Second Quarter 2018 Earnings July 25, 2018 IDEX Proprietary & Confidential

AGENDA • IDEX’s Overview and Outlook • Q2 Financial Performance • Segment Performance • Fluid & Metering Technologies • Health & Science Technologies • Fire & Safety / Diversified Products • 2018 Guidance Summary • Q&A Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 1

Replay Information • Dial toll–free: 877.660.6853 • International: 201.612.7415 • Conference ID: #13675420 • Log on to: www.idexcorp.com Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 2

Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation and discussion will include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, capital expenditures, acquisitions, cost reductions, cash flow, revenues, earnings, market conditions, global economies and operating improvements, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the company believes,” “the company intends,” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors, and levels of capital spending in certain industries – all of which could have a material impact on order rates and IDEX’s results, particularly in light of the low levels of order backlogs it typically maintains; its ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the company operates; interest rates; capacity utilization and the effect this has on costs; labor markets; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the company’s most recent annual report on Form 10-K filed with the SEC and the other risks discussed in the company’s filings with the SEC. The forward-looking statements included in this presentation and discussion are only made as of today’s date, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information in this presentation and discussion. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three-month period ending June 30, 2018, which is available on our website. Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 3

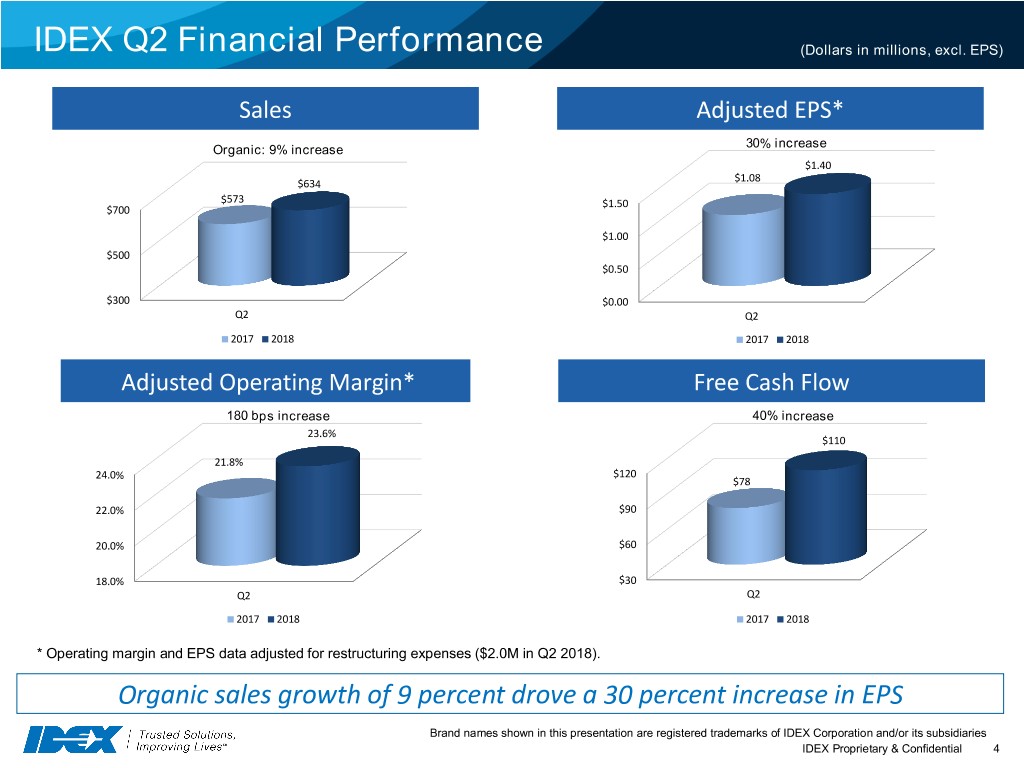

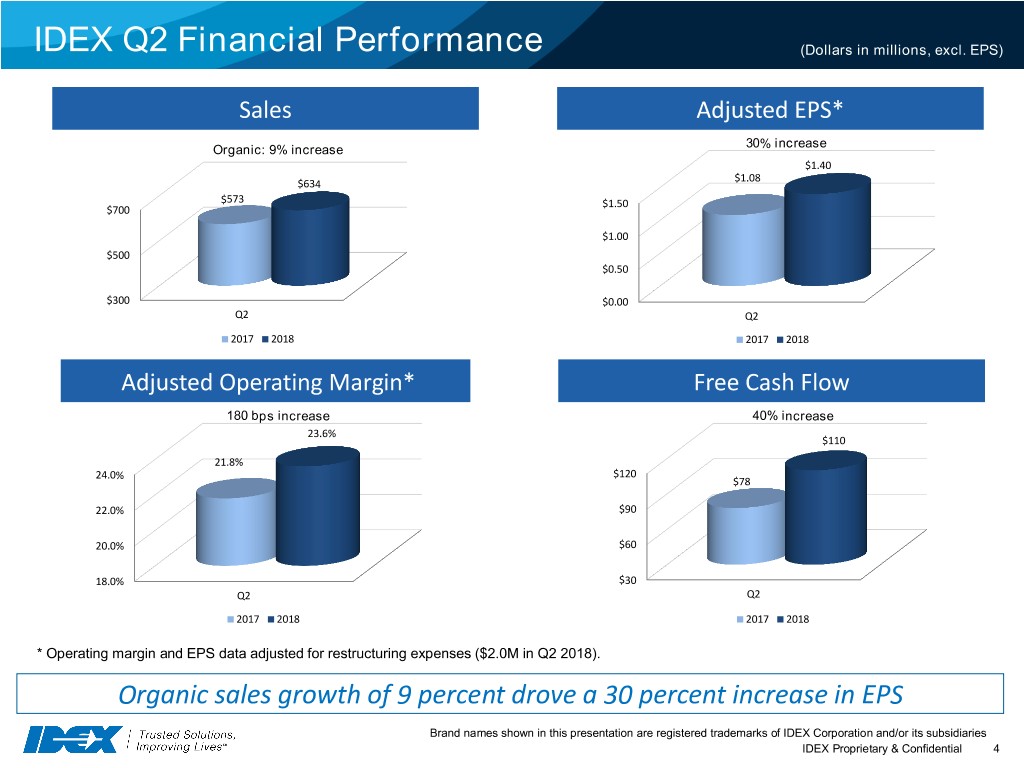

IDEX Q2 Financial Performance (Dollars in millions, excl. EPS) Sales Adjusted EPS* 30% increase Organic: 9% increase $1.40 $1.08 $634 $573 $1.50 $700 $1.00 $500 $0.50 $300 $0.00 Q2 Q2 2017 2018 2017 2018 Adjusted Operating Margin* Free Cash Flow 180 bps increase 40% increase 23.6% $110 21.8% 24.0% $120 $78 22.0% $90 20.0% $60 18.0% $30 Q2 Q2 2017 2018 2017 2018 * Operating margin and EPS data adjusted for restructuring expenses ($2.0M in Q2 2018). Organic sales growth of 9 percent drove a 30 percent increase in EPS Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 4

