Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

KINETIC CONCEPTS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

N/A

|

| | | (2) | | Aggregate number of securities to which transaction applies:

N/A

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A

|

| | | (4) | | Proposed maximum aggregate value of transaction:

N/A

|

| | | (5) | | Total fee paid:

N/A

|

o |

|

Fee paid previously with preliminary materials. N/A |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

N/A

|

| | | (2) | | Form, Schedule or Registration Statement No.:

N/A

|

| | | (3) | | Filing Party:

N/A

|

| | | (4) | | Date Filed:

N/A

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | KINETIC CONCEPTS, INC.

8023 Vantage Dr.

San Antonio, Texas 78230

www.kci1.com

|

April 26, 2006

To our Shareholders:

I am pleased to invite you to attend the 2006 annual meeting of shareholders of Kinetic Concepts, Inc., to be held on May 23, 2006 at 8:30 a.m. at the San Antonio Marriott Hotel Northwest, 3233 N.W. Loop 410, San Antonio, Texas 78213.

Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting and Proxy Statement.

Your vote is important. Whether or not you plan to attend the annual meeting, I hope you will vote as soon as possible. You may vote by mailing a proxy card according to the instructions enclosed. Voting by written proxy will ensure your representation at the annual meeting if you do not attend in person. Please review the instructions on the proxy card regarding each of the voting options.

Thank you for your ongoing support of and continued interest in KCI.

| | | Sincerely, |

|

|

Ronald W. Dollens

Chairman of the Board of Directors |

April 26, 2006

2006 ANNUAL MEETING OF SHAREHOLDERS

NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

TABLE OF CONTENTS

i

KINETIC CONCEPTS, INC.

8023 Vantage Drive

San Antonio, Texas 78230

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 23, 2006

| TIME: | | 8:30 a.m. |

PLACE: |

|

San Antonio Marriott Hotel Northwest

3233 N.W. Loop 410

San Antonio, Texas 78213 |

ITEMS OF BUSINESS: |

|

• |

|

To elect one Class A director for a two-year term and three Class B directors for a three-year term. |

|

|

• |

|

To ratify the selection of Ernst & Young LLP as our independent auditors for our fiscal year ending December 31, 2006. |

|

|

• |

|

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

|

|

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. |

RECORD DATE: |

|

Shareholders of record of Kinetic Concepts, Inc. at the close of business on April 24, 2006 are entitled to notice of and to vote at this annual meeting and at any adjournment or postponement thereof. |

VOTING BY PROXY: |

|

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy by mail according to the instructions enclosed. |

|

|

|

|

|

| | | By Order of the Board of Directors |

|

|

|

| | | Stephen D. Seidel

Vice President, General Counsel and Secretary |

San Antonio, Texas

April 26, 2006 | | | | |

1

KINETIC CONCEPTS, INC.

8023 Vantage Drive

San Antonio, Texas 78230

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by Kinetic Concepts, Inc. ("KCI," "we" or "us") on behalf of the Board of Directors for the 2006 annual meeting of shareholders to be held on May 23, 2006, beginning at 8:30 a.m., at the San Antonio Marriott Hotel Northwest, 3233 N.W. Loop 410, San Antonio, Texas 78213, and at any adjournment or postponement of the annual meeting. The Proxy Statement and accompanying proxy card are first being mailed to shareholders on or about April 26, 2006.

We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to shareholders.

Annual Meeting Business

At our annual meeting, shareholders will act upon the matters outlined in the accompanying Notice of Annual Meeting, including the following proposals:

- •

- the election of one Class A director for a two-year term and three Class B directors for a three-year term; and

- •

- the ratification of the appointment of Ernst & Young LLP as our independent auditors for our fiscal year ending December 31, 2006.

In addition, our management will report on our performance during fiscal 2005 and respond to questions from shareholders.

Shares to be Voted

You may vote all shares of KCI common stock owned by you as of the close of business on the record date, April 24, 2006. These shares include (1) shares held directly in your name as the shareholder of record and (2) shares held for you as the beneficial owner through a stock broker, bank or other nominee. Each share of common stock owned by you entitles you to cast one vote on each matter to be voted upon.

Most of our shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent directly to you by KCI. As the shareholder of record, you have

2

the right to grant your voting proxy directly to the proxies designated in the accompanying proxy card or to vote in person at the meeting. We have enclosed or sent a proxy card for you to use. If you choose to vote in person at the annual meeting, please bring the enclosed proxy card or other proof of identification.

Beneficial Owner

If you hold shares in a stock brokerage account or through a bank or other nominee, the shares are held in "street name" and you are considered the beneficial owner of the shares. These proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the meeting. However, because you are not the shareholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. Your broker, bank or nominee has enclosed or provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares.

EVEN IF YOU CURRENTLY PLAN TO ATTEND THE ANNUAL MEETING, WE RECOMMEND THAT YOU ALSO SUBMIT YOUR PROXY AS DESCRIBED BELOW SO THAT YOUR VOTE WILL BE COUNTED IF YOU LATER DECIDE NOT TO ATTEND THE MEETING. SHARES HELD BENEFICIALLY IN STREET NAME MAY BE VOTED IN PERSON BY YOU ONLY IF YOU OBTAIN A SIGNED PROXY FROM THE RECORD HOLDER GIVING YOU THE RIGHT TO VOTE THE SHARES.

Voting by Proxy

Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by signing your proxy card or, for shares held in street name, the voting instruction card included and mailing it in the accompanying enclosed, pre-addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct.

If you receive more than one proxy card or voting instruction, it means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Changing Your Vote or Revoking Your Proxy

If you are a shareholder of record, you may revoke your proxy or change your vote at any time prior to the close of voting at the annual meeting by filing a notice of revocation or by submitting a duly executed proxy bearing a later date with American Stock Transfer and Trust Company at 59 Maiden Lane, New York, NY 10038, or with our Corporate Secretary at 8023 Vantage Dr., San Antonio, Texas 78230. You may also revoke your proxy or change your vote by attending the meeting and voting in person. You may obtain a new proxy card by contacting American Stock Transfer and Trust Company at 1-800-937-5449 or by attending the meeting in person.

If your shares are held in a stock brokerage account or by a bank or other nominee, you may revoke your proxy or change your vote by following the instructions provided by your broker, bank or nominee.

Quorum Requirements

The presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding and entitled to vote on the record date will constitute a quorum,

3

permitting the annual meeting to conduct its business. At the close of business on the record date, 71,604,122 shares of our common stock were issued and outstanding. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the annual meeting for purposes of a quorum.

Board Recommendations

Unless you give other instructions via your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board of Directors. The Board of Directors' recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board of Directors recommends a vote:

- •

- "FOR" the election of each of our nominees to the Board of Directors

- •

- "FOR" the ratification of the appointment of Ernst & Young LLP as our independent auditors for our fiscal year ending December 31, 2006

With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote in accordance with their judgment on such matter.

Required Votes

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote, and the director nominees who receive the greatest number of votes at the annual meeting (up to the number of directors to be elected) will be elected. Abstentions, if any, will not affect the outcome of the vote on the election of directors. The proposal for ratification of the appointment of auditors will require the affirmative vote of a majority of the shares of common stock present in person or represented by proxy at the annual meeting. In determining whether these proposals received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal.

Stephen D. Seidel, Vice-President, General Counsel and Secretary, will tabulate the votes and act as the inspector of election. We will announce preliminary voting results at the meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal year 2006.

