The employment agreements of Keith L. Lampert and Alan Schutzman provided for, among other things, an annual base salary of $350,000 and $275,000, respectively, and a monthly automobile allowance for fiscal 2005 of $1,500 and $1,000, respectively. Pursuant to the terms of their separation from the Company, Mr. Keith Lampert’s employment term, which was to have expired on January 1, 2006, was extended through March 31, 2006 and Mr. Schutzman’s employment term, which was to have expired on September 15, 2006, was reduced to a period ending on March 31, 2006, inclusive. Under their respective employment agreements, if the Company terminated the executive’s employment at any time without cause, or if the executive terminated his employment after the stated term of his employment agreement, the executive was entitled to severance payments equal to one year of his then base salary and automobile allowance, payable in installments in accordance with the normal payroll schedule. The additional terms and conditions of the separation of each of Messrs. Keith Lampert and Schutzman are described in “Executive Separation Agreements” below.

The employment agreement of each NEO prohibits him from competing with the Company for one year following the termination of his employment with the Company; however, if Ira B. Lampert’s employment is terminated without cause, the duration of his non-compete covenants would extend throughout the period in which his base salary and other benefits are continued if such period exceeds twelve months.

On December 24, 2005, the Company and each of Keith L. Lampert and Alan Schutzman entered into Separation Agreements, pursuant to which they each separated from the Company effective April 1, 2006.

Each Separation Agreement provided that the separating executive was to receive, among other things, in addition to the benefits to which he was entitled under the Company’s 401(k) plan and his individual SERP: (a) the equivalent of his base salary per annum plus his automobile allowance for a period of twelve (12) months from and after the effective date of his termination other than for “cause” (as defined in his respective Terms of Employment) (March 31, 2006 or the date of any earlier voluntary termination or termination without cause) (the “Post-Employment Period”) in accordance with the severance provisions of his Terms of Employment, payable in accordance with the Company’s normal payroll practices; (b) his full vacation allotment for calendar year 2006 as though he was in the employ of the Company throughout calendar year 2006; (c) payment for his accrued but unused vacation allotment; (d) reimbursement of premiums for the continuation of his health insurance coverage under COBRA during the Post-Employment Period; and (e) reimbursement of certain agreed upon amounts for life and disability insurance coverage during the Post-Employment Period. Mr. Keith Lampert’s Separation Agreement also provided for the acceleration of the vesting date of one of his deferred compensation accounts under his SERP from August 6, 2006 to the earlier of (i) March 31, 2006 or (ii) the effective date of any earlier termination without cause or any earlier voluntary termination. See “Supplemental Executive Retirement Plans for Named Executive Officers” below for more information regarding Mr. Keith Lampert’s SERP.

Under the terms of their respective Separation Agreements, each separating executive (a) was prohibited from competing with the Company for a period of one year following the effective date of his separation from the Company; (b) agreed to provide to the Company certain cooperation and assistance (without additional compensation therefor during the one-year period covered by their severance payments); and (c) agreed to release the Company from any claims each may have against the Company.

Pursuant to the Lampert Agreement, the Company adopted a SERP for the benefit of Ira B. Lampert (the “Lampert SERP”). A specified amount of deferred compensation, which was $500,000 through June 30, 2005, was credited to the Lampert SERP account each year. These yearly credits were 100% vested and not subject to forfeiture. Mr. Lampert voluntarily reduced the amount of the credit that was made in January 2005 from $500,000 to $350,000. Effective as of July 1, 2005, the Company was no longer obligated to make $500,000 annual contributions to the Lampert SERP. However, if a change of control of the Company occurs and Mr. Lampert remains employed by the Company thereafter, the Company will be obligated to pay Mr. Lampert $500,000 within 30 days after the date of the change of control and annually during the remaining term of his employment with the Company on the first business day of each calendar year following the change of control.

Effective as of April 19, 2000, in connection with a one-time grant of deferred compensation to certain executive officers, the Company adopted certain SERPs, including those with respect to deferred compensation in the following amounts for the following NEOs (the “Executive SERPs”): (i) Keith L. Lampert, $450,000; and (ii) Urs W. Stampfli, $110,000. The amounts in the Executive SERP accounts vested in three equal annual installments on January 1st of 2001, 2002 and 2003. The Company simultaneously approved a one-time grant of deferred compensation to Ira B. Lampert in the amount of $1,549,998 with the same vesting schedule as under the Executive SERPs, and the Lampert SERP was amended to include appropriate terms to govern this one-time grant of deferred compensation.

In connection with a one-time grant of $115,000 in deferred compensation to Gerald J. Angeli, the Company adopted a SERP for his benefit as of July 31, 2001 (the “Angeli SERP”). Pursuant to the Angeli SERP, the grant vested, so long as Mr. Angeli continued to be employed by the Company, in five annual installments on June 11, 2002, 2003, 2004, 2005 and 2006. As of March 22, 2004, the Angeli SERP was amended pursuant to an amendment to his employment agreement granting him an additional amount of $50,000 in deferred compensation. The additional grant vested, so long as Mr. Angeli continued to be employed by the Company, in five equal annual installment of $10,000 each on March 22, 2005, 2006, 2007, 2008 and 2009. If his employment with the Company terminates for any reason (or no reason), Mr. Angeli will forfeit the balance of each grant that was not vested as of the termination date.

In connection with a one-time grant of $100,000 in deferred compensation to Alan Schutzman as of September 15, 2003, the Company adopted a SERP for his benefit. Pursuant to Mr. Schutzman’s SERP, the amounts in the SERP accounts vested, so long as he continued to be employed by the Company, in three equal annual installments on September 15th of 2004, 2005 and 2006, or immediately upon: (i) a change in control; or (ii) the termination of his employment as a result of his death or disability, or by the Company without “cause.” Pursuant to the terms of Mr. Schutzman’s SERP, the vesting of the final installment of his deferred compensation was accelerated to Mr. Schutzman’s separation date.

