Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | |||

Filed by a Party other than the Registranto | |||

Check the appropriate box: | |||

o | Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

ý | Definitive Proxy Statement | ||

o | Definitive Additional Materials | ||

o | Soliciting Material Pursuant to §240.14a-12 | ||

Tetra Tech, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

January 15, 2015

DEAR TETRA TECH STOCKHOLDERS:

You are cordially invited to attend the Annual Meeting of Stockholders of Tetra Tech, Inc., which will be held at the Westin Pasadena, 191 N. Los Robles Avenue, Pasadena, California 91101, on Thursday, March 5, 2015, at 10:00 a.m. Pacific Time.

Details of the business to be conducted at the annual meeting are given in the Notice of Annual Meeting of Stockholders and the proxy statement.

We use the Internet as our primary means of furnishing proxy materials to our stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. Internet transmission and voting are designed to be efficient, minimize cost and conserve natural resources.

Whether or not you plan to attend the annual meeting, please vote as soon as possible. As an alternative to voting in person at the annual meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting by any of these methods will ensure your representation at the annual meeting.

Thank you for your continued support of Tetra Tech. We look forward to seeing you at the annual meeting.

| Dan L. Batrack Chairman and Chief Executive Officer |

Pasadena, California

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the annual meeting, you may submit your proxy and voting instructions via the Internet, by telephone or, if you receive a paper proxy card and voting instructions by mail, you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope. Please refer to the section entitled "Voting via the Internet, by Telephone or by Mail" on page 3 of the proxy statement for a description of these voting methods. If your shares are held by a bank or brokerage firm (your record holder) and you have not given your record holder instructions to do so, your broker will NOT be able to vote your shares with respect to any matter other than ratification of the appointment of the independent registered public accounting firm. We strongly encourage you to vote.

3475 East Foothill Boulevard

Pasadena, California 91107

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held March 5, 2015

The Annual Meeting of Stockholders of Tetra Tech, Inc., a Delaware corporation, will be held on Thursday, March 5, 2015, at 10:00 a.m. Pacific Time, at the Westin Pasadena, 191 N. Los Robles Avenue, Pasadena, California 91101, for the following purposes:

- (1)

- To elect nine members of our Board of Directors;

- (2)

- To vote on an advisory resolution to approve our executive compensation;

- (3)

- To approve our 2015 Equity Incentive Plan;

- (4)

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2015; and

- (5)

- To act upon such other matters as may properly come before the annual meeting or any adjournments or postponements thereof.

These items of business are more fully described in the proxy statement. The record date for determining those stockholders who will be entitled to notice of, and to vote at, the annual meeting and any adjournments or postponements thereof is January 9, 2015. A list of stockholders entitled to vote at the annual meeting will be available for inspection at our principal executive offices at the address listed above.

Whether or not you plan to attend the annual meeting, please vote as soon as possible. As an alternative to voting in person at the annual meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing a completed proxy card. For detailed information regarding voting instructions, please refer to the section entitled "Voting via the Internet, by Telephone or by Mail," on page 3 of the proxy statement. You may revoke a previously delivered proxy at any time prior to the annual meeting. If you decide to attend the annual meeting and wish to change your proxy vote, you may do so automatically by voting in person at the annual meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | ||

Janis B. Salin Senior Vice President, General Counsel and Secretary | ||

| Pasadena, California January 15, 2015 |

| | Page | |

|---|---|---|

GENERAL INFORMATION | 1 | |

PURPOSE OF MEETING | 1 | |

VOTING | 1 | |

INTERNET AVAILABILITY OF PROXY MATERIALS | 4 | |

PROPOSAL NO. 1: ELECTION OF DIRECTORS | 5 | |

Vote Required | 5 | |

Board Composition, Skills and Experience | 6 | |

Business Experience and Qualifications of Nominees | 7 | |

Chairman Emeritus | 10 | |

Independent Directors | 10 | |

Corporate Governance | 10 | |

Board Leadership Structure | 12 | |

The Role of the Board of Directors in Risk Oversight and Management Continuity | 12 | |

Board Meetings and Board Committees | 13 | |

Director Compensation | 17 | |

Non-Employee Director Stock Ownership | 20 | |

Fiscal 2015 Director Compensation | 20 | |

Stockholder Communications with the Board of Directors | 20 | |

Recommendation of the Board of Directors | 20 | |

PROPOSAL NO. 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 21 | |

Vote Required | 22 | |

Recommendation of the Board of Directors | 22 | |

PROPOSAL NO. 3: APPROVAL OF THE 2015 EQUITY INCENTIVE PLAN | 23 | |

Description of the 2015 Plan | 23 | |

U.S. Tax Consequences under the 2015 Plan | 29 | |

Key Metrics Related to the Existing Plans | 31 | |

New Plan Benefits | 31 | |

Vote Required | 32 | |

Recommendation of the Board of Directors | 32 | |

PROPOSAL NO. 4: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 33 | |

Principal Accountant Fees and Services | 33 | |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm | 33 | |

Vote Required | 34 | |

Recommendation of the Board of Directors | 34 | |

OWNERSHIP OF SECURITIES | 35 | |

Equity Compensation Plan Information | 36 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 37 | |

EXECUTIVE COMPENSATION AND RELATED INFORMATION | 38 | |

Compensation Discussion and Analysis | 38 | |

Compensation Committee Report | 59 | |

Compensation Committee Interlocks and Insider Participation | 59 | |

Summary of Compensation | 59 | |

Potential Payments Upon Termination or Change in Control | 64 | |

Assumptions Regarding the Tables | 66 | |

Confidentiality | 69 | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 69 |

i

ii

3475 East Foothill Boulevard

Pasadena, California 91107

PROXY STATEMENT

These proxy materials are provided in connection with the solicitation of proxies by our Board of Directors. The proxies are for use at our 2015 Annual Meeting of Stockholders to be held at 10:00 a.m. Pacific Time on Thursday, March 5, 2015, at the Westin Pasadena, 191 N. Los Robles Avenue, Pasadena, California 91101. The proxies will remain valid for use at any meetings held upon adjournment or postponement of that meeting.

The Notice of Annual Meeting, this proxy statement and our Annual Report for the fiscal year ended September 28, 2014, have been made available to all stockholders entitled to notice and to vote at the annual meeting. The Annual Report is not incorporated into this proxy statement and is not considered proxy soliciting material. The Annual Report is posted at the following website addresses:www.tetratech.com andwww.proxyvote.com.

The annual meeting will be held for the following purposes:

- •

- To elect nine members of our Board of Directors (Proposal No. 1);

- •

- To vote on an advisory resolution to approve our executive compensation (Proposal No. 2);

- •

- To approve our 2015 Equity Incentive Plan (Proposal No. 3);

- •

- To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2015 (Proposal No. 4); and

- •

- To act upon such other matters as may properly come before the annual meeting or any adjournments or postponements thereof.