Admission to the Meeting

You will be admitted to the meeting only if you are listed as a shareholder of record or a beneficial owner as of the close of business on April 24, 2006 and bring proof of identification. If you hold your shares through a broker, bank or other nominee, you will need to provide proof of ownership by bringing either a copy of the voting instruction card provided by your broker, bank or nominee or a copy of a brokerage statement showing your share ownership as of April 24, 2006.

Shareholder Proposals

For a shareholder's proposal to be included in our Proxy Statement for the 2007 annual meeting of shareholders, the shareholder must follow the procedures of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the proposal must be received by our Corporate Secretary at 8023 Vantage Drive, San Antonio, Texas 78230 not later than December 27, 2006. In order for proposals of shareholders made outside of Rule 14a-8 under the Exchange Act to be considered timely, our By-laws require that such proposals must be submitted to our Corporate Secretary, not later than January 23, 2007 and not earlier than December 24, 2006, unless the annual meeting is called for a date earlier than April 23, 2007 or later than August 1, 2007, in which case such proposal must be received not earlier than 150 days prior to such annual meeting and may not be received later than

4

120 days prior to such annual meeting or 10 days following the day on which public announcement of the date of such meeting is such made, whichever occurs last.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS MATTERS

Board of Directors

The members of the Board of Directors on the date of this proxy statement, and the committees of the Board on which they serve, are identified below:

Director

| | Audit and

Compliance Committee

| | Nominating and

Governance Committee

| | Compensation

Committee

| |

|---|

| Ronald W. Dollens, | | | | | | X | |

| Chairman of the Board | | | | | | | |

James R. Leininger, M.D.,

Chairman Emeritus |

|

|

|

|

|

|

|

John P. Byrnes |

|

X |

|

X |

|

|

|

Woodrin Grossman |

|

X |

* |

|

|

|

|

Harry R. Jacobson, M.D. |

|

X |

|

|

|

|

|

N. Colin Lind |

|

|

|

|

|

X |

|

David J. Simpson |

|

|

|

|

|

|

|

C. Thomas Smith |

|

|

|

X |

|

X |

* |

Donald E. Steen |

|

|

|

X |

* |

|

|

Dennert O. Ware |

|

|

|

|

|

|

|

- X

- Committee member

- *

- Committee Chairman

During 2005, the Board of Directors revised the Director Independence Criteria applicable to all directors. Unless a director has some other material relationship with KCI, a director will be deemed independent if during the past year, and during the three years preceding the date on which such determination is made:

- •

- KCI has not employed the director or any of his or her immediate family members;

- •

- the director has not been employed in a professional capacity by, or affiliated with, KCI's internal or external auditors, nor has any of the director's immediate family members been so employed or affiliated;

- •

- neither the director, nor any of his or her immediate family members, has received more than $100,000 per year in direct compensation from KCI (other than director and committee fees and pension or other forms of deferred compensation for prior service that are not contingent in any way on continued services);

- •

- neither the director, nor any of his or her immediate family members, has been employed as an executive officer of another company where any of KCI's present executive officers serves on such other company's compensation committee or an equivalent committee;

- •

- the director has not (directly or indirectly as a partner, shareholder or officer of another corporation or other entity) provided paid consulting, legal or financial advisory services to KCI or KCI's present or former internal or external auditors;

5

- •

- the director has not been an executive officer or an employee, and no immediate family member of the director has been an executive officer, of a company that makes payments to, or receives payments from, KCI for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company's consolidated gross revenues; or

- •

- the director has not served as an executive officer of a charitable organization to which contributions by KCI in any single fiscal year exceeded the greater of $1 million or 2% of such charitable organization's consolidated gross revenues.

The full text of our independence criteria can be found in the Investor Relations section of our website at www.kci1.com. A copy may also be obtained upon request from our corporate secretary.

Pursuant to our Director Independence Criteria, our Board of Directors has reviewed the independence of each director. During this review, the Board considered, among other things, employment history, history of payments received from KCI, share ownership of the director and the director's affiliates, related party transactions and relationships with auditors for each director. As set forth in the Director Independence Criteria, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent. As a result of this review, the Board affirmatively determined that all of the directors are independent of KCI and its management under the standards set forth in the Guidelines, with the exception of Mr. Ware, Dr. Leininger and Mr. Simpson. Mr. Ware is considered non-independent because of his employment with KCI as Chief Executive Officer. Dr. Leininger may not be deemed to be independent because of his prior service to KCI, his direct, ongoing working relationship with management onsite at the corporate headquarters and the size of his share ownership. Mr. Simpson is considered non-independent because of a family member's employment with KCI's external auditors.

2005 Board Meetings

During the fiscal year ended December 31, 2005, the Board of Directors held nine meetings. Each Board member attended 75% or more of the aggregate of the meetings of the Board of Directors and of the committees on which he served that were held during the period for which he was a director or committee member, respectively. KCI does not have a policy on director attendance at the annual meeting of shareholders.

At each regularly scheduled board meeting, the non-management directors meet in an executive session without management to discuss the affairs of KCI. The Chairman of the Board presides over the executive sessions of our Board's non-management directors.

Communicating with the Board of Directors

The Board of Directors has established a process to receive communications from shareholders and other interested parties. Shareholders and other interested parties may contact any member (or all members) of the Board, any Board committee or any chair of any such committee by mail. All correspondence should be addressed to the Board of Directors or any individual director, group of directors or committee of directors by either name or title. All such correspondence should be sent "c/o Corporate Secretary" at 8023 Vantage Dr., San Antonio, Texas 78230. Those wishing to communicate with the director presiding over non-management executive sessions or non-management directors as a group may do so by sending correspondence to the same address.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary's

6

office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

Codes of Ethics

The Board of Directors has adopted the following three codes of ethics:

- •

- Director's Code of Business Conduct and Ethics;

- •

- Code of Ethics for Chief Executive and Senior Financial Officers; and

- •

- Officers' and Employees' Corporate Code of Conduct and Ethics.

Copies of each of these policies are available on our web site at www.kci1.com, and may be obtained free of charge by request in writing to the Corporate Secretary at 8023 Vantage Drive, San Antonio, Texas 78230. We intend to post on our web site any material changes to, or waiver from our code of business conduct, if any, within five business days of such event.

Board Committees

The Board of Directors has an Audit and Compliance Committee, a Compensation Committee and a Nominating and Governance Committee. Each committee is governed by a charter, a current copy of which is available on our corporate website at www.kci1.com. Copies of the charters are also available in print to shareholders upon request, addressed to the Corporate Secretary at 8023 Vantage Drive, San Antonio, Texas 78230.

Audit and Compliance Committee

The Audit and Compliance Committee reviews our internal accounting procedures and considers and reports to the Board of Directors with respect to other auditing and accounting matters, including the selection of our independent auditors, the scope of annual audits, fees to be paid to our independent auditors and the performance of our independent auditors.

During 2005, the members of the Audit and Compliance Committee were David J. Simpson (Chairman), John P. Byrnes and Harry R. Jacobson. Effective December 31, 2005, Mr. Simpson resigned as Chairman and member of the Audit and Compliance Committee. Effective January 1, 2006, the Board of Directors appointed Woodrin Grossman as the new Chairman of the Audit Committee. Each of the current members of the Committee is an independent director under the NYSE listing standards and KCI's Director Independence Criteria. Our Board of Directors has determined that Mr. Grossman, the current Chairman of our Audit and Compliance Committee, is qualified as an audit committee financial expert within the meaning of SEC regulations. The Audit and Compliance Committee held 12 meetings during the fiscal year ended December 31, 2005. A copy of our Audit and Compliance Committee Charter is attached as Appendix A hereto.