Each time the Company credited an executive’s account under a SERP agreement, the Company simultaneously contributed an equal amount to a trust established for the purpose of accumulating funds to satisfy the obligations incurred by the Company pursuant to the SERP. In addition, each account under a SERP agreement was subject to adjustment for income, expenses, gains or losses sustained as a result of investment of the SERP funds as directed by the executive (or an investment manager chosen by the executive) in his sole discretion, except that the Company directed the investment, in accordance with its Cash Investment Policy, of any unvested balances in an account established as a result of the deferred LTCIP awards to Ira B. Lampert and Keith L. Lampert described under the captionDeferred Long-Term Compensation below. See “Deferred Long-Term Compensation” below for information regarding SERP elections made by certain NEOs, pursuant to which the Company made distributions to them from their respective SERPs during fiscal 2006.

Deferred Long-Term Compensation

During fiscal 2004, certain NEOs were awarded the following amounts of contingent deferred compensation under the 2002 LTCIP with respect to the fiscal 2002-2003 performance period (the “Deferred LTCIP Awards”): (i) Ira B. Lampert, $670,474; (ii) Keith L. Lampert, $389,629; and (iii) Urs W. Stampfli, $274,021.

The Deferred LTCIP Awards to Keith L. Lampert and Urs W. Stampfli vested, so long as the executive continued to be employed by the Company, in three equal annual installments on August 6, 2004, 2005 and 2006, or immediately upon: (i) a change of control of the Company; or (ii) the executive’s death or disability.

Ira B. Lampert voluntarily agreed to delay the vesting of his Deferred LTCIP Award by one year, such that it vested in three equal installments beginning on August 6, 2005, 2006 and 2007 instead of August 6, 2004, 2005 and 2006. Otherwise, the Deferred LTCIP Award granted to Ira B. Lampert had substantially the same terms and conditions as the other Deferred LTCIP Awards, except that, in addition to the events that will accelerate the vesting of the other Deferred LTCIP Awards, it provides for immediate vesting in the event of termination without cause, a constructive termination of employment without cause or the non-renewal of his employment contract.

The Lampert SERP and the Executive SERPs were amended to include appropriate terms to govern the Deferred LTCIP Awards. The Company contributed the foregoing amounts to trusts established for the purpose of holding funds to satisfy the Company’s obligations under the Deferred LTCIP Awards.

14

On November 28, 2005, the Company entered into amendments to the SERPs with each of Messrs. Ira B. Lampert, Keith L. Lampert, Angeli, Schutzman and Stampfli. The amendments modified each SERP in response to new Section 409A (“Section 409A”) of the Internal Revenue Code of 1986, as amended, that affects non-qualified deferred compensation plans such as the SERPs.

The amendments addressed two types of deferred compensation governed by the SERPs: amounts deferred and vested on or before December 31, 2004 that are not subject to Section 409A (“Grandfathered Amounts”) and amounts deferred on or before December 31, 2004 but not vested on such date that are subject to Section 409A (“409A Amounts”). The amendments addressing Grandfathered Amounts terminated each SERP as to all Grandfathered Amounts and provided that such Grandfathered Amounts will be disbursed during calendar year 2005, except that the SERP between the Company and Ira B. Lampert was amended to permit Mr. Lampert, on or before November 30, 2005, to make an immediately effective election to withdraw his Grandfathered Amounts on January 3, 2006. The amendments addressing 409A Amounts permitted a SERP participant to elect, prior to December 31, 2005, to terminate his participation in his respective SERP as to all or a portion of the 409A Amounts, provided that all such vested 409A Amounts will be disbursed on or before December 31, 2005 or if not earned and vested on such date, during the calendar year in which such 409A Amounts will be earned and vested. Except for Mr. Schutzman, who, upon establishment of his SERP, elected to have each installment of his SERP award distributed as soon as it vested, each of the NEOs made such termination elections as of November 28, 2005. Accordingly, all vested amounts were distributed to each of them before December 31, 2005 and all amounts not yet vested as of that date will be distributed to them immediately upon vesting.

Management Equity Provisions of 1993 Incentive Plan

In August 1995, the Compensation and Stock Option Committee of the Board approved stock purchase awards under the Management Equity Provisions (“MEP”) of the Company’s 1993 Incentive Plan. The Company received commitments for the purchase of 888,000 shares (the “Purchased Shares”). Each purchaser was also granted the right to receive a contingent restricted stock award covering a number of shares equal to the number of shares he had purchased based upon attainment of increases in shareholder value in accordance with the plan.

In November 1995, each then participating member of the MEP Group entered into a Voting Agreement pursuant to which each member agreed to vote all of his Purchased Shares and contingent restricted stock awarded pursuant to the MEP in accordance with the determination of the holder of a majority of all of the Purchased Shares and contingent restricted stock held by the purchasers. To effect the foregoing, each of the members delivered an irrevocable proxy to Ira B. Lampert. In February 1997, the Voting Agreement and the irrevocable proxies were amended and restated to govern the options to purchase shares of Common Stock (“Option Shares”) awarded to the then members of the MEP Group in December 1996 in lieu of the contingent restricted stock.

As of October 2, 2006, the MEP Group consisted of the Ira B. Lampert and Keith L. Lampert and Ira Lampert held 432,344 Purchased Shares and 377,656 Option Shares and Keith Lampert held 110,000 Purchased Shares. Ira Lampert holds an irrevocable proxy entitling him to vote, in addition to his own voting shares of Common Stock, the Purchased Shares held by Keith Lampert.