Only stockholders of record of our common stock on January 9, 2015 (the "Record Date") will be entitled to vote at the annual meeting. Stockholders who hold shares in "street name" may vote at the annual meeting only if they hold a valid proxy from their broker. On the Record Date, there were 62,102,681 shares of common stock outstanding.

A majority of the outstanding shares of common stock entitled to vote at the annual meeting must be present or represented by proxy at the annual meeting in order to have a quorum. Stockholders of record who are present at the meeting in person or by proxy and who abstain from voting, including brokers

1

holding customers' shares of record who cause abstentions to be recorded at the meeting, will be included in the number of stockholders present at the meeting for purposes of determining whether a quorum is present.

Each stockholder of record is entitled to one vote at the annual meeting for each share of common stock held by such stockholder on the record date. In the election of directors, each director must be elected by the vote of the holders of a majority of the votes cast for the election of directors. A majority of the votes cast means that the number of votes cast "for" a director must exceed the number of votes cast "against" that director. Stockholders may not cumulate votes in the election of directors. A properly executed proxy marked "withhold authority" with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. For Proposals 2, 3 and 4, the affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy and entitled to vote on the item will be required for approval. A properly executed proxy marked "abstain" with respect to any matter, as applicable, will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

For shares held in "street name" through a broker or other nominee, the broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if stockholders do not give their broker or nominee specific instructions, their shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval. Shares represented by such "broker non-votes" will, however, be counted in determining whether there is a quorum.

If the persons present or represented by proxy at the annual meeting constitute the holders of less than a majority of the outstanding shares of common stock as of the Record Date, the annual meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. The inspector of elections appointed for the annual meeting will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

You are entitled to attend the annual meeting if you were a stockholder of record or a beneficial owner of our common stock on the Record Date, or you hold a valid legal proxy for the annual meeting. If you are a stockholder of record, you may be asked to present valid picture identification, such as a driver's license or passport, for admission to the annual meeting.

If your shares are registered in the name of a bank or brokerage firm (your record holder), you may be asked to provide proof of beneficial ownership as of the Record Date, such as a brokerage account statement, a copy of the Notice of Internet Availability of Proxy Materials or voting instruction form provided by your bank, broker or other holder of record, or other similar evidence of ownership, as well as picture identification, for admission. If you wish to be able to vote in person at the annual meeting, you must obtain a legal proxy from your brokerage firm, bank or other holder of record and present it to the inspector of elections with your ballot at the annual meeting.

Recommendations of the Board of Directors

Our Board of Directors recommends that you vote:

- •

- FOR each of the nominees of the Board of Directors (Proposal No. 1);

- •

- FOR the advisory resolution to approve our executive compensation (Proposal No. 2);

- •

- FOR the approval of our 2015 Equity Incentive Plan (Proposal No. 3); and

- •

- FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2015 (Proposal No. 4).

2

Voting via the Internet, by Telephone or by Mail

Holders of shares of our common stock whose shares are registered in their own name with our transfer agent, Computershare Investor Services, are record holders. As an alternative to voting in person at the annual meeting, record holders may vote via the Internet, by telephone or, for those stockholders who receive a paper proxy card in the mail, by mailing a completed proxy card.

For those record holders who receive a paper proxy card, instructions for voting via the Internet, telephone or by mail are set forth on the proxy card. Stockholders who elect to vote by mail should sign and mail the proxy card in the addressed, postage paid envelope that was enclosed with the proxy materials, and your shares will be voted at the annual meeting in the manner you direct. In the event that you return a signed proxy card on which no directions are specified, your shares will be voted

- •

- FOR each of the nominees of the Board of Directors (Proposal No. 1);

- •

- FOR the advisory resolution regarding executive compensation (Proposal No. 2);

- •

- FOR the approval of our 2015 Equity Incentive Plan (Proposal No. 3);

- •

- FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2015 (Proposal No. 4); and

- •

- in the discretion of the proxy holders as to any other matters that may properly come before the annual meeting or any postponement or adjournment of the annual meeting.

Stockholders whose shares are not registered in their own name with Computershare are beneficial holders of shares held in street name. Such shares may be held in an account at a bank or at a brokerage firm (your record holder). As the beneficial holder, you have the right to direct your record holder how to vote your shares, and you will receive instructions from your record holder that must be followed in order for your record holder to vote your shares per your instructions. Many banks and brokerage firms have a process for their beneficial holders to provide instructions via the Internet or by telephone. If Internet or telephone voting is unavailable from your record holder, please complete and return the enclosed voting instruction card in the addressed, postage paid envelope provided. If your shares are held beneficially in street name and you have not given your record holder voting instructions, your record holder will not be able to vote your shares with respect to any matter other than ratification of the appointment of our independent registered public accounting firm. Shares held beneficially in street name may be voted by you in person at the annual meeting only if you obtain from your record holder a legal proxy giving you the right to vote such shares.

For those stockholders who receive a Notice of Internet Availability of Proxy Materials (described under "Internet Availability of Proxy Materials" below), the Notice of Internet Availability of Proxy Materials provides information on how to access your proxy, which contains instructions on how to vote via the Internet or by telephone. If you received a Notice of Internet Availability, you can request a printed copy of your proxy materials by following the instructions contained in the notice.

You may revoke or change a previously delivered proxy at any time before the annual meeting by delivering another proxy with a later date, by voting again via the Internet or by telephone, or by delivering written notice of revocation of your proxy to our Secretary at our principal executive offices before the beginning of the annual meeting. You may also revoke your proxy by attending the annual meeting and voting in person, although attendance at the annual meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares through a bank or brokerage firm, you must contact that bank or brokerage firm to revoke any prior voting instructions. You also may revoke any prior voting instruction by voting in person at the annual meeting if you obtain a legal proxy as described under "Admission to Meeting" above.

3

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with Securities and Exchange Commission ("SEC") rules, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our proxy statement and annual report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly, and helps conserve natural resources. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via email unless you change your election.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The names of persons who are nominees for director and their positions with us are set forth in the table below. The proxy holders intend to vote all proxies received by them for the nominees listed below unless otherwise instructed.

Our Board has nine members. We believe a limited number of directors helps maintain personal and group accountability. Our Board is independent in composition and outlook, comprised of independent directors, other than the Chief Executive Officer. Each of the nine current directors has been nominated for election by the Board of Directors upon recommendation by the Nominating and Corporate Governance Committee and has decided to stand for election.

No arrangement or understanding exists between any nominee and any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee. The nominees do not have any family relationship among themselves or with any of our executive officers.

The following table presents information concerning the nominees.

