1 Fourth Quarter & Full Year 2021 Earnings February 2, 2022

2IDEX Proprietary & Confidential Agenda IDEX Business Overview • IDEX Overview • 2022 Segment Outlook Financials • Q4 & Full Year Performance • Full Year Operating Income Walk 2022 Guidance Q&A

3IDEX Proprietary & Confidential Replay Information • Dial toll–free: 877.660.6853 • International: 201.612.7415 • Conference ID: #13724802 • Log on to: www.idexcorp.com

4IDEX Proprietary & Confidential Cautionary Statement Cautionary Statement Under the Private Securities Litigation Reform Act; Non-GAAP Measures This presentation and discussion will include “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may relate to, among other things, the Company’s expected organic sales growth and expected earnings per share, and the assumptions underlying these expectations, plant and equipment capacity for future growth, the duration of supply chain challenges, anticipated future acquisition behavior, availability of cash and financing alternatives, the anticipated timing of the closing of the Company’s acquisition of Nexsight and the anticipated benefits of the Company’s acquisitions of ABEL Pumps, Airtech, and Nexsight, and are indicated by words or phrases such as “anticipates,” “estimates,” “plans,” “guidance,” “expects,” “projects,” “forecasts,” “should,” “could,” “will,” “management believes,” “the Company believes,” “the Company intends” and similar words or phrases. These statements are subject to inherent uncertainties and risks that could cause actual results to differ materially from those anticipated at the date of this news release. The risks and uncertainties include, but are not limited to, the following: the duration of the COVID- 19 pandemic and the continuing effects of the COVID-19 pandemic (including the emergence of variant strains) on our ability to operate our business and facilities, on our customers, on supply chains and on the U.S. and global economy generally; economic and political consequences resulting from terrorist attacks and wars; levels of industrial activity and economic conditions in the U.S. and other countries around the world; pricing pressures and other competitive factors and levels of capital spending in certain industries, all of which could have a material impact on order rates and the Company's results; the Company's ability to make acquisitions and to integrate and operate acquired businesses on a profitable basis; the relationship of the U.S. dollar to other currencies and its impact on pricing and cost competitiveness; political and economic conditions in foreign countries in which the Company operates; developments with respect to trade policy and tariffs; interest rates; capacity utilization and the effect this has on costs; labor markets; supply chain backlogs, including risks affecting component availability, labor inefficiencies, and freight logistical challenges; market conditions and material costs; and developments with respect to contingencies, such as litigation and environmental matters. Additional factors that could cause actual results to differ materially from those reflected in the forward-looking statements include, but are not limited to, the risks discussed in the “Risk Factors” section included in the Company’s most recent annual report on Form 10-K and the Company's subsequent quarterly reports filed with the SEC as well as the other risks discussed in the Company’s filings with the SEC. The forward-looking statements included in this presentation and discussion are only made as of today’s date, and management undertakes no obligation to publicly update them to reflect subsequent events or circumstances, except as may be required by law. Investors are cautioned not to rely unduly on forward-looking statements when evaluating the information in this presentation and discussion. This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website.

5IDEX Proprietary & Confidential Business Update

6IDEX Proprietary & Confidential IDEX Overview Strong Year in a Challenging Environment • Record financial results • Strong rebound in demand • Margin expansion despite inflationary environment • All time high capital deployment Manage the Short Term with Focus on the Long Term • Supply chain disruptions persist in near term • Continued organic investments • Ample capital available to support M&A strategy • Nexsight acquisition to close in first quarter 2022

7IDEX Proprietary & Confidential 2022 Segment Outlook Fluid & Metering Technology Health & Science Technology Fire & Safety / Diversified FY Revenue $999M / 36% of Total FY Revenue $1,122M / 41% of Total FY Revenue $648M / 23% of Total Key Market Drivers Growth vs IDEX 5-8% Guide Key Margin Drivers • Positive industrial book & ship • Energy & Chemical improving • Large projects lag in first half ‘22 • Strong secular growth trends • Wins in Life Science & Semicon • Well positioned for Auto recovery • Fire & Rescue OEM challenges • Paint capital investment slowing • Aero & Auto bounce • Strong Price/Cost • Site consolidation benefits • Balanced OpEx & Investment • Favorable Price/Cost • Leverage on strong volume • Significant growth investments • Rebounding Price/Cost • Marginal mix pressure • Targeted investments

8IDEX Proprietary & Confidential Financials

9IDEX Proprietary & Confidential IDEX 2021 Financial Performance Strong Revenue, Profitability, Earnings, and Cash Generation $615 $2,352 $715 $2,765 $149 $518 $136 $493 +12% Organic* + 21% +110 bps (9%) (Dollars in millions, excl. EPS) Sales Adjusted Operating Margin* Adjusted Earnings Per Share* Free Cash Flow* *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. +11% Organic* + 13% (60) bps (5%) Q4’20 Q4’21 FY’20 FY’21 $1.37 $5.19 $1.55 $6.30 Q4’20 Q4’21 FY’20 FY’21 23.4% 22.8%22.8% 23.9% Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21

10IDEX Proprietary & Confidential 2021 Adjusted Operating Income Walk Volume rebound and strong demand tempered by supply chain pressure and reinvestment (Dollars in millions) *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. 106 26 11 16 (35) FY'20 Adj Op Income* Organic Flow Thru Price/ Productivity/ Inflation Mix Discretionary / Reinvestment Acq/FX FY'21 Adj Op Income* 537 661 Flow through @ PY GM% 45% Organic flow through ex Acq / FX 38% Total flow through 30% $ $