Compensation Committee Interlocks and Insider Participation

The membership of the Compensation and Stock Option Committee of the Board during fiscal 2006 consisted of Messrs. O’Neill and Cooper. No member of the Compensation and Stock Option Committee is now or ever was an officer or an employee of the Company or any of its subsidiaries. No executive officer of the Company serves as a member of the compensation committee or as a director of any entity one or more of whose executive officers serves as a member of the Company’s Board or the Compensation and Stock Option Committee. There were no compensation committee interlocks during fiscal 2006.

Compensation Committee Report on Executive Compensation

The Compensation and Stock Option Committee of the Board (hereinafter, the “Committee”) is comprised of two independent directors as determined in accordance with the listing standards applicable to the Company. The Committee seeks to ensure that the Company’s compensation policies are designed and implemented to promote the goal of enhancing long-term shareholder value. The Committee believes that the key to achieving this goal is to

15

attract, retain and motivate qualified and experienced executive officers and employees. The Committee therefore favors forms of compensation that encourage and reward long-term service to the Company, and enable those who succeed in building shareholder value to share in the value they have helped to create. As such, the Committee believes that critical components of compensation for executives are: (i) the award of stock options at the time the executive joins the Company; (ii) the payment of annual cash incentive compensation based upon the attainment by the Company of a specified return on equity set by the Board; and (iii) the payment of compensation based upon the attainment by the Company of specified long-term performance-based goals. The Committee continues to evaluate the critical components of executive compensation from time to time through the utilization of outside compensation consultants. The Committee believes that providing executives with opportunities to acquire significant stakes in the Company’s growth and prosperity through the grant of stock options and other incentive awards will enable the Company to attract and retain qualified and experienced executive officers.

Executive Officers.Pursuant to the Company’s By-Laws, compensation of the Chief Executive Officer (“CEO”) and any executive officer or employee having a familial relationship to the CEO is determined by a majority of the Company’s independent directors (based on the Committee’s recommendation) or by the Committee. The compensation of all other executive officers is determined by the Committee.

Before the levels of compensation reflected in the “Summary Compensation Table” were established for certain of the NEOs, outside compensation consultants were engaged to obtain information and advice about competitive levels of compensation and particular compensation techniques used by public companies of comparable size (i.e., with comparable annual sales volume, results of operations, earnings per share, return on equity, market capitalization and/or assets) and survey data. After completing an internal recommendation and approval process involving the CEO and other executive officers, many factors are taken into consideration in determining an executive’s compensation including: individual performance; the Company’s financial performance; the compensation of executives at corporations of comparable size and operations; years of service to the Company; the executive’s responsibilities; the amount of time and travel required by the position; and the desire to encourage the long-term commitment of the executive. With respect to new executives, the results of any arms-length negotiations between the Company and such executive are also taken into consideration.

Executive officers are eligible to participate in an annual incentive compensation plan (“AICP”) pool equal to a percentage of the annual base salaries (in the aggregate) of all AICP participants selected for the fiscal year, provided that the Company’s return on shareholders’ equity is not less than a percentage established by the Board for each fiscal year (unless this requirement is otherwise waived by the Board). Based on the Company’s financial performance, the Committee decided that no AICP awards would be made to any of the Company’s executive officers with respect to fiscal 2006.

In order to further the Company’s interest in retaining the services of certain of its executive officers, and in order to provide additional long-term incentive to such executives, the Company established the Company’s Long-Term Incentive Plan commencing fiscal 2004 (the “LTIP”) in which certain executive officers are eligible to participate. The LTIP is linked to Concord’s long-term financial performance and the achievement of pre-determined performance criteria based on overlapping three-year fiscal cycles. The first such LTIP cycle was comprised of fiscal 2004, fiscal 2005 and fiscal 2006. If the performance criteria established by the Committee were met, the first LTIP awards would have been made after the end of fiscal 2006. Based on the Company’s recent financial performance, the Committee did not establish performance criteria in fiscal 2005 or fiscal 2006 for the LTIP cycles comprised of fiscal 2005, fiscal 2006 and fiscal 2007 and fiscal 2006, fiscal 2007 and fiscal 2008, respectively.

In addition, as part of the compensation package of each newly hired executive, the CEO may recommend, and the Committee considers, the grant of stock options based on the above factors.

Chief Executive Officer.Before considering an increase in the level of compensation for the CEO, the Committee engages the services of outside compensation consultants to obtain information and advice about competitive levels of compensation and particular compensation techniques used by public companies of comparable size (i.e., with comparable annual sales volume, results of operations, earnings per share, return on equity, market capitalization and/or assets) and survey data.

16

The annual base salary of the CEO was not increased in fiscal 2006. As discussed in greater detail elsewhere in this Proxy Statement, the CEO and the Company entered into an amendment to the CEO’s employment agreement effective as of July 1, 2005 to provide a four-year term that expires on July 1, 2009 and to end the Company’s obligation to make $500,000 annual contributions to a Supplemental Executive Retirement Plan adopted for the CEO’s benefit. See “Executive Compensation - Executive Employment Contracts, Termination of Employment and Change in Control Arrangements” above. The independent directors of the Board and/or the Committee, as the case may be, approve the CEO’s compensation based on criteria such as: (i) the complex international structure and operations of the Company, which are equivalent to those of much larger international corporations; (ii) the parity of CEO pay with other executive officers of the Company and executive officers to be hired in the future; (iii) the Company’s financial performance in meeting and exceeding certain targets and benchmarks; and (iv) the extensive worldwide travel and time requirements that the CEO position entails.

