- TTEK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Tetra Tech (TTEK) DEF 14ADefinitive proxy

Filed: 13 Jan 04, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

TETRA TECH, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

3475 East Foothill Boulevard

Pasadena, California 91107

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 26, 2004

TO OUR STOCKHOLDERS:

We will hold our 2004 annual meeting of the stockholders of Tetra Tech, Inc., a Delaware corporation, on Thursday, February 26, 2004 at 10:00 a.m. at the Westin Pasadena, 191 North Los Robles Avenue, Pasadena, California 91101. As further described in the accompanying proxy statement, at this meeting we will:

Our board of directors has fixed the close of business on December 29, 2003 as the record date for the determination of stockholders entitled to vote at the meeting or any meetings held upon adjournment of the meeting. Only record holders of our common stock at the close of business on that day will be entitled to vote. A copy of our 2003 annual report to stockholders is enclosed with this notice, but is not part of the proxy soliciting material.

We invite you to attend and to vote in person.If you cannot attend, to assure that you are represented at the meeting, please sign and return the enclosed proxy card as promptly as possible in the enclosed postage prepaid envelope. You may revoke a previously delivered proxy at any time prior to the meeting. If you attend the meeting, you may vote in person, even if you previously returned a signed proxy.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| Janis B. Salin Vice President, General Counsel and Secretary | |

Pasadena, California January 20, 2004 |

| | Page | |||

|---|---|---|---|---|

| GENERAL INFORMATION | 1 | |||

| PROPOSAL NO. 1—ELECTION OF DIRECTORS | 3 | |||

| Information Concerning Nominees | 3 | |||

| Board Committees and Meetings | 5 | |||

| Director Compensation | 6 | |||

| Compensation Committee Interlocks and Insider Participation | 6 | |||

| Recommendation | 6 | |||

| OWNERSHIP OF SECURITIES | 7 | |||

| Section 16(a) Beneficial Ownership Reporting Compliance | 8 | |||

| Equity Compensation Plan Information | 9 | |||

| INFORMATION CONCERNING OUR EXECUTIVE OFFICERS | 10 | |||

| EXECUTIVE COMPENSATION | 13 | |||

| Summary of Cash and Certain Other Compensation | 13 | |||

| SUMMARY COMPENSATION TABLE | 13 | |||

| Stock Options | 14 | |||

| OPTION GRANTS IN LAST FISCAL YEAR | 14 | |||

| OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END OPTION VALUES | 15 | |||

| Employment Contracts, Termination of Employment and Change in Control Agreements | 15 | |||

| 2002 Stock Option Plan | 15 | |||

| 1992 Incentive Stock Plan | 16 | |||

| Employee Stock Purchase Plan | 16 | |||

| Executive Medical Reimbursement Plan | 16 | |||

| REPORT OF THE COMPENSATION COMMITTEE REGARDING COMPENSATION | 17 | |||

| Compensation Committee Responsibilities | 17 | |||

| Compensation Policy and Programs | 17 | |||

| Base Salary | 17 | |||

| Bonuses | 18 | |||

| Stock Options | 18 | |||

| Internal Revenue Code Section 162(m) | 19 | |||

| REPORT OF THE AUDIT COMMITTEE | 20 | |||

| STOCK PERFORMANCE GRAPH | 21 | |||

| PROPOSAL NO. 2—APPROVAL OF THE AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN | 22 | |||

| Summary | 22 | |||

| Federal Income Tax Consequences | 23 | |||

| Plan Benefits | 23 | |||

| New Plan Benefits | 24 | |||

| Vote Required | 24 | |||

| Recommendation | 24 | |||

| PROPOSAL NO. 3—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 25 | |||

| Principal Accountant Fees and Services | 25 | |||

| Audit Fees | 25 | |||

| Audit-Related Fees | 25 | |||

| Tax Fees | 26 | |||

| All Other Fees | 26 | |||

i

| Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | 26 | |||

| Vote Required | 26 | |||

| Recommendation | 26 | |||

| CORPORATE GOVERNANCE | 26 | |||

| STOCKHOLDER COMMUNICATIONS WITH THE BOARD | 27 | |||

| STOCKHOLDER PROPOSALS FOR 2005 ANNUAL MEETING | 27 | |||

| Requirements for Stockholder Proposals to be Considered for Inclusion in Our Proxy Materials | 27 | |||

| Requirements for Stockholder Proposals to be Brought Before the Annual Meeting | 27 | |||

| ANNUAL REPORT AND FORM 8-K | 28 | |||

| OTHER MATTERS | 28 | |||

| APPENDIX A—Tetra Tech, Inc. Board of Directors Audit Committee Charter | A-1 | |||

| APPENDIX B—Tetra Tech, Inc. Employee Stock Purchase Plan (As Amended Through November 17, 2003) | B-1 | |||

ii

3475 East Foothill Boulevard

Pasadena, California 91107

GENERAL INFORMATION

We are sending you this proxy statement on or about January 20, 2004 in connection with the solicitation of proxies by our board of directors. The proxies are for use at our 2004 annual meeting of stockholders, which we will hold at 10:00 a.m. on Thursday, February 26, 2004, at the Westin Pasadena, 191 North Los Robles Avenue, Pasadena, California 91101. The proxies will remain valid for use at any meetings held upon adjournment of that meeting. The record date for the meeting is the close of business on December 29, 2003. All holders of record of our common stock on the record date are entitled to notice of the meeting and to vote at the meeting and any meetings held upon adjournment of that meeting. Our principal executive offices are located at 3475 East Foothill Boulevard, Pasadena, California 91107, and our telephone number is (626) 351-4664.

A proxy form is enclosed. Whether or not you plan to attend the meeting in person, please date, sign and return the enclosed proxy as promptly as possible, in the postage prepaid envelope provided, to ensure that your shares will be voted at the meeting. You may revoke your proxy at any time prior to its use by filing with our secretary an instrument revoking it or a duly executed proxy bearing a later date or by attending the meeting and voting in person.

Unless you instruct otherwise, your proxy, if not revoked, will be voted at the meeting:

Our only voting securities are the outstanding shares of our common stock. At the record date, we had 54,453,130 shares of common stock outstanding and 2,842 stockholders of record. For each share of common stock you hold on the record date, you are entitled to one vote on all matters that we will consider at this meeting. You are not entitled to cumulate your votes. If the stockholders of record present in person or represented by their proxies at the meeting hold at least a majority of our outstanding shares of common stock, a quorum will exist for the transaction of business at the meeting. If such stockholders hold less than a majority, the meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. Stockholders of record who abstain from voting, including brokers holding their customers' shares who cause abstentions to be recorded, are counted as present for quorum purposes.

Brokers holding shares of record for their customers generally are not entitled to vote on some matters unless their customers give them specific voting instructions. If the broker does not receive specific instructions, the broker will note this on the proxy form or otherwise advise us that it lacks voting authority. The votes that the brokers would have cast if their customers had given them specific instructions are commonly called "broker non-votes." Broker non-votes are not counted as votes cast. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

The voting requirements for the proposals we will consider at the meeting are:

We will pay for the cost of preparing, assembling, printing and mailing this proxy statement and the accompanying form of proxy to our stockholders, as well as the cost of soliciting proxies relating to the meeting. We have retained the services of Georgeson Shareholder Communications Inc. to assist in obtaining proxies from brokers and nominees of stockholders for the meeting. The estimated cost of such services is $7,500 plus out-of-pocket expenses. In addition, we may request banks and brokers to solicit their customers who beneficially own our common stock listed of record in names of nominees. We will reimburse these banks and brokers for their reasonable out-of-pocket expenses regarding these solicitations. Our officers, directors and employees may supplement the original solicitation by mail of proxies, by telephone, facsimile, e-mail and personal solicitations. We will pay no additional compensation to our officers, directors and employees for these activities.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the meeting, you will elect eight directors to serve for a term of office of the coming year or until their respective successors are elected and qualified. Upon the recommendation of our Nominating and Corporate Governance Committee, our board has nominated Li-San Hwang, James M. Jaska, J. Christopher Lewis, Patrick C. Haden, James J. Shelton, Daniel A. Whalen, Hugh M. Grant and Richard H. Truly for election as directors. Each nominee is a member of our board, has consented to being named in this proxy statement as a nominee for election as a director and has agreed to serve as a director if elected.