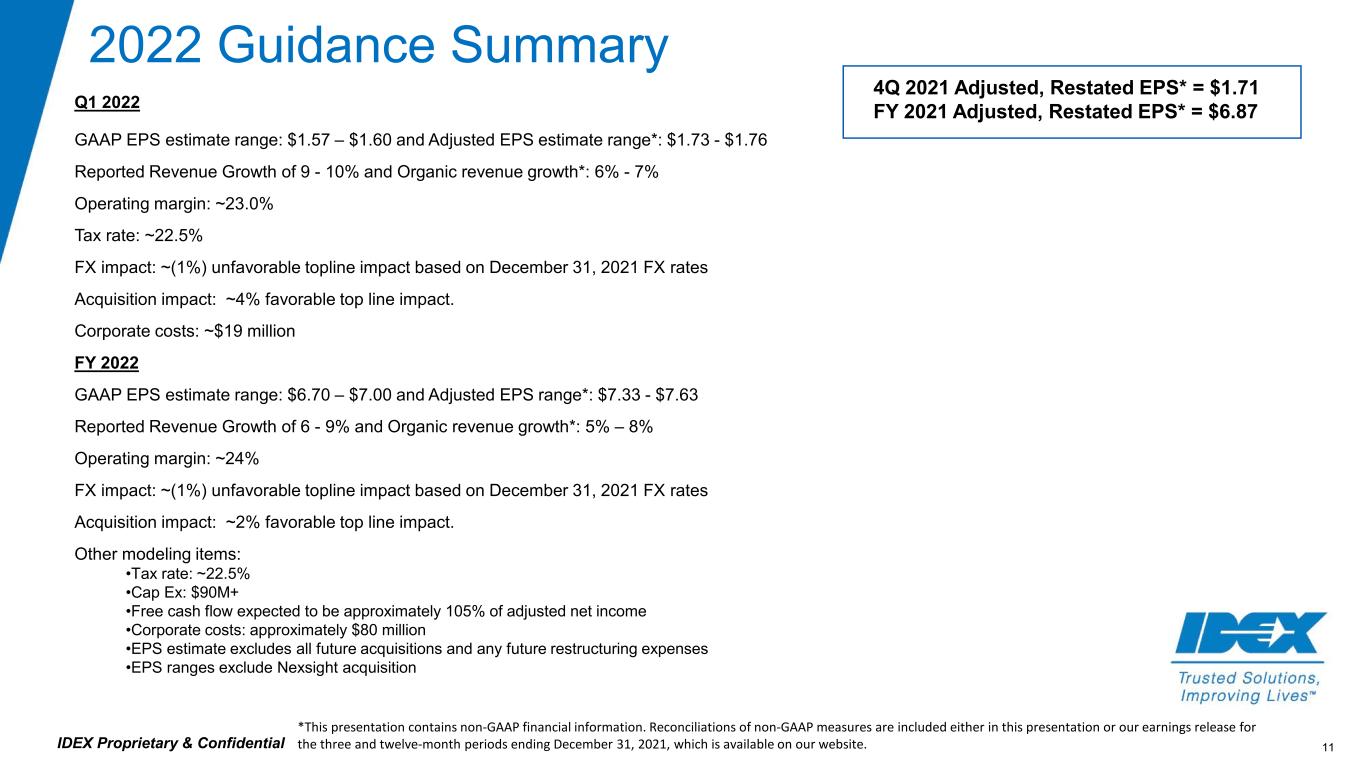

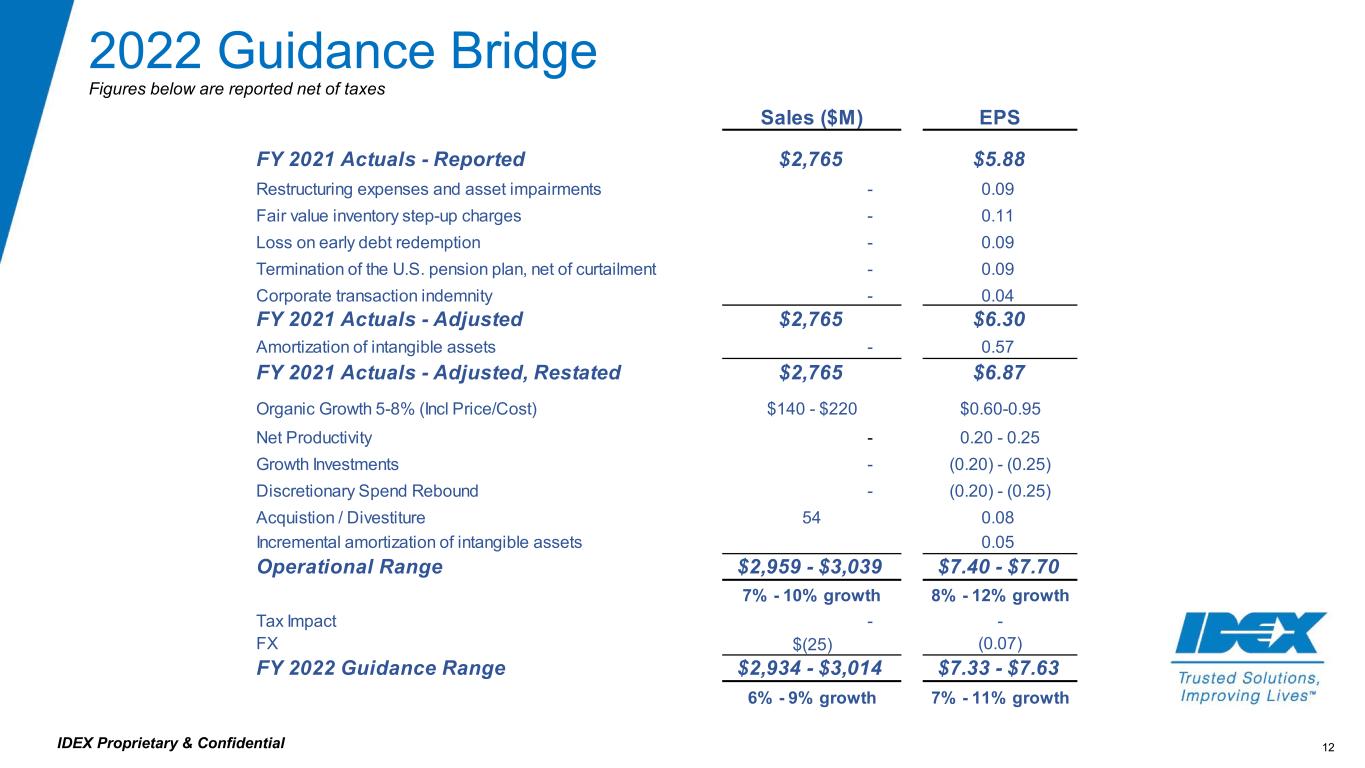

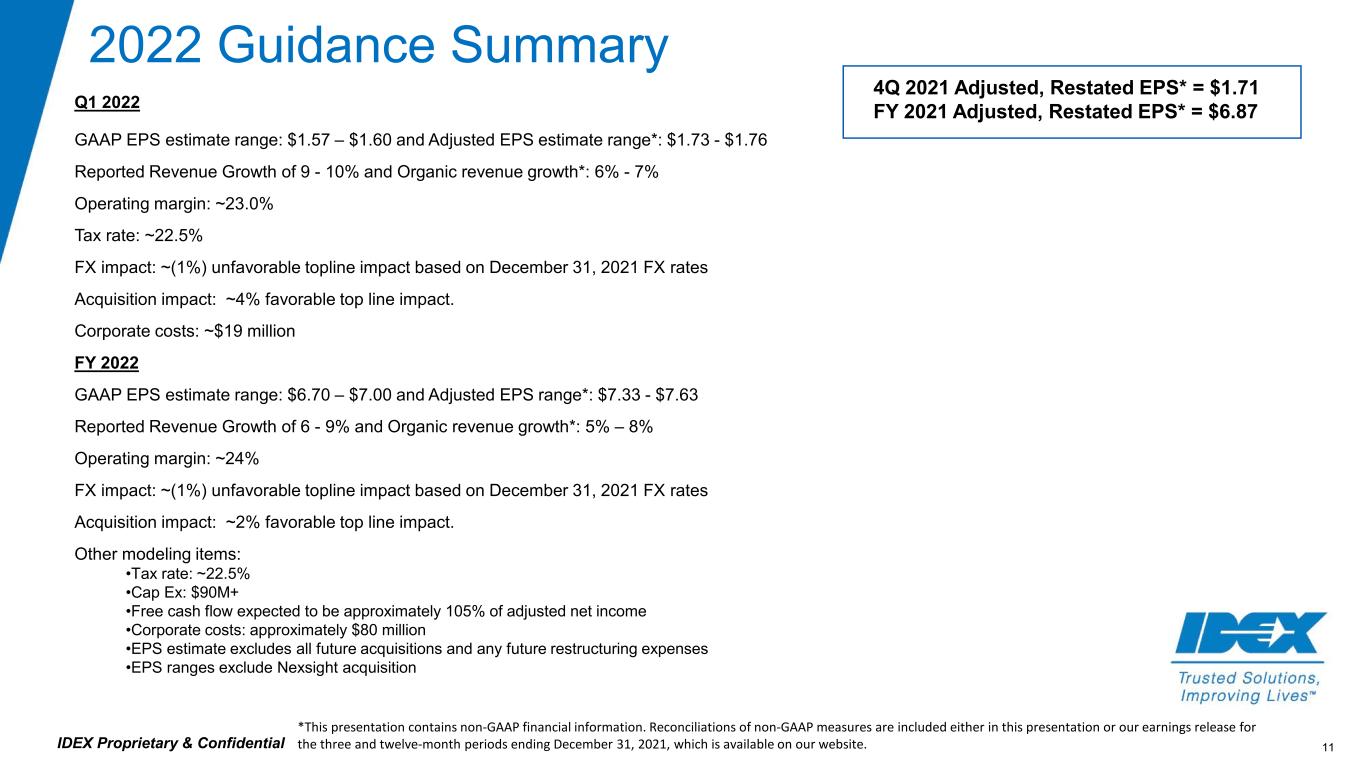

11IDEX Proprietary & Confidential 2022 Guidance Summary Q1 2022 GAAP EPS estimate range: $1.57 – $1.60 and Adjusted EPS estimate range*: $1.73 - $1.76 Reported Revenue Growth of 9 - 10% and Organic revenue growth*: 6% - 7% Operating margin: ~23.0% Tax rate: ~22.5% FX impact: ~(1%) unfavorable topline impact based on December 31, 2021 FX rates Acquisition impact: ~4% favorable top line impact. Corporate costs: ~$19 million FY 2022 GAAP EPS estimate range: $6.70 – $7.00 and Adjusted EPS range*: $7.33 - $7.63 Reported Revenue Growth of 6 - 9% and Organic revenue growth*: 5% – 8% Operating margin: ~24% FX impact: ~(1%) unfavorable topline impact based on December 31, 2021 FX rates Acquisition impact: ~2% favorable top line impact. Other modeling items: •Tax rate: ~22.5% •Cap Ex: $90M+ •Free cash flow expected to be approximately 105% of adjusted net income •Corporate costs: approximately $80 million •EPS estimate excludes all future acquisitions and any future restructuring expenses •EPS ranges exclude Nexsight acquisition *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. 4Q 2021 Adjusted, Restated EPS* = $1.71 FY 2021 Adjusted, Restated EPS* = $6.87

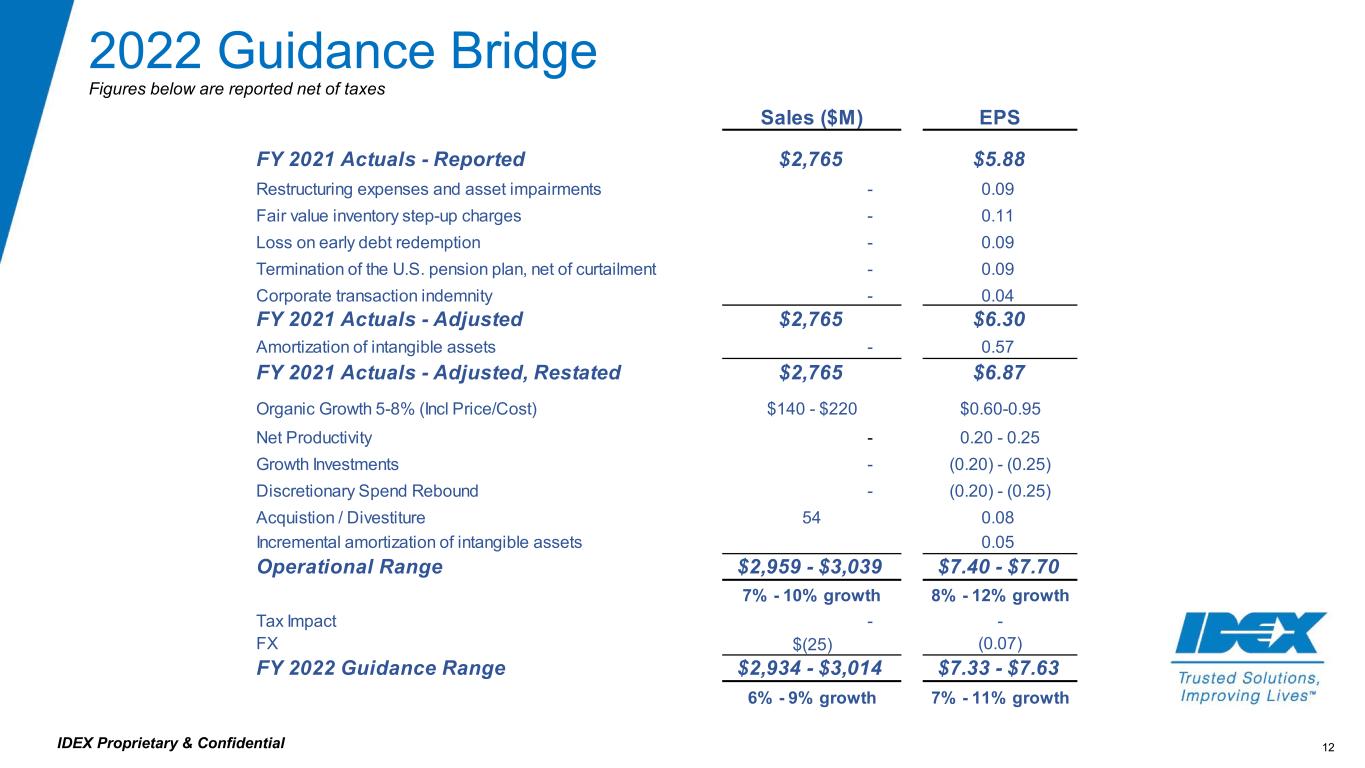