Compensation Committee

The Compensation Committee reviews and recommends to the Board of Directors certain salaries, benefits and stock option grants for employees, consultants, directors and other individuals compensated by KCI. The Compensation Committee also oversees our stock option and other employee benefit plans.

The members of the Compensation Committee are Ronald W. Dollens, N. Colin Lind and C. Thomas Smith (Chairman), each of whom is an independent director under the NYSE listing standards. The Compensation Committee held five meetings during the fiscal year ended December 31, 2005.

7

Nominating and Governance Committee

The functions of the Nominating and Governance Committee include the following: identifying and recommending to the Board individuals qualified to serve as directors of KCI; recommending to the Board directors to serve on committees of the Board; advising the Board with respect to matters of Board composition, procedures and compensation; developing and recommending to the Board a set of corporate governance principles applicable to KCI and overseeing corporate governance matters generally; and overseeing the annual evaluation of the Board and KCI's management.

During 2005, the members of the Nominating and Governance Committee were Donald E. Steen (Chairman), C. Thomas Smith and David J. Simpson. Effective December 31, 2005, Mr. Simpson resigned as a member of the Nominating and Governance Committee. Effective January 1, 2006, the Board of Directors appointed Mr. Byrnes to serve on the Nominating and Governance Committee. Each of the current members of the Committee is an independent director under the NYSE listing standards and KCI's Director Independence Criteria. The Nominating and Governance Committee met seven times during 2005.

The Nominating and Governance Committee will consider director candidates recommended by shareholders. In considering candidates submitted by shareholders, the Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Committee may also take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held. To have a candidate considered by the Committee, a shareholder must submit the recommendation in writing and must include the following information: the name of the shareholder and evidence of the person's ownership of our stock, including the number of shares owned and the length of time of ownership and the name of the candidate, the candidate's resume or a listing of his or her qualifications to be a director of KCI and the person's written consent to be named as a director if selected by the Committee and nominated by the Board.

The shareholder recommendation and information described above must be sent to the Corporate Secretary at 8023 Vantage Drive, San Antonio, Texas 78230, and must be received by the Corporate Secretary within the time periods described under the heading "Shareholder Proposals," above.

The Nominating and Governance Committee believes that the minimum qualifications for serving as a director of KCI are that a nominee for director must demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board's oversight of the business and affairs of KCI and have a reputation for honest and ethical conduct in both his or her professional and personal activities. Nominees for director shall be selected on the basis of, among other things, experience, knowledge, skills, expertise, integrity, ability to make independent analytical inquiries, understanding of KCI's business environment, and willingness to devote adequate time and effort to Board responsibilities. In addition, the Nominating and Governance Committee examines a candidate's specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and KCI.

The Nominating and Governance Committee identifies potential nominees by asking current directors and executive officers to notify the Committee if they become aware of persons, meeting the criteria described above, who have had a change in circumstances that might make them available to serve on the Board—for example, retirement as a CEO or CFO of a public company or exiting government or military service. The Nominating and Governance Committee also, from time to time, may engage firms that specialize in identifying director candidates.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Chairman or another member of the Committee contacts

8

the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Committee requests information from the candidate, reviews the person's accomplishments and qualifications, including in light of any other candidates that the Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate's accomplishments. The Committee's evaluation process does not vary based on whether or not a candidate is recommended by a shareholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held.

9

PROPOSAL 1

ELECTION OF DIRECTORS

Our By-laws authorize the Board of Directors to establish the number of directors serving on the Board. Our Board of Directors is currently comprised of ten directors. Our By-laws divide the Board of Directors into three classes—Class A, Class B and Class C—with members of each class serving staggered three-year terms. One class of directors is elected by the shareholders at each annual meeting to serve a three-year term and until their successors are duly elected and qualified. The Class B directors will stand for reelection or election at this year's annual meeting. In addition, Woodrin Grossman, a Class A director appointed to the Board on November 15, 2005, will stand for election at the 2006 annual meeting. The Class C directors will stand for reelection or election at the 2007 annual meeting and the Class A directors will stand for reelection or election at the 2008 annual meeting. If any nominee for any reason is unable to serve, or for good cause will not serve, as a director, the proxies may be voted for such substitute nominee as the proxy holders may determine. We are not aware of any nominee who will be unable to serve, or for good cause, will not serve, as a director.

The name of the nominee for election as a Class A director and the names of the nominees for election as Class B directors at the annual meeting and of the incumbent Class A and Class C directors and our executive officers, and certain information about them as of December 31, 2005, are set forth below:

Directors and Executive Officers

Name

| | Age

| | Occupation/Position Held With Us

|

|---|

| Nominee for Class A director: |

| | Woodrin Grossman | | 61 | | Director |

Nominees for Class B directors: |

| | N. Colin Lind | | 49 | | Director |

| | C. Thomas Smith | | 67 | | Director |

| | Donald E. Steen | | 59 | | Director |

Incumbent Class C directors: |

| | Ronald W. Dollens | | 59 | | Director, Chairman of the Board |

| | John P. Byrnes | | 47 | | Director |

| | Harry R. Jacobson, M.D. | | 58 | | Director |

| | David J. Simpson | | 59 | | Director |

Incumbent Class A directors: |

| | James R. Leininger, M.D. | | 61 | | Director, Chairman Emeritus |

| | Dennert O. Ware | | 64 | | Director, President and Chief Executive Officer |

Executive Officers: |

| | Michael J. Burke | | 58 | | Vice President, Manufacturing and Quality |

| | Mark B. Carbeau | | 45 | | President, KCI USA |

| | R. James Cravens | | 42 | | Vice President, Human Resources |

| | Christopher M. Fashek | | 56 | | Vice Chairman, KCI USA |

| | Steven J. Hartpence | | 57 | | Vice President, Business Systems |

| | Martin J. Landon | | 46 | | Vice President, Chief Financial Officer |

| | Jorg W. Menten | | 48 | | President, KCI International |

| | G. Frederick Rush | | 56 | | Vice President, Corporate Development |

| | Stephen D. Seidel | | 49 | | Vice President, General Counsel and Secretary |

| | Lynne D. Sly | | 45 | | President, Therapeutic Surfaces |

| | Daniel C. Wadsworth, Jr. | | 52 | | Vice President, Global Research and Development |

10

Woodrin Grossman became a director in November of 2005. Mr. Grossman has served as Senior Vice President—Strategy and Development of Odyssey HealthCare Inc. since January 2006. In June 2005, Mr. Grossman retired as partner and healthcare practice leader of PricewaterhouseCoopers after 37 years of service with the firm. With PricewaterhouseCoopers, Mr. Grossman served as the lead audit partner of audits of Fortune 500 and other companies, including some of the largest and most prominent investor-owned and tax-exempt healthcare providers and health insurers.

N. Colin Lind became a director in November 1997 pursuant to a voting agreement between KCI and various stockholders, including Blum Capital Partners, L.P., as a representative of Blum Capital Partners. Mr. Lind is the Managing Partner of Blum Capital Partners, L.P., a public strategic block and private equity investment firm with approximately $3.5 billion in assets under management. Mr. Lind joined Blum Capital Partners in 1986 and has previously been a director of four public and nine private companies.