The persons named as proxies in the accompanying form of proxy have advised us that they intend to vote the shares covered by the proxies for the election of the nominees named above. If any one or more of such nominees are unable to serve, or for good cause will not serve, the persons named as proxies may vote for the election of such substitute nominees that our board may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter. The persons named as proxies in the accompanying form of proxy may not vote for a greater number of persons than the number of nominees named above.

No arrangement or understanding exists between any nominee and any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee. The nominees do not have any family relationship among themselves or with any of our executive officers.

Information Concerning Nominees

| Name | Age | Position | ||

|---|---|---|---|---|

| Li-San Hwang | 68 | Chairman of the Board and Chief Executive Officer | ||

James M. Jaska | 52 | President and Director | ||

J. Christopher Lewis | 47 | Director | ||

Patrick C. Haden | 50 | Director | ||

James J. Shelton | 87 | Director | ||

Daniel A. Whalen | 56 | Director | ||

Hugh M. Grant | 67 | Director | ||

Richard H. Truly | 66 | Director |

Dr. Hwang joined our predecessor in 1967 and has held his present positions since our acquisition of the Water Management Group of Tetra Tech, Inc., a subsidiary of Honeywell Inc., in March 1988. Dr. Hwang was named the Director of Engineering in 1972 and a Vice President in 1974. Prior to the acquisition, Dr. Hwang was Senior Vice President of Operations. He has served as an advisor to numerous government and professional society committees and has published extensively in the field of hydrodynamics. Dr. Hwang is a graduate of the National Taiwan University, Michigan State University and the California Institute of Technology, holding B.S., M.S. and Ph.D. degrees, respectively, in Civil Engineering, specializing in water resources.

Mr. Jaska joined us in 1994 as our Vice President, Chief Financial Officer and Treasurer. He was named President in November 2001. In January 2003, he joined our board and resigned the offices of Chief Financial Officer and Treasurer. From 1991 to 1994, Mr. Jaska held several operations and management positions at Alliant Techsystems, Inc., in addition to leading the environmental business

3

venture and having operational responsibility for large government defense plants. From 1981 to 1990, he held various finance and business management positions at Honeywell Inc. From 1977 to 1981, Mr. Jaska managed regulatory affairs dealing with the production of specialty chemicals at Ecolab, Inc. Mr. Jaska also served as an advisor to numerous governmental and professional committees. Mr. Jaska holds B.S. and M.S. degrees from Western Illinois University and completed an executive management program through Harvard University.

Mr. Lewis has been a member our board since February 1988. Mr. Lewis has been a general partner of Riordan, Lewis & Haden, a Los Angeles-based partnership that invests equity in high-growth middle market companies, since 1982. Mr. Lewis also serves as a director of SM&A, a provider of management consulting, proposal management and program support services; California Beach Restaurants, Inc., an owner and operator of restaurants; and several privately-held companies.

Mr. Haden has been a member of our board since December 1992. Mr. Haden is a general partner of Riordan, Lewis & Haden, which he joined in 1987. Mr. Haden also serves as a director of IndyMac Bancorp, Inc., the holding company for IndyMac Bank, and as a director of IndyMac Bank. IndyMac Bank is a technology-based mortgage banker. In addition, Mr. Haden serves as a director of TCW Convertible Securities Fund, Inc., a diversified, closed-end management investment company, and TCW Galileo Mutual Funds, a registered investment company. Further, Mr. Haden serves as a director of several privately-held companies.

Mr. Shelton has been a member of our board since March 1995. Since 1985, Mr. Shelton has been a self-employed investor and venture capitalist. He is the former (retired) President of the Baker Drilling Equipment Co., and formerly served as the President and Chief Executive Officer and as a director of Baker Hughes Incorporated (formerly Baker International Corp.). During his tenure at Baker International Corp., Mr. Shelton oversaw the acquisition of several companies and served as a director of these companies following their acquisition. In addition, he has served as the president, chief executive officer and as a director of several privately-held companies, and as a trustee of the American Funds, a large mutual fund family.

Mr. Whalen has been a member of our board since July 1997. He is a former President of Whalen & Company, Inc. (WAC), one of our subsidiaries, and served as one of our former executive officers. Mr. Whalen joined our board upon our acquisition of WAC in June 1997. Prior to founding WAC, in 1987, Mr. Whalen co-founded and served as an executive officer of First Cellular Group, Inc., The Microwave Group, Inc., Network Building & Consulting, Inc. and Cellular Development Company. Earlier, he was Vice President-Operations of American Tele-Services, Inc. and Director of Operations of NYNEX Mobile Services.

Mr. Grant joined our board in January 2003. He has been a business consultant since 1996. Prior to 1996, Mr. Grant spent approximately 38 years with Ernst & Young LLP (Arthur Young & Company before its 1989 merger with Ernst & Whinney) where, among other things, he was Vice-Chairman and Regional Managing Partner—Western United States. Mr. Grant serves as a director and Chairman of the Audit Committee of IndyMac Bancorp, Inc., and as a director of IndyMac Bank. He also serves as a director and Chairman of the Audit Committee of Inglewood Park Cemetery.

Admiral Truly joined our board in April 2003. He is the Executive Vice President of Midwest Research Institute (MRI), a position he has held since 1997. Prior to joining MRI, Admiral Truly was Vice President of the Georgia Institute of Technology, and Director of the Georgia Tech Research Institute, from 1992 to 1997. From 1989 to 1992, he served as NASA's eighth Administrator under President George H. Bush, and prior to that, had a distinguished career in the U.S. Navy and NASA, retiring from the Navy as Vice Admiral. Admiral Truly was an astronaut with NASA and piloted theColumbia, commanded theChallenger and, in 1986, led the investigation of theChallenger accident. Admiral Truly was awarded the Presidential Citizen's Medal, has served on the Defense Policy Board and Army Science Board, and is a member of the National Academy of Engineering.

4

Board Committees and Meetings

Our board of directors held six meetings during fiscal 2003. Each of our directors attended or participated in more than 75% of the aggregate of the total number of meetings of the board and the total number of meetings held by all committees of the board on which each such director served (during the period within which each was a director or member of such committee) during fiscal 2003. Our board has determined that Messrs. Lewis, Haden, Shelton, Grant and Truly, who represent a majority of the members of our board, are "independent directors" as defined in the Marketplace Rules of the National Association of Securities Dealers, Inc.

We have three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The current members of the committees are identified in the following table.

| Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

|---|---|---|---|---|---|---|

| J. Christopher Lewis | Chairman | Chairman | X | |||

Patrick C. Haden | X | X | Chairman | |||

James J. Shelton | X | X | ||||

Hugh M. Grant | X | X | X | |||

Richard H. Truly | X | X |

Our board established our Audit Committee, which, among other things, is responsible for reviewing our accounting and financial reporting process and major issues regarding accounting and auditing principles and practices, our financial statements and financial statement audits, the adequacy of our internal controls, and selecting and reviewing the performance of our independent auditor. Our Audit Committee operates under a written charter that was amended in March 2003. A copy of the Audit Committee Charter is attached hereto as Appendix A. This committee held eight meetings during the last fiscal year, and its members were Messrs. Lewis, Haden, Shelton and Grant. Our board has determined that Mr. Grant is an "audit committee financial expert" as defined in Item 401(h) of Regulation S-K. Mr. Grant and each of the other members of this Committee is an "independent director" as defined in the Marketplace Rules of the National Association of Securities Dealers, Inc.