12IDEX Proprietary & Confidential 2022 Guidance Bridge Figures below are reported net of taxes Sales ($M) EPS FY 2021 Actuals - Reported $2,765 $5.88 Restructuring expenses and asset impairments - 0.09 Fair value inventory step-up charges - 0.11 Loss on early debt redemption - 0.09 Termination of the U.S. pension plan, net of curtailment - 0.09 Corporate transaction indemnity - 0.04 FY 2021 Actuals - Adjusted $2,765 $6.30 Amortization of intangible assets - 0.57 FY 2021 Actuals - Adjusted, Restated $2,765 $6.87 Organic Growth 5-8% (Incl Price/Cost) $140 - $220 $0.60-0.95 Net Productivity - 0.20 - 0.25 Growth Investments - (0.20) - (0.25) Discretionary Spend Rebound - (0.20) - (0.25) Acquistion / Divestiture 54 0.08 Incremental amortization of intangible assets 0.05 Operational Range $2,959 - $3,039 $7.40 - $7.70 7% - 10% growth 8% - 12% growth Tax Impact - - FX $(25) (0.07) FY 2022 Guidance Range $2,934 - $3,014 $7.33 - $7.63 6% - 9% growth 7% - 11% growth

13IDEX Proprietary & Confidential IDEX 2022 Focus Navigate the Short Term while Innovating for the Future • Leverage 8020 principles • Invest for growth • Solving our customers most challenging problems Build Great Global Teams • Develop great leaders and build high performing teams • Continue Diversity, Equity & Inclusion (DE&I) trajectory • Diversity and belonging key to long term vitality Capital Deployment • Strong cash flow and balance sheet flexibility • Internal capacity and Industrial automation build out • Continued ramp in M&A