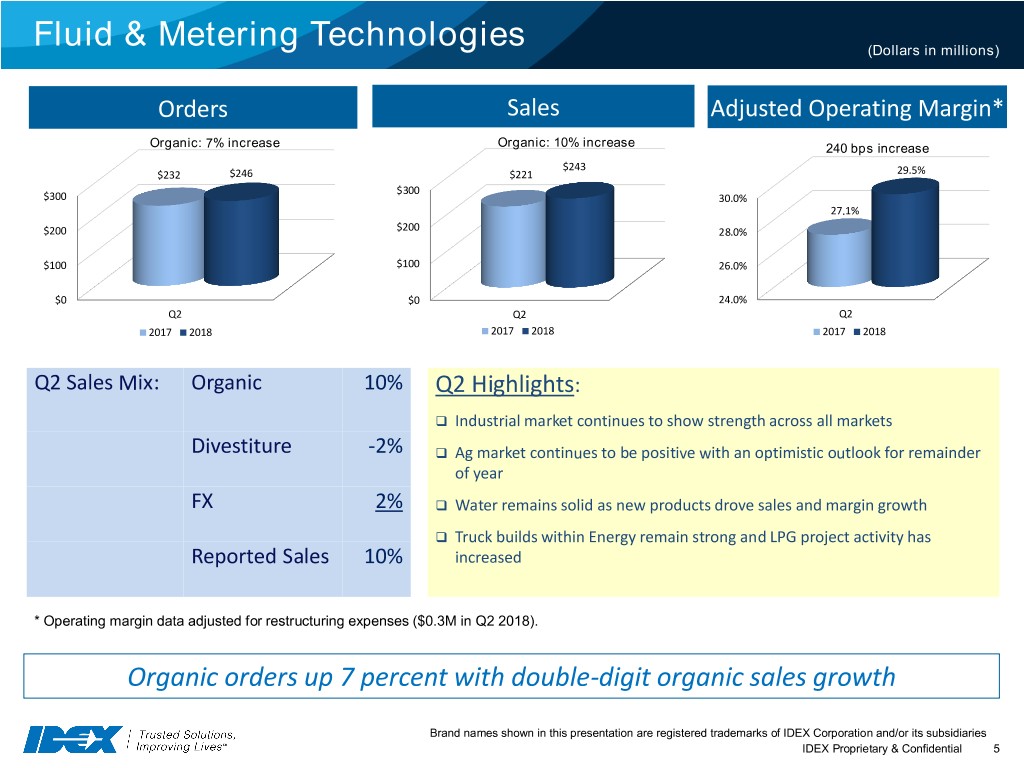

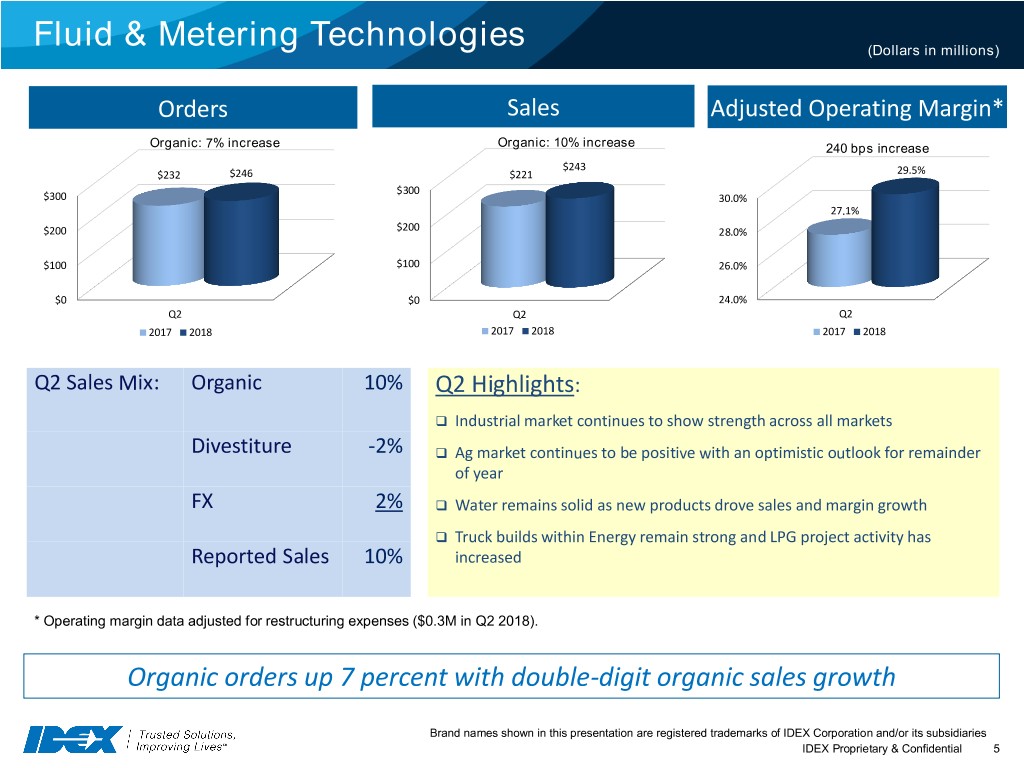

Fluid & Metering Technologies (Dollars in millions) Orders Sales Adjusted Operating Margin* Organic: 7% increase Organic: 10% increase 240 bps increase $243 $232 $246 $221 29.5% $300 $300 30.0% 27.1% $200 $200 28.0% $100 $100 26.0% $0 $0 24.0% Q2 Q2 Q2 2017 2018 2017 2018 2017 2018 Q2 Sales Mix: Organic 10% Q2 Highlights: Industrial market continues to show strength across all markets Divestiture -2% Ag market continues to be positive with an optimistic outlook for remainder of year FX 2% Water remains solid as new products drove sales and margin growth Truck builds within Energy remain strong and LPG project activity has Reported Sales 10% increased * Operating margin data adjusted for restructuring expenses ($0.3M in Q2 2018). Organic orders up 7 percent with double-digit organic sales growth Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 5

