | | 272,973 | | | | 2,882,866 | |

Reinvestments of distributions to shareholders | | | — | | | | 1,103,801 | |

Shares redeemed | | | (391,137 | ) | | | (2,559,333 | ) |

Total Investor Class | | | (118,164 | ) | | | 1,427,334 | |

| | | | | | | | | |

Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 1,292,229 | | | | 279,786 | |

Reinvestments of distributions to shareholders | | | — | | | | 6,385,005 | |

Shares redeemed | | | (7,828,772 | ) | | | (19,639,968 | ) |

Total Institutional Class | | | (6,536,543 | ) | | | (12,975,177 | ) |

Net increase/(decrease) in net assetes from capital share transactions | | | (6,654,707 | ) | | | (11,547,843 | ) |

TOTAL INCREASE/(DECREASE) IN NET ASSETS | | | (4,219,624 | ) | | | (4,615,118 | ) |

| | | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of period | | $ | 61,364,138 | | | $ | 65,979,256 | |

End of period | | $ | 57,144,514 | | | $ | 61,364,138 | |

| | | | | | | | | |

SHARE TRANSACTIONS | | | | | | | | |

Investor Class | | | | | | | | |

Shares sold | | | 20,252 | | | | 247,255 | |

Shares issued in reinvestment of distributions to shareholders | | | — | | | | 107,269 | |

Shares redeemed | | | (29,708 | ) | | | (212,368 | ) |

Net increase/(decrease) in shares | | | (9,456 | ) | | | 142,156 | |

| | | | | | | | | |

Institutional Class | | | | | | | | |

Shares sold | | | 89,122 | | | | 21,103 | |

Shares issued in reinvestment of distributions to shareholders | | | — | | | | 611,005 | |

Shares redeemed | | | (566,873 | ) | | | (1,588,452 | ) |

Net increase/(decrease) in shares | | | (477,751 | ) | | | (956,344 | ) |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Investor Class

Financial Highlights

Contained below is per share operating performance data for shares outstanding, total investment return/(loss), ratios to average net assets and other supplemental data for the respective periods. This information has been derived from information provided in the financial statements.

| | For the

Six Months

Ended

December 31, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | |

| | 2023(d)

(Unaudited) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 13.82 | | | $ | 12.57 | | | $ | 19.96 | | | $ | 15.90 | | | $ | 13.42 | | | $ | 12.98 | |

Net investment income/(loss) (a) | | | (0.03 | ) | | | (0.01 | ) | | | (0.08 | ) | | | (0.12 | ) | | | (0.03 | ) | | | 0.05 | |

Net realized and unrealized gain/(loss) from investments | | | 0.69 | | | | 3.04 | | | | (3.07 | ) | | | 6.59 | | | | 3.10 | | | | 1.05 | |

Net increase/(decrease) in net assets resulting from operations | | | 0.66 | | | | 3.03 | | | | (3.15 | ) | | | 6.47 | | | | 3.07 | | | | 1.10 | |

Dividends and distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.05 | ) | | | — | |

Net realized capital gains | | | — | | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.54 | ) | | | (0.66 | ) |

Total distributions | | | — | | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.59 | ) | | | (0.66 | ) |

Net asset value, end of period | | $ | 14.48 | | | $ | 13.82 | | | $ | 12.57 | | | $ | 19.96 | | | $ | 15.90 | | | $ | 13.42 | |

Total investment return/(loss) (b) | | | 4.78 | %(e) | | | 28.91 | % | | | (21.33 | )% | | | 42.64 | % | | | 23.56 | % | | | 9.42 | % |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 13,358 | | | $ | 12,887 | | | $ | 9,934 | | | $ | 13,643 | | | $ | 11,157 | | | $ | 9,788 | |

Ratio of total expenses to average net assets (c) | | | 1.36 | %(f) | | | 1.39 | % | | | 1.39 | % | | | 1.41 | % | | | 1.50 | % | | | 1.49 | % |

Ratio of net expenses to average net assets | | | 1.15 | %(f) | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