Our Compensation Committee reviews the performance of our chief executive officer and other executives, establishes the compensation of our chief executive officer and establishes the compensation levels of our other executive officers based, in part, on our chief executive officer's recommendations. The Committee's goal is to ensure that the compensation system for our executives is aligned with the long-term interest of our stockholders. Toward that end, the Compensation Committee oversees our equity plans, including our 2002 Stock Option Plan. This Committee held two meetings during the last fiscal year, and its members were Messrs. Lewis and Haden. Each of the members of the Compensation Committee is an "independent director" as defined in the Marketplace Rules of the National Association of Securities Dealers, Inc., and an "outside director" as defined in Section 162(m) of the Internal Revenue Code.

Our Nominating and Corporate Governance Committee is responsible for recommending to the full board candidates for election to the Board of Directors, making recommendations to the board regarding the membership of the committees of the board, and reviewing and making recommendations to the board regarding our governance processes and procedures. This Committee held one meeting during the last fiscal year, and its members were Messrs. Lewis and Haden. Each member of this Committee is an "independent director" as defined in the Marketplace Rules of the National Association of Securities Dealers, Inc.

5

Our Nominating and Corporate Governance Committee will consider nominees for election as director recommended by stockholders. According to our Corporate Governance Principles, candidates for director will be selected for their character, judgment, business experience and acumen. Expertise, prior government service and familiarity with national issues affecting our business are among the relevant criteria. Our Nominating and Corporate Governance Committee Charter, which can be found on our corporate website at www.tetratech.com, addresses our director nominations process and such related matters as may be required under federal securities laws. This Committee will conduct any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the board, and recommend nominees for approval by the board and the stockholders. To date, we have not paid a fee to any third party to assist in the process of identifying or evaluating director candidates. To date, we have not rejected a timely director nominee from a stockholder or stockholders holding more than 5% of our voting stock. To recommend a prospective nominee for the Nominating and Corporate Governance Committee's consideration, stockholders should submit the candidate's name and qualifications to our Secretary in writing at the following address: Tetra Tech, Inc., Attn: Secretary, 3475 East Foothill Boulevard, Pasadena, California 91107, with a copy to Tetra Tech, Inc., Attn: General Counsel at the same address.

Director Compensation

During fiscal 2003, each director who was not an employee received (i) an annual retainer fee of $35,000 (or $26,250 in the case of Admiral Truly who became a director in April 2003), (ii) a fee of $2,000 per board meeting attended; and (iii) a fee of $1,000 per committee meeting attended.

In addition, under our 2003 Outside Director Stock Option Plan, each of Messrs. Lewis, Haden, Shelton, Whalen and Grant received an annual grant of an option to purchase 8,000 shares of our common stock on March 1, 2003. The exercise price of each option was $13.16 per share, the fair market value on the date of grant. Each option vests and becomes exercisable in full on March 1, 2004 if the director has not ceased to be a director prior to such date. In addition, Mr. Grant and Admiral Truly each received an appointment grant of an option to purchase 2,500 shares of our common stock on February 1, 2003 and August 1, 2003, respectively, at exercise prices of $12.85 and $15.70 per share, respectively, the fair market value on the date of grant. These options vest on the first anniversary of the grant date if the director has not ceased to be a director prior to such date. Shares underlying the options granted under the 2003 Outside Director Stock Option Plan vest immediately in full upon certain changes in our control or ownership or upon the optionee's death, disability or retirement while a member of the board.

Directors who are also employees are eligible to receive options under our 2002 Stock Option Plan and to participate in our Employee Stock Purchase Plan, 401(k) retirement plan and bonus program.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee was at any time during fiscal year 2003 or at any other time one of our officers or employees, and no member of this Committee had any relationship with us requiring disclosure under Item 404 of Regulation S-K.

None of our executive officers has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers serving as a member of our board or our Compensation Committee during fiscal year 2003.

Recommendation

Our Board believes that the election of each of the nominees is in our best interests and the best interests of our stockholders and unanimously recommends a vote "FOR" the election of each of the nominees. Your proxies will be voted for the slate of nominees unless you specifically indicate otherwise.

6

The following table sets forth information regarding the ownership of our common stock as of December 15, 2003 by:

Except as otherwise noted, we know of no agreements among our stockholders which relate to voting or investment power over our common stock or any arrangement the operation of which may at a subsequent date result in a change of control of us.

| Name of Beneficial Owner(1) | Number of Shares Beneficially Owned(1) | Percentage Owned(2) | |||

|---|---|---|---|---|---|

| T. Rowe Price Associates, Inc. (3) 100 East Pratt Street Baltimore, Maryland 21202 | 4,784,700 | 8.8 | % | ||

Liberty Wanger Asset Management, L.P. and WAM Acquisition GP, Inc.(4) 227 West Monroe Street, Suite 3000 Chicago, Illinois 60606 | 2,693,000 | 5.0 | |||

Li-San Hwang (5) | 1,828,424 | 3.4 | |||

James M. Jaska (6) | 149,475 | * | |||

J. Christopher Lewis (7) | 75,898 | * | |||

Patrick C. Haden (8) | 25,380 | * | |||

James J. Shelton (9) | 34,800 | * | |||

Daniel A. Whalen (10) | 374,992 | * | |||

Hugh M. Grant (11) | 2,500 | * | |||

Richard H. Truly | — | — | |||

David W. King (12) | 12,500 | * | |||

Richard A. Lemmon (13) | 72,709 | * | |||

James T. Haney (14) | 22,625 | * | |||

All directors and executive officers as a group (19 persons) (15) | 2,809,988 | 5.2 | % |

7

beneficially owned. The number of shares beneficially owned by each person or group as of December 15, 2003 includes shares of common stock that such person or group had the right to acquire on or within 60 days after December 15, 2003, including, but not limited to, upon the exercise of options.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires "insiders," including our executive officers, directors and beneficial owners of more than 10% of our common stock, to file reports of ownership and changes in ownership of our common stock with the Securities and Exchange Commission and to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of such forms received by us and written representations from the executive officers and directors, we believe that our insiders complied with all applicable Section 16(a) filing requirements during fiscal 2003, except that Craig Christensen, Vice President and Controller, filed a late Form 4 with respect to two stock option exercises and the concurrent donations of an aggregate of 900 shares acquired upon exercise of these options.

8

Equity Compensation Plan Information

The following table provides information as of September 28, 2003 with respect to the shares of our common stock that may be issued under our existing equity compensation plans. All of our existing plans have been approved by our stockholders.

| | | | C | |||||

|---|---|---|---|---|---|---|---|---|

| | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column A) | |||||

| | A | B | ||||||

| | Number of Securities to be Issued Upon Exercise of Outstanding Options (1) | Weighted Average Exercise Price of Outstanding Options | ||||||

| Equity Compensation Plans Approved by Stockholders (2) | 5,312,047 | $ | 14.24 | 2,505,067 | (3) | |||

9

INFORMATION CONCERNING OUR EXECUTIVE OFFICERS

| Name | Age | Position | ||

|---|---|---|---|---|

| Li-San Hwang | 68 | Chairman of the Board and Chief Executive Officer | ||

James M. Jaska | 52 | President | ||

David W. King | 47 | Executive Vice President, Chief Financial Officer and Treasurer | ||

Richard A. Lemmon | 44 | Executive Vice President, Administration | ||

James T. Haney | 58 | Senior Vice President | ||

Dan L. Batrack | 45 | Senior Vice President | ||

Mark A. Walsh | 43 | Senior Vice President | ||

Sam W. Box | 58 | Senior Vice President | ||

Charles R. Faust | 57 | Vice President | ||

Arkan Say | 68 | Vice President | ||

Craig L. Christensen | 50 | Vice President and Controller | ||

Janis B. Salin | 50 | Vice President, General Counsel and Secretary | ||

Michael A. Bieber | 35 | Vice President, Investor Relations |

Our executive officers are elected by and serve at the discretion of our board of directors. Set forth below is a brief description of the business experience of all executive officers other than Li-San Hwang and James M. Jaska. For information concerning Dr. Hwang and Mr. Jaska, who are also directors and are nominees for re-election as directors, see "Proposal No. 1—Election of Directors—Information Concerning Nominees."