Name | Age | Position | |||

|---|---|---|---|---|---|

| Dan L. Batrack | 56 | Chairman, Chief Executive Officer and President | |||

| Hugh M. Grant | 78 | Director | |||

| Patrick C. Haden | 61 | Director | |||

| J. Christopher Lewis | 58 | Presiding Director | |||

| Kimberly E. Ritrievi | 56 | Director | |||

| Albert E. Smith | 65 | Director | |||

| J. Kenneth Thompson | 63 | Director | |||

| Richard H. Truly | 77 | Director | |||

| Kirsten M. Volpi | 50 | Director | |||

Our bylaws provide for a majority voting standard in elections of directors. As such, a nominee for director will be elected to the Board of Directors to serve until the next annual meeting of stockholders, and until his or her successor has been duly elected and qualified, if the number of shares voted for the nominee exceeds the number of shares voted against the nominee and also represents the affirmative vote of a majority of the required quorum. The required quorum for a meeting of our stockholders is a majority of the outstanding shares of common stock.

The majority voting standard will apply to the election taking place at the meeting. Consequently, in order to be elected, a nominee must receive more votes "for" than "against" and the number of votes "for" must be at least a majority of the required quorum. Proxies may not be voted for more than nine directors, and stockholders may not cumulate votes in the election of directors. In the event any nominee is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who may be designated by the Board of Directors to fill the vacancy, if any. As of the date of this proxy statement, the Board of Directors is not aware that any nominee is unable or will decline to serve as a director. If you hold shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote so that your vote can be counted on this proposal.

Should any of the nominees fail to receive the vote required to be elected in accordance with our bylaws, that director must promptly tender his or her resignation to the Board of Directors, which resignation will be irrevocable until either accepted or rejected by the Board. In that event, the Nominating and Corporate Governance Committee will make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will then act on the

5

tendered resignation, taking into account the Nominating and Corporate Governance Committee's recommendation, and publicly disclose its decision regarding the tendered resignation and the rationale behind the decision within ninety (90) days from the date of the certification of the election results.

Board Composition, Skills and Experience

Our individual Board members have varied expertise and bring extensive professional experience from both within and outside our industry. This provides our Board with an extensive collective skill set, which is advantageous to the Board's oversight of our company. While the industry-specific expertise possessed by certain of our Board members is essential, we also benefit from the viewpoints of our directors with expertise outside our industry. These varied perspectives expand the Board's ability to provide relevant guidance to our business.

Our Board acts as a coherent team and fosters an environment that allows individual insights to contribute to the group consensus. It is focused on long-term company success and maintains an effective dialogue with management through constructive relationships that provide timely and appropriate deliberation. Each Board member has knowledge and insight that provides guidance concerning our business, with particular focus on succession planning, corporate strategy, executive compensation, risk management and operating performance.

Listed below are key skills and experience that we consider important for our directors to have in light of our current business and structure.

- •

- Senior Leadership Experience. Directors who have served in senior leadership positions are important to us as they bring experience and perspective in analyzing, shaping and overseeing the execution of important operational and policy issues at a senior level.

- •

- Public Company Board Experience. Directors who have served on other public company boards can offer advice and insights with regard to the dynamics and operation of a board of directors; the relations of a board to the chief executive officer and other management personnel; the importance of particular agenda and oversight matters; and oversight of a changing mix of strategic, operational and compliance-related matters.

- •

- Business Development and Mergers and Acquisitions ("M&A") Experience. Directors who have a background in business development and in M&A transactions can provide insight into developing and implementing strategies for growing our business through combinations with other organizations. Useful experience in this area includes analysis of the "fit" of a proposed acquisition with a company's strategy, the valuation of transactions and management's plan for integration with existing operations.

- •

- Financial Expertise. Knowledge of financial markets, financing and funding operations, and accounting and financial reporting processes is important because it assists our directors in understanding, advising and overseeing our capital structure, financing and investing activities, financial reporting, and internal control of such activities.

- •

- Industry and Technical Expertise. Because we are a leading provider of consulting, engineering, program management, and construction management services that focus on water, the environment, infrastructure, resource management and energy, education or experience in these fields is useful in understanding our various services, the potential expansion of those services, and the market segments in which we compete.

- •

- Government Expertise. Since approximately 45% of our revenue in fiscal 2014 was derived from U.S. federal, state and local government clients, directors who have served in government positions can provide experience and insight into working constructively with government agencies and administrators, and addressing significant public policy issues in areas related to our business and operations.

6

Business Experience and Qualifications of Nominees

Mr. Batrack joined our predecessor in 1980. He has served as our Chief Executive Officer ("CEO") and a director since November 2005, and was named Chairman in January 2008. He has also served as our President since October 2008. Mr. Batrack has served in numerous capacities over the last 34 years, including project scientist, project manager, operations manager, senior vice president and president of an operating unit. He has managed complex programs for many small and Fortune 500 clients, both in the United States and internationally. Mr. Batrack holds a B.A. degree in Business Administration from the University of Washington.

Mr. Batrack provides to the Board executive leadership and vision, together with an extensive network of client and industry relationships. His thorough knowledge of our business, strategy, people, operations, competition and financial position, as evidenced by our growth during his tenure as CEO, provides us with strong leadership focused on long-term performance and stockholder value.

Mr. Grant joined our Board in January 2003. He spent approximately 38 years with Ernst & Young LLP (and its predecessor, Arthur Young & Company) where, among other things, he was Vice-Chairman and Regional Managing Partner of the Western United States, which had 2,000 employees. While at Ernst & Young, Mr. Grant served as the audit partner in charge of several large public companies, including those in the engineering and construction, and defense industries. He also served on Ernst & Young's Management Committee for ten years. Mr. Grant retired from Ernst & Young in 1996. Mr. Grant also serves as a director and chairman of the audit committee of a non-profit entity.

Mr. Grant has an in-depth understanding of the preparation and analysis of financial statements, and is considered an "audit committee financial expert" under SEC rules, based on his lengthy experience as a certified public accountant practicing public accounting. Mr. Grant's extensive accounting and financial knowledge is an invaluable asset to the Board in its oversight of the integrity of our financial statements, the financial reporting process and our system of internal controls. In addition, he has leadership and management experience, which is complemented by his prior service as a public company outside director.

Mr. Haden has been a member of our Board since December 1992. Since August 2010, Mr. Haden has served as the Athletic Director of the University of Southern California. From 1987 to August 2010, he was a general partner of Riordan, Lewis & Haden ("RLH"), a Los Angeles-based private equity firm that invests in high-growth middle market enterprises. During his tenure at RLH, he was a director of several portfolio companies. Since 2006, Mr. Haden has served as Chairman of the Board, and on several committees, of TCW Strategic Income Fund, Inc., a diversified, closed-end management investment company, and The TCW Funds, a registered investment company. Since 2012, he has served as a director and a member of the audit committee of Met West Funds, which is part of The TCW Funds. Mr. Haden also serves on the board of the Rose Hills Foundation, the Fletcher Jones Foundation and the Unihealth Foundation.

Mr. Haden brings to the Board his affiliation with a prestigious university, together with his demonstrated abilities in leadership, management and motivation. Through his prior relationship with RLH, he provides significant experience in finance and investment, and in M&A transactions. Mr. Haden's service as a director of a public company board brings cross-board experience. He is also an attorney.