Ratio of net investment income/(loss) to average net assets | | | (0.37 | )%(f) | | | (0.11 | )% | | | (0.46 | )% | | | (0.63 | )% | | | (0.24 | )% | | | 0.36 | % |

Portfolio turnover rate | | | 67 | %(e) | | | 113 | % | | | 169 | % | | | 195 | % | | | 139 | % | | | 230 | % |

(a) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Had the Adviser and/or administrator not reduced/waived its fees, the total returns would have been lower. |

(c) | Ratios were determined based on expenses prior to any fee reductions/waivers by the Adviser and/or administrator (Note 2). |

(d) | Prior to the close of business on October 27, 2023, the Fund was a series (the “Predecessor Fund”) of the F/m Funds Trust Fund, an open-end management investment company organized as an Ohio business trust. The Predecessor Fund was reorganized into the Fund following the close of business on October 27, 2023 (the “Reorganization”). As a result of the Reorganization, the performance and accounting history of the Predecessor Fund was assumed by the Fund. Performance and accounting information prior to October 30, 2023 included herein is that of the Predecessor Fund. (Note 1). |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Institutional Class

Financial Highlights

Per share data for a share outstanding throughout each period:

| | For the

Six Months

Ended

December 31, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | | | For the

Year

Ended

June 30, | |

| | 2023(e)

(Unaudited) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 14.06 | | | $ | 12.72 | | | $ | 20.10 | | | $ | 15.96 | | | $ | 13.47 | | | $ | 13.02 | |

Net investment income/(loss) (a) | | | — | (b) | | | 0.02 | | | | (0.02 | ) | | | (0.05 | ) | | | — | (b) | | | 0.07 | |

Net realized and unrealized gain/(loss) from investments | | | 0.68 | | | | 3.10 | | | | (3.12 | ) | | | 6.60 | | | | 3.11 | | | | 1.06 | |

Net increase/(decrease) in net assets resulting from operations | | | 0.68 | | | | 3.12 | | | | (3.14 | ) | | | 6.55 | | | | 3.11 | | | | 1.13 | |

Dividends and distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) | | | (0.02 | ) |

Net realized capital gains | | | — | | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.54 | ) | | | (0.66 | ) |

Total distributions | | | — | | | | (1.78 | ) | | | (4.24 | ) | | | (2.41 | ) | | | (0.62 | ) | | | (0.68 | ) |

Net asset value, end of period | | $ | 14.74 | | | $ | 14.06 | | | $ | 12.72 | | | $ | 20.10 | | | $ | 15.96 | | | $ | 13.47 | |

Total investment return/(loss) (c) | | | 4.84 | %(f) | | | 29.31 | % | | | (21.12 | )% | | | 43.00 | % | | | 23.84 | % | | | 9.64 | % |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 43,786 | | | $ | 48,477 | | | $ | 56,045 | | | $ | 75,757 | | | $ | 41,963 | | | $ | 35,795 | |

Ratio of total expenses to average net assets (d) | | | 1.11 | %(g) | | | 1.14 | % | | | 1.14 | % | | | 1.16 | % | | | 1.25 | % | | | 1.24 | % |

Ratio of net expenses to average net assets | | | 0.90 | %(g) | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % | | | 0.90 | % |

Ratio of net investment income/(loss) to average net assets | | | (0.13 | )%(g) | | | 0.16 | % | | | (0.21 | )% | | | (0.38 | )% | | | 0.01 | % | | | 0.61 | % |

Portfolio turnover rate | | | 67 | %(f) | | | 113 | % | | | 169 | % | | | 195 | % | | | 139 | % | | | 230 | % |

(a) | Per share net investment income (loss) has been determined on the basis of average number of shares outstanding during the period. |

(b) | Rounds to less than $0.005 per share. |

(c) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Had the Adviser and/or administrator not reduced/waived its fees, the total returns would have been lower. |

(d) | Ratios were determined based on expenses prior to any fee reductions/waivers by the Adviser and/or administrator (Note 2). |

(e) | Prior to the close of business on October 27, 2023, the Fund was a series (the “Predecessor Fund”) of the F/m Funds Trust Fund, an open-end management investment company organized as an Ohio business trust. The Predecessor Fund was reorganized into the Fund following the close of business on October 27, 2023 (the “Reorganization”). As a result of the Reorganization, the performance and accounting history of the Predecessor Fund was assumed by the Fund. Performance and accounting information prior to October 30, 2023 included herein is that of the Predecessor Fund. (Note 1). |

The accompanying notes are an integral part of these financial statements.