Mr. King joined us in November 2002 as Executive Vice President of Finance. He was named Chief Financial Officer and Treasurer in January 2003. Previously, Mr. King served as the Vice President of Finance and Operations at Walt Disney Imagineering in Los Angeles. From 1996 to 1999, he was the Chief Financial Officer of the Asia Pacific region for Bechtel Group, Inc., based in Hong Kong. Prior to his position at Bechtel, Mr. King had a decade of professional experience with Price Waterhouse in Seattle, Los Angeles and Hong Kong, specializing in international investment. Mr. King holds a B.A. degree in Business Administration from the University of Washington and is a Certified Public Accountant.

Mr. Lemmon joined our predecessor (the Water Management Group of Tetra Tech, Inc., a subsidiary of Honeywell Inc.) in 1981 in a technical capacity. In 1985, he joined our predecessor's corporate staff in a management position. In 1988, at the time of our predecessor's divestiture from Honeywell Inc., Mr. Lemmon structured and managed many of our corporate functions. In 1990, he was promoted to Director of Administration. Mr. Lemmon was elected a Vice President in November 1995 and was named Executive Vice President in December 2000. He serves as our Risk Manager. Mr. Lemmon holds a B.A. degree in Business Administration.

Mr. Haney joined us in May 2001 through the acquisition of our Maxim Technologies, Inc. (MTI) subsidiary, and was named a Vice President in December 2001. Mr. Haney joined Maxim Engineers, Inc., the predecessor of MTI, in 1992 as president and chief executive officer. During his tenure at Maxim Engineers, Inc., Mr. Haney was directly involved in the acquisition of the U.S.

10

subsidiary of Huntingdon International Holdings, PLC, Huntingdon Engineering and Environmental, Inc. and the formation of Maxim Technologies, Inc. Prior to his positions at MTI, among other companies, Mr. Haney held several engineering and management positions at Lockwood Greene Engineers, Inc. and served as Captain and Project Officer in the Biomedical Sciences Corps for the U.S. Air Force Weapons Laboratory. Mr. Haney holds B.S. and M.S. degrees in Chemical Engineering from Clemson University.

Mr. Batrack joined our predecessor in 1980 and was named Senior Vice President in November 2002. Mr. Batrack has served us in numerous capacities over the last 23 years, including project scientist, project manager, office manager, operations manager and vice president. He has managed complex solutions for many small and Fortune 500 customers, both in the U.S and internationally. Mr. Batrack holds a degree B.A. in Business Administration from the University of Washington.

Mr. Walsh joined us in 1995 through the acquisition of our Tetra Tech EM Inc. (EMI) subsidiary, and was named Senior Vice President in November 2002. Mr. Walsh joined EMI in 1987, and has served as information systems manager, office manager and vice president. He currently serves as the president of EMI. From 1985 to 1987, Mr. Walsh served as an environmental consultant to government agencies with Booz, Allen and Hamilton, Inc. Mr. Walsh has broad business development and contract management expertise with commercial clients and many government customers, including the Department of Defense, Environmental Protection Agency, Department of Energy, and numerous state and local agencies. He has published several articles for governmental research and professional associations. Mr. Walsh holds a B.S. degree in Environmental Resource Management and a Master's degree in Public Administration from Pennsylvania State University.

Mr. Box joined us in March 2003 through our acquisition of the assets of Foster Wheeler Environmental Corporation (FWEC), and was named Senior Vice President in November 2003. He also serves as president of our Tetra Tech FW, Inc. subsidiary. Mr. Box has over 34 years of experience in engineering, construction and environmental services. He served as chairman, president and chief executive officer of FWEC from October 1994 to March 2003. He joined Foster Wheeler Ltd., the parent of FWEC, in 1993. Previously, Mr. Box was with Morrison Knudsen Corporation (now Washington Group International) for 17 years, where he headed the environmental division and held several other executive management positions. Mr. Box holds a B.S. degree in Civil Engineering from the University of California.

Dr. Faust, Vice President since 1988 and president of our GeoTrans, Inc. (GTI) subsidiary, co-founded GTI in 1979. In addition to his management responsibilities, he is engaged in the quantitative assessment and investigation of highly technical groundwater problems. He has published 23 articles and has co-authored a book on groundwater modeling. Dr. Faust holds B.S. and Ph.D. degrees in Geology from Pennsylvania State University.

Mr. Say joined Edward H. Richardson & Associates (a firm that was acquired by our predecessor in 1981 and became one of our divisions in 1991) in 1958. He was named to his present position in November 2002. Mr. Say has authored several publications on site development, engineering and storm drainage. He holds a B.S. degree in Civil Engineering from Robert College in Istanbul, Turkey and an M.S. degree in Civil Engineering from the University of Delaware.

Mr. Christensen joined us in 1998 through the acquisition of our Tetra Tech NUS, Inc. subsidiary, and was named Vice President and Controller in November 2002. Previously, Mr. Christensen held positions at the NUS, Brown and Root Services, and Landmark Graphics subsidiaries of Halliburton Company where his responsibilities included contracts administration, finance and system development. Prior to his service at Halliburton, Mr. Christensen held positions at Burroughs Corporation and Apple Computer. Mr. Christensen holds B.A. and M.B.A. degrees from Brigham Young University.

11

Ms. Salin joined us in February 2002 and was named Vice President and General Counsel in November 2002. She was elected Secretary in November 2003. For the prior 17 years, Ms. Salin was a Principal with the law firm of Riordan & McKinzie (which was acquired by Bingham McCutchen LLP in July 2003), and served as Managing Principal of that firm from 1990 to 1992. She served as our outside counsel from the time of our formation in 1988. Ms. Salin holds B.A. and J.D. degrees from the University of California at Los Angeles.

Mr. Bieber joined us in 1996 as a proposal manager. He was named Director of Investor Relations in 2000 and was elected Vice President, Investor Relations in November 2003. From 1994 to 1996, Mr. Bieber served as a government proposal consultant at CRC Environmental, and its successor, Smith Environmental. Prior to that, he worked for IT Corporation (now The Shaw Group Inc.), where he served as project manager on government nuclear projects and was a staff engineer. Mr. Bieber holds a B.S. degree in Civil Engineering from the Tennessee Technological University.

12

Summary of Cash and Certain Other Compensation

The following table sets forth the compensation paid or accrued by us for each of the last three fiscal years to the following persons:

Compensation is presented only for years in which each person was an executive officer. We have not granted restricted stock or stock appreciation rights to any of the persons listed below during the past three fiscal years.