14IDEX Proprietary & Confidential Appendix

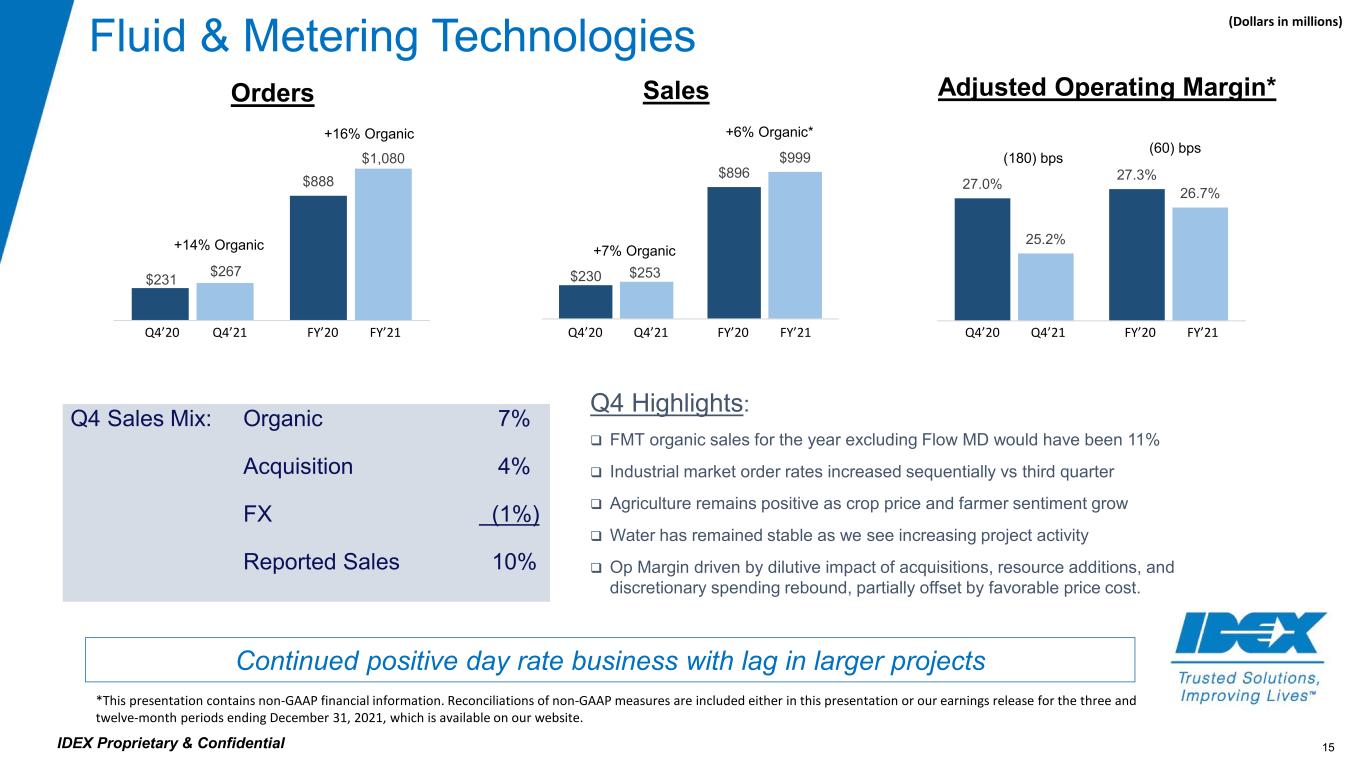

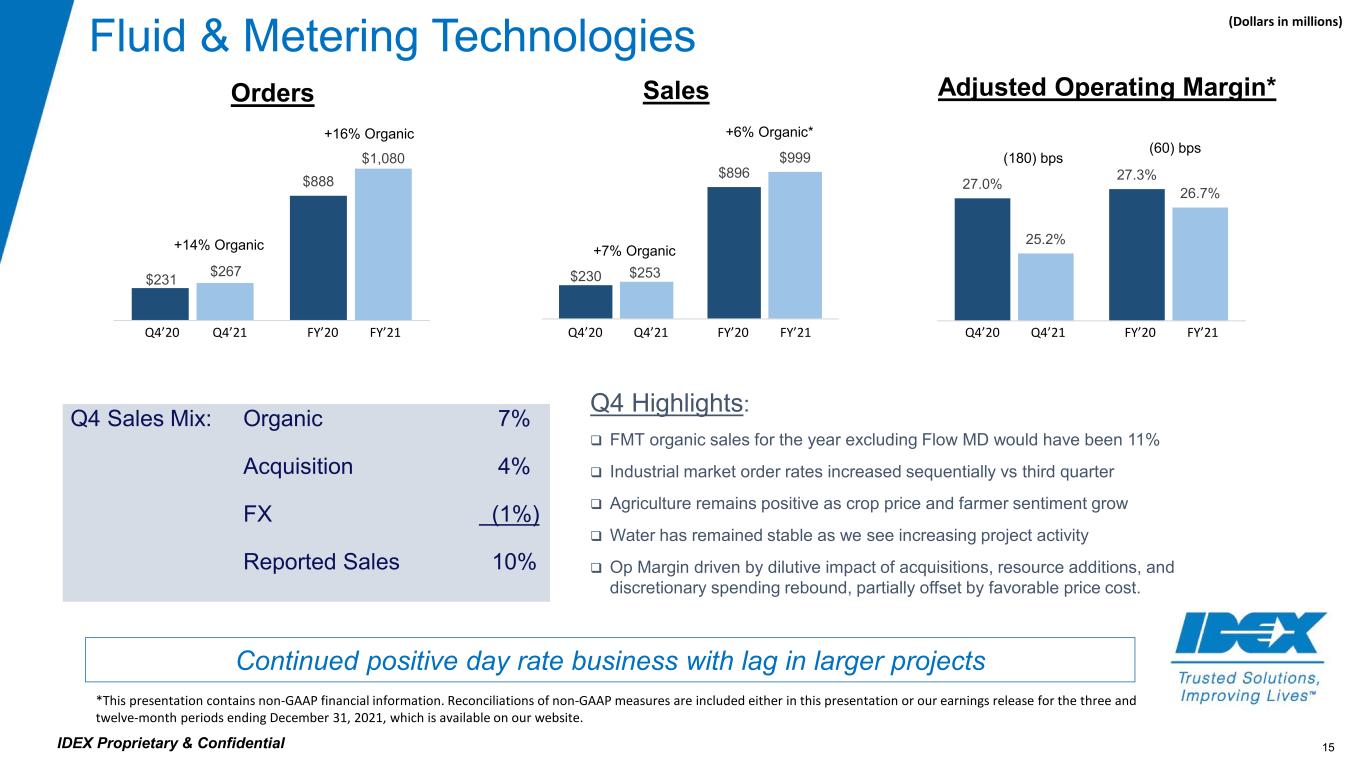

15IDEX Proprietary & Confidential Fluid & Metering Technologies $231 $888 $267 $1,080 $230 $896 $253 $999 27.0% 27.3% 25.2% 26.7% Q4 Highlights: FMT organic sales for the year excluding Flow MD would have been 11% Industrial market order rates increased sequentially vs third quarter Agriculture remains positive as crop price and farmer sentiment grow Water has remained stable as we see increasing project activity Op Margin driven by dilutive impact of acquisitions, resource additions, and discretionary spending rebound, partially offset by favorable price cost. Continued positive day rate business with lag in larger projects +16% Organic +6% Organic* (180) bps (Dollars in millions) Orders Sales Adjusted Operating Margin* Q4 Sales Mix: Organic 7% Acquisition 4% FX (1%) Reported Sales 10% +14% Organic +7% Organic (60) bps *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21