F/m Investments Large Cap Focused Fund

Notes to Financial Statements

December 31, 2023 (UNAUDITED)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The RBB Fund Inc. (“RBB” or the “Company”) was incorporated under the laws of the State of Maryland on February 29, 1988 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. RBB is a “series fund,” which is a mutual fund divided into separate portfolios. Each portfolio is treated as a separate entity for certain matters under the 1940 Act, and for other purposes, and a shareholder of one portfolio is not deemed to be a shareholder of any other portfolio. Currently, RBB has fifty two separate investment portfolios, including the F/m Investments Large Cap Focused Fund (the “Fund”). The Fund commenced operations on October 3, 2016 as a separate series (the “Predecessor Fund”) of the F/m Funds Trust, an open end management investment company established as an Ohio business trust. Effective as of the close of business on October 27, 2023, the Predecessor Fund was reorganized into the Fund, as a new series of RBB in a tax-free reorganization (the “Reorganization”), whereby the Fund acquired all the assets and liabilities of the Predecessor Fund in exchange for shares of the Fund which were distributed pro rata by the Predecessor Fund to its shareholders in complete liquidation and termination of the Predecessor Fund. The Agreement and Plan of Reorganization pursuant to which the Reorganization was accomplished was approved by shareholders of the Predecessor Fund on June 29, 2023. Unless otherwise indicated, references to the “Fund” in these Notes to Financial Statements refer to the Predecessor Fund and Fund. The Fund currently offers two classes of shares: Investor Class shares (sold without any sales loads, but subject to a distribution and/or shareholder servicing fee of up to 0.25% of the average daily net assets attributable to Investor Class shares and requiring a $1,000 initial investment) and Institutional Class shares (sold without any sales loads and distribution and/or shareholder servicing fees and requiring a $100,000 initial investment). Each share class represents an ownership interest of the respective class in the same investment portfolio.

The investment objective of the Fund is long-term growth of capital.

RBB has authorized capital of one hundred billion shares of common stock of which 92.523 billion shares are currently classified into two hundred and thirty-two classes of common stock. Each class represents an interest in an active or inactive RBB investment portfolio.

As a tax-free reorganization, any unrealized appreciation or depreciation on the securities held by the Fund on the date of Reorganization was treated as a non-taxable event, thus the cost basis of the securities held reflects their historical cost basis as of the date of Reorganization. As a result of the Reorganization, the Fund is the accounting successor. The Reorganization was accomplished by a tax-free exchange of the Fund’s shares and value of net assets for the same shares and value of the Predecessor Fund’s shares. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Immediately prior to the Reorganization, the net assets, fair value of investments, net unrealized appreciation and fund shares outstanding of the Predecessor Fund were as follows:

Net Assets | | Fair Value of

Investments | | | Net Unrealized

Appreciation | | | Fund Shares

Outstanding | |

$ 50,119,303 | | $ | 50,294,970 | | | $ | 1,790,168 | | | | 4,024,353 | |

The end of the reporting period for the Fund is December 31, 2023, and the period covered by these Notes to Financial Statements is the six-month period ended December 31, 2023 (the “current fiscal period”).