C. Thomas Smith became a director in May 2003. Prior to his retirement in April 2003, Mr. Smith served as Chief Executive Officer and President of VHA Inc., a member owned and member driven health care cooperative, since 1991. From 1977 to 1991, Mr. Smith was President of Yale-New Haven Hospital and President of Yale-New Haven Health Services Corp. From 1971 to 1976, he was Vice President and Executive Director of Hospitals and Clinics and a member of the board of trustees for Henry Ford Hospital in Detroit. From January 1987 until April 2003, Mr. Smith was a member of the VHA board. He also served on the boards of Novation, LLC and the Healthcare Leadership Council. Mr. Smith is a past Chairman of the American Hospital Association and the Council of Teaching Hospitals and a former member of the boards of the Association of American Medical Colleges, the International Hospital Federation, the Hospital Research and Educational Trust, the National Committee on Quality Healthcare, the Jackson Hole Group and Genentech, Inc. He also currently serves on the board of InPatient Care Management, Horizon Health Corporation, and CHG Healthcare Services, Inc.

Donald E. Steen became a director in 1998. Mr. Steen founded United Surgical Partners International, Inc. in February 1998 and served as its chief executive officer until April 2004 and currently serves as chairman of the Board of United Surgical Partners. Mr. Steen has served as chairman of the board of AmeriPath, Inc. since April 2004 and as its chief executive officer since July 2004. Mr. Steen served as president of the International Group of HCA from 1995 until 1997 and as president of the Western Group of HCA from 1994 until 1995. Mr. Steen founded Medical Care International, Inc., a pioneer in the surgery center business, in 1982.

Ronald W. Dollens became a director in 2000 and currently serves as Chairman of the Board. Mr. Dollens is Retired President and Chief Executive Officer of Guidant Corporation, a corporation that pioneers lifesaving technology for millions of cardiac and vascular patients worldwide. He served in that capacity from 1994 to 2005. Previously, he served as President of Eli Lilly and Company's Medical Devices and Diagnostics Division from 1991 until 1994. Mr. Dollens currently serves on the boards of ABIOMED, Inc., the Advanced Medical Technology Association, the Eiteljorg Museum, the Indiana Health Industry Forum, Alliance for Aging Research and Butler University.

John P. Byrnes became a director in 2003. He has served as Chief Executive Officer of Lincare Holdings Inc., a home health care company, since January 1997 and as a director of Lincare since May 1997. Mr. Byrnes was appointed Chairman of the Board of Lincare Holdings Inc. in March 2000. Mr. Byrnes has been President of Lincare since June 1996. Prior to becoming President, Mr. Byrnes served Lincare in a number of capacities over a ten-year period, including serving as Lincare's Chief Operating Officer throughout 1996.

Harry R. Jacobson, M.D. became a director in June 2003. Dr. Jacobson is Vice Chancellor for Health Affairs of Vanderbilt University, Nashville, Tennessee, a position he has held since 1997. He

11

served as a director of Renal Care Group from 1995 to March 2006 and was Chairman of the Board of Directors of Renal Care from 1995 to 1997. Dr. Jacobson currently serves as a director of Health Gate Data Corp. He also currently serves as Professor of Medicine at Vanderbilt University Medical Center, a position he has held since 1985.

David J. Simpson became a director in June 2003. Mr. Simpson served as Vice President, Chief Financial Officer and Secretary of Stryker Corporation, a worldwide medical products and services company from 1987 to 2002. He is currently Executive Vice President of Stryker Corporation. He had previously been Vice President and Treasurer of Rexnord Inc., a manufacturer of industrial and aerospace products and is currently a director of Regeneration Technologies, Inc.

James R. Leininger, M.D. is the founder of KCI and served as Chairman of the Board of Directors from 1976 until 1997. From January 1990 to November 1994, Dr. Leininger served as President and Chief Executive Officer of KCI. From 1975 until October 1986, Dr. Leininger was also a director of the Emergency Department of the Baptist Hospital System in San Antonio, Texas.

Dennert O. Ware joined KCI as Director, President and Chief Executive Officer in April of 2000. Before joining KCI, he served as President and CEO of Boehringer Mannheim Corporation, a market leader in medical diagnostic equipment. He joined Boehringer in 1972 as Vice President of Technical Affairs of DePuy, the company's Orthopedic Division. He later held senior management positions in the Diagnostic Division and became President and CEO of Boehringer Mannheim's North American operations in 1997.

Michael J. Burke joined KCI in September 1995 as Vice President, Manufacturing and Quality. Prior to joining KCI, Mr. Burke worked for Sterling Winthrop, Inc., a division of Eastman Kodak Company, for 25 years, where he served as Vice President, Manufacturing and as General Manager, Sterling Health HK/China.

Mark B. Carbeau joined KCI as President, KCI USA in October 2005. From December 2002 to September 2005, Mr. Carbeau served as founder and Managing Director of CM Partners, a corporate development and strategy consulting firm in Boston where he led the successful turnaround and expansion of several healthcare organizations as interim Chief Executive Officer and Chief Operating Officer. Prior to 2002, Mr. Carbeau served as Vice President, Corporate Development of OraPharma, Inc.

R. James Cravens joined KCI in July 2004 as Vice President, Human Resources. Prior to joining KCI, Mr. Cravens was Senior Vice President, Human Resources for VNU, Inc., a global media and information company. From 1995 to 2002, he held a number of roles with ACNielsen, where he most recently served as Senior Vice President and Chief Human Resources Officer. Mr. Cravens serves on the Board of Directors of the YMCA of Greater San Antonio.

Christopher M. Fashek joined KCI in February 1995 as President, KCI USA and was promoted to Vice Chairman, KCI USA in October 2005. Prior to joining KCI, he served as General Manager, New Zealand at Sterling Winthrop, a division of Eastman Kodak, from February 1993 to February 1995, and served as Vice President of Sales at Sterling Winthrop USA, a division of Eastman Kodak, from 1989 until February 1993. Mr. Fashek currently serves as an advisory board member of Network Consulting Information and is Vice Chairman of the World Craniofacial Foundation.

Steven J. Hartpence joined KCI in October 2001 as Vice President, Reimbursement Systems and was promoted to Vice President, Business Systems in December 2002. Prior to joining KCI, Mr. Hartpence worked for Sigma Aldrich Corporation, a biochemical and organic chemical products company, for nine years, where he most recently served as Vice President, Engineering.

12

Martin J. Landon has served as Vice President and Chief Financial Officer since December 2002. Mr. Landon joined KCI in May 1994 as Senior Director of Corporate Development and was promoted to Vice President, Accounting and Corporate Controller in October 1994. From 1987 to May 1994, Mr. Landon worked for Intelogic Trace, Inc., an independent computer maintenance company, where his last position was Vice President and Chief Financial Officer.

Jorg W. Menten joined KCI in July 2001 as President, KCI International. From August 1999 to June 2001, Mr. Menten was Chief Financial Officer of 4Sigma GmbH, a health care services venture in Hamburg, Germany. From April 1998 to July 1999, Mr. Menten was Executive Vice President, Finance and Controlling of F. Hoffman—LaRoche AG, a pharmaceutical company in Basel, Switzerland. Prior to April 1998, Mr. Menten was Chief Financial Officer of Boehringer Mannheim Group in Amsterdam, The Netherlands.