William J. O’Neill, Jr., Chairman

Ronald S. Cooper

17

Audit Committee Report

The members of the Audit Committee of the Board (the “Audit Committee”) are Messrs. Cooper, Gindi and O’Neill, all of whom are independent, as that term is defined in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. The primary purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s accounting and financial reporting processes. The Audit Committee’s functions are more fully described in its charter, which the Board has adopted. A copy of its charter was included as an appendix to the Company’s Proxy Statement as filed on December 18, 2003 with the SEC. The Audit Committee reviews and reassesses the adequacy of its charter on an annual basis. Based on its review in August 2006, the Audit Committee determined that since the Company no longer employed an internal auditor, the charter should be amended to delete references to an internal auditing function, and such amendments were duly made and approved. The Board annually reviews the NASDAQ listing standards’ definition of independence for audit committee members and has determined that each member of the Audit Committee meets that standard.

Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, BDO Seidman, LLP, is responsible for performing an independent annual audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with United States generally accepted accounting principles.

In conjunction with its activities during fiscal 2006, the Audit Committee reviewed and discussed the Company’s interim unaudited and annual audited financial statements with the Company’s independent registered public accounting firm with and without management present, and with management of the Company. The members of the Audit Committee discussed the agreed upon quarterly procedures and annual audit procedures performed by the independent registered public accounting firm in connection with the quarterly interim unaudited and annual audited financial statements with management of the Company and its independent registered public accounting firm. The members of the Audit Committee also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380), as amended by Statement of Auditing Standards No. 90. In addition, the Audit Committee received from the Company’s independent registered public accounting firm the written disclosures and the letter required by Independence Standards Board No. 1, and discussed its independence with the independent registered public accounting firm. Based on the foregoing reviews and discussions, the Audit Committee recommended to the Board, and the Board approved, that the fiscal 2006 annual audited financial statements be included in the Company’s Annual Report on Form 10-K for fiscal 2006 for filing with the SEC.

Ronald S. Cooper, Chairman

Morris H. Gindi

William J. O’Neill, Jr.

18

Beneficial Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of October 2, 2006 about the beneficial ownership of the Company’s Common Stock by: (i) each person or group who the Company knows beneficially owns more than 5% of its Common Stock; (ii) each director; (iii) each NEO; and (iv) all directors and executive officers as a group.

| | | Amount and Nature of | | Percent |

| Name of Beneficial Owner | | | Beneficial Ownership(1) | | of Class(1) |

| (i) Beneficial Owners of More Than 5% of the Common Stock | | | | | | |

| MT Trading LLC, Sondra Beit, RH Trading LLC and | | | | | | |

| LTC Racing LLC as a group | | 6,851,612 | (2) | | 23.7 | % |

| c/o MT Trading LLC | | | | | | |

| 530 Silas Deane Highway, Suite 130 | | | | | | |

| Wethersfield, CT 06109 | | | | | | |

| MT Trading LLC | | 5,522,072 | (2) | | 19.1 | % |

| 530 Silas Deane Highway, Suite 130 | | | | | | |

| Wethersfield, CT 06109 | | | | | | |

| Dimensional Fund Advisors Inc. | | 1,742,519 | (2) | | 6.0 | % |

| 1299 Ocean Avenue, 11thFloor | | | | | | |

| Santa Monica, CA 90401 | | | | | | |

| “MEP Group” of Company Officers or Former Officers as described in | | | | | | |

| note (3) below | | 2,083,446 | (3) | | 7.0 | % |

| (ii) Directors | | | | | | |

| Ira B. Lampert | | 1,983,446 | (3)(4) | | 6.7 | % |

| Ronald S. Cooper | | 52,000 | (5) | | * | |

| Morris H. Gindi | | 54,000 | (6) | | * | |

| William J. O’Neill, Jr. | | 39,000 | (7) | | * | |

| (iii) Named Executive Officers | | | | | | |

| Gerald J. Angeli | | 68,700 | (8) | | * | |

| Scott L. Lampert | | 16,900 | (7) | | * | |

| Blaine A. Robinson | | 17,000 | (7) | | * | |

| Urs W. Stampfli | | 63,665 | (7) | | * | |

| Keith L. Lampert | | 210,000 | (3) (9) | | * | |

| Alan Schutzman | | 3,000 | (10) | | * | |

| (iv) Directors and executive officers as a group 8 persons)(11) | | 2,294,711 | | | 7.6 | % |

____________________

| * | | Indicates less than one percent (1%). |

| |

| (1) | | For purposes of this table, beneficial ownership was determined in accordance with Rule 13d-3 under the Exchange Act based upon information furnished by the persons listed or contained in filings made by them with the SEC; the inclusion of shares as beneficially owned should not be construed as an admission that such shares are beneficially owned for purposes of Section 16 of the Exchange Act. As of October 2, 2006, the Company had 28,858,885 shares of Common Stock issued and outstanding. All shares were owned directly with sole voting and investment power unless otherwise indicated. |

| |

| (2) | | Based on information contained in a Form 4 filed with the SEC on November 17, 2005 by MT Trading LLC as to its beneficial ownership at November 16, 2005, a Form 4 filed on November 14, 2005 by LTC Racing LLC as to its beneficial ownership at November 10, 2005, a Form 4 filed with the SEC on October 27, 2005 by RH Trading LLC as to its beneficial ownership at October 25, 2005, a Form 4 filed with the SEC on September 1, 2005 by Sondra Jay Beit as to her beneficial ownership at August 30, 2005, a Schedule 13G/A filed February 6, 2006 by Dimensional Fund Advisors Inc. as to its beneficial ownership at December 31, 2005 and additional |