SUMMARY COMPENSATION TABLE

| | Compensation | | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Annual Compensation | | Long Term Compensation Awards Options (#) | | ||||||||

| Name and Principal Position | Other Annual Compensation ($) (2) | All Other Compensation ($) (3) | ||||||||||

| Year | Salary ($) | Bonus ($)(1) | ||||||||||

| Li-San Hwang Chairman and Chief Executive Officer | 2003 2002 2001 | 392,308 334,615 250,000 | 160,000 0 100,000 | 6,444 3,085 1,683 | 45,000 35,000 37,500 | 10,038 8,838 11,615 | ||||||

James M. Jaska President | 2003 2002 2001 | 342,308 283,077 190,000 | 140,000 0 90,000 | 5,400 5,400 5,400 | 50,000 30,000 31,250 | 13,154 12,385 13,954 | ||||||

David W. King (4) Executive Vice President, Chief Financial Officer and Treasurer | 2003 | 207,885 | (4) | 160,000 | (5) | 4,950 | 40,000 | 11,538 | ||||

Richard A. Lemmon Executive Vice President, Administration | 2003 2002 2001 | 242,308 193,846 160,000 | 90,000 0 70,000 | 5,400 5,400 5,400 | 40,000 18,000 25,000 | 9,163 7,754 11,369 | ||||||

James T. Haney (6) Senior Vice President | 2003 2002 | 250,012 268,373 | 43,000 0 | 5,400 5,435 | 4,000 37,500 | 13,000 10,435 | ||||||

13

Stock Options

The following table sets forth information concerning options granted to each of the named executive officers during fiscal 2003:

OPTION GRANTS IN LAST FISCAL YEAR

| | Individual Grants | | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Value of Assumed Annual Rates of Stock Price Appreciation for Option Term (3) | |||||||||||

| | Number of Securities Underlying Options Granted(1) | % of Total Options Granted to Employees in Fiscal Year | | | ||||||||

| Name | Exercise Price ($/Share)(2) | Expiration Date | ||||||||||

| 5% ($) | 10% ($) | |||||||||||

| Li-San Hwang | 45,000 | 3.4 | 12.84 | 12/23/12 | 363,375 | 920,864 | ||||||

James M. Jaska | 50,000 | 3.8 | 12.84 | 12/23/12 | 403,750 | 1,023,183 | ||||||

David W. King | 40,000 | 3.0 | 7.94 | 10/28/12 | 199,737 | 506,173 | ||||||

Richard A. Lemmon | 40,000 | 3.0 | 12.84 | 12/23/12 | 323,000 | 818,546 | ||||||

James T. Haney | 4,000 | 0.3 | 12.84 | 12/23/12 | 32,300 | 8,855 | ||||||

14

The following table sets forth information concerning the aggregate number of options exercised by, and year-end option values for, each of the named executive officers during fiscal 2003:

OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR END OPTION VALUES

| | | | Number of Unexercised Options at September 28, 2003 | Value of Unexercised In-the-Money Options at September 28, 2003 | ||||

|---|---|---|---|---|---|---|---|---|

| Name | Number of Shares Acquired on Exercise | Value Realized($)(1) | Exercisable/ Unexercisable (#) | Exercisable/ Unexercisable ($)(2) | ||||

| Li-San Hwang | 0 | 0 | 147,012/92,812 | 1,262,429/426,272 | ||||

James M. Jaska | 0 | 0 | 116,082/90,313 | 1,026,585/444,346 | ||||

David W. King | 0 | 0 | 0/40,000 | 0/481,200 | ||||

Richard A. Lemmon | 0 | 0 | 48,464/65,750 | 272,361/320,341 | ||||

James T. Haney | 0 | 0 | 11,875/34,625 | 0/28,520 |

Employment Contracts, Termination of Employment and Change in Control Agreements

As of the end of our 2003 fiscal year, none of our executive officers had employment or severance agreements, and their employment could be terminated at any time at the discretion of our board.

In the event of a merger, share exchange or reorganization in which we do not survive, or we survive as a subsidiary of another corporation, each outstanding option under our 2002 Stock Option Plan and 1992 Incentive Stock Plan will be assumed or an equivalent option substituted by the successor corporation. If the successor corporation refuses to assume or substitute for the option, the option holder will fully vest in and have the right to exercise the option as to all shares purchasable thereunder, including shares that would not otherwise be vested or exercisable.

2002 Stock Option Plan

The 2002 Stock Option Plan was adopted by our board on December 18, 2001 and approved by our stockholders at the 2002 annual meeting. The plan provides for the grant of incentive stock and nonqualified stock options to our key employees and officers, including directors who are also our key employees or officers. The maximum number of shares of common stock authorized for issuance under this plan is 4,000,000. As of December 15, 2003, 2,083,493 shares were subject to outstanding options granted under this plan, 19,322 shares have been issued upon the exercise of options granted under this plan, and 1,897,185 shares were available for future option grants.

15

1992 Incentive Stock Plan

The 1992 Incentive Stock Plan was adopted by our board on December 1, 1992 and subsequently approved by our stockholders. This plan terminated in December 2002 and no further options may be granted thereunder. As of December 15, 2003, 2,695,142 shares were subject to outstanding options granted under this plan.

Employee Stock Purchase Plan

The Employee Stock Purchase Plan was adopted by our board on November 15, 1995 and subsequently approved by our stockholders. As described in Proposal 2, the plan provides for the granting of purchase rights to purchase our common stock to our regular full-time and regular part-time employees and officers, including directors who are also employees or officers. The maximum number of shares of common stock authorized by the stockholders for issuance under this plan is 1,373,290. As of December 15, 2003, 1,111,050 shares had been issued and 262,240 shares were available for issuance under this plan. As described in Proposal 2, we are seeking approval of an amendment adopted by our board on November 17, 2003 to increase by 1,000,000 the number of shares of common stock available for issuance to our employees under the plan.

Executive Medical Reimbursement Plan

Our Executive Medical Reimbursement Plan, which was established by our predecessor in 1975 for the benefit of our executive officers, reimburses participants, their spouses and covered children for medical expenses not covered by our regular group medical plan. In effect, our medical plan provides participants with 100% medical coverage for all allowable medical expenses. At the present time, Dr. Hwang and one former officer are the only individuals covered by the medical plan, and we do not intend to offer the medical plan to any additional executive officers in the future.

16

REPORT OF THE COMPENSATION COMMITTEE

REGARDING COMPENSATION

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

Compensation Committee Responsibilities

The Compensation Committee of Tetra Tech, Inc. (the "Company") has the following responsibilities:

Compensation Policy and Programs

The Compensation Committee's responsibility is to provide a strong and direct link among stockholder values, the Company's financial performance and its executives' compensation through their oversight of the design and implementation of a sound compensation program that will attract and retain highly qualified personnel. Compensation programs are intended to complement the Company's short- and long-term business objectives and to focus executive efforts on the fulfillment of these objectives.

Each year the Committee conducts a review of the Company's executive compensation program. Periodically, the Committee establishes target levels of compensation for the executive officers consistent with that of companies comparable in size and complexity, as well as companies that are direct business competitors. After their review of data relating to all aspects of compensation paid by such groups of companies, actual compensation of the executive officers is subject to increase or decrease by the Committee from targeted levels according to the Company's overall performance and the individual's efforts and contributions. A significant portion of executive compensation is directly related to the Company's financial performance and is therefore at risk. Total compensation for the Company's senior management is composed of base salary, near-term incentive compensation in the form of bonuses and long-term incentive compensation in the form of stock options. The Committee retains the discretion to adjust certain items of compensation so long as total compensation reflects overall corporate performance, individual achievement and relative responsibility.

Base Salary

In establishing base salary levels for executive officer positions, the Committee considers levels of compensation at similarly situated companies and at direct competitors, levels of responsibility and internal issues of consistency and fairness. In determining the base salary of a particular executive, the Committee considers individual performance, including the accomplishment of short- and long-term objectives, and various subjective criteria including initiative, contribution to overall corporate

17

performance and leadership ability. The Committee also considers the recommendations of the chief executive officer as to the other executive officers.