Mr. Lewis has been a member of our Board since February 1988. He currently serves as the Presiding Director of our Board and, as such, chairs the executive sessions of Board meetings. Mr. Lewis co-founded RLH, and has been its Managing Director since 1982. From 1999 to 2009, he served as a director of SM&A, a provider of management consulting, proposal management and program support services. Mr. Lewis currently serves as a director, and on the audit and compensation committees, of several privately held companies, including The Chartis Group, RGM Group, Bluewolf Group and Silverado Senior Living.

7

As a Managing Director of a private equity firm, and as a director of several companies, Mr. Lewis brings to the Board significant senior leadership, management, operational and financial experience. He has extensive experience in evaluating new business opportunities, which strengthens our ability to select strategic acquisitions. Mr. Lewis also brings experience as a public company outside director.

Dr. Ritrievi has been a member of our Board since November 2013. She is currently President of The Ritrievi Group LLC where she has advised technology and chemical companies on financial strategies. From 2001 to 2004, she served as Co-Director of Americas Investment Research at Goldman, Sachs & Co. Prior to that, Dr. Ritrievi was a Specialty Chemicals Analyst at Goldman, Sachs & Co., Credit Suisse First Boston, Lehman Brothers and Paine Webber (now UBS Wealth Management). She started her career as a process development engineer at ARCO Chemical. Since 2001, Dr. Ritrievi has served on the board of the Harvard School of Dental Medicine. From 2005 to 2009, she served on the board, and on the finance and resources committee, of Princeton University. Dr. Ritrievi received her doctorate in Chemical Engineering from the Massachusetts Institute of Technology ("MIT"), and holds a master's degree in Management from the MIT Sloan School of Management.

Dr. Ritrievi provides to the Board more than two decades of experience in corporate finance, and financial and M&A strategies. She also brings an engineering background, specifically in the area of chemical engineering, which allows her to understand our business from a technical perspective. Dr. Ritrievi also adds executive experience in management and technology consulting, together with investor analyst experience.

Mr. Smith has been a member of our Board since May 2005. He served as Chairman from March 2006 to January 2008, after having served as Vice Chairman since September 2005. Mr. Smith is a former member of the U.S. Secretary of Defense's Defense Science Board, serving from 2002 to 2005. He was an Executive Vice President of Lockheed Martin and head of its Integrated Systems & Solutions business until 2004. From 1999 to 2003, Mr. Smith was Executive Vice President of Lockheed Martin's Space Systems Company. Prior to that, he was President of Government Systems at Harris Corporation. Mr. Smith has also worked for the Central Intelligence Agency, where he received the Intelligence Medal of Merit. He has served as a director of the Curtiss-Wright Corporation, a multinational provider of highly engineered products and services, since 2006, and is currently a member of its finance, and directors, nominating and governance committees. Mr. Smith has served as a director of CDI Corporation, a professional services company, since 2008, and is currently a member of its finance and compensation committees. He has served on the board of Siteworx, LLC, a provider of technology consulting services, since July 2014. Mr. Smith also served on the Board of Trustees of Aerospace Corporation from 2005 to 2007.

Mr. Smith has over 20 years of executive, management and operational experience, including his leadership roles with us and at Lockheed Martin Corporation. He brings broad knowledge of the federal defense industry, specifically in the areas of aerospace, systems and processes, and the engineering services business. Mr. Smith has an engineering degree, which gives him a technical understanding of our business. In addition, he has experience as a director of other public companies, which positions him to provide his insights into a variety of corporate governance practices and other board functions.

Mr. Thompson joined our Board in April 2007. Since 2000, he has been the President/Chief Executive Officer and a co-owner of Pacific Star Energy, LLC, a private energy investment firm in Alaska. Mr. Thompson served as Managing Director of the Alaska Venture Capital Group LLC, a private oil and gas exploration firm, from 2004 to 2012. From 1998 to 2000, he was the Executive Vice President for ARCO's Asia-Pacific Region. In this role, Mr. Thompson led ARCO's Asia-Pacific operating companies. In previous positions, Mr. Thompson was head of ARCO's oil and gas research and technology center, and was responsible for global technology strategy and energy technology transfer to more than 20 countries. Mr. Thompson served in various technical and management roles at ARCO from 1974 to 2000. Mr. Thompson has served as a director of Alaska Air Group, Inc., a holding company for Alaska Airlines

8

and Horizon Air Industries, since 1999, and is a member of its compensation (chair) and safety committees. He has served as a director of Coeur Mining, Inc. since 2002, and is a member of its governance/nominating, audit and safety/environmental (chair) committees. Mr. Thompson has served as a director of Pioneer Natural Resources Company, a large independent oil and gas exploration and production company, since August 2011, and is a member of its governance/nominating, compensation and safety/environmental (chair) committees. He also serves on the board of Provision Ministry Group, a non-profit organization.

Through Mr. Thompson's various executive positions, including the role of chief executive officer, he brings to the Board leadership, risk management, operations, strategic planning, engineering, environmental, safety and regulatory experience. He also brings expertise in mining and in oil and gas, our fastest growing commercial sector, in which we are expanding our environmental and process engineering practices. Mr. Thompson also has experience as a director of other public companies, which enables him to provide insights into a variety of strategic planning, risk management, compensation, finance and governance practices.

Admiral Truly joined our Board in April 2003. He is the former Executive Vice President of Midwest Research Institute ("MRI"). Prior to joining MRI in 1997, Admiral Truly was Vice President of the Georgia Institute of Technology, and Director of the Georgia Tech Research Institute, from 1992 to 1997. From 1989 to 1992, he served as the eighth Administrator of the National Aeronautics and Space Administration ("NASA") under President George H.W. Bush, and prior to that, he had a distinguished career in the U.S. Navy and NASA, retiring from the Navy as Vice Admiral. Admiral Truly was an astronaut with NASA and piloted theColumbia, commanded theChallenger, and in 1986 led the investigation of theChallenger accident. Admiral Truly was awarded the Presidential Citizens Medal, has served on the Defense Policy Board and Army Science Board, and is a member of the National Academy of Engineering. From 2005 to 2010, he served as a director of Xcel Energy, Inc., an electric power and natural gas utility. Admiral Truly also served on Xcel's finance, governance, compensation and nominating, and nuclear environmental and safety committees during his tenure. He has served as a director and member of the compensation committee of Suntricity Corporation, a private company, since 2011. Admiral Truly also serves on the boards, and on various committees, of Regis University and the Colorado School of Mines.

As a retired Vice Admiral of the U.S. Navy, Admiral Truly brings to the Board extensive knowledge of the federal government, particularly the U.S. Department of Defense. As the former Administrator of NASA, one of our clients, he brings a broad understanding of NASA's structure, goals and procedures. Admiral Truly also possesses an extensive background in the engineering services business, and his engineering degree gives him a technical understanding of our business. Admiral Truly also has experience serving as a public company outside director.