19

| | | discussions between the Company and MT Trading LLC. The 5,522,072 shares of Common Stock beneficially owned by MT Trading LLC at November 16, 2005 constitute the majority of the 6,851,612 shares beneficially owned by MT Trading LLC and the other members of the group listed first in this footnote. |

| |

| (3) | | As of October 2, 2006, a group comprised of Messrs. Ira B. Lampert and Keith L. Lampert (collectively, the “MEP Group”) beneficially owned, in the aggregate, 1,442,786 shares and fully vested options to purchase 640,660 shares of Common Stock, or 7.0% of 29,830,556 shares, consisting of the 28,858,885 shares of Common Stock outstanding on that date plus the 640,660 shares of Common Stock that would have been outstanding if the fully vested options held by Ira B. Lampert were exercised and the 331,011 shares deferred by Ira B. Lampert were outstanding). Of that total, 542,344 shares and an option to purchase 377,656 shares of Common Stock were purchased under the Management Equity Provisions (“MEP”) of the Company’s 1993 Incentive Plan and are subject to the terms of an Amended and Restated Voting Agreement, dated February 28, 1997, as amended (the “Voting Agreement”) pursuant to which MEP shares are voted in accordance with the will of the holders of a majority of the shares governed by the Voting Agreement. The balance of 900,442 shares and options to purchase 263,004 shares of Common Stock were purchased or held outside the MEP Group. See “Management Equity Provisions of 1993 Incentive Plan” above. The MEP Group’s address is c/o Concord Camera Corp., 4000 Hollywood Boulevard, Presidential Circle - North Tower, Hollywood, Florida 33021. |

| |

| (4) | | Represents: (i) 640,660 shares that may be acquired pursuant to stock options exercisable within 60 days after October 2, 2006; (ii) 873,775 shares owned, as to all of which Mr. Lampert has sole dispositive power; (iii) 331,011 shares, the delivery of which was deferred by Mr. Lampert into future years under the Company’s Deferred Delivery Plan, but which could be acquired by him within 60 days after October 2, 2006 under certain limited circumstances described in that plan; (iv) 28,000 shares held by a §501(c)(3) charitable trust of which Mr. Lampert is a trustee with voting and dispositive power; and (v) 110,000 additional MEP shares held by Keith L. Lampert that Ira B. Lampert has the right to vote since he currently owns a majority of the shares governed by the Voting Agreement. The MEP Group is deemed to have acquired the shares beneficially owned by a member of the MEP Group described in footnote (3) above. Since Mr. Lampert is part of the MEP Group, the shares beneficially owned by him are included in footnote (3) above. |

| |

| (5) | | Includes 39,000 shares that may be acquired pursuant to stock options exercisable within 60 days after October 2, 2006. |

| |

| (6) | | Represents 39,000 shares that may be acquired pursuant to stock options exercisable within 60 days after October 2, 2006, and 15,000 shares held by the Notra Trading Inc. Profit Sharing Plan & Trust, a retirement plan of which Mr. Gindi is a co-trustee and participant. |

| |

| (7) | | Represents shares that may be acquired pursuant to stock options exercisable within 60 days after October 2, 2006. |

| |

| (8) | | Includes 67,500 shares that may be acquired pursuant to stock options exercisable within 60 days after October 2, 2006. |

| |

| (9) | | Represents shares owned, as to all of which Mr. Keith Lampert has sole dispositive power. The MEP Group is deemed to have acquired the shares beneficially owned by any member of the MEP Group described in footnote (3) above. Since Mr. Lampert is part of the MEP Group, the shares beneficially owned by him are included in footnote (3) above. |

| |

| (10) | | Represents shares owned by an IRA account of Mr. Schutzman. |

| |

| (11) | | The group is comprised of Messrs. Ira B. Lampert, Cooper, Gindi, O’Neill, Angeli, Scott Lampert, Robinson and Stampfli. The group does not include any securities of the Company beneficially owned by Messrs. Keith Lampert or Schutzman, who no longer served as Company executives as of fiscal 2006 year end. |

20

Fiscal Year-End Equity Compensation Plan Information

The following table sets forth aggregated information concerning the Company’s equity compensation plans outstanding at July 1, 2006.

| | | | | | | No. of Securities |

| | | No. of Securities to be | | Weighted-Average | | Remaining Available for |

| | | Issued upon Exercise of | | Exercise Price of | | Future Issuance under |

| | | Options, Warrants and | | Options, Warrants and | | Equity Compensation |

| | | Rights Outstanding | | Rights Outstanding | | Plans (excluding shares |

| Plan Category | | | at FY End (#) | | at FY End ($) | | reflected in the 1st column) |

| Equity Compensation Plans | | | | | | |

| Approved by Shareholders | | 1,117,701 | | | $4.17 | | | — | |

| Equity Compensation Plans Not | | | | | | |

| Approved by Shareholders | | 520,752 | | | 4.31 | | | 725,832 | |

| Total | | 1,638,453 | | | $4.21 | | | 725,832 | |

At July 1, 2006, the Company had a total of twelve (12) compensation plans under which Common Stock was authorized for issuance that were adopted without shareholder approval: (i) the 2002 Incentive Plan for Non-Officer Employees, New Recruits and Consultants (the “First 2002 Incentive Plan”) and the 2002 Incentive Plan for New Recruits (the “Second 2002 Incentive Plan”; collectively with the First 2002 Incentive Plan, the “2002 Plans”); and (ii) ten (10) individual stock option plans, nine (9) of which were issued to employees (two of whom are executive officers) as an inducement to their employment with the Company and one (1) of which was issued to a consultant as a retention inducement. None of the options issued under any of these plans qualifies as an incentive stock option for federal tax purposes.