In fiscal 2003, the Committee determined the annual base salary of Dr. Li-San Hwang, the chief executive officer, based upon:

Bonuses

To reinforce the attainment of the Company's goals, the Committee believes that a substantial portion of the annual compensation of each executive officer should be in the form of variable incentive pay. The Company's executive officers are eligible for annual bonuses based upon recommendations made by the chief executive officer (as to the other executive officers) and the Compensation Committee (as to the chief executive officer) based upon their individual performance and the Company's achievement of certain operating results.

Amounts of individual awards are based principally upon the results of the Company's financial performance during the prior fiscal year. The actual amount awarded is determined principally by the Committee's and the chief executive officer's assessment of the individual's contribution to the Company's overall financial performance. Consideration is also given to factors such as the individual's successful completion of a special project, any significant increase or decrease in the level of the participant's executive responsibility, and the Committee's and the chief executive officer's evaluation of the individual's overall efforts and ability to discharge the responsibilities of his or her position.

The Committee typically awards bonuses to the executive officers each December for their contributions to the Company's performance in the prior fiscal year. In December 2003, cash bonuses related to performance in fiscal 2003 paid to the five named executive officers ranged from $43,000 to $160,000 and ranged from 17% to 52% of such officer's base salaries.

Stock Options

The goal of the Company's equity-based incentive awards is to align the interests of executive officers with stockholders and to provide each executive officer with a significant incentive to manage from the perspective of an owner with an equity stake in the business. The Committee sets guidelines for the number and terms of stock option awards based on factors similar to those considered in connection with other components of the Company's compensation program, including a comparison with the practices of the Company's peer group companies and direct competitors. The Committee reviews the size of the stock option awards according to each executive's position and sets a level it considers appropriate to create a meaningful opportunity for reward predicated on increasing stockholder value. In addition, the Committee takes into account an individual's performance history, his or her potential for future responsibility and promotion, and competitive total compensation targets for the individual's position and level of contribution. The relative weight given to each of these factors varies among individuals at the Committee's discretion. If the Company's performance is unsatisfactory, the Committee may decide not to award stock options in any given fiscal year, although exceptions to this policy may be made for individuals who have assumed substantially greater responsibilities and other similar factors.

During fiscal 2002, the Committee made option grants to the Company's executives under the 2002 Stock Option Plan. Each stock option grant allows the executive officer to acquire shares of the common stock at a fixed price per share (the market price on the grant date) over a specified period of

18

time. Generally, stock options become exercisable as to 25% of the shares covered thereby on the first anniversary of the grant date and as to the balance in 36 cumulative monthly installments following such first anniversary date, contingent upon the executive officer's continued employment with the Company. The individual forfeits any installment that has not vested during the period of his or her employment. Accordingly, the option grants will provide a return only if the executive officer remains with the Company and only if the market price appreciates over the option term.

The Committee typically awards stock options to the executive officers each December for their contributions to the Company's performance in the prior fiscal year. In December 2003, the Committee awarded stock options covering an aggregate of 145,000 shares under the 2002 Stock Option Plan to the five named executive officers.

Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code disallows a Federal income tax deduction to publicly held companies for certain compensation paid to certain of their executive officers, to the extent that compensation exceeds $1,000,000 per covered officer in any fiscal year. The limitation applies only to compensation that is not considered performance-based under the Section 162(m) rules. It is the current policy of the Committee to maximize, to the extent reasonably possible, the Company's ability to obtain a corporate tax deduction for compensation paid to the Company's executive officers to the extent consistent with the Company's best interests and those of its stockholders.

| COMPENSATION COMMITTEE | |

J. Christopher Lewis, Chairman Patrick C. Haden James J. Shelton Hugh M. Grant Richard H. Truly |

19

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Audit Committee has reviewed and discussed with management and Deloitte & Touche LLP the audited consolidated financial statements contained in the Annual Report on Form 10-K for the 2003 fiscal year. The Audit Committee has also discussed with Deloitte & Touche LLP the matters required to be discussed pursuant to SAS No. 61,Communication with Audit Committees, which includes, among other items, matters related to the conduct of the audit on the consolidated financial statements.

The Audit Committee has received and reviewed the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, and has discussed with Deloitte & Touche LLP its independence from the Company and its management.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board, and the board has approved, the inclusion of the audited financial statements in the Company's Annual Report on Form 10-K for the fiscal year ended September 28, 2003, for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE | |

J. Christopher Lewis, Chairman Patrick C. Haden Hugh M. Grant |

20

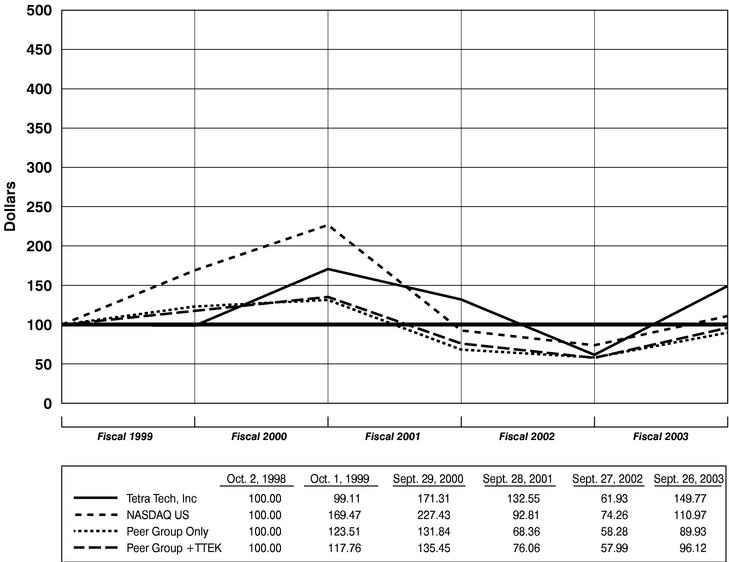

The following graph shows a comparison of our cumulative total returns with those of the Nasdaq Stock Market (U.S. Companies) Index and our self-constructed Peer Group Index (as defined below). The graph assumes that the value of an investment in our common stock and in each such index was $100 on October 2, 1998, and that all dividends have been reinvested. No cash dividends have been declared on shares of our common stock. Our self-constructed Peer Group Index includes the following companies: Foster Wheeler Inc., Jacobs Engineering Group Inc., Mastec, Inc., TRC Companies, Inc., URS Corporation and Wireless Facilities, Inc. We believe that the companies included in the Peer Group Index are among our primary competitors.

The comparison in the graph below is based on historical data and is not intended to forecast the possible future performance of our common stock.

Comparison of Cumulative Total Return Among

Tetra Tech, Nasdaq Stock Market (U.S. Companies),

and Tetra Tech's Self-Constructed Peer Group

The information contained in the Stock Performance Graph section shall not be deemed to be "soliciting material" of "filed" or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

21

PROPOSAL NO. 2

APPROVAL OF THE AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN

We are seeking stockholder approval of an amendment to our Employee Stock Purchase Plan ("ESPP") to increase the maximum number of shares of common stock authorized for issuance over the term of the ESPP by 1,000,000 shares.

The ESPP offers eligible employees the opportunity to acquire a stock ownership interest in us through period payroll deductions that will be applied towards the purchase of our common stock at a discount from the then current market price. The purpose of the amendment is to ensure that we will have a sufficient reserve of common stock available under the ESPP to provide eligible employees with the continuing opportunity to acquire a proprietary interest in us through participation in a payroll deduction-based employee stock purchase plan.