Ms. Volpi joined our Board in July 2013. She serves at the Colorado School of Mines as the Executive Vice President for Finance and Administration, Chief Financial Officer and Treasurer. She previously served on the U.S. Olympic Committee as the Chief Administrative Officer. In previous positions, Ms. Volpi served in various financial management roles for Rensselaer Polytechnic Institute, the University of Colorado Foundation and the American Water Works Association. Ms. Volpi holds a Bachelor of Science in Accounting from the University of Colorado and is a Certified Public Accountant.

Ms. Volpi has an extensive understanding of the preparation and analysis of financial statements. She is considered an "audit committee financial expert" under SEC rules, based on her background as a certified public accountant and her various financial management roles in both private and public sector institutions. Ms. Volpi's expertise in accounting and financial management makes her a key asset to the Board in its oversight of the integrity of our financial statements and the financial reporting process. This expertise is complemented by her leadership and management experience.

9

Dr. Li-San Hwang has served as our Chairman Emeritus since March 2006. As Chairman Emeritus, Dr. Hwang is invited to attend Board and Board committee meetings, but he does not have voting rights. Chairman Emeritus is an unpaid position; however, we reimburse Dr. Hwang for his attendance-related expenses.

Dr. Hwang joined our predecessor in 1967 and led our acquisition of the Water Management Group of Tetra Tech, Inc., a subsidiary of Honeywell Inc., in March 1988. He served as our Chief Executive Officer from our formation until November 2005. Dr. Hwang has served as an advisor to numerous government and professional society committees and has published extensively in the field of hydrodynamics. He is a graduate of the National Taiwan University, Michigan State University and the California Institute of Technology, holding B.S., M.S. and Ph.D. degrees, respectively, in Civil Engineering, specializing in water resources.

Upon recommendation of the Nominating and Corporate Governance Committee, our Board of Directors has determined that, as of the date of this proxy statement, each member of the Board of Directors other than Mr. Batrack is independent under the criteria established by NASDAQ for director independence. The NASDAQ criteria include various objective standards and a subjective test. A member of the Board of Directors is not considered independent under the objective standards if, for example, he or she is, or at any time during the past three years was, employed by us. Mr. Batrack is not independent because he is an employee. In connection with the assessment of Mr. Thompson's independence, we reviewed the facts and circumstances of his role as an independent director of Coeur Mining, Inc. and Pioneer Natural Resources Company, two of our clients, and Alaska Air Group, Inc., one of our vendors. We concluded that Mr. Thompson is an independent director because his role at each of these companies is limited to that of an independent director, each of the companies is a large public company, and the amount of business done with each of the companies is immaterial to us and each such company.

All members of each of our Audit, Compensation, Nominating and Corporate Governance, and Strategic Planning and Enterprise Risk committees are independent directors. In addition, upon recommendation of the Nominating and Corporate Governance Committee, the Board has determined that the members of the Audit Committee meet the additional independence criteria required for audit committee membership under applicable NASDAQ listing standards.

The subjective test under NASDAQ criteria for director independence requires that each independent director not have a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The subjective evaluation of director independence by the Board of Directors was made in the context of the objective standards referenced above. In making its independence determinations, the Board of Directors considers the transactions and other relationships between us and each director and his or her family members and affiliated entities. The Board of Directors determined that there were no transactions or other relationships that exceeded NASDAQ objective standards and none would otherwise interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

We are committed to excellence in corporate governance and maintain clear policies and practices that promote good corporate governance. As governance standards have evolved, we have enhanced our governance standards as appropriate to best serve the interests of our stockholders. Many of these policies and practices are designed to ensure compliance with the listing requirements of NASDAQ and applicable corporate governance requirements. We believe that the corporate governance practices we have adopted benefit our stockholders by maintaining appropriate accountability for our company.

10

- •

- Annual election of all directors.

- •

- Majority vote standard in uncontested elections. If a director receives more "AGAINST" votes than "FOR" votes, the director must submit a resignation for the Board to consider.

- •

- Allow stockholders owning 20% of our shares to call a special meeting.

- •

- Our Board is comprised entirely of independent directors, except our Chief Executive Officer.

- •

- Each of our Board committees (Audit, Compensation, Nominating and Corporate Governance, and Strategic Planning and Risk Management) is made up solely of independent directors.

- •

- Each of our Board committees has the authority to retain independent advisors, which will be paid for by the company.

- •

- The charters of our Board committees clearly establish their respective roles and responsibilities.

- •

- We are committed to operating with honesty and integrity, and maintaining the highest level of ethical conduct. Our Code of Corporate Conduct applies to all employees, as well as the Board. We also have a Finance Code of Professional Conduct that applies to our Chief Executive Officer and all members of our finance department, including our chief financial officer and principal accounting officer.

- •

- We maintain a hotline that is available to all employees for the anonymous submission of employee complaints, and all complaints relating to accounting, internal controls or auditing matters go directly to the Chairman of our Audit Committee.

- •

- We maintain an internal audit control function that provides critical oversight over the key areas of our business and financial processes and controls, and reports directly to the Audit Committee.

- •

- We maintain a compensation recoupment or "clawback" policy that applies to executive officers under our Executive Compensation Plan and our 2015 Equity Incentive Plan.

- •

- We maintain stock ownership guidelines for directors and executive officers.

What We Do:

- •

- We do not have a stockholders rights plan or poison pill.

- •

- We do not allow our directors, executives or employees to hedge or pledge company securities without obtaining prior written approval from our General Counsel.

- •

- We do not make corporate contributions to candidates for political office, political parties or committees, or political committees organized for the advance of political candidates without obtaining written approval from our Chief Executive Officer.

- •

- We do not have supermajority voting provisions in our Certificate of Incorporation or Bylaws.

What We Don't Do:

Key information regarding our corporate governance initiatives can be found on our website,www.tetratech.com, including our Corporate Governance Policies, Code of Business Conduct, Finance Code of Professional Conduct, and the charter for each committee of the Board of Directors. The corporate governance page can be found by clicking on "Corporate Governance" in the Investor Relations section of our website.

11

Our Board of Directors believes strongly in the value of an independent board of directors. Currently, all directors other than Mr. Batrack are independent. We have established a Presiding Director role with broad authority and responsibility, as described further below. The independent members of the Board also meet regularly without management, which meetings are chaired by the Presiding Director. Mr. Lewis currently serves as the Presiding Director, and Mr. Batrack currently serves as our Chairman and CEO.

The Board believes that it should maintain flexibility to select our Chairman and board leadership structure from time to time. Our policies do not preclude the CEO from also serving as Chairman of the Board. Combining the Chairman and CEO roles fosters clear accountability, effective decision-making and alignment on corporate strategy. In light of Mr. Batrack's knowledge of our company and its industry, and his experience successfully navigating us through both strong and challenging periods, his ability to speak as Chairman and CEO provides us with strong unified leadership.

