Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

IEX similar filings

- 5 Feb 15 Regulation FD Disclosure

- 29 Jan 15 Idex Reports 5 Percent Organic Revenue Growth and Record Eps for 2014

- 13 Nov 14 IDEX Corporation Announces Additional Share Repurchase Authorization

- 27 Oct 14 Regulation FD Disclosure

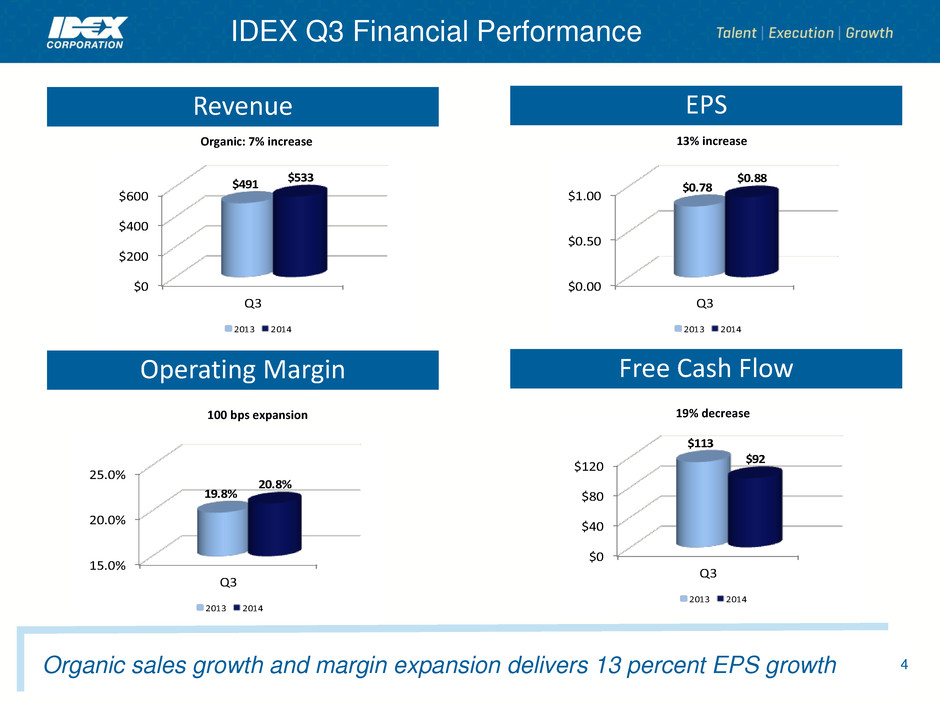

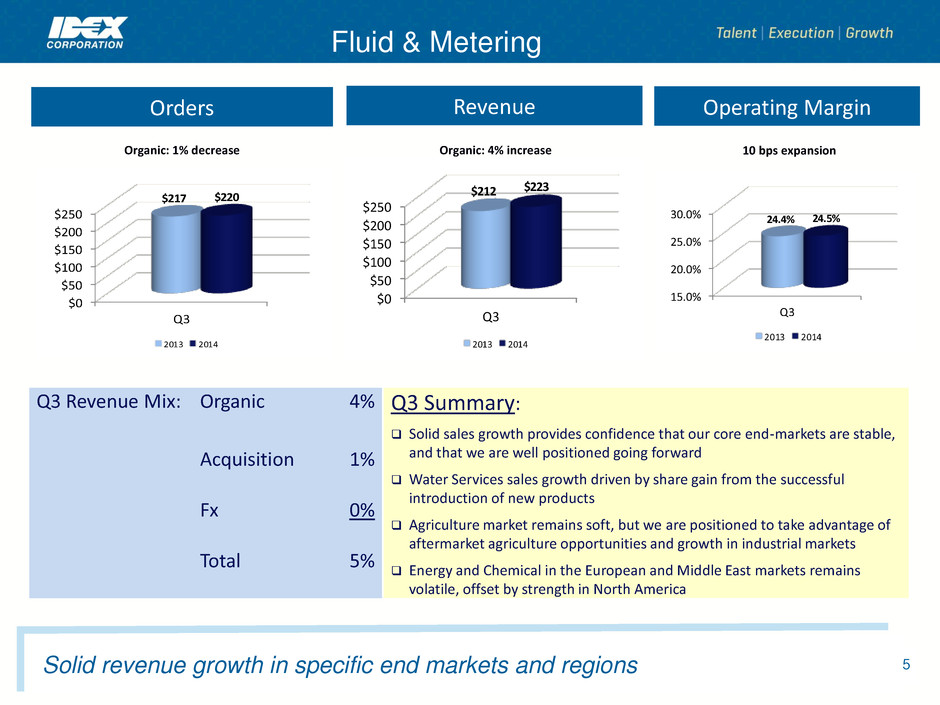

- 21 Oct 14 Results of Operations and Financial Condition

- 28 Jul 14 Regulation FD Disclosure

- 23 Jul 14 Idex Reports Second Quarter Eps of 88 Cents and Raises Full Year Eps Guidance to $3.50 - $3.55

Filing view

External links