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Portfolio valuation – The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its listed securities, including common stocks, on the basis of a security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted bid price. NASDAQ-listed securities are valued at the NASDAQ official closing price. Investments in registered investment companies, including money market funds, are reported at their respective NAV as reported by those companies. When using a quoted price and when the market for the security is

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value as determined by F/m Investments, LLC (the “Adviser”) as the Valuation Designee (as defined below), in accordance with procedures established by and under the general supervision of the board of directors of the Company (the “Board” or the “Directors”) pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended, (the “1940 Act”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade size; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

The Board has adopted a pricing and valuation policy for use by the Fund and its Valuation Designee (as defined below) in calculating the Fund’s NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Fund has designated the Adviser as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

FAIR VALUE MEASUREMENTS – The inputs and valuation techniques used to measure the fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| | ● | Level 1 – Prices are determined using quoted prices in active markets for identical securities. |

| | ● | Level 2 – Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | ● | Level 3 – Prices are determined using significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used, as of the end of the current fiscal period, in valuing the Fund’s investments carried at fair value:

| | Total | | | Level 1 | | | Level 2 | | | Level 3 | |

Common Stocks | | $ | 55,612,928 | | | $ | 55,612,928 | | | $ | — | | | $ | — | |

Short-Term Investments | | | 1,555,255 | | | | 1,555,255 | | | | — | | | | — | |

Total Investments* | | $ | 57,168,183 | | | $ | 57,168,183 | | | $ | — | | | $ | — | |

* | Please refer to the Schedule of Investments for further details. |

At the end of each quarter, management evaluates the classification of Levels 1, 2 and 3 assets and liabilities. Various factors are considered, such as changes in liquidity from the prior reporting period; whether or not a broker is willing to execute at the quoted price; the depth and consistency of prices from third party pricing services; and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the classification of Levels 1, 2 and 3 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

For fair valuations using significant unobservable inputs, U.S. generally accepted accounting principles (“U.S. GAAP”) requires the Fund to present a reconciliation of the beginning to ending balances for reported market values that presents changes attributable to total realized and unrealized gains or losses, purchase and sales, and transfers in and out of Level 3 during the period. Transfers in and out between levels are based on values at the end of the period. A reconciliation of Level 3 investments is presented only if the Fund had an amount of Level 3 investments at the end of the reporting period that was meaningful in relation to its net assets. The amounts and reasons for Level 3 transfers in and out of each level is disclosed when the Fund had an amount of total Level 3 transfers during the reporting period that was meaningful in relation to its net assets as of the end of the reporting period.

The Fund did not have any significant Level 3 transfers during the current fiscal period.

USE OF ESTIMATES – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and those differences could be significant.

INVESTMENT TRANSACTIONS, INVESTMENT INCOME AND EXPENSES – The Fund records security transactions based on trade date for financial reporting purposes. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes in determining realized gains and losses on investments. Interest income (including amortization of premiums and accretion of discounts) is accrued when earned. Dividend income is recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gains are recorded as a reduction of cost of investments and/or as a realized gain. The Fund’s investment income, expenses (other than class specific expenses) and unrealized and realized gains and losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day. Certain expenses are shared with The RBB Fund Trust (the “Trust”), a series trust of affiliated funds. Expenses incurred on behalf of a specific class, fund or fund family of the Company or Trust are charged directly to the class, fund or fund family (in proportion to net assets). Expenses incurred for all funds (such as director or professional fees) are charged to all funds in proportion to their average net assets of RBB and the Trust, or in such other manner as the Board deems fair or equitable. Expenses and fees, including investment advisory and administration fees, are accrued daily and taken into account for the purpose of determining the NAV of the Fund.

DIVIDENDS AND DISTRIBUTIONS to shareholders – Distributions to shareholders arising from net investment income and realized capital gains, if any, are declared and paid annually to shareholders. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date.

2. INVESTMENT ADVISER AND OTHER SERVICES

Effective October 30, 2023, under the terms of an investment advisory agreement between the Company, on behalf of the Fund, and the Adviser (the “Current Advisory Agreement”), the Adviser serves as the investment adviser to the Fund, and, the Fund pays the Adviser a fee, which is computed and accrued daily and paid monthly, at the annual rate of 0.70% of its average daily net assets.