G. Frederick Rush joined KCI as Vice President, Corporate Development in June 2000. Prior to joining KCI, Mr. Rush was Senior Vice President, Strategy and Business Development for Roche Diagnostics Corporation, formerly Boehringer Mannheim Corporation from April 1998 to April 2000. During a portion of this time, he also served as Vice President, Laboratory Diagnostics from May 1999 to February 2000. From August 1995 to April 1998, Mr. Rush was Senior Vice President, Global Marketing and Sales for Boehringer Mannheim Biochemicals. Prior to that he was Vice President, Strategy and Business Development for Boehringer Mannheim Diagnostics.

Stephen D. Seidel joined KCI in April 2005 as Vice President, General Counsel and Secretary. Prior to joining KCI, Mr. Seidel served for the last eight years as Managing Director of Cox Smith Matthews Incorporated, a business and litigation law firm based in San Antonio, Texas. Mr. Seidel currently serves as Chairman of the Board of the San Antonio March of Dimes and he is the current Chairman of the Greater San Antonio Chamber of Commerce. He also serves as a member of the Executive Committee of the San Antonio Economic Development Foundation.

Lynne D. Sly joined KCI in July of 2001 as Vice President of KCI USA Marketing and was promoted to President, Therapeutic Surfaces in December 2005. Ms. Sly oversees the Therapeutic Surfaces business, Acute Care and Extended Care National Accounts, and KCI Service Operations. Prior to KCI, Ms. Sly was employed with Roche Diagnostics for 19 years in various sales and marketing roles. She serves on the Board of Directors for Girls, Inc., a nonprofit corporation.

Daniel C. Wadsworth, Jr. joined KCI in March 2002 as Vice President, Global Research and Development. Prior to joining KCI, Mr. Wadsworth worked for C.R. Bard, Inc., a worldwide health care products company focused on vascular, urology, and oncology disease states, for 18 years, where he most recently served as Staff Vice President, New Technology and Research Alliances.

Vote Required

Directors are elected by the holders of a plurality of the votes present in person or represented by proxy and entitled to vote, and the director nominees who receive the greatest number of votes at the annual meeting (up to the number of directors to be elected) will be elected. Abstentions will not affect the outcome of the vote on the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED BOARD NOMINEE.

13

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit and Compliance Committee has selected Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2006 and has further directed that management submit the selection of independent auditors for ratification by the shareholders at the annual meeting. Ernst & Young has audited our financial statements since 1997. Representatives of Ernst & Young LLP are expected to be present at the annual meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Vote Required

The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy at the annual meeting is required for the ratification of the appointment of Ernst & Young as our independent auditors for the fiscal year ending December 31, 2006. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against this proposal.

Shareholder ratification of the selection of Ernst & Young as our independent auditors is not required by our By-laws or otherwise. However, the Board of Directors, upon recommendation of the Audit and Compliance Committee, is submitting the selection of Ernst & Young to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit and Compliance Committee may reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit and Compliance Committee in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of us and our shareholders.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of April 15, 2006 by: (a) each director and nominee for director named in "Proposal 1—Election of Directors;" (b) each of the executive officers and individuals named in the Summary Compensation Table; (c) all of our executive officers and directors as a group; and (d) all those known by us to be beneficial owners of more than five percent of our common stock. Percentage of beneficial ownership is based on 71,604,122 shares of our common stock outstanding as of April 15, 2006.

| | Shares of Common Stock

Beneficially Owned(1)

| |

|---|

Name(2)

| | # of Shares

| | % of Class

| |

|---|

Blum Capital Partners, L.P. and related parties(3)

909 Montgomery Street, Suite 400

San Francisco, CA 94133 | | 4,227,753 | | 5.90 | % |

Capital Research and Management Company(4)

333 South Hope Street

55th Floor

Los Angeles, CA 90071 |

|

4,895,000 |

|

6.84 |

% |

FMR Corporation and related parties(5)

82 Devonshire Street

Boston, MA 02109 |

|

4,972,000 |

|

6.94 |

% |

Directors and Executive Officers |

|

|

|

|

|

| | Ronald W. Dollens(6) | | 86,742 | | * | |

| | James R. Leininger, M.D.(7) | | 12,326,257 | | 17.21 | % |

| | Dennert O. Ware(8) | | 2,711,072 | | 3.69 | % |

| | John P. Byrnes(9) | | 87,657 | | * | |

| | Woodrin Grossman(10) | | 2,833 | | * | |

| | Harry R. Jacobson, M.D.(11) | | 36,266 | | * | |

| | N. Colin Lind(3)(12) | | 4,227,753 | | 5.90 | % |

| | David J. Simpson(13) | | 42,753 | | * | |

| | C. Thomas Smith(14) | | 21,077 | | * | |

| | Donald E. Steen(15) | | 43,411 | | * | |

| | Michael J. Burke(16) | | 149,961 | | * | |

| | Mark B. Carbeau | | 14,900 | | * | |

| | R. James Cravens(17) | | 19,035 | | * | |

| | Christopher M. Fashek(18) | | 153,573 | | * | |

| | Steven J. Hartpence(19) | | 62,077 | | * | |

| | Martin J. Landon(20) | | 246,618 | | * | |

| | Jorg W. Menten(21) | | 151,223 | | * | |

| | G. Frederick Rush(22) | | 417,199 | | * | |

| | Stephen D. Seidel(23) | | 18,445 | | * | |

| | Lynne D. Sly(24) | | 38,419 | | * | |

| | Daniel C. Wadsworth, Jr.(25) | | 129,647 | | * | |

Directors and Executive Officers as a Group(26) |

|

20,986,918 |

|

28.11 |

% |

Total |

|

30,853,918 |

|

41.33 |

% |

- *

- Less than one percent (1%).

15

- (1)

- Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or become exercisable within 60 days of April 15, 2006 are considered to be beneficially owned by such person. Unless otherwise indicated in the footnotes, the person or entity named has sole voting power and investment power with respect to all shares indicated.

- (2)

- Unless otherwise indicated the address of each individual listed in this table is c/o Kinetic Concepts, Inc., 8023 Vantage Drive, San Antonio, Texas 78230.

- (3)

- Shares of common stock held by Blum Capital Partners, L.P. and its related parties include (i) 3,675,127 shares held by RCBA-KCI Capital Partners, L.P., (ii) 268,630 shares held by Stinson Capital Partners II, L.P., (iii) 218,686 shares held by Blum Strategic Partners II, L.P., (iv) 4,512 shares held by Blum Strategic Partners II GmbH & Co. KG, (v) 50,698 shares held by RCBA-KCI Managers, L.L.C., and (vi) 5,499 shares held by N. Colin Lind and 4,601 shares acquirable upon the exercise of options held by N. Colin Lind within 60 days.

Blum Capital Partners, L.P. serves as the general partner of RCBA-KCI Capital Partners, L.P. and Stinson Capital Partners II, L.P. and as the managing member of RCBA-KCI Managers, L.L.C., with voting and investment discretion for shares held by all such entities. The shares owned by RCBA-KCI Capital Partners, L.P., Stinson Capital Partners II, L.P. and RCBA-KCI Managers, L.L.C. may be deemed to be owned indirectly by the following parties: (a) Blum Capital Partners, L.P., and (b) Richard C. Blum & Associates, Inc., the sole general partner of Blum Capital Partners, L.P. Richard C. Blum & Associates, Inc. and Blum Capital Partners, L.P. disclaim beneficial ownership of these shares, except to the extent of any pecuniary interest therein.

Blum Strategic GP II, L.L.C. serves as the general partner of Blum Strategic Partners II, L.P. and as the managing limited partner of Blum Strategic Partners II GmbH & Co. KG. The shares owned by Blum Strategic Partners II, L.P. and Blum Strategic Partners II GmbH & Co. KG may be deemed to be owned indirectly by Blum Strategic GP II, L.L.C. Blum Strategic GP II, L.L.C. disclaims beneficial ownership of these shares, except to the extent of any pecuniary interest therein.