At July 1, 2006, 498,000 and 500,000 shares of Common Stock were reserved for issuance pursuant to outstanding options granted under and options available for grant under the First 2002 Incentive Plan and the Second 2002 Incentive Plan, respectively. New recruits (including officers), non-officer employees and consultants in the Company’s service are eligible to participate in the First 2002 Incentive Plan. Only new recruits (including officers) are eligible to participate in the Second 2002 Incentive Plan. The 2002 Plans generally provide for the granting of stock, stock options, stock appreciation rights, restricted shares or any combination of the foregoing to eligible participants. Shares subject to any outstanding options under each of these plans which expire or otherwise terminate prior to exercise will be available for subsequent issuance under the plan. Except as otherwise required by law or the plan, the Compensation and Stock Option Committee or the Board determine which eligible individuals are to receive option grants, the number of shares subject to each such grant, the vesting schedule for the option grant, the maximum term for which any granted option is to remain outstanding, and the exercise price. The exercise price may not be less than the fair market value of the option shares on the grant date.

At July 1, 2006, 248,584 shares of Common Stock in the aggregate were reserved for issuance under individual stock option plans that were issued to employees (two of whom are executive officers) as an inducement to their becoming employed by the Company, and to a consultantas an inducement for his continued services, or were subsequently received by the employee or consultant, in exchange for their inducement option, in connection with a stock option repricing program. These plans were adopted for inducement of new employees and consultants and have substantially the same terms and conditions as options issued under the 2002 Plans. These stock options generally vest in three annual installments beginning on the first anniversary of the employee’s start date or the grant date, have an exercise price equal to the closing price of the Common Stock on the date of grant, and expire ten years after the grant date. For those stock options that were received in exchange for the person’s inducement option, the vesting schedule and expiration date of the inducement option were carried forward into the person’s repriced stock option. The consultant’s stock option began vesting on the date of grant, continued vesting in annual installments and became vested in full on April 24, 2004 since the consultant continued to make his services available to the Company.

21

Comparative Stock Performance

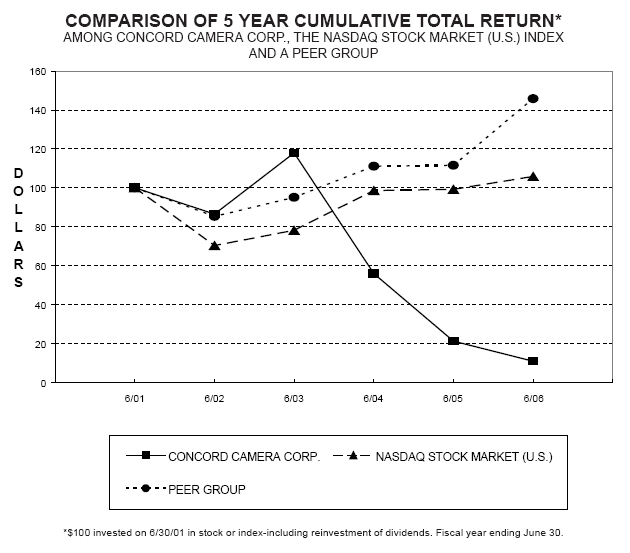

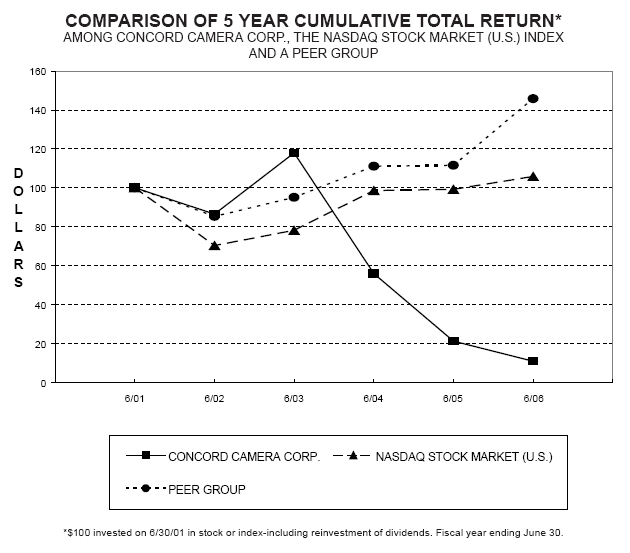

The following graph and table compare the cumulative total shareholder return in U.S. dollars on the Company’s Common Stock for the years ended June 30, 2001 through June 30, 2006 with The NASDAQ Stock Market LLC - U.S. Index and a seven-company peer group based on SIC Code 3861 (Photographic Equipment and Supplies) for the same periods. The graph and table assume an investment of $100 in the Company’s Common Stock, in the NASDAQ Index and in the peer group on June 30, 2001 and the reinvestment of all dividends. The peer group cumulative total return is calculated on a weighted average basis. The stock performance shown is not intended to forecast, and may not be indicative of, future stock performance.

| | | 6/01 | | 6/02 | | 6/03 | | 6/04 | | 6/05 | | 6/06 |

| | | (dollars) |

| Concord Camera Corp. | | 100 | | 86.46 | | 117.97 | | 55.93 | | 21.19 | | 10.85 |

| Nasdaq Stock Market – U.S. Index | | 100 | | 70.34 | | 78.10 | | 98.58 | | 99.24 | | 105.85 |

| Peer Group Index | | 100 | | 85.31 | | 95.06 | | 111.08 | | 111.61 | | 145.80 |

22

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors, executive officers and holders of ten percent (10%) or more of its Common Stock (collectively, “Reporting Persons”) to file initial reports of ownership and reports of changes in ownership of the Common Stock and any other equity securities with the SEC. Reporting Persons are required to furnish the Company with copies of all Section 16(a) reports they file. Based on a review of the copies of the reports furnished to the Company and written representations from its directors and executive officers that no other reports were required, with respect to fiscal 2006, the Company believes that the Reporting Persons timely complied with all Section 16(a) filing requirements applicable to them.