The ESPP was adopted by our board on November 15, 1995 and approved by our stockholders in February 1996. Initially, 1,373,290 shares (as adjusted for subsequent stock splits) were authorized to be issued under the ESPP. As of December 15, 2003, employees had purchased 1,111,050 shares of our common stock under the ESPP. At that date, approximately 5,636 employees were eligible to participate in the ESPP, including 13 executive officers.

The following is a brief summary of the principal features of the ESPP. The summary is qualified by and subject to the full text of the ESPP, as proposed to be amended, which is attached to this proxy statement as Appendix B and incorporated by reference into this proxy statement.

Summary

The ESPP provides for the granting of purchase rights ("Purchase Rights") to purchase common stock to our (and our subsidiaries') employees and officers, including directors who are also employees or officers. Under the ESPP, shares of common stock are issued upon the exercise of Purchase Rights. The ESPP is administered by the Compensation Committee, which has the authority to prescribe rules and procedures relating to the ESPP, and to take all other actions necessary or appropriate for the administration of the ESPP.

The classes of employees who are eligible to participate in the ESPP are regular full-time employees and regular part-time employees who are regularly scheduled to work more than 20 hours per week and who have completed three or more months of employment.

Each Purchase Right lasts for a period of 52 weeks ("Purchase Right Period"). The Compensation Committee may elect to suspend and/or recommence the ESPP at any time following the end of a Purchase Right Period. Prior to the beginning of each Purchase Right Period, employees may elect to contribute amounts to the ESPP during that Purchase Right Period to purchase common stock. Employees can only commence participation in the ESPP on the first day of a Purchase Right Period.

The maximum amount that an employee can contribute during a Purchase Right Period is $5,000, and the minimum contribution per payroll period is $25. The amount that an employee elects to contribute during a Purchase Right Period is fixed, and cannot be increased or decreased during the Purchase Right Period, although the employee may elect to stop contributing to the ESPP at any time. Except to the extent that the employee makes a lump sum contribution at the beginning of the Purchase Right Period, the amount that the employee elects to contribute is withdrawn from the employee's salary in equal amounts over the entire Purchase Right Period.

Under the ESPP, the exercise price of a Purchase Right is the lesser of 100% of the fair market value of such shares on the first day of the Purchase Right Period or 85% of the fair market value on the last day of the Purchase Right Period. For this purpose, the fair market value of the common stock is its closing price as reported on the Nasdaq National Market on the day in question. The employees'

22

contributions to the ESPP are automatically used to purchase common stock on the last day of the Purchase Right Period, unless they elect to withdraw from the ESPP prior to that date.

Employees whose employment is terminated for any reason forfeit their right to purchase common stock at the end of the Purchase Right Period, but receive a refund of all of their contributions. Employees who elect to suspend their contributions can elect either to withdraw their contributions or leave those amounts in the ESPP to be used to purchase common stock at the end of the Purchase Right Period. No interest is credited on any amounts contributed to the ESPP.

In the event we cease to be an independent publicly-owned corporation, or there is a sale or other disposition of all or substantially all of our assets, all Purchase Rights shall be automatically exercised immediately preceding such an event. If our outstanding shares of common stock are increased, decreased or exchanged for different securities, a proportionate adjustment will be made in the number, price and kind of shares subject to outstanding Purchase Rights.

Our board may amend or terminate the ESPP at any time, except with respect to any outstanding Purchase Rights. Stockholder approval is required for any amendment that changes the class of individuals who may participate or the aggregate number of shares to be granted under the ESPP. Further, the board may suspend or recommence the ESPP following the end of any Purchase Right Period.

The above description summarizes the main provisions of the ESPP and the Purchase Rights granted thereunder. This description does not purport to be complete and is qualified in its entirety by the provisions of the ESPP. Stockholders are urged to read the ESPP in its entirety.

Federal Income Tax Consequences

The ESPP is intended to qualify as an "employee stock purchase plan" within the meaning of Section 423 of the Internal Revenue Code. Under such an arrangement, no income will be taxable to a participant upon either the grant or the exercise of the Purchase Rights. Upon disposition of the shares issued under the ESPP, the participant will generally be subject to tax. The amount of the tax will depend upon the participant's holding period. We are not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant except to the extent of ordinary income reported by the participant that is attributable to a disqualifying disposition of shares (i.e., shares that are sold within two years after the grant of the Purchase Right or within one year after the purchase of such shares).

The foregoing summary of the effects of federal income taxation with respect to Purchase Rights granted and shares issued under the ESPP does not purport to be complete. Each participant is urged to consult with his or her personal tax advisor regarding the federal, state and local tax consequences of participating in the ESPP.

Plan Benefits

The table below shows, as to each of our executive officers named in the Summary Compensation Table of the Executive Compensation section of this proxy statement and the various indicated groups, the number of shares of common stock purchased under the ESPP during the 2003 fiscal year. All such purchases were made on June 2, 2003. For all participating employees other than the employees of our Ardaman & Associates, Inc. subsidiary, the purchase price was $13.96 per share. For the Ardaman &

23

Associates, Inc. employees, who had a special Purchase Right Period established in connection with the acquisition of that company, the purchase price was $12.26 per share.

| Name and Position | Number of Purchased Shares | |

|---|---|---|

| Li-San Hwang, Chairman of the Board and Chief Executive Officer | 0 | |

James M. Jaska, President and Director | 287 | |

David W. King, Executive Vice President, Chief Financial Officer and Treasurer | 0 | |

Richard A. Lemmon, Executive Vice President, Administration | 287 | |

James T. Haney, Senior Vice President | 0 | |

All current executive officers as a group (13 persons) | 1,147 | |

All current directors other than executive officers as a group (6 persons) | 0 | |

All participating employees, including current officers who are not executive officers, as a group (1,728 persons) | 214,146 |

New Plan Benefits

The benefits to be received by our executive officers, directors and employees as a result of the proposed amendment to the ESPP are not determinable, since the amounts of future purchases by participants are based on elective participant contributions. No Purchase Rights have been granted, and no shares of common stock have been issued, with respect to the 1,000,000 share increase for which stockholder approval is sought under this proposal.

The closing price of our common stock on the Nasdaq National Market on December 15, 2003 was $23.48 per share.

Vote Required

The affirmative vote of the holders of a majority of the shares represented and voting at the meeting will be required to approve this proposal. If you own shares through a broker, you must instruct your broker how to vote in order for your vote to be counted on this proposal. Should such stockholder approval not be obtained, then the 1,000,000 share increase will not be implemented. However, the ESPP will continue to remain in effect until the date the remaining share reserve under the ESPP is utilized.

Recommendation

Our board believes that the amendment to the ESPP is in our best interests and the best interests of our stockholders and unanimously recommends a vote "FOR" approval of this proposal. Your proxies will be voted for this proposal unless you specifically indicate otherwise.

24

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of our board of directors retained PricewaterhouseCoopers LLP as our independent accountant as of January 8, 2004. Our previous independent accountant, Deloitte & Touche LLP, was dismissed by the Audit Committee as our independent accountant effective January 8, 2004. We are asking our stockholders to ratify the Audit Committee's appointment of PricewaterhouseCoopers LLP to audit our consolidated financial statements for fiscal year 2004. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Representatives of PricewaterhouseCoopers LLP are expected to be present at the meeting, will have an opportunity to make a statement and will be available to respond to appropriate questions submitted by stockholders.

Deloitte & Touche LLP served as our independent auditors for fiscal years 1988 - 2003. The reports of Deloitte & Touche LLP on the financial statements for the last two fiscal years contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits for the two most recent fiscal years and through January 8, 2004, there were no:

Deloitte & Touche LLP has furnished us with a letter addressed to the Securities and Exchange Commission stating that it agrees with the above statements. A copy of such letter, dated January 13, 2004, is attached as Exhibit 16.1 to our current report on Form 8-K dated January 8, 2004.