The Board believes the role of Chairman and CEO, together with the role of the Presiding Director, provides an appropriate balance in our leadership. The role given to the Presiding Director helps ensure a strong, independent and active Board.

The Presiding Director is elected by and from the independent directors. The Presiding Director has the following roles and responsibilities:

- •

- scheduling meetings of the independent directors;

- •

- chairing the separate meetings of the independent directors;

- •

- serving as principal liaison between the independent directors and the Chairman and CEO on sensitive issues;

- •

- communicating from time to time with the Chairman and CEO, and disseminating information to the rest of the Board of Directors as appropriate;

- •

- providing leadership to the Board of Directors if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict; and

- •

- being available, as appropriate, for communication with stockholders.

The Role of the Board of Directors in Risk Oversight and Management Continuity

We believe that risk is inherent in the pursuit of long-term growth opportunities. Our management is responsible for day-to-day risk management activities. The Board of Directors, acting directly and through its committees, is responsible for the oversight of our risk management. With the oversight of the Board, we have implemented an enterprise risk management ("ERM") program with practices and policies designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase stockholder value.

The Strategic Planning and Risk Management Committee is responsible for the oversight of the ERM. Our Corporate Risk Management Officer reports the status of the ERM to the Strategic Planning and Enterprise Risk Committee on a semi-annual basis. The reports address our risk management effectiveness, those projects that may significantly impact our financial condition, and any new risk issues and mitigation measures that have been implemented.

As part of the overall risk oversight framework, other committees of the Board also oversee certain categories of risk associated with their respective areas of responsibility. For example, the Audit Committee oversees matters related to accounting and financial reporting, financial metrics and measures, liquidity and cash flow, tax and treasury, litigation and claims, and compliance with the Sarbanes-Oxley Act of 2002. The Compensation Committee oversees compensation-related risk management, as discussed

12

further under "Compensation Committee" and in the "Compensation Governance" portion of the "Compensation Discussion and Analysis." The Nominating and Corporate Governance Committee is responsible for our Code of Business Conduct and anti-fraud measures.

Each committee reports to the full Board on its activities. In addition, the Board participates in regular discussions among the directors and with our senior management with respect to several core subjects in which risk oversight is an inherent element, including strategy, operations, finance, mergers and acquisitions, and legal matters. The Board of Directors believes that the leadership structure described above under "Board Leadership Structure" facilitates the Board's oversight of risk management because it allows the Board, with leadership from the Presiding Director and working through its committees, including the independent Audit Committee, to participate actively in the oversight of management's actions.

A key responsibility of the Board and our CEO is ensuring that an effective process is in place to provide continuity of leadership over the long term at all levels in the company. Each year, succession planning reviews are held at each business group level, culminating in a full review of senior leadership talent by the independent directors. During this review, the CEO and the independent directors discuss future candidates for senior leadership positions, succession timing for those positions, and development plans for the highest-potential candidates. This process ensures continuity of leadership over the long term, and it forms the basis on which we make ongoing leadership assignments.

Board Meetings and Board Committees

During fiscal 2014, our Board of Directors held seven meetings. During this period, all of the incumbent directors attended or participated in more than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which each such director served, during the period for which each such director served. Our directors are strongly encouraged to attend the annual meeting of stockholders, and all of our directors attended last year's annual meeting.

We have four standing committees composed solely of independent directors, each with a different independent director serving as chairperson of the committee. Our Board committees are: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Strategic Planning and Enterprise Risk Committee. We hold our Board committee meetings sequentially (i.e., committee meetings do not overlap with one another). As a result of holding sequential meetings, each of our Board members is given the opportunity to attend each committee meeting. We believe this practice is highly beneficial to our Board as a whole and the company in general because each of our Board members is aware of the detailed work conducted by each Board committee. This practice also affords each of our Board members the opportunity to provide input to the committee members before any conclusions are reached.

13

The members of the committees, as of the date of this proxy statement, are identified in the following table.

Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Strategic Planning and Enterprise Risk Committee | ||||

|---|---|---|---|---|---|---|---|---|

Hugh M. Grant | Chair | X | ||||||

Patrick C. Haden | X | Chair | ||||||

J. Christopher Lewis | X | X | ||||||

Kimberly E. Ritrievi | X | X | ||||||

Albert E. Smith | X | Chair | ||||||

J. Kenneth Thompson | Chair | X | ||||||

Richard H. Truly | X | X | ||||||

Kirsten M. Volpi | X | X |

The general functions of the committees are set forth in the following paragraphs. Each of the committees has a written charter approved by the Board of Directors. A copy of each charter can be found by clicking on "Corporate Governance," then "Board Committees" in the Investor Relations section of our website atwww.tetratech.com.

Audit Committee

The Audit Committee is responsible for reviewing the financial information that will be provided to stockholders and others; reviewing the system of internal controls that management has established; appointing, retaining and overseeing the performance of our independent registered public accounting firm; overseeing our accounting and financial reporting processes and the audits of our financial statements; and pre-approving audit and permissible non-audit services provided by the independent registered public accounting firm. This committee held five meetings during fiscal 2014. Each of Mr. Grant and Ms. Volpi is an "audit committee financial expert" as defined in Item 407(d) of Regulation S-K. Each member of this committee is an independent director and meets each of the other requirements for audit committee members under applicable NASDAQ listing standards.

Compensation Committee

The Compensation Committee's basic responsibility is to review the performance and development of our management in achieving corporate goals and objectives and to assure that our executive officers are compensated effectively in a manner consistent with our strategy, competitive practice, sound corporate governance principles and stockholder interests. Toward that end, this committee reviews and approves our compensation to executive officers.

The Compensation Committee's responsibilities and duties include the review and approval of our compensation strategy to ensure that it promotes stockholder interests and supports our strategic and tactical objectives, and that it provides appropriate rewards and incentives for management and employees, including a review of compensation-related risk management. During fiscal 2014, the Compensation Committee performed these oversight responsibilities and duties by, among other things, reviewing our compensation practices and policies generally, including an evaluation of the design of our executive compensation program, in light of our risk management policies and programs. Additional information regarding the Compensation Committee's risk management review appears in the "Compensation Governance" portion of the "Compensation Discussion and Analysis" section of this proxy statement.

This committee held six meetings during fiscal 2014. Each member is an independent director under the applicable NASDAQ listing standards, an "outside director" as defined in Section 162(m) of the

14

Internal Revenue Code (the "Code"), and a "non-employee director" as defined in Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act").