Under an expense limitation agreement between the Company, on behalf of the Fund, and the Adviser (the “Current Expense Limitation Agreement”), the Adviser has contractually agreed until October 30, 2025 to reduce its investment advisory fees and to pay other operating expenses to the extent necessary to limit annual ordinary operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses) to 1.15% of the average daily net assets allocable to Investor Class shares and 0.90% of Institutional Class shares of the Fund. During the period from October 30, 2023 through December 31, 2023, the Adviser reduced advisory fees by $12,622.

Prior to October 30, 2023, the Adviser served as the investment adviser to the Predecessor Fund pursuant to an investment advisory agreement between the F/m Funds Trust, on behalf of the Predecessor Fund, and the Adviser (the “Prior Advisory Agreement”). The fee structure under the Prior Advisory Agreement was identical to the fee structure under the current Advisory Agreement. In addition, the Adviser contractually agreed through October 29, 2023 to limit the amount of the Predecessor Fund’s

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

total annual operating expenses pursuant to an expense limitation agreement (the “Prior Expense Limitation Agreement”) that had the same terms as the Fund’s Current Expense Limitation Agreement with the Adviser. During the period from July 1, 2023 through October 29, 2023, the Adviser reduced advisory fees to the Predecessor Fund by $47,764.

Advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause the Fund’s ordinary operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions, dividend expenses on short sales, and other expenditures which are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses) to exceed the expense caps that were in effect when the fees and expenses were paid, waived, or absorbed by the Adviser, as well as the expense cap currently in effect. As of December 31, 2023, the Adviser may in the future recover advisory fee reductions and expense reimbursements totaling $12,622. The Adviser may recover this amount no later than December 31, 2026. The advisory fees and expense waivers and/or reimbursement under the Prior Expense Limitation Agreement is not subject to repayment by the Fund.

During the current fiscal period, investment advisory fees accrued, waived and/or reimbursed were as follows:

GROSS

ADVISORY FEES | | WAIVERS AND/OR

REIMBURSEMENTS | | | RECOUPMENTS | | | NET

ADVISORY FEES | |

$ 200,708 | | $ | (60,386 | ) | | $ | — | | | $ | 140,322 | |

Ultimus Fund Solutions served as administrator for the Fund through October 27, 2023. Effective October 28, 2023, U.S. Bancorp Fund Services, LLC (“Fund Services”), doing business as U.S. Bank Global Fund Services, serves as administrator for the Fund. For providing administrative and accounting services, Fund Services is entitled to receive a monthly fee, subject to certain minimum and out of pocket expenses.

Ultimus Fund Solutions served as transfer and dividend disbursing agent for the Fund through October 27, 2023. Effective October 28, 2023, Fund Services serves as the Fund’s transfer and dividend disbursing agent. For providing transfer agent services, Fund Services is entitled to receive a monthly fee, subject to certain minimum and out of pocket expenses.

U.S. Bank, N.A. (the “Custodian”) provides certain custodial services to the Fund. The Custodian is entitled to receive a monthly fee, subject to certain minimum and out of pocket expenses.

Ultimus Fund Distributors, LLC served as the principal underwriter and distributor of the Fund’s shares pursuant to a distribution agreement with F/m Funds Trust through October 27, 2023. Effective October 28, 2023, Quasar Distributors, LLC (“Quasar”), a wholly-owned broker-dealer subsidiary of Foreside Financial Group, LLC, serves as the principal underwriter and distributor of the Fund’s shares pursuant to a distribution agreement with the Company.

DISTRIBUTION PLAN

The Fund has adopted a plan of distribution (the “Plan”), pursuant to Rule 12b-1 under the 1940 Act which permits Investor Class shares of the Fund to make payments to securities dealers and other financial organizations (including payments directly to the Adviser, Quasar, and Ultimus Fund Distributors, LLC) for expenses related to the distribution and servicing of the Fund’s Investor Class shares. The annual limitation for payment of expenses pursuant to the Plan is 0.25% of the Fund’s average daily net assets allocable to Investor Class shares. The Fund has not adopted a plan of distribution with respect to Institutional Class shares. During the current fiscal period, Investor Class shares of the Fund incurred $15,845 of distribution fees under the Plan.