- (4)

- Information is based on the Schedule 13G filing made by Capital Research and Management Company ("CRMC") on February 6, 2006. KCI has no reason to believe that such information is not complete or accurate or that a statement or amendment should have been filed and has not. Includes 2,395,000 shares over which CRMC has sole voting power and 4,895,000 shares over which CRMC has sole investment power.

- (5)

- Information is based on the Schedule 13G filing made by FMR Corporation ("FMR") on February 14, 2006. KCI has no reason to believe that such information is not complete or accurate or that a statement or amendment should have been filed and has not. Includes 455,200 shares over which FMR has sole voting power and 4,972,000 shares over which FMR has sole investment power.

- (6)

- Mr. Dollens's common stock holdings include 78,772 shares acquirable upon the exercise of options.

- (7)

- Shares of common stock beneficially owned by Dr. Leininger include (i) 4,601 shares acquirable upon the exercise of options and (ii) 10,100 shares of common stock held by J&E Investments, L.P., in which Dr. Leininger is a 1% general partner, with respect to which Dr. Leininger disclaims beneficial ownership, except to the extent of any pecuniary interest therein.

- (8)

- Mr. Ware's common stock holdings include 1,959,695 shares acquirable upon the exercise of options.

16

- (9)

- Mr. Byrnes's common stock holdings include 6,905 shares acquirable upon the exercise of options.

- (10)

- Mr. Grossman's common stock holdings include 833 shares acquirable upon the exercise of options.

- (11)

- Dr. Jacobson's common stock holdings include 6,905 shares acquirable upon the exercise of options, and 1,000 shares held by his wife.

- (12)

- Mr. Lind's common stock holdings reflect 5,499 shares held by him, 4,601 shares acquirable by him upon the exercise of options and the shares beneficially owned by Blum Capital Partners, L.P. and related parties. Mr. Lind is the managing partner of Richard C. Blum & Associates, Inc., which is the general partner of Blum Capital Partners, L.P. He is also a managing member of Blum Strategic GP II, L.L.C., which is the general partner of Blum Strategic Partners II, L.P. and the managing limited partner of Blum Strategic Partners II GmbH & Co. KG. Mr. Lind disclaims beneficial ownership of the shares held by Blum Capital Partners, L.P. and its related parties, except to the extent of his proportionate pecuniary interest in such shares.

- (13)

- Mr. Simpson's common stock holdings include (i) 19,356 shares held in the David J. Simpson Revocable Living Trust, with respect to which Mr. Simpson disclaims beneficial ownership except to the extent of any pecuniary interest therein, (ii) 100 shares held by his son, and (iii) 6,488 shares acquirable upon the exercise of options.

- (14)

- Mr. Smith's common stock holdings include 6,905 shares acquirable upon the exercise of options.

- (15)

- Mr. Steen's common stock holdings include 6,905 shares acquirable upon the exercise of options.

- (16)

- Mr. Burke's common stock holdings include 120,839 shares acquirable upon the exercise of options.

- (17)

- Mr. Craven's common stock holdings include 6,875 shares acquirable upon the exercise of options.

- (18)

- Mr. Fashek's common stock holdings include 200 shares held by Mr. Fashek's wife, and 3,750 shares acquirable upon the exercise of options.

- (19)

- Mr. Hartpence's common stock holdings include 50,896 shares acquirable upon the exercise of options.

- (20)

- Mr. Landon's common stock holdings include 800 shares held by Mr. Landon as trustee for his children under the Texas Uniform Transfers to Minors Act, with respect to which Mr. Landon disclaims beneficial ownership except to the extent of any pecuniary interest therein, and 201,250 shares acquirable upon the exercise of options.

- (21)

- Mr. Menten's common stock holdings include 145,422 shares acquirable upon the exercise of options.

- (22)

- Mr. Rush's common stock holdings include 284,054 shares acquirable upon the exercise of options.

- (23)

- Mr. Seidel's common stock holdings include 3,625 shares acquirable upon the exercise of options.

- (24)

- Ms. Sly's common stock holdings include 30,699 shares acquirable upon the exercise of options.

- (25)

- Mr. Wadsworth's common stock holdings include 117,214 shares acquirable upon the exercise of options, and 3,390 shares held by his wife.

- (26)

- Includes 3,047,234 shares of common stock issuable upon the exercise of options that are exercisable within 60 days of April 15, 2006.

17

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent shareholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, during the fiscal year ended December 31, 2005, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with, except that Form 5s for two of our Directors, Dr. Jacobson and Dr. Leininger, were filed late with respect to charitable gifts each of them made.

18

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid or accrued by KCI to the Chief Executive Officer and each of the four most highly compensated executive officers (collectively, the "named executive officers") for their services for the years ended December 31, 2005, 2004 and 2003.

| | Annual Compensation

| | Long Term Compensation Awards

|

|---|

Name and Principal

Position

| | Year

| | Salary

| | Bonus(1)

| | Other

Annual

Compensation

| | Restricted

Stock

Awards

| | Securities

Underlying

Options

| | All Other

Compensation(2)

|

|---|

| Dennert O. Ware Chief Executive Officer & President | | 2005

2004

2003 | | $

| 617,031

563,849

525,359 | | $

| 580,986

13,546,648

393,000 | | —

—

— | | | —

—

— | | 65,000

—

— | | $

| 8,039

8,039

7,336 |

Jorg W. Menten(3)

President KCI International |

|

2005

2004

2003 |

|

$

|

300,987

279,203

243,698 |

|

$

|

169,728

328,888

128,212 |

|

—

—

— |

|

$

|

134,055

257,578

— |

|

15,000

15,000

— |

|

$

|

28,302

26,713

21,901 |

Martin J. Landon

Vice President, Chief Financial Officer |

|

2005

2004

2003 |

|

$

|

271,625

233,008

200,997 |

|

$

|

174,924

412,481

123,240 |

|

—

—

— |

|

$

|

134,055

111,025

— |

|

15,000

15,000

400,000 |

|

$

|

5,759

4,614

3,622 |

G. Frederick Rush

Vice President, Corporate Development |

|

2005

2004

2003 |

|

$

|

272,716

276,676

266,595 |

|

$

|

170,498

596,599

150,453 |

|

—

—

— |

|

$

|

104,265

111,025

— |

|

12,500

15,000

— |

|

$

|

6,529

5,269

4,447 |

Michael J. Burke

Vice President, Manufacturing |

|

2005

2004

2003 |

|

$

|

257,427

244,880

236,793 |

|

$

|

161,037

331,642

140,377 |

|

—

—

— |

|

$

|

104,265

—

— |

|

12,500

—

— |

|

$

|

6,353

8,162

7,146 |

- (1)

- For 2004, bonus amounts include special IPO bonuses made in March 2004 in the following amounts: Mr. Ware—$13 million; Mr. Menten—$150,000; Mr. Landon—$247,821; Mr. Rush—$416,287; Mr. Burke—$175,642.