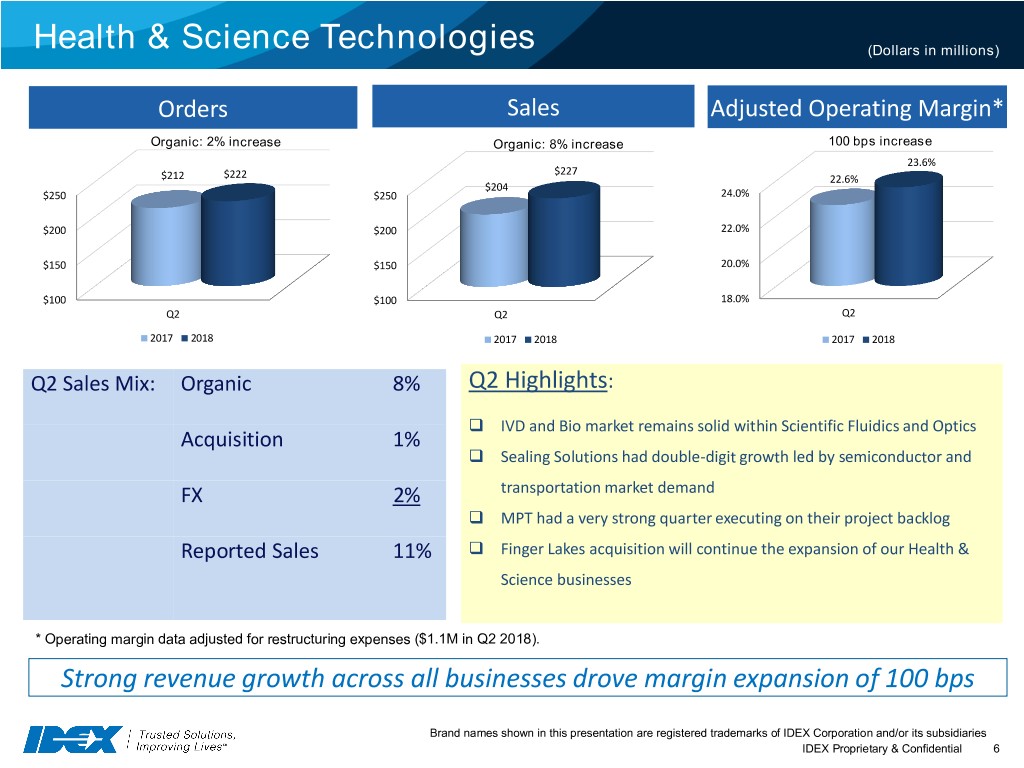

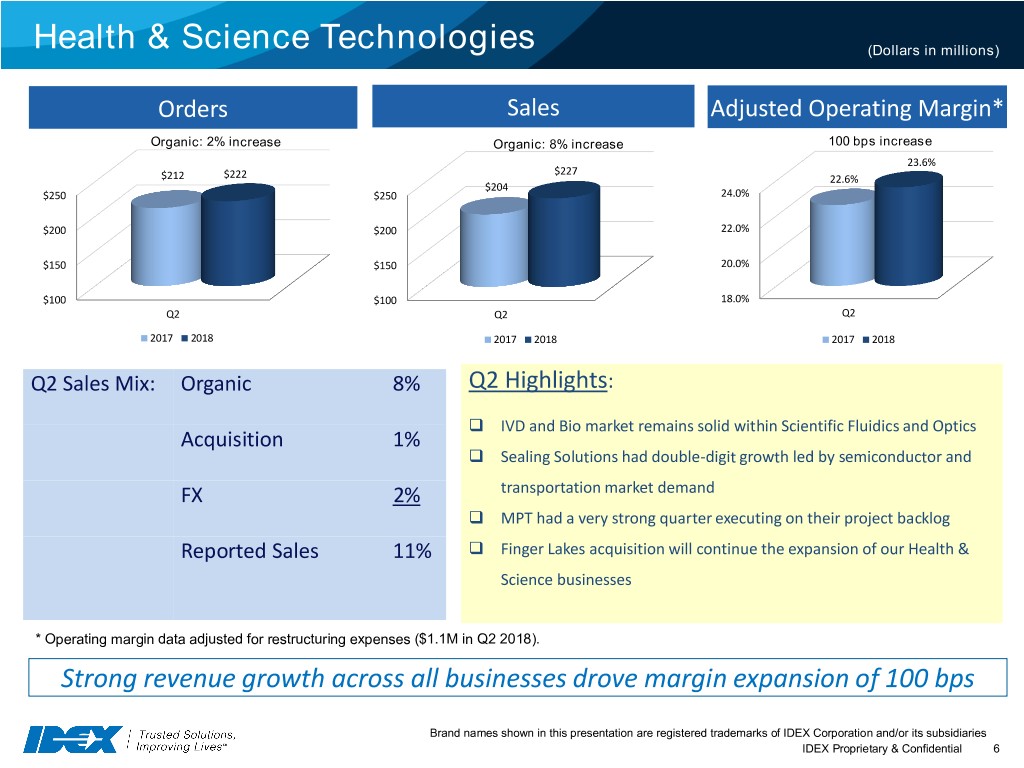

Health & Science Technologies (Dollars in millions) Orders Sales Adjusted Operating Margin* Organic: 2% increase Organic: 8% increase 100 bps increase 23.6% $227 $212 $222 22.6% $204 $250 $250 24.0% $200 $200 22.0% $150 $150 20.0% $100 $100 18.0% Q2 Q2 Q2 2017 2018 2017 2018 2017 2018 Q2 Sales Mix: Organic 8% Q2 Highlights: IVD and Bio market remains solid within Scientific Fluidics and Optics Acquisition 1% Sealing Solutions had double-digit growth led by semiconductor and FX 2% transportation market demand MPT had a very strong quarter executing on their project backlog Reported Sales 11% Finger Lakes acquisition will continue the expansion of our Health & Science businesses * Operating margin data adjusted for restructuring expenses ($1.1M in Q2 2018). Strong revenue growth across all businesses drove margin expansion of 100 bps Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 6

Fire & Safety / Diversified Products (Dollars in millions) Orders Sales Adjusted Operating Margin* Organic: 18% increase Organic: 8% increase 300 bps increase 28.1% $172 $164 $200 $148 30.0% $200 $142 25.1% $150 $150 25.0% $100 $100 20.0% $50 $50 Q2 Q2 Q2 2017 2018 2017 2018 2017 2018 Q2 Sales Mix: Organic 8% Q2 Highlights: Dispensing continues its strong performance providing double-digit revenue FX 3% growth and op margin expansion Rescue tool business remains solid with emerging market project activity Reported Sales 11% Fire’s OEM & Muni businesses remain steady globally Band-IT continues to over-deliver with NPD and new project wins * Operating margin data adjusted for restructuring expenses ($0.3M in Q2 2018). Strong organic order and sales growth drove a 300 bps op margin improvement Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 7