DIRECTOR AND OFFICER COMPENSATION

The Directors of the Company receive an annual retainer and meeting fees for meetings attended. An employee of Vigilant Compliance, LLC serves as Chief Compliance Officer of the Company. Vigilant Compliance, LLC is compensated for the services provided to the Company. Key Bridge Compliance, LLC provided the Chief Compliance Officer and compliance services to F/m Funds Trust. Additionally, certain trustees of the Predecessor Fund were affiliated with the Adviser and were not paid by the Predecessor Fund for serving in such capacities. Employees of the Company serve as President, Chief Financial Officer, Chief Operating Officer, Secretary and Director of Marketing & Business Development of the Company. They are compensated by the

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

Company for services provided. Certain employees of Fund Services serve as officers of the Company. They are not compensated by the Fund or the Company. As of the end of the current fiscal period, there were no director and officer fees charged or paid by the Fund.

PRINCIPAL HOLDERS OF FUND SHARES

As of December 31, 2023, the following shareholders owned of record 25% or more of the outstanding shares of each Class:

NAME OF RECORD OWNER | | % Ownership | |

Investor Class shares | | | | |

Charles Schwab & Company, Inc. (for the benefit of its customers) | | | 87.81 | % |

Institutional Class shares | | | | |

National Financial Services, LLC (for the benefit of its customers) | | | 99.56 | % |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

3. Investment Transactions

During the current fiscal period, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $21,533,650 and $25,003,248, respectively.

4. Sector Risk

If the Fund has significant investments in the securities of issuers in industries within a particular business sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s NAV per share. From time to time, circumstances may affect a particular sector and the companies within such sector. For instance, economic or market factors, regulation or deregulation, or other developments may negatively impact all companies in a particular sector and therefore the value of the Fund’s portfolio would be adversely affected. As of December 31, 2023, the Fund had 55.8% of its net assets invested in the Information Technology sector.

5. FEDERAL INCOME TAX INFORMATION

The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal income tax provision is provided in the Fund’s financial statements.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of June 30, 2023:

Tax cost of portfolio investments | | $ | 52,812,221 | |

Gross unrealized appreciation | | $ | 10,264,839 | |

Gross unrealized depreciation | | | (1,604,098 | ) |

Net unrealized appreciation | | | 8,660,741 | |

Accumulated capital and other losses | | | (5,836,597 | ) |

Distributed earnings | | $ | 2,824,144 | |

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

The difference between the federal income tax cost of investments and the financial statement cost of investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales.

The tax character of distributions paid to shareholders during the year ended June 30, 2023 was as follows:

| | Ordinary Income | | | Long Term Capital Gain | | | Total Distributions | |

| | $ | — | | | $ | 7,488,806 | | | $ | 7,488,806 | |

As of June 30, 2023, the Fund had short-term capital loss carryforwards (“CLCFs”) in the amount of $5,836,597 for income tax purposes. These CLCFs, which do not expire, may be utilized in future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

For the year ended June 30, 2023, the Fund reclassified $7,055 of distributable earnings against paid-in capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, had no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on Federal income tax returns for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next year. The Fund identifies its major tax jurisdiction as U.S. Federal.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations. During the year ended June 30, 2023, the Fund did not incur any interest or penalties.

6. Contingencies and Commitments

The Fund indemnifies the Company’s officers and Directors for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

7. Non-Diversified Fund

The Fund is a non-diversified fund. A non-diversified fund may or may not have a diversified portfolio of investments at any given time and may have large amounts of assets invested in a very small number of companies, industries or securities. Such lack of diversification substantially increases market risks and the risk of loss associated with an investment in the Fund, because the value of each security will have a greater impact on the Fund’s performance and the value of each shareholder’s investment. When the value of a security in a non-diversified fund falls, it may have a greater impact on the Fund than it would have in a diversified fund.