- (2)

- The "All Other Compensation" column includes a contribution of $4,000, $4,000 and $3,000 in 2005, 2004 and 2003, respectively to our 401(k) plan for Messrs. Ware, Landon, Rush and Burke. Amount also includes above market earnings of $895, $141 and $211 for Mr. Landon in 2005, 2004 and 2003, respectively, credited to compensation deferred at Mr. Landon's election in each respective year. Amount also includes above market earnings of $2,108 and $1,859 for Mr. Burke in 2004 and 2003, respectively, credited to compensation deferred at the election of Mr. Burke in each respective year. Also included is a premium for term life insurance in 2005, 2004 and 2003, respectively, for Mr. Ware of $4,039, $4,039 and $4,336, for Mr. Landon of $864, $473 and $411, for Mr. Rush of $2,529, $1,269, and $1,447 and Mr. Burke of $2,353, $2,054 and $2,287, respectively. The amounts shown for Mr. Menten are contributions to KCI's Dutch defined contribution plan.

- (3)

- Amounts for Mr. Menten have been converted from Euros at an average annual exchange rate for each year.

Employment and Severance Agreements

Upon hiring each of the named executive officers, KCI and the named executive officer each signed an offer letter outlining the terms of employment for such officer. In addition, Mr. Menten entered into an employment contract with KCI Europe Holdings B.V. Each of these agreements sets forth standard terms summarizing salary, bonus and benefits. None of these agreements establishes a term of employment for any named executive officer. For information on the most recent salary and bonus information for the named executive officers, see "Executive Compensation." Under Mr. Ware's offer letter, he is entitled to severance equal to one year's salary in the event he leaves the employment of KCI for a reason other than an act of malfeasance or moral turpitude. Under Mr. Menten's contract of employment, he is entitled to severance equal to six months' salary in the event of his termination of employment by KCI Europe Holdings B.V. for a reason other than an act of malfeasance or moral turpitude. None of the other named executive officers has any severance arrangement apart from standard severance policies that apply to all employees.

19

Option Grants in Last Fiscal Year

In 2005, options to purchase an aggregate of 766,068 shares of our common stock were issued to employees. Of this amount, options to purchase 120,000 shares were granted to the named executive officers. Over the last several years, annual equity grants to employees and senior management have been made on April 1 of each calendar year. In future periods, the date of the annual equity grants may change to coincide with the date of a regularly scheduled meeting of the Board of Directors during each calendar year.

| |

| |

| |

| |

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term (2)

|

|---|

| | Number of

Securities

Underlying

Options Granted

| |

| |

| |

|

|---|

| | % of Total Options Granted

to Employees

in Fiscal Year

| | Exercise

Price(1)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Dennert O. Ware | | 65,000 | | 8.49 | % | $ | 59.58 | | 4/1/2015 | | $ | 2,435,550 | | $ | 6,172,400 |

| Jorg W. Menten | | 15,000 | | 1.96 | % | $ | 59.58 | | 4/1/2015 | | $ | 562,050 | | $ | 1,424,400 |

| Martin J. Landon | | 15,000 | | 1.96 | % | $ | 59.58 | | 4/1/2015 | | $ | 562,050 | | $ | 1,424,400 |

| G. Frederick Rush | | 12,500 | | 1.63 | % | $ | 59.58 | | 4/1/2015 | | $ | 468,375 | | $ | 1,187,000 |

| Michael J. Burke | | 12,500 | | 1.63 | % | $ | 59.58 | | 4/1/2015 | | $ | 468,375 | | $ | 1,187,000 |

- (1)

- The 2005 grants were issued at the fair market value of the stock at the date of issuance. The options vest and become exercisable in twenty five percent (25%) increments on April 1 of each year and have a term of ten (10) years.

- (2)

- Potential realizable values are calculated by (i) multiplying the number of shares of common stock underlying an option by the market price of our common stock on the date of the grant; (ii) assuming that the amount derived from that calculation compounds at the annual 5% or 10% rates shown in the table for the entire ten-year term of the option; and (iii) subtracting from that result the total option exercise price. The 5% and 10% assumed annual rates of stock price appreciation are required by the rules of the Securities and Exchange Commission and do not reflect our estimate or projection of future common stock prices.

Aggregate Option Exercises and Fiscal Year-End Option Value

The following table sets forth certain information concerning the number and value of the options held by the named executive officers as of December 31, 2005.

Name

| | Number of

Securities

Underlying

Options

Exercised

| | Value

Realized(1)

| | Number of Securities

Underlying Unexercised

Options at FY End

Exercisable/Unexercisable

| | Value of Unexercised

In the Money

Options at FY End(2)

Exercisable/Unexercisable

|

|---|

| Dennert O. Ware | | 400,000 | | $ | 13,997,976 | | 3,220,700 | | 65,000 | | $ | 112,555,413 | | | — |

| Jorg W. Menten | | 45,000 | | $ | 2,704,496 | | 137,922 | | 56,250 | | $ | 4,688,976 | | $ | 1,048,425 |

| Martin J. Landon | | 36,000 | | $ | 2,201,073 | | 147,750 | | 266,250 | | $ | 4,366,190 | | $ | 7,322,400 |

| G. Frederick Rush | | — | | | — | | 257,179 | | 43,750 | | $ | 8,856,710 | | $ | 698,950 |

| Michael J. Burke | | 146,025 | | $ | 8,523,368 | | 148,414 | | 12,500 | | $ | 5,240,805 | | | — |

- (1)

- Represents the difference between the exercise price of the options and the closing price of our common stock on the date of exercise.

- (2)

- Represents the difference between the exercise price of the stock option and the fair market value of the common stock as of December 31, 2005 which was $39.76 per share, multiplied by the number of shares issuable upon exercise of the stock option.

20

Director Compensation

The 2005 director compensation policy provided for each outside director to receive the following annual compensation:

- •

- a $25,000 annual cash retainer;

- •

- a $10,000 additional retainer for the Chairperson of the Board and Audit and Compliance Committee;

- •

- a $5,000 additional retainer for the Chairperson of all other committees;

- •

- a quarterly meeting fee of $2,500 for each quarterly meeting attended;

- •

- an other meeting fee of $1,500 for each non-quarterly Board or committee meeting attended;

- •

- a stock option grant for the purchase of 4,500 shares of KCI common stock with an exercise price equal to the fair market value of common stock on the date of grant; and

- •

- a restricted stock grant of 1,000 shares.

During 2005, the following aggregate payments and grants were made to directors under the director compensation policy:

- •

- aggregate fees of $477,000 were paid;

- •

- options for the purchase of 41,000 shares were granted; and

- •

- 10,000 shares of restricted stock were granted.

The Board of Directors has revised the director compensation policy for 2006, which increased the grant of restricted stock to 1,600 shares.

In addition, KCI bears the expense of office facilities and administrative assistance at our corporate headquarters in San Antonio, Texas for Dr. James R. Leininger, the company's founder andChairman Emeritus of the Board of Directors. The total amount of expenses borne by KCI in this regard for 2005 were approximately $70,000.

Indemnification of Directors and Officers and Limitation of Liability

The Texas Business Corporation Act, or TBCA, permits us to indemnify, advance expenses to, and purchase and maintain insurance on behalf of, directors and officers, among others. Our Certificate of Incorporation and By-laws provide for the indemnification of our directors and officers to the fullest extent permitted by the TCBA, including circumstances in which indemnification is otherwise discretionary.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal 2005 were Ronald W. Dollens, N. Colin Lind and C. Thomas Smith. None of the members of the Compensation Committee during fiscal 2005 was an officer or employee of KCI or any of its subsidiaries, or was formerly an officer of KCI or any of its subsidiaries.