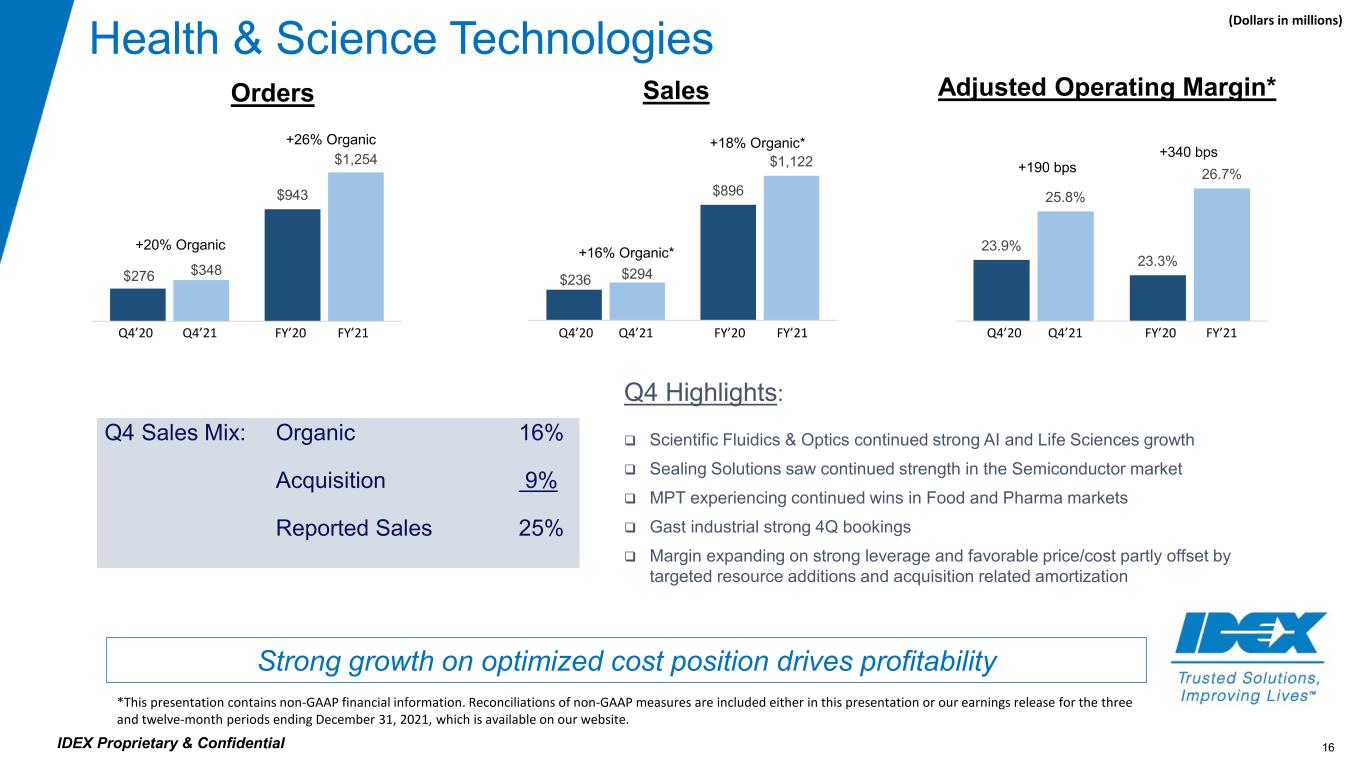

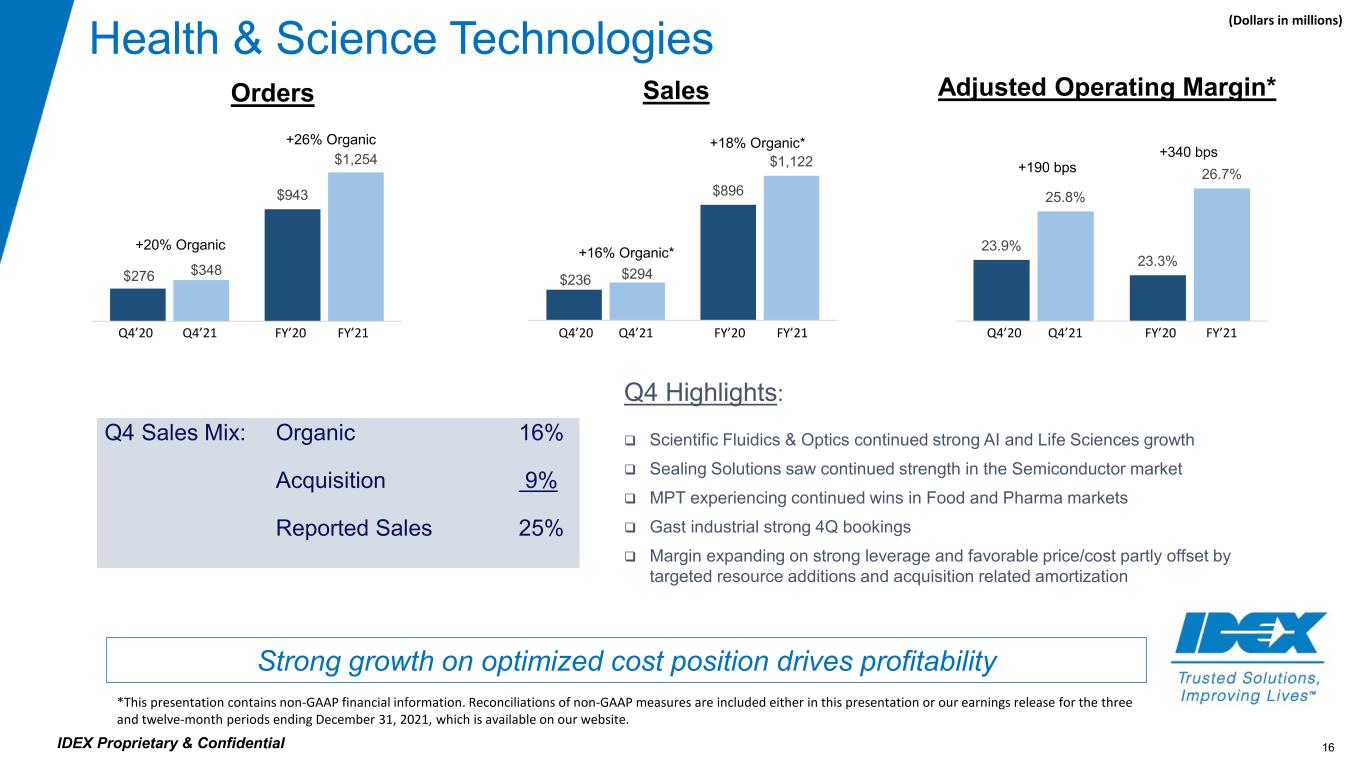

16IDEX Proprietary & Confidential Health & Science Technologies Q4 Sales Mix: Organic 16% Acquisition 9% Reported Sales 25% Q4 Highlights: Scientific Fluidics & Optics continued strong AI and Life Sciences growth Sealing Solutions saw continued strength in the Semiconductor market MPT experiencing continued wins in Food and Pharma markets Gast industrial strong 4Q bookings Margin expanding on strong leverage and favorable price/cost partly offset by targeted resource additions and acquisition related amortization Strong growth on optimized cost position drives profitability $276 $943 $348 $1,254 $236 $896 $294 $1,122 23.9% 23.3% 25.8% 26.7% +20% Organic +190 bps +18% Organic* (Dollars in millions) +26% Organic +16% Organic* +340 bps *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. Orders Sales Adjusted Operating Margin* Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21