The Compensation Committee has the exclusive authority and responsibility to determine all aspects of executive compensation packages for executive officers, other than input from the Audit Committee concerning the Chief Financial Officer's compensation. The Compensation Committee has directly retained Towers Watson as its independent, external compensation consultant to help establish and implement the Compensation Committee's compensation philosophy, evaluate compensation proposals recommended by management, and provide advice and recommendations on competitive market practices and specific compensation decisions for executive officers and directors. The Compensation Committee retains and does not delegate any of its exclusive power to determine all matters of executive compensation and benefits, although the CEO, together with the Human Resources staff, present compensation and benefit proposals to the Compensation Committee. Towers Watson works with the Compensation Committee (and not on behalf of management) to assist the Compensation Committee in satisfying its responsibilities and will undertake no projects for management except at the request of the Compensation Committee chair and in the capacity of the Compensation Committee's agent. Towers Watson performs no other consulting or other services for us.

In accordance with regulatory requirements, the Compensation Committee evaluated the following six factors to assess independence and conflicts of interest before it engaged Towers Watson to perform work in fiscal 2014:

- 1.

- The provision of other services to us by Towers Watson.

- 2.

- The amount of fees received from us by Towers Watson, as a percentage of the firm's total revenues.

- 3.

- The policies and procedures of Towers Watson that are designed to prevent conflicts of interest.

- 4.

- Any business or personal relationship of a member of the Compensation Committee with the regular members of the Towers Watson executive compensation team serving us.

- 5.

- Any of our stock owned by the regular members of the Towers Watson executive compensation team that serve us.

- 6.

- Any business or personal relationships between our executive officers and the regular members of the Towers Watson executive compensation team that serve us.

The Compensation Committee also obtained a representation letter from Towers Watson addressing these six factors and certain other matters related to its independence. Based on the Compensation Committee's evaluation of these factors and the representations from Towers Watson, the Compensation Committee concluded that Towers Watson is an independent adviser and has no conflicts of interest with us.

For additional information concerning the Compensation Committee's processes and procedures for consideration and determination of executive officer compensation, see the "Compensation Discussion and Analysis" section of this proxy statement.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for overseeing, reviewing and making periodic recommendations concerning our corporate governance policies, and for recommending to the full Board candidates for election to the Board of Directors. This committee is also responsible for making recommendations to the full Board regarding the compensation of non-employee directors with the assistance of Towers Watson. The Nominating and Corporate Governance Committee held four

15

meetings during fiscal 2014. Each member is an independent director under applicable NASDAQ listing standards.

Nominees for the Board of Directors should be committed to enhancing long-term stockholder value and must possess a high level of personal and professional ethics, sound business judgment and integrity. The Board of Directors has codified the standards for directors in our Corporate Governance Policies. These Policies provide that the Nominating and Corporate Governance Committee will work with the Board to determine the appropriate characteristics, skills and experiences for the Board as a whole and its individual members with the objective of having a Board with diverse backgrounds and experience. Characteristics expected of all directors include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to the Board.

In evaluating the suitability of individual Board members, the Nominating and Corporate Governance Committee takes into account many factors, including general understanding of business development and strategy, risk management, finance, financial reporting and other disciplines relevant to the success of a publicly traded company in today's business environment; understanding of our business and the issues affecting that business; education and professional background; personal accomplishment; and diversity. With regard to diversity, we are committed to considering candidates for the Board regardless of gender, ethnicity and national origin. Final approval of a candidate will be determined by the full Board. The Board will evaluate each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment using its diversity of experience. The Committee evaluates each incumbent director to determine whether he or she should be nominated to stand for re-election, based on the types of criteria outlined above as well as the director's contributions to the Board during that director's current term.

The brief biographical description of each nominee set forth in the "Business Experience and Qualifications of Nominees" section above includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of the Board of Directors at this time.

In recommending candidates for election to the Board of Directors, our Nominating and Corporate Governance Committee considers nominees recommended by directors, officers and others, using the same criteria to evaluate all candidates. The committee reviews each candidate's qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board of Directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating and Corporate Governance Committee recommends the candidate for consideration by the full Board of Directors. The committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

To recommend a prospective nominee for the Nominating and Corporate Governance Committee's consideration, stockholders should submit the candidate's name and qualifications to our Secretary in writing at the following address: Tetra Tech, Inc., Attn: Secretary, 3475 E. Foothill Boulevard, Pasadena, California 91107. When submitting candidates for nomination to be elected at our annual meeting of stockholders, stockholders must also follow the notice procedures and provide the information required by our bylaws. In particular, for the Nominating and Corporate Governance Committee to consider a candidate recommended by a stockholder for nomination at the 2016 annual meeting, the recommendation must be delivered or mailed to and received by the Secretary at our principal executive offices on or between October 17, 2015 and November 16, 2015 (or, if the 2016 annual meeting is not held within 30 days of the anniversary of the date of the 2015 annual meeting, no later than the tenth day following the date of our public announcement of the date of the 2016 annual meeting). The

16

recommendation must include the same information as is specified in our bylaws for stockholder nominees to be considered at an annual meeting, including the following:

- •

- the name and address of the stockholder who intends to make the nomination and of the person to be nominated;

- •

- a representation that the stockholder is a record holder of our common stock on the date of such notice and intends to appear in person or by proxy at the meeting to nominate the person specified in the notice;

- •

- a description of all arrangements or understandings between the stockholder and the nominee or any other person (naming such person) pursuant to which the nomination is to be made by the stockholder;

- •

- information regarding the nominee that would be required to be included in our proxy statement by the rules of the SEC, including the nominee's age, business experience for the past five years and any other directorships held by the nominee, including directorships held during the past five years; and

- •

- the consent of the nominee to serve as a director if so elected.

Strategic Planning and Enterprise Risk Committee

The Strategic Planning and Enterprise Risk Committee is responsible for overseeing our strategic planning process; reviewing and recommending to the Board certain strategic decisions regarding our exit from existing lines of business and entry into new lines of business, acquisitions, joint ventures, investments or dispositions of businesses and assets, and the financing of these transactions; reviewing and approving management's capital allocation strategy; reviewing our bid and proposal strategy for contracts that present high risk to our financial health; overseeing the ERM, including cybersecurity matters; and reviewing changes in technology and regulatory trends to assess the impact of technology and regulatory changes on business strategy and resource allocation. This committee held two meetings during fiscal 2014. Each member of this committee is an independent director under applicable NASDAQ listing standards.

This section provides information regarding the compensation policies for non-employee directors and amounts paid and securities awarded to these directors in fiscal 2014. Non-employee directors typically do not receive forms of remuneration, perquisites or benefits other than those described below, but are reimbursed for their expenses in attending meetings.

Fiscal 2014 Cash Compensation

During fiscal 2014, our non-employee director cash compensation program consisted of the following:

- •

- annual retainer of $65,000 for serving on the Board of Directors for the year of Board service beginning upon election at the 2014 Annual Meeting of Stockholders;

- •

- additional annual retainer fee of $15,000 for serving as the Presiding Director;

- •

- additional annual retainer fee of $15,000 for serving as the Chair of the Audit Committee;

- •

- additional annual retainer fee of $5,000 for serving as the Chair of the Compensation Committee;

- •

- additional annual retainer fee of $5,000 for serving as the Chair of the Nominating and Corporate Governance Committee;

17

- •

- additional annual retainer fee of $5,000 for serving as the Chair of the Strategic Planning and Enterprise Risk Committee;

- •

- additional fee of $2,000 per in-person or telephonic Board meeting attended;

- •

- additional fee of $2,000 per in-person or telephonic Audit Committee meeting attended; and

- •

- additional fee of $1,500 per in-person or telephonic Compensation Committee, Nominating and Corporate Governance Committee, or Strategic Planning and Enterprise Risk Committee meeting attended.