Principal Accountant Fees and Services

The following is a summary of the fees billed to us by Deloitte & Touche LLP for professional services rendered for the fiscal years ended September 28, 2003 and September 29, 2002:

| Fee Category | Fiscal 2003 Fees | Fiscal 2002 Fees | ||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 1,053,517 | $ | 771,400 | ||

| Audit-Related Fees | 50,503 | 16,400 | ||||

| Tax Fees | — | 600,000 | ||||

| All Other Fees | 99,812 | 95,400 | ||||

| Total Fees | $ | 1,203,832 | $ | 1,483,200 | ||

Audit Fees. Consists of fees billed for professional services rendered for the audit of our consolidated financial statements, review of the interim consolidated financial statements included in quarterly reports, services provided in connection with the adoption of SFAS No. 142 (Goodwill and Other Intangible Assets), and services that are normally provided by Deloitte & Touche LLP in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Consists of fees billed for related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under

25

"Audit Fees." These services include accounting consultations in connection with acquisitions and audits of employee benefit plans.

Tax Fees. Consists of fees billed for professional services for tax planning and consulting services. There were none in fiscal 2003.

All Other Fees. Consists primarily of fees billed for forensic services concerning internal accounting controls.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors subject to limited discretionary authority granted to our chief financial officer. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

Vote Required

The affirmative vote of the holders of a majority of the shares represented and voting at the meeting will be required to approve this proposal.

Recommendation

Our board believes that ratification of the appointment of PricewaterhouseCoopers LLP is in our best interests and the best interests of our stockholders and unanimously recommends a vote "FOR" approval of this proposal. Your proxies will be voted for this proposal unless you specifically indicate otherwise.

We maintain a corporate governance page on our website, www.tetratech.com, which includes key information about our corporate governance initiatives, including our Code of Business Conduct and Finance Code of Professional Conduct, and charters for the committees of our board. Our policies and practices reflect initiatives that are compliant with the NASDAQ Corporate Governance Rules and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

26

STOCKHOLDER COMMUNICATIONS WITH THE BOARD

Stockholders desiring to send a communication to the board, or to a specific director, may do so by delivering the communication c/o Tetra Tech, Inc., 3475 East Foothill Boulevard, Pasadena, California 91107. These communications will be relayed to the board, or to the individual director, as specified. Further, all directors are strongly encouraged to attend our annual meetings. At our 2003 annual meeting, all directors were in attendance.

STOCKHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Requirements for Stockholder Proposals to be Considered for Inclusion in Our Proxy Materials

Our stockholders may submit proposals on matters appropriate for stockholder action at meetings of our stockholders in accordance with Rule 14a-8 promulgated under the Securities Exchange Act of 1934. For such proposals to be included in our proxy materials relating to our 2005 Annual Meeting of Stockholders, all applicable requirements of Rule 14a-8 must be satisfied and such proposals must be received no later than September 22, 2004. Such proposals should be delivered to Tetra Tech, Inc., Attn: Secretary, 3475 East Foothill Boulevard, Pasadena, California 91107, with a copy to Tetra Tech, Inc., Attn: General Counsel at the same address.

Requirements for Stockholder Proposals to be Brought Before the Annual Meeting

Our bylaws provide that, except in the case of proposals made in accordance with Rule 14a-8, for stockholder nominations to the board or other proposals to be considered at an annual meeting, the stockholder must have given timely notice thereof in writing to the Secretary of Tetra Tech, Inc. not less than 60 nor more than 90 days prior to the anniversary of the date on which we mailed our proxy materials for our immediately preceding annual meeting of stockholders (as specified in our proxy materials for our immediately preceding annual meeting of stockholders). To be timely for the 2005 Annual Meeting, a stockholder's notice must be delivered to or mailed and received by the Secretary at our principal executive offices between October 21, 2004 and November 20, 2004. However, in the event that the annual meeting is called for a date that is not within 30 days of the anniversary of the date on which the immediately preceding annual meeting of stockholders was called, to be timely, notice by the stockholder must be so received not later than the close of business on the tenth day following the date on which public announcement of the date of the annual meeting is first made. The public announcement of an adjournment of an annual meeting of stockholders will not commence a new time period for the giving of a stockholder's notice as provided above. A stockholder's notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting the information required by our bylaws.

The proxy solicited by the board for the 2005 Annual Meeting of Stockholders will confer discretionary authority to vote on (i) any proposal presented by a stockholder at that meeting for which we have not been provided with notice on or prior to November 20, 2004 and (ii) on any proposal made in accordance with the bylaw provisions, if the related proxy statement briefly describes the matter and how management's proxy holders intend to vote on it, if the stockholder does not comply with the requirements of Rule 14a-4(c)(2) of the Securities Exchange Act of 1934.

27

A copy of our 2003 annual report is being mailed to each stockholder of record together with this proxy statement. The 2003 annual report includes our audited financial statements for the fiscal year ended September 28, 2003. Our annual report on Form 10-K includes these financial statements, as well as more detailed information about us and our operations, supplementary financial information and certain schedules. The annual report and Form 10-K are not part of our proxy soliciting material. COPIES OF THE ANNUAL REPORT ON FORM 10-K, WITHOUT EXHIBITS, CAN BE OBTAINED WITHOUT CHARGE BY CONTACTING US AT: INVESTOR RELATIONS, TETRA TECH, INC., 3475 EAST FOOTHILL BOULEVARD, PASADENA, CALIFORNIA 91107. A LIST OF EXHIBITS IS INCLUDED IN THE FORM 10-K, AND EXHIBITS ARE AVAILABLE FROM TETRA TECH UPON PAYMENT TO TETRA TECH OF THE COST OF FURNISHING THEM. THE ANNUAL REPORT ON FORM 10-K IS ALSO AVAILABLE AT WWW.TETRATECH.COM.

Our board of directors does not know of any other matters to be presented for stockholder action at the 2004 annual meeting. However, if other matters do properly come before the meeting or any adjournments or postponements thereof, the board intends that the persons named as proxies in the proxy will vote on them in accordance with their best judgment.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| Janis B. Salin Vice President, General Counsel and Secretary | |

Pasadena, California January 20, 2004 |

28

Tetra Tech, Inc.

Board of Directors

Audit Committee Charter

The Audit Committee is appointed by the Board of Directors (the "Board") of Tetra Tech, Inc. (the "Company"), and is responsible for (i) effective oversight of the Company's financial reporting process and adequacy of internal controls, (ii) independence and performance of the Company's external and internal auditors, and (iii) financial regulatory and legal compliance issues relating to the Company's financial statements.

The members of the Audit Committee shall meet the independence and experience requirements of the Nasdaq Stock Market, Inc. In particular, at least one member of the Committee shall have accounting or related financial management expertise. No member of the Audit Committee may, other than in his or her capacity as a member of the Audit Committee, the Board or any other Board committee, (i) accept any consulting, advisory or other compensatory fee from the Company or (ii) be an affiliated person of the Company or any subsidiary thereof.

The Company's independent auditor shall report directly to the Audit Committee, as representatives of the Company's stockholders. The Audit Committee has the authority to select (or nominate for stockholder approval), evaluate and, where appropriate, replace the independent auditor.

The Audit Committee shall have the authority to retain independent legal, accounting or other consultants to advise the Committee. The Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. In addition, the Company's internal auditors shall report to the Audit Committee.

The Audit Committee shall make regular reports to the Board.

The Audit Committee shall:

1. Review the annual audited financial statements with management and the independent auditor, including major issues regarding accounting and auditing principles and practices, as well as the adequacy of internal controls, that could significantly affect the Company's financial statements; recommend to the Board inclusion of the financial statements in the Form 10-K.