17IDEX Proprietary & Confidential Fire & Safety / Diversified Products Q4 Highlights: Fire & Rescue continues to lag due to supply chain issues with OEMs Band-IT Industrial recovery muted by Automotive and Energy volatility Dispensing strong demand within paint markets globally Profitability impacted by unfavorable price/cost and a rebound in discretionary spending partly offset by volume leverage Supply Chain factors continue to temper segment performance $174 $589 $181 $700 $151 $563 $169 $648 27.1% 26.1%25.6% 26.2% +17% Organic +13% Organic* Q4 Sales Mix: Organic 13% FX (1%) Reported Sales 12% (Dollars in millions) +5% Organic +13% Organic* (150) bps +10 bps *This presentation contains non-GAAP financial information. Reconciliations of non-GAAP measures are included either in this presentation or our earnings release for the three and twelve-month periods ending December 31, 2021, which is available on our website. Orders Sales Adjusted Operating Margin* Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21 Q4’20 Q4’21 FY’20 FY’21

18IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of the Change in Net Sales to Organic Net Sales

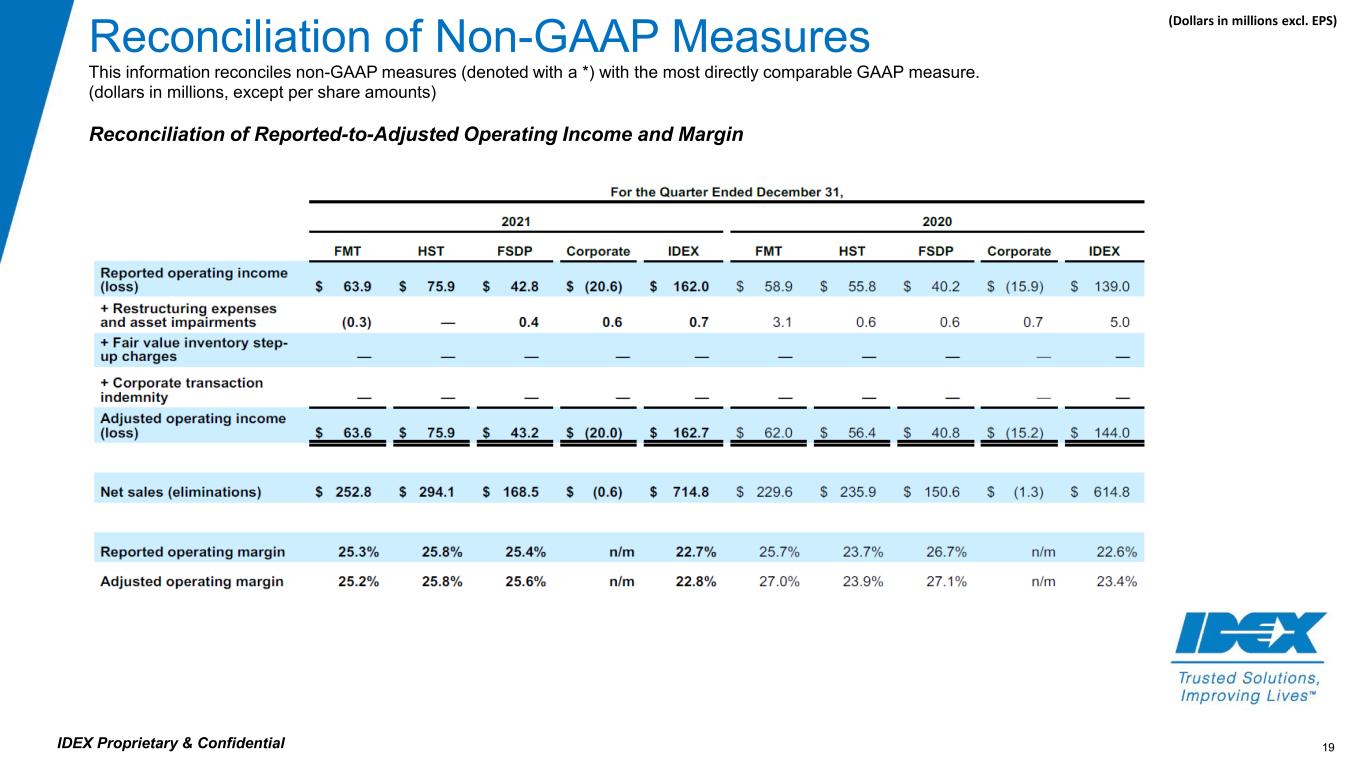

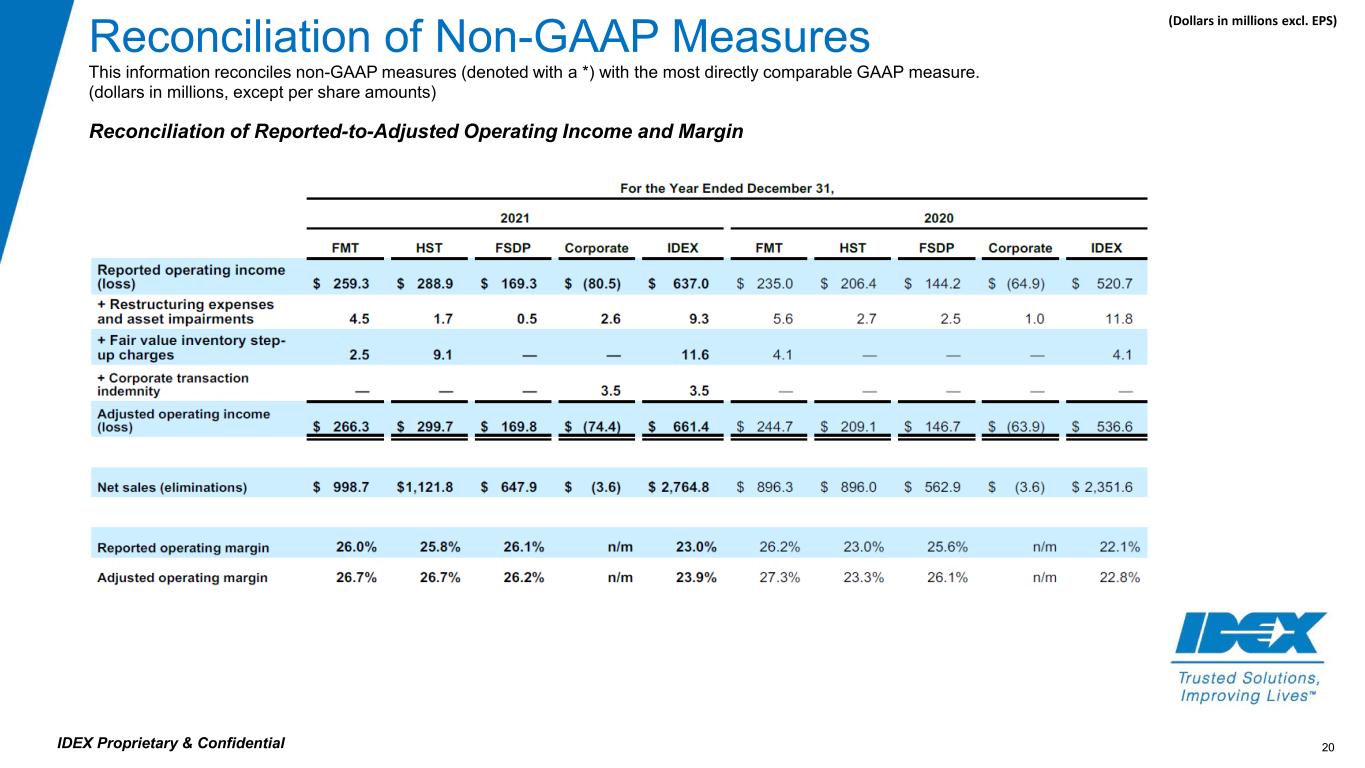

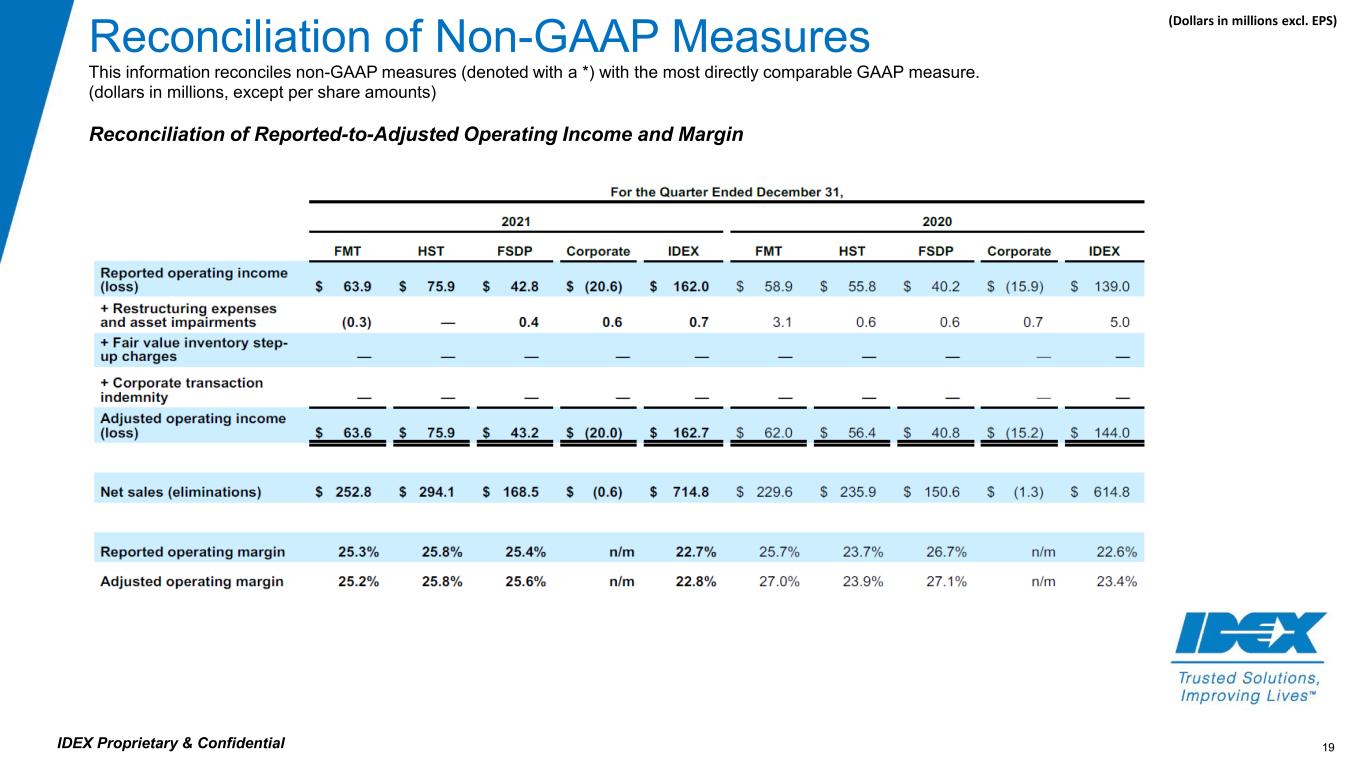

19IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of Reported-to-Adjusted Operating Income and Margin

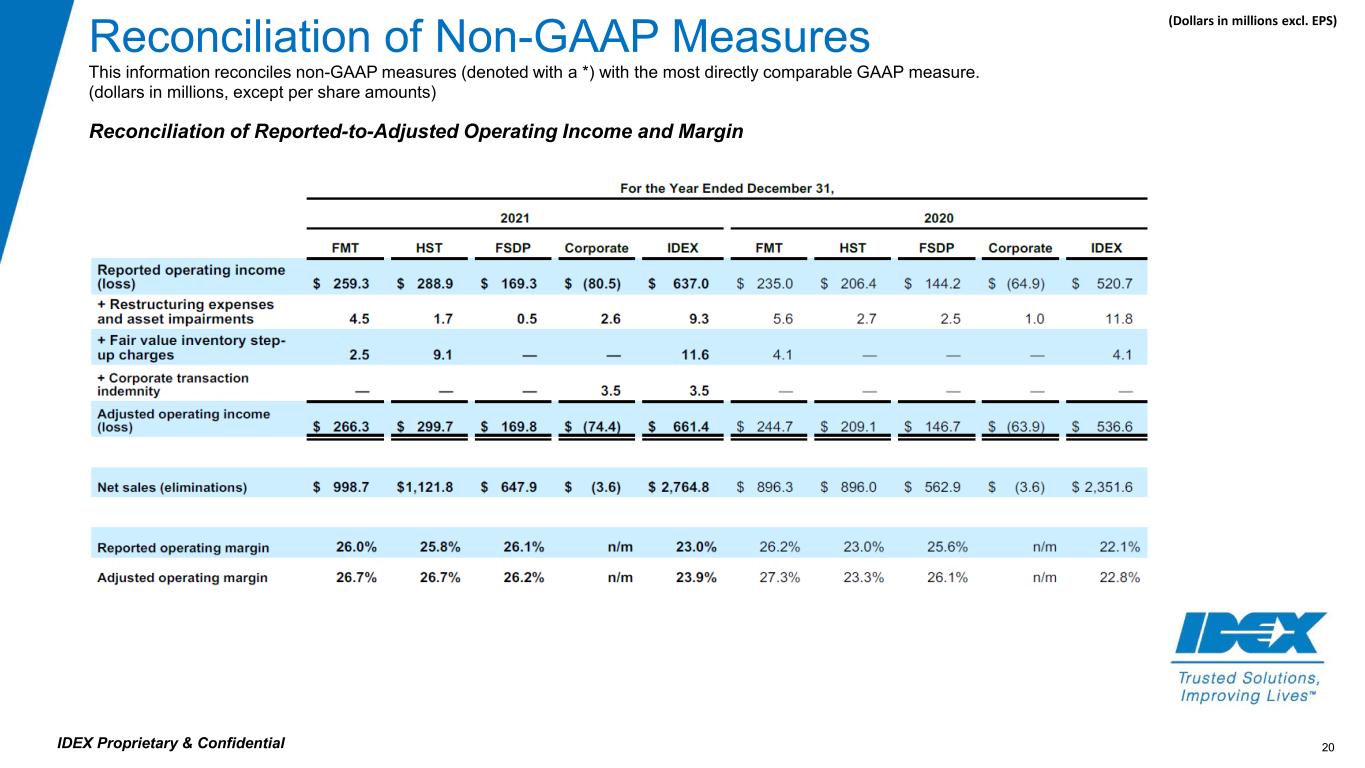

20IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of Reported-to-Adjusted Operating Income and Margin

21IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of Reported-to-Adjusted EPS attributable to IDEX Note: Starting in 2022, IDEX will revise adjusted EPS attributable to IDEX to exclude the impact of after-tax acquisition-related intangible asset amortization.