8. NEW ACCOUNTING PRONOUNCEMENTS AND REGULATORY UPDATES

In June 2022, the FASB issued Accounting Standards Update 2022-03, which amends Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions (“ASU 2022-03”). ASU 2022-03 clarifies guidance for fair value measurement of an equity security subject to a contractual sale restriction and establishes new disclosure requirements for such equity securities. ASU 2022-03 is effective for fiscal years beginning after December 15, 2023 and for interim periods within those fiscal years, with early adoption permitted. Management is currently evaluating the impact of these amendments on the financial statements.

F/m Investments Large Cap Focused Fund

Notes to Financial Statements (continued)

December 31, 2023 (UNAUDITED)

In October 2022, the SEC adopted a final rule relating to tailored shareholder reports for mutual funds and exchange-traded funds and fee information in investment company advertisements. Beginning in July 2024, the Fund will be required to transmit concise and visually engaging shareholder reports that highlight key information. The Fund will also be required to tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request.

In December 2022, the FASB issued an Accounting Standards Update, ASU 2022-06, Reference Rate Reform (Topic 848) – Deferral of the Sunset Date of Topic 848 (“ASU 2022-06”). ASU 2022-06 is an amendment to ASU 2020-04, which provided optional guidance to ease the potential accounting burden due to the discontinuation of the London Inter-Bank Offered Rate and other interbank-offered based reference rates and which was effective as of March 12, 2020 through December 31, 2022. ASU 2022-06 extends the effective period through December 31, 2024. Management is currently evaluating the impact, if any, of applying ASU 2022-06.

9. Subsequent Events

Management has evaluated subsequent events through the date the financial statements were issued and determined that no subsequent events occurred that require disclosure.

F/m Investments Large Cap Focused Fund

Other Information

(Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-292-6775, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-800-292-6775, or on the SEC’s website at www.sec.gov.

The Company files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit on Form N-PORT. These filings are available upon request by calling 1-800-292-6775. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov and the Fund’s website www.fm-funds.com.

APPROVAL OF F/M INVESTMENTS LARGE CAP FOCUSED FUND

As required by the 1940 Act, the Board, including all of the Directors who are not “interested persons” of the Company, as that term is defined in the 1940 Act (the “Independent Directors”), considered the approval of the investment advisory agreement between the Adviser and the Company (the “Investment Advisory Agreement”) on behalf of the Fund, at a meeting of the Board held on February 8-9, 2023, as reconvened on February 16, 2023 (for this section only, the “Meeting”). At the Meeting, the Board, including all of the Independent Directors, approved the Investment Advisory Agreement for an initial period ending August 16, 2024. In approving the Investment Advisory Agreement, the Board considered information provided by the Adviser with the assistance and advice of counsel to the Independent Directors and the Company.

In considering the approval of the Investment Advisory Agreement, the Directors took into account all materials provided prior to and during the Meeting and at other meetings throughout the past year, the presentations made during the Meeting, and the discussions held during the Meeting. The Directors reviewed these materials with management of the Adviser, and discussed the Investment Advisory Agreement with counsel in executive sessions, at which no representatives of the Adviser were present. The Directors considered whether approval of the Investment Advisory Agreement would be in the best interests of the Fund and its shareholders and the overall fairness of the Investment Advisory Agreement. Among other things, the Directors considered (i) the nature, extent, and quality of services to be provided to the Fund by the Adviser; (ii) descriptions of the experience and qualifications of the personnel providing those services; (iii) the Adviser’s investment philosophy and process; (iv) the Adviser’s assets under management and client descriptions; (v) the Adviser’s soft dollar commission and trade allocation policies; (vi) the Adviser’s advisory fee arrangements and other similarly managed clients, as applicable; (vii) the Adviser’s compliance procedures; (viii) the Adviser’s financial information, insurance coverage and profitability analysis relating to providing services to the Fund; (ix) the extent to which economies of scale are relevant to the Fund; and (x) a report comparing the advisory fees and total expense ratio of the F/m Investments Large Cap Focused Fund, a series of F/m Funds Trust (the “Acquired Fund”) which was reorganized into the Fund, to those of its Morningstar peer group and comparing the performance of the Acquired Fund to the performance of its Morningstar peer group.