Fiscal 2014 Equity Compensation

Our 2005 Equity Incentive Plan (the "2005 Plan") provides for discretionary equity grants to non-employee directors. The following awards were made to each of the non-employee directors on November 22, 2013:

- •

- a non-qualified stock option to purchase 4,200 shares of common stock at an exercise price of $28.58 per share, the fair market value (closing price) of a share of our common stock on the date of grant. Each option vests and becomes exercisable in full on the first anniversary of the grant date if the director has not ceased to be a director prior to such date. The options have a term of eight years measured from the grant date, and vest immediately in full upon certain changes in our control or ownership, or upon the optionee's death, disability or retirement while a member of the Board;

- •

- 1,800 performance shares, which were awarded concurrently with the annual grants of performance shares to our executive officers as described in the "Compensation Discussion and Analysis" section of this proxy statement. The performance shares are eligible for vesting in equal installments over three years beginning as of the award date. The number of vested shares in each installment (from 0% to 140%) is based on the average annual percentage growth in our earnings per share from the base year, using the same calculation that is used to determine the vesting of performance share awards to executive officers. Accordingly, based on this formula, on November 21, 2014, (i) 0% of the third installment of the fiscal 2012 award vested; (ii) 0% of the second installment of the fiscal 2013 award vested; and (iii) 140% of the first installment of the fiscal 2014 award vested. All unvested shares were forfeited. For additional information concerning the vesting of performance shares, please refer to the "Compensation Discussion and Analysis" section of this proxy statement; and

- •

- 900 time-vested restricted stock units ("RSUs"), vesting on the first anniversary of the award date.

Consistent with our policy regarding initial equity grants for new non-employee directors, on November 14, 2013, Dr. Ritrievi received a non-qualified stock option to purchase 8,000 shares of common stock at an exercise price of $28.68 per share, the fair market value of a share of our common stock on the grant date. The option vests and becomes exercisable in full on the first anniversary of the grant date if Dr. Ritrievi has not ceased to be a director prior to such date. The option has a term of eight years measured from the grant date, and vests immediately in full upon certain changes in our control or ownership, or upon Dr. Ritrievi's death, disability or retirement while a member of the Board.

18

Fiscal 2014 Total Director Compensation

The following table provides information as to compensation for services of our non-employee directors during fiscal 2014:

Non-Employee Director | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) | Performance Share Awards ($)(2) | Restricted Stock Unit (RSU) Awards ($)(3) | Total ($) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Hugh M. Grant | 114,500 | 39,312 | 51,444 | 25,722 | 230,978 | |||||||||||

Patrick C. Haden | 94,000 | 39,312 | 51,444 | 25,722 | 210,478 | |||||||||||

J. Christopher Lewis | 114,500 | 39,312 | 51,444 | 25,722 | 230,978 | |||||||||||

Kimberly E. Ritrievi | 84,500 | 114,832 | 51,444 | 25,722 | 276,498 | |||||||||||

Albert E. Smith | 96,000 | 39,312 | 51,444 | 25,722 | 212,478 | |||||||||||

J. Kenneth Thompson | 103,000 | 39,312 | 51,444 | 25,722 | 219,478 | |||||||||||

Richard H. Truly | 91,000 | 39,312 | 51,444 | 25,722 | 207,478 | |||||||||||

Kirsten M. Volpi | 93,500 | 39,312 | 51,444 | 25,722 | 209,978 | |||||||||||

- (1)

- The amounts in the Option Awards column represent the aggregate grant date fair values, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 ("FASB ASC Topic 718"), of stock option awards issued pursuant to the 2005 Plan. The grant date fair value of the stock option awards granted on November 22, 2013 to each non-employee director on that date was $9.36 per share. The grant date fair value of the stock option award granted on November 14, 2013 to Dr. Ritrievi was $9.44 per share. There can be no assurance that these grant date fair values will ever be realized by the non-employee directors. For information regarding the number of stock options held by each non-employee director as of September 28, 2014, see the column "Stock Options Outstanding" in the table below.

- (2)

- The amounts in the Performance Share Awards column represent the aggregate grant date fair values, computed in accordance with FASB ASC Topic 718, of performance share awards under the 2005 Plan. The grant date fair value of these awards is calculated using the closing price of our common stock on the grant date as if these awards were vested and issued on the grant date. The grant date fair value of the performance share awards granted on November 22, 2013 to each non-employee director on that date was $28.58 per share. There can be no assurance that these grant date fair values will ever be realized by the non-employee directors. For information regarding the number of unvested performance shares held by each non-employee director as of September 28, 2014, see the column "Unvested Performance Shares Outstanding" in the table below.

- (3)

- The amounts in the RSU Awards column represent the aggregate grant date fair values, computed in accordance with FASB ASC Topic 718, of RSU awards under the 2005 Plan. The grant date fair value of these awards is calculated using the closing price of our common stock on the grant date as if these awards were vested and issued on the grant date. The grant date fair value of the performance share awards granted on November 22, 2013 to each non-employee director was $28.58 per share. There can be no assurance that these grant date fair values will ever be realized by the non-employee directors. For information regarding the number of unvested RSUs held by each non-employee director as of September 28, 2014, see the column "Unvested RSUs Outstanding" in the table below.

Each of the non-employee directors owned the following number of stock options, unvested performance shares and unvested RSUs as of September 28, 2014:

Non-Employee Director | Stock Options Outstanding (#) | Unvested Performance Shares Outstanding (#) | Unvested RSUs Outstanding (#) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Hugh M. Grant | 72,400 | 3,500 | 1,575 | |||||||

Patrick C. Haden | 40,400 | 3,500 | 1,575 | |||||||

J. Christopher Lewis | 65,150 | 3,500 | 1,575 | |||||||

Kimberly E. Ritrievi | 12,200 | 1,800 | 900 | |||||||

Albert E. Smith | 65,150 | 3,500 | 1,575 | |||||||

J. Kenneth Thompson | 50,900 | 3,500 | 1,575 | |||||||

Richard H. Truly | 56,400 | 3,500 | 1,575 | |||||||

Kirsten M. Volpi | 12,200 | 1,800 | 900 | |||||||

19

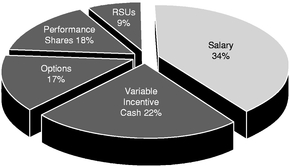

Non-Employee Director Stock Ownership