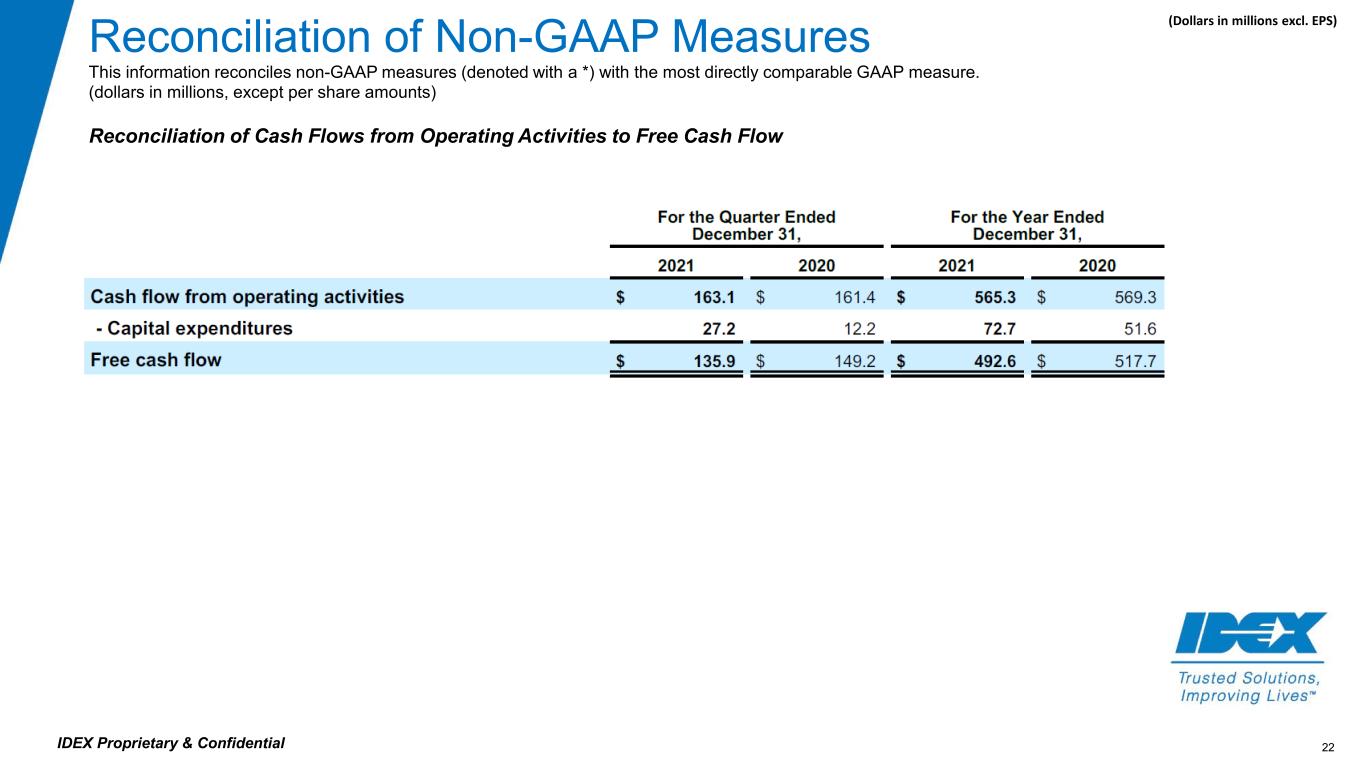

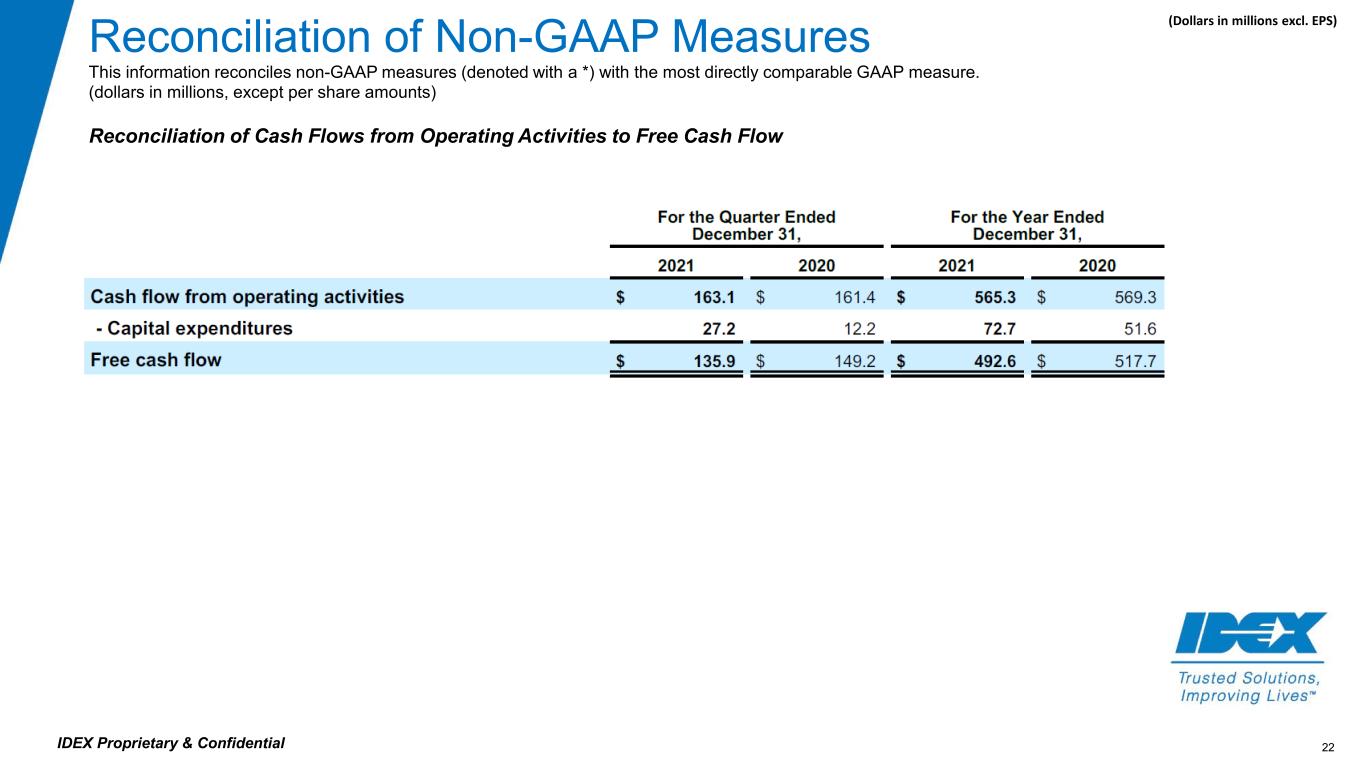

22IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of Cash Flows from Operating Activities to Free Cash Flow

23IDEX Proprietary & Confidential Reconciliation of Non-GAAP Measures (Dollars in millions excl. EPS) This information reconciles non-GAAP measures (denoted with a *) with the most directly comparable GAAP measure. (dollars in millions, except per share amounts) Reconciliation of Estimated 2022 EPS to Adjusted EPS Attributable to IDEX Note: Starting in 2022, IDEX will revise adjusted EPS attributable to IDEX to exclude the impact of after-tax acquisition-related intangible asset amortization.