The Directors evaluated the nature, extent and quality of the services that the Adviser would provide under the Investment Advisory Agreement. Based on the information provided and the Directors’ prior experience with affiliates of the Adviser, the Directors concluded that the nature and extent of the services that the Adviser would provide under the Investment Advisory Agreement, as well as the quality of those services, was satisfactory.

The Directors examined fee information for the Fund, including a comparison of such information to other similarly situated funds, and the projected total expense ratio of the Fund. The Directors also noted that the Adviser had contractually agreed to waive its management fee and reimburse expenses for at least two years to limit total annual operating expenses to agreed upon levels for each share class of the Fund

The Directors also reviewed analyses of the estimated profitability of the Adviser related to its provision of advisory services to the Fund. Based on the information provided, the Directors concluded that the amount of fees payable under the Investment Advisory Agreement to the Adviser were reasonable in light of the nature and quality of the services provided.

The Directors reviewed information concerning the Acquired Fund’s investment performance, both absolutely as well as compared to its benchmark index and Morningstar peer group. The Directors considered the Acquired Fund’s investment performance in light of its investment objective and strategies. After considering all of the information, the Directors concluded that the Fund and its shareholders were likely to benefit from the Adviser’s provision of investment management services to the Fund.

F/m Investments Large Cap Focused Fund

Other Information

(Unaudited)

In considering the overall fairness of the Investment Advisory Agreement, the Directors assessed the degree to which economies of scale that would be expected to be realized as the Fund’s assets increased and the extent to which fee levels would reflect those economies of scale for the benefit of the Fund’s shareholders. The Directors noted that the Fund’s advisory fee structure did not contain any breakpoint reductions as the Fund’s assets grew in size, but that the feasibility of incorporating breakpoints would continue to be reviewed on a regular basis. The Directors determined that the fee schedule in the Investment Advisory Agreement was reasonable and appropriate.

In addition to the above factors, the Directors also considered other benefits to be received by the Adviser from its management of the Fund, including, without limitation, the ability to market its advisory services for similar products in the future.

Based on all of the information presented to and considered by the Directors and the conclusions that they reached, the Board determined to approve the Investment Advisory Agreement.

Investment Adviser

F/m Investments, LLC

3050 K Street, NW

Suite 201

Washington, DC 20007

Administrator and Transfer Agent

U.S.Bank Global Fund Services

P.O. Box 701

Milwaukee,Wisconsin 53201-0701

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1350 Euclid Avenue,

Suite 800

Cleveland, OH 44115

Legal Counsel

Faegre Drinker Biddle & Reath LLP

One Logan Square, Suite 2000

Philadelphia, Pennsylvania 19103-6996

Custodian

U.S. Bank, N.A.

1555 North River Center Drive, Suite 302

Milwaukee, Wisconsin 53212

Underwriter

Quasar Distributors, LLC

3 Canal Plaza, Suite 100

Portland, ME 04101

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | The Schedule of Investments is included as part of the report to shareholders filed under Item 1(a) of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive and principal financial officers have reviewed the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the registrant and by the registrant’s service provider. |

| (b) | There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable. |

(2) A separate certification for each principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Furnished herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | The RBB Fund, Inc. | |

| | | |

| By (Signature and Title)* | /s/ Steven Plump | |

| | Steven Plump, President | |

| | (principal executive officer) | |

| | | |

| Date | March 4, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Steven Plump | |

| | Steven Plump, President | |

| | (principal executive officer) | |

| | | |

| Date | March 4, 2024 | |

| | | |

| By (Signature and Title)* | /s/ James G. Shaw | |

| | James G. Shaw, Chief Financial Officer | |

| | (principal financial officer) | |

| | | |

| Date | 2/29/2024 | |

| * | Print the name and title of each signing officer under his or her signature. |

3