Mr. Lind is affiliated with Blum Capital Partners, L.P., which together with its affiliates, hold greater than 5% of our outstanding common stock. Mr. Lind also owns a minority interest in Blum Capital Partners, L.P. In January 2005, the shareholder agreement among KCI and various shareholders, including Blum Capital Partners, L.P. and its related parties, was amended and restated. Under the amended shareholder agreement, we are required to file a shelf registration statement permitting the continuous resale of securities from time to time. We are also required to indemnify them for designated liability under the securities laws.

21

The material in the following report is not "soliciting material," is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of KCI under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

REPORT OF THE COMPENSATION COMMITTEE OF THE

BOARD OF DIRECTORS ON EXECUTIVE COMPENSATION

The compensation committee oversees KCI's executive compensation program. The committee's membership is determined by the Board of Directors and is composed entirely of independent directors. The committee's charter reflects its various responsibilities, which include review and oversight of KCI's compensation plans and policies, the annual review of all executive officers' compensation, administration of KCI's equity plans, and the approval of routine equity grants to employees. The committee meets regularly to perform its duties and will periodically approve and adopt, or make recommendations to the Board for, the Company's compensation decisions (including the approval of options and restricted stock to executive officers). KCI's Human Resources department provides support to the committee and, from time to time, the committee will engage the services of outside advisers.

KCI's executive compensation philosophy is designed to attract, retain and motivate highly qualified individuals in a fair and cost-effective manner. KCI also seeks to provide management with strong incentives to maximize divisional and overall company performance and to enhance shareholder value.

KCI's compensation programs are intended to encourage both annual and long-term performance objectives, which is required for KCI's success in the medical device industry. Accordingly, compensation of KCI employees is based on job responsibility, individual performance and KCI's overall corporate performance over both annual and longer term periods. Members of senior management have a greater portion of their pay based on KCI's performance than other employees.

In establishing total compensation, the committee considers compensation of similar positions at comparable companies and KCI-specific performance measures in order to assess overall performance and prospects for KCI. Among the performance measures considered are revenue, net income, earnings per share, consolidated cash flow, earnings before interest and taxes (EBIT), and stock price. The committee may consider additional performance measures in the future.

In 2005, the committee engaged outside consultants who reported back to the committee on compensation matters. With the assistance of the outside consultants, the committee compared KCI's compensation packages with those of a selected peer group of companies. The committee used data from the peer group as a benchmark to ensure that KCI's total compensation remained competitive as compared to the industry across various tiers of management. The committee also used data from the peer group over the course of the year to benchmark compensation levels for executive officers for consideration of annual merit-based increases.

Annual Compensation. Annual cash compensation for KCI's named executive officers consists of two components—base salary and annual cash bonuses.

Salary. In 2005, individual base salary was determined primarily by comparison to marketplace data and by attainment of individual performance goals. Assessment of an individual's performance included consideration of a person's impact on financial performance, as well as judgment, creativity,

22

effectiveness in developing subordinates and contributions to improvement in the quality of KCI's products, services and operations.

Bonus. KCI's annual bonus program is designed to reward team success as well as individual achievement, and to provide greater incentives to those individuals and company divisions that have a material impact on revenue, expenses and assets of KCI. In connection with the annual bonus program, the committee, together with management establishes performance objectives at the beginning of the year and measures individual and corporate attainment of those objectives at the end of each year. In 2005, annual cash bonuses were tied to the achievement of individual performance goals and the attainment of divisional and corporate performance measures compared to budget, which the committee refers to as the consolidated financial metric. For 2005, the consolidated financial metric was based on measurements of consolidated earnings per share and cash flow. In addition, the aggregate bonus pools for employees of the USA and International divisions are also adjusted in relation to the attainment of divisional EBIT targets. The performance measurements are subject to discretionary adjustments by the committee for matters such as non-recurring and certain non-operating items.

Long-Term Incentives. The committee believes that equity ownership helps assure management's long-term alignment with shareholders' interests. Accordingly, KCI's Management Stock Ownership Guidelines require KCI's senior executives to attain and hold investment positions equal to two to five times annual base salary, depending on the level of the executive.

In addition, KCI's equity plans have been established to provide KCI employees with an opportunity to share, along with shareholders, in KCI's long-term performance. Periodic grants of stock options are made to eligible employees, with additional grants being made to certain employees upon commencement of employment and, occasionally, following a significant change in job responsibilities, scope or title. Options granted under the plans generally have a four-year vesting schedule and generally expire ten years from the date of grant. In 2005, the Board approved grants of stock options and restricted stock to eligible employees and senior management. The 2005 option grants were made on the basis of a quantitative and qualitative analysis of individual performance and KCI's financial performance in order to encourage the long-term focus necessary for continued success in the medical device business.

The 2005 cash compensation earned by Dennert O. Ware, President and Chief Executive Officer, consisted of base salary of $617,031 and an annual bonus of $580,986. Also, on April 1, 2005, Mr. Ware received options to purchase 65,000 shares of common stock, with a fair market value exercise price of $59.58.

In Mr. Ware's 2005 performance evaluation, the committee considered his total cash compensation relative to KCI's performance over the last 12 months. The committee determined that an increase of $51,876 to Mr. Ware's base salary would allow his cash compensation to be competitive relative to persons in similar positions in KCI's peer group. Mr. Ware's annual bonus was based primarily on KCI's consolidated financial metric (as described above).

The committee reviewed all components of Mr. Ware's compensation, including salary, bonus, accumulated realized and unrealized stock option gains, the dollar value to the executive and cost to KCI of all perquisites and other personal benefits, and under several potential severance and change-in-control scenarios. A detailed schedule setting forth all the above components was reviewed by the committee. Based on this review, the committee determined Mr. Ware's total compensation to be appropriate.

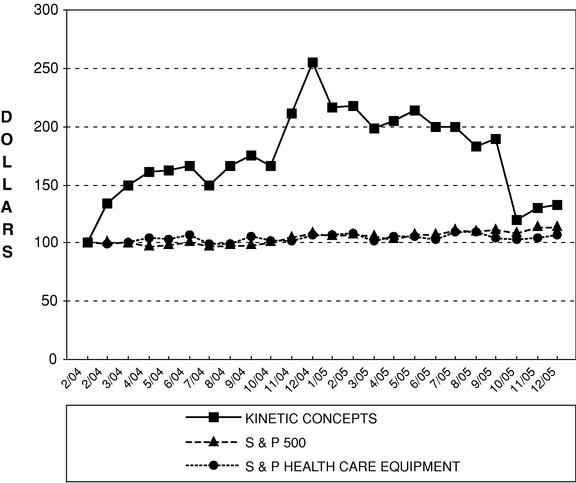

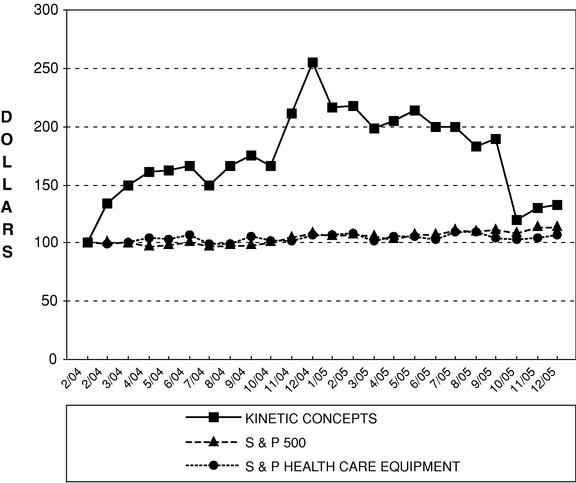

23