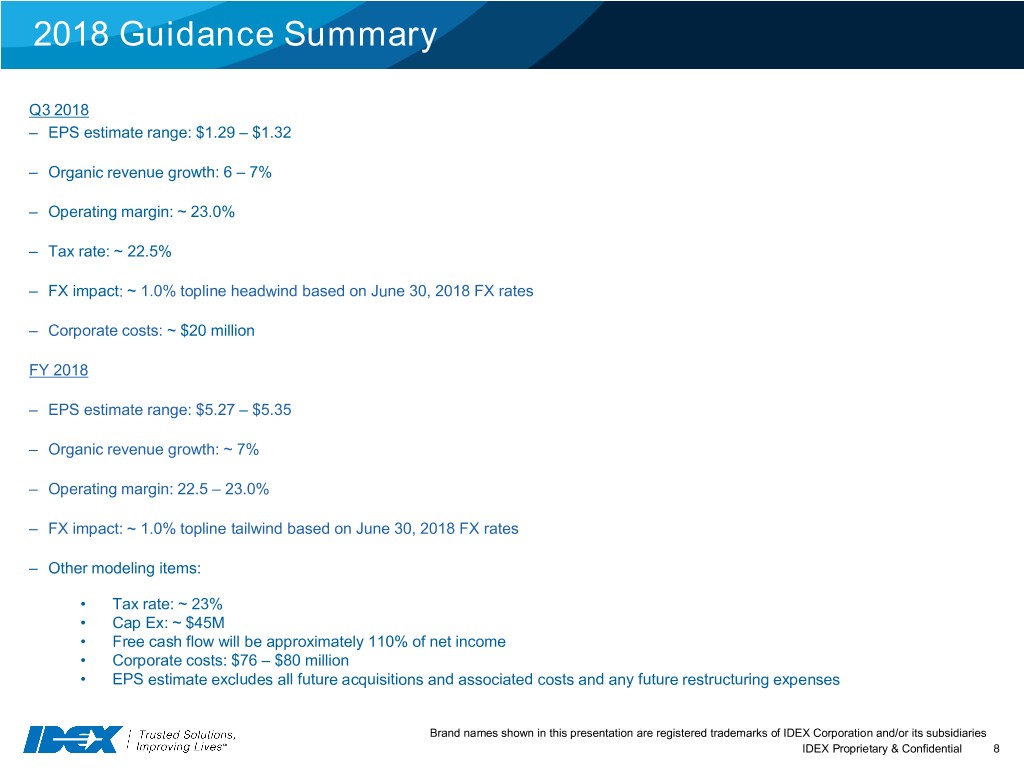

2018 Guidance Summary Q3 2018 – EPS estimate range: $1.29 – $1.32 – Organic revenue growth: 6 – 7% – Operating margin: ~ 23.0% – Tax rate: ~ 22.5% – FX impact: ~ 1.0% topline headwind based on June 30, 2018 FX rates – Corporate costs: ~ $20 million FY 2018 – EPS estimate range: $5.27 – $5.35 – Organic revenue growth: ~ 7% – Operating margin: 22.5 – 23.0% – FX impact: ~ 1.0% topline tailwind based on June 30, 2018 FX rates – Other modeling items: • Tax rate: ~ 23% • Cap Ex: ~ $45M • Free cash flow will be approximately 110% of net income • Corporate costs: $76 – $80 million • EPS estimate excludes all future acquisitions and associated costs and any future restructuring expenses Brand names shown in this presentation are registered trademarks of IDEX Corporation and/or its subsidiaries IDEX Proprietary & Confidential 8