Certain Relationships and Related Transactions

None.

23

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

BDO Seidman, LLP (“BDO Seidman”), an independent registered public accounting firm, was appointed by the Audit Committee to audit the Company’s financial statements for fiscal 2007. A representative of BDO Seidman is expected to attend the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions.

On June 16, 2005, the Company engaged BDO Seidman to serve as the Company’s independent registered public accounting firm effective immediately, and dismissed Ernst & Young LLP (“E&Y”) as its independent registered public accounting firm. The Audit Committee approved the decision to dismiss E&Y.

The reports of E&Y on the Company’s financial statements for the fiscal years ended July 3, 2004 and June 28, 2003 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle.

During the fiscal years ended July 3, 2004 and June 28, 2003, and through June 16, 2005, there were no disagreements with E&Y on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of E&Y, would have caused E&Y to make reference thereto in its reports on the financial statements of the Company for such periods.

During the fiscal years ended July 3, 2004 and June 28, 2003, and through June 16, 2005, there were no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K), except that in connection with the audit for fiscal 2004 and the review of the Company’s quarterly results for the first, second and third quarters of fiscal 2005, management and E&Y identified several deficiencies, including deficiencies that rose to the level of material weaknesses, in the Company’s internal control over financial reporting.

The material weaknesses identified by the Company’s management and E&Y relate to the following areas:

Planning and implementation of the Company’s Enterprise Resource Planning System;

Financial Statement closing process;

Ineffective Information Technology control environment, including the design of the Company’s information security and data protection controls;

Untimely detection and assessment of impairment of long-lived assets where indicators of impairment are present;

Inadequate review of the valuation of certain inventory balances in its worldwide inventory that resulted in post-closing journal entries to write down certain inventory items to market value;

Foreign currency translation, including the ability of certain managers to record journal entries without adequate review or supporting documentation and an inability by management to adequately explain fluctuations in quarterly analyses;

Inadequate resources and senior management’s involvement in the detailed compilation and preparation of the Company’s financial reports and analysis, as a result of which senior management is unable to provide quality assurance in the financial statement review process; and

Lack of the necessary depth of personnel with sufficient technical accounting experience with U.S. GAAP to perform an adequate and effective secondary review of technical accounting matters.

The Company furnished a copy of the above disclosures to E&Y and requested that E&Y furnish the Company with a letter addressed to the SEC stating whether or not E&Y agrees with the above disclosures, and if not, stating the respects in which it does not agree. E&Y’s response was attached as Exhibit 16.1 to the Current Report on Form 8-K that the Company filed with the SEC on June 20, 2005.

24

Prior to the engagement of BDO Seidman for fiscal 2005, neither the Company nor anyone on its behalf consulted with BDO Seidman during fiscal 2003 and fiscal 2004, in any manner regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements; or (ii) any matter that was the subject of either a disagreement or a reportable event with E&Y.

Fees for professional services provided by BDO Seidman to the Company during fiscal 2006 and fiscal 2005 were (in thousands):

| | | | | FY 2006 | | FY 2005 |

| Audit Fees | | | | $770 | | $1,876 |

| Audit Related Fees | | | | — | | — |

| Tax Fees | | | | — | | — |

| All Other Fees | | | | — | | — |

| Total | | | | $770 | | $1,876 |

Audit Fees included fees for services rendered for the audit of the Company’s annual financial statements, reviews of financial statements included in the Company’s quarterly reports on Form 10-Q, and consents and other services normally provided in connection with statutory and regulatory filings or engagements for those fiscal years. Audit fees for fiscal 2005 included the audit of the Company’s internal control over financial reporting and the attestation of management’s report on the effectiveness of internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. For fiscal 2006, no such services were provided by BDO Seidman.

Audit-Related Fees would principally include fees for due diligence in connection with potential transactions and accounting consultations.

Tax Fees would include fees for services rendered for tax compliance, tax advice and tax planning. The Company obtains these types of services from a professional services firm other than BDO Seidman.

All Other Fees would include fees for all other services rendered to the Company that do not constitute Audit Fees, Audit-Related Fees or Tax Fees.

In considering the nature of the services provided by BDO Seidman, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with BDO Seidman and management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Approval Policy

All services rendered by the Company’s independent auditors are pre-approved by the Audit Committee in accordance with the Company’s Audit and Non-Audit Pre-Approval Policy for independent auditor services and are monitored both as to spending level and work content by the Audit Committee to maintain the appropriate objectivity and independence of the core service of the independent registered public accounting firm, which is the audit of the Company’s consolidated financial statements. Under the policy, the terms and fees of annual audit services, and any changes thereto, must be approved by the Audit Committee.

The policy also sets forth detailed pre-approved categories of other audit, audit-related and other non-audit services that may be performed by the Company’s independent auditors during the fiscal year, subject to the dollar limitations set by the Audit Committee. The Audit Committee may, in accordance with the policy, delegate to any of its members the authority to approve audit and non-audit services to be performed by the independent auditors. Any Audit Committee member who exercises this delegated authority must report any approval decisions to the Audit Committee at its next scheduled meeting. The foregoing pre-approval requirements are subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Audit Committee prior to completion of the audit.

25

The Board is seeking shareholder approval of its selection of BDO Seidman since it is customary for a public company to obtain shareholder approval of its auditors. If shareholders do not approve the appointment of BDO Seidman as the independent registered public accounting firm of the Company for fiscal 2007 at the Annual Meeting, the Audit Committee may reconsider the selection.

The affirmative vote of a majority of the votes cast by the holders of shares present or represented and entitled to vote at the Annual Meeting is required for shareholder approval.The Board recommends a vote FOR the ratification of the appointment of BDO Seidman as the independent registered public accounting firm for the Company for fiscal 2007.

OTHER INFORMATION

Shareholder Proposals for 2007 Annual Meeting

Pursuant to Rule 14a-8 under the Exchange Act, shareholders of the Company may present proper proposals for inclusion in the Company’s Proxy Statement and form of proxy and for consideration at the next annual meeting by submitting their proposals to the Company in a timely manner. Any shareholder of the Company who wishes to present a proposal for inclusion in the Proxy Statement and form of proxy for action at the 2007 annual meeting of shareholders (the “2007 Annual Meeting”) must comply with the Company’s By-Laws and the rules and regulations of the SEC, each as then in effect. Such proposals must be mailed to the Company at its offices at 4000 Hollywood Boulevard, Presidential Circle –North Tower, Hollywood, Florida 33021, Attention: Secretary. Under the rules of the SEC, any shareholder proposal intended to be presented at the 2007 Annual Meeting must be received no later than July 2, 2007 in order to be considered for inclusion in the Company’s Proxy Statement and form of proxy relating to such meeting. If a shareholder notifies the Company of an intent to present a proposal at the 2007 Annual Meeting at any time after September 15, 2007 (and for any reason the proposal is voted on at that annual meeting), the Company’s proxy holders will have the right to exercise discretionary voting authority with respect to the proposal, if presented at the meeting, without including information regarding the proposal in its proxy materials.

Expenses of Solicitation

The cost of this proxy solicitation will be borne by the Company. In addition to the use of the mails, some regular employees of the Company, without additional remuneration, may solicit proxies personally or by telephone or facsimile. The Company will reimburse brokers, dealers, banks, and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding solicitation materials to beneficial owners of its Common Stock.

Other Business

As of the date of this Proxy Statement, the Board knows of no business to be presented at the Annual Meeting other than as set forth in this Proxy Statement. If other matters properly come before the Annual Meeting, or any of its adjournments, the persons named as proxies will vote on such matters in their discretion.

26

ADMISSION TICKET

_________________________

Concord Camera Corp. 2006 Annual Meeting of Shareholders

_________________________

DECEMBER 14, 2006

10:00 A.M., LOCAL TIME

MARRIOTT RESIDENCE INN AT AVENTURA MALL

19900 WEST COUNTRY CLUB DRIVE

AVENTURA, FL 33180

28

CONCORD CAMERA CORPORATION

4000 HOLLYWOOD BOULEVARD

NORTH TOWER

HOLLYWOOD, FL 33021

VOTE BY INTERNET -www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER

COMMUNICATIONS

If you would like to reduce the costs incurred by Concord Camera Corp. in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Concord Camera Corp., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

PLEASE MARK, DATE AND SIGN THIS PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE

| | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | CNCRD1 | KEEP THIS PORTION FOR YOUR RECORDS |

| |

| | | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

| CONCORD CAMERA CORP. | | | | | | | | | | |

| | | | | | | | | | | | |

| Vote on Directors | | | | | | | | | |

| 1. | ELECTION OF DIRECTORS.

NOMINEES:

01) Ira B. Lampert

02) Ronald S. Cooper | | | | For

All | Withhold

All | For All

Except | | To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below. | | |

| | | 03) Morris H. Gindi

04) William J. O’Neill, Jr. | | | | | | o | o | o | | | |

| | | | | | | | | | | | | |

| | Vote on Proposal | | | | | | | | | For | Against | Abstain | |

| | | | | | | | | | | | | | | |

| 2. | RATIFICATION OF BDO SEIDMAN, LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING JUNE 30, 2007. | o | o | o | |

| | | | | |

| If no specification is made, this proxy will be voted FOR Proposals 1 and 2 listed above. | | | |

| | | | | |

| Please sign exactly as name or names appear(s) on this Proxy. For joint accounts, each joint owner must sign. Please give full title if signing in a representative capacity. | | | |

| |

| |

| For address changes and/or comments, please check this box and write them on the back where indicated. | | o | | |

| | | | | | | |

| Please indicate if you plan to attend this meeting. | o

Yes | o

No | | |

| | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | | | Signature (Joint Owners) | Date | | | |

PROXY

CONCORD CAMERA CORP.

4000 Hollywood Boulevard - North Tower

Hollywood, Florida 33021

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

ANNUAL MEETING OF SHAREHOLDERS – DECEMBER 14, 2006 The undersigned hereby appoints Blaine A. Robinson and Scott L. Lampert, and each of them severally, as proxies of the undersigned, each with full power to appoint his substitute, to represent the undersigned at the Annual Meeting of Shareholders of Concord Camera Corp. (the “Company”) to be held on December 14, 2006, and at any adjournments thereof, and to vote thereat all shares of common stock of the Company held of record by the undersigned at the close of business on October 18, 2006 in accordance with the instructions set forth on this proxy card and, in their discretion, to vote such shares on any other business as may properly come before the meeting and on matters incident to the conduct of the meeting. Any proxy heretofore given by the undersigned with respect to such stock is hereby revoked.

| Address Changes/Comments: | |

| |

| |